As filed with the Securities and Exchange Commission on May 11, 2020.

Registration No. 333-237841

Switzerland | | | 2834 | | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification No.) |

Deanna L. Kirkpatrick Yasin Keshvargar Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 | | | Dieter Gericke Benjamin Leisinger Homburger AG Hardstrasse 201 CH-8005 Zurich, Switzerland +41 43 222 10 00 | | | Jacques Iffland Lenz & Staehelin Route de Chêne 30 CH-1211 Geneva 6, Switzerland +41 58 450 70 00 | | | Divakar Gupta Richard C. Segal Alison A. Haggerty Cooley LLP 55 Hudson Yards New York, NY 10001 (212) 479-6000 |

Title of each class of securities to be registered | | | Amount to be registered(1) | | | Proposed maximum aggregate offering price per unit(2) | | | Proposed maximum aggregate offering price(2)(3) | | | Amount of registration fee(4)(5) |

Common shares, par value CHF 0.08 per share | | | 8,458,250 | | | $18.00 | | | 152,248,500.00 | | | $19,761.86 |

| (1) | Includes 1,103,250 common shares granted pursuant to the underwriters’ option to purchase additional common shares. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Includes the offering price of the 1,103,250 common shares granted pursuant to the underwriters’ option to purchase additional common shares. |

| (4) | Filing fees in the amount of $12,980.00 were previously paid. |

| (5) | In accordance with Rule 457(p), $6,781.86, representing the remainder of the registration fee due in connection with this Registration Statement, has been offset by the registration fee previously paid with respect to the prior registration statement on Form F-1 (No. 333-233659) initially filed by ADC Therapeutics SA on September 6, 2019. Accordingly, no additional fee is due in connection with this filing. |

| | | PER SHARE | | | TOTAL | |

Initial public offering price | | | $ | | | $ |

Underwriting discounts and commissions(1) | | | $ | | | $ |

Proceeds, before expenses, to us | | | $ | | | $ |

| (1) | See “Underwriters” for a description of all compensation payable to the underwriters. |

MORGAN STANLEY | | | BofA SECURITIES | | | COWEN |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

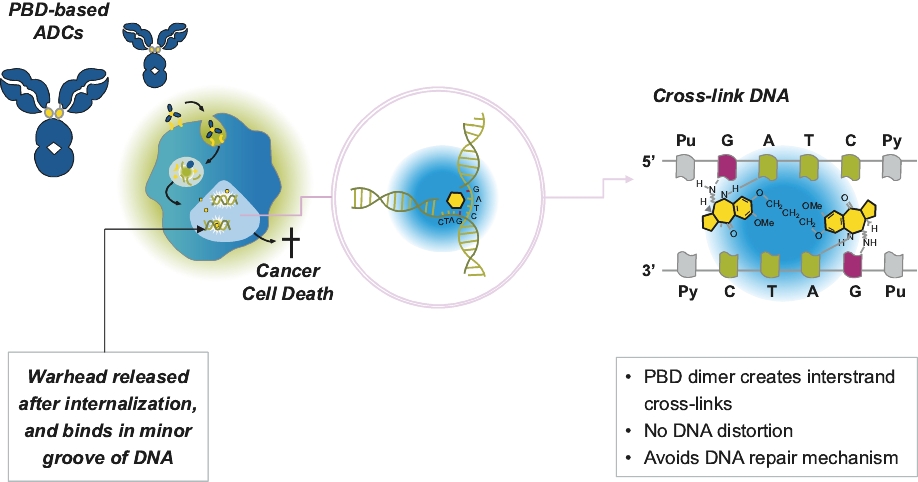

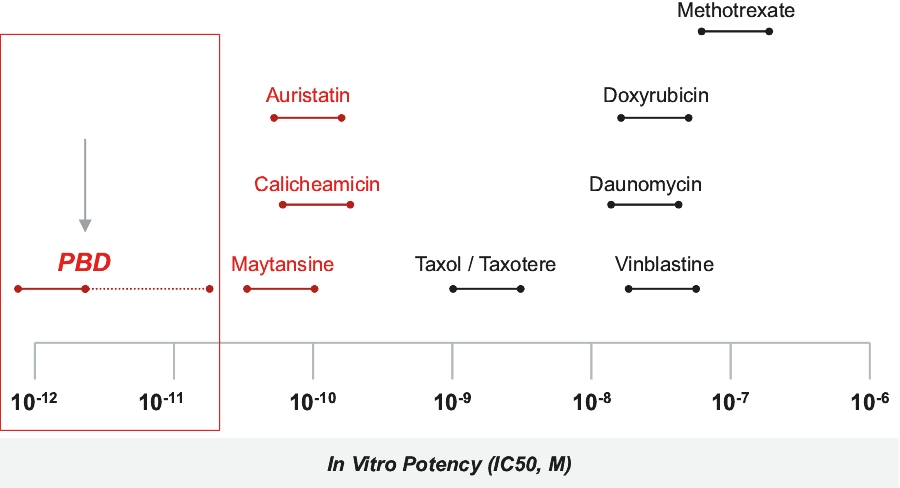

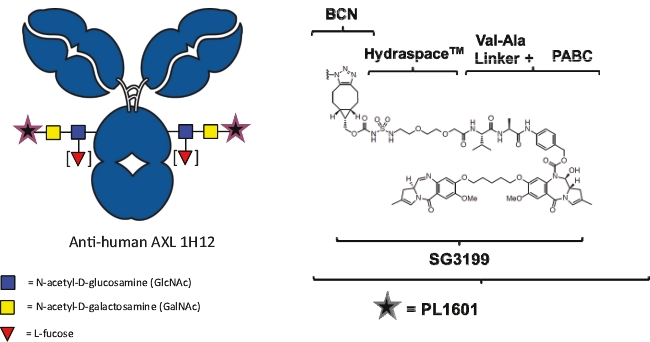

| • | Cytotoxic Potency. The PBD dimer warheads used in our ADCs have been shown preclinically to be approximately 100 times more potent than other warheads used in currently marketed ADCs, such as auristatin, maytansine and calicheamicin. |

| • | Activity in Tumors with Low-Expressing Targets. The high potency of our PBD-based warheads means that, compared to other warheads, fewer molecules of warhead should be needed to be internalized into the cancer cell to kill it. We believe that the potency of our PBD-based warheads may allow us to develop ADCs that target antigens with low expression levels in the tumor microenvironment, potentially increasing the range of cancers amenable to treatment with ADCs. |

| • | Durable Responses. Our PBD-based ADCs create interstrand cross-links in the target cells’ DNA. As PBD cross-links are non-distortive, they are designed to be able to evade the cells’ DNA repair mechanisms that result in limited clinical responses and relapses. We believe that this may contribute to the frequency and durability of responses in heavily pre-treated and primary refractory patients that we have observed in our clinical trials. |

| • | Bystander Effect. Since our PBD-based warheads are cell-permeable, they may be able to diffuse into adjacent cells and kill them in an antigen-independent manner. We believe that this may allow us to develop ADCs that target antigens with heterogeneous expression levels in the tumor microenvironment, potentially increasing the range of cancers amenable to treatment with ADCs. |

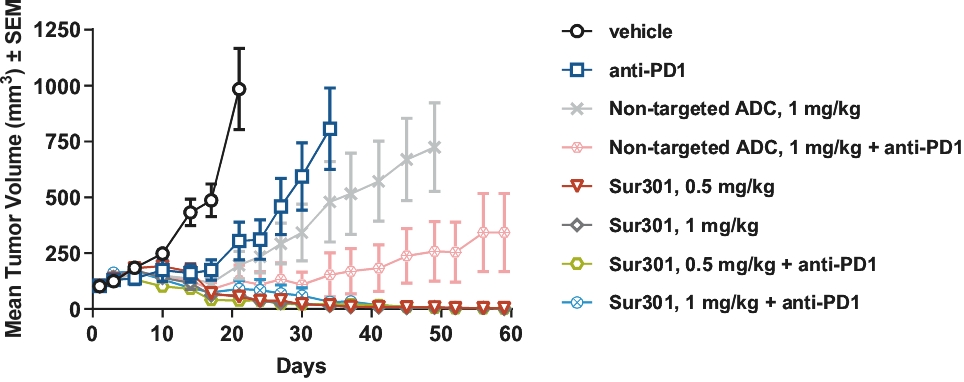

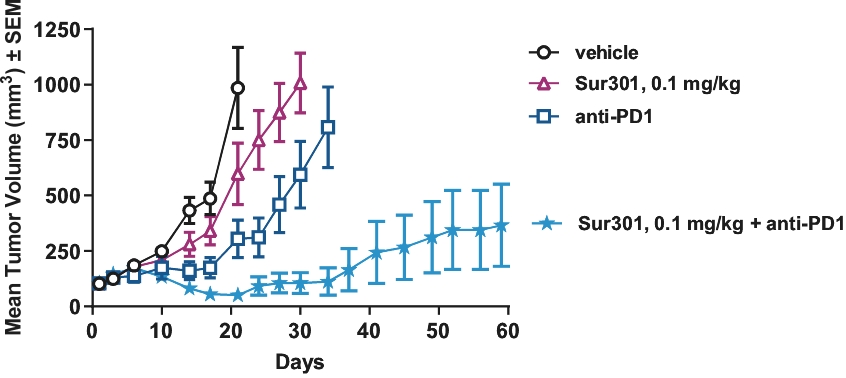

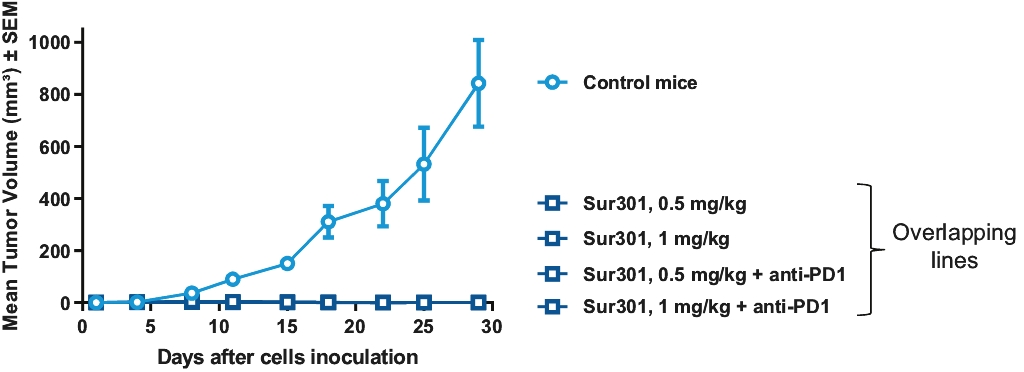

| • | Immunogenic Cell Death. PBD warheads have been observed to induce immunogenic cell death, whereby a cancer cell’s death expresses certain stress signals that induce the body’s anti-tumor immune response through the activation of T cells and antigen-presenting cells. This opens up the potential for combining our ADCs with other therapies, particularly with immuno-oncology therapies such as checkpoint inhibitors, that are specifically designed to activate the patient’s own immune system to combat cancer. |

