UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23270

Blackstone / GSO Floating Rate Enhanced Income Fund

(exact name of Registrant as specified in charter)

345 Park Avenue, 31st Floor

New York, New York 10154

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

Marisa Beeney

345 Park Avenue, 31st Floor

New York, New York 10154

Registrant’s telephone number, including area code:(877) 876-1121

Date of fiscal year end:September 30

Date of reporting period:March 31, 2020

| Item 1. | Report to Stockholders. |

Beginning with the Fund’s shareholder report for the period ending March 31, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Shareholders who hold accounts directly with Blackstone Advisory Partners L.P. (the “Distributor”) or the Fund may elect to receive shareholder reports and other communications from the Fund electronically by calling 1-212-583-5200 to make such arrangements. For shareholders who hold accounts through an investment advisor, bank, or broker-dealer, please contact that financial intermediary directly for information on how to receive shareholder reports and other communications electronically.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with the Distributor, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-212-583-5200 to make such arrangements. For shareholders who hold accounts through an investment advisor, bank, or broker-dealer, please contact your financial intermediary directly to inform them that you wish to continue receiving paper copies of your shareholder reports. If your common shares are held through a financial intermediary, your election to receive reports in paper will apply to all funds held with that financial intermediary.

Table of Contents

| Manager Commentary | 2 |

| Fund Summary | 4 |

| Portfolio of Investments | 6 |

| Statement of Assets and Liabilities | 17 |

| Statement of Operations | 18 |

| Statements of Changes in Net Assets | 19 |

| Statement of Cash Flows | 21 |

| Financial Highlights | 22 |

| Notes to Financial Statements | 27 |

| Additional Information | 40 |

| Privacy Procedures | 41 |

| Trustees & Officers | 49 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Manager Commentary |

| | March 31, 2020 (Unaudited) |

To Our Shareholders:

The first quarter of 2020 made economic and financial market history as the negative consequences of the novel coronavirus and related respiratory disease (“COVID-19”) and declining oil prices gripped the world. The run of unprecedented daily declines in global credit markets ended when the US central bank and government intervened in late March with a significant package of monetary and fiscal support. Though decisive policy responses in the United States prevented a deeper rout during the quarter, the downdraft still resulted in the credit markets’ worst performing quarter since 2008.

Initially, spreads and prices of loans and high yield bonds reacted to investors’ rising concerns regarding COVID-19 and declining oil prices. This was further exacerbated in the latter part of March by large capital outflows. In the global credit markets, some of the worst of March’s volatility resulted from forced selling by retail loan and high yield funds to meet daily redemptions; opportunistic investors stepped in as buyers of US loans.

Following a relatively strong fourth quarter in 2019, during which loans returned 1.73% and high yield bonds returned 2.61%, loans and high yield bonds returned -13.05% and -12.68%, respectively, in the quarter ended March 31, 2020. This represented a marked improvement, however, from the low point reached on March 23, when year-to-date returns for loans and high yield bonds were registering -20.07% and -19.78%, respectively.

New issue supply stalled in March 2020 as the market experienced historic volatility. However, issuance in the loan and high yield markets is up year-over-year due to strong issuance preceding the volatility. Gross loan issuance for the six-month period ending March 31, 2020 totaled $343 billion, a 95% increase year-over-year. January 2020 set a record high for loan issuance at $123 billion. Gross high yield issuance for the six-month period ending March 31, 2020 totaled $151 billion, representing an 80% increase year-over-year.

6 Month Total Returns as of March 31, 2020 | |

US Loans(S&P/LSTA Leveraged Loan Index) | -11.54% |

US High Yield Bonds(Bloomberg Barclays U.S. High Yield Index) | -10.40% |

3-month Treasury Bills(Bloomberg Barclays U.S. Treasury Bellwethers: 3 Month) | 1.05% |

10-Year Treasuries(Bloomberg Barclays U.S. Treasury Bellwethers: 10 Year) | 9.96% |

| US Aggregate Bonds(Bloomberg Barclays U.S. Aggregate Index) | 3.33% |

US Investment Grade Bonds(Bloomberg Barclays U.S. Corporate Investment Grade Index) | -2.49% |

Emerging Markets(Bloomberg Barclays EM USD Aggregate Index) | -7.59% |

US Large Cap Equities (S&P 500®Index) | -12.32% |

Sources: Bloomberg, Barclays, S&P/LCD

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

Lack of demand for loans from retail investors continued with loan mutual funds and exchanged-traded funds (“ETFs”) reporting outflows of almost $24 billion over the six-month period ending March 31, 2020. Retail demand for high yield bonds was strong throughout most of 2019, with high yield mutual funds and ETFs reporting inflows of $3.1 billion during the fourth quarter of 2019. However, that trend reversed with outflows totaling $15.4 billion during the first quarter of 2020. CLOs are an important investor in the loan asset class, accounting for approximately 56% of the loan holder base. US CLO gross issuance totaled $46 billion for the six-month period ending March 31, 2020, down $57 billion, or 14%, year-over-year.

While year-over-year average last-twelve-month (“LTM”) revenue growth has slowed, this metric remains positive for the public issuers in the S&P/LSTA Leveraged Loan Index as of March 31, 2020. For these issuers, current average leverage has increased quarter-over-quarter and now sits higher than the ten-year average; however, current average interest coverage remains higher than the ten-year average.

Default activity has picked up. The par-weighted LTM loan default rate through March 2020 was 1.87%, up 45 basis points (“bp”) versus the LTM period ending September 2019, but remains below the 20-year average of 3.0%, according to JP Morgan.1 The par-weighted LTM high yield default rate for the same period was 3.35%, up 83bp versus the LTM period ending September 2019, representing a three-year high. Energy accounted for 45% of high yield default volume for the LTM period through March 2020; excluding energy, the par-weighted LTM high yield default rate is 2.35%.

| 1 | JP Morgan Default Monitor, as of March 31, 2020. |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Manager Commentary |

| | March 31, 2020 (Unaudited) |

Market expectations for 2020 default rates per JP Morgan have been revised higher to 5% for loans and 8% for high yield but remain below peak rates experienced in 2009.

The negative impact of COVID-19 on the global economy is expected to reach across most issuers. The ability to accurately forecast economic performance, much less company performance, for the balance of 2020 is very limited and will be highly dependent on the duration of mandatory social distancing measures and the pace at which the global economy emerges from the COVID-19-induced freeze.

At GSO / Blackstone, we value your continued investment and confidence in us and in our family of funds. Additional information about our funds is available on our website at www.blackstone-gso.com and www.bgflx.com.

Sincerely,

GSO / Blackstone Debt Funds Management LLC

| Semi-Annual Report | March 31, 2020 | 3 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Fund Summary |

| | March 31, 2020 (Unaudited) |

Fund Overview

Blackstone / GSO Floating Rate Enhanced Income Fund (the “Fund”) is a non-diversified, closed-end management investment company that continuously offers its shares and is operated as an “interval fund.” The Fund’s investment objective is to provide attractive current income with low sensitivity to rising interest rates. Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in floating rate loans, notes or bonds. “Managed Assets” means net assets plus the amount of any borrowings and the liquidation preference of any preferred shares that may be outstanding. In addition, the Fund may invest up to 20% of its Managed Assets in each of (i) structured products, (ii) derivatives, (iii) warrants and equity securities that are incidental to the Fund’s purchase of floating rate instruments or acquired in connection with a reorganization of a Borrower (as defined below) or issuer, (iv) fixed rate instruments, and (v) equity investments in other investment companies, including ETFs. In pursuing the Fund’s investment objective, the Adviser will seek to enhance the Fund’s return with the use of leverage.

Portfolio Management Commentary

Fund Performance

The Fund’s Class I underperformed the Fund’s benchmark, the S&P/LSTA Leveraged Loan Index (“S&P LLI”), for the three-month, six-month, and 1-year periods and since inception. The Fund’s Class D underperformed the S&P LLI for the three-month, six-month, and 1-year periods and since inception. The Fund’s Class T underperformed the S&P LLI for the three-month, six-month, and 1-year periods and since inception. The Fund’s Class T-I underperformed the S&P LLI for the three-month and six-month periods and since inception. The Fund’s Class U underperformed the S&P LLI for the three-month period and since inception.

NAV Performance Factors

The Fund’s underperformance relative to the benchmark for the six months ended March 31, 2020 was primarily attributable to the allocation to CLO securities and ETFs, partially offset by positive credit selection within loans and the allocation to high yield bonds. By issuer, the largest positive contributors to performance were Vertiv, Tierpoint, and Maxar Technologies, and the most significant detractors were Travelport, Envision Healthcare, and Cineworld.

Portfolio Activity and Positioning2

During the period, we continued to dynamically manage the Fund to reduce risk and take advantage of select investment opportunities against a rapidly evolving macroeconomic backdrop. The Fund’s largest sector overweights were Business Equipment & Services, Electronics/Electric, and Healthcare; the largest sector underweights included Lodging & Casinos, Telecom, and Oil & Gas. The Fund reduced its allocation to loans during the period in favor of high yield bonds.

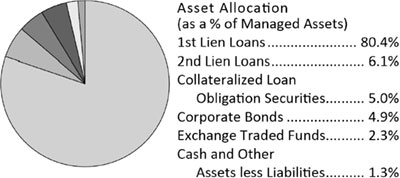

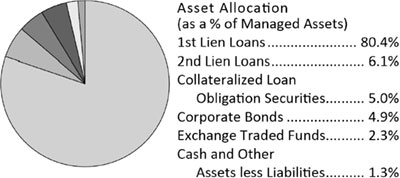

As of March 31, 2020, the Fund held 80.4% of its Managed Assets in first lien loans, 6.1% in second lien loans, 4.9% in corporate bonds, 5.0% in CLO securities, and 2.3% in an affiliated ETF. The Fund’s investments represented the obligations of 312 companies, with an average position size representing 0.37% of Managed Assets of the Fund.

| 2 | Industries per S&P’s Global Industry Classification Standard (GICS). |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Fund Summary |

March 31, 2020 (Unaudited)

Portfolio Composition*

| * | The Fund’s Cash & Other Assets less Liabilities represents net cash and other assets and liabilities, which includes amounts payable for investments purchased but not yet settled and amounts receivable for investments sold but not yet settled. At period end, the amounts payable for investments purchased but not yet settled exceeded the amount of cash on hand. The Fund uses sales proceeds or its leverage program to settle amounts payable for investments purchased, but such amounts are not reflected in the Fund’s net cash. |

