$1'5(3/$&(':,7+³>;<=@´68&+,'(17,),(',1)250$7,21 +$6%((1(;&/8'(')5207+,6(;+,%,7%(&$86(,7 , ,61270$7(5,$/$1' ,, ,67+(7<3(7+$77+(5(*,675$1775($76$635,9$7(25&21),'(17,$/ Exhibit (c)(10) &(57$,1&21),'(17,$/3257,2162)7+,6(;+,%,7+$9(%((120,77(' PROJECT PACIFIC STRATEGIC ALTERNATIVES CONSIDERATIONS APRIL 13, 2023 Confidential

PROJECT PACIFIC SITUATION OVERVIEW • Pardes Biosciences is evaluating its strategic options following the decision to suspend the clinical development of pomotrelvir, reduce headcount by 85% and conserve its current cash balance of ~$172 million. • Pardes’ attractive cash balance and the current weakness in the capital markets provide Pardes with a range of strategic alternatives to optimize value for shareholders. – Merge with a private company – In-license or acquire clinical assets or new technologies – Merge with a public company – Return capital to shareholders • Private company merger counterparties could have complementary assets and operating synergies or could be in different therapeutic areas that the board believes will create a compelling story for new and existing investors. • In-licensing or acquiring assets should be explored but can be challenging given both the competitive intensity and funding requirements to acquire and develop high-quality, clinical-stage assets through to value inflecting milestones. • Public-to-public mergers are rare for pre-commercial biopharma companies as public company targets with attractive assets often have financing options that are more efficient and feasible than a merger with a cash-rich fallen angel. • The return of capital option may be more efficient than in the past given the emergence of parties willing to acquire cash-rich companies for up to 80-90% of their net cash balance plus CVRs via a tender offer that can close in ~45 days vs the traditional dissolution process that can take up to three years to complete. • The typical private merger process can take approximately two to three months to announcement and can take up to another three to four months to close in the event the transaction does not qualify for a sign-and-close. • Our experience as a leading strategic advisor, history of screening and sourcing select targets for a number of similarly situated clients, differentiated knowledge resources and deep relationships with potential merger partners make us an ideal advisor for the board as it navigates options and executes potential strategic transactions. Confidential 1

