Exhibit 99.42

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF

SHAREHOLDERS TO BE HELD ON JUNE 15, 2020

AND

MANAGEMENT INFORMATION CIRCULAR

MAY 11, 2020

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual general and special meeting (the “Meeting”) of the holders (the “Shareholders”) of common shares (the “Common Shares”) of Fire & Flower Holdings Corp. (the “Corporation”) will be held on Monday, June 15, 2020 at 2:00 p.m. (Toronto time). This year, to deal with the public health impact of COVID-19, the Corporation is conducting an online only shareholders’ meeting.

Registered Shareholders (as defined in the accompanying information circular (the “Information Circular”) under the heading “Voting at the Meeting”) and duly appointed proxyholders can attend the meeting online at https://web.lumiagm.com/266364910 where they can participate, vote, or submit questions during the meeting’s live webcast.

The Meeting is being held for the following purposes:

| (a) | to receive the audited consolidated financial statements of the Corporation as at February 1, 2020 and for the period from February 3, 2019 to February 1, 2020 together with the auditors’ report thereon; |

| (b) | to fix the number of directors of the Corporation to be elected at the Meeting at seven (7); |

| (c) | to elect the directors of the Corporation for the ensuing year; |

| (d) | to reappoint PricewaterhouseCoopers LLP as the auditors of the Corporation for the ensuing year and to authorize the board of directors of the Corporation (the “Board”) to fix their remuneration and terms of engagement; |

| (e) | to consider, and if thought advisable, to pass, with or without amendment, an ordinary resolution authorizing and approving, the proposed issuance of 8,200 8.0% $1,000 principal amount secured convertible debentures of the Corporation upon the conversion of 8,200 subscription receipts of the Corporation; |

| (f) | to consider, and if thought advisable, to pass, with or without amendment, an ordinary resolution authorizing and approving, the proposed issuance of up to 5,650,000 common shares in satisfaction of certain interest payable on up to 28,000 8.0% $1,000 principal amount secured convertible debentures of the Corporation; and |

| (g) | to transact such further or other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. |

The Information Circular provides additional information relating to each of the matters to be addressed at the Meeting. Shareholders are directed to read the Information Circular carefully and in full to evaluate the matters to be considered at the Meeting.

The record date for the determination of shareholders of the Corporation entitled to receive notice of and to vote at the Meeting or any adjournment(s) or postponement(s) thereof is May 11, 2020 (the “Record Date”). Shareholders of the Corporation whose names have been entered in the register of shareholders of the Corporation at the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting or any adjournment(s) or postponement(s) thereof.

If you are a Registered Shareholder and are unable to attend the Meeting or any adjournment(s) or postponement(s) thereof, please date, sign and return the accompanying form of proxy (the “Proxy”) for use at the Meeting or any adjournment(s) or postponement(s) thereof in accordance with the instructions set forth in the Proxy and Information Circular.

If you are a Non-Registered Beneficial Shareholder, a voting information form (also known as a VIF), instead of a form of proxy, may be enclosed. You must follow the instructions provided by your intermediary in order to vote your Common Shares. Non-registered beneficial Shareholders who have not duly appointed themselves as proxyholders will be able to attend the Meeting virtually as guests, but guests will not be able to vote at the Meeting.

DATED at Toronto, Ontario this 11th day of May, 2020.

| | BY ORDER OF THE BOARD |

| | |

| | (signed) “Trevor Fencott” |

| | President, Chief Executive Officer and Director |

MANAGEMENT INFORMATION CIRCULAR

Unless otherwise stated, the information in this management information circular (the “Information Circular”) is as of May 11, 2020.

This Information Circular is furnished in connection with the solicitation of proxies by and on behalf of management of Fire & Flower Holdings Corp. (the “Corporation”) for use at the annual general and special meeting (the “Meeting”) of the shareholders of the Corporation (the “Shareholders”) to be held virtually at https://web.lumiagm.com/266364910 on Monday, June 15, 2020, at 2:00 p.m. (Toronto time) or any adjournment(s) or postponement(s) thereof for the purposes set forth in the accompanying notice of meeting (the “Notice”).

This year, to deal with the public health impact of COVID-19, the Corporation will hold the Meeting in a virtual-only format, which will be conducted via live audiocast.

GENERAL PROXY INFORMATION

Solicitation of Proxies

Solicitation of proxies for the Meeting will be primarily by mail, the cost of which will be borne by the Corporation. Proxies may also be solicited personally by employees of the Corporation at nominal cost to the Corporation. In some instances, the Corporation has distributed copies of the Notice, the Information Circular, and the accompanying form of proxy (the “Proxy”, and collectively with the Notice and Information Circular, the “Documents”) to clearing agencies, securities dealers, banks and trust companies, or their nominees (collectively “Intermediaries”, and each an “Intermediary”) for onward distribution to Shareholders whose common shares in the capital of the Corporation (the “Common Shares”) are held by or in the custody of those Intermediaries (“Non-registered Shareholders”). The Intermediaries are required to forward the Documents to Non-registered Shareholders.

Solicitation of proxies from Non-registered Shareholders will be carried out by Intermediaries, or by the Corporation if the names and addresses of Non-registered Shareholders are provided by the Intermediaries.

Voting at the Meeting

A Registered Shareholder (as defined below), or a Non-registered Shareholder who has appointed themselves or a third party proxyholder to represent him, her or it at the Meeting, will appear on a list of Shareholders prepared by Computershare Investor Services Inc. (“Computershare” or “Computershare Investor Services Inc.”). Each Registered Shareholder or proxyholder will be required to enter the control number or username provided by Computershare at https://web.lumiagm.com/266364910 prior to the start of the Meeting to have his, her or its Common Shares voted at the Meeting. In order to vote, Non-registered Shareholders who appoint themselves as a proxyholder MUST register with Computershare at http://www.computershare.com/FireFlower after submitting their voting instruction form in order to receive a username (please see the information under “Appointment of Proxyholders” below for details).

Registered Shareholders and duly appointed proxyholders can attend the Meeting online by going to https://web.lumiagm.com/266364910.

Registered Shareholders and duly appointed proxyholders can participate in the Meeting by clicking “I have a login” and entering a username and password before the start of the Meeting.

| ● | Registered Shareholders – The 15-digit control number located on the Proxy or in the email notification received by such Shareholder is the username and the password is “fireflower2020”. |

| ● | Duly appointed proxyholders – Computershare will provide the proxyholder with a username after the voting deadline has passed. The password to the Meeting is “fireflower2020”. |

Voting at the Meeting will only be available for Registered Shareholders and duly appointed proxyholders. Non-registered Shareholders who have not appointed themselves may attend the Meeting by clicking “I am a guest” and completing the online form.

Shareholders who wish to appoint a third party proxyholder to represent them at the Meeting must submit their Proxy or voting instruction form (as applicable) prior to registering their proxyholder. Registering the proxyholder is an additional step once a Shareholder has submitted his, her or its Proxy/voting instruction form. Failure to register a duly appointed proxyholder will result in the proxyholder not receiving a username to participate in the Meeting. To register a proxyholder, a Shareholder MUST visit http://www.computershare.com/FireFlower by no later than 2:00 p.m. (Toronto time) on June 11, 2020 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of Ontario) prior to the Meeting and provide Computershare with the contact information of his, her or its proxyholder, so that Computershare may provide the proxyholder with a username via email.

It is important to be connected to the internet at all times during the Meeting in order to vote when balloting commences.

In order to participate online, Shareholders must have a valid 15-digit control number and proxyholders must have received an email from Computershare containing a username.

