UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23325

SIX CIRCLES TRUST

(Exact name of registrant as specified in charter)

383 Madison Avenue

New York, NY 10179

(Address of principal executive offices) (Zip Code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 270-6000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Report to Stockholders. |

Semi-Annual Report

SIX CIRCLES® FUNDS

June 30, 2020

Six Circles Ultra Short Duration Fund

Six Circles Tax Aware Ultra Short Duration Fund

Six Circles U.S. Unconstrained Equity Fund

Six Circles International Unconstrained Equity Fund

Six Circles Global Bond Fund

Six Circles Tax Aware Bond Fund

Beginning on February 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Six Circles Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a Fund. Instead, the reports will be made available on the Funds’ website (www.sixcirclesfunds.com/literature), and you or your J.P. Morgan representative as applicable, will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund by contacting your J.P. Morgan representative or by calling us collect at 1-212-464-2070.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting your J.P. Morgan representative or by calling us collect at 1-212-464-2070. Your election to receive reports in paper will apply to all Six Circles Funds.

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

For more complete information about the Funds, including the Funds’ objectives, risks, charges and expenses, call your J.P. Morgan representative or call 1-212-464-2070 or go to www.sixcirclesfunds.com for a prospectus. Read the prospectus carefully. An investment in these Funds and any other Fund is not designed to be a complete investment program. The Funds are NOT designed to be used as stand-alone investments.

PRESIDENT’S LETTER

JUNE 30, 2020 (Unaudited)

Dear Shareholder,

Much has changed in the world since we last wrote to you. Please know that it is the sincere hope of all of us at J.P. Morgan that this letter finds you and your loved ones safe and well.

The Six Circles Funds were designed based on the premise that specialization matters – and this is perhaps most true when markets are in turmoil. Over the six months covered by this Semi-Annual report, we were witness to some of the most extreme periods of volatility the market has seen.

You can read more about the performance of all of the Six Circles Funds on the pages that follow. Please remember that the Six Circles Funds are purposefully constructed as completion funds, and are not meant to be standalone investments. As such, we believe they should be reviewed and evaluated within the context of your broader portfolio for a complete picture of their performance.

I’m pleased to also note that the Six Circles Funds family expanded further during the period, with the addition of two new fixed income funds: Six Circles Global Bond Fund, which was designed to give us the ability to isolate specific fixed income sub-sectors and regions, and Six Circles Tax Aware Bond Fund, which will make it possible for us to more precisely

allocate to different parts of the municipal bond curve to achieve a desired outcome. As with all of the Six Circles Funds, J.P. Morgan Private Investments Inc. (“JPMPI”), an affiliate of J.P. Morgan, is investment adviser to these new Funds, and is engaging third party investment managers with demonstrated asset class specialization to sub-advise the Funds in accordance with our investment philosophy.

I hope you find the information on these pages to be informative and helpful. If you should have any questions about the Funds, please contact your J.P. Morgan team, visit the Fund’s website at www.sixcirclesfunds.com, or call us at 212-464-2070.

Sincerely,

Mary Savino

President, Six Circles Funds

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 1 | |

Market Overview

As Of June 30, 2020 (Unaudited)

Equity markets across the globe posted negative returns in the first half of 2020. U.S. Equities witnessed a steep fall towards the end of the first quarter of 2020 on the back of the spread of COVID-19 and the sharp fall in oil prices, before rebounding significantly in the second quarter. The MSCI USA Index was down 2.2% during the first half of the year, with developed non-U.S. and Emerging Markets Equities also closing in negative territory. The MSCI World ex-USA Index down 11.5% and the MSCI Emerging Markets Index down 9.8%.

Global Bond and cash markets broadly outperformed Equities; the Bloomberg Barclays U.S. 1-3 Month Treasury Bills Index returned 0.5% and the Bloomberg Barclays Global Aggregate Hedged Index returned 3.9%, while the MSCI World Index was down 5.8% in the first half of 2020.

Policymakers globally moved to support economies and markets in response to the COVID-19 pandemic. The Fed cut rates three times in 2019 and made two emergency cuts in March 2020, moving the Fed Funds rate towards 0%. We anticipate that this monetary easing and other supportive actions by the Fed, coupled with strong fiscal support, should help soften the blow of the virus-related slowdown but is unlikely to completely reverse it in the short-term. The efforts by central banks have helped provide stability and liquidity to markets, enabling the financial system to continue running smoothly.

The economic shutdown in response to the spread of COVID-19 has hampered near-term growth and increased risk across financial markets, and we believe that growth will remain volatile in the short run, with the markets facing uncertainty as economies reopen.

| | | | | | |

| | | |

| 2 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

Six Circles Ultra Short Duration Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 1.22% | |

| Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index | | | 0.49% | |

| |

| Net Assets as of 6/30/2020 (In Thousands) | | $ | 672,394 | |

| Duration | | | 0.73 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles Ultra Short Duration Fund (the “Fund”) seeks to generate current income consistent with capital preservation. The Fund mainly invests in U.S. dollar and non-U.S. dollar denominated investment grade short-term fixed and floating rate debt securities. Allocates assets among securities with various maturities which, under normal market conditions, will not exceed an average effective portfolio duration of two years.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”). The Adviser currently allocates Fund assets to the following Sub-Advisers:

| • | | Goldman Sachs Asset Management, L.P. (“Goldman”)* |

| • | | BlackRock Investment Management, LLC (“BlackRock”) |

| • | | Pacific Investment Management Company LLC (“PIMCO”) |

*During the reporting period, the Adviser has reduced Goldman’s allocated portion and strategy of the Fund to zero

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2020 through June 30, 2020 (the “reporting period”), the Fund posted a positive return on an absolute basis, and outperformed relative to the Bloomberg Barclays 1-3 Month U.S. T-Bill Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely-recognized index.

