Exhibit 99.24

Fire & Flower Holdings Corp.

2020 ANNUAL INFORMATION FORM

April 29, 2020

TABLE OF CONTENTS

| 2020 ANNUAL INFORMATION FORM | Fire & Flower |

| Holdings Corp. | |

GENERAL MATTERS AND FORWARD-LOOKING STATEMENTS

This annual information form for the year ended February 1, 2020 (the “Annual Information Form” or the “AIF”) is dated as of April 29, 2020 and, unless otherwise noted or the context otherwise requires, “Corporation” shall refer to Fire & Flower Holdings Corp., and the term “cannabis” has the meaning given to the term “cannabis” in the Cannabis Act, S.C. 2018, c. 16 (the “Cannabis Act”).

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this AIF, and in the documents incorporated by reference in this AIF, constitute “forward-looking information” and “forward-looking statements” (together, “forward-looking statements”) within the meaning of applicable Canadian securities laws and are based on assumptions, expectations, estimates and projections as of the date of this AIF. Forward-looking statements include statements with respect to projected revenues, earnings, growth rates, targets, revenue mix, product plans and the Corporation’s future growth, results of operations, performance and business prospects and opportunities. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect”, “projected”, “forecasts”, “guidance”, “outlook”, “potential”, “prospects”, “seek”, “aim”, “strategy” and “targets” or variations of such words or negative versions thereof and other similar expressions identify forward-looking statements. Forward-looking statements are based upon management’s perceptions of historical trends, current conditions and expected future developments, as well as a number of specific factors and assumptions that, while considered reasonable by the Corporation as of the date of such statements, are, in many cases, outside of the Corporation’s control and are inherently subject to significant business, economic and competitive uncertainties and contingencies (including the anticipated effects of COVID-19 on the Corporation and its operations) which could result in the forward- looking statements ultimately being entirely or partially incorrect or untrue.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and a number of factors could cause actual events or results to differ materially from the results discussed in the forward-looking statements. In evaluating these statements, a reader should specifically consider various factors, including the risks outlined under the heading “Risk Factors”, which may cause actual results to differ materially from any forward-looking statements.

The forward-looking statements contained herein reflect management’s current expectations and beliefs and are based upon certain assumptions that management believes to be reasonable based on the information currently available to management. Such assumptions include, but are not limited to, assumptions regarding: (a) the grant and impact of any licence or supplemental licence to conduct activities with cannabis or any amendments thereof; (b) expectations with respect to the renewal and/or extension of the Corporation’s licences and permits; (c) the applicable laws, regulations and any amendments thereof; (d) the Corporation’s ability to comply with applicable governmental regulations and standards; (e) reliance on suppliers and other third parties; (f) product recalls; (g) product liability; (h) U.S. operations; (i) the price of cannabis; (j) general business and economic conditions, including negative impacts from the continued spread of COVID-19 on the global economy or on the Corporation’s business, financial position or results of operations; (k) being a public company; (l) strategic alliances; (m) the competitive conditions of the cannabis industry; (n) dependence on key management personnel; (o) general economic trends and conditions; (p) equity and debt markets continuing to provide the Corporation with access to capital on terms acceptable to the Corporation; (q) litigation; (r) cybersecurity; (s) the demand for the Corporation’s products and services and fluctuations in future revenues; (t) sufficiency of current working capital to support future operating and working capital requirements; (u) the Corporation’s future growth prospects and business opportunities; (v) the expected growth in the amount of cannabis sold by the Corporation and the expected size of and pricing of products in the recreational market; (w) capital cost of expected expansion by the Corporation; (x) the Corporation’s success in implementing its strategies and achieving its business objectives; and (y) the number of stores to be operated by the Corporation. By their nature, forward-looking statements are subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Should one or more of the risks or uncertainties identified herein materialize, or should the assumptions underlying the forward- looking statements prove to be incorrect, then actual results may vary materially from those described herein.

| 2020 ANNUAL INFORMATION FORM | Fire & Flower |

| Holdings Corp. | |

Readers are cautioned not to place undue reliance on forward-looking statements. Except as required by applicable securities laws, we do not intend, and do not assume any obligation, to update the forward- looking statements contained herein.

CORPORATE STRUCTURE

The Corporation was incorporated as Cinaport Acquisition Corp. II under the Business Corporations Act (Ontario) (“OBCA”) on December 12, 2017. On February 7, 2019, the Corporation filed articles of amendment to change its name from “Cinaport Acquisition Corp. II” to “Fire & Flower Holdings Corp.” (the “Name Change”). On February 12, 2019, the Corporation continued (the “Continuance”) from a company operating under the OBCA to a company operating under the Canada Business Corporations Act (“CBCA”). The Name Change and Continuance were completed in connection with the business combination (the “Qualifying Transaction”) involving the Corporation and Fire & Flower Inc. (“Old FFI”) which resulted in a reverse take-over of the Corporation by Old FFI pursuant to a “three-cornered amalgamation” among the Corporation, Old FFI and 11048449 Canada Inc. (a wholly-owned subsidiary of the Corporation) (“Subco”). Pursuant to the terms of the Qualifying Transaction, Old FFI and Subco amalgamated to form Fire & Flower Inc. (“FFI”) – a wholly-owned subsidiary of the Corporation. The Qualifying Transaction was completed on February 13, 2019.

The Corporation’s registered and head office is located at 150 King Street West, Suite 308, Toronto, Ontario M5H 1J9.