Non-registered Shareholders

Non-registered Shareholders who have received the Documents from their Intermediary should, other than as set out herein, follow the directions of their Intermediary with respect to the procedure to be followed for voting at the Meeting. Generally, Non-registered Shareholders will either:

| (a) | be provided with a form of proxy executed by the Intermediary but otherwise uncompleted. The Non-registered Shareholder may complete the proxy and return it directly to Computershare; or |

| (b) | be provided with a request for voting instructions. The Intermediary is required to send the Corporation an executed form of proxy completed in accordance with any voting instructions received by the Intermediary. |

If you are a Non-registered Shareholder, and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained from your Intermediary in accordance with applicable securities regulatory requirements. By choosing to send the Documents to you directly, the Corporation (and not your Intermediary) has assumed responsibility for (i) delivering the Documents to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Participating in the Meeting

The Meeting will be hosted online by way of a live audiocast. Shareholders will not be able to attend the Meeting in person. A summary of the information Shareholders will need to attend the Meeting is provided below. The Meeting will begin at 2:00 p.m. (Toronto time) on Monday, June 15, 2020.

| ● | Registered Shareholders that have a 15-digit control number, along with duly appointed proxyholders who were assigned a username by Computershare (see details under “Appointment of Proxyholders”), will be able to vote and submit questions during the Meeting. To do so, please go to https://web.lumiagm.com/266364910 prior to the start of the Meeting to login. Click on “I have a login” and enter your 15-digit control number or username along with the password “fireflower2020”. Non-Registered Shareholders who have not appointed themselves to vote at the Meeting may login as a guest by clicking on “I am a guest” and completing the online form. Guests will not be able to vote at the Meeting. |

| ● | United States Non-registered Shareholders: To attend and vote at the Meeting, you must first obtain a valid legal proxy from your Intermediary and then register in advance to attend the Meeting. Follow the instructions from your Intermediary included with these Meeting materials, or contact your Intermediary to request a legal proxy form. After first obtaining a valid legal proxy from your Intermediary, to then register to attend the Meeting, you must submit a copy of your legal proxy to Computershare. Requests for registration should be directed to Computershare, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 or via email at uslegalproxy@computershare.com. |

| | | Requests for registration must be labeled as “Legal Proxy” and be received no later than 2:00 p.m. (Toronto time) on June 11, 2020. You will receive a confirmation of your registration by email after your registration materials have been received. You may attend the Meeting and vote your Common Shares at https://web.lumiagm.com/266364910 during the Meeting. Please note that you are requested to register your appointment at http://www.computershare.com/FireFlower. |

| ● | Non-registered Shareholders who do not have a 15-digit control number or username will only be able to attend as a guest which allows such persons to listen to the Meeting, however, Non- registered Shareholders will not be able to vote or submit questions. |

| ● | If you are using a 15-digit control number to login to the Meeting and you accept the terms and conditions, you will be revoking any and all previously submitted proxies. However, in such a case, you will be provided the opportunity to vote by ballot on the matters put forth at the Meeting. If you DO NOT wish to revoke all previously submitted proxies, do not accept the terms and conditions, in which case you can only enter the Meeting as a guest. |

| ● | If you are eligible to vote at the Meeting, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. |

Appointment of Proxyholders

The persons named in the enclosed Proxy (the “Management Designees”) are directors and/or officers of the Corporation. SHAREHOLDERS HAVE THE RIGHT TO APPOINT A PERSON TO REPRESENT HIM, HER OR IT AT THE MEETING OTHER THAN THE PERSONS DESIGNATED IN THE PROXY INSTRUMENT either by striking out the names of the persons designated in the Proxy and by inserting the name of the person or company to be appointed in the space provided in the Proxy or by completing another proper form of proxy.

Shareholders who wish to appoint a third party proxyholder to represent them at the Meeting must submit their Proxy or voting instruction form (if applicable) prior to registering their proxyholder. Registering a proxyholder is an additional step once the Proxy or voting instruction form have been submitted. Failure to register the proxyholder will result in the proxyholder not receiving a username to participate in the Meeting. To register a proxyholder, Shareholders MUST visit http://www.computershare.com/FireFlower no later than 2:00 p.m. (Toronto time) on June 11, 2020 and provide Computershare with their proxyholder’s contact information, so that Computershare may provide the proxyholder with a username via email.

A Proxy can be submitted to Computershare either in person, or by mail or courier, to 8th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1, or via the internet at www.investorvote.com. The Proxy must be deposited with Computershare by no later than 2:00 p.m. (Toronto time) on June 11, 2020 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of Ontario) before the beginning of any adjournment(s) or postponement(s) to the Meeting. If a Shareholder who has submitted a Proxy attends the Meeting and has accepted the terms and conditions when entering the Meeting, any votes cast by such Shareholder on a ballot will be counted and the submitted Proxy will be disregarded.

Without a username, proxyholders will not be able to vote at the Meeting.

Revocation of Proxy

A Registered Shareholder who has given a proxy pursuant to this solicitation may revoke it at any time up to and including the last business day preceding the day of the Meeting or any adjournment(s) or postponement(s) thereof at which the proxy is to be used:

| (a) | by an instrument in writing executed by the Shareholder or by his, her or its attorney authorized in writing and either delivered to the attention of the Corporate Secretary of the Corporation c/o Computershare Investor Services Inc., 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1; |

| (b) | by delivering written notice of such revocation to the chair of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment(s) or postponement(s) thereof; |

| (c) | by attending the Meeting and voting the Common Shares; or |

| (d) | in any other manner permitted by law. |

Non-registered Shareholders who wish to change their vote must contact their Intermediary to discuss their options well in advance of the Meeting.

If as a Registered Shareholder you are using your control number to log into the Meeting and you accept the terms and conditions, you will be provided the opportunity to vote by online ballot at the appropriate time on the matters put forth at the Meeting. If you have already voted by proxy and you vote again during the online ballot during the Meeting, your online vote during the Meeting will revoke your previously submitted proxy. If you have already voted by proxy and do not wish to revoke your previously submitted proxy, do not vote again during the online ballot.

Voting of Proxies and Discretion Thereof

Common Shares represented by properly executed proxies in favour of persons designated in the printed portion of the enclosed Proxy WILL, UNLESS OTHERWISE INDICATED, BE VOTED FOR THE ELECTION OF DIRECTORS, FOR THE RE-APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP, AS THE AUDITORS OF THE CORPORATION, FOR THE AUTHORIZATION OF THE BOARD TO FIX AUDITORS’ REMUNERATION AND TERMS OF ENGAGEMENT, FOR THE DIRECTOR FIXING RESOLUTION, FOR THE CONVERSION RESOLUTION AND FOR THE INTEREST SETTLEMENT RESOLUTION. The Common Shares represented by the Proxy will be voted or withheld from voting in accordance with the instructions of the Shareholder on any ballot that may be called for and, if the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. The enclosed Proxy confers discretionary authority on the persons named therein with respect to amendments or variations to matters identified in the Notice or other matters which may properly come before the Meeting. At the date of this Information Circular, management knows of no such amendments, variations or other matters to come before the Meeting. However, if other matters properly come before the Meeting, it is the intention of the persons named in the enclosed Proxy to vote such proxy according to their best judgment.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The Corporation is authorized to issue an unlimited number of Common Shares. As at May 11, 2020 (the “Record Date”), an aggregate of 159,416,850 Common Shares were issued and outstanding.

Only Shareholders of record at the close of business on the Record Date who either attend the Meeting virtually or complete, sign and deliver a form of proxy in the manner and subject to the provisions described herein will be entitled to vote at the Meeting, unless that Shareholder has transferred any Common Shares subsequent to that date and the transferee shareholder, not later than 10 days before the Meeting, establishes ownership of such Common Shares and demands that the transferee’s name be included on the list of Shareholders entitled to vote at the Meeting.

Pursuant to the by-laws of the Corporation, a quorum for the transaction of business at the Meeting shall be not less than 10% of the votes entitled to be cast at the Meeting.

To the knowledge of the directors and executive officers of the Corporation, no person or company is known by the Corporation to beneficially own, or control or direct, directly or indirectly, more than 10% of the voting rights attached to any class of voting securities of the Corporation.

MATTERS TO BE ACTED UPON AT THE MEETING

| 1. | Presentation of Financial Statements |

The audited consolidated financial statements of the Corporation as at February 1, 2020 and for the period from February 3, 2019 to February 1, 2020 together with the auditors’ report thereon and the related management’s discussion and analysis (“MD&A”), will be presented to the Shareholders at the Meeting or any adjournment(s) or postponement(s) thereof for their consideration.

| 2. | Fixing Number of Directors |

The articles of the Corporation (the “Articles”) provide that the board of directors of the Corporation (the “Board”) shall consist of a minimum of one director and a maximum of 10 directors. Shareholders will be asked to consider, and if thought appropriate, approve an ordinary resolution fixing the number of directors to be elected at the Meeting or any adjournment(s) or postponement(s) thereof at seven directors (the “Director Fixing Resolution”).

