UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23285

| Name of Fund: | | BlackRock Multi-Sector Opportunities Trust |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Multi-Sector Opportunities Trust, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2022

Date of reporting period: 12/31/2022

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| | |

| | DECEMBER 31, 2022 |

BlackRock Multi-Sector Opportunities Trust

BlackRock Multi-Sector Opportunities Trust II

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

Significant economic headwinds emerged during the 12-month reporting period ended December 31, 2022, as investors navigated changing economic conditions and volatile markets. The U.S. economy shrank in the first half of 2022 before returning to modest growth in the third quarter, marking a shift to a more challenging post-reopening economic environment. Changes in consumer spending patterns and a tight labor market led to elevated inflation, which reached a 40-year high before beginning to moderate. Moreover, while the foremost effect of Russia’s invasion of Ukraine has been a severe humanitarian crisis, the ongoing war continued to present challenges for both investors and policymakers.

Equity prices fell as interest rates rose, particularly during the first half of the reporting period. Both large- and small-capitalization U.S. stocks fell, although equities began to recover in the second half of the year as inflation eased and economic growth resumed. Emerging market stocks and international equities from developed markets declined overall, pressured by rising interest rates and a strengthening U.S. dollar.

The 10-year U.S. Treasury yield rose notably during the reporting period, driving its price down, as investors reacted to fluctuating inflation data and attempted to anticipate its impact on future interest rate changes. The corporate bond market also faced inflationary headwinds, and heightened uncertainty led to higher corporate bond spreads (the difference in yield between U.S. Treasuries and similarly-dated corporate bonds).

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates seven times. Furthermore, the Fed wound down its bond-buying programs and is accelerating the reduction of its balance sheet. While the Fed suggested that additional rate hikes were likely, it also gave indications that the pace of increases would slow if inflation continued to subside.

The pandemic’s restructuring of the economy brought an ongoing mismatch between supply and demand, contributing to the current inflationary regime. While growth slowed in 2022, we believe that taming inflation requires a more dramatic economic decline to bring demand back to a level more in line with the economy’s capacity. The Fed has been raising interest rates at the fastest pace in decades, and seems set to overtighten in its effort to get inflation back to target. With this in mind, we believe the possibility of a U.S. recession in the near-term is high, but this prospect has not yet been fully priced in by markets. Investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt to rapidly changing conditions.

In this environment, while we favor an overweight to equities in the long-term, the market’s concerns over excessive rate hikes from central banks moderate our outlook. Rising input costs and a deteriorating economic backdrop are likely to challenge corporate earnings, so we are underweight equities overall in the near term. However, we see better opportunities in credit, where valuations are attractive and higher yields provide income opportunities. We believe that global investment-grade corporates, global inflation-linked bonds, and U.S. mortgage-backed securities offer strong opportunities for a six- to twelve-month horizon.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

Total Returns as of December 31, 2022 |

| | | 6-Month | | 12-Month |

| | |

U.S. large cap equities (S&P 500® Index) | | 2.31% | | (18.11)% |

| | |

U.S. small cap equities (Russell 2000® Index) | | 3.91 | | (20.44) |

| | |

International equities (MSCI Europe, Australasia, Far East Index) | | 6.36 | | (14.45) |

| | |

Emerging market equities (MSCI Emerging Markets Index) | | (2.99) | | (20.09) |

| | |

3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) | | 1.32 | | 1.47 |

| | |

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) | | (5.58) | | (16.28) |

| | |

U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) | | (2.97) | | (13.01) |

| | |

Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) | | 0.50 | | (8.53) |

| | |

U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | 3.50 | | (11.18) |

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

Table of Contents

The Benefits and Risks of Leveraging

The Trusts may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Trust on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Trust (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Trust’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume a Trust’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Trust’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by a Trust with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Trust’s financing cost of leverage is significantly lower than the income earned on a Trust’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed a Trust’s return on assets purchased with leverage proceeds, income to shareholders is lower than if a Trust had not used leverage. Furthermore, the value of the Trusts’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the amount of each Trust’s obligations under its respective leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Trusts’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that a Trust’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Trust’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Trust’s shares than if the Trust were not leveraged. In addition, each Trust may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Trust to incur losses. The use of leverage may limit a Trust’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Trust incurs expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of each Trust’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to each Trust’s investment adviser will be higher than if the Trusts did not use leverage.

Each Trust may utilize leverage through reverse repurchase agreements as described in the Notes to Financial Statements, if applicable.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Trust is permitted to borrow money (including through the use of TOB Trusts) or issue debt securities up to 33 1/3% of its total managed assets. A Trust may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act.

Derivative Financial Instruments

The Trusts may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Trusts must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Trusts’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Trust can realize on an investment and/or may result in lower distributions paid to shareholders. The Trusts’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

| 4 | | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Trust Summary as of December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust (MSO) |

Investment Objective

BlackRock Multi-Sector Opportunities Trust’s (MSO) (the “Trust”) investment objective is to seek to provide high income and total return. The Trust seeks to achieve its investment objective by investing at least 80% of its total assets in fixed income securities and other financial instruments that pay periodic income. The Trust may invest any amount of its assets in securities of any credit quality, including securities that are rated at the time of investment below investment grade — i.e., ‘‘Ba’’ or ‘‘BB’’ or below by Moody’s Investor’s Service, Inc. (“Moody’s”), S&P Global Ratings or Fitch Ratings, or securities that are judged to be of comparable quality by the Trust’s investment advisers. It is anticipated that the Trust will terminate on February 22, 2024 (the “Termination Date”); however, the Board of Trustees may, without shareholder approval, extend the Termination Date by up to one year to a date on or before February 22, 2025. The Board of Trustees may also, without shareholder approval, adopt a plan of liquidation at any time preceding the anticipated Termination Date. The Trust may invest directly in securities or synthetically through the use of derivatives.

The Trust’s common shares are not listed on any securities exchange. Investors should consider that they may not have access to their investment until the Termination Date. The Trust is designed for long-term investors and an investment in the common shares, unlike an investment in a traditional listed closed-end fund, should be considered illiquid.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Initial Offering Date | | February 23, 2018 |

| |

Termination Date(a) | | February 22, 2024 |

| |

Current Quarterly Distribution per Common Share(b) | | $1.5210 |

| |

Current Annualized Distribution per Common Share(b) | | $6.0840 |

| |

Leverage as of December 31, 2022(c) | | 1% |

| | (a) | The Board of Trustees may terminate the Trust, without shareholder approval, prior to the Termination Date and may, without shareholder approval, extend the Termination Date by up to one year to a date on or before February 22, 2025. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

| | (c) | Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. | |

Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/22 | | | 12/31/21 | | | Change | | | High | | | Low | |

Net Asset Value | | | $ 66.67 | | | | $ 84.34 | | | | (20.95) | % | | $ | 84.34 | | | $ | 65.67 | |

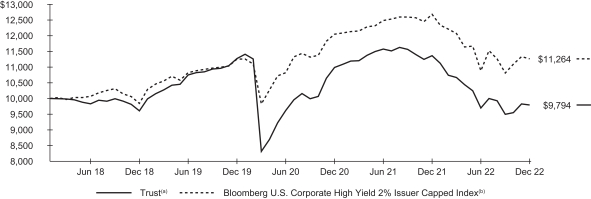

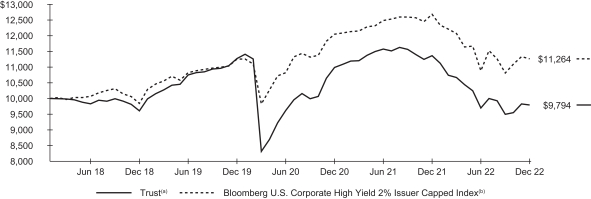

GROWTH OF $10,000 INVESTMENT

MSO commenced operations on February 23, 2018.

| | (a) | Represents the Trust’s NAV and reflects the reinvestment of dividends and/or distributions at NAV on the payable date. | |

| | (b) | An unmanaged index comprised of issuers that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. | |

| | |

T R U S T S U M M A R Y | | 5 |

| | |

Trust Summary as of December 31, 2022 (continued) | | BlackRock Multi-Sector Opportunities Trust (MSO) |

Performance

Returns for the period ended December 31, 2022 were as follows:

| | | | | | | | |

| | | Average Annual Total Returns | |

| | |

| | | | 1 Year | | |

| Since

Inception |

(a) |

Trust at NAV(b) | | | (13.82 | )% | | | (0.43 | )% |

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index | | | (11.18 | ) | | | 2.48 | |

| | (a) | MSO commenced operations on February 23, 2018. | |

| | (b) | All returns reflect reinvestment of dividends and/or distributions at NAV on the payable date. Performance results reflect the Trust’s use of leverage. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

The detractors from performance over the period were the Trust’s exposures to emerging market debt, securitized assets including collateralized loan obligations (“CLOs”) and commercial mortgage-backed securities (“CMBS”), European corporate credit, U.S. high yield corporate bonds and U.S. investment grade corporate bonds. The Trust’s positioning with respect to duration and corresponding interest rate sensitivity also detracted from performance as Treasury yields moved higher over the period.

The Trust’s allocation to private assets contributed to performance over the period.

Describe recent portfolio activity.

The Trust was positioned defensively over the period as the market has been dealing with persistent inflation and heightened volatility. The Trust held core allocations in U.S. high yield corporate bonds, emerging market debt, structured products including CLOs, CMBS and non-agency residential mortgage-backed securities (“MBS”), European corporate credit, agency MBS and U.S. investment grade corporate bonds. The Trust added to its agency MBS allocation based on attractive spreads and the outlook for declining interest rate volatility. The Trust added to risk within its emerging market debt allocation while actively managing concerns around tighter central bank policies, weakening growth, and reduced liquidity. The Trust remained cautious with respect to U.S. high yield corporate exposure and trimmed exposure to CMBS.