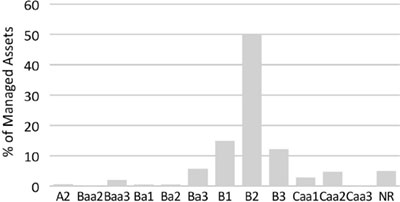

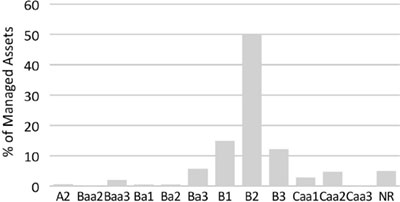

Moody’s Rating Distribution**

| ** | For more information on Moody's ratings and descriptions refer to www.moodys.com. |

| Portfolio Characteristics | |

| Weighted Average Bond Coupon | 5.19% |

| Current Dividend Yield – I Share^ | 7.42% |

| Current Dividend Yield – T Share^ | 6.92% |

| Current Dividend Yield – D Share^ | 7.17% |

| Current Dividend Yield – T-I Share^ | 6.90% |

| Current Dividend Yield – U Share^ | 6.79% |

| Average Duration^^ | 0.41 yr |

| Average Position* | 0.37% |

| Leverage* | 31.30% |

| ^ | Represents annualized distribution rate of I Share, T Share, D Share, T-I Share and U Share. Reflects March month cumulative distribution rate annualized. The cumulative distribution rate for the month presented represents the sum of the daily dividend distribution rate as calculated by dividing the daily dividend per share by the daily net asset value (“NAV”) per share, for each respective class, for each day in the month for which a daily dividend is declared. |

| ^^ | Loan durations are treated as 3 months because of LIBOR resets, however, the effective rate for loans with LIBOR floors will not change if LIBOR is below the floor. |

| * | As a percentage of Managed Assets. |

| Top 10 Issuers* | |

| SPDR Blackstone / GSO Senior Loan ETF | 2.3% |

| Ivanti Software | 0.9% |

| Access CIG | 0.9% |

| Brookfield WEC Holdings | 0.8% |

| Project Alpha Intermediate Holding | 0.8% |

| Globallogic Holdings | 0.8% |

| Dole Food Co. | 0.8% |

| Mitchell International | 0.7% |

| LifePoint Health | 0.7% |

| Aleris International | 0.7% |

| Top 10 Issuers | 9.4% |

| * | As a percentage of Managed Assets. |

Portfolio holdings and distributions are subject to change and are not recommendations to buy or sell any security.

| Top 5 Industries*^ | |

| Business Equipment & Services | 16.1% |

| Electronics/Electric | 13.8% |

| Healthcare | 11.1% |

| Financial Intermediaries | 5.4% |

| Structured Finance Obligations | 5.0% |

| Top 5 Industries | 51.4% |

| * | As a percentage of Managed Assets. |

| ^ | S&P Industry Classification Schema. |

Total Return

| | 3 Month | 6 Month | 1 Year | Since Inception |

| Class I* | -21.04% | -19.06% | -16.28% | -6.11%^ |

| Class T* | -21.15% | -19.27% | -16.70% | -8.16%^ |

| Class T* w/ 2.5% Sales Load** | -23.13% | -21.29% | -18.79% | -9.37%^ |

| Class D* | -20.93% | -19.04% | -16.36% | -11.05%^ |

| Class T-I* | -21.15% | -19.26% | N/A | -17.99%^ |

| Class T-I* w/ 3.5% Sales Load*** | -23.90% | -22.10% | N/A | -20.87%^ |

| Class U* | -21.16% | N/A | N/A | -19.26% |

| S&P/LSTA Leveraged Loan Index**** | -13.05% | -11.54% | -9.16% | -2.59%^ |

| * | Assumes distributions are reinvested pursuant to the Fund's dividend reinvestment plan. Performance data quoted represents past performance and does not guarantee future results. |

| ** | Assumes payment of the full front-end 2.5% sales load at initial subscription. |

| *** | Assumes payment of the full front-end 3.5% sales load at initial subscription. |

| **** | Inception to date returns for the S&P LLI are based on the I Share inception date of 1/18/18. |

| Semi-Annual Report | March 31, 2020 | 5 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

March 31, 2020 (Unaudited)

| Blackstone / GSO Floating Rate Enhanced Income Fund |

| |

| Portfolio of Investments |

| March 31, 2020 (Unaudited) |

| | | Principal Amount | | | Value | |

| FLOATING RATE LOAN INTERESTS(a)- 125.93% | | | | | | | | |

| Aerospace & Defense - 1.08% | | | | | | | | |

| TransDigm, Inc., First Lien Tranche E Refinancing Term Loan, 1M US L + 2.25%, 05/30/2025 | | $ | 2,882,385 | | | $ | 2,656,594 | |

| TransDigm, Inc., First Lien Tranche F Refinancing Term Loan, 1M US L + 2.25%, 12/09/2025 | | | 778,371 | | | | 717,397 | |

| | | | | | | | 3,373,991 | |

| | | | | | | | | |

| Air Transport - 0.94% | | | | | | | | |

| Atlantic Aviation FBO, Inc., First Lien B Term Loan, 1M US L + 3.75%, 12/06/2025 | | | 697,690 | | | | 669,783 | |

| Global Medical Response, Inc., First Lien 2018 Term Loan, 2M US L + 3.25%, 04/28/2022 | | | 2,441,889 | | | | 2,283,166 | |

| | | | | | | | 2,952,949 | |

| | | | | | | | | |

| Automotive - 1.15% | | | | | | | | |

| Panther BF Aggregator 2 L P, First Lien Initial Dollar Term Loan, 1M US L + 3.50%, 04/30/2026 | | | 1,282,051 | | | | 1,179,487 | |

| Wand NewCo 3, Inc., First Lien Tranche B-1 Term Loan, 3M US L + 3.00%, 02/05/2026 | | | 2,661,074 | | | | 2,408,272 | |

| | | | | | | | 3,587,759 | |

| | | | | | | | | |

| Brokers, Dealers & Investment Houses - 2.90% | | | | | | | | |

| Advisor Group Holdings, Inc., First Lien Initial B Term Loan, 1M US L + 5.00%, 07/31/2026 | | | 2,829,683 | | | | 2,152,908 | |

| AssetMark Financial Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.00%, 11/14/2025 | | | 733,333 | | | | 650,833 | |

| Deerfield Dakota Holding LLC, First Lien Initial Term Loan, 1M US L + 3.25%, 02/13/2025 | | | 891,804 | | | | 880,656 | |

| Edelman Financial Center LLC, First Lien Initial Term Loan, 1M US L + 3.25%, 07/21/2025 | | | 2,484,277 | | | | 2,139,583 | |

| Edelman Financial Center LLC, Second Lien Initial Term Loan, 1M US L + 6.75%, 07/20/2026 | | | 384,615 | | | | 296,539 | |

| Focus Financial Partners LLC, First Lien Tranche B-3 Term Loan, 1M US L + 2.00%, 07/03/2024 | | | 916,084 | | | | 836,687 | |

| Newport Group Holdings II, Inc., First Lien Initial Term Loan, 3M US L + 3.75%, 09/12/2025(b) | | | 2,368,455 | | | | 2,107,925 | |

| | | | | | | | 9,065,131 | |

| | | | | | | | | |

| Building & Development - 2.86% | | | | | | | | |

| APi Group DE, Inc., First Lien Initial Term Loan, 1M US L + 2.50%, 10/01/2026 | | | 1,210,390 | | | | 1,047,743 | |

| Builders FirstSource, Inc., First Lien Refinancing Term Loan, 3M US L + 3.00%, 02/29/2024 | | | 143,439 | | | | 130,530 | |

| C.H.I. Overhead Doors, Inc., First Lien Initial Term Loan, 1M US L + 3.25%, 07/29/2022 | | | 3,052,534 | | | | 2,664,603 | |

| Hillman Group, Inc., First Lien Initial Term Loan, 3M US L + 4.00%, 05/30/2025 | | | 1,622,356 | | | | 1,288,759 | |

| SRS Distribution, Inc., First Lien Initial Term Loan, 3M US L + 3.00%, 05/23/2025 | | | 1,253,636 | | | | 1,078,127 | |

| TAMKO Building Products LLC, First Lien Initial Term Loan, 1M US L + 3.25%, 05/29/2026 | | | 2,881,045 | | | | 2,722,587 | |

| | | | | | | | 8,932,349 | |

| | | | | | | | | |

| Business Equipment & Services - 23.50% | | | | | | | | |

| Access CIG LLC, First Lien B Term Loan, 3M US L + 3.75%, 02/27/2025 | | | 3,241,863 | | | | 2,670,484 | |

| Access CIG LLC, Second Lien Initial Term Loan, 3M US L + 7.75%, 02/27/2026 | | | 1,537,662 | | | | 1,318,546 | |

| Advantage Sales & Marketing, Inc., First Lien Initial Term Loan, 3M US L + 3.25%, 07/23/2021 | | | 2,590,540 | | | | 2,098,337 | |

| AlixPartners, LLP, First Lien 2017 Refinancing Term Loan, 1M US L + 2.50%, 04/04/2024 | | | 2,023,156 | | | | 1,947,288 | |

| Allied Universal Holdco LLC, First Lien Initial Term Loan, 1M US L + 4.25%, 07/10/2026 | | | 1,396,500 | | | | 1,298,745 | |

| APFS Staffing Holdings, Inc., First Lien Initial Term Loan, 1M US L + 4.75%, 04/15/2026(b) | | | 1,800,000 | | | | 1,485,000 | |

| AqGen Ascensus, Inc., First Lien Replacement Term Loan, 3M US L + 4.00%, 12/05/2022 | | | 3,662,790 | | | | 3,345,336 | |

| BMC Acquisition, Inc., First Lien Initial Term Loan, 3M US L + 5.25%, 12/28/2024(b) | | | 1,972,285 | | | | 1,947,632 | |

| Cambium Learning Group, Inc., First Lien Initial Term Loan, 3M US L + 4.50%, 12/18/2025 | | | 2,217,880 | | | | 1,829,751 | |

| Capri Acquisitions BidCo, Ltd., First Lien Initial Dollar Term Loan, 3M US L + 3.00%, 11/01/2024 | | | 2,489,884 | | | | 2,159,975 | |

| Cast & Crew Payroll LLC, First Lien B Term Loan, 3M US L + 3.75%, 02/09/2026(b) | | | 320,000 | | | | 254,400 | |

| Cast & Crew Payroll LLC, First Lien Initial Term Loan, 1M US L + 3.75%, 02/09/2026 | | | 2,776,933 | | | | 2,221,546 | |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

