UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23270

Blackstone Floating Rate Enhanced Income Fund

(exact name of Registrant as specified in charter)

345 Park Avenue, 31st Floor

New York, New York 10154

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

Marisa Beeney

Blackstone Alternative Credit Advisors LP

345 Park Avenue, 31st Floor

New York, New York 10154

Registrant’s telephone number, including area code: (877) 876-1121

Date of fiscal year end: September 30

Date of reporting period: March 31, 2022

| Item 1. | Report to Stockholders. |

Table of Contents

| Manager Commentary | 2 |

| Fund Summary | 4 |

| Portfolio of Investments | 7 |

| Statement of Assets and Liabilities | 23 |

| Statement of Operations | 24 |

| Statements of Changes in Net Assets | 25 |

| Statement of Cash Flows | 27 |

| Financial Highlights | 28 |

| Notes to Financial Statements | 35 |

| Additional Information | 51 |

| Privacy Procedures | 52 |

| Trustees & Officers | 63 |

| Blackstone Floating Rate Enhanced Income Fund | Manager Commentary |

| | March 31, 2022 (Unaudited) |

To Our Shareholders:

Volatility returned to global credit markets during the six month period ending March 31, 2022, as a confluence of macro headwinds pressured markets. These included the prospect of rising interest rates to combat persistently high inflation, supply chain disruption from COVID-19 and geopolitical pressures as Russia invaded Ukraine.

During the final quarter of 2021, the emergence of the Omicron variant caused temporary volatility in late November. But investors quickly moved in to buy-the-dip as appetite strengthened for floating-rate and higher-yielding assets. The year-end rally continued into early January, buoyed by the rollback of COVID-19 restrictions, but soon gave way to weakness as the US Federal Reserve’s (the “Fed’s”) increasingly hawkish stance in the face of 40-year high inflation rattled global markets. Russia’s invasion of Ukraine further intensified the weak sentiment amid rising energy and commodity prices.

The Fed’s 25 basis point (“bp”) rate hike in March sparked a quarter-end rally across risk assets, while expectations for another eight Fed rate hikes over the coming year, including a potential 50bp hike in May, pushed the 10-year Treasury yield to 2.33% by month-end.1 A brief inversion of the US Treasury yield curve raised recessionary concerns as the ongoing war in Ukraine prompted downward forecasts for global growth.

US loans significantly outperformed other credit and equity assets classes over the volatile six-month period. Increased demand for these floating rate assets as a hedge against rising inflation and rates shielded this portion of the market from the worst of the weakness, and loans returned 0.64% for the period.2

| 6-Month Total Returns as of March 31, 2022 | |

| US Loans | |

| (S&P/LSTA Leveraged Loan Index) | 0.64% |

| High Yield | |

| (Bloomberg High Yield Index) | -4.16% |

| 3-month Treasury Bills | |

| (Bloomberg U.S. Treasury Bellwethers: 3 Month) | 0.05% |

| 10-Year Treasuries | |

| (Bloomberg U.S. Treasury Bellwethers: 10 Year) | -6.24% |

| US Aggregate Bonds | |

| (Bloomberg U.S. Aggregate Bonds Index) | -5.92% |

| US Investment Grade Bonds | |

| (Bloomberg U.S. Investment Grade Bonds Index) | -7.48% |

| Emerging Markets | |

| (Bloomberg Emerging Markets Index) | -10.58% |

| US Large Cap Equities | |

| (Bloomberg U.S. Large Cap Equities Index) | 4.23% |

Sources: Bloomberg, Barclays, S&P/LCD

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

As investors rotated out of fixed-rate and into floating-rate assets, $29.5 billion of inflows entered loan mutual funds over the period.3 A record $9.6 billion flowed into loan mutual funds and exchange-traded funds ("ETFs") in January 2022 alone. Retail ownership of US loans reached its highest level since 2018 at 9% of the total loan market by the end of March 2022.4 A brief outflow ahead of the Fed rate hike mid-March broke a 13-week streak of inflows, pushing average loan prices down to levels last seen at the end of 2020.5 This created a buying opportunity and inflows resumed.

Demand from CLO buyers eased during the period as the market uncertainty and a more challenging CLO equity arbitrage dynamic curtailed issuance. Although the $87 billion of new CLOs priced over the six months through March 31 was just 3% lower than the previous six month period, the bulk of that activity took place in the final three months of 2021. The first quarter’s $30 billion of supply ended 46% behind the final quarter of 2021.6

High yield performance was more challenged than loans during the period. After ending 2021 as the best performing credit asset class, the rate-driven volatility in the first quarter of 2022 left high yield returns at -4.16% for the six-month period.7 Aversion to fixed-rate assets in the rising rate environment prompted strong outflows from high yield mutual funds and ETFs over the first quarter of 2022 compared to the final quarter of 2021. In total, $26.1 billion exited high-yield between October 2021 and March 2022 compared to $1.9 billion of outflows between April and September 2021.8

Following record issuance across credit markets in 2021, primary activity levels fell during the first quarter of 2022 as issuers stepped back amid market volatility. Gross loan issuance fell to $334 billion during the six months ended March 31, 16% lower than the prior six-month period.9 High yield issuance meanwhile decreased by 54% to $113 billion for the six months ending March 31 compared to the previous six months. Honing in on the most recent period, high yield supply dropped by 38% in the first quarter of 2022 compared to the last quarter of 2021.10

| Blackstone Floating Rate Enhanced Income Fund | Manager Commentary |

| | March 31, 2022 (Unaudited) |

In terms of sector performance, energy companies continued to benefit from high natural gas and oil prices, while sectors such as Building and Development and Autos11 exposed to increasing commodity prices came under pressure as the Ukrainian conflict progressed. As a result of the flight-to-quality reaction to enhanced market volatility in 2022, the CCC-rated loan cohort, which was 2021’s standout performer by rating, underperformed single- and double-B loans in the first quarter.12

Sub-investment grade borrowers remain in good fundamental health for now, with corporate balance sheets supported by high levels of liquidity. Credit fundamentals for leveraged loan and high yield issuers continued to improve in the final quarter of 2021 with both revenues and EBITDA meaningfully above pre-pandemic levels and leverage levels continuing to decline.13 Last-twelve-month default rates for US high-yield bonds and loans rose slightly to 0.50% and 0.86%, respectively, at the end of March 2022 but are expected to remain well below historical averages over the near term.14

Looking ahead we are mindful of the greater economic uncertainty posed both by the continuing war in Ukraine and the potential impact of tightening monetary policy on corporate performance. We continue to see value in shorter duration, floating rate assets, including senior loans, as rates rise. The rising interest rate environment is also accretive to loan returns as rates rise above LIBOR floors. Historically loans and high yield have both outperformed traditional fixed income assets during prior hiking cycles.15

At Blackstone Credit, we value your continued investment and confidence in us and in our family of funds. Additional information about our funds is available on our website at www.blackstone-credit.com and www.bgflx.com.

Sincerely,

Blackstone Liquid Credit Strategies LLC

| 1 | Bloomberg, March 31, 2022. |

| 2 | S&P/LSTA Leveraged Loan Index, March 31, 2022. |

| 3 | Lipper FMI; JPMorgan |

| 4 | J.P. Morgan, March 31, 2022. |

| 5 | S&P/LSTA US Leveraged Loan Index, March 31, 2022. |

| 6 | S&P LCD data as of March 31, 2022. |

| 7 | Bloomberg High Yield Index, March 31, 2022. |

| 8 | Lipper FMI; JPMorgan |

| 9 | S&P LCD data as of March 31, 2022. |

| 10 | S&P LCD data as of March 31, 2022. |

| 11 | S&P LCD Index data showing Autos down -0.9% YTD and Building & Development down -0.3% |

| 12 | S&P/LSTA Leveraged Loan Index, March 31, 2022. |

| 13 | JP Morgan Research, March 28 and April 2, 2022. |

| 14 | JP Morgan Default Rate, March 31, 2022. |

| 15 | Bloomberg February 28, 2022. |

| | |

| Semi-Annual Report | March 31, 2022 | 3 |

| Blackstone Floating Rate Enhanced Income Fund | Fund Summary |

| | March 31, 2022 (Unaudited) |

Fund Overview

Blackstone Floating Rate Enhanced Income Fund (the “Fund”) is a diversified, closed-end management investment company that continuously offers its shares and is operated as an “interval fund.” The Fund’s investment objective is to provide attractive current income with low sensitivity to rising interest rates. Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in floating rate loans, notes or bonds. “Managed Assets” means net assets plus the amount of any borrowings for investment purposes. In addition, the Fund may invest up to 20% of its Managed Assets in each of (i) structured products, (ii) derivatives, (iii) warrants and equity securities that are incidental to the Fund’s purchase of floating rate instruments or acquired in connection with a reorganization of a Borrower (as defined below) or issuer, (iv) fixed rate instruments, and (v) equity investments in other investment companies, including ETFs. In pursuing the Fund’s investment objective, the Adviser will seek to enhance the Fund’s return with the use of leverage.

Portfolio Management Commentary

Fund Performance

The Fund’s Class I, Class T, and Class D outperformed the Fund’s benchmark, the S&P/LSTA Leveraged Loan Index (“S&P LLI”), for the three-year period and since inception and underperformed for the three-month, six-month, and one-year periods. The Fund’s Class T-I and Class U outperformed the S&P LLI since inception and underperformed the benchmark for the three-month, six-month, and one-year periods.

NAV Performance Factors

The Fund’s performance relative to the benchmark for the six months ended March 31, 2022 was primarily attributable to the Fund’s positive selection within loans, and its allocation to CLO securities; the Fund’s allocation to bonds was a detractor to performance. By issuer, the largest positive contributors to performance were Access CIG, PetVet Care Centers, and Parallel 2018-2, and the most significant detractors were Envision Healthcare, Bright Bidco, and NFP Corp.

Portfolio Activity and Positioning

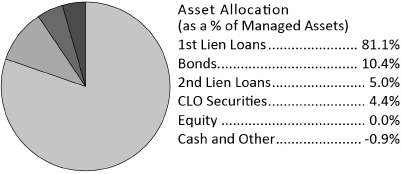

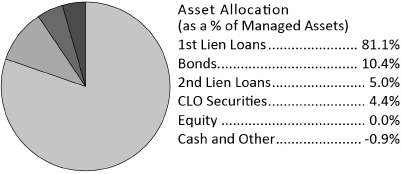

During the period, we continued to dynamically manage the Fund to take advantage of relative value opportunities between loans, high yield, and CLO securities. The Fund’s largest sector overweights were Electronics/Electric, Healthcare, and Business Equipment & Services; the largest sector underweights included Lodging & Casinos, Telecom, and Utilities. The Fund slightly reduced its allocation to loans and high yield bonds during the period and slightly increased its allocation to CLO securities.

As of March 31, 2022, the Fund held 81.1% of its Managed Assets in first lien loans, 5.0% in second lien loans, 10.4% in corporate bonds, and 4.4% in CLO securities. The Fund’s investments represented the obligations of 377 companies, with an average position size representing 0.22% of Managed Assets of the Fund.

| Blackstone Floating Rate Enhanced Income Fund | Fund Summary |

| | March 31, 2022 (Unaudited) |

Performance Summary

Performance quoted represents past performance, which is no guarantee of future results. Past performance is not indicative of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. The returns shown do not reflect taxes that an investor would pay on fund distributions or on the sale of fund shares. To obtain the most recent month-end performance, visit www.bgflx.com.

