UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23494

T. Rowe Price Exchange-Traded Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

ANNUAL REPORT

December 31, 2023

| | T. ROWE PRICE |

| TGRW | Growth Stock ETF |

| | For more insights from T. Rowe Price investment professionals, go to troweprice.com. |

T. ROWE PRICE GROWTH STOCK ETF

HIGHLIGHTS

| ■ | The Growth Stock ETF generated a positive absolute return in the 12-month period ended December 31, 2023. The fund outperformed its benchmark, the S&P 500 Index, and outpaced the style-specific Russell 1000 Growth Index. The fund also outperformed its peer group, the Lipper Large-Cap Growth Funds Index. |

| ■ | Major U.S. stock indexes produced strong gains in 2023, as the equity market rebounded from poor performance in 2022. Thanks in part to generally favorable corporate earnings, a resilient economy, and increased investor interest in artificial intelligence, equities climbed the proverbial wall of worry, led by a relatively small group of high-growth, technology-oriented mega-cap companies. |

| ■ | The fund’s top sector allocations are in information technology, communication services, and consumer discretionary. |

| ■ | Given the equity market’s impressive performance in 2023, which was driven primarily by multiple expansion, returns in the coming year may be more subdued. An additional move higher will likely hinge on the ability of companies to demonstrate meaningful earnings and free cash flow growth, an environment that we believe would be suitable to our focus on fundamental research and active, bottom-up stock selection. |

Go Paperless

Going paperless offers a host of benefits, which include:

| ■ | Timely delivery of important documents |

| ■ | Convenient access to your documents anytime, anywhere |

| ■ | Strong security protocols to safeguard sensitive data |

If you invest through a financial intermediary such as an investment advisor, a bank, or a brokerage firm, please contact that organization and ask if it can provide electronic documentation.

T. ROWE PRICE GROWTH STOCK ETF

Market Commentary

Dear Shareholder

Global stock and bond indexes were broadly positive during 2023 as most economies managed to avoid the recession that was widely predicted at the start of the year. Technology companies benefited from investor enthusiasm for artificial intelligence developments and led the equity rally, while fixed income benchmarks rebounded late in the year amid falling interest rates.

For the 12-month period, the technology-oriented Nasdaq Composite Index rose about 43%, reaching a record high and producing the strongest result of the major benchmarks. Growth stocks outperformed value shares, and developed market stocks generally outpaced their emerging markets counterparts. Currency movements were mixed over the period, although a weaker dollar versus major European currencies was beneficial for U.S. investors in European securities.

Within the S& P 500 Index, which finished the year just short of the record level it reached in early 2022, the information technology, communication services, and consumer discretionary sectors were all lifted by the tech rally and recorded significant gains. A small group of tech-oriented mega-cap companies helped drive much of the market’s advance. Conversely, the defensive utilities sector had the weakest returns in the growth-focused environment, and the energy sector also lost ground amid declining oil prices. The financials sector bounced back from the failure of three large regional banks in the spring and was one of the top-performing segments in the second half of the year.

The U.S. economy was the strongest among the major markets during the period, with gross domestic product growth coming in at 4.9% in the third quarter, the highest since the end of 2021. Corporate fundamentals were also broadly supportive. Year-over-year earnings growth contracted in the first and second quarters of 2023, but results were better than expected, and earnings growth turned positive again in the third quarter. Markets remained resilient despite a debt ceiling standoff in the U.S., the outbreak of war in the Middle East, the continuing conflict between Russia and Ukraine, and a sluggish economic recovery in China.

Inflation remained a concern, but investors were encouraged by the slowing pace of price increases as well as the possibility that the Federal Reserve was nearing the end of its rate-hiking cycle. The Fed held rates steady after raising its short-term lending benchmark rate to a target range of 5.25% to 5.50% in July,

T. ROWE PRICE GROWTH STOCK ETF

the highest level since March 2001, and at its final meeting of the year in December, the central bank indicated that there could be three 25-basis-point rate cuts in 2024.

The yield of the benchmark 10-year U.S. Treasury note briefly reached 5.00% in October for the first time since late 2007 before falling back to 3.88% by period-end, the same level where it started the year, amid cooler-than-expected inflation readings and less-hawkish Fed rhetoric. Fixed income benchmarks were lifted late in the year by falling yields. Investment-grade and high yield corporate bonds produced solid returns, supported by the higher coupons that have become available over the past year, as well as increasing hopes that the economy might be able to avoid a recession.

Global economies and markets showed surprising resilience in 2023, but considerable uncertainty remains as we look ahead. Geopolitical events, the path of monetary policy, and the impact of the Fed’s rate hikes on the economy all raise the potential for additional volatility. We believe this environment makes skilled active management a critical tool for identifying risks and opportunities, and our investment teams will continue to use fundamental research to help identify securities that can add value to your portfolio over the long term.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

CEO and President

T. ROWE PRICE GROWTH STOCK ETF

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fund seeks long-term capital growth.

FUND COMMENTARY

How did the fund perform in the past 12 months?

The Growth Stock ETF returned 48.87% (based on net asset value) and 48.92% (at market price) in the 12-month period ended December 31, 2023. The fund outperformed its benchmark, the S&P 500 Index, and outpaced the style-specific Russell 1000 Growth Index. The fund also outperformed its peer group, the Lipper Large-Cap Growth Funds Index. (Past performance cannot guarantee future results. Investors should note that the short-term performance for the fund is highly unusual and unlikely to be sustained.)

What factors influenced the fund’s performance?

Major U.S. stock indexes produced strong gains in 2023, as the equity market

PERFORMANCE COMPARISON

| | Total Return |

| Periods Ended 12/31/23 | 6 Months | 12 Months |

| Growth Stock ETF (Based on Net Asset Value) | 10.99% | 48.87% |

| Growth Stock ETF (At Market Price)* | 10.87 | 48.92 |

| S&P 500 Index | 8.04 | 26.29 |

| Russell 1000 Growth Index | 10.59 | 42.68 |

| Lipper Large-Cap Growth Funds Index | 10.64 | 42.03 |

*Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would have received if shares were traded at other times.

T. ROWE PRICE GROWTH STOCK ETF

rebounded from poor performance in 2022. Thanks in part to generally favorable corporate earnings, a resilient economy, and increased investor interest in artificial intelligence (AI), equities climbed the proverbial

wall of worry, led by a relatively small group of high-growth, technology-oriented mega-cap companies. While many of our highest-conviction investments were top performers, a handful of our more idiosyncratic ideas also provided important contributions.

