UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kent P. Barnes, Secretary

Listed Funds Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 10th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1681

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1. Reports to Stockholders.

TrueShares ETFs

TrueShares Technology, AI & Deep Learning ETF (LRNZ)

TrueShares ESG Active Opportunities ETF (ECOZ)

TrueShares Low Volatility Equity Income ETF (DIVZ)

TrueShares Eagle Global Renewable Energy Income ETF (RNWZ)

RiverNorth Patriot ETF (FLDZ)

RiverNorth Enhanced Pre-Merger SPAC ETF (SPCZ)

SEMI-ANNUAL REPORT

June 30, 2023

(Unaudited)

This report is submitted for the general information of shareholders of the Funds. It is not authorized for distribution unless preceded or accompanied by a current prospectus for the Funds.

TrueShares ETFs

Table of Contents

(Unaudited)

| | |

Shareholder Expense Example | 2 |

Schedules of Investments | 4 |

Statements of Assets and Liabilities | 17 |

Statements of Operations | 19 |

Statements of Changes in Net Assets | 21 |

Financial Highlights | 24 |

Notes to Financial Statements | 30 |

Review of Liquidity Risk Management Program | 41 |

Supplemental Information | 42 |

1

TrueShares ETFs

Shareholder Expense Example

June 30, 2023 (Unaudited)

As a shareholder of a fund you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (January 1, 2023 to June 30, 2023).

ACTUAL EXPENSES

The following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | Beginning

Account

Value

(1/1/23) | Ending

Account

Value

(6/30/23) | Annualized

Expense

Ratios | Expenses

Paid

During the

Period(1) |

TrueShares Technology, AI & Deep Learning ETF | $ 1,000.00 | $ 1,395.10 | 0.68% | $ 4.04 |

TrueShares ESG Active Opportunities ETF | 1,000.00 | 1,177.50 | 0.58 | 3.13 |

TrueShares Low Volatility Equity Income ETF | 1,000.00 | 961.70 | 0.65 | 3.16 |

TrueShares Eagle Global Renewable Energy Income ETF | 1,000.00 | 1,008.90 | 0.75 | 3.74 |

RiverNorth Patriot ETF | 1,000.00 | 1,042.70 | 0.70 | 3.55 |

RiverNorth Enhanced Pre-Merger SPAC ETF | 1,000.00 | 1,038.60 | 0.89 | 4.50 |

(1) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 181/365 (to reflect the six-month period). |

2

TrueShares ETFs

Shareholder Expense Example

June 30, 2023 (Unaudited) (Continued)

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares with respect to the Funds. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account

Value

(1/1/23) | Ending

Account

Value

(6/30/23) | Annualized

Expense

Ratios | Expenses

Paid

During the

Period(1) |

TrueShares Technology, AI & Deep Learning ETF | $ 1,000.00 | $ 1,021.42 | 0.68% | $ 3.41 |

TrueShares ESG Active Opportunities ETF | 1,000.00 | 1,021.92 | 0.58 | 2.91 |

TrueShares Low Volatility Equity Income ETF | 1,000.00 | 1,021.57 | 0.65 | 3.26 |

TrueShares Eagle Global Renewable Energy Income ETF | 1,000.00 | 1,021.08 | 0.75 | 3.76 |

RiverNorth Patriot ETF | 1,000.00 | 1,021.32 | 0.70 | 3.51 |

RiverNorth Enhanced Pre-Merger SPAC ETF | 1,000.00 | 1,020.38 | 0.89 | 4.46 |

(1) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 181/365 (to reflect the six-month period). |

3

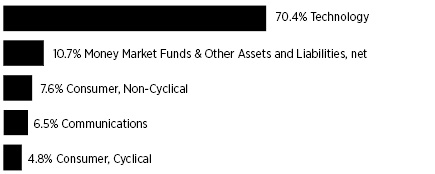

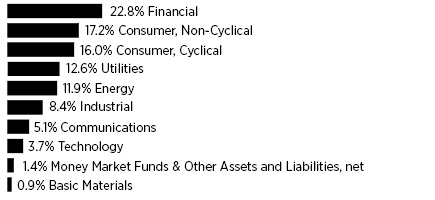

TrueShares Technology, AI & Deep Learning ETF

Schedule of Investments

June 30, 2023 (Unaudited)

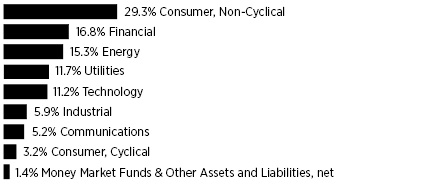

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 89.3% | | | | | | | | |

Auto Parts & Equipment — 4.8% | | | | | | | | |

Mobileye Global, Inc. - Class A (a) | | | 42,919 | | | $ | 1,648,948 | |

| | | | | | | | | |

Biotechnology — 5.6% | | | | | | | | |

Prime Medicine, Inc. (a) | | | 83,964 | | | | 1,230,073 | |

Relay Therapeutics, Inc. (a) | | | 53,564 | | | | 672,764 | |

| | | | | | | | 1,902,837 | |

Computers — 8.5% | | | | | | | | |

Crowdstrike Holdings, Inc. - Class A (a) | | | 10,549 | | | | 1,549,332 | |

Zscaler, Inc. (a) | | | 9,217 | | | | 1,348,447 | |

| | | | | | | | 2,897,779 | |

Internet — 6.5% | | | | | | | | |

Amazon.com, Inc. (a) | | | 8,428 | | | | 1,098,674 | |

Okta, Inc. (a) | | | 16,321 | | | | 1,131,861 | |

| | | | | | | | 2,230,535 | |

Pharmaceuticals — 2.1% | | | | | | | | |

AbCellera Biologics, Inc. (a)(b) | | | 108,773 | | | | 702,674 | |

| | | | | | | | | |

Semiconductors — 12.4% | | | | | | | | |

Advanced Micro Devices, Inc. (a) | | | 15,216 | | | | 1,733,255 | |

NVIDIA Corp. | | | 5,949 | | | | 2,516,545 | |

| | | | | | | | 4,249,800 | |

Software — 49.4% (c) | | | | | | | | |

Datadog, Inc. - Class A (a) | | | 15,174 | | | | 1,492,818 | |

Elastic N.V. (a)(b) | | | 19,918 | | | | 1,277,142 | |

ROBLOX Corp. - Class A (a) | | | 32,057 | | | | 1,291,897 | |

Samsara, Inc. - Class A (a) | | | 82,557 | | | | 2,287,655 | |

Schrodinger, Inc. (a) | | | 44,433 | | | | 2,218,095 | |

SentinelOne, Inc. - Class A (a) | | | 78,393 | | | | 1,183,734 | |

ServiceNow, Inc. (a) | | | 2,397 | | | | 1,347,042 | |

Snowflake, Inc. - Class A (a) | | | 12,768 | | | | 2,246,913 | |

Twilio, Inc. - Class A (a) | | | 17,181 | | | | 1,093,055 | |

UiPath, Inc. - Class A (a) | | | 60,183 | | | | 997,232 | |

Unity Software, Inc. (a) | | | 33,366 | | | | 1,448,752 | |

| | | | | | | | 16,884,335 | |

TOTAL COMMON STOCKS (Cost $34,642,915) | | | | | | | 30,516,908 | |

| | Shares | | | Value | |

MONEY MARKET FUNDS — 10.7% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 5.04% (d) | | | 3,644,531 | | | $ | 3,644,531 | |

TOTAL MONEY MARKET FUNDS (Cost $3,644,531) | | | | | | | 3,644,531 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $38,287,446) — 100.0% | | | | | | | 34,161,439 | |

Other assets and liabilities, net — (0.0)% (e) | | | | | | | (6,938 | ) |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 34,154,501 | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | Foreign issued security. |

(c) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(d) | The rate shown is the seven day yield at period end. |

(e) | Amount is less than 0.05%. |

The accompanying notes are an integral part of the financial statements.

4

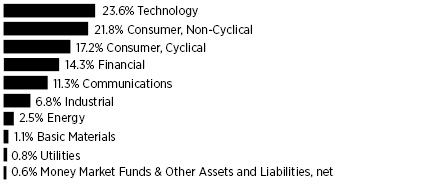

TrueShares ESG Active Opportunities ETF

Schedule of Investments

June 30, 2023 (Unaudited)