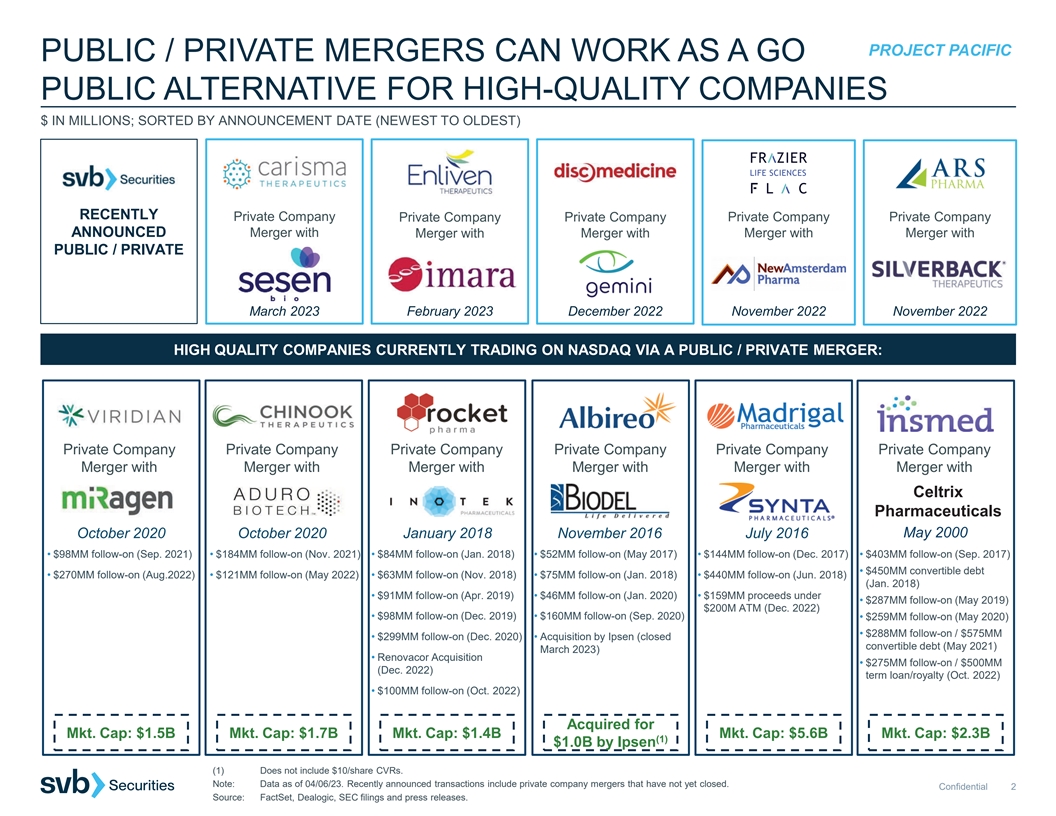

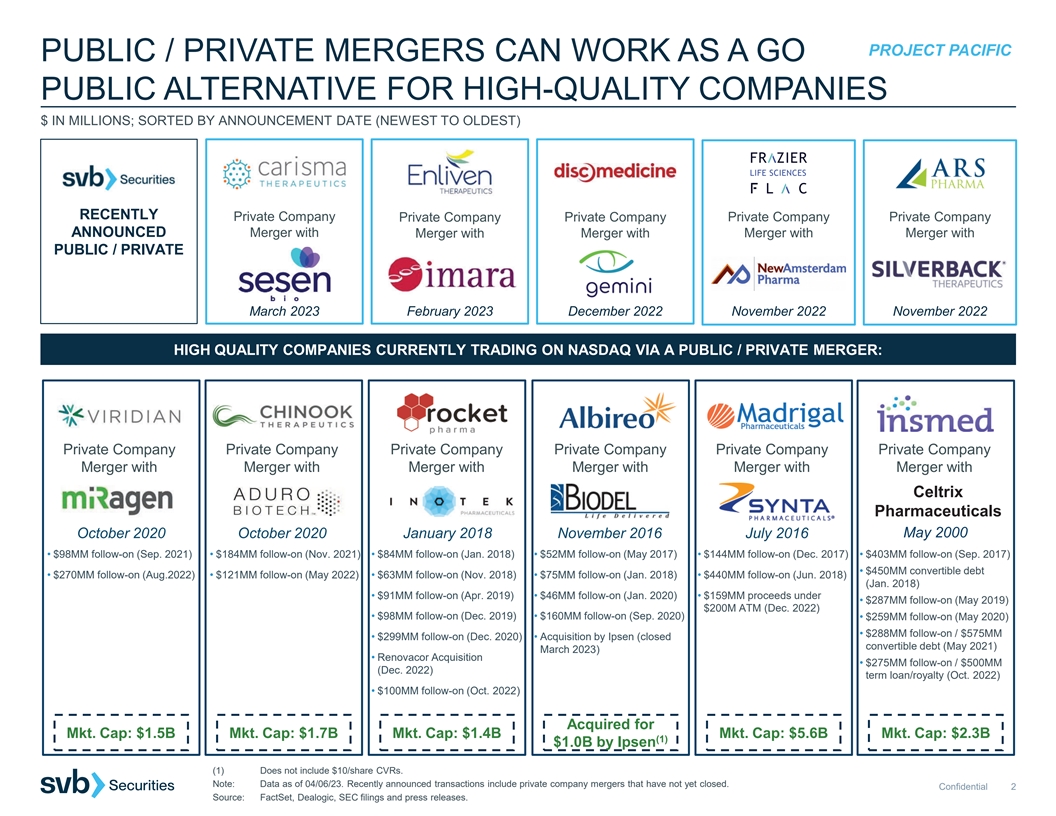

PROJECT PACIFIC PUBLIC / PRIVATE MERGERS CAN WORK AS A GO PUBLIC ALTERNATIVE FOR HIGH-QUALITY COMPANIES $ IN MILLIONS; SORTED BY ANNOUNCEMENT DATE (NEWEST TO OLDEST) RECENTLY Private Company Private Company Private Company Private Company Private Company ANNOUNCED Merger with Merger with Merger with Merger with Merger with PUBLIC / PRIVATE MERGERS: March 2023 February 2023 December 2022 November 2022 November 2022 HIGH QUALITY COMPANIES CURRENTLY TRADING ON NASDAQ VIA A PUBLIC / PRIVATE MERGER: Private Company Private Company Private Company Private Company Private Company Private Company Merger with Merger with Merger with Merger with Merger with Merger with Celtrix Pharmaceuticals May 2000 October 2020 October 2020 January 2018 November 2016 July 2016 • $98MM follow-on (Sep. 2021) • $184MM follow-on (Nov. 2021) • $84MM follow-on (Jan. 2018) • $52MM follow-on (May 2017) • $144MM follow-on (Dec. 2017) • $403MM follow-on (Sep. 2017) • $450MM convertible debt • $270MM follow-on (Aug.2022) • $121MM follow-on (May 2022) • $63MM follow-on (Nov. 2018) • $75MM follow-on (Jan. 2018) • $440MM follow-on (Jun. 2018) (Jan. 2018) • $91MM follow-on (Apr. 2019) • $46MM follow-on (Jan. 2020) • $159MM proceeds under • $287MM follow-on (May 2019) $200M ATM (Dec. 2022) • $98MM follow-on (Dec. 2019) • $160MM follow-on (Sep. 2020) • $259MM follow-on (May 2020) • $288MM follow-on / $575MM • $299MM follow-on (Dec. 2020) • Acquisition by Ipsen (closed convertible debt (May 2021) March 2023) • Renovacor Acquisition • $275MM follow-on / $500MM (Dec. 2022) term loan/royalty (Oct. 2022) • $100MM follow-on (Oct. 2022) Acquired for Mkt. Cap: $1.5B Mkt. Cap: $1.7B Mkt. Cap: $1.4B Mkt. Cap: $5.6B Mkt. Cap: $2.3B (1) $1.0B by Ipsen (1) Does not include $10/share CVRs. Note: Data as of 04/06/23. Recently announced transactions include private company mergers that have not yet closed. Confidential 2 Source: FactSet, Dealogic, SEC filings and press releases.