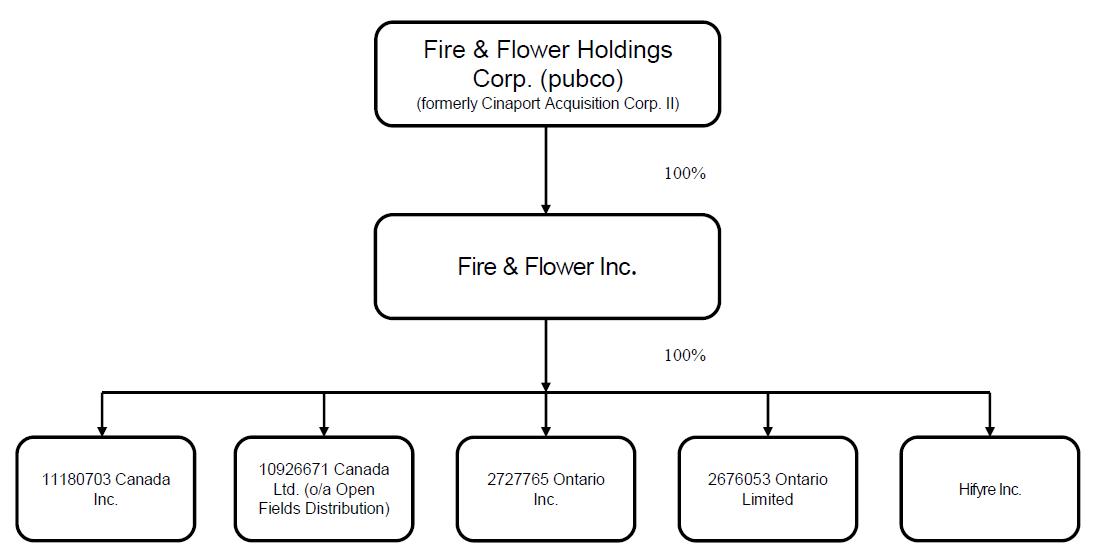

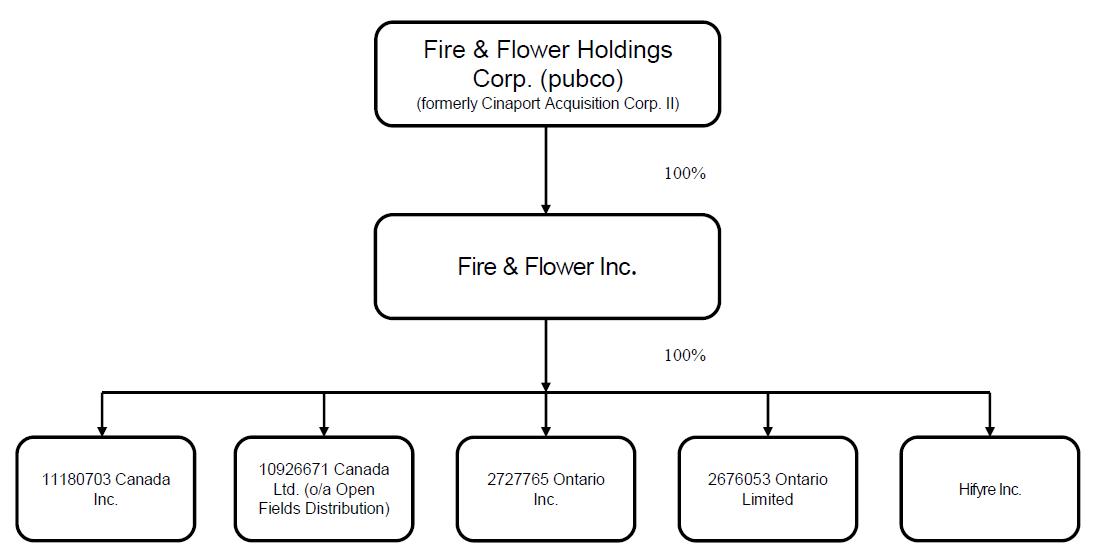

INTER-CORPORATE RELATIONSHIPS

The following chart outlines the inter-corporate relationships between the Corporation and its wholly owned subsidiaries.

Old FFI was a corporation existing under the CBCA and was incorporated pursuant to a certificate of incorporation issued under the CBCA on March 17, 2017 under the name 10150266 Canada Inc. The articles of incorporation of Old FFI were subsequently amended on:

| | (a) | November 24, 2017 to change the name of the company from “10150266 Canada Inc.” to “Fire & Flower Inc.”; |

| | | |

| | (b) | December 6, 2017 to subdivide all of the issued and outstanding common shares of the company on a 1:5,000 basis; |

| | | |

| | (c) | March 6, 2018 to change the province of the company’s registered office from Ontario to Alberta; and |

| | | |

| | (d) | April 9, 2018 to subdivide all of the issued common shares of the company on a 1:10 basis. |

On February 13, 2019, Old FFI amalgamated with Subco to form FFI – whereby FFI assumed all of the assets and liabilities of Old FFI and Subco.

10926671 Canada Inc. (d/b/a “Open Fields Distribution”) (“Open Fields”) was incorporated under the CBCA on August 1, 2018.

Hifyre Inc. (“Hifyre”) was incorporated under the OBCA on March 27, 2009 under the name “Kardeo Inc”. Old FFI acquired all of the issued and outstanding securities of Hifyre on July 20, 2018 pursuant to the terms of a share purchase agreement of the same date. On December 6, 2018, Hifyre filed articles of amendment to change its name from “Kardeo Inc.” to “Hifyre Inc.”.

11180703 Canada Inc. was incorporated on January 7, 2019 for the purposes of participating in the lottery (the “Lottery”) held by the Ontario Alcohol and Gaming Commission (“AGCO”). Selected Lottery participants were invited to apply for a licence to operate a retail cannabis store in Ontario. As 11180703 Canada Inc. was not selected in the Lottery, this entity has no active business as of the date hereof.

2727765 Ontario Inc. (“272 Ontario”) was incorporated on November 20, 2019. On February 11, 2020, FFI acquired all of the issued and outstanding securities of 272 Ontario. See “Description of the Business

– Recent Developments”.

2676053 Ontario Limited (“267 Ontario”) was incorporated on January 15, 2019. On February 28, 2020, FFI acquired all of the issued and outstanding securities of 267 Ontario. See “Description of the Business

– Recent Developments”.

GENERAL DEVELOPMENT OF THE BUSINESS

The Corporation was incorporated on December 12, 2017 under the name “Cinaport Acquisition Corp. II” by certificate of incorporation issued pursuant to the provisions of the OBCA. On June 6, 2018, the Corporation completed its initial public offering of 5,400,000 common shares in the capital of the Corporation at a price of $0.10 per share for aggregate gross proceeds of $540,000.

Until the completion of the Qualifying Transaction, the Corporation was a “capital pool company” as defined under the policies of the TSX Venture Exchange (the “TSXV”). Accordingly, the Corporation’s business from the date of incorporation until the completion of the Qualifying Transaction was limited to the identification and evaluation of businesses and assets with a view to completing a “qualifying transaction” as defined in the policies of the TSXV, and completing financing transactions in respect thereof. Until the completion of the Qualifying Transaction, the Corporation did not conduct commercial operations.

On October 31, 2018, the Corporation entered into an acquisition agreement with Old FFI and Subco which set out the terms of the Qualifying Transaction (see “Corporate Structure”). In connection with the completion of the Qualifying Transaction: (a) on February 7, 2019, the Corporation filed articles of amendment under the OBCA to: (i) change its name to “Fire & Flower Holdings Corp.”; and (ii) consolidate its share capital on a 10.64814815 to 1 basis (each post-consolidation share of the Corporation, a “Common Share”); and (b) on February 12, 2019, the Corporation filed articles of continuance to continue from the jurisdiction of Ontario to the federal jurisdiction of Canada. On February 13, 2019, the Corporation completed the Qualifying Transaction (see “Corporate Structure”). Immediately following the completion of the Qualifying Transaction, the Corporation filed articles of amendment to provide the Corporation with certain redemption rights as further set out under Description of Capital Structure. On August 7, 2019, the Corporation graduated from the TSXV to the Toronto Stock Exchange (the “TSX”) and the Common Shares commenced trading on the TSX under the symbol “FAF”.

The Corporation’s mission is to become a premier independent cannabis retailer and a global brand where international regulations permit. In addition to its Fire & Flower™ retail platform and its wholesale distribution and fulfilment capabilities (operating as “Open Fields Distribution”), the Corporation anticipates that its proprietary Hifyre™ digital retail and analytics platform will provide it with a significant competitive advantage, additional revenue opportunities, as well as a growth platform to enter international markets.

In Alberta, FFI currently operates 37 licensed cannabis retail stores pursuant to cannabis retail store licences received from the Alberta Gaming, Liquor and Cannabis Commission (“AGLC”). FFI sells cannabis and cannabis accessories to adults at its licensed retail premises in Alberta.

In Saskatchewan, FFI currently operates seven (7) licensed stores in Saskatchewan: one licence obtained via a lottery process and five (6) that were obtained via acquisition. FFI sells cannabis, cannabis accessories, apparel and related ancillary items to adults at its licensed retail premises and online for curbside pickup or delivered to residences in Saskatchewan.

In Ontario, 2727765 Ontario and 267 Ontario operate licensed cannabis retail stores in Ottawa and Kingston, respectively, and FFI has obtained a retail operator licence (“Operator Licence”) and submitted eight (8) applications for retail store authorizations (“Store Authorization”) (as such terms are considered under Ontario Regulation 468/18). 272 Ontario and 267 Ontario sell cannabis, cannabis accessories, apparel and related ancillary items to adults at its licensed retail premises. Pursuant to an order under the Emergency Management and Civil Protection Act (Ontario) (the “EMCPA”), currently 272 Ontario and 267 Ontario sell cannabis, cannabis accessories, apparel and related ancillary items online for curbside pickup or delivery to residences in Ontario.

In Manitoba, FFI operates one (1) licensed cannabis retail store in Swan River. FFI intends to expand its operations in Manitoba to include additional licensed cannabis retail locations and/or distribution businesses as regulations permit.

In the Yukon, FFI operates one (1) licensed cannabis retail store in Whitehorse.

In British Columbia, FFI has three (3) applications pending for cannabis retail store licences to the British Columbia Liquor and Cannabis Regulation Branch (“LCRB”) in respect of two (2) locations in Vancouver and one location in Kelowna.,

DESCRIPTION OF THE BUSINESS

History of the Business

The Corporation, through FFI, is an independent cannabis retail chain, operating in accordance with the Cannabis Act and applicable provincial and municipal legislation. FFI sells cannabis products and accessories through its retail locations, currently located in the provinces of Alberta, Saskatchewan, Manitoba and Ontario and in the Yukon. FFI intends to expand its operations: (a) in the provinces of Alberta, Saskatchewan, Manitoba and Ontario; and (b) into the province of British Columbia and such other provinces and territories where and as the private sale of retail cannabis is permitted. FFI is also pursuing opportunities to expand into the province of New Brunswick and other markets as permitted.