The Trust used Treasury futures during the period to hedge duration and yield curve exposure. The use of derivatives marginally contributed to performance.

Describe portfolio positioning at period end.

As of December 31, 2022, the Trust’s portfolio had an effective duration of 1.91 years and approximately 1% leverage, with a nominal yield of 9.19%. The Trust maintained a diversified exposure within spread sectors, including emerging markets, high yield corporate bonds, and securitized assets. Private assets comprised approximately 6% of total portfolio assets. The Trust continues to seek opportunities to harvest the illiquidity premium and enhance yield by adding exposure to private investments.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 6 | | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Trust Summary as of December 31, 2022 (continued) | | BlackRock Multi-Sector Opportunities Trust (MSO) |

Overview of the Trust’s Total Investments

| | | | |

| PORTFOLIO COMPOSITION | |

| | |

Asset Type | | 12/31/22 | |

| |

Corporate Bonds | | | 43.4 | % |

| |

Asset-Backed Securities | | | 15.5 | |

| |

Floating Rate Loan Interests | | | 9.0 | |

| |

Non-Agency Mortgage-Backed Securities | | | 7.9 | |

| |

Foreign Agency Obligations | | | 7.4 | |

| |

U.S. Government Sponsored Agency Securities | | | 6.7 | |

| |

Preferred Securities | | | 4.8 | |

| |

Short-Term Securities | | | 4.0 | |

| |

Other* | | | 1.3 | |

| | | | |

| CREDITQUALITY ALLOCATION | |

| | |

Credit Rating(a)(b) | | 12/31/22 | |

| |

AAA/Aaa(c) | | | 7.0 | % |

| |

A | | | 3.5 | |

| |

BBB/Baa | | | 15.9 | |

| |

BB/Ba | | | 34.8 | |

| |

B | | | 17.1 | |

| |

CCC/Caa | | | 4.4 | |

| |

CC | | | 0.1 | |

| |

C | | | — | (d) |

| |

N/R | | | 17.2 | |

| (a) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (b) | Excludes short-term securities. |

| (c) | Includes U.S. Government Sponsored Agency Securities which are deemed AAA/Aaa by the investment adviser. |

| (d) | Rounds to less than 1% of total investments. |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Trust’s total investments. Please refer to the Schedule of Investments for details. |

| | |

T R U S T S U M M A R Y | | 7 |

| | |

Trust Summary as of December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust II (MSO2) |

Investment Objective

BlackRock Multi-Sector Opportunities Trust II’s (MSO2) (the “Trust”) investment objective is to seek to provide high income and total return. The Trust seeks to achieve its investment objective by investing at least 80% of its total assets in fixed income securities and other financial instruments that pay periodic income. The Trust may invest any amount of its assets in securities of any credit quality, including securities that are rated at the time of investment below investment grade — i.e., ‘‘Ba’’ or ‘‘BB’’ or below by Moody’s, S&P Global Ratings or Fitch, or securities that are judged to be of comparable quality by the Trust’s investment advisers. It is anticipated that the Trust will terminate on February 28, 2025 (the “Termination Date”); however, the Board of Trustees may, without shareholder approval, extend the Termination Date by up to one year to a date on or before February 28, 2026. The Board of Trustees may also, without shareholder approval, adopt a plan of liquidation at any time preceding the anticipated Termination Date. The Trust may invest directly in securities or synthetically through the use of derivatives.

The Trust’s common shares are not listed on any securities exchange. Investors should consider that they may not have access to their investment until the Termination Date. The Trust is designed for long-term investors and an investment in the common shares, unlike an investment in a traditional listed closed-end fund, should be considered illiquid.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Initial Offering Date | | April 16, 2019 |

| |

Termination Date(a) | | February 28, 2025 |

| |

Current Quarterly Distribution per Common Share(b) | | $1.5780 |

| |

Current Annualized Distribution per Common Share(b) | | $6.3120 |

| |

Leverage as of December 31, 2022(c) | | 15% |

| | (a) | The Board of Trustees may terminate the Trust, without shareholder approval, prior to the Termination Date and may, without shareholder approval, extend the Termination Date by up to one year to a date on or before February 28, 2026. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

| | (c) | Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. | |

Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/22 | | | 12/31/21 | | | Change | | | High | | | Low | |

Net Asset Value | | $ | 69.62 | | | $ | 87.63 | | | | (20.55 | )% | | $ | 87.63 | | | $ | 67.53 | |

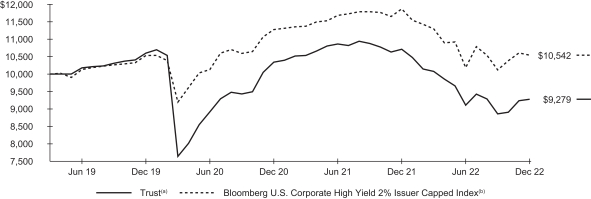

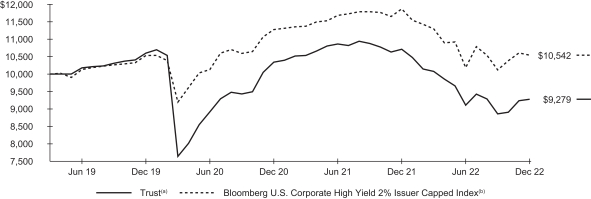

GROWTH OF$10,000 INVESTMENT

MSO2 commenced operations on April 16, 2019.

| | (a) | Represents the Trust’s NAV and reflects the reinvestment of dividends and/or distributions at NAV on the payable date. | |

| | (b) | An unmanaged index comprised of issuers that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. | |

| | |

| 8 | | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Trust Summary as of December 31, 2022 (continued) | | BlackRock Multi-Sector Opportunities Trust II (MSO2) |

Performance

Returns for the period ended December 31, 2022 were as follows:

| | | | | | | | |

| | | Average Annual Total Returns | |

| | | 1 Year | | | Since Inception(a) | |

Trust at NAV(b) | | | (13.37 | )% | | | (2.00 | )% |

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index | | | (11.18 | ) | | | 1.43 | |

| | (a) | MSO2 commenced operations on April 16, 2019. | |

| | (b) | All returns reflect reinvestment of dividends and/or distributions at NAV on the payable date. Performance results reflect the Trust’s use of leverage. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

The detractors from performance over the period were the Trust’s exposures to emerging market debt, securitized assets including collateralized loan obligations (“CLOs”) and commercial mortgage-backed securities (“CMBS”), European corporate credit, U.S. high yield corporate bonds and U.S. investment grade corporate bonds. The Trust’s positioning with respect to duration and corresponding interest rate sensitivity also detracted from performance as Treasury yields moved higher over the period.

The Trust’s allocation to private assets contributed to performance over the period.

Describe recent portfolio activity.

The Trust was positioned defensively over the period as the market has been dealing with persistent inflation and heightened volatility. The Trust held core allocations in U.S. high yield corporate bonds, emerging market debt, structured products including CLOs, CMBS and non-agency residential mortgage-backed securities (“MBS”), European corporate credit, agency MBS and U.S. investment grade corporate bonds. The Trust added to its agency MBS allocation based on attractive spreads and the outlook for declining interest rate volatility. The Trust added to risk within its emerging market debt allocation while actively managing concerns around tighter central bank policies, weakening growth, and reduced liquidity. The Trust remained cautious with respect to U.S. high yield corporate exposure and trimmed exposure to CMBS.

The Trust used Treasury futures during the period to hedge duration and yield curve exposure. The use of derivatives marginally contributed to performance. The Trust’s cash position did not materially impact performance.

Describe portfolio positioning at period end.

As of December 31, 2022, the Trust’s portfolio had an effective duration of 2.28 years and approximately 15% leverage, with a nominal yield of 9.73%. The Trust maintained a diversified exposure within spread sectors, including emerging markets, high yield corporate bonds, and securitized assets. Private assets comprised approximately 4.7% of total portfolio assets. The Trust continues to seek opportunities to harvest the illiquidity premium and enhance yield by adding exposure to private investments.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

T R U S T S U M M A R Y | | 9 |

| | |

Trust Summary as of December 31, 2022 (continued) | | BlackRock Multi-Sector Opportunities Trust II (MSO2) |

Overview of the Trust’s Total Investments

PORTFOLIO COMPOSITION

| | | | |

| Asset Type | | 12/31/22 | |

Corporate Bonds | | | 39.6 | % |

Asset-Backed Securities | | | 20.1 | |

Non-Agency Mortgage-Backed Securities | | | 12.2 | |

Foreign Agency Obligations | | | 7.4 | |

Short-Term Securities | | | 5.7 | |

Floating Rate Loan Interests | | | 5.3 | |

U.S. Government Sponsored Agency Securities | | | 5.0 | |

Preferred Securities | | | 4.2 | |

Other* | | | 0.5 | |

CREDIT QUALITY ALLOCATION

| | | | |

| Credit Rating(a)(b) | | 12/31/22 | |

AAA/Aaa(c) | | | 5.9 | % |

A | | | 3.4 | |

BBB/Baa | | | 18.7 | |

BB/Ba | | | 33.4 | |

B | | | 15.3 | |

CCC/Caa | | | 2.5 | |

CC | | | 1.5 | |

C | | | 2.5 | |

N/R | | | 16.8 | |

| (a) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| (b) | Excludes short-term securities. | |

| (c) | Includes U.S. Government Sponsored Agency Securities which are deemed AAA/Aaa by the investment adviser. | |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Trust’s total investments. Please refer to the Schedule of Investments for details. | |

| | |

| 10 | | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust (MSO) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

| Asset-Backed Securities | | | | | | | | | |

Ajax Mortgage Loan Trust(a) | | | | | | | | | | | | |

Series 2018-A, Class B, 0.00%, 04/25/58(b) | | | USD | | | | 13 | | | $ | 12,503 | |

