Preamble

| I. | Purpose and applicability |

The purpose of the seventh edition of the TIAA Policy Statement on Responsible Investing (“Policy Statement”) is to publicly express our commitment to responsible investing (RI), highlight the benefits RI approaches bring to our clients and outline the key activities we use to put our aspiration into action.

This document also serves to communicate the expectations that Teachers Insurance and Annuity Association of America (“TIAA”) and College Retirement Equities Fund (“CREF”), TIAA-CREF Funds (“TCF”), TIAA-CREF Life Funds (“TCLF”) and TIAA Separate Account VA-1 (and together with CREF, TCF and TCLF, the “TIAA-CREF Fund Complex”) have for the environmental, social and corporate governance (ESG) policies and practices of their respective investment portfolios.

Previous versions of our Policy Statement, whose first edition was published in 1993, focused on publicly traded operating companies. Due to its increasing relevance across all asset classes, including real estate, private markets, and real assets, our RI commitment and program has expanded over time. Recognizing that implementation will vary across asset classes, we strive to extend and connect our core RI principles across our portfolios.

| | |

| | Since 1970 we have been a leader in what is now called responsible investing.” |

| II. | Why we focus on responsible investing |

Since 1970, TIAA has been a leader in what we now call responsible investing, a constantly evolving discipline that incorporates the consideration of environmental, social and governance (ESG) factors into investment research, due diligence, portfolio construction and ongoing monitoring.

Our participants and clients expect us to be good stewards of their investments as we help them achieve financial well-being at all stages of life. We seek to implement a set of principles that support well-functioning markets in order to preserve financial, social and environmental capital. We believe this philosophy and our approach contributes to long-term performance and helps reduce risk in our investments.

Specifically, we aim to promote good governance practices and monitor issues that may affect a company’s ability to create long-term, sustainable value. To ensure that investors have a broad range of information about the effects of their investments on key stakeholders, we encourage the substantive consideration of a broader stakeholder lens, including customers, employees, suppliers and the larger community.

We are proud of the leadership role we have played for decades and of our track record of achieving beneficial outcomes related to ESG practices throughout the investment value chain. We believe that by driving transparency, innovation and global adoption of RI best practices across all asset classes, we have the opportunity to provide enduring benefits for portfolio companies, investors, society, our communities and the planet. We have spearheaded efforts to systematically integrate material ESG and sustainability factors into the investment decision process and going forward we expect our conviction and approaches to responsible investing to continue to evolve and take new forms.

1

The TIAA and TIAA-CREF Funds Boards respectively oversee the TIAA-CREF Fund Complex’s and TIAA General Account’s responsible investing programs, including management’s role in developing and implementing core programmatic activities.

The RI program is administered by the Nuveen Responsible Investing team (“RI team”). Nuveen is the investment management arm of TIAA. The RI team works collaboratively with investment management colleagues throughout Nuveen and key stakeholders within TIAA to continuously enhance and advance the investment activity of TIAA and the TIAA-CREF Fund Complex’s activities across asset classes.

The program activities and core principles of the responsible investing program may be inapplicable in some cases, depending on company type, underlying assets, and local market regulations. While specific activities and principles are most relevant to publicly traded operating companies, the spirit of the included policies can be applied to all companies in which TIAA invests throughout the world, and, to the extent practicable, also guide TIAA’s internal governance practices.

II. Program activities

As global institutional investors, we believe that responsible investing provides enduring benefits for our clients and our communities. We believe responsible business practices lower risk, improve financial performance and drive positive social and environmental outcomes.

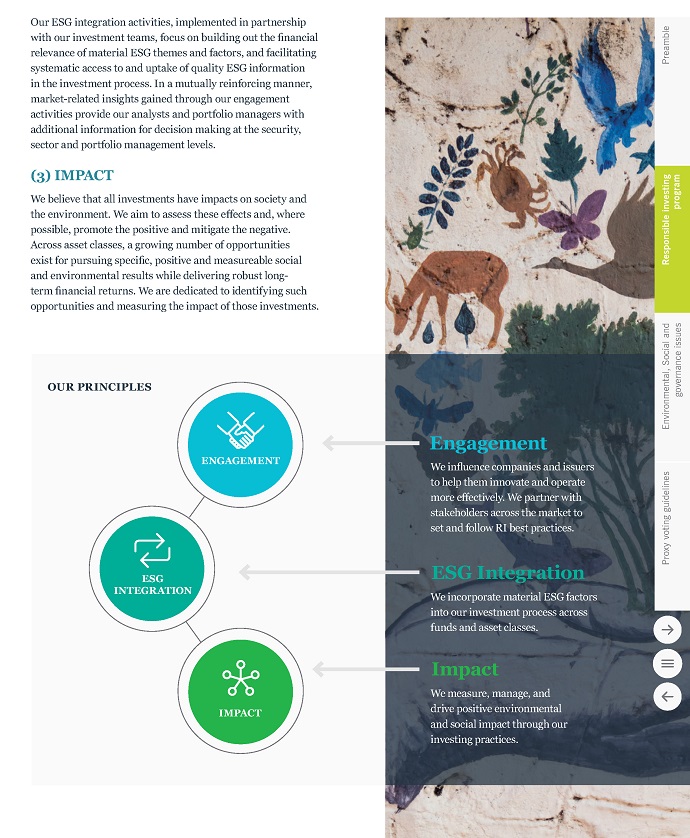

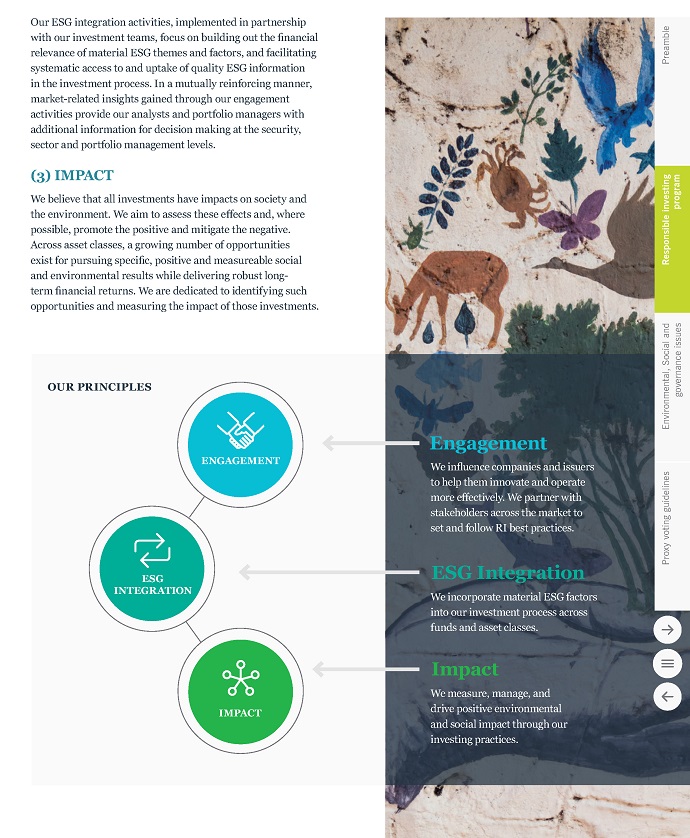

We implement our RI commitment through activities underlying a set of core principles across Nuveen: (1) engagement, (2) ESG integration and (3) driving positive impact across our portfolios. While each of our investment affiliates takes a unique investment approach to pursuing competitive risk-adjusted returns on behalf of its clients, we believe that our core principles are increasingly relevant and applicable across all asset classes. Our principles will continue to evolve over time to ensure alignment with market trends and business needs.

