Exhibit (a)(5)(D) 2 TCR Option Exchange Program October 2022 1 1

Agenda § Introductions and Overview § The Basics § How an Option Exchange Works § Eligibility § RSU Terms § Considering Your Choice § Important Disclaimers § Q&A 2

[REDACTED AS NOT RELEVANT TO EXCHANGE OFFER] 3

Offer to Exchange Overview 2 § Equity is an important component of your Total Rewards package at TCR § Many stock options granted before October 2021 are “under water” 2 • That means the exercise price is lower than the current TCR stock price § Significantly underwater stock options may not effectively incentivize, motivate and reward – and you are our most important asset § The Exchange Offer is an opportunity to trade underwater options for a smaller number of restricted stock units (RSUs) • Applies to options with $10 or higher exercise price § The current fair value of the new RSUs will be approximately equal to the current fair value of the exchanged stock options § You decide whether to keep or exchange 4

The Basics Understanding Types of Equity 5

What is a Stock Option? 2 Definition: A stock option is an option to purchase TCR stock in the future. “Option price, exercise price, grant price and strike price – 4 terms that mean the same thing – the price you pay for the option.” Price: The price is set Value: The value is Vesting: The process of at the grant date and “how much do we grow earning the right to equals stock price at from here?” exercise that time ◆ Time and continued service Exercise: The process Taxation: Gain only Expiration: 10 years of turning your options realized upon exercise from grant date into shares ◆ Tax event ◆ The last day you can exercise your option 6

What is a Restricted Stock Unit? 2 Definition: A grant valued in TCR stock that becomes stock at vest. Because RSUs do not have a fixed exercise price like stock options, they can never go under water. Price: Full-value Value: The value is the Vesting: The process of 2 shares. There is no full value of TCR stock turning units into shares price you pay as a ◆ Time and continued service recipient Release: Shares are Taxation: Taxable at Expiration: Doesn’t really released at vest vest apply. Unvested RSUs automatically. There is canceled if you leave the no exercise or decision. company 7

Examples: Options vs. RSUs Ethan has a grant of 500 Ellie has a grant of 200 stock options with a $15 RSUs. What does this exercise price. What does mean? this mean? • He has the right to purchase up to 500 shares of common stock at $15 • She will receive 200 shares of common stock at the current each, once the options are vested stock price, once the RSUs are vested • This right ends on the grant expiration date (or when he leaves the • Once vested, the RSUs convert to shares of stock and will company) belong to Ellie • To exercise all 500 vested options, he would pay $7,500 (500 x $15) • For example, if the stock is trading at $25 when the RSUs vest, the grant will be valued at $5,000 (200 x $25) at that • Options are valuable if the actual share price surpasses the exercise time price • Ellie may sell or hold onto the stock • For example, if Ethan sells the shares when the stock is trading at $25 (a $10 increase per share), his gain would be $5,000 (500 x $10) • Taxes are due at vest (on stock price at vest) and when sold (on investment gain) • Taxes are due at exercise (on the difference between the stock price at exercise and the exercise price) and when sold (on investment gain) 8

How an Option Exchange Works Offer to Exchange Options for RSUs 9

How an Option Exchange Works § Opportunity to exchange existing underwater options for restricted stock units (RSUs) • Eligible employees and eligible grants • Not required – you can retain all or some of your existing option grants • No one right answer § An underwater option is an option whose exercise price is above the current trading price of the stock • Yes – underwater options have ‘value’ • Stock could rebound above exercise price 2 § The replacement RSUs are worth the full value of a share of TCR stock • Will result in change of terms and fewer RSUs • One RSU becomes one share of stock at vesting § The option exchange rate is set up front • Exchange ratios were finalized as of the start of the tender offer based on the stock price at that time • Different levels of exercise prices have different exchange rates • Overall, the exchange is not intended to deliver less value or create a financial windfall 10