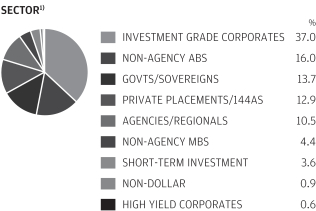

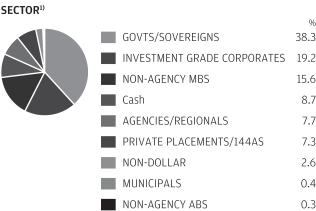

By sector composition, Investment Grade Credit and Securitized Credit comprised approximately 76% of the Fund’s exposure on

a look-through basis at the end of the reporting period, and were the Fund’s largest sector overweights relative to the Index. During the reporting period, both sectors contributed to the Fund’s performance on an absolute basis, as well as relative to the Index.

The Fund’s exposure to Government Bonds was the Fund’s largest sector underweight relative to the Index and comprised approximately 17% of the Fund’s exposure on a look-through basis at the end of the reporting period. During the reporting period, this sector detracted from the Fund’s performance on an absolute basis, as well as relative to the Index.

On allocation level, both of the Fund’s allocations — Global Markets and Core Ultra Short — contributed to the Fund’s return on an absolute basis during the reporting period.

HOW WAS THE FUND POSITIONED?

At the start of the reporting period, the Fund was allocated to three Sub-Advisers across various sectors, credit ratings, maturity buckets, and regional exposures. During the reporting period, the Adviser reduced the Conservative Income allocation of the Fund to zero and added to the Core Ultra Short allocation, given that market volatility resulting from the spread of COVID-19 created significant opportunities in areas of the fixed income market other than what the Conservative Income allocation targeted. At the end of the reporting period the Fund was allocated to two Sub-Advisers as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Core Ultra Short (BlackRock) | | | 70 | % |

| Global Markets (PIMCO) | | | 30 | |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at June 30, 2020 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of June 30, 2020. The portfolio allocation is subject to change. |

Within the fixed income allocation on the broader Portfolio level, the Adviser prefers high-quality liquid investments

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 3 | |

Six Circles Ultra Short Duration Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited) (continued)

combined with flexibility to implement opportunistic ideas across fixed income markets. The majority of the Fund’s assets were invested into the more liquid segments of the fixed income market, with approximately 96% of the Fund invested in instruments with maturities of 3 years and under as of June 30, 2020.

The Adviser allocates to the two Sub-Advisers in a diversified manner, with the expectation that the Sub-Advisers will capitalize on the opportunities present in the segment of the fixed income market that their specific mandate is focused on.

The Core Ultra Short allocation, which comprised approximately 70% of the Fund as of June 30, 2020, invests in a diversified fixed income portfolio on the shorter end of the U.S. fixed income market, balancing income against credit quality, within the context of the broader portfolio.

The Global Markets allocation, which comprised approximately 30% of the Fund as of June 30, 2020, has a broad investment universe, seeking total return opportunities within the global fixed income markets.

| | | | | | | | | | | | |

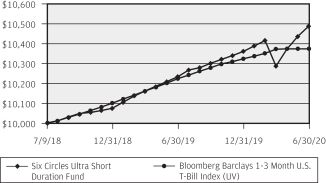

AVERAGE ANNUAL TOTAL RETURNS

AS OF JUNE 30, 2020 | |

| | | 6 Months* | | | 1 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles Ultra Short Duration Fund | | | 1.22 | % | | | 2.37 | % | | | 2.43 | % |

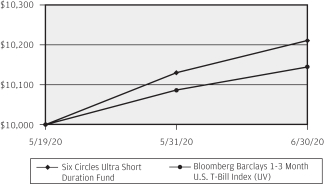

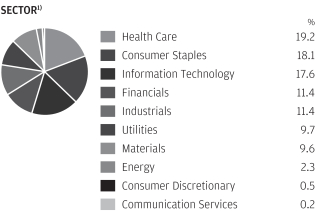

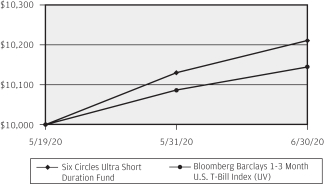

GROWTH OF $10,000 REPORT (07/9/18 TO 06/30/20)

| 1) | | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.41% and 0.25% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles Ultra Short Duration Fund and the Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index from July 9, 2018 to June 30, 2020. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index measures the performance of Treasury securities and is selected by a Market Value process. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | |

| | | |

| 4 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

Six Circles Tax Aware Ultra Short Duration Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 1.13% | |

| iMoneyNet Tax-Free National Institutional Money Market Index | | | 0.39% | |

| |

| Net Assets as of 6/30/2020 (In Thousands) | | $ | 781,043 | |

| Duration | | | 0.81 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles Tax Aware Ultra Short Duration Fund (the “Fund”) seeks to generate current income consistent with capital preservation. Invests at least 50% of its net assets in municipal securities, the income from which is exempt from federal income tax. The Fund also may invest in taxable instruments. Allocates assets among securities with various maturities which, under normal market conditions, will not exceed an average effective portfolio duration of two years.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”). The Adviser currently allocates Fund assets to the following Sub-Advisers:

| • | | Goldman Sachs Asset Management, L.P. (“Goldman”)* |

| • | | Mellon Investments Corporation (“Mellon”) |

| • | | Pacific Investment Management Company LLC (“PIMCO”) |

*During the reporting period, the Adviser has reduced Goldman’s allocated portion and strategy of the Fund to zero

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2020 through June 30, 2020, the Fund posted a positive return on an absolute basis, and outperformed relative to the iMoneyNet Tax-Free National Institutional Money Market (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely-recognized index.

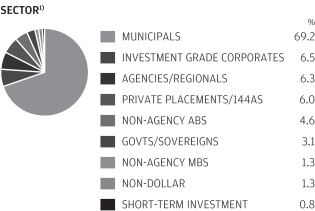

By sector composition, Municipal Bonds and Investment Grade Credit were the largest sector exposures in the Fund on a look-through basis and comprised approximately 69% and 7% of the Fund, respectively, at the end of the reporting period. Both of these exposures contributed to the Fund’s performance on an absolute basis.

On allocation level, both of the Fund’s allocations — Global Markets and Core Municipal Ultra Short — contributed to the Fund’s return on an absolute basis during the reporting period.

