UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23270

Blackstone / GSO Floating Rate Enhanced Income Fund

(exact name of Registrant as specified in charter)

345 Park Avenue, 31st Floor

New York, New York 10154

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

Marisa Beeney

345 Park Avenue, 31st Floor

New York, New York 10154

Registrant’s telephone number, including area code: (877) 876-1121

Date of fiscal year end: October 31

Date of reporting period: January 18, 2018 - April 30, 2018

| Item 1. | Report to Stockholders. |

Table of Contents

| Manager Commentary | 1 |

| Fund Summary | 3 |

| Portfolio of Investments | 5 |

| Statement of Assets and Liabilities | 15 |

| Statement of Operations | 16 |

| Statement of Changes in Net Assets | 17 |

| Statement of Cash Flows | 18 |

| Financial Highlights | 19 |

| Notes to Financial Statements | 20 |

| Additional Information | 30 |

| Trustees & Officers | 31 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Manager Commentary |

April 30, 2018 (Unaudited)

To Our Shareholders:

U.S. Gross Domestic Product (GDP) increased at a 2.2% annualized rate in the first quarter of 2018, according to the “second” estimate released by the Bureau of Economic Analysis. Despite a subdued GDP growth compared to the preceding few quarters, we anticipate growth reaching a strong pace as stimulus from federal tax cuts and spending is realized throughout 2018. Real disposable personal income increased 0.3% in April, which is expected to help further increase personal spending. The unemployment rate remains at lows not seen since 2000, reaching 3.9% in April 2018, down from 4.1% at the end of 2017. For the twelve months ending April 2018, the Consumer Price Index (CPI) increased by 2.5%, continuing a generally upward trend in rate of increase since mid-2017. While concerns about trade wars and tariffs have increased market volatility, sentiment is at historically healthy levels as U.S. earnings are strong and global expansion continues to benefit from accelerating growth in China.

Loans outperformed all other major asset classes year-to-date (YTD) as of April 30, 2018 with very little volatility, and loans were less affected by the sharp February sell off in equities and bonds. The S&P/LSTA Leveraged Loan Index posted a 1.87% YTD gain, outperforming both the Bloomberg Barclays U.S. Aggregate Fixed Income Index (-2.19%) and the Bloomberg Barclays High Yield Index (-0.21%), as well as the S&P 500 (-1.20%). In contrast to high yield bonds, investment grade bonds, and equities, we saw only sporadic pockets of volatility in the loan market and light trade volumes throughout the first quarter.

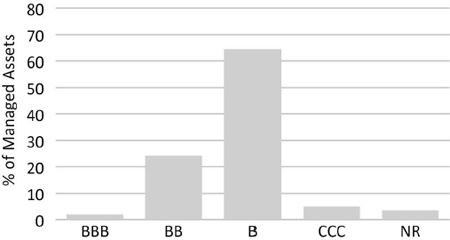

Lower quality loans (rated CCC/Split CC) outperformed the higher quality (rated BB and B) segment of the market YTD. The lower quality loan segment is largely composed of second lien loans and less liquid or middle market loans, which benefited from an increasing risk appetite and less repricing and refinancing activity. This relationship among quality segments was similar for high yield bonds. BB-rated high yield underperformed single B and CCCs YTD as a result of rapidly rising rates, as BB-rated bonds typically have longer duration. With rate volatility starting to decline, we saw high yield returns stabilize slightly in April 2018.

| Total Returns YTD as of April 30, 2018 | |

| US Loans (S&P/LSTA Leveraged Loan Index) | 1.87% |

| US High Yield Bonds (Bloomberg Barclays U.S. High Yield Index) | -0.21% |

| 3-month Treasury Bills (Bloomberg Barclays U.S. Treasury Bellweathers: 3 Month) | 0.50% |

| 10-Year Treasuries (Bloomberg Barclays U.S. Treasury Bellweathers: 10 Year) | -3.76% |

| US Aggregate Bonds (Bloomberg Barclays U.S. Aggregate Index) | -2.19% |

| US Investment Grade Bonds (Bloomberg Barclays U.S. Corporate Investment Grade Index) | -3.22% |

| Emerging Markets (Bloomberg Barclays EM USD Aggregate Index) | -2.48% |

| US Large Cap Equities (S&P 500® Index) | -1.20% |

Sources: Bloomberg, Barclays, S&P/LCD

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

As of April 30, 2018, institutional gross loan issuance YTD totaled $311 billion, with refinancings and repricings accounting for 76.8%, compared to an issuance of $418 billion, with refinancings and repricings at 82.5%, for the same time period in 2017. Limited net new supply of loans thus far in 2018, coupled with reinvigorated retail and institutional demand for the asset class, has bolstered the technical bid for loans. Looking at the current forward calendar, we expect subdued issuance in the near term and believe volumes will continue to lag 2017’s record pace.

In the first four months of 2018, loan retail funds added $7 billion in flows while high yield funds experienced $19 billion of retail outflows amid the broader market sell off. Although retail represents only approximately 15% of the overall loan market, we view these inflows as supportive of secondary loan prices and expect this trend to continue in the near term.

The outperformance of loans YTD compared to other fixed income asset classes is consistent with historical periods of economic growth and rising interest rates. Although loan spreads have compressed YTD as of April 30, 2018, 3-month LIBOR has increased 67bp, resulting in a net increase of 60bp in the average loan coupon of the J.P. Morgan Leveraged Loan Index, bringing it to 5.54%. Despite concerns that higher interest rates may negatively impact loan issuers, U.S. corporate performance continues to demonstrate robust fundamental strength and strong underlying trends in revenue, earnings, and overall credit health. EBITDA growth is expected to offset future increases in interest expense and prevent deterioration of leverage ratios. Notably, many loan issuers have switched from 3-month to 1-month LIBOR on underlying loan contracts, allowing for 45bp in cost savings as of the end of April, and issuers have swapped floating rate exposure into fixed rate exposure by purchasing interest rate swaps to hedge against interest rate increases.

Thus far in 2018, 16 companies have defaulted with $29.4 billion in combined default volume across loans and high yield bonds ($11.1 billion and $18.3 billion, respectively). The par-weighted U.S. loan last-twelve-months (LTM) default rate at the end of April 2018 was 2.35%, a 96bp year-over-year increase, but still 85bp below the 18-year historical average default rate of 3.20%. The par-weighted U.S. high yield LTM default rate was 2.26% at the end of April 2018, 85bp higher than a year ago but 64bp below the 25-year historical average default rate of 2.90%. The uptick in default volume was largely attributable to the default of iHeart Communications, a large 2008 leveraged buyout (LBO), which accounted for $16.0 billion or 54% of total default activity for 2018 YTD. As a result, the broadcasting sector accounted for the highest default volume, with energy and retail following thereafter with $4.3 billion (15% of total default volume) and $3.6 billion (12% of total default volume), respectively.

| Semi-Annual Report | April 30, 2018 | 1 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Manager Commentary |

April 30, 2018 (Unaudited)

As 2018 progresses, we believe a great deal of performance will be predicated on inflation trends, sustained healthy fundamental performance of issuers, and the continuation of a rising rate environment. We believe that expectations for rising interest rates, coupled with current relative yields, reinforce the attractiveness of loans relative to other longer-duration fixed income assets. Given the low correlation of loans with other fixed income investments, any volatility in loans caused by rising rates should present an opportunity to add exposure to the asset class.

At GSO / Blackstone, we value your continued investment and confidence in us and in our family of funds. Additional information about our funds is available on our website at www.blackstone-gso.com and www.bgfrei.com.

Sincerely,

GSO / Blackstone Debt Funds Management LLC

| Blackstone / GSO Floating Rate Enhanced Income Fund | Fund Summary |

April 30, 2018 (Unaudited)

Fund Overview

Blackstone / GSO Floating Rate Enhanced Income Fund (“BGFREI” or herein, the “Fund”) is a non-diversified, closed-end management investment company that continuously offers its shares and is operated as an “interval fund”. The Fund’s investment objective is to provide attractive current income with low sensitivity to rising interest rates. Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in floating rate loans, notes or bonds. “Managed Assets” means net assets plus the amount of any borrowings and the liquidation preference of any preferred shares that may be outstanding. In addition, the Fund may invest up to 20% of its Managed Assets in each of (i) structured products, (ii) derivatives, (iii) warrants and equity securities that are incidental to the Fund’s purchase of floating rate instruments or acquired in connection with a reorganization of a Borrower (as defined within) or issuer, (iv) fixed rate instruments, and (v) equity investments in other investment companies, including exchanged-traded funds. In pursuing the Fund’s investment objective, the Adviser (as defined within) will seek to enhance the Fund’s return with the use of leverage.

Portfolio Management Commentary – Fund Inception Through April 30, 2018

Fund Performance

BGFREI’s Class I outperformed its benchmark, the S&P/LSTA Leveraged Loan Index (“S&P LLI”), for the one-month and three-month periods but underperformed its benchmark since inception.

NAV Performance Factors

Since inception, the Fund has returned 1.24% compared to the S&P LLI return of 1.34%. Underperformance is mainly attributable to cash drag during the ramp phase. Cash was deployed utilizing a combination of the primary market (which typically comes at a discount) and select opportunities in the secondary market. The Fund’s average allocation to second lien loans over the period of approximately 5.3% was a top contributor as second lien loans returned 1.94% compared to first liens at 1.19%. By issuer, the largest contributors to performance relative to the benchmark were Access CIG, Solarwinds, and Oryx.

Portfolio Activity and Positioning

The Fund launched in January 2018 with initial capital contributions of approximately $125 million. Initial portfolio activities were focused on investing equity capital and subsequently drawing leverage to match loan settlement to avoid cash or leverage drag. We employed a methodical approach to the investment ramp, utilizing a combination of the primary new issue market and select secondary market opportunities. The Fund’s top overweights include Healthcare, Financial Intermediaries, and Technology and top underweights include Retail, Cable & Satellite, and Lodging.1 Ongoing portfolio management will include further optimizing the Fund and continuing to build out a diversified portfolio.

