Exhibit 99.3 PART I – Item 1 Century Bancorp, Inc. Consolidated Balance Sheets (unaudited) (In thousands, except share data) Assets September 30, 2021 December 31, 2020 Cash and due from banks $ 97,743 $ 136,735 Federal funds sold and interest-bearing deposits in other banks 492,243 237,265 Total cash and cash equivalents 589,986 374,000 Securities available-for-sale, amortized cost $202,720 and $282,273, respectively 204,182 282,448 Securities held-to-maturity, fair value $3,207,259 and $2,579,103, respectively 3,211,977 2,509,088 Federal Home Loan Bank of Boston, stock at cost 11,594 13,361 Equity securities, amortized cost $1,635 and $1,635, respectively 1,680 1,668 Loans, net: Construction and land development 6,358 10,909 Commercial and industrial 1,321,907 1,314,245 Municipal 138,945 137,607 Commercial real estate 729,384 789,836 Residential real estate 466,109 448,436 Consumer and overdrafts 19,549 20,439 Home equity 243,225 274,357 Total loans, net 2,925,477 2,995,829 Less: allowance for loan losses 34,764 35,486 Net loans 2,890,713 2,960,343 Bank premises and equipment 42,222 39,062 Accrued interest receivable 13,413 13,283 Goodwill 2,714 2,714 Other assets 161,081 162,867 Total assets $ 7,129,562 $6,358,834 Liabilities Deposits: Demand deposits $ 1,203,943 $1,103,878 Savings and NOW deposits 2,314,472 1,728,092 Money market accounts 2,337,665 2,074,108 Time deposits 348,296 546,143 Total deposits 6,204,376 5,452,221 Securities sold under agreements to repurchase 269,961 232,090 Other borrowed funds 118,786 177,009 Subordinated debentures 36,083 36,083 Due to broker — — Other liabilities 97,405 91,022 Total liabilities 6,726,611 5,988,425 Stockholders’ Equity Preferred Stock – $1.00 par value; 100,000 shares authorized; no shares issued and outstanding — — Common stock, Class A, $1.00 par value per share; authorized 10,000,000 shares; issued 3,672,969 shares and 3,655,469 shares, respectively 3,673 3,656 Common stock, Class B, $1.00 par value per share; authorized 5,000,000 shares; issued 1,894,940 shares and 1,912,440 shares respectively 1,895 1,912 Additional paid-in capital 12,292 12,292 Retained earnings 408,700 378,699 426,560 396,559 Unrealized gains on securities available-for-sale, net of taxes 1,062 130 Unrealized losses on securities transferred to held-to-maturity, net of taxes (830) (1,221) Pension liability, net of taxes (23,841) (25,059) Total accumulated other comprehensive loss, net of taxes (23,609) (26,150) Total stockholders’ equity 402,951 370,409 Total liabilities and stockholders’ equity $ 7,129,562 $6,358,834

See accompanying notes to unaudited consolidated interim financial statements. 1

Century Bancorp, Inc. Consolidated Statements of Income (unaudited) (In thousands, except share data) Three months ended September 30, Nine months ended September 30, 2021 2020 2021 2020 Interest income Loans $ 20,926 $ 21,431 $ 63,419 $ 63,478 Securities held-to-maturity 13,678 14,186 40,908 44,701 Securities available-for-sale 475 818 1,662 3,493 Federal funds sold and interest-bearing deposits in other banks 186 69 477 747 Total interest income 35,265 36,504 106,466 112,419 Interest expense Savings and NOW deposits 570 1,726 2,441 7,569 Money market accounts 2,368 3,056 7,743 12,090 Time deposits 791 2,858 3,487 9,141 Securities sold under agreements to repurchase 91 241 330 1,176 Other borrowed funds and subordinated debentures 1,065 1,292 3,527 4,093 Total interest expense 4,885 9,173 17,528 34,069 Net interest income 30,380 27,331 88,938 78,350 (Credit) provision for loan losses (200) 900 (750) 3,675 Net interest income after (credit) provision for loan losses 30,580 26,431 89,688 74,675 Other operating income Service charges on deposit accounts 2,243 2,239 6,632 6,558 Lockbox fees 914 996 2,876 2,850 Other income 1,015 934 2,973 3,112 Total other operating income 4,172 4,169 12,481 12,520 Operating expenses Salaries and employee benefits 11,907 11,362 36,459 33,020 Occupancy 1,457 1,477 4,750 4,448 Equipment 956 809 2,836 2,608 FDIC Assessments 1,020 410 2,249 720 Other 5,399 4,109 16,328 12,586 Total operating expenses 20,739 18,167 62,622 53,382 Income before income taxes 14,013 12,433 39,547 33,813 Provision for income taxes 2,281 1,546 6,222 3,204 Net income $ 11,732 $ 10,887 $ 33,325 $ 30,609 Share data: Weighted average number of shares outstanding, basic Class A 3,672,969 3,655,469 3,663,669 3,653,429 Class B 1,894,940 1,912,440 1,904,240 1,914,480 Weighted average number of shares outstanding, diluted Class A 5,567,909 5,567,909 5,567,909 5,567,909 Class B 1,894,940 1,912,440 1,904,240 1,914,480 Basic earnings per share: Class A $ 2.54 $ 2.36 $ 7.22 $ 6.64 Class B $ 1.27 $ 1.18 $ 3.61 $ 3.32 Diluted earnings per share Class A $ 2.11 $ 1.96 $ 5.99 $ 5.50 Class B $ 1.27 $ 1.18 $ 3.61 $ 3.32 See accompanying notes to unaudited consolidated interim financial statements. 2

Century Bancorp, Inc. Consolidated Statements of Comprehensive Income (unaudited) (In thousands) Three months ended September 30, 2021 2020 Net income $ 11,732 $ 10,887 Other comprehensive income, net of tax: Unrealized gains (losses) on securities: Unrealized gains (losses) arising during period (208) 486 Less: reclassification adjustment for gains included in net income — — Total unrealized gains (losses) on securities (208) 486 Accretion of net unrealized losses transferred 128 145 Defined benefit pension plans: Amortization of prior service cost and loss included in net periodic benefit cost 406 360 Other comprehensive income (loss) 326 991 Comprehensive income $ 12,058 $ 11,878 Nine months ended September 30, 2021 2020 Net income $ 33,325 $ 30,609 Other comprehensive income, net of tax: Unrealized gains (losses) on securities: Unrealized gains (losses) arising during period 932 445 Less: reclassification adjustment for gains included in net income — — Total unrealized gains (losses) on securities 932 445 Accretion of net unrealized losses transferred 391 471 Defined benefit pension plans: Amortization of prior service cost and loss included in net periodic benefit cost 1,218 1,081 Other comprehensive income (loss) 2,541 1,997 Comprehensive income $ 35,866 $ 32,606 See accompanying notes to unaudited consolidated interim financial statements. 3

Century Bancorp, Inc. Consolidated Statements of Changes in Stockholders’ Equity (unaudited) For the Three Months Ended September 30, 2021 and 2020 Class A Common Stock Class B Common Stock Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Total Stockholders’ Equity (In thousands) Balance at June 30, 2020 $3,653 $1,915 $12,292 $357,595 $(23,253) $352,202 Net income — — — 10,887 — 10,887 Other comprehensive income, net of tax: Unrealized holding (losses) gains arising during period, net of $181 in taxes — — — — 486 486 Accretion of unrealized losses on securities transferred to held-to-maturity, net of $51 in taxes — — — — 145 145 Pension liability adjustment, net of $142 in taxes — — — — 360 360 Conversion of Class B Common Stock to Class A Common Stock, 3,000 shares 3 (3) — — — — Cash dividends declared, Class A common stock, $.14 per share — — — (512) — (512) Cash dividends declared, Class B common stock, $.07 per share — — — (134) — (134) Balance at September 30, 2020 $3,656 $1,912 $12,292 $367,836 $(22,262) $363,434 Balance at June 30, 2021 $3,662 $1,906 $12,292 $398,630 $(23,935) $392,555 Net income — — — 11,732 — 11,732 Other comprehensive income, net of tax: Unrealized holding gains (losses) arising during period, net of $78 in taxes — — — — (208) (208) Accretion of unrealized losses on securities transferred to held-to-maturity, net of $35 in taxes — — — — 128 128 Pension liability adjustment, net of $159 in taxes — — — — 406 406 Conversion of Class B Common Stock to Class A Common Stock, 11,400 shares 11 (11) — — — — Cash dividends declared, Class A common stock, $0.36 per share — — — (1,320) — (1,320) Cash dividends declared, Class B common stock, $0.18 per share — — — (342) — (342) Balance at September 30, 2021 $3,673 $1,895 $12,292 $408,700 $(23,609) $402,951 See accompanying notes to unaudited consolidated interim financial statements. 4

Century Bancorp, Inc. Consolidated Statements of Changes in Stockholders’ Equity (unaudited) For the Nine Months Ended September 30, 2021 and 2020 Class A Common Stock Class B Common Stock Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Total Stockholders’ Equity (In thousands) Balance at December 31, 2019 $ 3,651 $ 1,917 $ 12,292 $338,980 $ (24,259) $ 332,581 Net income — — — 30,609 — 30,609 Other comprehensive income, net of tax: Unrealized holding (losses) gains arising during period, net of $169 in taxes — — — — 445 445 Accretion of unrealized losses on securities transferred to held-to-maturity, net of $166 in taxes — — — — 471 471 Pension liability adjustment, net of $422 in taxes — — — — 1,081 1,081 Conversion of Class B Common Stock to Class A Common Stock, 4,520 shares 5 (5) — — — — Cash dividends paid, Class A common stock, $.38 per share — — — (1,389) — (1,389) Cash dividends paid, Class B common stock, $.19 per share — — — (364) — (364) Balance at September 30, 2020 $ 3,656 $ 1,912 $ 12,292 $367,836 $ (22,262) $ 363,434 Balance at December 31, 2020 $ 3,656 $ 1,912 $ 12,292 $378,699 $ (26,150) $ 370,409 Net income — — — 33,325 — 33,325 Other comprehensive income, net of tax: Unrealized holding gains (losses) arising during period, net of $355 in taxes — — — — 932 932 Accretion of unrealized losses on securities transferred to held-to-maturity, net of $141 in taxes — — — — 391 391 Pension liability adjustment, net of $476 in taxes — — — — 1,218 1,218 Conversion of Class B Common Stock to Class A Common Stock, 17,500 shares 17 (17) — — — — Cash dividends declared, Class A common stock, $0.72 per share — — — (2,640) — (2,640) Cash dividends declared, Class B common stock, $0.36 per share — — — (684) — (684) Balance at September 30, 2021 $ 3,673 $ 1,895 $ 12,292 $408,700 $ (23,609) $ 402,951 See accompanying notes to unaudited consolidated interim financial statements. 5