HOW WAS THE FUND POSITIONED?

At the start of the reporting period, the Fund was allocated to three Sub-Advisers across various sectors, credit ratings, maturity buckets, and regional exposures. During the reporting period, the Adviser reduced the Municipal Conservative Income allocation of the Fund to zero and added to the Core Municipal Ultra Short allocation, given that market volatility resulting from the spread of COVID-19 created significant opportunities in areas of the fixed income market other than what the Municipal Conservative Income allocation targeted. At the end of the reporting period the Fund was allocated to two Sub-Advisers as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Core Municipal Ultra Short (Mellon) | | | 70 | % |

| Global Markets (PIMCO) | | | 30 | |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at June 30, 2020 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of June 30, 2020. The portfolio allocation is subject to change. |

Within the fixed income allocation on the broader Portfolio level, the Adviser prefers high-quality liquid investments combined with flexibility to implement opportunistic ideas across fixed income markets. The majority of the Fund’s assets were invested into the more liquid segments of the fixed income market, with approximately 94% of the Fund invested into

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 5 | |

Six Circles Tax Aware Ultra Short Duration Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited) (continued)

instruments with maturities of three years and under as of June 30, 2020.

The Adviser allocates to the two Sub-Advisers in a diversified manner, with the expectation that the Sub-Advisers will capitalize on the opportunities present in the segment of the fixed income market that their specific mandate is focused on.

The Core Municipal Ultra Short allocation, which comprised approximately 70% of the Fund as of June 30, 2020, invests in a diversified fixed income portfolio on the shorter end of the U.S. municipal fixed income market, balancing income against credit quality, within the context of the broader portfolio.

The Global Markets allocation, which comprised approximately 30% of the Fund as of June 30, 2020, has a broad investment universe, seeking total return opportunities within the global taxable fixed income markets.

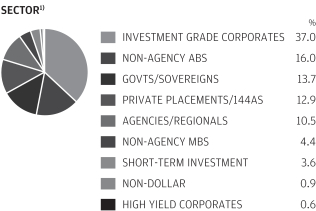

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF JUNE 30, 2020 | |

| | | 6 Months* | | | 1 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles Tax Aware Ultra Short Duration Fund | | | 1.13 | % | | | 1.89 | % | | | 1.82 | % |

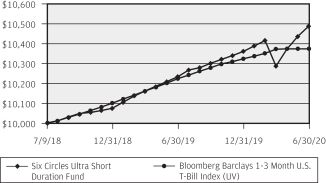

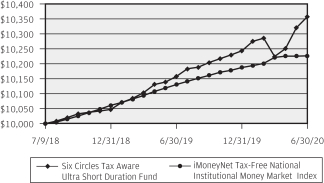

GROWTH OF $10,000 REPORT (07/9/18 TO 06/30/20)

| 1) | | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.37% and 0.21% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles Tax Aware Ultra Short Duration Fund and the iMoneyNet Tax-Free National Institutional Money Market Index from July 9, 2018 to June 30, 2020. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the iMoneyNet Tax-Free National Institutional Money Market Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The iMoneyNet Tax-Free National Institutional Money Market Index is an average of all tax-free and municipal, U.S.-domiciled institutional and retail money market funds. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | |

| | | |

| 6 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

Six Circles U.S. Unconstrained Equity Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 1.89% | |

| MSCI USA Index | | | (2.16%) | |

| |

| Net Assets as of 6/30/2020 (In Thousands) | | $ | 11,268,152 | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles U.S. Unconstrained Equity Fund (the “Fund”) seeks to provide capital appreciation. Invests at least 80% of its net assets in equity securities issued by U.S. companies and other instruments with economic characteristics similar to equity securities issued by U.S. companies. The Fund is generally unconstrained by any particular capitalization, style or industry sector.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”), actively allocates the Fund’s investments among a range of indexed investment strategies that are managed by the current sub-adviser, BlackRock Investment Management, LLC (the “Sub-Adviser” or “BlackRock”). For each indexed investment strategy, the Sub-Adviser seeks to replicate the performance of an index or sub-index selected by the Adviser. The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2020 through June 30, 2020 (the “reporting period”), the Fund posted a positive return on an absolute basis, and outperformed relative to the MSCI USA Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely-recognized index.

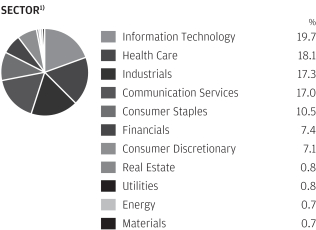

Industrials, Financials and Communication Services sectors comprised approximately 47% of the Fund’s sector exposure on a look-through basis at the end of the reporting period, and were the Fund’s largest sector overweights relative to the Index. During the reporting period, Communication Services and Industrials contributed to the Fund’s performance on an absolute basis, while Financials detracted. All the three sectors contributed to the fund’s performance relative to the index.

Information Technology and Consumer Discretionary sectors comprised approximately 24% of the Fund’s sector exposure on a look-through basis at the end of the reporting period, and were the Fund’s largest sector underweights relative to the Index. Both sectors contributed to the Fund’s performance on an absolute basis. While Consumer Discretionary contributed to the fund’s performance relative to index, Information Technology detracted.

The allocation to Dividend Growth, which the Adviser initiated as a way to obtain exposure to companies capable of consistently raising their dividend payments, was the largest detractor from the Fund’s return on an absolute basis during the reporting period. The Adviser eliminated the allocation to Dividend Growth during the reporting period.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund was allocated to ten strategies managed by one Sub-Adviser, across various sector, sub-industry, and factor exposures as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| USA | | | 38 | % |

| U.S. Interactive Media & Services | | | 12 | |

| U.S. Financials | | | 9 | |

| U.S. Machinery | | | 9 | |

| U.S. Pharmaceuticals | | | 7 | |

| U.S. Software | | | 7 | |

| U.S. Railroads | | | 6 | |

| U.S. Beverages | | | 5 | |

| U.S. Biotechnology | | | 4 | |

| U.S. Internet Retail | | | 3 | |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at June 30, 2020 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of June 30, 2020. The portfolio allocation is subject to change. |

Allocation to Broad USA comprised approximately 38% of the Fund as of June 30, 2020. Within the context of the broader

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 7 | |

Six Circles U.S. Unconstrained Equity Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited) (continued)

Portfolios, the Adviser believes that the allocation provides ability to tactically allocate to broad U.S. large cap exposure.