The Management Designees intend to vote IN FAVOUR of the Director Fixing Resolution, unless otherwise instructed on a properly executed and validly deposited proxy.

The text of the Director Fixing Resolution is as follows:

“BE IT RESOLVED that the number of directors of Fire & Flower Holdings Corp (the “Corporation”) to be elected at the meeting of shareholders of the Corporation held on June 15, 2020 or any adjournment(s) or postponement(s) thereof be fixed at seven.”

The Director Fixing Resolution must be approved by a majority of votes cast thereon at the Meeting or any adjournment(s) or postponement(s) thereof.

The Corporation currently has seven directors, all of which have been nominated for re-election at the Meeting or any adjournment(s) or postponement(s) thereof. The term of each of the Corporation’s present directors expires at the close of the Meeting and unless the director’s office is vacated earlier in accordance with the provisions of the Canada Business Corporations Act (“CBCA”) or removed in accordance with the by-laws of the Corporation, each director elected at the Meeting or any adjournment(s) or postponement(s) thereof will hold office until the conclusion of the next annual meeting of the Shareholders. Where directors fail to be elected at any such meeting of Shareholders, the incumbent directors shall continue in office until their successors are elected. The number of directors to be elected at any such meeting shall be the greater of the number (or the minimum number, as the case may be) of directors provided for in the Articles and the number of directors then in office unless the directors or the Shareholders otherwise determine.

Other than pursuant to an investor rights agreement (the “IRA”) between 2707031 Ontario Inc. (“2707031”) and the Corporation dated August 7, 2019, none of the proposed nominees for election as a director of the Corporation are proposed for election pursuant to any arrangement or understanding between a proposed nominee and any other person. Pursuant to the terms of the IRA, as of the Record Date, 2707031 is allowed to nominate one director to the Board at the Meeting or any adjournment(s) or postponement(s) thereof. Jeremy Bergeron is 2707031’s director nominee.

The Corporation’s by-laws provide for advance notice of nominations of directors (the “Advance Notice Requirement”). Among other things, the Advance Notice Requirement fixes a deadline by which Shareholders must submit a notice of director nominations to the Corporation prior to any annual or special meeting of Shareholders where directors are to be elected, sets forth the information that a Shareholder must include in the notice to the Corporation for the notice to be valid and establishes additional eligibility requirements for nominated candidates. No person shall be eligible for election as a director of the Corporation unless nominated in accordance with the provisions of the Advance Notice Requirement.

In the case of an annual meeting of Shareholders, notice to the Chief Executive Officer of the Corporation must be given not less than 30 nor more than 65 days prior to the date of the annual meeting; provided, however, that in the event that the annual meeting is called for a date that is less than 50 days after the date on which the first public announcement of the date of the annual meeting was made, notice may be made not later than the 10th day following such public announcement. In the case of a special meeting of shareholders (which is not also an annual meeting), notice to the Corporation must be given not later than the 15th day following the day on which the first public announcement of the date of the special meeting was made. The Board may, in its sole discretion, waive any requirement of the Advance Notice Requirement.

The purpose of the Advance Notice Requirement is to facilitate an orderly and efficient annual and special meeting process, to ensure all Shareholders receive adequate notice of director nominations and sufficient information with respect to all nominees, to allow the Corporation and the Shareholders to evaluate nominee’s qualifications and suitability as a director of the Corporation and to allow Shareholders to cast an informed vote.

A copy of the Corporation’s by-laws is available under its profile on SEDAR at www.sedar.com and on its website at https://fireandflower.com/.

Shareholders can vote or withhold from voting on the election of each director on an individual basis. The Board has adopted a policy which requires voting with respect to the election of directors at any meeting of Shareholders to be by individual nominee as opposed to by slate of directors, that is, Shareholders will be asked to vote in favour of, or withhold from voting, separately for each nominee.

On August 7, 2019, the Board adopted a majority voting policy (the “Majority Voting Policy”) stipulating that if the “WITHHOLD” votes in respect of the election of a director nominee at the Meeting or any adjournment(s) or postponement(s) thereof represent more than the “FOR” votes, the nominee will submit his or her resignation to the Board immediately after the Meeting, for the consideration of the Corporate Governance and Compensation Committee of the Board (the “CGC Committee”).

The CGC Committee will consider such resignation and will make a recommendation to the Board after reviewing the matter as to whether to accept it or not, having regard to, among other things, any stated reasons why Shareholders “withheld” from voting for a nominee and the number of “WITHHOLD” votes as compared to the number of “FOR” votes for such nominee. The Board will consider the CGC Committee’s recommendation within 90 days of the Meeting and will accept the director’s resignation absent exceptional circumstances, having regard to all matters it deems relevant, and a news release will be provided to the Toronto Stock Exchange (the “TSX”) and promptly issued announcing the Board’s determination in respect thereof. If the Board determines not to accept the resignation, the news release will fully state the reasons for that decision.

A director who tenders his or her resignation pursuant to the Majority Voting Policy will not participate in any meetings of the Board or CGC Committee at which such resignation is considered. The Majority Voting Policy does not apply in circumstances involving contested director elections. If the resignation is accepted, subject to any applicable law, the Board may leave the resultant vacancy unfilled until the next annual general meeting of the Shareholders, fill the vacancy through the appointment of a new director, or call a special meeting of Shareholders at which there will be presented one or more nominees to fill any vacancy or vacancies.

A copy of the Majority Voting Policy is available on the Corporation’s website at https://fireandflower.com/.

The Management Designees intend to vote FOR each of the proposed nominees set out herein, unless otherwise instructed on a properly executed and validly deposited proxy.

The names, provinces and countries of residence of each of the persons nominated as directors of the Corporation, their position(s) with the Corporation, the principal occupation for the past five (5) years of each, the period served as director and the number of voting securities of the Corporation beneficially owned, controlled or directed, directly or indirectly by such persons are set forth in the table below:

Name of Proposed Nominee, Province, Country of Residence and Position(s) with the Corporation | | Principal Occupation(s) for the Past Five (5) Years | | Director of the

Corporation

Since | | Common Shares

Owned, Controlled or

Directed, Directly or

Indirectly(1) | |

Trevor Fencott Ontario, Canada

President, Chief Executive Officer and Director | | President, Chief Executive Officer and Director of the Corporation.

President, Chief Executive Officer and Director of Fire & Flower Inc.

Chief Legal Officer & Director of Mettrum Health Corp. | | February, 2019 | | | 12,789,401 | |

| | | | | | | | | |

Harvey Shapiro Ontario, Canada

Executive Director and Chair of the Board | | Executive Director of the Corporation and Chair of the Board.

Executive Director and Director of Fire & Flower Inc. Chairman and Vice-President of Emblem Corp. | | February, 2019 | | | 14,777,260 | |

| | | | | | | | | |

Norman Inkster(2)(3) Ontario, Canada Director | | Former President of Inkster Incorporated. | | February, 2019 | | | 66,666 | |

| | | | | | | | | |

Sharon Ranson(2)(3) Ontario, Canada Director | | President and Founder of the Ranson Group Inc. | | February, 2019 | | | 150,000 | |

| | | | | | | | | |

Donald Wright Ontario, Canada

Lead Independent Director | | President and Chief Executive Officer of The Winnington Capital Group Inc. | | January, 2018 | | | 1,252,609 | |

| | | | | | | | | |

Avininder Grewal Ontario, Canada

Director | | President, Chief Executive Officer, and Director of Cinaport Capital Inc. | | December, 2017 | | | 326,299 | |

| | | | | | | | | |

Jeremy Bergeron(2)(3)(4) Texas, United States Director | | Vice President Alternative Channels of Alimentation Couche-Tard Inc.