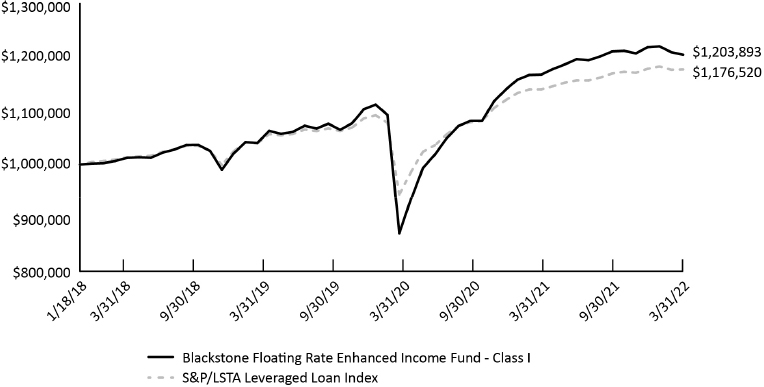

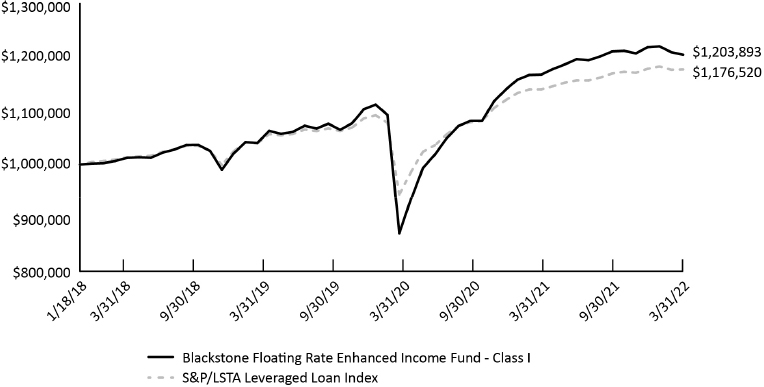

Value of a $1,000,000 Investment Since Inception at Net Asset Value*

| * | The line graph represents historical performance of a hypothetical investment of $1,000,000 in Class I Shares of the Fund from January 18, 2018 (commencement of operations) to March 31, 2022, assuming the reinvestment of distributions. |

Total Return (as of March 31, 2022)

| | 3 Month | 6 Month | 1 Year^ | 3 Year† | Since Inception† |

| Class I* | -1.13% | -0.50% | 3.17% | 5.00% | 4.52% |

| Class T* | -1.26% | -0.71% | 2.65% | 4.49% | 4.00% |

| Class T* w/ 2.5% Sales Load** | -3.71% | -3.20% | 0.10% | 3.61% | 3.33% |

| Class D* | -1.15% | -0.57% | 2.91% | 4.80% | 4.17% |

| Class T-I* | -1.24% | -0.71% | 2.67% | N/A | 4.12% |

| Class T-I* w/ 3.5% Sales Load*** | -4.70% | -4.20% | -0.93% | N/A | 2.87% |

| Class U* | -1.28% | -0.74% | 2.63% | N/A | 4.37% |

| S&P/LSTA Leveraged Loan Index**** | -0.10% | 0.64% | 3.25% | 4.22% | 3.95% |

| * | Assumes distributions are reinvested pursuant to the Fund's dividend reinvestment plan. Performance data quoted represents past performance and does not guarantee future results. |

| ** | Assumes payment of the full front-end 2.5% sales load at initial subscription. |

| *** | Assumes payment of the full front-end 3.5% sales load at initial subscription. |

| **** | Inception to date returns for the S&P LLI are based on the I Share inception date of 1/18/18. |

| ^ | Excludes adjustments in accordance with the accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market at period ended March 31, 2022 may differ from the net asset value for financial reporting purposes. |

| † | Annualized. |

| | |

| Semi-Annual Report | March 31, 2022 | 5 |

| Blackstone Floating Rate Enhanced Income Fund | Fund Summary |

| | March 31, 2022 (Unaudited) |

Portfolio Composition*

| * | The Fund’s Cash & Other Assets less Liabilities represents net cash and other assets and liabilities, which includes amounts payable for investments purchased but not yet settled and amounts receivable for investments sold but not yet settled. At period end, the amounts payable for investments purchased but not yet settled exceeded the amount of cash on hand. The Fund uses sales proceeds or its leverage program to settle amounts payable for investments purchased, but such amounts are not reflected in the Fund’s net cash. |

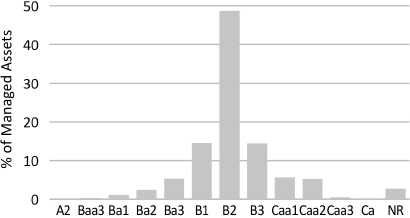

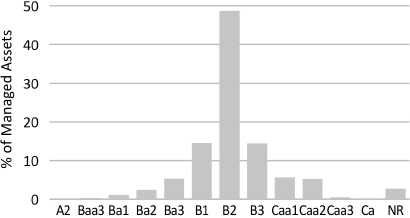

Moody’s Rating Distribution**

| ** | For more information on Moody's ratings and descriptions refer to www.moodys.com. |

Portfolio Characteristics

| Weighted Average Coupon | 4.99% |

| Current Dividend Yield – I Share^ | 5.56% |

| Current Dividend Yield – T Share^ | 5.06% |

| Current Dividend Yield – D Share^ | 5.32% |

| Current Dividend Yield – T-I Share^ | 5.06% |

| Current Dividend Yield – U Share^ | 5.06% |

| Average Duration^^ | 0.64 yr |

| Average Position* | 0.22% |

| Leverage* | 31.96% |

| ^ | Represents annualized distribution rate of I Share, T Share, D Share, T-I Share and U Share. Reflects March month cumulative distribution rate annualized. The cumulative distribution rate for the month presented represents the sum of the daily dividend distribution rate as calculated by dividing the daily dividend per share by the daily net asset value (“NAV”) per share, for each respective class, for each day in the month for which a daily dividend is declared. |

| ^^ | Loan durations are based on the actual remaining time until LIBOR is reset for each individual loan. |

| * | As a percentage of Managed Assets. |

Top 10 Issuers*

| PetVet Care Centers | 1.2% |

| Access CIG | 1.0% |

| AqGen Ascensus | 0.9% |

| Park River Holdings | 0.9% |

| Precisely Software | 0.8% |

| Project Alpha Intermediate Holdings | 0.8% |

| Mitchell International | 0.8% |

| Vantage Specialty Chemical | 0.8% |

| AMC Entetainment Holdings | 0.8% |

| Project Leopaerd Holdings | 0.8% |

| Top 10 Issuers | 8.8% |

| * | As a percentage of Managed Assets. |

Portfolio holdings and distributions are subject to change and are not recommendations to buy or sell any security.

Top 5 Industries*^

| Electronics/Electric | 18.3% |

| Business Equipment & Services | 13.7% |

| Healthcare | 12.9% |

| Structured Finance Obligations | 4.4% |

| Leisure Good/Activities/Movies | 4.1% |

| Top 5 Industries | 53.4% |

| * | As a percentage of Managed Assets. |

| ^ | S&P Industry Classification Schema. |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| FLOATING RATE LOAN INTERESTS(a) - 126.53% | | | | | | | | |

| Aerospace & Defense - 2.78% | | | | | | | | |

| Amentum Government Services Holdings LLC, First Lien Term Loan, 6M US L + 4.00%, 02/15/2029 | | $ | 1,405,102 | | | $ | 1,396,320 | |

| Atlas CC Acquisition Corp., First Lien B Term Loan, 3M US L + 4.25%, 0.75% Floor, 05/25/2028 | | | 1,857,131 | | | | 1,852,200 | |

| Atlas CC Acquisition Corp., First Lien C Term Loan, 3M US L + 4.25%, 0.75% Floor, 05/25/2028 | | | 378,675 | | | | 377,670 | |

| Dynasty Acquisition Co., Inc., First Lien 2020 B-1 Term Loan, 3M US L + 3.50%, 04/06/2026 | | | 847,330 | | | | 834,972 | |

| Dynasty Acquisition Co., Inc., First Lien 2020 B-2 Term Loan, 3M US L + 3.50%, 04/06/2026 | | | 455,554 | | | | 448,910 | |

| Peraton Corp., First Lien B Term Loan, 1M US L + 3.75%, 0.75% Floor, 02/01/2028 | | | 3,299,673 | | | | 3,283,175 | |

| Vertex Aerospace Corp., First Lien Term Loan, 1M US L + 4.00%, 12/06/2028 | | | 884,615 | | | | 882,961 | |

| | | | | | | | 9,076,208 | |

| | | | | | | | | |

| Air Transport - 2.18% | | | | | | | | |

| AAdvantage Loyality IP, Ltd., First Lien Initial Term Loan, 3M US L + 4.75%, 0.75% Floor, 04/20/2028 | | | 1,601,729 | | | | 1,625,755 | |

| American Airlines, Inc., First Lien 2018 Replacement Term Loan, 1M US L + 1.75%, 06/27/2025 | | | 329,261 | | | | 310,843 | |

| American Airlines, Inc., First Lien 2020 Term Loan, 1M US L + 1.75%, 01/29/2027 | | | 345,340 | | | | 324,188 | |

| Global Medical Response, Inc., First Lien 2018 New Term Loan, 3M US L + 4.25%, 1.00% Floor, 03/14/2025 | | | 624,045 | | | | 621,259 | |

| Global Medical Response, Inc., First Lien 2020 Refinancing Term Loan, 3M US L + 4.25%, 1.00% Floor, 10/02/2025 | | | 2,304,885 | | | | 2,293,004 | |

| KKR Apple Bidco LLC, Second Lien Initial Term Loan, 1M US L + 5.75%, 0.50% Floor, 09/21/2029 | | | 248,629 | | | | 247,736 | |

| United AirLines, Inc., First Lien Class B Term Loan, 3M US L + 3.75%, 0.75% Floor, 04/21/2028 | | | 1,699,302 | | | | 1,682,190 | |

| | | | | | | | 7,104,975 | |

| | | | | | | | | |

| Automotive - 2.06% | | | | | | | | |

| Bright BidCo B.V., First Lien 2018 Refinancing B Term Loan, 3M US L + 3.50%, 1.00% Floor, 06/30/2024 | | | 2,356,787 | | | | 1,426,964 | |

| GC EOS Buyer, Inc., First Lien Initial Term Loan, 1M US L + 4.50%, 08/01/2025 | | | 3,110,681 | | | | 3,082,903 | |

| Wheel Pros, Inc., First Lien Initial Term Loan, 1M US L + 4.50%, 0.75% Floor, 05/11/2028 | | | 2,320,999 | | | | 2,219,096 | |

| | | | | | | | 6,728,963 | |

| | | | | | | | | |

| Beverage & Tobacco - 0.99% | | | | | | | | |

| Bengal Debt Merger Sub, LLC Delayed, First Lien Term Loan, 3M US L + 3.25%, 01/24/2029 | | | 122 | | | | 120 | |

| Bengal Debt Merger Sub, LLC, First Lien Term Loan, L + 3.750%, 01/24/2029 | | | 2,117 | | | | 2,087 | |

| Triton Water Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.50%, 0.50% Floor, 03/31/2028 | | | 3,305,264 | | | | 3,230,301 | |

| | | | | | | | 3,232,508 | |

| | | | | | | | | |

| Brokers, Dealers & Investment Houses - 2.93% | | | | | | | | |

| Advisor Group Holdings, Inc., First Lien B-1 Term Loan, 1M US L + 4.50%, 07/31/2026 | | | 2,956,899 | | | | 2,948,132 | |

| Deerfield Dakota Holding LLC, First Lien Initial Dollar Term Loan, 1M US L + 3.75%, 1.00% Floor, 04/09/2027 | | | 2,590,667 | | | | 2,581,224 | |

| Deerfield Dakota Holding LLC, Second Lien 2021 Replacement Term Loan, 1M US L + 6.75%, 0.75% Floor, 04/07/2028 | | | 440,000 | | | | 441,100 | |

| Edelman Financial Center LLC, Second Lien Initial Term Loan, 1M US L + 6.75%, 07/20/2026 | | | 384,615 | | | | 380,240 | |

| Edelman Financial Engines Center LLC, First Lien Initial (2021) Term Loan, 1M US L + 3.50%, 0.75% Floor, 04/07/2028 | | | 3,255,132 | | | | 3,223,265 | |

| | | | | | | | 9,573,961 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2022 | 7 |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Building & Development - 4.75% | | | | | | | | |

| Arc Falcon I, Inc., First Lien Term Loan, 3M US L + 3.75%, 09/30/2028 | | $ | 702,452 | | | $ | 686,356 | |

| C.H.I. Overhead Doors, Inc., First Lien Third Amendment Initial Term Loan, 1M US L + 3.50%, 1.00% Floor, 07/31/2025 | | | 4,216 | | | | 4,182 | |

