UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kent P. Barnes, Secretary

Listed Funds Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 10th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-6511

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1. Reports to Stockholders.

(a)

TrueShares ETFs

TrueShares Technology, AI & Deep Learning ETF (LRNZ)

TrueShares ESG Active Opportunities ETF (ECOZ)

TrueShares Structured Outcome (July) ETF (JULZ)

TrueShares Structured Outcome (August) ETF (AUGZ)

TrueShares Structured Outcome (September) ETF (SEPZ)

TrueShares Structured Outcome (October) ETF (OCTZ)

TrueShares Structured Outcome (November) ETF (NVMZ)

TrueShares Structured Outcome (December) ETF (DECZ)

ANNUAL REPORT

December 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission(“SEC”), paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Funds’ reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future Fund reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

This report is submitted for the general information of shareholders of the Funds. It is not authorized for distribution unless preceded or accompanied by a current prospectus for the Funds.

TrueShares ETFs

Table of Contents

| | |

Letter to Shareholders (Unaudited) | 2 |

Shareholder Expense Example (Unaudited) | 8 |

Performance Overviews (Unaudited) | 10 |

Schedule of Investments and Written Options | 13 |

Statements of Assets and Liabilities | 22 |

Statements of Operations | 24 |

Statements of Changes in Net Assets | 26 |

Financial Highlights | 28 |

Notes to Financial Statements | 30 |

Report of Independent Registered Public Accounting Firm | 43 |

Board of Trustees and Officers (Unaudited) | 45 |

Board Consideration and Approval of Advisory and Sub-Advisory Agreements (Unaudited) | 47 |

Review of Liquidity Risk Management Program (Unaudited) | 49 |

Supplemental Information (Unaudited) | 50 |

Privacy Policy (Unaudited) | 51 |

1

TrueShares ETFs

Letter to Shareholders

December 31, 2020 (Unaudited)

Dear Shareholder,

First and foremost, the TrueShares team sincerely hopes that this letter finds you healthy and optimistic during these somewhat chaotic times. Adequately describing the events of 2020, and now 2021, might present too great a challenge given the allotted space for this update. Nonetheless, I am sure we can all agree that the past twelve months have been one of the most unexpected, strangest, and trying years in at least a generation.

Unsurprisingly, the investment markets were no exception. The historic, pandemic driven drop in the first quarter of 2020 was followed by a meteoric rebound to new equity market highs, with plenty of volatility in between. It was against this backdrop that TrueShares successfully listed TrueShares Technology, AI & Deep Learning ETF (LRNZ), TrueShares ESG Active Opportunities ETF (ECOZ) and the TrueShares Structured Outcome Series. We have been very pleased with the performance of each of these ETFs thus far and we hope they have served your portfolios well.

Moving forward, our management team will continue to pursue the investment themes which inspired our current funds, while opportunistically expanding the TrueShares ETF suite as we uncover additional areas of the market that may prove fertile ground for our trademark active, concentrated investment philosophy. Keep an eye out for new TrueShares listings in 2021.

As always, please don’t hesitate to contact our team. We would love to hear from you. With so many avenues to engage shareholders and their advisors, communication has finally achieved a primary role in our industry and TrueShares strives to be a leader in this democratization of ETFs.

Sincerely,

Michael N. Loukas

CEO, TrueMark Investments

2

TrueShares Technology, AI & Deep Learning ETF

Letter to Shareholders

December 31, 2020 (Unaudited)

Dear Shareholder,

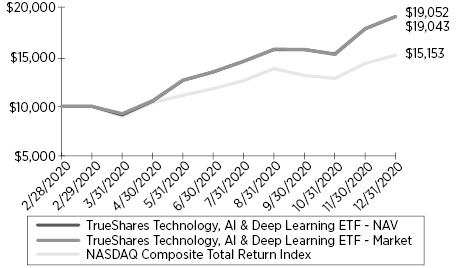

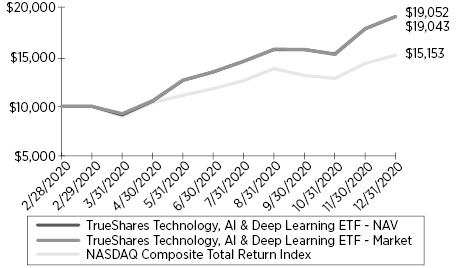

Black Hill Capital Partners, LLC, Sub-Adviser to the TrueShares Technology, AI and Deep Learning ETF (“LRNZ”) is pleased to provide you with the annual review and commentary for the year 2020 Annual Report. The Fund began trading on March 1, 2020, therefore, this report reflects the Fund’s performance from February 28, 2020 through December 31, 2020.

Despite the pandemic driven lockdowns present for most of the year, we are quite pleased with the performance of the Fund. LRNZ comfortably outperformed its benchmark in 2020, generating a 90.52% return at market and 90.43% return at NAV compared to the NASDAQ Composite Total Return Index at 51.53%. We continue to manage a concentrated portfolio of 20 holdings.

The portfolio’s outperformance during the period can generally be attributed to stock selection across the majority of its holdings. Soon after the onset of the lockdown cycle, investors started to identify the companies that would likely be the major beneficiaries of the shelter-in-place orders, broadly categorizing them as the “Work-From-Home” stocks. The lockdown clearly highlighted the power and advantages of these secular growth technologies companies which manifests in their ability to generate consistently robust results and guidance, quarter after quarter. We expect these companies to continue their favorable performance long after the economy gets back to a normal level. It is our belief that many of the trends that were spotlighted during the lockdowns were in place prior to the pandemic, realizing significant acceleration during the past year. As we move forward, we remain firmly committed to, through our proprietary fundamental research, continue discovering high quality secular growth companies with uncommon AI and Deep Learning expertise in the technology, healthcare and bio-technology sectors.

Investment Sub-adviser

Black Hill Capital Partners, LLC

Additional Information:

Expense ratio: 0.68%

As the Fund is less than a year old, Since Inception performance shown is cumulative. Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold in the secondary market, may be worth more or less than the original cost. Investors will incur usual and customary brokerage commissions when buying or selling shares of the exchange-traded funds (“ETFs”) in the secondary market, and that, if reflected, the brokerage commissions would reduce the performance returns. Current performance may be lower or higher than the performance shown. Shares are bought and sold at market price not net asset value (“NAV”) and are not individually redeemable from the fund. Call 877.774.TRUE for more information.

Index performance does not represent TrueShares fund performance. It is not possible to invest directly in an index. All performance figures assume reinvestment of dividend and capital gains at net asset value; actual returns may differ.

Performance 1-year and less are cumulative; performance over 1-year are average annualized total returns. Market price performance is determined using the bid/ask midpoint at 4:00pm Eastern time, when the NAV is typically calculated. NAV price performance is determined using the daily calculated NAV. They do not represent the returns you would receive if you traded shares at other times. Performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon redemption or sale of fund shares.

The NASDAQ Composite Total Return Index is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market. The index measures the performance of all domestic and international based common type stocks listed on the NASDAQ Stock Market. It includes common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. The index is market capitalization-weighted. The composition of the NASDAQ Composite is heavily weighted towards information technology companies.

3

TrueShares ESG Active Opportunities ETF

Letter to Shareholders

December 31, 2020 (Unaudited)

Dear Shareholder,

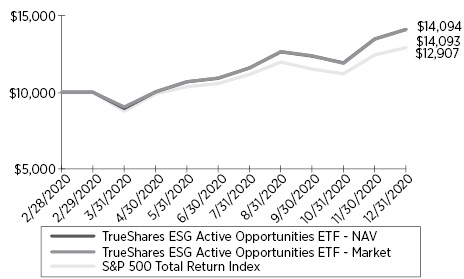

Happy 2021! We are pleased to inform you about the performance resilience of TrueShares’ ESG Active Opportunities ETF (“ECOZ”), for the year 2020. Despite the extreme market volatility, ECOZ was up 40.93% at market since its inception on February 28, 2020 and 40.94% at NAV. The S&P 500 Total Return Index, the benchmark for the product, was up 29.07% during the same period or 11.87% outperformance.

ECOZ is designed as a deep impact product that seeks long-term capital growth, and at the same time, drastically reduces your investment portfolio’s carbon footprint to just a fraction of a typical U.S. large cap product. We would like to congratulate you that through your investment in ECOZ, you are making an impact to help combat the climate issues and at the same time greatly benefited in investment result in 2020.

In managing ECOZ, we identify long-term business and economic trends toward better environment, equitable society and sound governance. We purposefully invest in the industry champions who lead the transitions. A key mega trend we have embraced is the decarbonization of the global economy and reduction in carbon emissions. This trend has several ramifications for industry transitions, such as electrification of transportation with electric vehicles and reduced traffic via ride sharing. The result is a rise of renewable as an energy source in a cleaner power grid. Our early investments in electric vehicle leader Tesla, ride hailing leader Uber, and solar firm Enphase, are among top contributors to ECOZ’s outperformance to the benchmark in 2020. We also invested in another major trend of the rise of fintech companies replacing certain functions of traditional large banks. Our early investment in Square is another top performance contributor. ECOZ also benefited from our long-term divestments from high carbon emitting industries such as fossil fuel energy firms and airlines.