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 96.0% | | | | | | | | |

Apparel — 1.5% | | | | | | | | |

NIKE, Inc. - Class B | | | 335 | | | $ | 36,974 | |

| | | | | | | | | |

Auto Manufacturers — 4.0% | | | | | | | | |

Tesla, Inc. (a) | | | 376 | | | | 98,426 | |

| | | | | | | | | |

Banks — 2.7% | | | | | | | | |

JPMorgan Chase & Co. | | | 301 | | | | 43,778 | |

Truist Financial Corp. | | | 727 | | | | 22,064 | |

| | | | | | | | 65,842 | |

Beverages — 1.6% | | | | | | | | |

PepsiCo, Inc. | | | 208 | | | | 38,526 | |

| | | | | | | | | |

Biotechnology — 1.2% | | | | | | | | |

Amgen, Inc. | | | 62 | | | | 13,765 | |

Gilead Sciences, Inc. | | | 196 | | | | 15,106 | |

| | | | | | | | 28,871 | |

Chemicals — 1.1% | | | | | | | | |

International Flavors & Fragrances, Inc. | | | 346 | | | | 27,538 | |

| | | | | | | | | |

Commercial Services — 3.6% | | | | | | | | |

Block, Inc. (a) | | | 272 | | | | 18,107 | |

Moody’s Corp. | | | 69 | | | | 23,993 | |

PayPal Holdings, Inc. (a) | | | 185 | | | | 12,345 | |

S&P Global, Inc. | | | 82 | | | | 32,873 | |

| | | | | | | | 87,318 | |

Computers — 3.6% | | | | | | | | |

Apple, Inc. | | | 450 | | | | 87,287 | |

| | | | | | | | | |

Cosmetics & Personal Care — 0.5% | | | | | | | | |

Colgate-Palmolive Co. | | | 143 | | | | 11,017 | |

| | | | | | | | | |

Distribution & Wholesale — 4.2% | | | | | | | | |

WW Grainger, Inc. | | | 130 | | | | 102,517 | |

| | | | | | | | | |

| | Shares | | | Value | |

Diversified Financial Services — 6.0% | | | | | | | | |

American Express Co. | | | 377 | | | $ | 65,674 | |

BlackRock, Inc. | | | 51 | | | | 35,248 | |

Mastercard, Inc. - Class A | | | 117 | | | | 46,016 | |

| | | | | | | | 146,938 | |

Electric — 0.8% | | | | | | | | |

Eversource Energy | | | 275 | | | | 19,503 | |

| | | | | | | | | |

Energy, Alternate Sources — 2.5% | | | | | | | | |

Enphase Energy, Inc. (a) | | | 359 | | | | 60,125 | |

| | | | | | | | | |

Food — 2.4% | | | | | | | | |

Sysco Corp. | | | 775 | | | | 57,505 | |

| | | | | | | | | |

Healthcare Products — 3.5% | | | | | | | | |

Abbott Laboratories | | | 417 | | | | 45,461 | |

Thermo Fisher Scientific, Inc. | | | 74 | | | | 38,610 | |

| | | | | | | | 84,071 | |

Healthcare Services — 1.4% | | | | | | | | |

UnitedHealth Group, Inc. | | | 73 | | | | 35,087 | |

| | | | | | | | | |

Insurance — 1.6% | | | | | | | | |

The Allstate Corp. | | | 366 | | | | 39,909 | |

| | | | | | | | | |

Internet — 9.9% | | | | | | | | |

Alphabet, Inc. - Class A (a) | | | 605 | | | | 72,418 | |

Amazon.com, Inc. (a) | | | 338 | | | | 44,062 | |

Booking Holdings, Inc. (a) | | | 21 | | | | 56,707 | |

Netflix, Inc. (a) | | | 56 | | | | 24,667 | |

Uber Technologies, Inc. (a) | | | 992 | | | | 42,825 | |

| | | | | | | | 240,679 | |

Machinery Diversified — 3.7% | | | | | | | | |

Rockwell Automation, Inc. | | | 273 | | | | 89,940 | |

| | | | | | | | | |

Miscellaneous Manufacturing — 1.6% | | | | | | | | |

Illinois Tool Works, Inc. | | | 158 | | | | 39,525 | |

| | | | | | | | | |

Pharmaceuticals — 7.7% | | | | | | | | |

AbbVie, Inc. | | | 251 | | | | 33,817 | |

AmerisourceBergen Corp. | | | 361 | | | | 69,467 | |

Cardinal Health, Inc. | | | 421 | | | | 39,814 | |

Johnson & Johnson | | | 88 | | | | 14,566 | |

Merck & Co., Inc. | | | 149 | | | | 17,193 | |

Zoetis, Inc. | | | 69 | | | | 11,882 | |

| | | | | | | | 186,739 | |

Real Estate — 0.5% | | | | | | | | |

CBRE Group, Inc. - Class A (a) | | | 142 | | | | 11,461 | |

| | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

TrueShares ESG Active Opportunities ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

| | Shares | | | Value | |

Retail — 7.4% | | | | | | | | |

Costco Wholesale Corp. | | | 127 | | | $ | 68,374 | |

Starbucks Corp. | | | 411 | | | | 40,714 | |

Target Corp. | | | 147 | | | | 19,389 | |

The Home Depot, Inc. | | | 82 | | | | 25,472 | |

Tractor Supply Co. | | | 116 | | | | 25,648 | |

| | | | | | | | 179,597 | |

Semiconductors — 10.1% | | | | | | | | |

Advanced Micro Devices, Inc.(a) | | | 307 | | | | 34,970 | |

Lam Research Corp. | | | 69 | | | | 44,357 | |

NVIDIA Corp. | | | 330 | | | | 139,596 | |

QUALCOMM, Inc. | | | 220 | | | | 26,189 | |

| | | | | | | | 245,112 | |

Software — 10.0% | | | | | | | | |

Adobe, Inc. (a) | | | 81 | | | | 39,608 | |

Electronic Arts, Inc. | | | 215 | | | | 27,886 | |

Intuit, Inc. | | | 62 | | | | 28,408 | |

Microsoft Corp. | | | 291 | | | | 99,096 | |

MSCI, Inc. | | | 89 | | | | 41,767 | |

Zoom Video Communications, Inc. - Class A (a) | | | 82 | | | | 5,566 | |

| | | | | | | | 242,331 | |

Telecommunications — 1.4% | | | | | | | | |

AT&T, Inc. | | | 934 | | | | 14,897 | |

Verizon Communications, Inc. | | | 515 | | | | 19,153 | |

| | | | | | | | 34,050 | |

Transportation — 1.5% | | | | | | | | |

Expeditors International of Washington, Inc. | | | 303 | | | | 36,702 | |

| | | | | | | | | |

TOTAL COMMON STOCKS (Cost $2,034,378) | | | | | | | 2,333,590 | |

| | | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS (REITS) — 3.4% | | | | | | | | |

AvalonBay Communities, Inc. | | | 183 | | | | 34,636 | |

Prologis, Inc. | | | 397 | | | | 48,685 | |

TOTAL REITS (Cost $93,744) | | | | | | | 83,321 | |

| | | | | | | | | |

| | Shares | | | Value | |

MONEY MARKET FUNDS — 0.5% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 5.04% (b) | | | 12,646 | | | $ | 12,646 | |

TOTAL MONEY MARKET FUNDS (Cost $12,646) | | | | | | | 12,646 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $2,140,768) — 99.9% | | | | | | | 2,429,557 | |

Other assets and liabilities, net — 0.1% | | | | | | | 900 | |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 2,430,457 | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | The rate shown is the seven day yield at period end. |

The accompanying notes are an integral part of the financial statements.

6

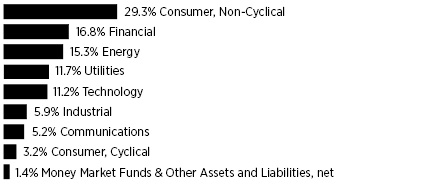

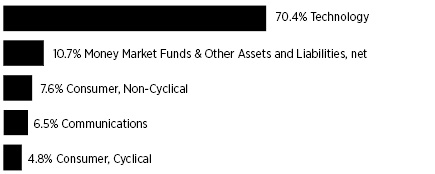

TrueShares Low Volatility Equity Income ETF

Schedule of Investments

June 30, 2023 (Unaudited)

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 98.6% | | | | | | | | |

Aerospace & Defense — 6.0% | | | | | | | | |

Lockheed Martin Corp. | | | 5,670 | | | $ | 2,610,355 | |

Raytheon Technologies Corp. | | | 13,073 | | | | 1,280,631 | |

| | | | | | | | 3,890,986 | |

Agriculture — 11.0% | | | | | | | | |

Altria Group, Inc. | | | 28,929 | | | | 1,310,484 | |

British American Tobacco PLC - ADR (a) | | | 92,426 | | | | 3,068,543 | |

Philip Morris International, Inc. | | | 28,565 | | | | 2,788,515 | |

| | | | | | | | 7,167,542 | |

Banks — 3.5% | | | | | | | | |

JPMorgan Chase & Co. | | | 15,923 | | | | 2,315,841 | |

| | | | | | | | | |

Finance & Insurance — 10.1% | | | | | | | | |

CME Group, Inc. | | | 8,826 | | | | 1,635,370 | |

The Charles Schwab Corp. | | | 51,298 | | | | 2,907,570 | |

Visa, Inc. - Class A | | | 8,606 | | | | 2,043,753 | |

| | | | | | | | 6,586,693 | |

Electric — 11.7% | | | | | | | | |

American Electric Power Co, Inc. | | | 30,454 | | | | 2,564,227 | |

FirstEnergy Corp. | | | 70,360 | | | | 2,735,597 | |

WEC Energy Group, Inc. | | | 26,453 | | | | 2,334,213 | |

| | | | | | | | 7,634,037 | |

Food — 3.7% | | | | | | | | |

The Kroger Co. | | | 51,832 | | | | 2,436,104 | |

| | | | | | | | | |

Healthcare Products — 3.0% | | | | | | | | |

Medtronic PLC (a) | | | 22,178 | | | | 1,953,882 | |

| | | | | | | | | |

Healthcare Services — 4.9% | | | | | | | | |

UnitedHealth Group, Inc. | | | 6,675 | | | | 3,208,272 | |

| | | | | | | | | |

Oil & Gas — 11.7% | | | | | | | | |

Chevron Corp. | | | 16,616 | | | | 2,614,528 | |

Coterra Energy, Inc. | | | 59,088 | | | | 1,494,926 | |

| | Shares | | | Value | |

Oil & Gas (continued) | | | | | | | | |

Devon Energy Corp. | | | 14,518 | | | $ | 701,800 | |

Exxon Mobil Corp. | | | 26,550 | | | | 2,847,487 | |

| | | | | | | | 7,658,741 | |

Pharmaceuticals — 6.7% | | | | | | | | |

AbbVie, Inc. | | | 12,543 | | | | 1,689,918 | |

Johnson & Johnson | | | 16,364 | | | | 2,708,570 | |

| | | | | | | | 4,398,488 | |

Pipelines — 3.6% | | | | | | | | |

Kinder Morgan, Inc. | | | 135,804 | | | | 2,338,545 | |

| | | | | | | | | |

Retail — 3.2% | | | | | | | | |

Genuine Parts Co. | | | 12,387 | | | | 2,096,252 | |

| | | | | | | | | |

Savings & Loans — 3.1% | | | | | | | | |

New York Community Bancorp, Inc. | | | 182,417 | | | | 2,050,367 | |

| | | | | | | | | |

Semiconductors — 11.2% | | | | | | | | |

Analog Devices, Inc. | | | 10,639 | | | | 2,072,584 | |

Broadcom, Inc. | | | 3,390 | | | | 2,940,587 | |

QUALCOMM, Inc. | | | 19,331 | | | | 2,301,162 | |

| | | | | | | | 7,314,333 | |

Telecommunications — 5.2% | | | | | | | | |

AT&T, Inc. | | | 94,318 | | | | 1,504,372 | |

Verizon Communications, Inc. | | | 50,705 | | | | 1,885,719 | |

| | | | | | | | 3,390,091 | |

TOTAL COMMON STOCKS (Cost $62,495,909) | | | | | | | 64,440,174 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 0.3% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 5.04% (b) | | | 209,914 | | | | 209,914 | |

TOTAL MONEY MARKET FUNDS (Cost $209,914) | | | | | | | 209,914 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $62,705,823) — 98.9% | | | | | | | 64,650,088 | |

Other assets and liabilities, net — 1.1% | | | | | | | 695,396 | |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 65,345,484 | |

Percentages are stated as a percent of net assets.

ADR — American Depositary Receipt

PLC — Public Limited Company

(a) | Foreign issued security. |

(b) | The rate shown is the yield at period end. |

The accompanying notes are an integral part of the financial statements.