| Cornerstone Building Brands, Inc., First Lien Tranche B Term Loan, 1M US L + 3.25%, 0.50% Floor, 04/12/2028 | | | 1,190,302 | | | | 1,155,087 | |

| Foundation Building Materials, Inc., First Lien Initial Term Loan, 3M US L + 3.25%, 0.50% Floor, 01/31/2028 | | | 900,183 | | | | 885,780 | |

| Hillman Group, Inc., First Lien Delayed Term Loan, L + 2.750%, 07/14/2028 | | | 16 | | | | 16 | |

| Illuminate Merger Sub Corp, First Lien Initial Term Loan, 3M US L + 3.50%, 0.50% Floor, 07/21/2028 | | | 627,737 | | | | 608,456 | |

| LBM Acquisition LLC, First Lien Initial Term Loan, 3M US L + 3.75%, 0.75% Floor, 12/17/2027 | | | 2,210,190 | | | | 2,160,472 | |

| Park River Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.25%, 0.75% Floor, 12/28/2027 | | | 4,351,911 | | | | 4,262,937 | |

| SRS Distribution, Inc., First Lien 2021 Refinancing Term Loan, 6M US L + 3.50%, 0.50% Floor, 06/02/2028 | | | 802,047 | | | | 793,361 | |

| SRS Distribution, Inc., First Lien Term Loan, 6M US L + 3.50%, 06/02/2028 | | | 696,957 | | | | 689,551 | |

| Tutor Perini Corp., First Lien B Term Loan, 3M US L + 4.75%, 1.00% Floor, 08/18/2027 | | | 737,012 | | | | 725,496 | |

| United Site Cov-Lite, First Lien Term Loan, 3M US L + 4.25%, 12/15/2028 | | | 1,571,404 | | | | 1,559,485 | |

| White Cap Buyer LLC, First Lien Initial Closing Date Term Loan, 1M US L + 3.75%, 0.50% Floor, 10/19/2027 | | | 2,002,304 | | | | 1,984,363 | |

| | | | | | | | 15,515,542 | |

| | | | | | | | | |

| Business Equipment & Services - 19.28% | | | | | | | | |

| Access CIG LLC, First Lien B Term Loan, 3M US L + 3.75%, 02/27/2025 | | | 2,363,831 | | | | 2,332,486 | |

| Access CIG LLC, Second Lien Initial Term Loan, 3M US L + 7.75%, 02/27/2026 | | | 2,385,997 | | | | 2,372,576 | |

| Aegion Corp., First Lien Initial Term Loan, 3M US L + 4.75%, 0.75% Floor, 05/17/2028(b) | | | 845,851 | | | | 842,679 | |

| AG Group Holdings, Inc., First Lien Term Loan, 1M US L + 4.25%, 12/29/2028 | | | 802,920 | | | | 800,415 | |

| Allied Universal Holdco LLC, First Lien Initial U.S. Dollar Term Loan, 1M US L + 3.75%, 0.50% Floor, 05/12/2028 | | | 2,832,180 | | | | 2,792,473 | |

| Anticimex International AB, First Lien Term Loan, 3M US L + 3.50%, 0.50% Floor, 11/16/2028 AqGen Island Holdings, Inc., First Lien Term Loan: | | | 1,853,947 | | | | 1,829,030 | |

| 3M US L + 3.50%, 08/02/2028 | | | 1,629,093 | | | | 1,618,912 | |

| 3M US L + 6.50%, 08/02/2029 | | | 2,669,198 | | | | 2,652,516 | |

| BMC Acquisition, Inc., First Lien Initial Term Loan, 3M US L + 5.25%, 1.00% Floor, 12/28/2024 | | | 1,810,213 | | | | 1,769,483 | |

| Connectwise, LLC, First Lien Term Loan, 1M US L + 3.50%, 0.50% Floor, 09/29/2028 | | | 728,675 | | | | 724,850 | |

| DG Investment Intermediate Holdings 2, Inc., First Lien Closing Date Initial Term Loan, 1M US L + 3.50%, 0.75% Floor, 03/31/2028 | | | 1,029,816 | | | | 1,020,934 | |

| DG Investment Intermediate Holdings 2, Inc., Second Lien Initial Term Loan, 1M US L + 6.75%, 0.75% Floor, 03/30/2029 | | | 860,357 | | | | 862,508 | |

| Divisions Holding Corp., First Lien B Term Loan, 3M US L + 4.75%, 0.75% Floor, 05/27/2028 | | | 787,184 | | | | 783,248 | |

| EAB Global, Inc., First Lien Term Loan, 3M US L + 3.50%, 0.50% Floor, 08/16/2028 | | | 1,004,587 | | | | 996,048 | |

| Epicor Software Corp., First Lien C Term Loan, 1M US L + 3.25%, 0.75% Floor, 07/30/2027 | | | 505,768 | | | | 502,402 | |

| Epicor Software Corp., Second Lien Initial Term Loan, 1M US L + 7.75%, 1.00% Floor, 07/31/2028 | | | 1,677,966 | | | | 1,717,818 | |

| Equiniti Group PLC, First Lien Term Loan, 3M US L + 4.50%, 12/11/2028 | | | 501,818 | | | | 502,237 | |

| eResearchTechnology, Inc., First Lien Initial Term Loan, 1M US L + 4.50%, 1.00% Floor, 02/04/2027 | | | 1,199,480 | | | | 1,196,859 | |

| Foundational Education Group, Inc., First Lien Term Loan, 4M US L + 4.25%, 08/31/2028 | | | 841,143 | | | | 841,147 | |

| Garda World Security Corp., First Lien B-2 Term Loan, 1M US L + 4.25%, 10/30/2026 | | | 3,344,472 | | | | 3,312,232 | |

| Garda World Security Corp., First Lien Term Loan, 1M US L + 4.25%, 02/01/2029 | | | 313,636 | | | | 311,284 | |

| KUEHG Corp., First Lien B-3 Term Loan, 3M US L + 3.75%, 1.00% Floor, 02/21/2025 | | | 3,487,883 | | | | 3,441,564 | |

| Learning Care Group No. 2, Inc., First Lien Initial Term Loan, 3M US L + 3.25%, 1.00% Floor, 03/13/2025 | | | 2,692,298 | | | | 2,656,679 | |

| Loyalty Ventures, Inc., First Lien Term Loan, 1M US L + 4.50%, 11/03/2027 | | | 862,500 | | | | 843,814 | |

| See Notes to Financial Statements. | |

| 8 | www.bgflx.com |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Business Equipment & Services (continued) | | | | | | | | |

| Madison IAQ LLC, First Lien Initial Term Loan, 3M US L + 3.25%, 0.50% Floor, 06/21/2028 | | $ | 1,341,015 | | | $ | 1,323,696 | |

| McKissock Investment Holdings, LLC, First Lien Term Loan, L + 5.750%, 03/12/2029 | | | 1,320,968 | | | | 1,316,015 | |

| Minotaur Acquisition, Inc., First Lien B Term Loan, 1M US L + 4.75%, 03/27/2026 | | | 1,979,644 | | | | 1,965,054 | |

| Mitchell International, Inc., First Lien Term Loan, 3M US L + 3.75%, 10/15/2028 | | | 3,352,204 | | | | 3,303,262 | |

| Mitchell International, Inc., Second Lien Term Loan, 3M US L + 6.50%, 10/15/2029 | | | 592,784 | | | | 588,524 | |

| National Intergovernmental Purchasing Alliance Company, First Lien Initial Term Loan, 3M US L + 3.50%, 05/23/2025 | | | 1,168,652 | | | | 1,151,122 | |

| Revspring, Inc., First Lien Initial Term Loan, 3M US L + 4.25%, 10/11/2025 | | | 1,746,000 | | | | 1,724,725 | |

| Rinchem Company, Inc., First Lien Term Loan, 3M US L + 0.00%, 03/02/2029(b) | | | 740,145 | | | | 738,294 | |

| Sabre GLBL, Inc., First Lien 2021 Other B-1 Term Loan, 1M US L + 3.50%, 0.50% Floor, 12/17/2027 | | | 343,210 | | | | 339,992 | |

| Sabre GLBL, Inc., First Lien 2021 Other B-2 Term Loan, 1M US L + 3.50%, 0.50% Floor, 12/17/2027 | | | 547,097 | | | | 541,967 | |

| Sedgwick Claims Management Services, Inc., First Lien 2020 Term Loan, 1M US L + 4.25%, 1.00% Floor, 09/03/2026 | | | 970,000 | | | | 966,120 | |

| Seren BidCo, First Lien Term Loan, 3M US L + 0.00%, 11/16/2028(b) | | | 792,000 | | | | 787,050 | |

| Skopima Merger Sub Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 05/12/2028 | | | 2,202,651 | | | | 2,180,966 | |

| St. George's University Scholastic Services LLC, First Lien Term Loan B Term Loan, 3M US L + 3.25%, 0.50% Floor, 02/10/2029 | | | 1,372,909 | | | | 1,358,150 | |

| TRC Companies, First Lien Term Loan, 1M US L + 3.75%, 12/08/2028 | | | 1,642,108 | | | | 1,619,940 | |

| TRC Companies, Second Lien Term Loan, 1M US L + 6.75%, 12/07/2029(b) | | | 1,026,154 | | | | 1,018,458 | |

| Virtusa Corp., First Lien Term Loan: | | | | | | | | |

| 1M US L + 3.75%, 0.75% Floor, 02/11/2028 | | | 749,057 | | | | 743,439 | |

| 1M US L + 3.75%, 02/15/2029 | | | 907,360 | | | | 901,122 | |

| Weld North Education LLC, First Lien Term Loan, 1M US L + 3.75%, 0.50% Floor, 12/21/2027 | | | 3,671,566 | | | | 3,647,701 | |

| | | | | | | | 62,939,791 | |

| | | | | | | | | |

| Cable & Satellite Television - 0.88% | | | | | | | | |

| Numericable U.S. LLC, First Lien USD TLB-[12] Term Loan, 3M US L + 3.6875%, 01/31/2026 | | | 2,923,664 | | | | 2,865,659 | |

| | | | | | | | | |

| Chemical & Plastics - 3.53% | | | | | | | | |

| Ascend Performance Materials Operations LLC, First Lien 2021 Refinancing Term Loan, 3M US L + 4.75%, 0.75% Floor, 08/27/2026 | | | 1,868,625 | | | | 1,865,710 | |

| CPC Acquisition Corp., First Lien Initial Term Loan, 3M US L + 3.75%, 0.75% Floor, 12/29/2027 | | | 608,401 | | | | 593,191 | |

| DCG Acquisition Corp., First Lien B Term Loan, 1M US L + 4.50%, 09/30/2026 | | | 2,168,099 | | | | 2,136,932 | |

| Geon Performance Solutions LLC, First Lien Term Loan, 1M US L + 4.75%, 0.75% Floor, 08/18/2028 | | | 565,062 | | | | 565,065 | |

| Hexion Holdings Corp., First Lien Term Loan, L + 5.000%, 03/15/2029 | | | 1,484,951 | | | | 1,455,252 | |

| Hyperion Materials & Technologies, Inc., First Lien Initial Term Loan, 3M US L + 4.50%, 0.50% Floor, 08/30/2028 | | | 1,088,918 | | | | 1,082,455 | |

| Vantage Specialty Chemicals, Inc., First Lien Closing Date Term Loan, 3M US L + 3.50%, 1.00% Floor, 10/28/2024 | | | 1,825,225 | | | | 1,761,114 | |

| Vantage Specialty Chemicals, Inc., First Lien Term Loan, 3M US L + 0.00%, 10/28/2024 | | | 920,000 | | | | 887,685 | |

| Vantage Specialty Chemicals, Inc., Second Lien Initial Term Loan, 3M US L + 8.25%, 1.00% Floor, 10/27/2025 | | | 1,200,000 | | | | 1,163,100 | |

| | | | | | | | 11,510,504 | |

| | | | | | | | | |

| Clothing & Textiles - 0.41% | | | | | | | | |

| S&S Holdings LLC, First Lien Initial Term Loan, 3M US L + 5.00%, 0.50% Floor, 03/11/2028 | | | 1,366,972 | | | | 1,320,836 | |

