Exhibit 99.62

Feasibility Study

NI 43-101 Technical Report on the Camino Rojo Gold Project

Municipality of Mazapil, Zacatecas, Mexico

Prepared for:

202 – 595 Howe Street

Vancouver, BC, V6C 2T5

Canada

Prepared by:

| Kappes, Cassiday & Associates

7950 Security Circle

Reno, NV 89506 |

Report Effective Date: 25 June 2019

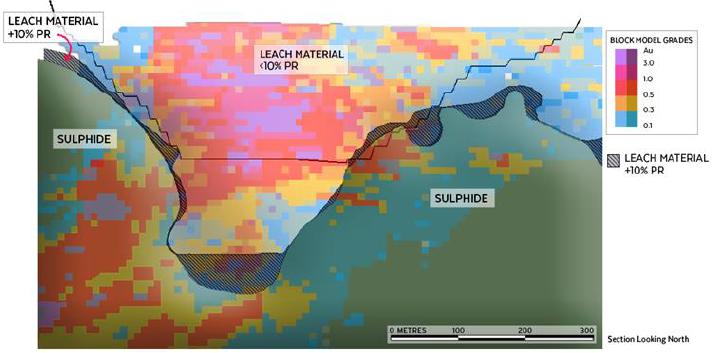

Mineral Reserve Effective Date: 24 June 2019

Authors:

Carl Defilippi, Kappes, Cassiday & Associates, RM SME

Michael Hester, Independent Mining Consultants, Inc., FAusIMM

Dr. Matthew Gray, Resource Geosciences Incorporated, CPG

David Hawkins, Barranca Group, LLC, CPG

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

Contents

| 1.0 SUMMARY | 1-1 |

| | |

| 1.1 Introduction and Overview | 1-1 |

| 1.2 Property Description and Ownership | 1-1 |

| 1.3 Geology & Mineralization | 1-2 |

| 1.4 Exploration and Drilling | 1-3 |

| 1.5 Metallurgical Test Work | 1-4 |

| 1.6 Mineral Resource Estimate | 1-5 |

| 1.7 Mineral Reserve Estimate | 1-8 |

| 1.8 Mining Methods | 1-11 |

| 1.9 Recovery Methods | 1-11 |

| 1.10 Infrastructure | 1-12 |

| 1.11 Environmental Studies, Permitting and Social or Community Impact | 1-13 |

| 1.12 Capital and Operating Costs | 1-15 |

| 1.13 Cautionary Statements | 1-17 |

| 1.13.1 Forward Looking Information | 1-17 |

| 1.13.2 Non-IFRS Measures | 1-18 |

| 1.14 Economic Analysis | 1-19 |

| 1.15 Interpretations and Conclusions | 1-22 |

| 1.15.1 Conclusions | 1-22 |

| 1.15.2 Opportunities | 1-22 |

| 1.15.3 Risks | 1-23 |

| 1.15.3.1 Mining | 1-23 |

| 1.15.3.2 Metallurgy and Process | 1-24 |

| 1.15.3.3 Access, Title and Permitting | 1-24 |

| 1.15.3.4 Other Risks | 1-25 |

| 1.16 Recommendations | 1-26 |

| 1.16.1 KCA Recommendations | 1-26 |

| 1.16.2 RGI Recommendations | 1-26 |

| 1.16.3 Barranca Recommendations | 1-26 |

| | |

| 2.0 INTRODUCTION | 2-1 |

| | |

| 2.1 Introduction and Overview | 2-1 |

| 2.2 Project Scope and Terms of Reference | 2-1 |

| 2.2.1 Scope of Work | 2-1 |

| 2.2.2 Terms of Reference | 2-3 |

| 2.3 Sources of Information | 2-3 |

| 2.4 Qualified Persons and Site Visits | 2-4 |

| 2.5 Frequently Used Acronyms, Abbreviations, Definitions and Units of Measure | 2-6 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 1 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 3.0 RELIANCE ON OTHER EXPERTS | 3-1 |

| | |

| 4.0 PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| | |

| 4.1 Area and Location | 4-1 |

| 4.2 Claims and Title | 4-2 |

| 4.2.1 Orla Control of Mining Concessions via Acquisition from Minera Peñasquito SA de CV | 4-6 |

| 4.2.2 Pending Concession Reductions | 4-7 |

| 4.3 Surface Rights | 4-7 |

| 4.4 Environmental Liability | 4-10 |

| 4.5 Permits | 4-11 |

| 4.6 Access, Title, Permit and Security Risks | 4-11 |

| 4.6.1 Access Risks | 4-11 |

| 4.6.2 Title Risks | 4-11 |

| 4.6.3 Permit Risks | 4-12 |

| 4.6.4 Security Risks | 4-13 |

| 4.7 Royalties | 4-13 |

| | |

| 5.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, AND PHYSIOGRAPHY | 5-1 |

| | |

| 5.1 Accessibility | 5-1 |

| 5.2 Physiography, Climate and Vegetation | 5-3 |

| 5.3 Local Resources and Infrastructure | 5-4 |

| | |

| 6.0 HISTORY | 6-1 |

| | |

| 6.1 Prior Ownership | 6-1 |

| 6.2 Prior Exploration | 6-1 |

| 6.3 Historical Metallurgical Studies | 6-4 |

| 6.4 Historical Resource Estimates | 6-4 |

| 6.4.1 Canplats | 6-4 |

| 6.4.2 Goldcorp | 6-4 |

| 6.5 Prior Production | 6-4 |

| | |

| 7.0 GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| | |

| 7.1 Sources of Information | 7-1 |

| 7.2 Regional Geology | 7-1 |

| 7.3 Local Geology | 7-4 |

| 7.3.1 General Deposit Geology | 7-4 |

| 7.3.2 Structural Setting | 7-7 |

| 7.3.3 Mineralized Zones | 7-7 |

| 7.3.4 Alteration | 7-11 |

| 7.4 Oxidation | 7-11 |

| 7.5 Conclusions | 7-13 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 2 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 8.0 DEPOSIT TYPES | 8-1 |

| | |

| 9.0 EXPLORATION | 9-1 |

| | |

| 10.0 DRILLING | 10-1 |

| | |

| 10.1 General | 10-1 |

| 10.2 Canplats Drilling | 10-2 |

| 10.3 Goldcorp Drilling | 10-3 |

| 10.4 Orla Drilling | 10-4 |

| 10.5 Sampling | 10-5 |

| 10.5.1 Canplats and Goldcorp Sampling | 10-5 |

| 10.5.2 Orla Sampling | 10-6 |

| 10.6 Conclusions | 10-6 |

| 10.6.1 IMC Conclusion | 10-6 |

| 10.6.2 RGI Conclusion | 10-6 |

| | |

| 11.0 SAMPLE PREPARATION, ANALYSES AND SECURITY | 11-1 |

| | |

| 11.1 Sample Preparation | 11-1 |

| 11.2 Analyses | 11-1 |

| 11.3 QA/QC Programs | 11-2 |

| 11.3.1 Canplats QA/QC Program | 11-2 |

| 11.3.2 Goldcorp QA/QC Program | 11-2 |

| 11.3.3 Orla QA/QC Program | 11-4 |

| 11.4 Sample Security | 11-6 |

| 11.4.1 Canplats and Goldcorp Sample Security | 11-6 |

| 11.4.2 Orla Sample Security | 11-6 |

| | |

| 12.0 DATA VERIFICATION | 12-1 |

| | |

| 12.1 Resource Model Data | 12-1 |

| 12.1.1 Canplats and Goldcorp Drill Data | 12-1 |

| 12.1.1.1 Assay Data | 12-1 |

| 12.1.1.2 Collar Locations | 12-1 |

| 12.1.1.3 Canplats RC Data | 12-2 |

| 12.1.2 Orla Drill Data | 12-3 |

| 12.1.3 Historical Data Reviews | 12-3 |

| 12.1.3.1 Canplats | 12-3 |

| 12.1.3.2 Goldcorp | 12-3 |

| 12.2 Metallurgical Test Data | 12-4 |

| 12.3 Site Visits by Qualified Persons | 12-4 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 3 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 13.0 MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| | |

| 13.1 Canplats (2009 & 2010) | 13-3 |

| 13.1.1 SGS Mineral Services (2009) | 13-3 |

| 13.1.1.1 SGS Mineral Services 2009 – Column Leach Tests | 13-3 |

| 13.1.1.2 SGS Mineral Services 2009 – Bottle Roll Leach Tests | 13-5 |

| 13.1.1.3 SGS Mineral Services 2009 – Flotation Tests | 13-7 |

| 13.1.2 Kappes, Cassiday & Associates (2010) | 13-8 |

| 13.1.2.1 Kappes, Cassiday & Associates (2010) – Head Analyses and Cyanide Shake Tests | 13-8 |

| 13.1.2.2 Kappes, Cassiday & Associates (2010) – Column Leach Tests | 13-11 |

| 13.2 Goldcorp (2012-2015) | 13-12 |

| 13.2.1 Kappes, Cassiday & Associates (2012) | 13-13 |

| 13.2.1.1 Kappes, Cassiday & Associates (2012) - Head Analyses | 13-13 |

| 13.2.1.2 Kappes, Cassiday & Associates (2012) – Bottle Roll Leach Tests | 13-15 |

| 13.2.1.3 Kappes, Cassiday & Associates (2012) – Column Leach Test Work | 13-19 |

| 13.2.2 Blue Coast Research Metallurgy (2012-2013) | 13-21 |

| 13.2.3 Hazen Research (2014) | 13-22 |

| 13.2.4 Comminution Testing | 13-22 |

| 13.2.5 Kappes, Cassiday & Associates (2014 & 2015) | 13-23 |

| 13.2.5.1 Kappes, Cassiday & Associates (2015) – Head Analyses | 13-26 |

| 13.2.5.2 Kappes, Cassiday & Associates (2014 & 2015) – Bottle Roll Leach Tests | 13-29 |

| 13.2.5.3 Kappes, Cassiday & Associates (2015) – Column Leach Test Work | 13-31 |

| 13.3 Orla (2019) | 13-32 |

| 13.3.1 Kappes, Cassiday & Associates (2019) | 13-33 |

| 13.3.1.1 Kappes, Cassiday & Associates (2019) – Head Analyses & Physical Characterization | 13-37 |

| 13.3.1.2 Kappes, Cassiday & Associates (2019) – Bottle Roll Leach Tests | 13-41 |

| 13.3.1.3 Kappes, Cassiday & Associates (2019) – Agglomeration Test Work | 13-42 |

| 13.3.1.4 Kappes, Cassiday & Associates (2019) – Column Leach Test Work | 13-42 |

| 13.3.1.5 Kappes, Cassiday & Associates (2019) – Diagnostic Leach Test Work | 13-47 |

| 13.4 Conclusions from Metallurgical Programs | 13-48 |

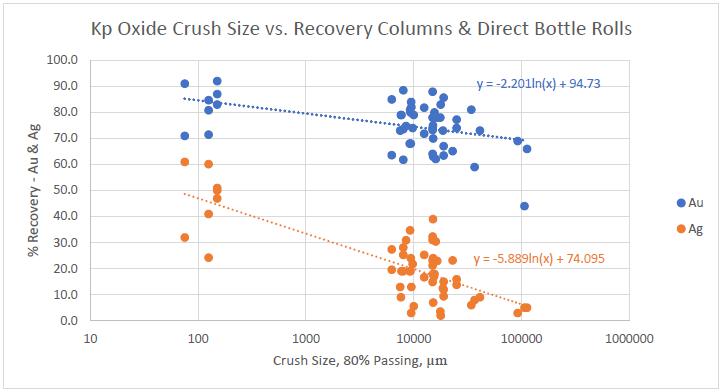

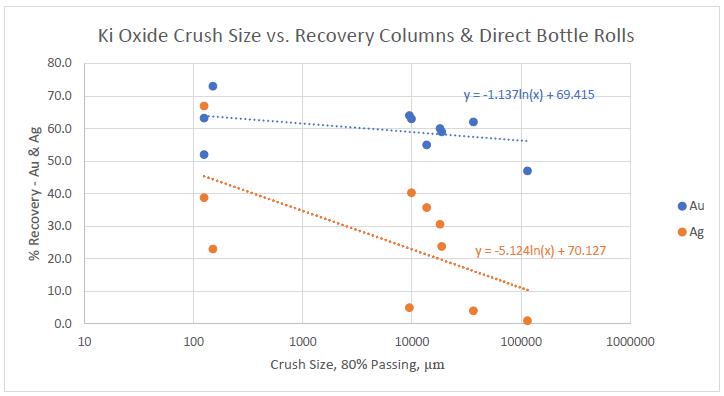

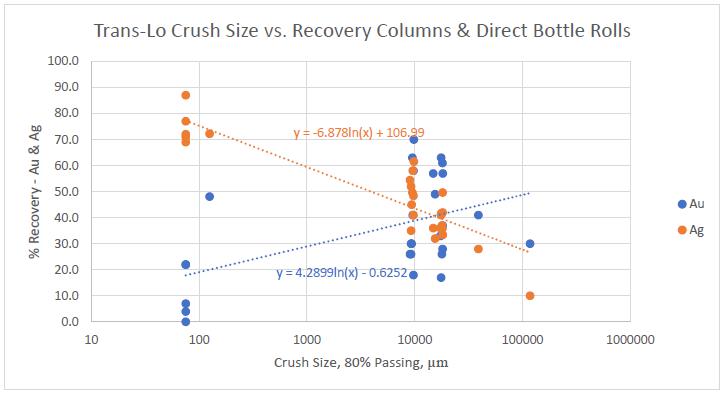

| 13.4.1 Crush Size and Recovery | 13-50 |

| 13.4.2 Leach Cycle | 13-53 |

| 13.4.3 Reagent Consumption Projection | 13-53 |

| 13.4.3.1 Cyanide | 13-53 |

| 13.4.3.2 Lime | 13-54 |

| 13.5 Preg Robbing Discussion | 13-54 |

| 13.6 Sulphide Mineralization Discussion | 13-58 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 4 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 14.0 MINERAL RESOURCE ESTIMATES | 14-1 |

