Exhibit (a)(5)(C)

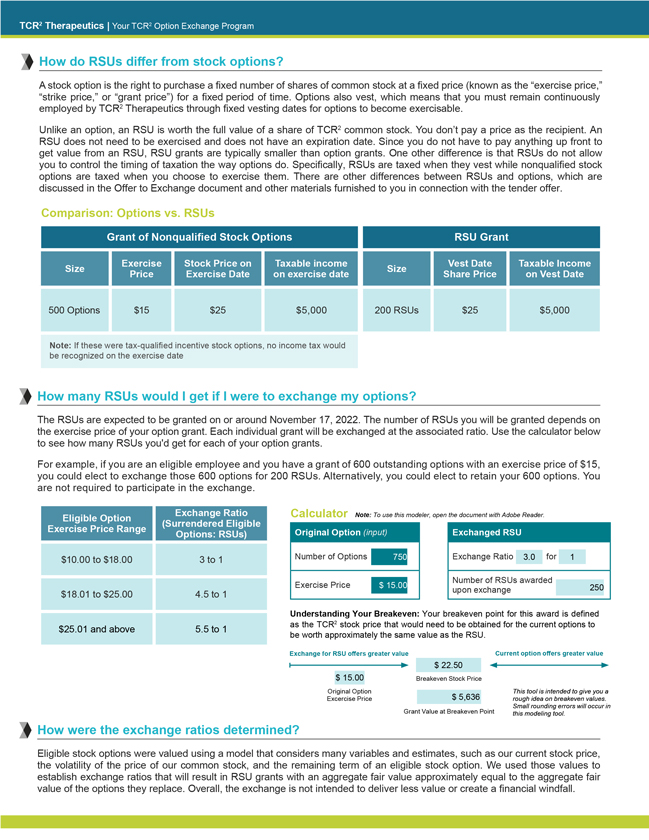

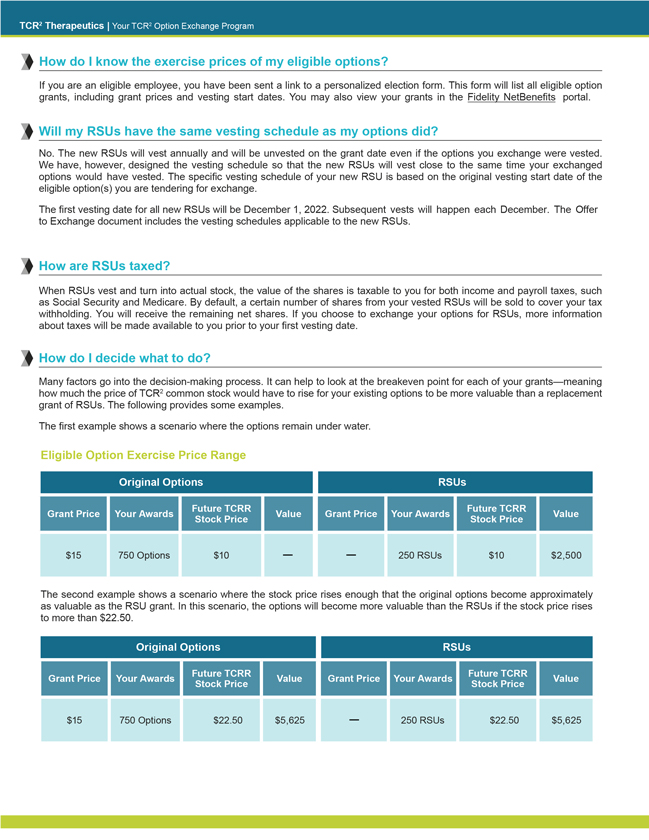

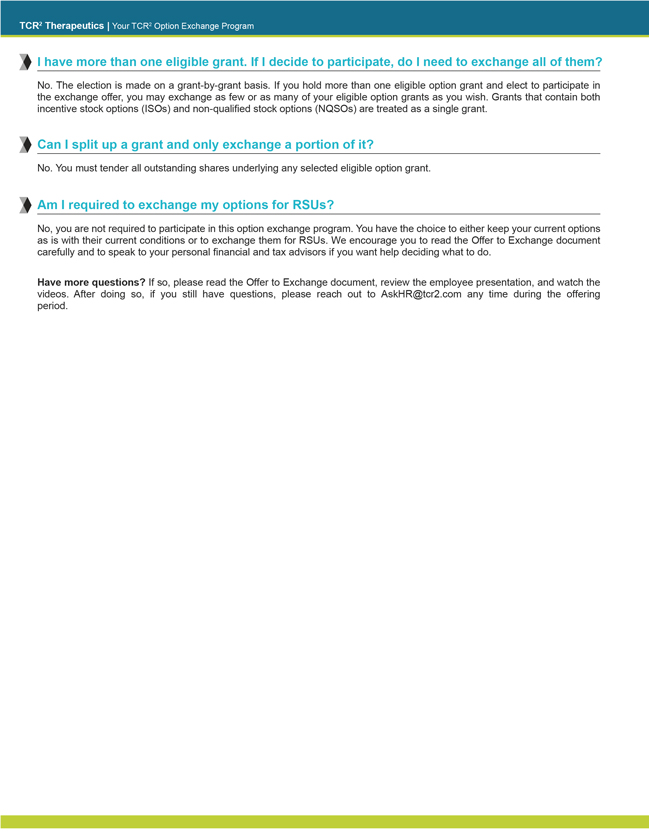

Your TCR2 Option Exchange Program offers employees who hold stock options with an exercise price of $10 or more the chance to exchange those options for fewer restricted stock units (RSU). The new RSU grant will be approximately equal in value from an accounting standpoint. The offer to exchange (which is called a “tender offer”) is open from October 19, 2022, until 11:59 p.m. Eastern Time on November 16, 2022. This Q&A is intended to help explain the program. The formal offer to exchange contains all details of the offer, and you should review it in full before deciding whether to participate. Ultimately, the choice to participate is up to you. Why are we doing this? Our employees are our most important asset and the key to our success. Equity in TCR2, granted in the form of stock options or restricted stock units (RSUs), is a critical component of your Total Rewards package. These grants serve to incentivize, motivate, and reward performance so we deliver on our strategic, operational, and financial goals as an organization. Currently, most of the stock options held by employees are under water. Considerably underwater options may present no meaningful value to you. Underwater Option A stock option whose exercise price is greater than the market price of the underlying stock. For example, options granted at $10 a share are under water if the stock is trading at $2 a share. To remedy this, we are offering you the choice to exchange your significantly underwater options for fewer, but approximately equal-in-value, RSUs. Because RSUs do not have a fixed exercise price like stock options, they can never go under water. If you decide to participate in the exchange, your original stock options will be canceled, and in their place you will receive RSUs with different terms and conditions, including a different vesting schedule. The number of new RSUs that you will receive is based on a set, upfront rate of exchange intended to be approximately equal in value to your underwater stock options. Who is