Century Bancorp, Inc. Consolidated Statements of Cash Flows (unaudited) For the Nine Months Ended September 30, 2021 and 2020 For the Nine Months Ended September 30, 2021 2020 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 33,325 $ 30,609 Adjustments to reconcile net income to net cash provided by operating activities: Net (gain) loss on equity securities (12) 43 (Credit) provision for loan losses (750) 3,675 Deferred income taxes (1,129) (1,487) Net depreciation and amortization (accretion) 1,872 (1,167) Increase in accrued interest receivable (130) (113) Decrease in other assets 928 3,897 Increase in other liabilities 8,187 3,396 Net cash provided by operating activities 42,291 38,853 CASH FLOWS FROM INVESTING ACTIVITIES: Proceeds from redemptions of Federal Home Loan Bank of Boston stock 1,767 10,836 Purchase of Federal Home Loan Bank of Boston stock — (4,726) Proceeds from calls/maturities of securities available-for-sale 95,808 57,493 Purchase of securities available-for-sale (16,155) (87,751) Proceeds from calls/maturities of securities held-to-maturity 717,320 596,043 Purchase of securities held-to-maturity (1,418,979) (638,023) Net decrease (increase) in loans 70,407 (563,850) Bank owned life insurance purchases — (6,000) Capital expenditures (5,783) (5,873) Net cash used in investing activities (555,615) (641,851) CASH FLOWS FROM FINANCING ACTIVITIES: Net (decrease) increase in time deposits (197,847) 26,419 Net increase in demand, savings, money market and NOW deposits 950,002 985,941 Cash dividends (2,493) (1,753) Net increase (decrease) in securities sold under agreements to repurchase 37,871 (35,015) Net decrease in other borrowed funds (58,223) (218,707) Net cash provided by financing activities 729,310 756,885 Net increase in cash and cash equivalents 215,986 153,887 Cash and cash equivalents at beginning of period 374,000 258,693 Cash and cash equivalents at end of period $ 589,986 $ 412,580 SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: Cash paid during the period for: Interest $ 17,891 $ 34,384 Income taxes 4,980 1,750 Change in unrealized gains (losses) on securities available-for-sale, net of taxes 932 445 Change in unrealized losses on securities transferred to held-to-maturity, net of taxes 391 471 Pension liability adjustment, net of taxes 1,218 1,081 Change in due to broker — 9,977 Dividends declared and not paid 831 — See accompanying notes to unaudited consolidated interim financial statements. 6

Century Bancorp, Inc. Notes to Unaudited Consolidated Interim Financial Statements Nine Months Ended September 30, 2021 and 2020 Note 1. Basis of Financial Statement Presentation The consolidated financial statements include the accounts of Century Bancorp, Inc. (the “Company”) and its wholly owned subsidiary, Century Bank and Trust Company (the “Bank”). The consolidated financial statements also include the accounts of the Bank’s wholly owned subsidiaries, Century Subsidiary Investments, Inc. (“CSII”), Century Subsidiary Investments, Inc. II (“CSII II”), Century Subsidiary Investments, Inc. III (“CSII III”) and Century Financial Services Inc. (“CFSI”). CSII, CSII II, and CSII III are engaged in buying, selling and holding investment securities. CFSI has the power to engage in financial agency, securities brokerage, and investment and financial advisory services and related securities credit. The Company also owns 100% of Century Bancorp Capital Trust II (“CBCT II”). The entity is an unconsolidated subsidiary of the Company. On November 1, 2021, the Company created a plan to dissolve CSII, and CSII II. The dissolution is expected to occur during the fourth quarter of 2021. All significant intercompany accounts and transactions have been eliminated in consolidation. The Company provides a full range of banking services to individual, business, and municipal customers in Massachusetts, New Hampshire, Rhode Island, Connecticut, New York, Virginia, Washington D.C., and Pennsylvania. As a bank holding company, the Company is subject to the regulation and supervision of the Board of Governors of the Federal Reserve System (the “Federal Reserve Board���). The Bank, a state chartered financial institution, is subject to supervision and regulation by applicable state and federal banking agencies, including the Federal Reserve Board, the Federal Deposit Insurance Corporation (the “FDIC”) and the Massachusetts Commissioner of Banks. The Bank is also subject to various requirements and restrictions under federal and state law, including requirements to maintain reserves against deposits, restrictions on the types and amounts of loans that may be granted and the interest that may be charged thereon, and limitations on the types of investments that may be made and the types of services that may be offered. Various consumer laws and regulations also affect the operations of the Bank. In addition to the impact of regulation, commercial banks are affected significantly by the actions of the Federal Reserve Board as it attempts to control the money supply and credit availability in order to influence the economy. All aspects of the Company’s business are highly competitive. The Company faces aggressive competition from other lending institutions and from numerous other providers of financial services. The Company has one reportable operating segment. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America and general practices within the banking industry. In preparing the financial statements, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the balance sheet and revenues and expenses for the period. Actual results could differ from those estimates. The Company’s Quarterly Report on Form 10-Q should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed with the Securities and Exchange Commission and which provides a summary of the Company’s significant accounting principles. The interim results of consolidated operations are not necessarily indicative of the results for the entire year. Certain reclassifications are made to prior-year amounts whenever necessary to conform with the current-year presentation. Material estimates that are susceptible to change in the near term relate to the allowance for loan losses. Management believes that the allowance for loan losses is adequate based on a review of factors, including historical charge-off rates with additional allocations based on qualitative risk factors for each category and general economic factors. While management uses available information to recognize loan losses, future additions to the allowance for loan losses may be necessary based on changes in economic conditions. Certain risks and uncertainties remain in the allowance for loan losses as a result of the COVID-19 pandemic. Future provision levels will be dependent upon the length of the economic disruption and the effectiveness of government programs to mitigate the economic impact. In addition, regulatory agencies periodically review the Company’s allowance for loan losses. Such agencies may require the Company to recognize additions to the allowance for loan losses based on their judgments about information available to them at the time of their examination. 7

Note 2. Securities Available-for-Sale September 30, 2021 December 31, 2020 Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Fair Value Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Fair Value (in thousands) SBA Backed Securities $ 38,663 $ 623 $ 1 $ 39,285 $ 44,328 $ — $ 289 $ 44,039 U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities 143,949 807 148 144,608 177,239 819 317 177,741 Privately Issued Residential Mortgage-Backed Securities 239 5 — 244 330 2 4 328 Obligations Issued by States and Political Subdivisions 11,769 — — 11,769 52,276 — — 52,276 Other Debt Securities 8,100 191 15 8,276 8,100 24 60 8,064 Total $ 202,720 $ 1,626 $ 164 $ 204,182 $ 282,273 $ 845 $ 670 $ 282,448 Included in SBA Backed Securities, and U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities are securities at fair value pledged to secure public deposits and repurchase agreements amounting to $150,214,000 and $183,269,000 at September 30, 2021 and December 31, 2020, respectively. Also included in securities available-for-sale are securities at fair value pledged for borrowing at the Federal Home Loan Bank of Boston (“FHLBB”) amounting to $26,059,000 and $29,885,000 at September 30, 2021 and December 31, 2020, respectively. There were no sales of available-for-sale securities for the nine months ended September 30, 2021 and September 30, 2020, respectively. Debt securities of U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities primarily refer to debt securities of Fannie Mae and Freddie Mac. The following table shows the maturity distribution of the Company’s securities available-for-sale at September 30, 2021. Amortized Cost Fair Value (in thousands) Within one year $ 13,046 $ 13,068 After one but within five years 89,147 89,838 After five but within ten years 91,211 91,849 More than 10 years 9,316 9,427 Total $ 202,720 $ 204,182 The weighted average remaining life of investment securities available-for-sale at September 30, 2021 was 5.4 years. The contractual maturities, which were used in the table above, of mortgage-backed securities, will differ from the actual maturities, due to the ability of the issuers to prepay underlying obligations. Also $182,362,000 of the securities are floating rate or adjustable rate and reprice prior to maturity. As of September 30, 2021 and December 31, 2020, management concluded that the unrealized losses of its investment securities are temporary in nature since they are not related to the underlying credit quality of the issuers, and the Company does not intend to sell these debt securities and it is not more likely than not that it will be required to sell these debt securities before the anticipated recovery of its remaining amortized cost. In making its other- than- temporary impairment evaluation, the Company considered that the principal and interest on these securities are from issuers that are investment grade. The unrealized loss on SBA Backed Securities, U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities related primarily to interest rates and not credit quality, and because the Company has the ability and intent to hold these investments until recovery of fair value, which may be maturity, the Company does not consider these investments to be other-than-temporarily impaired at September 30, 2021 or December 31, 2020. 8

