UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23417

X-Square Balanced Fund, LLC

(Exact name of Registrant as specified in charter)

Popular Center

209 Munoz Rivera, Suite 1111

San Juan, Puerto Rico 00918

(Address of Principal Executive Offices) (Zip code)

Joshua B. Deringer

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, Pennsylvania 19103

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: (787)282-1621

Date of fiscal year end: December 31

Date of reporting period: January 1, 2021 - December 31, 2021

Item 1. Report to Stockholders.

(a)

Table of Contents

| Shareholder Letter | 1 |

| Management Discussion of Fund Performance and Portfolio Update | 3 |

| Disclosure of Fund Expenses | 6 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 12 |

| Statement of Changes in Net Assets | 13 |

| Financial Highlights | 15 |

| Notes to Financial Statements | 18 |

| Report of Independent Registered Public Accounting Firm | 25 |

| Additional Information | 26 |

| Managers and Officers | 30 |

| X-Square Balanced Fund | Shareholder Letter |

| | December 31, 2021 (Unaudited) |

Dear Shareholder:

The X-Square Balanced Fund (the “Fund”) registered a 9.31% net gain for its fiscal year ended December 31, 2021.

The Fund

Fiscal year 2021 was marked by the economic recovery out of the COVID-19 global lockdown, supply chain turmoil, higher inflation, and heightened level of volatility, as measured by the S&P 500 Index (“SPX”) and the Volatility Index1 (“VIX”). During 2021, the world was hit by two major waves of COVID-19 led by the DELTA and OMICRON variants. The continued health emergency kept pressure on global supply chains, travel and the service industry. Interestingly, the commodity sector experienced a boom that brought down inventory to dangerously low levels in the base metals market as well as the energy markets. We believe that this market tightness for materials along with an easing COVID-19 epidemic, should continue to pressure prices resulting in higher readings of inflation for at least the next 12 months. We expect 2022 to be the year when the world exits the COVID-19 pandemic, travel fully recovers along with jet fuel consumption, and the Federal Reserve fights supply side driven inflation.

Fiscal year 2021 was another great year for the three main U.S. equity indices, the SPX, the Nasdaq Composite Index (“Nasdaq”), and the Dow Jones Industrial Average Index (“Dow”) posted double-digit gains for the year. Fixed Income, however, posted a loss during the same period as measured by the Bloomberg US Aggregate Bond Index. The fixed income portion of the Fund was invested on the short-end of the Treasury curve. This relatively low exposure to duration risk allowed the Fund to minimize its losses on the fixed income side of the portfolio. While sectors such as high-yield did generate a gain for the year, we believe it was best to avoid it given that credit spreads are artificially tight due to extremely loose monetary policy among major central banks. Moreover, the real estate sector within the Fund’s equity portfolio acted as a laggard during the period. Nonetheless, the great majority (i.e. information technology, financials, energy and industrials) generated a gain for fiscal year 2021.

Outlook

Consensus for the U.S. economy is that it will continue its expansion cycle in 2022, as measured by Gross Domestic Product (“GDP”). Nonetheless, we anticipate slower growth driven by less fiscal and monetary support. As this letter goes to print, the market is discounting at least 7 rate hikes consisting of 150 basis points by Q1 of 2023. Moreover, market participants expect inflation to start trending down from the latest 7.50% Consumer Price Index (“CPI”) print by Q4 of 2022 as the supply chain crisis abates. Nonetheless, inflation expectation surveys point to persistent higher prices. We believe this new period of less fiscal and monetary largess should lead to higher volatility across all asset classes as the market tries to balance out slower growth and inflation uncertainty.

In the past, this type of environment has led to a rotation resulting from downward repricing of growth stocks and an upward repricing of value stocks. This trend has already begun, as reflected in the energy and financial sectors’ outperformance over the SPX in 2021. In addition, the rotation has served as an acceleration of investment flows towards emerging market economies that are net exporters of commodities. Countries such as Brazil, Russia, Australia, and Chile should benefit from higher material prices. These commodity-driven capital inflows tend to favorably benefit the currency, stock and fixed-income markets of each respective country mainly driven by significantly larger account surpluses.

Past performance does not guarantee future results.

| Annual Report | December 31, 2021 | 1 |

| X-Square Balanced Fund | Shareholder Letter |

| | December 31, 2021 (Unaudited) |

Conclusion

The amount of stimulus provided in the U.S. and record low rates have positively impacted the economy and consumer confidence. This year the economy will need to find its own footing as monetary and fiscal measures put in place to fight off the COVID-19 pandemic are withdrawn. We plan to avoid credit risk on the fixed income side of the Fund’s portfolio and accentuate value stocks in the industries that tend to benefit from a rising rate monetary regime and a higher inflationary environment. Furthermore, as the New Year unfolds, we will monitor our portfolio companies diligently. The X-Square team is thankful and grateful for your patience and continued support and trust. We wish you a happy and prosperous New Year.

Best regards,

X-Square Capital, LLC

| 1 | Volatility Index - The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPXSM) call and put options. On a global basis, it is one of the most recognized measures of volatility — widely reported by financial media and closely followed by a variety of market participants as a daily market indicator. |

| | Management Discussion of Fund |

| X-Square Balanced Fund | Performance and Portfolio Update |

| | December 31, 2021 (Unaudited) |

Average Annual Total Returns (as of December 31, 2021)

| | 1 Year | Since Inception* |

| X- Square Balanced Fund - A - NAV | 9.31% | 11.64% |

| X- Square Balanced Fund - A - LOAD | 5.23% | 9.68% |

| X- Square Balanced Fund - C - NAV | 8.53% | 10.78% |

| X- Square Balanced Fund - C - LOAD | 7.53% | 10.78% |

| X- Square Balanced Fund - Institutional -NAV | 9.54%** | 11.92% |

| S&P 500 Total Return Index(a) | 28.71% | 24.65% |

| 60% S&P 500 and 40% Bloomberg | | |

| Barclays US Aggregate(b) | 15.86% | 15.84% |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the X-Square Balanced Fund (the "Fund”) shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. The table shown above does not reflect the dedication of taxes that a Shareholder would pay on Fund distributions or the redemption of Fund shares but does reflect the reinvestment of all dividends and distributions. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling (787) 282-1621 or by visiting www.xsquarecapital.com.

Fund performance reflects contractual reimbursements in effect. In their absence, performance would be reduced. X-Square Capital, LLC (the “Adviser”) has contractually agreed to reduce its fees and/or absorb expenses of the Fund through at least April 30, 2022, to ensure that Net Annual Operating Expenses will not exceed 2.75%, 3.50% and 2.50% of the Fund’s average daily net assets for Class A, Class C and Institutional Class, respectively. The Adviser may not terminate this waiver arrangement without the approval of the Fund’s Board of Managers.

