UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Gregory C. Bakken, President

Listed Funds Trust

c/o U.S. Bank Global Fund Services

811 E. Wisconsin Ave, 8th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-4711

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: May 31, 2020

Item 1. Reports to Stockholders.

Wahed FTSE USA Shariah ETF

(HLAL)

ANNUAL REPORT

May 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission (“SEC”), paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Fund’s reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future Fund reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Wahed FTSE USA Shariah ETF

Table of Contents

| | |

Letter to Shareholders (Unaudited) | 2 |

Shareholder Expense Example (Unaudited) | 4 |

Performance Overview (Unaudited) | 5 |

Schedule of Investments | 6 |

Statement of Assets and Liabilities | 11 |

Statement of Operations | 12 |

Statement of Changes in Net Assets | 13 |

Financial Highlights | 14 |

Notes to Financial Statements | 15 |

Report of Independent Registered Public Accounting Firm | 22 |

Review of Liquidity Risk Management Program (Unaudited) | 23 |

Board of Trustees and Officers (Unaudited) | 24 |

Supplemental Information (Unaudited) | 26 |

Privacy Policy (Unaudited) | 27 |

1

Wahed FTSE USA Shariah ETF

Letter to Shareholders

May 31, 2020 (Unaudited)

To Our Shareholders,

We hope this message finds you and your families in the best possible health and spirits. The past few months have been unprecedented, both for our firm and the broader financial markets, as we await the return to some semblance of normalcy in our communities and around the world.

Unsurprisingly, the COVID-19 pandemic has been front and center for markets and the Wahed FTSE USA Shariah ETF (ticker: HLAL or also referred to herein as the ‘Fund’). However, prior to the advent of the pandemic in the third and fourth quarters of 2019, HLAL performed in-line with the vicissitudes of U.S. equity markets. In July 2019 and for much of the remaining third quarter, continued concerns regarding the U.S.-China trade dispute put a damper on other steady U.S. equities performance, in tandem with an inverted U.S. yield curve in the month that gave indication of the long-predicted recession. However, moves by the Federal Reserve to cut interest rates by 25 basis points1 during the quarter, ameliorated some of the impact and still allowed U.S. equities some modest gains during the quarter, which were also enjoyed by HLAL. By the fourth quarter of 2019, U.S. equities witnessed strong gains as trade with the U.S. and China issued their ‘phase one’ trade deal announcement. China also agreed to increase its purchase of good and agricultural produce from the United States. Simultaneously, the Federal Reserve continued to be active, slashing interest rates at the start of the quarter, while indicating that “the current stance of monetary policy is appropriate.” The technology sector, of which HLAL holds significant constituents, benefited from the ease of trade tensions.

Of course, as with everything in our person, familial and professional lives, the arrival of 2020 and the rapid spread of the novel coronavirus, brought serious change. The Fund saw losses and minor outflows during the peak of the COVID-19 panic and shutdown in January through March, but subsequently recovered as the U.S. government introduced stimulus measures, the Federal Reserve provided unprecedented support to credit markets, and daily coronavirus casualties slowed down dramatically. Despite a challenging macro environment, heightened market volatility, and relatively young nature of the Fund, we are happy to report that HLAL performed exactly as designed, providing exceptional market-based performance in a passive, buy-and-hold investing style.

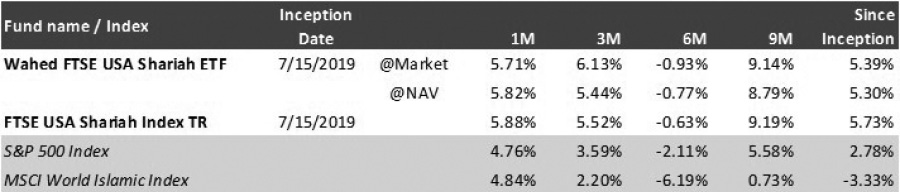

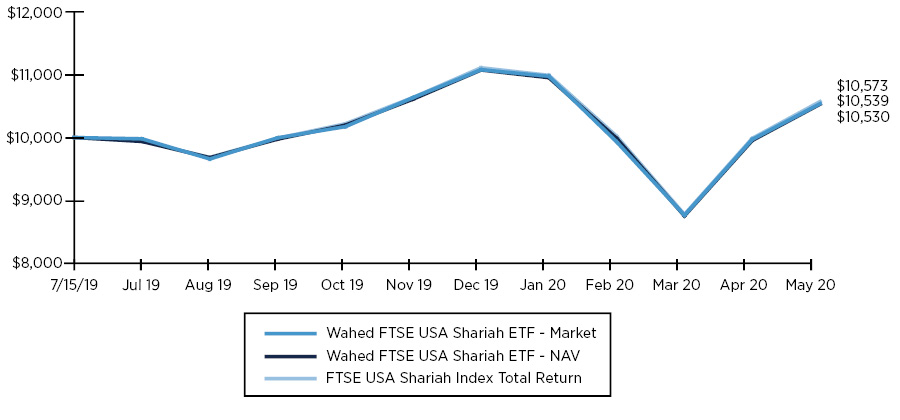

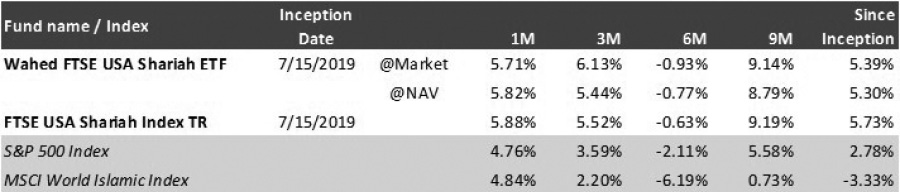

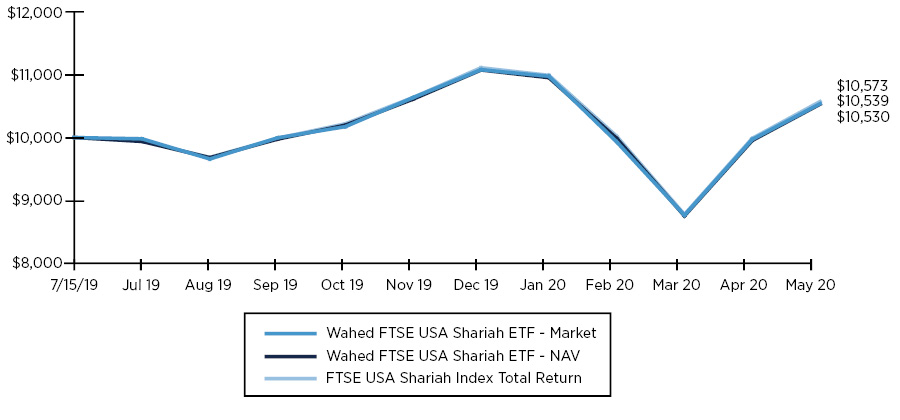

Per the chart below, the Fund displayed minimal tracking error to the underlying index (FTSE USA Shariah Index), well within the expected variance which were largely due to required fees and dividend distribution associated with the Fund. Additionally, relative to conventional indices, HLAL outperformed broader indices.

Source: Bloomberg L.P. as of 5/31/2020

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

The FTSE Global Equity Shariah Index Series has been designed to be used as the basis of Shariah compliant investment products that meet the requirements of Islamic investors globally. Using the Large and Mid Cap stocks from the FTSE Global Equity Index Series as a base universe, constituents are then screened against a clear set of Shariah principles.

The MSCI World Islamic Index reflects Sharia investment principles and is designed to measure the performance of the large and mid cap segments of the 23 Developed Markets (DM) countries* that are relevant for Islamic investors. The index, with 419 constituents applies stringent screens to exclude securities based on two types of criteria: business activities and financial ratios derived from total assets.