Series 2018-B, Class B, 0.00%, 02/26/57 | | | | | | | 31 | | | | 27,024 | |

Anchorage Capital CLO 5-R Ltd., Series 2014-5RA, Class E, (3 mo. LIBOR US + 5.40%), 9.48%, 01/15/30(a)(c) | | | | | | | 1,000 | | | | 908,299 | |

Anchorage Capital CLO Ltd., Series 2013-1A, Class DR, (3 mo. LIBOR US + 6.80%), 10.74%, 10/13/30(a)(c) | | | | | | | 3,050 | | | | 2,719,233 | |

Apidos CLO XV, Series 2013-15A, Class ERR, (3 mo. LIBOR US + 5.70%), 9.94%, 04/20/31(a)(c) | | | | | | | 1,000 | | | | 860,642 | |

Apres Static CLO Ltd., Series 2019-1A, Class CR, (3 mo. LIBOR US + 4.25%), 8.33%, 10/15/28(a)(c) | | | | | | | 500 | | | | 472,583 | |

Ares LI CLO Ltd., Series 2019-51A, Class ER, (3 mo. LIBOR US + 6.85%), 10.93%, 07/15/34(a)(c) | | | | | | | 700 | | | | 618,901 | |

Ares LV CLO Ltd., Series 2020-55A, Class DR, (3 mo. LIBOR US + 3.15%), 7.23%, 07/15/34(a)(c) | | | | | | | 1,000 | | | | 921,007 | |

Ares XXXVII CLO Ltd., Series 2015-4A, Class DR, (3 mo. LIBOR US + 6.15%), 10.23%, 10/15/30(a)(c) | | | | | | | 1,450 | | | | 1,172,964 | |

BankAmerica Manufactured Housing Contract Trust, | | | | | | | | | | | | |

Series 1997-2, Class B1, 7.07%, 02/10/22(c) | | | | | | | 2,300 | | | | 692,373 | |

Bean Creek CLO Ltd., Series 2015-1A, Class ER, (3 mo. LIBOR US + 5.75%), 9.99%, 04/20/31(a)(c) | | | | | | | 1,500 | | | | 1,237,828 | |

Brookside Mill CLO Ltd., Series 2013-1A, Class DR, (3 mo. LIBOR US + 2.65%), 6.73%, 01/17/28(a)(c) | | | | | | | 250 | | | | 241,299 | |

CarVal CLO II Ltd., Series 2019-1A, Class DR, (3 mo. LIBOR US + 3.20%), 7.44%, 04/20/32(a)(c) | | | | | | | 250 | | | | 235,016 | |

CarVal CLO III Ltd., Series 2019-2A, Class E, (3 mo. LIBOR US + 6.44%), 10.68%, 07/20/32(a)(c) | | | | | | | 2,200 | | | | 1,905,110 | |

Cedar Funding IX CLO Ltd., Series 2018-9A, Class E, (3 mo. LIBOR US + 5.35%), 9.59%, 04/20/31(a)(c) | | | | | | | 2,000 | | | | 1,767,123 | |

Cedar Funding XIV CLO Ltd.(a)(c) | | | | | | | | | | | | |

Series 2021-14A, Class D, (3 mo. LIBOR US + 3.25%), 7.33%, 07/15/33 | | | | | | | 1,000 | | | | 929,242 | |

Series 2021-14A, Class E, (3 mo. LIBOR US + 6.34%), 10.42%, 07/15/33 | | | | | | | 750 | | | | 679,040 | |

Series 2021-14A, Class SUB, 0.00%, 07/15/33 | | | | | | | 750 | | | | 404,175 | |

Deer Creek CLO Ltd., Series 2017-1A, Class E, (3 mo. LIBOR US + 6.35%), 10.59%, 10/20/30(a)(c) | | | | | | | 1,000 | | | | 867,534 | |

Elmwood CLO II Ltd., Series 2019-2A, Class ER, (3 mo. LIBOR US + 6.80%), 11.04%, 04/20/34(a)(c) | | | | | | | 250 | | | | 229,945 | |

Fairstone Financial Issuance Trust I, Series 2020-1A, Class D, 6.87%, 10/20/39(a) | | | CAD | | | | 210 | | | | 141,018 | |

Generate CLO 2 Ltd., Series 2A, Class ER, (3 mo. LIBOR US + 5.65%), 9.97%, 01/22/31(a)(c) | | | USD | | | | 500 | | | | 425,714 | |

Gilbert Park CLO Ltd., Series 2017-1A, Class D, (3 mo. LIBOR US + 2.95%), 7.03%, 10/15/30(a)(c) | | | | | | | 550 | | | | 513,578 | |

Goldentree Loan Management U.S. CLO 2 Ltd., Series 2017-2A, Class E, (3 mo. LIBOR US + 4.70%), 8.94%,

11/28/30(a)(c) | | | | | | | 1,500 | | | | 1,279,591 | |

GoldenTree Loan Opportunities IX Ltd., Series 2014-9A, Class ER2, (3 mo. LIBOR US + 5.66%), 10.07%, 10/29/29(a)(c) | | | | | | | 500 | | | | 451,047 | |

Gulf Stream Meridian 1 Ltd., Series 2020-IA, Class E, (3 mo. LIBOR US + 6.45%), 10.53%, 04/15/33(a)(c) | | | | | | | 250 | | | | 216,740 | |

JP Morgan Mortgage Acquisition Corp., Series 2006- FRE2, Class M2, (1 mo. LIBOR US + 0.54%), 4.93%, 02/25/36(c) | | | | | | | 2,787 | | | | 2,360,061 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Asset-Backed Securities (continued) | |

Lending Funding Trust, Series 2020-2A, Class D, 6.77%, 04/21/31(a) | | | USD | | | | 315 | | | $ | 267,547 | |

Madison Park Funding XXX Ltd. | | | | | | | | | | | | |

Series 2018-30A, Class E, (3 mo. LIBOR US + 4.95%), 9.03%, 04/15/29(a)(c) | | | | | | | 1,250 | | | | 1,128,866 | |

Series 2018-30X, Class E, 9.03%, 04/15/29 | | | | | | | 250 | | | | 225,773 | |

Mariner Finance Issuance Trust, Series 2020-AA, Class D, 5.75%, 08/21/34(a) | | | | | | | 250 | | | | 214,477 | |

Mosaic Solar Loan Trust, Series 2018-2GS, Class C, 5.97%, 02/22/44(a)(d) | | | | | | | 228 | | | | 191,535 | |

Oceana Australian Fixed Income Trust, A Note Upsize, 8.00%, 09/28/23(d) | | | AUD | | | | 1,210 | | | | 811,471 | |

OCP CLO Ltd.(a)(c) | | | | | | | | | | | | |

Series 2013-4A, Class CRR, (3 mo. LIBOR US + 3.00%), 7.32%, 04/24/29 | | | USD | | | | 600 | | | | 571,746 | |

Series 2019-16A, Class ER, (3 mo. LIBOR US + 6.35%), 10.26%, 04/10/33 | | | | | | | 250 | | | | 218,965 | |

Series 2019-17A, Class ER, (3 mo. LIBOR US + 6.50%), 10.74%, 07/20/32 | | | | | | | 1,000 | | | | 872,989 | |

Palmer Square CLO Ltd.(a)(c) | | | | | | | | | | | | |

Series 2015-2A, Class CR2, (3 mo. LIBOR US + 2.75%), 6.99%, 07/20/30 | | | | | | | 250 | | | | 230,260 | |

Series 2018-2A, Class D, (3 mo. LIBOR US + 5.60%), 9.68%, 07/16/ 31 | | | | | | | 1,500 | | | | 1,343,652 | |

Rad CLO 6 Ltd., Series 2019-6A, Class E, (3 mo. LIBOR US + 7.53%), 11.77%, 01/20/33(a)(c) | | | | | | | 500 | | | | 457,429 | |

Republic Finance Issuance Trust, Series 2020-A, Class D, 7.00%, 11/20/30(a) | | | | | | | 700 | | | | 645,420 | |

Rockford Tower CLO Ltd., Series 2017-3A, Class D, (3 mo. LIBOR US + 2.65%), 6.89%, 10/20/30(a)(c) | | | | | | | 970 | | | | 888,909 | |

Signal Peak CLO 7 Ltd., Series 2019-1A, Class E, (3 mo. LIBOR US + 6.89%), 11.30%, 04/30/32(a)(c) | | | | | | | 250 | | | | 222,876 | |

Strata CLO I Ltd.(a)(c) | | | | | | | | | | | | |

Series 2018-1A, Class E, (3 mo. LIBOR US + 7.08%), 11.16%, 01/15/31 | | | | | | | 500 | | | | 440,784 | |

Series 2018-1A, Class USUB, 0.00%, 01/15/2118 | | | | | | | 1,750 | | | | 648,137 | |

TICP CLO VII Ltd., Series 2017-7A, Class ER, (3 mo. LIBOR US + 7.05%), 11.13%, 04/15/33(a)(c) | | | | | | | 500 | | | | 446,875 | |