Chief Executive Officer of CrossAmerica Partners LP

Sr. Vice President Integration & Development of CST Brands, Inc. | | August, 2019 | | | 50,000 | |

Notes:

| (1) | The information as to the number of Common Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, by the directors, not being within the knowledge of the Corporation, has been obtained from the System for Electronic Disclosure by Insiders. |

| (2) | Member of the CGC Committee. |

| (3) | Member of the Corporation’s Audit Committee of the Board (the “Audit Committee”). |

| (4) | Mr. Bergeron is the nominee of 2707031 pursuant to the IRA. |

The following is a brief profile of each nominee to the Board:

Trevor Fencott

Mr. Fencott is the President and Chief Executive Officer of the Corporation. Mr. Fencott has been an executive in the cannabis industry since 2013 as a co-founder of Mettrum Health Corp. where he also served as its chief legal officer, corporate secretary and director through its go public transaction in September 2014 and its subsequent acquisition by Canopy Growth Corporation in January 2017. Additionally, he is a director of Push Capital Limited, an early-stage venture capital company focusing on the high-growth cannabis and digital technology industries. In addition to experience in the regulated cannabis industry, Mr. Fencott has more than 15 years of experience operating, building and financing businesses in the technology and media sectors. Mr. Fencott serves on the board of PopReach Incorporated, a global mobile applications publisher, he was former President and Executive Director of bitHeads Inc., a software development company based in Ottawa as well as an investor and strategic business consultant to Fuse Powered, a Toronto-based mobile analytics and digital distribution company. Mr. Fencott holds a BA Hons. from Queen’s University and an LLB from the University of Western Ontario, Faculty of Law. He is a member in good standing of the Law Society of Ontario.

Harvey Shapiro

Mr. Shapiro is the Chair of the Board. Mr. Shapiro has been an executive in the cannabis industry since 2014 as a founder, executive officer and director of Emblem Corp. (TSXV: EMC) prior to its acquisition by Aleafia Health Inc. (TSX: ALEF). Prior to Emblem Corp., Mr. Shapiro was the Chief Executive Officer of Dynacare Inc., a TSX listed medical diagnostic services company which was acquired by NYSE-listed Laboratory Corp. of America Holdings for approximately $1 billion in 2002. Mr. Shapiro was a former corporate lawyer, practicing at Goodman & Carr LLP from 1973 to 1987.

Norman Inkster

Mr. Inkster was the 18th Commissioner of the RCMP and is a former President of INTERPOL. Following his career in the RCMP, Mr. Inkster joined KPMG and became the Partner in charge of KPMG Forensic Canada and subsequently the Global Managing Partner KPMG Forensic. Mr. Inkster was appointed Chair of the Advisory Council on National Security by Prime Minister Harper a post he held for four years. Mr. Inkster served as an external advisor to the Departmental Audit Committee of Public Works and Government Services Canada and now serves in a similar capacity with Public Safety Canada. Mr. Inkster has served on the boards of several publicly traded companies acting as chair of both audit and governance committees, the most recent being Mettrum Health Corp., which was acquired by Canopy Growth Corporation. Mr. Inkster is currently the Chair of Technical Standards and Safety Authority of Ontario. Mr. Inkster holds a BA (Honours) and an LLD (Honourary) from the University of New Brunswick. He is also an Honourary Chief of the Blackfoot tribe and an Honourary member of the Cree Nation. Mr. Inkster is an Officer of the Order of Canada.

Sharon Ranson

Sharon Ranson is a corporate director and President of The Ranson Group Inc., a company offering executive coaching and consulting services. Ms. Ranson also currently serves as a director of Sprott Inc., Dorel Industries, Spark Power Corp. and the Toronto Investment Board. Prior to founding her current business in 2002, Ms. Ranson spent over 20 years in capital markets where she was a top ranked Financial Services Analyst and a senior Portfolio Manager. Ms. Ranson is an FCPA, FCA and holds the ICD.D designation. She graduated from Queen’s University with a Bachelor of Commerce and holds an MBA from York University.

Donald Wright

Mr. Wright’s career in the financial industry has spanned over 40 years. He has held a number of leadership positions, including President of Merrill Lynch Canada (1990 to 1994), Executive Vice President, director and member of the executive committee of Burns Fry Ltd. (1994), Chairman and Chief Executive Officer of TD Securities Inc. and Deputy Chairman of TD Bank Financial Group (2002). Mr. Wright retired from TD Bank in November 2002. Since his retirement, he has been an active investor in both the private and public equity markets and has been involved in financing small and medium cap companies with an emphasis in oil and gas, resources and technology and cannabis industries.

Mr. Wright has been serving as President and Chief Executive Officer of The Winnington Capital Group Inc., based in Toronto from October 2005, and Chairman of Metrolinx from August 2018. Mr. Wright currently serves as Chairman and/or a director of the following TSX or TSX Venture Exchange (“TSXV”) listed companies: WildBrain Ltd. (formerly DHX Media Ltd.) (chair, from May 2006), Richards Packaging Income Fund (chair, from April 2004) and GMP Capital Inc. (chair, from May 2009).

Mr. Wright is one of the founding members of Cinaport Group of Companies. He currently serves as a director and/or Chairman of each of the following companies: Cinaport China Opportunity Fund GP Inc., the general partner of Cinaport China Opportunity Fund GP LP, the general partner of Cinaport China Opportunity Fund LP (director, from May 2010); Cinaport Inc., the parent company of the aforementioned Cinaport companies (director and Chairman, from January 2010); and Cinaport Acquisition Corp. III, a TSXV listed CPC (director and Chairman, from July, 2018). From March 2011 to January 2014, Mr. Wright served as Chairman of Cinaport Acquisition Corp., a TSXV listed Capital Pool Company that completed its qualifying transaction in September 2014.

Avininder Grewal

Mr. Avininder Grewal previously served as the Chief Executive Officer and a director of Cinaport Acquisition Corp. II, prior to the completion of the qualifying transaction with Fire & Flower Inc (the “Qualifying Transaction”). Mr. Grewal is one of the founding members of the Cinaport Group of Companies. From May 2009, Mr. Grewal has been a director, President and Chief Executive Officer of Cinaport Capital Inc., a registered Investment Fund Manager, Portfolio Manager and Exempt Market Dealer based in Toronto and the fund manager of Cinaport China Opportunity Fund LP. Mr. Grewal also served as a director, President and Chief Executive Office of Cinaport Financial Services Inc., a financial consulting and investors relations company from June 2010 to December 2011. In addition, Mr. Grewal currently serves as a director, President and Chief Executive Officer of each of the following companies: Cinaport China Opportunity Fund GP Inc., the general partner of Cinaport China Opportunity Fund GP LP, the general partner of Cinaport China Opportunity Fund LP (from May 2010); Cinaport Inc., the parent company of the aforementioned companies (from January 2010); and Cinaport Acquisition Corp. III, a TSXV listed CPC (from July 2018). Mr. Grewal also served as President and Chief Executive Officer of Fralex Therapeutics Inc., a TSX listed medical technology company (March 2005 to June 2009) and Atwell Capital Inc., a NEX listed holding and investment company (March 2009 to September 2010). Mr. Grewal led Fralex Therapeutics Inc. from start- up and its first private financing to an Initial Public Offering and listing of the shares of the company on the TSX. Mr. Grewal co-founded Novadaq Technologies Inc., a medical technology company in 2000 and acted as Chief Financial Officer of the company from April 2000 to February 2004.

Jeremy Bergeron

Mr. Bergeron has served as Vice President of Alternative Channels for global convenience retailer Alimentation Couche-Tard Inc. (“ACT”) (TSX: ATD.A ATD.B) since July 2018, leading ACT’s exploration and investment in the cannabis industry. Prior to that role, Mr. Bergeron was President, Chief Executive Officer and a board member of CrossAmerica Partners (NYSE: CAPL) for three years. His previous roles have also included serving as Senior Vice President of Integration & Development as well as Treasurer for CST Brands, Inc. (“CST”), an international convenience retailer acquired by ACT in 2017. Before joining CST, Jeremy was employed by Valero Energy Corporation (NYSE: VLO) for 17 years, holding several managerial positions during that timeframe. He earned a BBA in Management and Information Systems from the University of the Incarnate Word and a MBA from the University of Texas at San Antonio. He is also a 2014 graduate of the Stanford Executive Program.