| | | | | | | | | |

| Conglomerates - 2.60% | | | | | | | | |

| Genuine Financial Holdings LLC, First Lien Initial Term Loan, 1M US L + 3.75%, 07/11/2025 | | | 3,067,321 | | | | 3,038,289 | |

| Hunter Douglas Inc., First Lien Term Loan, L + 4.000%, 02/26/2029 | | | 1,531,250 | | | | 1,503,021 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2022 | 9 |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Conglomerates (continued) | | | | | | | | |

| Spring Education Group, Inc., First Lien Initial Term Loan, 3M US L + 4.25%, 07/30/2025 | | $ | 2,382,462 | | | $ | 2,316,944 | |

| Vaco Holdings, LLC, First Lien Term Loan, 3M US L + 5.00%, 01/21/2029 | | | 492,857 | | | | 490,701 | |

| VT Topco, Inc., First Lien 2021 Term Loan, 3M US L + 3.75%, 0.75% Floor, 08/01/2025 | | | 1,150,525 | | | | 1,135,430 | |

| | | | | | | | 8,484,385 | |

| | | | | | | | | |

| Containers & Glass Products - 4.36% | | | | | | | | |

| Berlin Packaging L.L.C., First Lien Term Loan, 1M US L + 3.75%, 03/11/2028 | | | 2,655,406 | | | | 2,634,827 | |

| Charter Next Generation, Inc., First Lien Initial (2021) Term Loan, 1M US L + 3.75%, 0.75% Floor, 12/01/2027 | | | 2,919,423 | | | | 2,907,103 | |

| Clydesdale Acquisition Holdings, Inc., First Lien Term Loan, L + 4.780%, 03/30/2029 | | | 2,745,286 | | | | 2,704,106 | |

| IBC Capital I, Ltd., First Lien Tranche B-1 Term Loan, 3M US L + 3.75%, 09/11/2023 | | | 469,939 | | | | 461,275 | |

| LABL, Inc., First Lien Term Loan, 1M US L + 5.00%, 10/29/2028 | | | 819,375 | | | | 810,817 | |

| ProAmpac PG Borrower LLC, First Lien 2020-1 Term Loan, 3M US L + 3.75%, 0.75% Floor, 11/03/2025 | | | 3,499,498 | | | | 3,430,382 | |

| Ring Container Technologies Group, LLC, First Lien Initial Term Loan, 6M US L + 3.75%, 0.50% Floor, 08/12/2028 | | | 819,471 | | | | 809,232 | |

| Tekni-Plex, Inc., First Lien Delayed Draw Tem Term Loan, 1M US L + 4.00%, 0.50% Floor, 09/15/2028(c) | | | 39,055 | | | | 38,632 | |

| Tekni-Plex, Inc., First Lien Tranche B-3 Initial Term Loan, 1M US L + 4.00%, 0.50% Floor, 09/15/2028 | | | 438,037 | | | | 433,293 | |

| | | | | | | | 14,229,667 | |

| | | | | | | | | |

| Diversified Insurance - 1.09% | | | | | | | | |

| Acrisure LLC, First Lien 2021-1 Additional Term Loan, 1M US L + 3.75%, 02/15/2027 | | | 481,789 | | | | 479,082 | |

| Acrisure LLC, First Lien Term Loan, 1M US L + 4.25%, 02/15/2027 | | | 549,991 | | | | 548,619 | |

| Alliant Holdings Intermediate LLC, First Lien Term Loan, 1M US L + 3.50%, 11/05/2027 | | | 1,562,236 | | | | 1,554,534 | |

| NFP Corp., First Lien Closing Date Term Loan, 1M US L + 3.25%, 02/15/2027 | | | 997,455 | | | | 981,252 | |

| | | | | | | | 3,563,487 | |

| | | | | | | | | |

| Drugs - 2.64% | | | | | | | | |

| Cambrex Corp., First Lien Tranche B-2 Dollar Term Loan, 1M US L + 3.50%, 0.75% Floor, 12/04/2026 | | | 3,295,290 | | | | 3,272,124 | |

| Curia Global, Inc., First Lien 2021 Term Loan, 3M US L + 3.75%, 0.75% Floor, 08/30/2026 | | | 3,306,181 | | | | 3,282,856 | |

| LSCS Holdings/Eversana, First Lien Term Loan, 1M US L + 4.50%, 12/16/2028 | | | 724,409 | | | | 718,074 | |

| Packaging Coordinators Midco, Inc., First Lien Term Loan, 3M US L + 3.75%, 0.75% Floor, 11/30/2027 | | | 176,437 | | | | 175,739 | |

| Padagis LLC, First Lien Initial Term Loan, 3M US L + 4.75%, 0.50% Floor, 07/06/2028 | | | 590,793 | | | | 587,472 | |

| Sharp MicCo, LLC, First Lien Term Loan, 3M US L + 4.00%, 12/31/2028(b) | | | 571,290 | | | | 569,148 | |

| | | | | | | | 8,605,413 | |

| | | | | | | | | |

| Ecological Services & Equipment - 1.08% | | | | | | | | |

| Bingo Industries LTD, First Lien Term Loan, 3M US L + 3.50%, 07/14/2028 | | | 2,372,371 | | | | 2,354,578 | |

| Emerald 2, Ltd., First Lien Initial B-1 Term Loan, 3M US L + 3.25%, 07/12/2028 | | | 3,626 | | | | 3,580 | |

| EnergySolutions LLC, First Lien Initial Term Loan, 3M US L + 3.75%, 1.00% Floor, 05/09/2025 | | | 1,171,759 | | | | 1,151,254 | |

| | | | | | | | 3,509,412 | |

| | | | | | | | | |

| Electronics/Electric - 26.34% | | | | | | | | |

| Apttus Corp., First Lien Initial Term Loan, 3M US L + 4.25%, 0.75% Floor, 05/08/2028 | | | 835,436 | | | | 835,436 | |

| BMC Software, Inc., Second Lien 2nd Lien Term Loan, 1M US L + 5.50%, 0.50% Floor, 02/27/2026 | | | 1,217,347 | | | | 1,209,739 | |

| Boxer Parent Company, Inc., First Lien 2021 Replacement Dollar Term Loan, 3M US L + 3.75%, 0.50% Floor, 10/02/2025 | | | 1,978,046 | | | | 1,968,987 | |

| Brave Parent Holdings, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 04/18/2025 | | | 964,794 | | | | 956,149 | |

| Cloudera, Inc., First Lien Term Loan, 1M US L + 3.75%, 0.50% Floor, 10/08/2028 | | | 2,868,410 | | | | 2,837,933 | |

| See Notes to Financial Statements. | |

| 10 | www.bgflx.com |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Electronics/Electric (continued) | | | | | | | | |

| ConvergeOne Holdings, Corp., First Lien Initial Term Loan, 1M US L + 5.00%, 01/04/2026 | | $ | 2,910,000 | | | $ | 2,794,822 | |

| CoreLogic, Inc., First Lien Initial Term Loan, 1M US L + 3.50%, 0.50% Floor, 06/02/2028 | | | 2,655,814 | | | | 2,630,929 | |

| Cornerstone OnDemand, Inc., First Lien Initial Term Loan, 1M US L + 3.75%, 0.50% Floor, 10/16/2028 | | | 845,902 | | | | 839,029 | |

| CPI International, Inc., First Lien Initial Term Loan, 3M US L + 3.25%, 1.00% Floor, 07/26/2024 | | | 2,376,512 | | | | 2,361,362 | |

| DCert Buyer, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 10/16/2026 | | | 1,985,510 | | | | 1,974,064 | |

| DCert Buyer, Inc., Second Lien First Amendment Refinancing Term Loan, 1M US L + 7.00%, 02/19/2029 | | | 943,235 | | | | 934,784 | |

| Deliver Buyer, Inc., First Lien Term Loan, 3M US L + 5.00%, 05/01/2024 | | | 2,278,042 | | | | 2,278,042 | |

| Delta Topco, Inc., First Lien Initial Term Loan, 3M US L + 3.75%, 0.75% Floor, 12/01/2027 | | | 2,391,363 | | | | 2,357,633 | |

| ECI Macola/MAX Holding LLC, First Lien Initial Term Loan, 3M US L + 3.75%, 0.75% Floor, 11/09/2027 | | | 3,615,079 | | | | 3,578,928 | |

| Endurance International Group Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.50%, 0.75% Floor, 02/10/2028 | | | 2,358,514 | | | | 2,296,603 | |

| Excelitas Technologies Corp., First Lien Initial USD Term Loan, 3M US L + 3.50%, 1.00% Floor, 12/02/2024 | | | 2,878,776 | | | | 2,867,980 | |

| Fiserv Investment Solutions, Inc., First Lien Initial Term Loan, 3M US L + 4.00%, 02/18/2027 | | | 877,750 | | | | 874,095 | |

| Flexera Software LLC, First Lien B-1 Term Loan, 6M US L + 3.75%, 0.75% Floor, 03/03/2028 | | | 2,510,986 | | | | 2,486,328 | |

| Help/Systems Holdings, Inc., First Lien Seventh Amendment Refinancing Term Loan, 1M US L + 4.00%, 0.75% Floor, 11/19/2026 | | | 3,268,039 | | | | 3,235,358 | |

| Hyland Software, Inc., Second Lien 2021 Refinancing Term Loan, 1M US L + 6.25%, 0.75% Floor, 07/07/2025 | | | 3,005,003 | | | | 2,978,709 | |

| Idera, Inc., First Lien B-1 Term Loan, 4M US L + 3.75%, 0.75% Floor, 03/02/2028 | | | 1,576,689 | | | | 1,551,462 | |

| Imperva, Inc., First Lien Term Loan, 3M US L + 4.00%, 1.00% Floor, 01/12/2026 | | | 1,709,292 | | | | 1,691,558 | |

| Ingram Micro, Inc., First Lien Initial Term Loan, 3M US L + 3.50%, 0.50% Floor, 06/30/2028 | | | 1,091,750 | | | | 1,084,108 | |

| Internet Brands, Inc., First Lien 2020 June New Term Loan, 1M US L + 3.75%, 1.00% Floor, 09/13/2024 | | | 3,600,658 | | | | 3,567,226 | |

| Ivanti Software, Inc., First Lien First Amendment Term Loan, 3M US L + 4.00%, 0.75% Floor, 12/01/2027 | | | 358,509 | | | | 353,131 | |

| Ivanti Software, Inc., First Lien Term Loan, 3M US L + 4.25%, 12/01/2027 | | | 1,990,000 | | | | 1,966,369 | |

| Ivanti Software, Inc., Second Lien Term Loan, 3M US L + 7.25%, 12/01/2028 | | | 772,388 | | | | 764,664 | |

| LI Group Holdings, Inc., First Lien 2021 Term Loan, 3M US L + 3.75%, 0.75% Floor, 03/11/2028 | | | 1,045,440 | | | | 1,038,258 | |

| Magenta Buyer LLC, First Lien Initial Term Loan, 3M US L + 5.00%, 0.75% Floor, 07/27/2028 | | | 2,455,849 | | | | 2,441,114 | |

| McAfee Corp., First Lien Term Loan, 3M US L + 4.00%, 03/01/2029 | | | 1,972,477 | | | | 1,961,382 | |

| MH SUB I LLC, Second Lien 2021 Replacement Term Loan, 1M US L + 6.25%, 02/23/2029 | | | 972,997 | | | | 966,308 | |

| MLN US HoldCo LLC, First Lien B Term Loan, 1M US L + 4.50%, 11/30/2025 | | | 724,541 | | | | 698,729 | |

| Park Place Technologies LLC, First Lien Closing Date Term Loan, 1M US L + 5.00%, 1.00% Floor, 11/10/2027 | | | 2,970,000 | | | | 2,961,342 | |

| Perforce Software, Inc., First Lien New Term Loan, 1M US L + 3.75%, 07/01/2026 | | | 1,063,412 | | | | 1,052,943 | |

| Project Alpha Intermediate Holding, Inc., First Lien 2021 Refinancing Term Loan, 3M US L + 4.00%, 04/26/2024 | | | 3,974,698 | | | | 3,955,659 | |