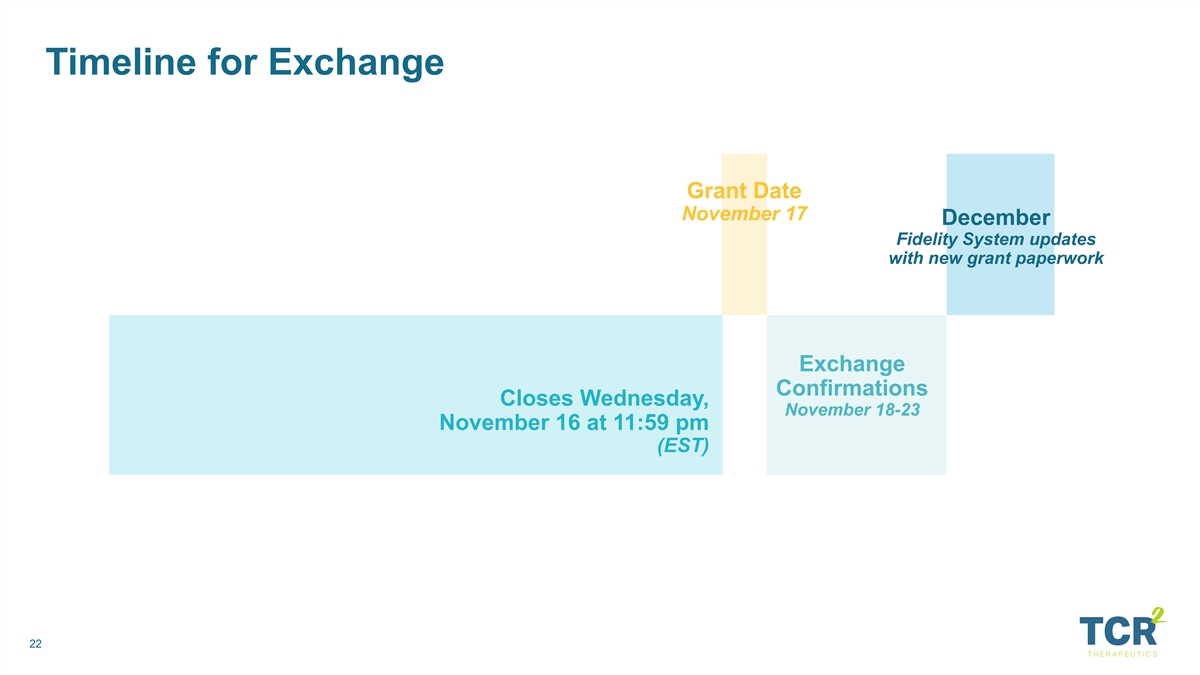

How an Option Exchange Works § The offer to exchange is managed through a formal process called a “tender offer” th th § Offer is open from October 19 – November 16 § All elections must be made by 11:59 pm ET on November 16, 2022 § If you choose to exchange • When the tender offer is completed, your original award is canceled, and you receive the new award th • New grant(s) will be effective on or around November 17 st • First vesting opportunity is December 1 § If you do not elect to exchange • Your original award will remain with original terms and conditions § Important: You can change your election as often as you want until the tender period closes. When it closes, your decision is locked. There will be no exceptions. 11

Option Exchange Materials § Offer to Exchange Eligible Options for New Restricted Stock Units document 2 § Your TCR Option Exchange Program Brochure § Education sessions (recording will be available) • October 20 at 11 a.m. ET • October 25 at 2 p.m. ET § Educational videos: 2 • TCR Therapeutics' Option Exchange Program Overview • Option Exchange Example • The Tender Offering 12

Eligibility 13

Eligible Employees Whose Options Can Be Exchanged? § Eligible participants • Active employees who hold grants with an exercise price of $10 or more • Including employees on leave of absence § Ineligible participants • Employees who resign or receive a notice of termination prior to the end of offer period • Non-employees, including non-employee board members • Employees who only hold grants with exercise prices less than $10 14

Eligible Options Outstanding as of Have a grant date Granted under the Held by an eligible the end of the tender strike price of $10 or 2018 Stock Option employee offering greater and Incentive Plan 15