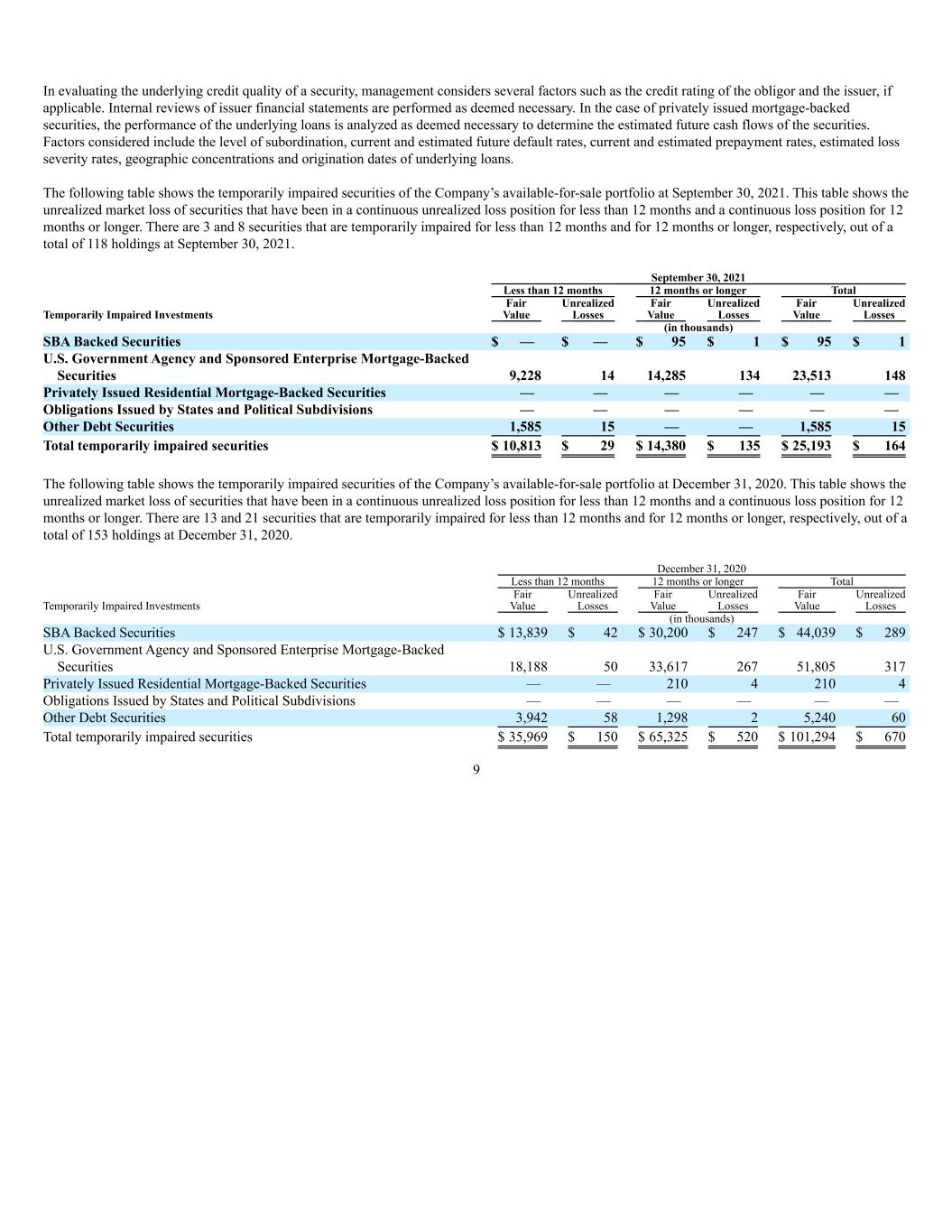

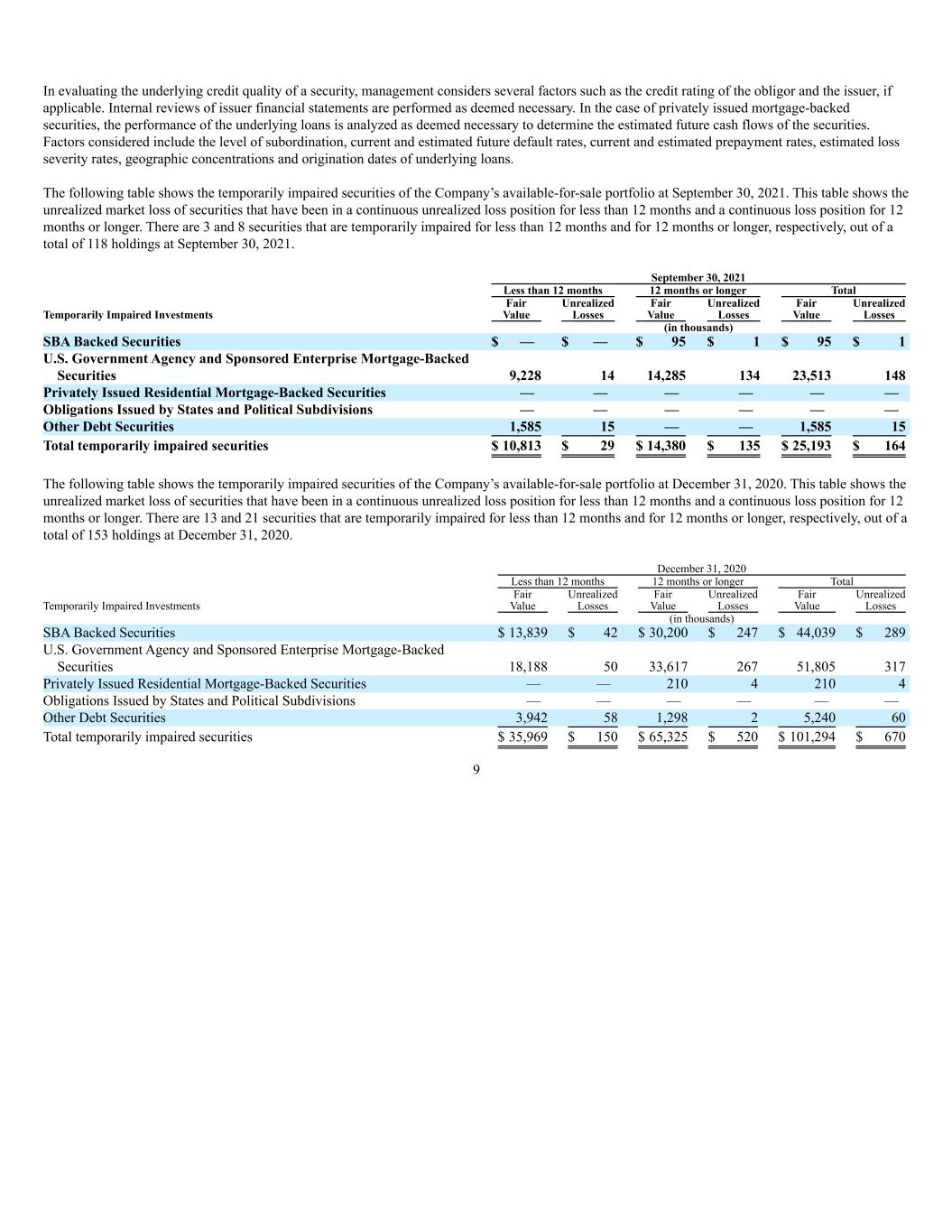

In evaluating the underlying credit quality of a security, management considers several factors such as the credit rating of the obligor and the issuer, if applicable. Internal reviews of issuer financial statements are performed as deemed necessary. In the case of privately issued mortgage-backed securities, the performance of the underlying loans is analyzed as deemed necessary to determine the estimated future cash flows of the securities. Factors considered include the level of subordination, current and estimated future default rates, current and estimated prepayment rates, estimated loss severity rates, geographic concentrations and origination dates of underlying loans. The following table shows the temporarily impaired securities of the Company’s available-for-sale portfolio at September 30, 2021. This table shows the unrealized market loss of securities that have been in a continuous unrealized loss position for less than 12 months and a continuous loss position for 12 months or longer. There are 3 and 8 securities that are temporarily impaired for less than 12 months and for 12 months or longer, respectively, out of a total of 118 holdings at September 30, 2021. September 30, 2021 Less than 12 months 12 months or longer Total Temporarily Impaired Investments Fair Value Unrealized Losses Fair Value Unrealized Losses Fair Value Unrealized Losses (in thousands) SBA Backed Securities $ — $ — $ 95 $ 1 $ 95 $ 1 U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities 9,228 14 14,285 134 23,513 148 Privately Issued Residential Mortgage-Backed Securities — — — — — — Obligations Issued by States and Political Subdivisions — — — — — — Other Debt Securities 1,585 15 — — 1,585 15 Total temporarily impaired securities $ 10,813 $ 29 $ 14,380 $ 135 $ 25,193 $ 164 The following table shows the temporarily impaired securities of the Company’s available-for-sale portfolio at December 31, 2020. This table shows the unrealized market loss of securities that have been in a continuous unrealized loss position for less than 12 months and a continuous loss position for 12 months or longer. There are 13 and 21 securities that are temporarily impaired for less than 12 months and for 12 months or longer, respectively, out of a total of 153 holdings at December 31, 2020. December 31, 2020 Less than 12 months 12 months or longer Total Temporarily Impaired Investments Fair Value Unrealized Losses Fair Value Unrealized Losses Fair Value Unrealized Losses (in thousands) SBA Backed Securities $ 13,839 $ 42 $ 30,200 $ 247 $ 44,039 $ 289 U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities 18,188 50 33,617 267 51,805 317 Privately Issued Residential Mortgage-Backed Securities — — 210 4 210 4 Obligations Issued by States and Political Subdivisions — — — — — — Other Debt Securities 3,942 58 1,298 2 5,240 60 Total temporarily impaired securities $ 35,969 $ 150 $ 65,325 $ 520 $ 101,294 $ 670 9