As of the date of this AIF, FFI owns 48 cannabis retail store licences: 37 stores in the province of Alberta; seven (7) cannabis retail stores in the province of Saskatchewan; one (1) cannabis retail store in the province of Manitoba; two (2) cannabis retail stores in the province of Ontario; and one (1) cannabis retail store in the Yukon.

FFI intends to expand the number of its operational licensed cannabis retail stores through: (a) opening stores in respect of which it has recently received a cannabis retail store licence; (b) the acquisition of existing cannabis retail store premises and/or licensees; and/or (c) the development of new cannabis retail stores subject to obtaining necessary licences, permits and other government approval.

FFI conducts online sales of cannabis products and cannabis accessories in Saskatchewan and in Ontario (pursuant to an order under the EMCPA) as well as online sales of cannabis accessories in Alberta in accordance with applicable laws.

In addition to the foregoing, through FFI’s wholly-owned subsidiary Open Fields, the Corporation operates a cannabis wholesale business from its licensed distribution center in Saskatoon, Saskatchewan. Open Fields is licensed to purchase cannabis directly from licensed producers (as such term is defined in the Cannabis Act, “Licensed Producers”). Open Fields purchases cannabis from Licensed Producers on both an exclusive and non-exclusive basis, and supplies both FFI cannabis retail stores in Saskatchewan as well as a significant number of independent private cannabis retailers in the province.

On July 20, 2018, Old FFI acquired Hifyre Inc. (then known as “Kardeo Inc.”), a company with expertise in building compliant technology systems for Licensed Producers, in order to accelerate the development of Old FFI’s retail cannabis technology platform (the “Hifyre Platform”). The Corporation expects that the Hifyre Platform, which is comprised of compliant e-commerce, in-store retail, customer experience functionality, analytics and an extended mobile application experience, will provide a competitive advantage for its retail operations as well as for its anticipated growth plans.

Strategic Investment

On August 7, 2019, the Corporation issued to 2707031 Ontario Inc., an indirect wholly-owned subsidiary of Alimentation Couche-Tard Inc. (TSX:ATD.A; ATD.B) (collectively “Alimentation Couche-Tard”), for an aggregate purchase price of $25,989,985.45: (a) $25,989,985.45 principal amount of 8.0% unsecured convertible debentures (the “ACT Debentures”); (b) 30,634,322 series A common share purchase warrants (the “Series A Warrants”); (c) 56,126,890 series B common share purchase warrants; and (d) 110,703,926 series C common share purchase warrants (the “Strategic Investment”). Pursuant to the terms of the Strategic Investment, Alimentation Couche-Tard acquired the right, but not the obligation, to acquire that number of Common Shares that may result in Alimentation Couche-Tard holding 50.1% of the issued and outstanding Common Shares if the principal amount of ACT Debentures and Warrants are converted and exercised, respectively, in full.

Concurrent with the closing of the Strategic Investment, the Corporation and Alimentation Couche-Tard entered into an investor rights agreement (the “Investor Rights Agreement”). Pursuant to the terms of the Investor Rights Agreement, Alimentation Couche-Tard is entitled to designate one nominee (an “Investor Nominee”) for election to the board of directors of the Corporation (the “Board”). For so long as (a) the ACT Debentures remain outstanding in full; (b) Alimentation Couche-Tard owns at least 9.9% of the issued and outstanding Common Shares; or (c) Alimentation Couche-Tard is entitled (including pursuant to the exercise of certain participation and top-up rights as further set out in the Investor Rights Agreement), to acquire Common Shares, which, together with the other Common Shares held by Alimentation Couche-Tard, would represent at least 9.9% of the issued and outstanding Common Shares, Alimentation Couche-Tard shall also be entitled to designate a number of Investor Nominees (but in any event at least one (1) Investor Nominee) for election to the Board proportionate to its then Common Share ownership interest in the Corporation, rounded down to the extent that such entitlement would result in a fractional Investor Nominee. In connection with the closing of the Strategic Investment, the Corporation announced the appointment of Mr. Jeremy Bergeron as Alimentation Couche-Tard’s nominee to the Board pursuant to the right afforded to Alimentation Couche-Tard under the Investor Rights Agreement.

In connection with the Strategic Investment, Alimentation Couche-Tard was granted certain registration rights as further set out in the Investor Rights Agreement. The Investor Rights Agreement also considers the issuance of the additional Common Share purchase warrants to be issued to allow Alimentation Couche-Tard to maintain its ability to acquire 50.1% of the issued and outstanding Common Shares if the principal amount of ACT Debentures and Warrants are converted and exercised, respectively, in full (including the exercise of such additional Common Share purchase warrants).

Alimentation Couche-Tard also agreed to a standstill pursuant to which, among other things, Alimentation Couche-Tard will not without the prior written authorization of the Corporation and subject to customary carve-outs, directly or indirectly, or jointly and in concert with any other person, purchase, offer or agree to purchase or negotiate to purchase any securities or material assets of the Corporation or any of its subsidiaries until the earlier of (a) the date the Series A Warrants are exercised in full; and (b) the date the ACT Debentures mature.

Recent Developments

On February 11, 2020, FFI acquired all of the issued and outstanding shares of 272 Ontario pursuant to the terms of a share purchase agreement dated January 10, 2020. 272 Ontario holds an Operator Licence and a Store Authorization with respect to FFI’s Ottawa store.

On February 13, 2020, the Corporation converted $14,000,000 principal amount of 8.0% unsecured convertible debentures into 12,173,912 Common Shares.

On February 28, 2020, FFI acquired all of the issued and outstanding shares of 267 Ontario pursuant to the terms of a share purchase agreement dated February 28, 2020. 267 Ontario holds an Operator Licence and a Store Authorization with respect to FFI’s Kingston store.

On April 21, 2020, the Corporation entered into a commitment letter (the “Commitment Letter”) to obtain up to an aggregate amount of $10 million in secured, non-dilutive credit facilities with ATB Financial (“ATB”). The Commitment Letter contemplates two separate loan facilities on a two-year term: a revolving credit facility in the amount of $5 million, and a term loan in the amount of $5 million. Both loan facilities bear interest at ATB’s reference rates plus a spread. The Commitment Letter also includes an “accordion” option to increase the revolving facility by an additional $5 million, subject to ATB’s consent and certain other customary conditions. Funding will become available under the Commitment Letter upon the Corporation satisfying certain conditions precedent.

On April 28, 2020, Corporation closed a private placement offering of $1,000 principal amount of 8.0% secured convertible debentures (the “Convertible Debentures”) and subscription receipts (the “Subscription Receipts”) for aggregate gross proceeds of $28 million (the “April Offerings”). In connection with the April Offerings, the Corporation issued (a) 19,800 Convertible Debentures; and (b) 8,200 Subscription Receipts, each at an offering price of $1,000 per security. The Convertible Debentures bear interest at an annual rate of 8.00% payable in arrears in equal installments semi- annually. The Convertible Debentures mature on June 1, 2021, which date may be extended to April 28, 2022 in the event the ACT Debentures and Series A Warrants are converted, exercised or otherwise cancelled (the “Maturity Date”) as further set out in the debenture indenture between the Corporation and Computershare Trust Company of Canada (“CTCC”) dated April 28, 2020 (the “April 2020 Indenture”). The principal amount of Convertible Debentures is convertible at the holder’s option into Common Shares at any time prior to the Maturity Date at a conversion price of $0.50 per Common Share. The Corporation’s obligations under the Convertible Debentures are secured by the assets of the Corporation (including the subsidiaries).

Subject to the approval of the TSX, which pursuant to the TSX policies requires the approval of the shareholders of the Corporation, in lieu of paying any interest accrued and payable in respect of the Convertible Debentures up to and including December 31, 2020 (or June 30, 2021 in the event the Maturity Date is extended), the Corporation may elect to add such accrued and unpaid interest to the then outstanding principal amount of Convertible Debentures. The gross proceeds of the offering of Subscription Receipts (the “Subscription Receipt Proceeds”) are held by CTCC, in its capacity as subscription receipt agent, pursuant to the terms of a subscription receipt agreement entered into between the Corporation and CTCC dated April 28, 2020 (the “Subscription Receipt Agreement”). Upon the satisfaction and/or waiver of certain escrow release conditions (the “Escrow Release Conditions”) each Subscription Receipt will automatically be converted into a $1,000 principal amount of Convertible Debentures and the Subscription Receipt Proceeds will be released to the Corporation. The Escrow Release Conditions include the Conversion Shares underlying the Convertible Debentures issuable upon conversion of the Subscription Receipts being conditionally approved for listing on the TSX and the completion, satisfaction or waiver of all conditions precedent to such listing, including the receipt of shareholder approval.