RSU Terms 16

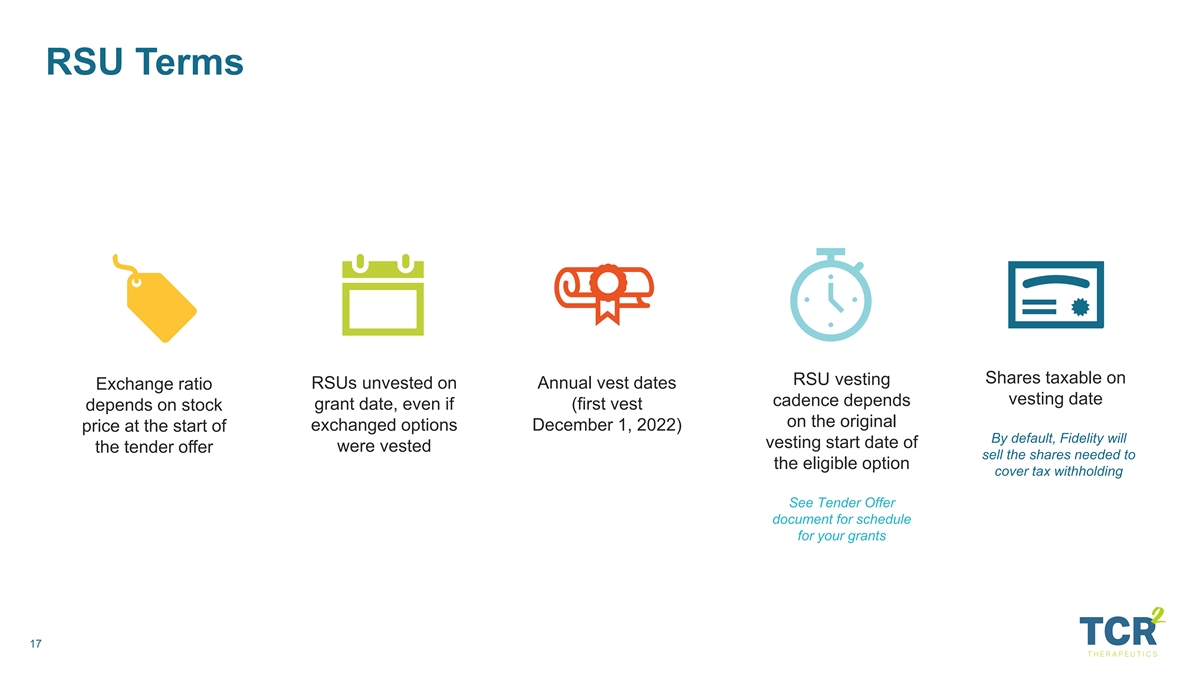

RSU Terms Shares taxable on RSU vesting RSUs unvested on Annual vest dates Exchange ratio vesting date cadence depends grant date, even if (first vest depends on stock on the original exchanged options December 1, 2022) price at the start of By default, Fidelity will vesting start date of the tender offer were vested sell the shares needed to the eligible option cover tax withholding See Tender Offer document for schedule for your grants 17

Ratios and Examples EXAMPLE 1 Current: Exchange Ratio 900 eligible options at Eligible Option (Surrendered Eligible Exercise Price Range $12 exercise price Options: RSUs)* Offer to Exchange: $10.00 to $18.00 3 to 1 Would receive 300 RSUs $18.01 to $25.00 4.5 to 1 (900 ÷ 3 = 300) $25.01 and above 5.5 to 1 EXAMPLE 2 *Ratios in your tender offer document Current: 900 eligible options at $32 exercise price Why are there different exchange ratios? If the stock is trading at $2, an option with a $10 price is worth more Offer to Exchange: than an option with a $20 price. Would receive 164 RSUs (900 ÷ 5.5 = 164) 18