1 | A basis point is one hundredth of one percent. |

* | DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Singapore, Spain, Sweden, Switzerland, the UK and the U.S. |

2

Wahed FTSE USA Shariah ETF

Letter to Shareholders

May 31, 2020 (Unaudited) (Continued)

As the Fund continues to grow in size, we do not expect any changes to the Fund’s stated strategy, both in passively tracking its underlying index ( FTSE USA Shariah Index), as well as continuing to validate the underlying shariah methodology with the FTSE Global Equity Shariah Index Series, which utilizes Yasaar Limited as a consultant to certify the series as Shariah-compliant. More specifically, the Fund is expected to hold at least 80% of its assets in index securities and minimize its cash holdings. As we’ve said in the past, Wahed Invest LLC believes that investors should not be disadvantaged for wanting to invest in line with their faith. With HLAL and the continued expansion of our platform, we are excited to continue the privilege of serving our community through adversity and for years to come.

Best regards,

Aris Parviz

Head of North America

Wahed Invest LLC

DISCLAIMER

Must be preceded or accompanied by a prospectus.

One cannot invest in an index.

An investment in the Fund is subject to investment risk, including the possible loss of principal. The Fund may trade at a premium or discount to NAV. The Fund has the same risk as the underlying securities traded on the exchange throughout the day. Redemptions are limited and often commission are charged on every trade. Wahed FTSE USA Shariah ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commissions and ETF expenses will reduce investment returns. There can be no assurance that an active trading market for ETF shares will be developed or maintained. The risks associated with this Fund are detailed in the “Principal Investment Risk” section of the prospectus and could include factors such as equity market risk, ETF risk, Market Capitalization risk, Market risk, new fund risk, non-diversification risk, passive investment risk, sector risk, tracking risk, Shariah-Compliant Investment risk, tracking error risk, and/or underlying index risk.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

The Wahed FTSE USA Shariah ETF (HLAL) is distributed by Quasar Distributors, LLC

3

Wahed FTSE USA Shariah ETF

Shareholder Expense Example

May 31, 2020 (Unaudited)

As a shareholder of a Fund you incur two types of costs: (1) transaction costs for purchasing and selling shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (December 1, 2019 to May 31, 2020), except as noted in footnotes below.

ACTUAL EXPENSES

The first line under the Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account

Value

12/1/19 | Ending

Account

Value

5/31/20 | Annualized

Expense

Ratios | Expenses

Paid

During the

Period(1) |

Wahed FTSE USA Shariah ETF | | | | |

Actual | $1,000.00 | $ 992.30 | 0.50% | $2.49 |

Hypothetical (5% return before expenses) | $1,000.00 | $ 1,022.50 | 0.50% | $2.53 |

(1) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 183/366 (to reflect the six-month period). |

4

Wahed FTSE USA Shariah ETF

Performance Overview

May 31, 2020 (Unaudited)

Hypothetical Growth of $10,000 Investment

(Since Commencement through 5/31/2020)

CUMULATIVE TOTAL RETURN FOR THE PERIOD ENDED MAY 31, 2020 |

Total Returns | Since

Commencement1 |

Wahed FTSE USA Shariah ETF—NAV | 5.30% |

Wahed FTSE USA Shariah ETF—Market | 5.39% |

FTSE USA Shariah Index Total Return | 5.73% |

1 | The Fund commenced operations on July 15, 2019 |

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. For the most recent month-end performance, please call (855) 976-4747. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (“NAV”), and are not individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00 p.m. Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns. Returns shown include the reinvestment of all dividends and distribution. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The FTSE Global Equity Shariah Index Series has been designed to be used as the basis for Shariah compliant investment products that meet the requirements of investors globally. Using large and mid-cap stocks from the FTSE Global Equity Index Series as a base universe, constituent are then screened against Shariah principles and standards by subject-matter experts at Yasaar Limited, to create a more discrete, certified Shariah compliant index series.

The FTSE USA Shariah Index contains U.S. stocks that meet the aforementioned criteria and is a sub-index of the FTSE Global Equity Shariah Index Series. The FTSE USA Shariah Index has been fully certified as Shariah compliant through a fatwa (Islamic legal opinion) issued by Yasaar Limited.