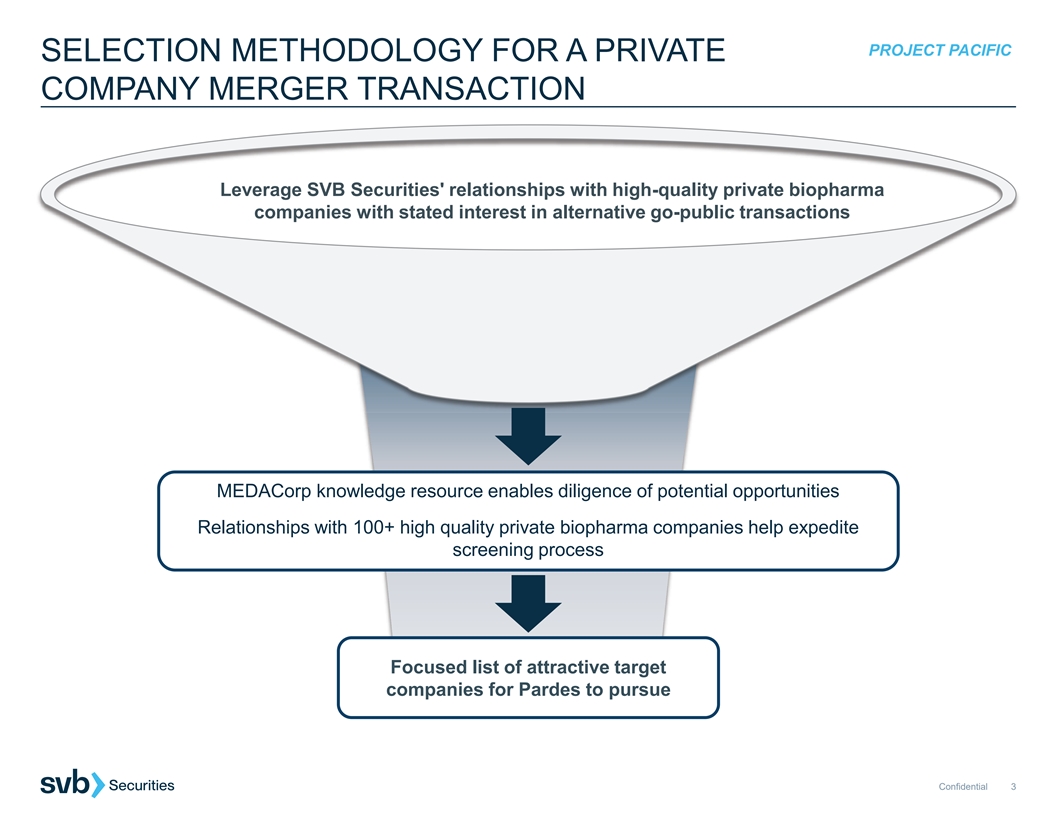

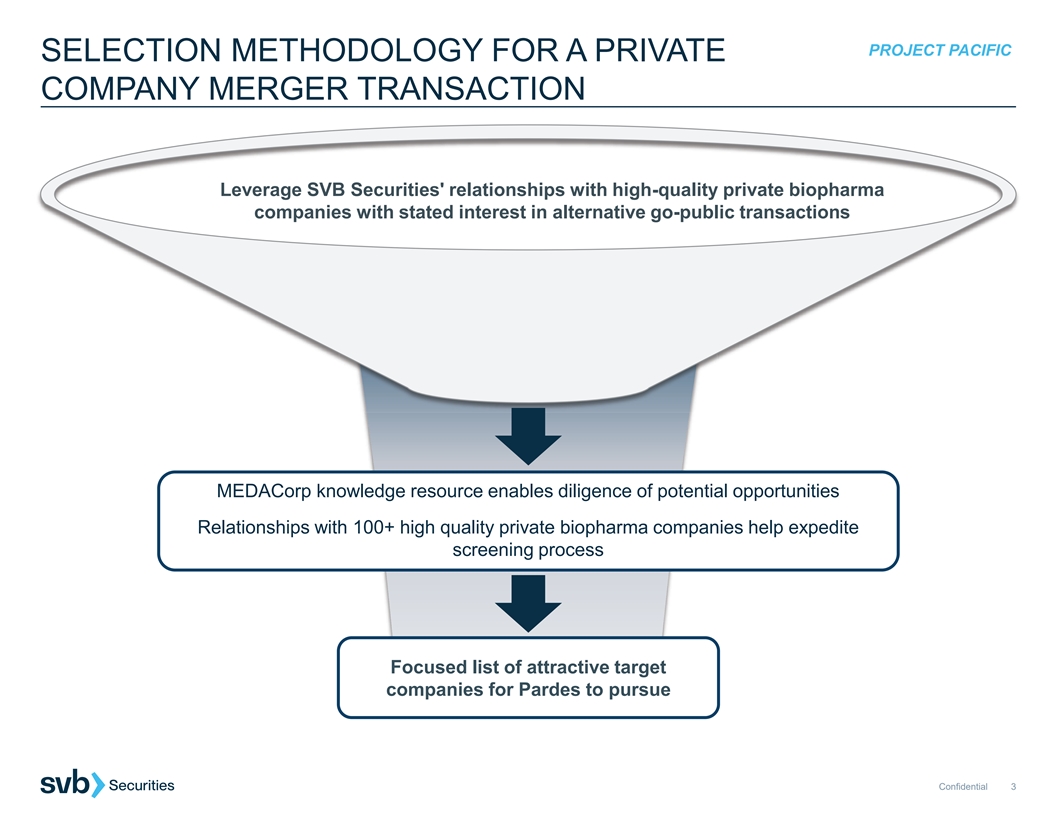

PROJECT PACIFIC SELECTION METHODOLOGY FOR A PRIVATE COMPANY MERGER TRANSACTION Leverage SVB Securities' relationships with high-quality private biopharma companies with stated interest in alternative go-public transactions MEDACorp knowledge resource enables diligence of potential opportunities Relationships with 100+ high quality private biopharma companies help expedite screening process Focused list of attractive target companies for Pardes to pursue Confidential 3