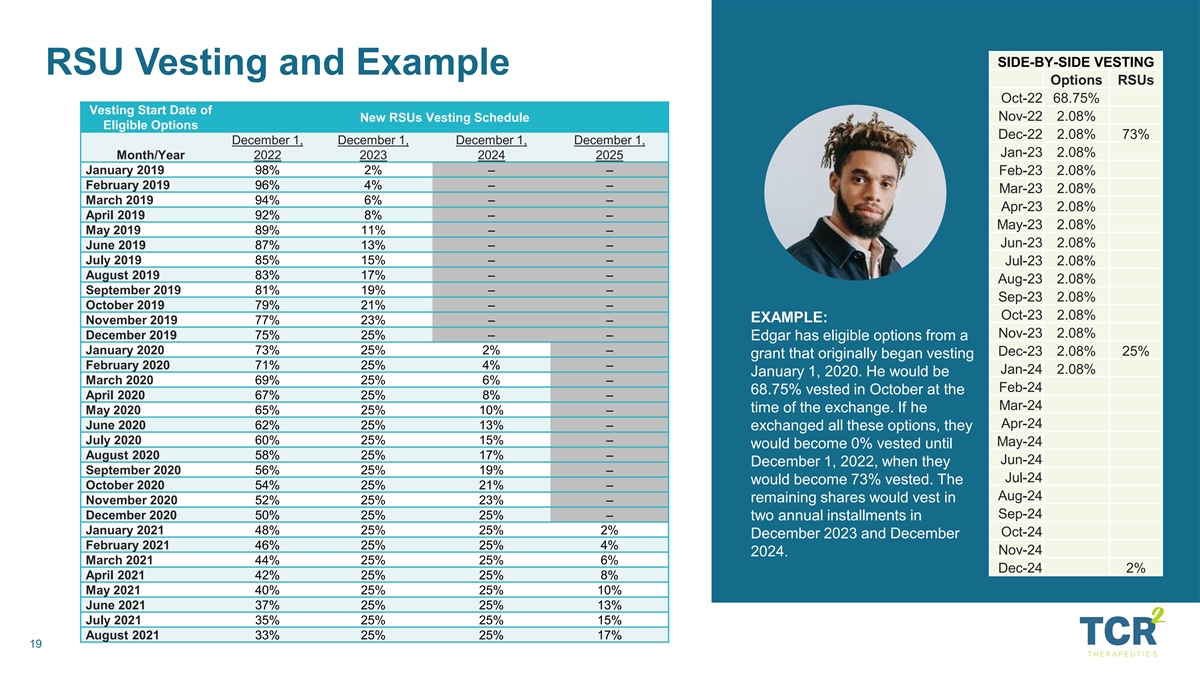

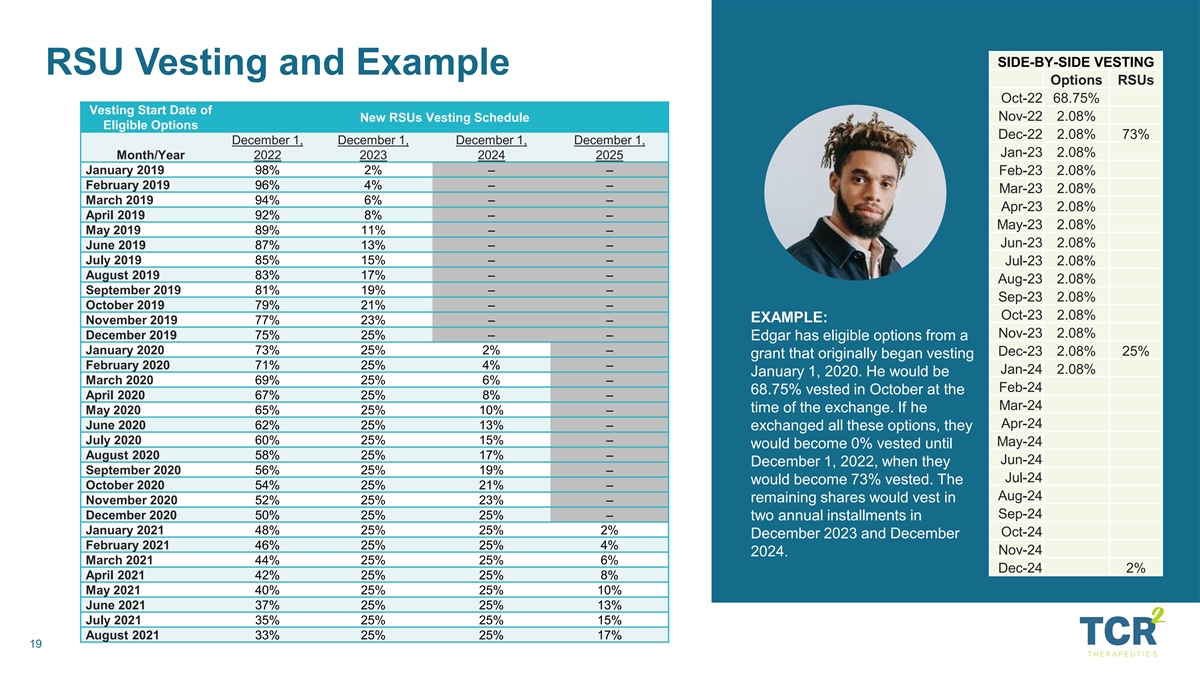

SIDE-BY-SIDE VESTING RSU Vesting and Example Options RSUs Oct-22 68.75% Vesting Start Date of Nov-22 2.08% New RSUs Vesting Schedule Eligible Options Dec-22 2.08% 73% December 1, December 1, December 1, December 1, Jan-23 2.08% Month/Year 2022 2023 2024 2025 January 2019 98% 2% – – Feb-23 2.08% February 2019 96% 4% – – Mar-23 2.08% March 2019 94% 6% – – Apr-23 2.08% April 2019 92% 8% – – May-23 2.08% May 2019 89% 11% – – Jun-23 2.08% June 2019 87% 13% – – July 2019 85% 15% – – Jul-23 2.08% August 2019 83% 17% – – Aug-23 2.08% September 2019 81% 19% – – Sep-23 2.08% October 2019 79% 21% – – Oct-23 2.08% EXAMPLE: November 2019 77% 23% – – Nov-23 2.08% December 2019 75% 25% – – Edgar has eligible options from a January 2020 73% 25% 2% – Dec-23 2.08% 25% grant that originally began vesting February 2020 71% 25% 4% – Jan-24 2.08% January 1, 2020. He would be March 2020 69% 25% 6% – Feb-24 68.75% vested in October at the April 2020 67% 25% 8% – Mar-24 time of the exchange. If he May 2020 65% 25% 10% – Apr-24 June 2020 62% 25% 13% – exchanged all these options, they July 2020 60% 25% 15% – May-24 would become 0% vested until August 2020 58% 25% 17% – Jun-24 December 1, 2022, when they September 2020 56% 25% 19% – Jul-24 would become 73% vested. The October 2020 54% 25% 21% – Aug-24 remaining shares would vest in November 2020 52% 25% 23% – Sep-24 December 2020 50% 25% 25% – two annual installments in January 2021 48% 25% 25% 2% Oct-24 December 2023 and December February 2021 46% 25% 25% 4% Nov-24 2024. March 2021 44% 25% 25% 6% Dec-24 2% April 2021 42% 25% 25% 8% May 2021 40% 25% 25% 10% June 2021 37% 25% 25% 13% July 2021 35% 25% 25% 15% August 2021 33% 25% 25% 17% 19