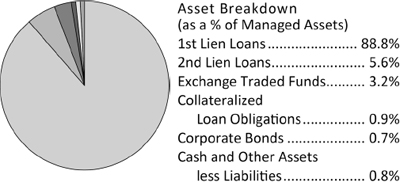

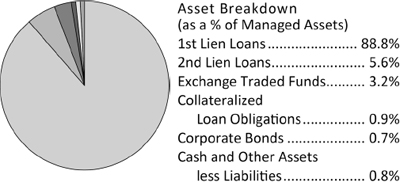

As of April 30, 2018, the Fund held 88.8% of its Managed Assets in first lien loans, 5.6% in second lien loans, 0.7% in corporate bonds, 0.9% in collateralized loan obligations (CLO) liabilities, and 3.2% in an exchange traded funds (ETF). BGFREI’s investments represented the obligations of 222 companies, with an average position size representing 0.44% of Managed Assets of the Fund. Healthcare and Pharmaceuticals, High Tech Industries, and Banking, Finance, Insurance and Real Estate represent the Fund’s top sector weightings.2

| 1 | Industries per S&P classifications. |

| 2 | Industries per Moody’s classifications. |

| Semi-Annual Report | April 30, 2018 | 3 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Fund Summary |

April 30, 2018 (Unaudited)

Portfolio Composition

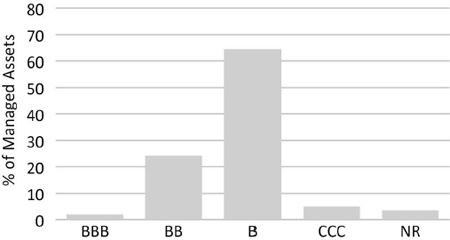

Moody’s Rating Distribution**

| ** | For more information on Moody's ratings and descriptions refer to www.moodys.com. |

| Portfolio Characteristics | |

| Weighted Average Coupon | 4.91% |

| Current Dividend Yield^ | 4.95% |

| Effective Duration^^ | 0.25 yr |

| Average Position* | 0.44% |

| Leverage* | 23.15% |

| ^ | Using a distribution rate of $0.102 per I Share, and a NAV per share of $25.06, as of 4/30/18. Represents latest cumulative monthly distribution shown as an annualized percentage of net asset value. |

| ^^ | Loan durations are assumed to be 3 months because of LIBOR resets. |

| * | As a percentage of Managed Assets. |

| Top 10 Issuers* | |

| SPDR Blackstone / GSO Senior Loan ETF | 3.2% |

| Epicor Software Corp | 1.0% |

| Zest Acquisition Corp | 1.0% |

| Flexera Software LLC | 1.0% |

| EG America LLC | 1.0% |

| Solarwinds Holdings Inc | 0.9% |

| Amneal Pharmaceuticals LLC | 0.9% |

| Mcafee, LLC | 0.9% |

| Sinclair Television Group Inc | 0.9% |

| First Data Corp | 0.9% |

| Top 10 Issuers | 11.6% |

| * | As a percentage of Managed Assets. |

Portfolio holdings and distributions are subject to change and are not recommendations to buy or sell any security.

| Top 5 Industries*^ | |

| Healthcare and Pharmaceuticals | 16.94% |

| High Tech Industries | 13.22% |

| Banking, Finance, Insurance and Real Estate | 11.41% |

| Services - Business | 5.64% |

| Telecommunications | 5.07% |

| Top 5 Industries | 52.28% |

| * | As a percentage of Managed Assets. |

| Total Return | | | |

| | 1 Month | 3 Month | Since Inception |

| BGFREI* - Class I | 0.57% | 1.07% | 1.24% |

| S&P/LSTA Leveraged Loan Index** | 0.41% | 0.90% | 1.34% |

| * | Assumes distributions are reinvested pursuant to the Fund’s dividend reinvestment plan. Performance data quoted represents past performance and does not guarantee future results. |

| ** | Inception to date returns for the S&P LLI are based on the I Share inception date of 1/18/18. |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

April 30, 2018 (Unaudited)

| | | Principal Amount | | | Value | |

| FLOATING RATE LOAN INTERESTS(a) - 122.92% | | | | | | | | |

| Aerospace and Defense - 2.58% | | | | | | | | |

| Engility Corp, Senior Secured First Lien Term B-2 Loan, 3M US L + 3.25%, 08/14/2023 | | $ | 338,082 | | | $ | 338,647 | |

| Transdigm Inc, Senior Secured First Lien New Tranche G Term Loans, 3M US L + 2.50%, 08/22/2024 | | | 1,197,000 | | | | 1,204,397 | |

| Vectra Co, Senior Secured First Lien Term Loan, 1M US L + 3.25%, 03/08/2025 | | | 897,015 | | | | 899,540 | |

| WP CPP Holdings LLC, Senior Secured First Lien Term B Loan, 3M US L + 3.75%, 04/30/2025(b) | | | 977,273 | | | | 983,381 | |

| | | | | | | | 3,425,965 | |

| | | | | | | | | |

| Automotive - 2.61% | | | | | | | | |

| American Axle & Manufacturing Inc, Senior Secured First Lien Tranche B Term Loan, 1M US L + 2.25%, 04/06/2024 | | | 750,000 | | | | 754,924 | |

| Belron Finance US LLC, Senior Secured First Lien Initial Term B Loan, 3M US L + 2.50%, 11/07/2024 | | | 748,125 | | | | 752,801 | |

| Bright Bidco BV, Senior Secured First Lien Term B Loan, 2M US L + 3.50%, 06/28/2024 | | | 748,116 | | | | 759,805 | |

| Mitchell International Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.25%, 11/29/2024 | | | 694,030 | | | | 694,970 | |

| Mitchell International Inc, Senior Secured Second Lien Initial Term Loan, 1M US L + 7.25%, 12/01/2025 | | | 500,000 | | | | 503,000 | |

| | | | | | | | 3,465,500 | |

| | | | | | | | | |

| Banking, Finance, Insurance and Real Estate - 13.60% | | | | | | | | |

| Alliant Holdings Intermediate LLC, Senior Secured First Lien Term B Loan, 3M US L + 3.00%, 04/28/2025 | | | 1,038,810 | | | | 1,046,601 | |

| Applied Systems Inc, Senior Secured First Lien Initial Term Loan, 3M US L + 3.25%, 09/19/2024 | | | 748,120 | | | | 755,602 | |

| Applied Systems Inc, Senior Secured Second Lien Initial Term Loan, 3M US L + 7.00%, 09/19/2025 | | | 500,000 | | | | 517,750 | |

| ASP MCS Acquisition Corp, Senior Secured First Lien Initial Term Loan, 1M US L + 4.75%, 05/20/2024(b) | | | 748,116 | | | | 757,467 | |

| Assured Partners Inc, Senior Secured First Lien 2017 September Refinancing Term Loan, 1M US L + 3.25%, 10/22/2024 | | | 1,440,895 | | | | 1,449,792 | |

| Asurion LLC, Senior Secured Second Lien Tranche B-2 Loan, 1M US L + 6.00%, 08/04/2025 | | | 500,000 | | | | 515,000 | |

| Clipper Acquisitions Corp, Senior Secured First Lien B-1 Term Loan, 3M US L + 2.00%, 12/27/2024 | | | 748,125 | | | | 753,111 | |

| CP VI Bella Topco LLC, Senior Secured First Lien Term Loan, 1M US L + 3.00%, 02/14/2025 | | | 670,195 | | | | 669,217 | |

| Cypress Intermediate Holdings III Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.00%, 04/29/2024 | | | 748,116 | | | | 753,023 | |

| Cypress Merger Sub Inc, Senior Secured Second Lien Initial Term Loan, 1M US L + 6.75%, 04/28/2025 | | | 473,721 | | | | 481,419 | |

| Deerfield Holding Corp, Senior Secured First Lien Initial Term Loan, 3M US L + 3.25%, 02/13/2025 | | | 863,636 | | | | 866,603 | |

| Edelman Financial Center LLC/The, Senior Secured First Lien Initial Term Loan, 3M US L + 4.25%, 11/09/2024 | | | 748,125 | | | | 756,541 | |

| ExamWorks Group Inc, Senior Secured First Lien Term B-1 Loan, 1M US L + 3.25%, 07/27/2023 | | | 320,455 | | | | 323,659 | |

| First Data Corp, Senior Secured First Lien 2024A New Dollar Term Loan, 1M US L + 2.25%, 04/26/2024 | | | 1,500,000 | | | | 1,506,960 | |

| Fly Funding II Sarl, Senior Secured First Lien Term Loan, 3M US L + 2.00%, 02/09/2023 | | | 733,651 | | | | 735,371 | |

| Focus Financial Partners LLC, Senior Secured First Lien Tranche B-1 Term Loan, 3M US L + 2.75%, 06/03/2024 | | | 269,024 | | | | 271,084 | |

| Gem Acquisitions Inc, Senior Secured First Lien Initial Term Loan, 3M US L + 3.25%, 03/02/2025 | | | 352,174 | | | | 352,906 | |

| HUB International Ltd, Senior Secured First Lien Initial Term Loan, 3M US L + 3.00%, 04/18/2025 | | | 1,285,714 | | | | 1,295,087 | |

| Semi-Annual Report | April 30, 2018 | 5 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