On the other hand, the COVID-19 pandemic has more than proportionally negatively affected the restaurants, leisure, and real estate rental markets. Our investments in food distributor Sysco and a real estate service firm CBRE group are among top detractors from the relative performance. If there is a silver lining from a horrendous year of health, environmental and economic crisis’ we have witnessed, it is an overwhelming policy push for tackling climate crisis around the world and companies’ initiatives to improve social equity. With its $2 trillion climate plan, the new U.S. administration is likely to accelerate the economy decarbonization process. The private sector is also stepping up, with more companies setting carbon neutral target year and action plans aided by technology advancements and significant cost reduction to implement transitions. We are likely to see continued supportive backdrops for investment themes of clean environment and equitable society to thrive, themes that ECOZ is designed to embrace and take advantage of from both impact and performance perspectives in the long run.

Investment Sub-adviser

Purview Investments, LLC

Additional Information:

Expense ratio: 0.58%

As the Fund is less than a year old, since Inception performance shown is cumulative. Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes. Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold in the secondary market, may be worth more or less than the original cost. Investors will incur usual and customary brokerage commissions when buying or selling shares of the exchange-traded funds (“ETFs”) in the secondary market, and that, if reflected, the brokerage commissions would reduce the performance returns. Current performance may be lower or higher than the performance shown. Shares are bought and sold at market price not net asset value (“NAV”) and are not individually redeemable from the fund. Call 877.774.TRUE for more information.

Index performance does not represent Fund performance. It is not possible to invest directly in an index. All performance figures assume reinvestment of dividend and capital gains at net asset value; actual returns may differ.

4

TrueShares ESG Active Opportunities ETF

Letter to Shareholders

December 31, 2020 (Continued) (Unaudited)

Performance 1-year and less are cumulative; performance over 1-year are average annualized total returns. Market price performance is determined using the bid/ask midpoint at 4:00pm Eastern time, when the NAV is typically calculated. NAV price performance is determined using the daily calculated NAV. They do not represent the returns you would receive if you traded shares at other times. Performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon redemption or sale of fund shares.

The S&P 500 Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the U.S. stock market.

5

TrueShares Structured Outcome ETFs

Letter to Shareholders

December 31, 2020 (Unaudited)

Dear Shareholder,

The year 2020 was unprecedented in many ways. The global pandemic affected capital markets, and more specifically the performance, volatility and path of the S&P 500 Index experienced record-setting levels. The TrueShares structured outcome launch occurred on the heels of the volatile conditions of the first two quarters of year, which exhibited some of the most vicious sell-offs and equally as impressive rallies in history. These events collectively registered one of the most volatile periods ever due to the COVID-19 induced pandemic selloff and the subsequent governmental response of fiscal and monetary policy intervention.

Performance Comparison:

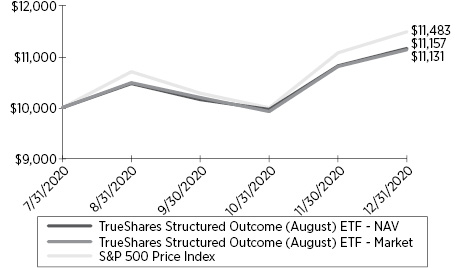

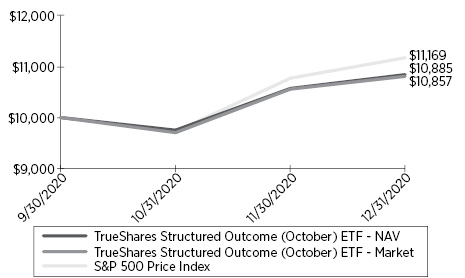

The following table details the cumulative total returns as of December 31, 2020 since inception for the Funds and the Funds’ volatility against the S&P 500 Price Index for the same period:

FUND | | INCEPTION | | | FUND TOTAL

RETURN

(@ MARKET) | | | FUND TOTAL

RETURN

(@NAV) | | | S&P 500

PRICE INDEX | | | FUND

VOLATILITY

(ANNUALIZED) | | | S&P 500

VOLATILITY

(ANNUALIZED) | |

JULZ | | | 06/30/2020 | | | | 16.55 | % | | | 16.81 | % | | | 21.15 | % | | | 13.65 | % | | | 16.51 | % |

AUGZ | | | 07/31/2020 | | | | 11.31 | % | | | 11.57 | % | | | 14.83 | % | | | 14.12 | % | | | 17.14 | % |

SEPZ | | | 08/31/2020 | | | | 6.08 | % | | | 6.51 | % | | | 7.31 | % | | | 15.55 | % | | | 18.73 | % |

OCTZ | | | 09/30/2020 | | | | 8.57 | % | | | 8.85 | % | | | 11.69 | % | | | 13.33 | % | | | 16.35 | % |

NVMZ | | | 10/30/2020 | | | | 10.35 | % | | | 10.51 | % | | | 14.87 | % | | | 9.84 | % | | | 12.85 | % |

DECZ | | | 11/30/2020 | | | | 1.72 | % | | | 1.75 | % | | | 3.71 | % | | | 5.71 | % | | | 8.57 | % |

By design, the TrueShares structured outcome series seeks to deliver a “predictable” return given the performance of the S&P 500 over a one-year period from its inception or “initialization date” by buffering the first 10% of losses. The protection is generated while participating as much as possible, given market conditions, in the market upside, or “participation” rate. In the interim of course, the performance is less defined and subject to market conditions.

All of the Funds in the series delivered a return and volatility within a range of acceptance given the market conditions experienced. The use of derivatives, implicit in the structures, delivered on their expectations as implied volatility levels changed throughout the second half of 2020. As one can see, all series are positively correlated to the S&P 500 Index performance over the period, and this is to be expected in the majority of market conditions. Hence, the direction of the S&P 500 Index will be the largest contributor to the performance of all series.

The second largest contributing factor has been the level of volatility, and more specifically the relationship between the Implied Volatility in the put options the strategy has sold contrasted versus the call options the strategy has purchased. This factor and relationship dictates the participation ratio which subsequently determines the “upside capture” of the series. While the actual volatility profile of each series is less than the benchmark (S&P 500 Index), this is intentional and expected in the majority of environments as the structure is designed to deliver this feature.

The design of the structures have met our expectations, and as the subadvisor of the Funds we continue to have confidence in the structural design of the strategy and its ability to deliver a consistent “Structured Outcome” while striving to simultaneously deliver superior risk-adjusted returns as compared to other like funds or ETFs.

Broadly speaking, the series will lag the S&P 500 Index performance in an up market, as our “participation ratio” will be less than 1.0, but on a risk-adjusted basis, the structure has outperformed over the time frame. There have not been any significant factors that have surprisingly contributed positively or negatively to the performance realized during 2020. We have a keen focus on managing flows as the Funds continually grow to adhere to a consistent tracking error through time to deliver upon the “structured outcome” philosophy that TrueShares has brought to market.

6

TrueShares Structured Outcome ETFs

Letter to Shareholders

December 31, 2020 (Continued) (Unaudited)

On behalf of SpiderRock Advisors, thank you for your trust & confidence,

Sincerely,

Eric Metz

President & Chief Investment Officer

Investment Sub-adviser

SpiderRock Advisors, LLC

Additional Information:

Expense ratio: 0.79%

Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold in the secondary market, may be worth more or less than the original cost. Investors will incur usual and customary brokerage commissions when buying or selling shares of the exchange-traded funds (“ETFs”) in the secondary market, and that, if reflected, the brokerage commissions would reduce the performance returns. Current performance may be lower or higher than the performance shown. Shares are bought and sold at market price not net asset value (“NAV”) and are not individually redeemable from the fund. Call 877-774-TRUE (8783) for performance data current to the most recent month end.

Index performance does not represent TrueShares fund performance. It is not possible to invest directly in an index. All performance figures assume reinvestment of dividend and capital gains at net asset value; actual returns may differ. Performance 1-year and less are cumulative; performance over 1-year are average annualized total returns. Market price performance is determined using the bid/ask midpoint at 4:00pm Eastern time, when the NAV is typically calculated. NAV price performance is determined using the daily calculated NAV. They do not represent the returns you would receive if you traded shares at other times. Performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon redemption or sale of fund shares.

The TrueShares Structured Outcome ETF Series utilizes a “buffer protect” options strategy, that seeks to provide investors with returns (before fees and expenses) that track those of the S&P 500 Index while seeking to provide an 8-12% downside buffer (with the advisor targeting 10%) on the first of that index’s losses over a 12-month investment period.**

** | In the event an investor purchases Shares after the date on which the options were entered into or sells Shares prior to the expiration of the options, the buffer that the Fund seeks to provide may not be available and there may be limited to no upside potential. The Fund does not provide principal protection and an investor may experience significant losses on its investment, including the loss of its entire investment. |

The S&P 500 Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the U.S. stock market. The S&P 500 Price Index does not include reinvestment of dividends.

7

TrueShares ETFs

Shareholder Expense Example

December 31, 2020 (Unaudited)

As a shareholder of a fund you incur two types of costs: (1) transaction costs for purchasing and selling shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (July 1, 2020 to December 31, 2020), except as noted in footnotes below.