| * | Fund’s inception date is November 1, 2019. |

| ** | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

| (a) | S&P 500® Total Return Index: the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. Total return assumes reinvestment of any dividends and distributions realized during a given time period. This index does not incur expenses and is not available for direct investment. |

| (b) | The 60/40 blend is composed of 60% Standard & Poor’s 500 Index (S&P) and 40% Bloomberg Barclays U.S. Aggregate Bond Index (BC Agg) and assumes monthly rebalancing. The S&P is an unmanaged index that is widely regarded as the standard for measuring large-cap U.S. stock market performance. The BC Agg is an unmanaged index that is widely regarded as a standard for measuring U.S. investment grade bond market performance. These indices do not incur expenses and are not available for direct investment. These indices include reinvestment of dividends and/or interest income. |

| Annual Report | December 31, 2021 | 3 |

| | Management Discussion of Fund |

| X-Square Balanced Fund | Performance and Portfolio Update |

| | December 31, 2021 (Unaudited) |

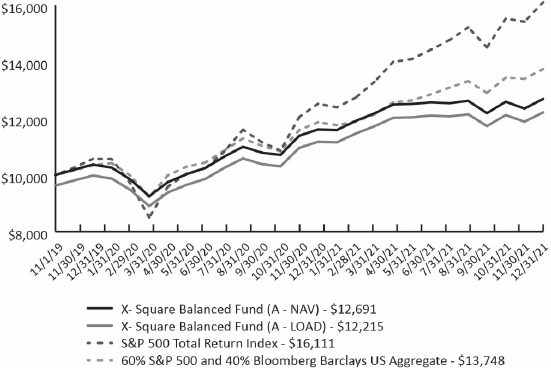

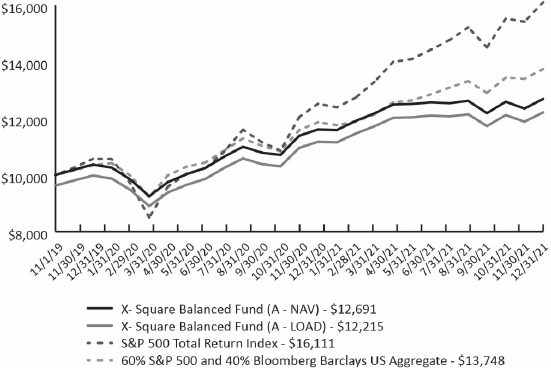

Growth of $10,000 (as of December 31, 2021)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

Top Ten Holdings (as a % of Net Assets)* as of December 31, 2021

| U.S. Treasury Note, 0.13%, 07/31/2022 | | | 25.29 | % |

| U.S. Treasury Note, 0.63%, 10/15/2024 | | | 4.44 | % |

| Suncor Energy, Inc. | | | 2.18 | % |

| Advanced Micro Devices, Inc. | | | 2.11 | % |

| Alphabet, Inc. | | | 1.82 | % |

| Costco Wholesale Corp. | | | 1.75 | % |

| Diamondback Energy, Inc. | | | 1.72 | % |

| Micron Technology, Inc. | | | 1.67 | % |

| Tractor Supply Co. | | | 1.55 | % |

| Activision Blizzard, Inc. | | | 1.52 | % |

| Top Ten Holdings | | | 44.05 | % |

| | Management Discussion of Fund |

| X-Square Balanced Fund | Performance and Portfolio Update |

| | December 31, 2021 (Unaudited) |

Portfolio Composition (as a % of Net Assets)* as of December 31, 2021

| Common Stock - US | | | 55.70 | % |

| Common Stock - Foreign | | | 13.38 | % |

| Government Bond | | | 30.27 | % |

| Other Assets in Excess of Liabilities | | | 0.65 | % |

| Net Assets | | | 100.00 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. Tables present indicative values only. |

| Annual Report | December 31, 2021 | 5 |

| X-Square Balanced Fund | Disclosure of Fund Expenses |

| | December 31, 2021 (Unaudited) |

Examples. As a shareholder of the X-Square Balanced Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including applicable redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on July 1, 2021 and held through December 31, 2021.

Actual Expenses. The first line under each class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period 7/1/21 to 12/31/21” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line under each class in the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| X-Square Balanced Fund | Disclosure of Fund Expenses |

| | December 31, 2021 (Unaudited) |

| | Beginning Account Value 7/1/2021 | Ending Account Value 12/31/21 | Expense Ratio | Expenses Paid During period 7/1/21 to 12/31/21(a) |

| Class A: | | | | |

| Actual Fund Return | $1,000.00 | $1,009.60 | 2.75% | $13.93 |

| Hypothetical Fund Return | $1,000.00 | $1,011.34 | 2.75% | $13.94 |

| Class C: | | | | |

| Actual Fund Return | $1,000.00 | $1,005.70 | 3.50% | $17.69 |

| Hypothetical Fund Return | $1,000.00 | $1,007.56 | 3.50% | $17.71 |

| Institutional Class: | | | | |

| Actual Fund Return | $1,000.00 | $1,010.40 | 2.50% | $12.67 |

| Hypothetical Fund Return | $1,000.00 | $1,012.60 | 2.50% | $12.68 |

| (a) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account values over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| Annual Report | December 31, 2021 | 7 |

| X-Square Balanced Fund | Schedule of Investments |

| | December 31, 2021 |

| Description | | Shares | | | Value | |

| COMMON STOCKS (69.08%) | | | | | | |

| COMMUNICATIONS (5.28%) | | | | | | |

| Activision Blizzard, Inc. | | | 7,332 | | | $ | 487,798 | |

| Alphabet, Inc., Class C(a) | | | 202 | | | | 584,505 | |

| Meta Platforms, Inc., Class A(a) | | | 1,340 | | | | 450,709 | |

| Zillow Group, Inc., Class C(a) | | | 2,688 | | | | 171,629 | |

| | | | | | | | 1,694,641 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY (13.29%) | | | | | | | | |