TICP CLO XII Ltd., Series 2018-12A, Class ER, (3 mo. LIBOR US + 6.25%), 10.33%, 07/15/34(a)(c) | | | | | | | 725 | | | | 631,879 | |

Trestles CLO II Ltd., Series 2018-2A, Class D, (3 mo. LIBOR US + 5.75%), 10.11%, 07/25/31(a)(c) | | | | | | | 1,900 | | | | 1,587,058 | |

York CLO 1 Ltd., Series 2014-1A, Class DRR, (3 mo. LIBOR US + 3.01%), 7.33%, 10/22/29(a)(c) | | | | | | | 250 | | | | 237,110 | |

| | | | | | | | | | | | |

| | | |

Total Asset-Backed Securities — 16.1%

(Cost: $41,177,572) | | | | | | | | | | | 34,573,348 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Shares | | | | |

| | | |

Common Stocks | | | | | | | | | | | | |

| |

Equity Real Estate Investment Trusts (REITs) — 0.0% | | | | | |

Service Properties Trust | | | | 4,000 | | | | 29,160 | |

| | | | | | | | | | | | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 11 |

| | |

Schedule of Investments (continued) December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust (MSO) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | |

Shares | | | Value | |

| | |

| Hotels, Restaurants & Leisure — 0.1% | | | | | | | |

Caesars Entertainment, Inc.(e) | | | | | | | 3,435 | | | $ | 142,896 | |

Carlson Travel, Inc. | | | | | | | 5,800 | | | | 35,380 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 178,276 | |

| | | |

| Oil, Gas & Consumable Fuels — 0.4% | | | | | | | | | |

California Resources Corp. | | | | | | | 19,725 | | | | 858,235 | |

| | | | | | | | | | | | |

| |

Total Common Stocks — 0.5%

(Cost: $1,311,347) | | | | 1,065,671 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Par

(000) | | | | |

| | | |

| Corporate Bonds | | | | | | | | | |

| | | |

Aerospace & Defense — 1.0% | | | | | | | | | | | | |

Embraer Netherlands Finance BV, 6.95%, 01/17/28(a) | | | USD | | | | 291 | | | | 289,963 | |

Rolls-Royce PLC, 1.63%, 05/09/28(f) | | | EUR | | | | 100 | | | | 84,432 | |

TransDigm, Inc.

6.25%, 03/15/26(a) | | | USD | | | | 1,505 | | | | 1,484,216 | |

6.38%, 06/15/26 | | | | | | | 348 | | | | 338,588 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,197,199 | |

| | | |

| Airlines — 0.6% | | | | | | | | | |

Air France-KLM, 3.88%, 07/01/26(f) | | | EUR | | | | 100 | | | | 95,780 | |

Allegiant Travel Co., 7.25%, 08/15/27(a) | | | USD | | | | 56 | | | | 53,265 | |

Avianca Midco 2 PLC, 9.00%, 12/01/28(a) | | | | | | | 615 | | | | 448,715 | |

Azul Investments LLP, 7.25%, 06/15/26(a) | | | | | | | 220 | | | | 134,791 | |

Deutsche Lufthansa AG, 2.88%, 05/16/27(f) | | | EUR | | | | 100 | | | | 92,861 | |

Gol Finance SA(a)

7.00%, 01/31/25 | | | USD | | | | 500 | | | | 217,594 | |

8.00%, 06/30/26 | | | | | | | 200 | | | | 118,100 | |

International Consolidated Airlines Group SA, 2.75%, 03/25/25(f) | | | EUR | | | | 100 | | | | 97,445 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,258,551 | |

| | | |

| Auto Components — 0.5% | | | | | | | | | |

Aptiv PLC, 3.10%, 12/01/51 | | | USD | | | | 273 | | | | 161,339 | |

Clarios Global LP/Clarios U.S. Finance Co., 6.25%, 05/15/26(a) | | | | | | | 71 | | | | 69,403 | |

Dana, Inc., 5.63%, 06/15/28 | | | | | | | 175 | | | | 159,191 | |

Faurecia SE(f)

3.13%, 06/15/26 | | | EUR | | | | 100 | | | | 94,537 | |

2.75%, 02/15/27 | | | | | | | 100 | | | | 90,068 | |

IHO Verwaltungs GmbH, (4.50% PIK), 3.75%, 09/15/26(f)(g) | | | | | | | 113 | | | | 104,843 | |

ZF Finance GmbH(f)

3.00%, 09/21/25 | | | | | | | 100 | | | | 98,349 | |

3.75%, 09/21/28 | | | | | | | 300 | | | | 269,196 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,046,926 | |

| | | |

| Automobiles — 0.4% | | | | | | | | | |

Constellation Automotive Financing PLC, 4.88%, 07/15/27(f) | | | GBP | | | | 100 | | | | 78,789 | |

Ford Motor Co., 6.10%, 08/19/32 | | | USD | | | | 197 | | | | 181,901 | |

Ford Motor Credit Co. LLC, 5.58%, 03/18/24 | | | | | | | 612 | | | | 603,952 | |

Jaguar Land Rover Automotive PLC, 4.50%, 07/15/28(f) | | | EUR | | | | 100 | | | | 80,837 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 945,479 | |

| | | |

| Banks — 1.1% | | | | | | | | | |

Bangkok Bank PCL, (5 year CMT + 4.73%), 5.00% | | | USD | | | | 200 | | | | 189,350 | |

BBK BSC, 5.50%, 07/09/24(f) | | | | | | | 279 | | | | 272,252 | |

Commerzbank AG, (5 year EUR Swap + 6.36%), 6.13%(c)(f)(h) | | | EUR | | | | 400 | | | | 397,171 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

| Banks (continued) | | | | | | | | | |

Freedom Mortgage Corp., 8.25%, 04/15/25(a) | | | USD | | | | 357 | | | $ | 321,113 | |

Grupo Aval Ltd., 4.38%, 02/04/30(a) | | | | | | | 780 | | | | 630,240 | |

Intesa Sanpaolo SpA, (5 year EUR Swap + 6.09%), 5.88%(c)(f)(h) | | | EUR | | | | 250 | | | | 214,887 | |

NBK Tier 1 Ltd., (6 year CMT + 2.88%), 3.63%(a)(c)(h) | | | USD | | | | 341 | | | | 296,841 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,321,854 | |

| | | |

| Beverages — 1.1% | | | | | | | | | |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, Inc., 4.70%, 02/01/36 | | | | | | | 145 | | | | 136,944 | |

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC, 3.25%, 09/01/28(a) | | | | | | | 493 | | | | 418,777 | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 4.75%, 07/15/27(f) | | | GBP | | | | 190 | | | | 157,655 | |

Mauser Packaging Solutions Holding Co., 5.50%, 04/15/24(a) | | | USD | | | | 1,092 | | | | 1,061,803 | |

OI European Group BV, 2.88%, 02/15/25(f) | | | EUR | | | | 260 | | | | 267,184 | |

Trivium Packaging Finance BV, 5.50%, 08/15/26(a) | | | USD | | | | 446 | | | | 408,953 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,451,316 | |

| | | |

| Biotechnology — 0.3% | | | | | | | | | |

Amgen, Inc. | | | | | | | | | | | | |

3.00%, 01/15/52 | | | | | | | 390 | | | | 248,912 | |

2.77%, 09/01/53 | | | | | | | 218 | | | | 131,204 | |

Gilead Sciences, Inc., | | | | | | | | | | | | |

2.60%, 10/01/40 | | | | | | | 355 | | | | 247,680 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 627,796 | |

| | | |

| Building Materials — 0.2% | | | | | | | | | |

Cemex SAB de CV, 3.13%, 03/19/26(f) | | | EUR | | | | 300 | | | | 307,346 | |

Standard Industries, Inc., 4.75%, 01/15/28(a) | | | USD | | | | 46 | | | | 41,395 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 348,741 | |

| | | |

| Building Products — 0.3% | | | | | | | | | |

Home Depot, Inc. | | | | | | | | | | | | |

2.75%, 09/15/51 | | | | | | | 335 | | | | 218,883 | |

3.63%, 04/15/52 | | | | | | | 107 | | | | 82,595 | |

Lowe’s Cos., Inc. | | | | | | | | | | | | |

3.00%, 10/15/50 | | | | | | | 413 | | | | 262,726 | |

4.25%, 04/01/52 | | | | | | | 100 | | | | 79,280 | |

SRS Distribution, Inc., | | | | | | | | | | | | |

4.63%, 07/01/28(a) | | | | | | | 29 | | | | 25,708 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 669,192 | |

| | | |

| Capital Markets — 0.5% | | | | | | | | | |

Intercorp Peru Ltd., 3.88%, 08/15/29(a) | | | | | | | 400 | | | | 329,250 | |

Sherwood Financing PLC(f) | | | | | | | | | | | | |

4.50%, 11/15/26 | | | EUR | | | | 100 | | | | 86,037 | |

6.00%, 11/15/26 | | | GBP | | | | 156 | | | | 145,219 | |

SURA Asset Management SA, 4.88%, 04/17/24(f) | | | USD | | | | 417 | | | | 413,873 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 974,379 | |

| | | |

| Chemicals — 1.5% | | | | | | | | | |

Alpek SAB de CV, 3.25%, 02/25/31(a) | | | | | | | 324 | | | | 269,183 | |

Axalta Coating Systems Dutch Holding B BV, 3.75%, 01/15/25(f) | | | EUR | | | | 100 | | | | 102,316 | |