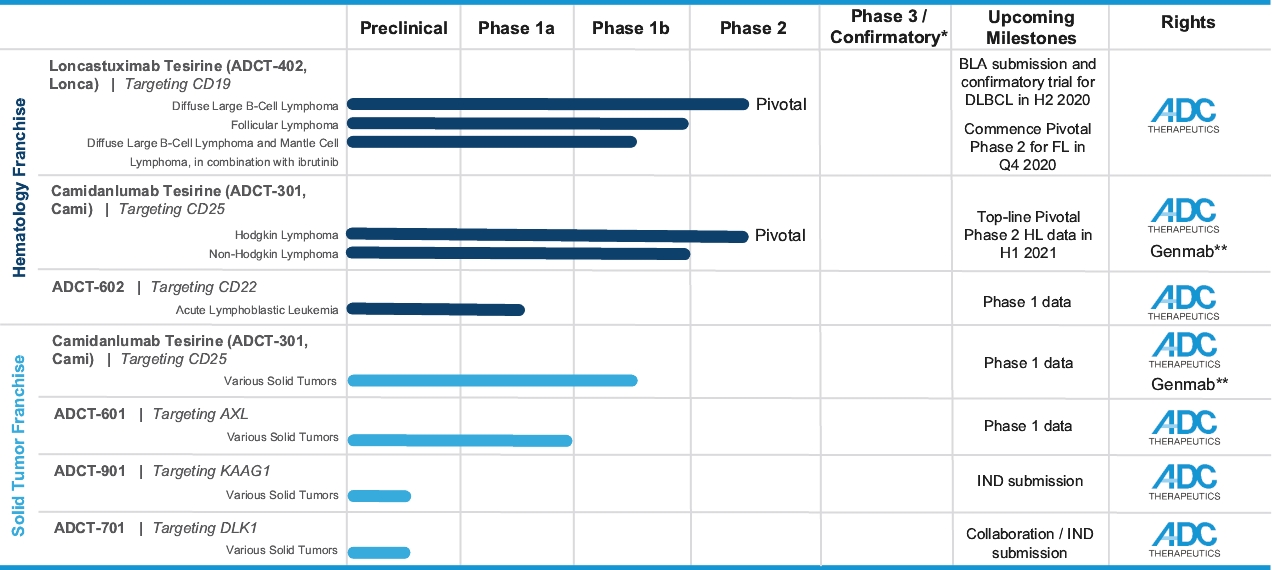

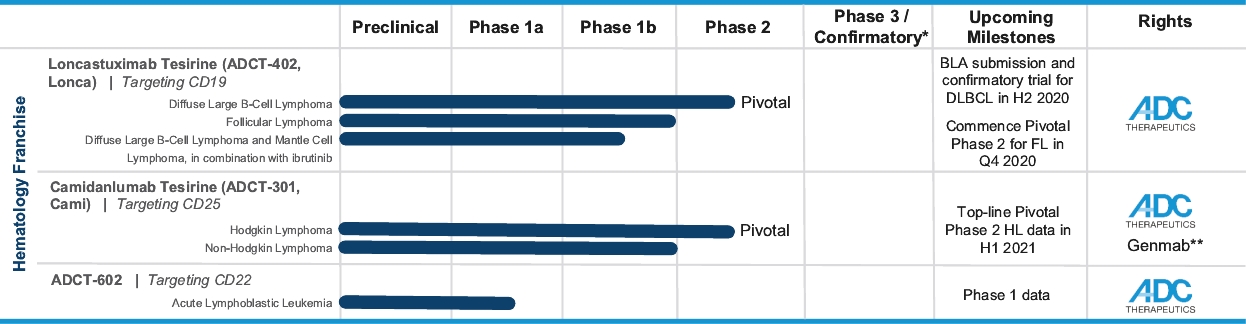

| • | We retain exclusive worldwide development and commercialization rights to Lonca. We intend to commercialize Lonca in the United States through our own infrastructure and may selectively pursue strategic collaborations in other geographies. |

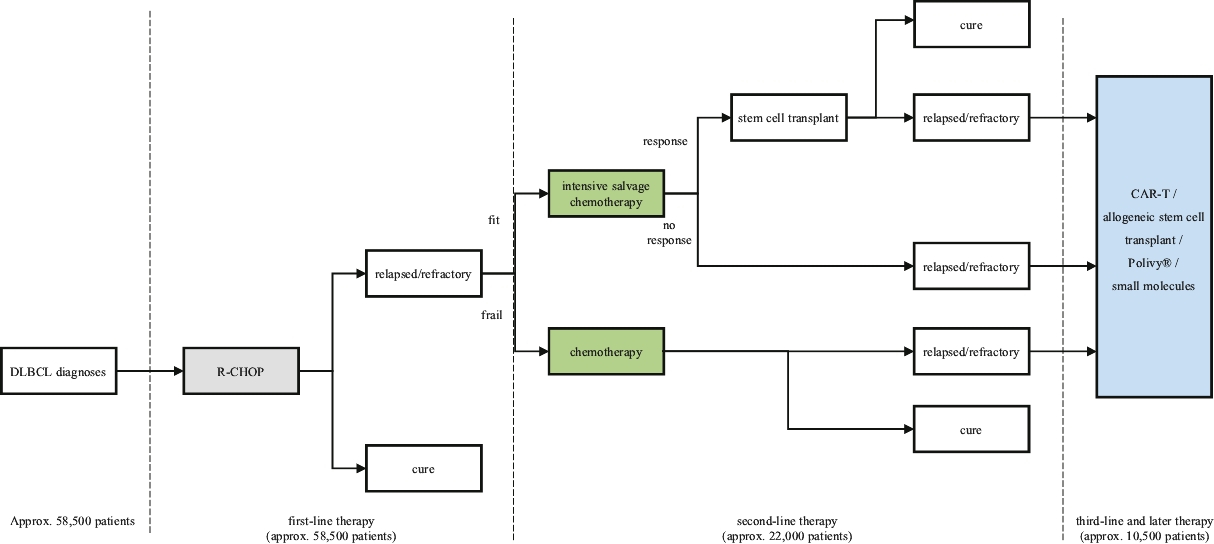

| • | We intend to submit a BLA to the FDA for Lonca for the treatment of relapsed or refractory DLBCL in the second half of 2020. Concurrently, we intend to commence a post-marketing confirmatory clinical trial of Lonca in combination with rituximab, which, if successful, we believe will support a supplemental BLA for Lonca to be used as a second-line therapy for the treatment of relapsed or refractory DLBCL. |

| • | We completed enrollment of a 145-patient pivotal Phase 2 clinical trial for the treatment of relapsed or refractory DLBCL, for which we anticipate reporting final data at a medical conference in the second quarter of 2020. |

| ○ | As of October 2019, we observed a 45.5% interim ORR in 145 heavily pre-treated patients who have received a median of three prior lines of therapy. This interim ORR exceeded our target primary endpoint and the 41.4% ORR observed for DLBCL patients in our 183-patient Phase 1 clinical trial who were treated at the initial dose used in our pivotal Phase 2 clinical trial. |

| ○ | Lonca’s significant clinical activity was observed across a broad patient population in this clinical trial, including patients with primary refractory disease, bulky disease, double-hit or triple-hit disease and transformed disease, elderly patients and patients who did not respond to prior therapy. |

| • | Lonca is also being evaluated in a Phase 1/2 clinical trial in combination with ibrutinib for the treatment of relapsed or refractory DLBCL and mantle cell lymphoma (“MCL”), for which we anticipate reporting interim safety and efficacy data from the Phase 1 part of this clinical trial at a medical conference in the second quarter of 2020. |

| ○ | As of April 21, 2020, at the dose that will be used in the pivotal Phase 2 part of the clinical trial, we observed a 76.9% ORR and a 61.5% complete response rate in heavily pre-treated evaluable DLBCL patients who have received a median of three prior lines of therapy. |

| ○ | We intend to advance Lonca into a potential pivotal Phase 2 stage of this clinical trial. |

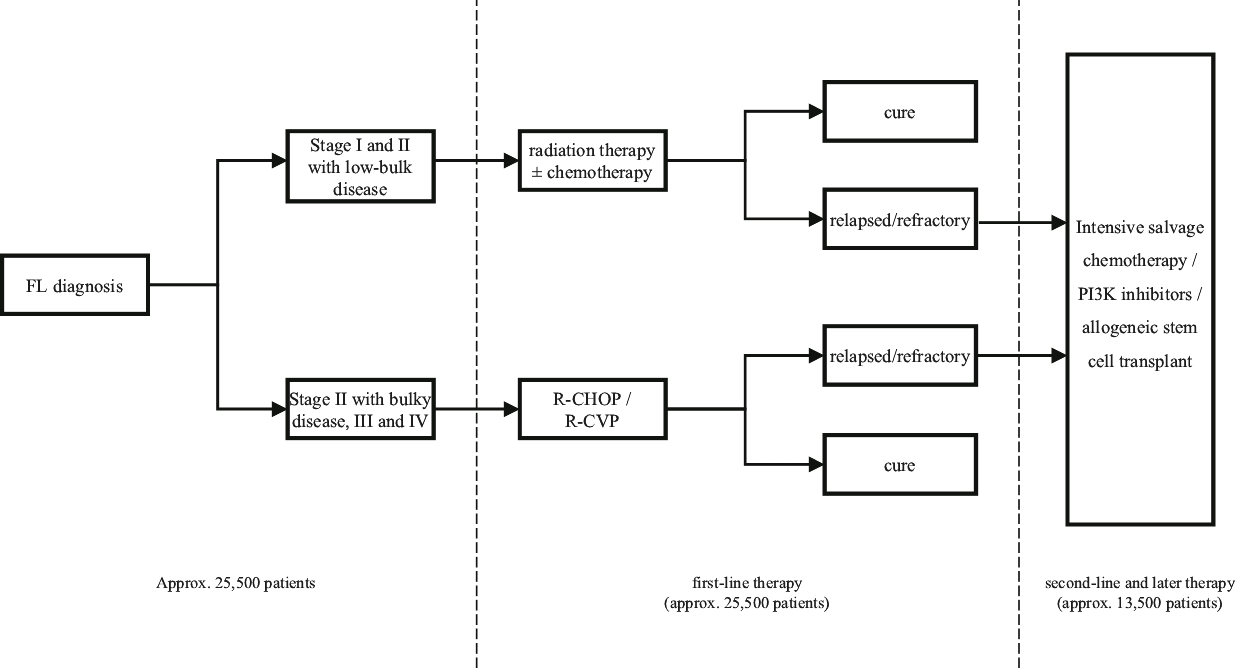

| • | We also intend to commence an additional pivotal Phase 2 clinical trial of Lonca for the treatment of FL in the fourth quarter of 2020. |