A LEGACY OF RESPONSIBLE INVESTING

| | | | | | |

| | |

| | | Nearly 5 decades | | |

| | of leadership in responsible investing | | |

| | | | |

Began engaging with companies on product and social issues in the 1970S | | |

| | | | | | | | |

| | |

| | | Launched one of the industry’s first dedicated ESG products in 1990 | | |

| | |

| | nuveen.com/responsible-investing-timeline |

3

III. Core principles

(1) ENGAGEMENT

Engaging with management and boards of directors of public and private companies to improve their ESG performance is in our clients’ economic interest. Individually and in collaboration with other investors, we use our influence, relationships and formal channels to address issues and engage in public policy discussions that may affect the sustainability of long-term profits.

Through constructive dialogue with regulators, public policy makers and other industry bodies, we help enable responsible investment globally. Advocating for relevant, consistent and comparable ESG disclosure from companies and other investees supports informed investment decisions. By prioritizing this transparency, we strive to fill the existing information gap that can otherwise hinder rigorous investment analysis.

Our key engagement activities include:

| · | | Proxy voting: We execute thoughtful, case-by-case voting on management and shareholder proposals for publicly traded companies. |

| · | | Dialogue: We engage in direct and constructive dialogue with CEOs, senior management, boards of directors, tenants and operators as well as other appropriate stakeholders to promote value-enhancing outcomes through encouraging relevant ESG disclosure and adoption of best practices. |

| · | | Targeted initiatives: We aim to drive measureable outcomes with company, industry, thematic and country-specific initiatives. |

| · | | Market initiatives: We collaborate with peers, interdisciplinary experts and industry stakeholders to create best practices and drive more effective outcomes. |

| · | | Policy influence: We actively help to shape legislation, public policy and global standards related to RI best practices. |

We are fundamentally committed to engaging with issuers.

In our experience, long-term engagement is the most effective and appropriate means of promoting responsible behavior. As a matter of general investment policy, we may consider divesting or underweighting an investment from our accounts in cases where we conclude that the financial or reputational risks from an issuer’s policies or activities are so great that continued investment is no longer prudent. In the rarest of circumstances and consistent with the policies outlined below, we may, as a last resort, consider divesting from issuers we judge to be complicit in genocide and crimes against humanity, the most serious human rights violations, after sustained efforts at dialogue have failed and divestment can be undertaken in a manner consistent with our fiduciary duties.

Our policy of engagement over divestment is a matter of principle that is based on several considerations: (i) divestment would eliminate our standing and rights as an investor and foreclose further engagement; (ii) divestment would be likely to have negligible impact on portfolio holdings or the market; (iii) divestment could result in increased costs and short-term losses; and (iv) divestment could compromise our investment strategies and negatively affect our performance. For these reasons, we believe that divestment does not offer TIAA an optimal strategy for changing the policies and practices of issuers we invest in, nor is it the best means to produce long-term value for our participants and shareholders.

(2) ESG INTEGRATION

Environmental, social and governance (ESG) information provides an additional lens to use when assessing company and issuer performance beyond traditional financial analysis. Continuing improvements in the quality, disclosure and accessibility of ESG information have enabled greater applications for incorporation into investment portfolios.

We believe that the consideration of relevant ESG factors in investment analysis, due diligence and portfolio construction can enhance long-term investment value and manage downside risk. Through ESG integration, we seek to expand our investment research and portfolio construction lens to include ESG risks, opportunities and megatrends that can inform investment decision-making. The ability to accurately forecast long-term industry and issuer trends also requires an understanding of relevant ESG factors and their potential impact.

4

As investors, we believe that issuers should demonstrate that they have carefully considered the strategic implications of relevant environmental, social and governance (ESG) issues on long-term performance. In our view, issuers that exercise diligence in their consideration of ESG issues are more competitive and can take better advantage of operational efficiencies, advance product innovation and reduce reputational risk. Failure to proactively address these issues can negatively affect individual businesses, investor returns and the market as a whole.

As a matter of good governance, we believe that issuers should carefully consider the strategic impact of environmental and social responsibility on long-term shareholder value. Therefore, we believe that issuers should apply a broader stakeholder lens when analyzing the key decisions they face in sustaining their own competitiveness, relevance, and growth potential: the environment, customers, employees and suppliers, and communities.

The sections below detail specific environmental, social and governance recommendations for publicly traded operating companies, but we encourage other issuers to assess how these topics are relevant for their specific contexts.

| | |

| | We believe that issuers should carefully consider the strategic impact of environmental and social responsibility on long-term shareholder value.” |

| II. | Business ethics, transparency and accountability |

Corporate governance practices that promote accountability and transparency create a framework to ensure companies operate in an ethical manner. Ethical business practices can mitigate against fraud, breaches of integrity, and abuses of authority, and can reduce a company’s overall risk profile. Ethics, transparency and accountability are relevant across all geographies, industries and asset classes and enable investors, creditors and other stakeholders to effectively evaluate corporate behavior that can impact company performance.

Risk: Failure by boards and management to be accountable for their actions and transparent with their strategic decisions can negatively impact investors. As investors and other stakeholders begin demanding a deeper understanding of the factors that influence board decision making, companies must provide adequate disclosure to ensure that mechanisms are in place to promote accountability and maintain the appropriate checks and balances.

Opportunity: We believe that board quality and shareholder accountability can positively impact firm performance. Additionally, markets tend to give higher valuations to firms that are more transparent with investors. We believe that robust corporate governance practices ensure board and management accountability, sustain a culture of integrity, and safeguard our rights as investors.

Board of Directors

Investors rely primarily on a corporation’s board of directors to fulfill a fiduciary duty to protect their assets and ensure they receive an appropriate return on investment. Boards are responsible for setting the ethical tone and culture for the company, assuring the corporation’s financial integrity, developing compensation and succession planning policies, and ensuring management accountability.