Cease Trade Orders

Except as set forth below, no proposed director of the Corporation is, as of the date of this Information Circular, or has been, within 10 years before the date hereof, a director, Chief Executive Officer or Chief Financial Officer of any company (including the Corporation) that was subject to a cease trade order, an order similar to a cease trade order or an order that denied such company access to any exemptions under securities legislation, that was in effect for a period of more than thirty (30) consecutive days, that was issued: (a) while that person was acting in such capacity; or (b) after that person ceased to act in such capacity but which resulted from an event that occurred while that person was acting in such capacity.

Donald Wright was Chairman of Jaguar Resources Inc. (“Jaguar”), a TSX listed issuer, when a cease trade order was issued by each of the Alberta Securities Commission (the “ASC”) and the British Columbia Commission (the “BCSC”) on May 6 and May 8, 2015, respectively, for Jaguar’s failure to file its annual audited financial statements, annual MD&A and certification of the annual filings for the fiscal year ended December 31, 2014. While subject to the cease trade order, Jaguar issued, in contravention of the cease trade order, promissory notes in the aggregate amount of $187,873.71 to certain investors familiar with Jaguar’s business for the purpose of providing Jaguar with working capital to complete the prescribed regulatory filings and seek revocation of the cease trade order. Following the contravention, Jaguar and each of its Chief Executive Officer, Chief Financial Officer and directors provided undertakings to the Executive Director of the ASC in respect of the contravention. The ASC and the BCSC revoked the cease trade orders on May 15, 2016.

Bankruptcies

Except as set forth below, no proposed director of the Corporation is, as of the date of this Information Circular, or has been, within 10 years before the date hereof, a director or executive officer of any company (including the Corporation) that, while such person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Donald Wright was a director of Tuscany International Drilling Inc. (“Tuscany”), a TSX listed issuer, when Tuscany announced on February 2, 2014 that it and one of its subsidiaries, Tuscany International Holdings (U.S.A.) Ltd., commenced proceedings under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware to implement a restructuring of Tuscany’s debt obligations and capital structure through a plan of reorganization under the US Code. Mr. Wright resigned from Tuscany in February 2014.

No proposed director of the Corporation has, within the 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

Penalties or Sanctions

No proposed director of the Corporation has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director.

| 4. | Appointment of Auditors |

Management proposes that PricewaterhouseCoopers LLP (“PwC”) be reappointed as the auditors of the Corporation to hold office until the next annual general meeting of the Shareholders or until its successor is appointed, and to authorize the Board to fix their remuneration and terms of engagement. PwC replaced UHY McGovern Hurley LLP (“UHY”) as the auditors of the Corporation effective as of July 25, 2019 upon receipt of UHY’s resignation.

The resignation of UHY and the appointment of PwC has been approved by the Audit Committee and the Board.

The Management Designees intend to vote FOR the reappointment of PwC as auditors of the Corporation, and to authorize the Board to fix their remuneration and terms of engagement, unless otherwise instructed on a properly executed and validly deposited proxy.

| 5. | Approval of Conversion Resolution |

Shareholders will be asked to consider, and if thought advisable, to pass, with or without amendment, an ordinary resolution authorizing and approving, the proposed issuance of 8,200 8.0% $1,000 principal amount secured convertible debentures of the Corporation upon the conversion of 8,200 Subscription Receipts (as defined herein) (the “Conversion Resolution”).

Background to the Subscription Receipt Financing

On April 28, 2020, the Corporation completed a non-brokered private placement of 19,800 secured convertible debentures, at a price of $1,000 per convertible debenture (the “Initial Debentures”), for aggregate gross proceeds of $19,800,000 million (the “Debenture Financing”). Each Initial Debenture bears interest at an annual rate of 8.00% payable in arrears in equal installments semi-annually. The Initial Debentures will mature on June 1, 2021, which date will be automatically extended to April 28, 2022 (collectively, the “Maturity Date”) in the event certain outstanding securities of the Corporation are converted, exercised or otherwise extinguished as set out in the debenture indenture between the Corporation and Computershare Trust Company of Canada dated April 28, 2020 (the “Debenture Indenture”). The full text of the Debenture Indenture is available on the Corporation’s SEDAR profile at www.sedar.com. The principal amount of Initial Debenture may be convertible at the holder’s option into Common Shares at any time prior to the Maturity Date at a conversion price of $0.50 per Common Shares, subject to adjustment.

Concurrently with the completion of the Debenture Financing, on April 28, 2020, the Corporation completed a non-brokered private placement of 8,200 subscription receipts (each, a “Subscription Receipt”), at a price of $1,000 per Subscription Receipt (the “Issue Price”), for aggregate gross proceeds of $8,200,000 (the “Subscription Receipt Financing” and, together with the Debenture Financing, the “Offerings”).

Each Subscription Receipt entitles the holder thereof to receive, without payment of additional consideration or further action on the part of the holder thereof, one $1,000 principal amount 8.0% secured convertible debenture of the Corporation (the “Underlying Debentures” and together with the Initial Debentures, the “Debentures”) on the same terms as the Initial Debentures (including accruing interest as at April 28, 2020) upon the satisfaction and/or waiver of the Escrow Release Conditions (as defined herein) at or before August 25, 2020, or such later date as may be approved by holders of not less than 662/3% of the Subscription Receipts (the “Escrow Release Deadline”).

The Corporation’s obligations under the Debentures are secured by the assets of the Corporation and its subsidiaries.

The gross proceeds of the Subscription Receipt Offering (the “Escrowed Funds”), have been deposited into escrow and are held by Computershare Trust Company of Canada, as subscription receipt agent (the “Subscription Receipt Agent”) pursuant to the terms of a subscription receipt agreement dated April 28, 2020 among the Corporation and the Subscription Receipt Agent (the “Subscription Receipt Agreement”). The full text of the Subscription Receipt Agreement is available on the Corporation’s SEDAR profile at www.sedar.com.

The Escrowed Funds and interest or other income actually earned on the investment of the Escrowed Funds (the “Earned Interest”) are held by the Subscription Receipt Agent and invested as directed by the Company in short-term obligations issued or fully guaranteed by the Government of Canada, or other approved investments, pending the satisfaction of the Escrow Release Conditions, all in accordance with the terms of the Subscription Receipt Agreement.

The Escrowed Funds will be released from escrow to the Corporation upon satisfaction of the following conditions (together, the “Escrow Release Conditions”) on or before 5:00 p.m. (Toronto time) on the Escrow Release Deadline: (a) the Conversion Shares being conditionally approved for listing on the TSX and the completion, satisfaction or waiver of all conditions precedent to such listing, other than the release of the Escrowed Funds and receipt of customary final documentation and payment of applicable fees; and (b) the Corporation having delivered an escrow release notice to the Subscription Receipt Agent.

If: (a) the Escrow Release Conditions are not satisfied on or before the Escrow Release Deadline; or (b) prior to the Escrow Release Deadline the Corporation advises the Subscription Receipt Agent or announces to the public that it does not intend to satisfy the Escrow Release Conditions, the Escrowed Funds shall be returned to the holders of the Subscription Receipts on a pro rata basis and the Subscription Receipts will be cancelled without any further action on the part of the holders. To the extent that the Escrowed Funds are not sufficient to refund the aggregate Issue Price paid by the holders of the Subscription Receipts, the Corporation is responsible and liable to contribute such amounts as are necessary to satisfy any shortfall.

The Corporation intends to use the net proceeds of the Offerings to repay the outstanding 8.0% unsecured convertible debentures that mature on June 26, 2020 and for general working capital purposes.

Insider Participation and Dilution

Certain “insiders” of the Corporation (as determined in accordance with TSX rules) and “related parties” of the Corporation (as defined in MI 61-101 (as defined herein)), namely Trevor Fencott, Harvey Shapiro, Norman Inkster, Sharon Ranson and Nadia Vattovaz, participated in the Offerings by subscribing for: (i) an aggregate of 795 Initial Debentures, representing approximately 4.0% of the Initial Debentures issued in the Debenture Financing; and (ii) an aggregate of 280 Subscription Receipts, representing approximately 3.4% of the Subscription Receipts issued in the Subscription Receipt Financing.