| ○ | In the Phase 1 clinical trial of Lonca for the treatment of relapsed or refractory NHL, which included 14 patients with FL, we observed a 78.6% ORR in heavily pre-treated patients with relapsed or refractory FL who have received a median of four prior lines of therapy. |

| • | Favorable clinical activity across a broad patient population, including transplant eligible and ineligible patients, patients who have not responded to first-line therapy or any prior therapy and patients with bulky disease, double-hit and triple-hit disease and transformed disease; |

| • | Significant single-agent clinical activity while maintaining a manageable tolerability profile with a low incidence of febrile neutropenia; |

| • | Activity in heavily pretreated patients, including those who have received prior CD19 therapies and stem cell transplant (“SCT”); |

| • | Promising clinical activity observed in our combination clinical trial with ibrutinib, which we believe demonstrates the opportunity to advance Lonca into earlier lines of therapy in combination with other therapies such as ibrutinib and rituximab; and |

| • | Convenient 30-minute intravenous infusions once every three weeks in the out-patient setting. |

| • | Our successful recruitment of an experienced Chief Commercial Officer and senior commercial leadership team, including a Vice President of Sales, a Vice President of Marketing and a Vice President of Market Access, with broader organizational recruitment underway; |

| • | Our successful recruitment of a Vice President of Medical Affairs, with a broader organizational recruitment underway to include field-based medical science liaisons; |

| • | Investing resources to assess the competitive landscape, supporting our differentiated profile and accelerating our launch readiness efforts; |

| • | Increased scientific interactions with Key Opinion Leaders; and |

| • | Our plans to build a U.S. field sales organization comprising of approximately 40 to 60 sales representatives, which we believe will be sufficient to reach approximately 80% of the potential prescribing physicians for Lonca. |

| • | We retain worldwide development and commercialization rights to Cami, subject to our collaboration and license agreement with Genmab. |

| • | Cami is being evaluated in a 100-patient pivotal Phase 2 clinical trial for the treatment of relapsed or refractory HL, for which we anticipate reporting top-line response rate data in the first half of 2021. |

| ○ | As of April 15, 2020, 47 patients have been enrolled in this pivotal Phase 2 clinical trial, which is currently subject to a partial clinical hold. See “Business—Camidanlumab Tesirine (ADCT-301): PBD-Based ADC Targeting CD25—Pivotal Phase 2 Clinical Trial in Relapsed or Refractory Hodgkin Lymphoma.” |

| • | We are advancing Cami through clinical development to support a BLA submission for the treatment of relapsed or refractory HL. |

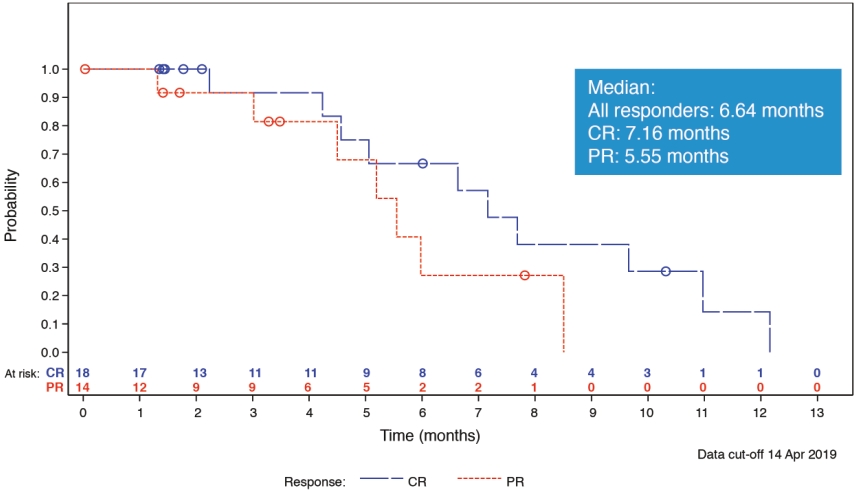

| • | Enrollment has been completed in a 133-patient Phase 1 clinical trial of Cami for the treatment of relapsed or refractory HL and NHL, including 77 patients with relapsed or refractory HL. In this clinical trial, Cami demonstrated significant clinical activity across a broad patient population and maintained a tolerability profile that we believe was manageable. More specifically, as of April 2019, we observed: |

| ○ | At the initial dose for our pivotal Phase 2 clinical trial, an 86.5% ORR in heavily pre-treated patients with relapsed or refractory HL who have received a median of five prior lines of therapy, including patients who were relapsed or refractory to any or all of brentuximab vedotin, checkpoint inhibitors and stem cell transplant; and |

| ○ | A 44.0% ORR in heavily pre-treated patients with relapsed or refractory T-cell lymphoma who have received a median of four prior lines of therapy. |

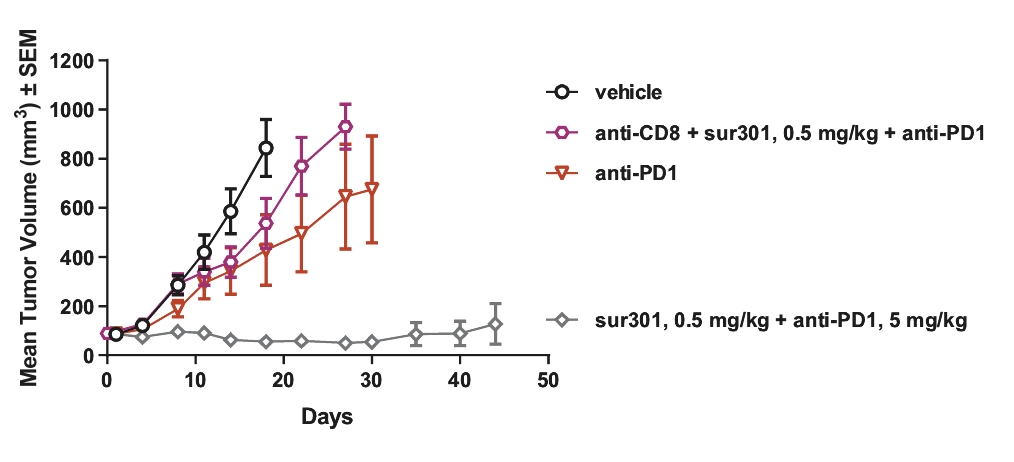

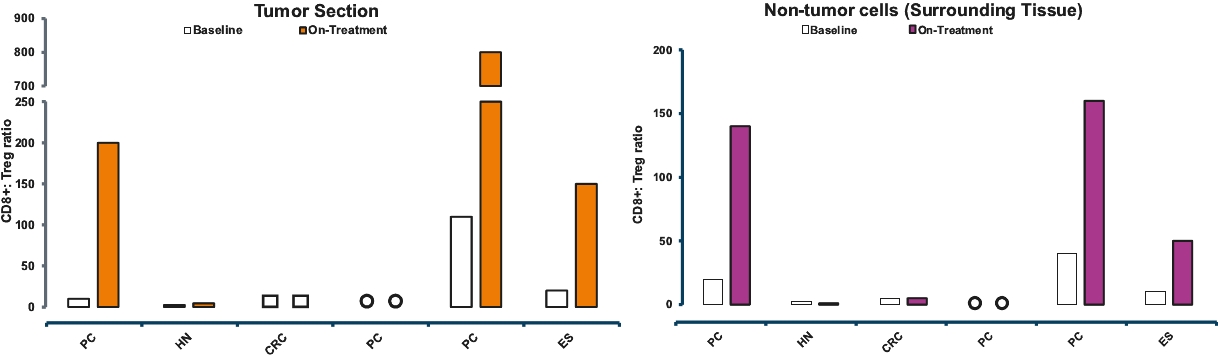

| • | Cami is also being evaluated in a Phase 1b clinical trial for the treatment of selected advanced solid tumors by targeting CD25-expressing regulatory T cells (“Tregs”), for which we anticipate reporting interim data at a medical conference in the second half of 2020. |

| ○ | In paired biopsies from three patients in the Phase 1b clinical trial, we have observed a significant increase in the ratio of T effector cells (“Teffs”) to Tregs. |

| • | At the initial dose for our pivotal Phase 2 clinical trial, an 86.5% ORR in heavily pre-treated patients with relapsed or refractory HL who were relapsed or refractory to any or all of brentuximab vedotin, checkpoint inhibitors and stem cell transplant; |

| • | Tolerability profile that we believe is manageable; |

| • | The potential opportunity to advance Cami into earlier lines of therapy as a monotherapy or in combination with other therapies; |

| • | Novel immuno-oncology approach targeting Tregs for the treatment of various advanced solid tumors; and |

| • | Convenient 30-minute intravenous infusions once every three weeks in the out-patient setting. |

| • | Advance our lead product candidate, Lonca, to BLA submission in the second half of 2020. |

| • | Expand the potential market opportunity by advancing Lonca into earlier lines of therapy and for multiple indications. |

| • | Advance our second lead product candidate, Cami, to support BLA submission. |

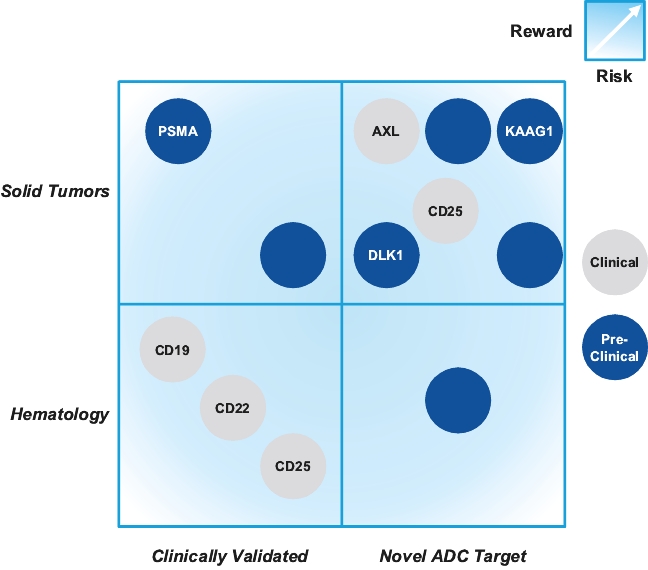

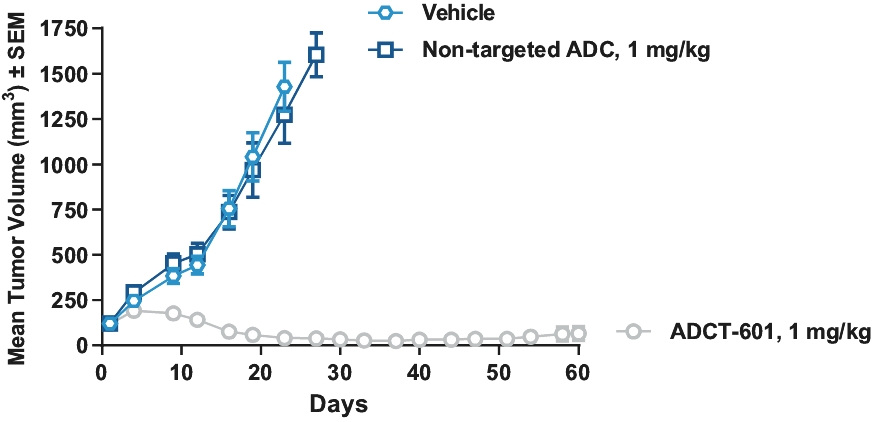

| • | Advance our two clinical-stage solid tumor product candidates to address multiple indications in areas of high unmet medical need. |