BOARD STRUCTURE AND OPERATION

We believe that boards should establish a structure that credibly demonstrates effective oversight of management, while also ensuring efficient use of the board’s time and resources. Boards should explain how the selected structure aligns with the company’s strategy, and disclose and enforce a meaningful set of governance principles.

7

| · | | Board Leadership. We believe that an independent board chair or the appointment of a lead independent director can provide the structural foundation for independent oversight. When the CEO and chair roles are combined, a company should disclose how the lead independent director’s role is structured to provide an appropriate counterbalance to the CEO/chair. We believe that companies must clearly demonstrate how their chosen board leadership structure contributes to the effective exchange of diverse views between independent and non-independent directors. |

| · | | Board Committees. Boards should establish at least three primary standing committees: an audit committee, a compensation committee and a nominating and governance committee. Each committee should be composed exclusively of independent directors to mitigate any perceived conflicts of interest. In addition to the three primary standing committees, boards should also establish additional committees as needed to fulfill their duties. |

| · | | CEO Selection, Evaluation and Succession Planning. Management is entrusted with acting in the best interests of shareholders and ensuring the company operates in an ethical manner. Strong, stable leadership with proper values is critical to the success of the corporate enterprise. The board should continuously monitor and evaluate the performance of the CEO and senior executives, and disclose the succession planning process generally. |

| · | | Board Evaluation. A board should conduct an annual evaluation of its performance and that of its key committees and disclose the process in general terms. We expect the board evaluation process to be robust, identifying both quantitative and qualitative factors of board structure and dynamics, as well as individual director skills and experience and how they support the strategy of the company. |

| · | | Director Compensation. Directors should have a direct, personal and meaningful investment in the company. We believe this helps align board members’ interests with those of shareholders. |

BOARD QUALITY

Boards must hold themselves to ethical standards and professional behavior of the highest quality. A high-quality board effectively oversees the management of material risks to ensure long-term sustainable shareholder value creation. We view the following as key indicators of board quality:

| • | | Independence. The board should be composed of a substantial majority of independent directors to ensure the protection of shareholders’ interests. The definition of independence should be interpreted broadly to ensure there is no conflict of interest, in fact or in appearance, that might compromise a director’s objectivity and loyalty to shareholders. |

| • | | Skills and Qualifications. Boards should be composed of individuals who can contribute expertise and judgment, based on their professional qualifications and business experience. Companies should provide disclosure concerning how the board’s collective expertise aligns with the company’s strategic direction and effective oversight of management. Board composition should be reviewed annually to ensure alignment with a company’s strategy. |

| · | | Board Refreshment. Boards that have not added new members for several years may become complacent and can pose risks to long-term performance and effective oversight of management. Additionally, many international governance codes view excessive director tenure as a factor that could compromise independence. Although we do not support arbitrary limits on the length of director service, we believe boards should establish a formal director retirement or tenure policy that can contribute to board stability, vitality and renewal. |

| · | | Board Diversity and Inclusion. Boards require a diverse range of skills and experiences to fulfill their strategy and oversight responsibilities. In addition to relevant skills and expertise, board nomination policies and refreshment practices should take into account the board’s composition in terms of gender, race, ethnicity and age. Boardroom culture should ensure that those diverse voices are proactively sought and valued, providing a counterbalance to potential board entrenchment and groupthink. Enrichment practices such as director training and rotating board leadership provide mechanisms that help foster inclusivity in the boardroom. |

8

Shareholder Rights

As providers of capital, shareholders are entitled to certain basic rights that should govern the conduct of every company to ensure accountability of the board and well-functioning markets. We believe that robust shareholder rights are the foundation of a company’s overall approach to corporate governance, and, in turn, shareholders have a duty to exercise their rights responsibly.

| · | | One Share, One Vote. Shareholders should have the right to vote in proportion to their economic stake in the company. The board should not create multiple classes of common stock with disparate or “super” voting rights, nor should it give itself the discretion to cap voting rights that reduce the proportional representation of larger shareholdings. Companies that do not have a one-share-one-vote structure should periodically assess the efficacy of such a structure and provide shareholders with a rationale for maintaining such a structure. |

| · | | Director Election Process. A publicly traded operating company’s charter or bylaws should dictate that directors be elected annually by a majority of votes cast. |

| · | | Fair and Transparent Vote Process. The board should not impose supermajority vote requirements, except in unusual cases where necessary to protect the interests of minority shareholders. The board should not combine or bundle disparate issues and present them for a single vote. Shareholders should be able to vote all their shares without impediments such as share blocking, beneficial owner registration, voting by show of hands, late notification of agenda items or other unreasonable requests. Shareholders should have the ability to confirm that their votes have been received and tabulated. |

| · | | Bylaw and Charter Amendments. Shareholders should have the right to approve any provisions that alter fundamental shareholder rights and powers. This includes poison pills and other antitakeover devices. We believe that antitakeover measures should be limited by reasonable expiration periods. |

| · | | Proxy Access. Shareholders should have the right to place their director nominees on the company’s proxy and ballot in accordance with applicable law, or, absent such law, if reasonable conditions are met. The board should not take actions designed to prevent the full execution of this right. |

| • | | IPO Governance. When companies access the public markets for capital, they should adopt governance provisions that protect shareholders’ rights equally. Practices that compromise accountability to shareholders include classified boards, plurality vote standards, multi-class equity structures with unequal voting rights, and supermajority vote requirements. Newly public companies that have these provisions should commit to review their governance practices over a reasonable period of time. |

Executive Compensation

Executive compensation should be used as a tool to drive and reward long-term sustainable value creation while also attracting and retaining top talent. We expect boards of directors, who are in the best position to take all of the relevant factors into consideration, to establish executive compensation programs that appropriately incentivize executive management.

