Exhibit (c)(15) PROJECT PACIFIC PROCESS UPDATE JUNE 11, 2023 Confidential

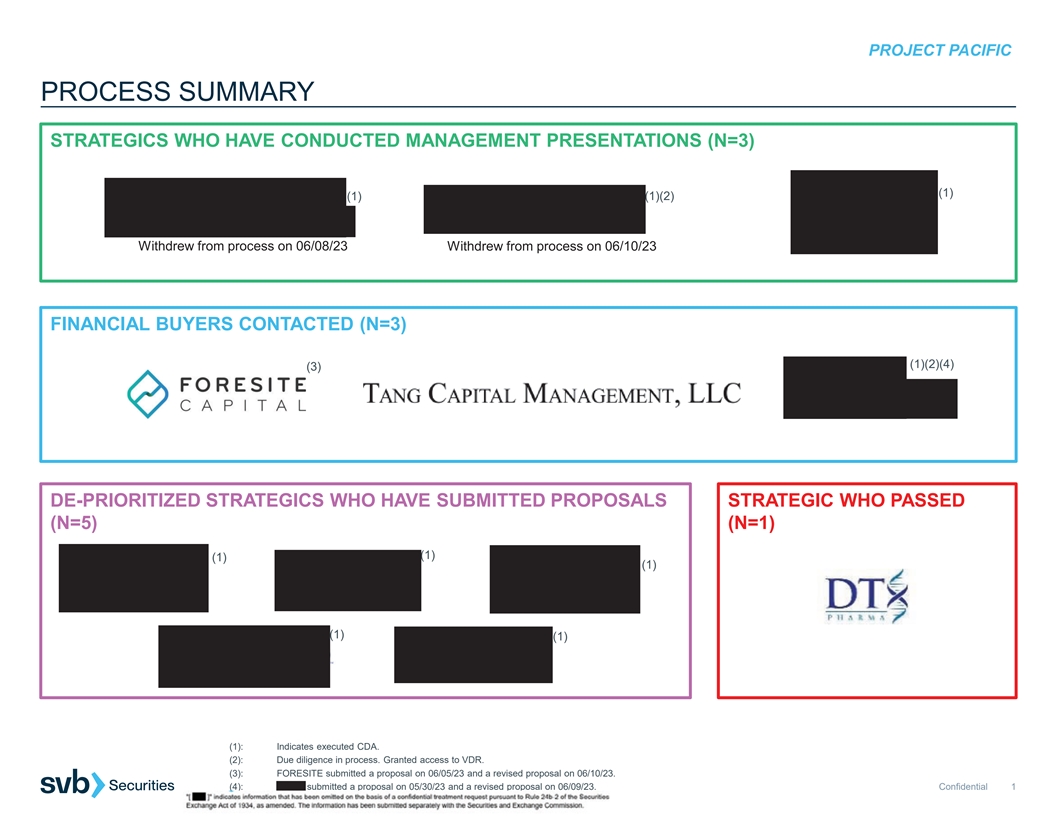

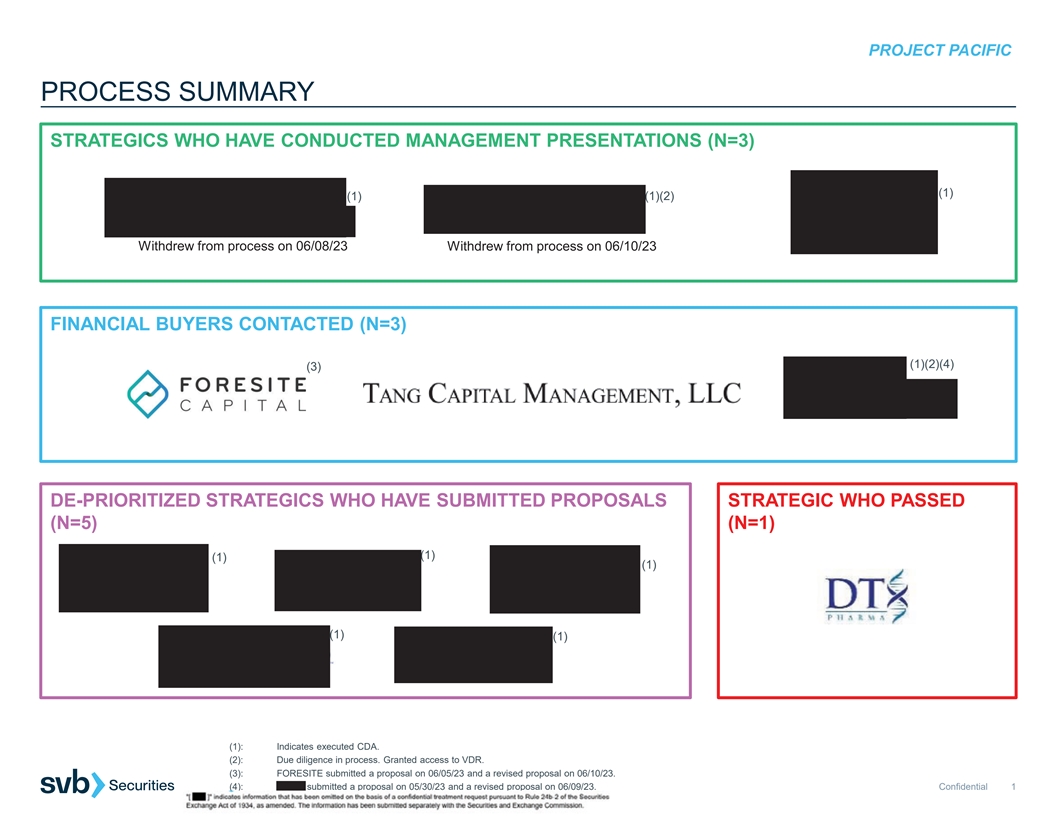

PROJECT PACIFIC PROCESS SUMMARY STRATEGICS WHO HAVE CONDUCTED MANAGEMENT PRESENTATIONS (N=3) (1) (1) (1)(2) Withdrew from process on 06/08/23 Withdrew from process on 06/10/23 FINANCIAL BUYERS CONTACTED (N=3) (1)(2)(4) (3) DE-PRIORITIZED STRATEGICS WHO HAVE SUBMITTED PROPOSALS STRATEGIC WHO PASSED (N=5) (N=1) (1) (1) (1) (1) (1) (1): Indicates executed CDA. (2): Due diligence in process. Granted access to VDR. (3): FORESITE submitted a proposal on 06/05/23 and a revised proposal on 06/10/23. (4): XOMA submitted a proposal on 05/30/23 and a revised proposal on 06/09/23. Confidential 1