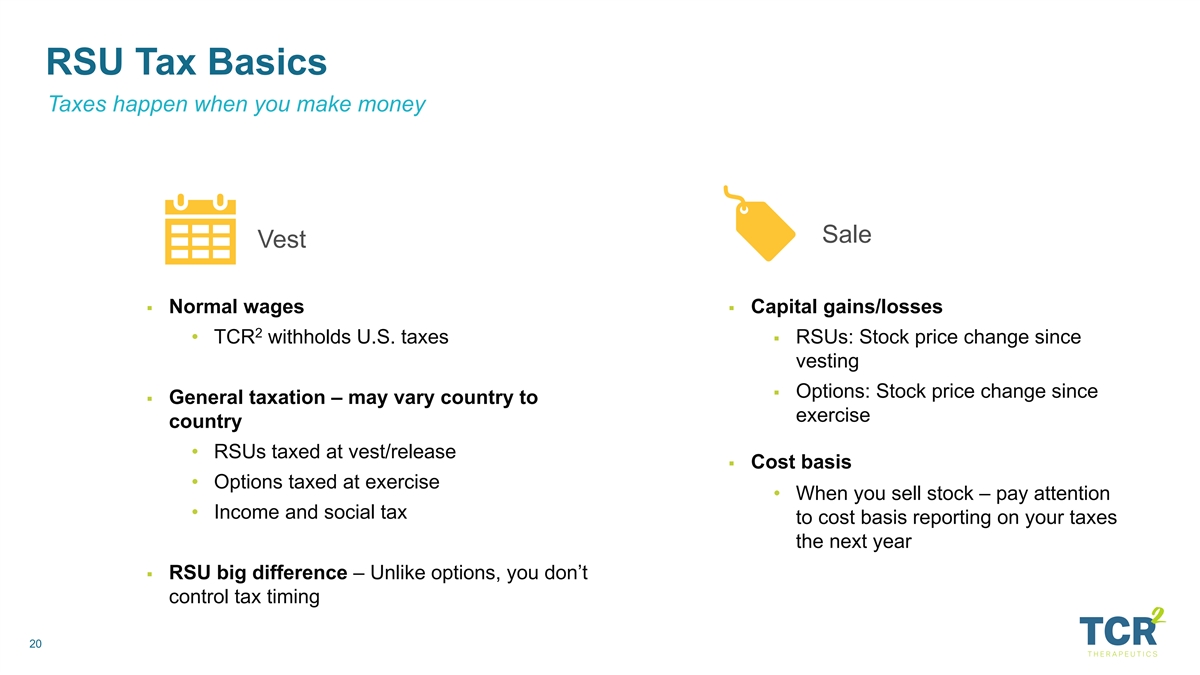

RSU Tax Basics Taxes happen when you make money Sale Vest § Normal wages§ Capital gains/losses 2 • TCR withholds U.S. taxes§ RSUs: Stock price change since vesting § Options: Stock price change since § General taxation – may vary country to exercise country • RSUs taxed at vest/release § Cost basis • Options taxed at exercise • When you sell stock – pay attention • Income and social tax to cost basis reporting on your taxes the next year § RSU big difference – Unlike options, you don’t control tax timing 20