COMPENSATION PHILOSOPHY

We are mindful that each company’s situation is unique, and encourage boards to craft compensation programs that are appropriately tailored to the company’s business strategy. Compensation plans should generally:

| • | | Be reasonable by prevailing industry standards, appropriate to the company’s size and complexity, and fair relative to pay practices throughout the company |

| • | | Align interests of directors and executives with interests of shareholders, such as through minimum stock ownership requirements and minimum vesting requirements and holding periods for equity-based plans that are commensurate with pay level and seniority |

| • | | Objectively link to appropriate company-specific metrics that drive long-term sustainable value |

| • | | Ensure employment contracts (if in place) balance the need to attract and retain executives with the obligation to avoid exposing the company to liability and unintended costs, especially in the event of terminations for misconduct, gross mismanagement or other reasons constituting a for-cause termination |

| • | | Establish policies to recoup, or claw back, variable compensation paid to senior executives for fraudulent activities, defective financial reporting, and creating undue reputational risk |

9

| • | | Prohibit any direct or indirect change to the strike price or value of options without the approval of shareholders (for equity-based plans) |

| • | | Prohibit executives from hedging or otherwise reducing their exposure to changes in the company’s stock price, and contain policies governing the pledging of company stock, including the process used by the board to oversee related risks |

PAY DISCLOSURE

A company’s disclosure should clearly articulate the rationale for incentives created by the compensation program and how it aligns with long-term strategy in order to mitigate compensation-related risks. In particular, disclosure should include:

| • | | Performance metrics, weights and targets, including why they are appropriate given the company’s business objectives and how they drive long-term sustainable value |

| • | | The rationale for peer group selection, including differences between the company peers used for strategic and business purposes versus the group used for compensation decisions |

| • | | Non-GAAP financial performance measures alongside their GAAP counterparts with an explanation of why non-GAAP measures better capture and incentivize long-term performance |

| • | | Employment contracts and tax gross-up arrangements |

| • | | Explanations of any inconsistencies in compensation decisions with these guidelines and generally accepted practices |

| • | | Rationale for any significant changes to the compensation program from year to year, including special one-off awards, changes to peer group selection, performance metrics, and award vehicles |

The principles described above form a foundation that enables investors and creditors to hold companies accountable for their impact on key stakeholders, as described in the following sections: the environment, customers, employees and suppliers, and communities.

III. Environment

Environmental sustainability is a critical strategic issue for businesses across sectors. How well a company manages its impacts on the natural environment can support longer-term sustainable growth, or present unmitigated costs and risks. As investors, it is imperative that we weigh certain material risks and opportunities related to two areas: climate change and natural resource management. The extent to which these risks and opportunities are material to company performance varies by sector, industry and geography.

Climate Change

Scientific consensus indicates that elevated concentration of greenhouse gas emissions in the atmosphere is contributing to climate change. Impacts from climate change may include significant risks to global financial assets and economic growth. We support measures that mitigate the risks associated with climate change and provide greater market certainty regarding the transition to a sustainable, low-carbon economy.

Risks: Climate change poses long-term risks to investments that should be assessed and mitigated. Risks fall into two primary categories, as outlined within the Task Force on Climate Related Financial Disclosure (TCFD):

| • | | Physical risk: Assets are exposed to physical risks related to specific events or longer-term shifts in climate patterns, such as changes in rainfall patterns, rising sea levels, or increased frequency of extreme weather events. While real assets such as farmland, timber, real estate, energy and infrastructure are particularly vulnerable to this type of risk, a much broader spectrum of businesses may be exposed depending on the location of their physical property. Health risks due to malnutrition, mortality, and population migration may also contribute to physical risk of climate change. |

| • | | Transition risk: Transitioning to a low-carbon economy may entail extensive policy, legal, regulatory, technology and market changes to mitigate and adapt to climate change. Depending on the nature, speed and focus of these changes, transition risks may pose varying levels of financial and reputational risk to organizations and, by definition, also to their investors. While transition risk is relevant across sectors, it is likely to be especially severe for carbon-intensive industries. |

10

Opportunities: Companies that proactively plan for climate risks in business strategy may be better able to manage and support a transition to a low-carbon economy that may include increased energy costs, shifts in consumer demand, and greater regulatory requirements, while avoiding stakeholder concern and reputational risk. Businesses and projects may be able to capture cost savings associated with increased energy efficiency. Across sectors, these can present attractive opportunities for investors to participate in supporting this transition.

Natural Resources

Rising populations and consumption levels are putting increased pressure on natural resources including fertile land, forests, clean air and water. Resource scarcity and ecosystem degradation pose several types of risks to businesses, while efficient use of natural resources may provide opportunities for cost savings and the introduction of new products or services. Sustainable stewardship of natural assets such as farmland and timberland safeguards long-term investments.

Risks: Companies that do not proactively manage risks related to water scarcity, biodiversity, land use, waste, and pollution may face financial impacts related to their licenses to operate, higher cost of raw materials or inputs, regulatory compliance costs, litigation from affected stakeholders (e.g., communities and landowners), and reputational risk. For example, companies in the agriculture, energy and mining sectors tend to have operations that are dependent on fragile land and ocean ecosystems and that can lead to harmful environmental pollution. Such companies need to be cognizant of how their operations affect and draw on natural resources to manage these risks.

Opportunities: Proactive strategies for improving natural resource efficiency can lead to cost savings for businesses and environmental benefits, which may better position companies with regulators, communities, customers and other stakeholders. A wide range of companies can benefit from technologies and solutions that minimize natural resources and toxic materials used, and the waste and pollutants generated, in production processes. Sustainable practices in the management of forestry, farmland and real estate can also enhance biodiversity while contributing to long-term investment success.

RECOMMENDED ACTIONS RELATED TO THE ENVIRONMENT

| · | | Company management should assess material climate-related risks and resource efficiency in operations, production processes, and supply chain management, and should publicly disclose relevant data related to both. Companies that are especially exposed to physical or transition risk should disclose the results of forward-looking climate risk scenario analysis, such as a scenario in which global average temperature rise is limited to two degrees Celsius or less above pre-industrial levels. Disclosure should capture how climate change may impact the company’s long term business outlook, strategic planning and capital allocation decisions. All companies should also consider setting targets for reducing greenhouse gas (GHG) emissions and improving resource efficiency. |

| · | | Boards should guide the development of a strategic, long-term approach to addressing environmental risks and opportunities and hold management accountable for its implementation. |

| | |

| | Sustainable stewardship of natural assets such as farmland and timberland safeguards long-term investments.” |

11

IV. Customers

Customers are a critical stakeholder for businesses, as they are the purchasers of the products and services that a company provides. Companies must continually innovate, ensure quality processes, and understand evolving consumer preferences to stay relevant and competitive. By providing better products and services, companies can build and maintain customer loyalty and trust while avoiding financial risks and reputational harm, which are crucial for growing the business and enhancing the consumer base. The point at which risks and opportunities related to customers become material to company performance varies by sector and industry.

