Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258754

COTTONWOOD COMMUNITIES, INC.

SUPPLEMENT NO. 5 DATED JANUARY 18, 2022

TO THE PROSPECTUS DATED NOVEMBER 4, 2021

This document supplements, and should be read in conjunction with, the prospectus of Cottonwood Communities, Inc. dated November 4, 2021 as supplemented by supplement no. 1 dated November 16, 2021, supplement no. 2 dated November 22, 2021, supplement no. 3 dated November 30, 2021 and supplement no. 4 dated December 15, 2021. As used herein, the terms “we,” “our” and “us” refer to Cottonwood Communities, Inc. and, as required by context, Cottonwood Residential O.P., LP, which we refer to as our “Operating Partnership,” and to their subsidiaries. Capitalized terms used in this supplement have the same meanings as set forth in the prospectus. The purpose of this supplement is to disclose:

•the transaction price for each class of our common stock as of February 1, 2022;

•the calculation of our December 31, 2021 net asset value (“NAV”) per share, as determined in accordance with our valuation guidelines, for each of our share classes;

•declaration of distributions for the month of January;

•updates to certain risk factors;

•additional information regarding compensation to our executive officers and directors;

•additional information related to our investment objectives and criteria; and

•updated experts information.

February 1, 2022 Transaction Price

The transaction price for each share class of our common stock for subscriptions accepted (and distribution reinvestment plan issuances) as of February 1, 2022 (and repurchases as of January 31, 2022) is as follows:

| | | | | | | | |

| | Transaction Price (per share) |

| Class T | | $17.2839 |

| Class D | | $17.2839 |

| Class I | | $17.2839 |

| Class A | | $17.2839 |

| Class TX | | $17.2839 |

The transaction price for each of our share classes is equal to such class’s NAV per share as of December 31, 2021. A calculation of the NAV per share is set forth below. The purchase price of our common stock for each share class equals the transaction price of such class, plus applicable upfront selling commissions and dealer manager fees.

December 31, 2021 NAV Calculation

Our board of directors, including a majority of our independent directors, has adopted valuation guidelines, as amended from time to time, that contain a comprehensive set of methodologies to be used in connection with the calculation of our NAV. Our most recent NAV per share for each share class, which is updated as of the last calendar day of each month, is posted on our website at www.cottonwoodcommunities.com and is also available on our toll-free, automated telephone line at (888) 422-2584.

The December 31, 2021 NAV for our outstanding Class I, Class A and Class TX shares was calculated pursuant to these valuation guidelines. As of December 31, 2021, we had no outstanding Class T or Class D shares. Until shares of these classes are outstanding as of the date our NAV is determined, we will deem the NAV per share of these classes to be the NAV per share of our Class I, Class A and Class TX shares.

Please see “Net Asset Value Calculation and Valuation Guidelines” in our prospectus for a more detailed description of our valuation guidelines, including important disclosures regarding real property valuations, debt-related asset valuations and property management business valuations provided by Altus Group U.S. Inc. (the “Independent Valuation Advisor”). All parties engaged by us in the calculation of our NAV, including CC Advisors III, LLC, our advisor, are subject to the oversight of our board of directors. As described in our valuation guidelines, each real property is appraised by a third-party appraiser (the “Third-Party Appraisal Firm”) at least once per calendar year and reviewed by our advisor and the Independent Valuation Advisor. Additionally, the real property assets not appraised by the Third-Party Appraisal Firm in a given calendar month will be appraised for such calendar month by our Independent Valuation Advisor, and such appraisals are reviewed by our advisor.

Our Operating Partnership has certain classes or series of OP Units that are each economically equivalent to a corresponding class of shares. Accordingly, on the last day of each month, for such classes or series of OP Units, the NAV per OP Unit equals the NAV per share of the corresponding class. To the extent our Operating Partnership has classes of units that do not correspond to a class of our shares, such units will be valued in a manner consistent with our valuation guidelines. The NAV of our Operating Partnership on the last day of each month equals the sum of the NAVs of each fully-diluted outstanding OP Unit on such day. In calculating the fully-diluted outstanding OP Units we include all outstanding vested LTIP Units, unvested time-based LTIP Units and those performance-based LTIP Units that would be earned based on the internal rate of return as of such day.