7

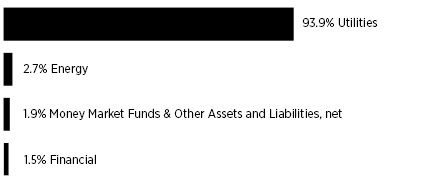

TrueShares Eagle Global Renewable Energy Income ETF

Schedule of Investments

June 30, 2023 (Unaudited)

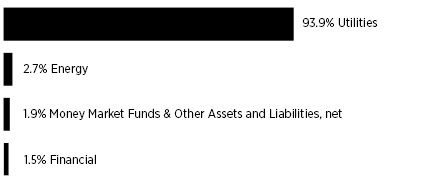

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 96.6% | | | | | | | | |

Electric — 93.9% (c) | | | | | | | | |

AGL Energy Ltd. (b) | | | 10,616 | | | $ | 76,447 | |

Atlantica Sustainable Infrastructure PLC (b) | | | 4,091 | | | | 95,893 | |

Boralex, Inc. - Class A (a)(b) | | | 2,068 | | | | 56,307 | |

Clearway Energy, Inc. - Class C | | | 2,895 | | | | 82,681 | |

EDP - Energias de Portugal SA (b) | | | 25,143 | | | | 122,804 | |

Electric Power Development Co. Ltd. (b) | | | 3,736 | | | | 54,864 | |

Endesa SA (b) | | | 6,334 | | | | 135,814 | |

Enel SpA (b) | | | 32,620 | | | | 219,550 | |

Enlight Renewable Energy Ltd. (a)(b) | | | 3,253 | | | | 57,741 | |

Fortum Oyj (b) | | | 4,190 | | | | 56,077 | |

Iberdrola SA (b) | | | 11,000 | | | | 143,439 | |

Mercury NZ Ltd. (b) | | | 16,492 | | | | 65,787 | |

NextEra Energy, Inc. | | | 4,046 | | | | 300,214 | |

Northland Power, Inc. (b) | | | 5,738 | | | | 119,676 | |

Orsted AS (b) | | | 2,361 | | | | 223,108 | |

PG&E Corp. (a) | | | 5,703 | | | | 98,548 | |

RWE AG (b) | | | 6,182 | | | | 268,956 | |

SSE PLC (b) | | | 9,971 | | | | 233,129 | |

The AES Corp. | | | 9,519 | | | | 197,329 | |

TransAlta Corp. (b) | | | 7,854 | | | | 73,515 | |

Verbund AG (b) | | | 1,002 | | | | 80,309 | |

| | | | | | | | 2,762,188 | |

Energy, Alternate Sources — 2.7% | | | | | | | | |

Enviva, Inc. | | | 7,217 | | | | 78,304 | |

TOTAL COMMON STOCKS (Cost $2,881,570) | | | | | | | 2,840,492 | |

| | | | | | | | | |

| | Shares | | | Value | |

REAL ESTATE INVESTMENT TRUSTS (REITS) — 1.5% | | | | | | | | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 1,735 | | | $ | 43,375 | |

TOTAL REITS (Cost $44,259) | | | | | | | 43,375 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 2.3% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 5.04% (d) | | | 68,350 | | | | 68,350 | |

TOTAL MONEY MARKET FUNDS (Cost $68,350) | | | | | | | 68,350 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $2,994,179) — 100.4% | | | | | | | 2,952,217 | |

Other assets and liabilities, net — (0.4)% | | | | | | | (11,605 | ) |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 2,940,612 | |

Percentages are stated as a percent of net assets.

PLC — Public Limited Company

(a) | Non-income producing security. |

(b) | Foreign issued security. |

(c) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(d) | The rate shown is the seven day yield at period end. |

COUNTRY | | Percentage of

Net Assets | |

United States | | | 27.2 | % |

United Kingdom | | | 11.2 | % |

Spain | | | 9.5 | % |

Germany | | | 9.1 | % |

Canada | | | 8.5 | % |

Denmark | | | 7.6 | % |

Italy | | | 7.5 | % |

Portugal | | | 4.2 | % |

Austria | | | 2.7 | % |

Australia | | | 2.6 | % |

New Zealand | | | 2.2 | % |

Israel | | | 2.0 | % |

Finland | | | 1.9 | % |

Japan | | | 1.9 | % |

Total Country | | | 98.1 | % |

MONEY MARKET FUNDS | | | 2.3 | % |

TOTAL INVESTMENTS | | | 100.4 | % |

Other assets and liabilities, net | | | (0.4 | )% |

NET ASSETS | | | 100.0 | % |

The accompanying notes are an integral part of the financial statements.

8

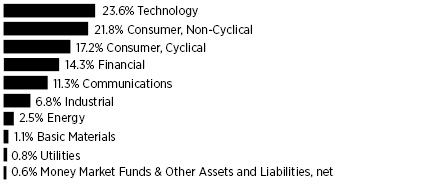

RiverNorth Patriot ETF

Schedule of Investments

June 30, 2023 (Unaudited)

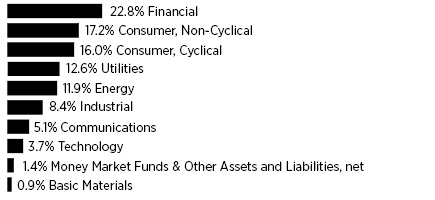

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 86.4% | | | | | | | | |

Advertising- 0.4% | | | | | | | | |

The Trade Desk, Inc. - Class A (a) | | | 177 | | | $ | 13,668 | |

| | | | | | | | | |

Agriculture — 0.5% | | | | | | | | |

Altria Group, Inc. | | | 331 | | | | 14,994 | |

| | | | | | | | | |

Airlines - 0.4% | | | | | | | | |

Southwest Airlines Co. | | | 372 | | | | 13,470 | |

| | | | | | | | | |

Auto Manufacturers — 0.9% | | | | | | | | |

Lucid Group, Inc. (a) | | | 2,079 | | | | 14,324 | |

Rivian Automotive, Inc. - Class A (a) | | | 903 | | | | 15,044 | |

| | | | | | | | 29,368 | |

Banks — 4.8% | | | | | | | | |

BOK Financial Corp. | | | 90 | | | | 7,270 | |

Citizens Financial Group, Inc. | | | 301 | | | | 7,850 | |

Comerica, Inc. | | | 142 | | | | 6,015 | |

Commerce Bancshares, Inc. | | | 162 | | | | 7,889 | |

Cullen/Frost Bankers, Inc. | | | 76 | | | | 8,172 | |

East West Bancorp, Inc. | | | 147 | | | | 7,760 | |

Fifth Third Bancorp | | | 287 | | | | 7,522 | |

First Citizens BancShares, Inc. - Class A | | | 5 | | | | 6,417 | |

First Horizon Corp. | | | 670 | | | | 7,551 | |

Huntington Bancshares, Inc. | | | 721 | | | | 7,772 | |

KeyCorp | | | 808 | | | | 7,466 | |

M&T Bank Corp. | | | 56 | | | | 6,931 | |

Prosperity Bancshares, Inc. | | | 103 | | | | 5,817 | |

Regions Financial Corp. | | | 437 | | | | 7,787 | |

SouthState Corp. | | | 91 | | | | 5,988 | |

The PNC Financial Services Group, Inc. | | | 73 | | | | 9,194 | |

Truist Financial Corp. | | | 248 | | | | 7,527 | |

U.S. Bancorp | | | 280 | | | | 9,251 | |

Webster Financial Corp. | | | 202 | | | | 7,626 | |

Wells Fargo & Co. | | | 219 | | | | 9,348 | |

| | | | | | | | 151,153 | |

| | Shares | | | Value | |

Beverages — 0.7% | | | | | | | | |

Coca-Cola Consolidated, Inc. | | | 15 | | | $ | 9,540 | |

Constellation Brands, Inc. - Class A | | | 55 | | | | 13,537 | |

| | | | | | | | 23,077 | |

Biotechnology — 1.7% | | | | | | | | |

Intra-Cellular Therapies, Inc. (a) | | | 209 | | | | 13,234 | |

Ionis Pharmaceuticals, Inc. (a) | | | 331 | | | | 13,581 | |

Sarepta Therapeutics, Inc. (a) | | | 117 | | | | 13,399 | |

Seagen, Inc. (a) | | | 73 | | | | 14,049 | |

| | | | | | | | 54,263 | |

Building Materials — 2.9% | | | | | | | | |

AAON, Inc. | | | 129 | | | | 12,230 | |

Builders FirstSource, Inc. (a) | | | 92 | | | | 12,512 | |

Eagle Materials, Inc. | | | 81 | | | | 15,100 | |

Martin Marietta Materials, Inc. | | | 26 | | | | 12,004 | |

Trex Co, Inc. (a) | | | 212 | | | | 13,899 | |

UFP Industries, Inc. | | | 121 | | | | 11,743 | |

Vulcan Materials Co. | | | 66 | | | | 14,879 | |

| | | | | | | | 92,367 | |

Chemicals — 0.5% | | | | | | | | |

Valvoline, Inc. | | | 368 | | | | 13,804 | |

| | | | | | | | | |

Commercial Services — 2.6% | | | | | | | | |

ADT, Inc. | | | 2,017 | | | | 12,163 | |

Booz Allen Hamilton Holding Corp. | | | 128 | | | | 14,285 | |

Paylocity Holding Corp. (a) | | | 75 | | | | 13,840 | |

R1 RCM, Inc. (a) | | | 741 | | | | 13,671 | |

Toast, Inc. - Class A (a) | | | 602 | | | | 13,587 | |

TriNet Group, Inc. (a) | | | 146 | | | | 13,866 | |

| | | | | | | | 81,412 | |

Computers — 0.9% | | | | | | | | |

CACI International, Inc. - Class A (a) | | | 41 | | | | 13,974 | |

Science Applications International Corp. | | | 126 | | | | 14,173 | |

| | | | | | | | 28,147 | |

Distribution & Wholesale — 0.4% | | | | | | | | |

SiteOne Landscape Supply, Inc. (a) | | | 81 | | | | 13,556 | |

| | | | | | | | | |

Diversified Financial Services — 3.6% | | | | | | | | |

Ally Financial, Inc. | | | 279 | | | | 7,536 | |

Ameriprise Financial, Inc. | | | 27 | | | | 8,968 | |

Apollo Global Management, Inc. | | | 100 | | | | 7,681 | |

Blue Owl Capital, Inc. | | | 516 | | | | 6,011 | |

Capital One Financial Corp. | | | 71 | | | | 7,765 | |

Cboe Global Markets, Inc. | | | 58 | | | | 8,005 | |

Credit Acceptance Corp. (a) | | | 13 | | | | 6,603 | |

Discover Financial Services | | | 69 | | | | 8,063 | |

LPL Financial Holdings, Inc. | | | 41 | | | | 8,915 | |

SoFi Technologies, Inc. (a) | | | 850 | | | | 7,089 | |

OneMain Holdings, Inc. | | | 140 | | | | 6,117 | |

The accompanying notes are an integral part of the financial statements.