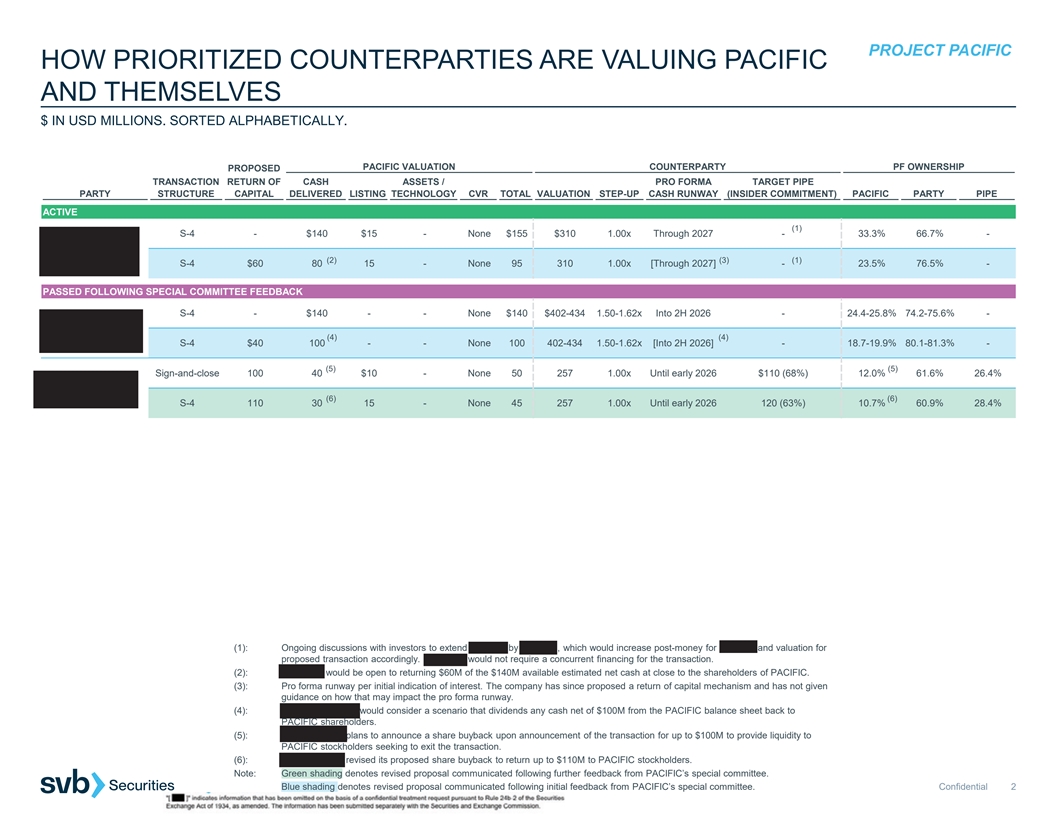

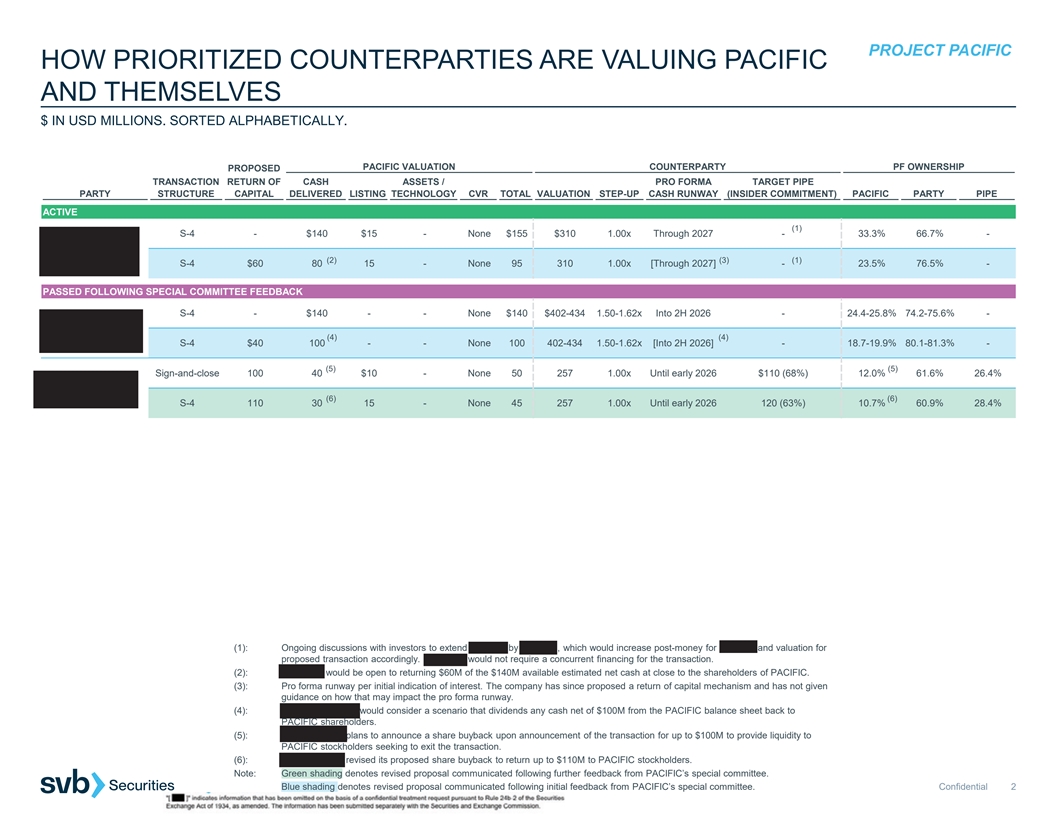

PROJECT PACIFIC HOW PRIORITIZED COUNTERPARTIES ARE VALUING PACIFIC AND THEMSELVES $ IN USD MILLIONS. SORTED ALPHABETICALLY. PACIFIC VALUATION COUNTERPARTY PF OWNERSHIP PROPOSED TRANSACTION RETURN OF CASH ASSETS / PRO FORMA TARGET PIPE PARTY STRUCTURE CAPITAL DELIVERED LISTING TECHNOLOGY CVR TOTAL VALUATION STEP-UP CASH RUNWAY (INSIDER COMMITMENT) PACIFIC PARTY PIPE ACTIVE (1) S-4 - $140 $15 - None $155 $310 1.00x Through 2027 - 33.3% 66.7% - (2) (3) (1) S-4 $60 80 15 - None 95 310 1.00x [Through 2027] - 23.5% 76.5% - PASSED FOLLOWING SPECIAL COMMITTEE FEEDBACK S-4 - $140 - - None $140 $402-434 1.50-1.62x Into 2H 2026 - 24.4-25.8% 74.2-75.6% - (4) (4) S-4 $40 100 - - None 100 402-434 1.50-1.62x [Into 2H 2026] - 18.7-19.9% 80.1-81.3% - (5) (5) Sign-and-close 100 40 $10 - None 50 257 1.00x Until early 2026 $110 (68%) 12.0% 61.6% 26.4% (6) (6) S-4 110 30 15 - None 45 257 1.00x Until early 2026 120 (63%) 10.7% 60.9% 28.4% (1): Ongoing discussions with investors to extend Series C by $25-50M, which would increase post-money for Series C and valuation for proposed transaction accordingly. PIPELINE would not require a concurrent financing for the transaction. (2): PIPELINE would be open to returning $60M of the $140M available estimated net cash at close to the shareholders of PACIFIC. (3): Pro forma runway per initial indication of interest. The company has since proposed a return of capital mechanism and has not given guidance on how that may impact the pro forma runway. (4): BOUNDLESS BIO would consider a scenario that dividends any cash net of $100M from the PACIFIC balance sheet back to PACIFIC shareholders. (5): IMMPACT BIO plans to announce a share buyback upon announcement of the transaction for up to $100M to provide liquidity to PACIFIC stockholders seeking to exit the transaction. (6): IMMPACT BIO revised its proposed share buyback to return up to $110M to PACIFIC stockholders. Note: Green shading denotes revised proposal communicated following further feedback from PACIFIC’s special committee. Blue shading denotes revised proposal communicated following initial feedback from PACIFIC’s special committee. Confidential 2