Based on information known to the Corporation as of the date of this Information Circular, the following table sets forth, for each such insider and related party, their current holdings of Common Shares, the number of Initial Debentures purchased by such insider, the number of Subscription Receipts purchased by such insider and such insider’s pro forma holdings of the Corporation assuming the conversion of the Initial Debentures, Subscription Receipts and Debentures purchased by such insider.

Name | | Holdings of

Common Shares

prior to the

Offerings (#)(1) / (%)(2) | | Number of Initial Debentures Purchased | | | Number of

Subscription

Receipts Purchased | | | Number of Common Shares owned following Conversion of the Debentures (#) / (%)(3) | |

| Trevor Fencott | | 12,789,401 / 8.02% | | | 675 | | | | 175 | | | | 14,489,401 / 8.99% | |

| Harvey Shapiro | | 14,777,260 / 9.27% | | | 80 | | | | 20 | | | | 14,977,260 / 9.38% | |

| Norman Inkster | | 66,666 / 0.04% | | | 0 | | | | 25 | | | | 116,666 / 0.07% | |

| Sharon Ranson | | 150,000 / 0.09% | | | 0 | | | | 50 | | | | 250,000 / 0.16% | |

| Nadia Vattovaz | | 21,000 / 0.01% | | | 40 | | | | 10 | | | | 122,100 / 0.08% | |

Notes:

| (1) | The information as to the number of Common Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, by the directors, not being within the knowledge of the Corporation, has been obtained from the System for Electronic Disclosure by Insiders. |

| (2) | Based on the 159,416,850 Common Shares currently outstanding. |

| (3) | Does not include any Common Shares which may be issued in connection with the approval of the Interest Settlement Resolution. |

Toronto Stock Exchange Matters

Pursuant to Section 607(g)(i) of the TSX Company Manual (the “Company Manual”), the TSX requires securityholder approval as a condition of acceptance of a notice of an issuance of securities if the aggregate number of listed securities issuable under a private placement is greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction and the price per security is less than the market price. Section 607(f)(iii) of the Company Manual provides that in the case of a private placement of convertible securities, unless the conversion price of such convertible security is defined as at least the applicable market price at the time of conversion, the underlying listed securities will be considered as being issued at a price per security less than the market price, and the securities so issuable will be regarded as being part of the number of securities being issued pursuant to the transaction. As the conversion price of the Conversion Shares is not tied to the market price at the time of conversion, the securities issuable upon the conversion of the Debentures will be included when determining the 25% maximum issuance.

Consequently, the TSX has approved: (a) the listing of the Conversion Shares issuable upon conversion of the Initial Debentures; and (b) subject to the satisfaction of certain conditions, including Shareholder approval, the listing of the Conversion Shares issuable upon conversion of the Underlying Debentures. Shareholder approval is being sought in connection with the issuance of the Conversion Shares upon conversion of the Underlying Debentures as the total number of Common Shares issuable upon conversion of the Underlying Debentures (when added to the number of Common Shares issuable upon conversion of the Initial Debentures) would exceed 25% of the number of Common Shares outstanding prior to the date of the closing of the Offerings.

Accordingly, as a condition of its listing of the Conversion Shares issuable upon conversion of the Underlying Debentures, approval of the TSX requires that the issuance of such Conversion Shares be approved by Shareholders at the Meeting.

MI 61-101 Matters

Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61- 101”) is intended to regulate certain transactions to ensure equality of treatment among shareholders, generally requiring enhanced disclosure, approval by a majority of shareholders excluding interested or related parties, the preparation of a formal valuation and, in certain instances, approval and oversight of the transaction by a special committee of independent directors. The protections of MI 61-101 generally apply to related party transactions.

In connection with the Offerings, certain “related parties” for the purposes of MI 61-101 subscribed for Initial Debentures and Subscription Receipts and the issuances thereto are considered “related party transactions” for the purposes of MI 61-101. The Corporation is relying on exemptions from the formal valuation and minority shareholder approval requirements available under MI 61-101. The Corporation is exempt from the formal valuation requirement in section 5.4 and the minority shareholder approval requirement in section 5.6 of MI 61-101 as neither the fair market value of the subject matter of, nor the fair market value of the consideration, for the transaction, insofar as it involves related parties, exceeds 25% of the Corporation’s market capitalization.

Approval of the Conversion Resolution

To be effective, the Conversion Resolution must be approved by a majority of the votes cast by Shareholders present or represented by proxy at the Meeting.

The Management Designees intend to vote FOR the Conversion Resolution, unless otherwise instructed on a properly executed and validly deposited proxy.

The text of the Conversion Resolution is as follows:

“BE IT RESOLVED THAT:

| (a) | the issuance of up to 8,200 Underlying Debentures to be issued on the exchange of the Subscription Receipts, as further described in the Information Circular, is approved; |

| (b) | the issuance of up to 16,400,000 Conversion Shares to be issued upon the conversion of the Debentures, in accordance with the terms of the Debenture Indenture and as further described in the Information Circular, is approved; |

| (c) | any one director or officer of the Corporation is hereby authorized and directed, for and on behalf of the Corporation, to finalize, sign and deliver all documents, to enter into any agreements and to do and perform all acts and things as such individual, in his or her discretion, deems necessary or advisable in order to give effect to the intent of this resolution and the matters authorized hereby, including compliance with all securities laws and regulations and the rules and requirements of the TSX, such determination to be conclusively evidenced by the finalizing, signing or delivery of such document or agreement or the performing of such act or thing.” |

| 6. | Approval of Interest Settlement Resolution |

Shareholders will be asked to consider, and if thought advisable, to pass, with or without amendment, an ordinary resolution authorizing and approving, the proposed issuance of up to 5,650,000 Common Shares in satisfaction of interest payable on up to: (a) $19,800,000 principal amount of Initial Debentures; and (b) $8,200,000 principal amount of Underlying Debentures (the “Interest Settlement Resolution”).

Background to the Interest Election

Following the issuance of the Underlying Debentures (as set out in the Conversion Resolution), it is expected that there will be a total of up to $28,000,000 principal amount of Debentures (comprised of 19,800 Initial Debentures and 8,200 Underlying Debentures).

The Initial Debentures and Underlying Debentures have been or will be, as applicable, issued under the Debenture Indenture. The Debenture Indenture provides for, among others, that the Corporation shall pay interest on the principal of the Initial Debentures and Underlying Debentures at a rate of 8.0% per annum which shall accrue and be payable semi-annually in arrears on the last day of June and December in each year, commencing on December 31, 2020. Interest is computed on the basis of a 360-day year composed of twelve 30-day months. The December 31, 2020 interest payment will represent accrued interest from and including the Closing Date to but excluding December 31, 2020.

Additionally, the Debenture Indenture provides that, subject to compliance with applicable laws and the rules and policies of the TSX, the Corporation may, in its sole discretion, elect to add any interest that accrues and becomes payable up to and including December 31, 2020 (and June 30, 2021 in the event the Maturity Date of the Debentures is extended pursuant to the terms of the Debenture Indenture) to the principal amount outstanding under such Debenture, in accordance with the terms of the Debenture Indenture (the “Interest Election”). Further, the principal amount (including, in the case of the Interest Election, accrued interest) of the Debentures will be convertible at the holder’s option into Common Shares (in the case of the additional Common Shares issuable for accrued interest, the “Interest Shares”) at any time prior to the Maturity Date at a conversion price of $0.50 per share. The full text of the Debenture Indenture is available on the Corporation’s SEDAR profile at www.sedar.com.

In connection with the Interest Election, the Corporation is seeking Shareholder approval to issue up to 3,950,000 Interest Shares and 1,700,000 Interest Shares, in connection with the Initial Debentures and Underlying Debentures, respectively.

Toronto Stock Exchange Matters

Pursuant to Section 607(g)(i) of the Manual, the TSX requires securityholder approval as a condition of acceptance of a notice of an issuance of securities if the aggregate number of listed securities issuable under a private placement is greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction and the price per security is less than the market price. As the conversion price of the Interest Shares is not tied to the market price at the time of conversion, the maximum number of Interest Shares issuable upon conversion of the Debentures will be included when determining the 25% maximum issuance.