9

RiverNorth Patriot ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

| | Shares | | | Value | |

Diversified Financial Services (continued) | | | | | | | | |

Synchrony Financial | | | 219 | | | $ | 7,428 | |

T. Rowe Price Group, Inc. | | | 73 | | | | 8,177 | |

The Charles Schwab Corp. | | | 164 | | | | 9,296 | |

Voya Financial, Inc. | | | 100 | | | | 7,171 | |

| | | | | | | | 114,825 | |

Electric — 11.1% |

Alliant Energy Corp. | | | 231 | | | | 12,123 | |

Ameren Corp. | | | 145 | | | | 11,842 | |

American Electric Power Co., Inc. | | | 147 | | | | 12,377 | |

Avangrid, Inc. | | | 315 | | | | 11,869 | |

CenterPoint Energy, Inc. | | | 414 | | | | 12,068 | |

CMS Energy Corp. | | | 204 | | | | 11,985 | |

Consolidated Edison, Inc. | | | 130 | | | | 11,752 | |

Constellation Energy Corp. | | | 129 | | | | 11,810 | |

Dominion Energy, Inc. | | | 233 | | | | 12,067 | |

DTE Energy Co. | | | 102 | | | | 11,222 | |

Duke Energy Corp. | | | 144 | | | | 12,923 | |

Edison International | | | 171 | | | | 11,876 | |

Entergy Corp. | | | 118 | | | | 11,490 | |

Evergy, Inc. | | | 202 | | | | 11,801 | |

Eversource Energy | | | 172 | | | | 12,198 | |

Exelon Corp. | | | 302 | | | | 12,303 | |

FirstEnergy Corp. | | | 304 | | | | 11,820 | |

IDACORP, Inc. | | | 101 | | | | 10,363 | |

NextEra Energy, Inc. | | | 187 | | | | 13,875 | |

NRG Energy, Inc. | | | 325 | | | | 12,152 | |

OGE Energy Corp. | | | 334 | | | | 11,994 | |

PG&E Corp. (a) | | | 703 | | | | 12,148 | |

Pinnacle West Capital Corp. | | | 146 | | | | 11,893 | |

PPL Corp. | | | 446 | | | | 11,801 | |

Public Service Enterprise Group, Inc. | | | 200 | | | | 12,522 | |

The Southern Co. | | | 200 | | | | 14,050 | |

Vistra Corp. | | | 465 | | | | 12,206 | |

WEC Energy Group, Inc. | | | 131 | | | | 11,559 | |

Xcel Energy, Inc. | | | 189 | | | | 11,750 | |

| | | | | | | | 349,839 | |

Engineering & Construction — 1.2% | | | | | | | | |

Comfort Systems USA, Inc. | | | 69 | | | | 11,330 | |

EMCOR Group, Inc. | | | 68 | | | | 12,565 | |

MasTec, Inc. (a) | | | 120 | | | | 14,156 | |

| | | | | | | | 38,051 | |

Entertainment — 1.3% | | | | | | | | |

Caesars Entertainment, Inc. (a) | | | 273 | | | | 13,915 | |

Churchill Downs, Inc. | | | 100 | | | | 13,917 | |

DraftKings, Inc. - Class A (a) | | | 516 | | | | 13,710 | |

| | | | | | | | 41,542 | |

| | Shares | | | Value | |

Environmental Control — 0.9% | | | | | | | | |

Republic Services, Inc. | | | 83 | | | $ | 12,713 | |

Waste Management, Inc. | | | 83 | | | | 14,394 | |

| | | | | | | | 27,107 | |

Food — 2.9% | | | | | | | | |

Albertsons Cos., Inc. - Class A | | | 612 | | | | 13,354 | |

Campbell Soup Co. | | | 300 | | | | 13,713 | |

Flowers Foods, Inc. | | | 482 | | | | 11,992 | |

Lancaster Colony Corp. | | | 67 | | | | 13,473 | |

Performance Food Group Co. (a) | | | 221 | | | | 13,314 | |

The Kroger Co. | | | 290 | | | | 13,630 | |

US Foods Holding Corp. (a) | | | 302 | | | | 13,288 | |

| | | | | | | | 92,764 | |

Gas — 0.8% | | | | | | | | |

Atmos Energy Corp. | | | 100 | | | | 11,634 | |

NiSource, Inc. | | | 440 | | | | 12,034 | |

| | | | | | | | 23,668 | |

Healthcare Products — 1.2% | | | | | | | | |

Inspire Medical Systems, Inc. (a) | | | 41 | | | | 13,310 | |

Lantheus Holdings, Inc. (a) | | | 156 | | | | 13,091 | |

Natera, Inc. (a) | | | 260 | | | | 12,652 | |

| | | | | | | | 39,053 | |

Healthcare Services — 4.9% | | | | | | | | |

agilon health, Inc. (a) | | | 775 | | | | 13,439 | |

Centene Corp. (a) | | | 197 | | | | 13,288 | |

Chemed Corp. | | | 28 | | | | 15,168 | |

Elevance Health, Inc. | | | 29 | | | | 12,884 | |

HealthEquity, Inc. (a) | | | 189 | | | | 11,933 | |

Humana, Inc. | | | 28 | | | | 12,520 | |

Molina Healthcare, Inc. (a) | | | 41 | | | | 12,351 | |

Quest Diagnostics, Inc. | | | 96 | | | | 13,494 | |

Surgery Partners, Inc. (a) | | | 263 | | | | 11,832 | |

Tenet Healthcare Corp. (a) | | | 166 | | | | 13,509 | |

The Ensign Group, Inc. | | | 129 | | | | 12,314 | |

UnitedHealth Group, Inc. | | | 27 | | | | 12,977 | |

| | | | | | | | 155,709 | |

Home Builders — 2.5% | | | | | | | | |

DR Horton, Inc. | | | 109 | | | | 13,264 | |

Lennar Corp. - Class A | | | 109 | | | | 13,659 | |

NVR, Inc. (a) | | | 2 | | | | 12,701 | |

PulteGroup, Inc. | | | 176 | | | | 13,672 | |

Taylor Morrison Home Corp. (a) | | | 250 | | | | 12,193 | |

Toll Brothers, Inc. | | | 176 | | | | 13,916 | |

| | | | | | | | 79,405 | |

Household Products & Wares — 0.4% | | | | | | | | |

Reynolds Consumer Products, Inc. | | | 484 | | | | 13,673 | |

| | | | | | | | | |

Insurance — 3.6% | | | | | | | | |

American Financial Group, Inc. | | | 69 | | | | 8,194 | |

The accompanying notes are an integral part of the financial statements.