| • | Continue to build a diverse and balanced portfolio of product candidates to address high unmet medical needs in oncology by leveraging our R&D strengths, our disciplined approach to target selection and our preclinical and clinical development strategy. |

| • | Maximize the commercial potential of our product candidates through both our own commercial organization and strategic collaborations. |

| • | We have incurred net losses during all fiscal periods since our inception, have no products approved for commercial sale and anticipate that we will continue to incur substantial net losses for the foreseeable future. |

| • | The Facility Agreement, our indebtedness and the associated restrictive covenants thereunder could adversely affect our financial condition and will restrict our ability to raise capital. |

| • | We have concentrated our research and development efforts on PBD-based ADCs, and our future success depends heavily on the successful development of this therapeutic approach. |

| • | Our current product candidates are in various stages of development, and it is possible that none of our product candidates will ever become commercial products. |

| • | Our pivotal Phase 2 clinical trial of Cami for the treatment of relapsed or refractory HL is currently subject to a partial clinical hold. In addition, in the past, certain of our clinical trials have been subject to clinical holds prior to the dosing of the first patient and partial clinical holds after the dosing of the first patient. A clinical hold on any of our clinical trials will result in delays of our clinical development timeline. |

| • | Our product candidates may cause undesirable side effects or have other properties that may delay or prevent their development or regulatory approval or limit their commercial potential. |

| • | The regulatory review and approval processes of the FDA, the European Medicines Agency (“EMA”) and comparable regulatory authorities in other jurisdictions are lengthy, time-consuming and inherently unpredictable. If we are unable to obtain, or if there are delays in obtaining, regulatory approval for our product candidates, we will not be able to commercialize our product candidates and our ability to generate revenue will be materially impaired. |

| • | As a company, we have never commercialized a product. We currently have no active sales force and we are in the process of building our commercial infrastructure. We may lack the necessary expertise, personnel and resources to successfully commercialize our product candidates. |

| • | We face substantial competition, which may result in others discovering, developing or commercializing products, treatment methods and/or technologies before or more successfully than we do. |

| • | Our rights to Cami are subject to our collaboration and license agreement with Genmab, and there can be no assurance that we will maintain the rights to develop or commercialize Cami. |

| • | We rely on third parties for the manufacture, production, storage and distribution of our product candidates. Our dependence on these third parties may impair the clinical advancement and commercialization of our product candidates. |

| • | Issued patents covering one or more of our product candidates or technologies, including Lonca, Cami or the technology we use in our product candidates, could be found invalid or unenforceable if challenged in court. |

| • | If we fail to attract and retain senior management and key scientific personnel or fail to adequately plan for succession, we may be unable to successfully develop our product candidates, conduct our clinical trials and commercialize our product candidates. |

| • | Our business could be adversely affected by the effects of health epidemics, including the recent COVID-19 pandemic, in regions where we or third parties on which we rely have significant manufacturing facilities, concentrations of clinical trial sites or other business operations. |

| • | We have identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect our business and the price of our common shares. |

| • | a requirement to have only two years of audited financial statements in addition to any required interim financial statements and correspondingly reduced disclosure in the Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in the registration statement of which this prospectus forms a part; |

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); and |

| • | to the extent that we no longer qualify as a foreign private issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirements of holding a non-binding advisory vote on executive compensation, including golden parachute compensation. |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

| • | 1,020,434 common shares issuable upon the exercise of options outstanding under our 2019 Equity Incentive Plan as of December 31, 2019, at a weighted-average exercise price of $18.75 per share, of which 7,857 common shares were forfeited in the first quarter of 2020; |

| • | 1,517,339 common shares issuable upon the exercise of options outstanding under our 2019 Equity Incentive Plan granted after December 31, 2019, at a weighted-average exercise price of $18.75 per share; |

| • | Approximately 400,000 common shares issuable upon the exercise of options to be granted in connection with this offering under our 2019 Equity Incentive Plan to certain of our directors, executive officers, employees and consultants, at an exercise price per share equal to the initial public offering price in this offering, as described under “Management’s Discussion and Analysis of Financial Results and Operations—Critical Accounting Policies and Significant Judgments and Estimates—Employee Benefits”; |

| • | 7,820,000 common shares reserved for future issuance under our 2019 Equity Incentive Plan, which include the common shares issuable upon the exercise of options granted or to be granted under our 2019 Equity Incentive Plan as described in the three preceding items; |

| • | 1,538,263 common shares we hold in treasury, net of the delivery of an estimated 300,000 common shares (subject to adjustments for final tax and social security deductions) that we expect to deliver to participants of our 2014 Incentive Plan to settle outstanding awards thereunder in connection with this offering; |

| • | common shares issuable upon the exercise of options to be granted to the chairman of our board of directors in connection with this offering, as described under “Management—Compensation of Directors and Executive Officers” to bring his total rights to acquire our common shares to 2% of our then-outstanding share capital; and |

| • | common shares issuable upon the conversion of the senior secured convertible notes to be issued under the Facility Agreement. |

| • | the Share Capital Reorganization; |

| • | the filing and effectiveness of our amended and restated articles of association, which will occur immediately prior to the completion of this offering; |

| • | no exercise of the option granted to the underwriters to purchase up to 1,103,250 additional common shares in connection with this offering; |

| • | an initial public offering price of $17.00 per common share, which is the midpoint of the price range set forth on the cover page of this prospectus; |

| • | no purchase of common shares in this offering by directors, officers or existing shareholders; |

| • | the delivery to participants of our 2014 Incentive Plan of an estimated 300,000 common shares (subject to adjustments for final tax and social security deductions), which we currently hold in treasury, to settle outstanding awards under our 2014 Incentive Plan in connection with this offering; |

| • | no exercise of outstanding options after December 31, 2019, other than the settlement of outstanding awards under our 2014 Incentive Plan in connection with this offering as contemplated above; and |

| • | no conversion of the senior secured convertible notes to be issued under the Facility Agreement. |

| | | Year Ended December 31, | ||||

| | | 2019(3) | | | 2018 | |

Consolidated Income Statement Data: | | | (in USD thousands except for share and per share data) | |||

Contract revenue | | | 2,340 | | | 1,140 |

Research and development expenses | | | (107,537) | | | (118,313) |

General and administrative expenses | | | (14,202) | | | (8,768) |

Operating loss | | | (119,399) | | | (125,941) |

Other income | | | 1,655 | | | — |

Financial income | | | 2,253 | | | 2,856 |

Financial expense | | | (156) | | | — |

Exchange differences | | | (255) | | | 213 |

Loss before taxes | | | (115,902) | | | (122,872) |

Income tax expenses | | | (582) | | | (224) |

Loss for the period | | | (116,484) | | | (123,096) |

Basic and diluted loss per share(1) | | | (2.36) | | | (2.64) |

Weighted-average number of shares used to compute basic and diluted loss per share(1) | | | 49,279,961 | | | 46,600,000 |

Pro forma basic and diluted loss per share(2) | | | (2.17) | | | |

Weighted-average number of shares used to compute pro forma basic and diluted loss per share(2) | | | 53,760,234 | | | |

| (1) | See Note 28 to our audited consolidated financial statements included elsewhere in this prospectus for a description of the method used to compute basic and diluted net loss per share. These figures have been retroactively adjusted to give effect to the Share Consolidation. |

| (2) | The pro forma information gives effect to the following: (i) the delivery of 597,774 common shares by plan participants for the settlement of the 2013 Promissory Notes and the 2016 Promissory Notes; (ii) the delivery to participants of our 2014 Incentive Plan of an estimated 300,000 common shares (subject to adjustments for final tax and social security deductions), which we currently hold in treasury, to settle outstanding awards under our 2014 Incentive Plan in connection with this offering and the related payment by us of an estimated $4.0 million in tax and social security liabilities on behalf of participants of our 2014 Incentive Plan; (iii) the issuance of 4,777,996 common shares to the holders of our Class E preferred shares, as described in “Related Party Transactions—Shareholders’ Agreement”; and (iv) the Conversion, as if each such event occurred on the first day of the period presented. |

| (3) | On January 1, 2019, we adopted IFRS 16 “Leases,” the impact of which is described in Note 17 to our audited consolidated financial statements included elsewhere in this prospectus. |

| | | As of December 31, 2019 | |||||||

| | | Actual | | | Pro Forma(1) | | | Pro Forma As Adjusted(2)(3) | |

Consolidated Balance Sheet Data: | | | (in USD thousands) | ||||||

Cash and cash equivalents | | | 115,551(4) | | | 111,517 | | | 284,800 |

Total assets | | | 137,682 | | | 133,648 | | | 306,931 |

Lease liability (long-term) | | | 3,899 | | | 3,899 | | | 3,899 |

Financial liability | | | — | | | — | | | 62,000 |

Total liabilities | | | 26,526 | | | 26,526 | | | 88,526 |

Share capital | | | 4,361 | | | 4,755 | | | 5,361 |

Share premium | | | 549,922 | | | 560,678 | | | 671,354 |

Treasury shares | | | (100) | | | (11,284) | | | (11,284) |

Other reserves | | | 5,473 | | | 9,089 | | | 9,089 |

Cumulative translation adjustments | | | 69 | | | 69 | | | 69 |

Accumulated losses | | | (448,569) | | | (456,185) | | | (456,185) |

Total equity | | | 111,156 | | | 107,122 | | | 218,405 |

| (1) | The pro forma information gives effect to the following: (i) the delivery of 597,774 common shares by plan participants for the settlement of the 2013 Promissory Notes and the 2016 Promissory Notes; (ii) the delivery to participants of our 2014 Incentive Plan of an estimated 300,000 common shares (subject to adjustments for final tax and social security deductions), which we currently hold in treasury, to settle outstanding awards under our 2014 Incentive Plan in connection with this offering and the related payment by us of an estimated $4.0 million in tax and social security liabilities on behalf of participants of our 2014 Incentive Plan; (iii) the issuance of 4,777,996 common shares to the holders of our Class E preferred shares, as described in “Related Party Transactions—Shareholders’ Agreement”; and (iv) the Conversion. |