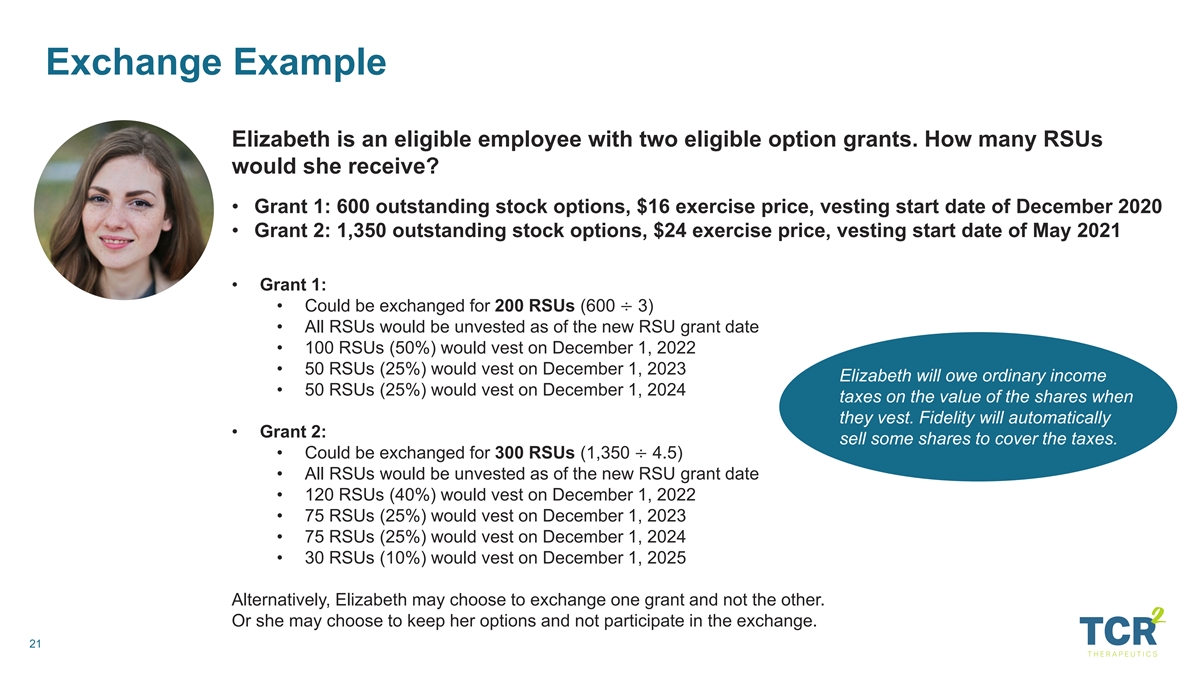

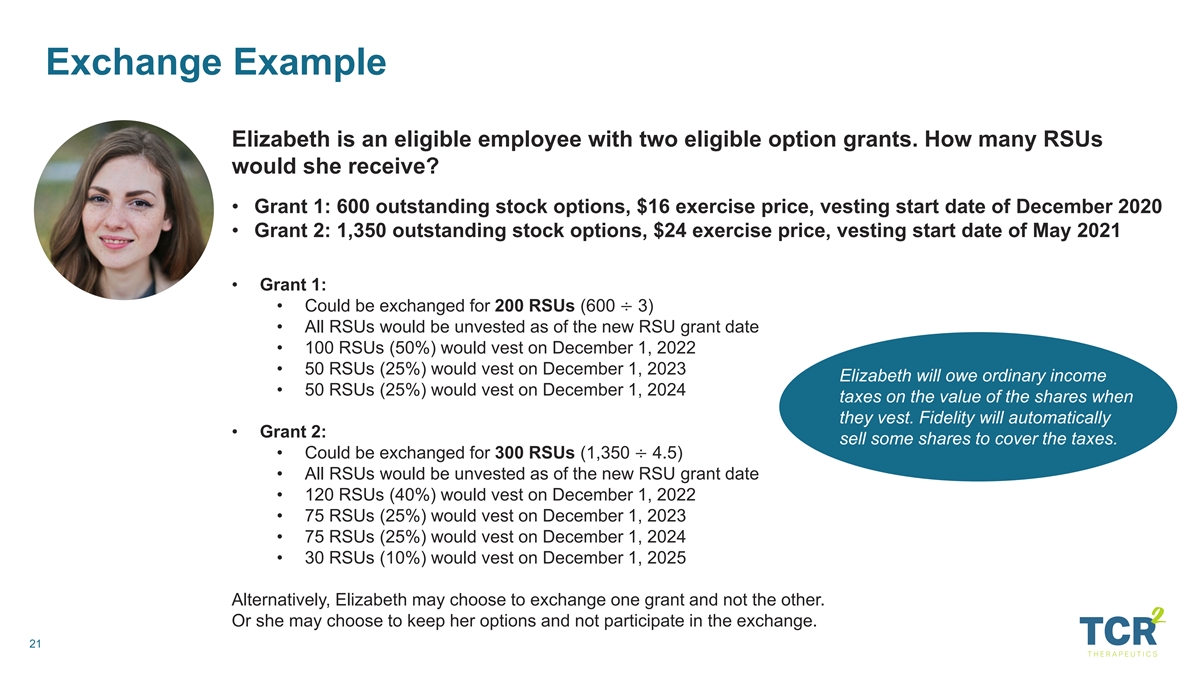

Exchange Example Elizabeth is an eligible employee with two eligible option grants. How many RSUs would she receive? • Grant 1: 600 outstanding stock options, $16 exercise price, vesting start date of December 2020 • Grant 2: 1,350 outstanding stock options, $24 exercise price, vesting start date of May 2021 • Grant 1: • Could be exchanged for 200 RSUs (600 ÷ 3) • All RSUs would be unvested as of the new RSU grant date • 100 RSUs (50%) would vest on December 1, 2022 • 50 RSUs (25%) would vest on December 1, 2023 Elizabeth will owe ordinary income • 50 RSUs (25%) would vest on December 1, 2024 taxes on the value of the shares when they vest. Fidelity will automatically • Grant 2: sell some shares to cover the taxes. • Could be exchanged for 300 RSUs (1,350 ÷ 4.5) • All RSUs would be unvested as of the new RSU grant date • 120 RSUs (40%) would vest on December 1, 2022 • 75 RSUs (25%) would vest on December 1, 2023 • 75 RSUs (25%) would vest on December 1, 2024 • 30 RSUs (10%) would vest on December 1, 2025 Alternatively, Elizabeth may choose to exchange one grant and not the other. Or she may choose to keep her options and not participate in the exchange. 21