| | |

| 14.1 Mineral Resource | 14-1 |

| 14.1.1 Metal Prices for Mineral Resources | 14-3 |

| 14.1.2 Cost and Recovery Estimates for Mineral Resources | 14-3 |

| 14.1.3 Parameters for Mill Material | 14-6 |

| 14.1.4 Additional Information | 14-7 |

| 14.2 Description of the Block Model | 14-10 |

| 14.2.1 General | 14-10 |

| 14.2.2 Geological Controls | 14-10 |

| 14.2.3 Potentially Contaminated RC Samples | 14-20 |

| 14.2.4 Cap Grades and Compositing | 14-20 |

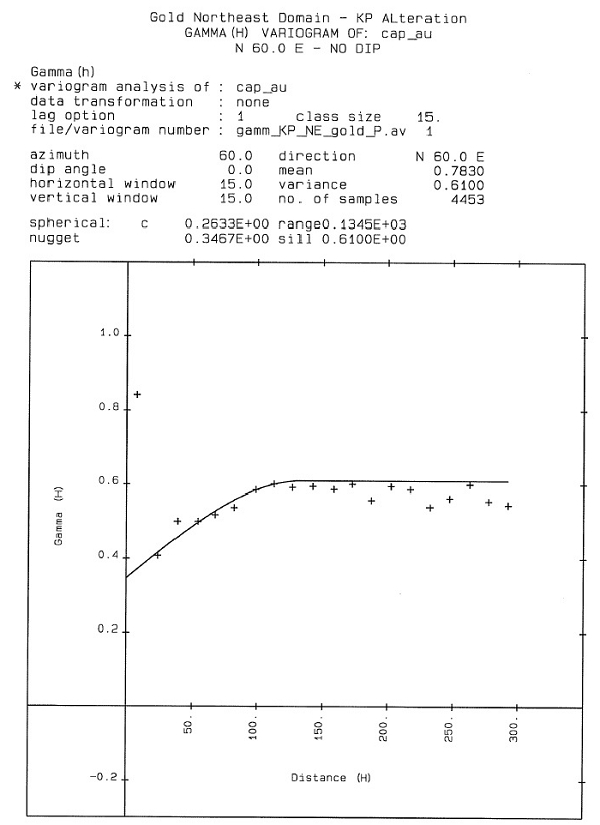

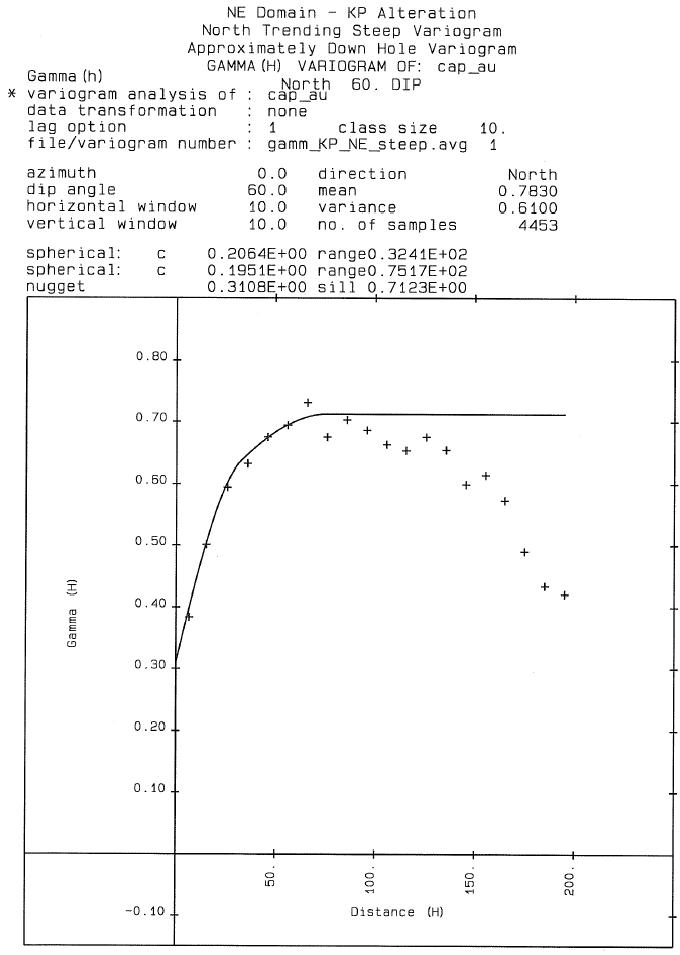

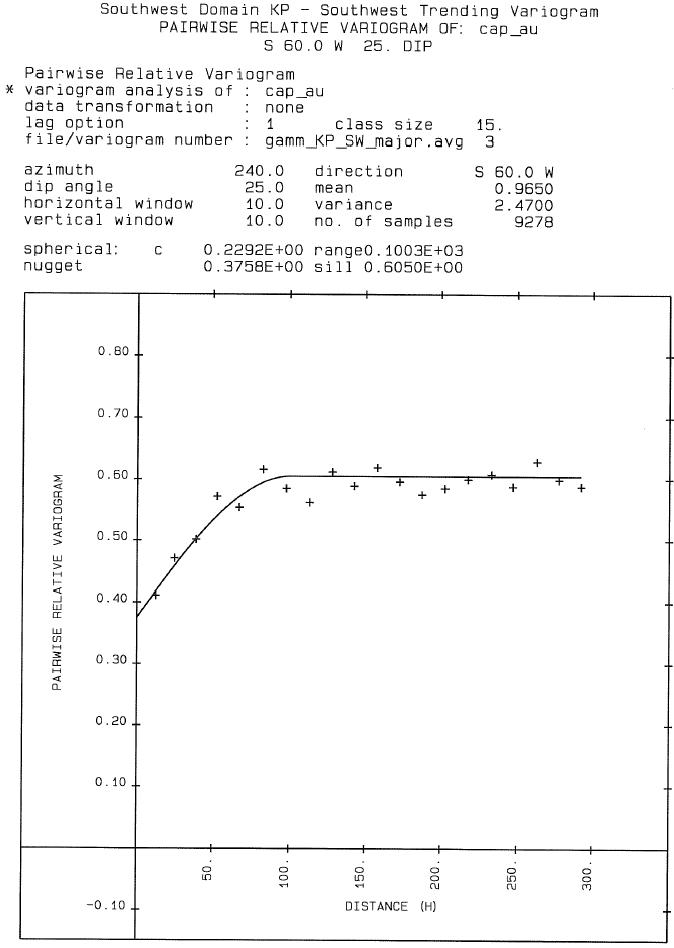

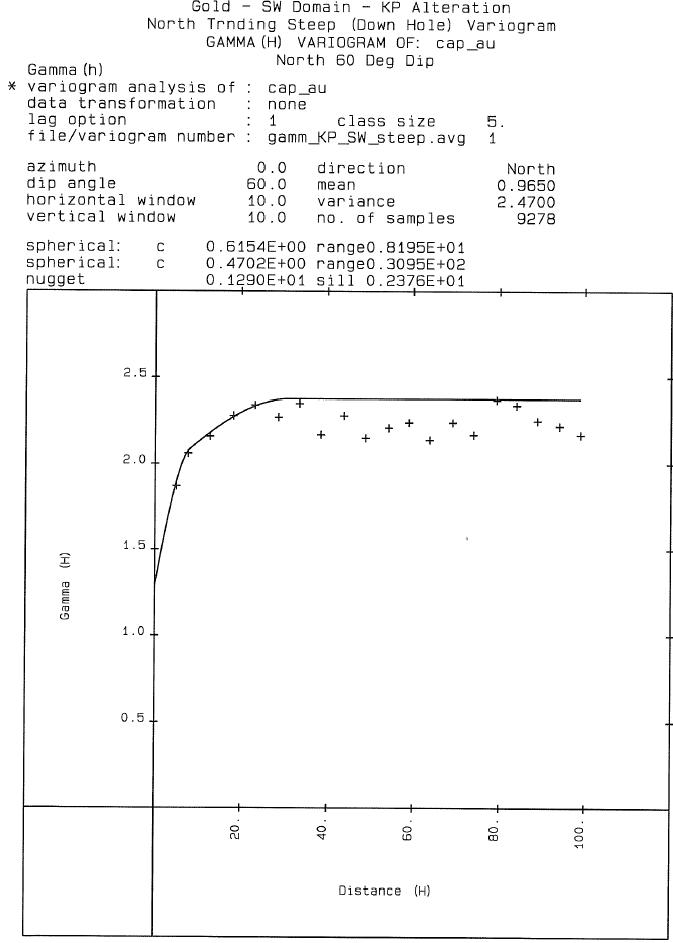

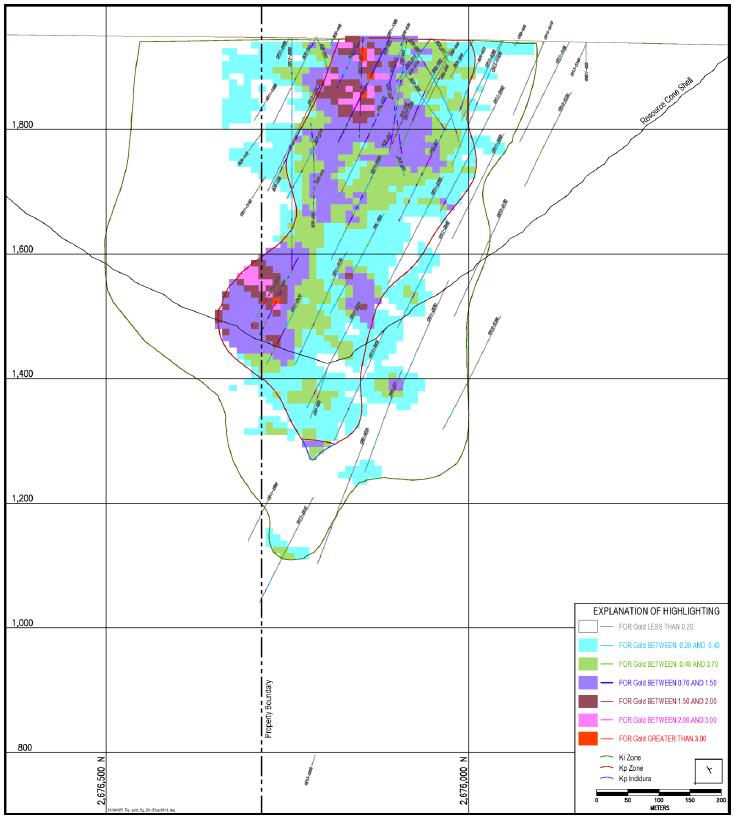

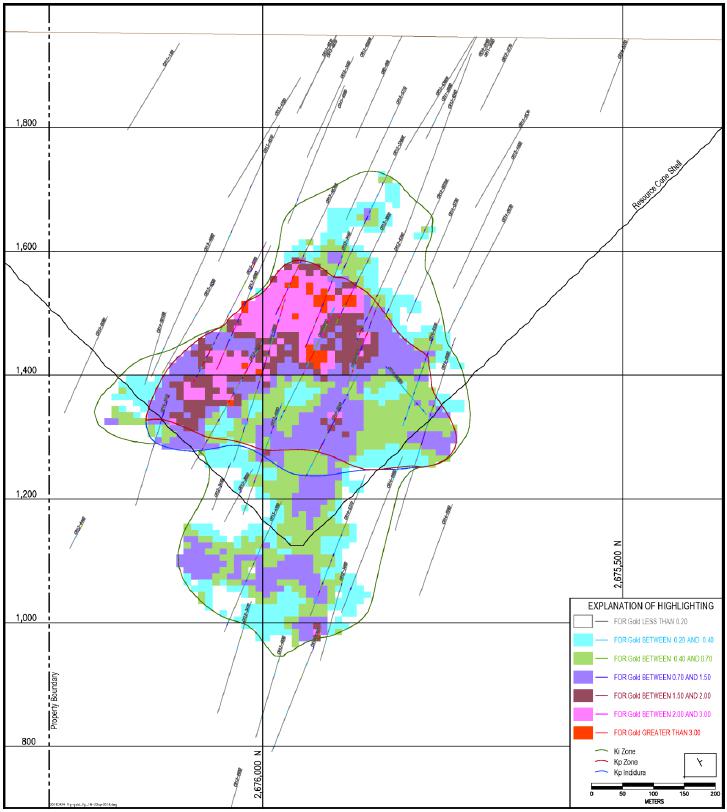

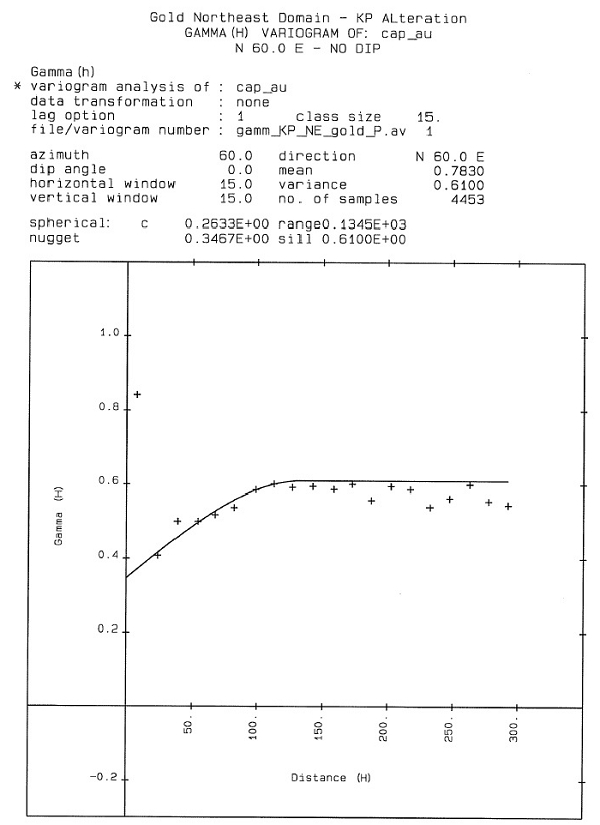

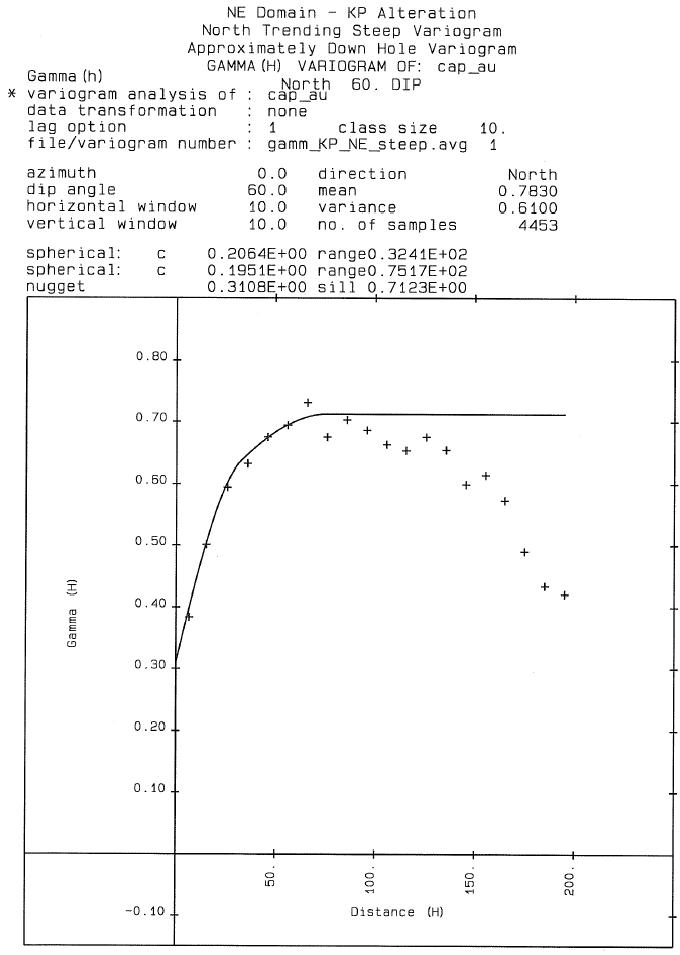

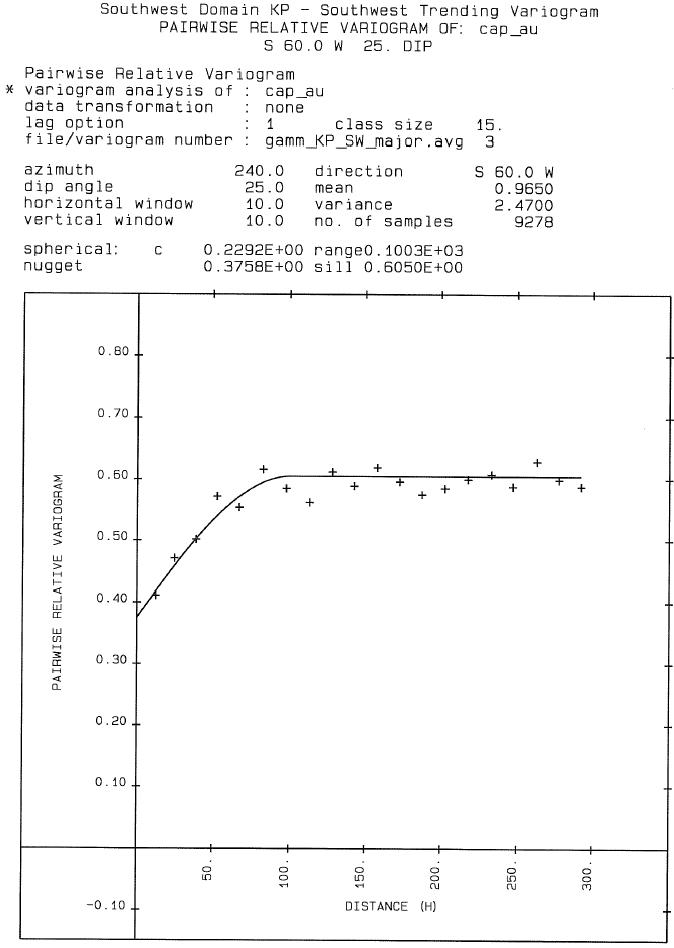

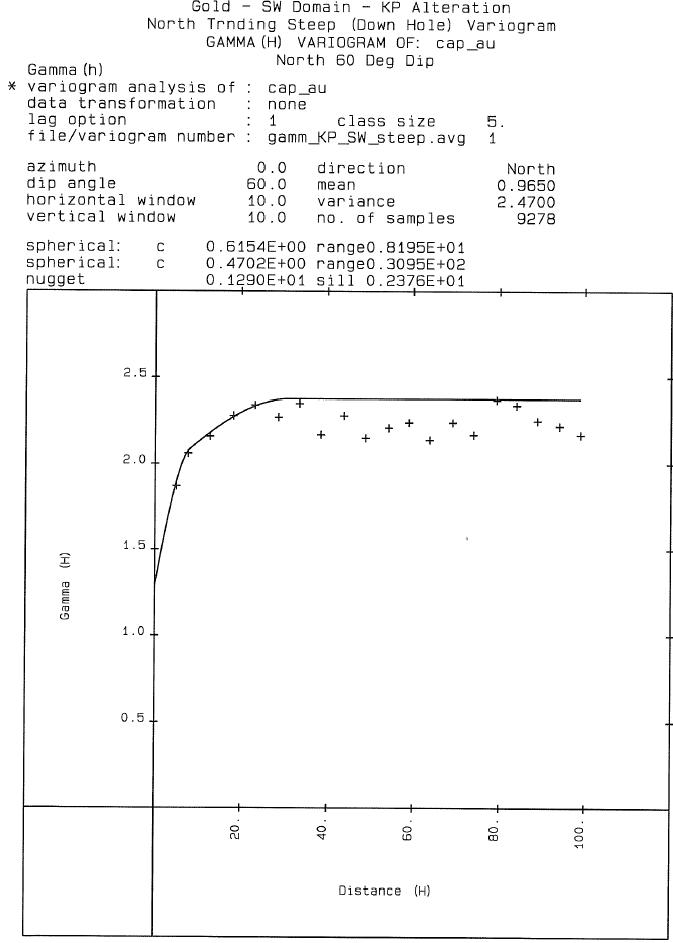

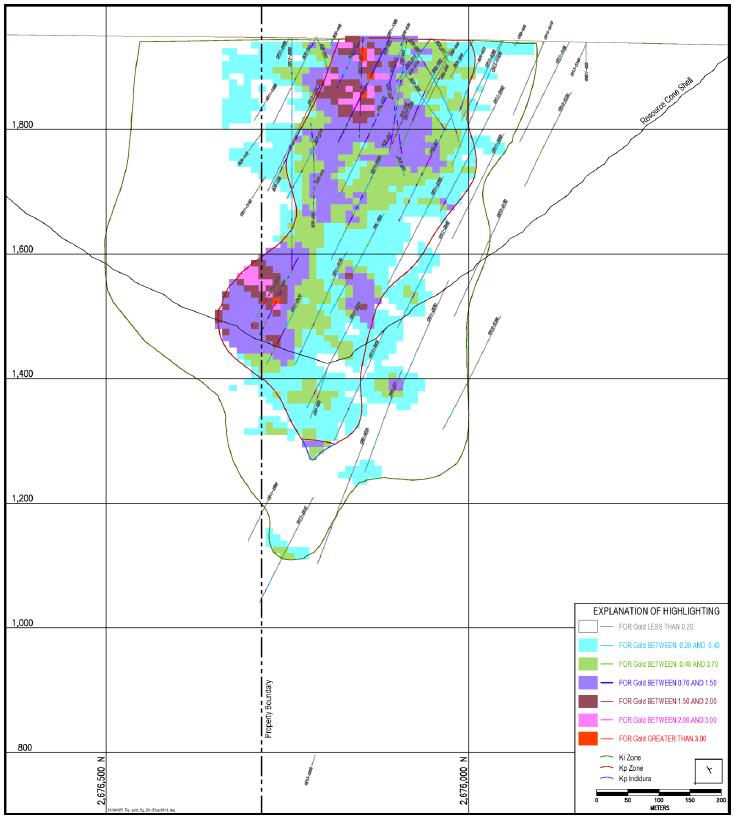

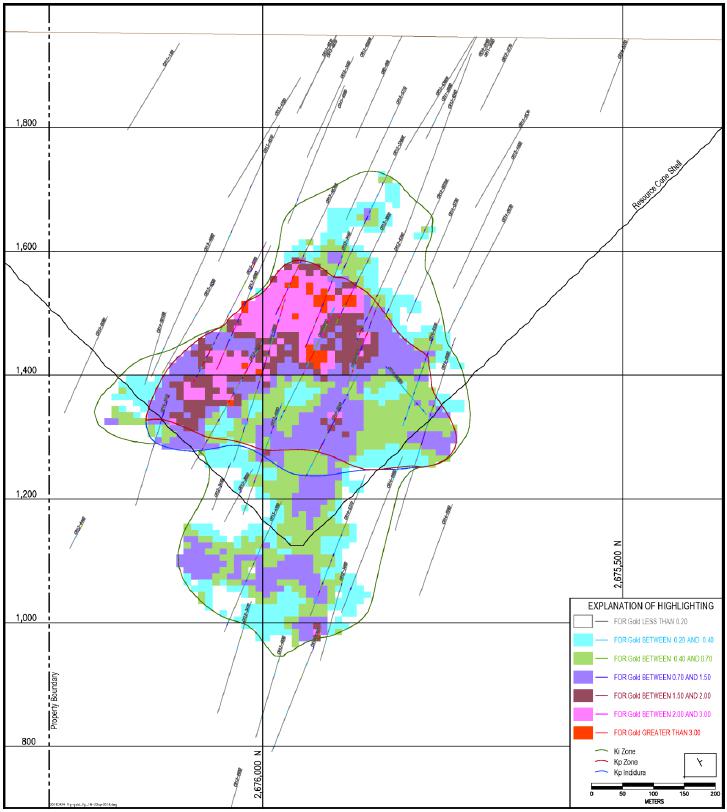

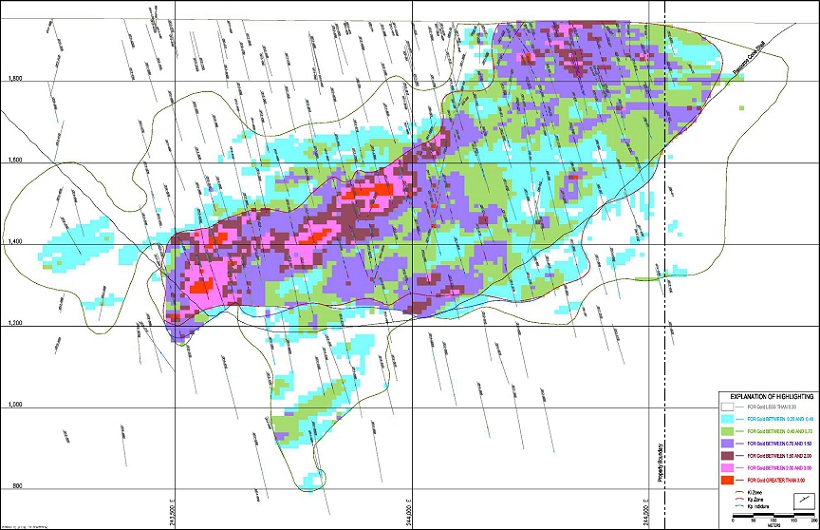

| 14.2.5 Variograms | 14-27 |

| 14.2.5.1 Northeast Domain | 14-27 |

| 14.2.5.2 Southwest Domain | 14-27 |

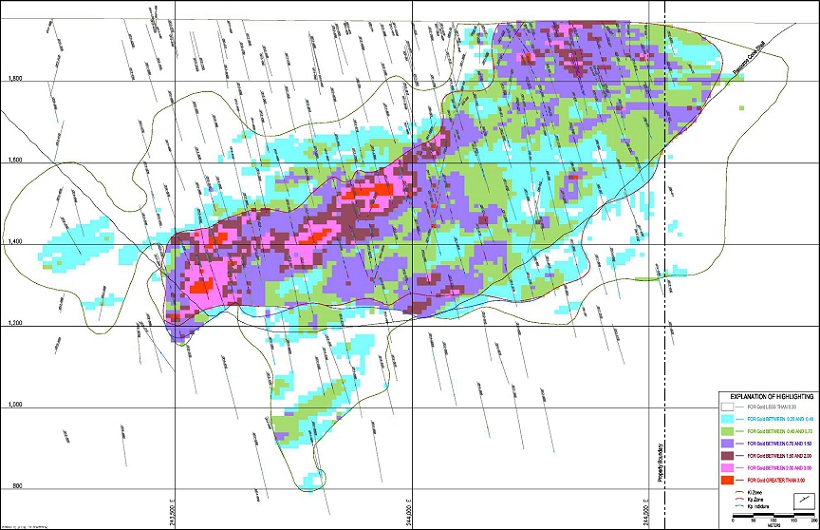

| 14.2.6 Block Grade Estimation | 14-33 |

| 14.2.7 Resource Classification | 14-38 |

| 14.2.8 Bulk Density | 14-45 |

| 14.2.9 Mineral Resource Reconciliation | 14-46 |

| 14.2.9.1 Leach Material | 14-46 |

| 14.2.9.2 Mill Material | 14-47 |

| 14.2.9.3 Total Leach Plus Mill Material | 14-47 |

| | |

| 15.0 MINERAL RESERVE ESTIMATE | 15-1 |

| | |

| 15.1 Mineral Reserve | 15-1 |

| 15.2 Economic Parameters | 15-4 |

| | |

| 16.0 MINING METHODS | 16-1 |

| | |

| 16.1 Operating Parameters and Criteria | 16-1 |

| 16.2 Slope Angles | 16-1 |

| 16.3 Final Pit Design | 16-4 |

| 16.4 Mine Production Schedule | 16-6 |

| 16.5 Waste Storage Area and Stockpile | 16-11 |

| 16.6 Mining Equipment | 16-22 |

| | |

| 17.0 RECOVERY METHODS | 17-1 |

| | |

| 17.1 Process Design Basis | 17-1 |

| 17.2 Process Summary | 17-2 |

| 17.3 Crushing | 17-6 |

| 17.4 Reclamation and Conveyor Stacking | 17-7 |

| 17.5 Leach Pad Design | 17-8 |

| 17.6 Solution Application & Storage | 17-12 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 5 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

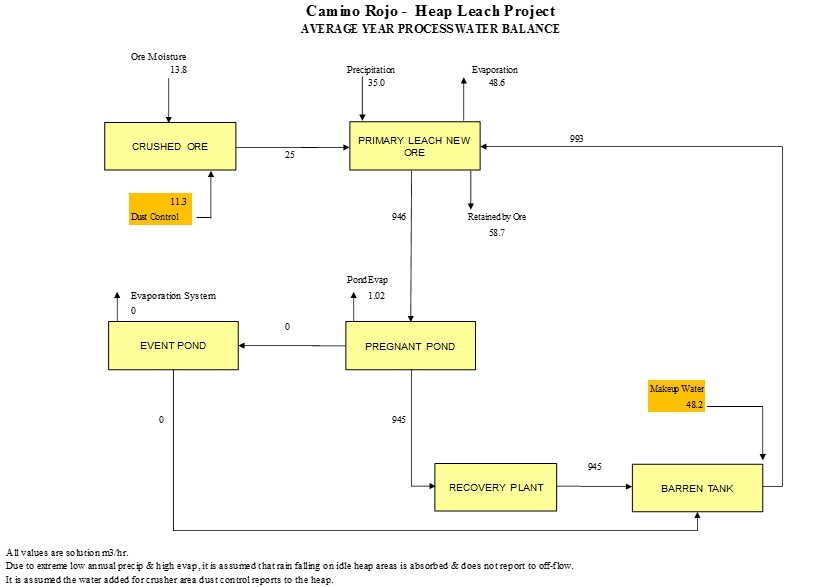

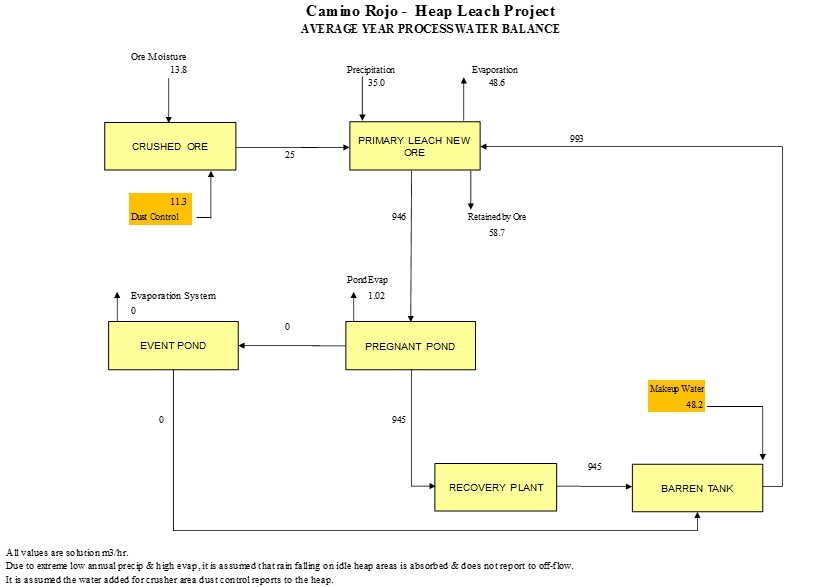

| 17.7 Process Water Balance | 17-16 |

| 17.7.1 Precipitation Data | 17-16 |

| 17.7.2 Water Balance | 17-18 |

| 17.8 Merrill-Crowe Recovery Plant | 17-22 |

| 17.8.1 Refinery | 17-25 |

| 17.8.2 Process Reagents and Consumables | 17-26 |

| 17.8.2.1 Lime | 17-27 |

| 17.8.2.2 Sodium Cyanide | 17-27 |

| 17.8.2.3 Zinc | 17-30 |

| 17.8.2.4 Lead Nitrate | 17-30 |

| 17.8.2.5 Diatomaceous Earth | 17-30 |

| 17.8.2.6 Antiscalant | 17-30 |

| 17.8.2.7 Fluxes | 17-30 |

| | |

| 18.0 PROJECT INFRASTRUCTURE | 18-1 |

| | |

| 18.1 Infrastructure | 18-1 |

| 18.1.1 Existing Installations | 18-1 |

| 18.1.2 Site Roads | 18-1 |

| 18.1.3 Mine Haulage Road | 18-1 |

| 18.1.4 Project Buildings | 18-2 |

| 18.1.5 Administrative Offices | 18-2 |

| 18.1.6 Mine Camp Facilities | 18-2 |

| 18.1.7 Merrill-Crowe Process Facility | 18-4 |

| 18.1.8 Refinery | 18-4 |

| 18.1.9 Laboratory | 18-5 |

| 18.1.10 Process Maintenance Workshop | 18-5 |

| 18.1.11 Reagent Storage | 18-5 |

| 18.1.12 Mine Truck Shop | 18-5 |

| 18.1.13 Light Duty Truck Shop | 18-6 |

| 18.1.14 Fuel Storage and Dispensing | 18-6 |

| 18.1.15 Warehouse and Fenced Laydown Yard | 18-6 |

| 18.1.16 Magazine Site | 18-6 |

| 18.1.17 Guard Shack and Security | 18-7 |

| 18.1.18 Medical Clinic | 18-7 |

| 18.1.19 Fenced Areas | 18-7 |

| 18.1.20 Airstrip | 18-8 |

| 18.2 Power Supply, Communication Systems & IT | 18-8 |

| 18.2.1 Power Supply | 18-8 |

| 18.2.2 Site Distribution | 18-9 |

| 18.2.3 Estimated Electric Power Consumption | 18-9 |

| 18.2.4 Emergency Power | 18-10 |

| 18.2.5 Communications | 18-10 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 6 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 18.3 Water | 18-10 |

| 18.3.1 Water Supply | 18-10 |

| 18.3.2 Potable and Domestic Water | 18-11 |

| 18.3.3 Fire Water and Protection | 18-11 |

| 18.3.4 Surface Water Management | 18-12 |

| 18.4 Sewage | 18-12 |

| | |

| 19.0 MARKET STUDIES AND CONTRACTS | 19-1 |

| | |

| 20.0 ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 20-1 |

| | |

| 20.1 Environmental Studies | 20-1 |

| 20.1.1 Project Area Description | 20-1 |

| 20.1.1.1 Climate | 20-1 |

| 20.1.1.2 Soils | 20-1 |

| 20.1.1.3 Hydrology | 20-1 |

| 20.1.1.4 Physiography | 20-2 |

| 20.1.1.5 Seismicity | 20-2 |

| 20.1.1.6 Vegetation | 20-2 |

| 20.1.1.7 Fauna | 20-3 |

| 20.1.2 Environmental Management Plans | 20-3 |

| 20.1.2.1 Surface Water Management | 20-3 |

| 20.1.2.2 Ground Water Management | 20-4 |

| 20.1.2.3 Air Quality Management | 20-5 |

| 20.1.2.4 Wildlife Management | 20-5 |

| 20.1.2.5 Cyanide Management Plan | 20-5 |

| 20.1.3 Waste Handling | 20-5 |

| 20.1.3.1 Hazardous Wastes | 20-5 |

| 20.1.3.2 Non-hazardous Wastes | 20-5 |

| 20.1.3.3 Putrescible (Domestic) Waste Disposal | 20-6 |

| 20.1.3.4 Boneyard Storage | 20-6 |

| 20.1.3.5 On-site BioRemediation Cell | 20-6 |

| 20.1.3.6 Waste Water (Sewage) Disposal | 20-6 |

| 20.1.4 Reclamation | 20-6 |

| 20.1.4.1 Soil Handling | 20-8 |

| 20.1.4.2 Camp | 20-8 |

| 20.1.4.3 Central Operating Area | 20-8 |

| 20.1.4.4 Mine Pits | 20-8 |

| 20.1.4.5 Waste Rock Storage Facility (Mine Waste Dumps) | 20-9 |

| 20.1.4.6 Roads | 20-11 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 7 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 20.1.5 Closure Activities – Heap Leach Facilities | 20-13 |

| 20.1.5.1 Chemistry | 20-13 |

| 20.1.5.2 Permanent Surface Water Diversion Works | 20-14 |

| 20.1.5.3 Permanent Slope Stabilization | 20-14 |

| 20.1.5.4 Final Engineering and Monitoring Plans | 20-15 |

| 20.1.5.5 Heap Rinsing, Neutralization and Solution Management of HLP Seepage | 20-15 |

| 20.1.5.6 Heap Slope Grooming and Slope Stabilization | 20-16 |

| 20.1.5.7 Cover, Topsoil Placement and Revegetation of Heap and Surrounding Areas | 20-16 |

| 20.1.5.8 Ponds and Pump Stations | 20-16 |

| 20.1.5.9 Physical and Mobile Equipment | 20-16 |

| 20.1.5.10 Roads, Diversion Works and Erosion Controls | 20-17 |

| 20.1.5.11 Fencing | 20-17 |

| 20.1.6 Post Closure Activities | 20-17 |

| 20.1.6.1 Physical Monitoring and Maintenance | 20-17 |

| 20.1.6.2 Geochemical Monitoring and Maintenance | 20-17 |

| 20.1.6.3 Biological Monitoring and Maintenance | 20-18 |

| 20.1.6.4 Surplus Water Management | 20-18 |

| 20.1.7 Closure Cost Estimates – Heap Leach Facilities | 20-19 |

| 20.2 Permitting | 20-20 |

| 20.3 Social and Community Impact | 20-25 |

| 20.3.1 Background | 20-25 |

| 20.3.2 Population and Demographics | 20-26 |

| 20.3.2.1 Indigenous Communities | 20-26 |

| 20.3.2.2 Inhabitants, Age and Gender | 20-26 |

| 20.3.2.3 Education | 20-28 |

| 20.3.3 Infrastructure and Public Services | 20-29 |

| 20.3.4 Government and Community | 20-31 |

| 20.3.5 Economic Activity, Income, Marginalization | 20-33 |

| 20.3.6 Social Management System and Mitigation of Negative Impacts | 20-35 |

| | |

| 21.0 CAPITAL AND OPERATING COSTS | 21-1 |

| | |

| 21.1 Capital Expenditures | 21-2 |

| 21.1.1 Mining Capital Costs | 21-4 |

| 21.1.1.1 Mining Contractor Mobilization and Demobilization | 21-4 |

| 21.1.1.2 Mining Owner Equipment | 21-4 |

| 21.1.1.3 Mine Development (Preproduction) | 21-6 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 8 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 21.1.2 Process and Infrastructure Capital Cost Estimate | 21-7 |

| 21.1.2.1 Process and Infrastructure Capital Cost Basis | 21-7 |

| 21.1.2.2 Major Earthworks and Liner | 21-8 |

| 21.1.2.3 Civils | 21-9 |

| 21.1.2.4 Structural Steel | 21-9 |

| 21.1.2.5 Platework | 21-9 |

| 21.1.2.6 Mechanical Equipment | 21-9 |

| 21.1.2.7 Piping | 21-10 |

| 21.1.2.8 Electrical | 21-10 |

| 21.1.2.9 Instrumentation | 21-11 |

| 21.1.2.10 Infrastructure & Buildings | 21-11 |

| 21.1.2.11 Supplier Engineering and Installation Supervision / Commissioning | 21-12 |

| 21.1.2.12 Process Mobile Equipment | 21-12 |

| 21.1.2.13 Spare Parts | 21-12 |

| 21.1.2.14 Process & Infrastructure Contingency | 21-12 |

| 21.1.2.15 Process & Infrastructure Sustaining Capital | 21-13 |

| 21.1.3 Construction Indirect Costs | 21-13 |

| 21.1.4 Other Owner’s Construction Costs | 21-14 |

| 21.1.5 Initial Fills Inventory | 21-15 |

| 21.1.6 Engineering, Procurement & Construction Management | 21-16 |

| 21.1.7 Working Capital | 21-17 |

| 21.1.8 IVA | 21-17 |

| 21.1.9 Exclusions | 21-17 |

| 21.2 Operating Costs | 21-17 |

| 21.2.1 Mining Operating Costs | 21-18 |

| 21.2.1.1 Contract Mining Cost Basis | 21-20 |

| 21.2.1.2 Blasting & Mine Technical Services Costs | 21-20 |

| 21.2.1.3 Pit Wall Support Costs | 21-20 |

| 21.2.1.4 Presplitting for Wall Control | 21-21 |

| 21.2.2 Process and G&A Operating Costs | 21-25 |

| 21.2.2.1 Personnel and Staffing | 21-27 |

| 21.2.2.2 Power | 21-27 |

| 21.2.2.3 Consumable Items | 21-28 |

| 21.2.2.4 Heap Leach Consumables | 21-28 |

| 21.2.2.5 Recovery Plant Consumables | 21-29 |

| 21.2.2.6 Laboratory | 21-29 |

| 21.2.2.7 Fuel | 21-29 |

| 21.2.2.8 Miscellaneous Operating & Maintenance Supplies | 21-29 |

| 21.2.2.9 Mobile / Support Equipment | 21-30 |

| 21.2.2.10 G&A Expenses | 21-30 |

| 21.3 Reclamation & Closure Costs | 21-32 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 9 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 22.0 ECONOMIC ANALYSIS | 22-1 |