Product Responsibility

Companies can impact customers at multiple points along the product lifecycle, including production, quality assurance, marketing and sales, and end use.

| • | | Production: Products that are sourced and produced in ways that aim to minimize negative impacts on society, customers and the environment can capture emerging consumer preferences for sustainable products. Companies that actively consider more responsible sourcing methods and less resource-intensive materials may also mitigate regulatory and reputational risks. |

| • | | Product Quality and Safety: |

| | – | Quality Assurance: Ensuring high-quality and safe products that minimize harm to society and the environment can lower reputational risk and financial costs from recalls, write-offs, warranty payments, fines, or lost sales. Product quality and safety extends beyond tangible products to services such as electronic data capture, where new risks are emerging for industries that collect and store large amounts of personal customer information. |

| | – | End Use: Even high-quality and safe products can have unintended consequences if used improperly. Promoting the responsible and safe use of products and services to safeguard communities and consumers avoids potential reputational risk and loss of consumer confidence. |

| · | | Marketing and Sales: Companies that provide incomplete or misleading claims about their products and services are at greater risk of regulatory and reputational damage. Accurate and transparent disclosure can facilitate increased customer engagement opportunities. |

| • | | Access and Affordability: Companies can face reputational risks and loss of consumer goodwill if perceived as engaging in discriminatory business practices with the intent or appearance of reducing access and affordability to essential goods and services. |

Risks: Companies’ failure to manage the potential hazards created by their products, services and marketing claims can create long-term financial risks. Product quality issues can negatively impact brand reputation and sales if they undermine customer trust, or they can result in unanticipated costs for companies through penalties, lawsuits or fines. Companies unprepared for new or emerging regulations related to consumer well-being (e.g., ingredients, labeling or privacy) may incur unexpected costs through required reformulations, operational investments and upgrades, or new protocols to be developed and implemented.

Opportunities: Customer trust is critical for enhancing brand and growing business. Companies that demonstrate ethical behavior and diligence with regard to product manufacturing, safety, marketing, pricing and end use can avoid reputational and liability risks while strengthening their competitive position. As customers become more aware of the social and environmental impacts of their products, companies that can quickly and efficiently respond to changing consumer preferences for sustainable goods can improve their ability to take advantage of a growing consumer market. Providing access to affordable products and services for underserved markets and vulnerable communities can also capture growing market segments for new sources of revenue and increase goodwill.

RECOMMENDED ACTIONS RELATED TO CUSTOMERS:

| • | | Company management should strive to create a culture of safety and sustainability at all levels of the firm. Further, management should carefully analyze the potential material risks to their business related to customer impacts at each point of the product lifecycle described above, develop policies and procedures to manage any potential concerns, and disclose those policies and practices to shareholders. Companies should adopt policies designed to prevent predatory or discriminatory consumer practices. |

| • | | Boards should provide appropriate oversight and accountability over management to implement those policies in a manner that upholds transparency and integrity with their customers. |

12

V. Employees and suppliers

Successful management of human capital – defined as the skills, talent and experience of individuals who carry out work – is critical to sustainable business growth. In particular, maintaining high standards of fairness, safety and inclusiveness in the workplace and supply chain can help a company protect its reputation, increase productivity, reduce liability and gain a competitive advantage.

Talent Management

Talent management is critical to firms’ ability to execute effectively and compete successfully over the long term. Specific talent needs and risks vary by industry and company. Robust talent management practices typically comprise a range of human resource (HR) policies and practices, including recruiting, retaining and compensating workers; ensuring workforce well-being; developing workforce skills and training; safeguarding worker health and safety; and managing people and labor relations. Beyond HR policies, talent management encompasses broader elements related to engaging and developing employees for strategic and long-term alignment with corporate goals and culture.

Employee satisfaction, engagement, and professional development are important factors for cultivating optimal performance within a firm’s workforce and throughout its supply chain. Wages and other compensation are important contributors to satisfaction. In addition, investments in training, mentoring, incentives, knowledge-sharing and shared decision-making can bolster workforce quality and productivity outcomes, especially when implemented in combination. Furthermore, productivity gains have been linked to managerial approaches that foster employee engagement and motivation, such as involving frontline workers in operational decisions (e.g., problem-solving and performance enhancements) and adopting partnership-style approaches to labor relations.

Risks: Gaps in internal talent management systems or supply chain oversight can exacerbate human capital risks including safety concerns, discrimination, harassment and misconduct, which can result in litigation, fines and reputational damages. Companies that lack competitive approaches to talent management may face difficulty attracting and retaining high-quality staff. Low levels of employee engagement and negative worker sentiment can result in lowered productivity, work stoppages and failures in ethical conduct. Additionally, companies that do not monitor or audit suppliers’ talent management systems can face

talent management failures, non-compliance with codes of conduct, and risks in the supply chain.

Opportunities: Proactive talent management strategies can enable companies to derive value from employees’ knowledge, innovative capacity and ability to work productively together and with technology. In addition, cost savings may result from lower employee and supplier turnover and more productive supplier relations. Positive employee perceptions also contribute to broader corporate reputation.

Health and Safety

A healthy workforce is a key driver of company productivity, retention and reputation. Companies should endeavor to safeguard the health, safety and welfare of their employees and those engaged in their supply chain. This involves several aspects, including mitigation of short- and long-term occupational health and safety risks, efforts to support health and well-being, adherence to fair labor practices, enforcement of anti-harassment policies, and avoidance of forced labor and human trafficking.

Firms with complex supply chain relationships should assess and monitor labor-related health and safety risks embedded in their direct and indirect supplier relationships, in order to assure investors and stakeholders of suppliers’ compliance with code of conduct standards and respect for human rights.

Risks: Companies can face various financial, legal, regulatory, reputational and operational risks related to worker health and safety. Industries involving jobs of a physical nature that produce or manufacture goods, extractive industries, or those that involve handling of chemicals are especially exposed to health and safety risks. These companies may face financial impacts due to loss of employee productivity, production disruptions stemming from labor unrest, declining product quality, and increased spending on healthcare benefit payouts. They may also face legal liabilities, difficulty recruiting and retaining employees and suppliers, and reputational damage.

Opportunities: Companies that ensure safe working conditions and provide robust employee health and well-being programs may be better able to attract and retain talent, increase worker productivity and enhance supply chain performance.

13

Diversity and Inclusion

The term diversity refers to the broad set of differences in skills, experiences, views and demographics associated with individuals in the workforce. Inclusion refers to actions intended to foster a work environment where differences among individuals are valued and effectively employed to achieve good business outcomes. Diversity and inclusion are fundamental elements of corporate culture that can be enhanced through talent recruitment and development programs, and policies and procedures that embed diversity and promote inclusion in corporate culture. For example, companies can demonstrate commitment to inclusive approaches through benefits and programs such as paid parental leave and flexible workplace policies.

As companies grapple with competition for talent in increasingly diverse domestic and global labor markets, effective management of diverse talent pipelines and an inclusive corporate culture have been linked to significant benefits that can drive competitive advantage. Research has shown that firms that demonstrate racial, ethnic or gender diversity in management ranks are associated with higher likelihood of financial outperformance over time. In order to reap the rewards of talent diversity, firms and boards should strive to foster a work environment that promotes personal safety, mutual respect, and substantive inclusion of diverse individuals in growth or leadership opportunities aligned with business objectives.