Allocation to U.S. Interactive Media & Services, which focuses on companies engaged in content and information creation or distribution through proprietary platforms, where revenues are derived primarily through pay-per-click advertisements, is trading at what the Adviser believes is a reasonable price-to-earnings ratio, and was approximately 12% of the Fund as of June 30, 2020.

Allocation to the U.S. Financials comprised approximately 9% of the Fund as of June 30, 2020. The Adviser believes that the sector remains significantly below February highs, evaluating potential credit losses and high revolver utilization and believes capital levels and dividend coverage are not at risk.

Allocation to the U.S. Machinery was approximately 9% of the Fund as of June 30, 2020. The Adviser believes that the Industrials sub-industry focused on production of machinery will continue re-rating after having reached trough levels earlier in the year.

Allocation to U.S. Pharmaceuticals and U.S. Biotechnology comprised approximately 7% and 4% of the Fund respectively, as of June 30, 2020. The Adviser believes that the market is overestimating the risks that potential policy changes would have, given the industry’s long-term growth tailwinds.

Allocation to U.S. Software and U.S. Internet Retail provides what the Adviser believes is a multi-year opportunity for the leaders in this space to take advantage of businesses shifting workloads onto Cloud-based platforms. These exposures collectively comprised approximately 10% of the Fund as of June 30, 2020.

Allocation to U.S. Railroads was approximately 6% of the Fund’s exposure as of June 30, 2020 and reflects the Adviser’s belief that these companies are in a position to improve margins as they increase volumes. The sector is at an attractive entry point after de-rating.

Allocation to U.S. Beverages was approximately 5% of the Fund’s exposure as of June 30, 2020 and reflects the Adviser’s belief that major players of this sector are going through structural changes and are set to improve free cash flow conversion.

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF JUNE 30, 2020 | |

| | | 6 Months* | | | 1 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles U.S. Unconstrained Equity Fund | | | 1.89 | % | | | 10.88 | % | | | 7.65 | % |

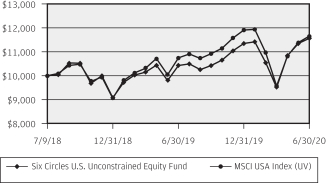

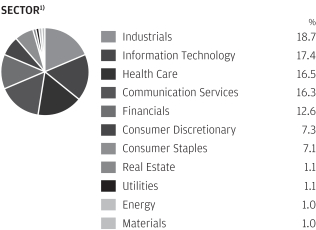

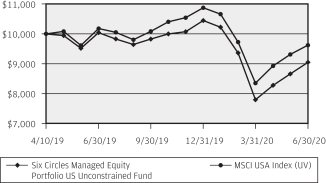

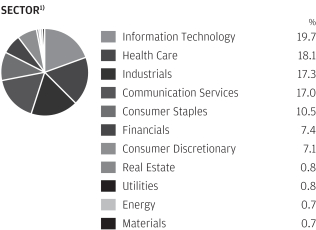

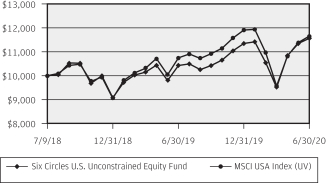

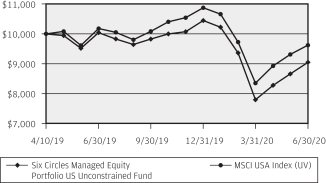

GROWTH OF $10,000 REPORT (07/9/18 TO 06/30/20)

| 1) | | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.29% and 0.08% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles U.S. Unconstrained Equity Fund and the MSCI USA Index from July 9, 2018 to June 30, 2020. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the MSCI USA Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The MSCI USA Index is designed to measure the performance of the large and mid-cap segments of the U.S. market. With 616 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the United States. Investors cannot invest directly in an index.

| | | | | | |

| | | |

| 8 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with

respect this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 9 | |

Six Circles International Unconstrained Equity Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | (14.49%) | |

| MSCI World ex USA Index | | | (11.49%) | |

| |

| Net Assets as of 6/30/2020 (In Thousands) | | $ | 5,503,368 | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles Six Circles International Unconstrained Equity Fund (the “Fund”) seeks to provide capital appreciation. Invests at least 80% of its net assets in equity securities and other instruments with economic characteristics similar to equity securities. Primarily invests in the equity securities of non-U.S. companies and is generally unconstrained by any particular capitalization, style, sector, region or country.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”), actively allocates the Fund’s investments among a range of indexed investment strategies that are managed by the current sub-adviser, BlackRock Investment Management, LLC (the “Sub-Adviser” or “BlackRock”). For each indexed investment strategy, the Sub-Adviser seeks to replicate the performance of an index or sub-index selected by the Adviser. The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

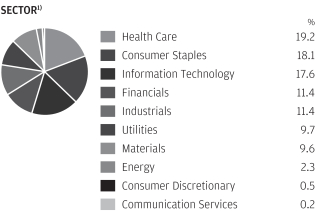

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2020 through June 30, 2020 (the “reporting period”), the Fund posted a negative return on an absolute basis, and underperformed the MSCI World ex USA Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely-recognized index.

Information Technology, Industrials and Health Care sectors comprised approximately 66% of the Fund’s sector exposure on a look-through basis at the end of the reporting period, and were the Fund’s largest sector overweights relative to the Index. While Health Care and Information Technology contributed to the Fund’s performance on an absolute basis, Industrials detracted. All three sectors detracted from the Fund’s performance relative to the Index.

