UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23494

T. Rowe Price Exchange-Traded Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

ANNUAL REPORT

October 31, 2023

| | T. ROWE PRICE |

| TAGG | QM U.S. Bond ETF |

| | For more insights from T. Rowe Price investment professionals, go to troweprice.com. |

T. ROWE PRICE QM U.S. BOND ETF

HIGHLIGHTS

| ■ | The QM U.S. Bond ETF generated modestly positive returns and performed in line with its benchmark, based on market price, for the reporting period. |

| ■ | Security selection and sector allocations both added value while interest rate volatility weighed on performance. A slight average duration overweight also dragged on relative results. |

| ■ | With our view that rates have likely peaked and that companies have yet to fully feel the effects of financial tightening, we believe it is beneficial to have ample liquidity, while earning yield, to take advantage of future opportunities should market volatility increase. |

| ■ | We believe that additional interest rate hikes are unlikely, and absent a significant reacceleration of economic data or fall in long-term yields, a resumption of rate increases next year is improbable. The Federal Reserve is more likely to rely on higher-for-longer messaging to further tighten financial conditions if necessary. |

Go Paperless

Going paperless offers a host of benefits, which include:

| ■ | Timely delivery of important documents |

| ■ | Convenient access to your documents anytime, anywhere |

| ■ | Strong security protocols to safeguard sensitive data |

If you invest through a financial intermediary such as an investment advisor, a bank, or a brokerage firm, please contact that organization and ask if it can provide electronic documentation.

Log in to your account at troweprice.com for more information.

T. ROWE PRICE QM U.S. BOND ETF

Market Commentary

Dear Shareholder

Most major global stock and bond indexes produced positive results during your fund’s fiscal year, the 12-month period ended October 31, 2023, although a downturn over the past six months offset some of the strong gains recorded in the first half of the period. Global economies managed to avoid the recession that was widely predicted at the start of 2023, but signs that central banks might need to keep interest rates higher for longer than previously expected weighed on market sentiment.

Growth stocks outperformed value shares over the 12-month period, and stocks in developed markets generally outpaced their counterparts in emerging markets. Currency movements were mixed over the period, although a weaker dollar versus major European currencies was beneficial for U.S. investors in European securities.

Technology companies benefited from investor enthusiasm for artificial intelligence developments and produced some of the strongest results in the equity market. Within the S&P 500 Index, the communication services and information technology sectors were lifted by the rally in tech-related companies and recorded significant gains. The financials sector partly recovered from the failure of three large regional banks during the period but still finished in negative territory.

Corporate fundamentals were broadly supportive. Although year-over-year earnings growth contracted in the first and second quarters of 2023, results were better than expected, and preliminary estimates pointed to a resumption of growth in the third quarter.

The U.S. economy was the strongest among the major markets during the period, with gross domestic product growth coming in at 4.9% in the third quarter’s initial estimate, the highest since the end of 2021. Growth in Europe and Japan was more sluggish, and China’s economy was beset by worries about its property sector after an initial boost from its decision at the end of 2022 to lift most of its pandemic-related restrictions. A protracted debt ceiling standoff in the U.S., the ongoing conflict between Ukraine and Russia, and the outbreak of war in the Middle East following the attack on Israel by Hamas produced headwinds for markets at various times.

Investors also remained focused on inflation as price increases moderated but remained well above the Federal Reserve’s 2% target. In response, the Fed continued to raise its short-term lending benchmark rate, lifting it to a target range of 5.25% to 5.50% by the end of July, the highest level since March 2001.

T. ROWE PRICE QM U.S. BOND ETF

U.S. Treasury yields increased as the Fed tightened monetary policy and investors priced in the possibility that the central bank may have to keep rates higher for longer than previously anticipated. In addition, Treasuries were pressured by Fitch Ratings’ decision to downgrade the credit rating of U.S. government debt from the highest level, AAA, to AA+ along with expectations for higher levels of borrowing by the Treasury Department. The yield on the benchmark 10-year Treasury note briefly reached 5.00% in October for the first time since late 2007 before falling back to 4.88% by period-end.

Increasing yields over the past six months led to weak results across most of the fixed income market, although high yield bonds, which are less sensitive to rising rates, held up relatively well as default rates remained low by historical standards.

Global economies and markets showed surprising resilience in 2023, but considerable uncertainty remains as we look ahead to 2024. Geopolitical events, the path of monetary policy, and the impact of the Fed’s rate hikes on the economy all raise the potential for additional volatility. We believe this environment makes skilled active management a critical tool for identifying risks and opportunities, and our investment teams will continue to use fundamental research to identify securities that have the potential to add value to your portfolio over the long term.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

CEO and President

T. ROWE PRICE QM U.S. BOND ETF

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fund seeks to provide a total return that exceeds the performance of the U.S. investment-grade bond market.

FUND COMMENTARY

How did the fund perform in the past 12 months?

The QM U.S. Bond ETF returned 0.45% (based on net asset value) and 0.34% (at market price) for the 12 months through October 31, 2023, compared with 0.36% for the Bloomberg U.S. Aggregate Bond Index, as shown in the Performance Comparison table. (Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

The fund recorded a modest gain for the one-year period despite a sharp rise in U.S. Treasury yields, benefiting from higher coupon return. Shorter-maturity yields rose the most as the Federal Reserve hiked policy rates six times during the period, raising the upper end of the target range to 5.5%, but intermediate- and

PERFORMANCE COMPARISON

| | Total Return |

| Periods Ended 10/31/23 | 6 Months | 12 months |

| QM U.S. Bond ETF (Based on Net Asset Value) | -6.21% | 0.45% |

| QM U.S. Bond ETF (At Market Price)* | -6.53 | 0.34 |

| Bloomberg U.S. Aggregate Bond Index | -6.13 | 0.36 |

*Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would have received if shares were traded at other times.

T. ROWE PRICE QM U.S. BOND ETF

longer-term Treasury yields also climbed higher as the market increasingly expected the Fed to keep rates “higher for longer.” In addition, supply pressures weighed on longer-term debt prices.

Security selection and sector allocations added value versus the benchmark for the period. Security selection within U.S. Treasuries was positive as exposure to longer-term U.S. Treasury securities helped. Out-of-benchmark exposure to non-agency residential mortgage-backed securities (MBS) contributed as the sector benefited from light supply, a rebound in national home prices, and increased risk appetite on fading recession concerns. While modestly underweighting investment-grade (IG) corporate bonds, on a risk-adjusted basis, weighed on relative performance, the fund’s risk overweight in the government-related sector, expressed mostly through taxable municipal securities, boosted performance. Overweight exposure in asset-backed securities (ABS) and commercial mortgage-backed securities also benefited the fund as these sectors outperformed on a risk-adjusted basis for the year, benefiting from their yield advantage versus Treasuries.

However, elevated interest rate volatility was a headwind for the fund, and duration positioning also dragged on relative results. (Duration is a measure of a bond’s or a bond portfolio’s sensitivity to interest rate changes.) Though duration was taken short relative to the benchmark in certain periods, the fund’s structural preference for a small duration overweight relative to the benchmark detracted in the rising rate environment. The fund’s cash holdings and overweight at the front end of the curve, however, provided beneficial carry with the yield curve inverted. (Carry is the excess income earned from holding a higher-yielding security relative to another.)

How is the fund positioned?

Most nominal sector allocations were generally steady over the year, but we added to U.S. Treasury securities at attractive yields, while our notional corporate exposure slightly ticked down. The fund held a sizable portion of assets in agency mortgage-backed securities, which can offer attractive yield and liquidity benefits. Spreads also gapped wider in September, and we believe agency MBS spreads could benefit once interest rate volatility subsides. We also trimmed our taxable municipal exposure.

The fund maintained an underweight in the IG corporate sector on a risk-weighted basis, which can help dampen volatility. While corporate credit spreads have the potential to tighten through the remainder of 2023 based on seasonal factors, and corporate fundamentals have been resilient, we believe longer-term concerns remain around the lagged effects of tighter monetary

T. ROWE PRICE QM U.S. BOND ETF

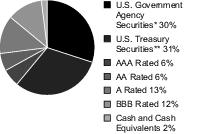

CREDIT QUALITY DIVERSIFICATION

Based on net assets as of 10/31/23.

Sources: Credit ratings for the securities held in the fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest-rated securities. If the rating agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated. T. Rowe Price uses the rating of the underlying investment vehicle to determine the creditworthiness of credit default swaps. The fund is not rated by any agency.

*U.S. government agency securities are issued or guaranteed by a U.S. government agency and may include conventional pass-through securities and collateralized mortgage obligations; unlike Treasuries, government agency securities are not issued directly by the U.S. government and are generally unrated but may have credit support from the U.S. Treasury (e.g., FHLMC and FNMA issues) or a direct government guarantee (e.g., GNMA issues). Therefore, this category may include rated and unrated securities.

**U.S. Treasury securities are issued by the U.S. Treasury and are backed by the full faith and credit of the U.S. government. The ratings of U.S. Treasury securities are derived from the ratings on the U.S. government.

T. ROWE PRICE QM U.S. BOND ETF

policy on corporate earnings. If the economy slows, as the Fed desires to control inflation, corporates could experience increased rating downgrades as the cost of borrowing increases.

With our view that rates have likely peaked in the U.S., and that companies have yet to fully feel the effects of financial tightening, we believe it is beneficial to have ample liquidity, while earning yield, to take advantage of future opportunities should market volatility increase.

Though we made tactical shifts in duration over the year, the fund maintained a neutral- to long duration posture versus the benchmark for most of the period as we believe overweighting duration can be complementary to the fund’s holdings in credit sectors. We held more conviction in a longer-duration stance after Treasury yields sold off meaningfully and the Federal Reserve appeared to be nearing the end of its policy tightening.