ACTUAL EXPENSES

The following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | Beginning

Account

Value | Ending

Account

Value | Annualized

Expense

Ratios | Expenses

Paid

During the

Period |

TrueShares Technology, AI & Deep Learning ETF | $1,000.00 | $ 1,414.30 | 0.68% | $4.13(1) |

TrueShares ESG Active Opportunities ETF | 1,000.00 | 1,292.20 | 0.58 | 3.34(1) |

TrueShares Structured Outcome (July) ETF | 1,000.00 | 1,168.10 | 0.79 | 4.31(1) |

TrueShares Structured Outcome (August) ETF | 1,000.00 | 1,115.70 | 0.79 | 3.52(2) |

TrueShares Structured Outcome (September) ETF | 1,000.00 | 1,065.10 | 0.79 | 2.74(3) |

TrueShares Structured Outcome (October) ETF | 1,000.00 | 1,088.50 | 0.79 | 2.10(4) |

TrueShares Structured Outcome (November) ETF | 1,000.00 | 1,105.10 | 0.79 | 1.43(5) |

TrueShares Structured Outcome (December) ETF | 1,000.00 | 1,017.50 | 0.79 | 0.70(6) |

(1) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 184/366 (to reflect the six-month period). |

(2) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 154/366 (to reflect the period since the Fund’s inception). |

(3) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 123/366 (to reflect the period since the Fund’s inception). |

(4) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 93/366 (to reflect the period since the Fund’s inception). |

(5) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 63/366 (to reflect the period since the Fund’s inception). |

(6) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 32/366 (to reflect the period since the Fund’s inception). |

8

TrueShares ETFs

Shareholder Expense Example

December 31, 2020 (Unaudited) (Continued)

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares with respect to the Funds. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account

Value | Ending

Account

Value | Annualized

Expense

Ratios | Expenses

Paid

During the

Period(1) |

TrueShares Technology, AI & Deep Learning ETF | $1,000.00 | $ 1,021.72 | 0.68% | $3.46 |

TrueShares ESG Active Opportunities ETF | 1,000.00 | 1,022.22 | 0.58 | 2.95 |

TrueShares Structured Outcome (July) ETF | 1,000.00 | 1,021.17 | 0.79 | 4.01 |

TrueShares Structured Outcome (August) ETF | 1,000.00 | 1,021.17 | 0.79 | 4.01(2) |

TrueShares Structured Outcome (September) ETF | 1,000.00 | 1,021.17 | 0.79 | 4.01(2) |

TrueShares Structured Outcome (October) ETF | 1,000.00 | 1,021.17 | 0.79 | 4.01(2) |

TrueShares Structured Outcome (November) ETF | 1,000.00 | 1,021.17 | 0.79 | 4.01(2) |

TrueShares Structured Outcome (December) ETF | 1,000.00 | 1,021.17 | 0.79 | 4.01(2) |

(1) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 184/366 (to reflect the six-month period). |

(2) | For comparative purposes only as the Fund was not in operation for the full six-month period. |

9

TrueShares ETFs

Performance Overviews

December 31, 2020 (Unaudited)

Hypothetical Growth of $10,000 Investment

(Since Inception through 12/31/2020)

1 | The Fund has an inception date and commenced operations on February 28, 2020 |

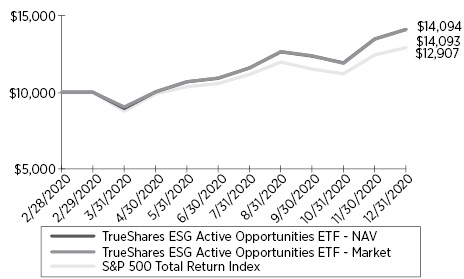

1 | The Fund has an inception date and commenced operations on February 28, 2020 |

1 | The Fund has an inception date of June 30, 2020 and commenced operations on July 1, 2020 |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares Technology, AI & Deep Learning ETF — NAV | 90.43% |

TrueShares Technology, AI & Deep Learning ETF — Market | 90.52% |

NASDAQ Composite Total Return Index | 51.53% |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares ESG Active Opportunities ETF — NAV | 40.94% |

TrueShares ESG Active Opportunities ETF — Market | 40.93% |

S&P 500 Total Return Index | 29.07% |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares Structured Outcome (July) ETF — NAV | 16.81% |

TrueShares Structured Outcome (July) ETF — Market | 16.55% |

S&P 500 Price Index | 21.15% |

10

TrueShares ETFs

Performance Overviews

December 31, 2020 (Unaudited) (Continued)

Hypothetical Growth of $10,000 Investment

(Since Inception through 12/31/2020)

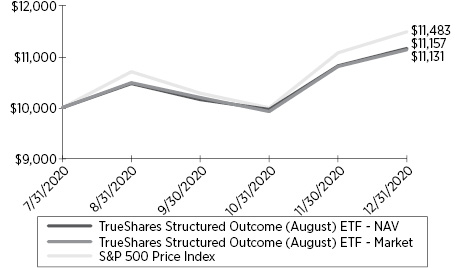

1 | The Fund has an inception date of July 31, 2020 and commenced operations on August 3, 2020 |

1 | The Fund has an inception date of August 31, 2020 and commenced operations on September 1, 2020 |

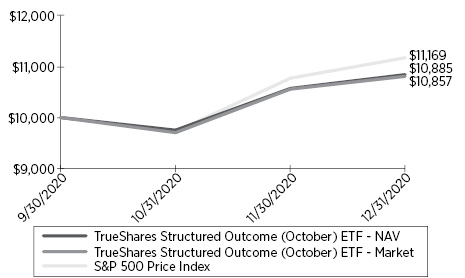

1 | The Fund has an inception date of September 30, 2020 and commenced operations on October 1, 2020 |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares Structured Outcome (August) ETF — NAV | 11.57% |

TrueShares Structured Outcome (August) ETF — Market | 11.31% |

S&P 500 Price Index | 14.83% |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares Structured Outcome (September) ETF — NAV | 6.51% |

TrueShares Structured Outcome (September) ETF — Market | 6.08% |

S&P 500 Price Index | 7.31% |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares Structured Outcome (October) ETF – NAV | 8.85% |

TrueShares Structured Outcome (October) ETF – Market | 8.57% |

S&P 500 Price Index | 11.69% |

11

TrueShares ETFs

Performance Overviews

December 31, 2020 (Unaudited) (Continued)

Hypothetical Growth of $10,000 Investment

(Since Inception through 12/31/2020)

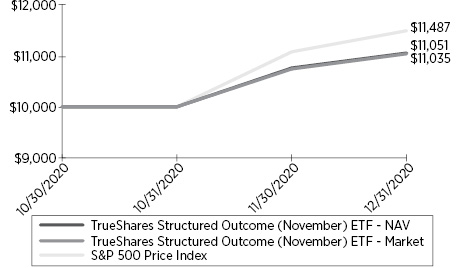

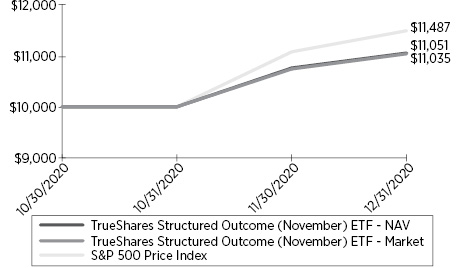

1 | The Fund has an inception date of October 30, 2020 and commenced operations on November 2, 2020 |

1 | The Fund has an inception date of November 30, 2020 and commenced operations on December 1, 2020 |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares Structured Outcome (November) ETF — NAV | 10.51% |

TrueShares Structured Outcome (November) ETF — Market | 10.35% |

S&P 500 Price Index | 14.87% |

CUMULATIVE TOTAL RETURN

FOR THE PERIOD ENDED DECEMBER 31, 2020 |

Total Returns | Since

Inception1 |

TrueShares Structured Outcome (December) ETF — NAV | 1.75% |

TrueShares Structured Outcome (December) ETF — Market | 1.72% |

S&P 500 Price Index | 3.71% |

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. For the most recent month-end performance, please call (877) 774-8789. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (NAV), and are individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00pm Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns. Returns shown include the reinvestment of all dividends and distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The NASDAQ Composite Total Return Index is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market. The index measures the performance of all domestic and international based common type stocks listed on the NASDAQ Stock Market. It includes common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. The index is market capitalization-weighted. The composition of the NASDAQ Composite is heavily weighted towards information technology companies. The total return index includes reinvestment of all cash dividends on the ex-date.

The S&P 500® Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the U.S. stock market. The S&P 500 Price Index does not include reinvestment of dividends.