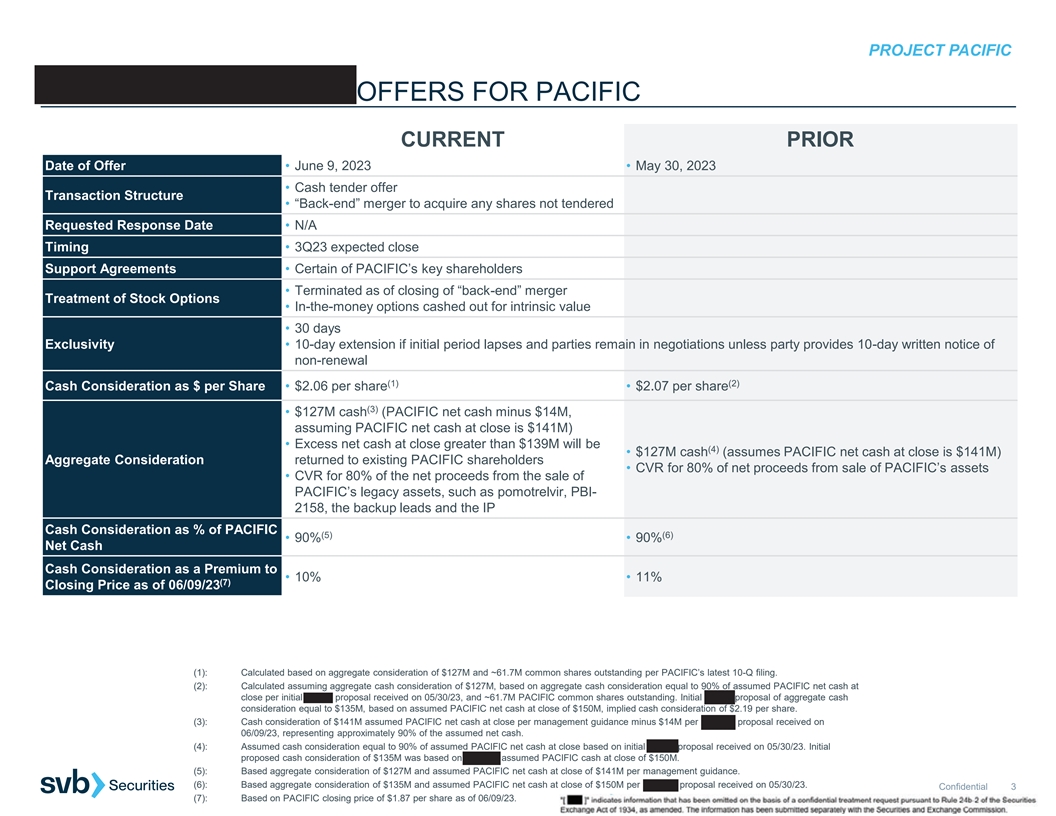

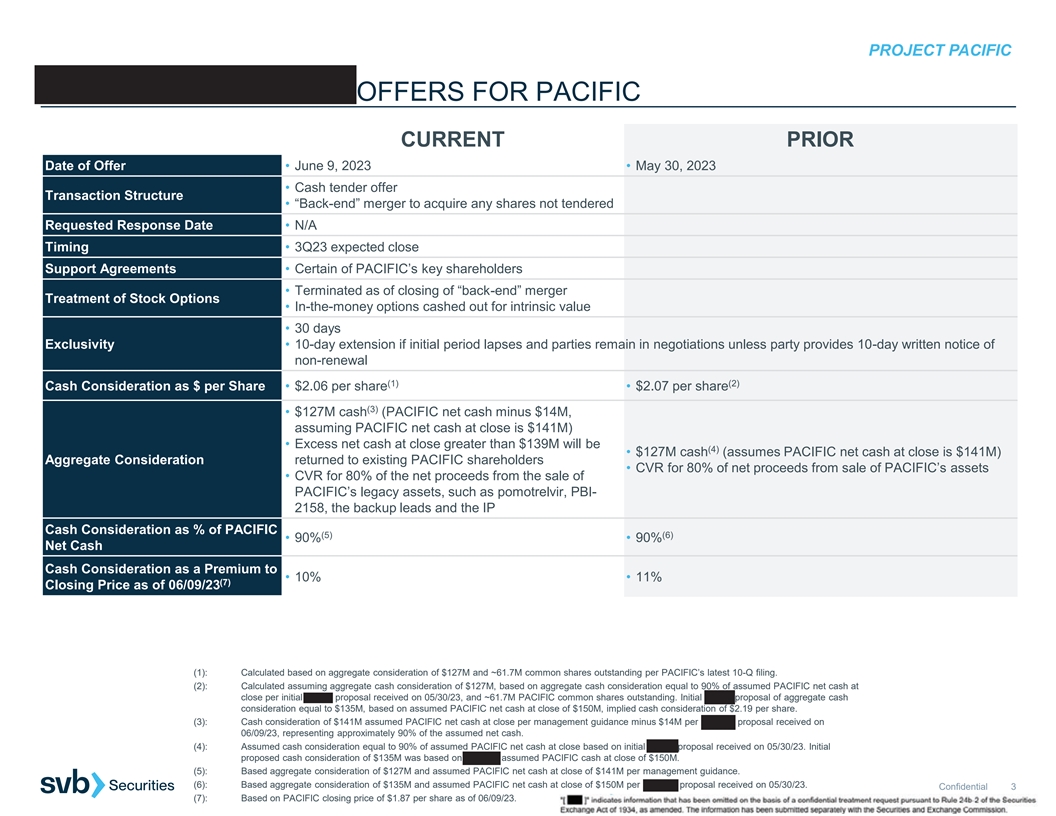

PROJECT PACIFIC XOMA CORPORATION’S OFFERS FOR PACIFIC CURRENT PRIOR Date of Offer • June 9, 2023 • May 30, 2023 • Cash tender offer Transaction Structure • “Back-end” merger to acquire any shares not tendered Requested Response Date • N/A Timing • 3Q23 expected close Support Agreements • Certain of PACIFIC’s key shareholders • Terminated as of closing of “back-end” merger Treatment of Stock Options • In-the-money options cashed out for intrinsic value • 30 days Exclusivity • 10-day extension if initial period lapses and parties remain in negotiations unless party provides 10-day written notice of non-renewal (1) (2) Cash Consideration as $ per Share • $2.06 per share • $2.07 per share (3) • $127M cash (PACIFIC net cash minus $14M, assuming PACIFIC net cash at close is $141M) • Excess net cash at close greater than $139M will be (4) • $127M cash (assumes PACIFIC net cash at close is $141M) Aggregate Consideration returned to existing PACIFIC shareholders • CVR for 80% of net proceeds from sale of PACIFIC’s assets • CVR for 80% of the net proceeds from the sale of PACIFIC’s legacy assets, such as pomotrelvir, PBI- 2158, the backup leads and the IP Cash Consideration as % of PACIFIC (5) (6) • 90% • 90% Net Cash Cash Consideration as a Premium to • 10% • 11% (7) Closing Price as of 06/09/23 (1): Calculated based on aggregate consideration of $127M and ~61.7M common shares outstanding per PACIFIC’s latest 10-Q filing. (2): Calculated assuming aggregate cash consideration of $127M, based on aggregate cash consideration equal to 90% of assumed PACIFIC net cash at close per initial XOMA proposal received on 05/30/23, and ~61.7M PACIFIC common shares outstanding. Initial XOMA proposal of aggregate cash consideration equal to $135M, based on assumed PACIFIC net cash at close of $150M, implied cash consideration of $2.19 per share. (3): Cash consideration of $141M assumed PACIFIC net cash at close per management guidance minus $14M per XOMA’s proposal received on 06/09/23, representing approximately 90% of the assumed net cash. (4): Assumed cash consideration equal to 90% of assumed PACIFIC net cash at close based on initial XOMA proposal received on 05/30/23. Initial proposed cash consideration of $135M was based on XOMA’s assumed PACIFIC cash at close of $150M. (5): Based aggregate consideration of $127M and assumed PACIFIC net cash at close of $141M per management guidance. (6): Based aggregate consideration of $135M and assumed PACIFIC net cash at close of $150M per XOMA’s proposal received on 05/30/23. Confidential 3 (7): Based on PACIFIC closing price of $1.87 per share as of 06/09/23.