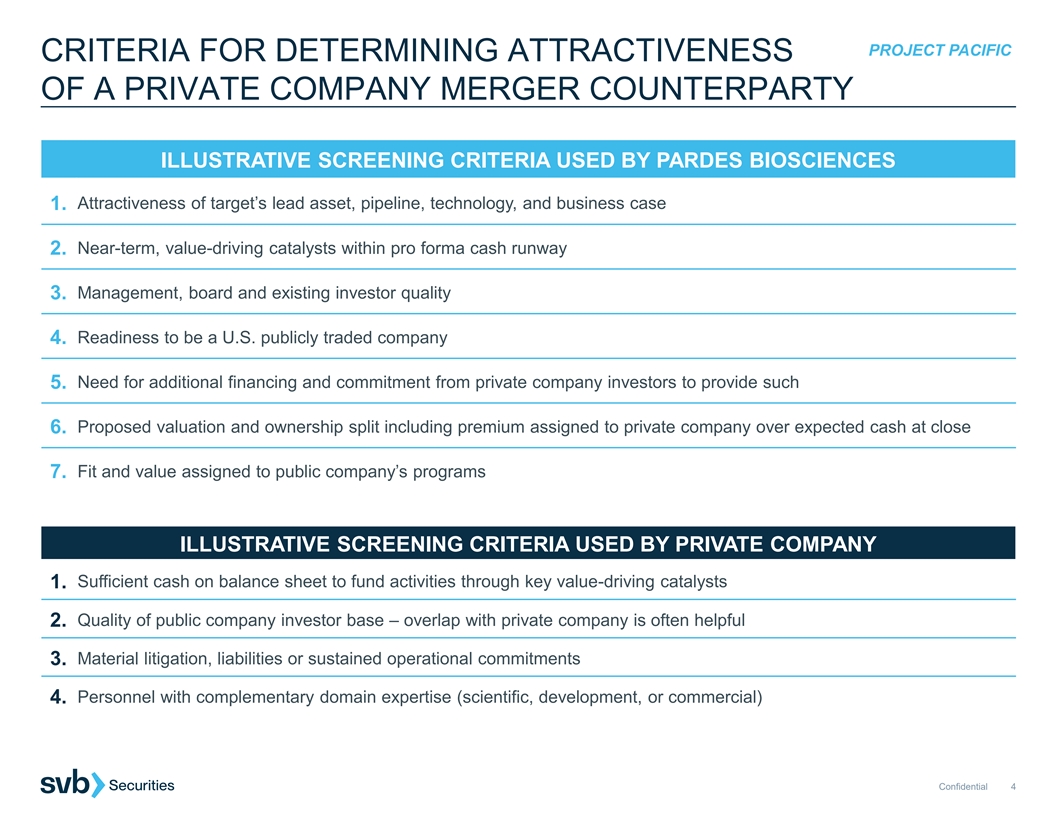

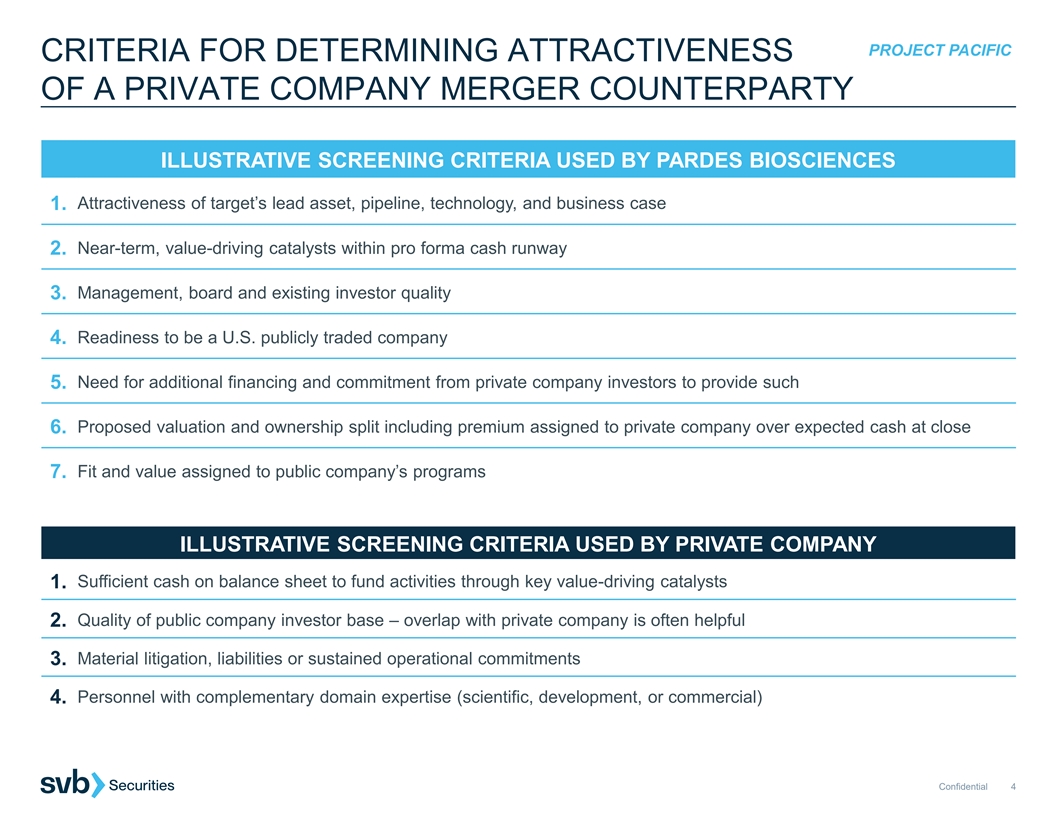

PROJECT PACIFIC CRITERIA FOR DETERMINING ATTRACTIVENESS OF A PRIVATE COMPANY MERGER COUNTERPARTY ILLUSTRATIVE SCREENING CRITERIA USED BY PARDES BIOSCIENCES Attractiveness of target’s lead asset, pipeline, technology, and business case 1. 2. Near-term, value-driving catalysts within pro forma cash runway Management, board and existing investor quality 3. 4. Readiness to be a U.S. publicly traded company Need for additional financing and commitment from private company investors to provide such 5. 6. Proposed valuation and ownership split including premium assigned to private company over expected cash at close Fit and value assigned to public company’s programs 7. ILLUSTRATIVE SCREENING CRITERIA USED BY PRIVATE COMPANY 1. Sufficient cash on balance sheet to fund activities through key value-driving catalysts 2. Quality of public company investor base – overlap with private company is often helpful Material litigation, liabilities or sustained operational commitments 3. Personnel with complementary domain expertise (scientific, development, or commercial) 4. Confidential 4