The allocation to European Mid Cap was removed by the Adviser during the reporting period.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund was allocated to eight strategies managed by one Sub-Adviser, across various sector and sub-industry exposures as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Europe | | | 27 | % |

| Europe Pharmaceuticals | | | 18 | |

| European Capital Goods | | | 18 | |

| Europe ex-UK Utilities | | | 8 | |

| Europe Food, Beverage & Tobacco | | | 8 | |

| European Info Technology | | | 8 | |

| Korea Tech Hrdw Stor & Periphrls | | | 8 | |

| Taiwan Semis & Semi Equip | | | 5 | |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at June 30, 2020 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of June 30, 2020. The portfolio allocation is subject to change. |

Allocation to Broad Europe comprised approximately 27% of the Fund as of June 30, 2020. Within the context of the broader Portfolios, the Adviser believes that the allocation provides ability to tactically allocate to broad Europe large cap exposure.

Allocation to Europe Pharmaceuticals comprised approximately 18% of the Fund as of June 30, 2020 and provides what the Adviser believes to be a defensive exposure with attractive fundamentals, within the context of the broader Portfolios.

The Adviser believes that the European Capital Goods allocation provides exposure to diversified companies that could benefit from a rebound in economic data. This allocation was approximately 18% of the Fund as of June 30, 2020.

The Adviser believes that allocation to Europe ex-UK Utilities serves as a defensive position with exposure to renewable energy, which helps diversify against European Energy

| | | | | | |

| | | |

| 10 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

positions and provides a growth dynamic to the sector. This allocation was approximately 8% of the Fund as of June 30, 2020.

The Adviser believes that allocation to Europe Food, Beverage & Tobacco serves as a defensive anchor in the broader Portfolios with better fundamentals and valuations than many other defensive anchors. This allocation was approximately 8% of the Fund as of June 30, 2020.

Allocation to Europe Information Technology, which allows the Adviser to access specific exposures within the Technology sector, was approximately 8% of the Fund as of June 30, 2020.

The Adviser believes that the allocation to Korea Technology Hardware, Software and Peripherals provides exposure to a strong player within the global technology supply chain. The allocation was approximately 8% of the Fund as of June 30, 2020.

Allocation to Taiwan Semiconductors and Semiconductors Equipment provides exposure that the Adviser believes is supported by secular tailwinds and is more attractive than its U.S. counterparts. This allocation comprised approximately 5% of the Fund as of June 30, 2020.

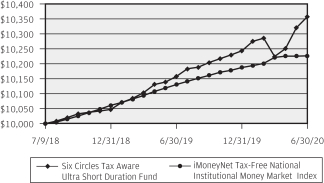

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF JUNE 30, 2020 | |

| | | 6 Months* | | | 1 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles International Unconstrained Equity Fund | | | (14.49 | )% | | | (11.41 | )% | | | (8.14 | )% |

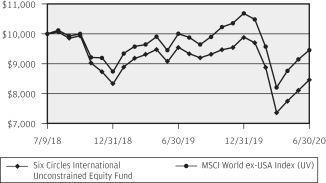

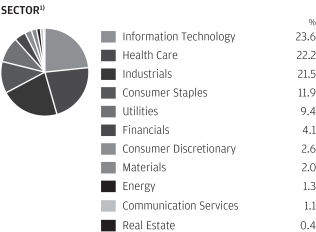

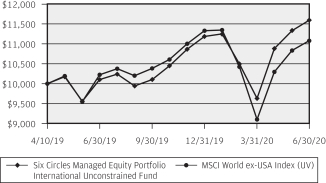

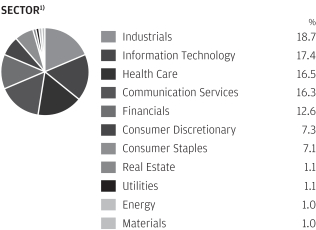

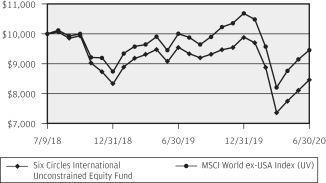

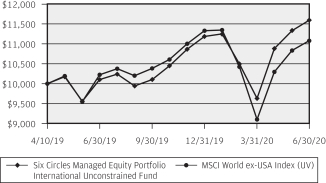

GROWTH OF $10,000 REPORT (07/9/18 TO 06/30/20)

| 1) | | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.33% and 0.13% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles International Unconstrained Equity Fund and the MSCI World ex-USA Index from July 9, 2018 to June 30, 2020. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the MSCI World ex-USA Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The MSCI World ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries—excluding the United States. With 987 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Investors cannot invest directly in an index.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 11 | |

Six Circles International Unconstrained Equity Fund

FUND COMMENTARY

Period January 1, 2020 Through June 30, 2020 (Unaudited) (continued)

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

International investing has a greater degree of risk and increased volatility due to political and economic instability of some overseas markets. Changes in currency exchange rates and different accounting and taxation policies outside the U.S. can affect returns.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively,

the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | |

| | | |

| 12 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

Six Circles Global Bond Fund

FUND COMMENTARY

Period May 19, 2020 (Fund Inception Date) Through June 30, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 1.18% | |

| Bloomberg Barclays Global-Aggregate Index - Hedged USD | | | 1.04% | |

| |

| Net Assets as of 6/30/2020 (In Thousands) | | $ | 50,566 | |

| Duration | | | 5.88 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Seeks to provide total return. Invests mainly in a global portfolio of investment grade fixed income securities with varying maturities across government, corporate, and securitized fixed income sectors. The fund will also allocate across regions including the US, Pan-European, and Asia Pacific.

INVESTMENT APPROACH

The Fund was launched on May 19, 2020.

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”). The Adviser currently allocates Fund assets to the following Sub-Advisers:

| • | | BlackRock Investment Management, LLC (“BlackRock”) |

| • | | Pacific Investment Management Company LLC (“PIMCO”) |

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

Since its launch on May 19, 2020 through June 30, 2020, the Fund posted positive returns on an absolute basis, and outperformed relative to the Bloomberg Barclays Global Aggregate Index (the “Hedged Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely-recognized index.