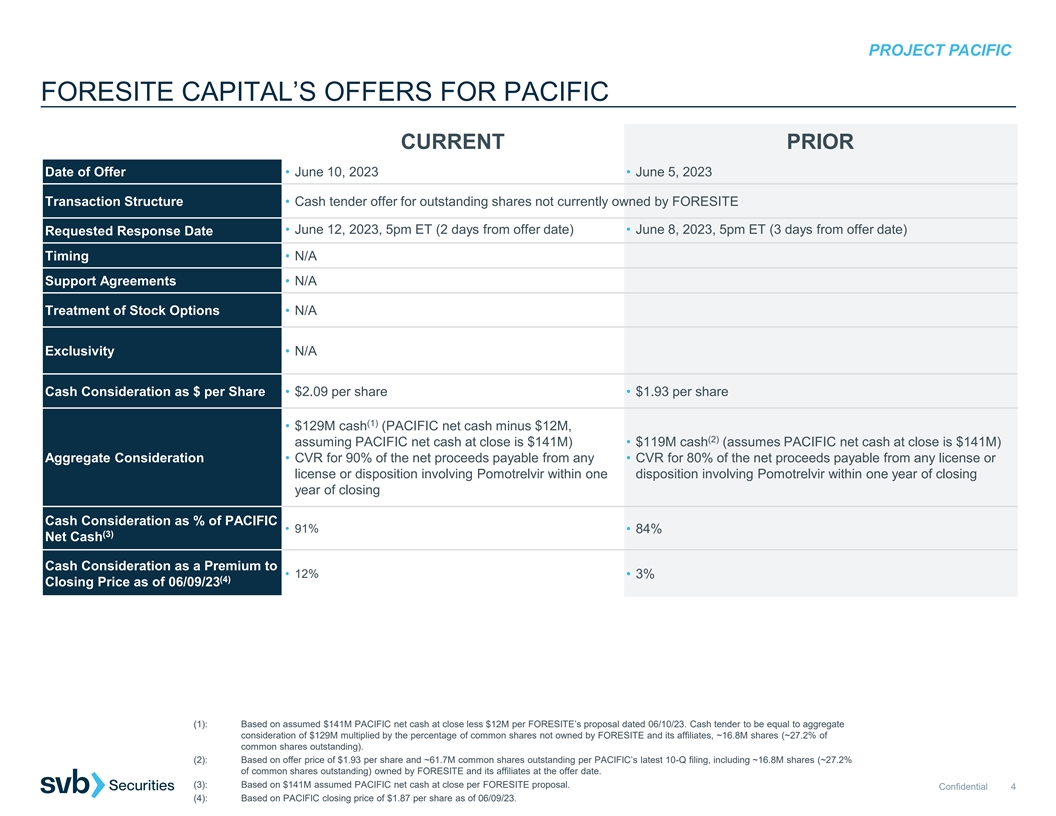

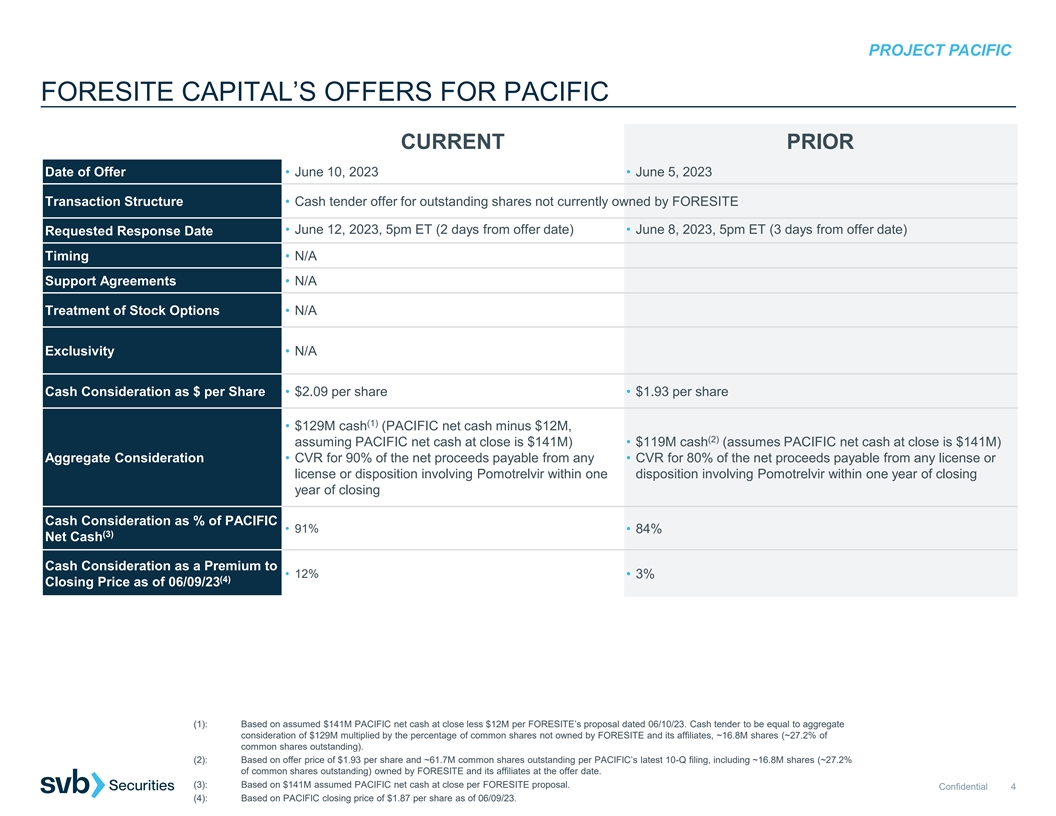

PROJECT PACIFIC FORESITE CAPITAL’S OFFERS FOR PACIFIC CURRENT PRIOR Date of Offer • June 10, 2023 • June 5, 2023 Transaction Structure • Cash tender offer for outstanding shares not currently owned by FORESITE • June 12, 2023, 5pm ET (2 days from offer date) • June 8, 2023, 5pm ET (3 days from offer date) Requested Response Date Timing • N/A Support Agreements • N/A Treatment of Stock Options • N/A Exclusivity • N/A Cash Consideration as $ per Share • $2.09 per share • $1.93 per share (1) • $129M cash (PACIFIC net cash minus $12M, (2) assuming PACIFIC net cash at close is $141M) • $119M cash (assumes PACIFIC net cash at close is $141M) Aggregate Consideration • CVR for 90% of the net proceeds payable from any • CVR for 80% of the net proceeds payable from any license or license or disposition involving Pomotrelvir within one disposition involving Pomotrelvir within one year of closing year of closing Cash Consideration as % of PACIFIC • 91% • 84% (3) Net Cash Cash Consideration as a Premium to • 12% • 3% (4) Closing Price as of 06/09/23 (1): Based on assumed $141M PACIFIC net cash at close less $12M per FORESITE’s proposal dated 06/10/23. Cash tender to be equal to aggregate consideration of $129M multiplied by the percentage of common shares not owned by FORESITE and its affiliates, ~16.8M shares (~27.2% of common shares outstanding). (2): Based on offer price of $1.93 per share and ~61.7M common shares outstanding per PACIFIC’s latest 10-Q filing, including ~16.8M shares (~27.2% of common shares outstanding) owned by FORESITE and its affiliates at the offer date. (3): Based on $141M assumed PACIFIC net cash at close per FORESITE proposal. Confidential 4 (4): Based on PACIFIC closing price of $1.87 per share as of 06/09/23.