5

Wahed FTSE USA Shariah ETF

Schedule of Investments

May 31, 2020

| | Shares | | | Value | |

COMMON STOCKS — 99.7% | | | | | | | | |

Administrative and Support Services — 1.3% | | | | | | | | |

Baker Hughes Co. | | | 2,473 | | | $ | 40,829 | |

Booking Holdings, Inc. (a) | | | 159 | | | | 260,668 | |

FleetCor Technologies, Inc. (a) | | | 326 | | | | 79,475 | |

Robert Half International, Inc. | | | 401 | | | | 20,347 | |

Rollins, Inc. | | | 499 | | | | 20,858 | |

| | | | | | | | 422,177 | |

Air Transportation — 0.1% | | | | | | | | |

Alaska Air Group, Inc. | | | 127 | | | | 4,342 | |

Delta Air Lines, Inc. | | | 604 | | | | 15,227 | |

Southwest Airlines Co. | | | 607 | | | | 19,485 | |

United Airlines Holdings, Inc. (a) | | | 235 | | | | 6,589 | |

| | | | | | | | 45,643 | |

Ambulatory Health Care Services — 0.2% | | | | | | | | |

Quest Diagnostics, Inc. | | | 498 | | | | 58,904 | |

| | | | | | | | | |

Apparel Manufacturing — 0.7% | | | | | | | | |

Lululemon Athletica, Inc. (a) | | | 444 | | | | 133,242 | |

PVH Corp. | | | 243 | | | | 11,049 | |

Ralph Lauren Corp. | | | 183 | | | | 13,819 | |

Under Armour, Inc. - Class A (a) | | | 648 | | | | 5,670 | |

Under Armour, Inc. - Class C (a) | | | 611 | | | | 4,803 | |

VF Corp. | | | 1,192 | | | | 66,871 | |

| | | | | | | | 235,454 | |

Beverage and Tobacco Product Manufacturing — 0.5% | | | | | | | | |

Coca-Cola European Partners PLC (b) | | | 631 | | | | 23,788 | |

Keurig Dr. Pepper, Inc. | | | 851 | | | | 23,760 | |

Monster Beverage Corp. (a) | | | 1,469 | | | | 105,636 | |

| | | | | | | | 153,184 | |

Chemical Manufacturing — 20.8% | | | | | | | | |

Abbott Laboratories | | | 6,552 | | | | 621,916 | |

Air Products & Chemicals, Inc. | | | 840 | | | | 202,986 | |

Albemarle Corp. | | | 417 | | | | 31,909 | |

Alexion Pharmaceuticals, Inc. (a) | | | 815 | | | | 97,719 | |

Biogen, Inc. (a) | | | 653 | | | | 200,530 | |

BioMarin Pharmaceutical, Inc. (a) | | | 673 | | | | 71,708 | |

CF Industries Holdings, Inc. | | | 818 | | | | 24,025 | |

Church & Dwight Co., Inc. | | | 923 | | | | 69,290 | |

Dow, Inc. | | | 2,819 | | | | 108,813 | |

DuPont de Nemours, Inc. | | | 2,791 | | | | 141,587 | |

FMC Corp. | | | 482 | | | | 47,434 | |

International Flavors & Fragrances, Inc. | | | 417 | | | | 55,540 | |

Jazz Pharmaceuticals PLC (a)(b) | | | 223 | | | | 26,608 | |

Johnson & Johnson | | | 10,115 | | | | 1,504,606 | |

Linde PLC (b) | | | 2,039 | | | | 412,571 | |

Merck & Co., Inc. | | | 9,697 | | | | 782,742 | |

Perrigo Co. PLC (b) | | | 471 | | | | 25,797 | |

Pfizer, Inc. | | | 21,202 | | | | 809,704 | |

PPG Industries, Inc. | | | 888 | | | | 90,283 | |

Regeneron Pharmaceuticals, Inc. (a) | | | 309 | | | | 189,358 | |

The Estee Lauder Cos., Inc. - Class A | | | 835 | | | | 164,888 | |

The Mosaic Co. | | | 1,259 | | | | 15,221 | |

The Procter & Gamble Co. | | | 9,262 | | | | 1,073,651 | |

Westlake Chemical Corp. | | | 122 | | | | 5,819 | |

| | | | | | | | 6,774,705 | |

Clothing and Clothing Accessories Stores — 1.4% | | | | | | | | |

Nordstrom, Inc. | | | 397 | | | | 6,404 | |

Ross Stores, Inc. | | | 1,347 | | | | 130,605 | |

The Gap, Inc. | | | 748 | | | | 6,657 | |

The TJX Cos., Inc. | | | 4,631 | | | | 244,331 | |

Tiffany & Co. | | | 453 | | | | 58,043 | |

| | | | | | | | 446,040 | |

Computer and Electronic Product Manufacturing — 31.8% (c) | | | | | | | | |

Advanced Micro Devices, Inc. (a) | | | 3,915 | | | | 210,627 | |

Agilent Technologies, Inc. | | | 1,165 | | | | 102,683 | |

Analog Devices, Inc. | | | 1,381 | | | | 155,984 | |

Apple, Inc. | | | 15,692 | | | | 4,989,114 | |

Cisco Systems, Inc. | | | 16,300 | | | | 779,466 | |

Danaher Corp. | | | 2,378 | | | | 396,199 | |

Eaton Corp. PLC | | | 1,573 | | | | 133,548 | |

Flex Ltd. (a) | | | 1,913 | | | | 18,575 | |

Fortive Corp. | | | 1,104 | | | | 67,322 | |

HP, Inc. | | | 5,492 | | | | 83,149 | |

Intel Corp. | | | 16,300 | | | | 1,025,759 | |

Jabil, Inc. | | | 608 | | | | 18,191 | |

Juniper Networks, Inc. | | | 1,250 | | | | 30,325 | |

Marvell Technology Group Ltd. | | | 2,490 | | | | 81,224 | |

Medtronic PLC (b) | | | 5,111 | | | | 503,842 | |

Micron Technology, Inc. (a) | | | 4,219 | | | | 202,132 | |

NXP Semiconductors NV (b) | | | 1,073 | | | | 103,115 | |

Roper Technologies, Inc. | | | 391 | | | | 153,976 | |

Seagate Technology PLC | | | 977 | | | | 51,820 | |

Texas Instruments, Inc. | | | 3,582 | | | | 425,327 | |

Thermo Fisher Scientific, Inc. | | | 1,520 | | | | 530,769 | |

Trane Technologies PLC (b) | | | 919 | | | | 82,903 | |

Trimble, Inc. (a) | | | 932 | | | | 36,460 | |

Varian Medical Systems, Inc. (a) | | | 339 | | | | 41,151 | |

Western Digital Corp. | | | 1,118 | | | | 49,606 | |

The accompanying notes are an integral part of the financial statements.

6

Wahed FTSE USA Shariah ETF

Schedule of Investments

May 31, 2020 (Continued)

| | Shares | | | Value | |

Computer and Electronic Product Manufacturing (Continued) | | | | | | | | |

Zebra Technologies Corp. - Class A (a) | | | 201 | | | $ | 52,525 | |

| | | | | | | | 10,325,792 | |

Construction of Buildings — 0.7% | | | | | | | | |

DR Horton, Inc. | | | 1,264 | | | | 69,899 | |

Lennar Corp. - Class A | | | 1,033 | | | | 62,455 | |

NVR, Inc. (a) | | | 12 | | | | 38,659 | |

PulteGroup, Inc. | | | 992 | | | | 33,698 | |

Toll Brothers, Inc. | | | 453 | | | | 14,637 | |

| | | | | | | | 219,348 | |

Couriers and Messengers — 0.4% | | | | | | | | |

FedEx Corp. | | | 928 | | | | 121,160 | |

| | | | | | | | | |

Data Processing, Hosting and Related Services — 0.1% | | | | | | | | |

Hewlett Packard Enterprise Co. | | | 4,941 | | | | 47,977 | |

| | | | | | | | | |

Electrical Equipment, Appliance and Component Manufacturing — 0.4% | | | | | | | | |

Acuity Brands, Inc. | | | 144 | | | | 12,405 | |

Rockwell Automation, Inc. | | | 430 | | | | 92,949 | |

Whirlpool Corp. | | | 224 | | | | 27,288 | |

| | | | | | | | 132,642 | |

Fabricated Metal Product Manufacturing — 0.7% | | | | | | | | |

Emerson Electric Co. | | | 2,343 | | | | 142,970 | |

Stanley Black & Decker, Inc. | | | 568 | | | | 71,256 | |

| | | | | | | | 214,226 | |

Food Manufacturing — 1.2% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 2,142 | | | | 84,202 | |

Bunge Ltd. | | | 503 | | | | 19,627 | |

Mondelez International, Inc. - Class A | | | 5,401 | | | | 281,500 | |

| | | | | | | | 385,329 | |

Funds, Trusts and Other Financial Vehicles — 0.2% | | | | | | | | |

Garmin Ltd. (b) | | | 561 | | | | 50,585 | |

| | | | | | | | | |

General Merchandise Stores — 1.2% | | | | | | | | |

Burlington Stores, Inc. (a) | | | 241 | | | | 50,530 | |

Dollar Tree, Inc. (a) | | | 902 | | | | 88,279 | |

Kohl’s Corp. | | | 606 | | | | 11,647 | |

Macy’s, Inc. | | | 1,083 | | | | 6,888 | |

Target Corp. | | | 1,872 | | | | 229,002 | |

| | | | | | | | 386,346 | |

Health and Personal Care Stores — 1.5% | | | | | | | | |

CVS Health Corp. | | | 4,952 | | | | 324,703 | |

Ulta Beauty, Inc. (a) | | | 207 | | | | 50,510 | |

Walgreens Boots Alliance, Inc. | | | 2,834 | | | | 121,692 | |

| | | | | | | | 496,905 | |

Leather and Allied Product Manufacturing — 1.4% | | | | | | | | |

NIKE, Inc. - Class B | | | 4,448 | | | | 438,484 | |

Tapestry, Inc. | | | 1,036 | | | | 14,090 | |

| | | | | | | | 452,574 | |

Machinery Manufacturing — 1.4% | | | | | | | | |

Applied Materials, Inc. | | | 3,516 | | | | 197,529 | |

Cummins, Inc. | | | 551 | | | | 93,450 | |

Flowserve Corp. | | | 480 | | | | 12,528 | |

IDEX Corp. | | | 297 | | | | 47,333 | |

National Oilwell Varco, Inc. | | | 1,450 | | | | 18,081 | |

Pentair PLC (b) | | | 626 | | | | 24,502 | |

Snap-on, Inc. | | | 198 | | | | 25,679 | |

Xylem, Inc. | | | 671 | | | | 44,514 | |

| | | | | | | | 463,616 | |

Management of Companies and Enterprises — 0.0% (d) | | | | | | | | |

Xerox Holdings Corp. | | | 594 | | | | 9,433 | |

| | | | | | | | | |

Merchant Wholesalers, Durable Goods — 1.9% | | | | | | | | |

Arrow Electronics, Inc. (a) | | | 329 | | | | 22,727 | |

Copart, Inc. (a) | | | 751 | | | | 67,132 | |

Fastenal Co. | | | 2,212 | | | | 91,267 | |

Genuine Parts Co. | | | 525 | | | | 43,790 | |

Henry Schein, Inc. (a) | | | 557 | | | | 33,821 | |

Johnson Controls International PLC | | | 2,875 | | | | 90,304 | |

KLA Corp. | | | 586 | | | | 103,113 | |

LKQ Corp. (a) | | | 1,156 | | | | 31,744 | |

Mohawk Industries, Inc. (a) | | | 214 | | | | 19,945 | |

TE Connectivity Ltd. (b) | | | 1,253 | | | | 101,806 | |

| | | | | | | | 605,649 | |

Merchant Wholesalers, Nondurable Goods — 0.8% | | | | | | | | |

AmerisourceBergen Corp. | | | 575 | | | | 54,820 | |

Capri Holdings Ltd. (a)(b) | | | 531 | | | | 7,986 | |

Cardinal Health, Inc. | | | 1,133 | | | | 61,964 | |

McKesson Corp. | | | 606 | | | | 96,154 | |

Tractor Supply Co. | | | 443 | | | | 54,055 | |

| | | | | | | | 274,979 | |

The accompanying notes are an integral part of the financial statements.