| Alibaba Group Holding, Ltd., Sponsored ADR(a) | | | 1,650 | | | | 196,004 | |

| Amazon.com, Inc.(a) | | | 118 | | | | 393,452 | |

| Chipotle Mexican Grill, Inc.(a) | | | 34 | | | | 59,441 | |

| Copart, Inc.(a) | | | 2,898 | | | | 439,395 | |

| Domino's Pizza, Inc. | | | 83 | | | | 46,839 | |

| General Motors Co.(a) | | | 6,532 | | | | 382,971 | |

| Home Depot, Inc. | | | 1,079 | | | | 447,796 | |

| Lennar Corp., Class A | | | 3,647 | | | | 423,636 | |

| MercadoLibre, Inc., Sponsored ADR (a) | | | 278 | | | | 374,855 | |

| PulteGroup, Inc. | | | 6,614 | | | | 378,056 | |

| TJX Cos., Inc. | | | 5,981 | | | | 454,078 | |

| Tractor Supply Co. | | | 2,087 | | | | 497,958 | |

| Vipshop Holdings, Ltd., ADR(a) | | | 22,355 | | | | 187,782 | |

| | | | | | | | 4,282,263 | |

| | | | | | | | | |

| CONSUMER STAPLES (9.17%) | | | | | | | | |

| Altria Group, Inc. | | | 7,192 | | | | 340,829 | |

| Calavo Growers, Inc. | | | 4,002 | | | | 169,685 | |

| Costco Wholesale Corp. | | | 992 | | | | 563,157 | |

| Dollar General Corp. | | | 1,854 | | | | 437,229 | |

| Mission Produce, Inc.(a) | | | 10,641 | | | | 167,064 | |

| Philip Morris International, Inc. | | | 4,259 | | | | 404,605 | |

| Target Corp. | | | 2,049 | | | | 474,221 | |

| Walmart, Inc. | | | 2,735 | | | | 395,727 | |

| | | | | | | | 2,952,517 | |

| | | | | | | | | |

| ENERGY (4.60%) | | | | | | | | |

| Diamondback Energy, Inc. | | | 5,122 | | | | 552,408 | |

| EOG Resources, Inc. | | | 2,557 | | | | 227,138 | |

| See Notes to Financial Statements. | |

| 8 | www.xsquarecapital.com |

| X-Square Balanced Fund | Schedule of Investments |

| | December 31, 2021 |

| Description | | Shares | | | Value | |

| ENERGY (continued) | | | | | | |

| Suncor Energy, Inc. | | | 28,001 | | | $ | 700,865 | |

| | | | | | | | 1,480,411 | |

| | | | | | | | | |

| FINANCIALS (8.74%) | | | | | | | | |

| Ally Financial, Inc. | | | 9,341 | | | | 444,725 | |

| Berkshire Hathaway, Inc., Class B(a) | | | 1,508 | | | | 450,891 | |

| Chubb, Ltd. | | | 2,119 | | | | 409,624 | |

| First BanCorp/Puerto Rico | | | 6,012 | | | | 82,845 | |

| JPMorgan Chase & Co. | | | 2,819 | | | | 446,389 | |

| Marsh & McLennan Cos., Inc. | | | 2,519 | | | | 437,853 | |

| OFG Bancorp | | | 3,525 | | | | 93,624 | |

| Popular, Inc. | | | 1,151 | | | | 94,428 | |

| Truist Financial Corp. | | | 6,033 | | | | 353,232 | |

| | | | | | | | 2,813,611 | |

| | | | | | | | | |

| HEALTH CARE (4.04%) | | | | | | | | |

| Amgen, Inc. | | | 1,602 | | | | 360,402 | |

| Bausch Health Cos., Inc.(a) | | | 11,163 | | | | 308,210 | |

| Johnson & Johnson | | | 2,378 | | | | 406,805 | |

| Teva Pharmaceutical Industries, Ltd., Sponsored ADR(a) | | | 28,065 | | | | 224,801 | |

| | | | | | | | 1,300,218 | |

| | | | | | | | | |

| INDUSTRIALS (6.05%) | | | | | | | | |

| Fastenal Co. | | | 6,437 | | | | 412,354 | |

| General Dynamics Corp. | | | 2,170 | | | | 452,381 | |

| Lockheed Martin Corp. | | | 1,003 | | | | 356,476 | |

| United Rentals, Inc.(a) | | | 1,125 | | | | 373,825 | |

| XPO Logistics, Inc.(a) | | | 4,622 | | | | 357,881 | |

| | | | | | | | 1,952,917 | |

| | | | | | | | | |

| MATERIALS (3.29%) | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 5,998 | | | | 250,297 | |

| Glencore PLC, ADR | | | 44,778 | | | | 451,362 | |

| Rio Tinto PLC, ADR | | | 2,831 | | | | 189,507 | |

| Vale SA, ADR | | | 12,032 | | | | 168,689 | |

| | | | | | | | 1,059,855 | |

| | | | | | | | | |

| TECHNOLOGY (13.70%) | | | | | | | | |

| Advanced Micro Devices, Inc.(a) | | | 4,720 | | | | 679,208 | |

| See Notes to Financial Statements. | |

| Annual Report | December 31, 2021 | 9 |

| X-Square Balanced Fund | Schedule of Investments |

| | December 31, 2021 |

| Description | | Shares | | | Value | |

| TECHNOLOGY (continued) | | | | | | |

| Akamai Technologies, Inc.(a) | | | 2,002 | | | $ | 234,314 | |

| Apple, Inc. | | | 2,297 | | | | 407,879 | |

| Booz Allen Hamilton Holding Corp. | | | 754 | | | | 63,932 | |

| Fortinet, Inc.(a) | | | 916 | | | | 329,210 | |

| Garmin, Ltd. | | | 3,088 | | | | 420,493 | |

| MarketAxess Holdings, Inc. | | | 661 | | | | 271,849 | |

| Mastercard, Inc., Class A | | | 858 | | | | 308,297 | |

| Micron Technology, Inc. | | | 5,763 | | | | 536,823 | |

| N-able, Inc.(a) | | | 5,242 | | | | 58,186 | |

| Palo Alto Networks, Inc.(a) | | | 574 | | | | 319,580 | |

| PayPal Holdings, Inc.(a) | | | 1,277 | | | | 240,817 | |

| Shopify, Inc., Class A(a) | | | 303 | | | | 417,349 | |

| SolarWinds Corp. | | | 8,666 | | | | 122,971 | |

| | | | | | | | 4,410,908 | |

| | | | | | | | | |

| UTILITIES (0.92%) | | | | | | | | |

| Iberdrola SA, Sponsored ADR | | | 6,242 | | | | 294,685 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $19,819,228) | | | | | | | 22,242,026 | |

| | | Principal Amount | | | Value | |

| GOVERNMENT BONDS (30.27%) | | | | | | |

| U.S. Treasury Notes | | | | | | | | |

| 07/31/22, 0.13% | | $ | 8,149,500 | | | $ | 8,143,770 | |

| 10/15/24, 0.63% | | | 1,440,000 | | | | 1,428,300 | |

| 01/31/25, 1.38% | | | 126,500 | | | | 127,943 | |

| 10/31/26, 1.63% | | | 45,600 | | | | 46,371 | |

| | | | | | | | | |

| TOTAL GOVERNMENT BONDS (Cost $9,756,407) | | | | | | | 9,746,384 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (99.35%) (Cost $29,575,635) | | | | | | | 31,988,410 | |

| Other Assets In Excess Of Liabilities (0.65%) | | | | | | | 208,364 | |

| NET ASSETS (100.00%) | | | | | | $ | 32,196,774 | |

| (a) | Non-income producing security. |

| See Notes to Financial Statements. | |

| 10 | www.xsquarecapital.com |

| X-Square Balanced Fund | Statement of Assets and Liabilities |

| | December 31, 2021 |

| ASSETS: | | | |

| Investments, at fair value (Cost $29,575,635) | | $ | 31,988,410 | |

| Cash | | | 274,403 | |

| Dividend and interest receivable | | | 24,106 | |

| Capital shares sold receivable | | | 379,230 | |

| Prepaid expenses and other assets | | | 123 | |

| Total Assets | | | 32,666,272 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investment securities purchased | | | 301,657 | |

| Accrued chief compliance officer fees payable | | | 8,686 | |

| Payable due to adviser | | | 13,710 | |

| Accrued fund investment and administration fees payable | | | 43,146 | |

| Accrued distribution fees payable | | | 8,970 | |

| Accrued professional fees payable | | | 74,778 | |

| Other payables and accrued expenses | | | 18,551 | |

| Total Liabilities | | | 469,498 | |

| Net Assets | | $ | 32,196,774 | |

| | | | | |

| COMPOSITION OF NET ASSETS ATTRIBUTABLE TO SHARES: | | | | |

| Paid-in capital | | $ | 29,983,335 | |

| Total distributable earnings | | | 2,213,439 | |

| Net Assets | | $ | 32,196,774 | |

| | | | | |

| NET ASSET VALUE | | | | |

| Class A: | | | | |

| Net assets | | $ | 26,261,615 | |

| Shares outstanding (unlimited shares authorized, no par value) | | | 2,090,027 | |

| Net Asset Value per Share | | $ | 12.57 | |

| Maximum offering price per share (NAV/0.945, based on maximum sales charge of 5.50% of the offering price) | | $ | 13.30 | |

| Class C: | | | | |

| Net assets | | $ | 4,344,981 | |

| Shares outstanding (unlimited shares authorized, no par value) | | | 351,564 | |

| Net Asset Value per Share | | $ | 12.36 | |

| Institutional Class: | | | | |

| Net assets | | $ | 1,590,178 | |

| Shares outstanding (unlimited shares authorized, no par value) | | | 125,856 | |

| Net Asset Value per Share | | $ | 12.63 | |

| See Notes to Financial Statements. | |

| Annual Report | December 31, 2021 | 11 |

| X-Square Balanced Fund | Statement of Operations |

| | For the Year Ended December 31, 2021 |

| INVESTMENT INCOME: | | | |

| Dividends (net of foreign withholding tax $5,869) | | $ | 242,617 | |

| Interest | | | 13,882 | |

| Total Investment Income | | | 256,499 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fee (see Note 4) | | | 220,907 | |