The information technology sector led the way during the year, contributing the most to relative returns. A burgeoning secular growth theme in the form of AI provided significant support for the group, particularly among names in the semiconductors and software industries. Our positioning in NVIDIA and Advanced Micro Devices was a bright spot for the fund. Improved visibility around future demand for advanced computing chips that are critical for the buildout of AI infrastructure benefited shares of both chipmakers. Microsoft, which represents the fund’s largest position, also outperformed during the year. The market responded positively to reacceleration in the company’s cloud business as headwinds from information technology spending constraints began to fade. AI tailwinds also provided a boost for the stock; Microsoft’s investments in the space began to produce tangible gains, with contributions from AI services starting to move the needle on Azure growth. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

The fund’s second-largest sector allocation is in communication services, where a handful of names in digital advertising bounced back following disappointing performances in 2022. Shares of social media giant Meta Platforms rose over the past 12 months, driven by (1) the company’s continued focus on cost discipline, (2) a rebound in digital ad spending, and (3) improving monetization trends within short-form video. Alphabet also added value as shares were driven higher by a reacceleration in advertising spending for both its search and YouTube segments, encouraging engagement and monetization signals from AI efforts, and some modest improvement on cost control efforts.

Robust consumer spending guided the consumer discretionary sector higher. Shares of Amazon.com gained due to improving profitability in its North American e-commerce segment and better-than-expected results from Amazon Web Services (AWS) as cloud optimization headwinds began to abate. Amazon, which remains one of our largest holdings, has three businesses (e-commerce, AWS, and advertising) that each are levered to durable secular growth themes, are attacking huge addressable markets, and have plenty of runway left for growth. Our out-of-benchmark position in Ferrari also assisted. Shares of the

T. ROWE PRICE GROWTH STOCK ETF

luxury sports car manufacturer benefited from resilient demand—driven by its premium brand and a historically strong product cycle—alongside continued positive earnings revisions throughout year.

While our favorable positioning in a narrow group of market-leading names was a notable source of strength for the fund, we were also rewarded for being right on some ideas within health care, where our investment theses are playing out nicely. Shares of Eli Lilly traded higher, buoyed by impressive sales across its product portfolio, better-than-expected clinical data for its developmental Alzheimer’s drug, and heightened attention and optimism around the GLP-1 agonist drug class, which several of Lilly’s most significant diabetes and weight loss treatments belong to. Our positioning in two medical device companies also contributed. Despite recent fears that GLP-1 drugs could dampen future business prospects for the medical device space, shares of Intuitive Surgical and Stryker finished the year higher, driven by improving procedure volumes alongside easing supply chain bottlenecks and inflationary pressures.

No subsectors hurt relative performance during the period. However, from an absolute perspective, Estee Lauder and Schlumberger, a global beauty manufacturer and an oil field services leader, respectively, were two of the largest detractors from the fund’s performance.

How is the fund positioned?

Information technology continues to be our largest sector allocation, where powerful secular growth themes such as cloud computing and generative AI represent significant profit opportunities; however, the sector was a source of sales in 2023. We trimmed shares of a handful of semiconductors and semiconductor equipment names that benefited from a groundswell of enthusiasm around AI, sparked by recent advancements in the technology, including ASML Holding and Advanced Micro Devices. We also trimmed our stake in Microsoft on strength. We maintain a positive view of the company as Microsoft’s broad-based success in cloud computing with Office 365 and Azure, along with its early leadership in AI, have made it a singularly advantaged and valuable enterprise technology business that we believe will be able to deliver above-average growth over the long term. However, we did make some additions in the sector during the year. We initiated a position in Adobe on increased conviction that the software company will be a beneficiary of generative AI-induced demand as its rapid progress on integrating generative AI into its design and graphics software offerings has shifted the company from being viewed as a laggard in the space to being seen as a leader with prospects for higher growth.

T. ROWE PRICE GROWTH STOCK ETF

We were also net sellers in the consumer discretionary sector. We curtailed our position in discount retailer Ross Stores on strength in order to allocate funds to other investment ideas elsewhere in the portfolio. We also scaled back our stake in Booking Holdings and eliminated our positions in Wynn Resorts and Expedia in order to maintain our desired weight in travel-related names. Conversely, one of our largest purchases during the year was Tesla. As the lead disruptor in both electric vehicles (EVs) and autonomous driving with significant advantages in technology, over the long term, we expect Tesla to be a major beneficiary of EV adoption as its scale advantage should allow it to eventually move down the cost curve, unlocking new addressable markets and appealing to consumers at lower price points.

Communication services was an area of buying activity during the year. We bought shares of Meta Platforms as the company delivered on improving operational efficiency and also saw a recovery in advertising revenue growth and overall user engagement trends. We also initiated a new position in T-Mobile US, which we appreciate for its impressive management team, pivot to strong free cash flow generation, methodical investment in network capacity and coverage, and thoughtful expansion of its distribution into underpenetrated suburban and rural areas. We believe T-Mobile has the potential to become the best wireless network in the U.S. as it realizes synergies from its now integrated Sprint merger, increases its U.S. consumer geographic coverage footprint as well as its exposure to the enterprise wireless market segment, and further expands its 5G network leadership.

We were also able to identify a few opportunities within consumer staples and energy that meet our earnings growth criteria. We bought shares of Dollar General following the company’s announcement in mid-October that its former chief executive officer (CEO) would be returning to the position. While operational improvement at Dollar General is likely to take time, we think the CEO change will stabilize the business, and we believe the company represents an attractive risk/reward trade-off at current levels. In the energy sector, we initiated a position in Schlumberger—a global leader in oil field services with a revenue mix that primarily skews international. We bought shares of the company, which is widely regarded as a technology leader in oil field services, as we expect Schlumberger to be a primary beneficiary of the international and offshore capital expenditure upcycle on the back of decreasing oil drilling productivity and a steepening cost curve onshore.

T. ROWE PRICE GROWTH STOCK ETF

What is portfolio management’s outlook?