7

Wahed FTSE USA Shariah ETF

Schedule of Investments

May 31, 2020 (Continued)

| | Shares | | | Value | |

Mining (Except Oil and Gas) — 1.0% | | | | | | | | |

Freeport-McMoRan, Inc. | | | 5,386 | | | $ | 48,851 | |

Martin Marietta Materials, Inc. | | | 232 | | | | 44,565 | |

Newmont Goldcorp Corp. | | | 3,075 | | | | 179,795 | |

Southern Copper Corp. | | | 271 | | | | 9,838 | |

Vulcan Materials Co. | | | 488 | | | | 52,860 | |

| | | | | | | | 335,909 | |

Miscellaneous Manufacturing — 4.8% | | | | | | | | |

3M Co. | | | 2,158 | | | | 337,597 | |

Align Technology, Inc. (a) | | | 302 | | | | 74,177 | |

Baxter International, Inc. | | | 1,833 | | | | 164,988 | |

DENTSPLY SIRONA, Inc. | | | 846 | | | | 39,356 | |

Dover Corp. | | | 567 | | | | 55,141 | |

Edwards Lifesciences Corp. (a) | | | 792 | | | | 177,978 | |

Hasbro, Inc. | | | 472 | | | | 34,697 | |

Intuitive Surgical, Inc. (a) | | | 433 | | | | 251,153 | |

STERIS PLC | | | 311 | | | | 51,592 | |

Stryker Corp. | | | 1,313 | | | | 256,993 | |

Teleflex, Inc. | | | 175 | | | | 63,501 | |

The Cooper Cos., Inc. | | | 181 | | | | 57,373 | |

| | | | | | | | 1,564,546 | |

Motion Picture and Sound Recording Industries — 0.2% | | | | | | | | |

Take-Two Interactive Software, Inc. (a) | | | 435 | | | | 59,234 | |

| | | | | | | | | |

Motor Vehicle and Parts Dealers — 0.1% | | | | | | | | |

Advance Auto Parts, Inc. | | | 261 | | | | 36,363 | |

| | | | | | | | | |

Nonstore Retailers — 0.1% | | | | | | | | |

WW Grainger, Inc. | | | 162 | | | | 50,158 | |

| | | | | | | | | |

Oil and Gas Extraction — 1.2% | | | | | | | | |

Cabot Oil & Gas Corp. | | | 1,523 | | | | 30,216 | |

Cimarex Energy Co. | | | 373 | | | | 9,802 | |

Concho Resources, Inc. | | | 736 | | | | 40,127 | |

Devon Energy Corp. | | | 1,357 | | | | 14,669 | |

EOG Resources, Inc. | | | 2,217 | | | | 113,000 | |

Occidental Petroleum Corp. | | | 3,385 | | | | 43,836 | |

Phillips 66 | | | 1,660 | | | | 129,912 | |

| | | | | | | | 381,562 | |

Paper Manufacturing — 0.3% | | | | | | | | |

International Paper Co. | | | 1,523 | | | | 51,858 | |

Packaging Corp. of America | | | 368 | | | | 37,319 | |

| | | | | | | | 89,177 | |

Petroleum and Coal Products Manufacturing — 5.0% | | | | | | | | |

Chevron Corp. | | | 7,267 | | | | 666,384 | |

Exxon Mobil Corp. | | | 16,102 | | | | 732,158 | |

HollyFrontier Corp. | | | 529 | | | | 16,637 | |

Marathon Oil Corp. | | | 2,862 | | | | 15,283 | |

Marathon Petroleum Corp. | | | 2,422 | | | | 85,109 | |

Valero Energy Corp. | | | 1,542 | | | | 102,759 | |

| | | | | | | | 1,618,330 | |

Primary Metal Manufacturing — 0.4% | | | | | | | | |

Corning, Inc. | | | 2,930 | | | | 66,775 | |

Nucor Corp. | | | 1,131 | | | | 47,796 | |

Steel Dynamics, Inc. | | | 779 | | | | 20,690 | |

| | | | | | | | 135,261 | |

Professional, Scientific and Technical Services — 2.3% | | | | | | | | |

Amdocs Ltd. | | | 500 | | | | 31,130 | |

Cerner Corp. | | | 1,173 | | | | 85,512 | |

Cognizant Technology Solutions Corp. - Class A | | | 2,108 | | | | 111,724 | |

F5 Networks, Inc. (a) | | | 226 | | | | 32,752 | |

Gartner, Inc. (a) | | | 327 | | | | 39,796 | |

GoDaddy, Inc. - Class A (a) | | | 674 | | | | 52,067 | |

Omnicom Group, Inc. | | | 841 | | | | 46,078 | |

ServiceNow, Inc. (a) | | | 709 | | | | 275,042 | |

The Interpublic Group of Cos., Inc. | | | 1,391 | | | | 23,800 | |

VMware, Inc. - Class A (a) | | | 283 | | | | 44,224 | |

| | | | | | | | 742,125 | |

Publishing Industries (Except Internet) — 8.6% | | | | | | | | |

Activision Blizzard, Inc. | | | 2,894 | | | | 208,310 | |

Adobe, Inc. (a) | | | 1,827 | | | | 706,318 | |

Akamai Technologies, Inc. (a) | | | 592 | | | | 62,634 | |

ANSYS, Inc. (a) | | | 314 | | | | 88,862 | |

Autodesk, Inc. (a) | | | 839 | | | | 176,509 | |

Cadence Design Systems, Inc. (a) | | | 1,043 | | | | 95,216 | |

Citrix Systems, Inc. | | | 435 | | | | 64,432 | |

News Corp. - Class A | | | 1,441 | | | | 17,652 | |

News Corp. - Class B | | | 369 | | | | 4,524 | |

NortonLifeLock, Inc. | | | 2,135 | | | | 48,635 | |

Oracle Corp. | | | 7,630 | | | | 410,265 | |

Paycom Software, Inc. (a) | | | 182 | | | | 54,096 | |

PTC, Inc. (a) | | | 377 | | | | 28,795 | |

Salesforce.com, Inc. (a) | | | 3,231 | | | | 564,747 | |

Synopsys, Inc. (a) | | | 568 | | | | 102,757 | |

Workday, Inc. - Class A (a) | | | 631 | | | | 115,744 | |

The accompanying notes are an integral part of the financial statements.