April 30, 2018 (Unaudited)

| | | Principal Amount | | | Value | |

| Banking, Finance, Insurance and Real Estate (continued) | | | | | | | | |

| Hyperion Insurance Group Ltd, Senior Secured First Lien Initial Dollar Term Loan, 1M US L + 3.50%, 12/20/2024 | | $ | 374,063 | | | $ | 377,530 | |

| SS&C Technologies Inc, Senior Secured First Lien Term B-3 Loan, 1M US L + 2.50%, 02/28/2025 | | | 870,294 | | | | 877,204 | |

| SS&C Technologies Inc, Senior Secured First Lien Term B4 Loan, 1M US L + 2.50%, 02/28/2025 | | | 322,000 | | | | 324,556 | |

| USI Inc, Senior Secured First Lien Term B Loan, 3M US L + 3.00%, 05/16/2024 | | | 1,496,241 | | | | 1,503,722 | |

| Verifone Inc, Senior Secured First Lien Facility Term B Loan, 1M US L + 2.00%, 1/31/2025 | | | 275,000 | | | | 276,147 | |

| Victory Capital Holdings Senior Secured First Lien Initial Term Loan, 3M US L + 2.75%, 02/07/2025 | | | 403,564 | | | | 407,852 | |

| York Risk Services Holding Corp (Onex York Finance LP), Senior Secured First Lien Initial Term Loan, 1M US L + 3.75%, 10/01/2021 | | | 498,708 | | | | 487,487 | |

| | | | | | | | 18,061,691 | |

| | | | | | | | | |

| Beverage, Food and Tobacco - 3.45% | | | | | | | | |

| Agro Merchants North America Holdings Inc, Senior Secured First Lien Effective Date Loan, 3M US L + 3.75%, 12/06/2024 | | | 748,177 | | | | 756,594 | |

| CH Guenther & Son Inc, Senior Secured First Lien Term Loan, 1M US L + 2.75%, 03/31/2025(b) | | | 722,892 | | | | 727,410 | |

| Chobani LLC, Senior Secured First Lien Term B Loan, 1M US L + 3.50%, 10/10/2023 | | | 748,120 | | | | 753,107 | |

| Dole Food Co Inc, Senior Secured First Lien Tranche B Term Loan, 3M US L + 1.75%, 04/06/2024 | | | 993,671 | | | | 999,633 | |

| Mastronardi Produce Ltd, Senior Secured First Lien Term B Loan, 3M US L + 3.25%, 04/21/2025 | | | 237,342 | | | | 238,825 | |

| TKC Holdings Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 4.25%, 02/01/2023 | | | 748,111 | | | | 756,059 | |

| TKC Holdings Inc, Senior Secured Second Lien Initial Term Loan, 1M US L + 8.00%, 02/01/2024 | | | 350,000 | | | | 354,200 | |

| | | | | | | | 4,585,828 | |

| | | | | | | | | |

| Capital Equipment - 2.91% | | | | | | | | |

| Clark Equipment Co, Senior Secured First Lien Refinancing Tranche B Term Loan, 3M US L + 2.00%, 05/18/2024 | | | 1,221,664 | | | | 1,224,627 | |

| Helix Acquisition Holdings Inc, Senior Secured First Lien 2018 New Term Loan 3M US L + 3.50%, 09/30/2024 | | | 343,765 | | | | 346,487 | |

| LTI Holdings Inc, Senior Secured First Lien Second Amendment Incremental Term Loan, 1M US L + 3.50%, 05/16/2024(b) | | | 152,174 | | | | 152,745 | |

| MTS System Corp, Senior Secured First Lien New Tranche B Term Loan, 1M US L + 3.25%, 07/05/2023 | | | 705,003 | | | | 712,498 | |

| Pro Mach Group Inc, Senior Secured First Lien Term Loan, 3M US L + 3.00%, 03/07/2025 | | | 506,757 | | | | 508,340 | |

| Robertshaw US Holding Corp, Senior Secured First Lien Initial Term Loan, 1M US L + 3.50%, 02/14/2025 | | | 414,634 | | | | 418,716 | |

| Titan Acquisition Ltd, Senior Secured First Lien Initial Term Loan, 2M US L + 3.00%, 03/28/2025 | | | 496,454 | | | | 497,695 | |

| | | | | | | | 3,861,108 | |

| | | | | | | | | |

| Chemicals, Plastics and Rubber - 4.05% | | | | | | | | |

| Alpha US Bidco Inc, Senior Secured First Lien Initial Term B-1 Loan, 3M US L + 3.00%, 01/31/2024 | | | 997,487 | | | | 1,005,592 | |

| Berry Global Inc, Senior Secured First Lien Term P Loan, 1M US L + 2.00%, 01/06/2021 | | | 750,000 | | | | 755,674 | |

| HB Fuller Co, Senior Secured First Lien Term Loan, 1M US L + 2.00%, 10/20/2024 | | | 1,017,312 | | | | 1,021,763 | |

| Spectrum Holdings III Corp, Senior Secured Second Lien Closing Date Loan, 1M US L + 7.00%, 01/26/2026(b) | | | 350,000 | | | | 354,375 | |

| Spectrum Holdings III, Senior Secured First Lien Term Loan, 1M US L + 3.25%, 01/31/2025 | | | 817,978 | | | | 821,217 | |

| Univar USA Inc, Senior Secured First Lien Term B-3 Loan, 1M US L + 2.50%, 07/01/2024 | | | 651,220 | | | | 657,784 | |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

April 30, 2018 (Unaudited)

| | | Principal Amount | | | Value | |

| Chemicals, Plastics and Rubber (continued) | | | | | | | | |

| Vantage Specialty Chemicals Inc, Senior Secured First Lien Closing Date Loan, 3M US L + 4.00%, 10/28/2024 | | $ | 748,125 | | | $ | 756,541 | |

| | | | | | | | 5,372,946 | |

| | | | | | | | | |

| Construction and Building - 3.24% | | | | | | | | |

| Builders FirstSource Inc, Senior Secured First Lien 2017 Initial Term Loan, 3M US L + 3.00%, 02/29/2024 | | | 374,048 | | | | 376,620 | |

| C.H.I. Overhead Doors Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.25%, 07/29/2022 | | | 997,449 | | | | 999,320 | |

| Henry Holdings Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 4.00%, 10/05/2023 | | | 748,106 | | | | 757,457 | |

| LBM Borrower LLC, Senior Secured First Lien Tranche C Term Loan, 1M US L + 3.75%, 08/19/2022 | | | 765,694 | | | | 774,906 | |

| Pisces Midco Inc, Senior Secured First Lien Initial Term Loan, 3M US L + 3.75%, 04/12/2025 | | | 637,255 | | | | 644,226 | |

| USS Ultimate Holdings Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.75%, 08/25/2024 | | | 747,702 | | | | 752,846 | |

| | | | | | | | 4,305,375 | |

| | | | | | | | | |

| Consumer Goods Durable - 1.74% | | | | | | | | |

| Al Aqua Merger Sub Inc, Senior Secured First Lien Term B1 Loan, 1M US L + 3.25%, 12/13/2023 | | | 561,079 | | | | 564,762 | |

| Power Products LLC, Senior Secured First Lien Tranche B-1 Term Loan, 3M US L + 4.00%, 12/20/2022(b) | | | 748,111 | | | | 757,462 | |

| PTL Acquisition Inc, Senior Secured First Lien Term Loan, 3M US L + 1.75%, 04/25/2025 | | | 573,770 | | | | 575,994 | |

| Zodiac Pool Holding SA - Zodiac Pool Solutions North America Inc, Senior Secured First Lien US Term Loan, 3M US L + 2.25%, 03/07/2025 | | | 409,836 | | | | 412,271 | |

| | | | | | | | 2,310,489 | |

| | | | | | | | | |

| Consumer Goods Non Durable - 0.57% | | | | | | | | |

| Hostess Brands LLC, Senior Secured First Lien November 2017 Refinancing Term B Loan, 1M US L + 2.25%, 08/03/2022 | | | 748,125 | | | | 754,765 | |

| | | | | | | | | |

| Containers, Packaging and Glass - 3.49% | | | | | | | | |

| Charter NEX US Inc, Senior Secured First Lien Term B-3 Loan, 1M US L + 3.00%, 05/16/2024 | | | 897,739 | | | | 900,768 | |

| IBC Capital Ltd, Senior Secured First Lien Initial Term Loan, 3M US L + 3.75%, 09/09/2021 | | | 727,851 | | | | 729,219 | |

| Pelican Products Inc, Senior Secured First Lien Term Loan, 3M US L + 3.50%, 04/19/2025 | | | 909,091 | | | | 917,614 | |

| ProAmpac PG Borrower LLC, Senior Secured First Lien Initial Loan, 3M US L + 3.50%, 11/20/2023 | | | 600,000 | | | | 605,925 | |

| Strategic Materials Holding Corp, Senior Secured First Lien Initial Term Loan, 3M US L + 3.75%, 11/01/2024 | | | 748,125 | | | | 754,203 | |

| Transcendia Holdings Inc, Senior Secured First Lien 2017 Refinancing Term Loan, 1M US L + 3.50%, 05/30/2024 | | | 493,763 | | | | 495,617 | |

| Trident TPI Holdings Inc, Senior Secured First Lien Incremental Term Loan, 3M US L + 3.25%, 10/17/2024(c) | | | 234,586 | | | | 236,053 | |

| | | | | | | | 4,639,399 | |

| | | | | | | | | |

| Energy, Oil and Gas - 3.72% | | | | | | | | |

| BCP Raptor LLC, Senior Secured First Lien Initial Term Loan, 2M US L + 4.25%, 06/24/2024 | | | 1,196,985 | | | | 1,210,080 | |

| Energy Transfer Equity LP, Senior Secured First Lien Refinanced Term Loan, 1M US L + 2.00%, 02/02/2024 | | | 1,200,000 | | | | 1,202,592 | |

| Lucid Energy Group II Borrower LLC, Senior Secured First Lien Initial Term Loan, 1M US L + 3.00%, 02/17/2025 | | | 1,052,632 | | | | 1,052,631 | |

| Oryx Southern Delaware Holdings LLC, Senior Secured First Lien Initial Term Loan, 1M US L + 3.25%, 02/28/2025 | | | 1,470,588 | | | | 1,476,103 | |

| | | | | | | | 4,941,406 | |

| Semi-Annual Report | April 30, 2018 | 7 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

