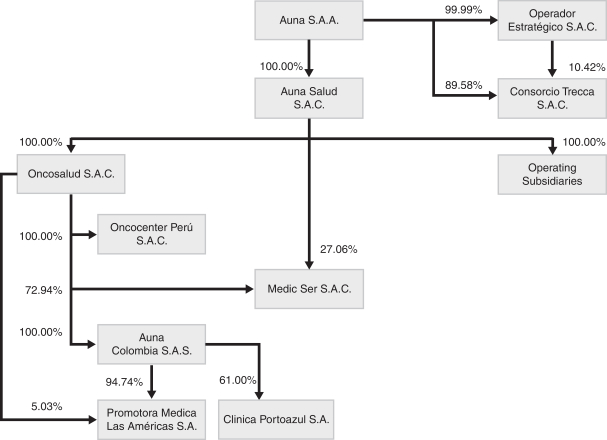

Auna S.A.A. (formerly known as Auna S.A. and formerly known as Grupo Salud del Perú S.A.C.) and Subsidiaries

Notes to the Consolidated Financial Statements

December 31, 2020, 2019 and 2018

Bancoomeva

As of December 31, 2019 and 2018, the balance payable to Bancoomeva includes short- and medium-term loans granted to PMLA for working capital and new investments amounting to S/ 1,039 thousand and S/ 13,962 thousand (equivalent to COP 1,000,000 thousand and COP 13,437,499 thousand), respectively. These loans accrued interest at variable rates such as DTF + 6.00% and IBR + 5.25%. Likewise, medium-term loans have maturities until 2029. In December 2020, these loans were prepaid and not generated penalties for early termination.

Banco Davivienda

As of December 31, 2019 and 2018, the balance payable to Banco Davivienda includes short- and medium-term loans granted to PMLA and Subsidiaries for working capital and new investments amounting to S/ 1,890 thousand and S/ 8,262 thousand (equivalent to COP 1,819,020 thousand and COP 7,952,027 thousand), respectively. These loans accrued interest at fixed rates, ranging from 6.31% to 7.60%, and at variable rates, ranging from DTF + 2.50% to DTF + 3.00% and IBR + 4.30% to IBR + 4.67%. Likewise, medium-term loans have maturities from 2020 to 2021. In December 2020, these loans were prepaid and did not generate penalties for early termination.

During 2020, Colombian subsidiaries obtained two medium-term loans for S/ 14,161 thousand equivalent to COP 13,296,497 thousand. These loans accrue interests at variable rates, ranging from IBR + 2.90% to IBR + 3.50% with maturities from 2021 to 2025.

On June and July 2020, Colombian subsidiaries, PMLA and Instituto de Cancerología, received government guaranted loans for S/ 12,861 thousand and S/ 4,147 thousand respectively, with annual interest rates of IBR + 1.50%. These loans were recognized at fair values with market interest annual rate for IBR + 4.56% and IBR + 4.0% respectively The government guaranted loans received were recorded in accordance with IAS 20, Accounting for Government Grants and Disclosure of Government Assistance. The commitments related to the government guaranted loans are subject to the funds being used for working capital. As of December 31, 2020, the Group is in compliance with the commitments above indicated.

Banco de Bogotá

As of December 31, 2019 and 2018, the balance payable to Banco de Bogotá includes short- and medium-term loans granted to PMLA and Subsidiaries for working capital and new investments amounting to S/ 113 thousand and S/ 8,478 thousand (equivalent to COP 108,297 thousand and COP 8,159,306 thousand), respectively. These loans accrued interest at fixed rates, ranging from 7.77% to 9.35%, and at variable rates such as DTF + 2.22% and IBR + 5.90%. Likewise, medium-term loans have maturities until 2029.

Banco de Occidente

As of December 31, 2019 and 2018, the balance payable to Banco de Occidente includes short- and medium-term loans granted to PMLA and Subsidiaries for working capital and new investments for amounts equivalent to S/ 4,317 thousand and S/ 2,038 thousand (equivalent to COP 1,961,857 thousand and COP 4,154,751 thousand), respectively. These loans accrued interest at a fixed rate of 8.64%, and at variable rates, ranging from IBR + 2.50% to IBR + 5.90%. Likewise, medium-term loans have maturities until 2029. In December 2020, these loans were prepaid and did not generate penalties for early termination.

F-74