| (2) | The pro forma as adjusted information gives effect to the pro forma adjustments described in footnote (1) above and to the following: (i) our issuance and sale of 7,355,000 common shares in this offering at the assumed initial public offering price of $17.00 per common share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us and (ii) the receipt of the $65.0 million initial disbursement under the Facility Agreement, after deducting estimated fees and expenses payable by us, and our issuance of $65.0 million aggregate principal amount of senior secured convertible notes in connection therewith. For the purposes of the pro forma as adjusted information, the amount to be received under the Facility Agreement has been presented entirely under financial liability and has not been divided between the fair value of the embedded derivative conversion feature and the residual convertible loan, pending valuation of the embedded derivative conversion feature. The sum of the embedded derivative and the financial liability will, upon the issuance of the senior secured convertible notes, be equal to the net proceeds associated with such issuance, which, for the issuance associated with the initial disbursement under the Facility Agreement, is estimated to be approximately $62.0 million. Once the embedded derivative conversion feature has been valued, enabling the amount receivable under the Facility Agreement to be divided between the fair value of the embedded derivative conversion feature and the residual convertible loan, the $3.0 million of estimated fees and expenses payable by us will be allocated pro rata to these two components. The share of expenses allocated to the embedded derivative conversion feature will be charged directly to the consolidated income statement, while the share of expenses allocated to the residual convertible loan will be deducted from the loan. As the embedded conversion feature has not yet been valued, no such charge has been made to accumulated losses in the pro forma as adjusted figures presented above. |

| (3) | The pro forma as adjusted information is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. Each $1.00 increase in the assumed initial public offering price of $17.00 per common share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase the pro forma as adjusted amount of each of cash and cash equivalents, total assets and total equity by $6.2 million, assuming that the number of common shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 decrease in the assumed initial public offering price of $17.00 per common share, which is the midpoint of the price range set forth on the cover page of this prospectus, would decrease the pro forma as adjusted amount of each of cash and cash equivalents, total assets and total equity by $5.9 million, assuming that the number of common shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each 1,000,000 share increase or decrease in the number of common shares offered by us would increase or decrease the pro forma as adjusted amount of each of cash and cash equivalents, total assets and total equity by $15.6 million, assuming the assumed initial public offering price of $17.00 per common share, the midpoint of the price range set forth on the cover page of this prospectus remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (4) | As of April 30, 2020, we had cash and cash equivalents of $72.5 million. |

| • | conduct and complete the pivotal Phase 2 clinical trial of Lonca for the treatment of relapsed or refractory DLBCL; |

| • | commence and conduct a confirmatory clinical trial of Lonca in combination with rituximab for the treatment of relapsed or refractory DLBCL; |

| • | commence and conduct a pivotal Phase 2 clinical trial of Lonca for the treatment of relapsed or refractory FL; |

| • | conduct and complete the pivotal Phase 2 clinical trial of Cami for the treatment of relapsed or refractory HL; |

| • | conduct and complete the Phase 1/2 clinical trial of Lonca and the Phase 1b clinical trial of Cami for the treatment of other indications and Phase 1 clinical trials for our other product candidates, as well as any subsequent clinical trials; |

| • | commence and conduct any required post-marketing confirmatory clinical trials for any of our product candidates in anticipation of potential accelerated approval from the FDA or similar conditional approval from the EMA or comparable regulatory agencies in other jurisdictions; |

| • | expand our research and development efforts for our preclinical product candidates and research pipeline; |

| • | seek regulatory approval for our product candidates from applicable regulatory authorities; |

| • | invest in our late-stage clinical development, manufacturing and commercialization activities, including launching commercial sales, marketing and distribution operations; |

| • | continue to prepare, file, prosecute, maintain, protect and enforce our intellectual property rights and claims; |

| • | add clinical, scientific, operational, financial and management information systems and personnel; and |

| • | operate as a public company. |

| • | the progress, results and costs of our pivotal Phase 2 clinical trial of Lonca for the treatment of relapsed or refractory DLBCL and our pivotal Phase 2 clinical trial of Cami for the treatment of relapsed or refractory HL; |

| • | the progress, results and costs of our planned confirmatory clinical trial of Lonca in combination with rituximab for the treatment of relapsed or refractory DLBCL; |

| • | the progress, results and costs of our clinical trials of Lonca and Cami for the treatment of other indications and for our other product candidates; |

| • | the progress, results and costs of any required post-marketing confirmatory clinical trials for any product candidates that receive accelerated approval from the FDA or similar conditional approval from the EMA or comparable regulatory agencies in other jurisdictions; |

| • | the scope, progress, results and costs of researching and developing product candidates in our research pipeline, including conducting preclinical studies and clinical trials of such product candidates; |

| • | the costs of outsourced manufacturing of our product candidates, which are complex biological molecules, for clinical trials and in preparation for regulatory approval and commercialization; |

| • | the outcome, timing and costs of obtaining regulatory approvals for our product candidates if the requisite clinical trials are successful; |

| • | the size of the markets for approved indications in territories in which we receive regulatory approval, if any; |

| • | the timing and costs of commercialization activities for our product candidates, if any are approved for sale, including establishing our sales and marketing capabilities and engaging in the marketing, sales and distribution of our product candidates; |

| • | the revenue, if any, received from the commercialization of our product candidates, if any are approved for sale; |

| • | our ability to maintain and establish collaboration, licensing or other arrangements and the financial terms of such agreements; |

| • | the costs involved in preparing, filing, prosecuting, maintaining, protecting and enforcing our intellectual property rights and claims, including any litigation costs and the outcome of such litigation; |

| • | the costs associated with potential product liability claims, including the costs associated with obtaining insurance against such claims and with defending against such claims; |

| • | the timing and amount of milestone payments we receive under our collaboration agreements; |

| • | the costs involved in maintaining and improving the technology we use in our product candidates; |

| • | our efforts to enhance operational systems and hire additional personnel, including personnel to support the development of our product candidates and to satisfy our obligations as a public company; |

| • | the effect of competing technological and market developments; and |

| • | the types of available sources of private and/or public market financing. |

| • | require us to dedicate a substantial portion of cash and cash equivalents to the payment of interest on, and principal of, the indebtedness, which will reduce the amounts available to fund working capital, capital expenditures, product development efforts and other general corporate purposes; |

| • | oblige us to negative covenants restricting our activities, including limitations on dispositions, mergers or acquisitions, encumbering our intellectual property, incurring indebtedness or liens, paying dividends, making investments and engaging in certain other business transactions; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and our industry; |

| • | place us at a competitive disadvantage compared to our competitors who have less debt or competitors with comparable debt at more favorable interest rates; and |

| • | limit our ability to borrow additional amounts for working capital, capital expenditures, research and development efforts, acquisitions, debt service requirements, execution of our business strategy and other purposes and otherwise restrict our financing options. |

| • | negative preclinical data; |

| • | delays in receiving the required regulatory clearance from the appropriate regulatory authorities to commence clinical trials or amend clinical trial protocols, including any objections to our INDs or protocol amendments from the FDA; |

| • | delays in reaching, or a failure to reach, a consensus with regulatory authorities on study design; |

| • | delays in reaching, or a failure to reach, an agreement on acceptable terms with prospective clinical research organizations (“CROs”) and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and clinical trial sites; |

| • | difficulties in obtaining required Institutional Review Board (“IRB”) or ethics committee approval at each clinical trial site; |

| • | challenges in recruiting and enrolling suitable patients that meet the study criteria to participate in clinical trials; |

| • | the inability to enroll a sufficient number of patients in clinical trials to ensure adequate statistical power to detect statistically significant treatment effects; |

| • | imposition of a clinical hold by regulatory authorities or IRBs for any reason, including safety concerns and non-compliance with regulatory requirements; |

| • | failure by CROs, other third parties or us to adhere to clinical trial requirements; |

| • | failure to perform in accordance with the FDA’s good clinical practices (“GCP”) or applicable regulatory guidelines in other jurisdictions; |

| • | the inability to manufacture adequate quantities of a product candidate or other materials necessary in accordance with current Good Manufacturing Practices (“cGMPs”) to conduct clinical trials, including, for example, quality issues and delays in the testing, validation, manufacturing delays or failures at our CROs and delivery of the product candidates to the clinical trial sites; |

| • | lower than anticipated patient retention rates; |

| • | difficulties in maintaining contact with patients after treatment, resulting in incomplete data; |

| • | ambiguous or negative interim results; |

| • | our CROs or clinical trial sites failing to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all, deviating from the protocol or dropping out of a clinical trial; |

| • | unforeseen safety issues, including occurrence of treatment emergent adverse events (“TEAEs”) associated with the product candidate that are viewed to outweigh the product candidate’s potential benefits; |

| • | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols; |

| • | lack of adequate funding to continue the clinical trial; or |

| • | delays and disruptions as a result of the COVID-19 pandemic. |

| • | the size and nature of the patient population; |

| • | the severity of the disease under investigation; |

| • | the eligibility criteria for the study in question, including any misjudgment of, and resultant adjustment to, the appropriate ranges applicable to the exclusion and inclusion criteria; |

| • | the number of clinical trial sites and the proximity of prospective patients to those sites; |

| • | the nature, severity and frequency of adverse side effects associated with our product candidates; |

| • | the standard of care in the diseases under investigation; |

| • | the commitment of our clinical investigators to identify eligible patients; |

| • | competing studies or trials with similar eligibility criteria; |

| • | the patient referral practices of physicians; |

| • | clinicians’ and patients’ perceptions as to the potential advantages and risks of the product candidate being studied in relation to other available therapies, including perception of ADCs generally and of PBD-based ADCs specifically; and |

| • | disruptions as a result of the COVID-19 pandemic. |

| • | we may encounter delays or difficulties in enrolling patients for our clinical trials due to a negative perception of our product candidates’ safety and tolerability profile; |

| • | we and/or regulatory authorities may temporarily or permanently put our clinical trials on hold; |

| • | we may be unable to obtain regulatory approval for our product candidates; |

| • | regulatory authorities may withdraw or limit their approvals of our product candidates; |

| • | regulatory authorities may require the addition of labeling statements, such as a contraindication, boxed warnings or additional warnings; |

| • | the FDA may require development of a Risk Evaluation and Mitigation Strategy with Elements to Assure Safe Use as a condition of approval; |

| • | we may decide to remove our product candidates from the marketplace; |

| • | we may be subject to regulatory investigations and government enforcement actions; |

| • | we could be sued and held liable for harm caused to patients, including as a result of hospital errors; and |

| • | our reputation may suffer. |

| • | the FDA, EMA or comparable regulatory authorities in other jurisdictions may disagree with the number, design or implementation of our clinical trials; |

| • | the population studied in the clinical trial may not be considered sufficiently broad or representative to assure safety in the full population for which we seek approval; |