April 30, 2018 (Unaudited)

| | | Principal Amount | | | Value | |

| Environmental Industries - 0.99% | | | | | | | | |

| Filtration Group Corp, Senior Secured First Lien Initial Dollar Term Loan, 3M US L + 3.00%, 03/29/2025 | | $ | 500,000 | | | $ | 505,573 | |

| Gopher Resource LLC, Senior Secured First Lien Term Loan, 3M US L + 3.25%, 03/06/2025(b) | | | 801,508 | | | | 812,027 | |

| | | | | | | | 1,317,600 | |

| | | | | | | | | |

| Healthcare and Pharmaceuticals - 22.06% | | | | | | | | |

| Albany Molecular Research Inc, Senior Secured Second Lien Initial Term Loan, 1M US L + 7.00%, 08/30/2025 | | | 750,000 | | | | 761,250 | |

| Alkermes Inc, Senior Secured First Lien 2023 Term Loan, 1M US L + 2.25%, 03/27/2023(b) | | | 295,696 | | | | 298,652 | |

| Amneal Pharmaceuticals LLC, Senior Secured First Lien Term B Loan, 3M US L + 3.50%, 03/21/2025 | | | 1,573,418 | | | | 1,582,764 | |

| Aspen Dental Management Inc, Senior Secured First Lien Term B Loan, 3M US L + 3.25%, 04/30/2025 | | | 1,241,379 | | | | 1,247,332 | |

| Avantor Inc, Senior Secured First Lien Initial Dollar Term Loan, 1M US L + 4.00%, 11/21/2024 | | | 1,197,000 | | | | 1,211,861 | |

| Certara Holdco Inc, Senior Secured First Lien Term Loan, 3M US L + 3.50%, 08/15/2024 | | | 209,302 | | | | 210,610 | |

| Change Healthcare Holdings LLC, Senior Secured First Lien Closing Date Term Loan, 1M US L + 2.75%, 03/01/2024 | | | 997,481 | | | | 1,002,548 | |

| CHG Healthcare Services Inc, Senior Secured First Lien New Term Loan, 3M US L + 3.00%, 06/07/2023 | | | 1,196,992 | | | | 1,208,717 | |

| Concentra Inc, Senior Secured Repriced First Lien Tranche B Term Loan, 1M US L + 2.75%, 06/01/2022 | | | 277,778 | | | | 280,556 | |

| Cryolife Inc, Senior Secured First Lien Initial Term Loan, 3M US L + 4.00%, 11/15/2024(b) | | | 748,125 | | | | 757,476 | |

| CVS Holdings I LP, Senior Secured First Lien Initial Term Loan, 3M US L + 3.00%, 02/06/2025 | | | 517,241 | | | | 514,334 | |

| Endo LLC, Senior Secured First Lien Initial Term Loan, 1M US L + 4.25%, 04/29/2024 | | | 748,116 | | | | 745,194 | |

| Equian LLC, Senior Secured First Lien 2018 Incremental Term B Loan, 1M US L + 3.25%, 05/20/2024 | | | 294,341 | | | | 296,548 | |

| Grifols Worldwide Operations USA Inc, Senior Secured First Lien Tranche B Term Loan, 1W US L + 2.25%, 01/31/2025 | | | 1,496,222 | | | | 1,505,730 | |

| HCA Inc, Senior Secured First Lien Tranche B10 Term Loan, 1M US L + 2.00%, 03/13/2025 | | | 1,138,304 | | | | 1,151,429 | |

| Heartland Dental LLC, Senior Secured First Lien Term Loan, 3M US L + 3.75%, 04/18/2025 | | | 1,349,325 | | | | 1,356,072 | |

| Horizon Pharma Inc, Senior Secured First Lien Third Amendment Refinanced Term Loan, 1M US L + 3.25%, 03/29/2024 | | | 748,111 | | | | 754,657 | |

| INC Research Holdings Inc, Senior Secured First Lien Term Loan, 3M US L + 2.00%, 08/01/2024 | | | 1,482,713 | | | | 1,490,127 | |

| Navicure Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.75%, 11/01/2024 | | | 482,661 | | | | 485,075 | |

| nThrive Inc, Senior Secured First Lien Term B-2 Loan, 1M US L + 4.50%, 10/20/2022 | | | 748,096 | | | | 753,240 | |

| Onex Carestream Finance LP, Senior Secured Second Lien Term Loan, 1M US L + 8.50%, 12/07/2019 | | | 500,000 | | | | 500,000 | |

| Ortho Clinical Diagnostics Holdings Luxembourg Sarl, Senior Secured First Lien Initial Term Loan, 1M US L + 3.75%, 06/30/2021 | | | 1,492,442 | | | | 1,504,254 | |

| Parexel International Corp, Senior Secured First Lien Initial Term Loan, 1M US L + 2.75%, 09/27/2024 | | | 1,196,992 | | | | 1,202,421 | |

| Pharmerica Corp, Senior Secured First Lien Term Loan, 1M US L + 3.50%, 12/06/2024 | | | 750,000 | | | | 754,687 | |

| Press Ganey Holdings Inc, Senior Secured Second Lien Initial Term Loan, 1M US L + 6.50%, 10/21/2024 | | | 500,000 | | | | 506,250 | |

| Sterigenics-Nordion Holdings LLC, Senior Secured First Lien New Term B Loan, 1M US L + 3.00%, 05/15/2022 | | | 498,741 | | | | 502,015 | |

| Surgery Center Holdings Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.25%, 09/02/2024 | | | 748,120 | | | | 750,810 | |

| Team Health Holdings Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 2.75%, 02/06/2024(b) | | | 748,111 | | | | 726,603 | |

| Tecostar Holdings Inc, Senior Secured First Lien 2017 Term Loan, 3M US L + 2.50%, 05/01/2024 | | | 498,744 | | | | 503,731 | |

| U.S. Anesthesia Partners Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.00%, 06/23/2024 | | | 374,058 | | | | 376,435 | |

| U.S. Renal Care Inc, Senior Secured First Lien Initial Term Loan, 3M US L + 4.25%, 12/30/2022 | | | 748,087 | | | | 746,527 | |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| April 30, 2018 (Unaudited) |

| | | Principal Amount | | | Value | |

| Healthcare and Pharmaceuticals (continued) | | | | | | | | |

| Valeant Pharmaceuticals International Inc, Senior Secured First Lien Series F-4 Tranche B Term Loan, 1M US L + 3.50%, 04/01/2022 | | $ | 1,129,927 | | | $ | 1,143,995 | |

| Wink Holdco Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.00%, 12/1/2024 | | | 748,125 | | | | 746,958 | |

| Zest Acquisition Corp, Senior Secured First Lien Initial Term Loan, 3M US L + 3.50%, 03/07/2025 | | | 1,704,545 | | | | 1,707,741 | |

| | | | | | | | 29,286,599 | |

| High Tech Industries - 17.18% | | | | | | | | |

| BMC Software Finance Inc, Senior Secured First Lien Initial B-2 US Term Loan, 1M US L + 3.25%, 09/10/2022 | | | 748,120 | | | | 752,127 | |

| Compuware Corp, Senior Secured First Lien Tranche B-3 Term Loan, 1M US L + 3.50%, 12/15/2021 | | | 819,372 | | | | 830,741 | |

| Cypress Semiconductor Corp, Senior Secured First Lien 2016 Incremental Term Loan, 1M US L + 2.25%, 07/05/2021 | | | 350,509 | | | | 354,781 | |

| Dell International LLC, Senior Secured First Lien Refinancing Term B Loan, 1M US L + 2.00%, 09/07/2023 | | | 995,000 | | | | 999,040 | |

| Epicor Software Corp, Senior Secured First Lien Term B Loan, 1M US L + 3.25%, 06/01/2022 | | | 1,734,671 | | | | 1,746,319 | |

| Excelitas Technologies Corp (fka IDS Acquisition), Senior Secured First Lien Initial USD Term Loan, 6M US L + 3.50%, 12/02/2024 | | | 748,125 | | | | 754,046 | |

| Flexera Software LLC, Senior Secured First Lien Term Loan, 1M US L + 3.25%, 02/26/2025 | | | 1,016,949 | | | | 1,024,195 | |

| Flexera Software LLC, Senior Secured Second Lien Term Loan, 1M US L + 7.25%, 02/26/2026 | | | 645,161 | | | | 651,074 | |

| Gigamon Inc, Senior Secured First Lien Initial Term Loan, 2M US L + 4.50%, 12/27/2024 | | | 374,063 | | | | 377,803 | |

| Help Systems Holdings Inc, Senior Secured First Lien Term Loan, 3M US L + 3.75%, 03/28/2025 | | | 787,402 | | | | 789,862 | |

| Hyland Software Inc, Senior Secured First Lien Term Loan, 1M US L + 3.25%, 07/01/2022 | | | 178,535 | | | | 180,335 | |

| Hyland Software Inc, Senior Secured Second Lien Initial Loan, 1M US L + 7.00%, 07/07/2025 | | | 173,913 | | | | 176,522 | |

| Idera Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 4.50%, 06/28/2024 | | | 374,040 | | | | 380,354 | |

| Informatica LLC, Senior Secured First Lien Dollar Term B-1 Loan, 1M US L + 3.25%, 08/05/2022 | | | 997,493 | | | | 1,005,678 | |

| Ivanti Software Inc, Senior Secured First Lien Term Loan, 1M US L + 4.25%, 01/20/2024 | | | 497,430 | | | | 491,585 | |

| Mcafee LLC, Senior Secured First Lien Closing Date USD Term Loan, 1M US L + 4.50%, 09/30/2024 | | | 1,496,241 | | | | 1,517,629 | |

| MH Sub I LLC, Senior Secured First Lien Term Loan, 1M US L + 3.75%, 09/13/2024 | | | 712,496 | | | | 713,532 | |

| Microsemi Corp, Senior Secured First Lien Term B Loan, 3M US L + 2.00%, 01/13/2023 | | | 750,000 | | | | 752,768 | |

| ON Semiconductor Corp, Senior Secured First Lien 2017 New Replacement Term B-2 Loan, 1M US L + 2.00%, 03/31/2023 | | | 750,000 | | | | 755,719 | |

| Ping Identity Corp, Senior Secured First Lien Term Loan, 1M US L + 3.75%, 1 /23/2025 | | | 933,333 | | | | 939,167 | |

| Quest Software US Holdings Inc, Senior Secured First Lien Refinancing Term Loan, 3M US L + 5.50%, 10/31/2022 | | | 374,062 | | | | 376,984 | |

| Riverbed Technology Inc, Senior Secured First Lien Amendment Term Loan, 1M US L + 3.25%, 04/24/2022 | | | 796,070 | | | | 793,917 | |

| Rocket Software Inc, Senior Secured First Lien Term Loan, 3M US L + 3.75%, 10/14/2023 | | | 960,714 | | | | 968,400 | |

| RP Crown Parent LLC, Senior Secured First Lien New Term B Loan, 1M US L + 2.75%, 10/12/2023 | | | 748,106 | | | | 754,416 | |