Operations

Retail Platform

The retail sale of adult-use cannabis is only permitted by approved store operators at licensed premises in accordance with applicable federal, provincial and municipal laws.

As of the date of this AIF, the Corporation, through its wholly-owned subsidiary, FFI and FFI’s wholly- owned subsidiaries 272 Ontario and 267 Ontario, holds all licences required to operate 48 cannabis retail stores, consisting of 37 cannabis retail stores in Alberta, seven (7) cannabis retail stores in Saskatchewan, one (1) cannabis retail store in Manitoba, one (1) cannabis retail store in the Yukon and two (2) cannabis retail stores in Ontario operated by 272 Ontario and 267 Ontario in Ottawa and Kingston, respectively.

The Corporation, through Open Fields, its indirectly wholly-owned subsidiary, also operates a cannabis wholesale business in Saskatchewan.

FFI is authorized to purchase, store and sell cannabis, cannabis accessories and other prescribed goods in accordance with the terms and conditions of its cannabis retail store licences. Open Fields is authorized to purchase, store and sell cannabis from Licensed Producers and other wholesalers in accordance with the terms and conditions of its cannabis wholesale licence. Open Fields also purchases, stores and sells cannabis accessories and related ancillary items in accordance with applicable laws.

At each of its operational stores, FFI (through its displays and in-store cannabis experts known as “cannistas”) educates customers on FFI’s products. FFI has developed its own proprietary training program and resources. For example, cannistas are trained to engage with FFI customers to provide information regarding: (a) brand characteristics of various cannabis strains and products; (b) the reported cannabinoid, including tetrahydrocannabinol (“THC”) and cannabidiol (“CBD”), composition of each cannabis product; (c) the reported terpene composition of each cannabis product; (d) production methods and processes utilized in a particular product; (e) the various product forms (e.g. dried flower, oils, capsules, sprays, concentrates, vaporizers, foods and beverages infused with THC and/or CBD, etc.); (f) other product attributes and characteristics; (g) methods of consumption (e.g. combustion, vaporization, oral, topical, etc.); and (h) harm reduction. The retail experience has been designed to encourage customers to better understand the products available for purchase and how they may align with their desired objectives.

In connection with such training, FFI’s in-store education operates under two key principles: (a) “start low and go slow”; and (b) encourage responsible use. Cannistas are trained to encourage new or infrequent users to start with cannabis products with a low potency and recommend that customers take note of the experience and effects cannabis has on their body before increasing dosage or consumption.

FFI also utilizes its Spark FastlaneTM “click-and-collect” service (developed by Hifyre) which allows for online cannabis ordering and pickup services for Sparks PerksTM members. The Spark Perks program offers its members benefits that are exclusive to Sparks Perks members and access to member-only events. The Spark Perks program currently has over 95,000 members.

FFI’s operations are arranged and its staff are trained to abide by the requirements of the Cannabis Act and the applicable provincial regulations including in respect to advertising, selling to minors, age verification of customers, transportation and storage of cannabis products and limits on purchases of cannabis.

FFI’s purchase of cannabis product inventory is determined by the applicable provincial regime. All cannabis products are purchased either directly or indirectly from Licensed Producers in accordance with the Cannabis Act and the applicable provincial regime. In the provinces of Alberta, Ontario and Manitoba and in the Yukon, all purchases of cannabis products are made through a provincial wholesaler (that acquires its cannabis products from Licensed Producers). In the province of Saskatchewan, no such intermediary exists and FFI engages directly with Licensed Producers.

Pricing for cannabis products purchased by FFI for sale in its cannabis retail stores in Alberta, Manitoba and the Yukon and by 272 Ontario and 267 Ontario in their respective cannabis retail stores in Ontario, is set by the provincial regulator.

The following table sets out FFI’s current retail operations across Canada:

| Province | | Directly Owned Licence(s) | | Stores in Operation1 | | Licences Pending |

| Alberta | | 37 | | 37 | | 62 |

| Saskatchewan | | 7 | | 7 | | 0 |

| Manitoba | | 1 | | 1 | | 0 |

| Yukon | | 1 | | 1 | | 0 |

| Ontario | | 2 | | 2 | | 83 |

| British Columbia | | 0 | | 0 | | 34 |

The Corporation is not substantially dependent on any individual retail cannabis licence or lease.

The Corporation believes that with 48 stores and the Corporation’s current cash position, the Corporation can maintain its current contractually committed spend and the spend required to run 48 stores and that it will be cash flow positive for over twelve months.

Focusing initially on its existing markets of Alberta, Saskatchewan, Manitoba, Ontario and the Yukon, the Corporation intends to enter British Columbia and other Canadian markets as regulations permit. The Corporation anticipates being able to grow both organically as well as through acquisition in the future.

The Corporation currently anticipates that as supply and licensing conditions improve and emergency orders impacting construction are lifted, it will be able to accomplish the following milestones across all addressable markets:

| Target Date | | Total Number of Stores |

| FY 2020 Q1 | | 48 |

| FY 2020 Q2 | | 52 |

| FY 2020 Q3 | | 72 |

| FY 2020 Q4 | | 78 |

| FY 2021 Q1 | | 88 |

| FY 2021 Q2 | | 98 |

| FY 2021 Q3 | | 108 |

| FY 2021 Q4 | | 118 |

1 The number of stores operating during the COVID-19 pandemic may vary as the Corporation continues to respond to the applicable legal requirements and guidelines from public health officials.

2 Reflects premises currently held in Alberta for development of licensed cannabis retail stores at various stages of development.

3 FFI has received its Operator licence and applied for Store Authorizations for eight retail locations in Ontario which are currently being reviewed by the AGCO.

4 FFI has applied for cannabis retail store licences in respect of two stores located in Vancouver, British Columbia and one store located in Kelowna, British Columbia, which are under review by the LCRB.

The Corporation is planning to have up to 78 retail stores in operation by the end of its fiscal 2020 year and expects to be able to achieve this target using its existing financial resources. This growth is anticipated in provinces where the Corporation currently has retail operations and is able to further expand its footprint. Growth is also planned in provinces that do or will permit the sale of recreational cannabis by independent retailers. The Corporation also requires the necessary real estate for locations and believes that it can achieve this with leases that the Corporation has already secured and the Corporation’s ability to secure additional leases where required. Furthermore, such growth is dependent upon the availability of product from Licensed Producers and the ability to secure licensing from the applicable regulatory authorities.

The Corporation anticipates that it will begin to generate positive cash flow in the second half of the fiscal 2020 year subject to any lasting economic or regulatory impact from the COVID-19 pandemic. However, to achieve the Corporation’s expansion plans beyond 78 stores, additional funding will be required to account for store capital buildout costs and the associated inventory and other start-up costs. The Corporation’s expansion plans are subject to additional financing, appropriate lease arrangements for each potential retail location and required approvals from the applicable regulatory authorities in each of the provinces (and municipalities) in which the Corporation plans to open retail cannabis locations. As well, certain provincial regulatory authorities have limited the number of retail cannabis licences available for issuance and certain provincial governments have temporarily prohibited construction due to the COVID-19 pandemic which may prohibit the Corporation from achieving its expansion goals. If the Corporation is not able to obtain adequate financing, enter into appropriate lease arrangements, complete construction and/or or obtain applicable regulatory approvals/licences to meet its expansion plans, the Corporation will scale back its expansion plans accordingly. There can be no assurance that additional debt or equity financing will be available (including funds from the exercise of any securities issued to Alimentation Couche-Tard - see “Strategic Investment”) to meet the Corporation’s requirements or, if available, on favorable terms, and there can be no assurance that the Corporation will be able to enter into appropriate lease arrangements or receive the applicable regulatory approvals to meet its expansion goals.