| • | the FDA, EMA or comparable regulatory authorities in other jurisdictions may disagree with our interpretation of data from preclinical studies or clinical trials; |

| • | the data collected from clinical trials of our product candidates may not meet the level of statistical or clinical significance required by the FDA, EMA or comparable regulatory authorities in other jurisdictions or may otherwise not be sufficient to support the submission of a BLA, Marketing Authorization Application (“MAA”) or other submission or to obtain regulatory approval in the United States, the European Union or elsewhere; |

| • | the FDA, EMA or comparable regulatory authorities in other jurisdictions may not accept data generated by our preclinical service providers and clinical trial sites; |

| • | the FDA, EMA or comparable regulatory authorities in other jurisdictions may require us to conduct additional preclinical studies and clinical trials; |

| • | we may be unable to demonstrate to the FDA, EMA or comparable regulatory authorities in other jurisdictions that a product candidate’s response rate, DoR or risk-benefit ratio for its proposed indication is acceptable; |

| • | the FDA, EMA or comparable regulatory authorities in other jurisdictions may fail to approve the manufacturing processes, test procedures and specifications applicable to the manufacture of our product candidates, the facilities of third-party manufacturers with which we contract for clinical or commercial supplies may fail to maintain a compliance status acceptable to the FDA, EMA or comparable regulatory authorities or the EMA or comparable regulatory authorities may fail to approve facilities of third-party manufacturers with which we contract for clinical and commercial supplies; |

| • | we or any third-party service providers may be unable to demonstrate compliance with cGMPs to the satisfaction of the FDA, EMA or comparable regulatory authorities in other jurisdictions, which could result in delays in regulatory approval or require us to withdraw or recall products and interrupt commercial supply of our products; |

| • | the approval policies or regulations of the FDA, EMA or comparable regulatory authorities in other jurisdictions may change in a manner rendering our clinical data insufficient for approval; or |

| • | political factors surrounding the approval process, such as government shutdowns and political instability. |

| • | the clinical trial(s) required to verify the predicted clinical benefit of a product candidate fails to verify such benefit or does not demonstrate sufficient clinical benefit to justify the risks associated with the product candidate; |

| • | other evidence demonstrates that a product candidate is not shown to be safe or effective under the conditions of use; |

| • | we fail to conduct any required post-marketing confirmatory clinical trial with due diligence; or |

| • | we disseminate false or misleading promotional materials relating to the relevant product candidate. |

| • | restrictions on the marketing or manufacturing of the product; |

| • | withdrawal of the product from the market or voluntary or mandatory product recalls; |

| • | fines, restitution or disgorgement of profits or revenues; |

| • | warning or untitled letters; |

| • | requirements to conduct post-marketing studies or clinical trials; |

| • | holds on clinical trials; |

| • | refusal by the FDA, EMA or comparable regulatory authorities in other jurisdictions to approve pending applications or supplements to approved applications filed by us, or suspension or revocation of product license approvals; |

| • | product seizure or detention; |

| • | refusal to permit the import or export of products; and |

| • | injunctions or the imposition of civil or criminal penalties. |

| • | the safety and efficacy of the product, as demonstrated in clinical trials; |

| • | the indications for which the product is approved and the labeling approved by regulatory authorities for use with the product, including any warnings that may be required in the labeling; |

| • | our ability to offer our products for sale at competitive prices; |

| • | the perceptions of physicians, patients and patient advocacy groups of ADCs generally and PBD-based ADCs specifically; |

| • | the treatment’s cost, safety, efficacy, convenience and ease of administration compared to that of alternative treatments; |

| • | acceptance by physicians, patients and patient advocacy groups of the product as a safe and effective treatment; |

| • | the availability of coverage and adequate reimbursement by third-party payors, including cost-sharing programs such as copays and deductibles; |

| • | patients’ willingness to pay out-of-pocket in the absence of coverage and/or adequate reimbursement from third-party payors; |

| • | the effectiveness of our and our competitors’ sales and marketing efforts; |

| • | our ability to establish sales, marketing and commercial product distribution capabilities or to partner with third parties with such capabilities; |

| • | the nature, severity and frequency of adverse side effects; |

| • | any restrictions on the use of our products together with other medications; |

| • | publication of any post-approval data on the safety and effectiveness of the product; and |

| • | the success of randomized post-marketing commitment studies to confirm the benefit-risk ratio of the product. |

| • | a covered benefit under its health plan; |

| • | safe, effective and medically necessary; |

| • | appropriate for the specific patient; |

| • | cost-effective; and |

| • | neither experimental nor investigational. |

| • | increased the minimum Medicaid rebates owed by manufacturers under the Medicaid Drug Rebate Program; |

| • | established a branded prescription drug fee that pharmaceutical manufacturers of certain branded prescription drugs must pay to the federal government; |

| • | expanded the list of covered entities eligible to participate in the 340B drug pricing program by adding new entities to the program; |

| • | established a new Medicare Part D coverage gap discount program, in which manufacturers must agree to offer 70% point-of-sale discounts off negotiated prices of applicable brand drugs to eligible beneficiaries during their coverage gap period, as a condition for the manufacturer’s outpatient drugs to be covered under Medicare Part D; |

| • | extended manufacturers’ Medicaid rebate liability to covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations; |

| • | expanded eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to additional individuals and by adding new mandatory eligibility categories for individuals with income at or below 133% of the federal poverty level, thereby potentially increasing manufacturers’ Medicaid rebate liability; |

| • | created a new methodology by which rebates owed by manufacturers under the Medicaid Drug Rebate Program are calculated for certain drugs and biologics, including our product candidates, that are inhaled, infused, instilled, implanted or injected; |

| • | established a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in, and conduct comparative clinical effectiveness research, along with funding for such research; |

| • | established a Center for Medicare and Medicaid Innovation at the CMS to test innovative payment and service delivery models to lower Medicare and Medicaid spending, potentially including prescription drug spending; and |

| • | created a licensure framework for follow-on biologic products. |

| • | the demand for any products for which we may obtain regulatory approval; |

| • | our ability to set a price that we believe is fair for our products; |

| • | our ability to obtain coverage and reimbursement approval for a product; |

| • | our ability to generate revenues and achieve or maintain profitability; and |

| • | the level of taxes that we are required to pay. |

| • | advance the technology we use in our product candidates; |

| • | obtain, maintain, protect and enforce intellectual property protection for our technologies and product candidates; |

| • | obtain required government and other public and private approvals on a timely basis; |

| • | attract and retain key personnel; |

| • | execute our research and development plans; |

| • | commercialize effectively; |

| • | obtain and maintain coverage and reimbursement for our products in approved indications; |

| • | obtain adequate funding for our activities; |

| • | comply with applicable laws, regulations and regulatory requirements and restrictions with respect to the commercialization of our products, including with respect to any changed or increased regulatory restrictions; and |

| • | enter into additional strategic collaborations to advance the development and commercialization of our product candidates. |

| • | have staffing difficulties; |

| • | fail to comply with contractual obligations; |

| • | experience regulatory compliance issues; |

| • | undergo changes in priorities or become financially distressed; or |

| • | form relationships with other entities, some of which may be our competitors. |

| • | delays or stoppages in product shipments for our product candidates, including loss shipments and cross-border logistical complications, resulting in delayed and lost shipments; |

| • | delays to the development timelines for our product candidates; |

| • | an inability to commence or continue clinical trials of product candidates under development; |

| • | interruption of supply resulting from modifications to a CMO’s operations; |

| • | delays or stoppage in manufacturing or shipment due to a CMO’s bankruptcy, winding up, reorganization or similar corporate failures or financial distress; |

| • | delays in product manufacturing or shipments resulting from uncorrected defects, reliability or stability issues, or a CMO’s variation in a component; |

| • | a lack of long-term arrangements for key components; |

| • | inability to obtain adequate supply in a timely manner, or to obtain adequate supply on commercially reasonable terms; |

| • | difficulty and cost associated with locating and qualifying alternative CMOs for our components or raw materials in a timely manner; |

| • | production delays related to the evaluation and testing of components from alternative CMOs, and corresponding regulatory qualifications; |

| • | delay in delivery due to our CMOs’ prioritizing other customer orders over ours; |

| • | damage to our reputation caused by defective product candidates produced by our CMOs; and |

| • | potential price increases. |

| • | the scope of rights granted under the license agreement and other interpretation-related issues; |

| • | the extent to which our technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| • | the sublicensing of patent and other rights under our existing collaborative development relationships and any collaboration relationships we might enter into in the future; |

| • | our diligence obligations under the license agreement and what activities satisfy those diligence obligations; |

| • | the inventorship and ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our current and future licensors and us; and |

| • | the priority of invention of patented technology. |

| • | others may be able to make products that are similar to any product candidates we may develop or utilize similar technology but that are not covered by the claims of the patents that we license or may own in the future; |

| • | we, or our license partners or current or future collaborators, might not have been the first to make the inventions covered by the issued patent or pending patent application that we license or may own in the future; |

| • | we, or our license partners or current or future collaborators, might not have been the first to file patent applications covering certain of our or their inventions; |

| • | others may independently develop similar or alternative technologies or duplicate any of our technologies without infringing our owned or licensed intellectual property rights; |

| • | it is possible that our pending licensed patent applications or those that we may own in the future will not lead to issued patents; |

| • | issued patents that we hold rights to may be held invalid or unenforceable, including as a result of legal challenges by our competitors; |

| • | our competitors might conduct research and development activities in countries where we do not have patent rights and then use the information learned from such activities to develop competitive products for sale in our major commercial markets; |

| • | we may not develop additional proprietary technologies that are patentable; |

| • | the patents of others may harm our business; and |

| • | we may choose not to file a patent in order to maintain certain trade secrets or know-how, and a third party may subsequently file a patent covering such intellectual property. |

| • | our available capital resources or capital constraints we experience; |

| • | the rate of progress, costs and results of our clinical trials and research and development activities, including the extent of scheduling conflicts with participating clinicians and collaborators; |

| • | our ability to identify and enroll patients who meet clinical trial eligibility criteria; |

| • | our receipt of approvals by the FDA, EMA and comparable regulatory authorities in other jurisdictions, and the timing thereof; |

| • | other actions, decisions or rules issued by regulators; |

| • | our ability to access sufficient, reliable and affordable supplies of materials used in the manufacture of our product candidates; |

| • | our ability to manufacture and supply clinical trial materials to our clinical sites on a timely basis; |

| • | the efforts of our collaborators with respect to the commercialization of our products; and |

| • | the securing of, costs related to, and timing issues associated with, commercial product manufacturing as well as sales and marketing activities. |