| Project Leopard Holdings, Inc., First Lien 2018 Repricing Term Loan, 3M US L + 4.75%, 1.00% Floor, 07/05/2024 | | | 2,417,713 | | | | 2,406,386 | |

| Project Leopard Holdings, Inc., First Lien 2019 Incremental Term Loan, 3M US L + 4.75%, 1.00% Floor, 07/05/2024 | | | 1,278,275 | | | | 1,274,440 | |

| Quest Borrower Ltd., First Lien Term Loan, 3M US L + 0.00%, 02/01/2029 | | | 2,010,732 | | | | 1,983,557 | |

| Rocket Software, Inc., First Lien Initial Term Loan, 1M US L + 4.25%, 11/28/2025 | | | 1,817,779 | | | | 1,797,902 | |

| Rocket Software, Inc., First Lien USD Term Loan, 1M US L + 4.25%, 11/28/2025 | | | 909,792 | | | | 899,557 | |

| S2P Acquisition Borrower, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 08/14/2026 | | | 1,614,167 | | | | 1,607,508 | |

| Sovos Compliance LLC, First Lien Initial Term Loan, 1M US L + 4.50%, 0.50% Floor, 08/11/2028 | | | 2,021,402 | | | | 2,021,413 | |

| Veritas US, Inc., First Lien Dollar B-2021 Term Loan, 3M US L + 5.00%, 1.00% Floor, 09/01/2025 | | | 1,748,870 | | | | 1,641,314 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2022 | 11 |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Electronics/Electric (continued) | | | | | | | | |

| Vision Solutions, Inc., First Lien Term Loan, 3M US L + 4.00%, 04/24/2028 | | $ | 4,031,784 | | | $ | 3,996,506 | |

| | | | | | | | 85,979,746 | |

| | | | | | | | | |

| Equipment Leasing - 0.55% | | | | | | | | |

| Spin Holdco, Inc., First Lien Initial Term Loan, 3M US L + 4.00%, 0.75% Floor, 03/04/2028 | | | 1,820,016 | | | | 1,809,269 | |

| | | | | | | | | |

| Financial Intermediaries - 1.92% | | | | | | | | |

| Apex Group Treasury LLC, First Lien Term Loan, 3M US L + 0.00%, 0.50% Floor, 07/27/2028 | | | 387,952 | | | | 385,287 | |

| Apex Group Treasury, Ltd., First Lien USD Term Loan, 3M US L + 3.75%, 0.50% Floor, 07/27/2028 | | | 698,837 | | | | 694,036 | |

| ION Trading Finance, Ltd., First Lien Initial Dollar (2021) Term Loan, 1M US L + 4.75%, 04/01/2028 | | | 2,307,520 | | | | 2,293,848 | |

| Lereta, LLC, First Lien Term Loan, 1M US L + 5.25%, 07/30/2028 | | | 794,618 | | | | 796,108 | |

| Pre Paid Legal Services, Inc., First Lien Term Loan, 1M US L + 3.75%, 12/15/2028 | | | 2,130,282 | | | | 2,107,424 | |

| | | | | | | | 6,276,703 | |

| | | | | | | | | |

| Food Products - 0.57% | | | | | | | | |

| Snacking Investments BidCo Pty, Ltd., First Lien Initial US Term Loan, 3M US L + 5.00%, 1.00% Floor, 12/18/2026 | | | 1,893,388 | | | | 1,872,088 | |

| | | | | | | | | |

| Food Service - 3.33% | | | | | | | | |

| Fertitta Entertainment, LLC, First Lien Term Loan, 1M US L + 4.00%, 01/27/2029 | | | 2,474,951 | | | | 2,465,831 | |

| Flynn Restaurant, First Lien Term Loan, 1M US L + 4.25%, 12/01/2028 | | | 772,816 | | | | 764,767 | |

| Fogo de Chao, Inc., First Lien 2018 Refinancing Term Loan, 1M US L + 4.25%, 1.00% Floor, 04/07/2025 | | | 3,082,570 | | | | 3,018,021 | |

| Quidditch Acquisition, Inc., First Lien B Term Loan, 1M US L + 7.00%, 1.00% Floor, 03/21/2025 | | | 2,709,612 | | | | 2,641,872 | |

| Tacala Investment Corp., Second Lien Initial Term Loan, 1M US L + 7.50%, 0.75% Floor, 02/04/2028 | | | 2,000,000 | | | | 1,977,500 | |

| | | | | | | | 10,867,991 | |

| | | | | | | | | |

| Food/Drug Retailers - 0.85% | | | | | | | | |

| EG Group, Ltd., First Lien Additional Facility Term Loan: | | | | | | | | |

| 3M US L + 4.00%, 02/07/2025 | | | 2,490,540 | | | | 2,456,731 | |

| 3M US L + 4.25%, 0.50% Floor, 03/31/2026 | | | 316,384 | | | | 312,587 | |

| | | | | | | | 2,769,318 | |

| | | | | | | | | |

| Healthcare - 18.11% | | | | | | | | |

| Artivion, Inc., First Lien Initial Term Loan, 3M US L + 3.50%, 1.00% Floor, 06/01/2027 | | | 2,409,835 | | | | 2,376,700 | |

| AthenaHealth Group, Inc., First Lien Term Loan, 1M US L + 3.50%, 02/15/2029 | | | 1,700,739 | | | | 1,685,858 | |

| Auris Luxembourg III SARL, First Lien Facility B2 Term Loan, 1M US L + 3.75%, 02/27/2026 | | | 3,255,485 | | | | 3,179,193 | |

| Carestream Health, Inc., Second Lien 2023 Extended Term Loan, 3M US L + 4.50, 8.00% PIK, 1.00% Floor, 08/08/2023(b)(d) | | | 1,770,490 | | | | 1,637,703 | |

| CHG Healthcare Services, Inc., First Lien Initial Term Loan, 3M US L + 3.50%, 0.50% Floor, 09/29/2028 | | | 1,920,849 | | | | 1,906,443 | |

| Covenant Surgical Partners, Inc., First Lien Delayed Draw Term Loan, 1M US L + 4.00%, 07/01/2026 | | | 555,686 | | | | 548,045 | |

| Covenant Surgical Partners, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 07/01/2026 | | | 2,715,405 | | | | 2,678,068 | |

| Envision Healthcare Corp., First Lien Initial Term Loan, 1M US L + 3.75%, 10/10/2025 | | | 2,266,799 | | | | 1,514,981 | |

| Femur Buyer, Inc., First Lien Initial Term Loan, 3M US L + 4.50%, 03/05/2026 | | | 1,872,891 | | | | 1,694,967 | |

| Genesis Care Finance Pty, Ltd., First Lien Facility B5 Term Loan, 3M US L + 5.00%, 1.00% Floor, 05/14/2027 | | | 1,891,201 | | | | 1,688,682 | |

| Heartland Dental LLC, First Lien 2021 Incremental Term Loan, 1M US L + 4.00%, 04/30/2025 | | | 1,581,569 | | | | 1,570,553 | |

| LifePoint Health, Inc., First Lien B Term Loan, 1M US L + 3.75%, 11/16/2025 | | | 2,017,692 | | | | 2,008,966 | |

| See Notes to Financial Statements. | |

| 12 | www.bgflx.com |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Healthcare (continued) | | | | | | | | |

| Medical Solutions LLC, First Lien Term Loan: | | | | | | | | |

| 3M US L + 0.00%, 11/01/2028(c) | | $ | 192,000 | | | $ | 190,680 | |

| 3M US L + 3.50%, 11/01/2028 | | | 1,937,060 | | | | 1,923,743 | |

| NAPA Management Services Corp., First Lien Term Loan, 3M US L + 0.00%, 0.75% Floor, 02/23/2029 | | | 1,748,000 | | | | 1,729,427 | |

| Navicure, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 10/22/2026 | | | 1,156,858 | | | | 1,155,412 | |

| Onex TSG Intermediate Corp., First Lien Initial Term Loan, 1M US L + 4.75%, 0.75% Floor, 02/28/2028 | | | 1,985,000 | | | | 1,973,219 | |

| Parexel International Corporation, First Lien Term Loan, 3M US L + 3.50%, 0.50% Floor, 11/15/2028 | | | 1,075,117 | | | | 1,068,591 | |

| Pathway Vet Alliance LLC, First Lien 2021 Replacement Term Loan, 1M US L + 3.75%, 03/31/2027 | | | 1,956,715 | | | | 1,940,826 | |

| Pediatric Associates Holding Co. LLC, First Lien Term Loan, 1M US L + 3.25%, 0.50% Floor, 12/29/2028 | | | 295,066 | | | | 291,931 | |

| PetVet Care Centers LLC, First Lien 2021 Replacement Term Loan, 1M US L + 3.50%, 0.75% Floor, 02/14/2025 | | | 2,292,983 | | | | 2,285,106 | |

| PetVet Care Centers LLC, Second Lien Initial Term Loan, 1M US L + 6.25%, 02/13/2026 | | | 3,373,588 | | | | 3,363,063 | |

| Phoenix Guarantor, Inc., First Lien Tranche B-3 Term Loan, 1M US L + 3.50%, 03/05/2026 | | | 1,954,678 | | | | 1,936,871 | |

| Project Ruby Ultimate Parent Corp., First Lien Closing Date Term Loan, 1M US L + 3.25%, 0.75% Floor, 03/10/2028 | | | 1,049,852 | | | | 1,040,929 | |

| Resonetics LLC, First Lien Initial Term Loan, 3M US L + 4.00%, 0.75% Floor, 04/28/2028 | | | 802,555 | | | | 796,034 | |

| Surgery Center Holdings, Inc., First Lien 2021 New Term Loan, 1M US L + 3.75%, 0.75% Floor, 08/31/2026 | | | 3,293,057 | | | | 3,272,903 | |

| Team Health Holdings, Inc., First Lien Initial Term Loan, 1M US L + 2.75%, 1.00% Floor, 02/06/2024 | | | 2,603,594 | | | | 2,484,102 | |

| Tecostar Holdings, Inc., First Lien 2017 Term Loan, 3M US L + 3.50%, 1.00% Floor, 05/01/2024 | | | 2,391,024 | | | | 2,247,562 | |

| U.S. Anesthesia Partners, Inc., First Lien Term Loan, 3M US L + 4.25%, 10/01/2028 | | | 1,301,920 | | | | 1,295,169 | |

| Unified Women’s Healthcare LP, First Lien Initial Term Loan, 1M US L + 4.25%, 0.75% Floor, 12/20/2027 | | | 2,931,288 | | | | 2,908,937 | |

| Verscend Holding Corp., First Lien B-1 Term Loan, 1M US L + 4.00%, 08/27/2025 | | | 2,126,348 | | | | 2,123,690 | |

| Viant Medical Holdings, Inc., First Lien Initial Term Loan, 1M US L + 3.75%, 07/02/2025 | | | 2,748,751 | | | | 2,592,168 | |

| | | | | | | | 59,110,522 | |

| | | | | | | | | |

| Home Furnishings - 0.84% | | | | | | | | |

| Osmosis Buyer Limited Delayed, First Lien Term Loan, 3M US L + 0.00%, 07/31/2028 | | | 212,963 | | | | 211,034 | |

| Osmosis Buyer Limited, First Lien Initial B Term Loan, 1M US L + 4.00%, 0.50% Floor, 07/31/2028 | | | 1,630,273 | | | | 1,617,288 | |

| Osmosis Buyer Limited, First Lien Term Loan, 3M US L + 0.00%, 07/31/2028 | | | 937,037 | | | | 928,547 | |

| | | | | | | | 2,756,869 | |

| | | | | | | | | |

| Industrial Equipment - 5.85% | | | | | | | | |

| Apex Tool Group LLC, First Lien Term Loan, 3M US L + 0.00%, 0.50% Floor, 02/08/2029 | | | 1,358,475 | | | | 1,326,455 | |

| Bettcher Industries, Inc., First Lien Term Loan, 3M US L + 0.00%, 12/14/2028 | | | 1,214,561 | | | | 1,196,343 | |

| Engineered Machinery Holdings, Inc., First Lien Term Loan, 3M US L + 3.75%, 0.75% Floor, 05/19/2028 | | | 2,556,469 | | | | 2,526,290 | |