10

RiverNorth Patriot ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

| | Shares | | | Value | |

Insurance (continued) | | | | | | | | |

Cincinnati Financial Corp. | | | 74 | | | $ | 7,202 | |

Equitable Holdings, Inc. | | | 279 | | | | 7,578 | |

Erie Indemnity Co. - Class A | | | 44 | | | | 9,241 | |

Fidelity National Financial, Inc. | | | 205 | | | | 7,380 | |

Globe Life, Inc. | | | 70 | | | | 7,673 | |

Kinsale Capital Group, Inc. | | | 13 | | | | 4,865 | |

Loews Corp. | | | 126 | | | | 7,482 | |

Markel Group, Inc. (a) | | | 5 | | | | 6,916 | |

Old Republic International Corp. | | | 309 | | | | 7,777 | |

The Allstate Corp. | | | 71 | | | | 7,742 | |

The Hartford Financial Services Group, Inc. | | | 114 | | | | 8,210 | |

The Progressive Corp. | | | 69 | | | | 9,133 | |

RLI Corp. | | | 55 | | | | 7,506 | |

Selective Insurance Group, Inc. | | | 72 | | | | 6,908 | |

| | | | | | | | 113,807 | |

Internet — 1.1% | | | | | | | | |

Robinhood Markets, Inc. - Class A (a) | | | 739 | | | | 7,375 | |

Roku, Inc. (a) | | | 208 | | | | 13,304 | |

Zillow Group, Inc. - Class C (a) | | | 258 | | | | 12,967 | |

| | | | | | | | 33,646 | |

Investment Companies — 0.6% |

Ares Capital Corp. | | | 408 | | | | 7,667 | |

FS KKR Capital Corp. | | | 308 | | | | 5,907 | |

Owl Rock Capital Corp. | | | 441 | | | | 5,918 | |

| | | | | | | | 19,492 | |

Iron & Steel — 0.4% | | | | | | | | |

Steel Dynamics, Inc. | | | 120 | | | | 13,072 | |

| | | | | | | | | |

Leisure Time — 0.4% | | | | | | | | |

Planet Fitness, Inc. - Class A (a) | | | 172 | | | | 11,600 | |

| | | | | | | | | |

Lodging — 0.4% | | | | | | | | |

Boyd Gaming Corp. | | | 198 | | | | 13,735 | |

| | | | | | | | | |

Media — 2.6% | | | | | | | | |

Charter Communications, Inc. - Class A (a) | | | 38 | | | | 13,960 | |

Fox Corp. - Class A | | | 396 | | | | 13,464 | |

Liberty Broadband Corp. - Class C (a) | | | 171 | | | | 13,699 | |

Nexstar Media Group, Inc. | | | 83 | | | | 13,824 | |

Sirius XM Holdings, Inc. | | | 3,174 | | | | 14,378 | |

The New York Times Co. - Class A | | | 335 | | | | 13,192 | |

| | | | | | | | 82,517 | |

Oil & Gas — 7.6% | | | | | | | | |

Antero Resources Corp. (a) | | | 601 | | | | 13,841 | |

Chesapeake Energy Corp. | | | 167 | | | | 13,975 | |

Chord Energy Corp. | | | 84 | | | | 12,919 | |

Civitas Resources, Inc. | | | 178 | | | | 12,348 | |

| | Shares | | | Value | |

Oil & Gas (continued) | | | | | | | | |

Coterra Energy, Inc. | | | 549 | | | $ | 13,889 | |

Devon Energy Corp. | | | 287 | | | | 13,874 | |

Diamondback Energy, Inc. | | | 98 | | | | 12,873 | |

EOG Resources, Inc. | | | 141 | | | | 16,136 | |

EQT Corp. | | | 334 | | | | 13,737 | |

HF Sinclair Corp. | | | 302 | | | | 13,472 | |

Marathon Oil Corp. | | | 606 | | | | 13,950 | |

Marathon Petroleum Corp. | | | 123 | | | | 14,342 | |

Matador Resources Co. | | | 260 | | | | 13,603 | |

PDC Energy, Inc. | | | 197 | | | | 14,015 | |

Pioneer Natural Resources Co. | | | 69 | | | | 14,295 | |

Range Resources Corp. | | | 464 | | | | 13,642 | |

Southwestern Energy Co. (a) | | | 2,320 | | | | 13,943 | |

Texas Pacific Land Corp. | | | 5 | | | | 6,583 | |

| | | | | | | | 241,437 | |

Pharmaceuticals — 2.2% | | | | | | | | |

Cardinal Health, Inc. | | | 137 | | | | 12,956 | |

CVS Health Corp. | | | 214 | | | | 14,794 | |

Neurocrine Biosciences, Inc. (a) | | | 146 | | | | 13,768 | |

Option Care Health, Inc. (a) | | | 374 | | | | 12,151 | |

The Cigna Group | | | 55 | | | | 15,432 | |

| | | | | | | | 69,101 | |

Pipelines — 1.7% | | | | | | | | |

Kinder Morgan, Inc. | | | 793 | | | | 13,655 | |

ONEOK, Inc. | | | 222 | | | | 13,702 | |

Targa Resources Corp. | | | 176 | | | | 13,394 | |

The Williams Cos., Inc. | | | 418 | | | | 13,639 | |

| | | | | | | | 54,390 | |

Private Equity — 0.5% | | | | | | | | |

Ares Management Corp. - Class A | | | 84 | | | | 8,093 | |

Blackstone, Inc. | | | 98 | | | | 9,111 | |

| | | | | | | | 17,204 | |

Retail — 9.6% | | | | | | | | |

AutoNation, Inc. (a) | | | 77 | | | | 12,675 | |

Beacon Roofing Supply, Inc. (a) | | | 140 | | | | 11,617 | |

BJ’s Wholesale Club Holdings, Inc. (a) | | | 207 | | | | 13,043 | |

Burlington Stores, Inc. (a) | | | 85 | | | | 13,378 | |

CarMax, Inc. (a) | | | 158 | | | | 13,225 | |

Casey’s General Stores, Inc. | | | 52 | | | | 12,682 | |

Chipotle Mexican Grill, Inc. (a) | | | 7 | | | | 14,973 | |

Darden Restaurants, Inc. | | | 87 | | | | 14,536 | |

Dick’s Sporting Goods, Inc. | | | 99 | | | | 13,087 | |

Dollar General Corp. | | | 84 | | | | 14,261 | |

Five Below, Inc. (a) | | | 68 | | | | 13,365 | |

Floor & Decor Holdings, Inc. - Class A (a) | | | 132 | | | | 13,723 | |

Lithia Motors, Inc. | | | 39 | | | | 11,860 | |

Murphy USA, Inc. | | | 41 | | | | 12,755 | |

The accompanying notes are an integral part of the financial statements.

11

RiverNorth Patriot ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

| | Shares | | | Value | |

Retail (continued) | | | | | | | | |

O’Reilly Automotive, Inc. (a) | | | 13 | | | $ | 12,419 | |

RH (a) | | | 39 | | | | 12,854 | |

Ross Stores, Inc. | | | 127 | | | | 14,241 | |

Target Corp. | | | 114 | | | | 15,036 | |

Texas Roadhouse, Inc. | | | 124 | | | | 13,923 | |

Tractor Supply Co. | | | 57 | | | | 12,603 | |

Ulta Beauty, Inc. (a) | | | 27 | | | | 12,706 | |

Williams-Sonoma, Inc. | | | 110 | | | | 13,765 | |

Wingstop, Inc. | | | 53 | | | | 10,609 | |

| | | | | | | | 303,336 | |

Savings & Loans — 0.2% | | | | | | | | |

New York Community Bancorp, Inc. | | | 678 | | | | 7,621 | |

| | | | | | | | | |

Shipbuilding — 0.4% | | | | | | | | |

Huntington Ingalls Industries, Inc. | | | 56 | | | | 12,746 | |

| | | | | | | | | |

Software — 2.8% | | | | | | | | |

Bill.com Holdings, Inc. (a) | | | 106 | | | | 12,386 | |

Black Knight, Inc. (a) | | | 126 | | | | 7,526 | |

CCC Intelligent Solutions Holdings, Inc. (a) | | | 679 | | | | 7,612 | |

DoubleVerify Holdings, Inc. (a) | | | 349 | | | | 13,583 | |

Intuit, Inc. | | | 29 | | | | 13,288 | |

Jack Henry & Associates, Inc. | | | 42 | | | | 7,028 | |

Paychex, Inc. | | | 115 | | | | 12,865 | |

Paycom Software, Inc. | | | 44 | | | | 14,134 | |

| | | | | | | | 88,422 | |

Telecommunications — 1.0% | | | | | | | | |

AT&T, Inc. | | | 948 | | | | 15,121 | |

Verizon Communications, Inc. | | | 414 | | | | 15,396 | |

| | | | | | | | 30,517 | |

Transportation — 3.0% | | | | | | | | |

CSX Corp. | | | 444 | | | | 15,140 | |

JB Hunt Transport Services, Inc. | | | 68 | | | | 12,310 | |

Knight-Swift Transportation Holdings, Inc. | | | 248 | | | | 13,780 | |

Landstar System, Inc. | | | 67 | | | | 12,900 | |

Norfolk Southern Corp. | | | 69 | | | | 15,646 | |

Old Dominion Freight Line, Inc. | | | 36 | | | | 13,311 | |

Saia, Inc. (a) | | | 37 | | | | 12,669 | |

| | | | | | | | 95,756 | |

Water — 0.8% | | | | | | | | |

American Water Works Co., Inc. | | | 90 | | | | 12,848 | |

Essential Utilities, Inc. | | | 294 | | | | 11,734 | |

| | | | | | | | 24,582 | |

TOTAL COMMON STOCKS (Cost $2,740,100) | | | | | | | 2,737,896 | |

| | | | | | | | | |

| | Shares | | | Value | |

PARTNERSHIPS — 3.0% | | | | | | | | |

Investment Companies — 0.4% | | | | | | | | |

Icahn Enterprises LP | | | 479 | | | $ | 13,905 | |

| | | | | | | | | |

Pipelines — 2.6% | | | | | | | | |

Cheniere Energy Partners LP | | | 286 | | | | 13,196 | |

Energy Transfer LP | | | 1,049 | | | | 13,322 | |

Enterprise Products Partners LP | | | 579 | | | | 15,258 | |

Magellan Midstream Partners LP | | | 217 | | | | 13,524 | |

MPLX LP | | | 394 | | | | 13,372 | |

Western Midstream Partners LP | | | 505 | | | | 13,392 | |

| | | | | | | | 82,064 | |

TOTAL PARTNERSHIPS (Cost $83,783) | | | | | | | 95,969 | |

| | | | | | | | | |

REAL ESTATE INVESTMENTS TRUSTS (REITS) — 9.2% |

AGNC Investment Corp. | | | 736 | | | | 7,456 | |

Agree Realty Corp. | | | 115 | | | | 7,520 | |

Alexandria Real Estate Equities, Inc. | | | 72 | | | | 8,171 | |

American Homes 4 Rent - Class A | | | 213 | | | | 7,551 | |

Annaly Capital Management, Inc. | | | 364 | | | | 7,284 | |

Apartment Income REIT Corp. | | | 176 | | | | 6,352 | |

AvalonBay Communities, Inc. | | | 44 | | | | 8,328 | |

Boston Properties, Inc. | | | 135 | | | | 7,775 | |

Brixmor Property Group, Inc. | | | 353 | | | | 7,766 | |

Camden Property Trust | | | 74 | | | | 8,056 | |

Crown Castle, Inc. | | | 85 | | | | 9,686 | |

CubeSmart | | | 168 | | | | 7,503 | |

EastGroup Properties, Inc. | | | 43 | | | | 7,465 | |

Equity LifeStyle Properties, Inc. | | | 118 | | | | 7,893 | |

Equity Residential | | | 115 | | | | 7,587 | |

Essex Property Trust, Inc. | | | 28 | | | | 6,560 | |

Extra Space Storage, Inc. | | | 55 | | | | 8,186 | |

Federal Realty Investment Trust | | | 85 | | | | 8,225 | |

First Industrial Realty Trust, Inc. | | | 144 | | | | 7,580 | |

Gaming and Leisure Properties, Inc. | | | 161 | | | | 7,802 | |

Healthcare Realty Trust, Inc. | | | 412 | | | | 7,770 | |

Healthpeak Properties, Inc. | | | 375 | | | | 7,537 | |

Host Hotels & Resorts, Inc. | | | 454 | | | | 7,641 | |

Invitation Homes, Inc. | | | 213 | | | | 7,327 | |

Kimco Realty Corp. | | | 396 | | | | 7,809 | |

Lamar Advertising Co. - Class A | | | 82 | | | | 8,139 | |

Life Storage, Inc. | | | 55 | | | | 7,313 | |

Mid-America Apartment Communities, Inc. | | | 43 | | | | 6,530 | |

NNN REIT, Inc. | | | 186 | | | | 7,959 | |

Public Storage | | | 28 | | | | 8,173 | |

Regency Centers Corp. | | | 129 | | | | 7,968 | |

Rexford Industrial Realty, Inc. | | | 147 | | | | 7,676 | |

Ryman Hospitality Properties, Inc. | | | 72 | | | | 6,690 | |

The accompanying notes are an integral part of the financial statements.

12

RiverNorth Patriot ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

| | Shares | | | Value | |

REITS (continued) | | | | |

Simon Property Group, Inc. | | | 69 | | | $ | 7,968 | |

Spirit Realty Capital, Inc. | | | 158 | | | | 6,222 | |

STAG Industrial, Inc. | | | 216 | | | | 7,750 | |

UDR, Inc. | | | 173 | | | | 7,432 | |

VICI Properties, Inc. | | | 249 | | | | 7,826 | |

TOTAL REITS (Cost $338,222) | | | | | | | 290,476 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 3.9% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 5.04% (b) | | | 122,080 | | | | 122,080 | |

TOTAL MONEY MARKET FUNDS (Cost $122,080) | | | | | | | 122,080 | |

| | | | | | | | | |

Total Investments (Cost $3,284,185) — 102.5% | | | | | | | 3,246,421 | |

Other assets and liabilities, net — (2.5)% | | | | | | | (78,675 | ) |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 3,167,746 | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | The rate shown is the seven day yield at period end. |

The accompanying notes are an integral part of the financial statements.