As the Corporation operates in the retail space, which would ordinarily result in a direct in-store face-to- face customer experience, the COVID-19 pandemic presents an unprecedented challenge for the Corporation and its operations as the Corporation is mindful of adhering to applicable laws and public health messaging regarding social distancing. On March 23, 2020, the provincial government of Ontario deemed cannabis retail stores “essential workplaces”. The Corporation has and continues to respond to the COVID-19 pandemic with the best interests of the Corporation’s customers, employees and communities in mind. As such and as of the date of this AIF, FFI has temporarily moved to serving customers exclusively in certain markets through its Spark FastlaneTM “click-and-collect” service in efforts to ensure the health and safety of the Corporation’s customers and employees

Distribution Platform

The Corporation’s indirect wholly-owned subsidiary, Open Fields purchases cannabis products directly from Licensed Producers that are authorized to sell into Saskatchewan, and distributes such products to FFI’s licensed corporate-owned and branded retail stores as well as third-party independent licensed retailers in Saskatchewan. Open Fields also purchases cannabis accessories and related ancillary products from Canadian-based and global suppliers and distributes them to FFI’s licensed corporate- owned and branded retail stores as well as third-party independent retailers in Canada. Open Fields acquired a property on August 8, 2018 and completed interior renovations required to utilize the premises as a cannabis wholesale business. Open Fields received a cannabis wholesale permit from the Saskatchewan Liquor and Gaming Authority (“SLGA”) on November 22, 2018, and commenced operations selling wholesale cannabis products and accessories.

Open Fields holds a wholesale distribution licence that authorizes it to purchase finished cannabis products from federally licensed producers that are authorized by the SLGA for re-sale only to wholesalers and retailers that are licensed by the SLGA. As such, Open Fields does not sell cannabis products in any provincial jurisdiction that prohibits vertical integration. Any agreements entered into with licensed producers include provisions exempting application or enforcement contrary to an applicable provincial regulatory regime.

Open Fields provides the Corporation with additional revenue and margin through the wholesale of regulated cannabis products and accessories in Saskatchewan as well as the fulfilment of e-commerce sales across Canada of cannabis accessories and related ancillary products.

Pricing for cannabis products purchased by Open Fields for re-sale through FFI stores and independent retailers in Saskatchewan is determined through negotiation with provincially authorized Licensed Producers, and pricing for cannabis accessories purchased by Open Fields for re-sale through FFI stores and independent retailers generally is determined through negotiation with manufacturers, distributors and wholesalers.

Hifyre™ Digital Retail and Analytics Platform

Hifyre (an indirect wholly-owned subsidiary of the Corporation) has developed and deployed a proprietary, omni-channel, data-driven system to support the Corporation’s advanced retail operations. The first generation of the platform was successfully launched for legalization on October 17, 2018, and the latest generation of the platform was successfully commercialized in April 2019. By capturing user behaviour data and applying predictive analytics, Hifyre is able to deliver a personalized customer experience. This allows customers to not only find the products they want but helps retailers suggest items the customer may enjoy.

The Corporation expects the Hifyre™ Digital Retail and Analytics Platform to provide it with a competitive advantage at retail and create opportunities for additional high-margin revenue streams and a platform for growth into international markets. Hifyre also licenses certain of the data analytics components of the Hifyre™ Digital Retail and Analytics Platform to allow its customers to better understand customer preferences and behavior and market dynamics.

Real Property

All of FFI’s licensed and operating cannabis retail stores are operated from leased premises. 272 Ontario operates a cannabis retail store from premises owned by FFI. 267 Ontario operates a cannabis retail store from leased premises. The typical lease term is for a period of five (5) years, with at least one (1) option for subsequent renewal for a further five (5) years.

FFI has also leased a property in Edmonton for a five (5) year term which is currently being used as FFI’s corporate headquarters. FFI also leases one (1) property in Toronto pursuant to a short-term lease which is currently undergoing renovations and will be used as corporate offices and training spaces. FFI’s other owned and leased properties are not being used by FFI for its active operations. Properties under development, held for development, or being sub-leased are not included in the above.

As of the date of this AIF, all of the above noted leases remain in effect and are in good standing.

In addition to the above noted leases, FFI has entered into binding offers to lease and/or lease agreements with respect to properties at which it intends to pursue additional cannabis retail store licences, subject to receipt of applicable municipal and provincial permits and licences. FFI’s typical binding offers to lease are conditional on obtaining all required municipal and provincial permits and licences to operate a cannabis retail store or, in the case of unconditional binding offers to lease or lease agreements, include an early termination right in the event that required municipal or provincial permits or licences cannot be obtained within a reasonable time.

FFI owns a property in Edmonton, Alberta which the Corporation may sell or use for future operations (pending receipt of applicable municipal and provincial permits and licences). Furthermore, Open Fields purchased a surface condominium parcel in Saskatchewan in 2018 in connection with its wholesale cannabis operations as further set out herein. FFI also owns a property in Ottawa, Ontario – this property is being leased to 272 Ontario.

The design of FFI’s cannabis retail stores is intended to re-define traditional expressions of cannabis culture prior to federal legalization through the use of clean, contemporary styles, eye catching visual merchandising and elegant showcases. Community tables, interactive displays and education boards all support in the delivery of an experience that resonates with FFI’s broad array of adult-use customers.

Proprietary Protection

The Corporation’s business plan focuses on associating its brand with expertly-curated product selections and an education-driven customer experience. In efforts to protect and expand its brand, FFI has applied for Canadian trademark protection for:

| | (a) | the word mark FIRE & FLOWER for use in connection with FFI’s business; |

| | (b) | the word mark HIFYRE for use in connection with Hifyre’s business; |

| | (c) | the word marks SPARK PERKS, SPARK FASTLANE, SPARK LIFESTYLE and SPARK REWARDS for use in connection with FFI’s business; |

| | (d) | the words REVITY and REVITY CBD for use in connection with FFI’s business; and |

| | (e) | each of the following design marks for use in connection with the business of the Corporation: |

The Corporation has also acquired the pending Canadian application for registration of the word “SPARK”.

The Corporation has further applied for trademark protection in relation to FFI’s business internationally with respect to the following trademarks and jurisdictions:

| | (a) | SPARK PERKS word mark in the United States, Mexico, Australia, Sweden, Denmark, Norway, Italy, Portugal, Spain, France, Germany, the Benelux countries (Belgium, the Netherlands and Luxemburg), Poland and the United Kingdom; |

| | | |

| | (b) | SPARK REWARDS word mark in the United States, Mexico, Australia, Sweden, Denmark, Norway, Italy, Portugal, Spain, France, Germany, the Benelux countries (Belgium, the Netherlands and Luxemburg), Poland and the United Kingdom; |

| | | |

| | (c) | SPARK LIFESTYLE word mark in the United States, Mexico, Australia, Sweden, Denmark, Norway, Italy, Portugal, Spain, France, Germany, the Benelux countries (Belgium, the Netherlands and Luxemburg), Poland and the United Kingdom; |

| | | |

| | (d) | SPARK FASTLANE word mark in the United States, Mexico, Australia, Sweden, Denmark, Norway, Italy, Portugal, Spain, France, Germany, the Benelux countries (Belgium, the Netherlands and Luxemburg), Poland, the United Kingdom and New Zealand; |

| | | |

| | (e) | FIRE & FLOWER word mark in the United States, Mexico, Australia, Sweden, Denmark, Norway, Italy, Portugal, Spain, France, Germany, the Benelux countries (Belgium, the Netherlands and Luxemburg), Poland, the United Kingdom and New Zealand; |

The Corporation is also pursuing additional intellectual property registrations to further protect its proprietary training materials and in-store collateral, and is analyzing its unregistered intellectual property to determine whether there are further opportunities for protection. The Corporation will periodically review its options with respect to the protection of its intellectual property.

Principal Products and Services

As a retailer, FFI sells cannabis products, cannabis accessories and other products permitted to be sold in accordance with applicable provincial regimes. In general, FFI is only authorized to sell cannabis products purchased from an authorized provincial distributor and cannabis accessories and other items prescribed by the applicable provincial regulator. Cannabis accessories may include rolling papers or wraps, holders, pipes, water pipes, bongs and vaporizers, and other things represented to be used in the consumption of cannabis.