| Solarwinds Holdings Inc, Senior Secured First Lien Refinancing Term Loan, 1M US L + 3.00%, 02/05/2024 | | | 1,607,219 | | | | 1,618,935 | |

| Sophia LP, Senior Secured First Lien Term B Loan, 3M US L + 3.25%, 09/30/2022 | | | 1,196,929 | | | | 1,203,961 | |

| TTM Technologies Inc, Senior Secured First Lien Term B Loan, 1M US L + 2.50%, 09/30/2024 | | | 891,489 | | | | 898,737 | |

| Verint Systems Inc, Senior Secured First Lien Refinancing Term Loan, 1M US L + 2.00%, 06/28/2024 | | | 997,487 | | | | 1,004,659 | |

| | | | | | | | 22,813,286 | |

| | | | | | | | | |

| Hotels, Gaming and Leisure - 5.24% | | | | | | | | |

| Alpha Topco Ltd - Delta 2 (Lux) Sarl, Senior Secured First Lien 2018 Incremental New Facility B3 (USD) Loan, 1M US L + 2.50%, 02/01/2024 | | | 972,222 | | | | 972,071 | |

| Semi-Annual Report | April 30, 2018 | 9 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| April 30, 2018 (Unaudited) |

| | | Principal Amount | | | Value | |

| Hotels, Gaming and Leisure (continued) | | | | | | | | |

| Aristocrat Technologies Inc, Senior Secured First Lien New 2017 Term Loan, 3M US L + 2.00%, 10/19/2024 | | $ | 748,125 | | | $ | 753,201 | |

| Crown Finance US Inc, Senior Secured First Lien Initial Dollar Tranche Term Loan, 1M US L + 2.50%, 02/28/2025 | | | 1,252,670 | | | | 1,252,539 | |

| GVC Holdings PLC, Senior Secured First Lien USD Term Loan, 3M US L + 2.50%, 03/15/2024 | | | 51,109 | | | | 51,264 | |

| Intrawest Resorts Holdings Inc, Senior Secured First Lien Term B Loan, 1M US L + 3.00%, 07/31/2024 | | | 748,125 | | | | 754,439 | |

| Scientific Games International Inc, Senior Secured First Lien Initial Term B-5 Loan, 3M US L + 2.75%, 08/14/2024 | | | 1,250,000 | | | | 1,259,081 | |

| Travelport Finance (Luxembourg) Sarl, Senior Secured First Lien Initial Term Loan, 3M US L + 2.50%, 03/17/2025 | | | 469,613 | | | | 471,912 | |

| VICI Properties 1 LLC, Senior Secured First Lien Term B Loan, 1M US L + 2.00%, 12/20/2024 | | | 1,431,818 | | | | 1,438,777 | |

| | | | | | | | 6,953,284 | |

| | | | | | | | | |

| Media Advertising, Printing and Publishing - 0.57% | | | | | | | | |

| Southern Graphics Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.50%, 12/31/2022 | | | 748,435 | | | | 754,984 | |

| | | | | | | | | |

| Media Broadcasting and Subscription - 3.34% | | | | | | | | |

| Charter Communications Operating LLC (aka CCO Safari LLC), Senior Secured First Lien Term B Loan, 1M US L + 2.00%, 04/30/2025 | | | 697,000 | | | | 700,921 | |

| SESAC Holdco II LLC, Senior Secured First Lien Initial Term Loan, 1M US L + 3.00%, 02/23/2024 | | | 748,111 | | | | 749,981 | |

| Sinclair Television Group Inc, Senior Secured First Lien Term Loan, 3M US L + 2.50%, 12/12/2024 | | | 1,500,000 | | | | 1,509,375 | |

| Univision Communications Inc, Senior Secured First Lien 2017 Replacement Term Loan, 1M US L + 2.75%, 03/15/2024 | | | 1,495,934 | | | | 1,478,042 | |

| | | | | | | | 4,438,319 | |

| | | | | | | | | |

| Media Diversified and Production - 0.61% | | | | | | | | |

| Lions Gate Capital Holdings LLC, Senior Secured First Lien Term B Loan, 1M US L + 2.25%, 03/24/2025 | | | 263,158 | | | | 264,557 | |

| Shutterfly Inc, Senior Secured First Lien Term B-2 Loan, 1M US L + 2.75%, 08/17/2024 | | | 326,087 | | | | 329,755 | |

| WMG Acquisition Corp, Senior Secured First Lien Tranche E Term Loan, 1M US L + 2.25%, 11/01/2023 | | | 214,815 | | | | 216,083 | |

| | | | | | | | 810,395 | |

| | | | | | | | | |

| Metals and Mining - 1.36% | | | | | | | | |

| American Rock Salt Co LLC, Senior Secured First Lien Term Loan, 1M US L + 3.75%, 03/21/2025 | | | 489,130 | | | | 493,564 | |

| GrafTech Finance Inc, Senior Secured First Lien Term B Loan, 1M US L + 3.50%, 02/12/2025 | | | 689,655 | | | | 693,535 | |

| Phoenix Services International LLC, Senior Secured First Lien Term Loan, 1M US L + 3.75%, 03/01/2025(b) | | | 607,143 | | | | 614,732 | |

| | | | | | | | 1,801,831 | |

| | | | | | | | | |

| Retail - 2.41% | | | | | | | | |

| EG America LLC, Senior Secured First Lien Term B Loan, 3M US L + 4.00%, 02/07/2025 | | | 1,642,523 | | | | 1,644,166 | |

| EG Group Ltd, Senior Secured First Lien Term B Loan, 3M US L + 4.00%, 02/07/2025 | | | 347,222 | | | | 347,569 | |

| National Vision Inc, Senior Secured First Lien New Term Loan, 1M US L + 2.75%, 11/20/2024 | | | 1,196,992 | | | | 1,208,717 | |

| | | | | | | | 3,200,452 | |

| | | | | | | | | |

| Services - Business - 8.08% | | | | | | | | |

| Access CIG LLC, Senior Secured First Lien Delayed Draw Term Loan, 3M US L + 3.75%, 02/27/2025(c) | | | 42,916 | | | | 43,405 | |

| Access CIG LLC, Senior Secured First Lien Term B Loan, 1M US L + 3.75%, 02/27/2025 | | | 573,876 | | | | 580,421 | |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| April 30, 2018 (Unaudited) |

| | | Principal Amount | | | Value | |

| Services - Business (continued) | | | | | | | | |

| Access CIG LLC, Senior Secured Second Lien Delayed Draw Term Loan, 3M US L + 7.75%, 02/27/2026(c) | | $ | 96,257 | | | $ | 97,160 | |

| Access CIG LLC, Senior Secured Second Lien Initial Term Loan, 1M US L + 7.75%, 02/27/2026 | | | 766,488 | | | | 773,678 | |

| Allied Universal Holdco LLC, Senior Secured First Lien Initial Term Loan, 3M US L + 3.75%, 07/28/2022 | | | 748,092 | | | | 735,310 | |

| ASGN Incorporated (fka On Assignment, Inc.), Senior Secured First Lien Term B Loan, 1M US L + 2.00%, 04/02/2025 | | | 609,268 | | | | 613,076 | |

| Autodata Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 3.25%, 12/12/2024(b) | | | 750,000 | | | | 754,688 | |

| Cast & Crew Payroll LLC, Senior Secured First Lien Term Loan, 3M US L + 2.75%, 09/27/2024 | | | 1,000,000 | | | | 1,001,720 | |

| DG Investment Intermediate Holdings 2 Inc, Senior Secured First Lien Term Loan, 3M US L + 3.00%, 02/03/2025(b) | | | 649,803 | | | | 650,615 | |

| DG Investment Intermediate Holdings 2 Inc, Senior Secured Second Lien Initial Term Loan, 3M US L + 6.75%, 02/01/2026(b) | | | 350,000 | | | | 355,250 | |

| GI Revelation Acquisition LLC, Senior Secured First Lien Term Loan, 1M US L + 5.00%, 04/16/2025 | | | 465,517 | | | | 469,979 | |

| Information Resources Inc, Senior Secured Second Lien Initial Bluebird Term Loan, 3M US L + 8.25%, 01/20/2025 | | | 750,000 | | | | 754,688 | |

| Red Ventures LLC, Senior Secured First Lien Term Loan, 1M US L + 4.00%, 11/08/2024 | | | 748,120 | | | | 758,313 | |

| Sedgwick Claims Management Services, Inc, Senior Secured First Lien Initial Team Loan, 3M US L + 2.75%, 03/01/2021 | | | 750,000 | | | | 751,564 | |

| Sedgwick Claims Management Services, Inc, Senior Secured Second Lien Initial Term Loan, 1M US L + 5.75%, 02/28/2022 | | | 500,000 | | | | 505,312 | |

| Travel Click, Senior Secured First Lien Term 3 Loan, 1M US L + 3.50%, 05/06/2021 | | | 671,875 | | | | 673,696 | |

| Travel Click, Senior Secured Second Lien Initial Term Loan, 1M US L + 7.75%, 11/06/2021 | | | 196,000 | | | | 196,123 | |

| Weld North Education LLC, Senior Secured First Lien Initial Term Loan, 3M US L + 4.25%, 02/15/2025 | | | 1,000,000 | | | | 1,006,875 | |

| | | | | | | | 10,721,873 | |

| | | | | | | | | |

| Services - Consumer - 4.49% | | | | | | | | |

| Aramark Services Inc, Senior Secured First Lien US Term B-1 Loan, 1M US L + 2.00%, 03/11/2025 | | | 374,063 | | | | 377,160 | |

| CSW SW Holdco Inc, Senior Secured First Lien Term B-1 Loan, 3M US L + 3.25%, 11/14/2022 | | | 748,116 | | | | 754,508 | |

| IRB Holding Corp, Senior Secured First Lien Term B Loan, 1M US L + 3.25%, 02/05/2025 | | | 750,000 | | | | 759,259 | |

| K-MAC Holdings Corp, Senior Secured First Lien Initial Term Loan, 1M US L + 3.25%, 03/07/2025 | | | 750,000 | | | | 756,750 | |