2223 PROJECT PACIFIC DISCOUNTS TO NET CASH IMPLIED BY RECENT FINANCIAL BUYERS’ PROPOSALS ($ in millions, except per share values) Terms of Proposal Cash Consideration Non-Contingent Offer Target As a % of Premium to Ann. Financial Cash per Equity Total per Aggregate Contingent Net Cash Net Cash Unaffected Offer (1) Date Company Buyer Share per Share Share Value Value Rights at Close at Close Price Accepted 80% of the net proceeds payable from any (2) 05/30/23 $8.00 - $8.00 $53 license or disposition of the MEI's clinical $76 70% 11% assets 80% of the net proceeds payable from any 05/22/23 5.75 - 5.75 480 570 84% 55% license or disposition of Atea’s programs Echo Lake (3) 03/21/23 1.60 - 1.60 58 None 87 67% 90% Capital 80% of the net proceeds for ten years post- closing from any license or disposition of (4) 03/14/23 1.85 - 1.85 96 Jounce’s programs effected within two years 115 85% 75% of closing and 100% of the potential aggregate value of certain potential cost savings Mean: 76% 58% Median: 77% 65% 25th Percentile: 69% 44% 75th Percentile: 84% 78% (1): Estimated net cash at close per offer filing unless otherwise noted. (2): Expected net cash of ~$93M at 06/30/23 per the S-4 filing, net of ~$17M of total minimum operating lease payments (carrying value of $13M due to present value discounting) as of 03/31/23. (3): $90M cash and cash equivalents net of $3M total liabilities as of 03/31/23. (4): Represents final offer accepted on 03/27/23, increased from the 03/14/23 offer of $1.80 per share + CVR. Note: Includes unsolicited offers from financial buyers for biopharma companies trading below net cash. Excludes unsolicited offers for companies which total liabilities exceeded cash and cash equivalents at the time of the offer. Source: Company press releases and filings. Confidential 5