What is portfolio management’s outlook?

Core inflation has gradually slowed, and the labor market has been loosening in an orderly fashion, giving the Federal Reserve greater flexibility with monetary policy. We believe that additional interest rate hikes are unlikely, and absent a significant reacceleration of economic data or fall in long-term yields, a resumption of rate increases next year is improbable. The Federal Reserve is more likely to rely on higher-for-longer messaging to further tighten financial conditions if necessary.

While the risk environment remains supportive for now, we are concerned that we have yet to feel the full force of monetary policy tightening. Moreover, bank funding conditions remain fragile, and while banking system stress has dissipated since March, ongoing quantitative tightening and deposit outflows are likely to cause more funding stress for regional banks. This could further impede the flow of credit to the economy and contribute to higher risk-asset volatility. Some of our longer-term quantitative models are also sending bearish signals for corporate credit.

We continue to look to earn yield in the portfolio above the benchmark and to use our research capabilities to take advantage of the structural inefficiencies that are prevalent in fixed income markets and benchmarks. We remain confident in our investment approach, which is built on a foundation of quantitative portfolio construction elements, augmented with fundamental insights from our deep global credit research platform.

T. ROWE PRICE QM U.S. BOND ETF

RISKS OF INVESTING IN FIXED INCOME SECURITIES

Funds that invest in fixed income securities are subject to price declines due to rising interest rates, with long-term securities generally most sensitive to rate fluctuations. Other risks include credit rating downgrades and defaults on scheduled interest and principal payments. Mortgage-backed securities are subject to prepayment risk, particularly if falling rates lead to heavy refinancing activity, and extension risk, which results from an increase in interest rates that causes a mortgage bond’s average maturity to lengthen unexpectedly due to a drop in mortgage prepayments. This would increase the fund’s sensitivity to rising interest rates and its potential for price declines.

BENCHMARK INFORMATION

Note: Bloomberg® and the Bloomberg U.S. Aggregate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

Note: Copyright © 2023 Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries.

Note: © 2023, Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “Moody’s”). All rights reserved. Moody’s ratings and other information (“Moody’s Information”) are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Client by Moody’s. MOODY’S INFORMATION MAY NOT BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT. Moody’s ® is a registered trademark.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

T. ROWE PRICE QM U.S. BOND ETF

Note: Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the appropriateness of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

T. ROWE PRICE QM U.S. BOND ETF

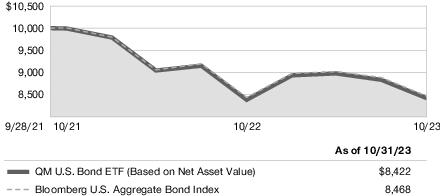

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

QM U.S. Bond ETF

Note: See the Average Annual Compound Total Return table.

AVERAGE ANNUAL COMPOUND TOTAL RETURN

| Periods Ended 10/31/23 | One Year | Since

Inception

9/28/21 |

| QM U.S. Bond ETF (Based on Net Asset Value) | 0.45% | -7.89% |

| QM U.S. Bond ETF (At Market Price) | 0.34 | -8.01 |

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. When assessing performance, investors should consider both short- and long-term returns. Past performance cannot guarantee future results. Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would have received if shares were traded at other times.

T. ROWE PRICE QM U.S. BOND ETF

PREMIUM/DISCOUNT INFORMATION

The frequency at which the daily market prices were at a discount or premium to the fund’s net asset value is available on the fund’s website (troweprice.com).

EXPENSE RATIO

The expense ratio shown is as of the fund’s most recent prospectus. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, includes acquired fund fees and expenses but does not include fee or expense waivers.

T. ROWE PRICE QM U.S. BOND ETF

FUND EXPENSE EXAMPLE

As a shareholder, you may incur two types of costs: (1) transaction costs, such as brokerage commissions on purchases and sales, and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as brokerage commissions paid on purchases and sales of shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

T. ROWE PRICE QM U.S. BOND ETF

QM U.S. Bond ETF

| | Beginning

Account Value

5/1/23 | Ending

Account Value

10/31/23 | Expenses Paid

During Period*

5/1/23 to 10/31/23 |

| Actual | $1,000.00 | $937.90 | $0.39 |

| Hypothetical (assumes 5% return before expenses) | 1,000.00 | 1,024.80 | 0.41 |

| * | Expenses are equal to the fund’s annualized expense ratio for the 6-month period (0.08%), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), and divided by the days in the year (365) to reflect the half-year period. |

T. ROWE PRICE QM U.S. BOND ETF

QUARTER-END RETURNS

| Periods Ended 9/30/23 | One Year | Since

Inception

9/28/21 |

| QM U.S. Bond ETF (Based on Net Asset Value) | 0.55% | -7.46% |

| QM U.S. Bond ETF (At Market Price) | 0.52 | -7.49 |

The fund’s performance information represents only past performance and is not necessarily an indication of future results. Current performance may be lower or higher than the performance data cited. Share price, principal value, and return will vary, and you may have a gain or loss when you sell your shares. Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would receive if shares were traded at other times. For the most recent month-end performance, please visit our website (troweprice.com) or contact a T. Rowe Price representative at 1-800-225-5132.

This table provides returns through the most recent calendar quarter-end rather than through the end of the fund’s fiscal period. It shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. When assessing performance, investors should consider both short- and long-term returns.

T. ROWE PRICE QM U.S. BOND ETF

For a share outstanding throughout each period

| | Year

Ended | Year

Ended | 9/28/21 (1)

Through |

| | 10/31/23 | 10/31/22 | 10/31/21 |

| NET ASSET VALUE | | | |

| Beginning of period | $ 41.11 | $ 49.96 | $ 50.00 |

| Investment activities | | | |

| Net investment income(2) (3) | 1.54 | 0.90 | 0.06 |

| Net realized and unrealized gain/loss | (1.31) | (8.87) | (0.07) |

| Total from investment activities | 0.23 | (7.97) | (0.01) (4) |

| Distributions | | | |

| Net investment income | (1.41) | (0.87) | (0.03) |

| Net realized gain | - | (0.01) | - |

| Total distributions | (1.41) | (0.88) | (0.03) |

| NET ASSET VALUE | | | |

| End of period | $ 39.93 | $ 41.11 | $ 49.96 |

T. ROWE PRICE QM U.S. BOND ETF

For a share outstanding throughout each period

| | Year

Ended | Year

Ended | 9/28/21 (1)

Through |

| | 10/31/23 | 10/31/22 | 10/31/21 |

| Ratios/Supplemental Data |

| Total return, based on NAV(3) (5) | 0.45% | (16.09)% | (0.08)% |

Ratios to average net

assets:(3) | | | |

Gross expenses before

waivers/payments by

Price Associates | 0.08% | 0.08% | 0.08% (6) |

Net expenses after

waivers/payments by

Price Associates | 0.08% | 0.08% | 0.08% (6) |

| Net investment income | 3.66% | 1.96% | 1.29% (6) |

| Portfolio turnover rate(7) | 211.9% | 403.7% | 50.9% |

| Portfolio turnover rate, excluding mortgage dollar roll transactions | 41.7% | 35.1% | 11.7% |

Net assets, end of period

(in thousands) | $ 103,819 | $ 35,973 | $ 27,477 |

| (1) | Inception date |

| (2) | Per share amounts calculated using average shares outstanding method. |

| (3) | See Note 6 for details to expense-related arrangements with Price Associates. |

| (4) | The amount presented is inconsistent with the fund's results of operations because of the timing of redemptions of fund shares in relation to fluctuating market values for the investment portfolio. |

| (5) | Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions. Total return is not annualized for periods less than one year. |

| (6) | Annualized |

| (7) | See Note 4. The portfolio turnover rate calculation includes purchases and sales from the mortgage dollar roll transactions. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE QM U.S. BOND ETF

October 31, 2023

| PORTFOLIO OF INVESTMENTS‡ | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| ASSET-BACKED SECURITIES 3.9% |

| Car Loan 1.5% | | |

| AmeriCredit Automobile Receivables Trust, Series 2020-1, Class C, 1.59%, 10/20/25 | 55 | 54 |

| CarMax Auto Owner Trust, Series 2021-1, Class D, 1.28%, 7/15/27 | 100 | 93 |

| CarMax Auto Owner Trust, Series 2023-3, Class A3, 5.28%, 5/15/28 | 75 | 74 |

| CarMax Auto Owner Trust, Series 2023-3, Class B, 5.47%, 2/15/29 | 65 | 63 |

| Carvana Auto Receivables Trust, Series 2021-P4, Class C, 2.33%, 2/10/28 | 45 | 39 |

| Chase Auto Credit Linked Notes, Series 2021-3, Class B, 0.76%, 2/26/29 (1) | 230 | 221 |

| Enterprise Fleet Financing, Series 2021-2, Class A3, 0.74%, 5/20/27 (1) | 300 | 279 |

| Enterprise Fleet Financing, Series 2023-2, Class A2, 5.56%, 4/22/30 (1) | 105 | 104 |

| Exeter Automobile Receivables Trust, Series 2021-4A, Class C, 1.46%, 10/15/27 | 65 | 63 |

| Ford Credit Auto Owner Trust, Series 2020-1, Class C, 2.54%, 8/15/31 (1) | 300 | 284 |

| Ford Credit Auto Owner Trust, Series 2023-1, Class A, 4.85%, 8/15/35 (1) | 100 | 96 |

| GM Financial Automobile Leasing Trust, Series 2023-1, Class C, 5.76%, 1/20/27 | 75 | 74 |

| Santander Drive Auto Receivables Trust, Series 2022-3, Class C, 4.49%, 8/15/29 | 40 | 38 |

| | | 1,482 |

| Credit Card 0.1% | | |

| Synchrony Card Funding, Series 2023-A1, Class A, 5.54%, 7/15/29 | 115 | 114 |

| | | 114 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Other Asset-Backed Securities 2.0% | | |