8

Wahed FTSE USA Shariah ETF

Schedule of Investments

May 31, 2020 (Continued)

| | Shares | | | Value | |

Publishing Industries (Except Internet) (Continued) | | | | | | | | |

Yandex NV - Class A (a)(b) | | | 1,091 | | | $ | 43,891 | |

| | | | | | | | 2,793,387 | |

Rail Transportation — 0.7% | | | | | | | | |

Kansas City Southern | | | 361 | | | | 54,338 | |

Norfolk Southern Corp. | | | 980 | | | | 174,724 | |

| | | | | | | | 229,062 | |

Support Activities for Agriculture and Forestry — 0.2% | | | | | | | | |

Corteva, Inc. | | | 2,889 | | | | 78,899 | |

| | | | | | | | | |

Support Activities for Mining — 1.4% | | | | | | | | |

ConocoPhillips | | | 4,087 | | | | 172,390 | |

Diamondback Energy, Inc. | | | 601 | | | | 25,591 | |

Halliburton Co. | | | 3,274 | | | | 38,469 | |

Hess Corp. | | | 1,010 | | | | 47,945 | |

Noble Energy, Inc. | | | 1,947 | | | | 16,997 | |

Pioneer Natural Resources Co. | | | 618 | | | | 56,609 | |

Schlumberger Ltd. | | | 5,216 | | | | 96,339 | |

| | | | | | | | 454,340 | |

Support Activities for Transportation — 0.3% | | | | | | | | |

CH Robinson Worldwide, Inc. | | | 525 | | | | 42,593 | |

Expeditors International of Washington, Inc. | | | 637 | | | | 48,648 | |

| | | | | | | | 91,241 | |

Telecommunications — 0.7% | | | | | | | | |

ResMed, Inc. | | | 539 | | | | 86,682 | |

T-Mobile US, Inc. (a) | | | 1,397 | | | | 139,756 | |

| | | | | | | | 226,438 | |

Transportation Equipment Manufacturing — 2.3% | | | | | | | | |

Aptiv PLC (b) | | | 970 | | | | 73,089 | |

Autoliv, Inc. | | | 310 | | | | 19,710 | |

BorgWarner, Inc. | | | 773 | | | | 24,852 | |

Gentex Corp. | | | 912 | | | | 24,113 | |

Lear Corp. | | | 220 | | | | 23,331 | |

PACCAR, Inc. | | | 1,274 | | | | 94,098 | |

Tesla, Inc. (a) | | | 549 | | | | 458,415 | |

Westinghouse Air Brake Technologies Corp. | | | 673 | | | | 41,100 | |

| | | | | | | | 758,708 | |

Truck Transportation — 0.3% | | | | | | | | |

JB Hunt Transport Services, Inc. | | | 310 | | | | 37,098 | |

Old Dominion Freight Line, Inc. | | | 367 | | | | 62,790 | |

| | | | | | | | 99,888 | |

Utilities — 1.1% | | | | | | | | |

Atmos Energy Corp. | | | 453 | | | | 46,560 | |

Avangrid, Inc. | | | 190 | | | | 8,451 | |

Edison International | | | 1,348 | | | | 78,332 | |

Exelon Corp. | | | 3,733 | | | | 143,011 | |

MDU Resources Group, Inc. | | | 741 | | | | 16,124 | |

PG&E Corp. (a) | | | 1,888 | | | | 22,392 | |

Pinnacle West Capital Corp. | | | 410 | | | | 31,939 | |

| | | | | | | | 346,809 | |

TOTAL COMMON STOCKS (Cost $30,970,016) | | | | | | | 32,414,105 | |

| | | | | | | | | |

TOTAL INVESTMENTS — 99.7% (Cost $30,970,016) | | | | | | | 32,414,105 | |

Other assets and liabilities, net — 0.3% | | | | | | | 91,846 | |

NET ASSETS — 100.0% | | | | | | $ | 32,505,951 | |

PLC Public Limited Company

(a) | Non-income producing security. |

(b) | Foreign issued security. |

(c) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensistive to developments that significantly affect those sectors. |

(d) | Amount is less than 0.05%. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

9

Wahed FTSE USA Shariah ETF

Schedule of Investments

May 31, 2020 (Continued)

Sector Diversification as of 5/31/2020

Manufacturing | 71.7% |

Information | 9.6 |

Retail Trade | 4.3 |

Mining, Quarrying & Oil & Gas Extraction | 3.6 |

Wholesale Trade | 2.7 |

Professional, Scientific & Technical Services | 2.3 |

Transportation & Warehousing | 1.8 |

Administrative & Support & Waste Management & Remediation Services | 1.3 |

Utilities | 1.1 |

Construction | 0.7 |

Agriculture, Forestry & Fishing & Hunting | 0.2 |

Health Care & Social Assistance | 0.2 |

Finance & Insurance | 0.2 |

Management of Companies & Enterprises | 0.0* |

Total Investments | 99.7% |

Other Assets & Liabilities, net | 0.3% |

Net Assets | 100.0% |

* | Amount is less than 0.05%. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

10

Wahed FTSE USA Shariah ETF

Statement of Assets and Liabilities

May 31, 2020

Assets | | | | |

Investments, at value (cost $30,970,016) | | $ | 32,414,105 | |

Dividends receivable | | | 78,091 | |

Cash | | | 26,861 | |

Total assets | | | 32,519,057 | |

| | | | | |

Liabilities | | | | |

Payable to Adviser | | | 13,016 | |

Dividend withholding tax payable | | | 90 | |

Total liabilities | | | 13,106 | |

Net Assets | | $ | 32,505,951 | |

| | | | | |

Net Assets Consists of: | | | | |

Paid-in capital | | $ | 31,535,820 | |

Total distributable earnings | | | 970,131 | |

Net Assets | | $ | 32,505,951 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 1,250,000 | |

Net Asset Value, redemption price and offering price per share | | $ | 26.00 | |

The accompanying notes are an integral part of the financial statements.

11

Wahed FTSE USA Shariah ETF

Statement of Operations

For the Period Ended May 31, 2020(1)

Investment Income | | | | |

Dividend income (net of withholding tax of $230) | | $ | 445,473 | |

Total investment income | | | 445,473 | |

| | | | | |

Expenses | | | | |

Investment advisory fees | | | 96,564 | |

Total expenses | | | 96,564 | |

Net investment income | | | 348,909 | |

| | | | | |

Realized and Unrealized Gain (Loss) on Investments | | | | |

Net realized gain (loss) on investments | | | (478,685 | ) |

Net change in unrealized appreciation/depreciation on investments | | | 1,444,089 | |

Net realized and unrealized gain (loss) on investments | | | 965,404 | |

Net increase in net assets from operations | | $ | 1,314,313 | |

(1) | The Fund commenced operations on July 15, 2019. |

The accompanying notes are an integral part of the financial statements.

12

Wahed FTSE USA Shariah ETF

Statement of Changes in Net Assets

| | | Period Ended

May 31, 2020(1) | |

From Operations | | | | |

Net investment income | | $ | 348,909 | |

Net realized loss on investments | | | (478,685 | ) |

Net change in unrealized appreciation/depreciation on investments | | | 1,444,089 | |

Net increase in net assets resulting from operations | | | 1,314,313 | |

| | | | | |

From Distributions | | | | |

Distributable earnings | | | (265,852 | ) |

Total distributions | | | (265,852 | ) |

| | | | | |

From Capital Share Transactions | | | | |

Proceeds from shares sold | | | 32,141,305 | |

Cost of shares redeemed | | | (683,815 | ) |

Net increase in net assets resulting from capital share transactions | | | 31,457,490 | |

| | | | | |

Total Increase in Net Assets | | | 32,505,951 | |

| | | | | |

Net Assets | | | | |

Beginning of period | | | — | |

End of period | | $ | 32,505,951 | |

| | | | | |

Changes in Shares Outstanding | | | | |

Shares outstanding, beginning of period | | | — | |

Shares sold | | | 1,275,000 | |

Shares redeemed | | | (25,000 | ) |

Shares outstanding, end of period | | | 1,250,000 | |

(1) | The Fund commenced operations on July 15, 2019. |

The accompanying notes are an integral part of the financial statements.

13

Wahed FTSE USA Shariah ETF

Financial Highlights

For a Share Outstanding Throughout the Period

| | | Period Ended

May 31, 2020(1) | |

Net Asset Value, Beginning of Period | | $ | 25.00 | |

| | | | | |

Income from investment operations: | | | | |

Net investment income(2) | | | 0.40 | |

Net realized and unrealized gain on investments | | | 0.90 | |

Total from investment operations | | | 1.30 | |

| | | | | |

Less distributions paid: | | | | |

From net investment income | | | (0.28 | ) |

From net realized gains | | | (0.02 | ) |

Total distributions paid | | | (0.30 | ) |

| | | | | |

Net Asset Value, End of Period | | $ | 26.00 | |

| | | | | |

Total return, at NAV(3)(4) | | | 5.30 | % |

Total return, at Market(3)(4) | | | 5.39 | % |

| | | | | |

Supplemental Data and Ratios: | | | | |

Net assets, end of period (000’s) | | $ | 32,506 | |

| | | | | |

Ratio of expenses to average net assets(5) | | | 0.50 | % |

| | | | | |

Ratio of net investment income to average net assets(5) | | | 1.81 | % |

| | | | | |

Portfolio turnover rate(4)(6) | | | 15 | % |

(1) | The Fund commenced investment operations on July 15, 2019. |

(2) | Per share net investment income was calculated using average shares outstanding. |

(3) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(4) | Not annualized for periods less than one year. |

(5) | Annualized for periods less than one year. |

(6) | Excludes in-kind transactions associated with creations and redemptions of the Fund. |

The accompanying notes are an integral part of the financial statements.