| Fund accounting, administration and compliance fees | | | 198,367 | |

| Distribution fees | | | | |

| Class A | | | 44,943 | |

| Class C | | | 28,705 | |

| Professional fees | | | 211,524 | |

| Trustees' fees and expenses | | | 24,000 | |

| Transfer agent fees | | | 39,822 | |

| Other expenses | | | 26,381 | |

| Total Expenses | | | 794,649 | |

| Less fees reimbursed by Adviser (See Note 4) | | | | |

| Class A | | | (135,149 | ) |

| Class C | | | (21,133 | ) |

| Institutional Class | | | (10,793 | ) |

| Net Expenses | | | 627,574 | |

| Net Investment Loss | | | (371,075 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain/(loss) on: | | | | |

| Investment securities | | | 319,442 | |

| Foreign currency transactions | | | (105 | ) |

| Net realized gain: | | | 319,337 | |

| Change in unrealized appreciation on: | | | | |

| Investment securities | | | 1,526,458 | |

| Net Realized and Unrealized Gain on Investments | | | 1,845,795 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 1,474,720 | |

| See Notes to Financial Statements. | |

| 12 | www.xsquarecapital.com |

| X-Square Balanced Fund | Statement of Changes in Net Assets |

| | | For the Year Ended December 31, 2021 | | | For the Year Ended December 31, 2020 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment loss | | $ | (371,075 | ) | | $ | (54,887 | ) |

| Net realized gain | | | 319,337 | | | | 127,438 | |

| Net change in unrealized appreciation | | | 1,526,458 | | | | 868,367 | |

| Net Increase in Net Assets from Operations | | | 1,474,720 | | | | 940,918 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Class A: | | | (180,802 | ) | | | – | |

| Class C: | | | (27,272 | ) | | | – | |

| Institutional Class: | | | (11,807 | ) | | | – | |

| Net Decrease in Net Assets from Distributions to Shareholders | | | (219,881 | ) | | | – | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | |

| Class A: | | | 17,426,292 | | | | 7,344,246 | |

| Class C: | | | 2,909,207 | | | | 1,268,500 | |

| Institutional Class: | | | 490,018 | | | | 871,415 | |

| Reinvestment of distributions | | | | | | | | |

| Class A: | | | 100,540 | | | | – | |

| Class C: | | | 12,003 | | | | – | |

| Institutional Class: | | | 10,977 | | | | – | |

| Cost of shares redeemed | | | | | | | | |

| Class A: | | | (1,050,043 | ) | | | (101,637 | ) |

| Class C: | | | (137,689 | ) | | | – | |

| Institutional Class: | | | (42,792 | ) | | | (34,450 | ) |

| Redemption fees | | | | | | | | |

| Class A: | | | – | | | | 136 | |

| Class C: | | | 683 | | | | – | |

| Institutional Class: | | | – | | | | 101 | |

| Net Increase from Capital Share Transactions | | | 19,719,196 | | | | 9,348,311 | |

| Net Increase in Net Assets | | | 20,974,035 | | | | 10,289,229 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 11,222,739 | | | | 933,510 | |

| End of period | | $ | 32,196,774 | | | $ | 11,222,739 | |

| See Notes to Financial Statements. | |

| Annual Report | December 31, 2021 | 13 |

| X-Square Balanced Fund | Statement of Changes in Net Assets |

| | | For the Year Ended December 31, 2021 | | | For the Year Ended December 31, 2020 | |

| OTHER INFORMATION: | | | | | | |

| Capital Share Transactions: | | | | | | |

| Class A: | | | | | | |

| Beginning shares | | | 754,096 | | | | 75,143 | |

| Shares sold | | | 1,412,272 | | | | 690,288 | |

| Shares issued as reinvestment of dividends | | | 8,076 | | | | – | |

| Shares redeemed | | | (84,417 | ) | | | (11,335 | ) |

| Ending Shares | | | 2,090,027 | | | | 754,096 | |

| Class C: | | | | | | | | |

| Beginning shares | | | 124,409 | | | | 10,894 | |

| Shares sold | | | 237,532 | | | | 113,515 | |

| Shares issued as reinvestment of dividends | | | 977 | | | | – | |

| Shares redeemed | | | (11,354 | ) | | | – | |

| Ending Shares | | | 351,564 | | | | 124,409 | |

| Institutional Class: | | | | | | | | |

| Beginning shares | | | 88,869 | | | | 4,000 | |

| Shares sold | | | 39,517 | | | | 87,992 | |

| Shares issued as reinvestment of dividends | | | 878 | | | | – | |

| Shares redeemed | | | (3,408 | ) | | | (3,123 | ) |

| Ending Shares | | | 125,856 | | | | 88,869 | |

| See Notes to Financial Statements. | |

| 14 | www.xsquarecapital.com |

| X-Square Balanced Fund – Class A | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | For the Year Ended December 31, 2021 | | | For the Year Ended December 31, 2020 | | | For the Period November 4, 2019 (Commencement of Operations) to December 31, 2019 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | |

| Net asset value - beginning of period | | $ | 11.61 | | | $ | 10.37 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.20 | ) | | | (0.14 | ) | | | (0.00 | )(b)(c) |

| Net realized and unrealized gain on investments | | | 1.28 | | | | 1.38 | | | | 0.37 | |

| Net increase in Net Asset Value | | | 1.08 | | | | 1.24 | | | | 0.37 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | |

| From net realized gains from investment transactions | | | (0.12 | ) | | | – | | | | – | |

| Total Distributions to Common Shareholders | | | (0.12 | ) | | | – | | | | – | |

| | | | | | | | | | | | | |

| Net asset value per share - end of period | | $ | 12.57 | | | $ | 11.61 | | | $ | 10.37 | |

| | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(d) | | | 9.31 | % | | | 11.96 | % | | | 3.70 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets attributable to shares, end of period (000s) | | $ | 26,262 | | | $ | 8,756 | | | $ | 779 | |

| Ratio of actual expenses to average net assets including fee waivers and reimbursements | | | 2.75 | % | | | 2.75 | % | | | 2.75 | %(e) |

| Ratio of actual expenses to average net assets excluding fee waivers and reimbursements | | | 3.50 | % | | | 13.07 | % | | | 115.61 | %(e) |

| Ratio of net investment loss to average net assets | | | (1.59 | %) | | | (1.26 | %) | | | (0.19 | %) |

| Portfolio turnover rate | | | 18.40 | % | | | 20.14 | % | | | 0.00 | % |

| (a) | Calculated using average shares outstanding. |

| (b) | Less than $0.005 per share. |

| (c) | Annualized. |

| (d) | Total investment return is calculated assuming a purchase of shares at the opening on the first day and a sale at closing on the last day of the period reported. Dividends and distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any, and are not annualized. |

| (e) | These ratios to average net assets have been annualized except the non-recurring offering costs, which have not been annualized. |

| See Notes to Financial Statements. | |

| Annual Report | December 31, 2021 | 15 |

| X-Square Balanced Fund – Class C | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | For the Year Ended December 31, 2021 | | | For the Year Ended December 31, 2020 | | | For the Period November 4, 2019 (Commencement of Operations) to December 31, 2019 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | |

| Net asset value - beginning of period | | $ | 11.50 | | | $ | 10.35 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.29 | ) | | | (0.21 | ) | | | (0.02 | )(b) |

| Net realized and unrealized gain on investments | | | 1.27 | | | | 1.36 | | | | 0.37 | |

| Net increase in Net Asset Value | | | 0.98 | | | | 1.15 | | | | 0.35 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | |

| From net realized gains from investment transactions | | | (0.12 | ) | | | – | | | | – | |

| Total Distributions to Common Shareholders | | | (0.12 | ) | | | – | | | | – | |

| | | | | | | | | | | | | |

| Net asset value per share - end of period | | $ | 12.36 | | | $ | 11.50 | | | $ | 10.35 | |

| | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(c) | | | 8.53 | % | | | 11.11 | % | | | 3.50 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets attributable to shares, end of period (000s) | | $ | 4,345 | | | $ | 1,431 | | | $ | 113 | |

| Ratio of actual expenses to average net assets including fee waivers and reimbursements | | | 3.50 | % | | | 3.50 | % | | | 3.50 | %(d) |

| Ratio of actual expenses to average net assets excluding fee waivers and reimbursements | | | 4.23 | % | | | 14.81 | % | | | 161.50 | %(d) |

| Ratio of net investment loss to average net assets | | | (2.34 | %) | | | (1.95 | %) | | | (0.99 | %) |

| Portfolio turnover rate | | | 18.40 | % | | | 20.14 | % | | | 0.00 | % |

| (a) | Calculated using average shares outstanding. |

| (b) | Annualized. |

| (c) | Total investment return is calculated assuming a purchase of shares at the opening on the first day and a sale at closing on the last day of the period reported. Dividends and distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any, and are not annualized. |

| (d) | These ratios to average net assets have been annualized except the non-recurring offering costs, which have not been annualized. |

| See Notes to Financial Statements. | |

| 16 | www.xsquarecapital.com |

| X-Square Balanced Fund – Institutional Class | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | For the Year Ended December 31, 2021 | | | For the Year Ended December 31, 2020 | | | For the Period November 4, 2019 (Commencement of Operations) to December 31, 2019 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | |

| Net asset value - beginning of period | | $ | 11.65 | | | $ | 10.37 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.17 | ) | | | (0.11 | ) | | | (0.00 | )(b)(c) |

| Net realized and unrealized gain on investments | | | 1.27 | | | | 1.39 | | | | 0.37 | |

| Net increase in Net Asset Value | | | 1.10 | | | | 1.28 | | | | 0.37 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | |

| From net realized gains from investment transactions | | | (0.12 | ) | | | – | | | | – | |

| Total Distributions to Common Shareholders | | | (0.12 | ) | | | – | | | | – | |

| | | | | | | | | | | | | |

| Net asset value per share - end of period | | $ | 12.63 | | | $ | 11.65 | | | $ | 10.37 | |

| | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(d) | | | 9.45 | % | | | 12.34 | % | | | 3.70 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets attributable to shares, end of period (000s) | | $ | 1,590 | | | $ | 1,035 | | | $ | 41 | |

| Ratio of actual expenses to average net assets including fee waivers and reimbursements | | | 2.50 | % | | | 2.50 | % | | | 2.50 | %(e) |

| Ratio of actual expenses to average net assets excluding fee waivers and reimbursements | | | 3.37 | % | | | 12.00 | % | | | 239.72 | %(e) |

| Ratio of net investment loss to average net assets | | | (1.37 | %) | | | (1.00 | %) | | | (0.21 | %) |

| Portfolio turnover rate | | | 18.40 | % | | | 20.14 | % | | | 0.00 | % |

| (a) | Calculated using average shares outstanding. |

| (b) | Less than $0.005 per share. |

| (c) | Annualized. |

| (d) | Total investment return is calculated assuming a purchase of shares at the opening on the first day and a sale at closing on the last day of the period reported. Dividends and distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any, and are not annualized. |

| (e) | These ratios to average net assets have been annualized except the non-recurring offering costs, which have not been annualized. |

| See Notes to Financial Statements. | |

| Annual Report | December 31, 2021 | 17 |

| X-Square Balanced Fund | Notes to Financial Statements |

| | December 31, 2021 |

NOTE 1 — ORGANIZATION AND REGISTRATION

X-Square Balanced Fund, LLC (the "Fund") is an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is a non-diversified investment company with an investment objective which seeks conservation of capital, current income and long-term growth of capital and income. The Fund currently offers Class A, Class C and Institutional Class Shares. Each share class of the Fund represents an investment in the same portfolio of securities, but each share class has its own expense structures. The Fund’s Investment Adviser is X-Square Capital, LLC (the “Adviser”). The Fund is a related party to the Adviser.

Subject to certain exceptions, investments in Class C shares are subject to a 1.00% contingent deferred sales charge if shares are sold within 12 months of purchase. The contingent deferred sales charge is expected to be calculated based on the lesser of the offering price and market value of shares being sold.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The financial statements are prepared in United States Dollars and in conformity with accounting principles generally accepted in the United States of America (“GAAP”), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results may differ from these estimates. The Fund is considered an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) as of the fiscal year end of the Fund.

Portfolio Valuation: The net asset value (“NAV”) per common share of the Fund is determined daily, on each day that there is a regular trading session on the NYSE as of the close of regular trading. The Fund’s NAV per common share is calculated by dividing the value of the Fund’s total assets, less its liabilities, by the number of shares outstanding and rounding the result to the nearest full cent.

The Fund generally values its securities based on market prices determined at the close of regular trading on the NYSE (normally, 4 p.m. Eastern time) on each business day (Monday through Friday). The Fund will not value its securities on any day that the NYSE is closed, including the following observed holidays: New Year’s Day, Martin Luther King, Jr. Day, Washington’s Birthday, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day. The Fund’s currency valuations are done as of the close of regular trading on the NYSE (normally, 4 p.m. Eastern time).

For equity securities that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange, provided such price is not deemed stale, and that it represents fair value. In the case of securities not traded on an exchange, or if such closing prices are not otherwise available, the market price is typically determined by independent third party pricing vendors approved by the Fund’s Board of Managers (“the Board”) using a variety of pricing techniques and methodologies.

| X-Square Balanced Fund | Notes to Financial Statements |

| | December 31, 2021 |

The market price for debt obligations (including short-term debt obligations with remaining maturities of 60 days or less) is generally the price supplied by an independent third-party pricing service approved by the Board, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. In certain circumstances, bid and ask prices may be obtained from: (i) a broker/ dealer specified and deemed reliable by the Adviser, (ii) pink sheets, yellow sheets or the blue list, or (iii) a pricing agent that obtains quotations from broker/dealers or evaluates the value of the respective bid and ask prices. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more brokers/dealers that make a market in the security.

When such prices or quotations are not available, or when the Adviser believes that they are unreliable, securities may be priced using fair value procedures approved by the Board. The Fund may also use fair value procedures if the Adviser determines that a significant event has occurred between the time at which a market price is determined and the time at which the Fund NAV is calculated. In particular, the value of foreign securities may be materially affected by events occurring after the close of the market on which they are traded, but before the Fund prices its shares.

The Fund may determine the fair value of investments based on information provided by pricing services and other third-party vendors, which may recommend fair value prices or adjustments with reference to other securities, indices or assets. In considering whether fair value pricing is required and in determining fair values, the Fund may, among other things, consider significant events (which may be considered to include changes in the value of U.S. securities or securities indices) that occur after the close of the relevant market and before the Fund values its securities. In addition, the Fund may utilize modeling tools provided by third-party vendors to determine fair values of foreign securities.

Valuing securities at fair value involves greater reliance on judgment than valuation of securities based on readily available market quotations. A fund that uses fair value to price securities may value those securities higher or lower than another fund using market quotations or its own fair value methodologies to price the same securities. There can be no assurance that the Fund could obtain the fair value assigned to a security if it were to sell the security at approximately the time at which the Fund determines its NAV.

The information above is not intended to reflect an exhaustive list of the methodologies that may be used to value portfolio investments. The Fund’s valuation procedures permit the use of a variety of valuation methodologies in connection with valuing portfolio investments. The methodology used for a specific type of investment may vary based on the market data available or other considerations. The methodologies summarized above may not represent the specific means by which portfolio investments are valued on any particular business day.