| CIFC Funding, Series 2021-4A, Class A, CLO, FRN, 3M TSFR + 1.31%, 6.705%, 7/15/33 (1) | 280 | 277 |

| DLLAA, Series 2023-1A, Class A3, 5.64%, 2/22/28 (1) | 60 | 59 |

| DLLAA, Series 2023-1A, Class A4, 5.73%, 10/20/31 (1) | 70 | 68 |

| Elara HGV Timeshare, Series 2023-A, Class A, 6.16%, 2/25/38 (1) | 100 | 99 |

| Elara HGV Timeshare, Series 2023-A, Class B, 6.53%, 2/25/38 (1) | 100 | 100 |

| FirstKey Homes Trust, Series 2020-SFR2, Class B, 1.567%, 10/19/37 (1) | 310 | 281 |

| HPEFS Equipment Trust, Series 2021-1A, Class D, 1.03%, 3/20/31 (1) | 265 | 260 |

| MMAF Equipment Finance, Series 2022-A, Class A4, 3.32%, 6/13/44 (1) | 100 | 94 |

| MMAF Equipment Finance, Series 2022-B, Class A3, 5.61%, 7/10/28 (1) | 169 | 168 |

| Octane Receivables Trust, Series 2023-1A, Class A, 5.87%, 5/21/29 (1) | 70 | 70 |

| Progress Residential Trust, Series 2020-SFR1, Class C, 2.183%, 4/17/37 (1) | 100 | 94 |

| Symphony Static, Series 2021-1A, Class A, CLO, FRN, 3M TSFR + 1.09%, 6.47%, 10/25/29 (1) | 181 | 180 |

| Tricon American Homes, Series 2019-SFR1, Class D, 3.198%, 3/17/38 (1) | 230 | 212 |

| Verdant Receivables, Series 2023-1A, Class A2, 6.24%, 1/13/31 (1) | 130 | 129 |

| | | 2,091 |

| Student Loan 0.3% | | |

| Navient Private Education Refi Loan Trust, Series 2019-CA, Class A2, 3.13%, 2/15/68 (1) | 84 | 80 |

| Navient Private Education Refi Loan Trust, Series 2020-A, Class A2A, 2.46%, 11/15/68 (1) | 122 | 112 |

| Nelnet Student Loan Trust, Series 2021-CA, Class AFX, 1.32%, 4/20/62 (1) | 56 | 49 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Nelnet Student Loan Trust, Series 2021-DA, Class AFX, 1.63%, 4/20/62 (1) | 83 | 74 |

| | | 315 |

Total Asset-Backed Securities

(Cost $4,069) | | 4,002 |

| CORPORATE BONDS 26.3% |

| FINANCIAL INSTITUTIONS 10.2% | | |

| Banking 7.0% | | |

| Ally Financial, 2.20%, 11/2/28 (2) | 35 | 27 |

| Bank of America, VR, 0.976%, 4/22/25 (3) | 100 | 97 |

| Bank of America, VR, 2.572%, 10/20/32 (3) | 65 | 49 |

| Bank of America, VR, 2.592%, 4/29/31 (3) | 310 | 245 |

| Bank of America, VR, 2.676%, 6/19/41 (3) | 230 | 140 |

| Bank of America, VR, 3.824%, 1/20/28 (3) | 215 | 198 |

| Bank of America, 4.00%, 1/22/25 | 70 | 68 |

| Bank of America, VR, 4.244%, 4/24/38 (3) | 15 | 12 |

| Bank of America, 5.875%, 2/7/42 | 15 | 14 |

| Bank of Montreal, 2.65%, 3/8/27 | 70 | 62 |

| Banque Federative du Credit Mutuel, 4.935%, 1/26/26 (1) | 300 | 291 |

| Barclays, VR, 2.279%, 11/24/27 (3) | 200 | 175 |

| Barclays, VR, 2.852%, 5/7/26 (3) | 200 | 189 |

| Capital One Financial, VR, 2.359%, 7/29/32 (3) | 50 | 33 |

| Capital One Financial, 3.65%, 5/11/27 | 155 | 140 |

| Capital One Financial, 3.90%, 1/29/24 (2) | 85 | 84 |

| Capital One Financial, 4.20%, 10/29/25 | 25 | 24 |

| Citigroup, VR, 3.106%, 4/8/26 (3) | 25 | 24 |

| Citigroup, VR, 3.887%, 1/10/28 (3) | 430 | 399 |

| Citigroup, 4.65%, 7/30/45 | 15 | 12 |

| Citigroup, 5.875%, 1/30/42 | 95 | 87 |

| Danske Bank, VR, 3.244%, 12/20/25 (1)(3) | 255 | 244 |

| Danske Bank, VR, 4.298%, 4/1/28 (1)(3) | 200 | 184 |

| Discover Financial Services, 3.75%, 3/4/25 | 105 | 101 |

| Fifth Third Bancorp, VR, 6.339%, 7/27/29 (3) | 45 | 44 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Goldman Sachs Group, VR, 1.948%, 10/21/27 (3) | 65 | 57 |

| Goldman Sachs Group, VR, 2.615%, 4/22/32 (3) | 150 | 114 |

| Goldman Sachs Group, VR, 3.272%, 9/29/25 (3) | 220 | 214 |

| Goldman Sachs Group, 3.50%, 1/23/25 | 85 | 82 |

| Goldman Sachs Group, 3.80%, 3/15/30 (2) | 140 | 121 |

| Goldman Sachs Group, 4.25%, 10/21/25 | 25 | 24 |

| Goldman Sachs Group, 6.75%, 10/1/37 | 15 | 15 |

| HSBC Holdings, VR, 1.162%, 11/22/24 (3) | 200 | 199 |

| HSBC Holdings, VR, 2.013%, 9/22/28 (3) | 265 | 222 |

| ING Groep, VR, 6.114%, 9/11/34 (3) | 200 | 187 |

| JPMorgan Chase, VR, 1.578%, 4/22/27 (3) | 125 | 111 |

| JPMorgan Chase, VR, 2.956%, 5/13/31 (3) | 275 | 222 |

| JPMorgan Chase, VR, 3.109%, 4/22/51 (3) | 15 | 9 |

| JPMorgan Chase, VR, 3.54%, 5/1/28 (2)(3) | 15 | 14 |

| JPMorgan Chase, VR, 3.782%, 2/1/28 (3) | 95 | 88 |

| JPMorgan Chase, VR, 3.882%, 7/24/38 (3) | 265 | 204 |

| Morgan Stanley, VR, 2.188%, 4/28/26 (3) | 125 | 117 |

| Morgan Stanley, 3.125%, 7/27/26 | 135 | 125 |

| Morgan Stanley, VR, 3.217%, 4/22/42 (3) | 205 | 135 |

| Morgan Stanley, VR, 3.622%, 4/1/31 (3) | 10 | 8 |

| Morgan Stanley, 4.30%, 1/27/45 | 15 | 11 |

| PNC Financial Services, VR, 4.758%, 1/26/27 (3) | 180 | 173 |

| PNC Financial Services Group, VR, 4.626%, 6/6/33 (3) | 110 | 91 |

| Royal Bank of Canada, 2.30%, 11/3/31 | 50 | 37 |

| Santander Holdings USA, VR, 6.499%, 3/9/29 (3) | 80 | 77 |

| Standard Chartered, VR, 1.822%, 11/23/25 (1)(3) | 200 | 189 |

| State Street, VR, 4.857%, 1/26/26 (3) | 55 | 54 |

| Sumitomo Mitsui Financial Group, 5.464%, 1/13/26 | 200 | 197 |

| Toronto-Dominion Bank, 1.15%, 6/12/25 | 185 | 171 |

| Toronto-Dominion Bank, 4.456%, 6/8/32 (2) | 95 | 83 |

| UBS Group, VR, 1.364%, 1/30/27 (1)(3) | 200 | 177 |

| UBS Group, VR, 2.193%, 6/5/26 (1)(3) | 250 | 233 |

| Wells Fargo, VR, 2.188%, 4/30/26 (3) | 185 | 174 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Wells Fargo, VR, 2.393%, 6/2/28 (3) | 430 | 375 |

| | | 7,253 |

| Brokerage Asset Managers Exchanges 0.0% | | |

| Intercontinental Exchange, 1.85%, 9/15/32 (2) | 15 | 11 |

| Nasdaq, 5.95%, 8/15/53 (2) | 15 | 13 |

| | | 24 |

| Finance Companies 0.7% | | |

| AerCap Ireland Capital, 2.45%, 10/29/26 | 150 | 133 |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 5.75%, 6/6/28 | 150 | 144 |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 6.15%, 9/30/30 | 150 | 143 |

| Avolon Holdings Funding, 3.95%, 7/1/24 (1) | 75 | 73 |

| Avolon Holdings Funding, 6.375%, 5/4/28 (1) | 150 | 145 |

| Park Aerospace Holdings, 5.50%, 2/15/24 (1) | 45 | 45 |

| | | 683 |

| Insurance 1.5% | | |

| American International Group, 3.875%, 1/15/35 (2) | 40 | 32 |

| Anthem, 2.25%, 5/15/30 | 60 | 48 |

| Anthem, 4.101%, 3/1/28 | 15 | 14 |

| Anthem, 4.55%, 3/1/48 | 30 | 23 |

| Anthem, 4.65%, 1/15/43 | 85 | 68 |

| Aon, 3.875%, 12/15/25 | 135 | 129 |

| Brighthouse Financial Global Funding, 1.00%, 4/12/24 (1) | 50 | 49 |

| Chubb INA Holdings, 3.35%, 5/15/24 | 85 | 84 |

| Fidelity National Financial, 4.50%, 8/15/28 | 70 | 64 |

| First American Financial, 4.60%, 11/15/24 | 70 | 69 |

| Health Care Service, 2.20%, 6/1/30 (1) | 15 | 12 |

| Humana, 2.15%, 2/3/32 | 85 | 63 |

| Humana, 3.70%, 3/23/29 (2) | 20 | 18 |

| Jackson Financial, 1.125%, 11/22/23 | 65 | 65 |

| Marsh & McLennan, 3.50%, 6/3/24 | 20 | 20 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| New York Life Insurance, 3.75%, 5/15/50 (1) | 20 | 13 |