Continued trends in disinflation, a relatively robust labor market, and a resilient consumer have widened the runway for a soft landing. The Federal Reserve’s dovish pivot—and implied rate cut cadence—has encouraged risk-on behavior as the probability of a recession continues to decline. We believe equity returns are likely to be more subdued in 2024; an additional move higher will likely hinge on the ability of companies to demonstrate meaningful earnings and free cash flow growth following the significant move up in the last 12 months, which was primarily driven by multiple expansion. From a positioning standpoint, we continue to refrain from taking a pronounced stance on macroeconomic implications. Instead, we are aiming for a balanced approach of offensive ideas that can thrive if the skies continue to clear as well as defensive positions with idiosyncratic investment theses that we believe are underappreciated by the

SECTOR DIVERSIFICATION

| | Percent of Net Assets |

| | 6/30/23 | 12/31/23 |

| Information Technology | 43.1% | 42.5% |

| Communication Services | 15.0 | 15.2 |

| Consumer Discretionary | 14.9 | 14.8 |

| Health Care | 12.8 | 12.6 |

| Financials | 8.3 | 8.2 |

| Industrials and Business Services | 3.6 | 3.1 |

| Consumer Staples | 1.5 | 1.1 |

| Materials | 0.6 | 0.9 |

| Energy | 0.0 | 0.8 |

| Real Estate | 0.0 | 0.0 |

| Utilities | 0.0 | 0.0 |

| Other and Reserves | 0.2 | 0.8 |

| Total | 100.0% | 100.0% |

Historical weightings reflect current industry/sector classifications.

T. ROWE PRICE GROWTH STOCK ETF

market and that can also provide downside support. Similarly, predicting election outcomes and subsequent market impacts is not an area of focus at this stage; however, as political agendas come into focus and the balance of political power crystalizes, actionable idiosyncratic investment opportunities may present themselves.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

T. ROWE PRICE GROWTH STOCK ETF

RISKS OF INVESTING IN THE FUND

RISKS OF STOCK INVESTING

The fund’s share price can fall because of weakness in the stock markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

RISKS OF GROWTH INVESTING

Growth stocks tend to be more volatile than other types of stocks, and their prices may fluctuate more dramatically than the overall stock markets. Growth stocks are typically priced higher than other stocks because investors believe they have more growth potential, which may or may not be realized. Since these companies usually invest a high portion of earnings in their businesses, they may lack the dividends that can cushion stock prices in a falling market. In addition, earnings disappointments often lead to sharply falling prices for growth stocks.

BENCHMARK INFORMATION

Note: Portions of the mutual fund information contained in this report was supplied by Lipper, a Refinitiv Company, subject to the following: Copyright 2024 © Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Note: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the

T. ROWE PRICE GROWTH STOCK ETF

indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price’s presentation thereof.

Note: The S& P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

T. ROWE PRICE GROWTH STOCK ETF

PORTFOLIO HIGHLIGHTS

TWENTY-FIVE LARGEST HOLDINGS

| | Percent of

Net Assets |

| | 12/31/23 |

| Microsoft | 13.2% |

| Apple | 9.7 |

| Amazon.com | 7.8 |

| Alphabet | 7.7 |

| NVIDIA | 6.0 |

| Meta Platforms | 3.7 |

| Visa | 3.1 |

| Eli Lilly and Co | 2.9 |

| UnitedHealth Group | 2.6 |

| MasterCard | 2.3 |

| ServiceNow | 1.7 |

| Intuit | 1.6 |

| Intuitive Surgical | 1.5 |

| Rivian Automotive | 1.4 |

| Tesla | 1.4 |

| ASML Holding | 1.3 |

| Netflix | 1.3 |

| Adobe | 1.2 |

| Salesforce | 1.2 |

| Danaher | 1.1 |

| Fiserv | 1.1 |

| Teledyne Technologies | 1.1 |

| Chubb | 1.0 |

| Cigna | 1.0 |

| T-Mobile US | 1.0 |

| Total | 77.9% |

Note: The information shown does not reflect any exchange-traded funds (ETFs), cash reserves, or collateral for securities lending that may be held in the portfolio.

T. ROWE PRICE GROWTH STOCK ETF

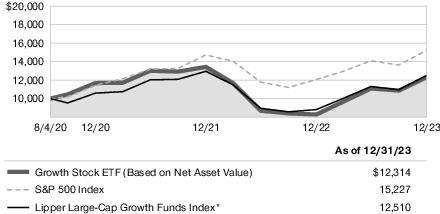

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

Growth Stock ETF

Note: See the Average Annual Compound Total Return table.

*Since 8/31/20.

T. ROWE PRICE GROWTH STOCK ETF

AVERAGE ANNUAL COMPOUND TOTAL RETURN

| Periods Ended 12/31/23 | One Year | Since

Inception

8/4/20 |

| Growth Stock ETF (Based on Net Asset Value) | 48.87% | 6.30% |

| Growth Stock ETF (At Market Price) | 48.92 | 6.31 |

The fund’s performance information represents only past performance and is not necessarily an indication of future results. Current performance may be lower or higher than the performance data cited. Share price, principal value, and return will vary, and you may have a gain or loss when you sell your shares. Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would have received if shares were traded at other times. For the most recent month-end performance, please visit our website (troweprice.com).

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. When assessing performance, investors should consider both short- and long-term returns. Past performance cannot guarantee future results. Investors should note that the short-term performance for the fund is highly unusual and unlikely to be sustained.

PREMIUM/DISCOUNT INFORMATION

The frequency at which the daily market prices were at a discount or premium to the fund’s net asset value is available on the fund’s website (troweprice.com).

EXPENSE RATIO

The expense ratio shown is as of the fund’s most recent prospectus. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, includes acquired fund fees and expenses but does not include fee or expense waivers.

T. ROWE PRICE GROWTH STOCK ETF

FUND EXPENSE EXAMPLE

As a shareholder, you may incur two types of costs: (1) transaction costs, such as brokerage commissions on purchases and sales, and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as brokerage commissions paid on purchases and sales of shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

T. ROWE PRICE GROWTH STOCK ETF

Growth Stock ETF

| | Beginning

Account Value

7/1/23 | Ending

Account Value

12/31/23 | Expenses Paid

During Period*

7/1/23 to 12/31/23 |

| Actual | $1,000.00 | $1,109.90 | $2.77 |

| Hypothetical (assumes 5% return before expenses) | 1,000.00 | 1,022.58 | 2.65 |

| * | Expenses are equal to the fund’s annualized expense ratio for the 6-month period (0.52%), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), and divided by the days in the year (365) to reflect the half-year period. |

T. ROWE PRICE GROWTH STOCK ETF

For a share outstanding throughout each period

| | Year

Ended | | | 8/4/20 (1)