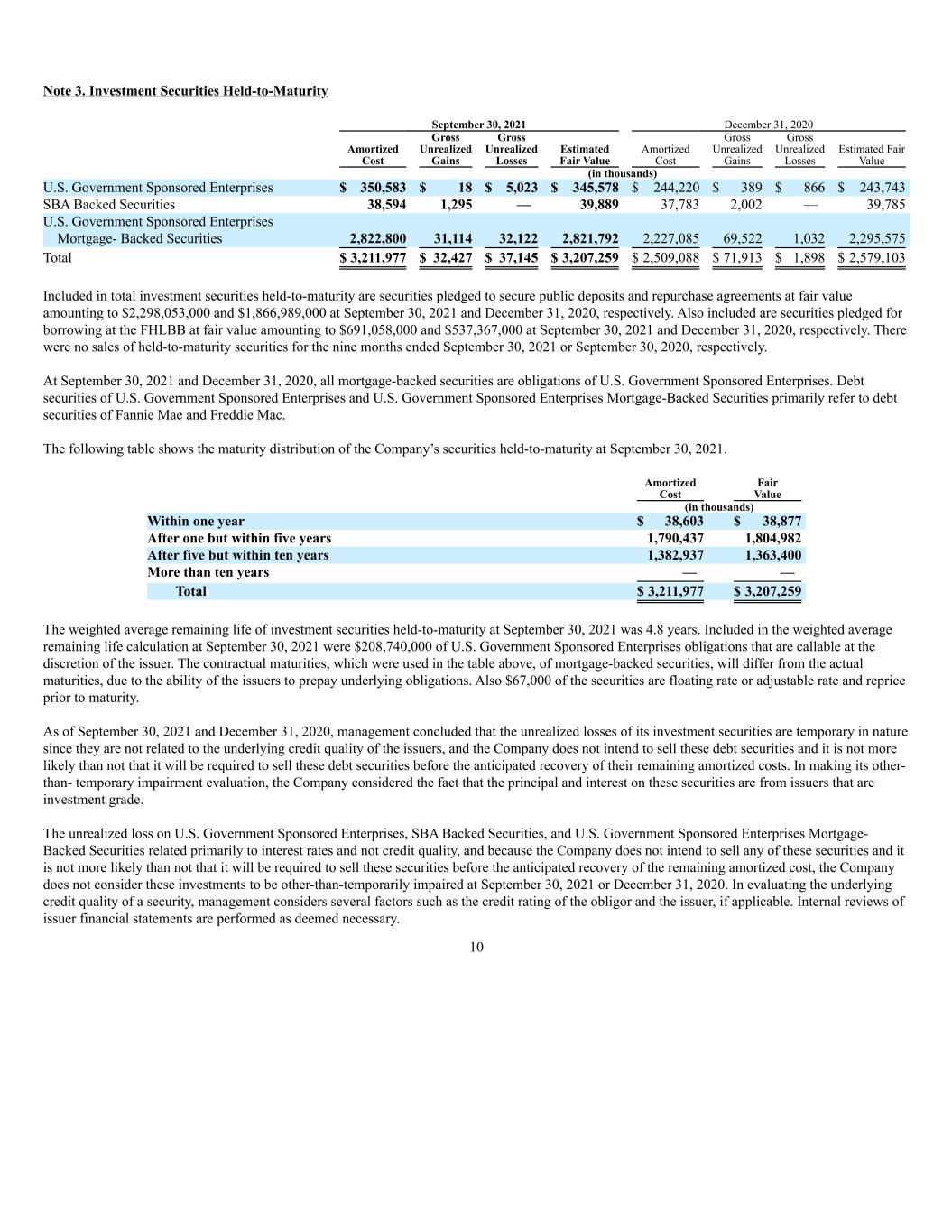

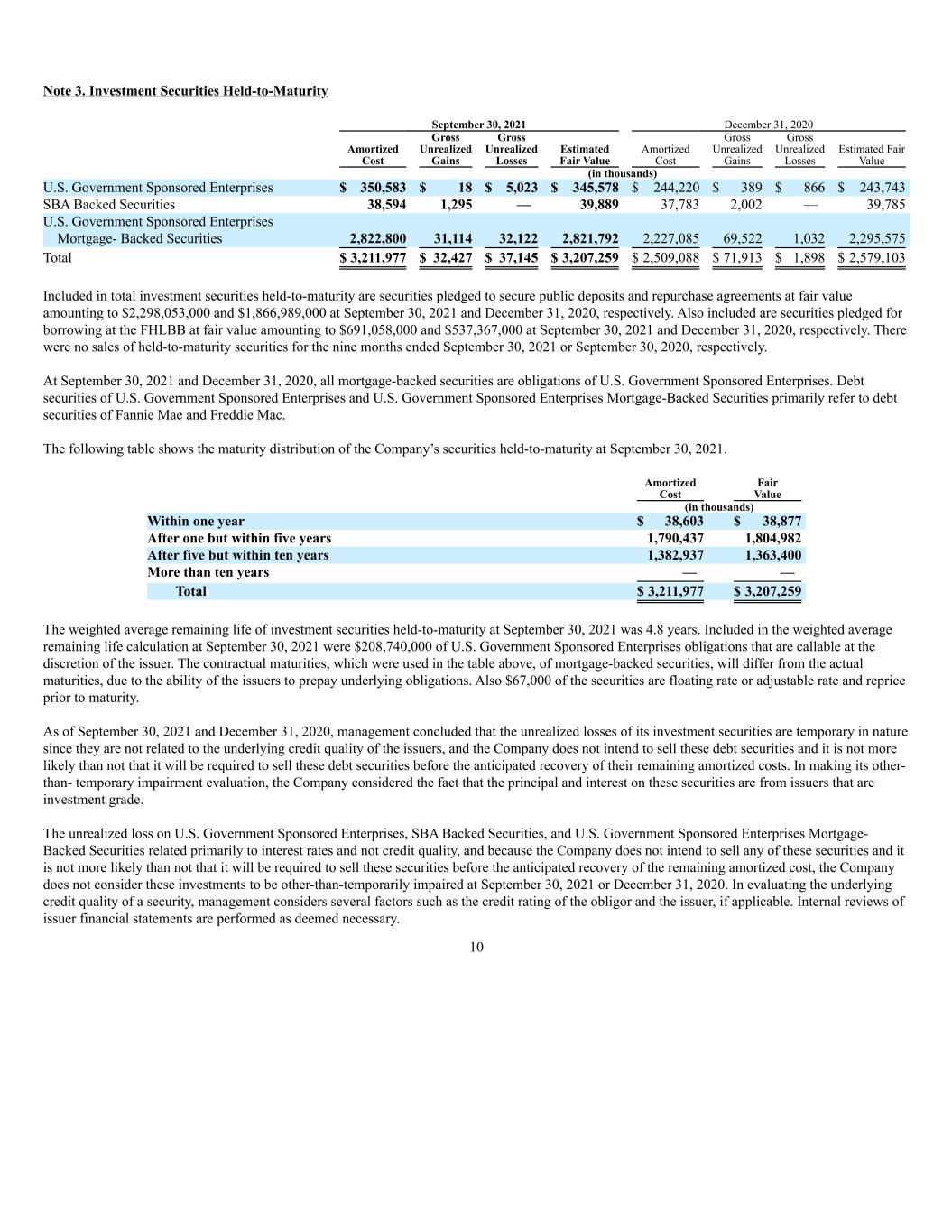

Note 3. Investment Securities Held-to-Maturity September 30, 2021 December 31, 2020 Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value (in thousands) U.S. Government Sponsored Enterprises $ 350,583 $ 18 $ 5,023 $ 345,578 $ 244,220 $ 389 $ 866 $ 243,743 SBA Backed Securities 38,594 1,295 — 39,889 37,783 2,002 — 39,785 U.S. Government Sponsored Enterprises Mortgage- Backed Securities 2,822,800 31,114 32,122 2,821,792 2,227,085 69,522 1,032 2,295,575 Total $ 3,211,977 $ 32,427 $ 37,145 $ 3,207,259 $ 2,509,088 $ 71,913 $ 1,898 $ 2,579,103 Included in total investment securities held-to-maturity are securities pledged to secure public deposits and repurchase agreements at fair value amounting to $2,298,053,000 and $1,866,989,000 at September 30, 2021 and December 31, 2020, respectively. Also included are securities pledged for borrowing at the FHLBB at fair value amounting to $691,058,000 and $537,367,000 at September 30, 2021 and December 31, 2020, respectively. There were no sales of held-to-maturity securities for the nine months ended September 30, 2021 or September 30, 2020, respectively. At September 30, 2021 and December 31, 2020, all mortgage-backed securities are obligations of U.S. Government Sponsored Enterprises. Debt securities of U.S. Government Sponsored Enterprises and U.S. Government Sponsored Enterprises Mortgage-Backed Securities primarily refer to debt securities of Fannie Mae and Freddie Mac. The following table shows the maturity distribution of the Company’s securities held-to-maturity at September 30, 2021. Amortized Cost Fair Value (in thousands) Within one year $ 38,603 $ 38,877 After one but within five years 1,790,437 1,804,982 After five but within ten years 1,382,937 1,363,400 More than ten years — — Total $ 3,211,977 $ 3,207,259 The weighted average remaining life of investment securities held-to-maturity at September 30, 2021 was 4.8 years. Included in the weighted average remaining life calculation at September 30, 2021 were $208,740,000 of U.S. Government Sponsored Enterprises obligations that are callable at the discretion of the issuer. The contractual maturities, which were used in the table above, of mortgage-backed securities, will differ from the actual maturities, due to the ability of the issuers to prepay underlying obligations. Also $67,000 of the securities are floating rate or adjustable rate and reprice prior to maturity. As of September 30, 2021 and December 31, 2020, management concluded that the unrealized losses of its investment securities are temporary in nature since they are not related to the underlying credit quality of the issuers, and the Company does not intend to sell these debt securities and it is not more likely than not that it will be required to sell these debt securities before the anticipated recovery of their remaining amortized costs. In making its other- than- temporary impairment evaluation, the Company considered the fact that the principal and interest on these securities are from issuers that are investment grade. The unrealized loss on U.S. Government Sponsored Enterprises, SBA Backed Securities, and U.S. Government Sponsored Enterprises Mortgage- Backed Securities related primarily to interest rates and not credit quality, and because the Company does not intend to sell any of these securities and it is not more likely than not that it will be required to sell these securities before the anticipated recovery of the remaining amortized cost, the Company does not consider these investments to be other-than-temporarily impaired at September 30, 2021 or December 31, 2020. In evaluating the underlying credit quality of a security, management considers several factors such as the credit rating of the obligor and the issuer, if applicable. Internal reviews of issuer financial statements are performed as deemed necessary. 10

The following table shows the temporarily impaired securities of the Company’s held-to-maturity portfolio September 30, 2021. This table shows the unrealized market loss of securities that have been in a continuous unrealized loss position for 12 months or less and a continuous loss position for 12 months or longer. There are 149 and 31 securities that are temporarily impaired for less than 12 months and for 12 months or longer, respectively, out of a total of 651 holdings at September 30, 2021. September 30, 2021 Less Than 12 Months 12 Months or Longer Total Temporarily Impaired Investments Fair Value Unrealized Losses Fair Value Unrealized Losses Fair Value Unrealized Losses (in thousands) US Government Sponsored Enterprises $ 194,263 $ 2,579 $ 146,298 $ 2,444 $ 340,561 $ 5,023 SBA Backed Securities — — — — — — U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities 1,585,765 28,423 107,977 3,699 1,693,742 32,122 Total temporarily impaired securities $ 1,780,028 $ 31,002 $ 254,275 $ 6,143 $ 2,034,303 $ 37,145 The following table shows the temporarily impaired securities of the Company’s held-to-maturity portfolio at December 31, 2020. This table shows the unrealized market loss of securities that have been in a continuous unrealized loss position for less than 12 months and a continuous loss position for 12 months or longer. There are 53 and 0 securities that are temporarily impaired for less than 12 months and for 12 months or longer, respectively, out of a total of 600 holdings at December 31, 2020. December 31, 2020 Less Than 12 Months 12 Months or Longer Total Temporarily Impaired Investments Fair Value Unrealized Losses Fair Value Unrealized Losses Fair Value Unrealized Losses (in thousands) U.S. Government Sponsored Enterprises $ 162,870 $ 866 $— $ — $ 162,870 $ 866 SBA Backed Securities ��� — — — — — U.S. Government Agency and Sponsored Enterprise Mortgage-Backed Securities 302,401 1,032 — — 302,401 1,032 Total temporarily impaired securities $ 465,271 $ 1,898 $— $ — $ 465,271 $ 1,898 Note 4. Allowance for Loan Losses The Company maintains an allowance for loan losses in an amount determined by management on the basis of the character of the loans, loan performance, financial condition of borrowers, the value of collateral securing loans and other relevant factors. The following table summarizes the changes in the Company’s allowance for loan losses for the periods indicated. Three months ended September 30, Nine months ended September 30, 2021 2020 2021 2020 (in thousands) (in thousands) Allowance for loan losses, beginning of period $ 34,949 $ 32,516 $ 35,486 $ 29,585 Loans charged off (38) (41) (134) (120) Recoveries on loans previously charged-off 53 19 162 254 Net recoveries (charge-offs) 15 (22) 28 134 (Credit) provision charged to expense (200) 900 (750) 3,675 Allowance for loan losses, end of period $ 34,764 $ 33,394 $ 34,764 $ 33,394 11

Further information pertaining to the allowance for loan losses for the three months ending September 30, 2021 is as follows: Construction and Land Development Commercial and Industrial Municipal Commercial Real Estate Residential Real Estate Consumer Home Equity Unallocated Total (in thousands) Allowance for loan losses: Balance at June 30, 2021 $ 220 $ 16,502 $ 2,817 $ 11,708 $ 2,029 $ 204 $ 957 $ 512 $ 34,949 Charge-offs — — — — — (38) — — (38) Recoveries — 30 — — — 23 — — 53 Provision (3) 1,134 (11) (1,137) (67) 10 (58) (68) (200) Ending balance at September 30, 2021 $ 217 $ 17,666 $ 2,806 $ 10,571 $ 1,962 $ 199 $ 899 $ 444 $ 34,764 Amount of allowance for loan losses for loans deemed to be impaired $ — $ 10 $ — $ 71 $ — $ — $ — $ — $ 81 Amount of allowance for loan losses for loans not deemed to be impaired $ 217 $ 17,656 $ 2,806 $ 10,500 $ 1,962 $ 199 $ 899 $ 444 $ 34,683 Loans: Ending balance $ 6,358 $ 1,321,907 $ 138,945 $ 729,384 $ 466,109 $ 19,549 $ 243,225 $ — $ 2,925,477 Loans deemed to be impaired $ — $ 77 $ — $ 2,239 $ — $ — $ — $ — $ 2,316 Loans not deemed to be impaired $ 6,358 $ 1,321,830 $ 138,945 $ 727,145 $ 466,109 $ 19,549 $ 243,225 $ — $ 2,923,161 Further information pertaining to the allowance for loan losses for the nine months ending September 30, 2021 is as follows: Construction and Land Development Commercial and Industrial Municipal Commercial Real Estate Residential Real Estate Consumer Home Equity Unallocated Total (in thousands) Allowance for loan losses: Balance at December 31, 2020 $ 429 $ 16,713 $ 2,804 $ 11,751 $ 2,111 $ 241 $ 1,208 $ 229 $ 35,486 Charge-offs — — — — — (134) — — (134) Recoveries — 35 — — — 127 — — 162 Provision (212) 918 2 (1,180) (149) (35) (309) 215 (750) Ending balance at September 30, 2021 $ 217 $ 17,666 $ 2,806 $ 10,571 $ 1,962 $ 199 $ 899 $ 444 $ 34,764 Amount of allowance for loan losses for loans deemed to be impaired $ — $ 10 $ — $ 71 $ — $ — $ — $ — $ 81 Amount of allowance for loan losses for loans not deemed to be impaired $ 217 $ 17,656 $ 2,806 $ 10,500 $ 1,962 $ 199 $ 899 $ 444 $ 34,683 Loans: Ending balance $ 6,358 $ 1,321,907 $ 138,945 $ 729,384 $ 466,109 $ 19,549 $ 243,225 $ — $ 2,925,477 Loans deemed to be impaired $ — $ 77 $ — $ 2,239 $ — $ — $ — $ — $ 2,316 Loans not deemed to be impaired $ 6,358 $ 1,321,830 $ 138,945 $ 727,145 $ 466,109 $ 19,549 $ 243,225 $ — $ 2,923,161 There was a credit to the provision for losses of $750,000 for the nine months ended September 30, 2021. The credit provision for the first nine months of 2021 was primarily attributable to a reduction in specific allocations to the allowance for loan losses and a reduction in the historical experience reserve allocation. This was offset, somewhat, by provisions associated with originations of commercial and industrial loans. 12