| Principal Financial Group, 2.125%, 6/15/30 (2) | 215 | 166 |

| Principal Financial Group, 3.40%, 5/15/25 | 10 | 10 |

| Principal Financial Group, 3.70%, 5/15/29 | 75 | 67 |

| Principal Life Global Funding II, 0.75%, 4/12/24 (1) | 70 | 68 |

| Teachers Insurance & Annuity Association of America, 4.27%, 5/15/47 (1) | 20 | 14 |

| UnitedHealth Group, 2.00%, 5/15/30 | 10 | 8 |

| UnitedHealth Group, 3.50%, 8/15/39 | 320 | 234 |

| UnitedHealth Group, 3.75%, 7/15/25 | 40 | 39 |

| UnitedHealth Group, 4.20%, 1/15/47 | 35 | 26 |

| UnitedHealth Group, 4.75%, 7/15/45 | 150 | 122 |

| | | 1,525 |

| Real Estate Investment Trusts 1.0% | | |

| Alexandria Real Estate Equities, 3.95%, 1/15/27 | 40 | 37 |

| Alexandria Real Estate Equities, 4.00%, 2/1/50 | 40 | 26 |

| Brixmor Operating Partnership, 3.85%, 2/1/25 | 60 | 58 |

| Brixmor Operating Partnership, 3.90%, 3/15/27 | 15 | 14 |

| Brixmor Operating Partnership, 4.05%, 7/1/30 | 85 | 73 |

| Essex Portfolio, 2.65%, 3/15/32 (2) | 35 | 27 |

| Essex Portfolio, 3.875%, 5/1/24 (2) | 45 | 45 |

| Essex Portfolio, 4.50%, 3/15/48 | 20 | 15 |

| Extra Space Storage, 4.00%, 6/15/29 | 15 | 13 |

| GAIF Bond Issuer, 3.40%, 9/30/26 (1) | 15 | 14 |

| Healthpeak Properties, 2.125%, 12/1/28 | 15 | 12 |

| Healthpeak Properties, 2.875%, 1/15/31 | 15 | 12 |

| Kilroy Realty, 3.45%, 12/15/24 | 35 | 34 |

| Kilroy Realty, 4.25%, 8/15/29 | 150 | 125 |

| Kilroy Realty, 4.375%, 10/1/25 | 65 | 62 |

| Physicians Realty, 2.625%, 11/1/31 | 15 | 11 |

| Prologis, 4.00%, 9/15/28 | 35 | 32 |

| Public Storage, 1.95%, 11/9/28 | 35 | 29 |

| Public Storage, 5.35%, 8/1/53 | 40 | 34 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Realty Income, 3.95%, 8/15/27 | 25 | 23 |

| Realty Income, 4.625%, 11/1/25 | 240 | 234 |

| Regency Centers, 3.60%, 2/1/27 | 40 | 37 |

| Simon Property Group, 3.375%, 10/1/24 (2) | 110 | 107 |

| Simon Property Group, 3.80%, 7/15/50 | 35 | 22 |

| | | 1,096 |

| Total Financial Institutions | | 10,581 |

| INDUSTRIAL 14.6% | | |

| Basic Industry 0.2% | | |

| LYB International Finance II, 3.50%, 3/2/27 | 25 | 23 |

| Westlake, 3.375%, 6/15/30 | 150 | 125 |

| Yara International, 7.378%, 11/14/32 (1)(2) | 100 | 102 |

| | | 250 |

| Capital Goods 0.5% | | |

| General Dynamics, 3.25%, 4/1/25 | 10 | 10 |

| John Deere Capital, 2.125%, 3/7/25 | 50 | 48 |

| John Deere Capital, 2.65%, 6/10/26 (2) | 15 | 14 |

| L3Harris Technologies, 3.832%, 4/27/25 | 60 | 58 |

| Mohawk Industries, 5.85%, 9/18/28 (2) | 125 | 123 |

| Northrop Grumman, 3.85%, 4/15/45 | 15 | 10 |

| Parker-Hannifin, 4.50%, 9/15/29 (2) | 25 | 23 |

| Republic Services, 2.50%, 8/15/24 | 70 | 68 |

| Republic Services, 3.375%, 11/15/27 | 65 | 60 |

| Republic Services, 5.00%, 4/1/34 | 15 | 14 |

| Waste Connections, 3.20%, 6/1/32 | 65 | 52 |

| | | 480 |

| Communications 3.4% | | |

| America Movil SAB de CV, 2.875%, 5/7/30 | 200 | 164 |

| America Movil SAB de CV, 6.375%, 3/1/35 | 85 | 86 |

| American Tower, 2.40%, 3/15/25 | 115 | 109 |

| American Tower, 5.00%, 2/15/24 | 60 | 60 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| AT&T, 2.25%, 2/1/32 (2) | 590 | 436 |

| Charter Communications Operating, 2.80%, 4/1/31 | 245 | 187 |

| Charter Communications Operating, 3.70%, 4/1/51 | 255 | 140 |

| Charter Communications Operating, 4.50%, 2/1/24 | 60 | 60 |

| Charter Communications Operating, 4.908%, 7/23/25 | 220 | 215 |

| Comcast, 2.65%, 2/1/30 | 40 | 33 |

| Comcast, 3.95%, 10/15/25 | 225 | 218 |

| Cox Communications, 3.15%, 8/15/24 (1) | 15 | 15 |

| Crown Castle International, 2.25%, 1/15/31 | 25 | 19 |

| Crown Castle International, 2.90%, 3/15/27 | 10 | 9 |

| Crown Castle International, 3.70%, 6/15/26 | 80 | 75 |

| Crown Castle International, 4.45%, 2/15/26 | 60 | 58 |

| Meta Platforms, 5.60%, 5/15/53 (2) | 300 | 270 |

| Rogers Communications, 3.625%, 12/15/25 | 40 | 38 |

| Rogers Communications, 4.50%, 3/15/42 | 85 | 63 |

| Time Warner Cable, 6.55%, 5/1/37 | 50 | 44 |

| Time Warner Cable, 6.75%, 6/15/39 | 110 | 96 |

| T-Mobile USA, 2.25%, 11/15/31 | 15 | 11 |

| T-Mobile USA, 3.75%, 4/15/27 | 395 | 366 |

| Verizon Communications, 2.355%, 3/15/32 | 150 | 112 |

| Verizon Communications, 2.65%, 11/20/40 | 415 | 250 |

| Verizon Communications, 2.987%, 10/30/56 | 15 | 8 |

| Verizon Communications, 4.00%, 3/22/50 | 10 | 7 |

| Walt Disney, 3.70%, 10/15/25 | 40 | 39 |

| Warnermedia Holdings, 5.05%, 3/15/42 | 305 | 225 |

| WPP Finance, Series 2010, 3.75%, 9/19/24 | 75 | 73 |

| | | 3,486 |

| Consumer Cyclical 2.4% | | |

| 7-Eleven, 0.80%, 2/10/24 (1)(2) | 25 | 25 |

| Amazon.com, 3.875%, 8/22/37 | 115 | 94 |

| AutoZone, 1.65%, 1/15/31 | 30 | 22 |

| AutoZone, 3.125%, 4/18/24 | 45 | 44 |

| AutoZone, 3.75%, 6/1/27 | 30 | 28 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| AutoZone, 5.05%, 7/15/26 | 250 | 245 |

| Best Buy, 1.95%, 10/1/30 | 100 | 76 |

| General Motors, 4.00%, 4/1/25 | 125 | 121 |

| Home Depot, 5.875%, 12/16/36 | 90 | 89 |

| Hyundai Capital America, 2.65%, 2/10/25 (1)(2) | 15 | 14 |

| Hyundai Capital America, 4.30%, 2/1/24 (1) | 60 | 60 |

| Hyundai Capital America, 5.50%, 3/30/26 (1) | 80 | 79 |

| Lowe's, 5.00%, 4/15/33 (2) | 250 | 227 |

| McDonald's, 3.30%, 7/1/25 | 50 | 48 |

| McDonald's, 5.45%, 8/14/53 | 150 | 132 |

| Mercedes-Benz Finance North America, 4.80%, 3/30/26 (1) | 180 | 176 |

| Mercedes-Benz Finance North America, 5.05%, 8/3/33 (1) | 200 | 183 |

| O'Reilly Automotive, 3.60%, 9/1/27 | 30 | 28 |

| O'Reilly Automotive, 3.90%, 6/1/29 | 285 | 258 |

| PACCAR Financial, 0.90%, 11/8/24 | 85 | 81 |

| Priceline Group, 3.65%, 3/15/25 | 85 | 83 |

| Ross Stores, 1.875%, 4/15/31 | 10 | 8 |

| Ross Stores, 4.60%, 4/15/25 | 335 | 328 |

| TJX, 1.60%, 5/15/31 | 30 | 23 |

| | | 2,472 |

| Consumer Non-Cyclical 3.8% | | |

| Abbott Laboratories, 1.15%, 1/30/28 (2) | 10 | 8 |

| Abbott Laboratories, 4.75%, 11/30/36 | 245 | 222 |

| AbbVie, 3.20%, 5/14/26 | 15 | 14 |

| AbbVie, 3.20%, 11/21/29 | 15 | 13 |

| AbbVie, 4.45%, 5/14/46 | 40 | 31 |

| AbbVie, 4.50%, 5/14/35 | 125 | 109 |

| AbbVie, 4.70%, 5/14/45 | 230 | 187 |

| Anheuser-Busch InBev Finance, 4.90%, 2/1/46 | 15 | 12 |

| Anheuser-Busch InBev Worldwide, 4.75%, 4/15/58 | 25 | 20 |

| Anheuser-Busch InBev Worldwide, 5.45%, 1/23/39 | 15 | 14 |

| Anheuser-Busch InBev Worldwide, 5.55%, 1/23/49 | 60 | 54 |

| AstraZeneca, 1.375%, 8/6/30 | 15 | 11 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| AstraZeneca, 4.00%, 9/18/42 | 50 | 39 |