Our total NAV in the following table includes the NAV of our outstanding classes of common stock as of December 31, 2021 (Class I, Class A and Class TX) as well as the partnership interests of the Operating Partnership held by parties other than us. The following table sets forth the components of our NAV as of December 31, 2021 and November 30, 2021:

| | | | | | | | |

| As of |

| Components of NAV* | December 31, 2021 | November 30, 2021 |

| Investments in Multifamily Operating Properties | $ | 1,827,614,205 | $ | 1,779,621,795 |

| Investments in Multifamily Development Properties | 200,935,008 | 193,252,363 |

| Investments in Real-estate Related Structured Investments | 61,745,742 | 60,923,576 |

| Operating Company, Land and Other Net Current Assets | 62,381,684 | 74,454,826 |

| Cash and Cash Equivalents | 12,516,809 | 11,220,788 |

| Secured Real Estate Financing | (864,209,321) | (851,130,224) |

| Subordinated Unsecured Notes | (43,543,000) | (48,643,000) |

| Preferred Equity | (254,431,343) | (247,092,109) |

| Accrued Performance Participation Allocation | (51,760,766) | (47,741,416) |

| Net Asset Value | $ | 951,249,018 | $ | 924,866,599 |

| Fully-diluted Shares/Units Outstanding | 55,036,824 | 54,623,705 |

| | |

| * Presented as adjusted for our economic ownership percentage in each asset. |

The following table provides a breakdown of our total NAV and NAV per share/unit by class as of December 31, 2021 and November 30, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | |

| I | | A | | TX | | OP(1) | | Total |

| As of December 31, 2021 | | | | | | | | | |

| Monthly NAV | $ | 2,963,334 | | | $ | 405,225,113 | | | $ | 302,814 | | | $ | 542,757,757 | | | $ | 951,249,018 | |

| Fully-diluted Outstanding Shares/Units | 171,451 | | | 23,445,284 | | | 17,520 | | | 31,402,569 | | | 55,036,824 | |

| NAV per Fully-diluted Share/Unit | $ | 17.2839 | | | $ | 17.2839 | | | $ | 17.2839 | | | $ | 17.2839 | | | |

| As of November 30, 2021 | | | | | | | | | |

| Monthly NAV | N/A | | $ | 397,684,404 | | | $ | 296,613 | | | $ | 526,885,582 | | | $ | 924,866,599 | |

| Fully-diluted Outstanding Shares/Units | N/A | | 23,487,707 | | | 17,518 | | | 31,118,480 | | | 54,623,705 | |

| NAV per Fully-diluted Share/Unit | N/A | | $ | 16.9316 | | | $ | 16.9316 | | | $ | 16.9316 | | | |

| | | | | | | | | |

(1) Includes the partnership interests of our Operating Partnership held by High Traverse Holdings, an entity beneficially owned by Daniel Shaeffer, Chad Christensen, Gregg Christensen and Eric Marlin and other Operating Partnership interests, including LTIP Units as described above, held by parties other than us. |

Set forth below are the weighted averages of the key assumptions that were used by the Independent Appraisal Firms in the discounted cash flow methodology used in the December 31, 2021, valuations of our real property assets, based on property types.

| | | | | | | | | | | |

| Discount Rate | | Exit Capitalization Rate |

| Operating Assets | 5.81% | | 4.49% |

| Development Assets | 5.98% | | 4.40% |

| | | |

| * Presented as adjusted for our economic ownership percentage in each asset, weighted by gross value. |

A change in these assumptions would impact the calculation of the value of our operating and development assets. For example, assuming all other factors remain unchanged, the changes listed below would result in the following effects on our operating and development asset values:

| | | | | | | | | | | |

| Sensitivities | Change | Operating Asset

Values | Development Asset

Values |

| Discount Rate | 0.25% decrease | 2.3% | 2.3% |

| | 0.25% increase | (2.3)% | (2.2)% |

| Exit Capitalization Rate | 0.25% decrease | 4.3% | 4.7% |

| 0.25% increase | (3.7)% | (4.1)% |

| | | |

| * Presented as adjusted for our economic ownership percentage in each asset. |

Declaration of Distributions

On January 17, 2022, our board of directors declared a distribution for the month of January of $0.05833333, or $0.70 annually, reduced for any class-specific expense allocated to the class, for each class of our common stock to holders of record on January 31, 2022, to be paid in February.