Additionally, firms have an opportunity to generate a range of added-value benefits by engaging diverse suppliers. As with managing diversity directly in their own workforce, companies that apply intentional objectives and track key indicators regarding supplier diversity are likely to generate greater returns on such investments.

Risks: Unconscious biases or acts of discrimination based on demographic and other personal characteristics such as race or gender can undermine the ability of diverse talent to contribute productively, and potentially lead to high turnover rates among diverse employees and suppliers. Systemic discrimination or harassment among workers can pose a threat to a firm’s reputation and increase the risk of labor disputes, litigation and regulatory enforcement actions.

Opportunities: Promoting diversity and inclusion among employees and suppliers can help companies improve decision making, attract and retain a talented and diverse workforce and compete more effectively. Firms that foster a diverse talent pipeline at all levels of the workforce, including among executives, senior management, and recruitment pools, tend to be well positioned to generate high-performing teams

and an attractive corporate culture. Teams that embody a diverse range of backgrounds, skills and views can also fuel innovation and more effective problem-solving. Potential benefits related to a diverse supplier base include multiple procurement channels (which increase contingencies and competition), positive community relations, and market expansion through exposure to wider and more diverse business networks.

RECOMMENDED ACTIONS RELATED TO EMPLOYEES AND SUPPLIERS:

| • | | Company management should develop and implement policies designed both to mitigate and adapt to challenges in regards to human capital management. |

| | – | We encourage the establishment of global labor policies based upon internationally recognized standards. Management should also establish policies or strategies to promote talent development and foster diversity and inclusion among employees and suppliers, as well as disclose relevant outcomes. |

| | – | Companies should be aware of any potential failures to provide equal opportunities and develop policies and initiatives to address any concerns (for example, by conducting pay equity risk assessments to spot potential biases in wage rates). Companies should reference gender identity and sexual orientation in corporate nondiscrimination policies, even when not specifically required by law. |

| | – | Companies with complex supply chains — especially those operating in industries or regions with high risk for violations of decent workplace standards — should explain efforts and outcomes related to supply chain oversight, monitoring and risk mitigation. |

| • | | Boards should provide oversight of, and independent perspective on, the quality of management performance, compensation and succession planning, the overall talent pipeline and recruitment strategies, and other qualitative and quantitative performance characteristics associated with the company’s talent management strategies. Furthermore, boards should monitor risks associated with wage strategies employed at varying levels, the behaviors they aim to incentivize, and their impacts, especially those tied to workforce sustainability and long-term financial results. |

| • | | Boards and management should each foster a culture of inclusiveness and acceptance of differences at all levels of the corporation. We encourage boards to foster diversity within the talent pipeline for management succession, as well as within their own board refreshment practices. |

14

Companies are increasingly scrutinized for their potential impacts on the communities in which they operate. While governments have a duty to protect human rights, businesses are increasingly recognized as having a role in ensuring they are neither undermining those rights nor otherwise contributing to harm in communities affected by their direct and indirect operations. Beyond avoiding harm, companies may also have opportunities to advance human rights and other benefits for communities by meeting basic needs for goods, services and livelihoods, which can in turn build goodwill, improve customer loyalty and enhance market share.

Risks: Failure to mitigate or address adverse impacts caused by company operations, products and services or business relationships, including perceived or indirect violations, could lead to operational, legal, reputational and financial threats and could weaken a company’s social license to operate.

Impacts on specific human rights (such as the right to water, health, personal security, freedom of expression and indigenous rights) vary depending on context, industry or size of the company. It is important for companies to conduct ongoing due diligence, and to remediate negative impacts when they arise. Certain contexts require companies to heighten their focus and responsibility:

| · | | Operations in certain sectors (e.g., extractives) and in communities where land or natural resource rights are obscure or obsolete may face increased threats to their license to operate, regulatory enforcement actions, or litigation by public and private entities if they fail to adequately engage with affected stakeholders. |

| · | | In contexts of conflict, there is greater risk of direct or indirect complicity in crimes against humanity or genocide, which constitute gross violations of international human rights law. |

In addition to monitoring direct impacts, companies should also consider the potential indirect impacts of their business operations. For example, significant public health impacts may result from company operations (such as toxic emissions), or products (such as addictive substances or defective products), which could lead to penalties, legal liability, diminished reputation or disruptions to company operations and long-term growth.

Opportunities: Companies can have positive impacts on the communities in which they operate by contributing to the fulfillment of basic needs and rights. While activities to support communities should not replace or offset the failure

to mitigate adverse impacts, they can strengthen business relationships and trust with stakeholders within a community. Examples of such activities include public advocacy of human rights and innovative product and service provision in markets that lack access to basic amenities.

Firms that consult with key community stakeholders – including civil society and local community groups – on their environmental and social risk management activities demonstrate willingness to understand and collaborate with communities they affect. By building trust with community stakeholders, a company can reinforce its social license to operate and create new opportunities, such as improved sourcing of talent and inputs, reputational benefits and customer loyalty.

RECOMMENDED ACTIONS RELATED TO COMMUNITIES:

| · | | Company management should develop a robust and transparent human rights due diligence framework that allows for continuous assessment to prevent and mitigate negative impacts. This framework should include applicable policies (or codes of conduct) and monitoring procedures to ensure compliance by employees and business partners. The framework should be developed and refined on an ongoing basis through meaningful dialogue and consultation with business partners, external experts and affected stakeholders to ensure existing and new risks are mitigated and addressed. Companies engaging in resource use impacting indigenous communities should strive to align with internationally recognized standards for corporate human rights performance. When rights violations occur, companies should be prepared to address and remediate. |

| · | | Boards should approve and oversee companies’ human rights policies and management implementation frameworks. Management of human rights risks and opportunities should be addressed at board meetings. Boards should also account for the company’s commitment to respecting human rights and the effectiveness of its risk frameworks through its oversight and management disclosures. |

15

THE POLICY APPLIES TO TIAA’S GENERAL ACCOUNT AND THE TIAA-CREF FUND COMPLEX.

Our voting practices are guided by our mission and obligations to our participants and shareholders. As indicated in this Policy Statement, we monitor portfolio companies’ environmental, social and governance (ESG) practices to ensure that boards consider these factors in the context of their strategic deliberations.

The following guidelines are intended to assist portfolio companies, participants and shareholders and other stakeholders in understanding how we are likely to vote on various issues. The list is not exhaustive and does not necessarily represent how we will vote on any particular proposal. We vote proxies in accordance with what we believe is in the best interest of our participants and shareholders. In making those decisions, we take into account many factors, including input from our investment teams and third-party research. We consider specific company context, including ESG practices and financial performance. It is our belief that a one-size-fits-all approach to proxy voting is not appropriate.