Further information pertaining to the allowance for loan losses for the three months ending September 30, 2020 is as follows: Construction and Land Development Commercial and Industrial Municipal Commercial Real Estate Residential Real Estate Consumer Home Equity Unallocated Total (in thousands) Allowance for loan losses: Balance at June 30, 2020 $ 289 $ 13,121 $ 2,868 $ 11,303 $ 3,094 $ 289 $ 1,465 $ 87 $ 32,516 Charge-offs — (20) — — — (21) — — (41) Recoveries — 12 — — — 7 — — 19 Provision 76 2,731 (300) (522) (958) 35 (200) 38 900 Ending balance at September 30, 2020 $ 365 $ 15,844 $ 2,568 $ 10,781 $ 2,136 $ 310 $ 1,265 $ 125 $ 33,394 Amount of allowance for loan losses for loans deemed to be impaired $ — $ 12 $ — $ 75 $ — $ — $ — $ — $ 87 Amount of allowance for loan losses for loans not deemed to be impaired $ 365 $ 15,832 $ 2,568 $ 10,706 $ 2,136 $ 310 $ 1,265 $ 125 $ 33,307 Loans: Ending balance $ 9,116 $ 1,315,407 $ 130,047 $ 784,895 $ 443,703 $ 19,866 $ 287,099 $ — $ 2,990,133 Loans deemed to be impaired $ — $ 160 $ — $ 2,675 $ 236 $ — $ — $ — $ 3,071 Loans not deemed to be impaired $ 9,116 $ 1,315,247 $ 130,047 $ 782,220 $ 443,467 $ 19,866 $ 287,099 $ — $ 2,987,062 Further information pertaining to the allowance for loan losses for the nine months ending September 30, 2020 is as follows: Construction and Land Development Commercial and Industrial Municipal Commercial Real Estate Residential Real Estate Consumer Home Equity Unallocated Total (in thousands) Allowance for loan losses: Balance at December 31, 2019 $ 331 $ 11,596 $ 2,566 $ 11,464 $ 2,194 $ 312 $ 1,065 $ 57 $ 29,585 Charge-offs — (31) — — — (89) — — (120) Recoveries — 182 — — — 67 5 — 254 Provision 34 4,097 2 (683) (58) 20 195 68 3,675 Ending balance at September 30, 2020 $ 365 $ 15,844 $ 2,568 $ 10,781 $ 2,136 $ 310 $ 1,265 $ 125 $ 33,394 Amount of allowance for loan losses for loans deemed to be impaired $ — $ 12 $ — $ 75 $ — $ — $ — $ — $ 87 Amount of allowance for loan losses for loans not deemed to be impaired $ 365 $ 15,832 $ 2,568 $ 10,706 $ 2,136 $ 310 $ 1,265 $ 125 $ 33,307 Loans: Ending balance $ 9,116 $ 1,315,407 $ 130,047 $ 784,895 $ 443,703 $ 19,866 $ 287,099 $ — $ 2,990,133 Loans deemed to be impaired $ — $ 160 $ — $ 2,675 $ 236 $ — $ — $ — $ 3,071 Loans not deemed to be impaired $ 9,116 $ 1,315,247 $ 130,047 $ 782,220 $ 443,467 $ 19,866 $ 287,099 $ — $ 2,987,062 There was a provision for loan losses of $3,675,000 for the nine months ended September 30, 2020. The provision for the first nine months of 2020 was primarily a result of provisions related to the onset of the COVID-19 pandemic. The Company utilizes a six-grade internal loan rating system for commercial real estate, construction, commercial, and municipal loans as follows: Loans rated 1-3 (Pass): Loans in this category are considered “pass” rated loans with low to average risk. Loans rated 4 (Monitor): These loans represent classified loans that management is closely monitoring for credit quality. These loans have had or may have minor credit quality deterioration as of September 30, 2021 and December 31, 2020. Loans rated 5 (Substandard):

Substandard loans represent classified loans that management is closely monitoring for credit quality. These loans have had more significant credit quality deterioration as of September 30, 2021 and December 31, 2020. 13

Loans rated 6 (Doubtful): Doubtful loans represent classified loans that management is closely monitoring for credit quality. These loans had more significant credit quality deterioration as of September 30, 2021 and December 31, 2020 and full collectability is doubtful. Impaired: Impaired loans represent classified loans that management is closely monitoring for credit quality. A loan is classified as impaired when it is probable that the Company will be unable to collect all amounts due. The following table presents the Company’s loans by risk rating at September 30, 2021. Construction and Land Development Commercial and Industrial Municipal Commercial Real Estate (in thousands) Grade: 1-3 (Pass) $ 6,358 $ 1,317,908 $ 138,945 $ 704,205 4 (Monitor) — 3,922 — 22,940 5 (Substandard) — — — — 6 (Doubtful) — — — — Impaired — 77 — 2,239 Total $ 6,358 $ 1,321,907 $ 138,945 $ 729,384 The following table presents the Company’s loans by risk rating at December 31, 2020. Construction and Land Development Commercial and Industrial Municipal Commercial Real Estate (in thousands) Grade: 1-3 (Pass) $ 10,909 $ 1,309,861 $ 137,607 $ 761,101 4 (Monitor) — 3,945 — 23,795 5 (Substandard) — — — — 6 (Doubtful) — — — — Impaired — 439 — 4,940 Total $ 10,909 $ 1,314,245 $ 137,607 $ 789,836 14