| | |

| 22.1 Summary | 22-1 |

| 22.2 Methodology | 22-4 |

| 22.2.1 General Assumptions | 22-4 |

| 22.3 Capital Expenditures | 22-6 |

| 22.4 Metal Production | 22-8 |

| 22.5 Royalties | 22-9 |

| 22.6 Operating Costs | 22-9 |

| 22.7 Closure Costs | 22-9 |

| 22.8 Taxation | 22-9 |

| 22.8.1 Value Added Tax (IVA) | 22-9 |

| 22.8.2 Federal Income Tax | 22-10 |

| 22.8.3 Special Mining Tax | 22-10 |

| 22.8.4 Zacatecas Environmental “Green Tax” | 22-10 |

| 22.8.5 Depreciation | 22-10 |

| 22.8.6 Loss Carry Forward | 22-11 |

| 22.9 Economic Model & Cash Flow | 22-11 |

| 22.10 Sensitivity | 22-14 |

| | |

| 23.0 ADJACENT PROPERTIES | 23-1 |

| | |

| 24.0 OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| | |

| 24.1 Project Implementation | 24-1 |

| 24.1.1 Project Development | 24-1 |

| 24.1.2 Project Controls | 24-1 |

| 24.1.3 Procurement and Logistics | 24-2 |

| 24.1.4 Construction | 24-2 |

| 24.1.5 Construction Schedule | 24-3 |

| 24.2 Site Geotechnical Analyses | 24-5 |

| 24.2.1 Heap Leach Pad Stability | 24-5 |

| 24.3 Hydrogeology | 24-5 |

| 24.3.1 Occurrence and Movement of Groundwater | 24-6 |

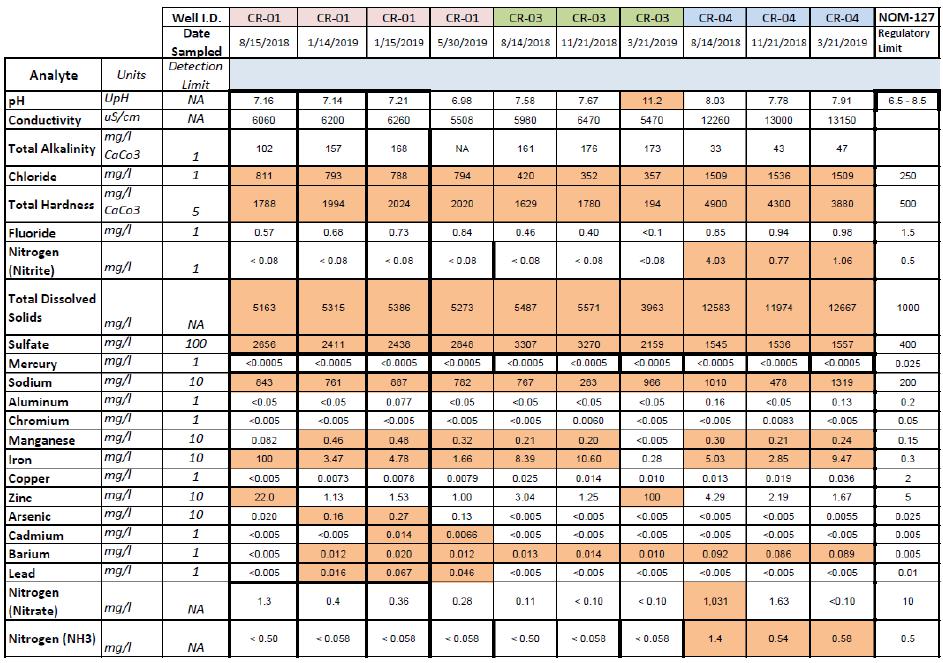

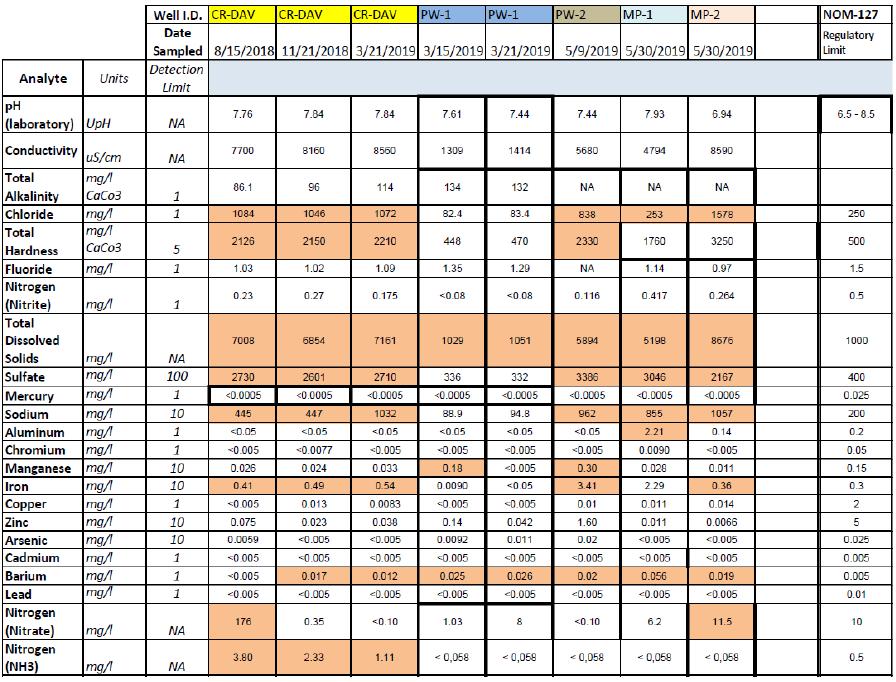

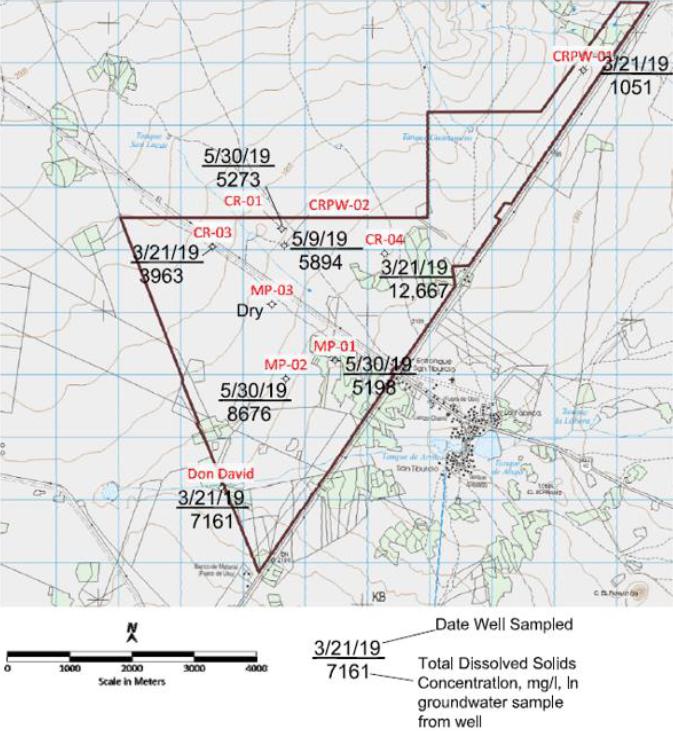

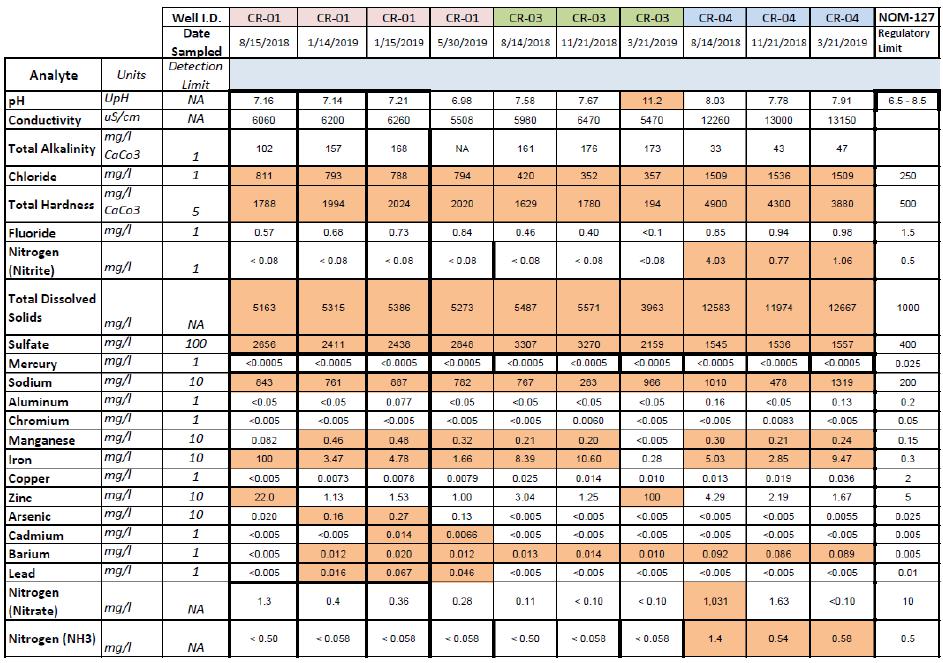

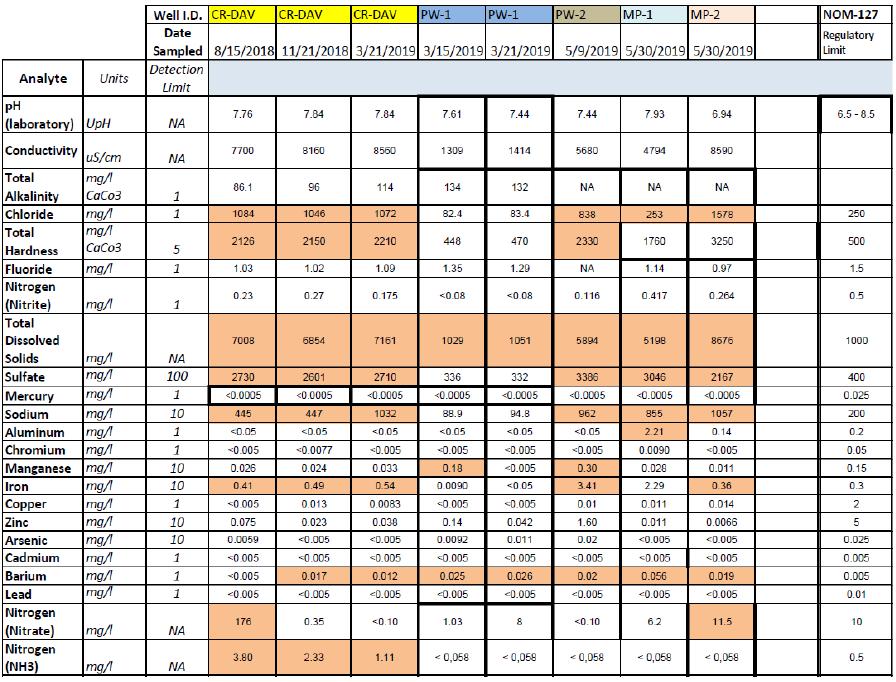

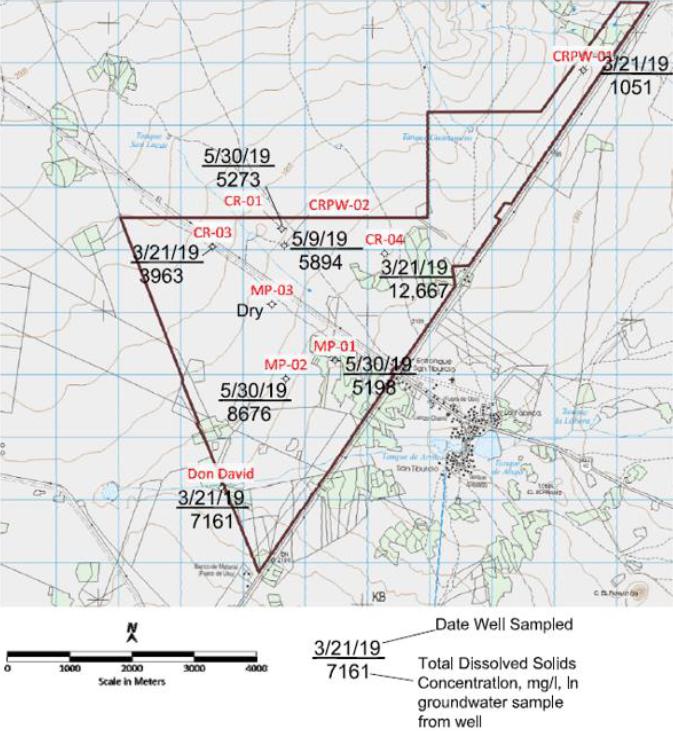

| 24.3.2 Groundwater Quality | 24-8 |

| 24.3.3 Drilling and Aquifer Testing | 24-11 |

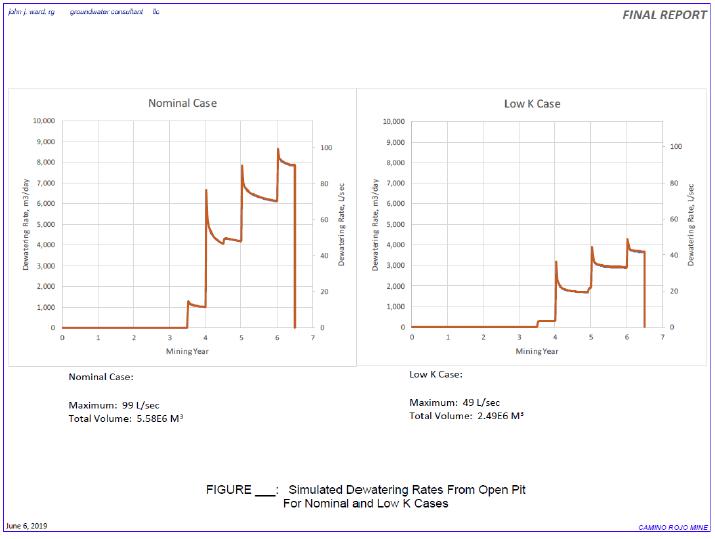

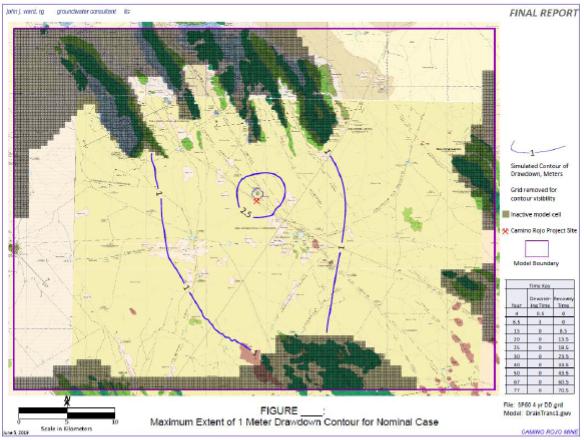

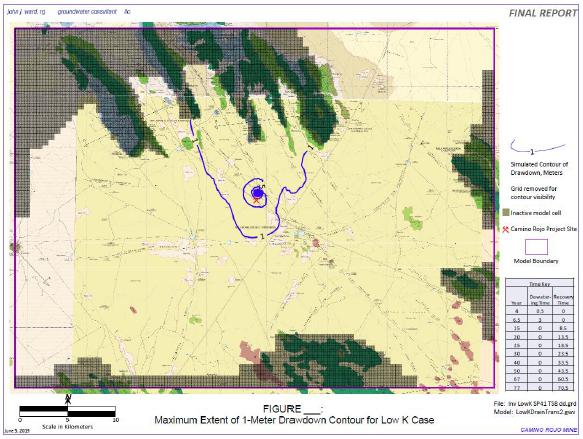

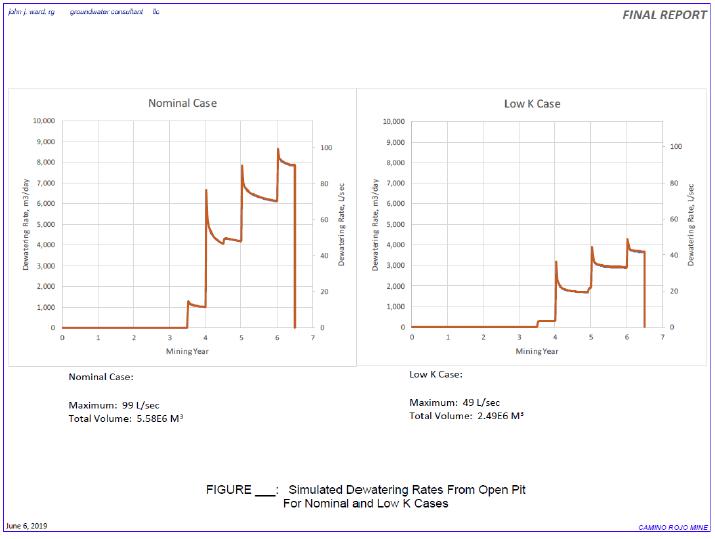

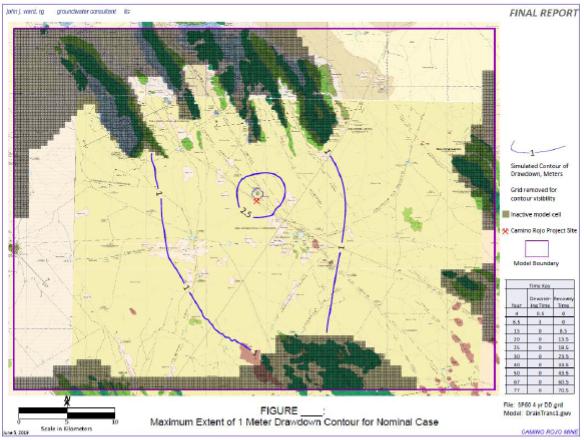

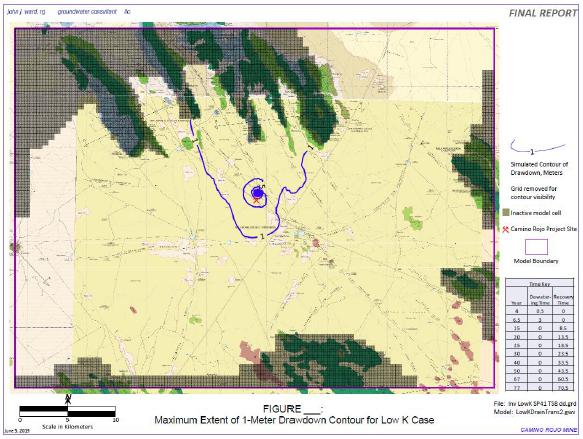

| 24.3.4 Computer Modeling of Effects of Proposed Groundwater Withdrawal | 24-12 |

| 24.3.4.1 Summary of Computer Modeling | 24-12 |

| 24.3.5 Model Limitations | 24-16 |

| 24.4 Sulphides | 24-16 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 10 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 25.0 INTERPRETATIONS AND CONCLUSIONS | 25-1 |

| | |

| 25.1 Conclusions | 25-1 |

| 25.1.1 Mining | 25-1 |

| 25.1.2 Metallurgy and Process | 25-1 |

| 25.1.3 Environmental and Permitting | 25-2 |

| 25.2 Opportunities | 25-3 |

| 25.2.1 Mining | 25-3 |

| 25.2.2 Mineral Resource | 25-3 |

| 25.2.3 Metallurgy and Process | 25-3 |

| 25.2.4 New Mineral Zones | 25-4 |

| 25.3 Risks | 25-4 |

| 25.3.1 Mining | 25-4 |

| 25.3.2 Metallurgy and Process | 25-5 |

| 25.3.3 Access, Title and Permitting | 25-5 |

| 25.3.4 Other Risks | 25-6 |

| | |

| 26.0 RECOMMENDATIONS | 26-1 |

| | |

| 26.1 KCA Recommendations | 26-1 |

| 26.2 RGI Recommendations | 26-1 |

| 26.3 Barranca Recommendations | 26-2 |

| | |

| 27.0 REFERENCES | 27-1 |

| | |

| 28.0 DATE AND SIGNATURE PAGE | 28-1 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 11 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

FIGURES

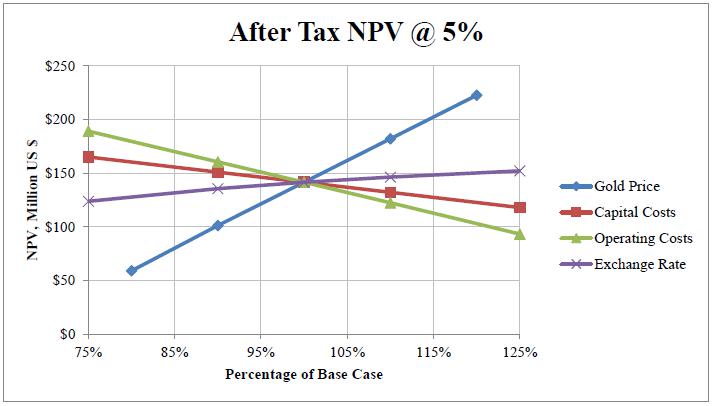

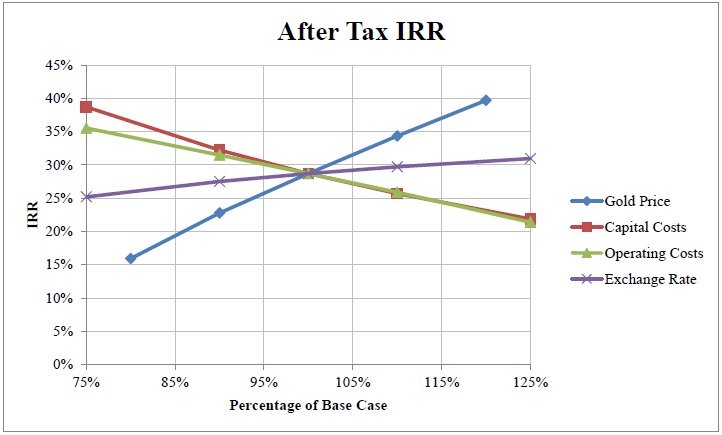

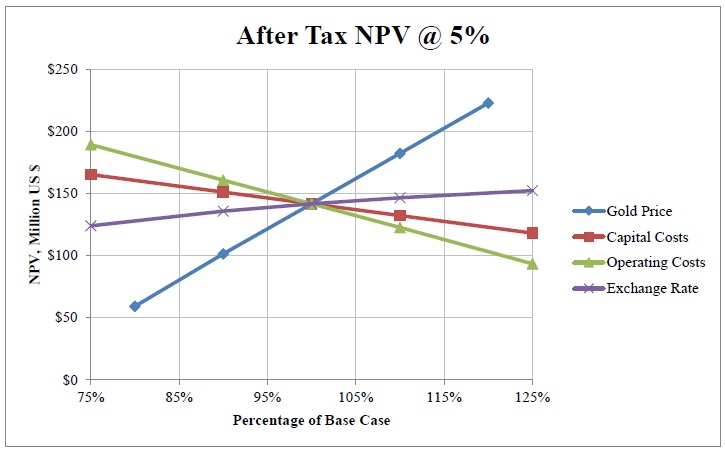

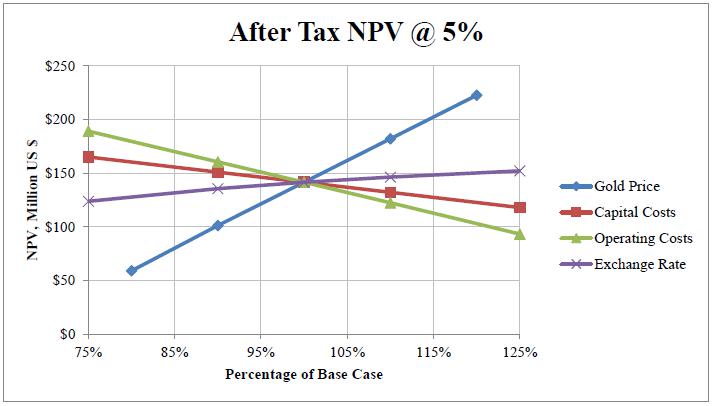

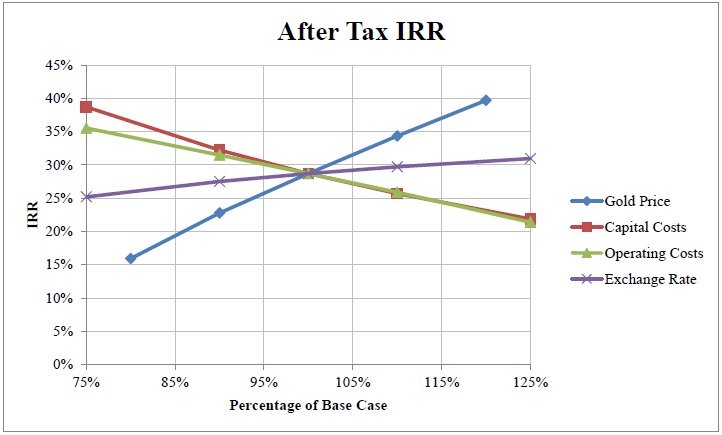

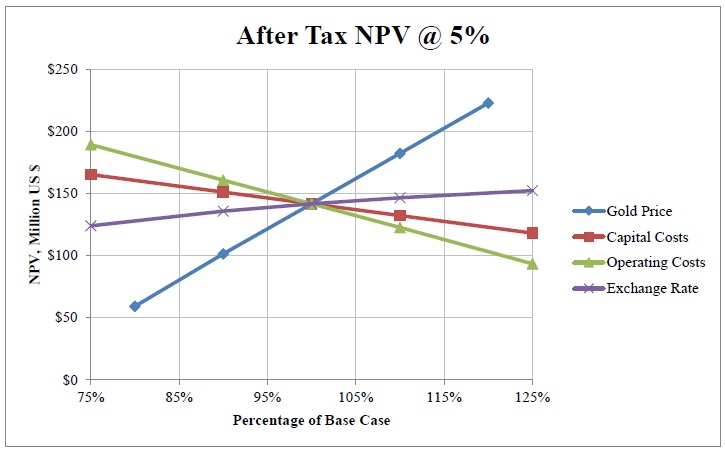

| Figure 1-1 After-Tax IRR vs. Gold Price, Capital Cost, Operating Cost & Exchange Rate | 1-21 |

| Figure 1-2 NPV @ 5% vs. Gold Price, Capital Cost, Operating Cost & Exchange Rate | 1-21 |

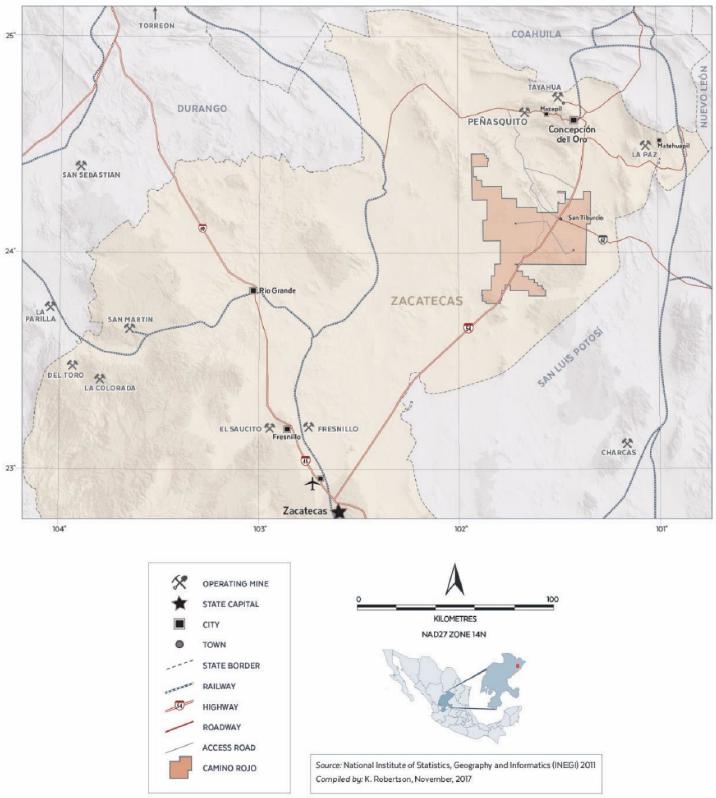

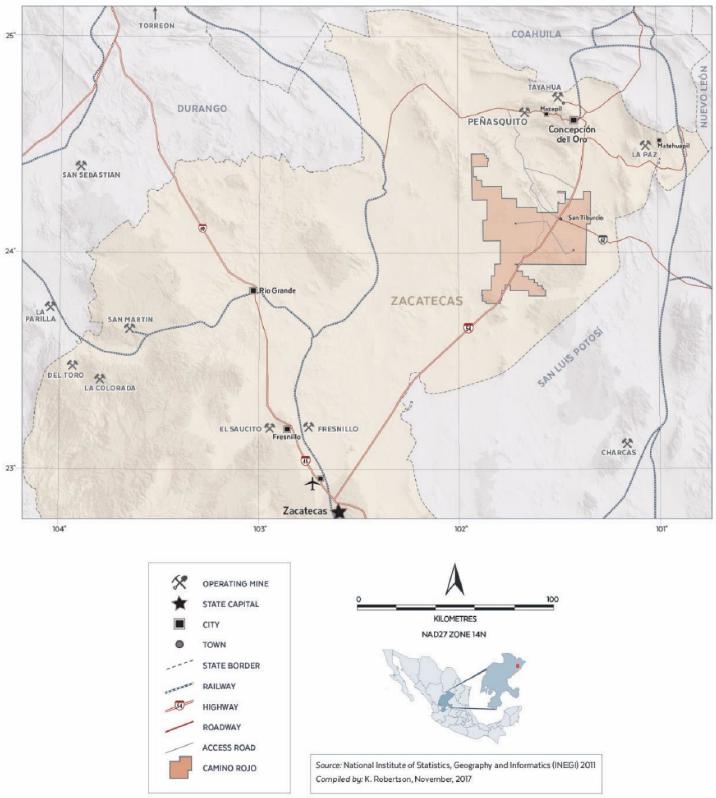

| Figure 4-1 Location Map, Camino Rojo Project | 4-2 |

| Figure 4-2 Mining Concessions, Camino Rojo Property | 4-5 |

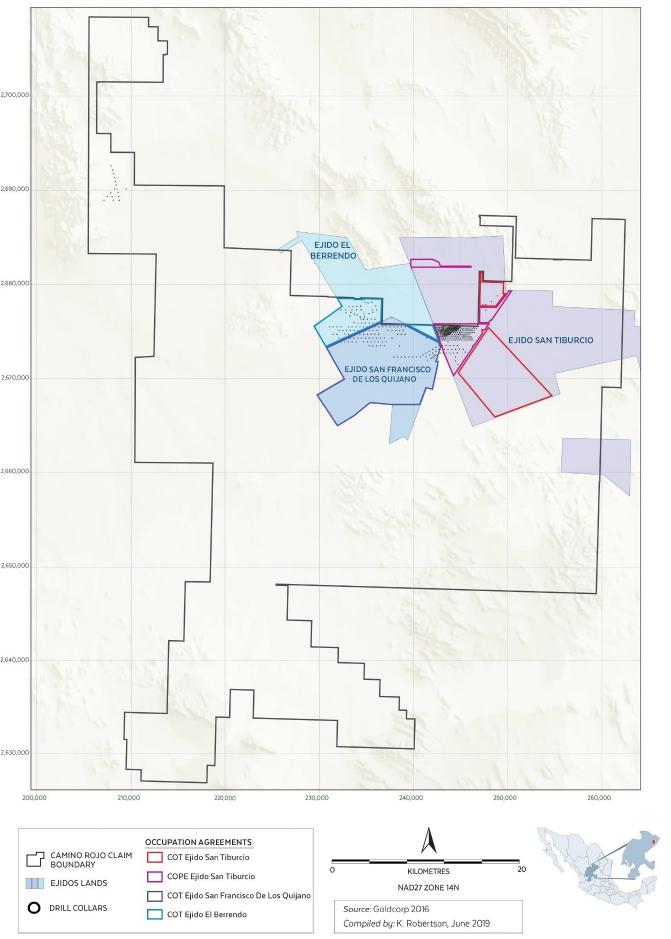

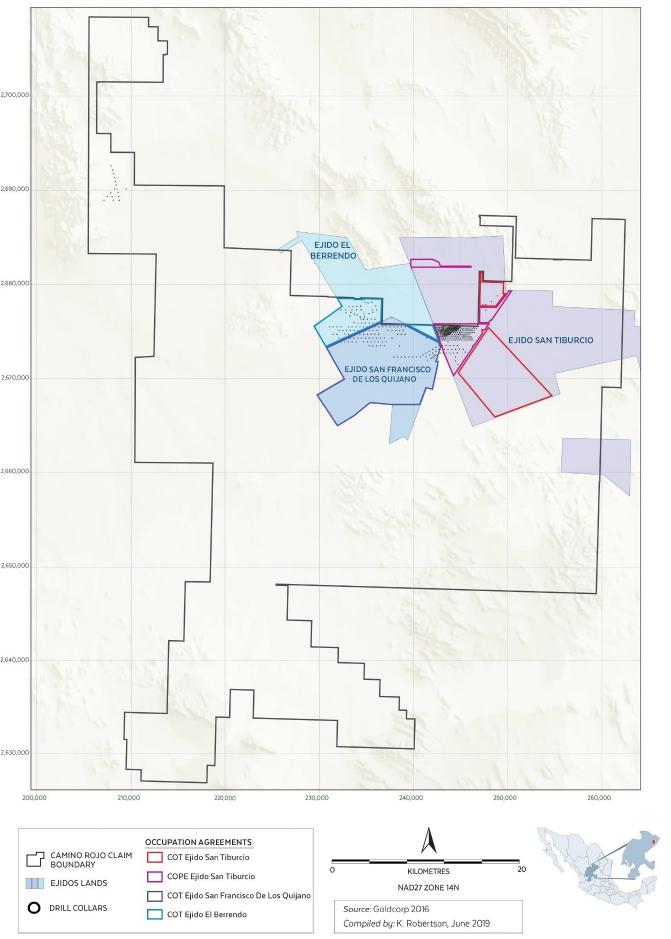

| Figure 4-3 Surface rights in Project Area | 4-8 |

| Figure 5-1 Project Location and Regional Infrastructure | 5-2 |

| Figure 5-2 View of Typical Topography and Vegetation at Camino Rojo | 5-3 |

| Figure 6-1 Historical Drillhole Locations and Project Claim Boundaries | 6-3 |

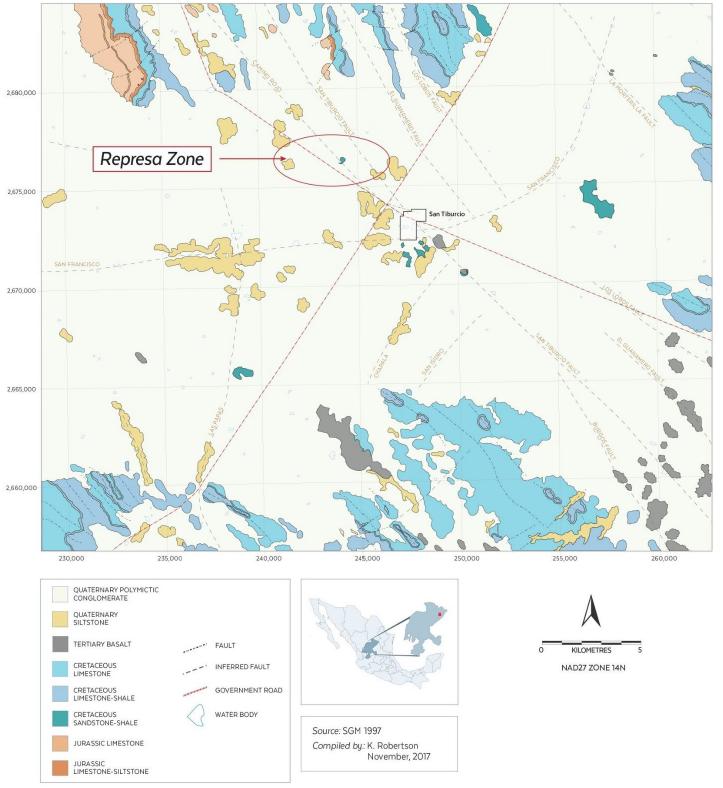

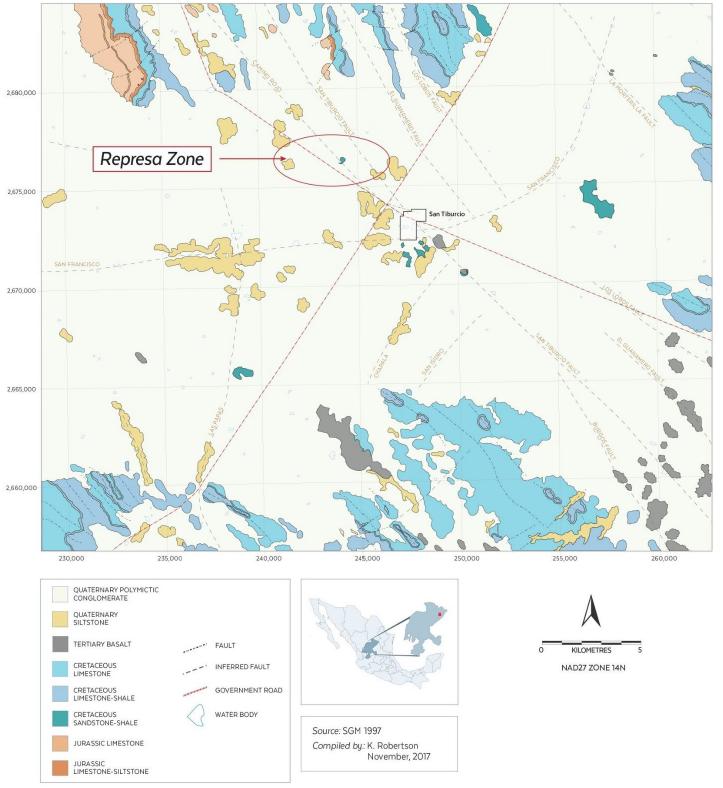

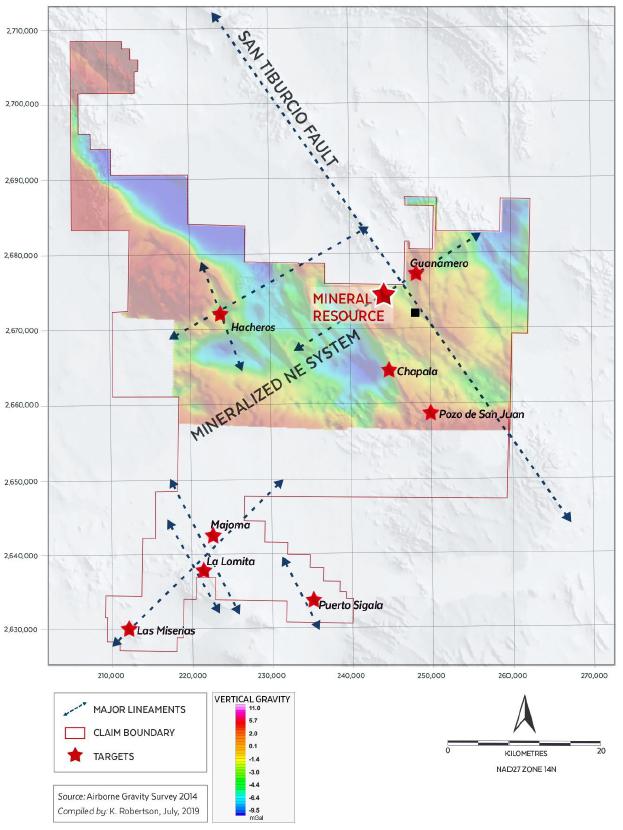

| Figure 7-1 Regional Geologic Map (Servicio Geológico Mexicano, 2000) | 7-3 |

| Figure 7-2 Local Geology, Camino Rojo Deposit (Servicio Geológico Mexicano, 2014) | 7-5 |

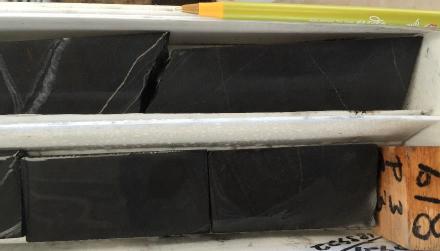

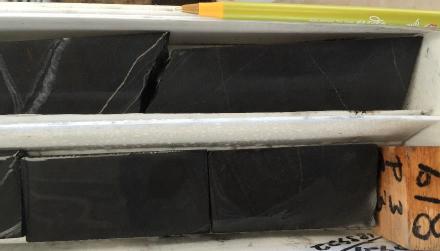

| Figure 7-3 Drillcore from CR12-345D, 818m | 7-6 |

| Figure 7-4 Drillcore from CR12-345D, 254m | 7-6 |

| Figure 7-5 Drillcore from CR12-345D, 993m | 7-7 |

| Figure 7-6 Drillcore from CR12 345D, 395m | 7-9 |

| Figure 7-7 Drillcore from CR12 345D, 727m | 7-9 |

| Figure 7-8 Drillcore from CR11 267D, 490m | 7-10 |

| Figure 7-9 Drillcore from CR11 267D, 473m | 7-10 |

| Figure 7-10 Drillcore from CR11 258D, 256m | 7-12 |

| Figure 7-11 Drillcore from CR11 258D, 257m | 7-12 |

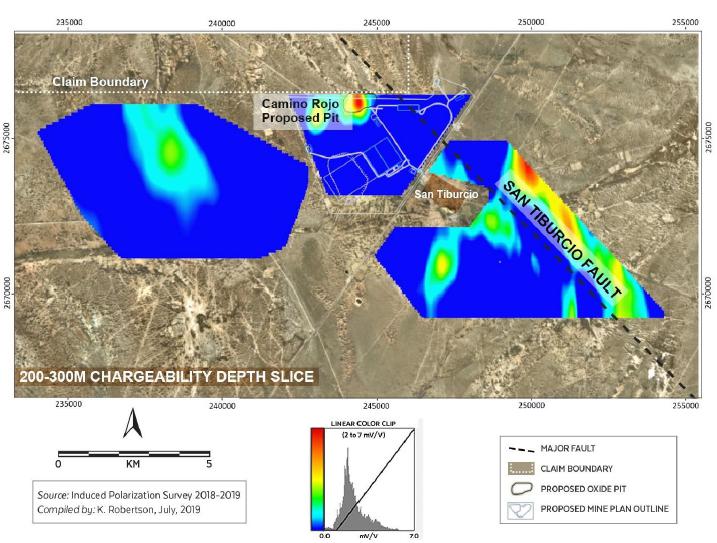

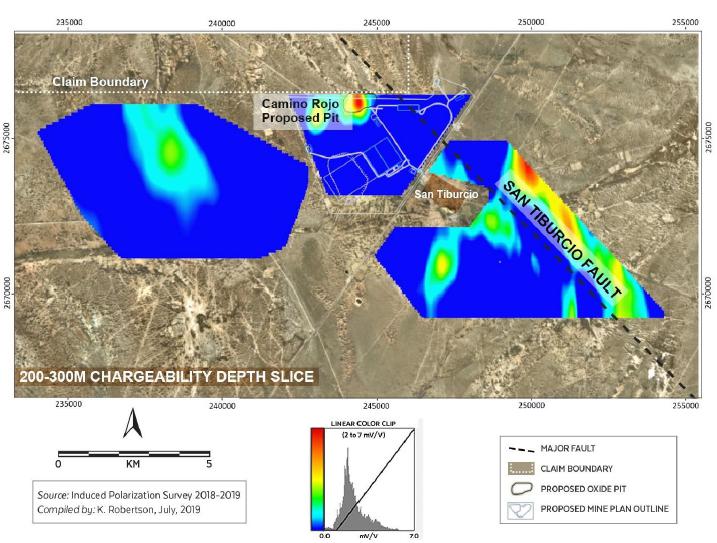

| Figure 9-1 Chargeability Features, 300m to 400m, from Orla’s 2018 and 2019 IP Survey | 9-1 |