Through |

| | 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 |

| NET ASSET VALUE | | | | |

| Beginning of period | $ 20.57 | $ 33.39 | $ 29.17 | $ 25.00 |

| Investment activities | | | | |

| Net investment loss(2) (3) | 0.00 (4) | (0.02) | (0.06) | (0.01) |

| Net realized and unrealized gain/loss | 10.05 | (12.80) | 4.41 | 4.21 |

| Total from investment activities | 10.05 | (12.82) | 4.35 | 4.20 |

| Distributions | | | | |

| Net investment income | (0.00) (4) | - | - | - |

| Net realized gain | - | - | (0.13) | (0.03) |

| Total distributions | (0.00) (4) | - | (0.13) | (0.03) |

| NET ASSET VALUE | | | | |

| End of period | $ 30.62 | $ 20.57 | $ 33.39 | $ 29.17 |

T. ROWE PRICE GROWTH STOCK ETF

For a share outstanding throughout each period

| | Year

Ended | | | 8/4/20 (1)

Through |

| | 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 |

| Ratios/Supplemental Data |

| Total return, based on NAV(3) (5) | 48.87% | (38.39)% | 14.94% | 16.81% |

Ratios to average net

assets:(3) | | | | |

Gross expenses before

waivers/payments by

Price Associates | 0.52% | 0.52% | 0.52% | 0.52% (6) |

Net expenses after

waivers/payments by

Price Associates | 0.52% | 0.52% | 0.52% | 0.52% (6) |

| Net investment income (loss) | 0.01% | (0.10)% | (0.20)% | (0.09)% (6) |

| Portfolio turnover rate(7) | 34.1% | 35.9% | 37.9% | 15.8% |

Net assets, end of period

(in thousands) | $ 60,005 | $ 34,669 | $ 50,256 | $ 26,547 |

| (1) | Inception date |

| (2) | Per share amounts calculated using average shares outstanding method. |

| (3) | See Note 6 for details to expense-related arrangements with Price Associates. |

| (4) | Amounts round to less than $0.01 per share. |

| (5) | Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions. Total return is not annualized for periods less than one year. |

| (6) | Annualized |

| (7) | Portfolio turnover excludes securities received or delivered through in-kind share transactions. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE GROWTH STOCK ETF