Cash and Cash Equivalents: Idle cash may be swept into various overnight demand deposits and is classified as cash and cash equivalents on the Statements of Assets and Liabilities. The Fund maintains cash in bank deposit accounts which, at times, may exceed United States federally insured limits. Amounts swept overnight are available on the next business day.

| Annual Report | December 31, 2021 | 19 |

| X-Square Balanced Fund | Notes to Financial Statements |

| | December 31, 2021 |

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the identified cost basis method for financial reporting purposes. Dividends are recorded net of foreign withholding taxes. Interest income is recorded on an accrual basis.

Expenses: Some expenses of the Fund can be directly attributed to a Fund specific share class. Expenses that cannot be directly attributed are apportioned among all share classes based on average net assets. Expenses are recognized when incurred.

Income Taxes: The Fund is taxed under the dispositions applicable to Registered Investment Companies established by the Puerto Rico Internal Revenue Code of 2011, as amended ("the Code"), its regulations and the administrative pronouncements promulgated thereunder. The Code states that every registered investment company will be exempt from Puerto Rico income tax for a taxable year if it distributes to its stockholders at least 90% of its taxable net investment income for such taxable year. The Fund intends to meet the 90% distribution requirement on a yearly basis to maintain the income tax exemption.

For U.S. federal income taxes, the Fund will be treated as a foreign corporation not engaged in a trade or business in the United States for purposes of the U.S. Internal Revenue Code of 1986, as amended (the “U.S. Code”) and does not intend to derive income treated as effectively connected with a trade or business in the United States. As a foreign corporation not engaged in a trade or business in the United States, the Fund will only be subject to United States federal income taxes if it realizes certain items of U.S. source income of a fixed or determinable annual or periodic nature, in which case the Fund will be subject to withholding of United States federal income tax at a 30% gross rate on such U.S. source income (not including interest received by the Fund on certain registered obligations).

Temporary differences between book-basis and tax-basis components of total distributable earnings arise when certain items, of income gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. As of period end, the tax-basis component of total distributable earnings are detailed as follows:

| Undistributed ordinary loss: | ($426,231) |

| Undistributed capital gains: | $226,896 |

| Unrealized appreciation: | $2,412,775 |

The Puerto Rico income tax basis of the Fund's investments at December 31, 2021, was $29,575,635, and net unrealized appreciation for income tax purposes was $2,412,775 (gross unrealized appreciation $2,423,298; gross unrealized depreciation ($10,523)).

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained, assuming examination by tax authorities. Management has analyzed the Fund's tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund's 2021 tax returns. The Fund identifies its major tax jurisdictions as Commonwealth of Puerto Rico; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months. The Fund remains subject to income tax examinations for its PR income taxes generally for the years 2019 through 2021.

| X-Square Balanced Fund | Notes to Financial Statements |

| | December 31, 2021 |

The Fund distributed to shareholders $219,881 in dividends from January 1, 2021 through December 31, 2021.

Indemnification: The Fund indemnifies its officers and managers for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties that provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

NOTE 3 — FAIR VALUE MEASUREMENTS

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Annual Report | December 31, 2021 | 21 |

| X-Square Balanced Fund | Notes to Financial Statements |

| | December 31, 2021 |

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2021:

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks(a) | | $ | 22,242,026 | | | $ | – | | | $ | – | | | $ | 22,242,026 | |

| Government Bonds | | | 9,746,384 | | | | – | | | | – | | | | 9,746,384 | |

| Total | | $ | 31,988,410 | | | $ | – | | | $ | – | | | $ | 31,988,410 | |

| (a) | For a detailed sector breakdown, see the accompanying Schedule of Investments. |

There were no Level 3 securities held in the Fund at December 31, 2021. There were no transfers in or out from Level 3.

NOTE 4 — INVESTMENT ADVISORY AGREEMENT

As compensation for its services, the Fund pays to the Adviser a monthly management fee at an annual rate of 1.00% of its average daily net assets.

The Adviser, a related party to the Fund, pursuant to an Amended and Restated Expense Reimbursement Agreement (the “Agreement”), has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until one year from the date of the Fund’s prospectus (through April 30, 2022), to ensure that Net Annual Operating Expenses (excluding taxes, extraordinary expenses, reorganization expenses, brokerage commissions, interest, other expenditures that are not capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund’s business) will not exceed 2.75%, 3.50% and 2.50% of the Fund’s average daily net assets, respectively for Class A, Class C and Institutional Class, respectively. The Adviser will be permitted to recover, on a class-by-class basis, any fees waived and/or expenses reimbursed pursuant to the Agreement described above to the extent that the Fund expenses in later periods fall below the lesser of (i) the expense limitation in effect at the time the fees and/or expenses to be recovered were waived and/or reimbursed and (ii) the expense limitation in effect at the time the Adviser seeks to recover the fees or expenses. The Adviser will not be entitled to recover any such waived or reimbursed fees and expenses more than three years after the date on which the fees were waived or expenses were reimbursed. The Adviser may not terminate this waiver arrangement without the approval of the Fund’s Board of Managers.

As of December 31, 2021, the following amounts were available for recoupment by the Adviser based upon their potential expiration date:

| | | Expiring in 2022 | | | Expiring in 2023 | | | Expiring in 2024 | |

| Class A | | $ | 84,992 | | | $ | 361,637 | | | $ | 135,149 | |

| Class C | | | 25,562 | | | | 30,046 | | | | 21,133 | |

| Institutional | | | 18,283 | | | | 53,037 | | | | 10,793 | |

| X-Square Balanced Fund | Notes to Financial Statements |

| | December 31, 2021 |

NOTE 5 — OTHER AGREEMENTS

Distribution and Services Agreement

The Fund has adopted a Distribution and Shareholder Servicing Plan pursuant to Rule 12b-1 under the 1940 Act (the “Plan”). Under the Plan, the Fund is authorized to pay distribution fees in connection with the sale and distribution of its shares and pay service fees in connection with the provision of ongoing services to shareholders of each class and the maintenance of shareholder accounts in an amount up to 0.25% of its average daily net assets each year with respect to Class A Shares, 0.00% with respect to Institutional Class shares and 1.00% with respect to Class C shares. The Class C distribution fee includes a distribution fee of up to 0.75% and a service fee of up to 0.25%.

ALPS Distributors, Inc. (the “Distributor”) serves as the Fund’s distributor. The Distributor acts as an agent for the Fund and the distributor of the Fund’s shares.

Administration, Bookkeeping and Pricing Agreement

ALPS Fund Services, Inc. (“ALPS”) serves as the administrator to the Fund. The Fund has agreed to pay expenses incurred in connection with ALPS administrative activities. Pursuant to the Administration, Bookkeeping and Pricing Services Agreement, ALPS will provide operational services to the Fund including, but not limited to fund accounting and fund administration and generally assist in the Fund operations.

Transfer Agency Agreement

ALPS also serves as the Transfer Agent to the Fund. Under the Transfer Agency Agreement, ALPS is responsible for maintaining all shareholder records of the Fund.

NOTE 6 — INVESTMENT TRANSACTIONS

Investment transactions for the year ended December 31, 2021, excluding U.S. Government Obligations and short-term investments, were as follows:

| | | Cost of Investments Purchased | | | Proceeds from Investments Sold | |

| | $ | 16,547,223 | | | $ | 3,492,492 | |

Purchases and sales of U.S. Government Obligations for the year ended December 31, 2021 were as follows:

| | | Cost of Investments Purchased | | | Proceeds from Investments Sold | |

| | $ | 7,241,810 | | | $ | 415,783 | |

| Annual Report | December 31, 2021 | 23 |

| X-Square Balanced Fund | Notes to Financial Statements |

| | December 31, 2021 |

NOTE 7 — RISKS AND UNCERTAINTIES

The business results of operations and financial condition of the Fund may be adversely affected by public health epidemics, such as the COVID-19 pandemic. A public health crisis poses the risk that the Fund, it’s employees, business partners and investors may be prevented from conducting business activities for an indefinite period, including due to lockdowns that may be requested or mandated by governmental authorities. As of the date of issuance of the financial statements, the impact the COVID-19 pandemic will have on the Fund´s overall future performance cannot be predicted.