Braskem Idesa SAPI, 6.99%, 02/20/32(a) | | | USD | | | | 300 | | | | 213,750 | |

Chemours Co., 4.00%, 05/15/26 | | | EUR | | | | 100 | | | | 95,554 | |

Equate Petrochemical BV | | | | | | | | | | | | |

4.25%, 11/03/26(f) | | | USD | | | | 200 | | | | 190,850 | |

2.63%, 04/28/28(a) | | | | | | | 200 | | | | 173,600 | |

NOVA Chemicals Corp., 4.88%, 06/01/24(a) | | | | | | | 1,407 | | | | 1,361,267 | |

OCI NV, 3.63%, 10/15/25(f) | | | EUR | | | | 90 | | | | 95,247 | |

Sasol Financing USA LLC | | | | | | | | | | | | |

4.38%, 09/18/26(i) | | | USD | | | | 200 | | | | 176,725 | |

| | |

| 12 | | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust (MSO) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

| Chemicals (continued) | | | | | | | | | |

| | | |

| Sasol Financing USA LLC (continued) | | | | | | | | | |

6.50%, 09/27/28 | | | USD | | | | 200 | | | $ | 180,725 | |

5.50%, 03/18/31 | | | | | | | 315 | | | | 255,012 | |

SCIL IV LLC/SCIL USA Holdings LLC, 4.38%, 11/01/26(f) | | | EUR | | | | 100 | | | | 91,523 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,205,752 | |

| | |

| Commercial Services & Supplies — 0.2% | | | | | | | |

AMN Healthcare, Inc., 4.63%, 10/01/27(a) | | | USD | | | | 210 | | | | 193,636 | |

Loxam SAS, 3.75%, 07/15/26(f) | | | EUR | | | | 200 | | | | 192,407 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 386,043 | |

| | | |

| Construction & Engineering — 0.0% | | | | | | | | | |

Ferrovial Netherlands BV, (5 year EUR Swap + 2.13%), 2.12%(c)(f)(h) | | | | | | | 100 | | | | 84,030 | |

| | | | | | | | | | | | |

| | | |

| Construction Materials — 0.1% | | | | | | | | | |

KAR Auction Services, Inc., 5.13%, 06/01/25(a) | | | USD | | | | 180 | | | | 175,849 | |

| | | | | | | | | | | | |

| | | |

| Consumer Discretionary(f) — 0.2% | | | | | | | | | |

Carnival Corp., 10.13%, 02/01/26 | | | EUR | | | | 110 | | | | 116,412 | |

Q-Park Holding I BV | | | | | | | | | | | | |

1.50%, 03/01/25 | | | | | | | 100 | | | | 98,013 | |

(3 mo. EURIBOR + 2.00%), 3.98%, 03/01/26(c) | | | | | | | 100 | | | | 98,702 | |

Techem Verwaltungsgesellschaft 674 mbH, 6.00%, 07/30/26 | | | | | | | 88 | | | | 88,267 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 401,394 | |

| | | |

| Consumer Finance — 0.1% | | | | | | | | | |

Encore Capital Group, Inc., 4.88%, 10/15/25(f) | | | | | | | 200 | | | | 200,435 | |

Moody’s Corp., 3.10%, 11/29/61 | | | USD | | | | 17 | | | | 10,699 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 211,134 | |

| | | |

| Containers & Packaging — 0.6% | | | | | | | | | |

Klabin Austria GmbH, 3.20%, 01/12/31(a) | | | | | | | 305 | | | | 245,525 | |

Suzano Austria GmbH | | | | | | | | | | | | |

3.13%, 01/15/32 | | | | | | | 290 | | | | 225,838 | |

7.00%, 03/16/47(a) | | | | | | | 773 | | | | 770,729 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,242,092 | |

| | | |

| Diversified Consumer Services — 0.1% | | | | | | | | | |

Rekeep SpA, 7.25%, 02/01/26(f) | | | EUR | | | | 200 | | | | 177,958 | |

| | | | | | | | | | | | |

| | | |

| Diversified Financial Services — 2.3% | | | | | | | | | |

ASG Finance Designated Activity Co., 7.88%, 12/03/24(a) | | | USD | | | | 428 | | | | 413,020 | |

Bank of America Corp., (3 mo. LIBOR US + 3.15%), 4.08%, 03/20/51(c) | | | | | | | 325 | | | | 254,332 | |

BNP Paribas SA, (5 year CMT + 3.34%), 4.63%(c)(f)(h) | | | | | | | 400 | | | | 309,040 | |

Garfunkelux Holdco 3 SA(f) | | | | | | | | | | | | |

6.75%, 11/01/25 | | | EUR | | | | 300 | | | | 256,025 | |

7.75%, 11/01/25 | | | GBP | | | | 100 | | | | 93,932 | |

Goldman Sachs Group, Inc.

4.80%, 07/08/44 | | | USD | | | | 195 | | | | 172,403 | |

(1 day SOFR + 1.47%), 2.91%, 07/21/42(c) | | | | | | | 23 | | | | 15,640 | |

Intrum AB, 4.88%, 08/15/25(f) | | | EUR | | | | 100 | | | | 97,047 | |

JPMorgan Chase & Co.(c) | | | | | | | | | | | | |

(1 day SOFR + 1.51%), 2.53%, 11/19/41 | | | USD | | | | 23 | | | | 15,037 | |

(1 day SOFR + 1.58%), 3.33%, 04/22/52 | | | | | | | 380 | | | | 256,810 | |

Lloyds Banking Group PLC, (5 year USD Swap + 4.76%), 7.50%(c)(h) | | | | | | | 500 | | | | 484,600 | |

Oceana Australian Fixed Income Trust, 10.00%, 08/31/23(d) | | | AUD | | | | 2,424 | | | | 1,650,381 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| |

| Diversified Financial Services (continued) | | | | |

Operadora de Servicios Mega SA de CV Sofom ER, 8.25%, 02/11/25(a) | | | USD | | | | 661 | | | $ | 326,906 | |

ProGroup AG, 3.00%, 03/31/26(f) | | | EUR | | | | 100 | | | | 93,798 | |

Sun Country Airlines Holdings, Inc., 7.00%, 12/15/23(d) | | | USD | | | | 422 | | | | 411,366 | |

UBS Group AG, (1 year CMT + 0.83%), 1.01%, 07/30/24(a)(c) | | | | | | | 150 | | | | 145,852 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,996,189 | |

| | | |

| Diversified Telecommunication Services — 1.6% | | | | | | | | | |

Level 3 Financing, Inc.(a)

4.63%, 09/15/27 | | | | | | | 19 | | | | 15,818 | |

4.25%, 07/01/28 | | | | | | | 975 | | | | 768,007 | |

3.63%, 01/15/29 | | | | | | | 865 | | | | 633,388 | |

Oi SA, (10.00% Cash or 8.00% Cash + 4.00% PIK), 10.00%, 07/27/25(g) | | | | | | | 375 | | | | 62,766 | |

SoftBank Group Corp.(f)

4.75%, 07/30/25 | | | EUR | | | | 300 | | | | 300,261 | |

(5 year USD ICE Swap + 4.23%),

6.00%(c)(h) | | | USD | | | | 200 | | | | 189,960 | |

Telecom Italia Capital SA, 6.38%, 11/15/33 | | | | | | | 1,239 | | | | 1,013,614 | |

Telecom Italia SpA/Milano, 5.88%, 05/19/23 | | | GBP | | | | 150 | | | | 179,719 | |

Verizon Communications, Inc. | | | | | | | | | | | | |

2.88%, 11/20/50 | | | USD | | | | 195 | | | | 122,257 | |

2.99%, 10/30/56 | | | | | | | 328 | | | | 200,113 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,485,903 | |

| | | |

| Electric Utilities — 1.5% | | | | | | | | | |

Adani Electricity Mumbai Ltd., 3.95%, 02/12/30(a) | | | | | | | 250 | | | | 188,641 | |

Comision Federal de Electricidad, 4.88%, 01/15/24 | | | | | | | 400 | | | | 395,325 | |

Empresas Publicas de Medellin ESP, 4.25%, 07/18/29(a) | | | | | | | 305 | | | | 241,579 | |

Oncor Electric Delivery Co. LLC, 2.70%, 11/15/51 | | | | | | | 485 | | | | 316,752 | |

Oryx Funding Ltd., 5.80%, 02/03/31(a) | | | | | | | 200 | | | | 189,975 | |

Talen Energy Supply LLC(a)(e)(j) | | | | | | | | | | | | |

7.25%, 05/15/27 | | | | | | | 1,243 | | | | 1,286,505 | |

6.63%, 01/15/28 | | | | | | | 675 | | | | 690,187 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,308,964 | |

| | | |

| Electrical Equipment(f) — 0.0% | | | | | | | | | |

Pearl Holding II Ltd., (6.00% Cash or 8.00% PIK), 6.00%(g)(h) | | | | | | | 95 | | | | 2,774 | |

Pearl Holding III Ltd., 9.00%, 10/22/25 | | | | | | | 76 | | | | 26,505 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 29,279 | |

| | | |

| Energy Equipment & Services — 0.4% | | | | | | | | | |

Transocean Phoenix 2 Ltd., 7.75%, 10/15/24(a) | | | | | | | 735 | | | | 727,848 | |

Vallourec SA, 8.50%, 06/30/26(f) | | | EUR | | | | 42 | | | | 44,077 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 771,925 | |

| | |

| Environmental, Maintenance & Security Service — 0.1% | | | | | | | |

Covanta Holding Corp., 4.88%, 12/01/29(a) | | | USD | | | | 22 | | | | 18,024 | |