Specialized Knowledge and Skills

The Corporation’s management team brings together strong complementary skills, expertise and experience in various aspects of the cannabis and retail industries. The Corporation is led by President & Chief Executive Officer, Trevor Fencott; Executive Chair, Harvey Shapiro; Chief Financial Officer & Executive Vice-President Operations, Nadia Vattovaz; Senior Vice-President Real Estate, Construction & Loss Prevention, Mike Vioncek; Corporate Secretary, Matthew Anderson; and President of Hifyre, Matthew Hollingshead.

Employees

As of February 1, 2020, the Corporation and its subsidiaries have an aggregate of 389 full-time employees and 106 part-time employees.

Foreign Operations

The Corporation does not currently conduct any foreign operations. Hifyre has entered into a strategic licence agreement (the “Licence Agreement”) with Retail Innovation Labs Inc. dba Cova Software (“Cova”) dated effective as of January 16, 2020 pursuant to which Hifyre will license to Cova certain intellectual property for inclusion in Cova technology to be provided to Cova customers in Canada and the United States. The Licence Agreement, including potential revenues derived from foreign sources, was cleared by the TSX prior to the parties entering into the Licence Agreement.

The Corporation does not currently conduct any foreign operations. The Corporation will only conduct business in jurisdictions outside of Canada where such operations are legally permissible in accordance with all of the laws of such foreign jurisdiction, the laws of Canada and the policies of the exchange on which the Corporation’s securities are then trading. The legal and regulatory requirements in the foreign countries in which the Corporation may operate in the future with respect to the sale of recreational cannabis, as well as local business culture and practices are different from those in Canada. Prior to commencing operations in a new country, the Corporation, in consultation with its local legal counsel, consultants and partners, will conduct legal and commercial due diligence in order to ensure that it and its officers and directors gain a sufficient understanding of the legal, political and commercial framework and specific risks associated with operating in such jurisdiction. Where possible, the Corporation will seek to work with respected and experienced local partners who can help the Corporation understand and navigate the local business and operating environment, language and cultural differences. In consultation with its advisors, the Corporation will take steps it deems appropriate in light of the level of activity and investment it expects to have in each country to ensure management of risks and the implementation of necessary internal controls.

Competition

The private retail cannabis industry is very competitive. In anticipation of the Cannabis Act coming into effect on October 17, 2018, there were a plethora of parties seeking licences to operate retail cannabis stores. A significant portion of these applicants (successful or otherwise) were single-store applicants.

The Corporation expects its most significant competition will be from other entities seeking multiple licences in multiple jurisdictions, which may have greater resources or longer operating histories. The Corporation believes that its competition can be broadly grouped into four categories: (a) large vertically integrated competitors; (b) competitors with existing retail operations; (c) government retailers; and (d) the illicit market.

Vertically Integrated Competitors

These competitors are generally also Licensed Producers that are able to produce the products sold at retail stores and may have significant scale and international operations. These competitors are generally well capitalized and have an established operating history in Canada. At the time of this AIF, they are able to compete directly with FFI in the Alberta, Saskatchewan and Manitoba markets. However, they are subject to regulatory operating restrictions in the major markets of British Columbia and Ontario that are likely to significantly limit their ability to compete directly with the Corporation in those jurisdictions. Examples of vertically integrated competitors include, but are not limited to, Canopy Growth Corp. (through its “Tweed” and “Tokyo Smoke” brands) and Delta 9 Cannabis Inc. (through its “Delta 9 Cannabis” brand).

Existing Retailers

These competitors generally have an existing business with some kind of retail footprint and are potentially entering the private retail cannabis market as a growth opportunity. These competitors may also be well capitalized with an established retail operating history in Canada. However, as they are also operating other non-cannabis businesses, the Corporation believes that its sole focus on cannabis will allow it to continue to effectively compete with such entities. Examples of competitors with an existing retail footprint include, but are not limited to: Alcanna Inc. (under its “Nova Cannabis” brand) that principally operates a large number of private liquor stores.

Government Competition

The Corporation also faces competition from government wholesalers that sell directly to consumers online such as the Ontario Cannabis Store in Ontario and the AGLC in Alberta. In British Columbia, the Corporation faces additional direct competition from the government in the form of government-owned retail stores.

Illicit Market

At the time of this AIF, provincial roll-out of private retail has been delayed in many respects. As a result, the Corporation faces significant competition from persons continuing to operate in the illicit market. Management believes that until there is sufficient private retail coverage, methods of engaging potential customers and types of products legally available to consumers, competition from the illicit market will remain significant. Additionally, management believes that the current COVID-19 pandemic has provided dramatically increased commercial opportunities for the illegal and unregulated market.

In light of the competition, cannabis retailers are attempting to differentiate their product offerings through perceived quality, strain variety and price. Retailers are using a variety of communication strategies to draw attention to these differentiators, including through social media, experiential marketing and traditional print and digital advertising.

The Corporation believes that the experience of management in both the retail and cannabis spaces has and will continue to be a competitive advantage in navigating the highly regulated marketplace, and the early-mover advantage of early licensing will generate a strong network effect in the retail cannabis community. The Corporation will continue to accommodate the media, where productive and in compliance with applicable law, and will facilitate strategic compliant communication with current and prospective customers across all available digital and physical channels.

RISK FACTORS

The following are the specific and general risks that could affect the Corporation and its business. Additional risks and uncertainties not presently known to the Corporation or that the Corporation does not currently anticipate will be material may impair the Corporation’s business operations and its operating results, and as a result could materially impact its business, results of operations, prospects and financial condition. Readers should additionally refer to the risk factors set out in the Corporation’s most recent annual management discussion and analysis, which, together with the risk factors below, do not necessarily constitute an exhaustive list.

Licences and Permits

The operations of the Corporation will require licences and permits from various Canadian or foreign, federal, provincial, state, regional, local or municipal government, any agency, administration, board, bureau, commission, department, service, or other instrumentality or political subdivision of the foregoing, and any person with jurisdiction exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government or monetary policy, including any court or arbitration authority (collectively, “Governmental Authorities”). The Corporation currently has all permits and licences that it believes are necessary to carry on its current business operation with the intention of obtaining additional licences and permits for additional operations. The Corporation will require additional licences or permits in the future to achieve its intended operations and there can be no assurance that the Corporation will be able to obtain all such additional licences and permits. In addition, there can be no assurance that any existing licence or permit will be renewed when required or that such existing licences and permits will not be revoked.

The Corporation may be required to obtain or renew further government permits and licences for its operations. Obtaining, amending or renewing the necessary governmental permits and licences can be a time-consuming process, potentially involving numerous regulatory agencies, and involving public hearings and costly undertakings on the Corporation’s part. The duration and success of the Corporation’s efforts to obtain, amend and renew permits and licences are contingent upon many variables not within its control, including the interpretation of applicable requirements implemented by the relevant permitting or licensing authority. The Corporation may not be able to obtain, amend or renew permits or licences that are necessary to its operations. Any unexpected delays or costs associated with the permitting and licensing process could impede the ongoing or proposed operations of the Corporation. To the extent necessary permits or licences are not obtained, amended or renewed, or are subsequently suspended or revoked, the Corporation may be curtailed or prohibited from proceeding with its ongoing operations or planned development and commercialization activities. Such curtailment or prohibition may result in a material adverse effect which means, with respect to any party, any change, event, effect, occurrence or state of facts that has, or could reasonably be expected to constitute a material adverse change in respect of or to have an effect that is materially adverse to the business, assets, liabilities (including contingent liabilities), conditions (financial or otherwise), prospects or results of operations of the party and its subsidiaries, as applicable, taken as a whole (“Material Adverse Effect”).

The Corporation will be dependent on its suppliers’ licences, or ability to obtain additional licences, which are subject to ongoing compliance and reporting requirements. Failure to comply with the requirements of these licences or any failure to obtain or maintain such licences could have a material adverse impact on the business, financial condition and operating results of the Corporation. There can be no guarantee that Health Canada and/or provincial regulators will issue, extend or renew these licences or, if issued, extended or renewed, that they will be issued, extended or renewed on terms that are favourable to the Corporation’s suppliers and the Corporation. Should Health Canada and/or provincial regulators not issue, extend or renew the licences or should they issue or renew the licences on terms that are less favourable to such supplier and the Corporation than anticipated, the business, financial condition and results of the operations of the Corporation could be materially adversely affected.