APPENDIX

A. CATALYSTS IN PRO FORMA CASH RUNWAY OF STRATEGICS THAT HAVE SUBMITTED INDICATIONS OF INTEREST

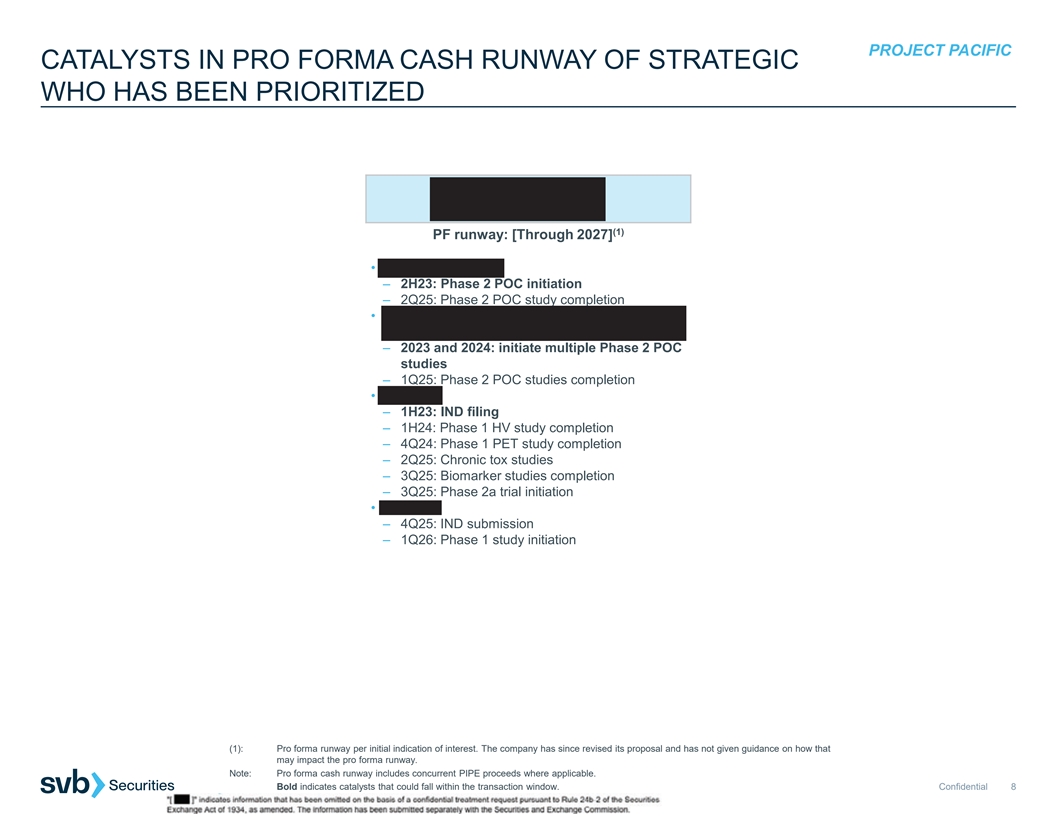

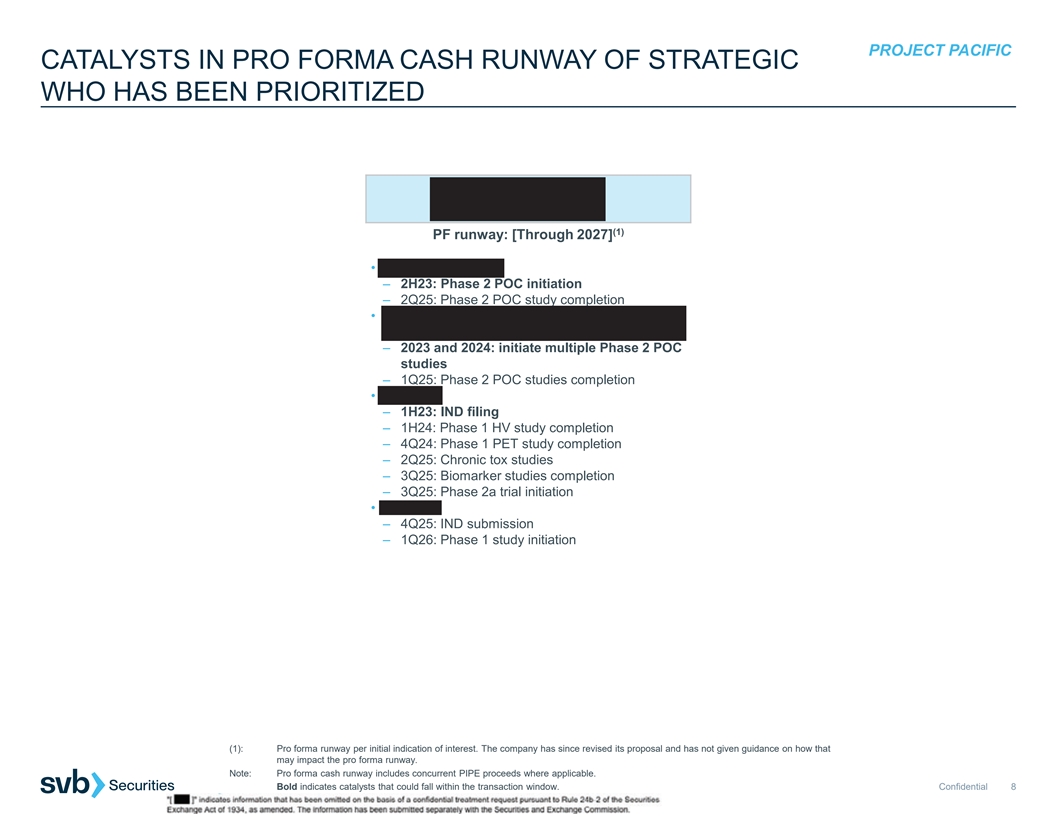

PROJECT PACIFIC CATALYSTS IN PRO FORMA CASH RUNWAY OF STRATEGIC WHO HAS BEEN PRIORITIZED (1) PF runway: [Through 2027] • PIPE-307 in r/r MS – 2H23: Phase 2 POC initiation – 2Q25: Phase 2 POC study completion • PIPE-307 in other neurological disorders, including MDD – 2023 and 2024: initiate multiple Phase 2 POC studies – 1Q25: Phase 2 POC studies completion • PIPE-791 – 1H23: IND filing – 1H24: Phase 1 HV study completion – 4Q24: Phase 1 PET study completion – 2Q25: Chronic tox studies – 3Q25: Biomarker studies completion – 3Q25: Phase 2a trial initiation • Calpain – 4Q25: IND submission – 1Q26: Phase 1 study initiation (1): Pro forma runway per initial indication of interest. The company has since revised its proposal and has not given guidance on how that may impact the pro forma runway. Note: Pro forma cash runway includes concurrent PIPE proceeds where applicable. Bold indicates catalysts that could fall within the transaction window. Confidential 8