By sector composition, Investment grade were the largest sector exposure in the Fund on a look-through basis and comprised approximately 100% of the Fund at the end of the reporting period, with the Fund being overweight this sector relative to the Index. Core Bonds contributed to the Fund’s performance on an absolute basis during the reporting period.

Below Investment grade comprised approximately 1% of the Fund’s exposure on a look-through basis at the end of the reporting period, with the Fund being underweight this sector relative to the Index. During the reporting period, exposure to below investment grade contributed to the Fund’s performance on an absolute basis.

On the sleeve level, the Fund’s allocation to Global Credit was the largest contributor, while the allocation to U.S. Government was the largest detractor from the Fund’s return on an absolute basis during the reporting period.

HOW WAS THE FUND POSITIONED?

As the Fund was launched on May 19, 2020, changes to the Fund were limited given the brief reporting period. At the end of the reporting period, the Fund was allocated to three Sub-Advisers across various sectors, credit ratings, maturity buckets, and regional exposures.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Global Credit (PGIM, Inc.) | | | 20 | % |

| Global Government (PGIM, Inc.) | | | 20 | |

| Asian Pacific Government (BlackRock) | | | 10 | |

| Global Securitized (PIMCO) | | | 10 | |

| Pan-European Government (BlackRock) | | | 10 | |

| U.S. Credit (BlackRock) | | | 10 | |

| U.S. Government (BlackRock) | | | 10 | |

| U.S. Securitized (BlackRock) | | | 10 | |

| * | | As the Fund launched on May 19, 2020, its performance history is limited and may not reflect how the Fund will perform over longer periods. The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at June 30, 2020 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of June 30, 2020. The portfolio allocation is subject to change. |

Allocation to Global Credit comprised approximately 20% of the Fund as of June 30, 2020, and provides what the Adviser believes to be a full tracking error, flexible access point to a broad range global corporate bonds across different regions, sectors, and credit qualities.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 13 | |

Six Circles Global Bond Fund

FUND COMMENTARY

Period May 19, 2020 (Fund Inception Date) Through June 30, 2020 (Unaudited) (continued)

The Adviser believes that the allocation to Global Government provides full tracking error access to a broad range of government bonds across different regions. The allocation was approximately 20% of the Fund as of June 30, 2020.

Allocations to Asia Pacific Government and Pan-European Government each comprised approximately 10% of the Fund as of June 30, 2020 and provide what the Adviser believes is a low tracking error, tactical way to allocate to government bonds within these regions.

Allocation to Global Securitized comprised approximately 10% of the Fund as of June 30, 2020 and provides what the Adviser believes to be full tracking error, flexible access to a broad range of securitized debt across different regions, sectors, and credit qualities.

Allocations to U.S. Credit, U.S. Government, and U.S. Securitized each comprised approximately 10% of the Fund as of June 30, 2020. These sleeves provide what the Adviser believes is a low tracking error, tactical way to allocate within these sectors.

| | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF JUNE 30, 2020 | |

| | | Since

Inception

(May 19, 2020) | |

| Six Circles Global Bond Fund | | | 1.18 | % |

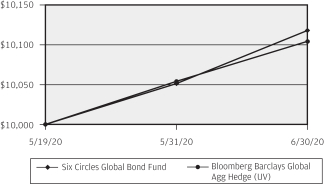

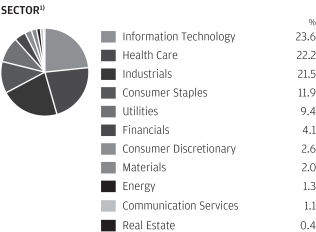

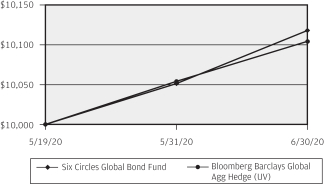

GROWTH OF $10,000 REPORT (05/19/20 TO 06/30/20)

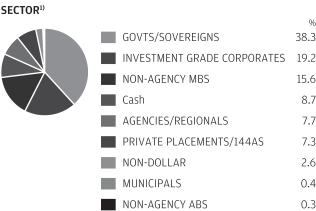

| 1) | | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.42% and 0.25% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on May 19, 2020

The graph illustrates comparative performance for $10,000 invested in the Six Circles Global Bond Fund and the Bloomberg Barclays Global Aggregate Index- Hedged USD Index from May 19, 2020 to June 30, 2020. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays Global Aggregate Index- Hedged USD Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Bloomberg Barclays Global Aggregate Index provides a broad-based measure of the global investment-grade fixed income markets. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party Involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages._

| | | | | | |

| | | |

| 14 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

Six Circles Tax Aware Bond Fund

FUND COMMENTARY

Period May 19, 2020 (Fund Inception Date) Through June 30, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 2.14% | |

| Bloomberg Barclays 1-15 Year Municipal Bond Index | | | 1.47% | |

| |

| Net Assets as of 6/30/2020 (In Thousands) | | | $34,738 | |

| Duration | | | 4.64 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Seeks to provide after-tax total return. Invests at least 50% in municipal securities (across varying maturity ranges), the income from which is exempt from federal income tax. The Fund also may invest in taxable instruments.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”). The Adviser currently allocates Fund assets to the following Sub-Advisers:

| • | | Capital International Inc. (“Capital”) |

| • | | Nuveen Asset Management, LLC (“Nuveen”) |

| • | | Wells Capital Management Incorporated (“WellsCap”) |

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

Since its launch on May 19, 2020 through June 30, 2020, the Fund posted positive returns on an absolute basis, and out-performed relative to the Bloomberg Barclays Municipal Bond Blend 1-15 Year Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely-recognized index.

By sector composition, Investment grade were the largest sector exposure in the Fund on a look-through basis and comprised approximately 89% of the Fund at the end of the reporting period. This sector contributed to the Fund’s performance on an absolute basis during the reporting period.

Below Investment grade was approximately 1% of the Fund’s exposure on a look-through basis at the end of the reporting

period, with the Fund being underweight this sector relative to the Index. During the reporting period, exposure to below Investment grade contributed to the Fund’s performance on an absolute basis.