NOTE 8 — SUBSEQUENT EVENTS

The Adviser has evaluated subsequent events through the date of issuance of the financial statements included herein. There have been no subsequent events that occurred during such period that would require disclosure or would be required to be recognized in the financial statements.

| | Report of Independent Registered |

| X-Square Balanced Fund | Public Accounting Firm |

To the Shareholders and Board of Managers of

X-Square Balanced Fund, LLC:

Opinion on the financial statements

We have audited the accompanying statement of assets and liabilities of X-Square Balanced Fund, LLC (the “Fund”) including the schedule of investments as of December 31, 2021, the related statements of operations, changes in net assets and the financial highlights for the year ended December 31, 2021, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2021, and the results of its operations, changes in net assets and the financial highlights for the year then ended in conformity with accounting principles generally accepted in the United States of America. The financial statements of the Fund for the year ended December 31, 2020 and for the period from November 4, 2019 to December 31, 2019 were audited by other auditors. Those auditors expressed an unqualified opinion on those financial statements in their report dated February 24, 2021.

Basis for opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2021.

/s/ Kevane Grant Thornton, LLP

San Juan, Puerto Rico

February 24, 2022.

Certified Public Accountants (of Puerto Rico) License 217 Expires December 1, 2022 Stamp E470014 of the Puerto Rico Society of CPAS was affixed to the file copy of this report

| Annual Report | December 31, 2021 | 25 |

| X-Square Balanced Fund | Additional Information |

| | December 31, 2021 (Unaudited) |

CHANGE IN INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On May 24, 2021, the Fund by action of the Board upon the recommendation of the Board's Audit Committee selected Kevane Grant Thornton, LLP as the independent registered public accounting firm to audit the Fund’s financial statements for the fiscal year ended December 31, 2021. During the Fund’s fiscal years ended December 31, 2020 and December 31, 2019, neither the Fund nor anyone on its behalf has consulted with Kevane Grant Thornton, LLP on items which (i) concerned the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements; or (ii) concerned the subject of a disagreement (as defined in paragraph (a)(l)(iv) of Item 304 of Regulation S-K under the Securities Exchange Act of 1934, as amended (“Regulation S-K”)) or reportable events (as described in paragraph (a)(l)(v) of said Item 304).

BDO Puerto Rico, P.S.C. ("BDO") was dismissed as the independent registered public accounting firm to the Fund effective May 24, 2021. BDO's reports on the Fund’s financial statements for the fiscal years ended December 31, 2020 and December 31, 2019 contained no adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the Fund’s fiscal years ended December 31, 2020 and December 31, 2019, (i) there were no disagreements with BDO on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BDO, would have caused it to make reference to the subject matter of the disagreements in connection with its reports on the Fund’s financial statements for such fiscal years, and (ii) there were no “reportable events” of the kind described in Item 304(a)(l)(v) of Regulation S-K.

PORTFOLIO HOLDINGS

The Fund files a complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT within 60 days after the end of the period. Copies of the Fund’s Form N-PORT are available without a charge, upon request, by contacting the Fund at 1-787-282-1621 and on the SEC’s website at http://www.sec.gov.

PROXY VOTING

A description of the Fund’s proxy voting policies and procedures is available (1) without charge, upon request, by calling 1-787-282-1621, (2) on the Fund’s website located at http://www.xsquarecapital.com, or (3) on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the twelve-month period ended June 30 will be available on the SEC’s website at http://www.sec.gov.

BOARD CONSIDERATION AND APPROVAL OF THE INVESTMENT ADVISORY CONTRACT

At a meeting (the “Meeting”) of the Board of Managers (the “Board” or the “Managers”), held on November 19, 2021, the Board, including a majority of those Managers of the X-Square Balanced Fund, LLC (the “Fund”) who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (the “Independent Managers”) of the Fund and X-Square Capital, LLC (the “Adviser”) considered and approved the renewal of Fund’s investment advisory agreement (the “Advisory Agreement”) between the Fund and the Adviser for an additional one-year term.

| X-Square Balanced Fund | Additional Information |

| | December 31, 2021 (Unaudited) |

In addition to evaluating, among other things, the written information provided by the Adviser, the Board also considered the presentations from the Adviser at the Meeting on the services provided to the Fund. The Independent Managers also met separately in executive session at the Meeting with their independent legal counsel to review and consider the information provided regarding the Advisory Agreement. Based on their review, the Board, and the Independent Managers, determined to renew the Advisory Agreement at the Meeting. In its deliberations, the Board did not identify any single factor or group of factors as all-important or controlling, but considered all factors together. The material factors and conclusions that forms the basis for the Board’s determinations are discussed below.

Nature, Extent, and Quality of the Services under the Investment Advisory Agreement

The Managers received and considered information regarding the nature, extent, and quality of services provided to the Fund by the Adviser under the Investment Advisory Agreement. The Managers also reviewed and considered the nature and extent of any non-advisory administrative services provided by the Adviser to the Fund.

The Managers reviewed and considered the Adviser’s investment advisory personnel, compensation and the Fund’s performance. The Managers considered the background and experience of the Adviser’s management in connection with the Fund, including reviewing the qualifications, backgrounds, and responsibilities of the management team primarily responsible for the day-to-day portfolio management of the Fund and the extent of the resources devoted to research and analysis of actual and potential investments. The Managers also reviewed the research and decision-making processes utilized by the Adviser, including the methods adopted to seek to achieve compliance with the investment strategies and policies of the Fund. The Managers also reviewed, among other things, the Adviser’s compliance policies and procedures, including its disaster recovery plan and cybersecurity standards.

After extensive discussion, the Board concluded that the nature, extent and quality of advisory services provided to the Fund by the Adviser pursuant to the Investment Advisory Agreement were satisfactory.

Performance

The Managers reviewed performance information for the Fund for the period from November 1, 2020 to October 31, 2021 and considered the comparison of the Fund’s performance to the performance of a composite of comparable balanced funds, noting that the Fund outperformed the composite of comparable funds during that period.

Breakpoints and Economies of Scale

The Managers reviewed the advisory fee rates and gross and net total expense ratio of the Fund, noting that the Adviser had waived fees and/or reimbursed expenses of the Fund pursuant to a contractual expense reimbursement agreement. The Managers noted that the Adviser currently does not manage comparable funds or accounts, and compared fees charged to the Fund against fees charged to funds utilizing a strategy similar to that employed by the Fund.

The Managers noted that the Fund continues to seek economies of scale and would be realized as the Fund grows.

| Annual Report | December 31, 2021 | 27 |

| X-Square Balanced Fund | Additional Information |

| | December 31, 2021 (Unaudited) |

Profitability

The Managers considered the costs of the services provided by the Adviser to the Fund and the compensation and benefits received by the Adviser in providing services to the Fund. The Managers reviewed the financial statements of the Adviser and considered any direct or indirect revenues that could be received by the Adviser. The Board concluded that Adviser’s fees were reasonable in relation to the nature and quality of the services provided to the Fund, taking into account the fees charged by other advisers for managing comparable funds. The Independent Managers also concluded that the overall expense ratio of the Fund was reasonable, taking into account the size of the Fund, the expense waivers, and the quality of services provided by the Adviser.