12

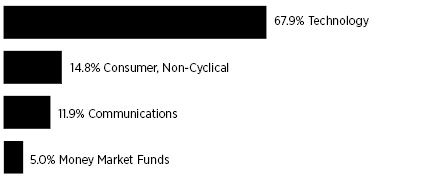

TrueShares Technology, AI & Deep Learning ETF

Schedule of Investments

December 31, 2020

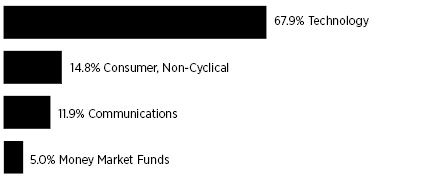

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 94.6% | | | | | | | | |

Biotechnology — 12.1% | | | | | | | | |

Berkeley Lights, Inc. (a) | | | 14,110 | | | $ | 1,261,575 | |

Guardant Health, Inc. (a) | | | 8,721 | | | | 1,123,962 | |

Relay Therapeutics, Inc. (a) | | | 22,110 | | | | 918,892 | |

| | | | | | | | 3,304,429 | |

Computers — 20.7% | | | | | | | | |

Crowdstrike Holdings, Inc. - Class A (a) | | | 10,401 | | | | 2,203,140 | |

Varonis Systems, Inc. (a) | | | 8,472 | | | | 1,386,104 | |

Zscaler, Inc. (a) | | | 10,407 | | | | 2,078,382 | |

| | | | | | | | 5,667,626 | |

Internet — 11.9% | | | | | | | | |

Amazon.com, Inc. (a) | | | 256 | | | | 833,774 | |

Anaplan, Inc. (a) | | | 16,998 | | | | 1,221,306 | |

Okta, Inc. (a) | | | 4,740 | | | | 1,205,193 | |

| | | | | | | | 3,260,273 | |

Pharmaceuticals — 2.7% | | | | | | | | |

AbCellera Biologics, Inc. (a)(b) | | | 18,611 | | | | 748,907 | |

| | | | | | | | | |

Semiconductors — 11.8% | | | | | | | | |

Advanced Micro Devices, Inc. (a) | | | 13,179 | | | | 1,208,646 | |

NVIDIA Corp. | | | 2,007 | | | | 1,048,056 | |

Xilinx, Inc. | | | 6,786 | | | | 962,051 | |

| | | | | | | | 3,218,753 | |

Software — 35.4% (c) | | | | | | | | |

C3.ai, Inc. - Class A (a) | | | 8,311 | | | | 1,153,151 | |

Datadog, Inc. - Class A (a) | | | 13,995 | | | | 1,377,668 | |

Elastic N.V. (a)(b) | | | 8,468 | | | | 1,237,429 | |

salesforce.com, Inc. (a) | | | 3,450 | | | | 767,728 | |

Schrodinger, Inc. (a) | | | 13,088 | | | | 1,036,308 | |

ServiceNow, Inc. (a) | | | 1,842 | | | | 1,013,892 | |

Twilio, Inc. - Class A (a) | | | 4,626 | | | | 1,565,901 | |

Unity Software, Inc. (a) | | | 9,943 | | | | 1,525,952 | |

| | | | | | | | 9,678,029 | |

TOTAL COMMON STOCKS (Cost $19,780,546) | | | | | | | 25,878,017 | |

MONEY MARKET FUNDS — 5.0% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 0.04% (d) | | | 1,377,274 | | | | 1,377,274 | |

TOTAL MONEY MARKET FUNDS (Cost $1,377,274) | | | | | | | 1,377,274 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $21,157,820) — 99.6% | | | | | | | 27,255,291 | |

Other assets and liabilities, net — 0.4% | | | | | | | 119,174 | |

NET ASSETS — 100.0% | | | | | | $ | 27,374,465 | |

(a) | Non-income producing security. |

(b) | Foreign issued security. |

(c) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(d) | The rate shown is the annualized seven-day yield at period end. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

13

TrueShares ESG Active Opportunities ETF

Schedule of Investments

December 31, 2020

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 96.8% | | | | | | | | |

Apparel — 2.0% | | | | | | | | |

NIKE, Inc. - Class B | | | 1,016 | | | $ | 143,734 | |

| | | | | | | | | |

Auto Manufacturers — 4.1% | | | | | | | | |

Tesla, Inc. (a) | | | 403 | | | | 284,385 | |

| | | | | | | | | |

Banks — 1.7% | | | | | | | | |

JPMorgan Chase & Co. | | | 912 | | | | 115,888 | |

| | | | | | | | | |

Beverages — 1.4% | | | | | | | | |

PepsiCo, Inc. | | | 640 | | | | 94,912 | |

| | | | | | | | | |

Biotechnology — 1.1% | | | | | | | | |

Amgen, Inc. | | | 184 | | | | 42,306 | |

Gilead Sciences, Inc. | | | 601 | | | | 35,014 | |

| | | | | | | | 77,320 | |

Chemicals — 0.7% | | | | | | | | |

International Flavors & Fragrances, Inc. | | | 435 | | | | 47,345 | |

| | | | | | | | | |

Commercial Services — 7.5% | | | | | | | | |

Moody’s Corp. | | | 280 | | | | 81,267 | |

PayPal Holdings, Inc. (a) | | | 438 | | | | 102,580 | |

S&P Global, Inc. | | | 232 | | | | 76,265 | |

Square, Inc. - Class A (a) | | | 1,235 | | | | 268,785 | |

| | | | | | | | 528,897 | |

Computers — 2.6% | | | | | | | | |

Apple, Inc. | | | 1,383 | | | | 183,510 | |

| | | | | | | | | |

Cosmetics & Personal Care — 0.9% | | | | | | | | |

Colgate-Palmolive Co. | | | 712 | | | | 60,883 | |

| | | | | | | | | |

Distribution & Wholesale — 1.8% | | | | | | | | |

WW Grainger, Inc. | | | 309 | | | | 126,177 | |

| | | | | | | | | |

Diversified Financial Services — 5.6% | | | | | | | | |

American Express Co. | | | 701 | | | | 84,758 | |

BlackRock, Inc. | | | 136 | | | | 98,130 | |

Mastercard, Inc. - Class A | | | 360 | | | | 128,498 | |

Nasdaq, Inc. | | | 227 | | | | 30,132 | |

Visa, Inc. - Class A | | | 248 | | | | 54,245 | |

| | | | | | | | 395,763 | |

Electric — 1.0% | | | | | | | | |

Eversource Energy | | | 832 | | | | 71,976 | |

| | | | | | | | | |

Energy, Alternate Sources — 6.4% | | | | | | | | |

Enphase Energy, Inc. (a) | | | 2,006 | | | | 351,993 | |

SolarEdge Technologies, Inc. (a) | | | 310 | | | | 98,927 | |

| | | | | | | | 450,920 | |

Food — 2.7% | | | | | | | | |

Beyond Meat, Inc. (a) | | | 722 | | | | 90,250 | |

Sysco Corp. | | | 1,324 | | | | 98,320 | |

| | | | | | | | 188,570 | |

Healthcare Products — 2.8% | | | | | | | | |

Abbott Laboratories | | | 1,273 | | | | 139,381 | |

Baxter International, Inc. | | | 681 | | | | 54,643 | |

| | | | | | | | 194,024 | |

Healthcare Services — 2.1% | | | | | | | | |

Teladoc Health, Inc. (a) | | | 346 | | | | 69,186 | |

UnitedHealth Group, Inc. | | | 219 | | | | 76,799 | |

| | | | | | | | 145,985 | |

Household Products & Wares — 0.6% | | | | | | | | |

The Clorox Co. | | | 224 | | | | 45,230 | |

| | | | | | | | | |

Insurance — 0.9% | | | | | | | | |

The Allstate Corp. | | | 585 | | | | 64,309 | |

| | | | | | | | | |

Internet — 13.4% | | | | | | | | |

Alphabet, Inc. - Class A (a) | | | 99 | | | | 173,511 | |

Amazon.com, Inc. (a) | | | 64 | | | | 208,444 | |

Booking Holdings, Inc. (a) | | | 43 | | | | 95,773 | |

Netflix, Inc. (a) | | | 200 | | | | 108,146 | |

Twitter, Inc. (a) | | | 2,867 | | | | 155,248 | |

Uber Technologies, Inc. (a) | | | 3,043 | | | | 155,193 | |

VeriSign, Inc. (a) | | | 193 | | | | 41,765 | |

| | | | | | | | 938,080 | |

Machinery Diversified — 2.0% | | | | | | | | |

Rockwell Automation, Inc. | | | 572 | | | | 143,463 | |

| | | | | | | | | |

Media — 2.8% | | | | | | | | |

The Walt Disney Co. (a) | | | 1,077 | | | | 195,131 | |

| | | | | | | | | |

Miscellaneous Manufacturing — 0.6% | | | | | | | | |

Illinois Tool Works, Inc. | | | 216 | | | | 44,038 | |

The accompanying notes are an integral part of the financial statements.