On the sleeve level, all the four allocations contributed to the fund’s performance on an absolute basis, with allocation to Municipal allocation managed by Nuveen being the largest contributor during the reporting period.

HOW WAS THE FUND POSITIONED?

As the Fund was launched on May 19, 2020, changes to the Fund were limited given the brief reporting period. At the end of the reporting period, the Fund was allocated to three Sub-Advisers across various sectors, credit ratings, maturity buckets, and regional exposures.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Short Duration Municipal (Capital Group) | | | 29 | % |

| Municipals (Nuveen) | | | 28 | |

| Municipals (WellsCap) | | | 28 | |

| Intermediate Duration Municipal (Capital Group) | | | 15 | |

| * | | As the Fund launched on May 19, 2020, its performance history is limited and may not reflect how the Fund will perform over longer periods. The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at June 30, 2020 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of June 30, 2020. The portfolio allocation is subject to change. |

Allocations to Short Duration Municipal and Intermediate Duration Municipal comprised approximately 29% and 15% of the Fund, respectively, as of June 30, 2020. These allocations provide what the Adviser believes to be low tracking error, flexible access points to municipal debt within short and intermediate maturity ranges.

The Adviser believes that the allocations to Municipal strategies sub-advised by Nuveen and WellsCap provide full tracking error, flexible access a broad range of municipals across different sectors and credit qualities. Each of these allocations were approximately 28% of the Fund as of June 30, 2020.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 15 | |

Six Circles Tax Aware Bond Fund

FUND COMMENTARY

Period May 19, 2020 (Fund Inception Date) Through June 30, 2020 (Unaudited) (continued)

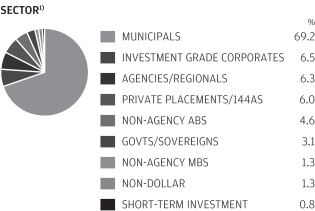

| | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF JUNE 30, 2020 | |

| | | Since

Inception

(May 19, 2020) | |

| Six Circles Tax Aware Bond Fund | | | 2.14 | % |

GROWTH OF $10,000 REPORT (05/19/20 TO 06/30/20)

| 1) | | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.39% and 0.24% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on May 19, 2020

The graph illustrates comparative performance for $10,000 invested in the Six Circles Tax Aware Bond Fund and the Bloomberg Barclays 1-15 Year Municipal Bond Index from May 19, 2020 to June 30, 2020. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays 1-15 Year Municipal Bond Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Bloomberg Barclays 1-15 Year Municipal Bond Index consists of a broad selection of investment grade general obligation and revenue bonds of maturities ranging from one year to 17 years. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGra w-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | |

| | | |

| 16 | | | | SIX CIRCLES TRUST | | JUNE 30, 2020 |

Six Circles Ultra Short Duration Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2020 (Unaudited)

(Amounts in U.S. Dollars, unless otherwise noted)

(Amounts in thousands, except number of Futures contracts)

| | | | | | | | |

| SECURITY DESCRIPTION | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Asset-Backed Securities — 15.0% | | | | | | | | |

American Express Credit Account Master Trust, Series 2018-4, Class A, 2.99%, 12/15/2023 | | | 3,375 | | | | 3,453 | |

Anchorage Capital CLO Ltd., (Cayman Islands), | | | | | | | | |

Series 2015-7A, Class AR2, (ICE LIBOR USD 3 Month + 1.09%), 2.11%, 01/28/2031 (e) (aa) | | | 577 | | | | 563 | |

Series 2016-8A, Class AR, (ICE LIBOR USD 3 Month + 1.00%), 1.89%, 07/28/2028 (e) (aa) | | | 1,850 | | | | 1,815 | |

Apidos CLO XXI, (Cayman Islands), | | | | | | | | |

Series 2015-21A, Class A1R, (ICE LIBOR USD 3 Month + 0.93%), 2.07%, 07/18/2027 (e) (aa) | | | 1,000 | | | | 989 | |

ARI Fleet Lease Trust, Series 2017-A, Class A2, 1.91%, 04/15/2026 (e) | | | 12 | | | | 12 | |

Atlas Senior Loan Fund III Ltd., (Cayman Islands), Series 2013-1A, Class AR, (ICE LIBOR USD 3 Month + 0.83%), 1.22%, 11/17/2027 (e) (aa) | | | 542 | | | | 531 | |

Atrium XII, (Cayman Islands), Series 12A, Class AR, (ICE LIBOR USD 3 Month + 0.83%), 1.93%, 04/22/2027 (e) (aa) | | | 992 | | | | 973 | |

B2R Mortgage Trust, Series 2016-1, Class A, 2.57%, 06/15/2049 (e) | | | 1,085 | | | | 1,088 | |

BA Credit Card Trust, Series 2017-A2, Class A2, 1.84%, 01/17/2023 | | | 1,480 | | | | 1,483 | |

Battalion CLO X Ltd., (Cayman Islands), Series 2016-10A, Class A1R, (ICE LIBOR USD 3 Month + 1.25%), 2.27%, 01/24/2029 (e) (aa) | | | 1,500 | | | | 1,471 | |

BlueMountain CLO Ltd., (Cayman Islands), Series 2012-2A, Class AR2, (ICE LIBOR USD 3 Month + 1.05%), 1.43%, 11/20/2028 (e) (aa) | | | 2,100 | | | | 2,055 | |

BMW Canada Auto Trust, (Canada), | | | | | | | | |

Series 2019-1A, Class A1, 2.15%, 10/20/2021 (e) | | CAD | 939 | | | | 695 | |

Series 2020-1A, Class A1, 1.96%, 09/20/2022 (e) | | CAD | 1,946 | | | | 1,442 | |

Burnham Park CLO Ltd., (Cayman Islands), Series 2016-1A, Class AR, (ICE LIBOR USD 3 Month + 1.15%), 2.29%, 10/20/2029 (e) (aa) | | | 500 | | | | 491 | |