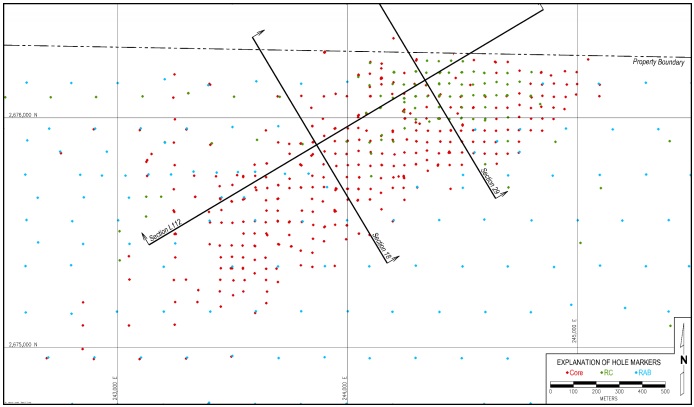

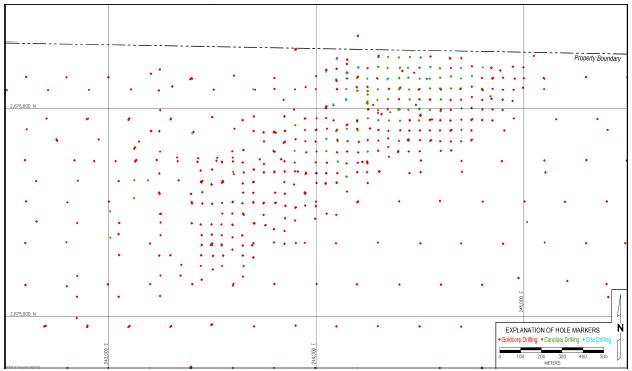

| Figure 10-1 Drilling by Type, IMC 2019 | 10-7 |

| Figure 10-2 Drilling by Company, IMC 2019 | 10-8 |

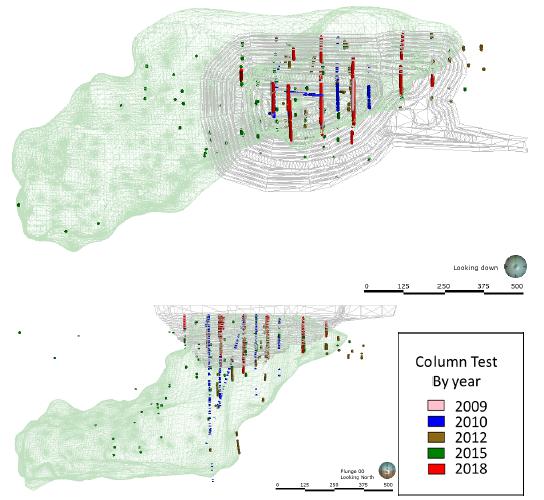

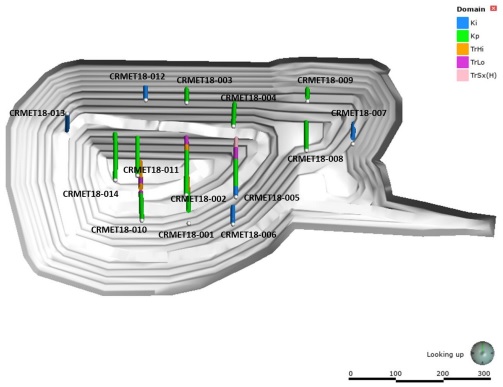

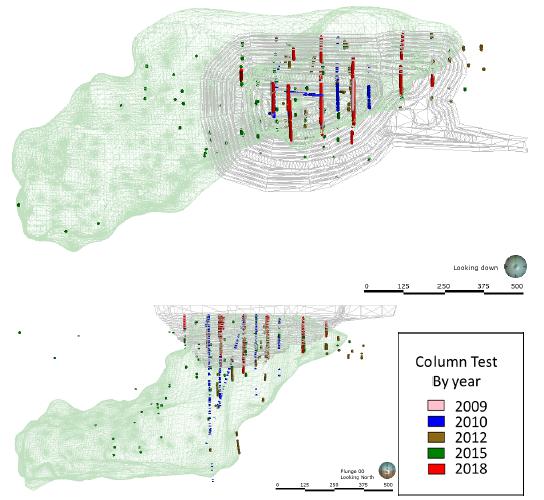

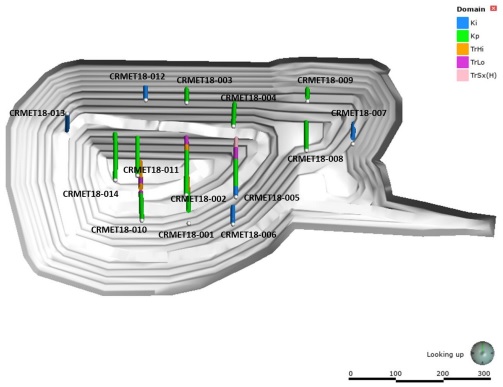

| Figure 13-1 Column Leach Test Sample Locations (Orla, 2019) | 13-2 |

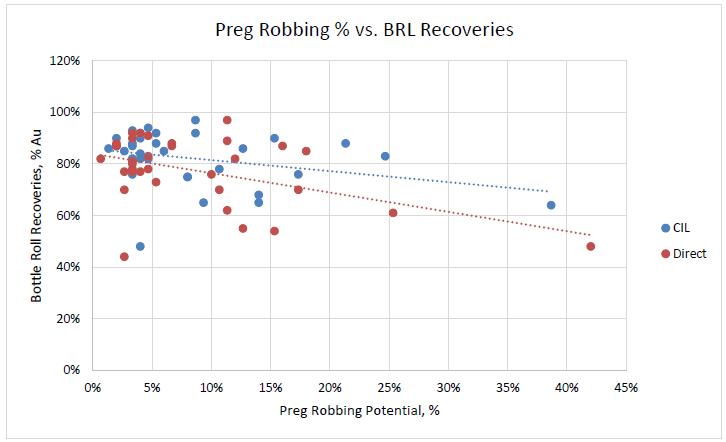

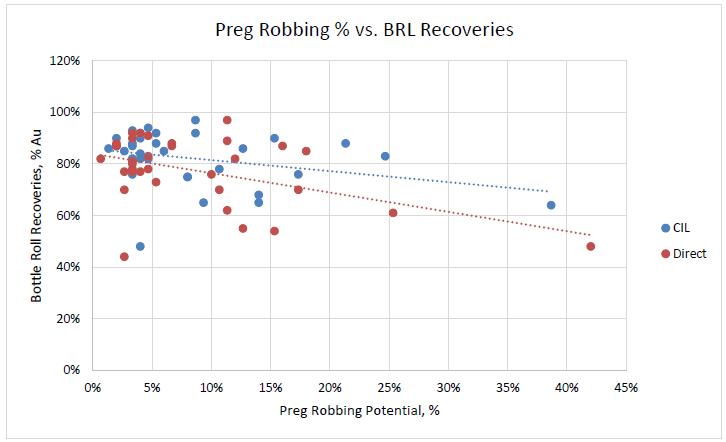

| Figure 13-2 Preg-Robbing Percentage vs. CIL & Direct Bottle Roll Leach Test Recoveries – KCA 2014 | 13-29 |

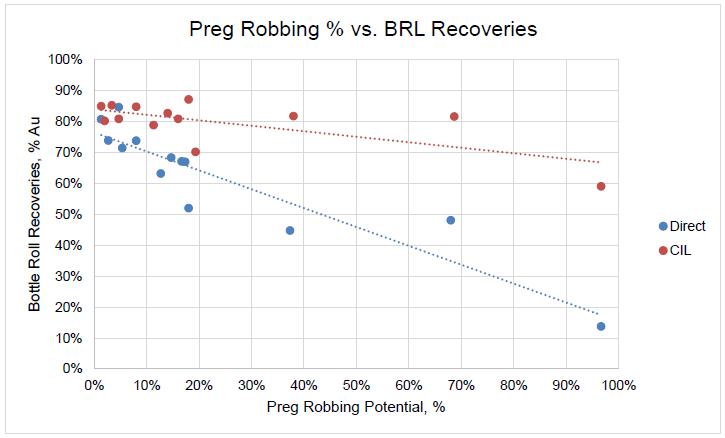

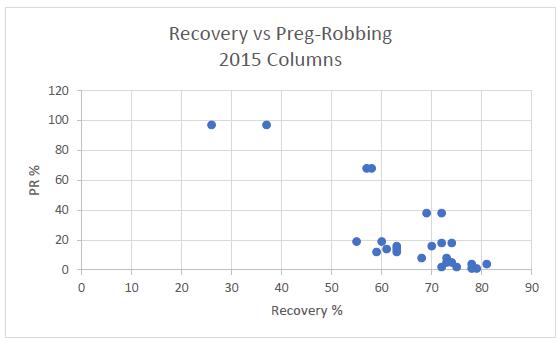

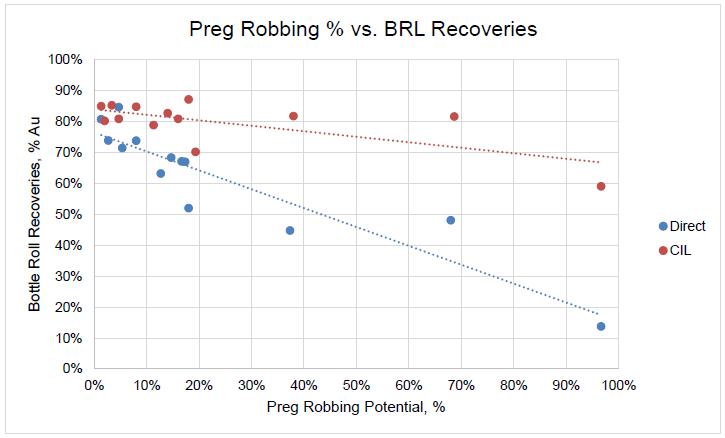

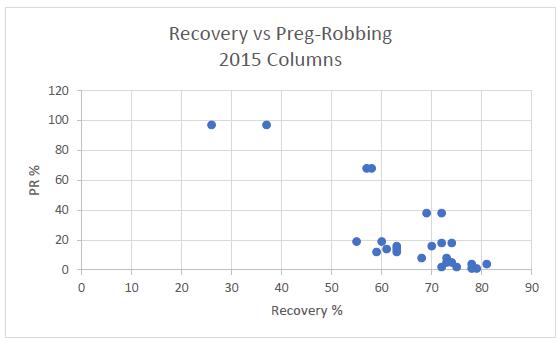

| Figure 13-3 Preg-Robbing Percentage vs. CIL & Direct Bottle Roll Leach Test Recoveries – KCA 2015 | 13-30 |

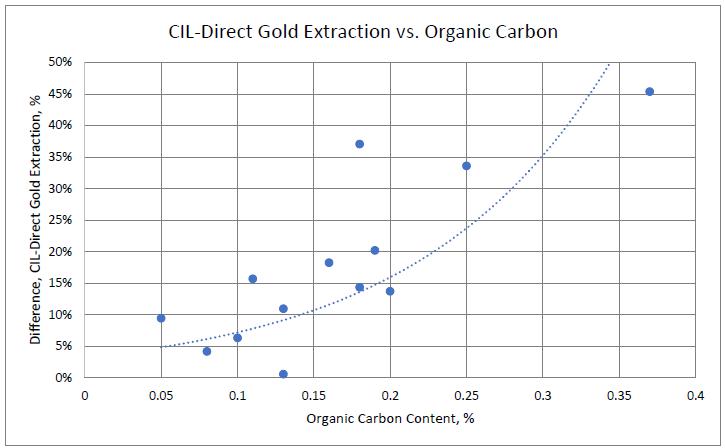

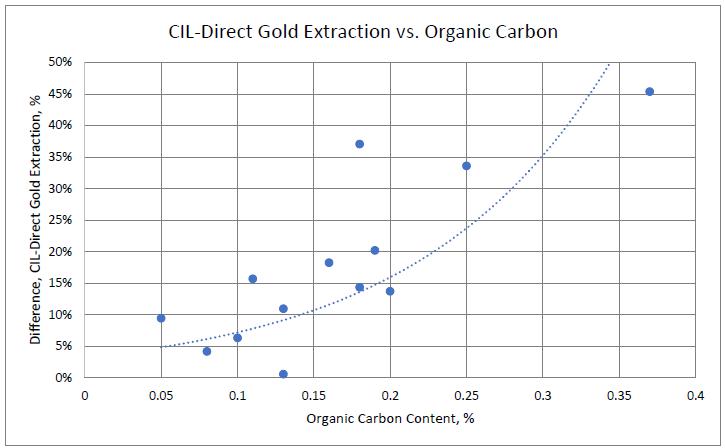

| Figure 13-4 CIL-Direct Bottle Roll Au Extraction Difference vs. Organic Carbon Content – KCA 2015 | 13-31 |

| Figure 13-5 Sample Drill Hole Locations for KCA 2019 Test Program | 13-34 |

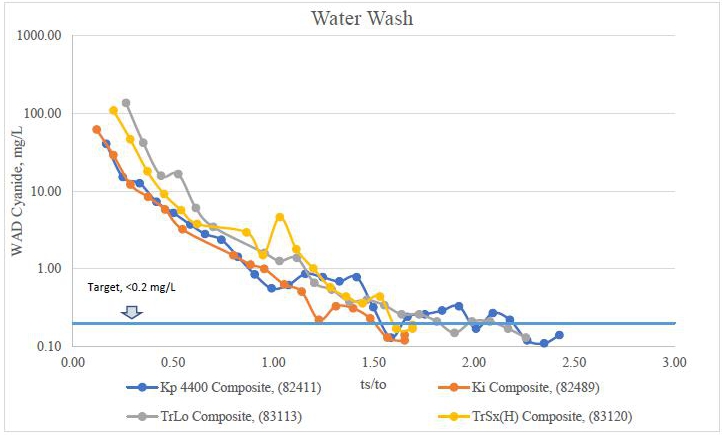

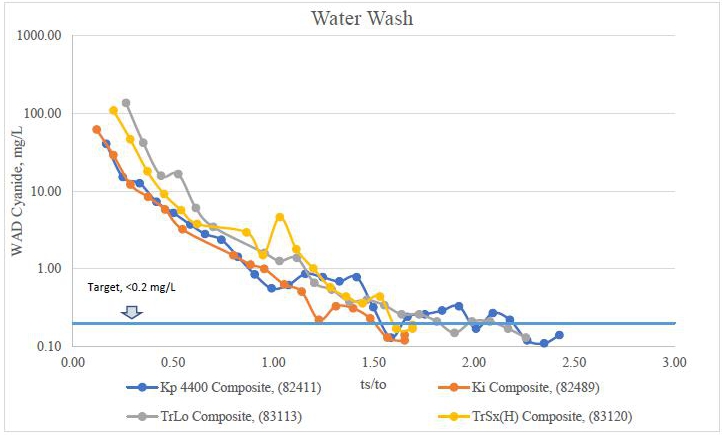

| Figure 13-6 Water Wash Summary | 13-46 |

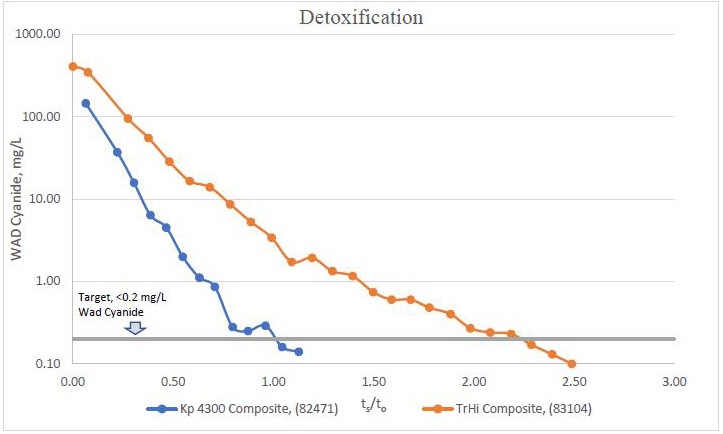

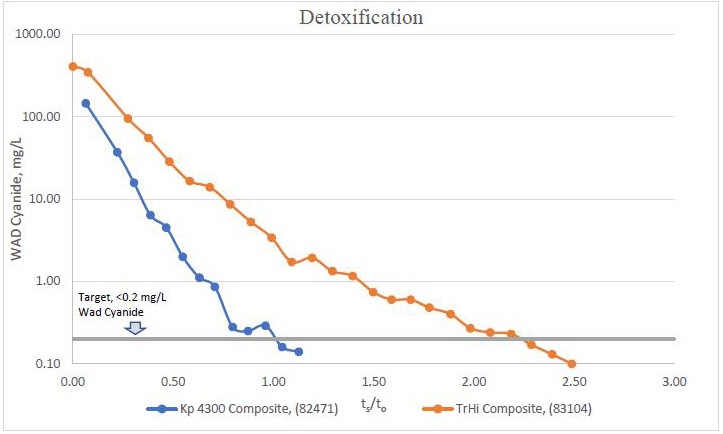

| Figure 13-7 Detoxification Summary, INCO SO2 | 13-46 |

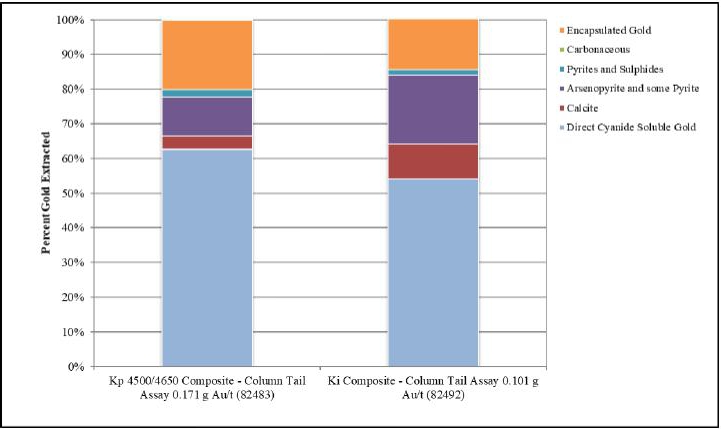

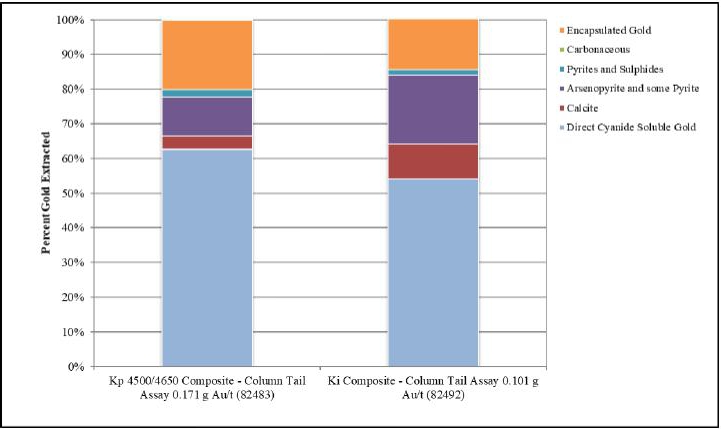

| Figure 13-8 Diagnostic Leach Results Summary – KCA 2019 | 13-48 |

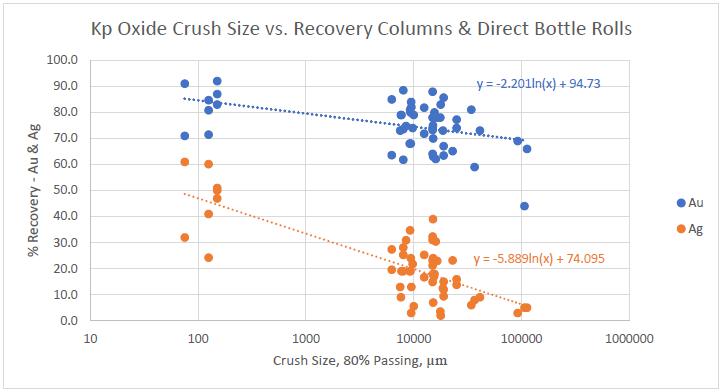

| Figure 13-9 Kp Oxide Recovery vs. Crush Size | 13-50 |

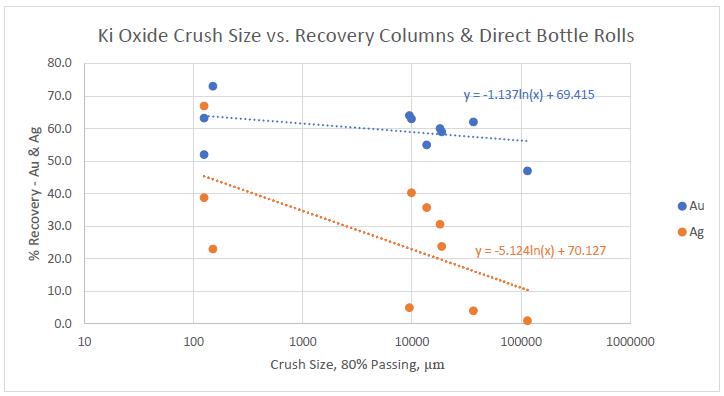

| Figure 13-10 Ki Oxide Recovery vs. Crush Size | 13-51 |

| Figure 13-11 Trans-Hi Recovery vs. Crush Size | 13-51 |

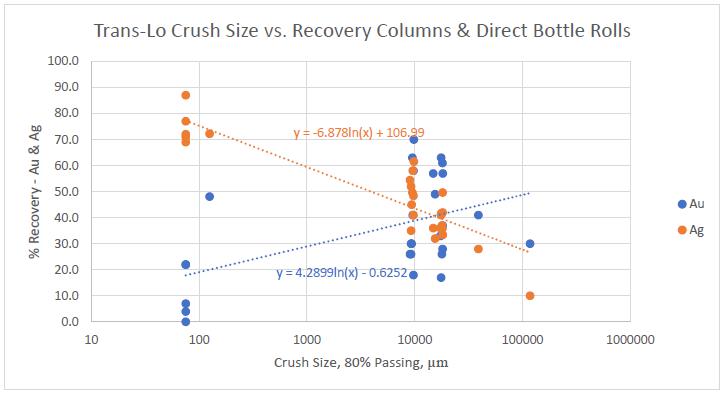

| Figure 13-12 Trans-Lo Recovery vs. Crush Size | 13-52 |

| Figure 13-13 Organic Carbon Versus Preg-Robbing | 13-56 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 12 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