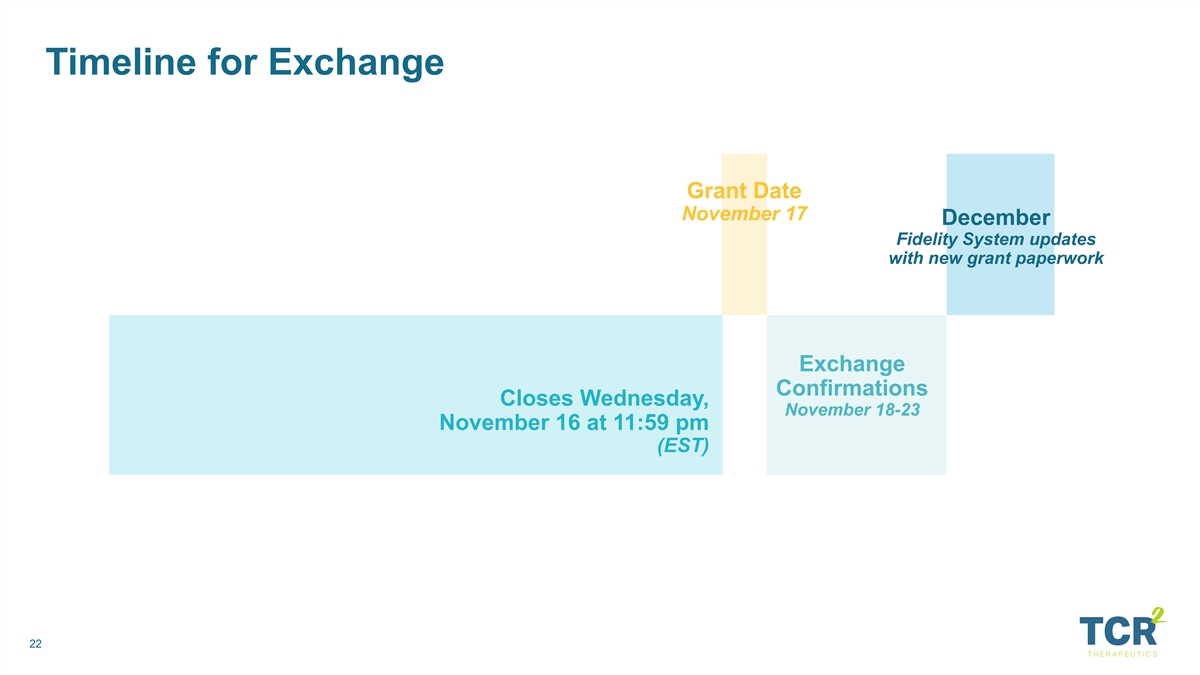

Timeline for Exchange Grant Date November 17 December Fidelity System updates with new grant paperwork Exchange Confirmations Closes Wednesday, November 18-23 November 16 at 11:59 pm (EST) 22

Process 2 § Personalized Election Form emailed to your TCR email address via DocuSign § If you wish to participate, complete the election form, sign it, and return using DocuSign § If you change your mind, you can submit a Notice of Withdrawal at any time (form available on Namely) § If you submit a Notice of Withdrawal, you will be issued a new Election Form through DocuSign § Your current election is locked when the tender offer period closes § Final exchange statements will be sent out by November 23 § You will be notified of your new award details when delivered via Fidelity system 23