March 31, 2020 (Unaudited)

| | | Principal Amount | | | Value | |

| Business Equipment & Services (continued) | | | | | | | | |

| CB Poly Investments LLC, First Lien Closing Date Term Loan, 3M US L + 4.50%, 08/16/2023 | | $ | 1,372,209 | | | $ | 1,132,073 | |

| DG Investment Intermediate Holdings 2, Inc., First Lien Initial Term Loan, 1M US L + 3.00%, 02/03/2025 | | | 1,954,394 | | | | 1,671,007 | |

| DG Investment Intermediate Holdings 2, Inc., Second Lien Initial Term Loan, 1M US L + 6.75%, 02/02/2026(b) | | | 850,000 | | | | 739,500 | |

| Dun & Bradstreet Corp., First Lien Initial Borrowing Term Loan, 1M US L + 4.00%, 02/06/2026 | | | 1,768,120 | | | | 1,606,779 | |

| Epicor Software Corp., First Lien B Term Loan, 1M US L + 3.25%, 06/01/2022 | | | 2,986,460 | | | | 2,756,503 | |

| eResearchTechnology, Inc., First Lien Initial Term Loan, 3M US L + 4.50%, 02/04/2027 | | | 1,000,000 | | | | 887,000 | |

| Garda World Security Corp., First Lien Initial Term Loan, 3M US L + 4.75%, 10/30/2026 | | | 1,567,918 | | | | 1,497,362 | |

| GI Revelation Acquisition LLC, First Lien Initial Term Loan, 1M US L + 5.00%, 04/16/2025 | | | 1,976,895 | | | | 1,561,747 | |

| Globallogic Holdings, Inc., First Lien Initial Term Loan, 1M US L + 2.75%, 08/01/2025 | | | 3,809,320 | | | | 3,618,854 | |

| IG Investments Holdings LLC, First Lien Refinancing Term Loan, 3M US L + 4.00%, 05/23/2025 | | | 3,034,631 | | | | 2,447,309 | |

| Informatica LLC, First Lien Dollar 2020 Term Loan, 3M US L + 3.25%, 02/25/2027 | | | 1,447,236 | | | | 1,268,748 | |

| Informatica LLC, Second Lien Initial Term Loan, 3M US L + 7.125%, 02/25/2025 | | | 1,310,078 | | | | 1,179,070 | |

| KUEHG Corp, First Lien B-3 Term Loan, 3M US L + 3.75%, 02/21/2025 | | | 2,494,027 | | | | 1,897,955 | |

| LD Intermediate Holdings, Inc., First Lien Initial Term Loan, 3M US L + 5.875%, 12/09/2022 | | | 2,540,914 | | | | 2,185,186 | |

| Mitchell International, Inc., First Lien Initial Term Loan, 1M US L + 3.25%, 11/29/2024 | | | 2,580,781 | | | | 2,167,856 | |

| Mitchell International, Inc., Second Lien Initial Term Loan, 1M US L + 7.25%, 12/01/2025 | | | 1,566,667 | | | | 1,232,442 | |

| National Intergovernmental Purchasing Alliance Co., First Lien Initial Term Loan, 3M US L + 3.75%, 05/23/2025 | | | 2,189,251 | | | | 1,915,595 | |

| PriceWaterhouseCoopers, First Lien Initial Term Loan, 1M US L + 4.50%, 05/01/2025 | | | 2,223,062 | | | | 1,822,910 | |

| PriceWaterhouseCoopers, Second Lien Initial Term Loan, 1M US L + 8.00%, 05/01/2026(b) | | | 750,000 | | | | 648,750 | |

| ProQuest LLC, First Lien Initial Term Loan, 1M US L + 3.50%, 10/23/2026 | | | 1,852,500 | | | | 1,750,612 | |

| Red Ventures LLC, First Lien B-2 Term Loan, 1M US L + 2.50%, 11/08/2024 | | | 2,548,121 | | | | 2,148,920 | |

| Revspring, Inc., First Lien Initial Term Loan, 3M US L + 4.00%, 10/11/2025 | | | 1,777,500 | | | | 1,541,981 | |

| Sedgwick Claims Management Services, Inc., First Lien 2019 Term Loan, 1M US L + 4.00%, 09/03/2026 | | | 1,479,503 | | | | 1,350,971 | |

| Sedgwick Claims Management Services, Inc., First Lien Initial Term Loan, 1M US L + 3.25%, 12/31/2025 | | | 1,034,989 | | | | 925,886 | |

| St. George's University Scholastic Services LLC, First Lien Term Loan, 1M US L + 3.25%, 07/17/2025 | | | 2,486,704 | | | | 2,412,103 | |

| STG-Fairway Holdings LLC, First Lien Facility Term Loan, 3M US L + 3.50%, 01/31/2027 | | | 2,804,348 | | | | 2,425,761 | |

| ThoughtWorks, Inc., First Lien Replacement (2020) Term Loan, 3M US L + 3.75%, 10/11/2024 | | | 3,231,336 | | | | 2,851,654 | |

| Weld North Education LLC, First Lien Initial Term Loan, 3M US L + 4.25%, 02/15/2025(b) | | | 3,608,132 | | | | 3,247,319 | |

| | | | | | | | 73,468,893 | |

| | | | | | | | | |

| Cable & Satellite Television - 3.02% | | | | | | | | |

| CSC Holdings LLC, First Lien September 2019 Initial Term Loan, 1M US L + 2.50%, 04/15/2027 | | | 1,074,954 | | | | 1,040,910 | |

| Numericable U.S. LLC, First Lien USD TLB-[12] Term Loan, 1M US L + 3.69%, 01/31/2026 | | | 2,984,733 | | | | 2,805,649 | |

| Radiate Holdco LLC, Senior Secured First Lien Term Loan, First Lien Closing Date Term Loan, 1M US L + 3.00%, 02/01/2024 | | | 2,384,113 | | | | 2,229,146 | |

| UPC Financing Partnership, First Lien Facility AT Term Loan, 1M US L + 2.25%, 04/30/2028 | | | 994,152 | | | | 909,649 | |

| Ziggo Financing Partnership, First Lien I Facility Term Loan, 1M US L + 2.50%, 04/30/2028 | | | 2,569,378 | | | | 2,453,756 | |

| | | | | | | | 9,439,110 | |

| | | | | | | | | |

| Chemical & Plastics - 2.37% | | | | | | | | |

| Ascend Performance Materials Operations LLC, First Lien Initial Term Loan, 3M US L + 5.25%, 08/27/2026 | | | 995,000 | | | | 885,550 | |

| Composite Resins Holding B.V., First Lien Initial Term Loan, 1M US L + 4.25%, 08/01/2025 | | | 982,500 | | | | 869,512 | |

| DCG Acquisition Corp., First Lien B Term Loan, 1M US L + 4.50%, 09/30/2026(b) | | | 2,180,031 | | | | 1,972,928 | |

| DCG Acquisition Corp., First Lien Delayed Draw Term Loan, 3M US L + 4.50%, 09/30/2026(b) | | | 352,967 | | | | 319,435 | |

| Spectrum Holdings III Corp., First Lien Closing Date Term Loan, 3M US L + 3.25%, 01/31/2025 | | | 1,273,039 | | | | 903,858 | |

| Spectrum Holdings III Corp., Second Lien Closing Date Term Loan, 3M US L + 7.00%, 01/31/2026 | | | 350,000 | | | | 231,875 | |

| Semi-Annual Report | March 31, 2020 | | 7 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

March 31, 2020 (Unaudited)

| | | Principal Amount | | | Value | |

| Chemical & Plastics (continued) | | | | | | | | |

| Vantage Specialty Chemicals, Inc., First Lien Closing Date Term Loan, 3M US L + 3.50%, 10/28/2024 | | $ | 1,863,350 | | | $ | 1,421,382 | |

| Vantage Specialty Chemicals, Inc., Second Lien Initial Term Loan, 3M US L + 8.25%, 10/27/2025 | | | 1,200,000 | | | | 810,750 | |

| | | | | | | | 7,415,290 | |

| | | | | | | | | |

| Conglomerates - 2.54% | | | | | | | | |

| Gbt US LLC, First Lien Cov-Lite Delayed Draw Term Loan, 3M US L + 4.00%, 02/26/2027(b) | | | 911,504 | | | | 797,566 | |

| Gbt US LLC, First Lien Cov-Lite Term Loan, 3M US L + 4.00%, 02/26/2027(b) | | | 1,088,496 | | | | 952,434 | |

| Genuine Financial Holdings LLC, First Lien Initial Term Loan, 1M US L + 3.75%, 07/11/2025 | | | 2,309,333 | | | | 1,919,633 | |

| Spring Education Group, Inc., First Lien Initial Term Loan, 3M US L + 4.25%, 07/30/2025 | | | 1,416,376 | | | | 1,196,837 | |

| VT Topco, Inc., First Lien Initial Term Loan, 3M US L + 3.50%, 08/01/2025(b) | | | 3,559,012 | | | | 3,060,751 | |

| | | | | | | | 7,927,221 | |

| | | | | | | | | |

| Containers & Glass Products - 2.49% | | | | | | | | |

| Flex Acquisition Co., Inc., First Lien Incremental B-2018 Term Loan, 3M US L + 3.25%, 06/29/2025 | | | 3,228,947 | | | | 2,970,631 | |

| ProAmpac PG Borrower LLC, First Lien Initial Term Loan, 3M US L + 3.50%, 11/20/2023 | | | 2,796,228 | | | | 2,366,308 | |

| Transcendia Holdings, Inc., First Lien 2017 Refinancing Term Loan, 3M US L + 3.50%, 05/30/2024 | | | 1,267,822 | | | | 851,977 | |

| Tricorbraun Holdings, Inc., First Lien Closing Date Term Loan, 3M US L + 3.75%, 11/30/2023 | | | 1,899,480 | | | | 1,600,312 | |

| | | | | | | | 7,789,228 | |

| | | | | | | | | |

| Diversified Insurance - 2.19% | | | | | | | | |

| Alliant Holdings Intermediate LLC, First Lien 2019 New Term Loan, 1M US L + 3.25%, 05/09/2025 | | | 1,007,278 | | | | 925,185 | |

| AmWINS Group, Inc., First Lien Term Loan, 1M US L + 2.75%, 01/25/2024 | | | 1,546,095 | | | | 1,459,127 | |

| Broadstreet Partners, Inc., First Lien Initial (2020) Term Loan, 1M US L + 3.25%, 01/27/2027 | | | 3,720,069 | | | | 3,320,943 | |

| USI, Inc., First Lien 2019 New Term Loan, 1M US L + 4.00%, 12/02/2026 | | | 1,242,170 | | | | 1,132,443 | |

| | | | | | | | 6,837,698 | |

| | | | | | | | | |

| Drugs - 1.15% | | | | | | | | |

| Albany Molecular Research, Inc., Second Lien Initial Term Loan, 1M US L + 7.00%, 08/30/2025 | | | 1,425,000 | | | | 1,033,125 | |

| Cambrex Corp., First Lien Initial Dollar Term Loan, 1M US L + 5.00%, 12/04/2026 | | | 2,992,500 | | | | 2,573,550 | |

| | | | | | | | 3,606,675 | |

| | | | | | | | | |

| Ecological Services & Equipment - 2.20% | | | | | | | | |

| Emerald 2, Ltd., First Lien Initial B-1 Term Loan, 3M US L + 3.75%, 07/10/2026 | | | 3,302,294 | | | | 2,963,809 | |

| EnergySolutions LLC, First Lien Initial Term Loan, 3M US L + 3.75%, 05/09/2025 | | | 1,554,122 | | | | 1,367,627 | |

| Tunnel Hill Partners LP, First Lien Initial Term Loan, 1M US L + 3.50%, 02/06/2026(b) | | | 2,959,049 | | | | 2,559,577 | |

| | | | | | | | 6,891,013 | |

| | | | | | | | | |

| Electronics/Electric - 19.80% | | | | | | | | |

| Applovin Corp., First Lien Initial Term Loan, 1M US L + 3.50%, 08/15/2025 | | | 2,700,165 | | | | 2,470,651 | |

| Boxer Parent Co., Inc., First Lien Initial Dollar Term Loan, 1M US L + 4.25%, 10/02/2025 | | | 2,267,508 | | | | 1,906,690 | |

| Brave Parent Holdings, Inc., First Lien Initial Term Loan, 3M US L + 4.00%, 04/18/2025 | | | 984,962 | | | | 860,202 | |

| Castle US Holding Corp., First Lien Initial Dollar Term Loan, 1M US L + 3.75%, 01/29/2027 | | | 690,898 | | | | 563,085 | |

| CommerceHub, Inc., First Lien Initial Term Loan, 1M US L + 3.50%, 05/21/2025(b) | | | 2,525,965 | | | | 2,121,811 | |

| ConvergeOne Holdings, Corp., First Lien Initial Term Loan, 1M US L + 5.00%, 01/04/2026 | | | 2,970,000 | | | | 2,338,875 | |

| CPI International, Inc., First Lien Initial Term Loan, 1M US L + 3.50%, 07/26/2024 | | | 3,516,314 | | | | 2,953,704 | |

| DCert Buyer, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 10/16/2026 | | | 2,771,951 | | | | 2,492,455 | |

| DiscoverOrg LLC, First Lien Initial Term Loan, 3M US L + 4.00%, 02/02/2026 | | | 812,762 | | | | 723,359 | |

| ECi Macola/MAX Holding LLC, First Lien Initial Term Loan, 3M US L + 4.25%, 09/27/2024 | | | 1,857,418 | | | | 1,631,435 | |

| Ellie Mae, Inc., First Lien Term Loan, 3M US L + 3.75%, 04/17/2026 | | | 2,266,389 | | | | 1,991,589 | |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