Republic Services, Inc., 3.05%, 03/01/50 | | | | | | | 345 | | | | 237,079 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 255,103 | |

| | | |

| Equity Real Estate Investment Trusts (REITs) — 0.8% | | | | | | | | | |

American Tower Corp., 3.10%, 06/15/50 | | | | | | | 218 | | | | 137,174 | |

Crown Castle, Inc., 2.90%, 04/01/41 | | | | | | | 195 | | | | 133,587 | |

Equinix, Inc., 2.95%, 09/15/51 | | | | | | | 195 | | | | 121,460 | |

Mid-America Apartments LP, 2.88%, 09/15/51 | | | | | | | 28 | | | | 17,845 | |

Park Intermediate Holdings LLC/PK Domestic Property LLC/PK Finance Co-Issuer, 4.88%, 05/15/29(a) | | | | | | | 87 | | | | 73,646 | |

Service Properties Trust | | | | | | | | | | | | |

4.50%, 06/15/23 | | | | | | | 865 | | | | 850,028 | |

4.35%, 10/01/24 | | | | | | | 24 | | | | 21,818 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 13 |

| | |

Schedule of Investments (continued) December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust (MSO) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Equity Real Estate Investment Trusts (REITs) (continued) | |

| | | |

| Service Properties Trust (continued) | | | | | | | | | |

7.50%, 09/15/25 | | | USD | | | | 69 | | | $ | 65,752 | |

Trust Fibra Uno, 5.25%, 01/30/26(a) | | | | | | | 230 | | | | 222,353 | |

XHR LP(a) | | | | | | | | | | | | |

6.38%, 08/15/25 | | | | | | | 148 | | | | 142,296 | |

4.88%, 06/01/29 | | | | | | | 27 | | | | 22,116 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,808,075 | |

| | | |

Food & Staples Retailing — 0.4% | | | | | | | | | | | | |

Albertsons Cos., Inc./Safeway, Inc./New Albertsons

LP/Albertsons LLC, 4.63%, 01/15/27(a) | | | | | | | 360 | | | | 334,392 | |

Bellis Acquisition Co. PLC, 3.25%, 02/16/26(f) | | | GBP | | | | 200 | | | | 196,333 | |

Market Bidco Finco PLC, 5.50%, 11/04/27(f) | | | | | | | 100 | | | | 91,832 | |

Ocado Group PLC, 3.88%, 10/08/26(f) | | | | | | | 100 | | | | 93,089 | |

Picard Groupe SAS, 3.88%, 07/01/26(f) | | | EUR | | | | 100 | | | | 91,102 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 806,748 | |

| | | |

Food Products — 0.2% | | | | | | | | | | | | |

BRF SA, 4.88%, 01/24/30(f) | | | USD | | | | 200 | | | | 168,413 | |

Frigorifico Concepcion SA, 7.70%, 07/21/28(a) | | | | | | | 200 | | | | 159,913 | |

Grupo Bimbo SAB de CV, (5 year CMT + 3.28%), 5.95%(a)(c)(h) | | | | | | | 200 | | | | 198,162 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 526,488 | |

| |

Health Care Equipment & Supplies — 0.0% | | | | | |

Becton Dickinson and Co., 3.79%, 05/20/50 | | | | | | | 88 | | | | 67,530 | |

| | | | | | | | | | | | |

| |

| Health Care Providers & Services — 2.4% | | | | |

Medline Borrower LP, 3.88%, 04/01/29(a) | | | | | | | 1,052 | | | | 847,870 | |

Phoenix PIB Dutch Finance BV, 2.38%, 08/05/25(f) | | | EUR | | | | 100 | | | | 100,125 | |

Select Medical Corp., 6.25%, 08/15/26(a)(i) | | | USD | | | | 780 | | | | 741,647 | |

Tenet Healthcare Corp.(a) | | | | | | | | | | | | |

4.63%, 09/01/24 | | | | | | | 901 | | | | 875,103 | |

4.88%, 01/01/26 | | | | | | | 1,488 | | | | 1,407,117 | |

4.63%, 06/15/28 | | | | | | | 49 | | | | 43,842 | |

4.25%, 06/01/29 | | | | | | | 1,124 | | | | 973,721 | |

4.38%, 01/15/30 | | | | | | | 111 | | | | 96,078 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,085,503 | |

| | | |

Health Care Technology — 0.1% | | | | | | | | | | | | |

Chrome Bidco SASU, 3.50%, 05/31/28(f) | | | EUR | | | | 100 | | | | 89,650 | |

Universal Health Services, Inc., 2.65%, 10/15/30 | | | USD | | | | 137 | | | | 109,035 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 198,685 | |

| | | |

Hotels, Restaurants & Leisure — 3.7% | | | | | | | | | | | | |

Affinity Gaming, 6.88%, 12/15/27(a) | | | | | | | 367 | | | | 311,157 | |

Boyd Gaming Corp., 4.75%, 12/01/27 | | | | | | | 797 | | | | 742,310 | |

Caesars Entertainment, Inc.(a) | | | | | | | | | | | | |

6.25%, 07/01/25 | | | | | | | 486 | | | | 472,234 | |

8.13%, 07/01/27(i) | | | | | | | 314 | | | | 308,521 | |

CDI Escrow Issuer, Inc., 5.75%, 04/01/30(a) | | | | | | | 9 | | | | 8,068 | |

Cedar Fair LP/Canada’s Wonderland Co./Magnum | | | | | | | | | | | | |

Management Corp./Millennium Op, 5.50%, 05/01/25(a) | | | | | | | 220 | | | | 217,606 | |

Cirsa Finance International SARL, 4.75%,

05/22/25(f) | | | EUR | | | | 100 | | | | 100,827 | |

CPUK Finance Ltd., 6.50%, 08/28/26(f) | | | GBP | | | | 100 | | | | 110,691 | |

Dave & Buster’s, Inc., 7.63%, 11/01/25(a) | | | USD | | | | 35 | | | | 35,175 | |

Fortune Star BVI Ltd., 6.85%, 07/02/24(f) | | | | | | | 200 | | | | 175,520 | |

Full House Resorts, Inc., 8.25%, 02/15/28(a) | | | | | | | 29 | | | | 25,674 | |

Golden Entertainment, Inc., 7.63%, 04/15/26(a) | | | | | | | 274 | | | | 270,059 | |

Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Esc, 5.00%, 06/01/29(a) | | | | | | | 361 | | | | 310,460 | |

IRB Holding Corp., 7.00%, 06/15/25(a) | | | | | | | 151 | | | | 150,622 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| |

| Hotels, Restaurants & Leisure (continued) | | | | |

Marriott International, Inc. | | | | | | | | | | | | |

Series FF, 4.63%, 06/15/30 | | | USD | | | | 106 | | | $ | 98,910 | |

Series GG, 3.50%, 10/15/32 | | | | | | | 508 | | | | 422,587 | |

Marriott Ownership Resorts, Inc.(a) | | | | | | | | | | | | |

6.13%, 09/15/25 | | | | | | | 278 | | | | 286,515 | |

4.50%, 06/15/29 | | | | | | | 370 | | | | 306,962 | |

MGM Resorts International | | | | | | | | | | | | |

4.63%, 09/01/26 | | | | | | | 355 | | | | 325,437 | |

5.50%, 04/15/27 | | | | | | | 355 | | | | 330,224 | |

Midwest Gaming Borrower LLC/Midwest Gaming Finance Corp., 4.88%, 05/01/29(a) | | | | | | | 218 | | | | 185,488 | |

Scientific Games International, Inc., 7.00%, 05/15/28(a) | | | | | | | 464 | | | | 442,614 | |

SeaWorld Parks & Entertainment, Inc.,

8.75%, 05/01/25(a) | | | | | | | 669 | | | | 684,889 | |

Stonegate Pub Co. Financing PLC(f) | | | | | | | | | | | | |

8.00%, 07/13/25 | | | GBP | | | | 100 | | | | 107,597 | |

8.25%, 07/31/25 | | | | | | | 200 | | | | 218,095 | |

Studio City Finance Ltd., 5.00%, 01/15/29(a) | | | USD | | | | 200 | | | | 147,750 | |

Travel & Leisure Co., 6.63%, 07/31/26(a) | | | | | | | 189 | | | | 184,891 | |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp.(a) | | | | | | | | | | | | |

5.50%, 03/01/25 | | | | | | | 391 | | | | 371,194 | |

5.25%, 05/15/27 | | | | | | | 7 | | | | 6,317 | |

Wynn Macau Ltd., 5.50%, 01/15/26(f) | | | | | | | 200 | | | | 182,100 | |

Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.13%, 10/01/29(a) | | | | | | | 482 | | | | 413,137 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,953,631 | |

| | | |

Household Durables — 3.3% | | | | | | | | | | | | |

Ashton Woods USA LLC/Ashton Woods Finance Co.(a) | | | | | | | | | | | | |

6.63%, 01/15/28 | | | | | | | 495 | | | | 435,511 | |

4.63%, 08/01/29 | | | | | | | 66 | | | | 52,848 | |

Brookfield Residential Properties, Inc./Brookfield Residential U.S. LLC(a) | | | | | | | | | | | | |