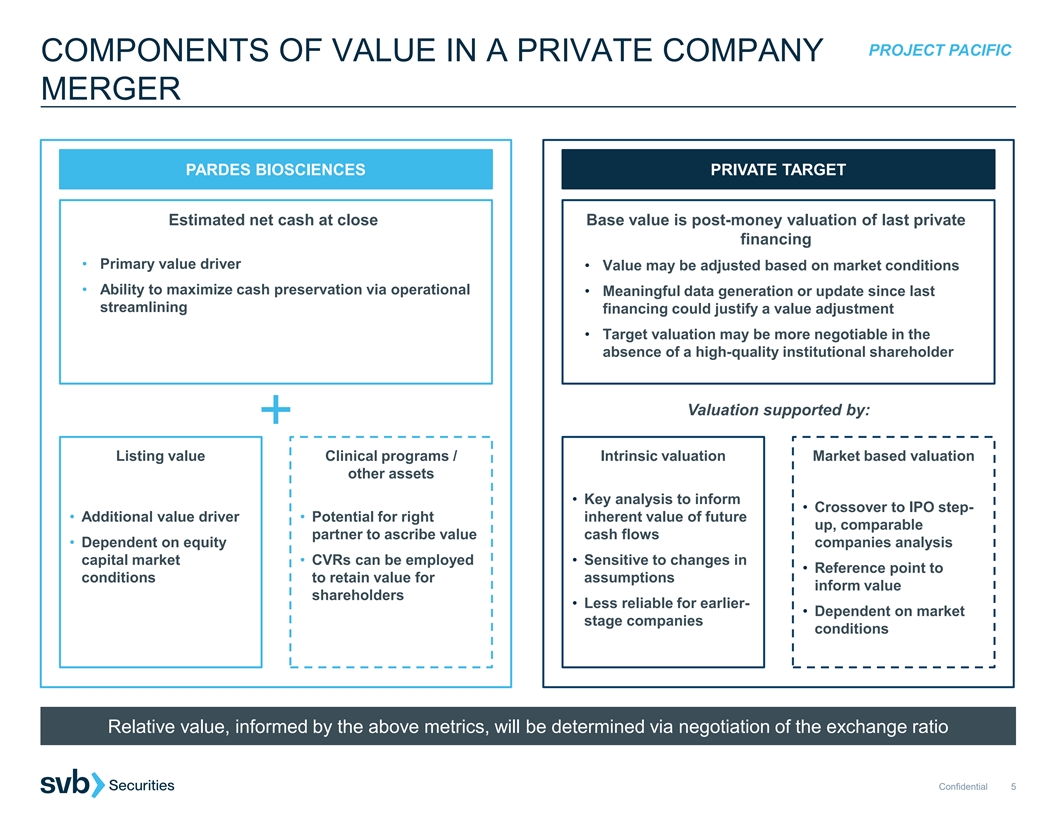

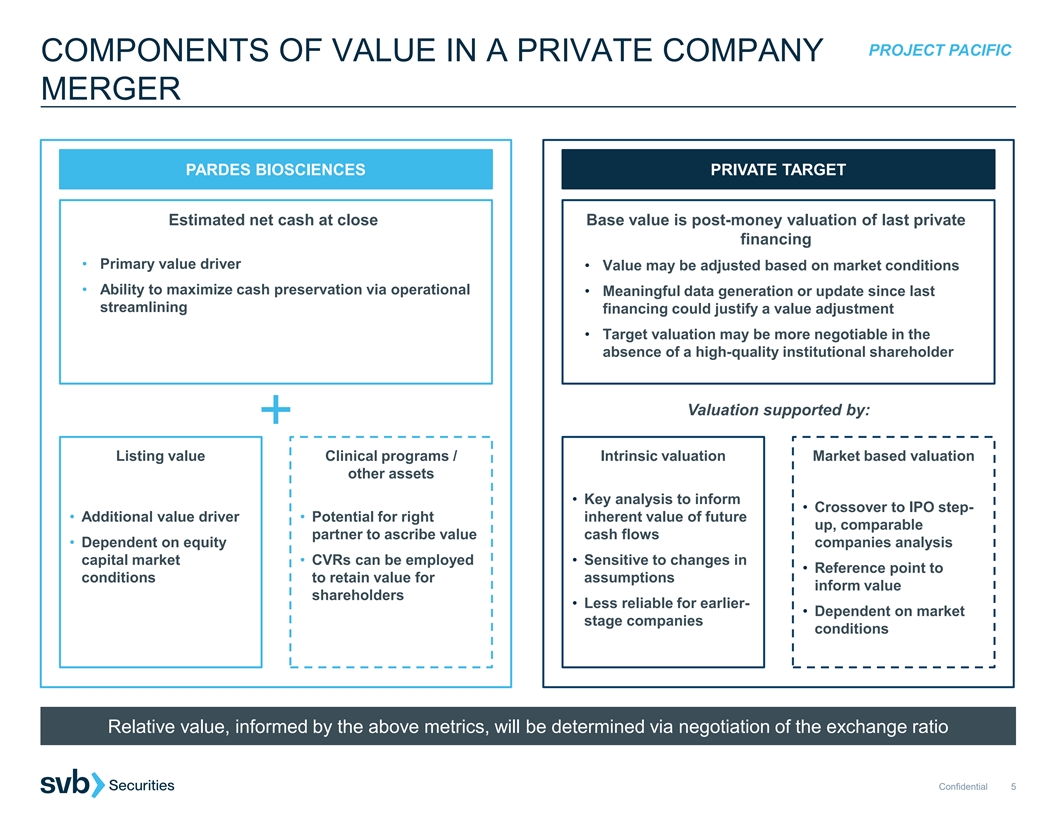

PROJECT PACIFIC COMPONENTS OF VALUE IN A PRIVATE COMPANY MERGER PARDES BIOSCIENCES PRIVATE TARGET Estimated net cash at close Base value is post-money valuation of last private financing • Primary value driver • Value may be adjusted based on market conditions • Ability to maximize cash preservation via operational • Meaningful data generation or update since last streamlining financing could justify a value adjustment • Target valuation may be more negotiable in the absence of a high-quality institutional shareholder Valuation supported by: Listing value Clinical programs / Intrinsic valuation Market based valuation other assets • Key analysis to inform • Crossover to IPO step- • Additional value driver • Potential for right inherent value of future up, comparable partner to ascribe value cash flows • Dependent on equity companies analysis capital market • CVRs can be employed • Sensitive to changes in • Reference point to conditions to retain value for assumptions inform value shareholders • Less reliable for earlier- • Dependent on market stage companies conditions Relative value, informed by the above metrics, will be determined via negotiation of the exchange ratio Confidential 5