March 31, 2020 (Unaudited)

| | | Principal Amount | | | Value | |

| Electronics/Electric (continued) | | | | | | | | |

| Excelitas Technologies Corp., First Lien Initial USD Term Loan, 3M US L + 3.50%, 12/02/2024 | | $ | 2,712,872 | | | $ | 2,373,763 | |

| Fiserv Investment Solutions, Inc., First Lien Initial Term Loan, 3M US L + 4.75%, 02/18/2027(b) | | | 740,741 | | | | 640,741 | |

| Flexera Software LLC, First Lien Initial Term Loan, 1M US L + 3.50%, 02/26/2025 | | | 2,109,739 | | | | 1,925,137 | |

| Gigamon, Inc., First Lien Initial Term Loan, 1M US L + 4.25%, 12/27/2024(b) | | | 1,840,275 | | | | 1,582,636 | |

| Help/Systems Holdings, Inc., First Lien Initial Term Loan, 1M US L + 4.75%, 11/19/2026 | | | 3,110,625 | | | | 2,682,914 | |

| Hyland Software, Inc., Second Lien Initial Term Loan, 1M US L + 7.00%, 07/07/2025 | | | 1,944,697 | | | | 1,784,260 | |

| Imperva, Inc., First Lien Term Loan, 3M US L + 4.00%, 01/12/2026 | | | 1,353,409 | | | | 1,121,069 | |

| Imperva, Inc., Second Lien Term Loan, 3M US L + 7.75%, 01/11/2027 | | | 557,276 | | | | 404,025 | |

| Ivanti Software, Inc., First Lien Term Loan, 1M US L + 4.25%, 01/20/2024 | | | 2,950,115 | | | | 2,625,603 | |

| Ivanti Software, Inc., Second Lien Term Loan, 1M US L + 9.00%, 01/20/2025 | | | 1,600,000 | | | | 1,414,000 | |

| LI Group Holdings, Inc., First Lien Initial Term Loan, 1M US L + 4.50%, 12/20/2026(b) | | | 798,000 | | | | 690,270 | |

| McAfee LLC, First Lien B USD Term Loan, 1M US L + 3.75%, 09/30/2024 | | | 2,676,724 | | | | 2,529,504 | |

| Merrill Communications LLC, First Lien Initial Term Loan, 3M US L + 5.00%, 10/05/2026(b) | | | 1,197,000 | | | | 1,065,330 | |

| MH Sub I LLC, First Lien Amendment No. 2 Initial Term Loan, 3M US L + 3.75%, 09/13/2024 | | | 2,656,872 | | | | 2,276,939 | |

| MLN US HoldCo LLC, First Lien B Term Loan, 1M US L + 4.50%, 11/30/2025 | | | 904,049 | | | | 646,395 | |

| Navico, Inc., First Lien Initial Term Loan, 1M US L + 4.50%, 03/31/2023 | | | 257,561 | | | | 159,366 | |

| Park Place Technologies LLC, First Lien Initial Term Loan, 1M US L + 4.00%, 03/29/2025(b) | | | 1,464,449 | | | | 1,252,104 | |

| Perforce Software, Inc., First Lien New Term Loan, 1M US L + 3.75%, 07/01/2026 | | | 1,085,170 | | | | 926,008 | |

| Presidio Holdings, Inc., First Lien Initial (2020) Term Loan, 2M US L + 3.50%, 01/22/2027 | | | 447,761 | | | | 420,896 | |

| Project Alpha Intermediate Holding, Inc., First Lien Term Loan, 3M US L + 3.50%, 04/26/2024 | | | 2,558,358 | | | | 2,328,105 | |

| Project Alpha Intermediate Holding, Inc., First Lien 2019 Incremental Term Loan, 3M US L + 4.25%, 04/26/2024 | | | 1,497,773 | | | | 1,359,229 | |

| Project Angel Parent LLC, First Lien Initial Term Loan, 3M US L + 4.00%, 05/30/2025(b) | | | 294,030 | | | | 239,634 | |

| Project Leopard Holdings, Inc., First Lien 2018 Repricing Term Loan, 3M US L + 4.50%, 07/07/2023 | | | 2,461,017 | | | | 2,169,793 | |

| Quest Software US Holdings, Inc., Second Lien Initial Term Loan, 3M US L + 8.25%, 05/18/2026 | | | 500,000 | | | | 308,333 | |

| Riverbed Technology, Inc., First Lien First Amendment Term Loan, 1M US L + 3.25%, 04/24/2022 | | | 496,596 | | | | 328,838 | |

| Rocket Software, Inc., First Lien Initial Term Loan, 1M US L + 4.25%, 11/28/2025 | | | 1,855,259 | | | | 1,550,171 | |

| Rocket Software, Inc., Second Lien Initial Term Loan, 1M US L + 8.25%, 11/27/2026 | | | 2,000,000 | | | | 1,335,000 | |

| S2P Acquisition Borrower, Inc., First Lien Initial Term Loan, 3M US L + 4.00%, 08/14/2026 | | | 1,647,278 | | | | 1,416,659 | |

| Vero Parent, Inc., First Lien 2018 Refinancing Term Loan, 3M US L + 6.25%, 08/16/2024 | | | 1,828,493 | | | | 1,481,079 | |

| Web.com Group, Inc., First Lien Initial Term Loan, 3M US L + 3.75%, 10/10/2025 | | | 2,717,352 | | | | 2,255,402 | |

| Web.com Group, Inc., Second Lien Initial Term Loan, 3M US L + 7.75%, 10/09/2026 | | | 731,809 | | | | 565,930 | |

| | | | | | | | 61,912,989 | |

| | | | | | | | | |

| Equipment Leasing - 0.32% | | | | | | | | |

| CSC SW Holdco, Inc., First Lien B-1 Term Loan, 3M US L + 3.25%, 11/14/2022 | | | 1,118,597 | | | | 1,006,737 | |

| | | | | | | | | |

| Financial Intermediaries - 4.54% | | | | | | | | |

| ION Trading Technologies S.A.R.L., First Lien 2018 Initial Dollar Term Loan, 3M US L + 4.00%, 11/21/2024 | | | 3,682,910 | | | | 3,069,098 | |

| Misys, Ltd., First Lien Dollar Term Loan, 3M US L + 3.50%, 06/13/2024 | | | 1,978,634 | | | | 1,709,866 | |

| NorthStar Financial Services Group LLC, First Lien Initial Term Loan, 1M US L + 3.50%, 05/25/2025 | | | 1,188,822 | | | | 988,701 | |

| PI UK Holdco II, Ltd., First Lien Facility B1 Term Loan, 3M US L + 3.25%, 01/03/2025 | | | 2,969,697 | | | | 2,546,515 | |

| Pre-Paid Legal Services, Inc., First Lien Initial Term Loan, 1M US L + 3.25%, 05/01/2025 | | | 3,787,119 | | | | 3,247,455 | |

| SS&C Technologies Holdings, Inc., First Lien B-3 Term Loan, 1M US L + 1.75%, 04/16/2025 | | | 483,363 | | | | 456,778 | |

| SS&C Technologies Holdings, Inc., First Lien B-4 Term Loan, 1M US L + 1.75%, 04/16/2025 | | | 344,871 | | | | 325,903 | |

| Victory Capital Holdings, Inc., First Lien Tranche B-1 Term Loan, 1M US L + 2.50%, 07/01/2026 | | | 2,077,273 | | | | 1,838,386 | |

| | | | | | | | 14,182,702 | |

| Semi-Annual Report | March 31, 2020 | | 9 |

| Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

March 31, 2020 (Unaudited)

| | | Principal Amount | | | Value | |

| Food Products - 4.49% | | | | | | | | |

| Alphabet Holding Co., Inc., First Lien Initial Term Loan, 1M US L + 3.50%, 09/26/2024 | | $ | 1,496,164 | | | $ | 1,209,401 | |

| CHG PPC Parent LLC, First Lien Initial Term Loan, 1M US L + 2.75%, 03/31/2025 | | | 2,189,214 | | | | 1,981,239 | |

| Dole Food Co., Inc., First Lien Tranche B Term Loan, 1M US L + 2.75%, 04/06/2024 | | | 3,774,826 | | | | 3,435,091 | |

| Froneri International, Ltd., Second Lien Facility Term Loan, 1M US L + 5.75%, 01/31/2028 | | | 1,340,000 | | | | 1,273,000 | |

| Mastronardi Produce, Ltd., First Lien 2020-A Refinancing Term Loan, 1M US L + 2.75%, 05/01/2025 | | | 1,854,384 | | | | 1,757,029 | |

| Snacking Investments Bidco Pty Limited, First Lien Initial US Term Loan, 1M US L + 4.00%, 12/18/2026 | | | 1,932,029 | | | | 1,724,336 | |

| TKC Holdings, Inc., First Lien Initial Term Loan, 1M US L + 3.75%, 02/01/2023 | | | 2,150,278 | | | | 1,757,315 | |

| TKC Holdings, Inc., Second Lien Initial Term Loan, 1M US L + 8.00%, 02/01/2024 | | | 1,149,770 | | | | 891,072 | |

| | | | | | | | 14,028,483 | |

| | | | | | | | | |

| Food Service - 3.89% | | | | | | | | |

| Agro Merchants North America Holdings, Inc., First Lien Effective Date Term Loan, 3M US L + 3.75%, 12/06/2024(b) | | | 1,703,837 | | | | 1,431,223 | |

| CEC Entertainment, Inc., First Lien B Term Loan, 3M US L + 6.50%, 08/30/2026 | | | 995,000 | | | | 567,150 | |

| Flynn Restaurant Group LP, First Lien Initial Term Loan, 1M US L + 3.50%, 06/27/2025 | | | 1,369,631 | | | | 1,088,856 | |

| Fogo de Chao, Inc., First Lien 2018 Refinancing Term Loan, 3M US L + 4.25%, 04/07/2025 | | | 2,273,768 | | | | 1,591,638 | |

| IRB Holding Corp., First Lien 2020 Replacement B Term Loan, 3M US L + 2.75%, 02/05/2025 | | | 2,951,283 | | | | 2,310,766 | |

| K-Mac Holdings Corp., Second Lien Initial Term Loan, 1M US L + 6.75%, 03/16/2026 | | | 1,720,833 | | | | 1,273,417 | |

| Tacala Investment Corp., First Lien Initial Term Loan, 1M US L + 3.50%, 02/05/2027 | | | 484,273 | | | | 393,876 | |

| Tacala Investment Corp., Second Lien Initial Term Loan, 1M US L + 7.50%, 02/04/2028 | | | 2,000,000 | | | | 1,565,000 | |