| KUEHG Corp, Senior Secured First Lien Term B-2 Loan, 3M US L + 3.75%, 08/12/2022 | | | 498,734 | | | | 503,098 | |

| Learning Care Group (US) No. 2 Inc, Senior Secured First Lien Initial Term Loan, 3M US L + 3.25%, 03/13/2025(b) | | | 508,427 | | | | 512,240 | |

| NVA Holdings Inc, Senior Secured First Lien Term B-3 Loan, 3M US L + 2.75%, 2/2/2025 | | | 509,231 | | | | 512,095 | |

| Pearl Intermediate Parent LLC, Senior Secured First Lien Initial Term Loan, 1M US L + 2.75%, 02/14/2025 | | | 401,997 | | | | 398,166 | |

| Pearl Intermediate Parent LLC, Senior Secured Second Lien Initial Term Loan, 1M US L + 6.25%, 02/13/2026 | | | 470,588 | | | | 472,941 | |

| Pre Paid Legal Services Inc, Senior Secured First Lien Term Loan, 3M US L + 3.25%, 04/11/2025 | | | 645,161 | | | | 652,320 | |

| Tacala Investment Corp, Senior Secured First Lien Term Loan, 1M US L + 3.25%, 01/31/2025 | | | 261,111 | | | | 263,820 | |

| | | | | | | | 5,962,357 | |

| | | | | | | | | |

| Telecommunications - 6.57% | | | | | | | | |

| C1 Holdings Corp, Senior Secured First Lien Term Loan, 1M US L + 3.75%, 04/04/2025 | | | 476,190 | | | | 477,976 | |

| Coral US Co-Borrower LLC, Senior Secured First Lien Term B-4 Loan, 1M US L + 3.25%, 02/02/2026 | | | 750,000 | | | | 755,936 | |

| Cyxtera DC Holdings, Inc. (fka Colorado Buyer Inc.), Senior Secured First Lien Term Loan, 3M US L + 7.25%, 05/01/2025 | | | 500,000 | | | | 496,250 | |

| Semi-Annual Report | April 30, 2018 | 11 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| April 30, 2018 (Unaudited) |

| | | Principal Amount | | | Value | |

| Telecommunications (continued) | | | | | | | | |

| Digicel International Finance Ltd, Senior Secured First Lien Initial Term B Loan, 3M US L + 3.25%, 05/27/2024 | | $ | 997,494 | | | $ | 998,118 | |

| Greeneden US Holdings II LLC, Senior Secured First Lien Tranche B-3 Dollar Term Loan, 3M US L + 3.50%, 12/01/2023 | | | 748,125 | | | | 753,736 | |

| Level 3 Financing Inc, Senior Secured First Lien Tranche B 2024 Term Loan, 1M US L + 2.25%, 02/22/2024 | | | 750,000 | | | | 754,166 | |

| Peak 10 Holding Corp, Senior Secured First Lien Term Loan, 3M US L + 3.50%, 08/01/2024 | | | 498,747 | | | | 499,121 | |

| Peak 10 Holding Corp, Senior Secured Second Lien Initial Term Loan, 3M US L + 7.25%, 08/01/2025 | | | 250,000 | | | | 252,062 | |

| SBA Senior Finance II LLC, Senior Secured First Lien Refinancing Term Loan, 3M US L + 2.00%, 04/04/2025 | | | 1,105,906 | | | | 1,110,285 | |

| Sprint Communications Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 2.50%, 02/02/2024 | | | 1,196,977 | | | | 1,202,029 | |

| TierPoint LLC, Senior Secured First Lien Term Loan, 1M US L + 3.75%, 05/06/2024 | | | 698,241 | | | | 677,078 | |

| TierPoint LLC, Senior Secured Second Lien Initial Term Loan, 1M US L + 7.25%, 05/05/2025 | | | 500,000 | | | | 495,625 | |

| Vertiv Group Corp, Senior Secured First Lien Term B Loan, 1M US L + 4.00%, 11/30/2023 | | | 250,000 | | | | 250,156 | |

| | | | | | | | 8,722,538 | |

| | | | | | | | | |

| Transportation - Consumer - 3.41% | | | | | | | | |

| Air Medical Group Holdings Inc, Senior Secured First Lien Term B Loan, 1M US L + 4.25%, 03/14/2025 | | | 1,197,000 | | | | 1,211,340 | |

| American Airlines Inc, Senior Secured First Lien 2017 Class B Term Loan, 1M US L + 2.00%, 04/28/2023 | | | 1,484,848 | | | | 1,488,033 | |

| Avis Budget Car Rental LLC, Senior Secured First Lien New 2018 Term B Loan, 3M US L + 2.00%, 02/13/2025 | | | 783,333 | | | | 790,188 | |

| Lineage Logistics LLC, Senior Secured First Lien Term Loan, 1M US L + 3.00%, 02/16/2025 | | | 710,363 | | | | 711,808 | |

| Sabre GLBL Inc, Senior Secured First Lien 2018 Other Term B Loan, 1M US L + 2.00%, 02/22/2024 | | | 322,607 | | | | 324,220 | |

| | | | | | | | 4,525,589 | |

| | | | | | | | | |

| Transportation Cargo - 0.73% | | | | | | | | |

| XPO Logistics Inc, Senior Secured First Lien Refinancing Term Loan, 3M US L + 2.00%, 02/24/2025 | | | 961,538 | | | | 968,082 | |

| | | | | | | | | |

| Utilities Electric - 3.35% | | | | | | | | |

| Calpine Corp Senior Secured First Lien 2015 Term Loan, 3M US L + 2.50%, 01/15/2023 | | | 1,196,939 | | | | 1,204,013 | |

| Eastern Power LLC, Senior Secured First Lien Term B Loan, 1M US L + 3.75%, 10/02/2023 | | | 745,273 | | | | 748,303 | |

| Granite Acquisition Inc, Senior Secured First Lien Term B Loan, 3M US L + 3.50%, 12/20/2021 | | | 748,381 | | | | 759,060 | |

| Helix Gen Funding LLC, Senior Secured First Lien Term Loan, 1M US L + 3.75%, 06/03/2024 | | | 747,337 | | | | 754,810 | |

| Pike Corp, Senior Secured Frist Lien Initial Term Loan, 1M US L + 3.50%, 03/23/2025 | | | 973,295 | | | | 987,081 | |

| | | | | | | | 4,453,267 | |

| | | | | | | | | |

| Wholesale - 0.57% | | | | | | | | |

| US Foods Inc, Senior Secured First Lien Initial Term Loan, 1M US L + 2.50%, 06/27/2023 | | | 748,096 | | | | 755,813 | |

| | | | | | | | | |

| TOTAL FLOATING RATE LOAN INTERESTS | | | | | | | | |

| (Cost $162,827,221) | | | | | | | 163,210,741 | |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| April 30, 2018 (Unaudited) |

| | | Principal Amount | | | Value | |

| CORPORATE BONDS - 0.92% | | | | | | | | |

| Containers, Packaging and Glass - 0.92% | | | | | | | | |

| Reynolds Group, Senior Secured Bond, 3M US L + 3.50%, 07/15/2021(d) | | $ | 1,200,000 | | | $ | 1,219,500 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $1,219,061) | | | | | | | 1,219,500 | |

| | | | | | | | | |

| COLLATERALIZED LOAN OBLIGATIONS (a) - 1.20% | | | | | | | | |

| Banking, Finance, Insurance and Real Estate - 1.20% | | | | | | | | |

| Barings CLO Ltd. 2015-1 Series 2015-IA, 3M US L + 5.50%, 01/20/2031(b)(d) | | | 250,000 | | | | 245,957 | |

| CIFC Funding 18-IA, Ltd. Series 2018-1A, 3M US L + 5.00%, 04/18/2031(b)(d) | | | 550,000 | | | | 514,611 | |

| HPS Loan Management 6-2015, LTD Series 2018-2015, 3M US L + 5.10%, 02/05/2031(b)(d) | | | 833,000 | | | | 830,666 | |

| | | | | | | | 1,591,234 | |

| | | | | | | | | |

| TOTAL COLLATERALIZED LOAN OBLIGATIONS | | | | | | | | |

| (Cost $1,633,000) | | | | | | | 1,591,234 | |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS - 4.11% | | | | | | | | |

| SPDR Blackstone / GSO Senior Loan ETF | | | 115,000 | | | | 5,455,600 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

| (Cost $5,465,743) | | | | | | | 5,455,600 | |

| | | | | | | | | |

| Total Investments - 129.15% | | | | | | | | |

| (Cost $171,145,025) | | | | | | | 171,477,075 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities - 0.98% | | | | | | | 1,298,403 | |

| | | | | | | | | |

| Leverage Facility - (30.13)% | | | | | | | (40,000,000 | ) |

| | | | | | | | | |

| Net Assets - 100.00% | | | | | | $ | 132,775,478 | |

Amounts above are shown as a percentage of net assets as of April 30, 2018.

| Semi-Annual Report | April 30, 2018 | 13 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| April 30, 2018 (Unaudited) |

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

LIBOR Rates:

1W US L - 1 Week LIBOR as of April 30, 2018 was 1.75%

1M US L - 1 Month LIBOR as of April 30, 2018 was 1.91%

2M US L - 2 Month LIBOR as of April 30, 2018 was 2.07%

3M US L - 3 Month LIBOR as of April 30, 2018 was 2.36%

6M US L - 6 Month LIBOR as of April 30, 2018 was 2.51%

| (a) | Floating or variable rate security. The reference rate is described above. The rate in effect as of April 30, 2018 is based on the reference rate plus the displayed spread as of the security's last reset date. |

| (b) | The level 3 assets were valued using significant unobservable inputs as a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. |

| (c) | A portion of this position was not funded as of April 30, 2018. The Portfolio of Investments records only the funded portion of each position. As of April 30, 2018, the Fund had a liability for unfunded delayed draws in the amount of $794,860. Fair value of these unfunded delayed draws was $797,262. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Total market value of Rule 144A securities amounts to $2,810,734, which represented approximately 2.12% of net assets as of April 30, 2018. Such securities may normally be sold to qualified institutional buyers in transactions exempt from registration. |

See Notes to Financial Statements.