| Astrazeneca Finance, 4.875%, 3/3/28 | 220 | 215 |

| Astrazeneca Finance, 4.875%, 3/3/33 | 100 | 94 |

| BAT Capital, 2.789%, 9/6/24 | 15 | 15 |

| BAT Capital, 3.557%, 8/15/27 | 18 | 16 |

| BAT Capital, 4.39%, 8/15/37 | 180 | 130 |

| BAT Capital, 7.079%, 8/2/43 | 90 | 82 |

| Becton Dickinson & Company, 2.823%, 5/20/30 | 245 | 202 |

| Becton Dickinson & Company, 3.70%, 6/6/27 | 145 | 135 |

| Biogen, 2.25%, 5/1/30 | 350 | 275 |

| Biogen, 3.15%, 5/1/50 | 15 | 9 |

| Bristol-Myers Squibb, 3.40%, 7/26/29 | 7 | 6 |

| Bristol-Myers Squibb, 4.25%, 10/26/49 | 15 | 11 |

| Cigna, 4.125%, 11/15/25 | 60 | 58 |

| CommonSpirit Health, 2.76%, 10/1/24 | 50 | 49 |

| CommonSpirit Health, 2.782%, 10/1/30 | 20 | 16 |

| CVS Health, 1.875%, 2/28/31 | 15 | 11 |

| CVS Health, 2.70%, 8/21/40 | 275 | 166 |

| CVS Health, 3.25%, 8/15/29 | 50 | 43 |

| CVS Health, 5.125%, 7/20/45 | 145 | 116 |

| CVS Health, 6.00%, 6/1/63 | 75 | 65 |

| Hackensack Meridian Health, 4.211%, 7/1/48 (2) | 85 | 64 |

| Hasbro, 3.00%, 11/19/24 | 25 | 24 |

| Hasbro, 3.55%, 11/19/26 | 205 | 189 |

| HCA, 4.125%, 6/15/29 | 200 | 177 |

| HCA, 4.375%, 3/15/42 | 20 | 14 |

| Mars, 4.75%, 4/20/33 (1) | 100 | 92 |

| McKesson, 5.25%, 2/15/26 | 300 | 296 |

| MedStar Health, Series 20A, 3.626%, 8/15/49 | 30 | 19 |

| Memorial Sloan-Kettering Cancer Center, Series 2015, 4.20%, 7/1/55 | 10 | 7 |

| Nestle Holdings, 4.85%, 3/14/33 (1) | 300 | 281 |

| Northwell Healthcare, 3.979%, 11/1/46 | 20 | 14 |

| NYU Langone Hospitals, 4.368%, 7/1/47 | 15 | 12 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Perrigo Finance Unlimited, 4.65%, 6/15/30 | 200 | 167 |

| Reynolds American, 4.45%, 6/12/25 | 13 | 13 |

| Smithfield Foods, 5.20%, 4/1/29 (1) | 15 | 14 |

| Stanford Health Care, Series 2018, 3.795%, 11/15/48 | 10 | 7 |

| Takeda Pharmaceutical, 2.05%, 3/31/30 (2) | 200 | 158 |

| | | 3,996 |

| Energy 1.6% | | |

| Amerada Hess, 7.125%, 3/15/33 | 50 | 54 |

| Boardwalk Pipelines, 3.40%, 2/15/31 | 25 | 20 |

| Boardwalk Pipelines, 4.95%, 12/15/24 | 25 | 25 |

| BP Capital Markets America, 3.41%, 2/11/26 | 45 | 43 |

| Cameron LNG, 3.701%, 1/15/39 (1) | 40 | 29 |

| Canadian Natural Resources, 2.95%, 7/15/30 | 20 | 16 |

| Enbridge Energy Partners, 5.50%, 9/15/40 (2) | 10 | 8 |

| Energy Transfer, 5.25%, 4/15/29 | 120 | 114 |

| Energy Transfer, 5.40%, 10/1/47 | 15 | 12 |

| Energy Transfer, 6.50%, 2/1/42 | 25 | 23 |

| Energy Transfer Operating, 3.75%, 5/15/30 | 70 | 60 |

| Enterprise Products Operating, 5.35%, 1/31/33 | 100 | 95 |

| Kinder Morgan, 5.20%, 6/1/33 | 195 | 176 |

| MPLX, 5.65%, 3/1/53 (2) | 350 | 286 |

| ONEOK, 6.625%, 9/1/53 | 200 | 187 |

| Pioneer Natural Resources, 1.125%, 1/15/26 | 10 | 9 |

| Sabine Pass Liquefaction, 4.20%, 3/15/28 | 70 | 64 |

| Sabine Pass Liquefaction, 4.50%, 5/15/30 | 85 | 76 |

| TotalEnergies Capital International, 2.434%, 1/10/25 | 40 | 39 |

| TotalEnergies Capital International, 2.986%, 6/29/41 | 60 | 40 |

| TransCanada PipeLines, 6.203%, 3/9/26 | 300 | 299 |

| Transcontinental Gas Pipe Line, 4.60%, 3/15/48 | 10 | 8 |

| Woodside Finance, 4.50%, 3/4/29 (1) | 20 | 18 |

| | | 1,701 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Industrial Other 0.0% | | |

| Northwestern University, Series 2020, 2.64%, 12/1/50 | 20 | 11 |

| | | 11 |

| Technology 2.3% | | |

| Apple, 3.20%, 5/13/25 (2) | 40 | 39 |

| Apple, 3.20%, 5/11/27 | 15 | 14 |

| Apple, 3.35%, 2/9/27 | 165 | 156 |

| Apple, 4.85%, 5/10/53 | 300 | 261 |

| CDW, 4.25%, 4/1/28 | 45 | 41 |

| Fiserv, 3.20%, 7/1/26 | 40 | 37 |

| Fiserv, 5.60%, 3/2/33 | 200 | 188 |

| Intuit, 5.125%, 9/15/28 | 260 | 256 |

| Keysight Technologies, 3.00%, 10/30/29 | 50 | 42 |

| Keysight Technologies, 4.55%, 10/30/24 | 10 | 10 |

| Micron Technology, 4.185%, 2/15/27 | 70 | 65 |

| Moody's, 2.00%, 8/19/31 | 180 | 136 |

| NXP, 2.50%, 5/11/31 | 65 | 50 |

| NXP, 3.15%, 5/1/27 | 125 | 113 |

| NXP, 3.40%, 5/1/30 | 15 | 13 |

| Oracle, 3.60%, 4/1/40 | 15 | 10 |

| RELX Capital, 3.00%, 5/22/30 | 25 | 21 |

| Roper Technologies, 2.95%, 9/15/29 | 25 | 21 |

| Roper Technologies, 3.80%, 12/15/26 | 25 | 24 |

| ServiceNow, 1.40%, 9/1/30 | 310 | 234 |

| Texas Instruments, 1.375%, 3/12/25 | 70 | 66 |

| Texas Instruments, 5.05%, 5/18/63 | 90 | 75 |

| Visa, 2.70%, 4/15/40 | 35 | 23 |

| VMware, 1.40%, 8/15/26 | 95 | 83 |

| Western Union, 2.85%, 1/10/25 | 50 | 48 |

| Western Union, 6.20%, 11/17/36 | 340 | 319 |

| | | 2,345 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Transportation 0.4% | | |

| American Airlines PTT, Series 2014-1, Class A, 3.70%, 10/1/26 | 8 | 7 |

| Canadian Pacific Railway, 1.75%, 12/2/26 | 95 | 85 |

| Canadian Pacific Railway, 2.875%, 11/15/29 | 120 | 101 |

| Canadian Pacific Railway, 3.50%, 5/1/50 | 15 | 10 |

| Canadian Pacific Railway, 4.70%, 5/1/48 | 10 | 8 |

| ERAC USA Finance, 4.50%, 2/15/45 (1) | 10 | 8 |

| ERAC USA Finance, 4.90%, 5/1/33 (1)(2) | 185 | 168 |

| Transurban Finance, 2.45%, 3/16/31 (1) | 30 | 23 |

| Transurban Finance, 4.125%, 2/2/26 (1) | 15 | 14 |

| | | 424 |

| Total Industrial | | 15,165 |

| UTILITY 1.5% | | |

| Electric 1.2% | | |

| AEP Texas, 4.70%, 5/15/32 | 30 | 27 |

| Berkshire Hathaway Energy, 6.125%, 4/1/36 | 65 | 64 |

| Duke Energy, 3.75%, 9/1/46 | 55 | 36 |

| Duke Energy Indiana, 5.40%, 4/1/53 | 40 | 34 |

| Exelon, 3.40%, 4/15/26 | 175 | 166 |

| Georgia Power, 4.95%, 5/17/33 | 100 | 91 |

| IPALCO Enterprises, 3.70%, 9/1/24 | 30 | 29 |

| Metropolitan Edison, 4.30%, 1/15/29 (1) | 75 | 69 |

| Mid-Atlantic Interstate Transmission, 4.10%, 5/15/28 (1) | 15 | 14 |

| NextEra Energy Capital Holdings, 5.749%, 9/1/25 | 130 | 129 |

| Pacific Gas & Electric, 2.10%, 8/1/27 | 215 | 182 |

| Pacific Gas and Electric, 6.15%, 1/15/33 | 100 | 93 |

| Southern, 4.40%, 7/1/46 | 300 | 221 |

| Vistra Operations, 3.55%, 7/15/24 (1) | 110 | 107 |

| | | 1,262 |

| Natural Gas 0.3% | | |

| APT Pipelines, 4.25%, 7/15/27 (1) | 10 | 9 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| NiSource, 1.70%, 2/15/31 | 160 | 117 |