Consequently, The TSX has approved the listing of the Interest Shares, subject to the satisfaction of certain conditions, including Shareholder approval as the total number of Interest Shares issuable (upon the exercise by the Corporation of the Interest Election and subsequent conversion of the accrued interest added as principal to the Debentures) when combined with the maximum additional Common Shares issuable upon conversion of the principal under the Debentures, would exceed 25% of the number of Common Shares outstanding prior to the date of the closing of the Offerings.

Accordingly, as a condition of its listing approval the TSX requires that the issuance of the Interest Shares be approved by Shareholders at the Meeting.

MI 61-101 Matters

In connection with the Offerings, certain “related parties” for the purposes of MI 61-101 subscribed for Initial Debentures and Subscription Receipts and the issuances thereto (including the potential issuance of Interest Shares thereunder) are considered “related party transactions” for the purposes of MI 61-101. The Corporation is relying on exemptions from the formal valuation and minority shareholder approval requirements available under MI 61-101. The Corporation is exempt from the formal valuation requirement in section 5.4 and the minority shareholder approval requirement in section 5.6 of MI 61-101 as neither the fair market value of the subject matter of, nor the fair market value of the consideration, for the transaction, insofar as it involves related parties, exceeds 25% of the Corporation’s market capitalization.

Approval of the Interest Settlement Resolution

To be effective, the Interest Settlement Resolution must be approved by a majority of the votes cast by Shareholders present or represented by proxy at the Meeting.

The Management Designees intend to vote FOR the Interest Settlement Resolution, unless otherwise instructed on a properly executed and validly deposited proxy.

The text of the Interest Settlement Resolution is as follows:

“BE IT RESOLVED THAT:

| (a) | the issuance of up to 3,950,000 Interest Shares and 1,700,000 Interest Shares to be issued upon the exercise of the Interest Election and the conversion of accrued interest added to the principal amount of the Initial Debentures and the Underlying Debentures, respectively, in accordance with the terms of the Debenture Indenture and as further described in the Information Circular, is approved; |

| (b) | any one director or officer of the Corporation and is hereby authorized and directed, for and on behalf of the Corporation, to finalize, sign and deliver all documents, to enter into any agreements and to do and perform all acts and things as such individual, in his or her discretion, deems necessary or advisable in order to give effect to the intent of this resolution and the matters authorized hereby, including compliance with all securities laws and regulations and the rules and requirements of the TSX, such determination to be conclusively evidenced by the finalizing, signing or delivery of such document or agreement or the performing of such act or thing.” |

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes the executive compensation program for the Corporation’s named executive officers (collectively, the “Named Executive Officers” or “NEO’s”). Until February 2, 2019, the Corporation was operating as Cinaport Acquisition Corp. II, a capital pool company (as such term is defined in the TSXV Corporate Finance Manual). On February 13, 2019, the Corporation completed its qualifying transaction with Fire & Flower Inc. (the “Qualifying Transaction”).

The Corporation’s NEOs for the fifty-two weeks ended February 1, 2020 were:

| ● | Trevor Fencott, President and Chief Executive Officer; |

| ● | Avinder Grewal, Chief Executive Officer (resigned following the completion of the Qualifying Transaction); |

| ● | Nadia Vattovaz, Chief Financial Officer; |

| ● | Grant Kehrli, Chief Financial Officer (resigned following the completion of the Qualifying Transaction); |

| ● | Harvey Shapiro, Executive Chair; |

| ● | Mike Vioncek, Chief Operating Officer; and |

| ● | Matthew Hollingshead, President of Hifyre Inc. (“Hifyre”), an indirect wholly-owned subsidiary of the Corporation. |

Compensation Objectives and Philosophy

The Corporation’s current executive compensation program is comprised of the following three (3) components: (a) base salary; (b) short-term incentives; and (c) long-term incentives. Together, these components support the Corporation’s long-term growth strategy and objectives, including:

| (i) | to align executive compensation with Shareholders’ interests; |

| (ii) | to attract and retain qualified executives; and |

| (iii) | to motivate the short-term and long-term performance of these executives. |

The current executive compensation program is designed to reward high performance. Named Executive Officers are compensated for their progress in executing the Corporation’s long-term growth strategy and for delivering strong total Shareholder return performance.

Components of Compensation

Base Salary

The base salary component is intended to provide a fixed level of competitive pay that reflects each NEO’s primary duties and responsibilities in fulfilling his or her role. It also provides a foundation upon which performance based incentive compensation elements are addressed and established. The base salary of NEOs also considers the salary made by other executive officers of a peer group of companies presented to the Corporation by its compensation consultant Meridian Compensation Partners, LLC (“Meridian”) (see “Compensation Consultant”). This peer group was selected based on a variety of size and industry criteria with market cap used as a primary screen and included 48North Cannabis Corp, Alcanna Inc, Aleafia Health Inc., Canlan Ice Sports Corp., Choom Holdings Inc., DAVIDsTEA Inc., Delta 9 Cannabis Inc., Freshii Inc., Gamehost Inc., Goodfood Market Corp, Inner Spirit Holdings Ltd., James E. Wagner Cultivation Corporation, Khiron Life Sciences Corp., Namaste Technologies Inc., National Access Cannabis Corp., Neptune Wellness Solutions Inc., The Second Cup Ltd., The Supreme Cannabis Company, Inc. and WeedMD Inc. Salaries of the NEOs will be reviewed annually by the CGC Committee.

Short-Term Incentives

In addition to base salaries, the Corporation has a discretionary bonus plan pursuant to which the Board, upon recommendation of the CGC Committee, may award annual cash bonuses to NEOs. The annual cash bonus element of the executive compensation program is designed to reward both corporate and individual performance during the Corporation’s last completed financial year. It is the CGC Committee’s philosophy that an individual bonus should be tied primarily to that individual’s contribution to corporate performance. In addition, the discretionary bonus plan is intended to help ensure that overall executive cash compensation (i.e. salary and bonus) is comparable to the average cash compensation of executives at peer surveyed companies during the year in question. The amount of the bonus paid is in relation to the achievement of specific criteria as previously established in keeping with the Corporation’s goals and objectives as well as individual objectives. The CGC Committee has established predetermined quantitative and qualitative performance criteria linked to the payment of bonuses.

The Corporation has a performance and restricted share unit plan (the “PRSU Plan”) which is overseen by the CGC Committee. Under the terms of the PRSU Plan, the Corporation may grant either restricted share units (each, an “RSU”) or performance share units (each a “PSU” and with the RSUs, the “Share Units”) to employees or officers of the Corporation. The RSUs entitle the holder thereof to receive an amount of cash consideration based on the value of a Common Share at the time such RSU vests. The PSU acts similarly to an RSU with the number of PSUs to vest adjusting based on the achievement of certain performance goals. To date the Corporation has granted time-vesting Restricted Share Units with a shorter vesting schedule (ratable vesting over two years). Moving forward, the Corporation anticipates granting Share Units with a longer vesting schedule.

Long-Term Incentives

The Corporation believes that encouraging its executives and employees to become shareholders is the best way of aligning their interests with those of its Shareholders. Equity participation is accomplished through participation in the Stock Option Plan (as defined herein) and PRSU Plan. Options (as defined herein) and Share Units are granted to executives and employees taking into account a number of factors, including the amount and term of Options and Share Units previously granted, base salary and competitive factors. The amounts and terms of Options and Share Units granted have been determined by the Board based on recommendations put forward by the CGC Committee, with input from the Chief Executive Officer.

Compensation Policies and Risk Management

As part of its review of the Corporation’s compensation policies and practices, the CGC Committee will consider the implications of risks associated with the Corporation’s compensation policies and practices. The CGC Committee will keep itself apprised of the current compensation policies of companies in the same space and draw upon the CGC Committee members’ backgrounds with other issuers to help identify and mitigate compensation policies and practices that could encourage a Named Executive Officer or individual at a principal business unit or division to take inappropriate or excessive risks. As of the date hereof, the CGC Committee is not aware of any material risks arising from the Corporation’s current compensation policies or practices that would be reasonably likely to have a material adverse effect on the Corporation.

The Corporation does not currently have any policies in place that would prevent Named Executive Officers or directors of the Corporation from purchasing financial instruments that might be designed to hedge or offset a decrease in market value of equity securities granted as compensation or held by Named Executive Officers or directors.