14

TrueShares ESG Active Opportunities ETF

Schedule of Investments

December 31, 2020 (Continued)

| | Shares | | | Value | |

Packaging & Containers — 0.7% | | | | | | | | |

Ball Corp. | | | 529 | | | $ | 49,292 | |

| | | | | | | | | |

Pharmaceuticals — 3.9% | | | | | | | | |

AbbVie, Inc. | | | 377 | | | | 40,395 | |

AmerisourceBergen Corp. | | | 889 | | | | 86,909 | |

Bristol-Myers Squibb Co. | | | 619 | | | | 38,397 | |

Cardinal Health, Inc. | | | 510 | | | | 27,316 | |

Johnson & Johnson | | | 264 | | | | 41,548 | |

Merck & Co., Inc. | | | 449 | | | | 36,728 | |

| | | | | | | | 271,293 | |

Retail — 5.9% | | | | | | | | |

Costco Wholesale Corp. | | | 313 | | | | 117,932 | |

Starbucks Corp. | | | 1,264 | | | | 135,223 | |

Target Corp. | | | 384 | | | | 67,788 | |

The Home Depot, Inc. | | | 234 | | | | 62,155 | |

Tractor Supply Co. | | | 235 | | | | 33,036 | |

| | | | | | | | 416,134 | |

Semiconductors — 5.7% | | | | | | | | |

Advanced Micro Devices, Inc. (a) | | | 941 | | | | 86,299 | |

Lam Research Corp. | | | 194 | | | | 91,621 | |

NVIDIA Corp. | | | 240 | | | | 125,328 | |

QUALCOMM, Inc. | | | 656 | | | | 99,935 | |

| | | | | | | | 403,183 | |

Software — 11.8% | | | | | | | | |

Adobe, Inc. (a) | | | 243 | | | | 121,529 | |

Electronic Arts, Inc. | | | 798 | | | | 114,593 | |

Intuit, Inc. | | | 184 | | | | 69,892 | |

Microsoft Corp. | | | 944 | | | | 209,965 | |

MSCI, Inc. | | | 265 | | | | 118,330 | |

salesforce.com, Inc. (a) | | | 378 | | | | 84,116 | |

VMware, Inc. - Class A (a) | | | 283 | | | | 39,694 | |

Zoom Video Communications, Inc. - Class A (a) | | | 201 | | | | 67,801 | |

| | | | | | | | 825,920 | |

Telecommunications — 1.3% | | | | | | | | |

Verizon Communications, Inc. | | | 1,586 | | | | 93,178 | |

| | | | | | | | | |

Transportation — 2.8% | | | | | | | | |

Expeditors International of Washington, Inc. | | | 515 | | | | 48,982 | |

Union Pacific Corp. | | | 153 | | | | 31,858 | |

United Parcel Service, Inc. - Class B | | | 688 | | | | 115,859 | |

| | | | | | | | 196,699 | |

TOTAL COMMON STOCKS (Cost $4,976,492) | | | | | | | 6,796,239 | |

REAL ESTATE INVESTMENT TRUSTS — 1.9% | | | | | | | | |

Iron Mountain, Inc. | | | 1,049 | | | | 30,924 | |

Prologis, Inc. | | | 993 | | | | 98,962 | |

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $117,406) | | | | | | | 129,886 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 1.3% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 0.04% (b) | | | 93,540 | | | | 93,540 | |

TOTAL MONEY MARKET FUNDS (Cost $93,540) | | | | | | | 93,540 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $5,187,438) — 100.0% | | | | | | | 7,019,665 | |

Other assets and liabilities, net — (0.0)% (c) | | | | | | | (73 | ) |

NET ASSETS — 100.0% | | | | | | $ | 7,019,592 | |

(a) | Non-income producing security. |

(b) | The rate shown is the annualized seven-day yield at period end. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

15

TrueShares Structured Outcome (July) ETF

Schedule of Investments

December 31, 2020

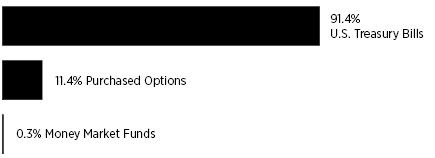

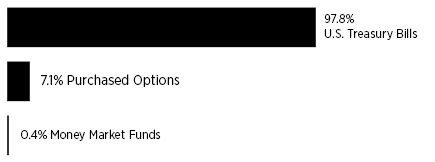

Sector Diversification *

* | Percentages are stated as a percent of net assets. Percentages expressed exclude written options. |

| | Shares /

Principal

Amount | | | Value | | | | |

SHORT-TERM INVESTMENTS — 85.4% |

Money Market Funds — 0.4% |

First American Treasury Obligations Fund - Class X, 0.04% (a) | | | 23,769 | | | $ | 23,769 | | | | | |

Total Money Market Funds (Cost $23,769) | | | | | | | 23,769 | | | | | |

| | | | | | | | | | | | | |

U.S. Treasury Bills — 85.0% | | | | | | | | | | | | |

0.07%, 06/24/2021 (c)(d) | | | 5,590,000 | | | | 5,588,075 | | | | | |

Total U.S. Treasury Bills (Cost $5,589,189) | | | | | | | 5,588,075 | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $5,612,958) | | | | | | | 5,611,844 | | | | | |

| | Number of

Contracts(b) | | | Value | | | Notional

Value | |

PURCHASED OPTIONS — 15.9% |

PURCHASED CALL OPTIONS — 15.9% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: June 30, 2021, Exercise Price: $311 | | | 149 | | | | 1,046,757 | | | $ | 5,570,812 | |

TOTAL PURCHASED OPTIONS (Cost $440,179) | | | | | | | 1,046,757 | | | | | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS (Cost $6,053,137) — 101.3% | | | | | | | 6,658,601 | | | | | |

Other assets and liabilities, net — (1.3)% | | | | | | | (87,787 | ) | | | | |

NET ASSETS — 100.0% | | | | | | $ | 6,570,814 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | The rate shown is the annualized seven-day yield at period end. |

(b) | Each contract has a multiplier of 100. |

(c) | The rate shown is the effective yield as of December 31, 2020. |

(d) | Designated as collateral for written options. |

Schedule of Written Options

December 31, 2020

| | Number of

Contracts (a) | | | Value | | | Notional

Value | |

WRITTEN OPTIONS — (1.3)% | | | | |

WRITTEN PUT OPTIONS — (1.3)% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: June 30, 2021, Exercise Price: $279 | | | 199 | | | $ | 83,458 | | | $ | 7,440,212 | |

TOTAL WRITTEN OPTIONS (Premiums Received $399,686) | | | | | | $ | 83,458 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | Each contract has a multiplier of 100. |

The accompanying notes are an integral part of the financial statements.

16

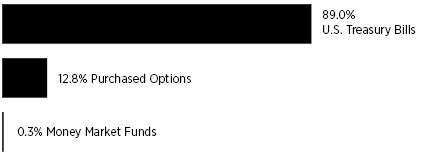

TrueShares Structured Outcome (August) ETF

Schedule of Investments

December 31, 2020

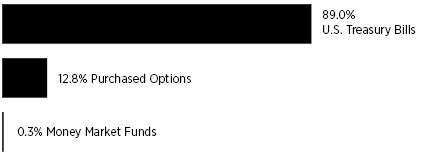

Sector Diversification *

* | Percentages are stated as a percent of net assets. Percentages expressed exclude written options. |

| | Shares /

Principal

Amount | | | Value | | | | |

SHORT-TERM INVESTMENTS — 89.3% |

Money Market Funds — 0.3% |

First American Treasury Obligations Fund - Class X, 0.04% (a) | | | 27,681 | | | $ | 27,681 | | | | | |

Total Money Market Funds (Cost $27,681) | | | | | | | 27,681 | | | | | |

| | | | | | | | | | | | | |

U.S. Treasury Bills — 89.0% | | | | | | | | | | | | |

0.04%, 01/28/2021 (c)(d) | | | 8,067,000 | | | | 8,066,745 | | | | | |

Total U.S. Treasury Bills (Cost $8,066,656) | | | | | | | 8,066,745 | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $8,094,337) | | | | | | | 8,094,426 | | | | | |

| | | | | | | | | | | | | |

| | Number of

Contracts(b) | | | Value | | | Notional

Value | |

PURCHASED OPTIONS — 12.8% |

PURCHASED CALL OPTIONS — 12.8% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: July 30, 2021, Exercise Price: $329 | | | 205 | | | | 1,157,785 | | | $ | 7,664,540 | |

TOTAL PURCHASED OPTIONS (Cost $565,102) | | | | | | | 1,157,785 | | | | | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS (Cost $8,659,439) — 102.1% | | | | | | | 9,252,211 | | | | | |

Other assets and liabilities, net — (2.1)% | | | | | | | (187,012 | ) | | | | |

NET ASSETS — 100.0% | | | | | | $ | 9,065,199 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | The rate shown is the annualized seven-day yield at period end. |

(b) | Each contract has a multiplier of 100. |

(c) | The rate shown is the effective yield as of December 31, 2020. |

(d) | Designated as collateral for written options. |

Schedule of Written Options

December 31, 2020

| | Number of

Contracts (a) | | | Value | | | Notional

Value | |

WRITTEN OPTIONS — (2.0)% | | | | |

WRITTEN PUT OPTIONS — (2.0)% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: July 30, 2021, Exercise Price: $296 | | | 272 | | | $ | 181,043 | | | $ | 10,169,536 | |

TOTAL WRITTEN OPTIONS (Premiums Received $531,408) | | | | | | $ | 181,043 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | Each contract has a multiplier of 100. |

The accompanying notes are an integral part of the financial statements.