Changes in Laws, Regulations and Guidelines

The Cannabis Act became effective on October 17, 2018. However, uncertainty remains with respect to the implementation of the Cannabis Act, federal regulations thereunder as well as the various provincial and territorial regimes governing the distribution and sale of cannabis for adult-use purposes. The impact of these new laws, regulations and guidelines on the business of the Corporation, including increased costs of compliance and other potential risks cannot be predicted, and accordingly, the Corporation may experience adverse effects.

The Canadian federal regulatory regime requires plain packaging in order to prohibit testimonials, lifestyle branding and packaging that is appealing to youth. The restriction on the use of logos and brand names on cannabis products could have a material adverse impact on the Corporation’s business, financial condition and results of operation.

Provincial governments in Canada have also implemented varying regulatory regimes for the distribution and sale of cannabis for adult-use purposes. The provincial regimes have been subject to a number of changes since their implementation and it is expected that additional changes will occur in the near, medium and long term. It cannot be known what changes in provincial regulation regarding the distribution and sale of cannabis for adult-use purposes will or will not occur. There is no guarantee that provincial legislation will be enacted according to the terms announced by such provinces, or at all, or that any such legislation, if enacted, will remain in any anticipated form or create the growth opportunities that are currently anticipated by the Corporation.

Compliance with Laws

The Corporation’s and many of its suppliers’ operations are subject to various laws, regulations and guidelines. The Corporation intends to comply with all relevant laws, regulations and guidelines. However, there is a risk that the Corporation’s interpretation of laws, regulations and guidelines, including, but not limited to the Controlled Drugs and Substances Act, the Cannabis Act, the regulations thereunder (the “Cannabis Regulations”), the various provincial regimes governing the sale of adult-use recreational cannabis (the “Provincial Regimes”) and applicable stock exchange rules and regulations may differ from those of others, and the Corporation’s and its suppliers’ operations may not be in compliance with such laws, regulations and guidelines. In addition, achievement of the Corporation’s business objectives is contingent, in part, upon compliance with regulatory requirements enacted by Governmental Authorities and, where necessary, obtaining regulatory approvals. The impact of regulatory compliance regimes, any delays in obtaining, or failure to obtain regulatory approvals required by the Corporation may significantly delay or impact the development and operations of the Corporation’s business, and could have a Material Adverse Effect on the business, results of operations and financial condition of the Corporation. Any potential non-compliance could cause the business, financial condition and results of the operations of the Corporation to be adversely affected. Furthermore, any amendment to or replacement of the Cannabis Regulations, the Cannabis Act, the Provincial Regimes or other applicable rules and regulations governing the activities of the Corporation and its suppliers may cause adverse effects to the Corporation’s operations. The risks to the business of the Corporation or its suppliers associated with the decision to amend or replace the Cannabis Regulations, the Cannabis Act, any Provincial Regime and subsequent regulatory changes could reduce the potential customers of the Corporation and could materially and adversely affect the business, financial condition and results of operations of the Corporation.

It is unclear how certain regulatory bodies will interpret commercial agreements with respect to licensed retail cannabis operations. The Corporation intends to enter into commercial agreements in compliance with all applicable law, however, provincial regulators are continuing to provide guidance on how cannabis retailers should interpret certain Provincial Regimes. In the event provincial regulators indicate that they shall interpret certain Provincial Regimes in a manner inconsistent with that of cannabis retailers, including, but not limited to the Corporation, this could result in the Corporation being unable to enter into certain commercial agreements or provide certain services which could have a Material Adverse Effect on the business, results or operations and financial condition of the Corporation.

The Corporation will incur ongoing costs and obligations related to regulatory compliance. Failure to comply with applicable laws and regulations may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures or remedial actions. Parties may be liable for civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permitting requirements, or more stringent application of existing laws or regulations may have a material adverse impact on the Corporation or its suppliers, resulting in increased capital expenditures or production costs, reduced levels of cannabis production or abandonment or delays in the development of facilities which could have a Material Adverse Effect on the business, results of operations and financial condition of the Corporation.

The introduction of new tax laws, regulations or rules, or changes to, or differing interpretation of, or application of existing tax laws, regulations or rules could result in an increase in the Corporation’s taxes, or other governmental charges, duties or impositions. No assurance can be given that new tax laws, regulations or rules will not be enacted or that existing tax laws, regulations or rules will not be changed, interpreted or applied in a manner which could result in the Corporation’s profits being subject to additional taxation or which could otherwise have a Material Adverse Effect on the Corporation.

Due to the nature of the Corporation’s operations, various legal and tax matters may be outstanding from time to time. If the Corporation is unable to resolve any of these matters favourably, there may be a Material Adverse Effect on the Corporation. There are also risks to the business of the Corporation represented by court rulings or legislative changes.

Risks Relating to its Suppliers

In addition to the risk factors that may impact the business, operations and financial condition of the Corporation and its suppliers noted above, the risk factors contemplated herein may directly impact the business, operations and financial condition of the Corporation’s suppliers and, accordingly, may have an indirect Material Adverse Effect on the Corporation.

Cannabis retailers are dependent on the supply of cannabis products from Licensed Producers. There can be no assurance that there will be a sufficient supply of cannabis available to the Corporation to purchase and to operate its business or satisfy demand. Licensed Producers’ growing operations are dependent on a number of key inputs and their related costs, including raw materials and supplies. Any significant interruption or negative change in the availability or economics of the supply chain for key inputs could materially impact Licensed Producers and, in turn, the Corporation’s financial condition and operating results. Any inability of Licensed Producers to secure required supplies and services or to do so on appropriate terms could have a materially adverse impact on the Corporation’s business, financial condition and operating results.

The facilities of the Corporation’s suppliers could be subject to adverse changes or developments, including but not limited to a breach of security, which could have a Material Adverse Effect on the Corporation’s business, financial condition and prospects. Any breach of the security measures and other facility requirements, including any failure to comply with recommendations or requirements arising from inspections by Health Canada or other legal or regulatory requirements could also have an impact on the Corporation’s suppliers’ ability to continue operating under their licences or the prospect of renewing their licences or on the Corporation’s ability or willingness to sell product sourced from a supplier, which may have an adverse effect on the Corporation.

Furthermore, the Corporation’s suppliers may experience operational slowdowns or other barriers to operations as a result of protective measures associated with the COVID-19 pandemic and which may affect the ability of the Corporation to obtain and sell product sourced from a supplier, which may have an adverse effect on the Corporation.

Product Recalls

Manufacturers and distributors of products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labeling disclosure. If any of the products produced by the Corporation’s suppliers are recalled due to an alleged product defect or for any other reason, the Corporation may be required to incur unexpected expenses relating to the recall and potentially any legal proceedings that might arise in connection with the recall. In addition, a product recall may require significant management attention. There can be no assurance that any quality, potency or contamination problems will be detected in time to avoid unforeseen product recalls, regulatory action or lawsuits. Additionally, if one of the products produced by the Corporation’s suppliers were subject to recall, the image of that product, the supplier and the Corporation could be harmed. A recall for any of the foregoing reasons could lead to decreased demand and could have a Material Adverse Effect on the results of operations and financial condition of the Corporation. Additionally, product recalls may lead to increased scrutiny of the operations by Health Canada or other regulatory agencies, requiring further management attention and potential legal fees and other expenses which may also have an adverse effect on the Corporation.

Product Liability

As a seller of products designed to be ingested by humans, the Corporation will face an inherent risk of exposure to product liability claims, regulatory action and litigation if the products it sells are alleged to have caused significant loss or injury. In addition, the manufacture and sale of cannabis products involve the risk of injury to consumers due to tampering by unauthorized third parties or product contamination. Previously unknown adverse reactions resulting from human consumption of cannabis products alone or in combination with other medications or substances could occur. The Corporation may be subject to various product liability claims, including that the products they sell caused injury or illness, include inadequate instructions for use or include inadequate warnings concerning possible side effects or interactions with other substances.