eligible? To participate, you must be actively employed by TCR2 Therapeutics and hold outstanding stock options with an exercise price of $10 per share or more, granted under the TCR2 Therapeutics Inc. 2018 Stock Option and Incentive Plan. An employee who has submitted a notice of resignation or has been notified by TCR2 Therapeutics that their employment is being terminated, on or before the end of the tender offer period, is not eligible. What is an option exchange? An option exchange is an opportunity (but not a requirement) for eligible employees with eligible underwater options to agree to have their option grants canceled in exchange for RSUs of TCR2 stock. An option exchange is conducted through a tender offer, which is a formal process for a company to offer its securities to existing holders. Complete information regarding the option exchange and the tender offer can be found in the document titled “Offer to Exchange Eligible Options for New Restricted Stock Units,” dated October 19, 2022 (or the “Offer to Exchange”). The tender offer has a deadline for completion, but you can change your election as many times as you like during the offering period, which is currently expected to expire on November 16, 2022. Will TCR2 offer option exchanges on a regular basis? No. This a unique opportunity largely driven by external market conditions. Given current circumstances, we believe this program is in the best interests of our employees and our shareholders. It provides our employees with appropriate incentives to achieve their performance goals so that we can achieve our overarching corporate goals. What is an RSU? An RSU is a right to receive a fixed number of shares of common stock at a fixed time in the future, as long as you remain continuously employed by TCR2. Once you reach the vest date, shares of TCR2 common stock are issued at no cost to you, other than withholding taxes associated with the RSU. The value you receive for an RSU upon issuance of the common stock will be based on the then-current TCR2 stock price. For more information on how RSUs work, see the example below or view these videos in Fidelity’s Stock Plan Resource Center.