| FCG Acquisitions, Inc., First Lien Initial Term Loan, 3M US L + 3.75%, 0.50% Floor, 03/31/2028 | | | 842,555 | | | | 830,266 | |

| Justrite Safety Group, First Lien Delayed Draw Term Loan, 3M US L + 4.50%, 06/28/2026 | | | 97,868 | | | | 93,219 | |

| Justrite Safety Group, First Lien Initial Term Loan, 3M US L + 4.50%, 06/28/2026 | | | 1,810,473 | | | | 1,724,476 | |

| LTI Holdings, Inc., First Lien Initial Term Loan, 1M US L + 3.50%, 09/06/2025 | | | 2,235,541 | | | | 2,188,964 | |

| LTI Holdings, Inc., First Lien Term Loan, 1M US L + 4.75%, 07/24/2026 | | | 301,875 | | | | 299,611 | |

| PRO MACH Group, Inc. Delayed, First Lien Delayed Draw Term Loan, 3M US L + 0.00%, 1.00% Floor, 08/31/2028(c) | | | 32,122 | | | | 32,022 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2022 | 13 |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Industrial Equipment (continued) | | | | | | | | |

| PRO MACH Group, Inc., First Lien Closing Date Initial Term Loan, 3M US L + 4.00%, 1.00% Floor, 08/31/2028 | | $ | 2,814,583 | | | $ | 2,805,787 | |

| Redwood Star Merger Sub, Inc., First Lien Term Loan, L + 5.000%, 03/16/2029 | | | 1,840,000 | | | | 1,794,764 | |

| Tailwind Smith Cooper Intermediate Corp., First Lien Initial Term Loan, 1M US L + 5.00%, 05/28/2026 | | | 2,381,979 | | | | 2,341,485 | |

| TK Elevator Midco GmbH, First Lien Facility B1 Term Loan, 3M US L + 3.50%, 0.50% Floor, 07/30/2027 | | | 1,950,870 | | | | 1,936,248 | |

| | | | | | | | 19,095,930 | |

| | | | | | | | | |

| Insurance - 2.47% | | | | | | | | |

| Baldwin Risk Partners, LLC, First Lien Initial Term Loan, 1M US L + 3.50%, 10/14/2027 | | | 2,738,269 | | | | 2,717,732 | |

| HIG Finance 2, Ltd., First Lien 2021 Dollar Refinancing Term Loan, 1M US L + 3.25%, 0.75% Floor, 11/12/2027 | | | 2,764,406 | | | | 2,737,343 | |

| Hyperion Ins/Howden 11/21 Incremental Cov-Lite, First Lien Term Loan, 3M US L + 0.00%, 11/12/2027 | | | 460,058 | | | | 455,528 | |

| Outcomes Group Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.25%, 10/24/2025 | | | 2,028,182 | | | | 1,991,431 | |

| Outcomes Group Holdings, Inc., Second Lien Initial Term Loan, 3M US L + 7.50%, 10/26/2026 | | | 147,929 | | | | 145,710 | |

| | | | | | | | 8,047,744 | |

| | | | | | | | | |

| Leisure Goods/Activities/Movies - 5.28% | | | | | | | | |

| Alterra Mountain Company, First Lien Series B-2 Term Loan, 1M US L + 3.50%, 0.50% Floor, 08/17/2028 | | | 2,152,076 | | | | 2,138,626 | |

| AMC Entertainment Holdings, Inc., First Lien B-1 Term Loan, 1M US L + 3.00%, 04/22/2026 | | | 4,172,427 | | | | 3,734,489 | |

| Amplify Finco Pty, Ltd., First Lien U.S. Dollar Term Loan, 3M US L + 4.25%, 0.75% Floor, 11/26/2026 | | | 2,467,387 | | | | 2,403,654 | |

| CE Intermediate I, LLC, First Lien Term Loan, 3M US L + 4.00%, 11/10/2028(b) | | | 1,252,222 | | | | 1,239,700 | |

| Crown Finance US, Inc., First Lien Initial Dollar Tranche Term Loan, 3M US L + 2.50%, 1.00% Floor, 02/28/2025 | | | 2,054,797 | | | | 1,591,266 | |

| Crown Finance US, Inc., First Lien Second Amendment Dollar Tranche Term Loan, 3M US L + 2.75%, 09/30/2026 | | | 322,882 | | | | 245,290 | |

| Motion Finco LLC, First Lien Facility B1 (USD) Loan Term Loan, 3M US L + 3.25%, 11/12/2026 | | | 1,706,488 | | | | 1,680,652 | |

| Motion Finco LLC, First Lien Facility B2 (USD) Loan Term Loan, 3M US L + 3.25%, 11/12/2026 | | | 224,281 | | | | 220,886 | |

| Recess Holdings, Inc., First Lien Initial Term Loan, 3M US L + 3.75%, 1.00% Floor, 09/30/2024 | | | 1,880,362 | | | | 1,852,156 | |

| Travel Leaders Group LLC, First Lien 2018 Refinancing Term Loan, 1M US L + 4.00%, 01/25/2024 | | | 2,245,833 | | | | 2,127,231 | |

| | | | | | | | 17,233,950 | |

| | | | | | | | | |

| Lodging & Casinos - 0.17% | | | | | | | | |

| Scientific Games Holdings LP, First Lien Term Loan, L + 4.470%, 02/04/2029 | | | 573,750 | | | | 569,344 | |

| | | | | | | | | |

| Oil & Gas - 0.63% | | | | | | | | |

| Freeport LNG, First Lien Term Loan, 3M US L + 0.00%, 12/21/2028 | | | 2,057,754 | | | | 2,045,634 | |

| | | | | | | | | |

| Property & Casualty Insurance - 1.37% | | | | | | | | |

| AssuredPartners, Inc., First Lien Term Loan: | | | | | | | | |

| 1M US L + 3.50%, 02/12/2027 | | | 570,000 | | | | 564,480 | |

| 1M US L + 3.50%, 0.50% Floor, 02/12/2027 | | | 1,789,935 | | | | 1,772,045 | |

| Polaris Newco LLC, First Lien Dollar Term Loan, 1M US L + 4.00%, 0.50% Floor, 06/02/2028 | | | 2,153,459 | | | | 2,140,807 | |

| | | | | | | | 4,477,332 | |

| | | | | | | | | |

| Publishing - 2.64% | | | | | | | | |

| Cengage Learning, Inc., First Lien Term Loan B Term Loan, 3M US L + 4.75%, 07/14/2026 | | | 1,072,613 | | | | 1,065,378 | |

| Clear Channel Outdoor Holdings, Inc., First Lien B Term Loan, 3M US L + 3.50%, 08/21/2026 | | | 1,745,524 | | | | 1,718,800 | |

| See Notes to Financial Statements. | |

| 14 | www.bgflx.com |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Publishing (continued) | | | | | | | | |

| McGraw-Hill Education, Inc., First Lien Initial Term Loan, 3M US L + 4.75%, 0.50% Floor, 07/28/2028 | | $ | 1,538,884 | | | $ | 1,525,181 | |

| Recorded Books, Inc., First Lien 2021 Replacement Term Loan, 1M US L + 4.00%, 08/29/2025 | | | 2,487,743 | | | | 2,473,239 | |

| Shutterfly LLC, First Lien 2021 Refinancing B Term Loan, 4M US L + 5.00%, 0.75% Floor, 09/25/2026 | | | 1,993,737 | | | | 1,838,226 | |

| | | | | | | | 8,620,824 | |

| | | | | | | | | |

| Surface Transport - 1.21% | | | | | | | | |

| Drive Chassis Holdco LLC, Second Lien 2021 Refinancing B Term Loan, 3M US L + 6.75%, 04/10/2026 | | | 1,180,158 | | | | 1,179,420 | |

| Kenan Advantage Group, Inc.,The, First Lien U.S. B-1 Term Loan, 3M US L + 3.75%, 0.75% Floor, 03/24/2026 | | | 1,789,390 | | | | 1,768,705 | |

| WWEX UNI TopCo Holdings LLC, First Lien Initial Term Loan, 3M US L + 4.25%, 0.75% Floor, 07/26/2028 | | | 996,377 | | | | 988,127 | |

| | | | | | | | 3,936,252 | |

| | | | | | | | | |

| Telecommunications - 2.84% | | | | | | | | |

| CCI Buyer, Inc., First Lien Initial Term Loan, 3M US L + 4.00%, 0.75% Floor, 12/17/2027 | | | 3,478,991 | | | | 3,438,409 | |

| Ensono LP, First Lien Initial Term Loan, 6M US L + 4.00%, 05/26/2028 | | | 1,476,874 | | | | 1,454,108 | |

| Greeneden U.S. Holdings I LLC, First Lien Initial Dollar (2020) Term Loan, 1M US L + 4.00%, 0.75% Floor, 12/01/2027 | | | 2,232,601 | | | | 2,231,909 | |

| Zacapa S.A.R.L., First Lien Term Loan, 3M US L + 0.00%, 03/22/2029 | | | 2,158,013 | | | | 2,148,842 | |

| | | | | | | | 9,273,268 | |

| | | | | | | | | |

| TOTAL FLOATING RATE LOAN INTERESTS | | | | | | | | |

| (Cost $417,691,381) | | | | | | | 413,004,095 | |

| | | | | | | | | |

| COLLATERALIZED LOAN OBLIGATION SECURITIES(a) -6.46% | | | | | | | | |

| Structured Finance Obligations - 6.46% | | | | | | | | |

| 522 Funding CLO 2021-7, Ltd., 3M US L + 6.22%, 04/23/2034(b)(e) | | | 500,000 | | | | 471,280 | |

| AGL CLO 9, Ltd., 3M US L + 7.26%, 01/20/2034(b)(e) | | | 1,500,000 | | | | 1,473,785 | |

| Allegro CLO XII, Ltd., 3M US L + 7.10%, 01/21/2032(b)(e) | | | 1,000,000 | | | | 970,821 | |

| Ares LIV CLO, Ltd., 3M US L + 7.34%, 10/15/2032(b)(e) | | | 500,000 | | | | 484,538 | |

| Barings Clo, Ltd. 2021-III, 3M US L + 6.65%, 01/18/2035(b)(e) | | | 1,000,000 | | | | 976,569 | |

| CarVal CLO I, Ltd., 3M US L + 5.77%, 07/16/2031(b)(e) | | | 1,000,000 | | | | 952,609 | |

| Eaton Vance CLO 2013-1, Ltd., 3M US L + 6.80%, 01/15/2034(b)(e) | | | 250,000 | | | | 245,126 | |

| Elmwood CLO 16, Ltd., 3M US SOFR + 7.22%, 04/20/2034(b)(e) | | | 750,000 | | | | 742,425 | |

| Galaxy 30 Clo, Ltd., 3M US SOFR + 6.95%, 04/15/2035(b)(e) | | | 1,000,000 | | | | 990,000 | |

| HalseyPoint CLO 4, Ltd., 3M US L + 6.71%, 04/20/2034(b)(e) | | | 1,000,000 | | | | 951,319 | |

| Halseypoint Clo 5, Ltd., 3M US L + 6.94%, 01/30/2035(b)(e) | | | 1,500,000 | | | | 1,474,793 | |

| HPS Loan Management CLO 6-2015, Ltd., 3M US L + 5.10%, 02/05/2031(b)(e) | | | 833,000 | | | | 771,572 | |

| Jamestown CLO XIV, Ltd., 3M US L + 7.20%, 10/20/2034(b)(e) | | | 1,000,000 | | | | 952,664 | |

| OCP CLO 2017-13, Ltd., 3M US L + 6.50%, 07/15/2030(b)(e) | | | 1,500,000 | | | | 1,478,118 | |

| Palmer Square CLO 2019-1, Ltd., 3M US L + 6.50%, 11/14/2034(b)(e) | | | 1,000,000 | | | | 969,001 | |

| Parallel 2021-2, Ltd., 3M US L + 7.20%, 10/20/2034(b)(e) | | | 1,000,000 | | | | 954,330 | |

| Parallel CLO 2019-1, Ltd., 3M US L + 6.72%, 07/20/2032(b)(e) | | | 667,000 | | | | 629,855 | |

| Park Avenue Institutional Advisers CLO, Ltd. 2022-1, 3M US SOFR + 7.29%, 04/20/2035(b)(e) | | | 1,000,000 | | | | 999,959 | |