17

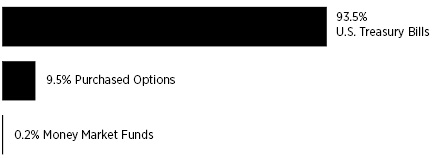

TrueShares Structured Outcome (September) ETF

Schedule of Investments

December 31, 2020

Sector Diversification *

* | Percentages are stated as a percent of net assets. Percentages expressed exclude written options. |

| | Shares /

Principal

Amount | | | Value | | | | |

SHORT-TERM INVESTMENTS — 93.8% |

Money Market Funds — 0.3% |

First American Treasury Obligations Fund - Class X, 0.04% (a) | | | 25,071 | | | $ | 25,071 | | | | | |

Total Money Market Funds (Cost $25,071) | | | | | | | 25,071 | | | | | |

| | | | | | | | | | | | | |

U.S. Treasury Bills — 93.5% | | | | | | | | | | | | |

0.05%, 02/25/2021 (c)(d) | | | 9,960,000 | | | | 9,959,173 | | | | | |

Total U.S. Treasury Bills (Cost $9,959,045) | | | | | | | 9,959,173 | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $9,984,116) | | | | | | | 9,984,244 | | | | | |

| | | | | | | | | | | | | |

| | Number of

Contracts(b) | | | Value | | | Notional

Value | |

PURCHASED OPTIONS — 9.5% |

PURCHASED CALL OPTIONS — 9.5% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: August 31, 2021, Exercise Price: $353 | | | 254 | | | | 1,012,892 | | | $ | 9,496,552 | |

TOTAL PURCHASED OPTIONS (Cost $648,024) | | | | | | | 1,012,892 | | | | | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS (Cost $10,632,140) — 103.3% | | | | | | | 10,997,136 | | | | | |

Other assets and liabilities, net — (3.3)% | | | | | | | (346,434 | ) | | | | |

NET ASSETS — 100.0% | | | | | | $ | 10,650,702 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | The rate shown is the annualized seven-day yield at period end. |

(b) | Each contract has a multiplier of 100. |

(c) | The rate shown is the effective yield as of December 31, 2020. |

(d) | Designated as collateral for written options. |

Schedule of Written Options

December 31, 2020

| | Number of

Contracts (a) | | | Value | | | Notional

Value | |

WRITTEN OPTIONS — (3.2)% | | | | |

WRITTEN PUT OPTIONS — (3.2)% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: August 31, 2021, Exercise Price: $317 | | | 313 | | | $ | 339,382 | | | $ | 11,702,444 | |

TOTAL WRITTEN OPTIONS (Premiums Received $778,306) | | | | | | $ | 339,382 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | Each contract has a multiplier of 100. |

The accompanying notes are an integral part of the financial statements.

18

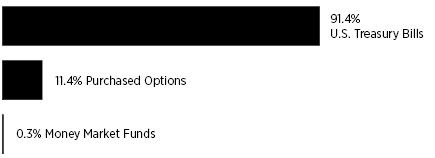

TrueShares Structured Outcome (October) ETF

Schedule of Investments

December 31, 2020

Sector Diversification *

* | Percentages are stated as a percent of net assets. Percentages expressed exclude written options. |

| | Shares /

Principal

Amount | | | Value | | | | |

SHORT-TERM INVESTMENTS — 91.7% |

Money Market Funds — 0.3% |

First American Treasury Obligations Fund - Class X, 0.04% (a) | | | 13,818 | | | $ | 13,818 | | | | | |

Total Money Market Funds (Cost $13,818) | | | | | | | 13,818 | | | | | |

| | | | | | | | | | | | | |

U.S. Treasury Bills — 91.4% | | | | | | | | | | | | |

0.06%, 03/25/2021 (c)(d) | | | 3,730,000 | | | | 3,729,461 | | | | | |

Total U.S. Treasury Bills (Cost $3,729,455) | | | | | | | 3,729,461 | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $3,743,273) | | | | | | | 3,743,279 | | | | | |

| | | | | | | | | | | | | |

| | Number of

Contracts(b) | | | Value | | | Notional

Value | |

PURCHASED OPTIONS — 11.4% |

PURCHASED CALL OPTIONS — 11.4% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: September 30, 2021, Exercise Price: $337 | | | 90 | | | | 464,676 | | | $ | 3,364,920 | |

TOTAL PURCHASED OPTIONS (Cost $289,354) | | | | | | | 464,676 | | | | | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS (Cost $4,032,627) — 103.1% | | | | | | | 4,207,955 | | | | | |

Other assets and liabilities, net — (3.1)% | | | | | | | (126,138 | ) | | | | |

NET ASSETS — 100.0% | | | | | | $ | 4,081,817 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | The rate shown is the annualized seven-day yield at period end. |

(b) | Each contract has a multiplier of 100. |

(c) | The rate shown is the effective yield as of December 31, 2020. |

(d) | Designated as collateral for written options. |

Schedule of Written Options

December 31, 2020

| | Number of

Contracts (a) | | | Value | | | Notional

Value | |

WRITTEN OPTIONS — (3.0)% | | | | |

WRITTEN PUT OPTIONS — (3.0)% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: September 30, 2021, Exercise Price: $303 | | | 122 | | | $ | 123,447 | | | $ | 4,561,336 | |

TOTAL WRITTEN OPTIONS (Premiums Received $258,682) | | | | | | $ | 123,447 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | Each contract has a multiplier of 100. |

The accompanying notes are an integral part of the financial statements.

19

TrueShares Structured Outcome (November) ETF

Schedule of Investments

December 31, 2020

Sector Diversification *

* | Percentages are stated as a percent of net assets. Percentages expressed exclude written options. |

| | Shares /

Principal

Amount | | | Value | | | | |

SHORT-TERM INVESTMENTS — 88.7% |

U.S. Treasury Bills — 88.7% | | | | | | | | | | | | |

0.07%, 04/29/2021 (b)(c) | | | 1,225,000 | | | $ | 1,224,706 | | | | | |

Total U.S. Treasury Bills (Cost $1,224,819) | | | | | | | 1,224,706 | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $1,224,819) | | | | | | | 1,224,706 | | | | | |

| | Number of

Contracts(a) | | | Value | | | Notional

Value | |

PURCHASED OPTIONS — 13.0% |

PURCHASED CALL OPTIONS — 13.0% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: October 29, 2021, Exercise Price: $330 | | | 31 | | | | 179,478 | | | $ | 1,159,028 | |

TOTAL PURCHASED OPTIONS (Cost $89,994) | | | | | | | 179,478 | | | | | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS (Cost $1,314,813) — 101.7% | | | | | | | 1,404,184 | | | | | |

Other assets and liabilities, net — (1.7)% | | | | | | | (23,152 | ) | | | | |

NET ASSETS — 100.0% | | | | | | $ | 1,381,032 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | Each contract has a multiplier of 100. |

(b) | The rate shown is the effective yield as of December 31, 2020. |

(c) | Designated as collateral for written options. |

Schedule of Written Options

December 31, 2020

| | Number of

Contracts (a) | | | Value | | | Notional

Value | |

WRITTEN OPTIONS — (3.0)% | | | | |

WRITTEN PUT OPTIONS — (3.0)% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: October 29, 2021, Exercise Price: $297 | | | 41 | | | $ | 42,050 | | | $ | 1,532,908 | |

TOTAL WRITTEN OPTIONS (Premiums Received $87,654) | | | | | | $ | 42,050 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | Each contract has a multiplier of 100. |

The accompanying notes are an integral part of the financial statements.

20

TrueShares Structured Outcome (December) ETF

Schedule of Investments

December 31, 2020

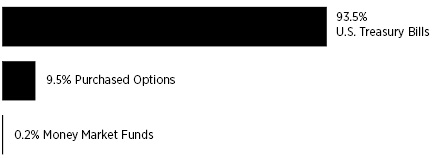

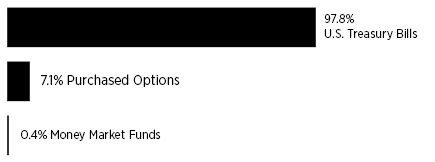

Sector Diversification *

* | Percentages are stated as a percent of net assets. Percentages expressed exclude written options. |

| | Shares /

Principal

Amount | | | Value | | | | |

SHORT-TERM INVESTMENTS — 98.2% |

Money Market Funds — 0.4% |

First American Treasury Obligations Fund - Class X, 0.04% (a) | | | 20,827 | | | $ | 20,827 | | | | | |

Total Money Market Funds (Cost $20,827) | | | | | | | 20,827 | | | | | |

| | | | | | | | | | | | | |

U.S. Treasury Bills — 97.8% | | | | | | | | | | | | |

0.07%, 05/27/2021 (c)(d) | | | 5,600,000 | | | | 5,598,498 | | | | | |

Total U.S. Treasury Bills (Cost $5,598,965) | | | | | | | 5,598,498 | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $5,619,792) | | | | | | | 5,619,325 | | | | | |

| | | | | | | | | | | | | |

| | Number of

Contracts(b) | | | Value | | | Notional

Value | |

PURCHASED OPTIONS — 7.1% | | | | | | | | | | | | |

PURCHASED CALL OPTIONS — 7.1% | | | | |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: November 30, 2021, Exercise Price: $366 | | | 121 | | | | 404,828 | | | $ | 4,523,948 | |

TOTAL PURCHASED OPTIONS (Cost $324,671) | | | | | | | 404,828 | | | | | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS (Cost $5,944,463) — 105.3% | | | | | | | 6,024,153 | | | | | |

Other assets and liabilities, net — (5.3)% | | | | | | | (300,722 | ) | | | | |

NET ASSETS — 100.0% | | | | | | $ | 5,723,431 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | The rate shown is the annualized seven-day yield at period end. |

(b) | Each contract has a multiplier of 100. |

(c) | The rate shown is the effective yield as of December 31, 2020. |

(d) | Designated as collateral for written options. |

Schedule of Written Options

December 31, 2020

| | Number of

Contracts (a) | | | Value | | | Notional

Value | |

WRITTEN OPTIONS — (5.2)% | | | | |

WRITTEN PUT OPTIONS — (5.2)% |

CBOE SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: November 30, 2021, Exercise Price: $329 | | | 169 | | | $ | 297,399 | | | $ | 6,318,572 | |

TOTAL WRITTEN OPTIONS (Premiums Received $314,583) | | | | | | $ | 297,399 | | | | | |

Percentages are stated as a percent of net assets.