| NiSource, 5.65%, 2/1/45 | 15 | 13 |

| NiSource , 3.95%, 3/30/48 | 45 | 31 |

| NiSource Finance, 3.49%, 5/15/27 | 55 | 51 |

| Southern Co Gas Capital, 5.15%, 9/15/32 | 100 | 92 |

| | | 313 |

| Total Utility | | 1,575 |

Total Corporate Bonds

(Cost $30,178) | | 27,321 |

| FOREIGN GOVERNMENT OBLIGATIONS & MUNICIPALITIES 0.8% |

| Local Authorities 0.3% | | |

| Province of British Columbia Canada, 4.20%, 7/6/33 | 98 | 89 |

| Province of Manitoba Canada, 4.30%, 7/27/33 | 250 | 230 |

| | | 319 |

| Owned No Guarantee 0.2% | | |

| Corp Nacional del Cobre de Chile, 3.75%, 1/15/31 (1) | 200 | 166 |

| | | 166 |

| Sovereign 0.3% | | |

| Panama Government International Bond, 3.298%, 1/19/33 | 200 | 149 |

| United Mexican States, 4.75%, 3/8/44 | 300 | 223 |

| | | 372 |

Total Foreign Government Obligations & Municipalities

(Cost $973) | | 857 |

| MUNICIPAL SECURITIES 1.7% |

| California 0.5% | | |

| Bay Area Toll Auth., Series S-10, 3.176%, 4/1/41 | 50 | 34 |

| California St, 5.20%, 3/1/43 | 200 | 175 |

| California State University, 6.484%, 11/1/41 | 250 | 254 |

| Univ. of California Regents, Build America, 5.77%, 5/15/43 | 50 | 48 |

| | | 511 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| District Of Columbia 0.2% | | |

| Metropolitan Washington Airports Authority Dulles Toll Road Revenue, 7.462%, 10/1/46 | 225 | 251 |

| | | 251 |

| Georgia 0.0% | | |

| Municipal Electric Auth. of Georgia, Build America, Vogtle Units, Series A, 6.637%, 4/1/57 | 40 | 41 |

| | | 41 |

| Illinois 0.3% | | |

| Chicago O'Hare Int'l Airport, Build America, 6.395%, 1/1/40 | 250 | 259 |

| Cook County, 6.36%, 11/15/33 | 25 | 26 |

| | | 285 |

| Louisiana 0.1% | | |

| Louisiana Local Government Environmental Facilities & Community Development Auth, Series A, 4.475%, 8/1/39 | 60 | 52 |

| | | 52 |

| Maryland 0.0% | | |

| Maryland Health & Higher Educational Facilities Auth., Series B, 4.815%, 7/1/43 | 40 | 33 |

| | | 33 |

| New York 0.1% | | |

| New York State Urban Dev. Sales Tax Revenue, Series B, 2.59%, 3/15/35 | 70 | 51 |

| | | 51 |

| Tennessee 0.0% | | |

| Metropolitan Government of Nashville & Davidson County, Series B, 3.235%, 7/1/52 | 75 | 42 |

| | | 42 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Texas 0.4% | | |

| Central Texas Regional Mobility Auth., Series E, 3.167%, 1/1/41 | 75 | 52 |

| Dallas/Fort Worth Int'l Airport, Series C, 2.843%, 11/1/46 | 65 | 42 |

| Dallas/Fort Worth Int'l Airport, Series A, 5.045%, 11/1/47 | 250 | 220 |

| Texas Natural Gas Securitiztn Fin Corp, 5.169%, 4/1/41 | 30 | 28 |

| Texas Private Activity Bond Surface Transportation, North Tarrant, Express, Series B, 3.922%, 12/31/49 | 30 | 21 |

| | | 363 |

| Virginia 0.1% | | |

| Univ. of Virginia, Series B, 2.584%, 11/1/51 | 75 | 43 |

| Virginia Commonwealth Transportation Board, Build America, Series B, 5.35%, 5/15/35 | 50 | 48 |

| | | 91 |

| Wisconsin 0.0% | | |

| Public Finance Auth., Series B, 3.405%, 7/1/51 | 70 | 43 |

| | | 43 |

Total Municipal Securities

(Cost $2,202) | | 1,763 |

| NON-U.S. GOVERNMENT MORTGAGE-BACKED SECURITIES 4.7% |

| Collateralized Mortgage Obligations 2.3% | | |

| Angel Oak Mortgage Trust, Series 2019-5, Class A1, CMO, ARM, 2.593%, 10/25/49 (1) | 24 | 23 |

| Angel Oak Mortgage Trust, Series 2021-6, Class A3, CMO, ARM, 1.714%, 9/25/66 (1) | 69 | 52 |

| Angel Oak Mortgage Trust, Series 2022-6, Class A1, CMO, ARM, 4.30%, 7/25/67 (1) | 317 | 287 |

| Angel Oak Mortgage Trust, Series 2023-3, Class A1, CMO, ARM, 4.80%, 9/26/67 (1) | 49 | 45 |

| Barclays Mortgage Loan Trust, Series 2021-NQM1, Class A3, CMO, ARM, 2.189%, 9/25/51 (1) | 57 | 47 |

| Bayview MSR Opportunity Master Fund Trust, Series 2021-5, Class A20, CMO, ARM, 2.50%, 11/25/51 (1) | 113 | 81 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| BRAVO Residential Funding Trust, Series 2021-NQM3, Class A1, CMO, ARM, 1.699%, 4/25/60 (1) | 48 | 41 |

| Chase Home Lending Mortgage Trust, Series 2023-RPL1, Class A1, CMO, ARM, 3.50%, 6/25/62 (1) | 311 | 270 |

| COLT Mortgage Trust, Series 2022-3, Class A1, CMO, ARM, 3.901%, 2/25/67 (1) | 85 | 75 |

| Connecticut Avenue Securities Trust, Series 2022-R01, Class 1M1, FRN, SOFR30A + 1.00%, 6.321%, 12/25/41 (1) | 13 | 12 |

| Connecticut Avenue Securities Trust, Series 2023-R04, Class 1M1, FRN, SOFR30A + 2.30%, 7.621%, 5/25/43 (1) | 65 | 66 |

| Ellington Financial Mortgage Trust, Series 2021-3, Class M1, CMO, ARM, 2.53%, 9/25/66 (1) | 100 | 51 |

| Freddie Mac STACR REMIC Trust, Series 2021-DNA7, Class M1, FRN, SOFR30A + 0.85%, 6.171%, 11/25/41 (1) | 42 | 42 |

| GCAT, Series 2021-NQM5, Class A1, CMO, ARM, 1.262%, 7/25/66 (1) | 68 | 52 |

| GCAT Trust, Series 2023-INV1, Class A1, CMO, ARM, 6.00%, 8/25/53 (1) | 222 | 212 |

| JP Morgan Mortgage Trust, Series 2023-DSC2, Class A1, CMO, ARM, 5.25%, 11/25/63 (1) | 242 | 223 |

| Morgan Stanley Residential Mortgage Loan Trust, Series 2023-NQM1, Class A2, 7.53%, 9/25/68 (1) | 100 | 100 |

| New Residential Mortgage Loan Trust, Series 2022-INV1, Class A4, CMO, ARM, 3.00%, 3/25/52 (1) | 89 | 66 |

| OBX Trust, Series 2023-NQM9, Class A2, 7.318%, 10/25/63 (1) | 100 | 100 |

| Verus Securitization Trust, Series 2019-INV3, Class A1, CMO, ARM, 2.692%, 11/25/59 (1) | 64 | 62 |

| Verus Securitization Trust, Series 2021-7, Class A1, CMO, ARM, 1.829%, 10/25/66 (1) | 75 | 62 |

| Verus Securitization Trust, Series 2023-6, Class A2, 6.939%, 9/25/68 (1) | 203 | 201 |

| Verus Securitization Trust, Series 2023-7, Class A2, 7.272%, 10/25/68 (1) | 145 | 145 |

| Verus Securitization Trust, Series 2023-INV1, Class A1, CMO, ARM, 5.999%, 2/25/68 (1) | 89 | 87 |

| | | 2,402 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Commercial Mortgage-Backed Securities 2.4% | | |

| Benchmark Mortgage Trust, Series 2023-V3, Class A3, ARM, 6.363%, 7/15/56 | 265 | 265 |

| Big Trust, Series 2022-BIG, Class A, FRN, 1M TSFR + 1.34%, 6.676%, 2/15/39 (1) | 100 | 98 |

| BWAY Trust, Series 2022-26BW, Class A, ARM, 3.402%, 2/10/44 (1) | 100 | 70 |

| BX Trust, Series 2020-VKNG, Class A, FRN, 1M TSFR + 1.04%, 6.379%, 10/15/37 (1) | 301 | 298 |

| BX Trust, Series 2021-ARIA, Class B, FRN, 1M TSFR + 1.41%, 6.745%, 10/15/36 (1) | 105 | 101 |

| BX Trust, Series 2021-ARIA, Class A, FRN, 1M TSFR + 1.01%, 6.348%, 10/15/36 (1) | 315 | 305 |

| BX Trust, Series 2022-CSMO, Class A, FRN, 1M TSFR + 2.11%, 7.449%, 6/15/27 (1) | 176 | 176 |

| BX Trust, Series 2022-LP2, Class C, FRN, 1M TSFR + 1.56%, 6.896%, 2/15/39 (1) | 81 | 78 |

| BX Trust, Series 2023-LIFE, Class B, 5.39%, 2/15/28 (1) | 100 | 92 |

| COMM Trust, Series 2015-CR23, Class A3, 3.23%, 5/10/48 | 35 | 33 |

| Five Mortgage Trust, Series 2023-V1, Class A3, ARM, 5.668%, 2/10/56 | 50 | 48 |

| Great Wolf Trust, Series 2019-WOLF, Class A, FRN, 1M TSFR + 1.15%, 6.482%, 12/15/36 (1) | 285 | 283 |