| Rad CLO 5, Ltd., 3M US L + 6.70%, 07/24/2032(b)(e) | | | 500,000 | | | | 492,627 | |

| Regatta CLO XV Funding, Ltd., 3M US L + 3.30%, 10/25/2031(b)(e) | | | 250,000 | | | | 250,431 | |

| Romark CLO II, Ltd., 3M US L + 3.35%, 07/25/2031(b)(e) | | | 500,000 | | | | 494,638 | |

| Romark CLO IV, Ltd., 3M US L + 6.95%, 07/10/2034(b)(e) | | | 1,000,000 | | | | 937,850 | |

| Romark CLO, Ltd., 3M US L + 3.00%, 10/23/2030(b)(e) | | | 500,000 | | | | 492,290 | |

| Sound Point CLO XXVII, Ltd., 3M US L + 6.56%, 10/25/2034(b)(e) | | | 1,000,000 | | | | 932,418 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2022 | 15 |

| | | | | |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Structured Finance Obligations (continued) | | | | | | | | |

| TIAA CLO IV, Ltd., 3M US L + 5.95%, 01/20/2032(b)(e) | | $ | 800,000 | | | $ | 745,620 | |

| Voya CLO 2016-2, Ltd., 3M US L + 4.00%, 07/19/2028(b)(e) | | | 250,000 | | | | 247,801 | |

| | | | | | | | 21,082,439 | |

| | | | | | | | | |

| TOTAL COLLATERALIZED LOAN OBLIGATION SECURITIES | | | | | | | | |

| (Cost $21,467,067) | | | | | | | 21,082,439 | |

| | | | | | | | | |

| CORPORATE BONDS - 15.30% | | | | | | | | |

| Aerospace & Defense - 0.75% | | | | | | | | |

| Bombardier, Inc., 7.875%, 04/15/2027(e) | | | 730,000 | | | | 715,568 | |

| Howmet Aerospace, Inc., 5.900%, 02/01/2027 | | | 690,000 | | | | 740,522 | |

| Science Applications International Corp., 4.875%, 04/01/2028(e) | | | 190,000 | | | | 187,604 | |

| Spirit AeroSystems, Inc., 4.600%, 06/15/2028 | | | 90,000 | | | | 84,670 | |

| TransDigm, Inc.: | | | | | | | | |

| 4.625%, 01/15/2029 | | | 560,000 | | | | 524,292 | |

| 4.875%, 05/01/2029 | | | 200,000 | | | | 187,860 | |

| | | | | | | | 2,440,516 | |

| | | | | | | | | |

| Air Transport - 0.15% | | | | | | | | |

| Air Canada, 3.875%, 08/15/2026(e) | | | 520,000 | | | | 491,397 | |

| | | | | | | | | |

| Automotive - 0.17% | | | | | | | | |

| Allison Transmission, Inc., 3.750%, 01/30/2031(e) | | | 440,000 | | | | 399,806 | |

| Titan International, Inc., 7.000%, 04/30/2028 | | | 160,000 | | | | 160,682 | |

| | | | | | | | 560,488 | |

| | | | | | | | | |

| Brokers, Dealers & Investment Houses - 0.46% | | | | | | | | |

| CVR Energy, Inc., 5.250%, 02/15/2025(e) | | | 470,000 | | | | 457,021 | |

| Icahn Enterprises LP / Icahn Enterprises Finance Corp.: | | | | | | | | |

| 4.750%, 09/15/2024 | | | 50,000 | | | | 50,291 | |

| 5.250%, 05/15/2027 | | | 760,000 | | | | 747,156 | |

| Navient Corp., 5.625%, 08/01/2033 | | | 300,000 | | | | 253,211 | |

| | | | | | | | 1,507,679 | |

| | | | | | | | | |

| Building & Development - 0.24% | | | | | | | | |

| Builders FirstSource, Inc., 4.250%, 02/01/2032(e) | | | 100,000 | | | | 93,284 | |

| Howard Hughes Corp.: | | | | | | | | |

| 4.125%, 02/01/2029(e) | | | 120,000 | | | | 112,846 | |

| 4.375%, 02/01/2031(e) | | | 200,000 | | | | 188,278 | |

| Louisiana-Pacific Corp., 3.625%, 03/15/2029(e) | | | 170,000 | | | | 157,520 | |

| Realogy Group LLC / Realogy Co.-Issuer Corp., 5.750%, 01/15/2029(e) | | | 70,000 | | | | 66,111 | |

| Tri Pointe Homes, Inc., 5.700%, 06/15/2028 | | | 150,000 | | | | 149,925 | |

| | | | | | | | 767,964 | |

| | | | | | | | | |

| Business Equipment & Services - 0.85% | | | | | | | | |

| Black Knight InfoServ LLC, 3.625%, 09/01/2028(e) | | | 450,000 | | | | 426,991 | |

| Diebold Inc, Senior Unsecured Bond, 8.500%, 04/15/2024 | | | 100,000 | | | | 95,995 | |

| Iron Mountain, Inc.: | | | | | | | | |

| 4.875%, 09/15/2029(e) | | | 510,000 | | | | 486,329 | |

| 4.500%, 02/15/2031(e) | | | 90,000 | | | | 83,232 | |

| 5.625%, 07/15/2032(e) | | | 350,000 | | | | 345,455 | |

| Open Text Corp., 3.875%, 02/15/2028(e) | | | 770,000 | | | | 739,593 | |

| TriNet Group, Inc., 3.500%, 03/01/2029(e) | | | 165,000 | | | | 151,924 | |

| See Notes to Financial Statements. | |

| 16 | www.bgflx.com |

| | | | | |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Business Equipment & Services (continued) | | | | | | | | |

| Xerox Holdings Corp., 5.500%, 08/15/2028(e) | | $ | 460,000 | | | $ | 449,089 | |

| | | | | | | | 2,778,608 | |

| | | | | | | | | |

| Cable & Satellite Television - 0.52% | | | | | | | | |

| CCO Holdings LLC / CCO Holdings Capital Corp.: | | | | | | | | |

| 5.000%, 02/01/2028(e) | | | 780,000 | | | | 773,300 | |

| 4.250%, 02/01/2031(e) | | | 160,000 | | | | 145,407 | |

| DISH DBS Corp., 7.375%, 07/01/2028 | | | 220,000 | | | | 208,697 | |

| Viasat, Inc.: | | | | | | | | |

| 5.625%, 09/15/2025(e) | | | 80,000 | | | | 78,267 | |

| 6.500%, 07/15/2028(e) | | | 505,000 | | | | 485,439 | |

| | | | | | | | 1,691,110 | |

| | | | | | | | | |

| Chemical & Plastics - 0.56% | | | | | | | | |

| Ashland LLC, 3.375%, 09/01/2031(e) | | | 170,000 | | | | 150,380 | |

| Chemours Co., 4.625%, 11/15/2029(e) | | | 265,000 | | | | 243,212 | |

| CVR Partners LP / CVR Nitrogen Finance Corp., 6.125%, 06/15/2028(e) | | | 240,000 | | | | 240,324 | |

| Methanex Corp., 5.250%, 12/15/2029 | | | 540,000 | | | | 549,123 | |

| Nufarm Australia, Ltd. / Nufarm Americas, Inc., 5.000%, 01/27/2030(e) | | | 160,000 | | | | 157,957 | |

| Valvoline, Inc., 4.250%, 02/15/2030(e) | | | 530,000 | | | | 484,640 | |

| | | | | | | | 1,825,636 | |

| | | | | | | | | |

| Conglomerates - 0.35% | | | | | | | | |

| Eldorado Gold Corp., 6.250%, 09/01/2029(e) | | | 120,000 | | | | 120,915 | |

| LSB Industries, Inc., 6.250%, 10/15/2028(e) | | | 180,000 | | | | 182,836 | |

| NCR Corp., 5.250%, 10/01/2030(e) | | | 200,000 | | | | 189,936 | |

| Service Corp. International: | | | | | | | | |

| 3.375%, 08/15/2030 | | | 250,000 | | | | 225,735 | |

| 4.000%, 05/15/2031 | | | 450,000 | | | | 419,654 | |

| | | | | | | | 1,139,076 | |

| | | | | | | | | |

| Containers & Glass Products - 0.32% | | | | | | | | |

| Ball Corp., 3.125%, 09/15/2031 | | | 270,000 | | | | 241,893 | |

| Crown Americas LLC / Crown Americas Capital Corp. VI, 4.750%, 02/01/2026 | | | 100,000 | | | | 101,211 | |

| Sealed Air Corp., 6.875%, 07/15/2033(e) | | | 500,000 | | | | 571,075 | |

| TriMas Corp., 4.125%, 04/15/2029(e) | | | 160,000 | | | | 146,302 | |

| | | | | | | | 1,060,481 | |

| | | | | | | | | |

| Drugs - 0.05% | | | | | | | | |

| Bausch Health Cos., Inc., 7.250%, 05/30/2029(e) | | | 180,000 | | | | 153,864 | |

| | | | | | | | | |

| Ecological Services & Equipment - 0.09% | | | | | | | | |

| Stericycle, Inc., 3.875%, 01/15/2029(e) | | | 310,000 | | | | 288,658 | |

| | | | | | | | | |

| Electronics/Electric - 0.57% | | | | | | | | |

| Ciena Corp., 4.000%, 01/31/2030(e) | | | 150,000 | | | | 144,593 | |

| Entegris, Inc., 3.625%, 05/01/2029(e) | | | 360,000 | | | | 337,288 | |

| Fair Isaac Corp., 4.000%, 06/15/2028(e) | | | 600,000 | | | | 581,952 | |

| Seagate HDD Cayman, 5.750%, 12/01/2034 | | | 420,000 | | | | 430,296 | |

| Synaptics, Inc., 4.000%, 06/15/2029(e) | | | 180,000 | | | | 170,030 | |

| TTM Technologies, Inc., 4.000%, 03/01/2029(e) | | | 200,000 | | | | 185,413 | |

| | | | | | | | 1,849,572 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2022 | 17 |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Equipment Leasing - 0.10% | | | | | | | | |

| Avis Budget Car Rental LLC / Avis Budget Finance, Inc., 5.750%, 07/15/2027(e) | | $ | 220,000 | | | $ | 220,044 | |

| Hertz Corp., 5.000%, 12/01/2029(e) | | | 120,000 | | | | 108,755 | |

| | | | | | | | 328,799 | |

| | | | | | | | | |

| Financial Intermediaries - 0.65% | | | | | | | | |

| Nationstar Mortgage Holdings, Inc.: | | | | | | | | |

| 5.125%, 12/15/2030(e) | | | 434,000 | | | | 402,257 | |

| 5.750%, 11/15/2031(e) | | | 530,000 | | | | 506,407 | |

| PRA Group, Inc., 5.000%, 10/01/2029(e) | | | 250,000 | | | | 237,404 | |

| SS&C Technologies, Inc., 5.500%, 09/30/2027(e) | | | 845,000 | | | | 852,394 | |

| World Acceptance Corp., 7.000%, 11/01/2026(e) | | | 140,000 | | | | 123,396 | |

| | | | | | | | 2,121,858 | |

| | | | | | | | | |

| Food Products - 0.27% | | | | | | | | |

| Lamb Weston Holdings, Inc.: | | | | | | | | |

| 4.875%, 05/15/2028(e) | | | 165,000 | | | | 165,338 | |

| 4.125%, 01/31/2030(e) | | | 210,000 | | | | 196,455 | |

| Pilgrim's Pride Corp., 4.250%, 04/15/2031(e) | | | 135,000 | | | | 125,162 | |

| Post Holdings, Inc.: | | | | | | | | |

| 5.750%, 03/01/2027(e) | | | 34,000 | | | | 34,212 | |

| 5.625%, 01/15/2028(e) | | | 160,000 | | | | 157,310 | |

| 4.625%, 04/15/2030(e) | | | 225,000 | | | | 202,973 | |

| | | | | | | | 881,450 | |

| | | | | | | | | |

| Food Service - 0.50% | | | | | | | | |

| 1011778 BC ULC / New Red Finance, Inc.: | | | | | | | | |

| 3.875%, 01/15/2028(e) | | | 440,000 | | | | 417,727 | |

| 4.375%, 01/15/2028(e) | | | 240,000 | | | | 230,824 | |

| 3.500%, 02/15/2029(e) | | | 250,000 | | | | 231,175 | |

| Yum! Brands, Inc.: | | | | | | | | |

| 4.750%, 01/15/2030(e) | | | 570,000 | | | | 560,025 | |

| 3.625%, 03/15/2031 | | | 70,000 | | | | 63,941 | |

| 4.625%, 01/31/2032 | | | 150,000 | | | | 145,349 | |

| | | | | | | | 1,649,041 | |

| | | | | | | | | |

| Food/Drug Retailers - 0.25% | | | | | | | | |

| Albertsons Cos. Inc / Safeway, Inc. / New Albertsons LP / Albertsons LLC: | | | | | | | | |