| • | The federal Anti-Kickback Statute, which prohibits any person or entity from, among other things, knowingly and willfully soliciting, receiving, offering or paying any remuneration, directly or indirectly, overtly or covertly, in cash or in kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of an item or service reimbursable, in whole or in part, under a federal healthcare program, such as the Medicare and Medicaid programs. The term “remuneration” has been broadly interpreted to include anything of value. The federal Anti-Kickback Statute has also been interpreted to apply to arrangements between pharmaceutical manufacturers on the one hand and prescribers, purchasers, and formulary managers on the other hand. There are a number of statutory exceptions and regulatory safe harbors protecting some common activities from prosecution, but the exceptions and safe harbors are drawn narrowly and require strict compliance in order to offer protection. |

| • | Federal civil and criminal false claims laws, such as the False Claims Act (“FCA”), which can be enforced by private citizens through civil qui tam actions, and civil monetary penalty laws prohibit individuals or entities from, among other things, knowingly presenting, or causing to be presented, false, fictitious or fraudulent claims for payment of federal funds, and knowingly making, using or causing to be made or used a false record or statement material to a false or fraudulent claim to avoid, decrease or conceal an obligation to pay money to the federal government. For example, pharmaceutical companies have been prosecuted under the FCA in connection with their alleged off-label promotion of drugs, purportedly concealing price concessions in the pricing information submitted to the government for government price reporting purposes, and allegedly providing free product to customers with the expectation that the customers would bill federal healthcare programs for the product. In addition, a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the FCA. As a result of a modification made by the Fraud Enforcement and Recovery Act of 2009, a claim includes “any request or demand” for money or property presented to the U.S. government. In addition, manufacturers can be held liable under the FCA even when they do not submit claims directly to government payors if they are deemed to “cause” the submission of false or fraudulent claims. |

| • | HIPAA, among other things, imposes criminal liability for executing or attempting to execute a scheme to defraud any healthcare benefit program, including private third-party payors, knowingly and willfully embezzling or stealing from a healthcare benefit program, willfully obstructing a criminal investigation of a healthcare offense, and creates federal criminal laws that prohibit knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement or representation, or making or using any false writing or document knowing the same to contain any materially false, fictitious or fraudulent statement or entry in connection with the delivery of or payment for healthcare benefits, items or services. |

| • | HIPAA, as amended by HITECH, and their implementing regulations, which impose privacy, security and breach reporting obligations with respect to individually identifiable health information upon entities subject to the law, such as health plans, healthcare clearinghouses and certain healthcare providers, known as covered entities, and their respective business associates that perform services for them that involve individually identifiable health information. HITECH also created new tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority to file civil actions for damages or injunctions in U.S. federal courts to enforce HIPAA laws and seek attorneys’ fees and costs associated with pursuing federal civil actions. |

| • | Federal and state consumer protection and unfair competition laws, which broadly regulate marketplace activities and activities that potentially harm consumers. |

| • | The federal transparency requirements under the Physician Payments Sunshine Act, created under the Health Care Reform Act, which requires, among other things, certain manufacturers of drugs, devices, biologics and medical supplies reimbursed under Medicare, Medicaid, or the Children’s Health Insurance Program to report annually to CMS information related to payments and other transfers of value provided to physicians, as defined by such law, and teaching hospitals and physician ownership and investment interests, including such ownership and investment interests held by a physician’s immediate family members. |

| • | State and foreign laws that are analogous to each of the above federal laws, such as anti-kickback and false claims laws, that may impose similar or more prohibitive restrictions, and may apply to items or services reimbursed by non-governmental third-party payors, including private insurers. |

| • | State and foreign laws that require pharmaceutical companies to implement compliance programs, comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government, or to track and report gifts, compensation and other remuneration provided to physicians and other healthcare providers; state laws that require the reporting of marketing expenditures or drug pricing, including information pertaining to and justifying price increases; state and local laws that require the registration of pharmaceutical sales representatives; state laws that prohibit various marketing-related activities, such as the provision of certain kinds of gifts or meals; state laws that require the posting of information relating to clinical trials and their outcomes; and other federal, state and foreign laws that govern the privacy and security of health information or personally identifiable information in certain circumstances, including state health information privacy and data breach notification laws which govern the collection, use, disclosure, and protection of health-related and other personal information, many of which differ from each other in significant ways and often are not pre-empted by HIPAA, thus requiring additional compliance efforts. |

| • | decreased demand for our product candidates or products that we may develop; |

| • | injury to our reputation and significant negative media attention; |

| • | withdrawal of clinical trial sites and/or study participants; |

| • | significant costs to defend the related litigations; |

| • | a diversion of management’s time and our resources to pursue our business strategy; |

| • | substantial monetary awards to study participants or patients; |

| • | product recalls, withdrawals or labeling, marketing or promotional restrictions; |

| • | loss of revenue; |

| • | the inability to commercialize our product candidates that we may develop; and |

| • | a decline in the price of our common shares. |

| • | high acquisition costs; |

| • | the need to incur substantial debt or engage in dilutive issuances of equity securities to pay for acquisitions; |

| • | the potential disruption of our historical business and our activities under our collaboration agreements; |

| • | the strain on, and need to expand, our existing operational, technical, financial and administrative infrastructure; |

| • | our lack of experience in late-stage product development and commercialization; |

| • | the difficulties in assimilating employees and corporate cultures; |

| • | the difficulties in hiring qualified personnel and establishing necessary development and/or commercialization capabilities; |

| • | the failure to retain key management and other personnel; |

| • | the challenges in controlling additional costs and expenses in connection with and as a result of the acquisition; |

| • | the need to write down assets or recognize impairment charges; |

| • | the diversion of our management’s attention to integration of operations and corporate and administrative infrastructures; and |

| • | any unanticipated liabilities for activities of or related to the acquired business or its operations, products or product candidates. |

| • | economic weakness, including inflation, or political instability in particular non-U.S. economies and markets; |

| • | global trends towards pharmaceutical pricing; |

| • | differing regulatory requirements for drug approvals in non-U.S. countries; |

| • | differing reimbursement, pricing and insurance regimes; |

| • | potentially reduced protection for, and complexities and difficulties in obtaining, maintaining, protecting and enforcing, intellectual property rights; |

| • | difficulties in compliance with non-U.S. laws and regulations; |

| • | changes in non-U.S. regulations and customs, tariffs and trade barriers; |

| • | changes in non-U.S. currency exchange rates and currency controls; |

| • | changes in a specific country’s or region’s political or economic environment; |

| • | trade protection measures, economic sanctions and embargoes, import or export licensing requirements or other restrictive actions by U.S. or non-U.S. governments; |

| • | negative consequences from changes in tax laws; |

| • | compliance with tax, employment, immigration and labor laws for employees living or traveling abroad; |

| • | workforce uncertainty in countries where labor unrest is more common than in the United States; |

| • | difficulties associated with staffing and managing international operations, including differing labor relations; |

| • | production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; |

| • | business interruptions resulting from geopolitical actions, including war and terrorism, or natural disasters including earthquakes, typhoons, floods and fires; and |

| • | the impact of public health epidemics on employees and the global economy, such as the novel coronavirus. |

| • | results and timing of preclinical studies and clinical trials of our product candidates; |

| • | results of clinical trials of our competitors’ products; |

| • | public concern relating to the commercial value or safety of any of our product candidates; |

| • | our inability to adequately protect our proprietary rights, including patents, trademarks and trade secrets; |

| • | our inability to raise additional capital and the terms on which we raise it; |

| • | commencement or termination of any strategic collaboration or licensing arrangement; |

| • | regulatory developments, including actions with respect to our products or our competitors’ products; |

| • | actual or anticipated fluctuations in our financial condition and operating results; |

| • | publication of research reports by securities analysts about us or our competitors or our industry; |

| • | our failure or the failure of our competitors to meet analysts’ projections or guidance that we or our competitors may give to the market; |

| • | additions and departures of key personnel; |

| • | strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; |

| • | the passage of legislation or other regulatory developments affecting us or our industry; |

| • | fluctuations in the valuation of companies perceived by investors to be comparable to us; |

| • | sales of our common shares by us, our insiders or our other shareholders; |

| • | speculation in the press or investment community; |

| • | announcement or expectation of additional financing efforts; |

| • | any default under the Facility Agreement or the timing of any conversion of the convertible notes issued thereunder into common shares; |

| • | changes in market conditions for biopharmaceutical stocks; and |

| • | changes in general market and economic conditions. |

| • | variations in the level of expense related to the ongoing development of our product candidates or research pipeline; |

| • | results of clinical trials, or the addition or termination of clinical trials or funding support by us, or existing or future collaborators or licensing partners; |

| • | our execution of any additional collaboration, licensing or similar arrangements, and the timing of payments we may make or receive under existing or future arrangements, or the termination or modification of any such existing or future arrangements; |

| • | developments or disputes concerning patents or other proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our products; |

| • | any intellectual property infringement lawsuit or any opposition, interference, cancellation or other intellectual-property-related proceeding in which we may become involved; |

| • | additions and departures of key personnel; |

| • | strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; |

| • | if any of our product candidates receives regulatory approval, the terms of such approval and market acceptance and demand for such product candidates; |

| • | regulatory developments affecting our product candidates or those of our competitors; and |

| • | changes in general market and economic conditions. |

| • | the non-Swiss court had jurisdiction pursuant to the PILA; |

| • | the judgment of such non-Swiss court has become final and non-appealable; |

| • | the judgment does not contravene Swiss public policy; |

| • | the court procedures and the service of documents leading to the judgment were in accordance with the due process of law; and |

| • | no proceeding involving the same parties and the same subject matter was first brought in Switzerland, or adjudicated in Switzerland, or was earlier adjudicated in a third state, and this decision is recognizable in Switzerland. |

| • | in certain cases, allow our board of directors to place up to 32,000,000 common shares and rights to acquire an additional 32,000,000 common shares (in aggregate, approximately 50.1% of the expected outstanding share capital after completion of this offering) with affiliates or third parties, without existing shareholders having statutory pre-emptive rights in relation to this share placement; |

| • | allow our board of directors not to record any acquirer of common shares, or several acquirers acting in concert, in our share register as a shareholder with voting rights with respect to more than 15% of our share capital as set forth in the commercial register; |

| • | limit the size of our board of directors to 11 members; and |

| • | require two-thirds of the votes represented at a shareholder meeting for amending or repealing the above-mentioned voting and recording restrictions, for amending the provision setting a maximum board size or providing for indemnification of our directors and members of our executive committee and for removing the chairman or any member of the board of directors before the end of his or her term of office. |

| • | the commencement, timing, progress and results of our research and development programs, preclinical studies and clinical trials; |

| • | the timing of IND, BLA, MAA and other regulatory submissions with the FDA, EMA or comparable regulatory authorities in other jurisdictions; |

| • | the proposed clinical development pathway for our lead product candidates, Lonca and Cami, and our other product candidates, and the acceptability of the results of clinical trials for regulatory approval of such product candidates by the FDA, EMA or comparable regulatory authorities in other jurisdictions; |

| • | assumptions relating to the identification of serious adverse, undesirable or unacceptable side effects related to our product candidates; |

| • | the timing of and our ability to obtain and maintain regulatory approval for our product candidates; |

| • | our plan for the commercialization of Lonca and, subject to our collaboration and license agreement with Genmab, of Cami, if approved; |