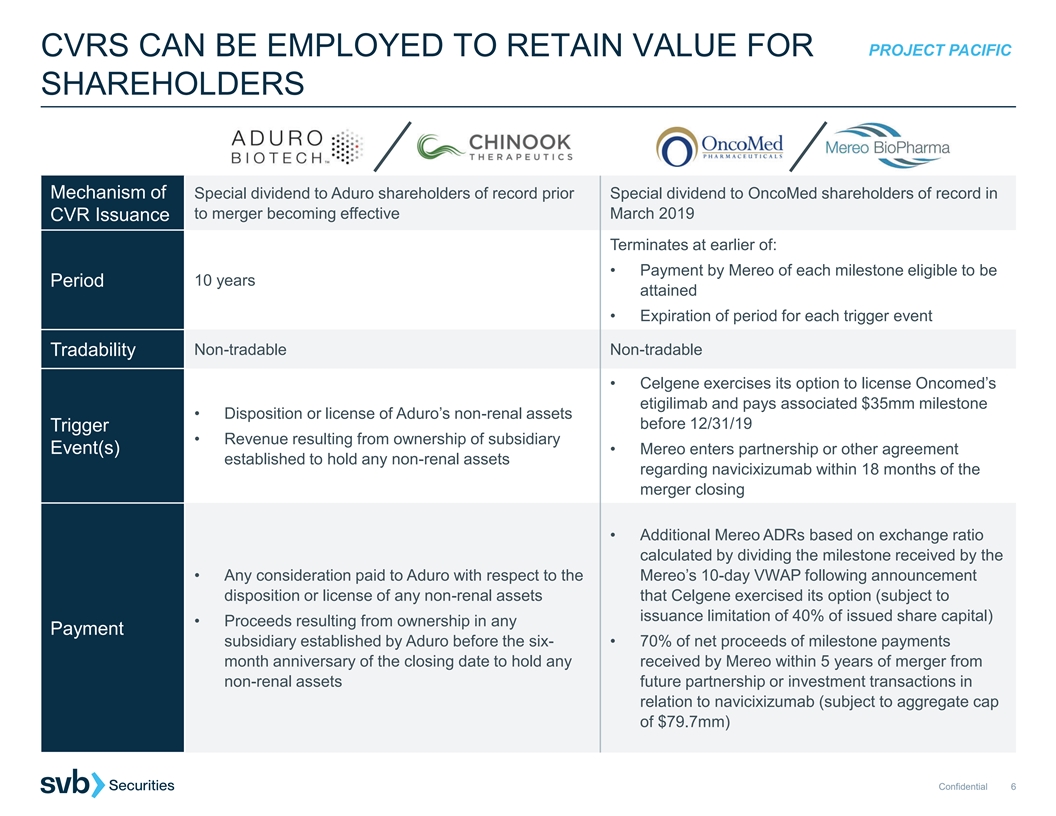

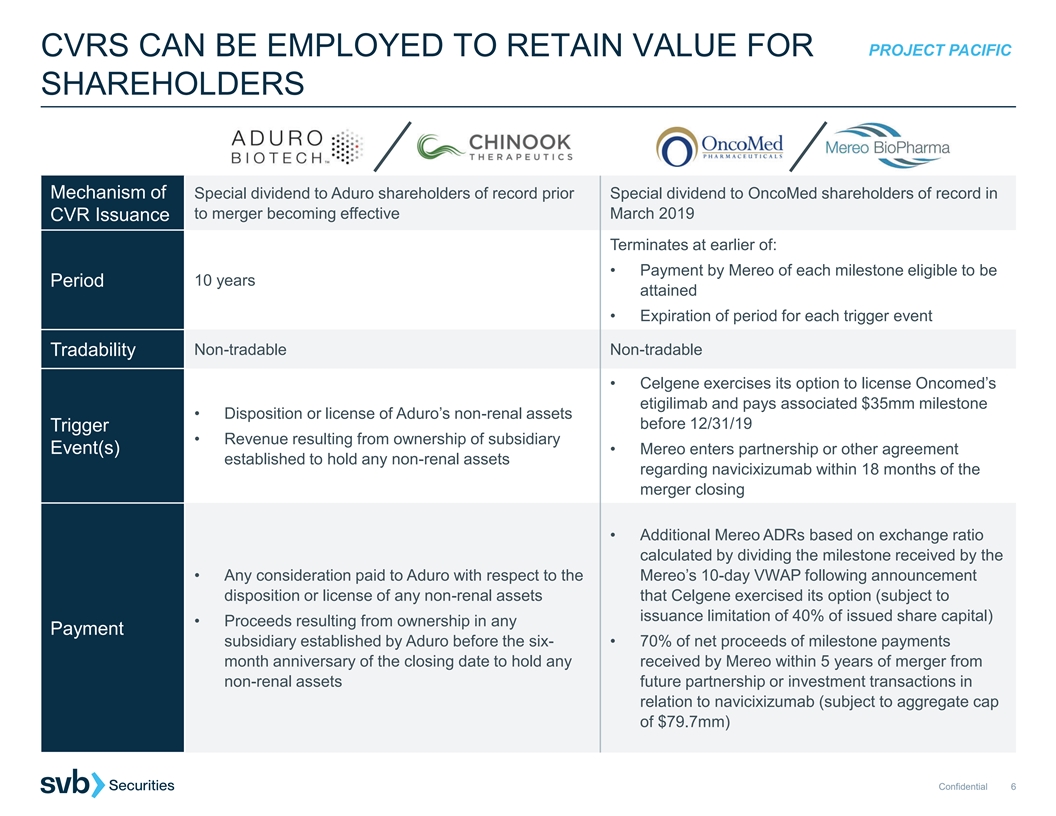

CVRS CAN BE EMPLOYED TO RETAIN VALUE FOR PROJECT PACIFIC SHAREHOLDERS Mechanism of Special dividend to Aduro shareholders of record prior Special dividend to OncoMed shareholders of record in to merger becoming effective March 2019 CVR Issuance Terminates at earlier of: • Payment by Mereo of each milestone eligible to be 10 years Period attained • Expiration of period for each trigger event Non-tradable Non-tradable Tradability • Celgene exercises its option to license Oncomed’s etigilimab and pays associated $35mm milestone • Disposition or license of Aduro’s non-renal assets before 12/31/19 Trigger • Revenue resulting from ownership of subsidiary Event(s) • Mereo enters partnership or other agreement established to hold any non-renal assets regarding navicixizumab within 18 months of the merger closing • Additional Mereo ADRs based on exchange ratio calculated by dividing the milestone received by the • Any consideration paid to Aduro with respect to the Mereo’s 10-day VWAP following announcement disposition or license of any non-renal assets that Celgene exercised its option (subject to issuance limitation of 40% of issued share capital) • Proceeds resulting from ownership in any Payment subsidiary established by Aduro before the six- • 70% of net proceeds of milestone payments month anniversary of the closing date to hold any received by Mereo within 5 years of merger from non-renal assets future partnership or investment transactions in relation to navicixizumab (subject to aggregate cap of $79.7mm) Confidential 6