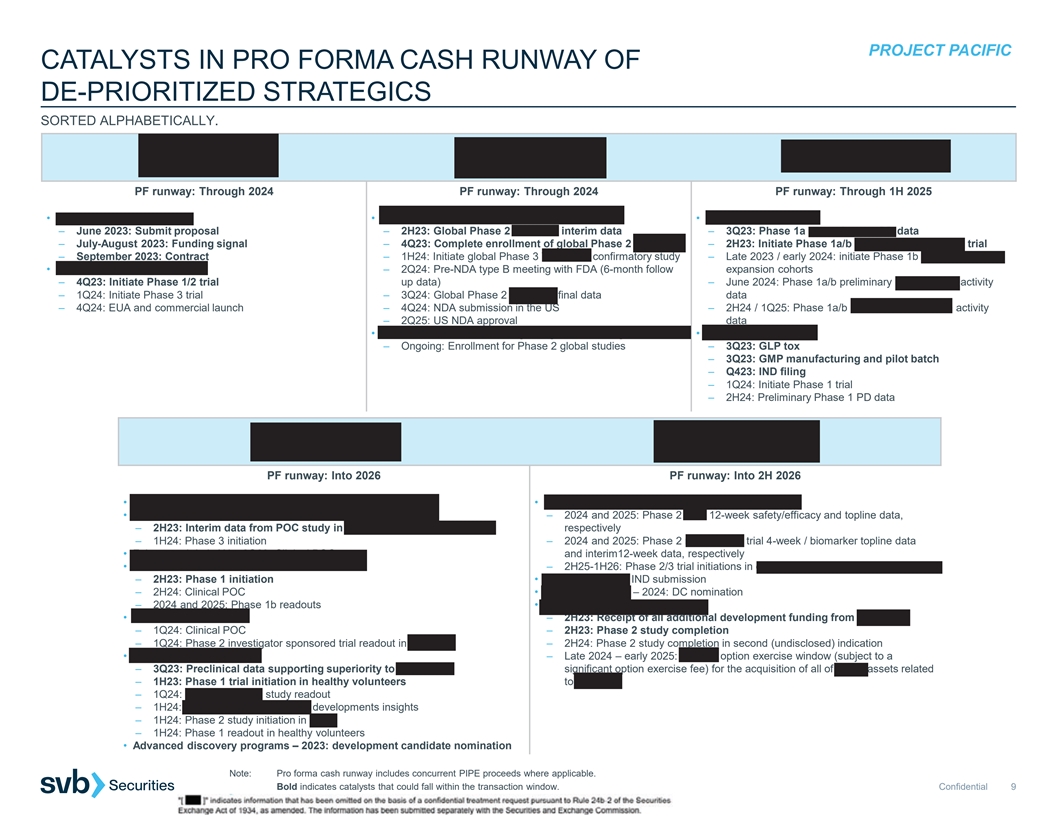

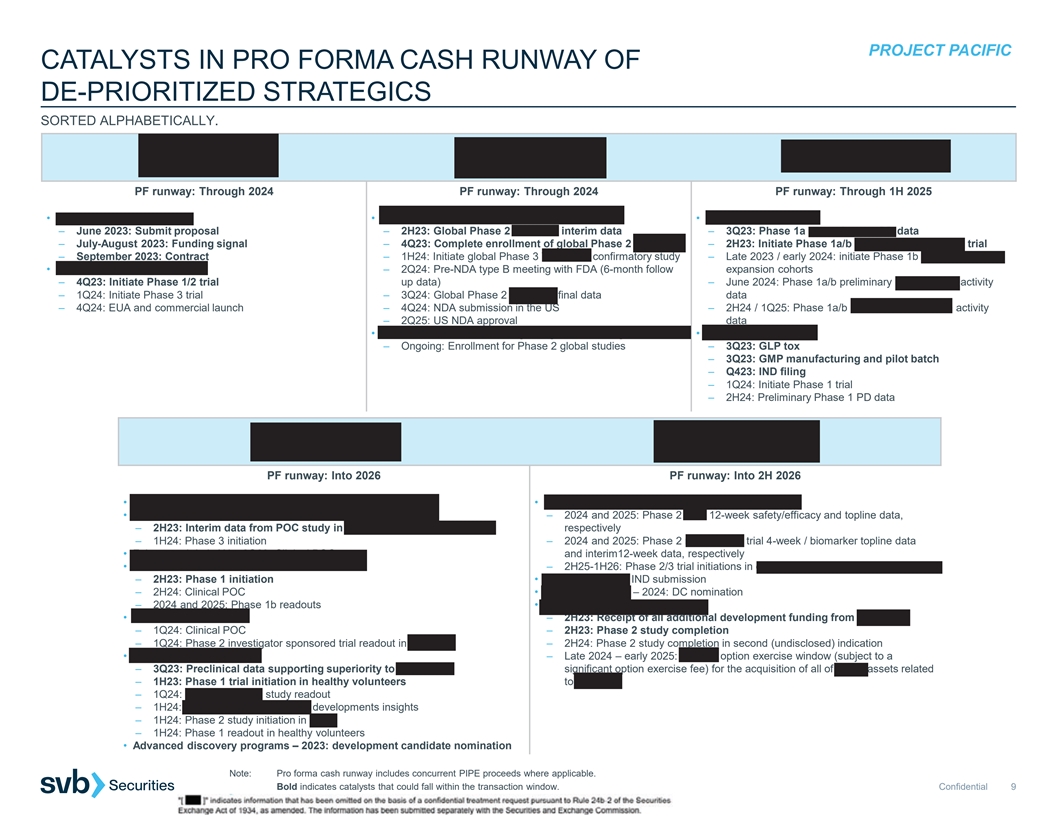

PROJECT PACIFIC CATALYSTS IN PRO FORMA CASH RUNWAY OF DE-PRIORITIZED STRATEGICS SORTED ALPHABETICALLY. PF runway: Through 2024 PF runway: Through 2024 PF runway: Through 1H 2025 • BARDA contract (~$280M) • Taletrectinib/AB-106 in non-small cell lung cancer • AB248 in solid tumors – June 2023: Submit proposal – 2H23: Global Phase 2 TRUST-II interim data – 3Q23: Phase 1a monotherapy PD data – July-August 2023: Funding signal – 4Q23: Complete enrollment of global Phase 2 TRUST-II – 2H23: Initiate Phase 1a/b anti-PD1 combination trial – September 2023: Contract – 1H24: Initiate global Phase 3 TRUST-III confirmatory study – Late 2023 / early 2024: initiate Phase 1b monotherapy • AER003 / AER004 / AER005 – 2Q24: Pre-NDA type B meeting with FDA (6-month follow expansion cohorts – 4Q23: Initiate Phase 1/2 trial up data) – June 2024: Phase 1a/b preliminary monotherapy activity – 1Q24: Initiate Phase 3 trial – 3Q24: Global Phase 2 TRUST-II final data data – 4Q24: EUA and commercial launch – 4Q24: NDA submission in the US – 2H24 / 1Q25: Phase 1a/b anti-PD1 combination activity – 2Q25: US NDA approval data • Safusidenib/AB-218 in lower grade glioma, cholangiocarcinoma • AB821 in solid tumors – Ongoing: Enrollment for Phase 2 global studies – 3Q23: GLP tox – 3Q23: GMP manufacturing and pilot batch – Q423: IND filing – 1Q24: Initiate Phase 1 trial – 2H24: Preliminary Phase 1 PD data PF runway: Into 2026 PF runway: Into 2H 2026 • Felzartamab – 2Q23: reproductive tox data • ADX-097 in complement-mediated renal diseases • Felzartamab in PMN – 2024 and 2025: Phase 2 AAV 12-week safety/efficacy and topline data, – 2H23: Interim data from POC study in aCD20-refractory population respectively – 1H24: Phase 3 initiation – 2024 and 2025: Phase 2 renal basket trial 4-week / biomarker topline data • Felzartamab in IgAN – 2Q23: Clinical POC and interim12-week data, respectively • Felzartamab in LN – 2H25-1H26: Phase 2/3 trial initiations in complement-mediated renal diseases – 2H23: Phase 1 initiation • ADX-096 – 1H25: IND submission – 2H24: Clinical POC • Novel nanobodies – 2024: DC nomination – 2024 and 2025: Phase 1b readouts • ADX-914 in atopic dermatitis • Felzartamab in AMR – 2H23: Receipt of all additional development funding from Horizon – 1Q24: Clinical POC – 2H23: Phase 2 study completion – 1Q24: Phase 2 investigator sponsored trial readout in AMR – 2H24: Phase 2 study completion in second (undisclosed) indication • HIB210 in severe IMDs – Late 2024 – early 2025: Horizon option exercise window (subject to a – 3Q23: Preclinical data supporting superiority to avacopan significant option exercise fee) for the acquisition of all of Q32’s assets related – 1H23: Phase 1 trial initiation in healthy volunteers to ADX-914 – 1Q24: NHP chronic tox study readout – 1H24: Subcutaneous formulation developments insights – 1H24: Phase 2 study initiation in AAV – 1H24: Phase 1 readout in healthy volunteers • Advanced discovery programs – 2023: development candidate nomination Note: Pro forma cash runway includes concurrent PIPE proceeds where applicable. Bold indicates catalysts that could fall within the transaction window. Confidential 9