A product liability claim or regulatory action against the Corporation could result in increased costs to the Corporation, could adversely affect the Corporation’s reputation with its clients and consumers generally and could have a Material Adverse Effect on the Corporation’s results of operations and financial condition of the Corporation. There can be no assurances that the Corporation or the Corporation’s suppliers will be able to obtain or maintain product liability insurance on acceptable terms or with adequate coverage against potential liabilities. Such insurance is expensive and may not be available in the future on acceptable terms, or at all. The inability to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims could prevent or inhibit the commercialization of products.

U.S. Operations

On October 16, 2017, the TSX and TSXV provided clarity to TSX and TSXV-listed issuers with business activities in the cannabis sector. The TSX and TSXV noted that issuers with ongoing business activities that violate U.S. federal law regarding cannabis are not in compliance with the TSX/TSXV requirements. These business activities may include: (a) direct or indirect ownership of, or investment in, entities engaging in activities related to the cultivation, distribution or possession of cannabis in the U.S.; (b) commercial interests or arrangements with such entities; (c) providing services or products specifically targeted to such entities; or (d) commercial interests or arrangements with entities engaging in providing services or products to U.S. cannabis companies. The TSX and TSXV reminded issuers that, among other things, should the TSX or TSXV, as applicable, find that a listed issuer is engaging in activities contrary to their respective requirements, the TSX or TSXV, as applicable, has the discretion to initiate a delisting review. Failure of the Corporation to comply with the applicable exchange requirements could have an adverse effect on the business of the Corporation.

On January 4, 2018, then U.S. Attorney General Jeff Sessions issued a memorandum to U.S. district attorneys which rescinded previous guidance from the U.S. Department of Justice specific to cannabis enforcement in the U.S., including the August 2013 memorandum authored by then Deputy Attorney General James Cole (the “Cole Memorandum”) indicating that the U.S. Department of Justice would not prioritize the prosecution of cannabis-related violations of U.S. federal law in jurisdictions that had enacted laws legalizing cannabis in some form and that had also implemented strong and effective regulatory and enforcement systems. With the Cole Memorandum rescinded, U.S. federal prosecutors can exercise their discretion in determining whether to prosecute cannabis-related violations of U.S. federal law.

Additional uncertainty arose on November 7, 2018, when Attorney General Jeff Sessions resigned at the request of President Trump. It is unclear what impact, if any, Mr. Sessions’ resignation will have on U.S. federal government enforcement policy on cannabis. On February 14, 2019, William Barr assumed the office as Attorney General. Mr. Barr is a former Attorney General under George H.W. Bush, with an anti- drug stance during his tenure. During his Senate confirmation hearing, Mr. Barr stated that he disagrees with efforts by States to legalize cannabis, but will not go after cannabis companies in states that legalized it under Obama administration policies. He stated further that he would not upset settled expectations that have arisen as a result of the Cole Memorandum. Mr. Barr supported Mr. Sessions while Mr. Sessions ran the Department of Justice and Mr. Barr may take a similar approach to cannabis policy.

Additionally, the Rohrabacher-Farr Amendment (the “Amendment”) has been adopted by the Congress in successive budgets since 2015. The Amendment prohibits the U.S. Department of Justice from spending funds appropriated by Congress to enforce the tenets of the Controlled Substances Act against the medical cannabis industry in states which have legalized such activity. This Amendment has historically been passed as an amendment to omnibus appropriations bills, which by their nature expire at the end of a fiscal year or other defined term. The Amendment was included in the Consolidated Appropriations Act of 2019, which was signed by President Trump on February 14, 2019 and funds the departments of the federal government through the fiscal year ending September 30, 2019 and subsequently renewed on December 20, 2019 through the signing of the FY 2020 omnibus spending bill, effective through September 30, 2020.

The Corporation does not engage in any U.S. cannabis-related activities as defined in Canadian Securities Administrators Staff Notice 51-352 (Revised). Although focused on Canada, the Corporation will only conduct business in jurisdictions outside of Canada where such operations are legally permissible in accordance with all of the laws of the foreign jurisdiction, the laws of Canada and the Corporation’s obligations pursuant to the policies of the TSXV.

Cannabis Prices

The price of the Common Shares and the Corporation’s financial results may be significantly and adversely affected by a decline or increase in the price of cannabis. There is currently no established market price for cannabis, and the price of cannabis is affected by numerous factors beyond the Corporation’s control. Any price decline may have a Material Adverse Effect on the Corporation.

The profitability of the Corporation may be directly related to the price of cannabis. The Corporation’s operating income may be sensitive to changes in the price of cannabis and the overall condition of the cannabis industry.

Epidemics/Pandemics

The Corporation faces risks related to health epidemics, pandemics and other outbreaks of communicable diseases, which could significantly disrupt its operations and may materially and adversely affect its business and financial conditions. The Corporation’s business could be adversely impacted by the effects of the COVID-19 pandemic or other epidemics and/or pandemics. In December 2019, COVID- 19 emerged in China and the virus has now spread to several other countries, including Canada, and infections have been reported globally. On March 11, 2020, the World Health Organization declared the outbreak of COVID-19 to be a pandemic. The extent to which COVID-19 impacts the Corporation’s business, including its operations and the market for its securities, will depend on future developments, which are highly uncertain and cannot be predicted at this time, and include the duration, severity and scope of the pandemic and the actions taken to contain or treat the COVID-19 pandemic (including recommendations from public health officials). In particular, the continued spread of COVID-19 globally could materially and adversely impact the Corporation’s business including without limitation, store closures or reduced operational hours or service methods, employee health, workforce productivity, reduced access to supply, increased insurance premiums, limitations on travel, the availability of experts and personnel and other factors that will depend on future developments beyond the Corporation’s control, which may have a Material Adverse Effect on its business, financial condition and results of operations. There can be no assurance that the Corporation’s personnel will not be impacted by these pandemic diseases and ultimately see its workforce productivity reduced or incur increased costs as a result of these health risks. In addition, the COVID-19 pandemic represents a widespread global health crisis that could adversely affect global economies and financial markets resulting in an economic downturn that could have an adverse effect on the Corporation.

History of Negative Cash Flow

The Corporation has a history of negative cash flow from operating activities. To the extent that the Corporation has negative cash flow in future periods, the Corporation may need to allocate a portion of the net proceeds received from future offerings of the Corporation’s securities or other financings to fund such negative cash flow. There can be no assurance that additional capital or other types of financing will be available when needed or that these financings will be on terms at least as favourable to the Corporation as those previously obtained, or available to the Corporation or at all.

Being a Public Company May Increase Price Volatility

The Corporation’s status as a reporting issuer may increase price volatility due to various factors, including the ability to buy or sell its shares, different market conditions in different capital markets and different trading volumes. In addition, low trading volume may increase the price volatility of the Corporation’s shares. The increased price volatility could adversely affect the results of operations or financial condition.

The Requirements of Being a Public Corporation May Strain the Corporation’s Resources

As a reporting issuer, the Corporation, and its business activities, will be subject to the reporting requirements of applicable securities legislation of the jurisdiction in which it is a reporting issuer, the listing requirements of the exchange on which it would be listed and other applicable securities rules and regulations. Compliance with those rules and regulations will increase the Corporation’s legal and financial costs making some activities more difficult, time consuming or costly and increase demand on its systems and resources.

Risks Inherent in Strategic Alliances

The Corporation may enter into further strategic alliances with third parties that it believes will complement or augment its existing business. The Corporation’s ability to complete strategic alliances is dependent upon, and may be limited by, the availability of suitable candidates and capital. In addition, strategic alliances could present unforeseen integration obstacles or costs, may not enhance the Corporation’s business and may involve risks that could adversely affect the Corporation, including significant amounts of management time that may be diverted from operations to pursue and complete such transactions or maintain such strategic alliances. Future strategic alliances could result in the incurrence of additional debt, costs and contingent liabilities, and there can be no assurance that future strategic alliances will achieve the expected benefits to the Corporation’s business or that the Corporation will be able to consummate future strategic alliances on satisfactory terms, or at all.

Competition

The introduction of an adult-use model for cannabis production and distribution may impact the medical and/or adult-use cannabis market. The impact may be negative for the Corporation and could result in increased levels of competition in the adult-use cannabis market and/or the entry of new competitors in the overall cannabis market in which the Corporation operates.