Risk Factors

The following risk factors update the corresponding risk factors in the prospectus.

We have incurred net losses under GAAP in the past and may incur net losses in the future, and we have an accumulated deficit and may continue to have an accumulated deficit in the future.

For the nine months ended September 30, 2021 and the year ended December 31, 2020, we had net loss of approximately $81.4 million and $8.6 million, respectively. As of September 30, 2021 and December 31, 2020, we had accumulated deficit of approximately $44.5 million and $11.9 million, respectively. These amounts largely reflect the expense of real estate depreciation and amortization in accordance with GAAP, which was approximately $43.5 million and $7.0 million during these periods, and the nine months ended September 30, 2021 also included $36.0 million of charges related to the performance participation allocation.

Net loss and accumulated deficit are calculated and presented in accordance with GAAP, which, among other things, requires depreciation of real estate investments to be calculated on a straight-line basis. As a result, our operating results imply that the value of our real estate investments will decrease evenly over a set time period. However, we believe that the value of real estate investments will fluctuate over time based on market conditions. Thus, in addition to GAAP financial metrics, management reviews certain non-GAAP financial metrics, funds from operations, or FFO, and Core FFO. FFO measure operating performance that excludes gains or losses from sales of depreciable properties, the cumulative effects of changes in accounting principles, real estate-related depreciation and amortization and after adjustments for the Issuer’s share of unconsolidated partnerships and joint ventures. See “Selected Information Regarding Our Operations” for considerations on how to review this metric.

We have paid distributions from offering proceeds. In the future we may continue to fund distributions with offering proceeds. To the extent we fund distributions from sources other than our cash flow from operations, we will have less funds available for investment in multifamily apartment communities and multifamily real estate-related assets and the overall return to our stockholders may be reduced.

Our charter permits us to make distributions from any source, including offering proceeds or borrowings (which may constitute a return of capital), and our charter does not limit the amount of funds we may use from any source to pay such distributions. We intend to make distributions on our common stock on a per share basis with each share receiving the same distribution, subject to any class-specific expenses such as distribution fees on our Class T and Class D shares. If we fund distributions from financings, the proceeds from this or future offerings or other sources, we will have less funds available for investment in multifamily apartment communities and other multifamily real estate-related assets and the number of real estate properties that we invest in and the overall return to our stockholders may be reduced. If we fund distributions from borrowings, our interest expense and other financing costs, as well as the repayment of such borrowings, will reduce our earnings and cash flow from operations available for distribution in future periods. If we fund distributions from the sale of assets or the maturity, payoff or settlement of multifamily real estate-related assets, this will affect our ability to generate cash flows from operations in future periods.

During the early stages of our operations, it is likely that we will use sources of funds, which may constitute a return of capital to fund distributions. During this offering stage, when we may raise capital more quickly than we acquire income-producing assets, and for some period after this offering stage, we may not be able to make distributions solely from our cash flow from operations. Further, because we may receive income from our investments at various times during our fiscal year and because we may need cash flow from operations during a particular period to fund capital expenditures and other expenses, we expect that at least during the early stages of our existence and from time to time during our operational stage, we will declare distributions in anticipation of cash flow that we expect to receive during a later period and we will make these distributions in advance of our actual receipt of these funds. In addition, to the extent our investments are in development or redevelopment projects or in properties that have significant capital requirements, our ability to make distributions may be negatively impacted, especially during our early periods of operation. In these instances, we expect to look to third party borrowings to fund our distributions. We may also fund such distributions from the sale of assets. To the extent distributions exceed cash flow from operations, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize capital gain.

For the year ended December 31, 2020, we paid aggregate distributions of approximately $5.3 million, including approximately $4.2 million of distributions paid in cash and $1.1 million of distributions reinvested through our distribution reinvestment plan. Our net loss for the year ended December 31, 2020 was approximately $8.6 million. Cash flows used in operating activities were approximately $2.8 million during the year ended December 31, 2020. We funded our total distributions paid during 2020, which includes net cash distributions and distributions reinvested by stockholders, with $572,000 prior period cash provided by operating activities and $4.7 million of offering proceeds.