14

Wahed FTSE USA Shariah ETF

Notes to Financial Statements

May 31, 2020

1. ORGANIZATION

Wahed FTSE USA Shariah ETF (the “Fund”) is a non-diversified series of Listed Funds Trust (the “Trust”), formerly Active Weighting Funds ETF Trust. The Trust was organized as a Delaware statutory trust on August 26, 2016, under a Declaration of Trust amended on December 21, 2018 and is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund is a passively-managed exchange-traded fund (“ETF”). The Fund’s objective is to track the total return performance, before fees and expenses, of the FTSE USA Shariah Index (the “Index”). The Index is composed of common stocks of large and mid-capitalization U.S. companies the characteristics of which meet the requirements of the Shariah and are consistent with Islamic principles as interpreted by subject-matter experts. The Fund commenced operations on July 15, 2019.

Costs incurred by the Fund in connection with the organization, registration and the initial public offering of shares were paid by Wahed Invest LLC (“Wahed” or the “Adviser”), the Fund’s Investment Adviser.

2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. The Fund prepares its financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and follows the significant accounting policies described below.

Use of Estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Shares Transactions

The net asset value (“NAV”) per share of the Fund is equal to the Fund’s total assets minus the Fund’s total liabilities divided by the total number of shares outstanding. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the New York Stock Exchange (“NYSE”) is open for trading.

Fair Value Measurement

In calculating the NAV, the Fund’s exchange-traded equity securities will be valued at fair value, which will generally be determined using the last reported official closing or last trading price on the exchange or market on which the security is primarily traded at the time of valuation. Such valuations are typically categorized as Level 1 in the fair value hierarchy described below.

Securities listed on the NASDAQ Stock Market, Inc. are generally valued at the NASDAQ official closing price.

If market quotations are not readily available, or if it is determined that a quotation of a security does not represent fair value, then the security is valued at fair value as determined in good faith by the Adviser using procedures adopted by the Board of Trustees of the Trust (the “Board”). The circumstances in which a security may be fair valued include, among others: the occurrence of events that are significant to a particular issuer, such as mergers, restructurings or defaults; the occurrence of events that are significant to an entire market, such as natural disasters in a particular region or government actions; trading restrictions on securities; thinly traded securities; and market events such as trading halts and early market closings. Due to the inherent uncertainty of valuations, fair values may differ significantly from the values that would have been used had an active market existed. Fair valuation could result in a different NAV than a NAV determined by using market quotations. Such valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy described below.

15

Wahed FTSE USA Shariah ETF

Notes to Financial Statements

May 31, 2020 (Continued)

FASB ASC Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) defines fair value, establishes a framework for measuring fair value in accordance with U.S. GAAP, and requires disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly, and how that information must be incorporated into fair value measurements. Under ASC 820, various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the following hierarchy:

| | ● | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | ● | Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | ● | Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

All other securities and investments for which market values are not readily available, including restricted securities, and those securities for which it is inappropriate to determine prices in accordance with the aforementioned procedures, are valued at fair value as determined in good faith under procedures adopted by the Board, although the actual calculations may be done by others. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The hierarchy classification of inputs used to value the Fund’s investments at May 31, 2020 are as follows:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Common Stocks* | | $ | 32,414,105 | | | $ | — | | | $ | — | | | $ | 32,414,105 | |

Total Investments in Securities | | $ | 32,414,105 | | | $ | — | | | $ | — | | | $ | 32,414,105 | |

* | See the Schedule of Investments for industry classifications. |

Security Transactions

Investment transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses from the sale or disposition of securities are calculated based on the specific identification basis.

16

Wahed FTSE USA Shariah ETF

Notes to Financial Statements

May 31, 2020 (Continued)

Investment Income

Dividend income is recognized on the ex-dividend date. Withholding taxes on foreign dividends has been provided for in accordance with the Fund’s understanding of the applicable tax rules and regulations. An amortized cost method of valuation may be used with respect to debt obligations with sixty days or less remaining to maturity, unless the Adviser determines in good faith that such method does not represent fair value.

Tax Information, Dividends and Distributions to Shareholders and Uncertain Tax Positions

The Fund is treated as a separate entity for Federal income tax purposes. The Fund intends to qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). To qualify and remain eligible for the special tax treatment accorded to RICs, the Fund must meet certain annual income and quarterly asset diversification requirements and must distribute annually at least 90% of the sum of (i) its investment company taxable income (which includes dividends and net short-term capital gains) and (ii) certain net tax-exempt income, if any. If so qualified, the Fund will not be subject to Federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders.

Distributions to shareholders are recorded on the ex-dividend date. The Fund distributes substantially all net investment income to shareholders in the form of dividends. The Fund generally pays out dividends from net investment income, if any, quarterly, and distributes its net capital gains, if any, to shareholders at least annually. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their Federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed earnings and profit for tax purposes are reported as a tax return of capital.

Management evaluates the Fund’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. Interest and penalties related to income taxes would be recorded as income tax expense. The Fund’s Federal income tax returns are subject to examination by the Internal Revenue Service (the “IRS”) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. As of May 31, 2020, the Fund’s fiscal period end, the Fund had no material uncertain tax positions and did not have a liability for any unrecognized tax benefits. As of May 31, 2020, the Fund’s fiscal period end, the Fund had no examination in progress and management is not aware of any tax positions for which it is reasonably possible that the amounts of unrecognized tax benefits will significantly change in the next twelve months.

The Fund recognized no interest or penalties related to uncertain tax benefits in the fiscal period 2020. At May 31, 2020, the Fund’s fiscal period end, the tax period 2019 remained open to examination in the Fund’s major tax jurisdiction.

Indemnification

In the normal course of business, the Fund expects to enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these anticipated arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Adviser expects the risk of loss to be remote.

17

Wahed FTSE USA Shariah ETF

Notes to Financial Statements

May 31, 2020 (Continued)

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

Investment Advisory Agreement

The Trust has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Under the Advisory Agreement, the Adviser provides a continuous investment program for the Fund’s assets in accordance with its investment objectives, policies and limitations, and oversees the day-to-day operations of the Fund subject to the supervision of the Board, including the Trustees who are not “interested persons” of the Trust as defined in the 1940 Act (the “Independent Trustees”).

Pursuant to the Advisory Agreement between the Trust, on behalf of the Fund, and Wahed, the Fund pays a unified management fee to the Adviser, which is calculated daily and paid monthly, at an annual rate of 0.50% of the Fund’s average daily net assets. Wahed has agreed to pay all expenses of the Fund except the fee paid to Wahed under the Advisory Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses (if any).

At May 31, 2020, a majority of the outstanding shares of the Fund were held in separately managed accounts of the Adviser.

Distribution Agreement and 12b-1 Plan

Quasar Distributors, LLC (“Quasar” or, the “Distributor”), a wholly owned subsidiary of Foreside Financial Group, serves as the Fund’s distributor pursuant to a Distribution Services Agreement. The Distributor receives compensation for the statutory underwriting services it provides to the Fund. The Distributor enters into agreements with certain broker-dealers and others that will allow those parties to be “Authorized Participants” and to subscribe for and redeem shares of the Fund. The Distributor will not distribute shares in less than whole Creation Units and does not maintain a secondary market in shares.