Compensation Governance

The CGC Committee is charged with, among other things, a periodic review of directors’ and officers’ compensation having regard to the Corporation’s peers, various governance reports on current trends in directors’ compensation and independently compiled compensation data for directors and officers of reporting issuers of comparable size to the Corporation. For a description of the peer group of companies, see “Compensation Discussion and Analysis – Components of Compensation”.

CGC Committee

The CGC Committee is currently comprised of Norman Inkster (Chair), Sharon Ranson and Jeremy Bergeron. All members of the CGC Committee are considered independent, in accordance with applicable securities legislation. The skills and experience that enable the members of the CGC Committee to make decisions on the suitability of the Corporation’s compensation policies and practices are summarized below:

| ● | Norman Inkster (Chair) – Norman Inkster was the 18th Commissioner of the RCMP and is a former President of INTERPOL. Following his career in the RCMP, Mr. Inkster joined KPMG and became the Partner in charge of KPMG Forensic Canada and subsequently the Global Managing Partner at KPMG Forensic. Mr. Inkster was appointed Chair of the Advisory Council on National Security by Prime Minister Stephen Harper a post he held for four years. Mr. Inkster served as an external advisor to the Departmental Audit Committee of Public Works and Government Services Canada and now serves in a similar capacity with Public Safety Canada. Mr. Inkster has served on the boards of several publicly traded companies acting as chair of both audit and governance committees, the most recent being Mettrum Health Corp., which was acquired by Canopy Growth Corporation. Mr. Inkster is currently the Chair of Technical Standards and Safety Authority of Ontario. Mr. Inkster holds a BA (Honours) and an LLD (Honourary) from the University of New Brunswick. He is also an Honourary Chief of the Blackfoot tribe and an Honourary member of the Cree Nation. Mr. Inkster is an Officer of the Order of Canada. |

| ● | Sharon Ranson – Sharon Ranson is a corporate director and President of The Ranson Group Inc., a company offering executive coaching and consulting services. Ms. Ranson also currently serves as a director of Sprott Inc., Dorel Industries, Spark Power Corp. and the Toronto Investment Board. Prior to founding her current business in 2002, Ms. Ranson spent over 20 years in capital markets where she was a top ranked Financial Services Analyst and a senior Portfolio Manager. Ms. Ranson is an FCPA, FCA and holds the ICD.D designation. She graduated from Queen’s University with a Bachelor of Commerce and holds an MBA from York University. |

| ● | Jeremy Bergeron – Jeremy Bergeron has served as Vice President of Alternative Channels for global convenience retailer ACT since July 2018, leading ACT’s exploration and investment in the cannabis industry. Prior to that role, Mr. Bergeron was President, Chief Executive Officer and a board member of CrossAmerica Partners (NYSE: CAPL) for three years. His previous roles have also included serving as Senior Vice President of Integration & Development as well as Treasurer for CST, an international convenience retailer acquired by ACT in 2017. Before joining CST, Jeremy was employed by Valero Energy Corporation (NYSE: VLO) for 17 years, holding several managerial positions during that timeframe. He earned a BBA in Management and Information Systems from the University of the Incarnate Word and a MBA from the University of Texas at San Antonio. He is also a 2014 graduate of the Stanford Executive Program. |

CGC Committee Mandate

The overall purpose of the CGC Committee as set out in the CGC Committee’s mandate (the “CGC Committee Mandate”) is to assist the Board (a) in maintaining high standards of corporate governance by developing, recommending and monitoring effective guidelines and procedures applicable to the Corporation; (b) by establishing the process for identifying, recruiting, appointing and/or providing ongoing development for directors of the Corporation; and (c) in fulfilling its oversight responsibilities in relation to human resources and compensation by developing, monitoring and assessing the Corporation’s approach to the development and succession of key executives and the compensation of its directors, senior management and employees.

Corporate governance responsibilities include reviewing the mandates of the Board and its committees; periodically reviewing and evaluating the performance of all directors, committees and the Board as a whole; recommending new candidates for Board membership, making recommendations to the Board regarding the size and composition of the Board and qualification criteria for the selection of new Board members and ensuring that appropriate orientation and education programs are available for new Board members; reviewing annually the membership and chairs of all committees of the Board; and reviewing annually and recommending retainers and fees paid to Board members; reviewing human resources and compensation responsibilities include recommending to the Board candidates for Chief Executive Officer and all other senior management positions and approving the terms of their appointment and termination or retirement; reviewing succession planning programs for the Chief Executive Officer, President and all other senior management and specific career planning for potential successors; reviewing, in consultation with the Chair, and recommending to the Board for approval, the remuneration of the Corporation’s Chief Executive Officer, President and other senior executive officers; reviewing and recommending to the Board for approval, on an annual basis, the corporate goals and objectives for the Chief Executive Officer and evaluating the Chief Executive Officer’s performance against such goals and objectives; reviewing and approving compensation for any newly hired individual whose total annual compensation (including salary, bonus and any other incentive compensation) exceeds $400,000 in addition to being informed of any party entering into any engagement with the Corporation where the consideration payable to such third party by the Corporation is reasonably expected to exceed $400,000 in any 12 month period; and determining (or delegating the authority to determine) and recommending to the Board for approval awards of Options under the Stock Option Plan.

Compensation Consultant

In March 2019, the CGC Committee engaged Meridian to conduct a comprehensive compensation benchmarking review for NEOs and directors using a peer group of companies identified by Meridian. For a description of the peer group of companies, see “Compensation Discussion and Analysis – Components of Compensation”. The Corporation has not paid any fees to Meridian for services rendered prior to February 2, 2019.

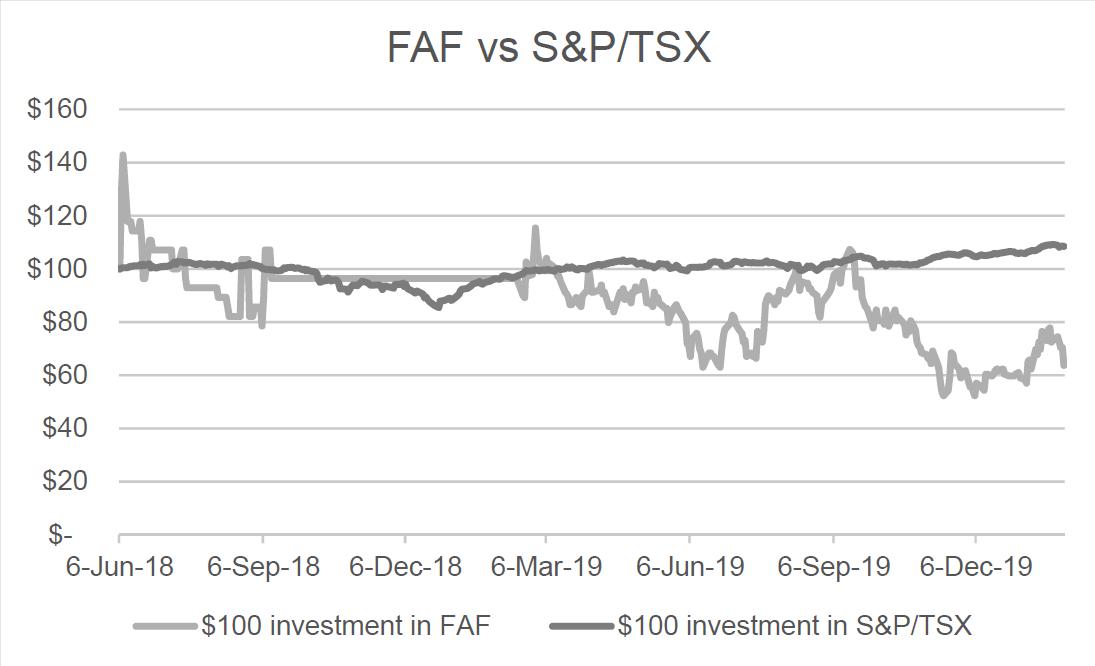

Performance Graph

The following performance graph compares the total cumulative return to a Shareholder who invested $100 in Common Shares on June 6, 2018 (the date the Common Shares commenced trading on the TSX), assuming reinvestment of dividends, with the cumulative total return on the S&P/TSX Composite Total Return Index for each year following June 6, 2018.