For the nine months ended September 30, 2021, we paid aggregate distributions to common stockholders and limited partners of approximately $6.4 million and $6.3 million, respectively, all paid in cash due to our distribution reinvestment plan being suspended. For the nine months ended September 30, 2021, our net loss was approximately $81.4 million. Cash flows provided by operating activities for the nine months ended September 30, 2021 was approximately $10.8 million. We funded our distributions for the nine months ended September 30, 2021 with approximately $10.8 million of cash provided by operating activities and $1.8 million of cash provided by our revolving credit facility.

Generally, for purposes of determining the source of our distributions paid, we assume first that we use cash flow from operating activities from the relevant or prior periods to fund distribution payments. To the extent that we pay distributions from sources other than our cash flow from operating activities, we will have less funds available for the acquisition of real estate investments, the overall return to our stockholders may be reduced and subsequent investors will experience dilution. In addition, to the extent distributions exceed cash flow from operating activities, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize capital gain.

Compensation of Executive Officers

The following disclosure updates the disclosure in the prospectus regarding equity grants to our executive officers.

Grant of LTIP Units

On January 7, 2022, our compensation committee approved grants of LTIP Units from the Operating Partnership for fiscal year 2022 to our executive officers and certain of our employees. The compensation committee approved awards of time-based LTIP Units to our executive officers in an aggregate amount of $1,537,553.32, including $399,403.55 to Daniel Shaeffer, our Chief Executive Officer, $87,500.00 to Enzio A. Cassinis, our President, $78,750.00 to Adam Larson, our Chief Financial Officer, and $70,000.00 to Paul Fredenberg, our Chief Investment Officer. Each of Mr. Cassinis, Mr. Larson and Mr. Fredenberg were our named executive officers as of December 31, 2020. Each award will vest approximately one-quarter of the awarded amount on January 1, 2023, 2024, 2025 and 2026.

The compensation committee also approved awards of performance-based LTIP Units to our executive officers in an aggregate target amount of $2,773,748.90, including $741,749.45 to Daniel Shaeffer, our Chief Executive Officer, $162,500.00 to Enzio A. Cassinis, our President, $146,250.00 to Adam Larson, our Chief Financial Officer and $130,000.00 to Paul Fredenberg, our Chief Investment Officer. The actual amount of each performance-based LTIP Unit award will be determined at the conclusion of a three-year performance period and will depend on the internal rate of return as defined in the award agreement. The earned LTIP Units will become fully vested on the first anniversary of the last day of the performance period, subject to continued employment with the advisor or its affiliates.

The grant of LTIP Units approved by our compensation committee included $1,157,803.32 time-based awards and $2,068,498.90 targeted performance-based awards granted to employees of our advisor or its affiliates. The number of units granted were valued by reference to our November 30, 2021 NAV per share as announced on December 15, 2021 of $16.9316. The time-based and performance-based awards were designed to align the executive officers’ and our employees interests with those of our stockholders and to encourage the retention of our executive officers and employees.

Compensation of Directors

The following disclosure updates the disclosure in the prospectus regarding compensation to our independent directors.

Following the completion of our merger with Cottonwood Residential II, Inc. and the Operating Partnership, our compensation committee undertook a review of our director compensation and approved a revised compensation structure for our independent directors. The revised compensation structure was approved following a review of peer board compensation data provided by an independent compensation consultant Ferguson Partners, a nationally recognized firm specializing in the real estate industry.

Starting January 1, 2022, we will pay an annual cash retainer of $50,000 to each independent director for their service as a director, as well as an annual equity grant of time-based LTIP Units in the Operating Partnership with a value of approximately $63,750 at the time of grant. The equity will have a one-year vesting schedule. The independent board members serving as chairperson of each of our audit, compensation and conflicts committees will receive an additional annual cash retainer of $15,000, $10,000 and $10,000, respectively.

Investment Objective and Criteria.