CBOE Chicago Board Options Exchange

SPDR Standard & Poor’s Depository Receipt

(a) | Each contract has a multiplier of 100. |

The accompanying notes are an integral part of the financial statements.

21

TrueShares ETFs

Statements of Assets and Liabilities

December 31, 2020

| | | TrueShares

Technology, AI

& Deep Learning

ETF | | | TrueShares

ESG Active

Opportunities

ETF | | | TrueShares

Structured

Outcome

(July) ETF | | | TrueShares

Structured

Outcome

(August) ETF | |

Assets | | | | | | | | | | | | | | | | |

Investments, at value (cost $21,157,820, $5,187,438, $6,053,137, and $8,659,439 respectively) | | $ | 27,255,291 | | | $ | 7,019,665 | | | $ | 6,658,601 | | | $ | 9,252,211 | |

Dividends and interest receivable | | | 51 | | | | 3,303 | | | | — | | | | 1 | |

Fund shares sold | | | 2,380,390 | | | | — | | | | — | | | | — | |

Total assets | | | 29,635,732 | | | | 7,022,968 | | | | 6,658,601 | | | | 9,252,212 | |

| | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | |

Payable to Adviser | | | 13,282 | | | | 3,376 | | | | 4,329 | | | | 5,970 | |

Written options, at value (premiums received $0, $0, $399,686, and $531,408 respectively) | | | — | | | | — | | | | 83,458 | | | | 181,043 | |

Investment securities purchased | | | 2,247,985 | | | | — | | | | — | | | | — | |

Total liabilities | | | 2,261,267 | | | | 3,376 | | | | 87,787 | | | | 187,013 | |

Net Assets | | $ | 27,374,465 | | | $ | 7,019,592 | | | $ | 6,570,814 | | | $ | 9,065,199 | |

| | | | | | | | | | | | | | | | | |

Net Assets Consists of: | | | | | | | | | | | | | | | | |

Paid-in capital | | $ | 21,242,861 | | | $ | 5,296,432 | | | $ | 5,649,131 | | | $ | 8,128,357 | |

Total distributable earnings | | | 6,131,604 | | | | 1,723,160 | | | | 921,683 | | | | 936,842 | |

Net Assets | | $ | 27,374,465 | | | $ | 7,019,592 | | | $ | 6,570,814 | | | $ | 9,065,199 | |

| | | | | | | | | | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 575,000 | | | | 200,000 | | | | 225,000 | | | | 325,000 | |

Net Asset Value, redemption price and offering price per share | | $ | 47.61 | | | $ | 35.10 | | | $ | 29.20 | | | $ | 27.89 | |

The accompanying notes are an integral part of the financial statements.

22

TrueShares ETFs

Statements of Assets and Liabilities

December 31, 2020 (Continued)

| | | TrueShares

Structured

Outcome

(September)

ETF | | | TrueShares

Structured

Outcome

(October) ETF | | | TrueShares

Structured

Outcome

(November) ETF | | | TrueShares

Structured

Outcome

(December) ETF | |

Assets | | | | | | | | | | | | | | | | |

Investments, at value (cost $10,632,140, $4,032,627, $1,314,813, and $5,944,463 respectively) | | $ | 10,997,136 | | | $ | 4,207,955 | | | $ | 1,404,184 | | | $ | 6,024,153 | |

Cash | | | — | | | | — | | | | 20,449 | | | | — | |

Dividends and interest receivable | | | 1 | | | | — | | | | — | | | | 4 | |

Receivable for investment securities sold | | | — | | | | — | | | | 276 | | | | — | |

Total assets | | | 10,997,137 | | | | 4,207,955 | | | | 1,424,909 | | | | 6,024,157 | |

| | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | |

Payable to Adviser | | | 7,053 | | | | 2,691 | | | | 1,827 | | | | 3,327 | |

Written options, at value (premiums received $778,306, $258,682, $87,654 and $314,583 respectively) | | | 339,382 | | | | 123,447 | | | | 42,050 | | | | 297,399 | |

Total liabilities | | | 346,435 | | | | 126,138 | | | | 43,877 | | | | 300,726 | |

Net Assets | | $ | 10,650,702 | | | $ | 4,081,817 | | | $ | 1,381,032 | | | $ | 5,723,431 | |

| | | | | | | | | | | | | | | | | |

Net Assets Consists of: | | | | | | | | | | | | | | | | |

Paid-in capital | | $ | 9,834,008 | | | $ | 3,771,254 | | | $ | 1,176,859 | | | $ | 5,626,557 | |

Total distributable earnings | | | 816,694 | | | | 310,563 | | | | 204,173 | | | | 96,874 | |

Net Assets | | $ | 10,650,702 | | | $ | 4,081,817 | | | $ | 1,381,032 | | | $ | 5,723,431 | |

| | | | | | | | | | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 400,000 | | | | 150,000 | | | | 50,000 | | | | 225,000 | |

Net Asset Value, redemption price and offering price per share | | $ | 26.63 | | | $ | 27.21 | | | $ | 27.62 | | | $ | 25.44 | |

The accompanying notes are an integral part of the financial statements.

23

TrueShares ETFs

Statements of Operations

For the Period Ended December 31, 2020

| | | TrueShares

Technology,

AI & Deep

Learning ETF(1) | | | TrueShares

ESG Active

Opportunities

ETF(1) | | | TrueShares

Structured

Outcome

(July) ETF(2) | | | TrueShares

Structured

Outcome

(August) ETF(3) | |

Investment Income | | | | | | | | | | | | | | | | |

Dividend Income | | $ | 7,372 | | | $ | 48,563 | | | $ | — | | | $ | — | |

Interest income | | | 567 | | | | 80 | | | | 3,171 | | | | 1,929 | |

Total investment income | | | 7,939 | | | | 48,643 | | | | 3,171 | | | | 1,929 | |

| | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | |

Investment advisory fees | | | 60,346 | | | | 22,118 | | | | 23,456 | | | | 27,635 | |

Total expenses | | | 60,346 | | | | 22,118 | | | | 23,456 | | | | 27,635 | |

Net investment income (loss) | | | (52,407 | ) | | | 26,525 | | | | (20,285 | ) | | | (25,706 | ) |

| | | | | | | | | | | | | | | | | |

Realized and Unrealized Gain (Loss) on Investments | | | | | | | | | | | | | | | | |

Net realized gain (loss) from: | | | | | | | | | | | | | | | | |

Investments | | | 168,341 | | | | (183,545 | ) | | | (9 | ) | | | (541 | ) |

Purchased options | | | — | | | | — | | | | — | | | | (3,507 | ) |

Written options | | | — | | | | — | | | | — | | | | (2,247 | ) |

Net realized gain (loss) | | | 168,341 | | | | (183,545 | ) | | | (9 | ) | | | (6,295 | ) |

Net change in unrealized appreciation/depreciation on: | | | | | | | | | | | | | | | | |

Investments | | | 6,097,471 | | | | 1,832,227 | | | | (1,114 | ) | | | 89 | |

Purchased options | | | — | | | | — | | | | 606,578 | | | | 592,683 | |

Written options | | | — | | | | — | | | | 316,228 | | | | 350,365 | |

Net change in unrealized appreciation/depreciation | | | 6,097,471 | | | | 1,832,227 | | | | 921,692 | | | | 943,137 | |

Net realized and unrealized gain on investments | | | 6,265,812 | | | | 1,648,682 | | | | 921,683 | | | | 936,842 | |

Net increase in net assets from operations | | $ | 6,213,405 | | | $ | 1,675,207 | | | $ | 901,398 | | | $ | 911,136 | |

(1) | The Fund commenced operations on February 28, 2020. |

(2) | The Fund commenced operations on July 1, 2020. |

(3) | The Fund commenced operations on August 3, 2020. |

The accompanying notes are an integral part of the financial statements.

24

TrueShares ETFs

Statements of Operations

For the Period Ended December 31, 2020 (Continued)

| | | TrueShares

Structured

Outcome

(September)

ETF (1) | | | TrueShares

Structured

Outcome

(October) ETF(2) | | | TrueShares

Structured

Outcome

(November)

ETF(3) | | | TrueShares

Structured

Outcome

(December)

ETF(4) | |

Investment Income | | | | | | | | | | | | | | | | |

Interest income | | $ | 2,239 | | | $ | 584 | | | $ | 183 | | | $ | 208 | |

Total investment income | | | 2,239 | | | | 584 | | | | 183 | | | | 208 | |

| | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | |

Investment advisory fees | | | 28,087 | | | | 7,360 | | | | 3,426 | | | | 3,327 | |

Total expenses | | | 28,087 | | | | 7,360 | | | | 3,426 | | | | 3,327 | |

Net investment loss | | | (25,848 | ) | | | (6,776 | ) | | | (3,243 | ) | | | (3,119 | ) |

| | | | | | | | | | | | | | | | | |

Realized and Unrealized Gain (Loss) on Investments | | | | | | | | | | | | | | | | |

Net realized gain (loss) from: | | | | | | | | | | | | | | | | |

Investments | | | (339 | ) | | | (4 | ) | | | (400 | ) | | | — | |

Purchased options | | | (4,476 | ) | | | — | | | | 83,015 | | | | — | |

Written options | | | 46,632 | | | | 668 | | | | 46,649 | | | | — | |

Net realized gain | | | 41,817 | | | | 664 | | | | 129,264 | | | | — | |

Net change in unrealized appreciation/depreciation on: | | | | | | | | | | | | | | | | |

Investments | | | 128 | | | | 6 | | | | (113 | ) | | | (467 | ) |

Purchased options | | | 364,868 | | | | 175,322 | | | | 89,484 | | | | 80,157 | |

Written options | | | 438,924 | | | | 135,235 | | | | 45,604 | | | | 17,184 | |

Net change in unrealized appreciation/depreciation | | | 803,920 | | | | 310,563 | | | | 134,975 | | | | 96,874 | |

Net realized and unrealized gain on investments | | | 845,737 | | | | 311,227 | | | | 264,239 | | | | 96,874 | |

Net increase in net assets from operations | | $ | 819,889 | | | $ | 304,451 | | | $ | 260,996 | | | $ | 93,755 | |

(1) | The Fund commenced operations on September 1, 2020. |

(2) | The Fund commenced operations on October 1, 2020. |

(3) | The Fund commenced operations on November 2, 2020. |

(4) | The Fund commenced operations on December 1, 2020. |

The accompanying notes are an integral part of the financial statements.