| Whatabrands LLC, First Lien 2020 Refinancing Term Loan, 1M US L + 2.75%, 07/31/2026 | | | 2,328,004 | | | | 1,951,403 | |

| | | | | | | | 12,173,329 | |

| | | | | | | | | |

| Food/Drug Retailers - 0.85% | | | | | | | | |

| EG Group, Ltd., First Lien Additional Facility Term Loan, 6M US L + 4.00%, 02/07/2025 | | | 3,237,584 | | | | 2,408,762 | |

| EG Group, Ltd., First Lien Facility B Term Loan, 6M US L + 4.00%, 02/07/2025 | | | 340,278 | | | | 253,167 | |

| | | | | | | | 2,661,929 | |

| | | | | | | | | |

| Healthcare - 15.47% | | | | | | | | |

| American Renal Holdings, Inc., First Lien B Term Loan, 1M US L + 5.00%, 06/21/2024 | | | 1,984,655 | | | | 1,721,688 | |

| Auris Luxembourg III S.a r.l., First Lien Facility B2 Term Loan, 1M US L + 3.75%, 02/27/2026 | | | 3,322,598 | | | | 2,550,094 | |

| Carestream Health, Inc., Second Lien Extended Term Loan, 3M US L + 10.50%, 06/07/2021 | | | 1,517,440 | | | | 1,308,792 | |

| CHG Healthcare Services, Inc., First Lien 2017 New Term Loan, 3M US L + 3.00%, 06/07/2023 | | | 3,627,633 | | | | 3,270,910 | |

| Covenant Surgical Partners, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 07/01/2026 | | | 2,387,683 | | | | 2,017,592 | |

| CryoLife, Inc., First Lien Initial Term Loan, 3M US L + 3.25%, 12/02/2024 | | | 2,460,172 | | | | 2,152,650 | |

| Envision Healthcare Corp., First Lien Initial Term Loan, 1M US L + 3.75%, 10/10/2025 | | | 2,307,695 | | | | 1,236,544 | |

| Femur Buyer, Inc., First Lien Initial Term Loan, 3M US L + 4.50%, 03/05/2026 | | | 1,911,408 | | | | 1,548,241 | |

| Genesis Specialist Care Finance UK, Ltd., First Lien B Term Loan, 3M US L + 5.00%, 03/05/2027(b) | | | 1,929,825 | | | | 1,736,842 | |

| Heartland Dental LLC, First Lien Incremental 2 Facility Term Loan, 1M US L + 4.50%, 04/30/2025 | | | 1,550,781 | | | | 1,263,887 | |

| Heartland Dental LLC, First Lien Initial Term Loan, 1M US L + 3.75%, 04/30/2025 | | | 1,229,122 | | | | 961,788 | |

| Immucor, Inc., First Lien B-3 Term Loan, 3M US L + 5.00%, 06/15/2021 | | | 1,488,520 | | | | 1,306,177 | |

| LifePoint Health, Inc., First Lien B Term Loan, 1M US L + 3.75%, 11/16/2025 | | | 3,624,201 | | | | 3,384,116 | |

| Lifescan Global Corp., First Lien Initial Term Loan, 3M US L + 6.00%, 10/01/2024 | | | 991,551 | | | | 796,959 | |

| Maravai Intermediate Holdings LLC, First Lien Initial Term Loan, 3M US L + 4.25%, 08/02/2025(b) | | | 905,565 | | | | 792,369 | |

| Navicure, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 10/22/2026 | | | 2,421,739 | | | | 2,246,163 | |

| Netsmart Technologies, Inc., First Lien D-1 Term Loan, 3M US L + 3.75%, 04/19/2023 | | | 2,214,107 | | | | 2,014,837 | |

| NMSC Holdings, Inc., First Lien Initial Term Loan, 2M US L + 5.00%, 04/19/2023(b) | | | 2,608,311 | | | | 1,825,818 | |

| nThrive, Inc., First Lien Additional B-2 Term Loan, 1M US L + 4.50%, 10/20/2022 | | | 1,418,619 | | | | 1,202,279 | |

| Onex TSG Holdings II Corp., First Lien Initial Term Loan, 3M US L + 4.00%, 07/29/2022 | | | 1,250,000 | | | | 977,500 | |

| Parexel International Corp., First Lien Initial Term Loan, 1M US L + 2.75%, 09/27/2024 | | | 1,386,716 | | | | 1,197,776 | |

Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| March 31, 2020 (Unaudited) |

| | Principal

Amount | | | Value | |

Healthcare (continued) | | | | | | | | |

PetVet Care Centers LLC, Second Lien Initial Term Loan, 1M US L + 6.25%, 02/13/2026 | | $ | 1,770,588 | | | $ | 1,478,441 | |

Phoenix Guarantor, Inc., First Lien Tranche B-1 Term Loan, 1M US L + 3.25%, 03/05/2026 | | | 3,004,530 | | | | 2,741,633 | |

Surgery Center Holdings, Inc., First Lien Initial Term Loan, 1M US L + 3.25%, 09/02/2024 | | | 1,262,629 | | | | 979,169 | |

Team Health Holdings, Inc., First Lien Initial Term Loan, 1M US L + 2.75%, 02/06/2024 | | | 2,210,155 | | | | 1,425,550 | |

U.S. Anesthesia Partners, Inc., First Lien Initial Term Loan, 1M US L + 3.00%, 06/23/2024 | | | 2,708,032 | | | | 2,051,334 | |

Verscend Holding Corp., First Lien B Term Loan, 1M US L + 4.50%, 08/27/2025 | | | 678,405 | | | | 644,485 | |

Viant Medical Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.75%, 07/02/2025 | | | 2,805,720 | | | | 2,474,645 | |

Zest Acquisition Corp., First Lien Initial Term Loan, 1M US L + 3.50%, 03/14/2025 | | | 1,180,455 | | | | 1,041,751 | |

| | | | | | | 48,350,030 | |

| | | | | | | | | |

Home Furnishings - 1.43% | | | | | | | | |

AI Aqua Merger Sub, Inc., First Lien Tranche B-1 Term Loan, 3M US L + 3.25%, 12/13/2023 | | | 3,506,960 | | | | 3,015,985 | |

Prime Security Services Borrower LLC, First Lien 2019 Refinancing B-1 Term Loan, 1M US L + 3.25%, 09/23/2026 | | | 1,588,259 | | | | 1,442,934 | |

| | | | | | | 4,458,919 | |

| | | | | | | | | |

Industrial Equipment - 2.81% | | | | | | | | |

Apex Tool Group LLC, First Lien Third Amendment Term Loan, 1M US L + 5.25%, 08/01/2024 | | | 1,949,839 | | | | 1,528,186 | |

Husky Injection Molding Systems, Ltd., First Lien Initial Term Loan, 3M US L + 3.00%, 03/28/2025 | | | 577,033 | | | | 480,212 | |

Justrite Safety Group, First Lien Delayed Draw Term Loan, 3M US L + 4.50%, 06/28/2026(b)(c) | | | 60,566 | | | | 49,967 | |

Justrite Safety Group, First Lien Initial Term Loan, 3M US L + 4.50%, 06/28/2026(b) | | | 1,120,518 | | | | 924,427 | |

LTI Holdings, Inc., First Lien Initial Term Loan, 1M US L + 3.50%, 09/06/2025 | | | 1,567,860 | | | | 1,179,164 | |

Minimax Viking GmbH, First Lien Facility B1C Term Loan, 1M US L + 2.75%, 07/31/2025 | | | 3,006,154 | | | | 2,690,508 | |

Robertshaw US Holding Corp., First Lien Initial Term Loan, 1M US L + 3.25%, 02/28/2025 | | | 699,113 | | | | 445,685 | |

Tailwind Smith Cooper Intermediate Corp., First Lien Initial Term Loan, 3M US L + 5.00%, 05/28/2026 | | | 1,990,000 | | | | 1,481,724 | |

| | | | | | | 8,779,873 | |

| | | | | | | | | |

Insurance - 1.15% | | | | | | | | |

HIG Finance 2, Ltd., First Lien Initial Dollar Term Loan, 1M US L + 3.50%, 12/20/2024 | | | 1,682,215 | | | | 1,585,488 | |

Outcomes Group Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.50%, 10/24/2025 | | | 2,064,773 | | | | 1,703,438 | |

Outcomes Group Holdings, Inc., Second Lien Initial Term Loan, 3M US L + 7.50%, 10/26/2026(b) | | | 384,615 | | | | 307,692 | |

| | | | | | | 3,596,618 | |

| | | | | | | | | |

Leisure Goods/Activities/Movies - 4.90% | | | | | | | | |

Alterra Mountain Co., First Lien Initial Bluebird Term Loan, 1M US L + 2.75%, 07/31/2024 | | | 3,459,244 | | | | 3,165,208 | |

AMC Entertainment Holdings, Inc., First Lien B-1 Term Loan, 3M US L + 3.00%, 04/22/2026 | | | 3,472,462 | | | | 2,585,352 | |

Crown Finance US, Inc., First Lien Incremental Term Loan, 3M US L + 3.00%, 02/05/2027 | | | 1,868,132 | | | | 1,270,330 | |

Crown Finance US, Inc., First Lien Initial Dollar Tranche Term Loan, 1M US L + 2.25%, 02/28/2025 | | | 1,093,289 | | | | 765,302 | |

Crown Finance US, Inc., First Lien Second Amendment Dollar Tranche Term Loan, 3M US L + 2.50%, 09/30/2026 | | | 914,943 | | | | 591,666 | |

Thunder Finco Pty, Ltd., First Lien Term Loan, 1M US L + 4.25%, 11/20/2026 | | | 1,000,000 | | | | 782,500 | |

Travel Leaders Group LLC, First Lien 2018 Refinancing Term Loan, 1M US L + 4.00%, 01/25/2024 | | | 2,292,500 | | | | 1,761,408 | |

Travelport Finance S.à r.l., First Lien Initial Term Loan, 3M US L + 5.00%, 05/29/2026 | | | 1,691,500 | | | | 1,109,624 | |

Travelport Finance S.à r.l., Second Lien Initial Term Loan, 3M US L + 9.00%, 05/28/2027 | | | 2,000,000 | | | | 700,000 | |

UFC Holdings LLC, First Lien 2019 Term Loan, 1M US L + 3.25%, 04/29/2026 | | | 2,913,166 | | | | 2,596,360 | |

| | | | | | | 15,327,750 | |

| | | | | | | | | |

Lodging & Casinos - 1.14% | | | | | | | | |

Caesars Resort Collection LLC, First Lien B Term Loan, 1M US L + 2.75%, 12/23/2024 | | | 1,994,898 | | | | 1,635,816 | |

Semi-Annual Report | March 31, 2020 | 11 |

Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| March 31, 2020 (Unaudited) |

| | Principal

Amount | | | Value | |

Lodging & Casinos (continued) | | | | | | | | |

PCI Gaming Authority, First Lien B Facility Term Loan, 1M US L + 2.50%, 05/29/2026 | | $ | 2,309,393 | | | $ | 1,914,487 | |

| | | | | | | 3,550,303 | |

| | | | | | | | | |

Nonferrous Metals/Minerals - 1.63% | | | | | | | | |

Aleris International, Inc., First Lien Initial Term Loan, 3M US L + 4.75%, 02/27/2023 | | | 3,730,068 | | | | 3,380,374 | |