The disclosure in the prospectus under Investment Objectives and Criteria – General – Multifamily Focus is superseded and replaced with the following:

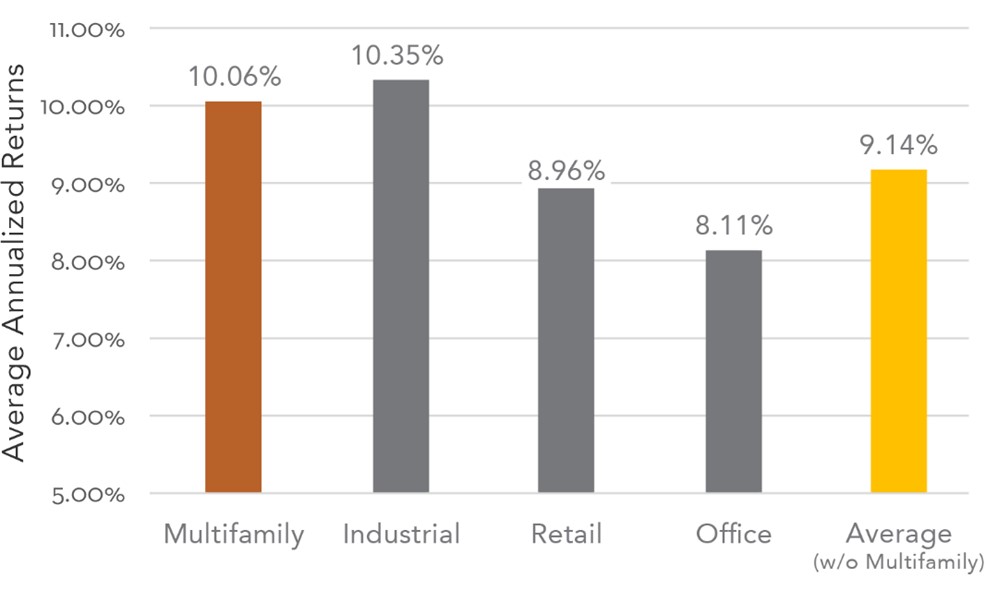

Compelling Long-Term Investment. According to the National Council of Real Estate Investment Fiduciaries (NCREIF) research, since 1977 when NCREIF began tracking returns, the multifamily sector has performed well relative to other major core real estate sectors (see below).

Source: National Council of Real Estate Investment Fiduciaries. Information as of September 30, 2021. Our sponsor created all graphs and calculations based on the referenced data. Past performance is no guarantee of future results. There is no guarantee that these trends in the multifamily sector will continue.

Only three of those years produced negative returns, while sector volatility remained lower relative to the average of other core sectors. Further, real estate total returns, and specifically private real estate, have historically displayed a low correlation to stocks and bonds, and may serve as a meaningful diversifier to portfolios. We note that the NAV of non-traded REITs like ourselves may be subject to volatility related to the values of their underlying assets. In addition, the lower volatility of an investment in a non-traded REIT may in part be the result of the appraisal-based method for determining our NAV. Appraisal-based pricing for our shares may create a smoothing effect on our NAV due to the reliance on lagged variables such as comparable valuations or capitalization rates in the appraisal process.

| | | | | | | | | | | |

| | | Last 10 Years |

| Index | | Notes | Correlation to Private Multifamily

Real Estate |

| Private Multifamily Real Estate | 1 | 1.00 |

| Public U.S. Multifamily Real Estate | 2 | 0.10 |

| Public U.S. Real Estate | 3 | 0.05 |

| Public Real Estate (Excluding U.S.) | 4 | -0.13 |

| Public Equities | 5 | 0.01 |

| Corporate Bonds | 6 | -0.01 |

| Hedge Funds | 7 | -0.21 |

| Sources: Bloomberg, NAREIT, NCREIF and S&P Global Market Intelligence. Our sponsor performed all calculations based on the referenced data. |

| Notes: As of December 31, 2018. |

| 1) Private Multifamily Real Estate is represented by the NCREIF Property Index - Apartments Only. |

| 2) Public U.S. Multifamily Real Estate is represented by the FTSE Nareit Equity Apartments total return index series. |

| 3) Public U.S. Real Estate is represented by the FTSE Nareit All-Equity REITs total return index series. |

| 4) Public Real Estate (Excluding U.S.) is represented by FTSE EPRA/Developed Ex-U.S. Index. |

| 5) Public Equities is represented by the S&P 500 Total Returns Index. |

| 6) Corporate Bonds is represented by the Barclays U.S. Aggregate Bond Index. |

| 7) Hedge Funds is represented by the Dow Jones Credit Suisse Hedge Fund Index. |

Experts

The statements included in this supplement under “December 31, 2021 NAV Calculation,” relating to the role of Altus Group U.S. Inc. have been reviewed by Altus Group U.S. Inc., an independent valuation firm, and are included in this supplement given the authority of such firm as experts in real estate valuations.