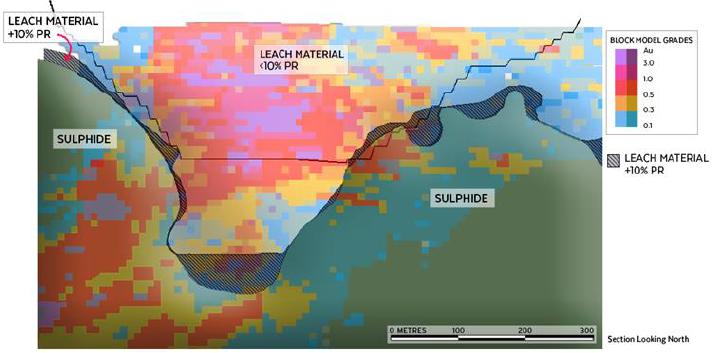

| Figure 13-14 Areas with +10% Preg-Robbing Test Results | 13-57 |

| Figure 13-15 Recovery Versus Preg-Robbing | 13-57 |

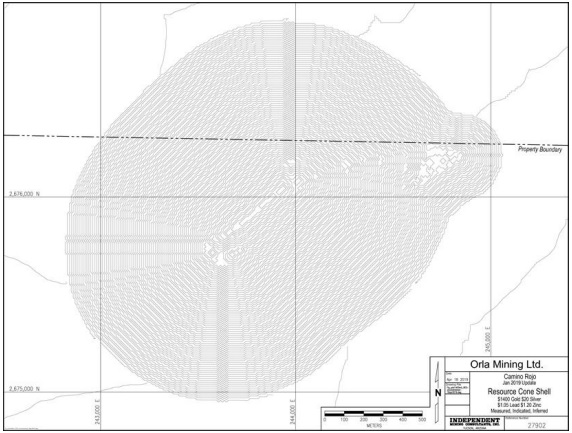

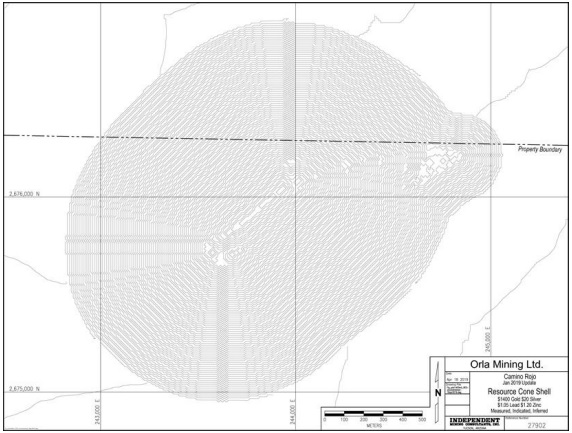

| Figure 14-1 Mineral Resource Constraining Cone Shell, IMC 2019 | 14-9 |

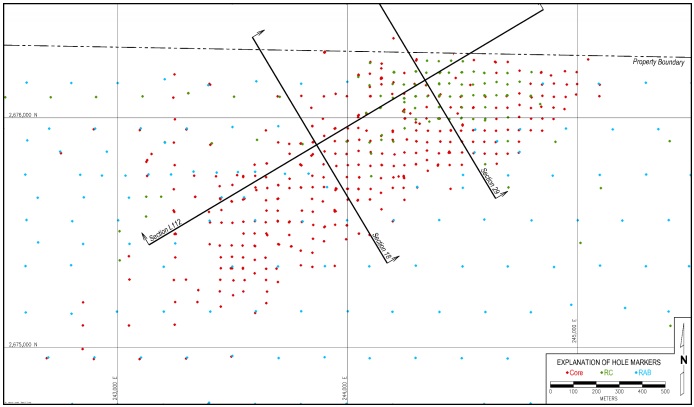

| Figure 14-2 Hole and Cross Section Locations, IMC 2019 | 14-11 |

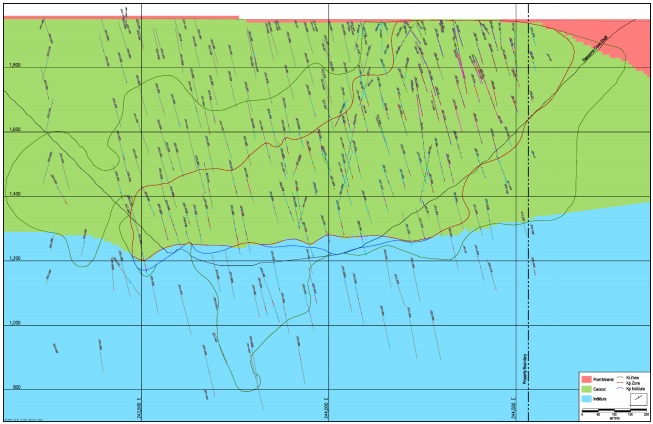

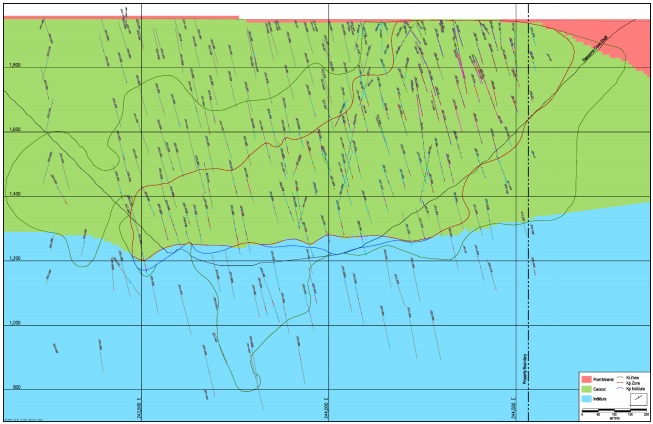

| Figure 14-3 Lithology on Section L112, IMC 2019 | 14-12 |

| Figure 14-4 Alteration on Section L112, IMC 2019 | 14-15 |

| Figure 14-5 Alteration on Section 18, IMC 2019 | 14-16 |

| Figure 14-6 Alteration on Section 29, IMC 2019 | 14-17 |

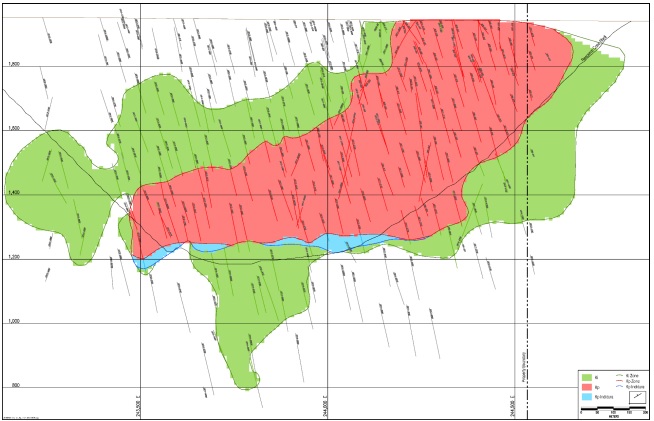

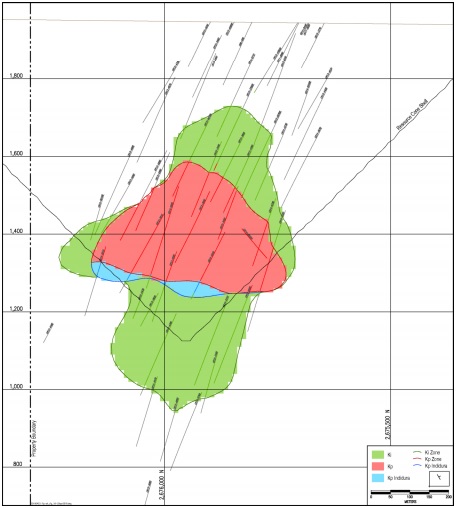

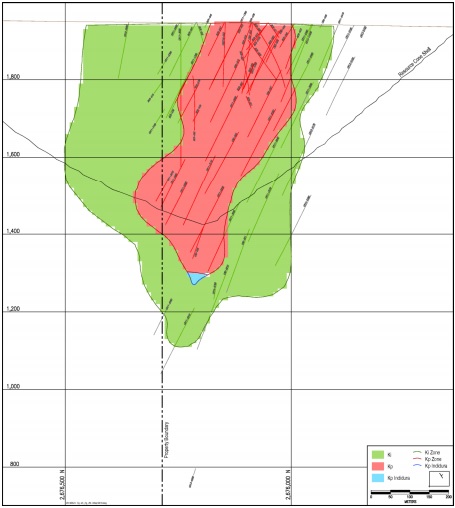

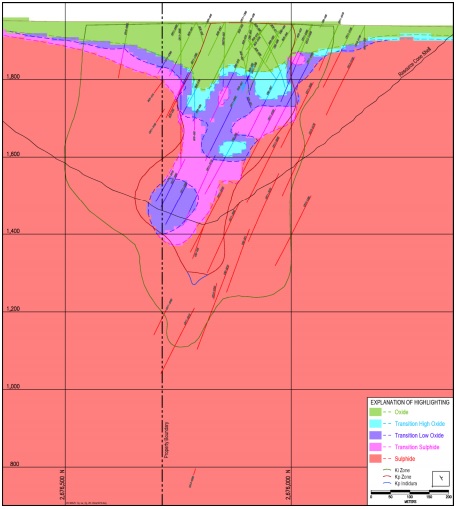

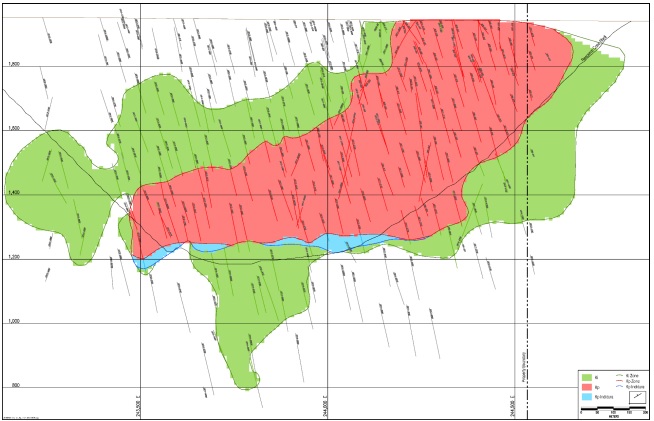

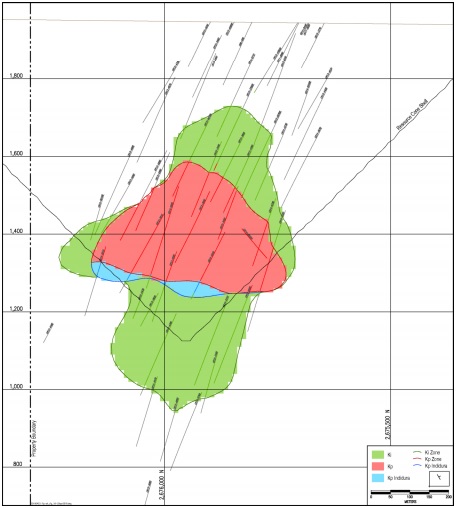

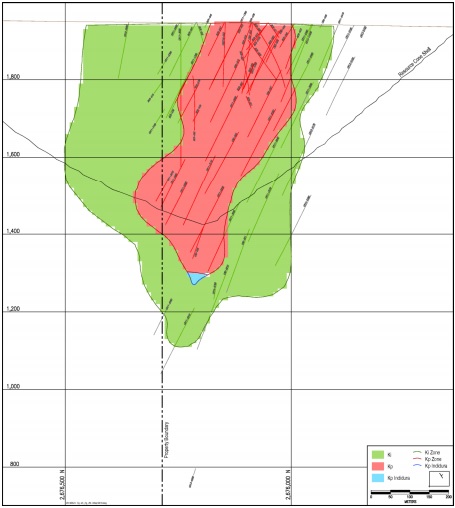

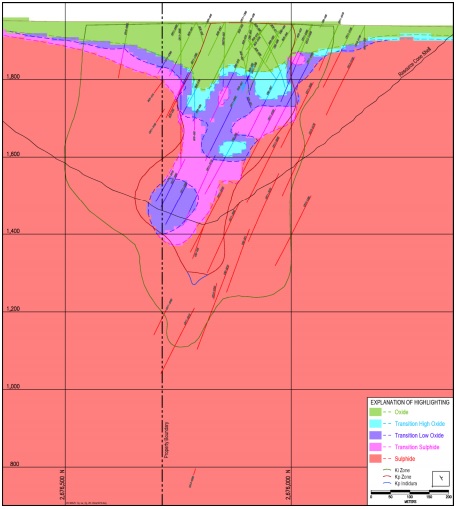

| Figure 14-7 Oxidation Zones on Section 29, IMC 2019 | 14-18 |

| Figure 14-8 Estimation Domains on Section L112, IMC 2019 | 14-19 |

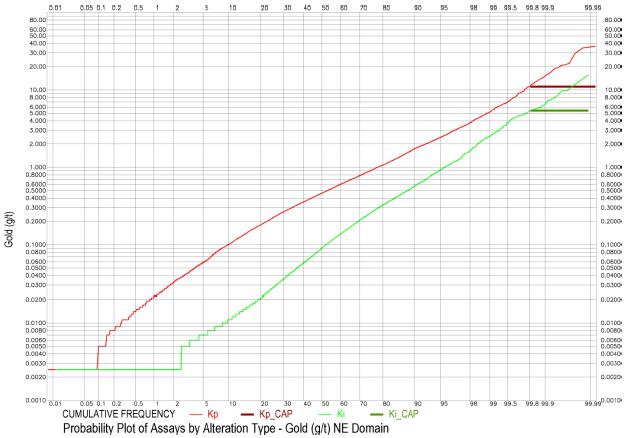

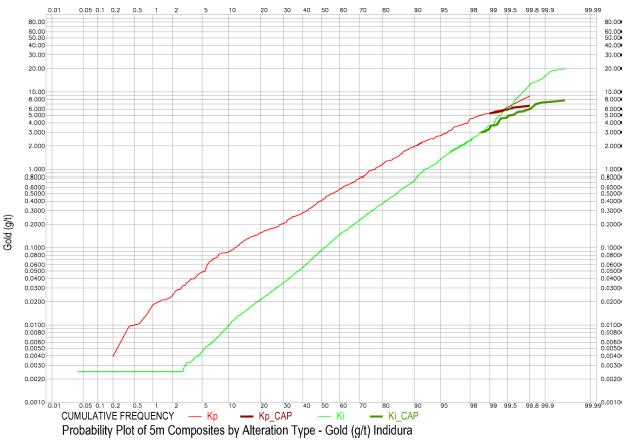

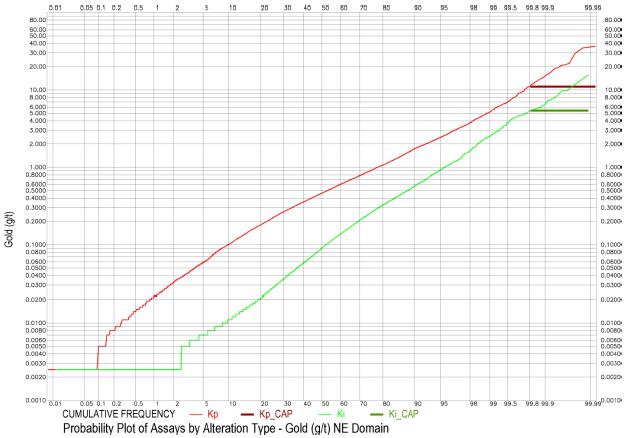

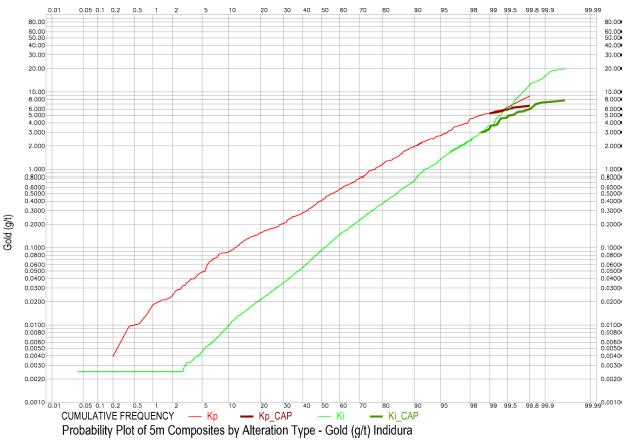

| Figure 14-9 Probability Plot of Gold Assays by Alteration Type – NE Domain | 14-24 |

| Figure 14-10 Probability Plot of Gold 5m Composites by Alteration Type – NE Domain | 14-24 |

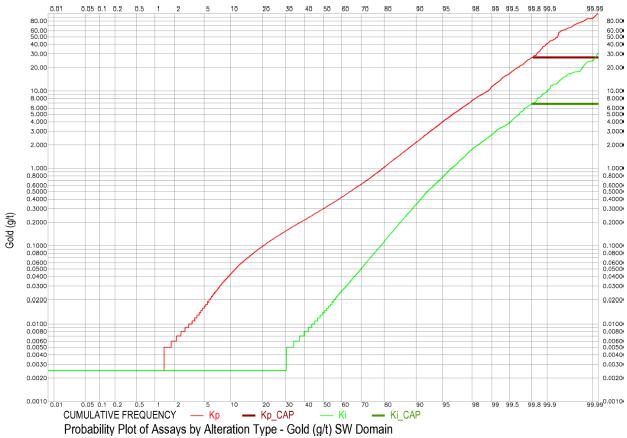

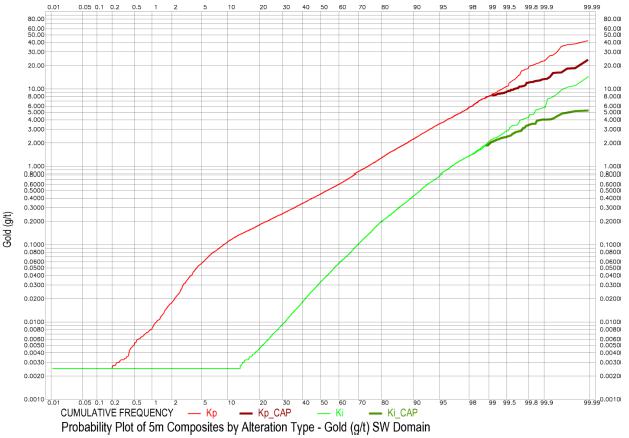

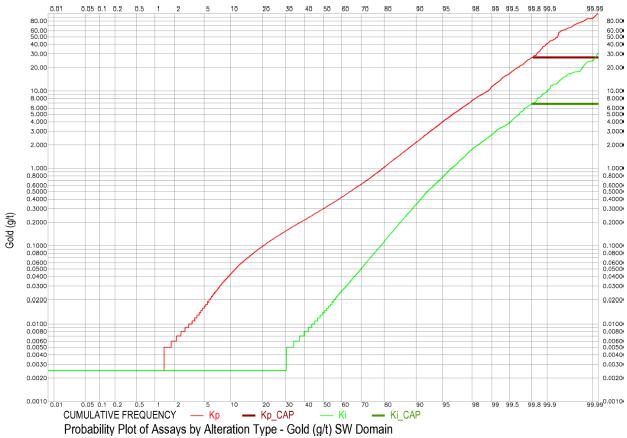

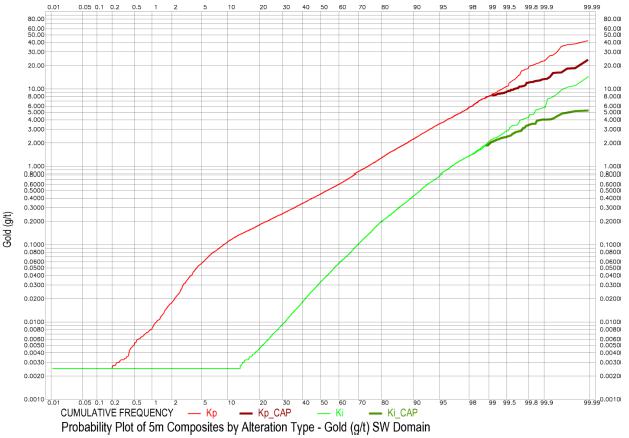

| Figure 14-11 Probability Plot of Gold Assays by Alteration Type – SW Domain | 14-25 |

| Figure 14-12 Probability Plot of Gold 5m Composites by Alteration Type – SW Domain | 14-25 |

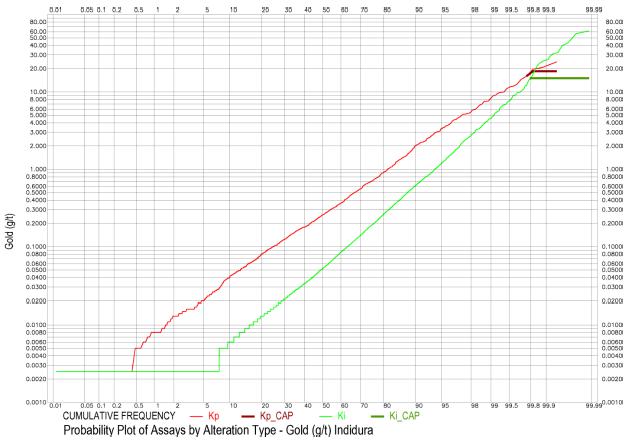

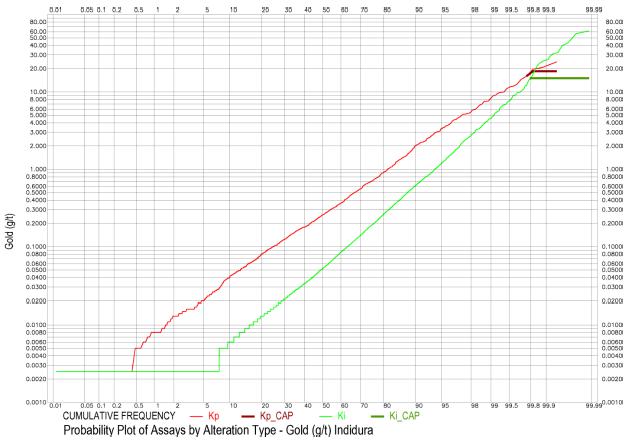

| Figure 14-13 Probability Plot of Gold Assays by Alteration Type – Indidura | 14-26 |

| Figure 14-14 Probability Plot of Gold 5m Composites by Alteration Type – Indidura | 14-26 |

| Figure 14-15 NE Domain Gold Variogram – Primary Axis | 14-28 |

| Figure 14-16 NE Domain Gold Variogram – Secondary Axis | 14-29 |

| Figure 14-17 NE Domain Gold Variogram – Tertiary Axis | 14-30 |

| Figure 14-18 SW Domain Gold Variogram – Primary Axis | 14-31 |

| Figure 14-19 SW Domain Gold Variogram – Down Hole Variogram | 14-32 |

| Figure 14-20 Gold Grades on Section 29, IMC 2019 | 14-35 |

| Figure 14-21 Gold Grades on Section 18, IMC 2019 | 14-36 |

| Figure 14-22 Gold Grades on Section L112, IMC 2019 | 14-37 |

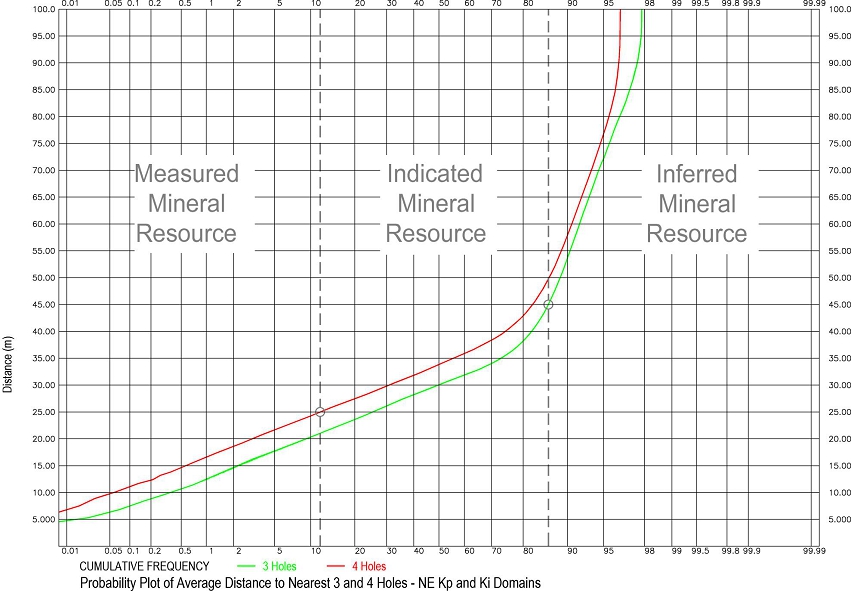

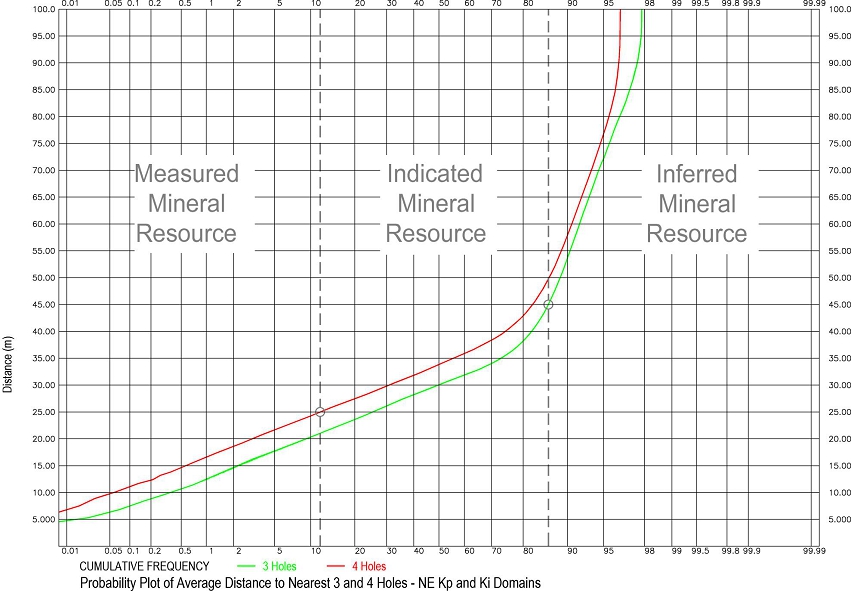

| Figure 14-23 Average Distance to Nearest 3 & 4 Holes – NE Kp & Ki Domains | 14-40 |

| Figure 14-24 Average Distance to Nearest 3 & 4 Holes – SW Kp & Ki Domains | 14-41 |

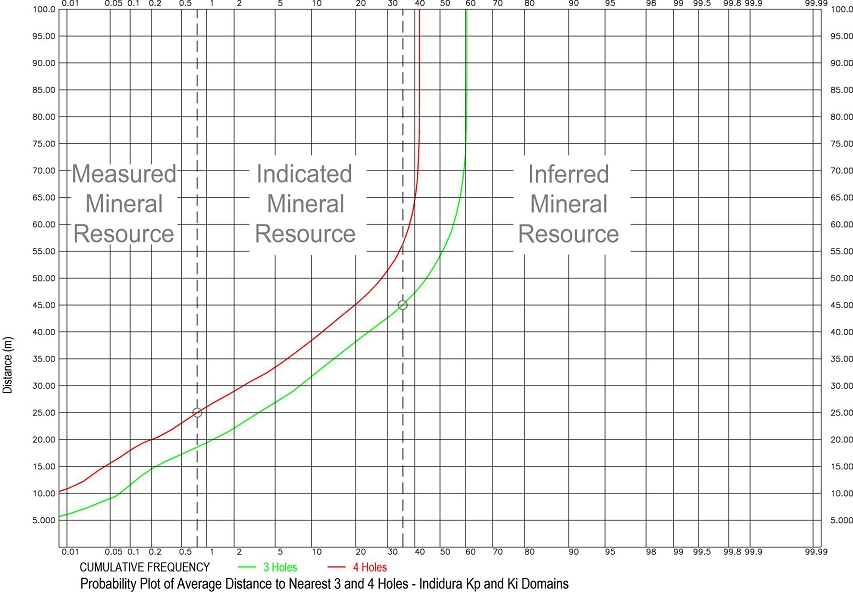

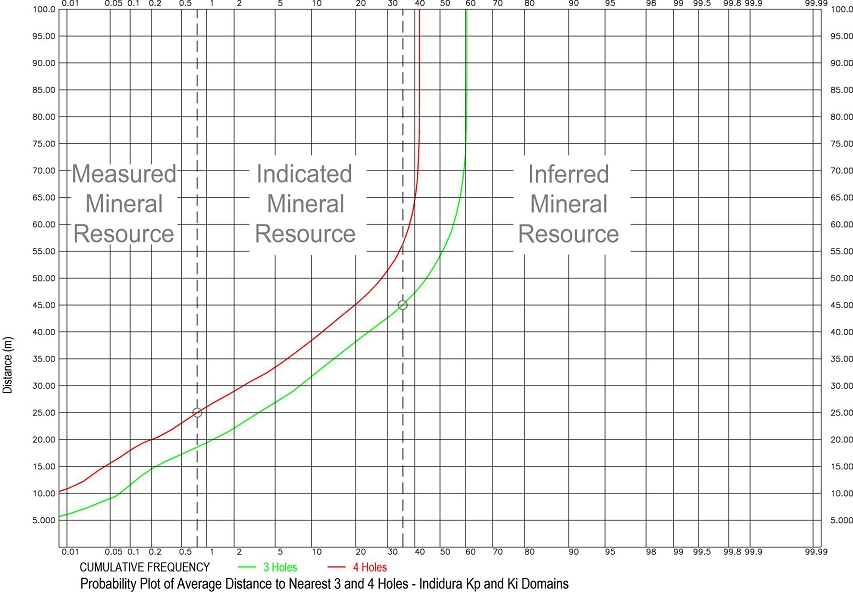

| Figure 14-25 Average Distance to Nearest 3 & 4 Holes – Indidura Kp & Ki Domains | 14-42 |