American Rock Salt Co. LLC, First Lien Initial Term Loan, 1M US L + 3.50%, 03/21/2025 | | | 1,960,031 | | | | 1,705,226 | |

| | | | | | | 5,085,600 | |

| | | | | | | | | |

Oil & Gas - 0.95% | | | | | | | | |

BCP Raptor LLC, First Lien Initial Term Loan, 1M US L + 4.25%, 06/24/2024 | | | 1,068,925 | | | | 483,689 | |

Buckeye Partners LP, First Lien Initial Term Loan, 1M US L + 2.75%, 11/01/2026 | | | 2,689,206 | | | | 2,488,860 | |

| | | | | | | 2,972,549 | |

| | | | | | | | | |

Property & Casualty Insurance - 2.00% | | | | | | | | |

AssuredPartners, Inc., First Lien 2020 February Refinancing Term Loan, 1M US L + 3.50%, 02/12/2027 | | | 1,728,049 | | | | 1,525,003 | |

Asurion LLC, Second Lien Replacement B-2 Term Loan, 1M US L + 6.50%, 08/04/2025 | | | 1,547,368 | | | | 1,434,217 | |

ExamWorks Group, Inc., First Lien B-1 Term Loan, 3M US L + 3.25%, 07/27/2023 | | | 3,642,481 | | | | 3,305,552 | |

| | | | | | | 6,264,772 | |

| | | | | | | | | |

Publishing - 1.33% | | | | | | | | |

Ancestry.com Operations, Inc., First Lien Extended Term Loan, 1M US L + 4.25%, 08/27/2026 | | | 220,649 | | | | 177,623 | |

Champ Acquisition Corp., First Lien Initial Term Loan, 3M US L + 5.50%, 12/19/2025 | | | 1,457,090 | | | | 1,136,530 | |

Recorded Books, Inc., First Lien Initial Term Loan, 1M US L + 4.25%, 08/29/2025 | | | 1,196,525 | | | | 1,058,924 | |

Shutterfly, Inc., First Lien B Term Loan, 3M US L + 6.00%, 09/25/2026 | | | 1,741,935 | | | | 1,424,032 | |

Southern Graphics, Inc., First Lien Refinancing Term Loan, 3M US L + 3.25%, 12/31/2022 | | | 694,408 | | | | 373,244 | |

| | | | | | | 4,170,353 | |

| | | | | | | | | |

Radio & Television - 3.06% | | | | | | | | |

iHeartCommunications, Inc., First Lien New Term Loan, 1M US L + 3.00%, 05/01/2026 | | | 2,896,118 | | | | 2,466,233 | |

Terrier Media Buyer, Inc., First Lien B Term Loan, 3M US L + 4.25%, 12/17/2026 | | | 3,461,680 | | | | 3,141,475 | |

Univision Communications, Inc., First Lien 2017 Replacement Repriced First-Lien Term Loan, 1M US L + 2.75%, 03/15/2024 | | | 1,081,661 | | | | 930,904 | |

William Morris Endeavor Entertainment LLC, First Lien B-1 Term Loan, 1M US L + 2.75%, 05/18/2025 | | | 3,789,780 | | | | 3,041,299 | |

| | | | | | | 9,579,911 | |

| | | | | | | | | |

Steel - 0.92% | | | | | | | | |

Graftech International, Ltd., First Lien Initial Term Loan, 1M US L + 3.50%, 02/12/2025 | | | 2,268,738 | | | | 1,985,146 | |

Phoenix Services International LLC, First Lien B Term Loan, 1M US L + 3.75%, 03/01/2025 | | | 1,086,228 | | | | 896,138 | |

| | | | | | | 2,881,284 | |

| | | | | | | | | |

Surface Transport - 0.76% | | | | | | | | |

Lineage Logistics LLC, First Lien Term Loan, 1M US L + 3.00%, 02/27/2025 | | | 2,488,182 | | | | 2,360,663 | |

| | | | | | | | | |

Telecommunications - 3.54% | | | | | | | | |

Avaya, Inc., First Lien Tranche B Term Loan, 1M US L + 4.25%, 12/15/2024 | | | 2,118,613 | | | | 1,827,304 | |

Aventiv Technologies LLC, First Lien Initial Term Loan, 3M US L + 4.50%, 11/01/2024 | | | 1,818,824 | | | | 1,445,965 | |

Cyxtera DC Holdings, Inc., Second Lien Initial Term Loan, 1M US L + 7.25%, 05/01/2025 | | | 500,000 | | | | 196,250 | |

Greeneden U.S. Holdings I LLC, First Lien Tranche B-3 Dollar Term Loan, 1M US L + 3.25%, 12/01/2023 | | | 2,705,426 | | | | 2,556,627 | |

Masergy Holdings, Inc., First Lien 2017 Replacement Term Loan, 1M US L + 3.25%, 12/15/2023 | | | 1,816,787 | | | | 1,544,269 | |

Masergy Holdings, Inc., Second Lien Initial Term Loan, 3M US L + 7.50%, 12/16/2024 | | | 1,000,000 | | | | 828,335 | |

Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| March 31, 2020 (Unaudited) |

| | Principal

Amount | | | Value | |

Telecommunications (continued) | | | | | | | | |

Peak 10 Holding Corp., First Lien Initial Term Loan, 3M US L + 3.50%, 08/01/2024 | | $ | 488,722 | | | $ | 351,269 | |

Peak 10 Holding Corp., Second Lien Initial Term Loan, 3M US L + 7.25%, 08/01/2025 | | | 250,000 | | | | 100,000 | |

TierPoint LLC, First Lien Initial Term Loan, 1M US L + 3.75%, 05/06/2024 | | | 1,175,332 | | | | 1,054,861 | |

TierPoint LLC, Second Lien Initial Term Loan, 3M US L + 6.25%, 05/05/2025 | | | 1,170,000 | | | | 1,146,600 | |

| | | | | | | 11,051,480 | |

| | | | | | | | | |

Utilities - 2.56% | | | | | | | | |

Brookfield WEC Holdings, Inc., First Lien Initial (2020) Term Loan, 1M US L + 3.00%, 08/01/2025 | | | 3,987,643 | | | | 3,803,215 | |

Granite Acquisition, Inc., Second Lien B Term Loan, 3M US L + 7.25%, 12/19/2022 | | | 2,051,137 | | | | 1,866,535 | |

Pike Corp., First Lien Initial (2019) Term Loan, 1M US L + 3.25%, 07/24/2026 | | | 2,475,753 | | | | 2,323,085 | |

| | | | | | | 7,992,835 | |

| | | | | | | | | |

| TOTAL FLOATING RATE LOAN INTERESTS | | | | | | | | |

(Cost $459,717,668) | | | | | | | 393,676,416 | |

| | | | | | | | | |

COLLATERALIZED LOAN OBLIGATION SECURITIES(a) - 7.26% | | | | | | | | |

Structured Finance Obligations - 7.26% | | | | | | | | |

AIG CLO 2019-2, Ltd.: | | | | | | | | |

3M US L + 1.36%, 10/25/2032(b)(d) | | | 250,000 | | | | 237,938 | |

3M US L + 7.25%, 10/25/2032(b)(d) | | | 250,000 | | | | 151,733 | |

Ares LIV CLO, Ltd., 3M US L + 7.34%, 10/15/2032(b)(d) | | | 500,000 | | | | 302,899 | |

Ares XLII Clo, Ltd., 3M US L + 3.45%, 01/22/2028(b)(d) | | | 1,100,000 | | | | 851,924 | |

Ares XXVII CLO, Ltd., 3M US L + 2.40%, 07/28/2029(b)(d) | | | 250,000 | | | | 213,999 | |

Babson CLO, Ltd. 2015-I, 3M US L + 5.50%, 01/20/2031(b)(d) | | | 250,000 | | | | 125,473 | |

BlueMountain CLO 2016-2, Ltd., 3M US L + 4.00%, 08/20/2032(b)(d) | | | 1,500,000 | | | | 1,093,736 | |

California Street CLO IX LP, 3M US L + 3.70%, 07/16/2032(b)(d) | | | 1,500,000 | | | | 1,119,491 | |

Carlyle Global Market Strategies CLO 2016-1, Ltd., 3M US L + 5.20%, 04/20/2027(b)(d) | | | 1,000,000 | | | | 555,119 | |

CarVal CLO III, Ltd., 3M US L + 3.70%, 07/20/2032(b)(d) | | | 1,000,000 | | | | 700,968 | |

Cedar Funding XI Clo, Ltd., 3M US L + 6.85%, 05/29/2032(b)(d) | | | 500,000 | | | | 297,359 | |

CIFC Funding 2016-I, Ltd.: | | | | | | | | |

3M US L + 4.00%, 10/21/2031(b)(d) | | | 1,000,000 | | | | 789,605 | |

3M US L + 4.43%, 10/21/2031(b)(d) | | | 500,000 | | | | 372,351 | |

3M US L + 7.70%, 10/21/2031(b)(d) | | | 500,000 | | | | 305,904 | |

Dryden 40 Senior Loan Fund, 3M US L + 5.75%, 08/15/2031(b)(d) | | | 1,500,000 | | | | 862,674 | |

Dryden 65 CLO, Ltd., 3M US L + 5.75%, 07/18/2030(b)(d) | | | 500,000 | | | | 288,339 | |

Dryden 80 CLO, Ltd., 3M US L + 4.10%, 01/17/2033(b)(d) | | | 250,000 | | | | 189,997 | |

Fort Washington CLO 2019-1: | | | | | | | | |

3M US L + 3.90%, 10/20/2032(b)(d) | | | 500,000 | | | | 390,014 | |

3M US L + 7.25%, 10/20/2032(b)(d) | | | 500,000 | | | | 307,066 | |

Galaxy XXII CLO, Ltd., 3M US L + 5.75%, 07/16/2028(b)(d) | | | 500,000 | | | | 324,057 | |

Galaxy XXIII CLO, Ltd., 3M US L + 3.48%, 04/24/2029(b)(d) | | | 500,000 | | | | 402,840 | |

Galaxy XXV CLO, Ltd., 3M US L + 3.10%, 10/25/2031(b)(d) | | | 500,000 | | | | 378,453 | |

Greywolf CLO IV, Ltd., 3M US L + 6.94%, 04/17/2030(b)(d) | | | 1,500,000 | | | | 949,246 | |

Highbridge Loan Management 6-2015, Ltd., 3M US L + 5.10%, 02/05/2031(b)(d) | | | 833,000 | | | | 454,064 | |

KKR CLO 18, Ltd., 3M US L + 2.35%, 07/18/2030(b)(d) | | | 250,000 | | | | 209,298 | |

Neuberger Berman CLO XXIII, Ltd., 3M US L + 2.15%, 10/17/2027(b)(d) | | | 250,000 | | | | 216,990 | |

Octagon Investment Partners 18-R, Ltd., 3M US L + 5.51%, 04/16/2031(b)(d) | | | 1,000,000 | | | | 567,232 | |

OHA Credit Partners XIII, Ltd., 3M US L + 7.15%, 01/21/2030(b)(d) | | | 750,000 | | | | 506,278 | |

Parallel 2018-2, Ltd., 3M US L + 3.15%, 10/20/2031(b)(d) | | | 2,000,000 | | | | 1,323,618 | |

Parallel 2019-1, Ltd.: | | | | | | | | |

3M US L + 4.20%, 07/20/2032(b)(d) | | | 1,000,000 | | | | 696,097 | |

3M US L + 6.72%, 07/20/2032(b)(d) | | | 1,334,000 | | | | 774,221 | |

Rockford Tower CLO 2019-1, Ltd., 3M US L + 2.75%, 04/20/2032(b)(d) | | | 750,000 | | | | 635,941 | |