Considering Your Choice 24

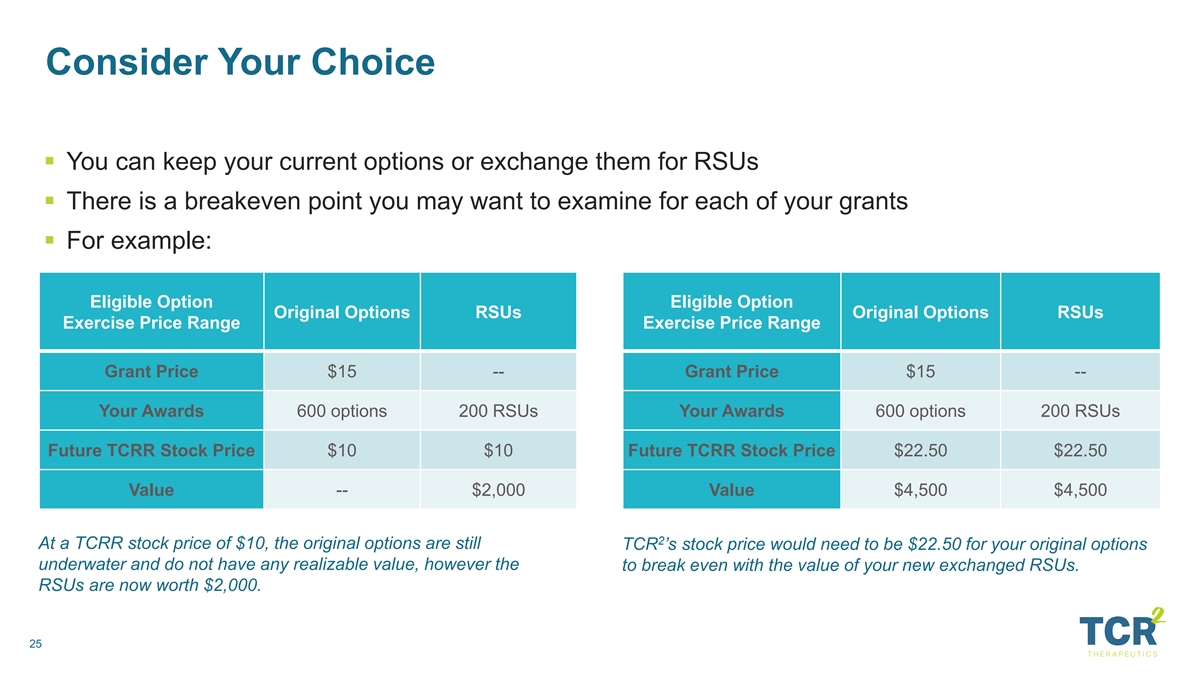

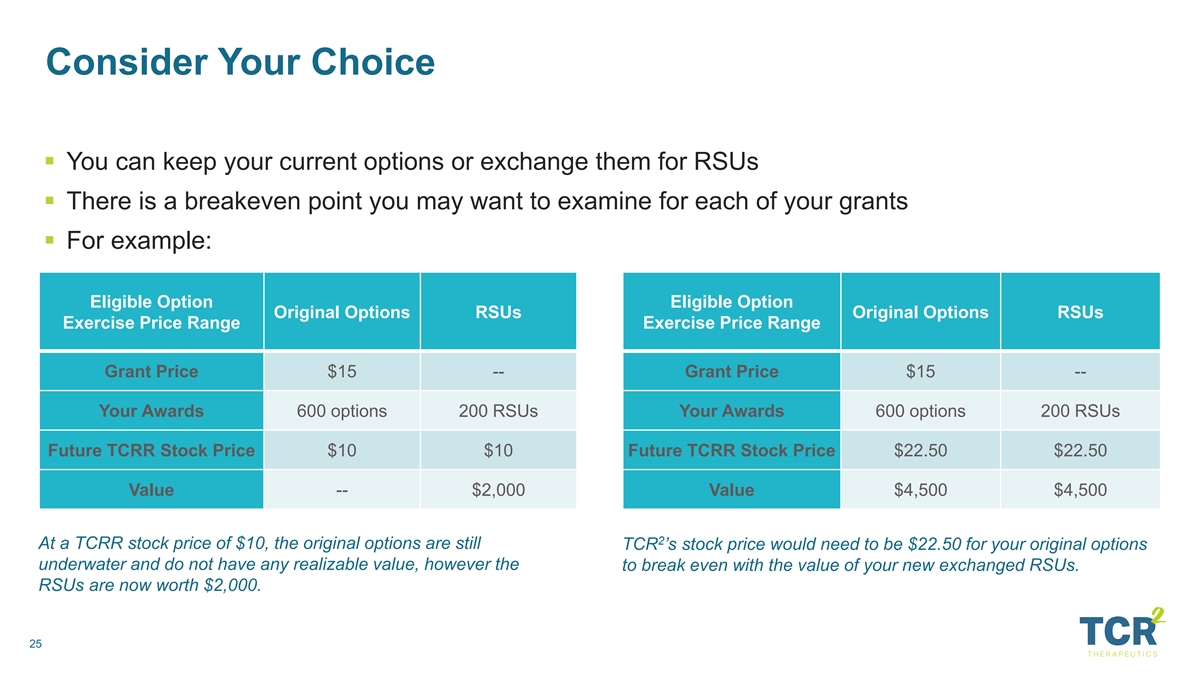

Consider Your Choice § You can keep your current options or exchange them for RSUs § There is a breakeven point you may want to examine for each of your grants § For example: Eligible Option Eligible Option Original Options RSUs Original Options RSUs Exercise Price Range Exercise Price Range Grant Price $15 -- Grant Price $15 -- Your Awards 600 options 200 RSUs Your Awards 600 options 200 RSUs Future TCRR Stock Price $10 $10 Future TCRR Stock Price $22.50 $22.50 Value -- $2,000 Value $4,500 $4,500 2 At a TCRR stock price of $10, the original options are still TCR ’s stock price would need to be $22.50 for your original options underwater and do not have any realizable value, however the to break even with the value of your new exchanged RSUs. RSUs are now worth $2,000. 25

Important Disclaimers 2 TCR Therapeutics cannot advise you on what to do – this is a financial decision that is entirely yours § A tender offer is regulated by the SEC and there are strict guidelines § If you ask for advice, we are required to say ‘read through your materials’ / ‘talk to your advisor’ § If you have questions, email AskHR@tcr2.com You must complete your tender offer on time § Return your Election Form by 11:59 pm ET on November 16, 2022 § You will receive an e-mail confirmation with your elections – keep it for documentation § This is a one-time event and is only 20 business days long – make time to review the materials 26

Q&A Send all questions to AskHR@tcr2.com 27

Q&A § Q: How were the exchange ratios determined? A: Eligible stock options were valued using a model that takes into account many variables and estimates, such as our current stock price, the volatility of the price of our common stock, and the remaining term of an eligible stock option. We used those values to establish exchange ratios that will result in RSU grants with an aggregate fair value approximately equal to the aggregate fair value of the options they replace. Overall, the exchange is not intended to deliver less value or create a financial windfall. § Q: How do I know the exercise price(s) of my eligible option(s)? A: If you are an eligible employee, you have been sent a link to a personalized election form. This form will list all eligible option grants, including their respective grant prices and vesting start dates. You may also view your grants in the Fidelity NetBenefits web portal. § Q: I have more than one eligible grant. If I decide to participate, do I need to exchange all of them? A: No. The election is made on a grant-by-grant basis. If you hold more than one eligible option grant and elect to participate in the exchange offer, you may exchange as few or as many of your eligible option grants as you wish. Grants that contain both Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NQSOs) are treated as a single grant. § Q: Can I split up a grant and only exchange a portion of it? A: No. You must tender all of the outstanding shares underlying any selected eligible option grant. § Q: Am I required to exchange my options for RSUs? A: No, you are not required to participate in this option exchange program. You have the choice to either keep your current options as is with their current conditions or to exchange them for RSUs. We encourage you to read the Offer to Exchange document carefully and to speak to your personal financial and tax advisors if you want help deciding what to do. § Q: What happens if I participate in the exchange and then leave the company? A: If you tender options in the exchange and leave the company before December 1, 2022, you will forfeit the grant, since no shares will be vested. On December 1, 2022, some portion of the RSUs will vest and will belong to you, even if you leave the company. Subsequent vest dates are on December 1, 2023, December 1, 2024, and December 1, 2025. See the Offer to Exchange document for the vesting schedule. 28