6.25%, 09/15/27 | | | | | | | 541 | | | | 480,462 | |

5.00%, 06/15/29 | | | | | | | 27 | | | | 21,097 | |

Century Communities, Inc., 6.75%, 06/01/27 | | | | | | | 110 | | | | 104,952 | |

Forestar Group, Inc.(a) | | | | | | | | | | | | |

3.85%, 05/15/26 | | | | | | | 560 | | | | 490,947 | |

5.00%, 03/01/28 | | | | | | | 669 | | | | 573,978 | |

M/I Homes, Inc., 4.95%, 02/01/28 | | | | | | | 510 | | | | 453,115 | |

PulteGroup, Inc., 7.88%, 06/15/32 | | | | | | | 1,138 | | | | 1,264,661 | |

Taylor Morrison Communities, Inc.(a) | | | | | | | | | | | | |

5.88%, 06/15/27 | | | | | | | 647 | | | | 621,198 | |

5.75%, 01/15/28 | | | | | | | 2,269 | | | | 2,124,584 | |

Tri Pointe Homes, Inc. | | | | | | | | | | | | |

5.25%, 06/01/27 | | | | | | | 505 | | | | 450,829 | |

5.70%, 06/15/28 | | | | | | | 38 | | | | 34,422 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,108,604 | |

|

Independent Power and Renewable Electricity Producers — 1.3% | |

Calpine Corp.(a) | | | | | | | | | | | | |

4.50%, 02/15/28 | | | | | | | 1,523 | | | | 1,358,483 | |

5.13%, 03/15/28(i) | | | | | | | 722 | | | | 644,235 | |

Greenko Solar Mauritius Ltd., 5.95%, 07/29/26(f) | | | | | | | 100 | | | | 90,625 | |

India Cleantech Energy, 4.70%, 08/10/26(a) | | | | | | | 237 | | | | 202,421 | |

SCC Power PLC(a)(g) | | | | | | | | | | | | |

(4.00% PIK), 4.00%, 05/17/32 | | | | | | | 745 | | | | 22,354 | |

(8.00% Cash or 4.00% Cash + 4.00% PIK), 8.00%, 12/31/28 | | | | | | | 1,376 | | | | 468,744 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,786,862 | |

| | |

| 14 | | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust (MSO) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Insurance(f) — 0.6% | | | | | | | | | | | | |

Argentum Netherlands BV for Swiss Re Ltd., (3 mo. LIBOR US + 3.78%),

5.63%, 08/15/52(c) | | | USD | | | | 400 | | | $ | 366,000 | |

Argentum Netherlands BV for Zurich Insurance Co. Ltd.,

(3 mo. EURIBOR + 3.95%), 3.50%, 10/01/46(c) | | | EUR | | | | 300 | | | | 302,632 | |

AXA SA, (3 mo. EURIBOR + 3.75%),

3.38%, 07/06/47(c) | | | | | | | 300 | | | | 297,027 | |

Galaxy Bidco Ltd., 6.50%, 07/31/26 | | | GBP | | | | 220 | | | | 225,276 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,190,935 | |

| | | |

Interactive Media & Services(f) — 0.1% | | | | | | | | | | | | |

iliad SA, 5.38%, 06/14/27 | | | EUR | | | | 100 | | | | 106,189 | |

United Group BV, 4.88%, 07/01/24 | | | | | | | 130 | | | | 129,179 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 235,368 | |

| | | |

Internet Software & Services — 0.1% | | | | | | | | | | | | |

Gen Digital, Inc., 6.75%, 09/30/27(a) | | | USD | | | | 120 | | | | 117,600 | |

| | | | | | | | | | | | |

| | | |

IT Services — 0.2% | | | | | | | | | | | | |

Centurion Bidco SpA, 5.88%, 09/30/26(f) | | | EUR | | | | 200 | | | | 184,188 | |

International Business Machines Corp., 2.95%, 05/15/50 | | | USD | | | | 218 | | | | 141,862 | |

La Financiere Atalian SASU, 6.63%, 05/15/25(f) | | | GBP | | | | 200 | | | | 161,012 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 487,062 | |

| | | |

Machinery — 0.3% | | | | | | | | | | | | |

TK Elevator Midco GmbH(f) | | | | | | | | | | | | |

4.38%, 07/15/27 | | | EUR | | | | 115 | | | | 108,908 | |

(3 mo. EURIBOR + 4.75%), 6.13%, 07/15/27(c) | | | | | | | 173 | | | | 178,706 | |

TK Elevator U.S. Newco, Inc., 5.25%, 07/15/27(a) | | | USD | | | | 274 | | | | 243,186 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 530,800 | |

| | | |

Media — 1.4% | | | | | | | | | | | | |

Altice Financing SA, 2.25%, 01/15/25(f) | | | EUR | | | | 180 | | | | 176,361 | |

Charter Communications Operating LLC/Charter Communications Operating Capital, 3.85%, 04/01/61 | | | USD | | | | 23 | | | | 13,302 | |

Clear Channel Outdoor Holdings, Inc., 5.13%, 08/15/27(a) | | | | | | | 738 | | | | 639,477 | |

Comcast Corp. | | | | | | | | | | | | |

2.89%, 11/01/51 | | | | | | | 235 | | | | 150,928 | |

2.45%, 08/15/52 | | | | | | | 198 | | | | 115,359 | |

CSC Holdings LLC, 5.38%, 02/01/28(a) | | | | | | | 360 | | | | 290,250 | |

Liquid Telecommunications Financing PLC, 5.50%, 09/04/26(a) | | | | | | | 200 | | | | 143,225 | |

Lorca Telecom Bondco SA, 4.00%, 09/18/27(f) | | | EUR | | | | 150 | | | | 143,306 | |

Nexstar Media, Inc., 5.63%, 07/15/27(a) | | | USD | | | | 733 | | | | 672,423 | |

SES SA, (5 year EUR Swap + 5.40%), 5.63%(c)(f)(h) | | | EUR | | | | 100 | | | | 103,913 | |

Sirius XM Radio, Inc.(a) | | | | | | | | | | | | |

5.00%, 08/01/27 | | | USD | | | | 70 | | | | 64,705 | |

5.50%, 07/01/29 | | | | | | | 66 | | | | 60,243 | |

Summer BC Holdco B SARL, 5.75%, 10/31/26(f) | | | EUR | | | | 131 | | | | 117,968 | |

TEGNA, Inc., 4.63%, 03/15/28 | | | USD | | | | 301 | | | | 285,860 | |

Tele Columbus AG, 3.88%, 05/02/25(f) | | | EUR | | | | 100 | | | | 80,165 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,057,485 | |

| | | |

Metals & Mining — 1.5% | | | | | | | | | | | | |

AngloGold Ashanti Holdings PLC, 3.75%, 10/01/30 | | | USD | | | | 471 | | | | 408,681 | |

Commercial Metals Co., 4.13%, 01/15/30 | | | | | | | 650 | | | | 575,157 | |

Freeport Indonesia PT, 4.76%, 04/14/27(f) | | | | | | | 344 | | | | 329,848 | |

Metinvest BV(f) 8.50%, 04/23/26 | | | | | | | 296 | | | | 153,328 | |

7.65%, 10/01/27 | | | | | | | 400 | | | | 205,250 | |

Nexa Resources SA, 5.38%, 05/04/27(a) | | | | | | | 462 | | | | 433,067 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

| Metals & Mining (continued) | | | | | | | | | |

Periama Holdings LLC, 5.95%, 04/19/26(f) | | | USD | | | | 200 | | | $ | 186,037 | |

Stillwater Mining Co., 4.00%, 11/16/26(f) | | | | | | | 567 | | | | 498,358 | |

thyssenkrupp AG, 1.88%, 03/06/23(f) | | | EUR | | | | 127 | | | | 135,267 | |

Vedanta Resources Finance II PLC, 8.95%, 03/11/25(a) | | | USD | | | | 320 | | | | 216,400 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,141,393 | |

| | | |

Multi-Utilities — 0.2% | | | | | | | | | | | | |

Promigas SA ESP/Gases del Pacifico SAC, 3.75%, 10/16/29(a) | | | | | | | 300 | | | | 244,125 | |

UGI International LLC, 2.50%, 12/01/29(f) | | | EUR | | | | 100 | | | | 81,656 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 325,781 | |

| | | |

Oil, Gas & Consumable Fuels — 5.9% | | | | | | | | | | | | |

AI Candelaria Spain SA, 7.50%, 12/15/28(f) | | | USD | | | | 235 | | | | 223,057 | |

BP Capital Markets PLC, (5 year EUR Swap + 4.12%), 3.63%(c)(f)(h) | | | EUR | | | | 812 | | | | 745,303 | |

Buckeye Partners LP, 4.13%, 03/01/25(a) | | | USD | | | | 195 | | | | 185,719 | |

California Resources Corp., 7.13%, 02/01/26(a) | | | | | | | 378 | | | | 363,273 | |

Chesapeake Energy Corp., 5.50%, 02/01/26(a) | | | | | | | 110 | | | | 106,147 | |

CrownRock LP/CrownRock Finance, Inc., 5.63%, 10/15/25(a) | | | | | | | 54 | | | | 52,110 | |

Ecopetrol SA | | | | | | | | | | | | |

4.13%, 01/16/25 | | | | | | | 440 | | | | 418,220 | |

4.63%, 11/02/31 | | | | | | | 339 | | | | 258,488 | |

EIG Pearl Holdings SARL, 3.55%, 08/31/36(a) | | | | | | | 401 | | | | 336,289 | |

Geopark Ltd., 5.50%, 01/17/27(a) | | | | | | | 205 | | | | 176,595 | |

Hammerhead Resources, Inc., Series AI, (12.00% PIK), 9.00%, 07/10/22(d)(g) | | | | | | | 442 | | | | 441,431 | |