Romark CLO III, Ltd., 3M US L + 3.90%, 07/15/2032(b)(d) | | | 1,000,000 | | | | 774,288 | |

Semi-Annual Report | March 31, 2020 | 13 |

Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| March 31, 2020 (Unaudited) |

| | Principal

Amount | | | Value | |

Structured Finance Obligations (continued) | | | | | | | | |

Romark CLO LLC, 3M US L + 3.35%, 07/25/2031(b) | | $ | 500,000 | | | $ | 360,509 | |

Romark CLO, Ltd.: | | | | | | | | |

3M US L + 2.15%, 10/23/2030(b)(d) | | | 500,000 | | | | 409,839 | |

3M US L + 3.00%, 10/23/2030(b)(d) | | | 500,000 | | | | 372,775 | |

RR 2, Ltd., 3M US L + 3.00%, 10/15/2029(b)(d) | | | 1,000,000 | | | | 780,714 | |

TIAA CLO II, Ltd., 3M US L + 5.85%, 04/20/2029(b)(d) | | | 500,000 | | | | 311,057 | |

TIAA CLO IV, Ltd., 3M US L + 5.95%, 01/20/2032(b)(d) | | | 2,000,000 | | | | 1,158,874 | |

TICP CLO X, Ltd.: | | | | | | | | |

3M US L + 1.90%, 04/20/2031(b)(d) | | | 500,000 | | | | 415,312 | |

3M US L + 2.80%, 04/20/2031(b)(d) | | | 250,000 | | | | 180,878 | |

Venture XXIII CLO, Ltd., 3M US L + 3.05%, 07/19/2028(b)(d) | | | 1,500,000 | | | | 1,133,844 | |

Voya CLO 2016-2, Ltd., 3M US L + 4.00%, 07/19/2028(b)(d) | | | 250,000 | | | | 201,351 | |

| | | | | | | 22,694,365 | |

| | | | | | | | | |

| TOTAL COLLATERALIZED LOAN OBLIGATION SECURITIES | | | | | | | | |

(Cost $32,349,781) | | | | | | | 22,694,365 | |

| | | | | | | | | |

CORPORATE BONDS - 7.17% | | | | | | | | |

Aerospace & Defense - 0.15% | | | | | | | | |

Science Applications International Corp., 4.875%, 04/01/2028(d) | | | 490,000 | | | | 473,156 | |

| | | | | | | | | |

Brokers, Dealers & Investment Houses - 0.20% | | | | | | | | |

AG Issuer LLC, 6.250%, 03/01/2028(d) | | | 721,000 | | | | 611,047 | |

| | | | | | | | | |

Building & Development - 0.86% | | | | | | | | |

Griffon Corp., 5.750%, 03/01/2028(d) | | | 882,000 | | | | 834,041 | |

Hillman Group, Inc., 6.375%, 07/15/2022(d) | | | 750,000 | | | | 588,515 | |

Tutor Perini Corp., 6.875%, 05/01/2025(d) | | | 1,500,000 | | | | 1,256,250 | |

| | | | | | | 2,678,806 | |

| | | | | | | | | |

Cable & Satellite Television - 1.01% | | | | | | | | |

Altice France Holding SA/LU, 6.000%, 02/15/2028(d) | | | 2,149,000 | | | | 1,906,550 | |

CCO Holdings LLC / CCO Holdings Capital Corp.: | | | | | | | | |

4.500%, 08/15/2030(d) | | | 273,000 | | | | 269,076 | |

4.500%, 05/01/2032(d) | | | 1,011,000 | | | | 991,614 | |

| | | | | | | 3,167,240 | |

| | | | | | | | | |

Containers & Glass Products - 0.19% | | | | | | | | |

Trident TPI Holdings, Inc., 6.625%, 11/01/2025(d) | | | 750,000 | | | | 608,441 | |

| | | | | | | | | |

Diversified Insurance - 0.53% | | | | | | | | |

HUB International, Ltd., 7.000%, 05/01/2026(d) | | | 1,650,000 | | | | 1,645,999 | |

| | | | | | | | | |

Electronics/Electric - 0.23% | | | | | | | | |

Presidio Holdings, Inc., 8.250%, 02/01/2028(d) | | | 800,000 | | | | 711,000 | |

| | | | | | | | | |

Equipment Leasing - 0.43% | | | | | | | | |

United Rentals North America, Inc., 4.000%, 07/15/2030 | | | 1,500,000 | | | | 1,348,125 | |

| | | | | | | | | |

Food Products - 0.97% | | | | | | | | |

Kraft Heinz Foods Co., 4.625%, 01/30/2029 | | | 3,000,000 | | | | 3,030,569 | |

| | | | | | | | | |

Food Service - 0.34% | | | | | | | | |

IRB Holding Corp., 6.750%, 02/15/2026(d) | | | 750,000 | | | | 597,343 | |

Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| March 31, 2020 (Unaudited) |

| | Principal

Amount | | | Value | |

Food Service (continued) | | | | | | | | |

Yum! Brands, Inc., 7.750%, 04/01/2025(d) | | $ | 430,000 | | | $ | 452,575 | |

| | | | | | | 1,049,918 | |

| | | | | | | | | |

Healthcare - 0.70% | | | | | | | | |

Envision Healthcare Corp., 8.750%, 10/15/2026(d) | | | 1,584,000 | | | | 397,651 | |

Team Health Holdings, Inc., 6.375%, 02/01/2025(d) | | | 750,000 | | | | 269,059 | |

Tenet Healthcare Corp., 7.000%, 08/01/2025 | | | 1,750,000 | | | | 1,524,696 | |

| | | | | | | 2,191,406 | |

| | | | | | | | | |

Home Furnishings - 0.60% | | | | | | | | |

Prime Security Services Borrower LLC / Prime Finance, Inc., 6.250%, 01/15/2028(d) | | | 2,167,000 | | | | 1,885,290 | |

| | | | | | | | | |

Property & Casualty Insurance - 0.33% | | | | | | | | |

AssuredPartners, Inc., 7.000%, 08/15/2025(d) | | | 1,150,000 | | | | 1,043,591 | |

| | | | | | | | | |

Radio & Television - 0.41% | | | | | | | | |

Univision Communications, Inc., 5.125%, 02/15/2025(d) | | | 1,500,000 | | | | 1,290,000 | |

| | | | | | | | | |

Utilities - 0.22% | | | | | | | | |

Calpine Corp., 4.500%, 02/15/2028(d) | | | 700,000 | | | | 681,100 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

(Cost $25,868,950) | | | | | | | 22,415,688 | |

| | Shares | | | Value | |

EXCHANGE TRADED FUNDS - 3.31% | | | | | | | | |

Financial Intermediaries - 3.31% | | | | | | | | |

SPDR Blackstone / GSO Senior Loan ETF | | | 258,888 | | | | 10,358,109 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

(Cost $11,731,628) | | | | | | | 10,358,109 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS - 5.22% | | | | | | | | |

| Fidelity Treasury Portfolio | | | | | | | | |

(0.224% 7-Day Yield) | | | 16,307,570 | | | | 16,307,570 | |

| | | | | | | | | |

TOTAL SHORT TERM INVESTMENTS (Cost $16,307,570) | | | | | | | 16,307,570 | |

| | | | | | | | | |

Total Investments - 148.89% (Cost $545,975,597) | | | | | | | 465,452,148 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets - (3.34)% | | | | | | | (10,432,953 | ) |

| | | | | | | | | |

Leverage Facility - (45.55)% | | | | | | | (142,400,000 | ) |

| | | | | | | | | |

Net Assets - 100.00% | | | | | | $ | 312,619,195 | |

Amounts above are shown as a percentage of net assets as of March 31, 2020.

Semi-Annual Report | March 31, 2020 | 15 |

Blackstone / GSO Floating Rate Enhanced Income Fund | Portfolio of Investments |

| March 31, 2020 (Unaudited) |

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

Libor Rates:

1M US L - 1 Month LIBOR as of March 31, 2020 was 0.99%

2M US L - 2 Month LIBOR as of March 31, 2020 was 1.26%

3M US L - 3 Month LIBOR as of March 31, 2020 was 1.45%

6M US L - 6 Month LIBOR as of March 31, 2020 was 1.18%

(a) | Floating or variable rate security. The reference rate is described above. The rate in effect as of March 31, 2020 is based on the reference rate plus the displayed spread as of the security’s last reset date. |

(b) | Level 3 assets valued using significant unobservable inputs as a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. |

| (c) | A portion of this position was not funded as of March 31, 2020. The Portfolio of Investments records only the funded portion of each position. As of March 31, 2020, the Fund has unfunded delayed draw loans in the amount of $556,478. Fair value of these unfunded delayed draws was $468,685. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Total market value of Rule 144A securities amounts to $38,846,154, which represented approximately 12.43% of net assets as of March 31, 2020. Such securities may normally be sold to qualified institutional buyers in transactions exempt from registration. |

See Notes to Financial Statements.

Blackstone / GSO Floating Rate

Enhanced Income Fund | Statement of Assets and Liabilities |

March 31, 2020 (Unaudited)

| ASSETS: | | | |

| Investments, at fair value (Cost $545,975,597) | | $ | 465,452,148 | |

| Cash | | | 25,643 | |

| Receivable for investment securities sold | | | 19,447,568 | |

| Interest receivable | | | 1,480,240 | |

| Receivable for shares sold | | | 1,574,795 | |

| Prepaid offering costs | | | 123,907 | |

| Prepaid expenses and other assets | | | 17,270 | |

| Total Assets | | | 488,121,571 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investment securities purchased | | | 29,678,945 | |

| Leverage facility | | | 142,400,000 | |

| Interest due on leverage facility | | | 114,269 | |

| Distributions payable to common shareholders | | | 2,061,905 | |

| Accrued investment advisory fee payable | | | 4,370 | |

| Accrued trustees’ fees payable | | | 3,924 | |

| Accrued distribution fees payable | | | 32,965 | |

| Accrued shareholder servicing fees payable | | | 32,989 | |

| Accrued transfer agent fees payable | | | 101,067 | |

| Other payables and accrued expenses | | | 1,071,942 | |

| Total Liabilities | | | 175,502,376 | |

| Net Assets Attributable to Common Shareholders | | $ | 312,619,195 | |

| | | | | |

| COMPOSITION OF NET ASSETS ATTRIBUTABLE TO COMMON SHARES: | | | | |

| Paid-in capital | | $ | 408,631,551 | |

| Total distributable earnings | | | (96,012,356 | ) |

| Net Assets Attributable to Common Shareholders | | $ | 312,619,195 | |

| | | | | |

| NET ASSET VALUE | | | | |

| Class I: | | | | |

| Net asset value per share | | $ | 18.97 | |

| Net assets | | | 169,761,586 | |

| Shares of beneficial interest outstanding (unlimited shares authorized, par value $0.001 per share) | | | 8,947,366 | |

| | | | | |

| Class T: | | | | |

| Net asset value per share | | | 18.93 | |

| Net assets | | | 133,215,486 | |

| Shares of beneficial interest outstanding (unlimited shares authorized, par value $0.001 per share) | | | 7,035,444 | |

| | | | | |

| Class D: | | | | |

| Net asset value per share | | | 19.00 | |

| Net assets | | | 101,713 | |

| Shares of beneficial interest outstanding (unlimited shares authorized, par value $0.001 per share) | | | 5,353 | |

| | | | | |

| Class T-I: | | | | |

| Net asset value per share | | | 19.34 | |

| Net assets | | | 2,846,345 | |

| Shares of beneficial interest outstanding (unlimited shares authorized, par value $0.001 per share) | | | 147,154 | |

| | | | | |

| Class U: | | | | |

| Net asset value per share | | | 19.77 | |

| Net assets | | | 6,694,065 | |

| Shares of beneficial interest outstanding (unlimited shares authorized, par value $0.001 per share) | | | 338,576 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2020 | 17 |