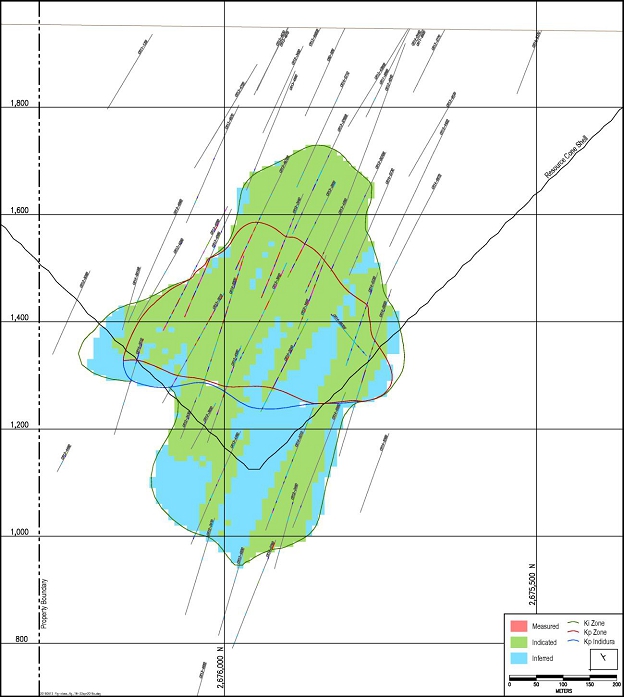

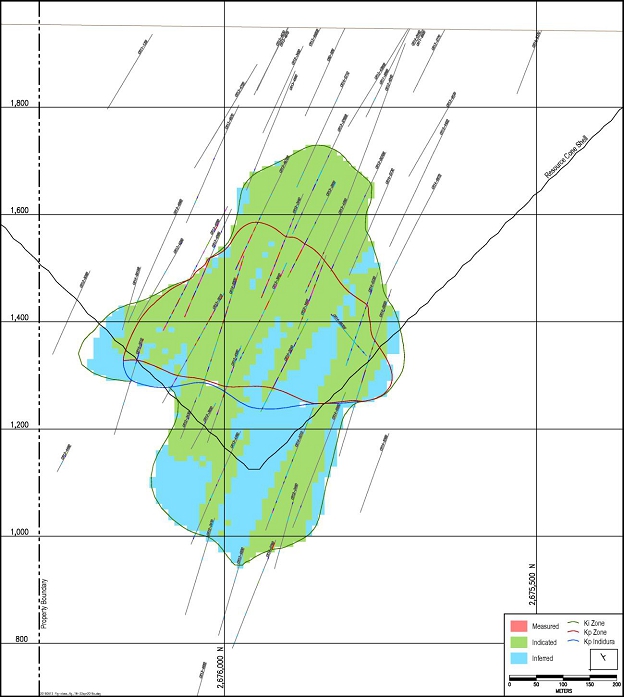

| Figure 14-26 Resource Categories on Section 18, IMC 2019 | 14-43 |

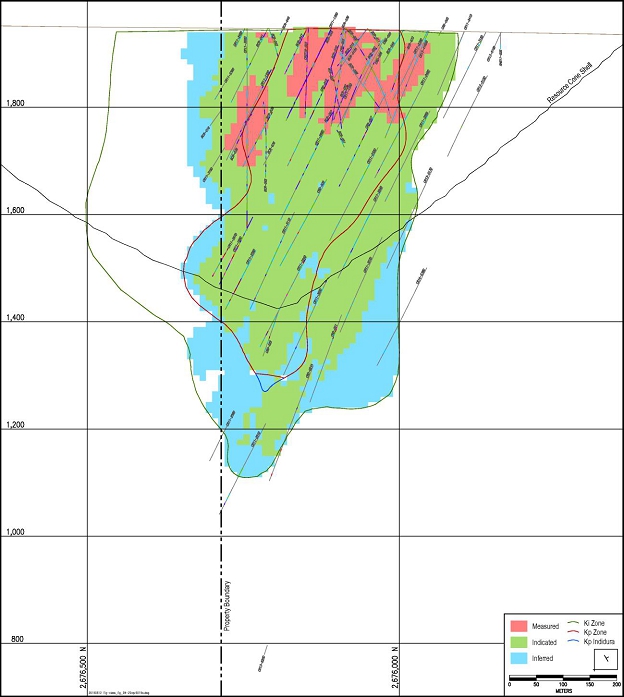

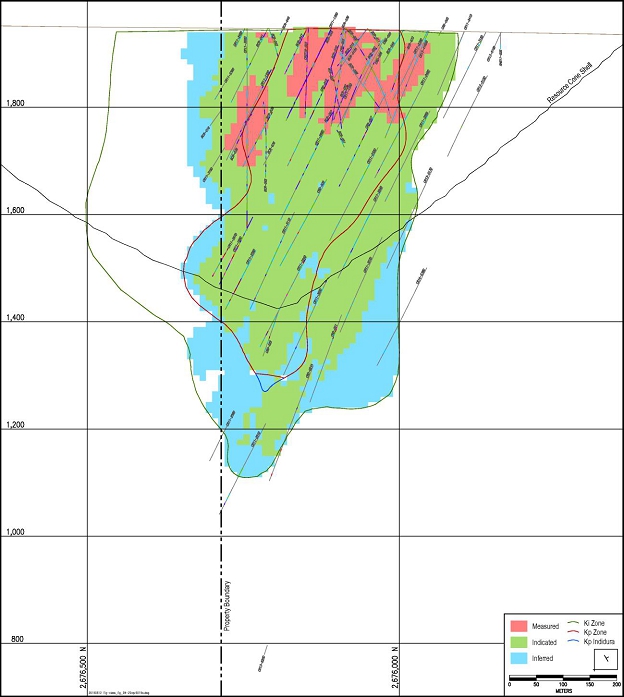

| Figure 14-27 Resource Categories on Section 29, IMC 2019 | 14-44 |

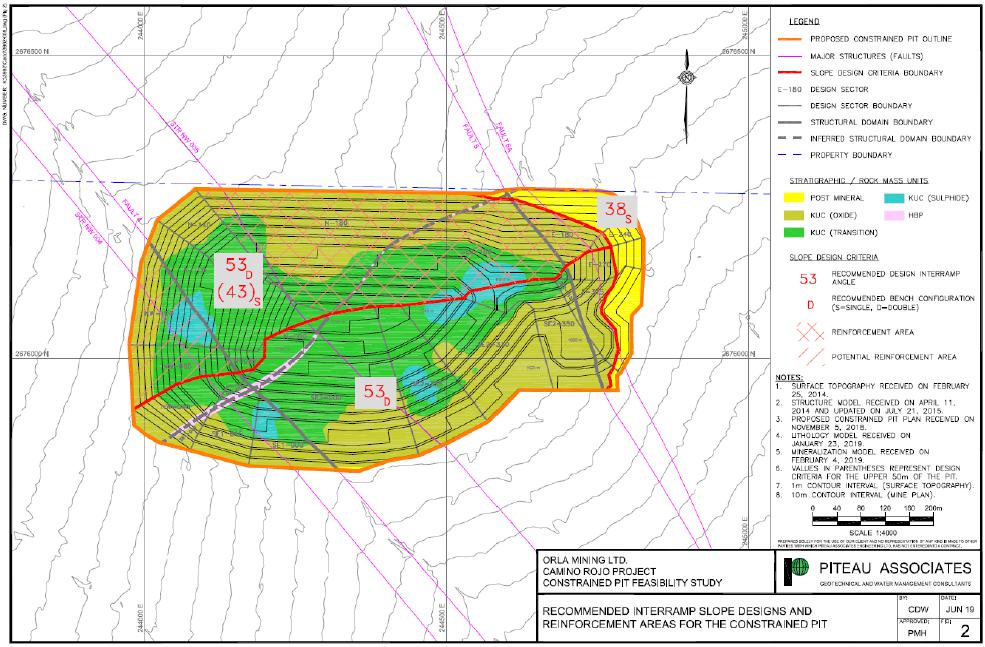

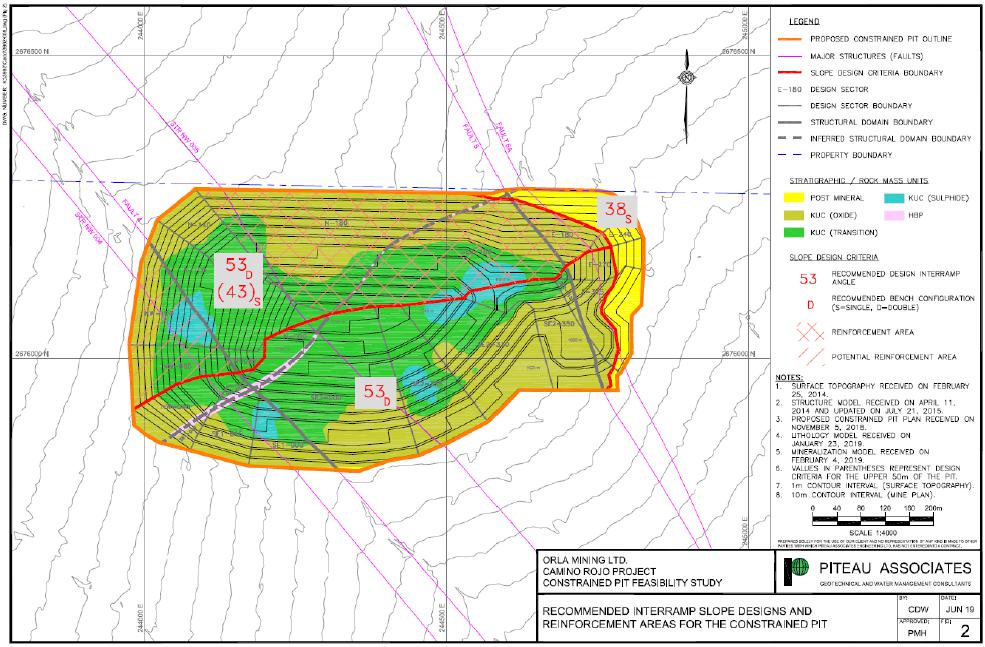

| Figure 16-1 Slope Angle Recommendations, Piteau 2019 | 16-3 |

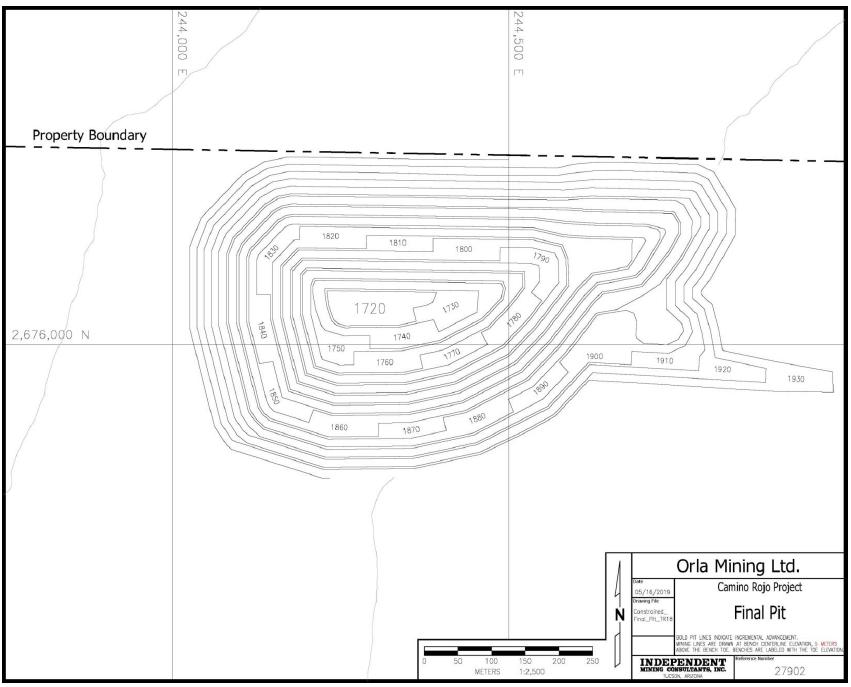

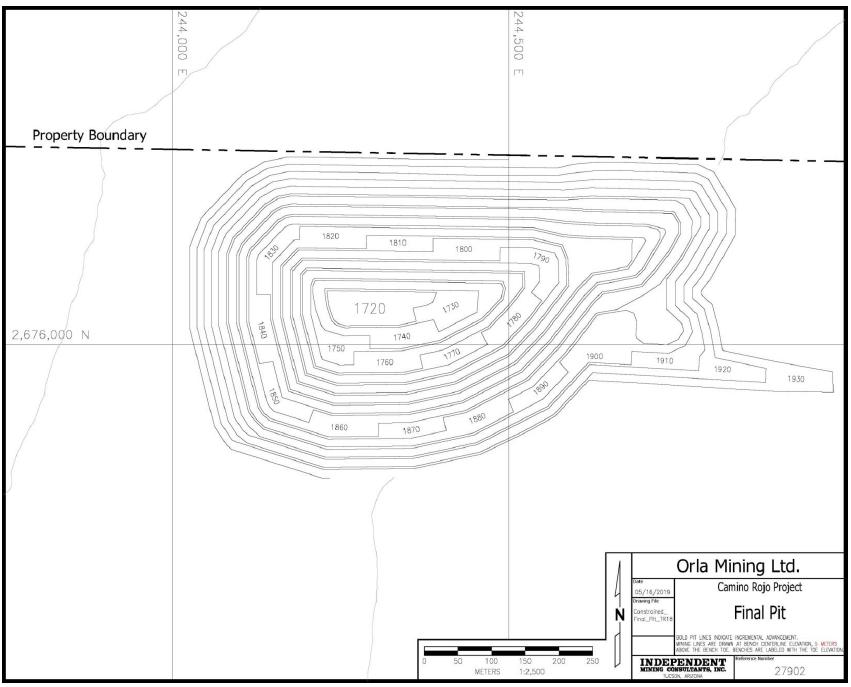

| Figure 16-2 Final Pit, IMC 2019 | 16-5 |

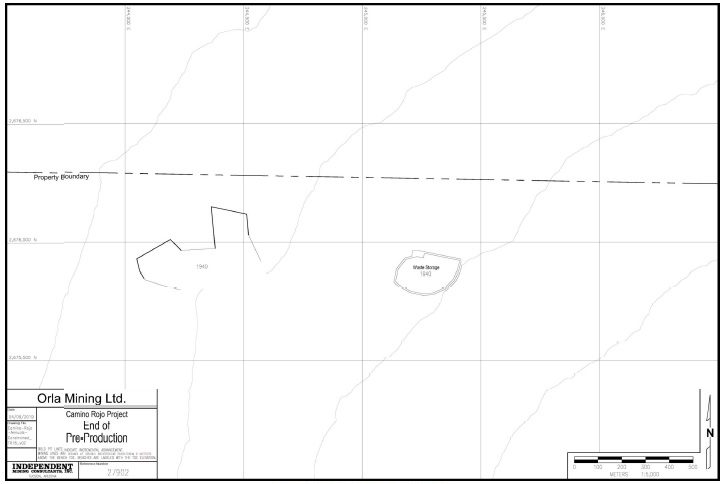

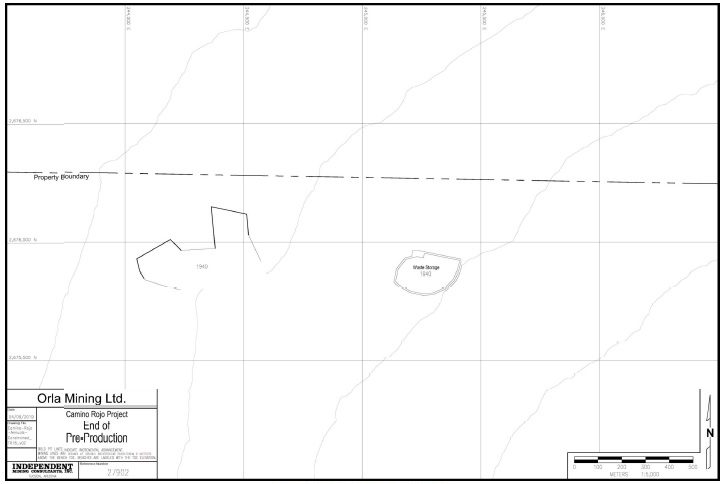

| Figure 16-3 End of Preproduction, IMC 2019 | 16-13 |

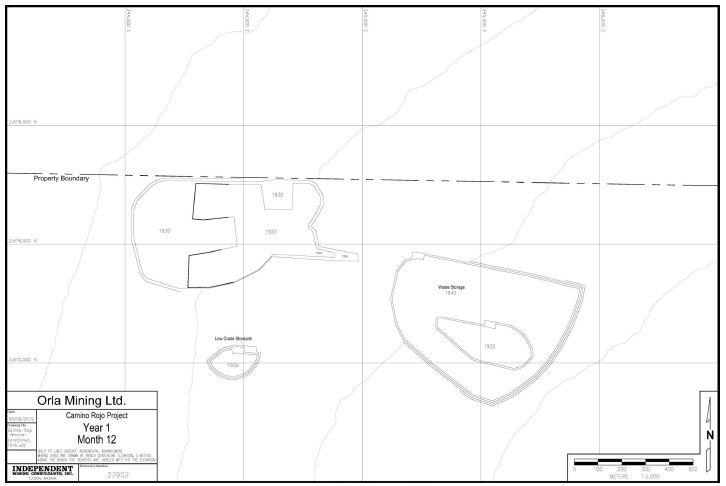

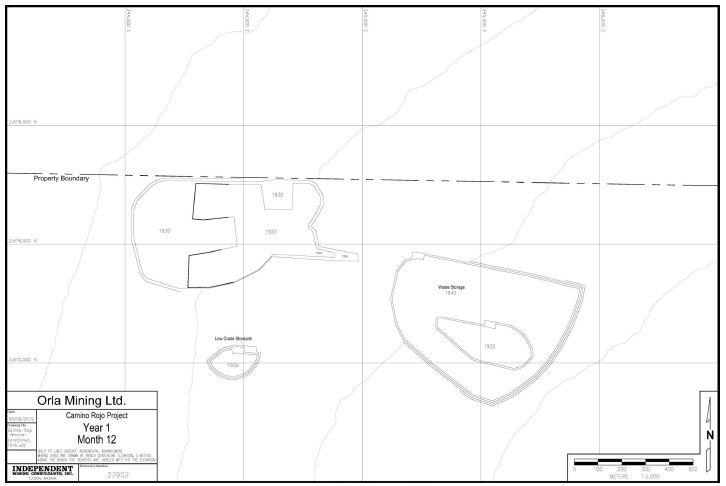

| Figure 16-4 End of Year 1, IMC 2019 | 16-14 |

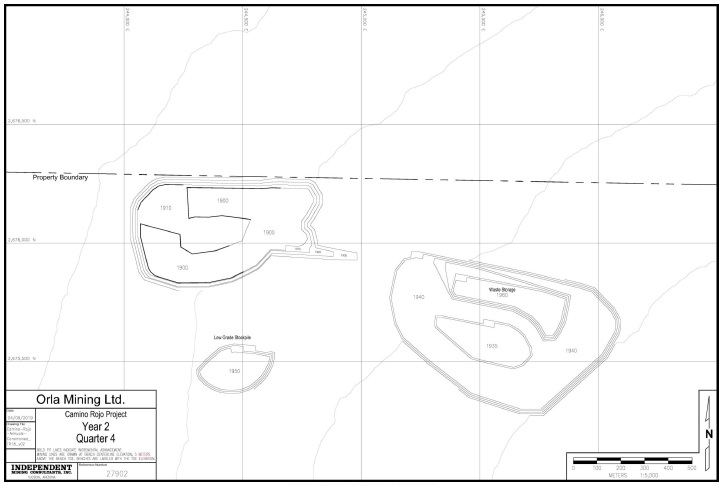

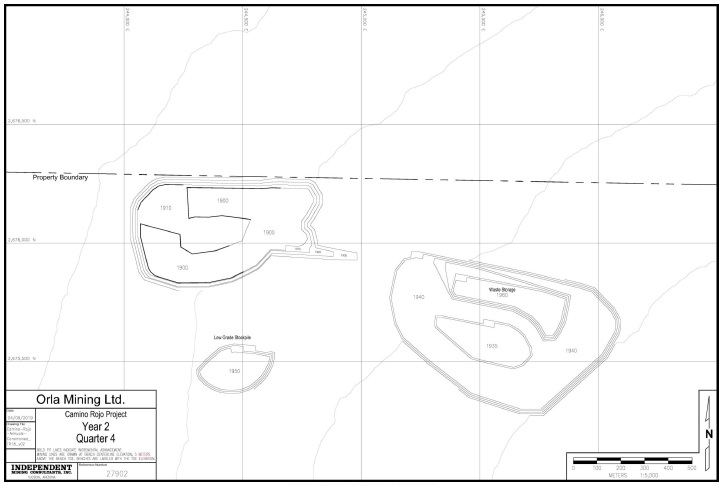

| Figure 16-5 End of Year 2, IMC 2019 | 16-15 |

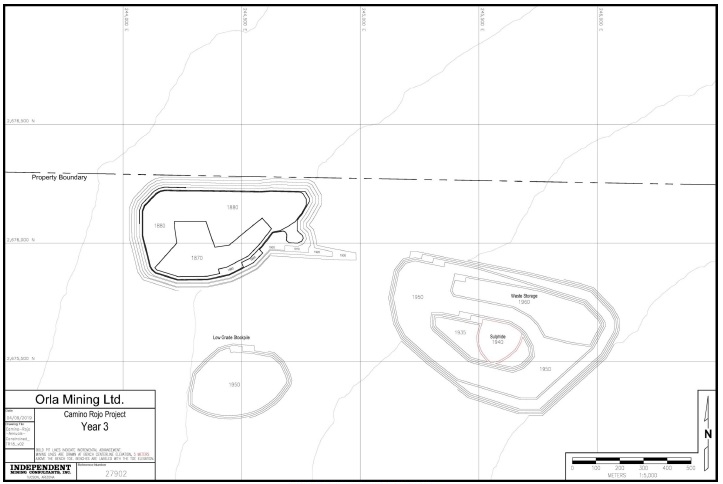

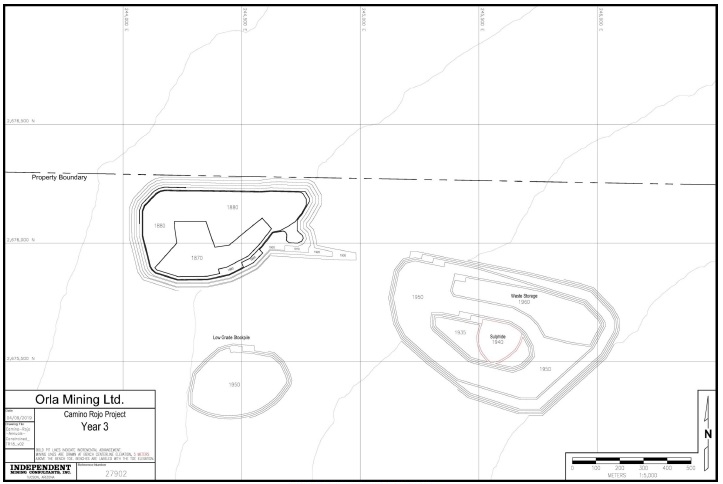

| Figure 16-6 End of Year 3, IMC 2019 | 16-16 |

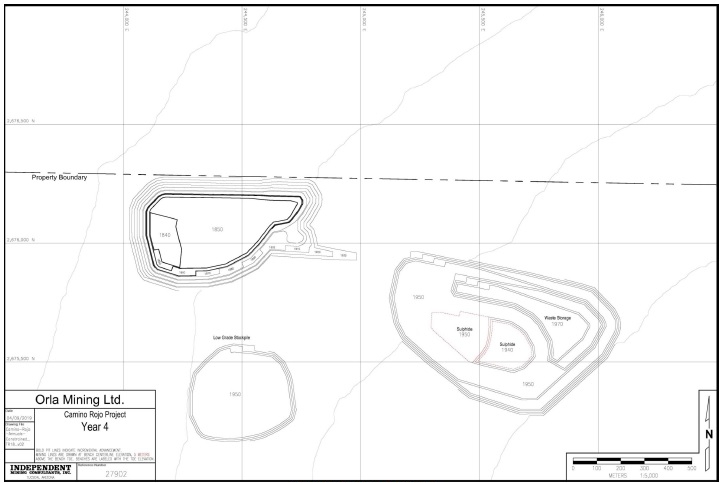

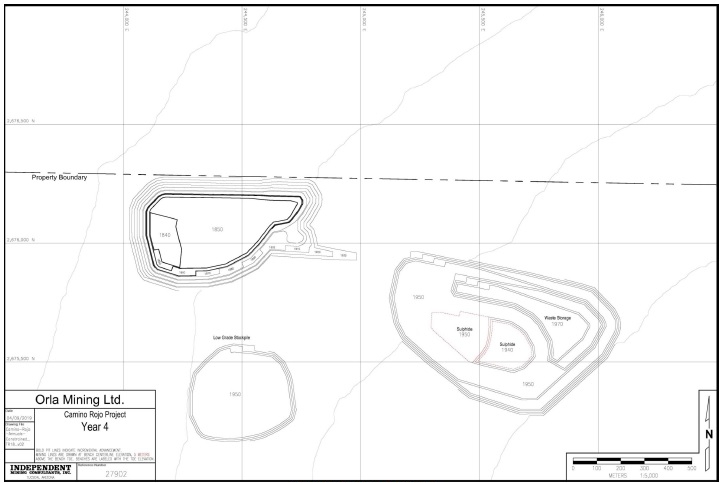

| Figure 16-7 End of Year 4, IMC 2019 | 16-17 |

| Figure 16-8 End of Year 5, IMC 2019 | 16-18 |

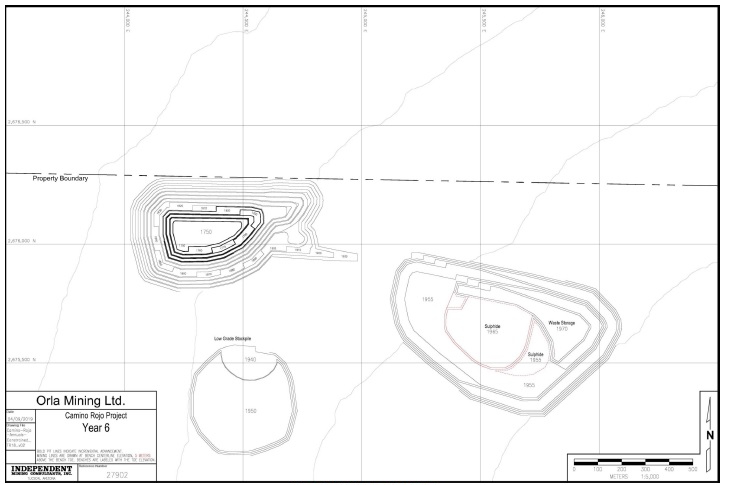

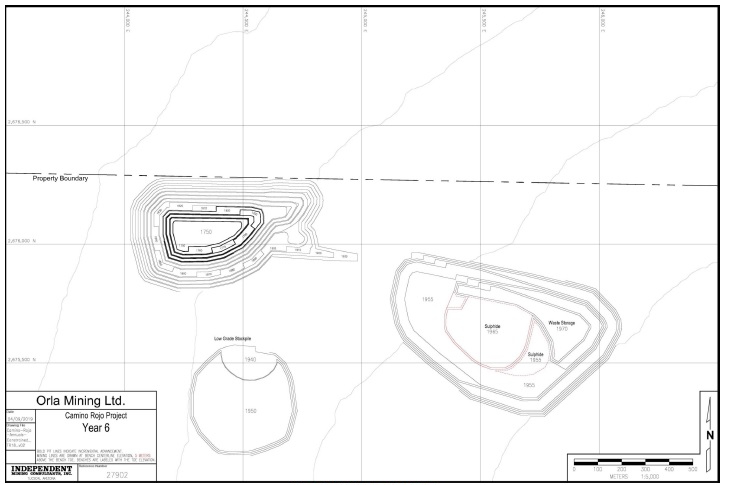

| Figure 16-9 End of Year 6, IMC 2019 | 16-19 |

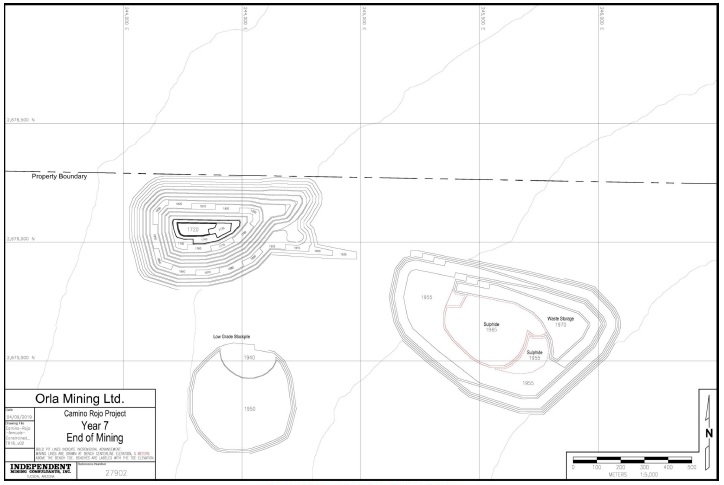

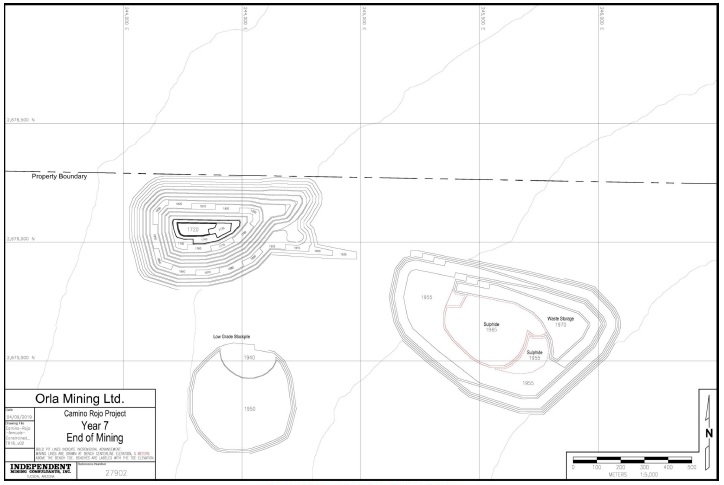

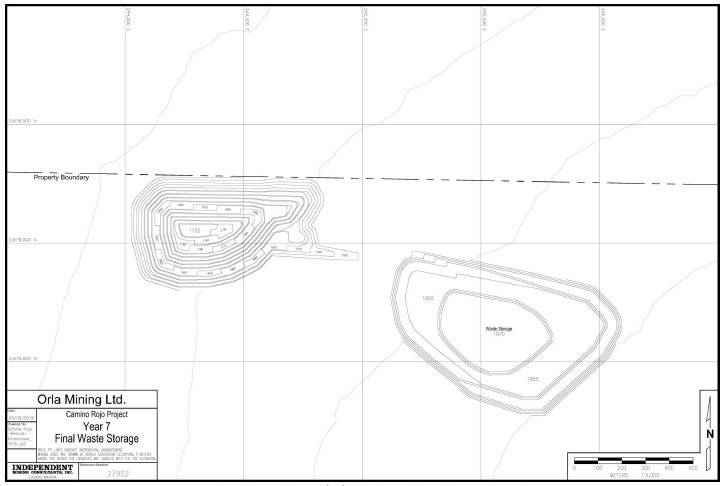

| Figure 16-10 Year 7 – End of Mining, IMC 2019 | 16-20 |

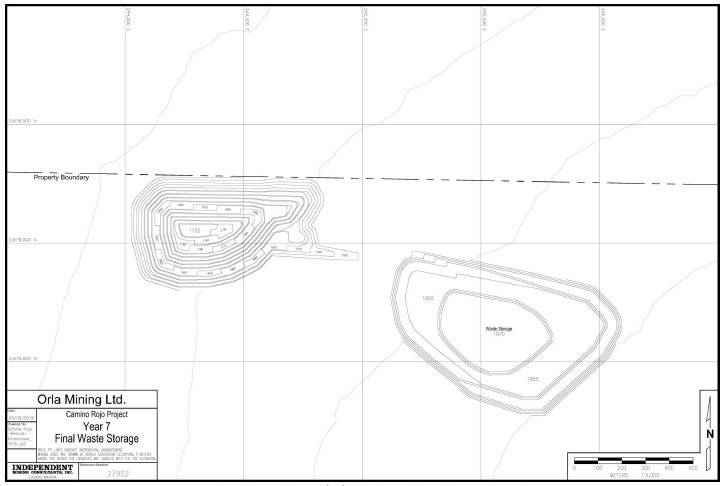

| Figure 16-11 Year 7 – End of Waste Storage Capping & Low Grade Reclaim, IMC 2019 | 16-21 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 13 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