13

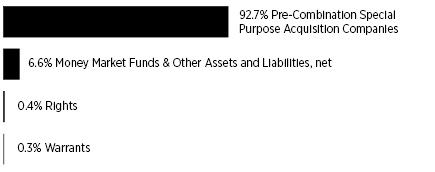

RiverNorth Enhanced Pre-Merger SPAC ETF

Schedule of Investments

June 30, 2023 (Unaudited)

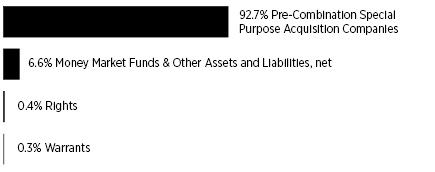

Sector Diversification *

* | Percentages are stated as a percent of net assets. |

| | Shares | | | Value | |

COMMON STOCKS — 92.7% | | | | | | | | |

Pre-Combination Special Purpose Acquisition Companies — 92.7% (a) |

Acri Capital Acquisition Corp. | | | 10,522 | | | $ | 113,638 | |

Alchemy Investments Acquisition Corp. 1 - Tracking Stock (b) | | | 6,363 | | | | 65,157 | |

Ares Acquisition Corp. - Class A (b) | | | 7,946 | | | | 83,989 | |

Ares Acquisition Corp. II - Tracking Stock (b) | | | 23,273 | | | | 238,548 | |

Bukit Jalil Global Acquisition 1 Ltd. - Tracking Stock (b) | | | 23,000 | | | | 234,140 | |

Churchill Capital Corp. V - Class A | | | 20,425 | | | | 207,722 | |

Churchill Capital Corp. VII | | | 20,000 | | | | 206,800 | |

Conyers Park III Acquisition Corp. - Class A | | | 10,552 | | | | 107,841 | |

Distoken Acquisition Corp. (b) | | | 10,238 | | | | 105,810 | |

ESH Acquisition Corp. - Tracking Stock | | | 23,000 | | | | 233,220 | |

Four Leaf Acquisition Corp. - Class A | | | 23,000 | | | | 237,130 | |

FTAC Zeus Acquisition Corp. - Class A | | | 18,192 | | | | 189,652 | |

Fusion Acquisition Corp. II - Class A | | | 2 | | | | 22 | |

Fusion Acquisition Corp. II | | | 22,998 | | | | 238,719 | |

Goal Acquisitions Corp. | | | 6,973 | | | | 72,415 | |

Gores Holdings IX, Inc. - Class A | | | 21,142 | | | | 216,707 | |

Golden Star Acquisition Corp. - Tracking Stock (b) | | | 28,085 | | | | 292,365 | |

Graf Acquisition Corp. IV | | | 10,502 | | | | 108,486 | |

Hennessy Capital Investment Corp. VI - Class A | | | 14,565 | | | | 150,020 | |

Horizon Space Acquisition I Corp. (b) | | | 3,578 | | | | 37,372 | |

Inflection Point Acquisition Corp. II - Tracking Stock (b) | | | 23,374 | | | | 236,545 | |

Innovative International Acquisition Corp. - Class A (b) | | | 21,043 | | | | 229,578 | |

Israel Acquisitions Corp. - Class A (b) | | | 5,375 | | | | 55,846 | |

Kernel Group Holdings, Inc. - Class A (b) | | | 10,522 | | | | 110,481 | |

Live Oak Crestview Climate Acquisition Corp. - Class A | | | 7,077 | | | | 72,539 | |

Mars Acquisition Corp. (b) | | | 10,840 | | | | 112,519 | |

Newbury Street Acquisition Corp. | | | 21,043 | | | | 218,426 | |

Oak Woods Acquisition Corp. - Class A (b) | | | 23,000 | | | | 236,325 | |

OCA Acquisition Corp. - Class A | | | 13,677 | | | | 143,745 | |

| | Shares | | | Value | |

Pre-Combination Special Purpose Acquisition Companies (continued) |

Pono Capital Three, Inc. - Class A (b) | | | 10,989 | | | $ | 114,231 | |

Quantum FinTech Acquisition Corp. | | | 13,725 | | | | 142,603 | |

Screaming Eagle Acquisition Corp. - Class A (b) | | | 22,929 | | | | 236,856 | |

TMT Acquisition Corp. - Class A (b) | | | 23,000 | | | | 236,670 | |

Trailblazer Merger Corp. I | | | 22,022 | | | | 224,404 | |

TOTAL COMMON STOCKS (Cost $5,327,615) | | | | | | | 5,510,521 | |

| | | | | | | | | |

RIGHTS — 0.4% (a) | | | | | | | | |

Distoken Acquisition Corp., Expiration: November 2027 (b) | | | 10,238 | | | | 2,114 | |

Horizon Space Acquisition I Corp., Expiration: March 2024 (b) | | | 3,578 | | | | 531 | |

Mars Acquisition Corp., Expiration: February 2028 (b) | | | 10,840 | | | | 2,708 | |

Oak Woods Acquisition Corp., Expiration: March 2028 (b) | | | 23,000 | | | | 4,830 | |

TMT Acquisition Corp., Expiration: March 2028 (b) | | | 23,000 | | | | 8,050 | |

Trailblazer Merger Corp. I, Expiration: April 2028 | | | 22,022 | | | | 3,127 | |

TOTAL RIGHTS (Cost $15,050) | | | | | | | 21,360 | |

| | | | | | | | | |

WARRANTS — 0.3% (a) | | | | | | | | |

Apollo Strategic Growth Capital II - Class A, Expiration: December 2027, Exercise Price: $11.50 (b) | | | 3,562 | | | | 437 | |

Ares Acquisition Corp. - Class A, Expiration: December 2027, Exercise Price: $11.50 (b) | | | 767 | | | | 614 | |

Bite Acquisition Corp., Expiration: December 2027, Exercise Price: $11.50 | | | 2,317 | | | | 193 | |

CC Neuberger Principal Holdings III, Expiration: December 2027, Exercise Price: $11.50 (b) | | | 455 | | | | 86 | |

CF Acquisition Corp. IV, Expiration: December 2025, Exercise Price: $11.50 | | | 2,118 | | | | 147 | |

Churchill Capital Corp. V - Class A, Expiration: October 2027, Exercise Price: $11.50 | | | 3,679 | | | | 663 | |

Churchill Capital Corp. VI - Class A, Expiration: December 2027, Exercise Price: $11.50 | | | 3,511 | | | | 632 | |

Churchill Capital Corp. VII - Class A, Expiration: February 2028, Exercise Price: $11.50 | | | 3,382 | | | | 473 | |

Conyers Park III Acquisition Corp., Expiration: August 2028, Exercise Price: $11.50 | | | 2,175 | | | | 109 | |

Distoken Acquisition Corp., Expiration: March 2028, Exercise Price: $11.50 (b) | | | 10,238 | | | | 393 | |

The accompanying notes are an integral part of the financial statements.

14

RiverNorth Enhanced Pre-Merger SPAC ETF

Schedule of Investments

June 30, 2023 (Unaudited) (Continued)

| | Shares | | | Value | |

WARRANTS (continued) | | | | | | | | |

FAST Acquisition Corp. II - Class A, Expiration: March 2026, Exercise Price: $11.50 | | | 2,675 | | | $ | 1,870 | |

Four Leaf Acquisition Corp., Expiration: May 2028, Exercise Price: $11.50 | | | 23,000 | | | | 2,230 | |

Fusion Acquisition Corp. II - Class A, Expiration: December 2027, Exercise Price: $11.50 | | | 7,666 | | | | 38 | |

Goal Acquisitions Corp., Expiration: February 2026, Exercise Price: $11.50 | | | 2,841 | | | | 69 | |

Gores Holdings IX, Inc., Expiration: January 2029, Exercise Price: $11.50 | | | 5,071 | | | | 1,114 | |

Graf Acquisition Corp. IV, Expiration: May 2028, Exercise Price: $11.50 | | | 1,751 | | | | 399 | |

Hennessy Capital Investment Corp. VI - Class A, Expiration: December 2027, Exercise Price: $11.50 | | | 4,085 | | | | 449 | |

Horizon Space Acquisition I Corp., Expiration: January 2028, Exercise Price: $11.50 (b) | | | 3,578 | | | | 185 | |

Israel Acquisitions Corp., Expiration: February 2028, Exercise Price: $11.50 (b) | | | 5,375 | | | | 806 | |

Jaws Mustang Acquisition Corp., Expiration: January 2026, Exercise Price: $11.50 (b) | | | 2,053 | | | | 103 | |

Live Oak Crestview Climate Acquisition Corp., Expiration: March 2026, Exercise Price: $11.50 | | | 1,424 | | | | 49 | |

Net Power, Inc., Expiration: March 2026, Exercise Price: $11.50 | | | 1,085 | | | | 3,646 | |

Oak Woods Acquisition Corp., Expiration: May 2028, Exercise Price: $11.50 (b) | | | 23,000 | | | | 745 | |

Pono Capital Three, Inc. - Class A, Expiration: April 2028, Exercise Price: $11.50 (b) | | | 10,989 | | | | 1,868 | |

Screaming Eagle Acquisition Corp. - Class A, Expiration: December 2027, Exercise Price: $11.50 (b) | | | 5,917 | | | | 804 | |

Slam Corp. - Class A, Expiration: December 2027, Exercise Price: $11.50 (b) | | | 3,592 | | | | 682 | |

Twelve Seas Investment Co. II - Class A, Expiration: March 2028, Exercise Price: $11.50 | | | 3,509 | | | | 234 | |

TOTAL WARRANTS (Cost $15,603) | | | | | | | 19,038 | |

| | Shares | | | Value | |

MONEY MARKET FUNDS — 8.5% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 5.04% (c) | | | 506,797 | | | $ | 506,797 | |

TOTAL MONEY MARKET FUNDS (Cost $506,797) | | | | | | | 506,797 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $5,865,065) — 101.9% | | | | | | | 6,057,716 | |

Other assets and liabilities, net — (1.9)% | | | | | | | (110,406 | ) |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 5,947,310 | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | Foreign issued security. |

(c) | The rate shown is the seven day yield at period end. |

COUNTRY | Percentage of

Net Assets |

United States | 48.5% |

Cayman Islands | 44.6%* |

Total Country | 93.1% |

RIGHTS | 0.4% |

WARRANTS | 0.3% |

MONEY MARKET FUNDS | 8.5% |

TOTAL INVESTMENTS | 101.9% |

Other assets and liabilities, net | (1.9)% |

NET ASSETS | 100.0% |

* | To the extent the Fund invests more heavily in particular countries, its performance will be especially sensitive to developments that significantly affect those countries. |

The accompanying notes are an integral part of the financial statements.

15

THIS PAGE INTENTIONALLY LEFT BLANK

TrueShares ETFs

Statements of Assets and Liabilities

June 30, 2023 (Unaudited)

| | | TrueShares

Technology,

AI & Deep

Learning ETF | | | TrueShares

ESG Active

Opportunities

ETF | | | TrueShares Low

Volatility Equity

Income ETF | | | TrueShares

Eagle Global

Renewable

Energy

Income ETF | |

Assets | | | | | | | | | | | | | | | | |

Investments, at value(1) | | $ | 34,161,439 | | | $ | 2,429,557 | | | $ | 64,650,088 | | | $ | 2,952,217 | |

Receivable for investment securities sold | | | — | | | | — | | | | 3,054,426 | | | | — | |

Receivable for Fund shares sold | | | — | | | | — | | | | 1,089,524 | | | | — | |

Dividends and interest receivable | | | 8,685 | | | | 2,222 | | | | 113,453 | | | | 11,593 | |

Total assets | | | 34,170,124 | | | | 2,431,779 | | | | 68,907,491 | | | | 2,963,810 | |

| | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | |

Payable to Adviser | | | 15,623 | | | | 1,322 | | | | 34,337 | | | | 1,780 | |

Payable for investment securities purchased | | | — | | | | — | | | | 2,429,406 | | | | 21,418 | |

Payable for Fund shares redeemed | | | — | | | | — | | | | 1,098,264 | | | | — | |

Total liabilities | | | 15,623 | | | | 1,322 | | | | 3,562,007 | | | | 23,198 | |

Net Assets | | $ | 34,154,501 | | | $ | 2,430,457 | | | $ | 65,345,484 | | | $ | 2,940,612 | |

| | | | | | | | | | | | | | | | | |

Net Assets Consists of: | | | | | | | | | | | | | | | | |

Paid-in capital | | $ | 46,228,764 | | | $ | 1,210,305 | | | $ | 67,919,996 | | | $ | 2,972,232 | |

Total distributable earnings (accumulated losses) | | | (12,074,263 | ) | | | 1,220,152 | | | | (2,574,512 | ) | | | (31,620 | ) |

Net Assets | | $ | 34,154,501 | | | $ | 2,430,457 | | | $ | 65,345,484 | | | $ | 2,940,612 | |

| | | | | | | | | | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 1,070,000 | | | | 65,000 | | | | 2,380,000 | | | | 120,000 | |

Net Asset Value, redemption price and offering price per share | | $ | 31.92 | | | $ | 37.39 | | | | 27.46 | | | | 24.51 | |

| | | | | | | | | | | | | | | | | |

(1) Cost of investments | | $ | 38,287,446 | | | $ | 2,140,768 | | | $ | 62,705,823 | | | $ | 2,994,179 | |

The accompanying notes are an integral part of the financial statements.