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2022-OPO, Class B, ARM, 3.376%, 1/5/39 (1) | 100 | 75 |

| JPMBB Commercial Mortgage Securities Trust, Series 2015-C31, Class A3, 3.801%, 8/15/48 | 160 | 151 |

| MHC Commercial Mortgage Trust, Series 2021-MHC, Class B, FRN, 1M TSFR + 1.22%, 6.549%, 4/15/38 (1) | 92 | 90 |

| Morgan Stanley Capital I Trust, Series 2018-H4, Class A4, 4.31%, 12/15/51 | 175 | 159 |

| NYO Commercial Mortgage Trust, Series 2021-1290, Class C, FRN, 1M TSFR + 2.11%, 7.444%, 11/15/38 (1) | 90 | 68 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Wells Fargo Commercial Mortgage Trust, Series 2019-JWDR, Class A, ARM, 2.501%, 9/15/31 (1) | 100 | 89 |

| | | 2,479 |

Total Non-U.S. Government Mortgage-Backed Securities

(Cost $5,285) | | 4,881 |

| U.S. GOVERNMENT & AGENCY MORTGAGE-BACKED SECURITIES 29.6% |

| U.S. Government Agency Obligations 22.4% | | |

| Fannie Mae Pool | | |

| 2.00%, 5/1/36 - 11/1/51 | 2,240 | 1,718 |

| 2.50%, 4/1/37 - 5/1/52 | 1,798 | 1,430 |

| 3.00%, 7/1/40 - 3/1/52 | 1,149 | 951 |

| 3.50%, 1/1/33 | 102 | 95 |

| 4.00%, 7/1/48 | 68 | 60 |

| 4.50%, 3/1/50 - 7/1/53 | 652 | 585 |

| 5.00%, 7/1/53 | 90 | 83 |

| 5.50%, 3/1/53 | 65 | 61 |

| 6.00%, 9/1/53 | 64 | 63 |

| Federal Home Loan Mortgage, ARM | | |

| 3.71%, 9/25/32 | 165 | 143 |

| 4.43%, 2/25/33 | 125 | 114 |

| Federal National Mortgage Assn. | | |

| 1.50%, 4/1/37 - 1/1/42 | 322 | 260 |

| 2.00%, 4/1/37 - 4/1/52 | 5,890 | 4,372 |

| 2.50%, 7/1/30 - 5/1/52 | 1,678 | 1,333 |

| 3.00%, 1/1/33 - 6/1/52 | 1,739 | 1,438 |

| 3.50%, 12/1/33 - 4/1/52 | 996 | 847 |

| 4.00%, 2/1/47 - 9/1/52 | 809 | 707 |

| 4.50%, 4/1/41 - 8/1/52 | 403 | 366 |

| 5.00%, 11/1/44 - 9/1/52 | 130 | 124 |

| 5.50%, 5/1/44 | 70 | 69 |

| 6.00%, 1/1/53 - 2/1/53 | 164 | 161 |

| Freddie Mac Multifamily Structured Pass Through Certificates, 2.347%, 11/25/31 | 390 | 307 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Freddie Mac Pool | | |

| 1.50%, 2/1/36 - 4/1/41 | 684 | 552 |

| 2.00%, 8/1/36 - 4/1/52 | 408 | 320 |

| 2.50%, 6/1/42 - 4/1/52 | 2,664 | 2,059 |

| 3.00%, 9/1/32 - 1/1/52 | 1,086 | 915 |

| 3.50%, 8/1/49 - 4/1/50 | 949 | 810 |

| 4.00%, 7/1/49 | 720 | 635 |

| 5.00%, 5/1/53 | 23 | 21 |

| 5.50%, 8/1/53 | 206 | 195 |

| 6.00%, 2/1/53 | 350 | 342 |

| UMBS, TBA (4) | | |

| 2.00%, 11/1/38 | 490 | 415 |

| 3.50%, 11/1/53 | 125 | 104 |

| 5.00%, 11/1/53 | 820 | 756 |

| 5.50%, 11/1/53 | 280 | 266 |

| 6.00%, 11/1/53 | 150 | 146 |

| 6.50%, 11/1/53 | 465 | 462 |

| | | 23,285 |

| U.S. Government Obligations 7.2% | | |

| Ginnie Mae II Pool | | |

| 2.00%, 12/20/51 | 149 | 115 |

| 7.00%, 8/20/53 - 9/20/53 | 30 | 30 |

| Government National Mortgage Assn. | | |

| 1.50%, 5/20/37 | 45 | 37 |

| 2.00%, 3/20/51 - 3/20/52 | 1,636 | 1,264 |

| 2.50%, 8/20/50 - 1/20/52 | 1,710 | 1,362 |

| 3.00%, 6/20/45 - 6/20/52 | 1,329 | 1,109 |

| 3.50%, 6/20/46 - 10/20/50 | 1,025 | 884 |

| 4.00%, 10/20/40 - 10/20/52 | 740 | 653 |

| 4.50%, 10/20/47 - 10/20/52 | 537 | 487 |

| 5.00%, 8/20/47 - 8/20/52 | 182 | 172 |

| Government National Mortgage Assn., TBA (4) | | |

| 5.00%, 11/20/53 | 230 | 214 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| 5.50%, 11/20/53 | 815 | 779 |

| 6.00%, 11/20/53 | 190 | 186 |

| 6.50%, 11/20/53 | 195 | 195 |

| | | 7,487 |

Total U.S. Government & Agency Mortgage-Backed Securities

(Cost $34,096) | | 30,772 |

| U.S. GOVERNMENT AGENCY OBLIGATIONS (EXCLUDING MORTGAGE-BACKED) 32.2% |

| U.S. Treasury Obligations 32.2% | | |

| U.S. Treasury Bills, 5.379%, 1/11/24 | 2,040 | 2,019 |

| U.S. Treasury Bonds, 1.75%, 8/15/41 | 2,110 | 1,251 |

| U.S. Treasury Bonds, 2.00%, 8/15/51 | 1,665 | 900 |

| U.S. Treasury Bonds, 2.25%, 2/15/52 | 350 | 201 |

| U.S. Treasury Bonds, 3.375%, 8/15/42 | 115 | 89 |

| U.S. Treasury Bonds, 3.625%, 2/15/53 | 205 | 160 |

| U.S. Treasury Bonds, 3.625%, 5/15/53 | 3,360 | 2,618 |

| U.S. Treasury Bonds, 3.875%, 2/15/43 | 140 | 116 |

| U.S. Treasury Bonds, 3.875%, 5/15/43 | 3,165 | 2,627 |

| U.S. Treasury Notes, 0.75%, 8/31/26 | 4,580 | 4,080 |

| U.S. Treasury Notes, 1.25%, 8/15/31 | 590 | 452 |

| U.S. Treasury Notes, 1.875%, 2/28/27 | 830 | 754 |

| U.S. Treasury Notes, 3.375%, 5/15/33 | 1,615 | 1,428 |

| U.S. Treasury Notes, 3.50%, 2/15/33 | 200 | 179 |

| U.S. Treasury Notes, 3.50%, 1/31/28 | 385 | 365 |

| U.S. Treasury Notes, 3.625%, 5/31/28 | 800 | 761 |

| U.S. Treasury Notes, 4.00%, 2/29/28 | 1,130 | 1,093 |

| U.S. Treasury Notes, 4.00%, 6/30/28 (5) | 8,155 | 7,872 |

| U.S. Treasury Notes, 4.125%, 1/31/25 | 300 | 296 |

| U.S. Treasury Notes, 4.125%, 10/31/27 | 530 | 516 |

| U.S. Treasury Notes, 4.25%, 10/15/25 | 200 | 197 |

T. ROWE PRICE QM U.S. BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| U.S. Treasury Notes, 4.625%, 6/30/25 | 5,495 | 5,448 |

| | | 33,422 |

Total U.S. Government Agency Obligations (Excluding Mortgage-Backed)

(Cost $37,108) | | 33,422 |

| SHORT-TERM INVESTMENTS 2.8% |

| Money Market Funds 2.8% | | |

| T. Rowe Price Government Reserve Fund, 5.42% (6)(7) | 2,912 | 2,912 |

Total Short-Term Investments

(Cost $2,912) | | 2,912 |

| SECURITIES LENDING COLLATERAL 2.5% |

| Investments in a Pooled Account through Securities Lending Program with State Street Bank 2.5% | | |

| Money Market Funds 2.5% | | |

| T. Rowe Price Government Reserve Fund, 5.42% (6)(7) | 2,522 | 2,522 |

| Total Investments in a Pooled Account through Securities Lending Program with State Street Bank | | 2,522 |