| 4.625%, 01/15/2027(e) | | | 420,000 | | | | 406,745 | |

| 5.875%, 02/15/2028(e) | | | 250,000 | | | | 249,612 | |

| 4.875%, 02/15/2030(e) | | | 165,000 | | | | 160,978 | |

| | | | | | | | 817,335 | |

| | | | | | | | | |

| Forest Products - 0.20% | | | | | | | | |

| Mercer International, Inc., 5.125%, 02/01/2029 | | | 490,000 | | | | 473,431 | |

| Resolute Forest Products, Inc., 4.875%, 03/01/2026(e) | | | 120,000 | | | | 115,621 | |

| Schweitzer-Mauduit International, Inc., 6.875%, 10/01/2026(e) | | | 80,000 | | | | 75,696 | |

| | | | | | | | 664,748 | |

| | | | | | | | | |

| Healthcare - 0.84% | | | | | | | | |

| Acadia Healthcare Co., Inc., 5.500%, 07/01/2028(e) | | | 130,000 | | | | 130,812 | |

| Carriage Services, Inc., 4.250%, 05/15/2029(e) | | | 160,000 | | | | 149,326 | |

| Charles River Laboratories International, Inc., 4.250%, 05/01/2028(e) | | | 420,000 | | | | 411,428 | |

| CHS/Community Health Systems, Inc., 6.875%, 04/01/2028(e) | | | 220,000 | | | | 199,980 | |

| DaVita, Inc., 4.625%, 06/01/2030(e) | | | 440,000 | | | | 411,488 | |

| See Notes to Financial Statements. | |

| 18 | www.bgflx.com |

| | | | | |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Healthcare (continued) | | | | | | | | |

| Encompass Health Corp.: | | | | | | | | |

| 4.750%, 02/01/2030 | | $ | 250,000 | | | $ | 240,416 | |

| 4.625%, 04/01/2031 | | | 140,000 | | | | 131,286 | |

| Hologic, Inc., 3.250%, 02/15/2029(e) | | | 300,000 | | | | 280,510 | |

| Tenet Healthcare Corp.: | | | | | | | | |

| 6.125%, 10/01/2028(e) | | | 700,000 | | | | 712,149 | |

| 6.875%, 11/15/2031 | | | 70,000 | | | | 74,885 | |

| | | | | | | | 2,742,280 | |

| | | | | | | | | |

| Industrial Equipment - 0.03% | | | | | | | | |

| Ritchie Bros Holdings, Inc., 4.750%, 12/15/2031(e) | | | 100,000 | | | | 97,662 | |

| | | | | | | | | |

| Insurance - 0.25% | | | | | | | | |

| MGIC Investment Corp., 5.250%, 08/15/2028 | | | 290,000 | | | | 286,807 | |

| NMI Holdings, Inc., 7.375%, 06/01/2025(e) | | | 180,000 | | | | 189,230 | |

| Radian Group, Inc.: | | | | | | | | |

| 4.500%, 10/01/2024 | | | 150,000 | | | | 150,940 | |

| 4.875%, 03/15/2027 | | | 190,000 | | | | 191,192 | |

| | | | | | | | 818,169 | |

| | | | | | | | | |

| Leisure Goods/Activities/Movies - 0.77% | | | | | | | | |

| Carnival Corp., 7.625%, 03/01/2026(e) | | | 735,000 | | | | 740,659 | |

| Cinemark USA, Inc., 5.875%, 03/15/2026(e) | | | 376,000 | | | | 365,160 | |

| Live Nation Entertainment, Inc., 4.750%, 10/15/2027(e) | | | 700,000 | | | | 683,739 | |

| NCL Corp., Ltd., 5.875%, 02/15/2027(e) | | | 72,000 | | | | 71,012 | |

| Royal Caribbean Cruises, Ltd., 4.250%, 07/01/2026(e) | | | 530,000 | | | | 493,944 | |

| SeaWorld Parks & Entertainment, Inc., 5.250%, 08/15/2029(e) | | | 150,000 | | | | 143,370 | |

| | | | | | | | 2,497,884 | |

| | | | | | | | | |

| Lodging & Casinos - 0.61% | | | | | | | | |

| CDI Escrow Issuer, Inc., 5.750%, 04/01/2030(e) | | | 65,000 | | | | 65,732 | |

| Churchill Downs, Inc., 4.750%, 01/15/2028(e) | | | 640,000 | | | | 622,003 | |

| Full House Resorts, Inc., 8.250%, 02/15/2028(e) | | | 130,000 | | | | 133,077 | |

| Go Daddy Operating Co. LLC / GD Finance Co, Inc., 3.500%, 03/01/2029(e) | | | 30,000 | | | | 27,628 | |

| Hilton Domestic Operating Co., Inc.: | | | | | | | | |

| 3.750%, 05/01/2029(e) | | | 150,000 | | | | 141,094 | |

| 4.875%, 01/15/2030 | | | 800,000 | | | | 799,760 | |

| Travel + Leisure Co., 4.625%, 03/01/2030(e) | | | 220,000 | | | | 205,018 | |

| | | | | | | | 1,994,312 | |

| | | | | | | | | |

| Nonferrous Metals/Minerals - 0.18% | | | | | | | | |

| Commercial Metals Co., 3.875%, 02/15/2031 | | | 295,000 | | | | 268,587 | |

| Minerals Technologies, Inc., 5.000%, 07/01/2028(e) | | | 90,000 | | | | 85,837 | |

| SunCoke Energy, Inc., 4.875%, 06/30/2029(e) | | | 235,000 | | | | 221,840 | |

| | | | | | | | 576,264 | |

| | | | | | | | | |

| Oil & Gas - 3.11% | | | | | | | | |

| Antero Midstream Partners LP / Antero Midstream Finance Corp., 7.875%, 05/15/2026(e) | | | 430,000 | | | | 466,004 | |

| Apache Corp., 5.350%, 07/01/2049 | | | 300,000 | | | | 289,300 | |

| Athabasca Oil Corp., 9.750%, 11/01/2026(e) | | | 150,000 | | | | 159,922 | |

| Baytex Energy Corp., 8.750%, 04/01/2027(e) | | | 110,000 | | | | 118,119 | |

| Berry Petroleum Co. LLC, 7.000%, 02/15/2026(e) | | | 150,000 | | | | 148,279 | |

| Calumet Specialty Products Partners LP / Calumet Finance Corp., 8.125%, 01/15/2027(e) | | | 450,000 | | | | 419,027 | |

| Civitas Resources, Inc., 5.000%, 10/15/2026(e) | | | 180,000 | | | | 178,654 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2022 | 19 |

| | | | | |

| Blackstone Floating Rate Enhanced Income Fund | Portfolio of Investments |

| | March 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value | |

| | | | | | | |

| Oil & Gas (continued) | | | | | | | | |

| CNX Resources Corp., 6.000%, 01/15/2029(e) | | $ | 380,000 | | | $ | 384,296 | |

| Crestwood Midstream Partners LP / Crestwood Midstream Finance Corp., 6.000%, 02/01/2029(e) | | | 255,000 | | | | 254,574 | |

| EnLink Midstream Partners LP, 5.450%, 06/01/2047 | | | 665,000 | | | | 561,606 | |

| Ensign Drilling, Inc., 9.250%, 04/15/2024(e) | | | 140,000 | | | | 138,453 | |

| Exterran Energy Solutions LP / EES Finance Corp., 8.125%, 05/01/2025 | | | 100,000 | | | | 100,950 | |

| Global Partners LP / GLP Finance Corp., 7.000%, 08/01/2027 | | | 290,000 | | | | 290,315 | |

| Laredo Petroleum, Inc., 9.500%, 01/15/2025 | | | 270,000 | | | | 281,961 | |

| Matador Resources Co., 5.875%, 09/15/2026 | | | 440,000 | | | | 448,646 | |

| MEG Energy Corp.: | | | | | | | | |

| 7.125%, 02/01/2027(e) | | | 180,000 | | | | 188,700 | |

| 5.875%, 02/01/2029(e) | | | 210,000 | | | | 213,288 | |

| Murphy Oil Corp., 6.375%, 07/15/2028 | | | 388,000 | | | | 404,185 | |

| Murphy Oil USA, Inc., 3.750%, 02/15/2031(e) | | | 120,000 | | | | 109,750 | |

| Nabors Industries, Ltd.: | | | | | | | | |

| 7.250%, 01/15/2026(e) | | | 440,000 | | | | 440,735 | |

| 7.500%, 01/15/2028(e) | | | 405,000 | | | | 395,705 | |

| Northern Oil and Gas, Inc., 8.125%, 03/01/2028(e) | | | 190,000 | | | | 198,248 | |

| Occidental Petroleum Corp.: | | | | | | | | |

| 6.200%, 03/15/2040 | | | 240,000 | | | | 266,897 | |

| 4.625%, 06/15/2045 | | | 270,000 | | | | 262,480 | |

| 6.600%, 03/15/2046 | | | 70,000 | | | | 82,398 | |

| Patterson-UTI Energy, Inc., 5.150%, 11/15/2029 | | | 350,000 | | | | 342,003 | |

| PBF Holding Co. LLC / PBF Finance Corp., 6.000%, 02/15/2028 | | | 610,000 | | | | 491,364 | |

| Penn Virginia Holdings LLC, 9.250%, 08/15/2026(e) | | | 170,000 | | | | 179,529 | |

| Petrofac, Ltd., 9.750%, 11/15/2026(e) | | | 450,000 | | | | 412,337 | |

| Precision Drilling Corp., 6.875%, 01/15/2029(e) | | | 350,000 | | | | 355,675 | |

| SM Energy Co., 6.750%, 09/15/2026 | | | 440,000 | | | | 453,042 | |

| Sunoco LP / Sunoco Finance Corp., 4.500%, 05/15/2029 | | | 260,000 | | | | 245,622 | |

| Transocean, Inc.: | | | | | | | | |

| 7.250%, 11/01/2025(e) | | | 385,000 | | | | 335,377 | |

| 7.500%, 01/15/2026(e) | | | 300,000 | | | | 261,000 | |

| W&T Offshore, Inc., 9.750%, 11/01/2023(e) | | | 270,000 | | | | 269,063 | |

| | | | | | | | 10,147,504 | |

| | | | | | | | | |

| Publishing - 0.17% | | | | | | | | |

| Clear Channel Outdoor Holdings, Inc., 7.500%, 06/01/2029(e) | | | 455,000 | | | | 454,559 | |

| Gartner, Inc., 3.625%, 06/15/2029(e) | | | 95,000 | | | | 89,194 | |

| | | | | | | | 543,753 | |

| | | | | | | | | |

| Radio & Television - 0.44% | | | | | | | | |

| Gray Escrow II, Inc., 5.375%, 11/15/2031(e) | | | 230,000 | | | | 220,225 | |

| National CineMedia LLC, 5.875%, 04/15/2028(e) | | | 170,000 | | | | 148,816 | |

| Scripps Escrow II, Inc., 5.375%, 01/15/2031(e) | | | 230,000 | | | | 220,542 | |

| Sirius XM Radio, Inc.: | | | | | | | | |

| 4.000%, 07/15/2028(e) | | | 260,000 | | | | 247,353 | |

| 3.875%, 09/01/2031(e) | | | 495,000 | | | | 451,279 | |

| Urban One, Inc., 7.375%, 02/01/2028(e) | | | 150,000 | | | | 150,793 | |