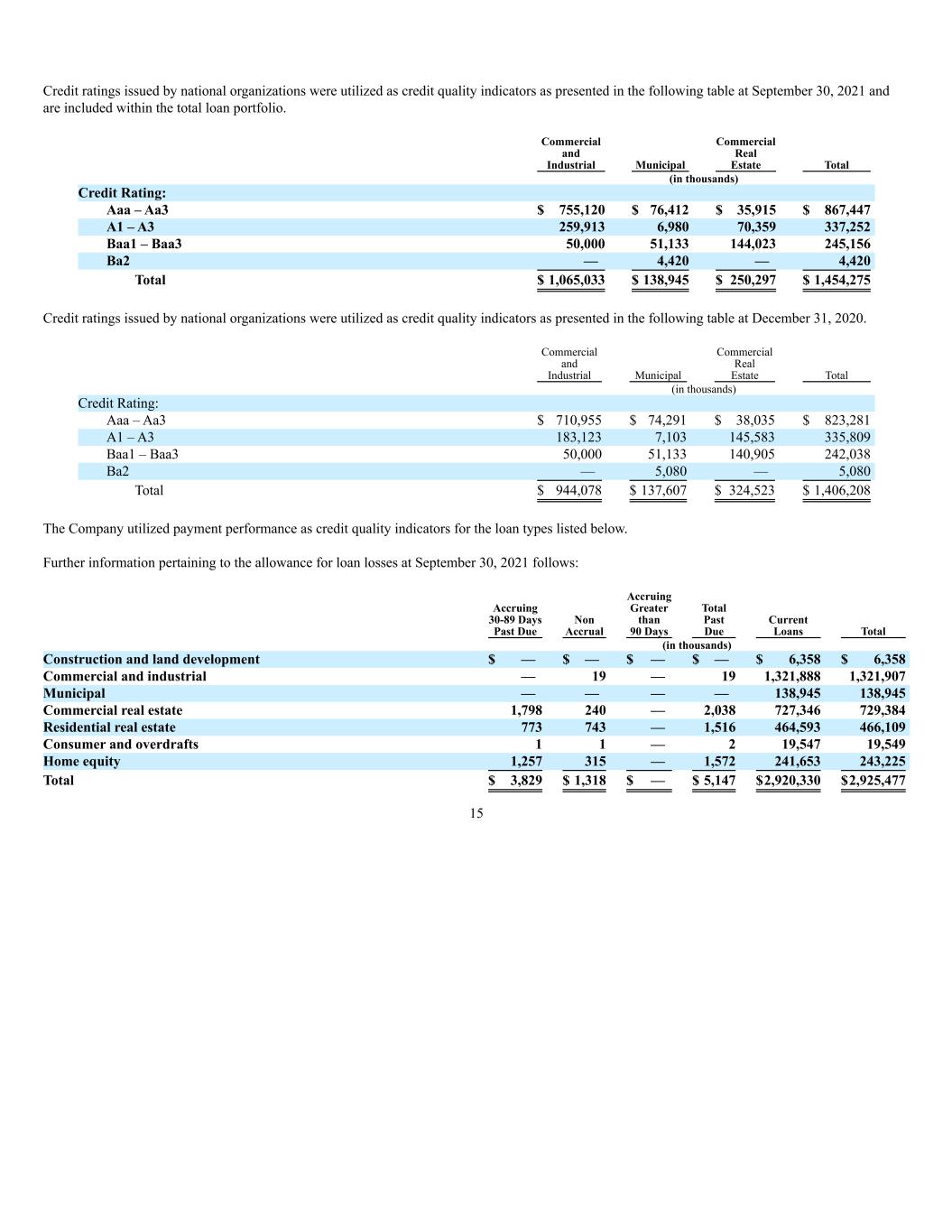

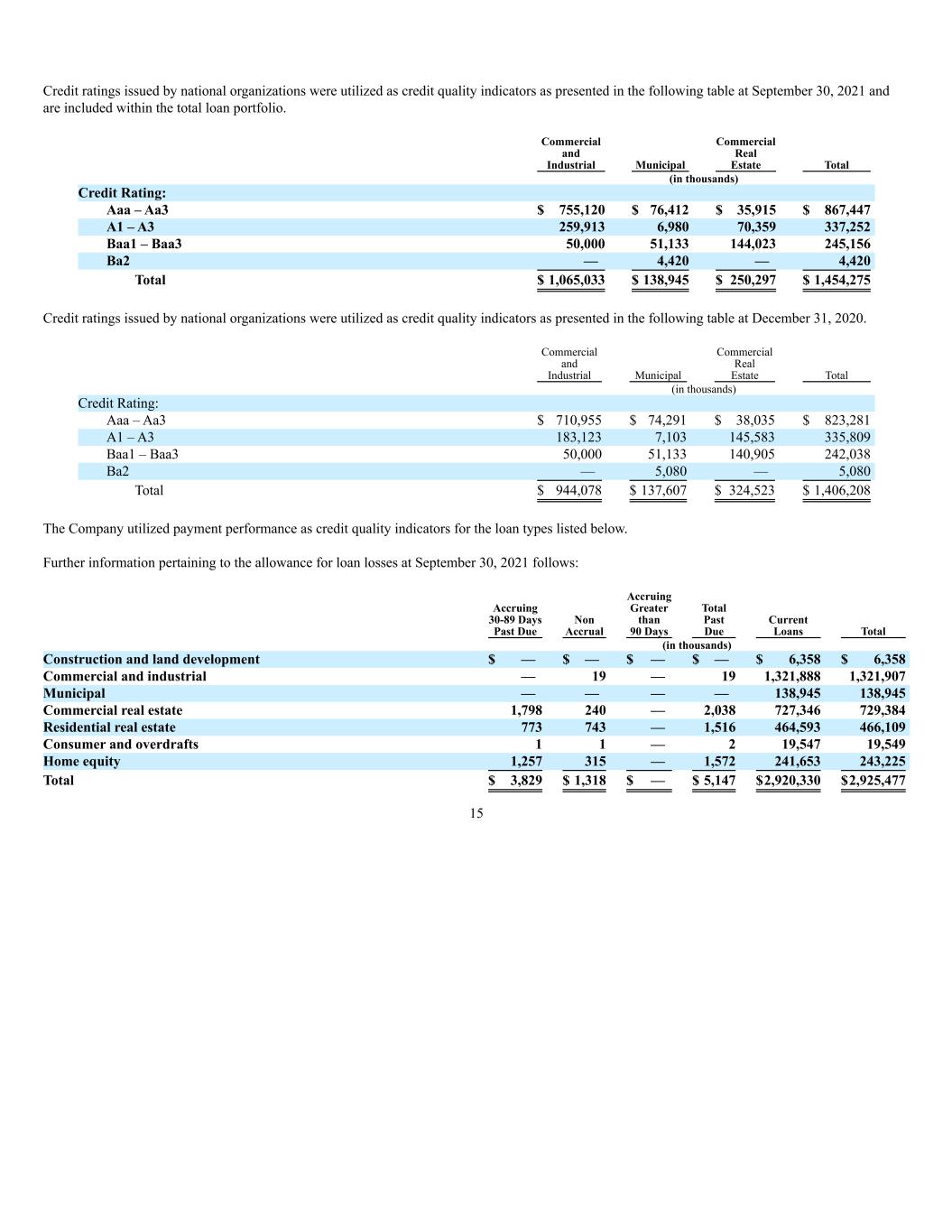

Credit ratings issued by national organizations were utilized as credit quality indicators as presented in the following table at September 30, 2021 and are included within the total loan portfolio. Commercial and Industrial Municipal Commercial Real Estate Total (in thousands) Credit Rating: Aaa – Aa3 $ 755,120 $ 76,412 $ 35,915 $ 867,447 A1 – A3 259,913 6,980 70,359 337,252 Baa1 – Baa3 50,000 51,133 144,023 245,156 Ba2 — 4,420 — 4,420 Total $ 1,065,033 $ 138,945 $ 250,297 $ 1,454,275 Credit ratings issued by national organizations were utilized as credit quality indicators as presented in the following table at December 31, 2020. Commercial and Industrial Municipal Commercial Real Estate Total (in thousands) Credit Rating: Aaa – Aa3 $ 710,955 $ 74,291 $ 38,035 $ 823,281 A1 – A3 183,123 7,103 145,583 335,809 Baa1 – Baa3 50,000 51,133 140,905 242,038 Ba2 — 5,080 — 5,080 Total $ 944,078 $ 137,607 $ 324,523 $ 1,406,208 The Company utilized payment performance as credit quality indicators for the loan types listed below. Further information pertaining to the allowance for loan losses at September 30, 2021 follows: Accruing 30-89 Days Past Due Non Accrual Accruing Greater than 90 Days Total Past Due Current Loans Total (in thousands) Construction and land development $ — $ — $ — $ — $ 6,358 $ 6,358 Commercial and industrial — 19 — 19 1,321,888 1,321,907 Municipal — — — — 138,945 138,945 Commercial real estate 1,798 240 — 2,038 727,346 729,384 Residential real estate 773 743 — 1,516 464,593 466,109 Consumer and overdrafts 1 1 — 2 19,547 19,549 Home equity 1,257 315 — 1,572 241,653 243,225 Total $ 3,829 $ 1,318 $ — $ 5,147 $2,920,330 $2,925,477 15

Further information pertaining to the allowance for loan losses at December 31, 2020 follows: Accruing 30-89 Days Past Due Non Accrual Accruing Greater than 90 Days Total Past Due Current Loans Total (in thousands) Construction and land development $ — $ — $ — $ — $ 10,909 $ 10,909 Commercial and industrial 56 297 90 443 1,313,802 1,314,245 Municipal — — — — 137,607 137,607 Commercial real estate — 2,881 — 2,881 786,955 789,836 Residential real estate 390 527 — 917 447,519 448,436 Consumer and overdrafts 21 1 — 22 20,417 20,439 Home equity 1,001 290 — 1,291 273,066 274,357 Total $ 1,468 $ 3,996 $ 90 $ 5,554 $ 2,990,275 $ 2,995,829 Impaired Loans A loan is impaired when, based on current information and events, it is probable that a creditor will be unable to collect all amounts due according to the contractual terms of the loan agreement. When a loan is impaired, the Company measures impairment based on the present value of expected future cash flows discounted at the loan’s effective interest rate, except that as a practical expedient, the Company measures impairment based on a loan’s observable market price or the fair value of the collateral if the loan is collateral dependent. Loans are charged-off when management believes that the collectability of the loan’s principal is not probable. The specific factors that management considers in making the determination that the collectability of the loan’s principal is not probable include: the delinquency status of the loan, the fair value of the collateral, if secured, and the financial strength of the borrower and/or guarantors. For collateral dependent loans, the amount of the recorded investment in a loan that exceeds the fair value of the collateral is charged-off against the allowance for loan losses in lieu of an allocation of a specific allowance amount when such an amount has been identified definitively as uncollectible. The Company’s policy for recognizing interest income on impaired loans is contained within Note 1 of the consolidated financial statements contained in the Company’s Annual Report for the fiscal year ended December 31, 2020. 16

The following is information pertaining to impaired loans for September 30, 2021: Carrying Value Unpaid Principal Balance Required Reserve Average Carrying Value for 3 Months Ending 9/30/2021 Interest Income Recognized for 3 Months Ending 9/30/2021 Average Carrying Value for 9 Months Ending 9/30/2021 Interest Income Recognized for 9 Months Ending 9/30/2021 (in thousands) With no required reserve recorded: Construction and land development $ — $ — $ — $ — $ — $ — $ — Commercial and industrial — — — 41 — 19 — Municipal — — — — — — — Commercial real estate 239 276 — 245 — 256 — Residential real estate — — — — — — — Consumer — — — — — — — Home equity — — — — — — — Total $ 239 $ 276 $ — $ 286 $ — $ 275 $ — With required reserve recorded: Construction and land development $ — $ — $ — $ — $ — $ — $ — Commercial and industrial 77 97 10 105 1 262 3 Municipal — — — — — — — Commercial real estate 2,000 2,132 71 2,009 21 2,551 62 Residential real estate — — — — — — — Consumer — — — — — — — Home equity — — — — — — — Total $ 2,077 $ 2,229 $ 81 $ 2,114 $ 22 $ 2,813 $ 65 Total: Construction and land development $ — $ — $ — $ — $ — $ — $ — Commercial and industrial 77 97 10 146 1 281 3 Municipal — — — — — — — Commercial real estate 2,239 2,408 71 2,254 21 2,807 62 Residential real estate — — — — — — — Consumer — — — — — — — Home equity — — — — — — — Total $ 2,316 $ 2,505 $ 81 $ 2,400 $ 22 $ 3,088 $ 65 17

The following is information pertaining to impaired loans for September 30, 2020: Carrying Value Unpaid Principal Balance Required Reserve Average Carrying Value for 3 Months Ending 9/30/2020 Interest Income Recognized for 3 Months Ending 9/30/2020 Average Carrying Value for 9 Months Ending 9/30/2020 Interest Income Recognized for 9 Months Ending 9/30/2020 (in thousands) With no required reserve recorded: Construction and land development $ — $ — $ — $ — $ — $ — $ — Commercial and industrial 67 88 — 73 — 288 2 Municipal — — — — — — — Commercial real estate 592 624 — 601 — 365 — Residential real estate 236 236 — 236 — 118 — Consumer — — — — — — — Home equity — — — — — — — Total $ 895 $ 948 $ — $ 910 $ — $ 771 $ 2 With required reserve recorded: Construction and land development $ — $ — $ — $ — $ — $ — $ — Commercial and industrial 93 93 12 100 1 95 3 Municipal — — — — — — — Commercial real estate 2,083 2,209 75 2,094 21 2,140 65 Residential real estate — — — — — — — Consumer — — — — — — — Home equity — — — — — — — Total $2,176 $ 2,302 $ 87 $ 2,194 $ 22 $ 2,235 $ 68 Total: Construction and land development $ — $ — $ — $ — $ — $ — $ — Commercial and industrial 160 181 12 173 1 383 5 Municipal — — — — — — — Commercial real estate 2,675 2,833 75 2,695 21 2,505 65 Residential real estate 236 236 — 236 — 118 — Consumer — — — — — — — Home equity — — — — — — — Total $3,071 $ 3,250 $ 87 $ 3,104 $ 22 $ 3,006 $ 70 Troubled debt restructurings (“TDR”) are identified as modifications in which a concession was granted to a customer who was having financial difficulties. This concession may be below market rate, longer amortization/term, or a lower payment amount. The present value calculation of the modifications did not result in an increase in the allowance for these loans beyond any previously established allocations. There were no TDRs made during the nine-month period ended September 30, 2021. Also, there were no commitments to lend additional funds to TDR borrowers. There were no TDRs that subsequently defaulted during the first nine months of 2021. Under Section 4013 of the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”), loans less than 30 days past due as of December 31, 2019 will be considered current for COVID-19 modifications. The Company can then suspend the requirements under GAAP for loan modifications related to COVID-19 that would otherwise be categorized as a TDR and suspend any determination of a loan modified as a result of COVID-19 as being a TDR, including the requirement to determine impairment for accounting purposes. 18

As of September 30, 2021, and as a result of COVID-19 loan modifications, the Company had modifications of 2 loans aggregating $16,329,000, primarily consisting of short-term payment deferrals. Both loans were performing in accordance with their modified terms. There were no TDRs made during the nine-month period ended September 30, 2020. Also, there were no commitments to lend additional funds to TDR borrowers. There were no TDRs that subsequently defaulted during the first nine months of 2020. As of September 30, 2020, and as a result of COVID-19 loan modifications, the Company has modifications of 33 loans aggregating $37,987,000, primarily consisting of short-term payment deferrals. Of these modifications, $37,987,000, or 100%, were performing in accordance with their modified terms. Note 5. Reclassifications Out of Accumulated Other Comprehensive Income (a) Amount Reclassified from Accumulated Other Comprehensive Income Details about Accumulated Other Comprehensive Income Components Three Months Ended September 30, 2021 Three Months Ended September 30, 2020 Affected Line Item in the Statement where Net Income is Presented (in thousands) Unrealized gains and losses on available-for-sale securities $ — $ — Net gains on sales of investments — — Provision for income taxes $ — $ — Net income Accretion of unrealized losses transferred $ (163) $ (196) Interest on securities held-to-maturity 35 51 Provision for income taxes $ (128) $ (145) Net income Amortization of defined benefit pension items Prior-service costs $ (54) (b) $ (29) (b) Salaries and employee benefits Actuarial gains (losses) (511) (b) (472) (b) Salaries and employee benefits Total before tax (565) (501) Income before taxes Tax (expense) or benefit 159 141 Provision for income taxes Net of tax $ (406) $ (360) Net income Details about Accumulated Other Comprehensive Income Components Nine Months Ended September 30, 2021 Nine Months Ended September 30, 2020 Affected Line Item in the Statement where Net Income is Presented (in thousands) Unrealized gains and losses on available-for-sale securities $ — $ — Net gains on sales of investments — — Provision for income taxes $ — $ — Net income Accretion of unrealized losses transferred $ (532) $ (637) Interest on securities held-to-maturity 141 166 Provision for income taxes $ (391) $ (471) Net income Amortization of defined benefit pension items Prior-service costs $ (162) (b) $ (86) (b) Salaries and employee benefits Actuarial gains (losses) (1,532) (b) (1,417) (b) Salaries and employee benefits Total before tax (1,694) (1,503) Income before taxes Tax (expense) or benefit 476 422 Provision for income taxes Net of tax $ (1,218) $ (1,081) Net income (a) Amount in parentheses indicates reductions to net income. (b) These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see Employee Benefits footnote (Note 7) for additional details). 19

Note 6. Earnings per Share (“EPS”) Class A and Class B shares participate equally in undistributed earnings. Under the Company’s Articles of Organization, the holders of Class A Common Stock are entitled to receive dividends per share equal to at least 200% of dividends paid, if any, from time to time, on each share of Class B Common Stock. Diluted EPS includes the dilutive effect of common stock equivalents and assumes the conversion of all Class B common stock; basic EPS excludes all common stock equivalents. The Company had no common stock equivalents outstanding for the periods ended September 30, 2021 and 2020. The following table is a reconciliation of basic EPS and diluted EPS. Three Months Ended September 30, Nine Months Ended September 30, (in thousands except share and per share data) 2021 2020 2021 2020 Basic EPS Computation: Numerator: Net income, Class A $ 9,326 $ 8,630 $ 26,452 $ 24,254 Net income, Class B 2,406 2,257 6,873 6,355 Denominator: Weighted average shares outstanding, Class A 3,672,969 3,655,469 3,663,669 3,653,429 Weighted average shares outstanding, Class B 1,894,940 1,912,440 1,904,240 1,914,480 Basic EPS, Class A $ 2.54 $ 2.36 $ 7.22 $ 6.64 Basic EPS, Class B 1.27 1.18 3.61 3.32 Diluted EPS Computation: Numerator: Net income, Class A $ 9,326 $ 8,630 $ 26,452 $ 24,254 Net income, Class B 2,406 2,257 6,873 6,355 Total net income, for diluted EPS, Class A computation 11,732 10,887 33,325 30,609 Denominator: Weighted average shares outstanding, basic, Class A 3,672,969 3,655,469 3,663,669 3,653,429 Weighted average shares outstanding, Class B 1,894,940 1,912,440 1,904,240 1,914,480 Weighted average shares outstanding diluted, Class A 5,567,909 5,567,909 5,567,909 5,567,909 Weighted average shares outstanding, Class B 1,894,940 1,912,440 1,904,240 1,914,480 Diluted EPS, Class A $ 2.11 $ 1.96 $ 5.99 $ 5.50 Diluted EPS, Class B 1.27 1.18 3.61 3.32 20