Capital One Multi-Asset Execution Trust, | | | | | | | | |

Series 2017-A4, Class A4, 1.99%, 07/17/2023 | | | 1,615 | | | | 1,620 | |

Series 2019-A1, Class A1, 2.84%, 12/15/2024 | | | 5,000 | | | | 5,195 | |

CarMax Auto Owner Trust, | | | | | | | | |

Series 2017-1, Class A3, 1.98%, 11/15/2021 | | | 65 | | | | 65 | |

Series 2017-2, Class A3, 1.93%, 03/15/2022 | | | 176 | | | | 176 | |

Series 2017-3, Class A3, 1.97%, 04/15/2022 | | | 487 | | | | 489 | |

Series 2018-4, Class A3, 3.36%, 09/15/2023 | | | 1,950 | | | | 2,011 | |

| | | | | | | | |

| SECURITY DESCRIPTION | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

| | | | | | | | |

Series 2019-1, Class A2A, 3.02%, 07/15/2022 | | | 522 | | | | 525 | |

Series 2019-3, Class A3, 2.18%, 08/15/2024 | | | 1,000 | | | | 1,029 | |

CBAM Ltd., (Cayman Islands), Series 2017-3A, Class A, (ICE LIBOR USD 3 Month + 1.23%), 2.36%, 10/17/2029 (e) (aa) | | | 1,140 | | | | 1,120 | |

Chesapeake Funding II LLC, | | | | | | | | |

Series 2018-2A, Class A1, 3.23%, 08/15/2030 (e) | | | 1,195 | | | | 1,217 | |

Series 2019-1A, Class A1, 2.94%, 04/15/2031 (e) | | | 1,025 | | | | 1,041 | |

Chrysler Capital Auto Receivables Trust, Series 2016-BA, Class A4, 1.87%, 02/15/2022 (e) | | | 197 | | | | 197 | |

CIFC Funding Ltd., (Cayman Islands), Series 2014-5A, Class A1R2, (ICE LIBOR USD 3 Month + 1.20%), 2.33%, 10/17/2031 (e) (aa) | | | 750 | | | | 734 | |

Citibank Credit Card Issuance Trust, Series 2017-A8, Class A8, 1.86%, 08/08/2022 | | | 1,185 | | | | 1,187 | |

CNH Equipment Trust, | | | | | | | | |

Series 2019-A, Class A2, 2.96%, 05/16/2022 | | | 305 | | | | 307 | |

Series 2020-A, Class A2, 1.08%, 07/17/2023 | | | 1,030 | | | | 1,032 | |

Discover Card Execution Note Trust, | | | | | | | | |

Series 2019-A2, Class A, (ICE LIBOR USD 1 Month + 0.27%), 0.45%, 12/15/2023 (aa) | | | 1,500 | | | | 1,502 | |

Drive Auto Receivables Trust, Series 2019-4, Class A3, 2.16%, 05/15/2023 | | | 810 | | | | 816 | |

Enterprise Fleet Financing LLC, Series 2018-2, Class A2, 3.14%, 02/20/2024 (e) | | | 802 | | | | 810 | |

Ford Auto Securitization Trust, (Canada), Series 2019-BA, Class A2, 2.32%, 10/15/2023 (e) | | CAD | 1,000 | | | | 740 | |

Ford Credit Auto Owner Trust, Series 2017-B, Class A3, 1.69%, 11/15/2021 | | | 438 | | | | 439 | |

Ford Credit Floorplan Master Owner Trust A, | | | | | | | | |

Series 2018-3, Class A2, (ICE LIBOR USD 1 Month + 0.40%), 0.58%, 10/15/2023 (aa) | | | 3,000 | | | | 2,972 | |

Series 2019-1, Class A, 2.84%, 03/15/2024 | | | 1,400 | | | | 1,438 | |

Series 2019-3, Class A2, (ICE LIBOR USD 1 Month + 0.60%), 0.78%, 09/15/2024 (aa) | | | 2,480 | | | | 2,438 | |

Galaxy XXIII CLO Ltd., (Cayman Islands), Series 2017-23A, Class A, (ICE LIBOR USD 3 Month + 1.28%), 2.30%, 04/24/2029 (e) (aa) | | | 720 | | | | 709 | |

GM Financial Automobile Leasing Trust, Series 2019-1, Class A2A, 2.91%, 04/20/2021 | | | 397 | | | | 398 | |

GM Financial Consumer Automobile Receivables Trust, Series 2020-1, Class A3, 1.84%, 09/16/2024 | | | 2,600 | | | | 2,661 | |

Home Equity Asset Trust, Series 2005-8, Class M1, (ICE LIBOR USD 1 Month + 0.43%), 0.61%, 02/25/2036 (aa) | | | 1,319 | | | | 1,313 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | SIX CIRCLES TRUST | | | | | 17 | |

Six Circles Ultra Short Duration Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2020 (Unaudited) (continued)

(Amounts in U.S. Dollars, unless otherwise noted)

(Amounts in thousands, except number of Futures contracts)

| | | | | | | | |

| SECURITY DESCRIPTION | | PRINCIPAL

AMOUNT($) | | | VALUE($) | |

Asset-Backed Securities — continued | | | | | | | | |

Honda Auto Receivables Owner Trust, | | | | | | | | |

Series 2018-4, Class A2, 2.98%, 05/17/2021 | | | 147 | | | | 147 | |

Series 2018-4, Class A3, 3.16%, 01/17/2023 | | | 700 | | | | 716 | |

Series 2020-1, Class A3, 1.61%, 04/22/2024 | | | 2,500 | | | | 2,561 | |

Series 2020-2, Class A3, 0.82%, 07/15/2024 | | | 3,660 | | | | 3,685 | |

ICG US CLO Ltd., (Cayman Islands), Series 2015-1A, Class A1R, (ICE LIBOR USD 3 Month + 1.14%), 2.28%, 10/19/2028 (e) (aa) | | | 1,000 | | | | 979 | |

Legacy Mortgage Asset Trust, Series 2019-GS3, Class A1, SUB, 3.75%, 04/25/2059 (e) | | | 263 | | | | 267 | |

Marlette Funding Trust, Series 2018-4A, Class A, 3.71%, 12/15/2028 (e) | | | 302 | | | | 305 | |