December 31, 2023

| PORTFOLIO OF INVESTMENTS‡ | Shares | $ Value |

| (Cost and value in $000s) | | |

| | | |

| COMMON STOCKS 99.2% |

| COMMUNICATION SERVICES 15.2% |

| Entertainment 1.9% | | |

| Netflix (1) | 1,589 | 774 |

| Spotify Technology (1) | 1,884 | 354 |

| | | 1,128 |

| Interactive Media & Services 12.1% | | |

| Alphabet, Class A (1) | 26,530 | 3,706 |

| Alphabet, Class C (1) | 6,381 | 899 |

| Match Group (1) | 357 | 13 |

| Meta Platforms, Class A (1) | 6,291 | 2,227 |

| Pinterest, Class A (1) | 10,731 | 397 |

| | | 7,242 |

| Media 0.2% | | |

| Trade Desk, Class A (1) | 2,125 | 153 |

| | | 153 |

| Wireless Telecommunication Services 1.0% | | |

| T-Mobile US | 3,855 | 618 |

| | | 618 |

| Total Communication Services | | 9,141 |

| CONSUMER DISCRETIONARY 14.8% |

| Automobiles 3.6% | | |

| Ferrari NV | 1,453 | 492 |

| Rivian Automotive, Class A (1)(2) | 35,382 | 830 |

| Tesla (1) | 3,358 | 834 |

| | | 2,156 |

T. ROWE PRICE GROWTH STOCK ETF

| | Shares | $ Value |

| (Cost and value in $000s) | | |

| Broadline Retail 8.3% | | |

| Amazon.com (1) | 30,624 | 4,653 |

| Coupang, Class A (1) | 20,985 | 340 |

| | | 4,993 |

| Hotels Restaurants & Leisure 1.7% | | |

| Booking Holdings (1) | 64 | 227 |

| Chipotle Mexican Grill (1) | 188 | 430 |

| Las Vegas Sands | 6,751 | 332 |

| | | 989 |

| Specialty Retail 0.6% | | |

| Floor & Decor Holdings, Class A (1) | 1,179 | 131 |

| Ross Stores | 1,826 | 253 |

| | | 384 |

| Textiles, Apparel & Luxury Goods 0.6% | | |

| Lululemon Athletica (1) | 51 | 26 |

| NIKE, Class B | 3,328 | 362 |

| | | 388 |

| Total Consumer Discretionary | | 8,910 |

| CONSUMER STAPLES 1.1% |

| Beverages 0.1% | | |

| Constellation Brands, Class A | 104 | 25 |

| | | 25 |

| Consumer Staples Distribution & Retail 1.0% | | |

| Dollar General | 4,202 | 571 |

| Maplebear (1) | 706 | 17 |

| | | 588 |

T. ROWE PRICE GROWTH STOCK ETF

| | Shares | $ Value |

| (Cost and value in $000s) | | |

| Household Products 0.0% | | |

| Procter & Gamble | 126 | 18 |

| | | 18 |

| Personal Care Products 0.0% | | |

| Estee Lauder, Class A | 169 | 25 |

| | | 25 |

| Total Consumer Staples | | 656 |

| ENERGY 0.8% |

| Energy Equipment & Services 0.8% | | |

| Schlumberger | 8,671 | 451 |

| | | 451 |

| Oil, Gas & Consumable Fuels 0.0% | | |

| Hess | 115 | 17 |

| | | 17 |

| Total Energy | | 468 |

| FINANCIALS 8.2% |

| Capital Markets 0.7% | | |

| Charles Schwab | 5,897 | 406 |

| | | 406 |

| Financial Services 6.5% | | |

| Fiserv (1) | 4,998 | 664 |

| Mastercard, Class A | 3,304 | 1,409 |

| Visa, Class A | 7,155 | 1,863 |

| | | 3,936 |

| Insurance 1.0% | | |

| Chubb | 2,594 | 586 |

| | | 586 |

| Total Financials | | 4,928 |

T. ROWE PRICE GROWTH STOCK ETF

| | Shares | $ Value |

| (Cost and value in $000s) | | |

| HEALTH CARE 12.6% |

| Biotechnology 1.5% | | |

| Argenx SE, ADR (1) | 714 | 272 |

| Legend Biotech, ADR (1) | 2,669 | 160 |

| Vertex Pharmaceuticals (1) | 1,082 | 440 |

| | | 872 |

| Health Care Equipment & Supplies 2.0% | | |

| Intuitive Surgical (1) | 2,725 | 919 |

| Stryker | 846 | 254 |

| | | 1,173 |

| Health Care Providers & Services 3.7% | | |

| Cigna | 2,078 | 622 |

| Humana | 56 | 26 |

| McKesson | 44 | 20 |

| UnitedHealth Group | 2,933 | 1,544 |

| | | 2,212 |

| Life Sciences Tools & Services 2.0% | | |

| Avantor (1) | 8,094 | 185 |

| Danaher | 2,983 | 690 |

| Thermo Fisher Scientific | 671 | 356 |

| | | 1,231 |

| Pharmaceuticals 3.4% | | |

| Eli Lilly | 2,969 | 1,731 |

| Zoetis | 1,592 | 314 |

| | | 2,045 |

| Total Health Care | | 7,533 |

T. ROWE PRICE GROWTH STOCK ETF

| | Shares | $ Value |

| (Cost and value in $000s) | | |

| INDUSTRIALS & BUSINESS SERVICES 2.7% |

| Aerospace & Defense 0.5% | | |

| Boeing (1) | 1,207 | 315 |

| | | 315 |

| Commercial Services & Supplies 0.3% | | |

| Cintas | 299 | 180 |

| Veralto | 241 | 20 |

| | | 200 |

| Ground Transportation 0.4% | | |

| Old Dominion Freight Line | 632 | 256 |

| | | 256 |

| Industrial Conglomerates 0.9% | | |

| Roper Technologies | 974 | 531 |

| | | 531 |

| Professional Services 0.6% | | |

| Ceridian HCM Holding (1) | 2,128 | 143 |

| TransUnion | 2,645 | 181 |

| | | 324 |

| Total Industrials & Business Services | | 1,626 |

| INFORMATION TECHNOLOGY 42.5% |

| Electronic Equipment, Instruments & Components 1.1% | | |

| Amphenol, Class A | 48 | 5 |

| Teledyne Technologies (1) | 1,441 | 643 |

| | | 648 |

| IT Services 1.9% | | |

| Accenture, Class A | 1,326 | 465 |

| MongoDB (1) | 305 | 125 |

| Shopify, Class A (1) | 4,860 | 379 |

T. ROWE PRICE GROWTH STOCK ETF

| | Shares | $ Value |

| (Cost and value in $000s) | | |

| Snowflake (1) | 846 | 168 |

| | | 1,137 |

| Semiconductors & Semiconductor Equipment 9.4% | | |

| Advanced Micro Devices (1) | 3,913 | 577 |

| ASML Holding NV | 1,031 | 780 |

| Intel | 4,800 | 241 |

| Lam Research | 505 | 396 |

| Marvell Technology | 413 | 25 |

| NVIDIA | 7,302 | 3,616 |

| | | 5,635 |

| Software 20.4% | | |

| Adobe (1) | 1,176 | 702 |

| Atlassian, Class A (1) | 1,740 | 414 |

| Aurora Innovation (1)(2) | 18,526 | 81 |

| Dynatrace (1) | 6,622 | 362 |

| Intuit | 1,526 | 954 |

| Klaviyo, Class A (1) | 378 | 10 |

| Microsoft | 21,134 | 7,947 |

| Monday.com (1) | 255 | 48 |

| Salesforce.com (1) | 2,631 | 692 |

| ServiceNow (1) | 1,419 | 1,003 |

| | | 12,213 |

| Technology Hardware, Storage & Peripherals 9.7% | | |

| Apple | 30,344 | 5,842 |

| | | 5,842 |

| Total Information Technology | | 25,475 |

| MATERIALS 0.9% |

| Chemicals 0.9% | | |

| Linde | 1,271 | 522 |

| Total Materials | | 522 |

T. ROWE PRICE GROWTH STOCK ETF

| | Shares | $ Value |

| (Cost and value in $000s) | | |

| | | |

| | | |

| Total Miscellaneous Common Stocks 0.4% (3) | | 265 |

| Total Common Stocks (Cost $46,248) | | 59,524 |

| SHORT-TERM INVESTMENTS 0.7% |

| Money Market Funds 0.7% | | |

| State Street Institutional U.S. Government Money Market Fund, 5.32% (4) | 400,269 | 400 |

| Total Short-Term Investments (Cost $400) | | 400 |

| SECURITIES LENDING COLLATERAL 1.4% |

| Investments in a Pooled Account through Securities Lending Program with State Street Bank 1.4% | | |

| Money Market Funds 1.4% | | |

| T. Rowe Price Government Reserve Fund, 5.42% (4)(5) | 850,382 | 851 |

| Total Investments in a Pooled Account through Securities Lending Program with State Street Bank | | 851 |

| Total Securities Lending Collateral (Cost $851) | | 851 |

Total Investments in Securities

101.3% of Net Assets (Cost $47,499) | | $60,775 |

| | |

| ‡ | Shares are denominated in U.S. dollars unless otherwise noted. |

| (1) | Non-income producing. |

| (2) | All or a portion of this security is on loan at December 31, 2023. See Note 3. |

| (3) | The identity of certain securities has been concealed to protect the fund while it completes a purchase or selling program for the securities. |

| (4) | Seven-day yield |

| (5) | Affiliated Companies |

| ADR | American Depositary Receipts |

T. ROWE PRICE GROWTH STOCK ETF

AFFILIATED COMPANIES

($000s)

The fund may invest in certain securities that are considered affiliated companies. As defined by the 1940 Act, an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or a company that is under common ownership or control. The following securities were considered affiliated companies for all or some portion of the year ended December 31, 2023. Net realized gain (loss), investment income, change in net unrealized gain/loss, and purchase and sales cost reflect all activity for the period then ended.

| Affiliate | Net Realized Gain

(Loss) | Changes in Net

Unrealized

Gain/Loss | Investment

Income |

| T. Rowe Price Government Reserve Fund | $ — | $— | $—++ |

| Totals | $—# | $— | $ —+ |

| Supplementary Investment Schedule |

| Affiliate | Value

12/31/22 | Purchase

Cost | Sales

Cost | Value

12/31/23 |

| T. Rowe Price Government Reserve Fund | $ — | ¤ | ¤ | $ 851 |

| | Total | | | $851^ |

| ++ | Excludes earnings on securities lending collateral, which are subject to rebates and fees as described in Note 3. |

| # | Capital gain distributions from mutual funds represented $0 of the net realized gain (loss). |

| + | Investment income comprised $0 of dividend income and $0 of interest income. |

| ¤ | Purchase and sale information not shown for cash management funds. |

| ^ | The cost basis of investments in affiliated companies was $851. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE GROWTH STOCK ETF