HTA Group Ltd., 7.00%, 12/18/25(a) | | | | | | | 415 | | | | 380,970 | |

IHS Holding Ltd., 6.25%, 11/29/28(a) | | | | | | | 305 | | | | 245,201 | |

Kinetik Holdings LP, 5.88%, 06/15/30(a) | | | | | | | 47 | | | | 44,076 | |

Leviathan Bond Ltd., 5.75%, 06/30/23(a)(f) | | | | | | | 124 | | | | 123,130 | |

MC Brazil Downstream Trading SARL | | | | | | | | | | | | |

7.25%, 06/30/31(a) | | | | | | | 315 | | | | 258,497 | |

7.25%, 06/30/31(f) | | | | | | | 200 | | | | 164,125 | |

Medco Oak Tree Pte. Ltd., 7.38%, 05/14/26(f) | | | | | | | 200 | | | | 189,750 | |

Neptune Energy Bondco PLC, 6.63%, 05/15/25(a) | | | | | | | 200 | | | | 194,202 | |

NGPL PipeCo LLC, 7.77%, 12/15/37(a) | | | | | | | 1,032 | | | | 1,073,813 | |

Oil & Gas Holding Co. BSCC, 7.63%, 11/07/24(f) | | | | | | | 263 | | | | 267,323 | |

OQ SAOC, 5.13%, 05/06/28(a) | | | | | | | 286 | | | | 269,698 | |

Permian Resources Operating LLC(a) | | | | | | | | | | | | |

5.38%, 01/15/26 | | | | | | | 1,841 | | | | 1,675,834 | |

6.88%, 04/01/27 | | | | | | | 127 | | | | 119,664 | |

Pertamina Persero PT, 3.65%, 07/30/29(f) | | | | | | | 404 | | | | 368,694 | |

Petroleos Mexicanos 6.50%, 03/13/27 | | | | | | | 934 | | | | 848,772 | |

8.75%, 06/02/29 | | | | | | | 406 | | | | 379,940 | |

5.95%, 01/28/31 | | | | | | | 514 | | | | 388,584 | |

6.70%, 02/16/32 | | | | | | | 181 | | | | 141,859 | |

Puma International Financing SA, 5.13%, 10/06/24(a) | | | | | | | 442 | | | | 408,850 | |

SM Energy Co., 6.75%, 09/15/26 | | | | | | | 341 | | | | 331,060 | |

Sunoco LP/Sunoco Finance Corp. | | | | | | | | | | | | |

4.50%, 05/15/29 | | | | | | | 67 | | | | 58,605 | |

4.50%, 04/30/30 | | | | | | | 427 | | | | 370,657 | |

TotalEnergies SE(c)(f)(h) | | | | | | | | | | | | |

(5 year EUR Swap + 2.15%), 2.63% | | | EUR | | | | 180 | | | | 180,236 | |

Series NC7, (5 year EUR Swap + 1.99%), 1.63% | | | | | | | 400 | | | | 347,138 | |

Transocean Guardian Ltd., 5.88%, 01/15/24(a) | | | USD | | | | 131 | | | | 128,270 | |

Vivo Energy Investments BV, 5.13%, 09/24/27(a) | | | | | | | 400 | | | | 356,450 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 12,622,030 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 15 |

| | |

Schedule of Investments (continued) December 31, 2022 | | BlackRock Multi-Sector Opportunities Trust (MSO) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Personal Products — 0.0% | | | | | | | | | | | | |

Coty, Inc., 3.88%, 04/15/26(f) | | | EUR | | | | 100 | | | $ | 99,390 | |

| | | | | | | | | | | | |

| | | |

Pharmaceuticals — 0.8% | | | | | | | | | | | | |

Cheplapharm Arzneimittel GmbH(f) | | | | | | | | | | | | |

3.50%, 02/11/27 | | | | | | | 100 | | | | 93,450 | |

4.38%, 01/15/28 | | | | | | | 331 | | | | 310,401 | |

CVS Health Corp. | | | | | | | | | | | | |

2.70%, 08/21/40 | | | USD | | | | 295 | | | | 203,807 | |

5.05%, 03/25/48 | | | | | | | 195 | | | | 175,021 | |

Merck & Co., Inc., 2.75%, 12/10/51 | | | | | | | 538 | | | | 359,459 | |

Nidda Healthcare Holding GmbH, 7.50%, 08/21/26(f) | | | EUR | | | | 172 | | | | 175,142 | |

Rossini SARL(f) | | | | | | | | | | | | |

6.75%, 10/30/25 | | | | | | | 100 | | | | 105,852 | |

(3 mo. EURIBOR + 3.88%), 5.48%, 10/30/25(c) | | | | | | | 100 | | | | 104,904 | |

Teva Pharmaceutical Finance Netherlands II BV 3.75%, 05/09/27 | | | | | | | 100 | | | | 92,279 | |

4.38%, 05/09/30 | | | | | | | 100 | | | | 88,131 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,708,446 | |

|

Real Estate Management & Development — 1.6% | |

Adler Group SA(e)(f)(j) | | | | | | | | | | | | |

3.25%, 08/05/25 | | | | | | | 300 | | | | 130,381 | |

2.75%, 11/13/26 | | | | | | | 100 | | | | 42,283 | |

Arabian Centres Sukuk II Ltd., 5.63%, 10/07/26(a) | | | USD | | | | 510 | | | | 461,805 | |

China Evergrande Group(e)(f)(j) | | | | | | | | | | | | |

9.50%, 04/11/22 | | | | | | | 200 | | | | 13,500 | |

11.50%, 01/22/23 | | | | | | | 200 | | | | 13,662 | |

DEMIRE Deutsche Mittelstand Real Estate AG, 1.88%,

10/15/24(f) | | | EUR | | | | 100 | | | | 72,748 | |

Fantasia Holdings Group Co. Ltd.(e)(f)(j) | | | | | | | | | | | | |

11.75%, 04/17/22 | | | USD | | | | 400 | | | | 31,000 | |

9.25%, 07/28/23 | | | | | | | 200 | | | | 15,500 | |

Five Point Operating Co. LP/Five Point Capital Corp., | | | | | | | | | | | | |

7.88%, 11/15/25(a) | | | | | | | 750 | | | | 630,466 | |

Heimstaden Bostad AB, (5 year EUR Swap + 3.15%), 2.63%(c)(f)(h) | | | EUR | | | | 100 | | | | 55,580 | |

Howard Hughes Corp., 5.38%, 08/01/28(a) | | | USD | | | | 981 | | | | 883,616 | |

JGC Ventures Pte. Ltd.(g) | | | | | | | | | | | | |

(3.00% PIK), 0.00%, 06/30/25 | | | | | | | 7 | | | | 1,527 | |

(3.00% PIK), 3.00%, 06/30/25(e)(f)(j) | | | | | | | 239 | | | | 95,550 | |

(3.00% PIK), 10.75%, 06/30/25 | | | | | | | — | (k) | | | 56 | |

Jingrui Holdings Ltd., 12.00%, 07/25/22(e)(f)(j) | | | | | | | 200 | | | | 18,400 | |

Kaisa Group Holdings Ltd., 11.95%, 10/22/22(e)(j) | | | | | | | 200 | | | | 26,000 | |

MAF Global Securities Ltd., (5 year CMT + 3.54%), 6.38%(c)(f)(h) | | | | | | | 200 | | | | 191,225 | |

MAF Sukuk Ltd.(f) | | | | | | | | | | | | |

4.64%, 05/14/29 | | | | | | | 250 | | | | 242,547 | |

3.93%, 02/28/30 | | | | | | | 243 | | | | 224,896 | |

Modern Land China Co. Ltd.(e)(j) | | | | | | | | | | | | |

11.50%, 11/13/22 | | | | | | | 240 | | | | 12,759 | |

9.80%, 04/11/23(f) | | | | | | | 200 | | | | 11,500 | |

Ronshine China Holdings Ltd.(e)(f)(j) | | | | | | | | | | | | |

7.35%, 12/15/23 | | | | | | | 200 | | | | 10,000 | |

7.10%, 01/25/25 | | | | | | | 200 | | | | 10,000 | |

Sinic Holdings Group Co. Ltd., 10.50%, 06/18/22(e)(j) | | | | | | | 200 | | | | 2,000 | |

Yango Justice International Ltd.(e)(j) | | | | | | | | | | | | |

10.25%, 09/15/22 | | | | | | | 250 | | | | 5,000 | |

7.88%, 09/04/24(f) | | | | | | | 200 | | | | 3,000 | |

Yanlord Land HK Co. Ltd., 6.80%, 02/27/24(f) | | | | | | | 200 | | | | 192,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,397,001 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Road & Rail — 0.5% | | | | | | | | | | | | |

CMA CGM SA, 7.50%, 01/15/26(f) | | | EUR | | | | 236 | | | $ | 260,584 | |

Danaos Corp., 8.50%, 03/01/28(a) | | | USD | | | | 100 | | | | 96,000 | |

Getlink SE, 3.50%, 10/30/25(f) | | | EUR | | | | 175 | | | | 181,709 | |

Norfolk Southern Corp., 3.05%, 05/15/50 | | | USD | | | | 450 | | | | 301,402 | |

United Rentals North America, Inc., 6.00%, 12/15/29 | | | | | | | 133 | | | | 132,168 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 971,863 | |

|

Semiconductors & Semiconductor Equipment — 0.2% | |

ams-OSRAM AG, Series AMS, 0.00%, 03/05/25(f)(l) | | | EUR | | | | 200 | | | | 163,833 | |

Broadcom, Inc., 3.75%, 02/15/51(a) | | | USD | | | | 390 | | | | 269,248 | |

NXP BV/NXP Funding LLC/NXP USA, Inc., 3.25%, 11/30/51 | | | | | | | 23 | | | | 14,286 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 447,367 | |

| | | |

Software — 0.5% | | | | | | | | | | | | |

Boxer Parent Co., Inc., 6.50%, 10/02/25(f) | | | EUR | | | | 100 | | | | 101,636 | |