Our proxy voting decisions with respect to shareholder resolutions may be influenced by several additional factors: (i) whether the shareholder resolution process is the appropriate means of addressing the issue; (ii) whether the resolution promotes best ESG practices and is related to economic performance and shareholder value; and (iii) whether the information and actions recommended by the resolution are reasonable and practical.

Voting decisions for other clients of Teachers Advisors, LLC and TIAA-CREF Investment Management, LLC will also be undertaken using these proxy voting guidelines unless other proxy voting arrangements have been made on behalf of a client.

| | |

| | We believe that a one-size- fits-all approach to proxy voting is not appropriate.” |

| II. | Accountability and transparency |

Board of Directors

ELECT DIRECTORS

General Policy: We generally vote in favor of the board’s nominees but will consider withholding or voting against some or all directors in the following circumstances:

| • | | When we conclude that the actions of directors are unlawful, unethical, negligent, or do not meet fiduciary standards of care and loyalty, or are otherwise not in the best interest of shareholders. Such actions would include: |

| | – | Egregious compensation practices |

| | – | Lack of responsiveness to a failed vote |

| | – | Unequal treatment of shareholders |

| | – | Adoption of inappropriate antitakeover devices |

| | – | When a director has consistently failed to attend board and committee meetings without an appropriate rationale being provided |

| | – | When board independence is not in line with local market regulations or best practices |

| | – | When a member of executive management sits on a key board committee that should be composed of only independent directors |

| | – | When directors have failed to disclose, resolve or eliminate conflicts of interest that affect their decisions |

| | – | When there is insufficient diversity on the board and the company has not demonstrated its commitment to adding diverse candidates |

| | – | When we determine that director tenure is excessive and there has been no recent board refreshment |

CONTESTED ELECTIONS

General Policy: We will support the candidates we believe will best represent the interests of long-term shareholders.

17

MAJORITY VOTE FOR THE ELECTION OF DIRECTORS

General Policy: We generally support shareholder resolutions asking that companies amend their governance documents to provide for director election by majority vote.

ESTABLISH SPECIFIC BOARD COMMITTEES

General Policy: We generally vote against shareholder resolutions asking the company to establish specific board committees unless we believe specific circumstances dictate otherwise.

ANNUAL ELECTION OF DIRECTORS

General Policy: We generally support shareholder resolutions asking that each member of the board of a publicly traded operating company stand for re-election annually.

CUMULATIVE VOTING

General Policy: We generally do not support proposals asking that shareholders be allowed to cumulate votes in director elections, as this practice may encourage the election of special interest directors.

SEPARATION OF CHAIRMAN AND CHIEF EXECUTIVE OFFICER

General Policy: We will consider supporting shareholder resolutions asking that the roles of chairman and CEO be separated when we believe the company’s board structure and operation has insufficient features of independent board leadership, such as the lack of a lead independent director. In addition, we may also support resolutions on a case-by-case basis where we believe, in practice, that there is not a bona-fide lead independent director acting with robust responsibilities or the company’s ESG practices or business performance suggest a material deficiency in independent influence into the company’s strategy and oversight.

Shareholder Rights

PROXY ACCESS

General Policy: We will consider on a case-by-case basis shareholder proposals asking that the company implement a form of proxy access. In making our voting decision, we will consider several factors, including, but not limited to: current performance of the company, minimum filing thresholds, holding periods, number of director nominees that can be elected, existing governance issues and board/management responsiveness to material shareholder concerns.

RATIFICATION OF AUDITOR

General Policy: We will generally support the board’s choice of auditor and believe that the auditor should be elected annually. However, we will consider voting against the ratification of an audit firm where non-audit fees are excessive, where the firm has been involved in conflict of interest or fraudulent activities in connection with the company’s audit, where there has been a material restatement of financials or where the auditor’s independence is questionable.

SUPERMAJORITY VOTE REQUIREMENTS

General Policy: We will generally support shareholder resolutions asking for the elimination of supermajority vote requirements.

DUAL-CLASS COMMON STOCK AND UNEQUAL VOTING RIGHTS

General Policy: We will generally support shareholder resolutions asking for the elimination of dual classes of common stock or other forms of equity with unequal voting rights or special privileges.

RIGHT TO CALL A SPECIAL MEETING

General Policy: We will generally support shareholder resolutions asking for the right to call a special meeting. However, we believe a 25% ownership level is reasonable and generally would not be supportive of proposals to lower the threshold if it is already at that level.

RIGHT TO ACT BY WRITTEN CONSENT

General Policy: We will consider on a case-by-case basis shareholder resolutions requesting the right to act by written consent.

ANTITAKEOVER DEVICES (POISON PILLS)

General Policy: We will consider on a case-by-case basis proposals relating to the adoption or rescission of antitakeover devices with attention to the following criteria:

| • | | Whether the company has demonstrated a need for antitakeover protection |

| • | | Whether the provisions of the device are in line with generally accepted governance principles |

| • | | Whether the company has submitted the device for shareholder approval |

| • | | Whether the proposal arises in the context of a takeover bid or contest for control |

18

We will generally support shareholder resolutions asking to rescind or put to a shareholder vote antitakeover devices that were adopted without shareholder approval.

REINCORPORATION

General Policy: We will evaluate on a case-by-case basis proposals for reincorporation taking into account the intention of the proposal, established laws of the new domicile and jurisprudence of the target domicile. We will not support the proposal if we believe the intention is to take advantage of laws or judicial interpretations that provide antitakeover protection or otherwise reduce shareholder rights.

CORPORATE POLITICAL INFLUENCE

General Policies:

| • | | We will generally support reasonable shareholder resolutions seeking disclosure or reports relating to a company’s direct political contributions, including board oversight procedures. |

| • | | We will generally support reasonable shareholder resolutions seeking disclosure or reports relating to a company’s charitable contributions and other philanthropic activities. |

| • | | We may consider not supporting shareholder resolutions that appear to promote a political agenda that is contrary to the mission or values of TIAA or the long-term health of the corporation. |

| • | | We will evaluate on a case-by-case basis shareholder resolutions seeking disclosure of a company’s lobbying expenditures. |

Compensation Issues

ADVISORY VOTES ON EXECUTIVE COMPENSATION (SAY ON PAY)

General Policy: We will consider on a case-by-case basis the advisory vote on executive compensation (say on pay). We expect well-designed plans that clearly demonstrate the alignment between pay and performance, and we encourage companies to be responsive to low levels of support by engaging with shareholders. We also prefer that companies offer an annual non-binding vote on executive compensation. In absence of an annual vote, companies should clearly articulate the rationale behind offering the vote less frequently.