Note 7. Employee Benefits The Company provides pension benefits to its employees under a noncontributory defined benefit pension plan, the “Defined Benefit Pension Plan”, which is funded on a current basis in compliance with the requirements of the Employee Retirement Income Security Act of 1974 (“ERISA”) and recognizes costs over the estimated employee service period. The Company also has the Century Bancorp, Inc. Supplemental Executive Retirement and Insurance Plan (the “Supplemental Plan”) which is limited to certain officers and employees of the Company. The Supplemental Plan is accrued on a current basis and recognizes costs over the estimated employee service period. Executive officers of the Company and its subsidiaries who have at least one year of service may participate in the Supplemental Plan. The Supplemental Plan is voluntary, and participants are required to contribute to its cost. Life insurance policies, which are owned by the Company, are purchased covering the lives of each participant. Components of Net Periodic Benefit Cost for the Three Months Ended September 30, Pension Benefits Supplemental Insurance/ Retirement Plan 2021 2020 2021 2020 (in thousands) Service cost $ 379 $344 $ 363 $ 353 Interest 434 450 434 466 Expected return on plan assets (1,062) (952) — — Recognized prior service cost (benefit) — 54 29 Recognized net actuarial losses 241 261 269 211 Net periodic benefit (credit) cost $ (8) $103 $1,120 $1,059 Pension Benefits Supplemental Insurance/ Retirement Plan 2021 2020 2021 2020 (in thousands) Service cost $1,137 $1,032 $1,089 $1,059 Interest 1,302 1,350 1,302 1,398 Expected return on plan assets (3,186) (2,856) — — Recognized prior service cost (benefit) — — 162 87 Recognized net actuarial losses 723 783 807 633 Net periodic benefit (credit) cost $ (24) $ 309 $3,360 $3,177 Components of Net Periodic Benefit Cost for the Nine Months Ended September 30, Approximately $1,110,000 and $1,395,000 of costs other than service costs, from the table above, are included in other expenses with the remaining cost included in salaries and employee benefits, for the nine months ended September 30, 2021 and 2020, respectively. Contributions The Company has contributed $1,302,000 to the Defined Benefit Pension Plan in 2021. 21

Note 8. Fair Value Measurements The Company follows FASB ASC 820-10, Fair Value Measurements and Disclosures and ASU 2016-1, “Financial Instruments-Overall” (Subtopic 825-10) Recognition and Measurement of Financial Assets and Financial Liabilities, which among other things, requires enhanced disclosures about assets and liabilities carried at fair value. ASC 820-10 establishes a hierarchal disclosure framework associated with the level of pricing observability utilized in measuring financial instruments at fair value. The three broad levels of the hierarchy are as follows: Level I – Quoted prices are available in active markets for identical assets or liabilities as of the reported date. The type of financial instruments included in Level I are highly liquid cash instruments with quoted prices such as G-7 government, agency securities, listed equities and money market securities, as well as listed derivative instruments. Level II – Pricing inputs are other than quoted prices in active markets, which are either directly or indirectly observable as of the reported date. The nature of these financial instruments include cash instruments for which quoted prices are available but traded less frequently, derivative instruments whose fair value have been derived using a model where inputs to the model are directly observable in the market or can be derived principally from or corroborated by observable market data, and instruments that are fair valued using other financial instruments, the parameters of which can be directly observed. Instruments which are generally included in this category are corporate bonds and loans, mortgage whole loans, municipal bonds, and OTC derivatives. Level III – Instruments that have little to no pricing observability as of the reported date. These financial instruments do not have two-way markets and are measured using management’s best estimate of fair value, where the inputs into the determination of fair value require significant management judgment or estimation. Instruments that are included in this category generally include municipal securities with no observable fair value with an average life of one year or less. The securities are carried at cost which approximates fair value. A periodic review of underlying financial statements and credit ratings is performed to assess the appropriateness of these valuations. The results of the fair value hierarchy as of September 30, 2021, are as follows: Securities AFS Fair Value Measurements Using Carrying Value Quoted Prices In Active Markets for Identical Assets (Level 1) Significant Observable Inputs (Level 2) Significant Other Unobservable Inputs (Level 3) (in thousands) SBA Backed Securities $ 39,285 $ — $ 39,285 $ — U.S. Government Agency and Sponsored Mortgage-Backed Securities 144,608 — 144,608 — Privately Issued Residential Mortgage- Backed Securities 244 — 244 — Obligations Issued by States and Political Subdivisions 11,769 — — 11,769 Other Debt Securities 8,276 — 8,276 — Total $204,182 $ — $ 192,413 $ 11,769 Equity Securities $ 1,680 $ 342 $ 1,338 $ — Financial Instruments Measured at Fair Value on a Non-recurring Basis Impaired Loans $ 258 $ — $ — $ 258 22

The results of the fair value hierarchy as of December 31, 2020, are as follows: Securities AFS Fair Value Measurements Using Carrying Value Quoted Prices In Active Markets for Identical Assets (Level 1) Significant Observable Inputs (Level 2) Significant Other Unobservable Inputs (Level 3) (in thousands) Financial Instruments Measured at Fair Value on a Recurring Basis SBA Backed Securities $ 44,039 $ — $ 44,039 $ — U.S. Government Agency and Sponsored Mortgage-Backed Securities 177,741 — 177,741 — Privately Issued Residential Mortgage- Backed Securities 328 — 328 — Obligations Issued by States and Political Subdivisions 52,276 — — 52,276 Other Debt Securities 8,064 — 8,064 — Total $ 282,448 $ — $ 230,172 $ 52,276 Equity Securities $ 1,668 $ 303 $ 1,365 $ — Financial Instruments Measured at Fair Value on a Non-recurring Basis Impaired Loans $ 3,178 $ — $ — $ 3,178 Impaired loan balances represent those collateral dependent loans where management has estimated the credit loss by comparing the loan’s carrying value against the expected realizable fair value of the collateral. Fair value is generally determined through a review process that includes independent appraisals, discounted cash flows, or other external assessments of the underlying collateral, which generally include various Level 3 inputs which are not observable. The Company discounts the fair values, as appropriate, based on management’s observations of the local real estate market for loans in this category. Appraisals, discounted cash flows and real estate tax assessments are reviewed quarterly. There is no specific policy regarding how frequently appraisals will be updated. Adjustments are made to appraisals and real estate tax assessments based on management’s estimate of changes in real estate values. All impaired loans have been reviewed during the past quarter using either a discounted cash flow analysis, appraisal of collateral or other type of real estate tax assessment. The types of adjustments that are made to specific provisions (credits) related to impaired loans recognized for the three and nine-month period ended September 30, 2021 amounted to $9,000 and ($491,000). The types of adjustments that are made to specific provisions related to impaired loans recognized for the year ended December 31, 2020 amounted to $501,000. There were no transfers between level 1, 2 and 3 for the nine months ended September 30, 2021 and the year ended December 31, 2020. There were no liabilities measured at fair value on a recurring or nonrecurring basis during the nine months ended September 30, 2021 and the year ended December 31, 2020. 23

The following table presents additional information about assets measured at fair value on a recurring and nonrecurring basis for which the Company has utilized Level 3 inputs to determine fair value (dollars in thousands) at September 30, 2021. Management continues to monitor the assumptions used to value the assets listed below. Asset Fair Value Valuation Technique Unobservable Input Unobservable Input Value or Range Securities AFS (1) $ 11,769 Discounted cash flow Discount rate 0% - 1.0% (2) Impaired Loans $ 1,680 Appraisal of collateral (3) Appraisal adjustments (4) 0% - 17% discount The following table presents additional information about assets measured at fair value on a recurring and nonrecurring basis for which the Company has utilized Level 3 inputs to determine fair value (dollars in thousands) at December 31, 2020. Management continues to monitor the assumptions used to value the assets listed below. Asset Fair Value Valuation Technique Unobservable Input Unobservable Input Value or Range Securities AFS (1) $ 52,276 Discounted cash flow Discount rate 0% - 1.0% (2) Impaired Loans $ 3,178 Appraisal of collateral (3) Appraisal adjustments (4) 0% - 17% discount (1) Municipal securities generally have maturities of one year or less and, therefore, the amortized cost equates to the fair value. (2) Weighted averages. (3) Fair value is generally determined through independent appraisals of the underlying collateral, which generally include various Level 3 inputs which are not observable. (4) Appraisals may be adjusted by management for qualitative factors such as economic conditions and estimated expenses. The changes in Level 3 securities for the nine-month period ended September 30, 2021 are shown in the table below: Obligations Issued by States & Political Subdivisions Balance at December 31, 2020 $ 52,276 Purchases 14,855 Maturities and calls (55,325) Amortization (37) Balance at September 30, 2021 $ 11,769 The amortized cost of Level 3 securities was $11,769,000 at September 30, 2021 with an unrealized loss of $0. The securities in this category are generally municipal securities with no readily determinable fair value. Management evaluated the fair value of these securities based on an evaluation of the underlying issuer, prevailing rates and market liquidity. 24

The changes in Level 3 securities for the nine-month period ended September 30, 2020 are shown in the table below: Obligations Issued by States & Political Subdivisions Balance at December 31, 2019 $ 13,301 Purchases 53,903 Maturities and calls (18,357) Amortization (32) Balance at September 30, 2020 $ 48,815 The amortized cost of Level 3 securities was $48,815,000 at September 30, 2020 with an unrealized loss of $0. The securities in this category are generally municipal securities with no readily determinable fair value. Management evaluated the fair value of these securities based on an evaluation of the underlying issuer, prevailing rates and market liquidity. The fair value of impaired loans decreased by $2,920,000, for the first nine months of 2021, mainly attributable to one loan relationship that was paid down. There were no liabilities measured at fair value on a recurring or nonrecurring basis during the nine-month period ended September 30, 2020. Note 9. Fair Values of Financial Instruments The following methods and assumptions were used by the Company in estimating fair values of its financial instruments. Excluded from this disclosure are all non-financial instruments. Accordingly, the aggregate fair value amounts presented do not represent the underlying value of the Company. The assumptions used below are expected to approximate those that market participants would use in valuing these financial instruments. Fair value estimates are made at a specific point in time, based on available market information and judgments about the financial instrument, including estimates of timing, amount of expected future cash flows and the credit standing of the issuer. Such estimates do not consider the tax impact of the realization of unrealized gains or losses. In some cases, the fair value estimates cannot be substantiated by comparison to independent markets. In addition, the disclosed fair value may not be realized in the immediate settlement of the financial instrument. Care should be exercised in deriving conclusions about our business, its value or financial position based on the fair value information of financial instruments presented below. Securities Held-to-Maturity The fair values of these securities were based on quoted market prices, where available, as provided by third-party investment portfolio pricing vendors. If quoted market prices were not available, fair values provided by the vendors were based on quoted market prices of comparable instruments in active markets and/or based on a matrix pricing methodology which employs The Bond Market Association’s standard calculations for cash flow and price/yield analysis, live benchmark bond pricing and terms/condition data available from major pricing sources. Management regards the inputs and methods used by third party pricing vendors to be “Level 2 inputs and methods” as defined in the “fair value hierarchy” provided by FASB. Loans The fair value of loans is estimated using the exit price notion consistent with Topic 820, Fair Value Measurement. Fair value is determined based on a discounted cash flow analysis. The discounted cash flow analysis was based on the contractual maturity of the loan and market indications of rates, prepayment speeds, defaults and credit risk. For certain non-performing assets, fair value of the underlying collateral is determined based on the estimated values of individual receipts. 25