| Blackstone / GSO Floating Rate Enhanced Income Fund | Statement of Assets and Liabilities |

April 30, 2018 (Unaudited)

| ASSETS: | | | | |

| Investments, at fair value (Cost $171,145,025) | | $ | 171,477,075 | |

| Cash | | | 19,987,681 | |

| Receivable for investment securities sold | | | 9,592,438 | |

| Interest receivable | | | 360,972 | |

| Receivable due from Adviser | | | 1,180,967 | |

| Prepaid offering costs | | | 500,055 | |

| Total Assets | | | 203,099,188 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investment securities purchased | | | 28,308,073 | |

| Payable to Adviser for offering costs | | | 691,510 | |

| Leverage facility | | | 40,000,000 | |

| Interest due on leverage facility | | | 52,782 | |

| Distributions payable to common shareholders | | | 223,146 | |

| Accrued organizational costs | | | 885,049 | |

| Other payables and accrued expenses | | | 163,150 | |

| Total Liabilities | | | 70,323,710 | |

| Net Assets Attributable to Common Shareholders | | $ | 132,775,478 | |

| | | | | |

| COMPOSITION OF NET ASSETS ATTRIBUTABLE TO COMMON SHARES: | | | | |

| Paid-in capital | | $ | 132,439,299 | |

| Overdistributed net investment income | | | (77 | ) |

| Accumulated net realized gain | | | 4,206 | |

| Net unrealized appreciation | | | 332,050 | |

| Net Assets Attributable to Common Shareholders | | $ | 132,775,478 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Class I: | | | | |

| Net asset value per share | | $ | 25.06 | |

| Net assets | | | 132,775,478 | |

| Shares of beneficial interest outstanding (unlimited shares authorized, par value $0.001 per share) | | | 5,297,645 | |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2018 | 15 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Statement of Operations |

For the Period January 18, 2018 (Commencement of Operations) to April 30, 2018 (Unaudited)

| INVESTMENT INCOME: | | | |

| Interest | | $ | 1,567,882 | |

| Total Investment Income | | | 1,567,882 | |

| | | | | |

| EXPENSES: | | | | |

| Advisory fee | | | 357,522 | |

| Fund accounting and administration fees | | | 76,583 | |

| Offering cost | | | 193,912 | |

| Legal and audit fees | | | 89,369 | |

| Custodian fees | | | 13,973 | |

| Trustees' fees and expenses | | | 11,231 | |

| Printing expense | | | 10,629 | |

| Transfer agent fees | | | 10,904 | |

| Interest on leverage facility | | | 148,652 | |

| Other expenses | | | 3,089 | |

| Total expenses | | | 915,864 | |

| Reimbursement from Adviser/Advisory fee waiver | | | (641,440 | ) |

| Net Expenses | | | 274,424 | |

| Net Investment Income | | | 1,293,458 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain/(loss) on: | | | | |

| Investment securities | | | 4,206 | |

| Net realized gain: | | | 4,206 | |

| Change in Unrealized appreciation/(depreciation) on: | | | | |

| Investment securities | | | 332,050 | |

| Net change in unrealized appreciation on investments: | | | 332,050 | |

| Net Realized and Unrealized Gain on Investments | | | 336,256 | |

| | | | | |

| Net Increase in Net Assets Attributable to Common Shares from Operations | | $ | 1,629,714 | |

See Notes to Financial Statements.

| Blackstone / GSO Floating Rate Enhanced Income Fund | Statement of Changes in Net Assets |

| | | For the Period January 18, 2018 (Commencement of Operations) to April 30, 2018 | |

| FROM OPERATIONS: | | | | |

| Net investment income | | $ | 1,293,458 | |

| Net realized gain on investments | | | 4,206 | |

| Net change in unrealized appreciation on investments | | | 332,050 | |

| Net Increase in Net Assets Attributable to Common Shares from Operations | | | 1,629,714 | |

| | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | |

| Class I | | | | |

| From net investment income | | | (1,293,535 | ) |

| Net Decrease in Net Assets from Distributions to Common Shareholders | | | (1,293,535 | ) |

| | | | | |

| SHARES TRANSACTIONS, IN DOLLARS: | | | | |

| Class I | | | | |

| Proceeds from shares sold | | | 131,530,008 | |

| Distributions reinvested | | | 809,291 | |

| Net Increase from Capital Share Transactions | | | 132,339,299 | |

| Net Increase in Net Assets | | | 132,675,478 | |

| | | | | |

| NET ASSETS | | | | |

| Beginning of period | | | 100,000 | |

| End of period* | | $ | 132,775,478 | |

| * Including overdistributed net investment income of: | | $ | (77 | ) |

| | | | | |

| SHARE TRANSACTIONS, IN SHARES: | | | | |

| Class I | | | | |

| Beginning shares | | | 4,000 | |

| Shares sold | | | 5,261,321 | |

| Reinvestment in shares | | | 32,324 | |

| Net change in shares resulting from shares transactions | | | 5,293,645 | |

| Ending shares | | | 5,297,645 | |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2018 | 17 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Statement of Cash Flows |

For the Period January 18, 2018 (Commencement of Operations) to April 30, 2018 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets from operations | | $ | 1,629,714 | |

| Adjustments to reconcile net increase in net assets from operations to net cash provided by (used in) operating activities: | | | | |

| Purchases of investment securities | | | (170,299,663 | ) |

| Proceeds from disposition of investment securities | | | 17,849,064 | |

| Discounts accreted/premiums amortized | | | 25,415 | |

| Net realized (gain)/loss on: | | | | |

| Investment securities | | | (4,206 | ) |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investment securities | | | (332,050 | ) |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (360,972 | ) |

| Due from Adviser | | | (1,180,967 | ) |

| Prepaid offering costs | | | (500,055 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Payable to Adviser for offering costs | | | 691,510 | |

| Interest due on leverage facility | | | 52,782 | |

| Accrued organizational costs | | | 885,049 | |

| Other payables and accrued expenses | | | 163,150 | |

| Net Cash Provided by (Used in) Operating Activities | | | (151,381,229 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from leverage facility | | | 40,000,000 | |

| Proceeds from shares sold | | | 131,530,008 | |

| Cash distributions paid | | | (261,098 | ) |

| Net Cash Provided by (Used in) Financing Activities | | | 171,268,910 | |

| | | | | |

| Net Increase/(Decrease) in Cash | | | 19,887,681 | |

| Cash, beginning balance | | $ | 100,000 | |

| Cash, ending balance | | $ | 19,987,681 | |

| | | | | |

| Supplemental disclosure of cash flow information: | | | | |

| Distributions reinvested | | $ | 809,291 | |

| Cash paid on interest on leverage facility | | $ | 95,870 | |

See Notes to Financial Statements.

| Blackstone / GSO Floating Rate Enhanced Income Fund – Class I | Financial Highlights |

For a Share Outstanding Throughout the Period Indicated

| | | For the Period January 18, 2018 (Commencement of Operations) to April 30, 2018 | |

| PER SHARE OPERATING PERFORMANCE: | | | |

| Net asset value - beginning of period | | $ | 25.00 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | |

| Net investment income(a) | | | 0.25 | |

| Net realized and unrealized gain on investments | | | 0.06 | |

| Total Income from Investment Operations | | | 0.31 | |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| From net investment income | | | (0.25 | ) |

| Total Distributions to Shareholders | | | (0.25 | ) |

| | | | | |

| Net asset value - end of period | | $ | 25.06 | |

| | | | | |

| Total Investment Return - Net Asset Value(b) | | | 1.24 | % |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS(c) | | | | |

| Expenses before reimbursement from Adviser and Advisory fee waiver | | | 0.75 | % |

| Advisory Fee | | | 1.00 | % |

| Interest on leverage | | | 0.42 | % |

| Total expenses before reimbursement from Adviser and Advisory fee waiver | | | 2.17 | % |

| Reimbursement from Adviser and Advisory fee waiver | | | (1.40 | %) |

| Total expenses after reimbursement from Adviser and Advisory fee waiver | | | 0.77 | % |

| Excluded expenses(d) | | | (0.42 | %) |

| Total expenses, net of excluded expenses, after reimbursement from Adviser and Advisory fee waiver | | | 0.35 | % |

| Net investment income | | | 3.62 | % |

| | | | | |

| Net assets, end of period (000s) | | $ | 132,775 | |

| Portfolio turnover rate | | | 19 | %(e) |

| (a) | Calculated using average common shares outstanding. |

| (b) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported. Dividends and distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any, and are not annualized. |

| (c) | Financial ratios have been annualized except for non-recurring costs. |

| (d) | Represents expenses excluded from reimbursement by the Investment Adviser, as defined in the Expense Limitation and Reimbursement Agreement. See Note 3. |

| (e) | Percentage represents the results for the period and is not annualized. |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2018 | 19 |

Blackstone / GSO Floating Rate Enhanced Income Fund | Notes to Financial Statements |

April 30, 2018 (Unaudited)

NOTE 1. ORGANIZATION

Blackstone / GSO Floating Rate Enhanced Income Fund (the “Fund”) is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as a non-diversified, closed-end management investment company. The Fund engages in continuous offering of shares and operates as an interval fund that offers to make monthly repurchases of shares at the net asset value (the “NAV”).

The Fund’s investment objective is to provide attractive current income with low sensitivity to rising interest rates.

The Fund was organized as a Delaware statutory trust on June 20, 2017 pursuant to an Agreement and Declaration of Trust governed by the laws of the State of Delaware. The Fund had no operations from that date to November 10, 2017, other than those related to organizational matters and the registration of its shares under applicable securities laws. GSO / Blackstone Debt Funds Management LLC (the “Adviser”) purchased 4,000 Class I shares at a net asset value of $25.00 per share on November 10, 2017. The Fund is authorized to issue an unlimited number of Institutional Class I Common Shares (“Class I Shares”), Class D Common Shares (the “Class D Shares”) and Class T Common Shares (the “Class T Shares”). The Fund commenced operations on January 18, 2018. Prior to that, the Fund had no operations other than matters relating to its organization and the sale and issuance of common shares to the Adviser. As of April 30, 2018, Class I shares (BGFLX) were the only shares outstanding.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation: The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and are stated in U.S. dollars. The Fund is considered an Investment Company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946.