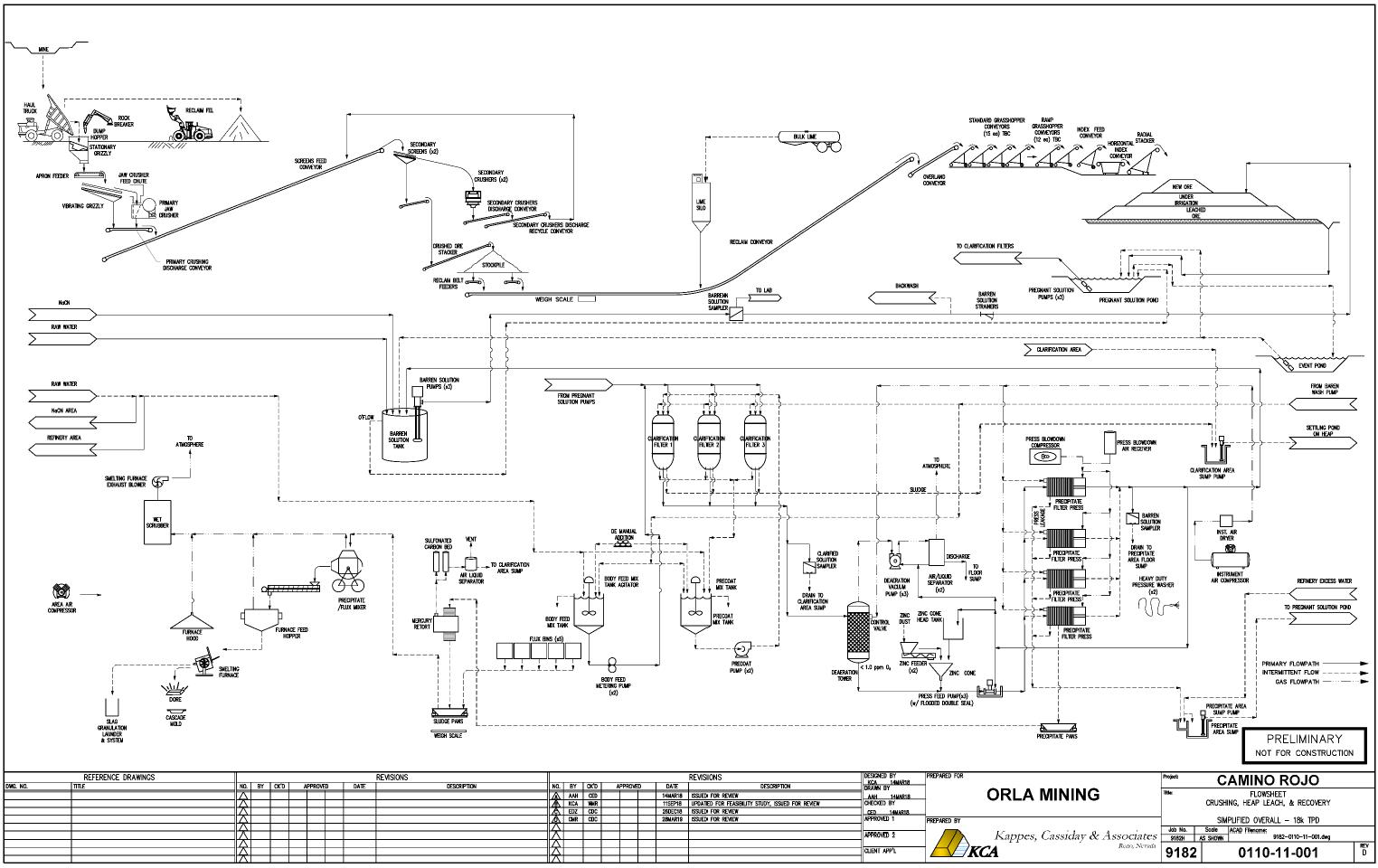

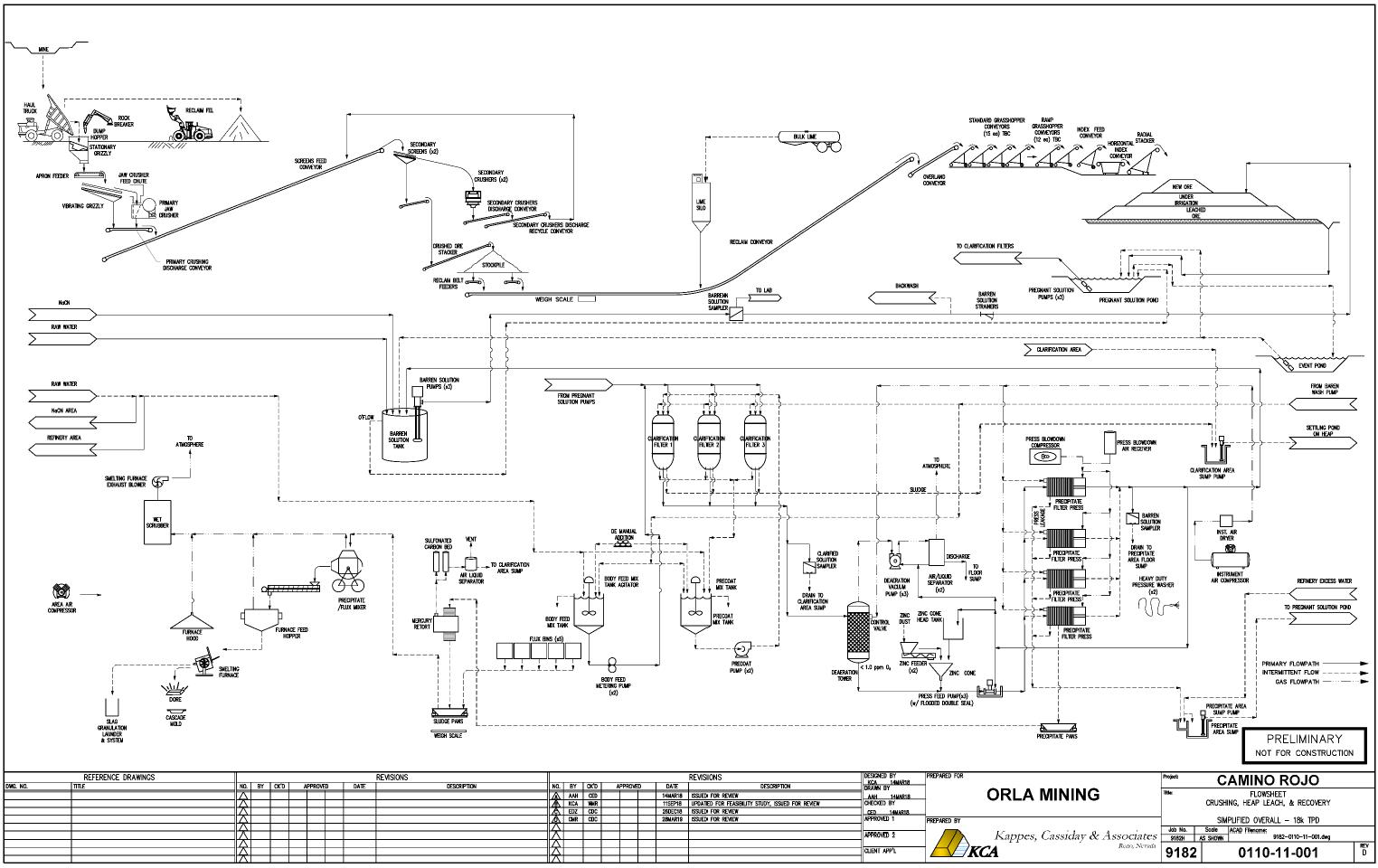

| Figure 17-1 Process Overall Flowsheet | 17-4 |

| Figure 17-2 Project General Arrangement | 17-5 |

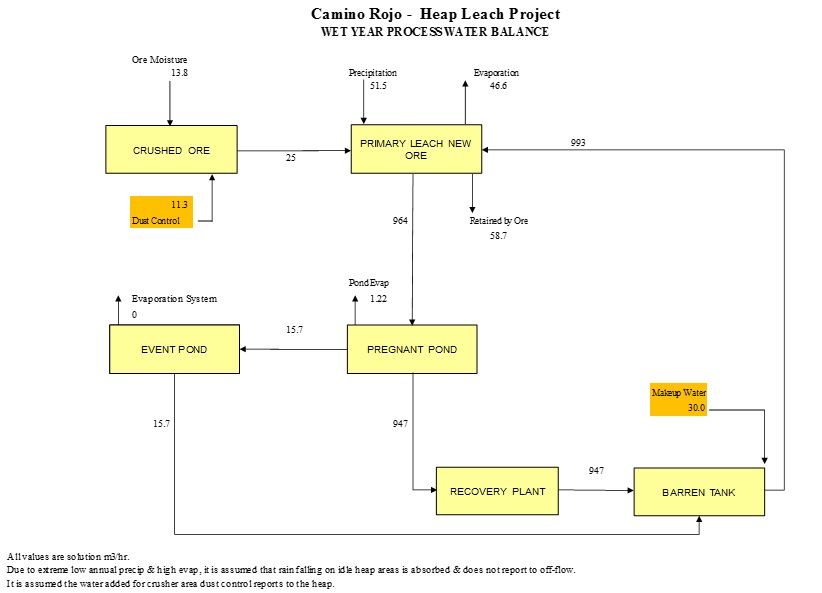

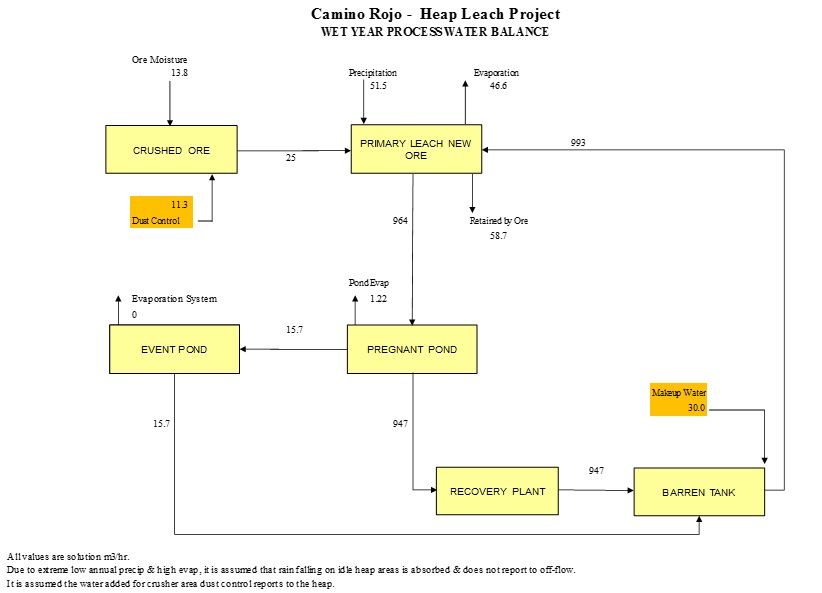

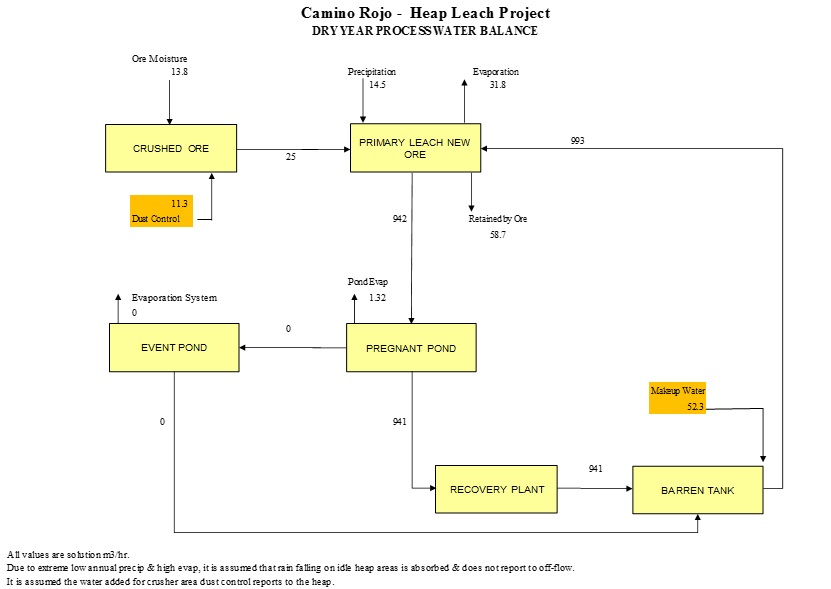

| Figure 17-3 Average Year Water Balance Diagram | 17-19 |

| Figure 17-4 Wet Year Water Balance Diagram | 17-20 |

| Figure 17-5 Dry Year Water Balance Diagram | 17-21 |

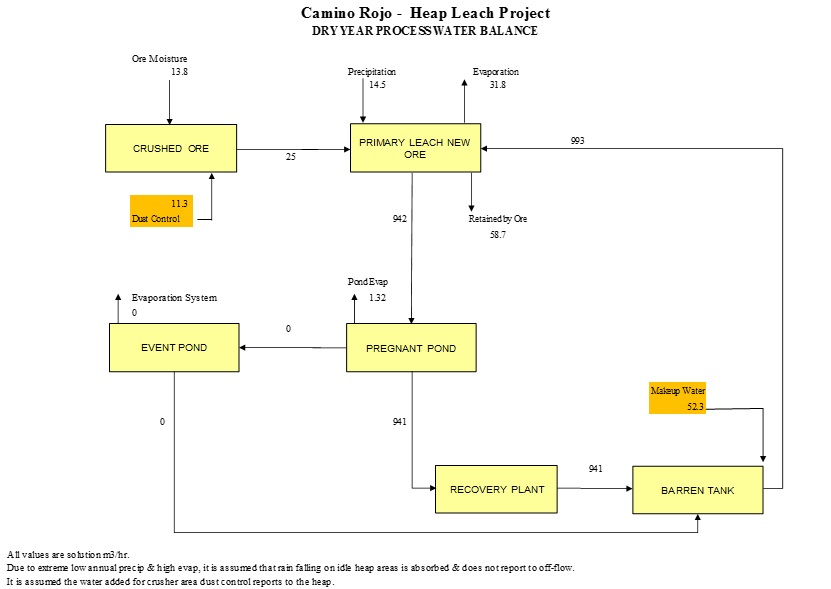

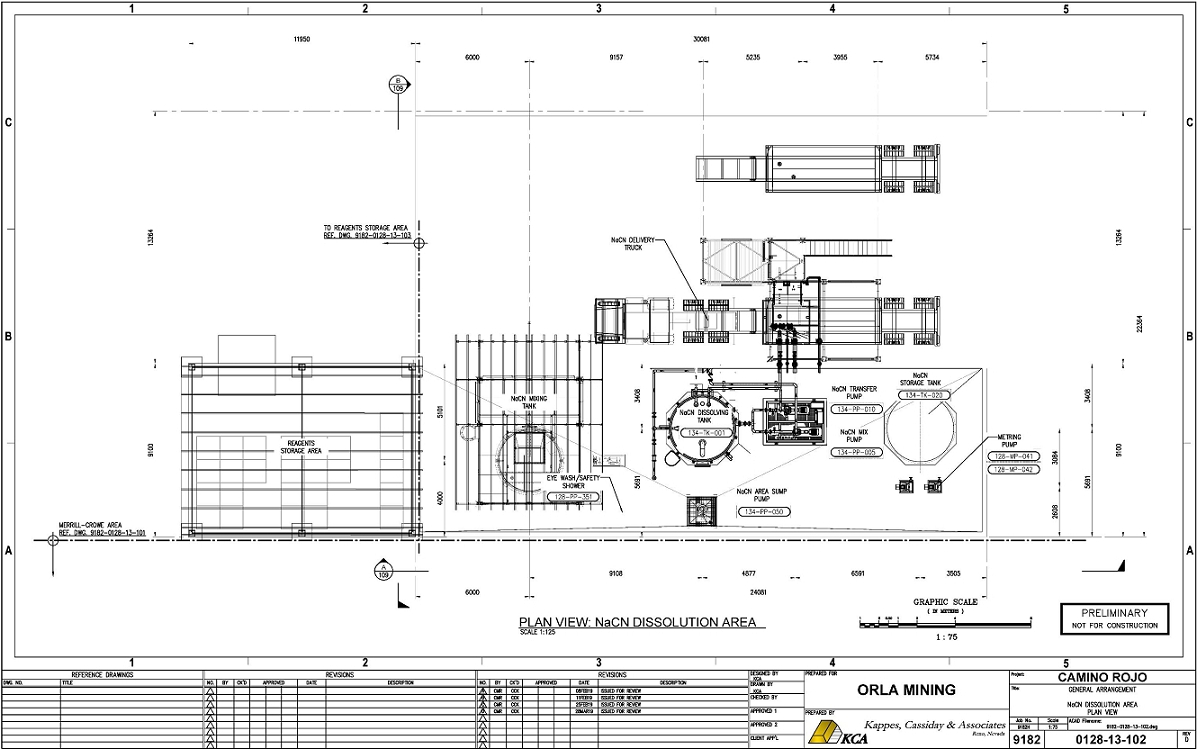

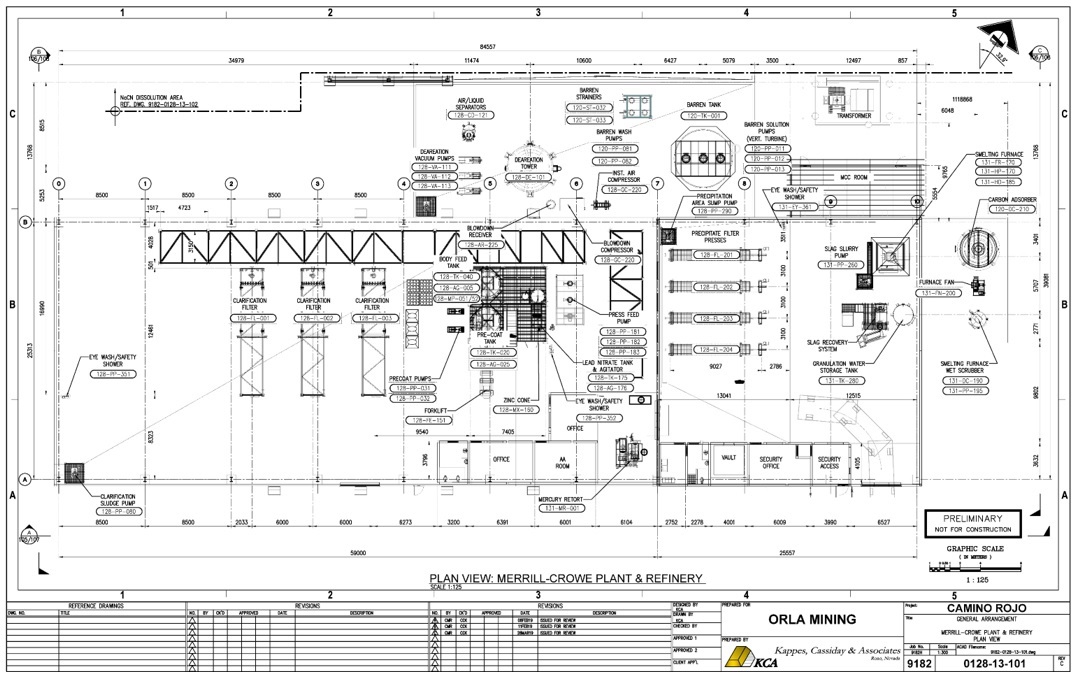

| Figure 17-6 Merrill-Crowe Recovery Plant & Refinery Layout | 17-23 |

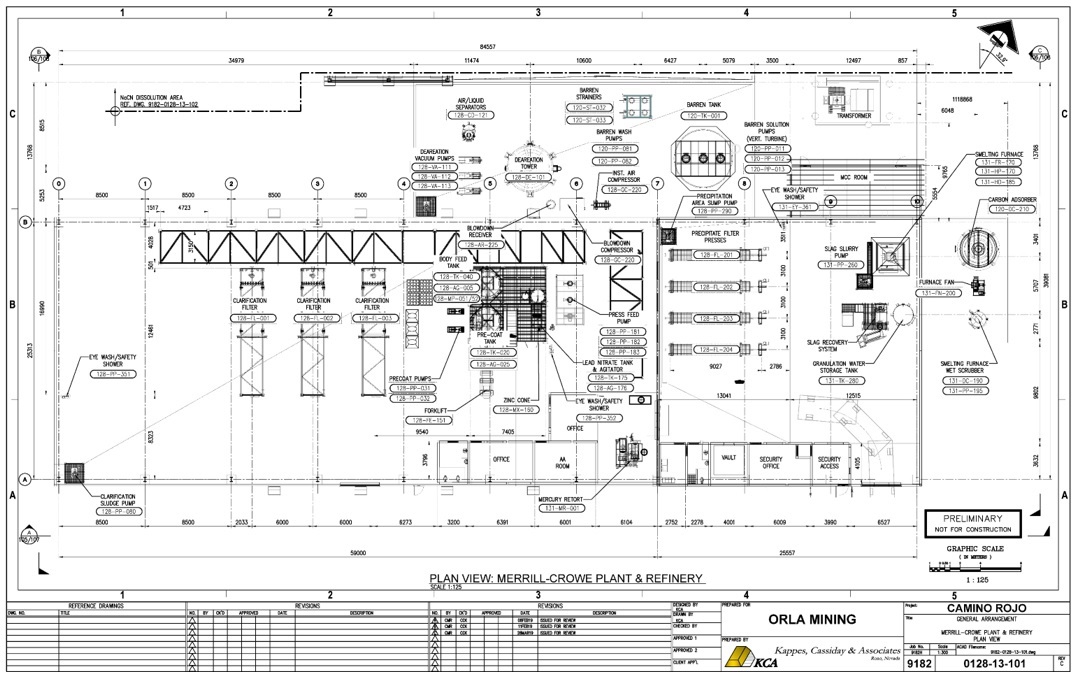

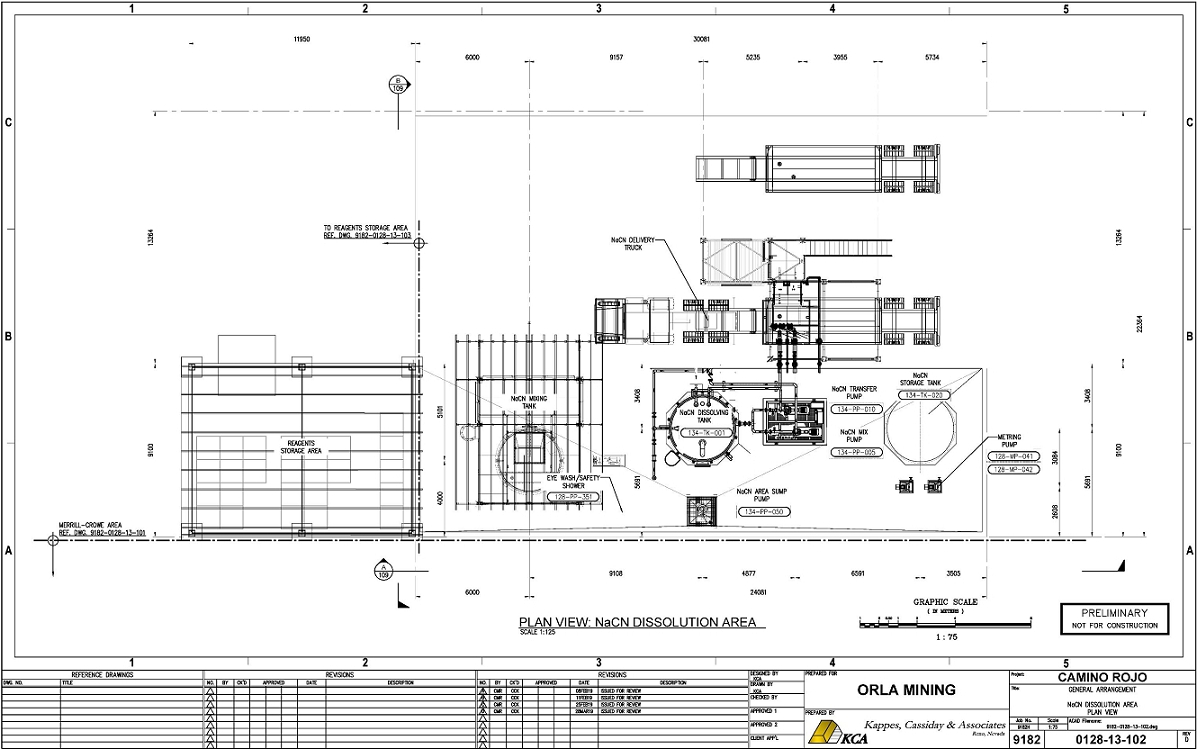

| Figure 17-7 NaCN Mix & Storage Area Layout | 17-29 |

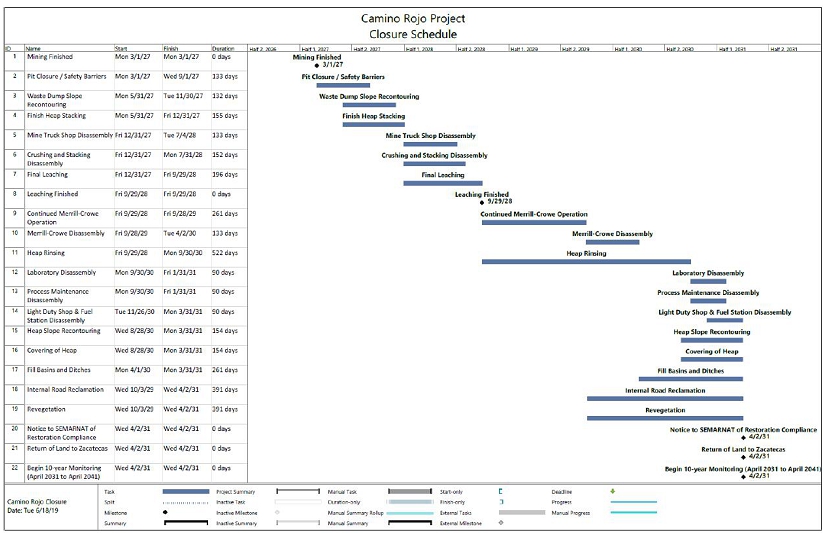

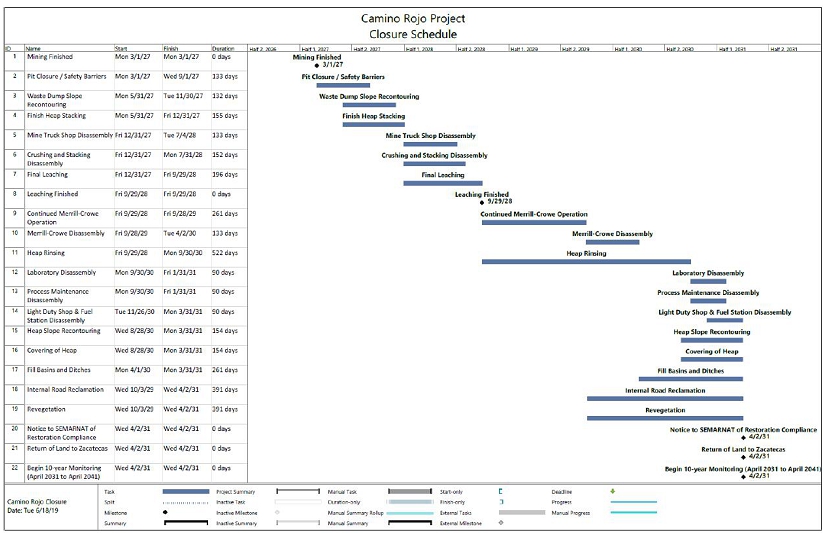

| Figure 20-1 Camino Rojo Project Closure Schedule | 20-12 |

| Figure 20-2 Permitting Process Flowsheet | 20-24 |

| Figure 20-3 Medical Clinic in San Tiburcio – ERM 2018. | 20-30 |

| Figure 20-4 Home in El Berrendo – ERM 2018 | 20-32 |

| Figure 20-5 Unoccupied Home in San Francisco de los Quijano – ERM 2018. | 20-32 |

| Figure 20-6 Town Plaza in San Tiburcio – ERM 2018. | 20-33 |

| Figure 20-7 Public Plaza in La Fabrica (part of San Tiburcio) – ERM 2018. | 20-33 |

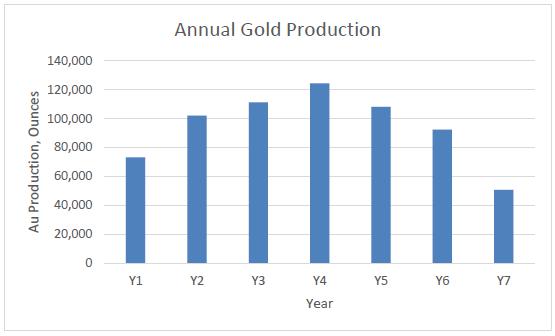

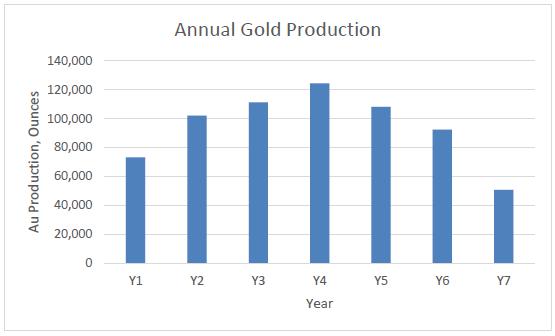

| Figure 22-1 Annual Gold Production | 22-8 |

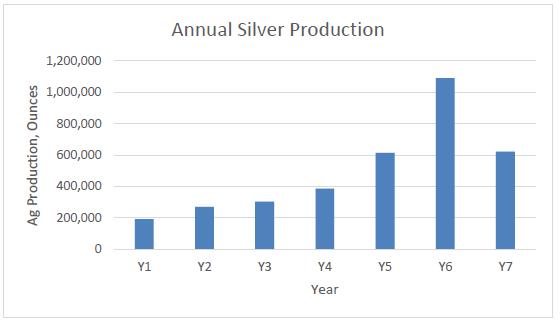

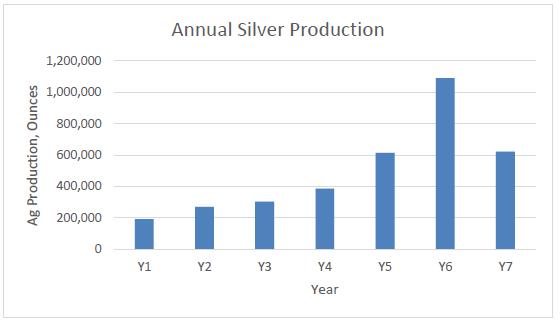

| Figure 22-2 Annual Silver Production | 22-8 |

| Figure 22-3 After Tax Sensitivity – IRR | 22-15 |

| Figure 22-4 After Tax Sensitivity – NPV @ 5% | 22-15 |

| Figure 24-1 Project Development & Implementation Schedule | 24-4 |

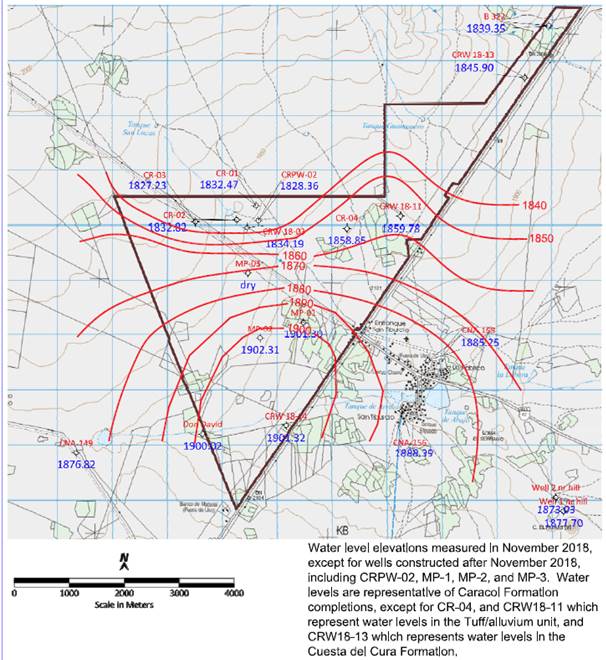

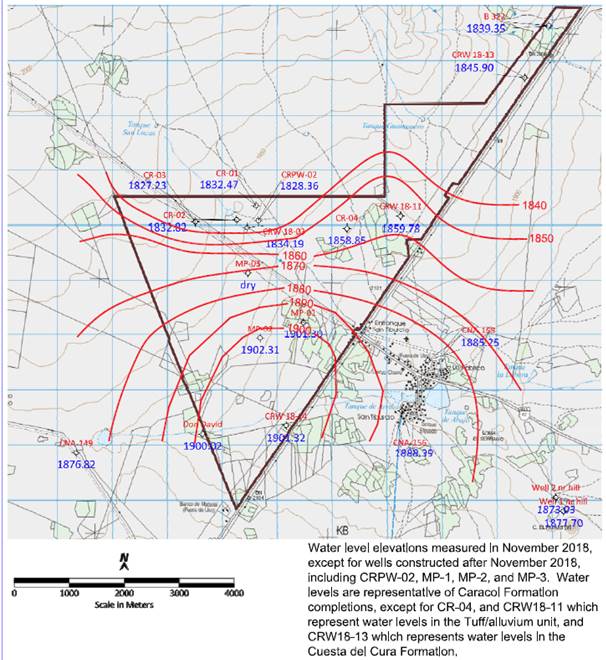

| Figure 24-2 Groundwater Elevation Contours Camino Rojo Project, Zacatecas | 24-7 |

| Figure 24-3 Total Dissolved Solids in Groundwater | 24-11 |

| Figure 24-4 Simulated Dewatering Rates from Open Pit | 24-14 |

| Figure 24-5 Maximum Extent of 1 Metre Drawdown Contour for Nominal Case | 24-15 |

| Figure 24-6 Maximum Extent of 1 Metre Drawdown Contour for Low K Case | 24-15 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 14 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

TABLES

| Table 1-1 Mineral Resource (Inclusive of Mineral Reserve) | 1-8 |

| Table 1-2 Mineral Resource – Lead and Zinc | 1-8 |

| Table 1-3 Mineral Reserve | 1-10 |

| Table 1-4 Capital Cost Summary | 1-16 |

| Table 1-5 Operating Cost Summary | 1-16 |

| Table 1-6 Economic Analysis Summary | 1-20 |

| Table 4-1 Listing of Mining Concessions | 4-4 |

| Table 10-1 Summary of Camino Rojo Drilling, 2007-2018 | 10-1 |

| Table 10-2 Drillholes by Orla Included in Mineral Resource Model Database | 10-4 |

| Table 10-3 Non-Resource Drilling Completed by Orla, 2018 and 2019 | 10-5 |

| Table 13-1 Oxide Column Test Results - SGS Mineral Services 2009 | 13-4 |

| Table 13-2 Transition Column Test Results - SGS Mineral Services 2009 | 13-5 |

| Table 13-3 Bottle Roll Test Results CRM 06 Composites - SGS Mineral Services 2009 | 13-5 |

| Table 13-4 Bottle Roll Test Results CRM 14 Composites - SGS Mineral Services 2009 | 13-6 |

| Table 13-5 Bottle Roll Test Results CRM 20 Composites - SGS Mineral Services 2009 | 13-6 |

| Table 13-6 Transition & Sulphide Samples for Flotation Tests - SGS Mineral Services 2009 | 13-7 |

| Table 13-7 Head Analysis Gold & Silver – KCA 2010 | 13-9 |

| Table 13-8 Carbon & Sulphur Summary – KCA 2010 | 13-9 |

| Table 13-9 Mercury & Copper Summary – KCA 2010 | 13-10 |

| Table 13-10 Composite Cyanide Shake Tests Results Summary – KCA 2010 | 13-11 |

| Table 13-11 Column Leach Test Results on Composites – KCA 2010 | 13-12 |

| Table 13-12 Head Analysis Gold & Silver– KCA 2012 | 13-14 |

| Table 13-13 Head Analysis Carbon & Sulphur– KCA 2012 | 13-14 |

| Table 13-14 Head Analysis Mercury & Copper– KCA 2012 | 13-15 |

| Table 13-15 Bottle Roll Leach Tests Summary, Gold– KCA 2012 | 13-17 |

| Table 13-16 Bottle Roll Leach Tests Summary, Silver– KCA 2012 | 13-18 |

| Table 13-17 KCA 2012 Summary of Column Leach Test Results by Material Type | 13-20 |

| Table 13-18 Summary of Flotation Composite Feed Grades | 13-22 |

| Table 13-19 Lead Flotation Concentrate Grades | 13-22 |

| Table 13-20 Zinc Flotation Concentrate Grades | 13-22 |

| Table 13-21 Comminution Test Results Summary | 13-23 |

| Table 13-22 Comminution Test Results by Alteration Type | 13-23 |

| Table 13-23 Description of Received Material– KCA 2014 | 13-25 |

| Table 13-24 Description of Received Material– KCA 2015 | 13-26 |

| Table 13-25 Head Analyses, Gold & Silver– KCA 2015 | 13-27 |

| Table 13-26 Head Analyses Carbon & Sulphur– KCA 2015 | 13-27 |

| Table 13-27 Head Analyses Mercury & Copper– KCA 2015 | 13-28 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 15 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| Table 13-28 KCA 2015 Column Leach Test Results by Lithology | 13-32 |

| Table 13-29 Description of Received Material – KCA 2019 | 13-35 |

| Table 13-30 Composite Generation Information – KCA 2019 | 13-36 |

| Table 13-31 Head Analyses Gold & Silver – KCA 2019 | 13-37 |

| Table 13-32 Head Analyses Carbon & Sulphur – KCA 2019 | 13-37 |

| Table 13-33 Head Analyses Mercury & Copper – KCA 2019 | 13-38 |

| Table 13-34 Head Analyses Lead & Zinc – KCA 2019 | 13-38 |

| Table 13-35 Head Analyses Multi-Element Analysis – KCA 2019 | 13-39 |

| Table 13-36 Head Analyses Whole Rock Analysis – KCA 2019 | 13-40 |

| Table 13-37 Phisical Characterization Test Work Summary – KCA 2019 | 13-41 |

| Table 13-38 Bottle Roll Leach Test Summary, Gold – KCA 2019 | 13-41 |

| Table 13-39 Bottle Roll Leach Test Summary, Silver – KCA 2019 | 13-42 |

| Table 13-40 Column Leach Tests Results Summary, Gold – KCA 2019 | 13-44 |

| Table 13-41 Column Leach Tests Results Summary, Silver – KCA 2019 | 13-45 |

| Table 13-42 Diagnostic Leach Test Summary – KCA 2019 | 13-47 |

| Table 13-43 Estimated Recoveries by Material Type for P80 28mm Crush Size | 13-52 |

| Table 13-44 Projected Field Cyanide Consumptions by Material Type | 13-53 |

| Table 13-45 Projected Field Lime Consumptions by Material Type | 13-54 |

| Table 13-46 Distribution of Metals to Various Sulphide Products | 13-58 |

| Table 14-1 Mineral Resource | 14-2 |

| Table 14-2 Mineral Resource – Lead and Zinc | 14-3 |

| Table 14-3 Economic Parameters for Mineral Resource Estimate | 14-5 |

| Table 14-4 Treatment Costs for Lead and Zinc Concentrates | 14-6 |

| Table 14-5 Camino Rojo Model Rock Types (lith) | 14-10 |

| Table 14-6 Camino Rojo Alteration Types (alt) | 14-13 |

| Table 14-7 Camino Rojo Oxide-Sulphide Model (oxide) | 14-13 |

| Table 14-8 Camino Rojo Estimation Domains (domain) | 14-14 |

| Table 14-9 Cap Grades and Number of Assays Capped | 14-21 |

| Table 14-10 Summary Statistics of Assays | 14-22 |

| Table 14-11 Summary Statistics of 5m Composites | 14-23 |

| Table 14-12 Specific Gravity and Bulk Density | 14-45 |

| Table 14-13 Reconciliation of 2018 versus 2019 Mineral Resource - Leach Material | 14-48 |

| Table 14-14 Reconciliation of 2018 versus 2019 Mineral Resource - Mill Material | 14-48 |

| Table 14-15 Reconciliation of 2018 versus 2019 Mineral Resource - Leach & Mill Material | 14-49 |

| Table 15-1 Mineral Reserve | 15-3 |

| Table 15-2 Economic Parameters for Mine Design | 15-6 |

| Table 16-1 Mine Production Schedule - 6,570 KTPY | 16-8 |

| Table 16-2 Proposed Plant Production Schedule - 6,570 KTPY | 16-9 |

| Table 16-3 Proposed Plant Production Schedule by Material Type - 6,570 KTPY | 16-10 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 16 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| Table 16-4 Mine Waste by Material Type | 16-11 |

| Table 16-5 Mine Major Equipment Fleet Requirement | 16-22 |

| Table 17-1 Processing Design Criteria Summary | 17-2 |

| Table 17-2 Heap Leach Design Parameters | 17-11 |

| Table 17-3 Phase 1 Process Pond Storage Requirements | 17-15 |

| Table 17-4 Phase 2 Process Pond Storage Requirements | 17-15 |

| Table 17-5 Average Monthly Precipitation – San Tiburcio Weather Station | 17-16 |

| Table 17-6 24-h Storm Event Estimations – NewFields | 17-17 |

| Table 17-7 Average Monthly Evaporation Data – Conception del Oro Weather Station | 17-17 |

| Table 17-8 Average Make-up Water Requirements | 17-18 |

| Table 17-9 Projected Annual Reagents and Consumables | 17-27 |

| Table 18-1 Camp Capacity | 18-4 |

| Table 18-2 Power Demand | 18-9 |

| Table 20-1 Summary of Camino Rojo Closure Costs | 20-20 |

| Table 20-2 Permits Required for Mine Construction | 20-22 |

| Table 20-3 Permits Required for Mine Operation and Closure | 20-23 |

| Table 20-4 Populations of Communities in Area of Influence of Project | 20-27 |

| Table 20-5 Marginalization by Community | 20-34 |

| Table 21-1 Capital Cost Summary | 21-1 |

| Table 21-2 LOM Operating Cost Summary | 21-1 |

| Table 21-3 Summary of Pre-Production Capital Costs by Area | 21-3 |

| Table 21-4 LOM Mining Capital Costs | 21-4 |

| Table 21-5 Owner Mining Equipment Capital Costs | 21-6 |

| Table 21-6 Mine Development Capital Costs | 21-6 |

| Table 21-7 Summary of Process & Infrastructure Pre-Production Capital Costs by Discipline | 21-8 |

| Table 21-8 Process Mobile Equipment | 21-12 |

| Table 21-9 Process & Infrastructure Contingency | 21-13 |

| Table 21-10 Construction Indirect Costs | 21-14 |

| Table 21-11 Other Owner’s Construction Costs | 21-15 |

| Table 21-12 Initial Fills | 21-16 |

| Table 21-13 Contract Mining Cost Summary | 21-19 |

| Table 21-14 Contract Mining Costs Based on Unit Rates | 21-22 |

| Table 21-15 Contract Blasting Costs Based on Unit Rates | 21-22 |

| Table 21-16 Owner Mine Personnel & Technical Services | 21-23 |

| Table 21-17 Pit Wall Support Costs | 21-24 |

| Table 21-18 Wall Control Drilling Costs | 21-24 |

| Table 21-19 Average Process, Support & G&A Operating Cost | 21-25 |

| Table 21-20 Personnel & Staffing Summary | 21-27 |

| Table 21-21 Support Equipment Operating Costs | 21-30 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 17 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| Table 21-22 Fixed G&A Expenses | 21-31 |

| Table 21-23 G&A Expenses by Year | 21-32 |

| Table 21-24 Reclamation and Closure Cost Summary | 21-33 |

| Table 22-1 Key Economic Parameters | 22-2 |

| Table 22-2 Economic Analysis Summary | 22-3 |

| Table 22-3 Capital Expenditures Summary | 22-7 |

| Table 22-4 LOM Operating Costs | 22-9 |

| Table 22-5 Depreciation and Pre-Production Tax Pools | 22-11 |

| Table 22-6 Cashflow Model Summary | 22-12 |

| Table 22-7 After-Tax Sensitivity Analysis Results | 22-14 |

| Table 24-1 Summary of Groundwater Quality Analyses from On-Site (COPE) Wells | 24-9 |

Kappes, Cassiday & Associates June, 2019 | | Contents Page 18 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 1.1 | Introduction and Overview |

The Camino Rojo property, located in Zacatecas State, Mexico, is 100% owned by Orla Mining Ltd. (Orla) through its Mexican subsidiary Minera Camino Rojo S.A. de C.V. (MCR). At the request of Orla, this Report was prepared by Kappes, Cassiday and Associates (KCA), Independent Mining Consultants, Inc. (IMC), Resource Geosciences Incorporated (RGI) and Barranca Group, LLC (Barranca) with input from other consultant groups.

This Technical Report is a summary of a Feasibility Study (FS) on the Camino Rojo Project and has been prepared in accordance with disclosure and reporting requirements set forth in the Canadian Securities Administrators’ current “Standards of Disclosure for Mineral Projects” under the provisions of National Instrument 43-101 (NI 43-101), Companion Policy 43-101 CP and Form 43-101F1 and supersedes a Technical Report prepared by KCA dated 19 June 2018 and amended 11 March 2019, “Preliminary Economic Assessment - Amended NI 43-101 Technical Report on the Camino Rojo Gold Project Municipality of Mazapil, Zacatecas, Mexico”.

The Camino Rojo Project considers open pit mining of approximately 44 million tonnes of ore with an estimated grade of 0.73 grams per tonne (g/t) gold and 14.2 g/t silver. Ore from the pit will be crushed to 80% passing 28mm, conveyor stacked onto a heap leach pad and leached using a low concentration sodium cyanide solution. Pregnant solution from the heap leach will be processed in a Merrill-Crowe recovery plant where gold and silver will be precipitated from deaerated pregnant solution with ultra-fine zinc. The resulting precious metal sludge will be filtered and dried in a mercury retort, and then smelted to produce the final doré product.

The average processing throughput for the Camino Rojo Project is 18,000 tonnes of ore per day (tpd). The Project will be developed in two stages with expansion of the leach pad and addition of conveying equipment occurring in Year 2 of operation. Pit dewatering equipment including pumps and evaporators will be required in Year 4 of operation. The scope of the FS includes a mine production schedule, as well as costing for all process components and infrastructure required for the operation. This report is based on the oxide and transitional portion of the Measured and Indicated Mineral Resource on the Property.

| 1.2 | Property Description and Ownership |

The Camino Rojo property is located in the Municipality of Mazapil, State of Zacatecas, near the village of San Tiburcio. The property lies 190 kilometres (km) NE of the city of Zacatecas, 48km S-SW of the town of Concepcion del Oro, Zacatecas, and 54km S-SE of Newmont Goldcorp Corporation’s (Newmont) Peñasquito Mine. The Project area is centred at approximately 244150E 2675900N UTM NAD27 Zone 14N.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-1 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

The property mineral rights are held by Orla’s Mexican subsidiary MCR in 8 mining concessions covering approximately 2,059 km2. Currently, ongoing exploration programs are identifying the most prospective areas surrounding the Camino Rojo deposit, and Orla, through its Mexican subsidiary MCR, plans to reduce its mineral concession holdings to 1,631 km2 by relinquishing mineral rights to the least prospective ground. Surface rights are held by the Ejido San Tiburcio, a communal agrarian cooperative. Exploration has been carried out under the authority of agreements between the project operators and the Ejido San Tiburcio. There is a temporary occupation with right to expropriate agreement in place with the Ejido San Tiburcio that covers all the area of the Mineral Resource and Mineral Reserve estimate as well as the area of potential development described in this report. MCR has water rights for sufficient volumes of water to develop the Project.

| 1.3 | Geology & Mineralization |

The Camino Rojo deposit comprises intrusive related, clastic sedimentary strata hosted, polymetallic gold, silver, arsenic, zinc and lead mineralization.