December 31, 2023

STATEMENT OF ASSETS AND LIABILITIES

($000s, except shares and per share amounts)

| Assets | |

| Investments in securities, at value (cost $47,499) | $ 60,775 |

| Receivable for investment securities sold | 96 |

| Dividends receivable | 11 |

| Total assets | 60,882 |

| Liabilities | |

| Obligation to return securities lending collateral | 851 |

| Investment management and administrative fees payable | 26 |

| Total liabilities | 877 |

| NET ASSETS | $ 60,005 |

| Net assets consists of: | |

| Total distributable earnings (loss) | $ 3,522 |

Paid-in capital applicable to 1,960,000 shares of $0.0001 par value

capital stock outstanding; 4,000,000,000 shares authorized | 56,483 |

| NET ASSETS | $60,005 |

| NET ASSET VALUE PER SHARE | $ 30.62 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE GROWTH STOCK ETF

STATEMENT OF OPERATIONS

($000s)

| | Year

Ended |

| | 12/31/23 |

| Investment Income (Loss) | |

| Income | |

| Dividend (net of foreign taxes of $2) | $ 253 |

| Securities lending | 1 |

| Total income | 254 |

| Investment management and administrative expense | 248 |

| Net investment income | 6 |

| Realized and Unrealized Gain / Loss | |

| Net realized gain (loss) | |

| Securities | (1,599) |

| In-kind redemptions | 289 |

| Net realized loss | (1,310) |

| Change in net unrealized gain / loss on securities | 19,296 |

| Net realized and unrealized gain / loss | 17,986 |

| INCREASE IN NET ASSETS FROM OPERATIONS | $17,992 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE GROWTH STOCK ETF

STATEMENT OF CHANGES IN NET ASSETS

($000s)

| | Year

Ended | | |

| | 12/31/23 | | 12/31/22 |

| Increase (Decrease) in Net Assets | | | |

| Operations | | | |

| Net investment income (loss) | $ 6 | | $ (40) |

| Net realized loss | (1,310) | | (6,106) |

| Change in net unrealized gain / loss | 19,296 | | (14,528) |

| Increase (Decrease) in net assets from operations | 17,992 | | (20,674) |

| Distributions to shareholders | | | |

| Net earnings | (7) | | — |

| Capital share transactions* | | | |

| Shares sold | 8,841 | | 16,143 |

| Shares redeemed | (1,490) | | (11,056) |

| Increase in net assets from capital share transactions | 7,351 | | 5,087 |

| Net Assets | | | |

| Increase (decrease) during period | 25,336 | | (15,587) |

| Beginning of period | 34,669 | | 50,256 |

| End of period | $60,005 | | $ 34,669 |

| *Share information | | | |

| Shares sold | 340 | | 650 |

| Shares redeemed | (65) | | (470) |

| Increase in shares outstanding | 275 | | 180 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE GROWTH STOCK ETF

NOTES TO FINANCIAL STATEMENTS

T. Rowe Price Exchange-Traded Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Growth Stock ETF (the fund) is a nondiversified, open-end management investment company established by the corporation. The fund seeks to provide long-term capital growth.

The fund is considered an actively-managed exchange-traded fund (ETF) that does not disclose its portfolio holdings daily, which is different from a traditional ETF and may create additional risks. In order to provide market participants with information on the fund’s investments, the fund publishes a “Proxy Portfolio” on its website daily. A Proxy Portfolio is a basket of securities that is designed to closely track the daily performance of the fund’s portfolio holdings. While the Proxy Portfolio includes some of the fund’s holdings, it is not the fund’s actual portfolio. The fund does disclose its full portfolio holdings on a quarterly basis, similar to mutual funds.

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation

The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions

Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividends received from other investment companies are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the asset received. Proceeds from litigation payments, if any, are included in net realized gain (loss) or change in net unrealized gain/loss from securities. Distributions to shareholders are recorded on the ex-dividend

T. ROWE PRICE GROWTH STOCK ETF

date. Income distributions, if any, are declared and paid annually. A capital gain distribution, if any, may also be declared and paid by the fund annually. Dividends and distributions cannot be automatically reinvested in additional shares of the fund.

Capital Transactions

The fund issues and redeems shares at its net asset value (NAV) only with Authorized Participants and only in large blocks of 5,000 shares (each, a “Creation Unit”). The fund’s NAV per share is computed at the close of the New York Stock Exchange (NYSE). However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Individual fund shares may not be purchased or redeemed directly with the fund. An Authorized Participant may purchase or redeem a Creation Unit of the fund each business day that the fund is open in exchange for the delivery of a designated portfolio of in-kind securities and/or cash. When purchasing or redeeming Creation Units, Authorized Participants are also required to pay a fixed and/or variable purchase or redemption transaction fee as well as any applicable additional variable charge to defray the transaction cost to a fund.

Individual fund shares may be purchased and sold only on a national securities exchange through brokers. Shares are listed for trading on NYSE Arca, Inc. (NYSE Arca) and because the shares will trade at market prices rather than NAV, shares may trade at prices greater than NAV (at a premium), at NAV, or less than NAV (at a discount). The fund’s shares are ordinarily valued as of the close of regular trading (normally 4:00 p.m. Eastern time) on each day that the NYSE Arca is open.

New Accounting Guidance

In June 2022, the FASB issued Accounting Standards Update (ASU), ASU 2022-03, Fair Value Measurement (Topic 820) – Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions, which clarifies that a contractual restriction on the sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered in measuring fair value. The amendments under this ASU are effective for fiscal years beginning after December 15, 2023; however, the fund opted to early adopt, as permitted, effective December 1, 2022. Adoption of the guidance did not have a material impact on the fund’s financial statements.

Indemnification

In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

T. ROWE PRICE GROWTH STOCK ETF

NOTE 2 – VALUATION

Fair Value

The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fund’s Board of Directors (the Board) has designated T. Rowe Price Associates, Inc. as the fund’s valuation designee (Valuation Designee). Subject to oversight by the Board, the Valuation Designee performs the following functions in performing fair value determinations: assesses and manages valuation risks; establishes and applies fair value methodologies; tests fair value methodologies; and evaluates pricing vendors and pricing agents. The duties and responsibilities of the Valuation Designee are performed by its Valuation Committee. The Valuation Designee provides periodic reporting to the Board on valuation matters.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs (including the Valuation Designee’s assumptions in determining fair value)

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based

T. ROWE PRICE GROWTH STOCK ETF

on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques

Equity securities, including exchange-traded funds, listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Investments for which market quotations are not readily available or deemed unreliable are valued at fair value as determined in good faith by the Valuation Designee. The Valuation Designee has adopted methodologies for determining the fair value of investments for which market quotations are not readily available or deemed unreliable, including the use of other pricing sources. Factors used in determining fair value vary by type of investment and may include market or investment specific considerations. The Valuation Designee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Designee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions. Fair value prices determined by the Valuation Designee could differ from those of other market participants, and it is possible that the fair value determined for a security may be materially different from the value that could be realized upon the sale of that security.