Other Benefits to the Adviser

The Managers also discussed other benefits received by the Adviser from its management of the Fund, including, without limitation, the ability to market its advisory services for similar products in the future and the potential growth of the Adviser’s assets under management, which could allow the Adviser to enter into a wider distribution network. After discussion, the Board concluded that the advisory fees were reasonable in light of these fall-out benefits.

Conclusion

The Board concluded, based on consideration of all factors that it deemed material, and assisted by the advice of counsel, that it would be in the best interest of the Fund and its shareholders to approve the continuation of the Investment Advisory Agreement for an additional one-year term. In making such determination, the Managers considered all factors and no one factor alone was deemed dispositive.

LIQUIDITY RISK MANAGEMENT PROGRAM

The Fund has adopted and implemented a written liquidity risk management program (the “Program”), as consistent with Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”). The Program seeks to assess, manage and review the Fund’s Liquidity Risk. “Liquidity Risk” is defined as the risk that the Fund could not meet requests to redeem shares issued by the Fund without significant dilution of remaining investors’ interest in the Fund.

In accordance with the requirements of the Liquidity Rule, the program administrator conducted an annual review of the Program and, on November 19, 2021, provided the Board of Managers (the “Board”) with a report addressing the operation of the Program and assessing its adequacy and effectiveness of implementation for the previous year of operation. Among other things, the program administrator reported to the Board as to the following:

| · | the Fund had sufficient liquidity to meet redemptions and operate effectively on behalf of its shareholders; |

| · | there were no material changes to the Program during the review period; |

| · | the Fund’s strategy continued to be effective for an open-end mutual fund; |

| · | the implementation of the Program was effective to manage the Fund’s liquidity risk and remains reasonably designed to manage the Fund’s liquidity risk; |

| X-Square Balanced Fund | Additional Information |

| | December 31, 2021 (Unaudited) |

| · | the Program includes provisions reasonably designed to comply with the 15% limit on illiquid investments and for determining, periodically reviewing and complying with the highly liquid investment minimum requirements; and |

| · | the Program operated adequately during the period and was effective in assessing, monitoring and managing the liquidity risk of the Fund’s portfolio. |

There can be no assurance that the Program will achieve its objectives in the future. Please refer to the Fund’s prospectus for more information regarding the Fund’s exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

| Annual Report | December 31, 2021 | 29 |

| X-Square Balanced Fund | Managers and Officers |

| | December 31, 2021 (Unaudited) |

Overall responsibility for management of the Fund rests with the members of the Board (the “Managers”), who are elected by the shareholders of the Fund, unless appointed to fill a vacancy in accordance with the limited liability company agreement of the Fund and the 1940 Act. The Fund is managed by the Board in accordance with the laws of the Commonwealth of Puerto Rico. There are currently three (3) Managers, two (2) of whom are not “interested persons” (as defined in the 1940 Act) of the Fund (the “Independent Managers”). The Managers, in turn, elect the officers of the Fund to supervise actively its day-to-day operations.

The following table lists each Manager, his or her year of birth, position with the Fund, principal occupations during the past five years, and other directorships. Each Manager oversees the Fund. There is no defined term of office, and each Manager serves until the earlier of his resignation, retirement, removal, death, or the election of a qualified successor. Each Manager’s address is c/o X-Square Balanced Fund, Popular Center Building, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918.

INDEPENDENT MANAGERS

| Name, Address and YOB | Positions Held with the Fund and Length of Time Served | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex* Overseen by Manager | Other Directorships held by Manager During Last Five Years |

Fernando Nido

(1959) | Manager since January 2019 | Managing Partner, Deloitte & Touche LLP, Puerto Rico from 1981 until 2014; currently independent consultant. | 1 | Trans-Oceanic Life Insurance Company |

Luis Roig

(1959) | Manager since June 2019 | Managing Director and CFO, Santander Securities LLC from 2013 until 2016; Chief Financial Officer, Americas Leading Finance LLC since 2016. | 1 | None |

INTERESTED MANAGERS

| Name, Address and YOB | Positions Held with the Fund and Length of Time Served | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex* Overseen by Trustee | Other Directorships held by Trustee During Last Five Years |

Ignacio Canto**

(1983) | President, since January 2019 | President of X-Square Capital, LLC since 2013. | 1 | Director of X2 Alternative Dividend Alpha Fund, Inc. |

| * | The “Fund Complex” consists of the Fund. |

| ** | An “interested person,” as defined by the 1940 Act. Mr. Canto is deemed to be an “interested” Manager because he is the owner of all membership interests of the Adviser and also serves as its President, Treasurer and sole director. |

| X-Square Balanced Fund | Managers and Officers |

| | December 31, 2021 (Unaudited) |

OFFICERS

| Name, Address and YOB | Position/Term of Office* | Principal Occupation During the Past Five Years |

Ignacio Canto (1983) | President since January 2019 | President of X-Square Capital, LLC since 2013. |

Ruben Tapia (1986) | Treasurer since January 2019 | Chief Compliance Officer and Chief Financial Officer of X-Square Capital, LLC since 2018. Vice President of Finance, Premier Warranty Services from 2015 to 2018. Investment adviser for Banco Popular de Puerto Rico from 2013 to 2015. |

Gabriel Medina (1989) | Secretary since January 2019 | Portfolio Manager of X-Square Capital, LLC since 2018. Chief Compliance Officer of X-Square Capital, LLC from 2015 to 2018. Analyst at Accenture from 2014 to 2015. |

Lucas D. Foss (1977) | Chief Compliance Officer, since January 2019 | Deputy Chief Compliance Officer, ALPS Holdings, Inc. since December 2017. Mr. Foss joined ALPS in November 2017 as Vice President and Deputy Chief Compliance Officer. Prior to his current role, Mr. Foss served as the Director of Compliance at Transamerica Asset Management (July 2015-November 2017). Deputy Chief Compliance Officer at ALPS (September 2012 – June 2015). Mr. Foss is also CCO of ALPS Series Trust, Clough Funds Trust, Clough Global Equity, Clough Global Opportunities Fund, Clough Global Dividend and Income Fund Popular High Grade Fixed Income Fund, Popular Income Plus Fund, Inc., Popular Total Return Fund, Inc., Puerto Rico Residents Bond Fund I, Puerto Rico Residents Tax-Free Fund, Inc., Puerto Rico Residents Tax-Free Fund II, Inc., Puerto Rico Residents Tax-Free Fund III, Inc., Puerto Rico Residents Tax-Free Fund IV, Inc., Puerto Rico Residents Tax-Free Fund V, Inc., and Puerto Rico Residents Tax-Free Fund VI, Inc. |

The Statement of Additional Information includes additional information about the Managers and is available, without charge, upon request, by calling (toll-free) 1-787-282-1621.

| Annual Report | December 31, 2021 | 31 |

Must be accompanied or preceded by a Prospectus.

ALPS Distributors, Inc. is the Distributor for the X-Square Balanced Fund.

(b) N/A

| (a) | The Registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or any persons performing similar functions on behalf of the Registrant. |

(b) Not applicable.

| (c) | During the period covered by this report, no amendments to the provisions of the code of ethics referred to above in Item 2(a) were made. |

| (d) | During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics referred to above in Item 2(a) were granted. |

| (f) | The Registrant’s Code of Ethics is attached as Exhibit 13(a)(1) hereto. |

| Item 3. | Audit Committee Financial Expert. |

The Board of Managers (“Board”) of the Registrant has determined that the Registrant has at least one Audit Committee Financial Expert serving on its audit committee. The Board has designated Fernando Nido and Luis Roig as the Registrant’s Audit Committee Financial Experts. Messrs. Nido and Roig are “independent” as that term is defined in paragraph (a)(2) of Item 3 to Form N-CSR.