Mineralization is hosted by Cretaceous submarine sedimentary strata, dominantly clastic. The most important host is the Caracol Formation, a rhythmically interbedded sequence of weakly calcareous turbiditic sandstones, siltstones and shales. The underlying Indidura Formation, comprised of regularly bedded reduced siltstones and shales, and the Cuesta del Cura limestone, now recrystallized to white fine-grained marble, host a minor amount of sulphide mineralization, but are inconsequential hosts of oxide mineralization. The gold-silver-lead-zinc deposit is situated above, and extends down into, a zone of feldspathic hornfels developed in the sedimentary strata, and variably mineralized dacitic dikes. The mineralized zones correspond to zones of sheeted sulphidic veins and veinlet networks, creating a bulk-mineable style of gold mineralization. Skarn mineralization has been encountered in the deeper portions of the system. The observed geologic and geochemical characteristics of the gold-silver-lead-zinc deposit at Camino Rojo are consistent with those of a distal oxidized gold skarn deposit. The metal suite and style of mineralization at Camino Rojo are similar to the intrusion-related deposits in the Caracol Formation and underlying carbonate rocks adjacent to the diatremes at the Peñasquito mine.

For purposes of this Report, only the economic potential of the oxide and partially oxidized transitional mineralization amenable to gold and silver recovery via standard cyanide heap leach processing, was evaluated.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-2 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 1.4 | Exploration and Drilling |

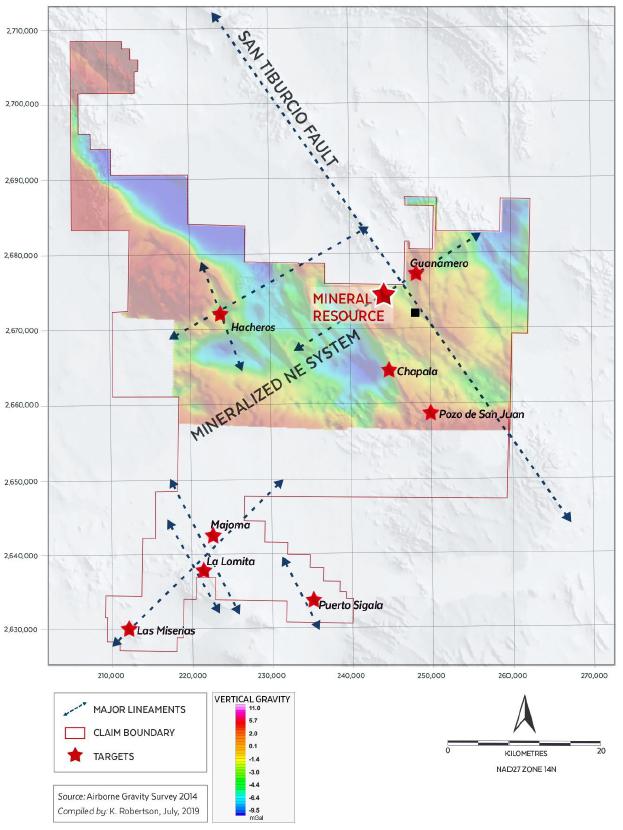

The Camino Rojo deposit was discovered in mid-2007 and was originally entirely concealed beneath post-mineral cover in a broad, low relief alluvial valley adjacent to the western flank of the Sierra Madre Oriental. Mineralized road ballast placed on a dirt road near San Tiburcio, Zacatecas, was traced to its source by geologists Perry Durning and Bud Hillemeyer from La Cuesta International, working under contract to Canplats Resources Corporation (Canplats). A shallow pit excavated through a thin veneer of alluvium, located adjacent to a stock pond (represa) was the discovery exposure of the deposit. Canplats began concurrent programs of surface geophysics and reverse-circulation (RC) drilling in late 2007, which continued into 2008.

The initial drilling was focused on a 450 x 600 metre gold-in-rock geochemical anomaly named the Represa zone. Core drilling began in 2008. The geophysical survey defined two principal areas of high chargeability: one centred on the Represa zone and another 1 km to the west named the Don Julio zone. The elevated chargeability zones were interpreted as large volumes of sulphide mineralized rocks. Drilling by Canplats, and later drilling by Goldcorp Inc. (Goldcorp), confirmed the presence of extensive sulphide mineralization at depth in the Represa zone, and much lower quantities of sulphide minerals at Don Julio, which is an extension of the Represa zone mineralization.

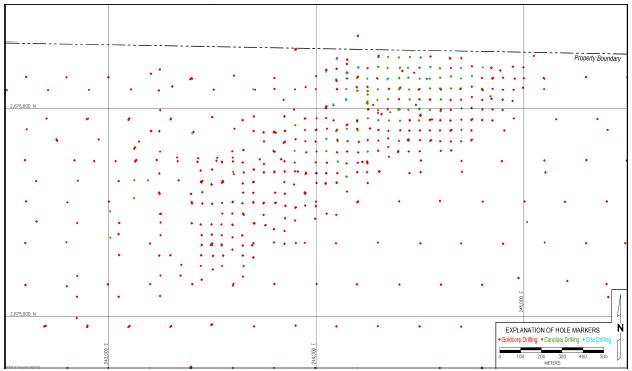

By August of 2008, Canplats drilled a total of 92 RC, and 30 diamond-core holes, for a total of 23,988 and 16,044 metres respectively, mainly focused in the Represa zone.

Canplats was acquired by Goldcorp in early 2010. Validation, infill, condemnation, and expansion drilling began in January 2011. By the end of 2015, a total of 279,788 metres of new core drilling in 415 drillholes and 20,569 metres of new RC drilling in 96 drillholes was completed in the Represa and Don Julio zones and their immediate surroundings. An additional 31,286 metres of shallow rotary air blast (RAB)-style, RC drilling in 306 drillholes was completed, with most of the RAB drilling testing other exploration targets within the concession. Airborne gravity, magnetic and TEM surveys were also carried out. As of the end of 2015 a total of 295,832 metres in 445 diamond core holes, 44,557 metres in 188 RC drillholes, and 31,286 metres of RAB drilling had been completed.

Orla acquired the property from Goldcorp in 2017 and through the effective date of this report, Orla has completed: 2,228.5 metres of additional drilling in 14 diamond core holes for metallurgical sampling; 5,340.5 metres of drilling in 16 reverse circulation holes testing for water; 803.1 metres of RC holes as resource infill drillholes; 1,767.8 metres of drilling in 7 RC holes as condemnation holes; 1,261.0 metres of drilling in 6 deep diamond core holes as condemnation and infrastructure geotechnical holes; 323.4 metres of drilling in 19 shallow diamond core holes as geotechnical tests of the substrate in the areas of proposed mine infrastructure; 726.0 metres of drilling in diamond core holes as pit slope stability geotechnical holes, 56 metres of drilling in 5 diamond core holes evaluating clay sources for pond liner material; and 197.4 metres of RC drilling to construct 3 monitoring wells. Orla has not yet conducted any drilling to explore for new mineralized zones.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-3 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| 1.5 | Metallurgical Test Work |

Historical metallurgical test work programs on the Camino Rojo property were commissioned by the prior operators of the Project between 2010 and 2015. A confirmatory metallurgical test program was commissioned by Orla in 2018 to confirm the results and conclusions from the previous campaigns. In total, 107 column leach tests (85 on representative samples for the material types and pit area) and 164 bottle roll tests have been completed to date on the Camino Rojo ore body as well as physical characterization and preliminary flotation test work.

Based on the metallurgical tests completed on the deposit, key design parameters for the Project include:

| · | Crush size of 100% passing 38mm (P80 28mm). |

| · | Estimated gold recoveries (including 2% field deduction) of: |

| · | Estimated silver recoveries (including 3% field deduction) of: |

| · | Design leach cycle of 80 days. |

| · | Agglomeration with cement not required for permeability or stability. |

| · | Average cyanide consumption of 0.35 kilograms per tonne (kg/t) ore. |

| · | Average lime consumption of 1.25 kg/t ore. |

The key design parameters are based on a substantial number of metallurgical tests including 85 column leach tests on samples representative of domains in the current deposit model. These 85 representative samples from documented drillholes with good spatial distribution in the proposed pit include 41 columns tests on Kp Oxide material, 7 column tests on Ki Oxide material, 16 column tests on Trans-Hi material and 21 column tests on Trans-Lo material. The 22 non-representative columns were excluded based on the following criteria:

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-4 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| · | Columns on Trans-S or sulphide material that were not considered in the Mineral Reserve. |

| · | Mix of Tran-S or other material types. |

| · | Samples taken from outside of the proposed pit area. |

An additional 54 bottle roll leach tests with direct correlations with the column tests have been included as part of the evaluation to support these results and conclusions.

In general, the Camino Rojo deposit shows variability in gold and silver recoveries based on material type and geological domain with preg-robbing organic carbon being the only significant deleterious element identified, which is primarily associated with the transition material at depth along the outer edges of the deposit. Recoveries for the oxide material are good and will yield acceptable results using conventional heap leaching methods with cyanide. Recoveries for the transition material are lower compared with the oxide material for conventional leaching with some areas of transition showing reasonably high recoveries. Reagent consumptions for all material types are reasonably low.

Preg robbing, a phenomenon where gold and gold-cyanide complexes are preferentially absorbed by carbonaceous, and to a lesser extent, other material within the orebody; presents a low risk to the overall Project. A significant investigation by Orla into the preg robbing material indicates that potentially preg robbing material represents a small percentage of the total material to be processed and will not be encountered until later in the Project life and can be mitigated by proper ore control.

| 1.6 | Mineral Resource Estimate |

Table 1-1 presents the gold and silver Mineral Resource estimation for the Camino Rojo property. Measured and Indicated Mineral Resources amount to 353.4 million tonnes at 0.83 g/t gold and 8.8 g/t silver. Contained metal amounts to 9.46 million ounces gold and 100.4 million ounces of silver for the Measured and Indicated Mineral Resources. Inferred Mineral Resource is an additional 60.9 million tonnes at 0.87 g/t gold and 7.4 g/t silver. Contained metal amounts to 1.70 million ounces of gold and 14.5 million ounces of silver for the Inferred Mineral Resource.

The gold and silver Mineral Resource includes material amenable to heap leach recovery methods (leach material) and material amenable to mill and flotation concentration methods (mill material). For the leach material, Measured and Indicated Mineral Resources amount to 94.6 million tonnes at 0.71 g/t gold and 12.7 g/t silver. Contained metal amounts to 2.16 million ounces gold and 38.8 million ounces of silver for the Measured and Indicated Mineral Resources. Inferred Mineral Resource is an additional 4.4 million tonnes at 0.86 g/t gold and 5.8 g/t silver. Contained metal amounts to 119,800 ounces of gold and 805,000 ounces of silver for the Inferred Mineral Resource amenable to heap leach methods. The resources amenable to heap leach methods are oxide dominant and are the emphasis of the Feasibility Study.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-5 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

For the gold and silver resource in mill material, the Measured and Indicated Mineral Resources amount to 258.8 million tonnes at 0.88 g/t gold and 7.4 g/t silver. Contained metal amounts to 7.30 million ounces gold and 61.6 million ounces of silver for the Measured and Indicated Mineral Resources. Inferred Mineral Resource is an additional 56.6 million tonnes at 0.87 g/t gold, 7.5 g/t silver. Contained metal amounts to 1.58 million ounces of gold and 13.7 million ounces of silver for the Inferred Mineral Resource in mill material.

Table 1-2 presents the lead and zinc Mineral Resources for the Camino Rojo Project. The lead and zinc Mineral Resources are in sulphide dominant material and are recovered along with the gold and silver in the mill material. Lead and zinc Measured and Indicated Mineral Resources amount to 258.8 million tonnes at 0.07% lead and 0.26% zinc. Contained metal amounts to 413.6 million pounds of lead, and 1.50 billion pounds of zinc for the Measured and Indicated Mineral Resource. Inferred Mineral Resource is an additional 56.6 million tonnes at 0.05% lead and 0.23% zinc. Contained metal amounts to 63.1 million pounds of lead and 290.4 million pounds of zinc for the Inferred Mineral Resource category.

The Mineral Resources from the leach material are reported inclusive of those Mineral Resources that were converted to Mineral Reserves presented in Section 1.7. The Mineral Resources from the mill material were excluded from the mine design in the Feasibility Study.

The Mineral Resources are based on a block model developed by IMC during January and February 2019. This updated model incorporated the 2018 Orla drilling and updated geologic models.

The Measured, Indicated, and Inferred Mineral Resources reported herein are constrained within a floating cone pit shell to demonstrate “reasonable prospects for eventual economic extraction” to meet the definition of Mineral Resources in NI 43-101.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-6 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

All of the mineralization comprised in the Mineral Resource estimate with respect to the Camino Rojo Project is contained on mineral titles controlled by Orla. However, the Mineral Resource estimate assumes that the north wall of the conceptual floating pit cone used to demonstrate reasonable prospects for eventual economic extraction extends onto lands where mineral title is held by the owner of the adjacent property (Adjacent Owner), that waste would be mined on the Adjacent Owner’s mineral titles, and an assumption that an agreement will be negotiated to allow a push-back of the pit onto the Adjacent Owner’s mineral titles to gain access to the mineral resources on Orla’s mineral properties. Any potential development of the Camino Rojo property that includes an open pit encompassing the entire Mineral Resource estimate would be dependent on obtaining an agreement with the Adjacent Owner. It is estimated that approximately two-thirds of the Mineral Resource estimate is dependent on an agreement being obtained with the Adjacent Owner. The Mineral Resource estimate has been prepared based on the Qualified Person’s reasoned judgment, in accordance with Canadian Institute of Mining, metallurgy and Petroleum (CIM) Best Practices Guidelines and his professional standards of competence, that there is a reasonable expectation that all necessary permits, agreements and approvals will be obtained and maintained, including an agreement with the Adjacent Owner to allow mining of waste material on its mineral concessions. In particular, when determining the prospects for eventual economic extraction, consideration was given to industry practice, including the past practices of the Adjacent Owner in entering similar agreements on commercially reasonable terms, and a timeframe of 10-15 years.

Delays in, or failure to obtain, such agreement would affect the development of a significant portion of the Mineral Resources of the Camino Rojo property that are not included in the Feasibility Study, in particular by limiting access to significant mineralized material at depth. There can be no assurance that Orla will be able to negotiate such agreement on terms that are satisfactory to Orla or that there will not be delays in obtaining the necessary agreement.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-7 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

Table 1-1

Mineral Resource (Inclusive of Mineral Reserve)

| | | | NSR Cut-off | | Gold | Silver | Gold | Silver |

| Resource Type | ($/t) | Kt | (g/t) | (g/t) | (koz) | (koz) |

| Leach Resource: | | | | | | |

| | Measured Mineral Resource | 4.73 | 19,391 | 0.77 | 14.9 | 482.3 | 9,305 |

| | Indicated Mineral Resource | 4.73 | 75,249 | 0.70 | 12.2 | 1,680.7 | 29,471 |

| | Meas/Ind Mineral Resource | 4.73 | 94,640 | 0.71 | 12.7 | 2,163.0 | 38,776 |

| | Inferred Mineral Resource | 4.73 | 4,355 | 0.86 | 5.8 | 119.8 | 805 |

| | | | | | | | | |

| Mill Resource: | | | | | | |

| | Measured Mineral Resource | 13.71 | 3,358 | 0.69 | 9.2 | 74.2 | 997 |

| | Indicated Mineral Resource | 13.71 | 255,445 | 0.88 | 7.4 | 7,221.4 | 60,606 |

| | Meas/Ind Mineral Resource | 13.71 | 258,803 | 0.88 | 7.4 | 7,295.6 | 61,603 |

| | Inferred Mineral Resource | 13.71 | 56,564 | 0.87 | 7.5 | 1,576.9 | 13,713 |

| | | | | | | | | |

| Total Mineral Resource | | | | | | |

| | Measured Mineral Resource | | 22,749 | 0.76 | 14.1 | 556.5 | 10,302 |

| | Indicated Mineral Resource | | 330,694 | 0.84 | 8.5 | 8,902.1 | 90,078 |

| | Meas/Ind Mineral Resource | | 353,443 | 0.83 | 8.8 | 9,458.6 | 100,379 |

| | Inferred Mineral Resource | | 60,919 | 0.87 | 7.4 | 1,696.7 | 14,518 |

| | | | | | | | | |

Table 1-2

Mineral Resource – Lead and Zinc

| | | NSR Cut off | | NSR | Lead | Zinc | Lead | Zinc |

| Resource Type | ($/t) | Kt | ($/t) | (%) | (%) | (Mlb) | (Mlb) |

| Mill Resource: | | | | | | | |

| | Measured Mineral Resource | 13.71 | 3,358 | 35.04 | 0.13 | 0.38 | 9.3 | 28.2 |

| | Indicated Mineral Resource | 13.71 | 255,445 | 39.33 | 0.07 | 0.26 | 404.3 | 1,468.7 |

| | Meas/Ind Mineral Resource | 13.71 | 258,803 | 39.27 | 0.07 | 0.26 | 413.6 | 1,496.8 |

| | Inferred Mineral Resource | 13.71 | 56,564 | 38.4 | 0.05 | 0.23 | 63.1 | 290.4 |

| | | | | | | | | |

Notes:

1. The Mineral Resource has an effective date of June 7, 2019 and the estimate was prepared using the CIM Definition Standards (May 10, 2014).

2. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

3. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

4. Mineral Resources for leach material are based on prices of $1400/oz gold and $20/oz silver.

5. Mineral Resources for mill material are based on prices of $1400/oz gold, $20/oz silver, $1.05/lb lead, and $1.20/lb zinc.

6. Mineral Resources are based on NSR cut-off of $4.73/t for leach material and $13.71/t for mill material.

7. NSR value for leach material is as follows:

Kp Oxide: NSR ($/t) = 30.77 x gold (g/t) + 0.068 x silver (g/t), based on gold recovery of 70% and silver recovery of 11%

Ki Oxide: NSR ($/t) = 24.61 x gold (g/t) + 0.092 x silver (g/t), based on gold recovery of 56% and silver recovery of 15%

Tran-Hi: NSR ($/t) = 26.37 x gold (g/t) + 0.166 x silver (g/t), based on gold recovery of 60% and silver recovery of 27%

Tran-Lo: NSR ($/t) = 17.58 x gold (g/t) + 0.209 x silver (g/t), based on gold recovery of 40% and silver recovery of 34%

8. NSR value for mill material is 36.75 x gold (g/t) + 0.429 x silver (g/t) + 10.75 x lead (%) + 11.77 x zinc (%), based on recoveries of 86% gold, 76% silver, 60% lead, and 64% zinc.

9. Table 14-3 accompanies this Mineral Resource statement and shows all relevant parameters.

10. Mineral Resources are constrained within a conceptual pit shell in order to demonstrate reasonable prospects for eventual economic extraction, to meet the definition of Mineral Resource in NI 43-101; mineralization lying outside of the pit shell is not reported as a Mineral Resource.

11. The Mineral Resource estimate requires the floating pit cone used to demonstrate reasonable prospects for eventual economic extraction to extend onto land held by the Adjacent Owner. Any potential development of the Camino Rojo property that includes an open pit encompassing the entire Mineral Resource estimate would be dependent on obtaining an agreement with the Adjacent Owner.

12. The Mineral Resources in the leach material is inclusive of those Mineral Resources that were converted to Mineral Reserves.

| 1.7 | Mineral Reserve Estimate |

Table 1-3 presents the Mineral Reserve estimation for the Camino Rojo Project. The Proven and Probable Mineral Reserve amounts to 44.0 million tonnes at 0.73 g/t Au and 14.2 g/t Ag for 1.03 million contained gold ounces and 20.1 million contained silver ounces. Direct feed material in the Mineral Reserve is material that will be processed the same year it is mined. The low-grade stockpile material will be processed after the open pit is completed. The effective date of this Mineral Reserve estimation is 24 June 2019.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-8 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

The Mineral Reserve estimation is based on an open pit mine plan and mine production schedule developed by IMC. Processing is based on crushing and heap leaching to recover gold and silver. Table 1-3 shows the parameters used for economic and cut-off calculations. The Mineral Reserve is based on a gold price of US$1250 per ounce and a silver price of US$17.00 per ounce. Measured Mineral Resource in the mine production schedule was converted to proven Mineral Reserve and indicated Mineral Resource in the schedule was converted to probable Mineral Reserve.

The Mineral Reserves are classified in accordance with the “CIM Definition Standards – For Mineral Resources and Mineral Reserves” adopted by the CIM Council (as amended, the “CIM Definition Standards”) in accordance with the requirements of NI 43-101. Mineral Reserve estimates reflect the reasonable expectation that all necessary permits and approvals will be obtained and maintained.

IMC does not believe that there are significant risks to the Mineral Reserve estimate based on metallurgical or infrastructure factors. There has been a significant amount of metallurgical testing and the infrastructure requirements are relatively straightforward compared to many operations. However, recoveries lower than forecast would result is loss of revenue for the project. There has also been some potential preg-robbing material identified in the deposit, as discussed in Section 13.5 and 25.3.2, but this does not appear to represent a significant risk.

There is risk to the Mineral Reserve based on mining factors. As discussed in Section 16.2 and 25.3.1, the slope angle assumptions are based on careful application of wall control blasting, and the north and west wall slope angles are also based on significant mechanical support. Failure of these systems to perform as expected would result in less ore available for the process plant and potentially a shorter project life. Also, slope stability issues on the north wall of the pit could be difficult to mitigate due to lack of access to the ground north of the pit.

Other risks to the Mineral Reserve are related to economic parameters such as prices lower than forecast or costs higher than the current estimates. The impact of these is modeled in the sensitivity study with the economic analysis in Section 22.10.

All of the mineralization comprised in the Mineral Reserve estimate with respect to the Camino Rojo Project is contained on mineral titles controlled by Orla as is all the proposed development and mining and processing activities.

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-9 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

Table 1-3

Mineral Reserve

| | | | | | | | | Cont. | Cont. |

| | | | | | NSR | Gold | Silver | Gold | Silver |

| Reserve Class | Ktonnes | ($/t) | (g/t) | (g/t) | (koz) | (koz) |

| Proven Mineral Reserve | | | | | | | |

| | Direct Feed | | 13,331 | 22.87 | 0.84 | 15.6 | 358.8 | 6,698 |

| | Low Grade Stockpile | | 1,264 | 7.19 | 0.27 | 10.0 | 10.9 | 406 |

| | Total Proven Mineral Reserve | 14,595 | 21.51 | 0.79 | 15.1 | 369.7 | 7,104 |

| Probable Mineral Reserve | | | | | | |

| | Direct Feed | | 25,939 | 20.27 | 0.76 | 14.4 | 629.8 | 12,029 |

| | Low Grade Stockpile | | 3,485 | 7.05 | 0.28 | 8.6 | 31.3 | 962 |

| | Total Probable Mineral Reserve | 29,424 | 18.70 | 0.70 | 13.7 | 661.1 | 12,991 |

| Probable/Probable Mineral Reserve | | | | | | |

| | Direct Feed | | 39,270 | 21.15 | 0.78 | 14.8 | 988.6 | 18,726 |

| | Low Grade Stockpile | | 4,749 | 7.09 | 0.28 | 9.0 | 42.3 | 1,368 |

| | Total Probable/Probable Reserve | 44,019 | 19.63 | 0.73 | 14.2 | 1,030.9 | 20,095 |

Notes:

1. The Mineral Reserve estimate has an effective date of June 24, 2019 and was prepared using the CIM Definition Standards (10 May 2014).

2. Columns may not sum exactly due to rounding.

3. Mineral Reserves are based on prices of $1250/oz gold and $17/oz silver.

4. Mineral Reserves are based on NSR cut-offs that vary by time period to balance mine and plant production capacities (see Section 16). They range from a low of $4.73/t to a high of $9.00/t.

5. NSR value for leach material is as follows:

Kp Oxide: NSR ($/t) = 27.46 x gold (g/t) + 0.057 x silver (g/t), based on gold recovery of 70% and silver recovery of 11%

Ki Oxide: NSR ($/t) = 21.97 x gold (g/t) + 0.078 x silver (g/t), based on gold recovery of 56% and silver recovery of 15%

Tran-Hi: NSR ($/t) = 23.54 x gold (g/t) + 0.140 x silver (g/t), based on gold recovery of 60% and silver recovery of 27%

Tran-Lo: NSR ($/t) = 15.69 x gold (g/t) + 0.177 x silver (g/t), based on gold recovery of 40% and silver recovery of 34%

6. Table 15-2 accompanies this Mineral Reserve estimate and shows all relevant parameters

| Kappes, Cassiday & Associates | 1.0 Summary |

| June, 2019 | Page 1-10 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

The Camino Rojo Feasibility Study is based on a conventional open pit mine. Mine operations will consist of drilling medium diameter blast holes (approximately 17cm), blasting with explosive emulsions or ANFO (ammonium nitrate/fuel oil) depending on water conditions, and loading into large off-road trucks with hydraulic shovels and wheel loaders. Ore will be delivered to the primary crusher and waste to the waste storage facility southeast of the pit. There will also be a low-grade stockpile facility to store marginal ore for processing at the end of commercial pit operations. There will be a fleet of track dozers, rubber-tired dozers, motor graders and water trucks to maintain the working areas of the pit, waste storage areas, and haul roads.

A mine plan was developed to supply ore to a conventional crushing and heap leach facility with the capacity to process 18,000 tpd (6,570 ktpy). The mine is scheduled to operate two 10-hour shifts per day for 365 days per year.

The mine plan is constrained by the Adjacent Owner concession boundary on the north side of the pit, i.e. the FS is based on the assumption that no mining activities, including waste stripping, would occur on the Adjacent Owner’s mineral titles. Accordingly, delays in, or failure to obtain, an agreement with the Adjacent Owner to conduct mining operations on its mineral titles would have no impact on the timetable or cost of development of the potential mine modelled in this technical report.

Eventually, mining will be conducted below the water table, probably during Year 4 of commercial operation. Estimates of pit dewatering requirements have been prepared for cost estimation purposes, but additional hydrogeological studies will be required to better estimate the requirements.

Test work results developed by KCA and others have indicated that part of the Camino Rojo Mineral Resource is amenable to heap leaching for the recovery of gold and silver. Based on a Mineral Reserve of 44.0 million tonnes and established processing rate of 18,000 tonnes per day of ore, the Project has an estimated mine life of approximately 6.8 years.

Ore will be mined using standard open pit mining methods and delivered to the crushing circuit using haul trucks which will direct-dump into a dump hopper; front-end loaders will feed material to the dump hopper as needed from a run of mine (ROM) stockpile located near the primary crusher. Ore will be crushed to a final product size of 80% passing 28mm (100% passing 38mm) using a two-stage closed crushing circuit. The crushing circuit will operate 7 days/week, 24 hours/day with an overall estimated availability of 75%.

Kappes, Cassiday & Associates June, 2019 | | 1.0 Summary Page 1-11 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

The crushed product will be stockpiled using a fixed stacker, reclaimed by belt feeders to a reclaim conveyor, and conveyed to the heap stacking system by an overland conveyor system. Pebble lime will be added to the reclaim conveyor belt for pH control; agglomeration with cement is not needed.

Stacked ore will be leached using a drip irrigation system for solution application; sprinkler irrigation will be used beginning in Year 4 of operations to increase evaporation rates and reduce water treatment requirements from pit dewatering. After percolating through the ore, the gold and silver bearing pregnant leach solution will drain by gravity to a pregnant solution pond where it will be collected and pumped to a Merrill-Crowe recovery plant. Pregnant solution will be pumped through clarification filter presses to remove any suspended solids before being deaerated in a vacuum tower to remove oxygen. Ultra-fine zinc dust will be added to the deaerated pregnant solution to precipitate gold and silver values, which will be collected by precipitate filter presses. Barren leach solution leaving the precipitate filter presses will flow to a barren solution tank and will then be pumped to the heap for further leaching. High strength cyanide solution will be injected into the barren solution to maintain the cyanide concentration in the leach solutions at the desired levels.

The precipitate from the Merrill-Crowe recovery plant will be processed in the refinery. Precipitate will be treated by an electric mercury retort with a fume collection system for drying and removal of mercury before being mixed with fluxes and smelted using an induction smelting furnace to produce the final doré product.

An event pond is included to collect contact solution from storm events. Solution collected will be returned to the process as soon as practical. Evaporators will be installed in the event pond beginning in Year 3 of operation to remove excess water generated by pit dewatering.

Existing infrastructure for the Camino Rojo Project includes a 20-man exploration camp and dirt and gravel roads throughout the Project site. Internet and limited cellular communications are currently available, though these systems will need to be expanded for operations.

Access to the Project site is by the paved four lane Mexican Highway 54 and Route 62, a secondary paved highway that passes through San Tiburcio. This is approximately 260 km southwest of Monterrey and 190 km northeast of Zacatecas. A private road will enter into the mine property approximately 250 metres northeast of the intersection between highway 54 and 62. This road will provide access to the camps, offices, mine, process plant and other Project facilities. Site access roads will be constructed during pre-production and will include approximately 24 km of dirt and gravel roads.

Kappes, Cassiday & Associates June, 2019 | | 1.0 Summary Page 1-12 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

The onsite operations camp will be arranged to lodge up to 408 people and will be under maximum occupancy during the construction phase (multiple bunks in rooms that will be single rooms during operations).

Power supply to the Camino Rojo Project will initially be generated on site using two each 2500 ekW diesel generator units operating, with an additional unit on standby, as well as by the existing power line which services the surrounding area. Power will be generated at 4160 V, 3 phase, 60 Hz and stepped up to 13.8 kV by a transformer for site distribution. The generator system has been sized to meet both the average power demand of 4.8 MW as well as the peak estimated demand of 6 MW based on detailed electrical loads with estimated utilization and demand factors. The existing power line has a reported 1 MW of capacity which will be used to supply power to dedicated loads (man camp, site buildings, water supply). The existing power line will be stepped down from 34.5 kV to 13.8 kV.

It is assumed that in Year 2 of operations, power supply will be available by connecting to the national grid and power generation at site will no longer be needed. Overhead power lines will connect 34.5 kV, three phase and 60 Hz power system, pending Centro Nacional de Control de Energía (CENACE) approval, to a metering and switching substation. This main substation will be located at approximately NAD27 245609E, 2674826N. Power from the main substation will be stepped down to 13.8 kV and connected to the existing switch gear for site distribution. The temporary generators and associated fuel tanks will be removed once line power is available.

Total Project water supply will be sourced from production wells located within the property boundary. Process make-up water will also be supplied during pit dewatering activities starting in about Year 4. Total water consumption for the Project will average 24 liters per second (L/s) with a peak water demand of 33 L/s.

Project buildings will primarily be prefabricated steel buildings or concrete masonry unit buildings and include an administration building, mine truck shop, warehouse, laboratory, guard house, clinic, refinery and motor control centres (MCC).

| 1.11 | Environmental Studies, Permitting and Social or Community Impact |

Exploration and mining activities in Mexico are subject to control by the Federal agency of the Secretaria del Medio Ambiente y Recursos Naturales (Secretary of the Environment and Natural Resources), known by its acronym SEMARNAT, which has authority over the 2 principal Federal permits:

| i. | A Manifesto de Impacto Ambiental (Environmental Impact Statement), known by its acronym as an MIA accompanied by an Estudio de Riesgo (Risk Study, hereafter referred to as ER); and |

| | | |

Kappes, Cassiday & Associates June, 2019 | | 1.0 Summary Page 1-13 |

| Camino Rojo Project Feasibility Study NI 43-101 Technical Report |

|

| ii. | A Cambio de Uso de Suelo (Land Use Change) permit, known by its acronym as a CUS, supported by an Estudio Tecnico Justificativo (Technical Justification Study, known by its acronym ETJ). |

Thus far exploration work at Camino Rojo has been conducted under the auspices of two separate MIA permits and corresponding CUS permits. These permits allow for extensive exploration drilling but are not sufficient for mine construction or operation.

Baseline environmental studies required for permitting were commissioned by Orla on April 2018 and were completed in May 2019 by independent consultants. The Project area includes five flora species with legally protected status and nine fauna species that are listed as threatened or protected. In accordance with Federal laws, 100% of the protected plants will be rescued and transplanted prior to construction and qualified biologists will survey the areas to be disturbed to identify nesting areas, dens and lairs of animals present. Any animals not naturally prone to leave the area that are found will be relocated to suitable habitats elsewhere in the property area. Current and ongoing environmental investigations are still in progress. Submission of MIA and CUS permitting documents to SEMARNAT is anticipated in the 3rd Quarter 2019.

The Project is not located in an area with any special Federal environmental protection designation and no factors have been identified that would be expected to hinder authorization of required Federal and State environmental permits. The legislated timelines for review of properly prepared MIA and Change of Land Use applications and mine operating permits for a project that does not affect Federally protected biospheres or ecological reserves are 120 calendar days and 105 working days, respectively, which can be completed concurrently.

The Peñasquito mine, a large scale, open pit mine, presently operated by Newmont, is in the same Municipality and the mine encountered no impediments to receipt of needed permits. Should construction and operation permits be solicited for the Camino Rojo Project, no obstacles to obtaining them are anticipated provided that Orla design and mitigation criteria meet all applicable standards.