17

TrueShares ETFs

Statements of Assets and Liabilities

June 30, 2023 (Unaudited) (Continued)

| | | RiverNorth

Patriot ETF | | | RiverNorth

Enhanced

Pre-Merger

SPAC ETF | |

Assets | | | | | | | | |

Investments, at value(1) | | $ | 3,246,421 | | | $ | 6,057,716 | |

Dividends and interest receivable | | | 4,303 | | | | 2,948 | |

Receivable for investment securities sold | | | 165,259 | | | | — | |

Total assets | | | 3,415,983 | | | | 6,060,664 | |

| | | | | | | | | |

Liabilities | | | | | | | | |

Payable to Adviser | | | 1,772 | | | | 4,384 | |

Payable for investment securities purchased | | | 246,465 | | | | 108,970 | |

Total liabilities | | | 248,237 | | | | 113,354 | |

Net Assets | | $ | 3,167,746 | | | $ | 5,947,310 | |

| | | | | | | | | |

Net Assets Consists of: | | | | | | | | |

Paid-in capital | | $ | 3,523,075 | | | $ | 5,656,515 | |

Total distributable earnings (accumulated losses) | | | (355,329 | ) | | | 290,795 | |

Net Assets | | $ | 3,167,746 | | | $ | 5,947,310 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 140,000 | | | | 225,000 | |

Net Asset Value, redemption price and offering price per share | | $ | 22.63 | | | $ | 26.43 | |

| | | | | | | | | |

(1) Cost of investments | | $ | 3,284,185 | | | $ | 5,865,065 | |

The accompanying notes are an integral part of the financial statements.

18

TrueShares ETFs

Statements of Operations

For the Six Months Ended June 30, 2023 (Unaudited)

| | | TrueShares

Technology,

AI & Deep

Learning ETF | | | TrueShares

ESG Active

Opportunities

ETF | | | TrueShares Low

Volatility Equity

Income ETF | | | TrueShares

Eagle Global

Renewable

Energy

Income ETF | |

Investment Income | | | | | | | | | | | | | | | | |

Dividend income (net of withholding taxes and issuance fees of $—, $—, $541 and $7,672, respectively) | | $ | 344 | | | $ | 37,305 | | | $ | 1,165,981 | | | $ | 46,548 | |

Interest income | | | 9,796 | | | | 1,469 | | | | 49,947 | | | | 1,275 | |

Total investment income | | | 10,140 | | | | 38,775 | | | | 1,215,928 | | | | 47,823 | |

| | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | |

Investment advisory fees | | | 60,440 | | | | 14,560 | | | | 227,812 | | | | 9,349 | |

Total expenses | | | 60,440 | | | | 14,560 | | | | 227,812 | | | | 9,349 | |

Net Investment Income (Loss) | | | (50,300 | ) | | | 24,215 | | | | 988,116 | | | | 38,474 | |

| | | | | | | | | | | | | | | | | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

Investments | | | (3,937,463 | ) | | | 996,961 | | | | (913,116 | ) | | | 2,039 | |

Foreign currency transactions | | | — | | | | — | | | | — | | | | (107 | ) |

Net realized gain (loss) on investments and foreign currency transactions | | | (3,937,463 | ) | | | 996,961 | | | | (913,116 | ) | | | 1,932 | |

Net change in unrealized appreciation/depreciation on: | | | | | | | | | | | | | | | | |

Investments | | | 9,543,766 | | | | (266,235 | ) | | | (2,877,169 | ) | | | (6,058 | ) |

Foreign currency translation | | | — | | | | — | | | | — | | | | 818 | |

Net change in unrealized appreciation/depreciation on investments and foreign currency translation | | | 9,543,766 | | | | (266,235 | ) | | | (2,877,169 | ) | | | (5,240 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 5,606,303 | | | | 730,726 | | | | (3,790,285 | ) | | | (3,308 | ) |

Net increase (decrease) in net assets from operations | | $ | 5,556,003 | | | $ | 754,941 | | | $ | (2,802,169 | ) | | $ | 35,166 | |

The accompanying notes are an integral part of the financial statements.

19

TrueShares ETFs

Statements of Operations

For the Six Months Ended June 30, 2023 (Unaudited) (Continued)

| | | RiverNorth

Patriot ETF | | | RiverNorth

Enhanced

Pre-Merger

SPAC ETF | |

Investment Income | | | | | | | | |

Dividend income | | $ | 34,450 | | | $ | — | |

Interest income | | | 473 | | | | 12,420 | |

Total investment income | | | 34,923 | | | | 12,420 | |

| | | | | | | | | |

Expenses | | | | | | | | |

Investment advisory fees | | | 11,237 | | | | 25,596 | |

Total expenses | | | 11,237 | | | | 25,596 | |

Net Investment Income (Loss) | | | 23,686 | | | | (13,176 | ) |

| | | | | | | | | |

Realized and Unrealized Gain (Loss) on Investments | | | | | | | | |

Net realized gain (loss) on investments | | | (149,393 | ) | | | 102,508 | |

Net change in unrealized appreciation/depreciation on investments | | | 255,282 | | | | 131,070 | |

Net realized and unrealized gain on investments | | | 105,889 | | | | 233,578 | |

Net increase in net assets from operations | | $ | 129,575 | | | $ | 220,402 | |

The accompanying notes are an integral part of the financial statements.

20

TrueShares ETFs

Statements of Changes in Net Assets

| | | TrueShares Technology, AI

& Deep Learning ETF | | | TrueShares ESG Active

Opportunities ETF | |

| | | Six Months

Ended

June 30, 2023

(Unaudited) | | | Year Ended

December 31,

2022 | | | Six Months

Ended

June 30, 2023

(Unaudited) | | | Year Ended

December 31,

2022 | |

From Operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (50,300 | ) | | $ | (131,297 | ) | | $ | 24,215 | | | $ | 56,514 | |

Net realized gain (loss) on investments | | | (3,937,463 | ) | | | (1,688,095 | ) | | | 996,961 | | | | 518,697 | |

Net change in unrealized appreciation/depreciation on investments | | | 9,543,766 | | | | (16,195,089 | ) | | | (266,235 | ) | | | (2,722,553 | ) |

Net increase (decrease) in net assets resulting from operations | | | 5,556,003 | | | | (18,014,481 | ) | | | 754,941 | | | | (2,147,342 | ) |

| | | | | | | | | | | | | | | | | |

From Distributions | | | | | | | | | | | | | | | | |

Distributable earnings | | | — | | | | — | | | | — | | | | (55,980 | ) |

Total distributions | | | — | | | | — | | | | — | | | | (55,980 | ) |

| | | | | | | | | | | | | | | | | |

From Capital Share Transactions | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | 18,647,455 | | | | 5,630,240 | | | | — | | | | — | |

Cost of shares redeemed | | | (4,348,829 | ) | | | (11,009,818 | ) | | | (4,675,272 | ) | | | (1,793,493 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | | 14,298,626 | | | | (5,379,578 | ) | | | (4,675,272 | ) | | | (1,793,493 | ) |

| | | | | | | | | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | 19,854,629 | | | | (23,394,059 | ) | | | (3,920,331 | ) | | | (3,996,815 | ) |

| | | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of period | | | 14,299,872 | | | | 37,693,931 | | | | 6,350,788 | | | | 10,347,603 | |

End of period | | $ | 34,154,501 | | | $ | 14,299,872 | | | $ | 2,430,457 | | | $ | 6,350,788 | |

| | | | | | | | | | | | | | | | | |

Changes in Shares Outstanding | | | | | | | | | | | | | | | | |

Shares outstanding, beginning of period | | | 625,000 | | | | 800,000 | | | | 200,000 | | | | 250,000 | |

Shares sold | | | 600,000 | | | | 150,000 | | | | — | | | | — | |

Shares redeemed | | | (155,000 | ) | | | (325,000 | ) | | | (135,000 | ) | | | (50,000 | ) |

Shares outstanding, end of period | | | 1,070,000 | | | | 625,000 | | | | 65,000 | | | | 200,000 | |

The accompanying notes are an integral part of the financial statements.

21

TrueShares ETFs

Statements of Changes in Net Assets

(Continued)

| | | TrueShares Low Volatility

Equity Income ETF | | | TrueShares Eagle Global

Renewable Energy Income ETF | |

| | | Six Months

Ended

June 30, 2023

(Unaudited) | | | Year Ended

December 31,

2022 | | | Six Months

Ended

June 30, 2023

(Unaudited) | | | Period Ended

December 31,

2022(1) | |

From Operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 988,116 | | | $ | 2,076,126 | | | $ | 38,474 | | | $ | (271 | ) |

Net realized gain (loss) on investments and foreign currency | | | (913,116 | ) | | | (1,788,783 | ) | | | 1,932 | | | | (1,747 | ) |

Net change in unrealized appreciation/depreciation on investments and foreign currency | | | (2,877,169 | ) | | | 1,890,513 | | | | (5,240 | ) | | | (36,740 | ) |

Net increase (decrease) in net assets resulting from operations | | | (2,802,169 | ) | | | 2,177,856 | | | | 35,166 | | | | (38,758 | ) |

| | | | | | | | | | | | | | | | | |

From Distributions | | | | | | | | | | | | | | | | |

Distributable earnings | | | (987,990 | ) | | | (2,075,345 | ) | | | (28,300 | ) | | | — | |

Return of capital | | | — | | | | (693 | ) | | | — | | | | (238 | ) |

Total distributions | | | (987,990 | ) | | | (2,076,038 | ) | | | (28,300 | ) | | | (238 | ) |

| | | | | | | | | | | | | | | | | |

From Capital Share Transactions | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | 11,153,717 | | | | 39,931,580 | | | | 724,352 | | | | 2,494,265 | |

Cost of shares redeemed | | | (20,289,376 | ) | | | (7,987,377 | ) | | | (245,875 | ) | | | — | |

Net increase (decrease) in net assets resulting from capital share transactions | | | (9,135,659 | ) | | | 31,944,203 | | | | 478,477 | | | | 2,494,265 | |

| | | | | | | | | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | (12,925,818 | ) | | | 32,046,021 | | | | 485,343 | | | | 2,455,269 | |

| | | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of period | | | 78,271,302 | | | | 46,225,281 | | | | 2,455,269 | | | | — | |

End of period | | $ | 65,345,484 | | | $ | 78,271,302 | | | $ | 2,940,612 | | | $ | 2,455,269 | |

| | | | | | | | | | | | | | | | | |

Changes in Shares Outstanding | | | | | | | | | | | | | | | | |

Shares outstanding, beginning of period | | | 2,700,000 | | | | 1,600,000 | | | | 100,000 | | | | — | |

Shares sold | | | 400,000 | | | | 1,375,000 | | | | 30,000 | | | | 100,000 | |

Shares redeemed | | | (720,000 | ) | | | (275,000 | ) | | | (10,000 | ) | | | — | |

Shares outstanding, end of period | | | 2,380,000 | | | | 2,700,000 | | | | 120,000 | | | | 100,000 | |

(1) | The Fund commenced operations on December 8, 2022. |

The accompanying notes are an integral part of the financial statements.