We generally note the following red flags when evaluating executive compensation plans:

| • | | Undisclosed or Inadequate Performance Metrics: We believe that performance goals for compensation plans should be disclosed meaningfully. Performance hurdles should not be too easily attainable. Disclosure of these metrics should enable shareholders to assess whether the plan will drive long-term value creation. |

| • | | Excessive Equity Grants: We will examine a company’s past grants to determine the rate at which shares are being issued. We will also seek to ensure that equity is being offered to more than just the top executives at the company. A pattern of excessive grants can indicate failure by the board to properly monitor executive compensation and its costs. |

| • | | Lack of Minimum Vesting Requirements: We believe that companies should establish minimum vesting guidelines for senior executives who receive stock grants. Vesting requirements help influence executives to focus on maximizing the company’s long-term performance rather than managing for short-term gain. |

| • | | Misalignment of Interests: We support equity ownership requirements for senior executives and directors to align their interests with those of shareholders. |

| • | | Special Award Grants: We will generally not support mega-grants. A company’s history of such excessive grant practices may prompt us to vote against the stock plans and the directors who approve them. Mega-grants include equity grants that are excessive in relation to other forms of compensation or to the compensation of other employees and grants that transfer disproportionate value to senior executives without relation to their performance. We also expect companies to provide a rationale for any other one-time awards such as a guaranteed bonus or a retention award. |

| • | | Excess Discretion: We will generally not support plans where significant terms of awards — such as coverage, option price, or type of awards — are unspecified, or where the board has too much discretion to override minimum vesting or performance requirements. |

| • | | Lack of Clawback Policy: We believe companies should establish clawback policies that permit recoupment from any senior executive who received compensation as a result of defective financial reporting, or whose behavior caused financial harm to shareholders or reputational risk to the company. |

19

EQUITY-BASED COMPENSATION PLANS

General Policy: We will review equity-based compensation plans on a case-by-case basis, giving closer scrutiny to companies where plans include features that are not performance-based or where potential dilution or burn rate total is excessive. As a practical matter, we recognize that more dilutive broad-based plans may be appropriate for human-capital intensive industries and for small- or mid-capitalization firms and start-up companies.

We generally note the following red flags when evaluating equity incentive plans:

| • | | Evergreen Features: We will generally not support option plans that contain evergreen features, which reserve a specified percentage of outstanding shares for award each year and lack a termination date. |

| • | | Reload Options: We will generally not support reload options that are automatically replaced at market price following exercise of initial grants. |

| • | | Repricing Options: We will generally not support plans that authorize repricing. However, we will consider on a case-by-case basis management proposals seeking shareholder approval to reprice options. We are likely to vote in favor of repricing in cases where the company excludes named executive officers and board members and ties the repricing to a significant reduction in the number of options. |

| • | | Undisclosed or Inappropriate Option Pricing: We will generally not support plans that fail to specify exercise prices or that establish exercise prices below fair market value on the date of grant. |

GOLDEN PARACHUTES

General Policy: We will vote on a case-by-case basis on golden parachute proposals, taking into account the structure of the agreement and the circumstances of the situation. However, we would prefer to see a double trigger on all change-of-control agreements and no excise tax gross-up.

SHAREHOLDER RESOLUTIONS ON EXECUTIVE COMPENSATION

General Policy: We will consider on a case-by-case basis shareholder resolutions related to specific compensation practices. Generally, we believe specific practices are the purview of the board.

| III. | Guidelines for ESG shareholder resolutions |

We generally support shareholder resolutions seeking reasonable disclosure of the environmental or social impact of a company’s policies, operations or products. We believe that a company’s management and directors should determine the strategic impact of environmental and social issues and disclose how they are dealing with these issues to mitigate risk.

Environmental Issues

GLOBAL CLIMATE CHANGE

General Policy: We will generally support reasonable shareholder resolutions seeking disclosure of greenhouse gas emissions, the impact of climate change on a company’s business activities and products and strategies designed to reduce the company’s long-term impact on the global climate.

USE OF NATURAL RESOURCES

General Policy: We will generally support reasonable shareholder resolutions seeking disclosure or reports relating to a company’s use of natural resources, the impact on its business of declining resources and its plans to improve the efficiency of its use of natural resources.

IMPACT ON ECOSYSTEMS

General Policy: We will generally support reasonable shareholder resolutions seeking disclosure or reports relating to a company’s initiatives to reduce any harmful impacts or other hazards to local, regional or global ecosystems that result from its operations or activities.

ANIMAL WELFARE

General Policy: We will generally support reasonable shareholder resolutions asking for reports on the company’s impact on animal welfare.

20

Issues Related to Customers

PRODUCT RESPONSIBILITY

General Policy: We will generally support reasonable shareholder resolutions seeking disclosure relating to the quality, safety and impact of a company’s goods and services on the customers and communities it serves.

PREDATORY LENDING

General Policy: We will generally support reasonable shareholder resolutions asking companies for disclosure about the impact of lending activities on borrowers and about policies designed to prevent predatory lending practices.

Issues Related to Employees and Suppliers

DIVERSITY AND NONDISCRIMINATION

General Policies:

| • | | We will generally support reasonable shareholder resolutions seeking disclosure or reports relating to a company’s nondiscrimination policies and practices, or seeking to implement such policies, including equal employment opportunity standards. |

| • | | We will generally support reasonable shareholder resolutions seeking disclosure or reports relating to a company’s workforce, board diversity, and gender pay equity policies and practices. |

GLOBAL LABOR STANDARDS

General Policy: We will generally support reasonable shareholder resolutions seeking a review of a company’s labor standards and enforcement practices, as well as the establishment of global labor policies based upon internationally recognized standards.

Issues Related to Communities

CORPORATE RESPONSE TO GLOBAL HEALTH RISKS

General Policy: We will generally support reasonable shareholder resolutions seeking disclosure or reports relating to significant public health impacts resulting from company operations and products, as well as the impact of global health pandemics on the company’s operations and long-term growth.

GLOBAL HUMAN RIGHTS CODES OF CONDUCT

General Policy: We will generally support reasonable shareholder resolutions seeking a review of a company’s human rights standards and the establishment of global human rights policies, especially regarding company operations in conflict zones or areas of weak governance.

| | |

| | We believe that a company’s management and directors should determine the strategic impact of environmental and social issues...” |

For more information about RI, visit us at nuveen.com/responsible-investing.

Glossary

Poison pill: A defense tactic utilized by a target company to prevent or discourage hostile takeover attempts.

Responsible investing incorporates Environmental Social Governance (ESG) factors that may affect exposure to issuers, sectors, industries, limiting the type and number of investment opportunities available, which could result in excluding investments that perform well.

The investment advisory services, strategies and expertise of TIAA Investments, a division of Nuveen, are provided by Teachers Advisors, LLC and TIAA-CREF Investment Management, LLC. Nuveen Securities, LLC, member FINRA and SIPC.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.