PROJECT PACIFIC CASE STUDY: CONCENTRA’S ACQUISITION OF JOUNCE POST REDX MERGER ANNOUNCEMENT TIMELINE • 02/23: Jounce announced an all-stock merger with Redx Pharma (37% / 63% split, respectively) • 03/14: Concentra offered to acquire Jounce for $1.80 cash per share + a CVR • 03/27: Jounce announced acquisition by Concentra for $1.85 cash per share + CVRs TRANSACTION DETAILS • On 04/07, Concentra will commence a tender offer to acquire all outstanding shares of Jounce for $1.85 per share + CVRs ‒ Estimated / minimum Jounce net cash at close: $115M / $110M ‒ Upfront cash of $1.85 per share represents 61% of current net cash per share, 85% of estimated net cash at close and 89% of minimum net cash ‒ Jounce’s liquidation analysis suggested distribution would result in proceeds of 61% of current net cash and 89% of merger minimum cash • CVRs are for proceeds from (1) a transaction for Jounce’s programs and (2) certain specified cost savings (1) 80% of proceeds from a transaction for Jounce’s programs within two years of merger close; 10-year tail on payments (2) 100% of the potential aggregate value of certain specified potential cost savings, including: o Any reduction in the amount of the expected lease obligation o Any increase in net working capital • Concurrent with the merger, Jounce announced an 84% RIF (compared to a 57% RIF with the Redx merger) and restructuring costs of $6.5M • Jounce’s board also recommended not moving forward with the Redx merger, causing Redx shares to decline 11% TRADING PERFORMANCE PERFORMANCE RELATIVE TO CASH PER SHARE Share TANGCAPITALMANAGEMENT Price 03/27: Announced $3.00 acquisition by Concentra Merger (2/23) + Offer (3/14): Merger (3/27): (1) Current Net Cash Per Share: $3.01 57% RIF $1.80 + CVR $1.85 + CVRs $2.50 T-0 +1 Day T-0 +1 Day T-0 +1 Day (2) 03/14: Announced Est. Net Cash at Close Per Share: $2.16 Concentra’s offer to acquire $2.00 Jounce Share Price $0.99 $1.10 $1.06 $1.49 $1.51 $1.83 (3) Merger Min. Net Cash Per Share: $2.07 Change 11% 41% 21% $1.50 Share Price as a % of Net Cash Share Price as % of: $1.00 (1) Latest Net Cash 33% 37% 35% 50% 50% 61% (2) Est. Net Cash at Close 46% 51% 49% 69% 70% 85% $0.50 02/23: Announced merger 03/06: Tang Capital acquired (3) with Redx a 9.7% stake in Jounce Merger Min. Net Cash 48% 53% 51% 72% 73% 88% $0.00 1/3 1/10 1/17 1/24 1/31 2/7 2/14 2/21 2/28 3/7 3/14 3/21 (1): Net cash per share of $3.01, assuming $160M last reported net cash and 53.1 fully diluted shares outstanding using treasury stock methodology. (2): Net cash per share of $2.16, assuming $115M net cash at close and 53.1 fully diluted shares outstanding using treasury stock methodology. Confidential 7 (3): Net cash per share of $2.07, assuming $110M net cash at close and 53.1 fully diluted shares outstanding using treasury stock methodology.

PROJECT PACIFIC ILLUSTRATIVE POTENTIAL MERGER CANDIDATES Oncology Autoimmune & Inflammation (1) (1) (1) Vida Ventures (1) (1) (1) Portfolio Company (2) (1): Public company. (2): Highest stage of development not disclosed. Inbound Interest Source: Company websites. Confidential 8 Preclinical Phase 1 & 1/2 Phase 2 & 3