The Board has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act (“Rule 12b-1 Plan”). In accordance with the Rule 12b-1 Plan, the Fund is authorized to pay an amount up to 0.25% of the Fund’s average daily net assets each year for certain distribution-related activities. As authorized by the Board, no Rule 12b-1 fees are currently paid by the Fund and there are no plans to impose these fees. However, in the event Rule 12b-1 fees are charged in the future, they will be paid out of the Fund’s assets. The Adviser and its affiliates may, out of their own resources, pay amounts to third parties for distribution or marketing services on behalf of the Fund.

Administrator, Custodian and Transfer Agent

U.S. Bancorp Fund Services LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or “Administrator”) serves as administrator, transfer agent and fund accountant of the Fund pursuant to a Fund Servicing Agreement. U.S. Bank N.A. (the “Custodian”), an affiliate of Fund Services, serves as the Fund’s custodian pursuant to a Custody Agreement. Under the terms of these agreements, the Adviser pays the Fund’s administrative, custody and transfer agency fees.

A Trustee and all officers of the Trust are affiliated with the Administrator and Custodian. Quasar was a subsidiary of Fund Services through March 31, 2020. Effective March 31, 2020, Foreside Financial Group acquired Quasar from Fund Services. As a result of the acquisition, Quasar became a wholly owned broker-dealer subsidiary of Foreside and is no longer affiliated with Fund Services or U.S. Bank N.A. The Board approved a new Distribution Agreement to enable Quasar to continue serving as the Fund’s distributor.

4. CREATION AND REDEMPTION TRANSACTIONS

Shares of the Fund are listed and traded on the NASDAQ Stock Market LLC, (the “Exchange”). The Fund issues and redeems shares on a continuous basis at NAV only in large blocks of shares called “Creation Units”. A Creation Unit consists of 25,000 shares. Creation Units are to be issued and redeemed principally in kind for a basket of securities and a balancing cash amount. Shares generally will trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Market prices for the shares may be different from their NAV. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the NYSE is open for trading. The NAV of the shares of the Fund will be equal

18

Wahed FTSE USA Shariah ETF

Notes to Financial Statements

May 31, 2020 (Continued)

to the Fund’s total assets minus the Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent; however, for purposes of determining the price of Creation Units, the NAV will be calculated to five decimal places.

Creation Transaction Fee

Authorized Participants will be required to pay to the Custodian a fixed transaction fee (the “Creation Transaction Fee”) in connection with the issuance of Creation Units. The standard Creation Transaction Fee will be the same regardless of the number of Creation Units purchased by an investor on the applicable Business Day. The Creation Transaction Fee charged by the Fund for each creation order is $500.

An additional variable fee of up to a maximum of 2% of the value of the Creation Units subject to the transaction may be imposed for (1) creations effected outside the clearing process and (2) creations made in an all cash amount (to offset the Trust’s brokerage and other transaction costs associated with using cash to purchase the requisite Deposit Securities). Investors are responsible for the costs of transferring the securities constituting the Deposit Securities to the account of the Trust. The Fund may determine to not charge a variable fee on certain orders when the Adviser has determined that doing so is in the best interests of Fund shareholders. Variable fees, if any, received by the Fund are displayed in the Capital Share Transactions section on the Statement of Changes in Net Assets.

Only “Authorized Participants” may purchase or redeem shares directly from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees. Securities received or delivered in connection with in-kind creates and redeems are valued as of the close of business on the effective date of the creation or redemption.

5. FEDERAL INCOME TAX

The tax character of distributions paid was as follows:

| | | Ordinary

Income(1) | | | Long-Term

Capital Gain | |

Fiscal period ended May 31, 2020 | | $ | 265,852 | | | $ | — | |

(1) | Ordinary income includes short-term capital gains. |

At May 31, 2020, the Fund’s fiscal period end, the components of distributable earnings (accumulated losses) and the cost of investments on a tax basis, including the adjustments for financial reporting purposes as of the most recently completed Federal income tax reporting year, were as follows:

Federal Tax Cost of Investments | | $ | 31,258,048 | |

Gross Tax Unrealized Appreciation | | $ | 3,820,480 | |

Gross Tax Unrealized Depreciation | | | (2,664,423 | ) |

Net Tax Unrealized Appreciation (Depreciation) | | | 1,156,057 | |

Undistributed Ordinary Income | | | 83,059 | |

Other Accumulated Gain (Loss) | | | (268,985 | ) |

Distributable Earnings / (Accumulated Losses) | | $ | 970,131 | |

The difference between book-basis and tax-basis unrealized appreciation is attributable primarily to the tax deferral of losses on wash sales.

19

Wahed FTSE USA Shariah ETF

Notes to Financial Statements

May 31, 2020 (Continued)

At May 31, 2020, the Fund’s fiscal period end, the Fund had short-term capital losses of $268,985 which will be carried forward indefinitely to offset future realized capital gains.

U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. The permanent differences primarily relate to redemptions in-kind. For the fiscal period ended May 31, 2020, the following reclassifications were made for permanent tax differences on the Statement of Assets and Liabilities.

| | | Total

distributable

earnings | | | Paid-in capital | |

Wahed FTSE USA Shariah ETF | | $ | (78,330 | ) | | $ | 78,330 | |

During the fiscal period ended May 31, 2020, the Fund realized $79,254 in net capital gains resulting from in-kind redemptions, in which shareholders exchanged Fund shares for securities held by the Fund rather than for cash. Because such gains are not taxable to the Fund, and are not distributed to shareholders, they have been reclassified from distributable earnings (accumulated losses) to paid in-capital.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short-term investments), creations in-kind and redemptions in-kind for the period ended May 31, 2020 were as follows:

| | Purchases | | | Sales | | | Creations In-Kind | | | Redemptions

In-Kind | |

| | $ | 4,279,554 | | | $ | 3,646,271 | | | $ | 31,212,024 | | | $ | 395,152 | |

7. PRINCIPAL RISKS

As with all ETFs, shareholders of the Fund are subject to the risk that their investment could lose money. The Fund is subject to the principal risks, any of which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment objective.

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance.

A complete description of principal risks is included in the prospectus under the heading “Principal Investment Risks.”

20

Wahed FTSE USA Shariah ETF

Notes to Financial Statements

May 31, 2020 (Continued)

8. SUBSEQUENT EVENTS

On June 30, 2020, the Fund paid a distribution to shareholders of record on June 29, 2020 as follows:

| | Ordinary

Income Rate | | | Ordinary Income

Distribution Paid | |

| | $ | 0.006 | | | $ | 8,400 | |

Other than as disclosed, there were no other subsequent events requiring recognition or disclosure through the date the financial statements were issued.

21

Wahed FTSE USA Shariah ETF

Report of Independent Registered Public Accounting Firm

To the Shareholders of Wahed FTSE USA Shariah ETF and

Board of Trustees of Listed Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Wahed FTSE USA Shariah ETF (the “Fund”), a series of Listed Funds Trust, as of May 31, 2020, the related statements of operations and changes in net assets, including the related notes, and the financial highlights for the period July 15, 2019 (commencement of operations) through May 31, 2020 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2020, the results of its operations, the changes in its net assets, and the financial highlights for the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2020, by correspondence with the custodian. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2019.

COHEN & COMPANY, LTD.

Cleveland, Ohio

July 29, 2020

22

Wahed FTSE USA Shariah ETF

Review of Liquidity Risk Management Program

(Unaudited)

Pursuant to Rule 22e-4 under the Investment Company Act of 1940, the Trust, on behalf of the series of the Trust covered by this shareholder report (the “Series”), has adopted a liquidity risk management program to govern the Trust’s approach to managing liquidity risk. Rule 22e-4 seeks to promote effective liquidity risk management, thereby reducing the risk that a fund will be unable to meet its redemption obligations and mitigating dilution of the interests of fund shareholders. The Trust’s liquidity risk management program is tailored to reflect the Series’ particular risks, but not to eliminate all adverse impacts of liquidity risk, which would be incompatible with the nature of such Series.