Valuation Inputs

On December 31, 2023, all of the fund’s financial instruments were classified as Level 1, based on the inputs used to determine their fair values.

T. ROWE PRICE GROWTH STOCK ETF

NOTE 3 – OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Securities Lending

The fund may lend its securities to approved borrowers to earn additional income. Its securities lending activities are administered by a lending agent in accordance with a securities lending agreement. Security loans generally do not have stated maturity dates, and the fund may recall a security at any time. The fund receives collateral in the form of cash or U.S. government securities. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested in accordance with investment guidelines approved by fund management. Additionally, the lending agent indemnifies the fund against losses resulting from borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities, collateral investments decline in value, and the lending agent fails to perform. Securities lending revenue consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower, compensation to the lending agent, and other administrative costs. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At December 31, 2023, the value of loaned securities was $819,000; the value of cash collateral and related investments was $851,000.

Other

Purchases and sales of portfolio securities excluding in-kind transactions and short-term securities aggregated $17,382,000 and $16,111,000, respectively, for the year ended December 31, 2023. Portfolio securities received and delivered through in-kind transactions aggregated $8,662,000 and $1,426,000, respectively, for the year ended December 31, 2023.

T. ROWE PRICE GROWTH STOCK ETF

NOTE 4 – FEDERAL INCOME TAXES

Generally, no provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Capital accounts within the financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The permanent book/tax adjustments, if any, have no impact on results of operations or net assets. The permanent book/tax adjustments relate primarily to redemptions in kind.

The tax character of distributions paid for the periods presented was as follows:

| ($000s) | | |

| | December 31, | December 31, |

| | 2023 | 2022 |

| Ordinary income (including short-term capital gains, if any) | $7 | $— |

At December 31, 2023, the tax-basis cost of investments, (including derivatives, if any) and gross unrealized appreciation and depreciation were as follows:

| ($000s) | |

| Cost of investments | $47,604 |

| Unrealized appreciation | $13,574 |

| Unrealized depreciation | (403) |

| Net unrealized appreciation (depreciation) | $13,171 |

At December 31, 2023, the tax-basis components of accumulated net earnings (loss) were as follows:

T. ROWE PRICE GROWTH STOCK ETF

| ($000s) | |

| Net unrealized appreciation (depreciation) | $13,171 |

| Loss carryforwards and deferrals | (9,649) |

| Total distributable earnings (loss) | $ 3,522 |

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement purposes versus for tax purposes; these differences will reverse in a subsequent reporting period. The temporary differences relate primarily to the deferral of losses from wash sales. The loss carryforwards and deferrals primarily relate to capital loss carryforwards. Capital loss carryforwards are available indefinitely to offset future realized capital gains.

NOTE 5 – FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, capital gains realized upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Taxes attributable to income are accrued by the fund as a reduction of income. Current and deferred tax expense attributable to capital gains is reflected as a component of realized or change in unrealized gain/loss on securities in the accompanying financial statements. To the extent that the fund has country specific capital loss carryforwards, such carryforwards are applied against net unrealized gains when determining the deferred tax liability. Any deferred tax liability incurred by the fund is included in either Other liabilities or Deferred tax liability on the accompanying Statement of Assets and Liabilities.

NOTE 6 – RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 0.52% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management

T. ROWE PRICE GROWTH STOCK ETF

services and ordinary, recurring operating expenses but does not cover interest and borrowing expenses; taxes; brokerage commissions and other transaction costs; fund proxy expenses; and nonrecurring and extraordinary expenses.

T. Rowe Price Investment Services, Inc. (Investment Services) serves as distributor to the fund. Pursuant to an underwriting agreement, no compensation for any distribution services provided is paid to Investment Services by the fund.

Cash collateral from securities lending, if any, is invested in the T. Rowe Price Government Reserve Fund (the Price Reserve Fund), a money market fund offered as a short-term investment option to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and is not available for direct purchase by members of the public. The Price Reserve Fund does not pay investment management fees.

As of December 31, 2023, T. Rowe Price Group, Inc., or its wholly owned subsidiaries, owned 600,000 shares of the fund, representing 31% of the fund’s net assets.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the year ended December 31, 2023, fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

Price Associates has voluntarily agreed to reimburse the fund from its own resources on a monthly basis for the cost of investment research embedded in the cost of the fund’s securities trades. This agreement may be rescinded at any time. For the year ended December 31, 2023, this reimbursement amounted to less than $1,000.

NOTE 7 – OTHER MATTERS

Unpredictable events such as environmental or natural disasters, war and conflict, terrorism, geopolitical events, and public health epidemics and similar public health threats may significantly affect the economy and the markets and issuers in which the fund invests. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others, and exacerbate other pre-existing political, social, and economic risks.

T. ROWE PRICE GROWTH STOCK ETF

The global outbreak of COVID-19 and related governmental and public responses have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities and sectors of the market either in specific countries or worldwide.

In February 2022, Russian forces entered Ukraine and commenced an armed conflict, leading to economic sanctions imposed on Russia that target certain of its citizens and issuers and sectors of the Russian economy, creating impacts on Russian-related stocks and debt and greater volatility in global markets.

In March 2023, the banking industry experienced heightened volatility, which sparked concerns of potential broader adverse market conditions. The extent of impact of these events on the US and global markets is highly uncertain.

These are recent examples of global events which may have a negative impact on the values of certain portfolio holdings or the fund’s overall performance. Management is actively monitoring the risks and financial impacts arising from these events.

T. ROWE PRICE GROWTH STOCK ETF

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of T. Rowe Price Exchange-Traded Funds, Inc. and Shareholders of T. Rowe Price Growth Stock ETF

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of T. Rowe Price Growth Stock ETF (one of the funds constituting T. Rowe Price Exchange-Traded Funds, Inc., referred to hereafter as the "Fund") as of December 31, 2023, the related statement of operations for the year ended December 31, 2023, the statement of changes in net assets for each of the two years in the period ended December 31, 2023, including the related notes, and the financial highlights for each of the years ended December 31, 2023, 2022 and 2021 and for the period August 4, 2020 (inception) through December 31, 2020 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2023 and the financial highlights for each of the years ended December 31, 2023, 2022 and 2021 and for the period August 4, 2020 (inception) through December 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by

T. ROWE PRICE GROWTH STOCK ETF

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(CONTINUED)

management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Baltimore, Maryland

February 16, 2024

We have served as the auditor of one or more investment companies in the T. Rowe Price group of investment companies since 1973.