22

TrueShares ETFs

Statements of Changes in Net Assets

(Continued)

| | | RiverNorth Patriot ETF | | | RiverNorth Enhanced Pre-

Merger SPAC ETF | |

| | | Six Months

Ended

June 30, 2023

(Unaudited) | | | Year Ended

December 31,

2022 | | | Six Months

Ended

June 30, 2023

(Unaudited) | | | Period Ended

December 31,

2022(1) | |

From Operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 23,686 | | | $ | 48,932 | | | $ | (13,176 | ) | | $ | (13,101 | ) |

Net realized gain (loss) on investments | | | (149,393 | ) | | | (163,346 | ) | | | 102,508 | | | | 31,432 | |

Net change in unrealized appreciation/depreciation on investments | | | 255,282 | | | | (293,046 | ) | | | 131,070 | | | | 61,581 | |

Net increase (decrease) in net assets resulting from operations | | | 129,575 | | | | (407,460 | ) | | | 220,402 | | | | 79,912 | |

| | | | | | | | | | | | | | | | | |

From Distributions | | | | | | | | | | | | | | | | |

Distributable earnings | | | — | | | | (48,932 | ) | | | — | | | | (8,355 | ) |

Return of capital | | | — | | | | (407 | ) | | | — | | | | — | |

Total distributions | | | — | | | | (49,339 | ) | | | — | | | | (8,355 | ) |

| | | | | | | | | | | | | | | | | |

From Capital Share Transactions | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | 222,927 | | | | 3,691,633 | | | | 2,430,981 | | | | 4,372,345 | |

Cost of shares redeemed | | | (439,785 | ) | | | (1,229,805 | ) | | | (522,192 | ) | | | (625,783 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | | (216,858 | ) | | | 2,461,828 | | | | 1,908,789 | | | | 3,746,562 | |

| | | | | | | | | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | (87,283 | ) | | | 2,005,029 | | | | 2,129,191 | | | | 3,818,119 | |

| | | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of period | | | 3,255,029 | | | | 1,250,000 | | | | 3,818,119 | | | | — | |

End of period | | $ | 3,167,746 | | | $ | 3,255,029 | | | $ | 5,947,310 | | | $ | 3,818,119 | |

| | | | | | | | | | | | | | | | | |

Changes in Shares Outstanding | | | | | | | | | | | | | | | | |

Shares outstanding, beginning of period | | | 150,000 | | | | 50,000 | | | | 150,000 | | | | — | |

Shares sold | | | 10,000 | | | | 150,000 | | | | 95,000 | | | | 175,000 | |

Shares redeemed | | | (20,000 | ) | | | (50,000 | ) | | | (20,000 | ) | | | (25,000 | ) |

Shares outstanding, end of period | | | 140,000 | | | | 150,000 | | | | 225,000 | | | | 150,000 | |

(1) | The Fund commenced operations on July 11, 2022. |

The accompanying notes are an integral part of the financial statements.

23

TrueShares ETFs

Financial Highlights

For a Share Outstanding Throughout each Period

| | | Per Share Operating Performance

(For a share outstanding throughout each period) | |

| | | | | | | Income from Investment Operations | | | Less Distributions Paid From | |

| | | Net Asset

Value,

Beginning

of Period | | | Net

investment

income

(loss)(1) | | | Net realized

and

unrealized

gain

(loss) on

investments | | | Total from

investment

operations | | | Net

investment

income | | | Return of

capital | | | Net realized

gains | | | Total

distributions

paid | |

TrueShares Technology, AI & Deep Learning ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 01/01/2023 - 6/30/2023 (Unaudited) | | $ | 22.88 | | | | (0.08 | ) | | | 9.12 | | | | 9.04 | | | | — | | | | — | | | | — | | | | — | |

For the year 01/01/2022 - 12/31/2022 | | $ | 47.12 | | | | (0.19 | ) | | | (24.05 | ) | | | (24.24 | ) | | | — | | | | — | | | | — | | | | — | |

For the year 01/01/2021 - 12/31/2021 | | $ | 47.61 | | | | (0.31 | ) | | | (0.12 | )(9) | | | (0.43 | ) | | | — | | | | — | | | | (0.06 | ) | | | (0.06 | ) |

For the period 02/28/2020(8) - 12/31/2020 | | $ | 25.00 | | | | (0.19 | ) | | | 22.80 | | | | 22.61 | | | | — | | | | — | | | | — | | | | — | |

TrueShares ESG Active Opportunities ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 01/01/2023 - 6/30/2023 (Unaudited) | | $ | 31.75 | | | | 0.16 | | | | 5.48 | | | | 5.64 | | | | — | | | | — | | | | — | | | | — | |

For the year 01/01/2022 - 12/31/2022 | | $ | 41.39 | | | | 0.26 | | | | (9.62 | ) | | | (9.36 | ) | | | (0.28 | ) | | | — | | | | — | | | | (0.28 | ) |

For the year 01/01/2021 - 12/31/2021 | | $ | 35.10 | | | | 0.16 | | | | 6.29 | | | | 6.45 | | | | (0.16 | ) | | | — | | | | — | | | | (0.16 | ) |

For the period 02/28/2020(8) - 12/31/2020 | | $ | 25.00 | | | | 0.17 | | | | 10.07 | | | | 10.24 | | | | (0.14 | ) | | | (0.00 | )(7) | | | — | | | | (0.14 | ) |

(1) | Per share net investment income (loss) was calculated using average shares outstanding. |

(2) | Annualized for periods less than one year. |

(3) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, if any, and redemption on the last day of the period at net asset value. This percentage is not an indication of the performance of a shareholder’s investment in the Fund based on market value due to the differences between the market price of the shares and the net asset value per share of the Fund. |

(4) | Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at market value during the period, if any, and redemption on the last day of the period at market value. Market value is determined by the composite closing price. Composite closing security price is defined as the last reported sale price on the NYSE Arca, Inc. The composite closing price is the last reported sale, regardless of volume, and not an average price, and may have occurred on a date prior to the close of the reporting period. Market value may be greater or less than net asset value, depending on the Fund’s closing price on the NYSE Arca, Inc. |

The accompanying notes are an integral part of the financial statements.

24

TrueShares ETFs

Financial Highlights

For a Share Outstanding Throughout each Period (Continued)

| | Per Share

Operating

Performance

(For a share

outstanding

throughout

each period) | | | Ratios/Supplemental Data | |

| | | | | | | | | | | | | | | | | | Ratios to Average

Net Assets of: (2) | | | | | |

| | Net Asset Value,

End of Period | | | Total return,

at NAV(3)(5) | | | Total return,

at Market(4)(5) | | | Net assets,

end of period

(000’s) | | | Expenses | | | Net investment

income (loss) | | | Portfolio

turnover

rate(5)(6) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 31.92 | | | | 39.51 | % | | | 39.70 | % | | $ | 34,155 | | | | 0.68 | % | | | (0.57 | )% | | | 23 | % |

| | $ | 22.88 | | | | (51.44 | )% | | | (51.46 | )% | | $ | 14,300 | | | | 0.68 | % | | | (0.60 | )% | | | 25 | % |

| | $ | 47.12 | | | | (0.90 | )% | | | (0.96 | )% | | $ | 37,694 | | | | 0.68 | % | | | (0.67 | )% | | | 14 | % |

| | $ | 47.61 | | | | 90.43 | % | | | 90.52 | % | | $ | 27,374 | | | | 0.68 | % | | | (0.59 | )% | | | 30 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 37.39 | | | | 17.75 | % | | | 17.97 | % | | $ | 2,430 | | | | 0.58 | % | | | 0.96 | % | | | 0 | % |

| | $ | 31.75 | | | | (22.61 | )% | | | (22.70 | )% | | $ | 6,351 | | | | 0.58 | % | | | 0.74 | % | | | 4 | % |

| | $ | 41.39 | | | | 18.40 | % | | | 18.42 | % | | $ | 10,348 | | | | 0.58 | % | | | 0.42 | % | | | 14 | % |

| | $ | 35.10 | | | | 40.94 | % | | | 40.93 | % | | $ | 7,020 | | | | 0.58 | % | | | 0.70 | % | | | 29 | % |

(5) | Not annualized for periods less than one year. |

(6) | Excludes in-kind transactions associated with creations and redemptions of the Fund. |

(8) | Commencement of Operations. |

(9) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the period. |

The accompanying notes are an integral part of the financial statements.

25

TrueShares ETFs

Financial Highlights

For a Share Outstanding Throughout each Period (Continued)

| | | Per Share Operating Performance

(For a share outstanding throughout each period) | |

| | | | | | | Income from Investment Operations | | | Less Distributions Paid From | |

| | | Net Asset

Value,

Beginning

of Period | | | Net

investment

income

(loss)(1) | | | Net realized

and

unrealized

gain

(loss) on

investments | | | Total from

investment

operations | | | Net

investment

income | | | Return of

capital | | | Net realized

gains | | | Total

distributions

paid | |

TrueShares Low Volatility Equity Income ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the period 01/01/2023 - 6/30/2023 (Unaudited) | | $ | 28.99 | | | | 0.39 | | | | (1.50 | ) | | | (1.11 | ) | | | (0.42 | ) | | | — | | | | — | | | | (0.42 | ) |

For the year 01/01/2022 - 12/31/2022 | | $ | 28.89 | | | | 0.99 | | | | 0.04 | | | | 1.03 | | | | (0.93 | ) | | | (0.00 | )(9) | | | — | | | | (0.93 | ) |

For the period 01/27/2021(8) - 12/31/2021 | | $ | 25.00 | | | | 0.81 | | | | 4.19 | | | | 5.00 | | | | (0.69 | ) | | | — | | | | (0.42 | ) | | | (1.11 | ) |