Blackstone / GSO Floating Rate

Enhanced Income Fund | Statement of Operations |

For the Six Months Ended March 31, 2020 (Unaudited)

| INVESTMENT INCOME: | | | |

| Dividends | | $ | 347,364 | |

| Interest | | | 17,321,917 | |

| Total Investment Income | | | 17,669,281 | |

| | | | | |

| EXPENSES: | | | | |

| Advisory fee | | | 1,912,972 | |

| Fund accounting and administration fees | | | 278,190 | |

| Distribution fees | | | 218,920 | |

| Shareholder servicing fees | | | 219,067 | |

| Offering cost | | | 93,485 | |

| Insurance expense | | | 40,265 | |

| Legal and audit fees | | | 637,323 | |

| Custodian fees | | | 36,237 | |

| Trustees’ fees and expenses | | | 41,041 | |

| Printing expense | | | 122,072 | |

| Transfer agent fees | | | 156,129 | |

| Interest on leverage facility | | | 2,492,296 | |

| Facility and other fees | | | 13,572 | |

| Other expenses | | | 53,936 | |

| Total expenses | | | 6,315,505 | |

| Reimbursement from Adviser/Advisory fee waiver | | | (865,670 | ) |

| Net Expenses | | | 5,449,835 | |

| Net Investment Income | | | 12,219,446 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain/(loss) on: | | | | |

| Investment securities | | | (14,066,863 | ) |

| Net realized loss | | | (14,066,863 | ) |

| Change in unrealized appreciation/depreciation on: | | | | |

| Investment securities | | | (72,182,225 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (72,182,225 | ) |

| Net Realized and Unrealized Loss on Investments | | | (86,249,088 | ) |

| | | | | |

| Net Decrease in Net Assets Attributable to Common Shares from Operations | | $ | (74,029,642 | ) |

See Notes to Financial Statements.

Blackstone / GSO Floating Rate

Enhanced Income Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended

March 31, 2020 (Unaudited) | | | For the

Year Ended

September 30, 2019 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 12,219,446 | | | $ | 24,069,582 | |

| Net realized loss on investments | | | (14,066,863 | ) | | | (1,442,899 | ) |

| Net change in unrealized depreciation on investments | | | (72,182,225 | ) | | | (8,956,100 | ) |

| Net Increase/(Decrease) in Net Assets Attributable to Common Shares from Operations | | | (74,029,642 | ) | | | 13,670,583 | |

| | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | |

| Class I | | | (6,884,719 | ) | | | (14,006,557 | ) |

| Class T | | | (5,184,158 | ) | | | (10,108,129 | ) |

| Class D | | | (3,614 | ) | | | (3,853 | ) |

| Class T-I | | | (34,532 | ) | | | (5,525 | ) |

| Class U | | | (57,418 | ) | | | – | |

| Net Decrease in Net Assets from Distributions to Common Shareholders | | | (12,164,441 | ) | | | (24,124,064 | ) |

| | | | | | | | | |

| SHARES TRANSACTIONS, IN DOLLARS: | | | | | | | | |

| Class I(a) | | | | | | | | |

| Proceeds from shares sold | | | 20,712,326 | | | | 41,997,174 | |

| Distributions reinvested | | | 4,014,897 | | | | 8,234,678 | |

| Cost of shares redeemed | | | (22,919,258 | ) | | | (16,871,197 | ) |

| Redemption fees | | | 9,523 | | | | 834 | |

| Class T(b) | | | | | | | | |

| Proceeds from shares sold | | | 8,504,967 | | | | 84,713,123 | |

| Distributions reinvested | | | 2,571,615 | | | | 4,873,243 | |

| Cost of shares redeemed | | | (17,917,837 | ) | | | (25,908,082 | ) |

| Redemption fees | | | 9,707 | | | | 33,976 | |

| Class D(c) | | | | | | | | |

| Proceeds from shares sold | | | 68,900 | | | | 55,000 | |

| Distributions reinvested | | | 648 | | | | 1,224 | |

| Cost of shares redeemed | | | (9,286 | ) | | | – | |

| Redemption fees | | | 186 | | | | – | |

| Class T-I(d) | | | | | | | | |

| Proceeds from shares sold | | | 3,249,020 | | | | 284,675 | |

| Distributions reinvested | | | 17,384 | | | | 5,553 | |

| Cost of shares redeemed | | | (258 | ) | | | – | |

| Redemption fees | | | – | | | | – | |

| Class U(e) | | | | | | | | |

| Proceeds from shares sold | | | 7,862,250 | | | | – | |

| Distributions reinvested | | | 53,341 | | | | – | |

| Cost of shares redeemed | | | – | | | | – | |

| Redemption fees | | | – | | | | – | |

| Net Increase from Capital Share Transactions | | | 6,228,125 | | | | 97,420,201 | |

| Net Increase/(Decrease) in Net Assets | | | (79,965,958 | ) | | | 86,966,720 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 392,585,153 | | | | 305,618,433 | |

| End of period | | $ | 312,619,195 | | | $ | 392,585,153 | |

| (a) | The Fund’s Class I commenced operations on January 18, 2018. |

| (b) | The Fund’s Class T commenced operations on May 7, 2018. |

| (c) | The Fund’s Class D commenced operations on October 1, 2018. |

| (d) | The Fund’s Class T-I commenced operations on April 22, 2019. |

| (e) | The Fund’s Class U commenced operations on November 29, 2019. |

| Semi-Annual Report | March 31, 2020 | 19 |

Blackstone / GSO Floating Rate

Enhanced Income Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended March 31, 2020 (Unaudited) | | | For the

Year Ended

September 30, 2019 | |

| SHARE TRANSACTIONS, IN SHARES: | | | | | | |

| Class I(a) | | | | | | | | |

| Beginning shares | | | 8,878,040 | | | | 7,517,587 | |

| Shares sold | | | 866,647 | | | | 1,716,846 | |

| Reinvestment in shares | | | 174,096 | | | | 339,042 | |

| Shares redeemed | | | (971,417 | ) | | | (695,435 | ) |

| Net change in shares resulting from shares transactions | | | 69,326 | | | | 1,360,453 | |

| Ending shares | | | 8,947,366 | | | | 8,878,040 | |

| | | | | | | | | |

| Class T(b) | | | | | | | | |

| Beginning shares | | | 7,318,446 | | | | 4,717,010 | |

| Shares sold | | | 355,603 | | | | 3,466,342 | |

| Reinvestment in shares | | | 111,357 | | | | 201,102 | |

| Shares redeemed | | | (749,962 | ) | | | (1,066,008 | ) |

| Net change in shares resulting from shares transactions | | | (283,002 | ) | | | 2,601,436 | |

| Ending shares | | | 7,035,444 | | | | 7,318,446 | |

| | | | | | | | | |

| Class D(c) | | | | | | | | |

| Beginning shares | | | 2,870 | | | | 600 | |

| Shares sold | | | 2,863 | | | | 2,219 | |

| Reinvestment in shares | | | 28 | | | | 51 | |

| Shares redeemed | | | (408 | ) | | | – | |

| Net change in shares resulting from shares transactions | | | 2,483 | | | | 2,270 | |

| Ending shares | | | 5,353 | | | | 2,870 | |

| | | | | | | | | |

| Class T-I(d) | | | | | | | | |

| Beginning shares | | | 11,624 | | | | – | |

| Shares sold | | | 134,813 | | | | 11,400 | |

| Reinvestment in shares | | | 727 | | | | 224 | |

| Shares redeemed | | | (10 | ) | | | – | |

| Net change in shares resulting from shares transactions | | | 135,530 | | | | 11,624 | |

| Ending shares | | | 147,154 | | | | 11,624 | |

| | | | | | | | | |

| Class U(e) | | | | | | | | |

| Beginning shares | | | – | | | | – | |

| Shares sold | | | 336,166 | | | | – | |

| Reinvestment in shares | | | 2,410 | | | | – | |

| Shares redeemed | | | – | | | | – | |

| Net change in shares resulting from shares transactions | | | 338,576 | | | | – | |

| Ending shares | | | 338,576 | | | | – | |

| (a) | The Fund’s Class I commenced operations on January 18, 2018. |

| (b) | The Fund’s Class T commenced operations on May 7, 2018. |

| (c) | The Fund’s Class D commenced operations on October 1, 2018. |

| (d) | The Fund’s Class T-I commenced operations on April 22, 2019. |

| (e) | The Fund’s Class U commenced operations on November 29, 2019. |

See Notes to Financial Statements.

Blackstone / GSO Floating Rate

Enhanced Income Fund | Statement of Cash Flows |

For the Six Months Ended March 31, 2020 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net decrease in net assets attributable to common shares from operations | | $ | (74,029,642 | ) |

| Adjustments to reconcile net decrease in net assets attributable to common shares from operations to | | | | |

| net cash used in operating activities: | | | | |

| Purchases of investment securities | | | (301,759,378 | ) |

| Proceeds from disposition of investment securities | | | 341,149,206 | |

| Discounts accreted/premiums amortized | | | (251,022 | ) |

| Net realized loss on: | | | | |

| Investment securities | | | 14,066,863 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investment securities | | | 72,182,225 | |

| Net sale of short term investments | | | 1,053,768 | |

| (Increase)/Decrease in assets: | | | | |

| Receivable due from Adviser | | | 356 | |

| Interest receivable | | | 224,266 | |

| Prepaid offering costs | | | (64,798 | ) |

| Prepaid expenses and other assets | | | 52,267 | |

| Increase/(Decrease) in liabilities: | | | | |

| Interest due on leverage facility | | | (1,126,481 | ) |

| Accrued distribution fees payable | | | (1,431 | ) |

| Accrued investment advisory fees payable | | | 4,370 | |

| Accrued trustees’ fees payable | | | (31,096 | ) |

| Accrued shareholder servicing fees payable | | | (1,418 | ) |

| Accrued transfer agent fees payable | | | 17,851 | |

| Other payables and accrued expenses | | | 522,947 | |

| Net Cash Provided by (Used in) Operating Activities | | | 52,008,853 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from leverage facility | | | 17,700,000 | |

| Payments on leverage facility | | | (63,800,000 | ) |

| Cost of shares redeemed - common shares | | | (40,827,223 | ) |

| Proceeds from shares sold - common shares | | | 40,255,779 | |

| Distributions paid - common shareholders - net of distributions reinvested | | | (5,447,936 | ) |

| Net Cash Provided by (Used in) Financing Activities | | | (52,119,380 | ) |

| | | | | |

| | | | | |

| Net Decrease in Cash | | | (110,527 | ) |

| Cash, beginning balance | | $ | 136,170 | |

| Cash, ending balance | | $ | 25,643 | |

| | | | | |