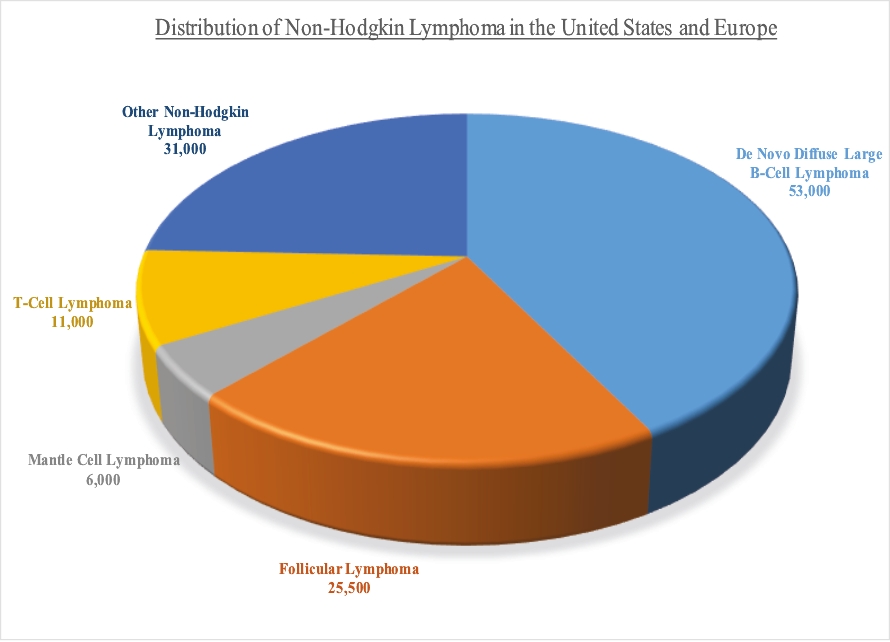

| • | our expectations regarding the size of the patient populations amenable to treatment with our product candidates, if approved, as well as the treatment landscape of the indications that we are targeting with our product candidates; |

| • | assumptions relating to the rate and degree of market acceptance of any approved product candidates; |

| • | the pricing and reimbursement of our product candidates; |

| • | our ability to identify and develop additional product candidates; |

| • | the ability of our competitors to discover, develop or commercialize competing products before or more successfully than we do; |

| • | our competitive position and the development of and projections relating to our competitors or our industry; |

| • | our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional financing; |

| • | our ability to raise capital when needed in order to continue our research and development programs or commercialization efforts; |

| • | assumptions regarding the receipt of the disbursements under the Facility Agreement; |

| • | our ability to identify and successfully enter into strategic collaborations in the future, and our assumptions regarding any potential revenue that we may generate thereunder; |

| • | our ability to obtain, maintain, protect and enforce intellectual property protection for our product candidates, and the scope of such protection; |

| • | our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of third parties; |

| • | our expectations regarding the impact of the COVID-19 pandemic; |

| • | our ability to attract and retain qualified key management and technical personnel; and |

| • | our expectations regarding the time during which we will be an emerging growth company under the JOBS Act and a foreign private issuer. |

| • | approximately $52 million to advance Lonca through the completion of the ongoing pivotal Phase 2 clinical trial for the treatment of relapsed or refractory DLBCL, to advance Lonca through the completion of the ongoing Phase 1/2 clinical trial in combination with ibrutinib for the treatment of relapsed or refractory DLBCL and MCL, to commence a confirmatory clinical trial of Lonca in combination with rituximab for the treatment of relapsed or refractory DLBCL, to commence a pivotal Phase 2 clinical trial of Lonca for the treatment of relapsed or refractory FL and, if our ongoing Phase 1/2 clinical trial of Lonca in combination with ibrutinib is successful, to commence a confirmatory clinical trial of Lonca in combination with ibrutinib for the treatment of relapsed or refractory DLBCL; |

| • | approximately $14 million to advance Cami through the completion of the ongoing pivotal Phase 2 clinical trial for the treatment of relapsed or refractory HL, to advance Cami through the completion of the ongoing Phase 1b clinical trial for the treatment of selected advanced solid tumors, including the dose expansion stage in combination with a checkpoint inhibitor, and to commence potential combination clinical trials for Cami in these and other indications; |

| • | approximately $2 million to advance ADCT-602 through the completion of the ongoing Phase 1/2 clinical trial for the treatment of relapsed or refractory ALL that we are conducting with MD Anderson Cancer Center; |

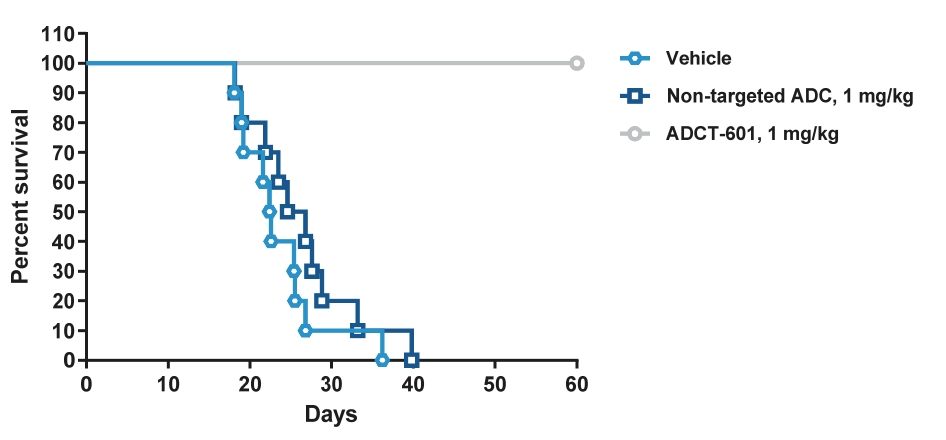

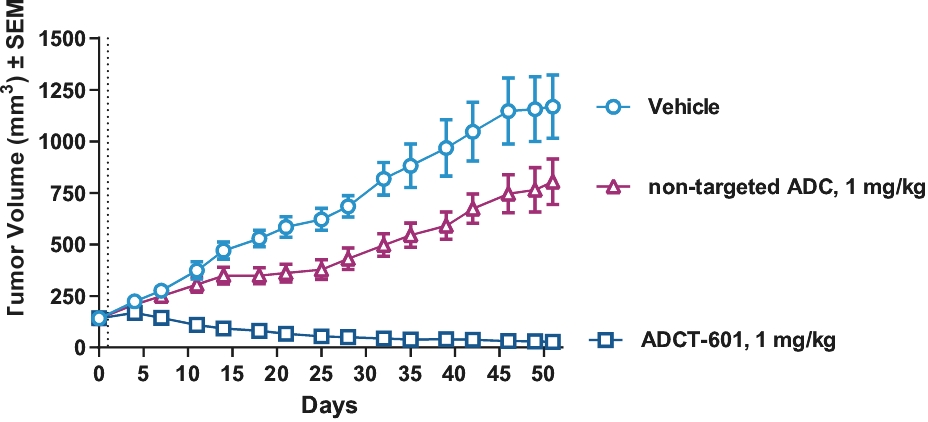

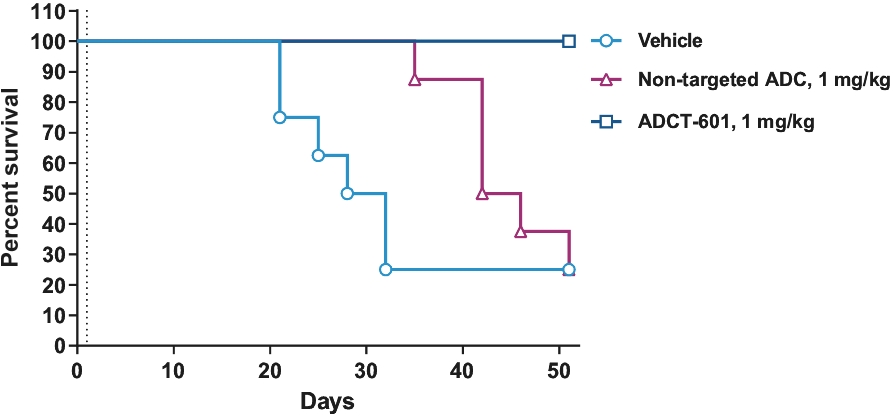

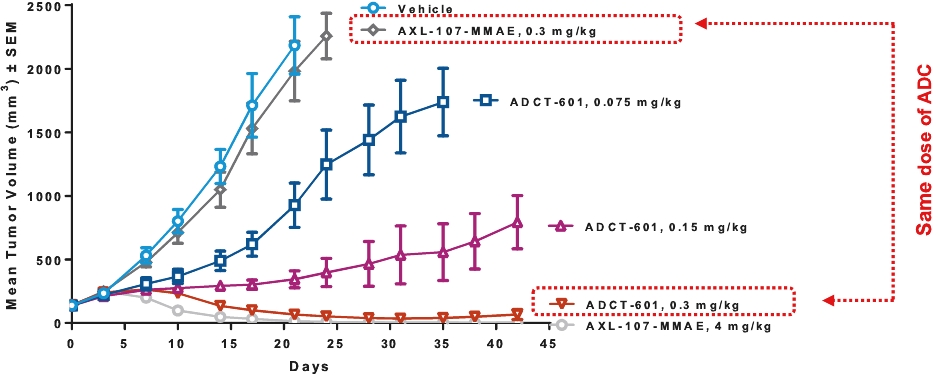

| • | approximately $10 million to further advance the clinical development of ADCT-601; |

| • | approximately $100 million to further build out our commercial operations and implement our launch plans for Lonca in the United States; |

| • | approximately $19 million to fund the research and development of our preclinical product candidates and preclinical pipeline; and |

| • | the remainder for working capital and other general corporate purposes. |

| • | on an actual basis; |

| • | on a pro forma basis to give effect to the following adjustments: (i) the delivery of 597,774 common shares by plan participants for the settlement of the 2013 Promissory Notes and the 2016 Promissory Notes; (ii) the delivery to participants of our 2014 Incentive Plan of an estimated 300,000 common shares (subject to adjustments for final tax and social security deductions), which we currently hold in treasury, to settle outstanding awards under our 2014 Incentive Plan in connection with this offering and the related payment by us of an estimated $4.0 million in tax and social security liabilities on behalf of participants of our 2014 Incentive Plan; (iii) the issuance of 4,777,996 common shares to the holders of our Class E preferred shares, as described in “Related Party Transactions—Shareholders’ Agreement”; and (iv) the Conversion; and |