The preparation of financial statements requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statement. Actual results could differ from these estimates.

Portfolio Valuation: The Fund’s net asset value (“NAV”) is determined daily on each day that the New York Stock Exchange is open for business, as of the close of the regular trading session on the Exchange. The Fund calculates NAV per share by subtracting liabilities (including accrued expenses or dividends) from the total assets of the Fund (the value of the securities plus cash or other assets, including interest accrued but not yet received) and dividing the result by the total number of outstanding common shares of the Fund.

Loans are primarily valued by using a composite loan price from a nationally recognized loan pricing service. The methodology used by the Fund’s nationally recognized loan pricing provider for composite loan prices is to value loans at the mean of the bid and ask prices from one or more brokers or dealers. Collateralized Loan Obligations (“CLOs”) are valued at the price provided by a nationally recognized pricing service. The prices provided by the nationally recognized pricing service are typically based on the evaluated mid-price of each of the CLOs. Corporate bonds and convertible bonds, other than short-term investments, are valued at the price provided by a nationally recognized pricing service. The prices provided by the nationally recognized pricing service are typically based on the mean of bid and ask prices for each corporate bond security. In determining the value of a particular investment, pricing services may use certain information with respect to transactions in such investments, quotations from dealers, pricing matrices, market transactions in comparable investments, various relationships observed in the market between investments and calculated yield measures based on valuation technology commonly employed in the market for such investments. Equity securities for which market quotations are available are generally valued at the last sale price or official closing price on the primary market or exchange on which they trade. Futures contracts are ordinarily valued at the last sales price on the securities or commodities exchange on which they are traded. Written and purchased options are ordinarily valued at the closing price on the securities or commodities exchange on which they are traded. Short-term debt investments, if any, having a remaining maturity of 60 days or less when purchased would be valued at cost adjusted for amortization of premiums and accretion of discounts. Any investments and other assets for which such current market quotations are not readily available are valued at fair value (“Fair Valued Assets”) as determined in good faith by a committee of the Adviser (“Fair Valued Asset Committee”) under procedures established by, and under the general supervision and responsibility of, the Fund’s Boards of Trustees. Such methods may include, but are not limited to, the use of a market comparable and/or income approach methodologies. A Fair Valued Asset Committee meeting may be called at any time by any member of the Fair Valued Asset Committee. The pricing of all Fair Valued Assets and determinations thereof shall be reported by the Fair Valued Asset Committee to the Board at each regularly scheduled quarterly meeting. The Fund has procedures to identify and investigate potentially stale prices for investments which are valued using a nationally recognized pricing service, exchange price or broker-dealer quotations. After performing such procedures, any prices which are deemed to be stale are reviewed by the Fair Valued Asset Committee and an alternative pricing source is determined.

Various inputs are used to determine the value of the Fund’s investments. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

Blackstone / GSO Floating Rate Enhanced Income Fund | Notes to Financial Statements |

April 30, 2018 (Unaudited)

| Level 1 — | Unadjusted quoted prices in active markets for identical investments at the measurement date. |

| Level 2 — | Significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.). |

| Level 3 — | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The categorization of investments and other financial instruments is based on the pricing transparency of the investment and other financial instrument and does not necessarily correspond to the Fund’s perceived risk of investing in those securities. Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement.

The following tables summarize valuation of the Fund’s investments under the fair value hierarchy levels as of April 30, 2018:

Blackstone / GSO Floating Rate Enhanced Income Fund

| Investments in Securities at Value | | Level 1 - Quoted Prices | | | Level 2 - Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Floating Rate Loan Interests | | | | | | | | | | | | | | | | |

| Aerospace and Defense | | $ | – | | | $ | 2,442,584 | | | $ | 983,381 | | | $ | 3,425,965 | |

| Banking, Finance, Insurance and Real Estate | | | – | | | | 17,304,224 | | | | 757,467 | | | | 18,061,691 | |

| Beverage, Food and Tobacco | | | – | | | | 3,858,418 | | | | 727,410 | | | | 4,585,828 | |

| Capital Equipment | | | – | | | | 3,708,363 | | | | 152,745 | | | | 3,861,108 | |

| Chemicals, Plastics and Rubber | | | – | | | | 5,018,571 | | | | 354,375 | | | | 5,372,946 | |

| Consumer Goods Durable | | | – | | | | 1,553,027 | | | | 757,462 | | | | 2,310,489 | |

| Environmental Industries | | | – | | | | 505,573 | | | | 812,027 | | | | 1,317,600 | |

| Healthcare and Pharmaceuticals | | | – | | | | 27,503,868 | | | | 1,782,731 | | | | 29,286,599 | |

| Metals and Mining | | | – | | | | 1,187,099 | | | | 614,732 | | | | 1,801,831 | |

| Services - Business | | | – | | | | 8,961,320 | | | | 1,760,553 | | | | 10,721,873 | |

| Services - Consumer | | | – | | | | 5,450,117 | | | | 512,240 | | | | 5,962,357 | |

| Other | | | – | | | | 76,502,454 | | | | – | | | | 76,502,454 | |

| Corporate Bonds | | | – | | | | 1,219,500 | | | | – | | | | 1,219,500 | |

| Collateralized Loan Obligations | | | | | | | | | | | | | | | | |

| Banking, Finance, Insurance and Real Estate | | | – | | | | – | | | | 1,591,234 | | | | 1,591,234 | |

| Exchange Traded Funds | | | 5,455,600 | | | | – | | | | – | | | | 5,455,600 | |

| Total | | $ | 5,455,600 | | | $ | 155,215,118 | | | $ | 10,806,357 | | | $ | 171,477,075 | |

The changes of the fair value of investments for which the Fund has used Level 3 inputs to determine the fair value are as follows:

| Blackstone / GSO Floating Rate Enhanced Income Fund | | Floating Rate Loan Interests | | | Collateralized Loan Obligations | | | Total | |

| Balance as of January 18, 2018 (Commencement of Operations) | | $ | – | | | $ | – | | | $ | – | |

| Accrued discount/ premium | | | (809 | ) | | | – | | | | (809 | ) |

| Realized Gain/(Loss) | | | 3,889 | | | | – | | | | 3,889 | |

| Change in Unrealized Appreciation/(Depreciation) | | | 27,765 | | | | (41,766 | ) | | | (14,001 | ) |

| Purchases | | | 9,717,155 | | | | 1,633,000 | | | | 11,350,155 | |

| Sales Proceeds | | | (532,877 | ) | | | – | | | | (532,877 | ) |

| Transfer into Level 3 | | | – | | | | – | | | | – | |

| Transfer out of Level 3 | | | – | | | | – | | | | – | |

| Balance as of April 30, 2018 | | $ | 9,215,123 | | | $ | 1,591,234 | | | $ | 10,806,357 | |

| Net change in unrealized appreciation/(depreciation) included in the Statements of Operations attributable to Level 3 investments held at April 30, 2018 | | $ | 27,765 | | | $ | (41,766 | ) | | $ | (14,001 | ) |

| Semi-Annual Report | April 30, 2018 | 21 |

Blackstone / GSO Floating Rate Enhanced Income Fund | Notes to Financial Statements |

April 30, 2018 (Unaudited)

Information about Level 3 fair value measurements as of April 30, 2018:

| | | Fair Value | | Valuation Technique(s) | Unobservable Input(s) | Value/Range |

| Floating Rate Loan Interests | | $ | 9,215,123 | | Third-party vendor pricing service | Broker quotes | N/A |

| Collateralized Loan Obligations | | $ | 1,591,234 | | Third-party vendor pricing service | Broker quotes | N/A |

The Fund evaluates transfers into or out of Level 1, 2 and 3 as of the end of the reporting period. There were no transfers between Level 1, 2 or 3 during the period.

Securities Transactions and Investment Income: Securities transactions are recorded on trade date for financial reporting purposes and amounts payable or receivable for trades not settled at the time of period end are reflected as liabilities and assets, respectively. Interest income, including accretion of discount and amortization of premium, is recorded on the accrual basis. Realized gains and losses from securities transactions and foreign currency transactions, if any, are recorded on the basis of identified cost and stated separately in the Statement of Operations.

Federal Income Taxes: The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code (the “Code”) and distribute all of its taxable income and net realized gains, if any, to shareholders. Accordingly, no provision for Federal income taxes has been made.

Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

As of and during the period ended April 30, 2018, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns.

Distributions to Shareholders: The Fund intends to distribute substantially all of its net investment income to shareholders in the form of dividends. The Fund declares income dividends daily and distributes them monthly. In addition, the Fund intends to distribute any net capital gains it earns from the sale of portfolio securities to shareholders no less frequently than annually. Net short-term capital gains may be paid more frequently.

Offering Costs: Offering costs incurred by the Fund of $693,967 were treated as deferred charges until operations commenced and are being amortized over a 12-month period using the straight line method. As of April 30, 2018, $193,912 in offering costs has been amortized. Unamortized amounts are included in prepaid offering costs in the Statement of Assets and Liabilities.

Organizational Expenses: Organizational expenses associated with the establishment of the Fund were expensed by the Fund and reimbursed by the Adviser. The payable related to organizational expenses as of April 30, 2018, was $885,049.

NOTE 3. FEES AND EXPENSES

Investment Advisory

The Adviser, a wholly-owned subsidiary of GSO Capital Partners LP (collectively with its affiliates in the credit-focused business of The Blackstone Group L.P., “GSO”), is a registered investment adviser and is responsible for the day-to-day management of, and provides administrative and compliance oversight services to, the Fund.

Blackstone / GSO Floating Rate Enhanced Income Fund | Notes to Financial Statements |

April 30, 2018 (Unaudited)

Management Fees

The Adviser receives a monthly management fee at the annual rate of 1.00% of the average daily value of the Fund’s net assets ( the “Management Fee”). The Adviser has temporarily waived its management fee through June 30, 2018 (which may be extended, terminated or modified by the Adviser in its sole discretion). All voluntarily waived management fees are permanently waived and not recoupable by the Adviser. During the period ended April 30, 2018 the Adviser voluntarily waived $357,522 of management fees.

Expense Limitation and Reimbursement