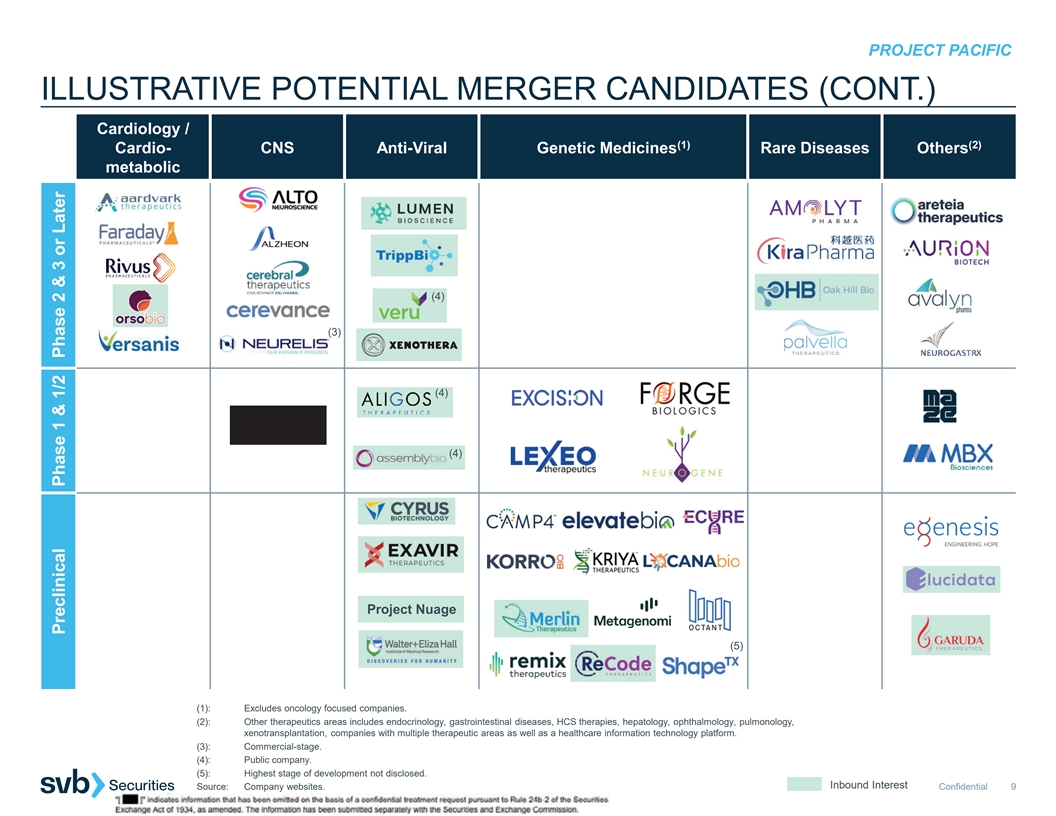

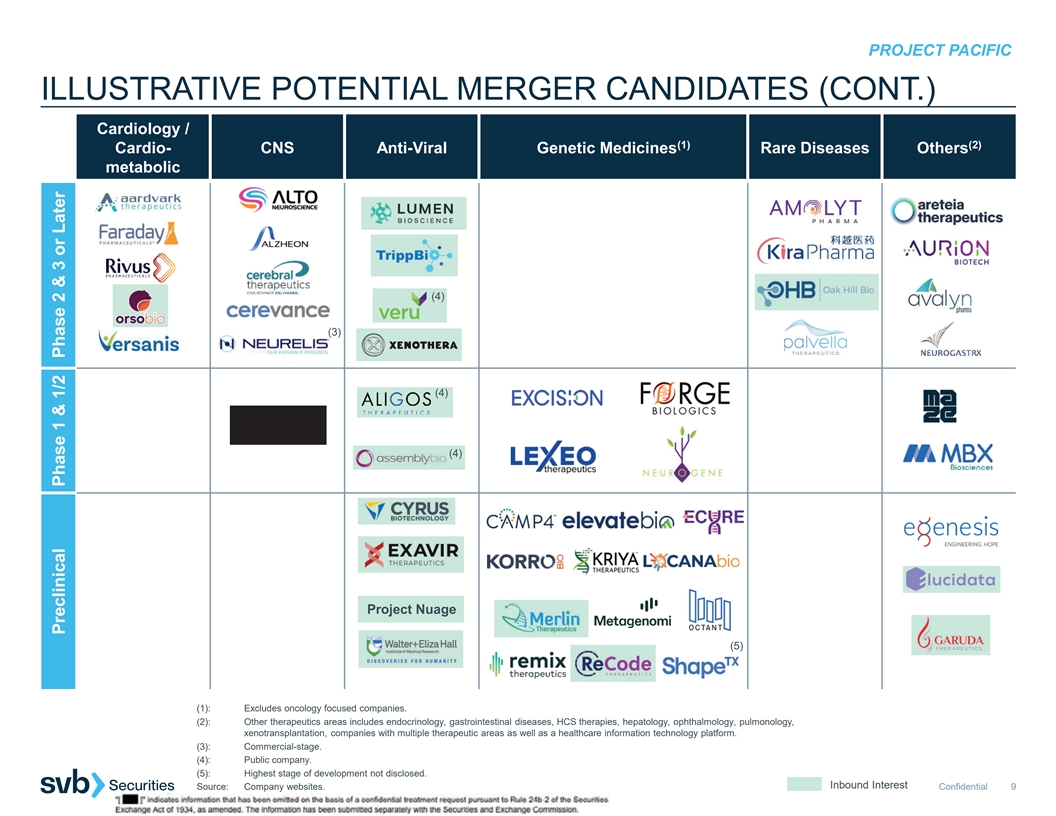

PROJECT PACIFIC ILLUSTRATIVE POTENTIAL MERGER CANDIDATES (CONT.) Cardiology / X (1) (2) Cardio- CNS Anti-Viral Genetic Medicines Rare Diseases Others metabolic (4) (3) (4) (4) Project Nuage (5) (1): Excludes oncology focused companies. (2): Other therapeutics areas includes endocrinology, gastrointestinal diseases, HCS therapies, hepatology, ophthalmology, pulmonology, xenotransplantation, companies with multiple therapeutic areas as well as a healthcare information technology platform. (3): Commercial-stage. (4): Public company. (5): Highest stage of development not disclosed. Inbound Interest Source: Company websites. Confidential 9 Preclinical Phase 1 & 1/2 Phase 2 & 3 or Later

PROJECT PACIFIC ILLUSTRATIVE PRIVATE COMPANY MERGER PROCESS TIMELINE THROUGH ANNOUNCEMENT MONTH APRIL MAY JUNE JULY WEEK OF 10 17 24 1 8 15 22 29 5 12 19 26 3 10 17 24 Weekly reoccurring meeting to track process Private company target selection Formally initiate outreach to selected parties Send process letter and receive initial proposals Evaluate proposals and advance parties to further diligence Due diligence Management presentations Receipt of final proposals Negotiate final terms and definitive documentation If Nasdaq agrees no shareholder approval is required, the merger can close shortly after announcement. Confidential 10

PROJECT PACIFIC Disclosures This information (including, but not limited to, prices, quotes and statistics) has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice. The information is intended for Institutional Use Only and is not an offer to sell or a solicitation to buy any product to which this information relates. SVB Securities LLC (“Firm”), its officers, directors, employees, proprietary accounts and affiliates may have a position, long or short, in the securities referred to in this report, and/or other related securities, and from time to time may increase or decrease the position or express a view that is contrary to that contained in this report. The Firm's research analysts, salespeople, traders and other professionals may provide oral or written market commentary or trading strategies that are contrary to opinions expressed in this report. The Firm's asset management group and proprietary accounts may make investment decisions that are inconsistent with the opinions expressed in this document. The past performance of securities does not guarantee or predict future performance. Transaction strategies described herein may not be suitable for all investors. This document may not be reproduced or circulated without SVB Securities’ written authority. Additional information is available upon request by contacting the Editorial Department, SVB Securities LLC, 53 State Street, 40th Floor, Boston, MA 02109. Like all Firm employees, research analysts receive compensation that is impacted by, among other factors, overall firm profitability, which includes revenues from, among other business units, Institutional Equities, Research, and Investment Banking. Research analysts, however, are not compensated for a specific investment banking services transaction. To the extent SVB Securities' research reports are referenced in this material, they are either attached hereto or information about these companies, including prices, rating, market making status, price charts, compensation disclosures, Analyst Certifications, etc. is available on https://svbsecurities.bluematrix.com/bluematrix/Disclosure2. SVB MEDACorp LLC (MEDACorp), an affiliate of SVB Securities LLC, is a global network of independent healthcare professionals (Key Opinion Leaders and consultants) providing industry and market insights to SVB Securities and its clients. © 2023 SVB Securities LLC. All Rights Reserved. Member FINRA/SIPC. SVB Securities LLC is a member of SVB Financial Group. Confidential