Time Deposits The fair value of time deposits was estimated using a discounted cash flow approach that applies prevailing market interest rates for similar maturity instruments. The fair values of the Company’s time deposit liabilities do not take into consideration the value of the Company’s long-term relationships with depositors, which may have significant value. Other Borrowed Funds The fair value of other borrowed funds is based on the discounted value of contractual cash flows. The discount rate used is estimated based on the rates currently offered for other borrowed funds of similar remaining maturities. Subordinated Debentures The fair value of subordinated debentures is based on the discounted value of contractual cash flows. The discount rate used is estimated based on the rates currently offered for other subordinated debentures of similar remaining maturities. The following presents (in thousands) the carrying amount, estimated fair value, and placement in the fair value hierarchy of the Company’s financial instruments as of September 30, 2021 and December 31, 2020. This table excludes financial instruments for which the carrying amount approximates fair value. Financial assets for which the fair value approximates carrying value include cash and cash equivalents, short-term investments, FHLBB stock and accrued interest receivable. Financial liabilities for which the fair value approximates carrying value include non-maturity deposits, short-term borrowings and accrued interest payable. September 30, 2021 Carrying Amount Estimated Fair Value Fair Value Measurements Level 1 Inputs Level 2 Inputs Level 3 Inputs (in thousands) Financial assets: Securities held-to-maturity $ 3,211,977 $ 3,207,259 $ — $ 3,207,259 $ — Loans (1) 2,890,713 2,796,258 — — 2,796,258 Financial liabilities: Time deposits 348,296 345,677 — 345,677 — Other borrowed funds 118,786 122,013 — 122,013 — Subordinated debentures 36,083 36,083 — 36,083 — December 31, 2020 Financial assets: Securities held-to-maturity $ 2,509,088 $ 2,579,103 $ — $ 2,579,103 $ — Loans (1) 2,960,343 2,902,390 — — 2,902,390 Financial liabilities: Time deposits 546,143 556,470 — 556,470 — Other borrowed funds 177,009 183,000 — 183,000 — Subordinated debentures 36,083 36,083 — 36,083 — (1) Comprised of loans (including collateral dependent impaired loans), net of deferred loan costs and the allowance for loan losses. Limitations Fair value estimates are made at a specific point in time, based on relevant market information and information about the type of financial instrument. These estimates do not reflect any premium or discount that could result from offering for sale at one time the Bank’s entire holdings of a particular financial instrument. Because no active market exists for some of the Bank’s financial instruments, fair value estimates are based on judgments regarding future expected loss experience, cash flows, current economic conditions, risk characteristics and other factors. These estimates are subjective in nature and involve uncertainties and matters of significant judgment and therefore cannot be determined with precision. Changes in assumptions and changes in the loan, debt and interest rate markets could significantly affect the estimates. Further, the income tax ramifications related to the realization of the unrealized gains and losses can have a significant effect on the fair value estimates and have not been considered. 26

Note 10. Revenue from Contracts with Customers Revenue from contracts with customers in the scope of ASC Topic 606 is measured based on the consideration specified in the contract with a customer, and excludes amounts collected on behalf of third parties. The Company recognizes revenue from contracts with customers when it satisfies its performance obligations. The Company’s performance obligations are typically satisfied as services are rendered, and our contracts do not include multiple performance obligations. Payment is generally collected at the time services are rendered, or monthly. Unsatisfied performance obligations at the report date are not material to our consolidated financial statements. The Company pays sales commissions to its employees in accordance with certain incentive plans. The Company expenses sales commissions when incurred if we do not expect to recover these costs from the terms of the contract with the customer. Sales commissions are included in compensation expense. In certain cases, other parties are involved with providing products and services to our customers. If the Company is a principal in the transaction (providing goods or services itself), revenues are reported based on the gross consideration received from the customer and any related expenses are reported gross in noninterest expense. If the Company is an agent in the transaction (arranging for another party to provide goods or services), the Company reports its net fee or commission retained as revenue. Waivers and reversals are recorded as a reduction of revenue either when the revenue is recognized by the Company or at the time the waiver or reversal is earned by the customer. A. Nature of goods and services The vast majority of the Company’s revenue is specifically out-of-scope of Topic 606. For the revenue in-scope, the following is a description of principal activities, separated by the timing of revenue recognition, from which the Company generates its revenue from contracts with customers. a. Revenue earned at a point in time – Examples of revenue earned at a point in time are ATM transaction fees, wire transfer fees, “non-sufficient funds” fees, credit and debit card interchange fees and foreign exchange transaction fees. Revenue is generally derived from transactional information accumulated by our systems and is recognized as revenue immediately as the transactions occur or upon providing the service to complete the customer’s transaction. The Company is the principal in each of these contracts, with the exception of credit and debit card interchange fees, in which case we are acting as the agent and record revenue net of expenses paid to the principal. b. Revenue earned over time – The Company earns revenue from contracts with customers in a variety of ways in which the revenue is earned over a period of time – generally monthly or quarterly. Examples of this type of revenue are deposit account service fees, lockbox fees, investment management fees, merchant referral services, and safe deposit box fees. Account service charges, management fees and referral fees are recognized on a monthly basis while any transaction based income is recorded as the activity occurs. Revenue is primarily based on the number and type of transactions or assets managed and is generally derived from transactional information accumulated by our systems. Revenue is recorded in the same period as the related transactions occur or services are rendered to the customer. B. Disaggregation of revenue The following table presents total revenues as presented in the Consolidated Statements of Income and the related amounts which are from contracts with customers within the scope of Topic 606. As illustrated here, the vast majority of our revenues are specifically excluded from the scope of Topic 606. 27

Nine Months Ended 9/30/2021 Revenue from Contracts in Scope of Topic 606 Nine Months Ended 9/30/2020 Revenue from Contracts in Scope of Topic 606 (dollars in thousands) Net interest income $ 88,938 $ — $ 78,350 $ — Noninterest income: Service charges on deposit accounts 6,632 6,632 6,558 6,558 Lockbox fees 2,876 2,876 2,850 2,850 Net gains on sales of securities — — — — Gains on sales of mortgage loans — — — — Other income 2,973 2,050 3,112 1,738 Total noninterest income 12,481 11,558 12,520 11,146 Total revenues $ 101,419 $ 11,558 $ 90,870 $ 11,146 Three Months Ended 9/30/2021 Revenue from Contracts in Scope of Topic 606 Three Months Ended 9/30/2020 Revenue from Contracts in Scope of Topic 606 (dollars in thousands) Net interest income $ 30,380 $ — $ 27,331 $ — Noninterest income: Service charges on deposit accounts 2,243 2,243 2,239 2,239 Lockbox fees 914 914 996 996 Net gains on sales of securities — — — — Gains on sales of mortgage loans — — — — Other income 1,015 684 934 580 Total noninterest income 4,172 3,841 4,169 3,815 Total revenues $ 34,552 $ 3,841 $ 31,500 $ 3,815 The following table provides information about receivables with customers. September 30, 2021 December 31, 2020 (dollars in thousands) Receivables, which are included in “Other assets” $ 1,348 $ 1,397 Note 11. Leases The Company has operating leases primarily for branch locations as well as data processing centers. The Company’s operating leases have remaining lease terms of 1 year to 31 years, some of which include options to extend the leases for up to 10 years, and some of which include options to terminate the leases within 1 year. The Company also has one sublease for part of a data processing center that the Company currently leases from a lessor. The sublease which expires in 2024, can be terminated early after each sublease year. Lease income, for the sublease, totaled approximately $31,000 for the nine months ended September 30, 2021. Variable lease costs include costs that are not included in the lease liability. 28

The components of lease expense were as follows: Three Months Ended 9/30/2021 Nine Months Ended 9/30/2021 Three Months Ended 9/30/2020 Nine Months Ended 9/30/2020 (in thousands) Operating lease cost $ 543 $ 1,663 $ 546 $ 1,638 Variable lease cost 192 546 135 441 Total lease cost $ 735 $ 2,209 $ 681 $ 2,079 Supplemental cash flow information related to leases was as follows: Three Months Ended 9/30/2021 Nine Months Ended 9/30/2021 Three Months Ended 9/30/2020 Nine Months Ended 9/30/2020 (in thousands) Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows from operating leases $ 541 $ 1,624 $ 529 $ 1,586 Right-of-use assets obtained in exchange for lease obligations: Operating leases $ 376 $ 376 $ 431 $ 1,306 Supplemental balance sheet information related to leases was as follows: 9/30/2021 12/31/2020 (in thousands, except lease term and discount rate) Operating Leases: Operating lease right-of-use assets $ 12,734 $ 13,713 Operating lease liabilities $ 12,994 $ 13,935 Weighted Average Remaining Lease Term: Operating Leases 10 Years 10 Years Weighted Average Discount Rate: Operating Leases 3.1% 3.1% The Company has payment obligations under several non-cancelable operating leases for premises and equipment expiring in various years through 2030. Total lease expense approximated $2,209,000 and $2,079,000 for the nine months ended September 30, 2021, and 2020, respectively. Included in lease expense are amounts paid to a company affiliated with Barry R. Sloane, Chairman, President and CEO, and Linda Sloane Kay, Vice Chair, amounting to $395,000 and $329,000, for the nine months ended September 30, 2021, and 2020, respectively. Rental income approximated $621,000 and $498,000, for the nine months ended September 30, 2021, and 2020, respectively. 29

A summary of future minimum rental payments under such leases as the dates indicated follows: Minimum Rental Payments September 30, 2021 December 31, 2020 (in thousands) Year Ending December 31, 2020 2021 $ 544 $ 2,156 2022 2,072 1,995 2023 2,039 1,962 2024 1,769 1,692 2025 1,548 1,471 Thereafter 7,453 7,394 Total lease payments $ 15,425 $ 16,670 Less imputed interest (2,431) (2,735) Present value of lease liability $ 12,994 $ 13,935 September 30, 2021 minimum rental payments represent three months of rental payments remaining in calendar year 2021. Note 12. Transaction with Eastern Bankshares, Inc. On April 7, 2021, the Company and Eastern Bankshares, Inc. (“Eastern”) (NASDAQ: EBC) entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which, through a series of transactions, Eastern will acquire the Company in a cash transaction for total consideration valued at approximately $642 million. Under the terms of the Merger Agreement, (i) each holder of Class A common stock will receive a cash payment of $115.28 per share of Class A common stock and (ii) each holder of Class B common stock will receive a cash payment of $115.28 per share of Class B common stock. The transaction is expected to close in the fourth quarter of 2021 and is subject to customary closing conditions. The Company’s shareholders approved the Merger Agreement at the Special Meeting of the Shareholders held on July 7, 2021. The Company received the required regulatory approvals during the third quarter of 2021. The Company has recognized approximately $2.0 million in merger related costs, mainly consisting of legal and consulting expenses. The expenses have been recorded in other expenses on the income statement. The Company also has contingent merger related fees of approximately $7.4 million mainly consisting of advisory and legal fees that have not been recognized. The contingent merger related fees will be recognized upon closing of the proposed transaction. 30