T. ROWE PRICE GROWTH STOCK ETF

TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 12/31/23

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements. The fund’s distributions to shareholders included:

For taxable non-corporate shareholders, $237,000 of the fund’s income represents qualified dividend income subject to a long-term capital gains tax rate of not greater than 20%.

For corporate shareholders, $202,000 of the fund’s income qualifies for the dividends received deduction.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-638-5660 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www.troweprice.com/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT is available electronically on the SEC’s website (sec.gov). In addition, most T. Rowe Price funds disclose their first and third fiscal quarter-end holdings at troweprice.com.

TAILORED SHAREHOLDER REPORTS FOR MUTUAL FUNDS AND EXCHANGE TRADED FUNDS

In October 2022, the Securities and Exchange Commission (SEC) adopted rule and form amendments requiring Mutual Funds and Exchange-Traded Funds to transmit concise and visually engaging streamlined annual and semiannual reports that highlight key information to shareholders. Other information, including financial statements, will no longer appear in

T. ROWE PRICE GROWTH STOCK ETF

the funds’ shareholder reports but will be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024.

T. ROWE PRICE GROWTH STOCK ETF

Liquidity Risk Management Program

In accordance with Rule 22e-4 (Liquidity Rule) under the Investment Company Act of 1940, as amended, the fund has established a liquidity risk management program (Liquidity Program) reasonably designed to assess and manage the fund’s liquidity risk, which generally represents the risk that the fund would not be able to meet redemption requests without significant dilution of remaining investors’ interests in the fund. The fund’s Board of Directors (Board) has appointed the fund’s investment adviser, T. Rowe Price Associates, Inc. (Adviser), as the administrator of the Liquidity Program. As administrator, the Adviser is responsible for overseeing the day-to-day operations of the Liquidity Program and, among other things, is responsible for assessing, managing, and reviewing with the Board at least annually the liquidity risk of each T. Rowe Price fund. The Adviser has delegated oversight of the Liquidity Program to a Liquidity Risk Committee (LRC), which is a cross-functional committee composed of personnel from multiple departments within the Adviser.

The Liquidity Program’s principal objectives include supporting the T. Rowe Price funds’ compliance with limits on investments in illiquid assets and mitigating the risk that the fund will be unable to timely meet its redemption obligations. The Liquidity Program also includes a number of elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the fund’s liquidity and the periodic classification and reclassification of a fund’s investments into categories that reflect the LRC’s assessment of their relative liquidity under current market conditions. Under the Liquidity Program, every investment held by the fund is classified at least monthly into one of four liquidity categories based on estimations of the investment’s ability to be sold during designated time frames in current market conditions without significantly changing the investment’s market value.

As required by the Liquidity Rule, at a meeting held on July 24, 2023, the Board was presented with an annual assessment that was prepared by the LRC on behalf of the Adviser and addressed the operation of the Liquidity Program and assessed its adequacy and effectiveness of implementation, including any material changes to the Liquidity Program and the determination of each fund’s Highly Liquid Investment Minimum (HLIM). The annual assessment included consideration of the following factors, as applicable: the fund’s investment strategy and liquidity of portfolio investments during normal and reasonably foreseeable stressed conditions, including whether the investment strategy is appropriate for an open-end fund, the extent to which the strategy involves a relatively concentrated portfolio or large positions in particular issuers, and the use of borrowings for investment purposes and derivatives; short-term and long-term cash flow projections covering both normal and reasonably foreseeable stressed conditions; and holdings of cash and cash equivalents, as well as available borrowing arrangements.

For the fund and other T. Rowe Price funds, the annual assessment incorporated a report related to a fund’s holdings, shareholder and portfolio concentration, any borrowings during the period, cash flow projections, and other relevant data for the period of April 1, 2022, through March 31, 2023. The report described the methodology for classifying a fund’s investments (including any derivative transactions) into one of four liquidity

T. ROWE PRICE GROWTH STOCK ETF

categories, as well as the percentage of a fund’s investments assigned to each category. It also explained the methodology for establishing a fund’s HLIM and noted that the LRC reviews the HLIM assigned to each fund no less frequently than annually.

During the period covered by the annual assessment, the LRC has concluded, and reported to the Board, that the Liquidity Program continues to operate adequately and effectively and is reasonably designed to assess and manage the fund’s liquidity risk.

T. ROWE PRICE GROWTH STOCK ETF

ABOUT THE FUND’S DIRECTORS AND OFFICERS

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. The directors who are also employees or officers of T. Rowe Price are considered to be “interested” directors as defined in Section 2(a)(19) of the 1940 Act because of their relationships with T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

INDEPENDENT DIRECTORS(a)

Name

(Year of Birth)

Year Elected

[Number of T. Rowe Price

Portfolios Overseen] | Principal Occupation(s) and Directorships of Public Companies and

Other Investment Companies During the Past Five Years |

Teresa Bryce Bazemore

(1959)

2020

[209] | President and Chief Executive Officer, Federal Home Loan

Bank of San Francisco (2021 to present); Chief Executive Officer,

Bazemore Consulting LLC (2018 to 2021); Director, Chimera

Investment Corporation (2017 to 2021); Director, First Industrial

Realty Trust (2020 to present); Director, Federal Home Loan Bank of

Pittsburgh (2017 to 2019) |

Melody Bianchetto

(1966)

2023

[209] | Vice President for Finance, University of Virginia (2015 to 2023)

|

Bruce W. Duncan

(1951)

2020

[209] | President, Chief Executive Officer, and Director, CyrusOne, Inc. (2020 to

2021); Chair of the Board (2016 to 2020) and President (2009 to 2016),

First Industrial Realty Trust, owner and operator of industrial properties;

Member, Investment Company Institute Board of Governors (2017 to

2019); Member, Independent Directors Council Governing Board (2017

to 2019); Senior Advisor, KKR (2018 to 2022); Director, Boston

Properties (2016 to present); Director, Marriott International, Inc. (2016 to

2020) |

Robert J. Gerrard, Jr.

(1952)

2020

[209] | Chair of the Board, all funds (July 2018 to present)

|

T. ROWE PRICE GROWTH STOCK ETF

INDEPENDENT DIRECTORS(a) (continued)

Name

(Year of Birth)

Year Elected

[Number of T. Rowe Price

Portfolios Overseen] | Principal Occupation(s) and Directorships of Public Companies and

Other Investment Companies During the Past Five Years |

Paul F. McBride

(1956)

2020