The investment adviser to the Series has adopted and implemented its own written liquidity risk management program (the “Program”) tailored specifically to assess and manage the liquidity risk of the Series. At a recent meeting of the Board of Trustees of the Trust, the Trustees received a report pertaining to the operation, adequacy, and effectiveness of implementation of the Program for the period ended December 31, 2019. The report concluded that the Program is reasonably designed to assess and manage the Series’ liquidity risk and has operated adequately and effectively to manage such risk. The report reflected that there were no liquidity events that impacted the Series’ ability to timely meet redemptions without dilution to existing shareholders. The report further noted that no material changes have been made to the Program since its implementation.

There can be no assurance that the Program will achieve its objectives in the future. Please refer to the prospectus for more information regarding the Series’ exposure to liquidity risk and other principal risks to which an investment in the Series may be subject.

23

Wahed FTSE USA Shariah ETF

Board of Trustees and Officers

May 31, 2020 (Unaudited)

The Fund’s Statement of Additional Information includes additional information about the Fund’s Trustees and Officers, and is available, without charge upon request by calling 1-855-976-4747, or by visiting the Fund’s website at www.funds.wahedinvest.com.

Name and Year of Birth | Position Held with the Trust | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During Past 5 Years |

Independent Trustees | | | | | |

John L. Jacobs

Year of birth: 1959 | Trustee and Audit Committee Chair | Indefinite term; since 2017 | Chairman of Alerian, Inc. (Since June 2018); Executive Director of Center for Financial Markets and Policy (Since 2016); Founder and CEO of Q3 Advisors, LLC (financial consulting firm) (since 2015); Distinguished Policy Fellow and Executive Director, Center for Financial Markets and Policy, Georgetown University (since 2015); Senior Advisor, Nasdaq OMX Group (2015–2016); Executive Vice President, Nasdaq OMX Group (2013–2015). | 11 | Independent Trustee, Procure ETF Trust II (since 2018) (2 portfolios). Independent Trustee, Horizons ETF Trust I (2015-2019) (3 portfolios). |

Koji Felton

Year of birth: 1961 | Trustee | Indefinite term; since 2019 | Counsel, Kohlberg Kravis Roberts & Co. L.P. (investment firm) (2013–2015); Counsel, Dechert LLP (law firm) (2011–2013). | 11 | Independent Trustee, Series Portfolios Trust (since 2015) (8 portfolios). |

Pamela H. Conroy Year of birth: 1961 | Trustee and Nominating and Governance Committee Chair | Indefinite term; since 2019 | Retired; formerly Executive Vice President, Chief Operating Officer & Chief Compliance Officer, Institutional Capital Corporation (investment firm) (1994–2008). | 11 | Independent Trustee, Frontier Funds, Inc. (since 2020) (8 portfolios). |

24

Wahed FTSE USA Shariah ETF

Board of Trustees and Officers

May 31, 2020 (Unaudited) (Continued)

Name and Year of Birth | Position Held with the Trust | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During Past 5 Years |

Interested Trustee | | | | | |

Paul R. Fearday, CPA* Year of birth: 1979 | Trustee and Chairman | Indefinite term; since 2019 | Senior Vice President, U.S. Bancorp Fund Services, LLC (since 2008); Manager, PricewaterhouseCoopers LLP (accounting firm) (2002–2008). | 11 | None. |

* | This Trustee is considered an “Interested Trustee” as defined in the 1940 Act because of his affiliation with U.S. Bancorp Fund Services LLC, d/b/a U.S. Bank Global Fund Services and U.S. Bank N.A., which provide fund accounting, administration, transfer agency and custodian services to the Fund. |

Name and Year of Birth | Position(s)

Held with

the Trust | Term of Office

and Length of

Time Served | Principal Occupation(s) During Past 5 Years |

Officers | | | |

Gregory Bakken Year of birth: 1983 | President and Principal Executive Officer | Indefinite term, February 2019 | Vice President, U.S. Bancorp Fund Services, LLC (since 2006). |

Travis G. Babich Year of birth: 1980 | Treasurer and Principal Financial Officer | Indefinite term, September 2019 | Vice President, U.S. Bancorp Fund Services, LLC (since 2005). |

Kacie M. Gronstal Year of birth: 1992 | Assistant Treasurer | Indefinite term, March 2019 | Officer, U.S. Bancorp Fund Services, LLC (since 2014). |

Kent Barnes Year of birth: 1968 | Secretary | Indefinite term, February 2019 | Vice President, U.S. Bancorp Fund Services, LLC (since 2018); Chief Compliance Officer, Rafferty Asset Management, LLC (2016 to 2018); Vice President, U.S. Bancorp Fund Services, LLC (2007 to 2016). |

Steve Jensen Year of birth: 1957 | Chief Compliance Officer | Indefinite term, February 2019 | Senior Vice President, U.S. Bancorp Fund Services, LLC (since 2011). |

25

Wahed FTSE USA Shariah ETF

Supplemental Information

(Unaudited)

Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus contains this and other information relevant to an investment in the Fund. Please read the prospectus carefully before investing. A copy of the Prospectus for the Fund may be obtained without charge by writing to the Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701, by calling 1-855-976-4747, or by visiting the Fund’s website at www.funds.wahedinvest.com

QUARTERLY PORTFOLIO HOLDING INFORMATION

The Fund files its complete schedule of portfolio holdings for its first and third fiscal quarters with the Securities and Exchange Commission (“SEC”) on Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2020). The Fund’s Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2020) is available without charge, upon request, by calling toll-free at 1-855-976-4747. Furthermore, you may obtain the Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2020) on the SEC’s website at www.sec.gov.

PROXY VOTING INFORMATION

The Fund is required to file a Form N-PX, with the Fund’s complete proxy voting record for the 12 months ended June 30, no later than August 31 of each year. The Fund’s proxy voting record will be available without charge, upon request, by calling toll-free 1-855-976-4747 and on the SEC’s website at www.sec.gov.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

Information regarding how often shares of the Fund trade on an exchange at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund is available without charge, on the Fund’s website at www.funds.wahedinvest.com

TAX INFORMATION

The Fund designated 100.00% of its ordinary income distribution for the period ended May 31, 2020 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

For the period ended May 31, 2020, 100.00% of dividends paid from net ordinary income qualified for the dividends received deduction available to corporate shareholders.

For the period ended May 31, 2020, the percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Code Section 871(k)(2)(C) for the Fund was 7.37%.

26

Wahed FTSE USA Shariah ETF

Privacy Policy

(Unaudited)

We are committed to respecting the privacy of personal information you entrust to us in the course of doing business with us.

The Fund collects non-public information about you from the following sources:

| | ● | Information we receive about you on applications or other forms; |

| | ● | Information you give us orally; and/or |

| | ● | Information about your transactions with us or others. |

We do not disclose any non-public personal information about our customers or former customers without the customer’s authorization, except as permitted by law or in response to inquiries from governmental authorities. We may share information with affiliated and unaffiliated third parties with whom we have contracts for servicing the Fund. We will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibilities. We maintain physical, electronic and procedural safeguards to guard your non-public personal information and require third parties to treat your personal information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared by those entities with unaffiliated third parties.

27

THIS PAGE INTENTIONALLY LEFT BLANK

THIS PAGE INTENTIONALLY LEFT BLANK

Investment Adviser:

Wahed Invest LLC

12 East 49th Street, 11th Floor

New York, NY 10017

Legal Counsel:

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, N.W.

Washington, D.C. 20004

Independent Registered Public Accounting Firm:

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

Distributor:

Quasar Distributors, LLC

111 East Kilbourn Avenue, Suite 1250

Milwaukee, WI 53202

Administrator, Fund Accountant & Transfer Agent:

U.S. Bancorp Fund Services, LLC

d/b/a U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

Custodian:

U.S. Bank N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

This information must be preceded or accompanied by a current prospectus for the Fund.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The Registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Mr. John Jacobs is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.