Total Securities Lending Collateral

(Cost $2,522) | | 2,522 |

Total Investments

104.5% of Net Assets (Cost $119,345) | | $108,452 |

| ‡ | Par/Shares and Notional Amount are denominated in U.S. dollars unless otherwise noted. |

| (1) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. Total value of such securities at period-end amounts to $11,032 and represents 10.6% of net assets. |

| (2) | All or a portion of this security is on loan at October 31, 2023. See Note 4. |

| (3) | Security is a fix-to-float security, which carries a fixed coupon until a certain date, upon which it switches to a floating rate. Reference rate and spread are provided if the rate is currently floating. |

| (4) | To-Be-Announced purchase commitment. Total value of such securities at period-end amounts to $3,523 and represents 3.4% of net assets. |

T. ROWE PRICE QM U.S. BOND ETF

| (5) | At October 31, 2023, all or a portion of this security is pledged as collateral and/or margin deposit to cover future funding obligations. |

| (6) | Seven-day yield |

| (7) | Affiliated Companies |

| 1M TSFR | One month term SOFR (Secured overnight financing rate) |

| 3M TSFR | Three month term SOFR (Secured overnight financing rate) |

| ARM | Adjustable Rate Mortgage (ARM); rate shown is effective rate at period-end. The rates for certain ARMs are not based on a published reference rate and spread but may be determined using a formula based on the rates of the underlying loans. |

| CLO | Collateralized Loan Obligation |

| CMO | Collateralized Mortgage Obligation |

| FRN | Floating Rate Note |

| PTT | Pass-Through Trust |

| SOFR30A | 30-day Average term SOFR (Secured Overnight Financing Rate) |

| TBA | To-Be-Announced |

| UMBS | Uniform Mortgage-Backed Securities |

| VR | Variable Rate; rate shown is effective rate at period-end. The rates for certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and based on current market conditions. |

T. ROWE PRICE QM U.S. BOND ETF

| | Expiration

Date | Notional

Amount | Value and

Unrealized

Gain (Loss) |

| Long, 1 Ultra U.S. Treasury Bonds contracts | 12/23 | 127 | $ (15) |

| Long, 68 U.S. Treasury Notes five year contracts | 12/23 | 7,211 | (107) |

| Long, 3 U.S. Treasury Notes ten year contracts | 12/23 | 330 | (11) |

| Long, 5 U.S. Treasury Notes two year contracts | 12/23 | 1,014 | (1) |

| Net payments (receipts) of variation margin to date | 129 |

| Variation margin receivable (payable) on open futures contracts | $ (5) |

T. ROWE PRICE QM U.S. BOND ETF

AFFILIATED COMPANIES

($000s)

The fund may invest in certain securities that are considered affiliated companies. As defined by the 1940 Act, an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or a company that is under common ownership or control. The following securities were considered affiliated companies for all or some portion of the year ended October 31, 2023. Net realized gain (loss), investment income, change in net unrealized gain/loss, and purchase and sales cost reflect all activity for the period then ended.

| Affiliate | Net Realized Gain

(Loss) | Changes in Net

Unrealized

Gain/Loss | Investment

Income |

| T. Rowe Price Government Reserve Fund | $ — | $— | $159++ |

| Totals | $—# | $— | $ 159+ |

| Supplementary Investment Schedule |

| Affiliate | Value

10/31/22 | Purchase

Cost | Sales

Cost | Value

10/31/23 |

| T. Rowe Price Government Reserve Fund | $1,003 | ¤ | ¤ | $ 5,434 |

| | Total | | | $5,434^ |

| ++ | Excludes earnings on securities lending collateral, which are subject to rebates and fees. |

| # | Capital gain distributions from mutual funds represented $0 of the net realized gain (loss). |

| + | Investment income comprised $159 of dividend income and $0 of interest income. |

| ¤ | Purchase and sale information not shown for cash management funds. |

| ^ | The cost basis of investments in affiliated companies was $5,434. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE QM U.S. BOND ETF

October 31, 2023

STATEMENT OF ASSETS AND LIABILITIES

($000s, except shares and per share amounts)

| Assets | |

| Investments in securities, at value (cost $119,345) | $ 108,452 |

| Receivable for investment securities sold | 896 |

| Interest and dividends receivable | 877 |

| Cash | 1 |

| Total assets | 110,226 |

| Liabilities | |

| Payable for investment securities purchased | 3,873 |

| Obligation to return securities lending collateral | 2,522 |

| Investment management and administrative fees payable | 7 |

| Variation margin payable on futures contracts | 5 |

| Total liabilities | 6,407 |

| NET ASSETS | $ 103,819 |

| Net assets consists of: | |

| Total distributable earnings (loss) | $ (13,117) |

Paid-in capital applicable to 2,600,000 shares of $0.0001 par value

capital stock outstanding; 4,000,000,000 shares authorized | 116,936 |

| NET ASSETS | $103,819 |

| NET ASSET VALUE PER SHARE | $ 39.93 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE QM U.S. BOND ETF

STATEMENT OF OPERATIONS

($000s)

| | Year Ended |

| | 10/31/23 |

| Investment Income (Loss) | |

| Income | |

| Interest | $ 2,111 |

| Dividend | 159 |

| Securities lending | 3 |

| Total income | 2,273 |

| Expenses | |

| Investment management and administrative expense | 48 |

| Miscellaneous expense | 1 |

| Total expenses | 49 |

| Net investment income | 2,224 |

| Realized and Unrealized Gain / Loss | |

| Net realized gain (loss) | |

| Securities | (1,017) |

| Futures | (232) |

| Swaps | 20 |

| Net realized loss | (1,229) |

| Change in net unrealized gain / loss | |

| Securities | (4,478) |

| Futures | (16) |

| Change in unrealized gain / loss | (4,494) |

| Net realized and unrealized gain / loss | (5,723) |

| DECREASE IN NET ASSETS FROM OPERATIONS | $(3,499) |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE QM U.S. BOND ETF

STATEMENT OF CHANGES IN NET ASSETS

($000s)

| | Year

Ended | | Year

Ended |

| | 10/31/23 | | 10/31/22 |

| Increase (Decrease) in Net Assets | | | |

| Operations | | | |

| Net investment income | $ 2,224 | | $ 741 |

| Net realized loss | (1,229) | | (851) |

| Change in net unrealized gain / loss | (4,494) | | (6,530) |

| Decrease in net assets from operations | (3,499) | | (6,640) |

| Distributions to shareholders | | | |

| Net earnings | (2,246) | | (741) |

| Capital share transactions* | | | |

| Shares sold | 76,693 | | 16,978 |

| Shares redeemed | (3,102) | | (1,101) |

| Increase in net assets from capital share transactions | 73,591 | | 15,877 |

| Net Assets | | | |

| Increase during period | 67,846 | | 8,496 |

| Beginning of period | 35,973 | | 27,477 |

| End of period | $103,819 | | $35,973 |

| *Share information | | | |

| Shares sold | 1,800 | | 350 |

| Shares redeemed | (75) | | (25) |

| Increase in shares outstanding | 1,725 | | 325 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE QM U.S. BOND ETF

NOTES TO FINANCIAL STATEMENTS

T. Rowe Price Exchange-Traded Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The QM U.S. Bond ETF (the fund) is a diversified, open-end management investment company established by the corporation. The fund seeks to provide a total return that exceeds the performance of the U.S. investment-grade bond market.

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation

The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions

Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividends received from other investment companies are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the asset received. Distributions to shareholders are recorded on the ex-dividend date. Income distributions, if any, are declared and paid monthly. A capital gain distribution, if any, may also be declared and paid by the fund annually. Dividends and distributions cannot be automatically reinvested in additional shares of the fund.

T. ROWE PRICE QM U.S. BOND ETF

Capital Transactions

The fund issues and redeems shares at its net asset value (NAV) only with Authorized Participants and only in large blocks of 25,000 shares (each, a “Creation Unit”). The fund’s NAV per share is computed at the close of the New York Stock Exchange (NYSE). However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Individual fund shares may not be purchased or redeemed directly with the fund. An Authorized Participant may purchase or redeem a Creation Unit of the fund each business day that the fund is open in exchange for the delivery of a designated portfolio of in-kind securities and/or cash. When purchasing or redeeming Creation Units, Authorized Participants are also required to pay a fixed and/or variable purchase or redemption transaction fee as well as any applicable additional variable charge to defray the transaction cost to a fund.

Individual fund shares may be purchased and sold only on a national securities exchange through brokers. Shares are listed for trading on NYSE Arca, Inc. (NYSE Arca) and because the shares will trade at market prices rather than NAV, shares may trade at prices greater than NAV (at a premium), at NAV, or less than NAV (at a discount). The fund’s shares are ordinarily valued as of the close of regular trading (normally 4:00 p.m. Eastern time) on each day that the NYSE Arca is open.

New Accounting Guidance

The FASB issued Accounting Standards Update (ASU), ASU 2020-04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting in March 2020 and ASU 2021-01 in January 2021 which provided further amendments and clarifications to Topic 848. These ASUs provide optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (LIBOR), and other interbank-offered based reference rates, through December 31, 2022. In December 2022, FASB issued ASU 2022-06 which defers the sunset date of Topic 848 from December 31, 2022 to December 31, 2024, after which entities will no longer be permitted to apply the relief in Topic 848. Management intends to rely upon the relief provided under Topic 848, which is not expected to have a material impact on the fund’s financial statements.

Indemnification

In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

T. ROWE PRICE QM U.S. BOND ETF

NOTE 2 – VALUATION

Fair Value

The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fund’s Board of Directors (the Board) has designated T. Rowe Price Associates, Inc. as the fund’s valuation designee (Valuation Designee). Subject to oversight by the Board, the Valuation Designee performs the following functions in performing fair value determinations: assesses and manages valuation risks; establishes and applies fair value methodologies; tests fair value methodologies; and evaluates pricing vendors and pricing agents. The duties and responsibilities of the Valuation Designee are performed by its Valuation Committee. The Valuation Designee provides periodic reporting to the Board on valuation matters.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date