25

TrueShares ETFs

Statements of Changes in Net Assets

For the Period Ended December 31, 2020

| | | TrueShares

Technology,

AI & Deep

Learning ETF(1) | | | TrueShares

ESG Active

Opportunities

ETF(1) | | | TrueShares

Structured

Outcome

(July) ETF(2) | | | TrueShares

Structured

Outcome

(August) ETF(3) | |

From Operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (52,407 | ) | | $ | 26,525 | | | $ | (20,285 | ) | | $ | (25,706 | ) |

Net realized gain (loss) on investments, purchased options and written options | | | 168,341 | | | | (183,545 | ) | | | (9 | ) | | | (6,295 | ) |

Net change in unrealized appreciation on investments, purchased options and written options | | | 6,097,471 | | | | 1,832,227 | | | | 921,692 | | | | 943,137 | |

Net increase in net assets resulting from operations | | | 6,213,405 | | | | 1,675,207 | | | | 901,398 | | | | 911,136 | |

| | | | | | | | | | | | | | | | | |

From Distributions | | | | | | | | | | | | | | | | |

Distributable earnings | | | — | | | | (26,525 | ) | | | — | | | | — | |

Return of capital | | | — | | | | (678 | ) | | | — | | | | — | |

Total distributions | | | — | | | | (27,203 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | |

From Capital Share Transactions | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | 23,714,745 | | | | 5,904,520 | | | | 5,668,907 | | | | 9,433,430 | |

Cost of shares redeemed | | | (2,553,685 | ) | | | (532,932 | ) | | | — | | | | (1,281,010 | ) |

Transaction fees (Note 4) | | | — | | | | — | | | | 509 | | | | 1,643 | |

Net increase in net assets resulting from capital share transactions | | | 21,161,060 | | | | 5,371,588 | | | | 5,669,416 | | | | 8,154,063 | |

| | | | | | | | | | | | | | | | | |

Total Increase in Net Assets | | | 27,374,465 | | | | 7,019,592 | | | | 6,570,814 | | | | 9,065,199 | |

| | | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of period | | | — | | | | — | | | | — | | | | — | |

End of period | | $ | 27,374,465 | | | $ | 7,019,592 | | | $ | 6,570,814 | | | $ | 9,065,199 | |

| | | | | | | | | | | | | | | | | |

Changes in Shares Outstanding | | | | | | | | | | | | | | | | |

Shares outstanding, beginning of period | | | — | | | | — | | | | — | | | | — | |

Shares sold | | | 675,000 | | | | 225,000 | | | | 225,000 | | | | 375,000 | |

Shares redeemed | | | (100,000 | ) | | | (25,000 | ) | | | — | | | | (50,000 | ) |

Shares outstanding, end of period | | | 575,000 | | | | 200,000 | | | | 225,000 | | | | 325,000 | |

(1) | The Fund commenced operations on February 28, 2020. |

(2) | The Fund commenced operations on July 1, 2020. |

(3) | The Fund commenced operations on August 3, 2020. |

The accompanying notes are an integral part of the financial statements.

26

TrueShares ETFs

Statements of Changes in Net Assets

For the Period Ended December 31, 2020 (Continued)

| | | TrueShares

Structured

Outcome

(September)

ETF (1) | | | TrueShares

Structured

Outcome

(October) ETF(2) | | | TrueShares

Structured

Outcome

(November)

ETF(3) | | | TrueShares

Structured

Outcome

(December)

ETF(4) | |

From Operations | | | | | | | | | | | | | | | | |

Net investment loss | | $ | (25,848 | ) | | $ | (6,776 | ) | | $ | (3,243 | ) | | $ | (3,119 | ) |

Net realized gain on investments, purchased options and written options | | | 41,817 | | | | 664 | | | | 129,264 | | | | — | |

Net change in unrealized appreciation on investments, purchased options and written options | | | 803,920 | | | | 310,563 | | | | 134,975 | | | | 96,874 | |

Net increase in net assets resulting from operations | | | 819,889 | | | | 304,451 | | | | 260,996 | | | | 93,755 | |

| | | | | | | | | | | | | | | | | |

From Capital Share Transactions | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | 11,765,612 | | | | 3,777,110 | | | | 2,500,000 | | | | 5,629,050 | |

Cost of shares redeemed | | | (1,937,040 | ) | | | — | | | | (1,380,240 | ) | | | — | |

Transaction fees (Note 4) | | | 2,241 | | | | 256 | | | | 276 | | | | 626 | |

Net increase in net assets resulting from capital share transactions | | | 9,830,813 | | | | 3,777,366 | | | | 1,120,036 | | | | 5,629,676 | |

| | | | | | | | | | | | | | | | | |

Total Increase in Net Assets | | | 10,650,702 | | | | 4,081,817 | | | | 1,381,032 | | | | 5,723,431 | |

| | | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of period | | | — | | | | — | | | | — | | | | — | |

End of period | | $ | 10,650,702 | | | $ | 4,081,817 | | | $ | 1,381,032 | | | $ | 5,723,431 | |

| | | | | | | | | | | | | | | | | |

Changes in Shares Outstanding | | | | | | | | | | | | | | | | |

Shares outstanding, beginning of period | | | — | | | | — | | | | — | | | | — | |

Shares sold | | | 475,000 | | | | 150,000 | | | | 100,000 | | | | 225,000 | |

Shares redeemed | | | (75,000 | ) | | | — | | | | (50,000 | ) | | | — | |

Shares outstanding, end of period | | | 400,000 | | | | 150,000 | | | | 50,000 | | | | 225,000 | |

(1) | The Fund commenced operations on September 1, 2020. |

(2) | The Fund commenced operations on October 1, 2020. |

(3) | The Fund commenced operations on November 2, 2020. |

(4) | The Fund commenced operations on December 1, 2020. |

The accompanying notes are an integral part of the financial statements.

27

TrueShares ETFs

Financial Highlights

For a Share Outstanding Throughout the Period

| | | | | | Per Share Operating Performance (For a share outstanding throughout the period) | |

| | | | | | Change in Net Assets Resulting from Operations: | | | Less Distributions Paid: | |

| | | Net Asset

Value,

Beginning

of Period | | | Net

investment

income

(loss)(1) | | | Net realized

and

unrealized

gain on

investments | | | Total from

investment

operations | | | Net

investment

income | | | Return of

capital | | | | Total distributions paid | |

TrueShares Technology, AI & Deep Learning ETF | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 02/28/2020(7) - 12/31/2020 | | $ | 25.00 | | | | (0.19 | ) | | | 22.80 | | | | 22.61 | | | | — | | | | — | | | | — | |

TrueShares ESG Active Opportunities ETF | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 02/28/2020(7) - 12/31/2020 | | $ | 25.00 | | | | 0.17 | | | | 10.07 | | | | 10.24 | | | | (0.14 | ) | | | (0.00 | )(8) | | | (0.14 | ) |

TrueShares Structured Outcome (July) ETF | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 7/01/2020(7) - 12/31/2020 | | $ | 25.00 | | | | (0.09 | ) | | | 4.29 | | | | 4.20 | | | | — | | | | — | | | | — | |

TrueShares Structured Outcome (August) ETF | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 8/03/2020(7) - 12/31/2020 | | $ | 25.00 | | | | (0.08 | ) | | | 2.96 | | | | 2.88 | | | | — | | | | — | | | | — | |

TrueShares Structured Outcome (September) ETF | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 9/01/2020(7) - 12/31/2020 | | $ | 25.00 | | | | (0.06 | ) | | | 1.68 | | | | 1.62 | | | | — | | | | — | | | | — | |

TrueShares Structured Outcome (October) ETF | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 10/01/2020(7) - 12/31/2020 | | $ | 25.00 | | | | (0.05 | ) | | | 2.26 | | | | 2.21 | | | | — | | | | — | | | | — | |

TrueShares Structured Outcome (November) ETF | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 11/02/2020(7) - 12/31/2020 | | $ | 25.00 | | | | (0.03 | ) | | | 2.65 | | | | 2.62 | | | | — | | | | — | | | | — | |