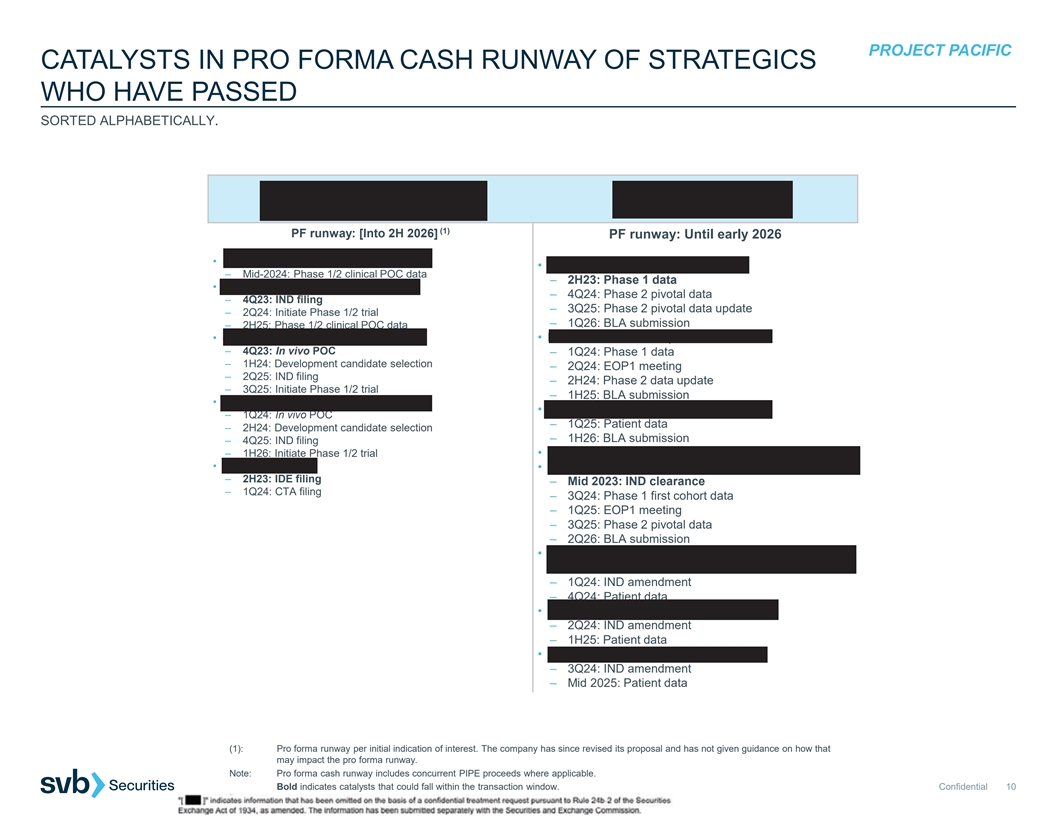

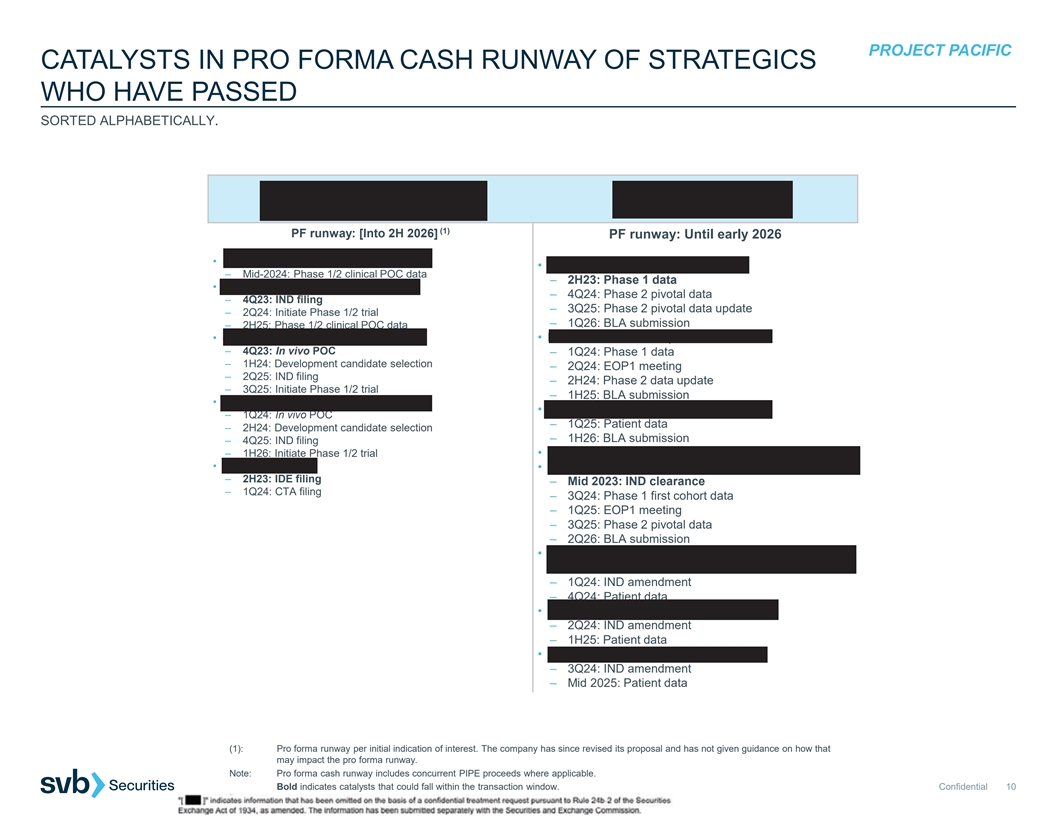

PROJECT PACIFIC CATALYSTS IN PRO FORMA CASH RUNWAY OF STRATEGICS WHO HAVE PASSED SORTED ALPHABETICALLY. (1) PF runway: [Into 2H 2026] PF runway: Until early 2026 • BBI-355 in oncogene amplified cancers • IMPT-314 in ≥3L CAR-T naïve ABCL – Mid-2024: Phase 1/2 clinical POC data – 2H23: Phase 1 data • BBI-825 in oncogene amplified cancers – 4Q24: Phase 2 pivotal data – 4Q23: IND filing – 3Q25: Phase 2 pivotal data update – 2Q24: Initiate Phase 1/2 trial – 1Q26: BLA submission – 2H25: Phase 1/2 clinical POC data • ecDTx 3 in oncogene amplified cancers • IMPT-314 in CAR-T experienced ABCL – 4Q23: In vivo POC – 1Q24: Phase 1 data – 1H24: Development candidate selection – 2Q24: EOP1 meeting – 2Q25: IND filing – 2H24: Phase 2 data update – 3Q25: Initiate Phase 1/2 trial – 1H25: BLA submission • ecDTx 4 in oncogene amplified cancers • IMPT-314 in 2L HCT unintended ABCL – 1Q24: In vivo POC – 1Q25: Patient data – 2H24: Development candidate selection – 1H26: BLA submission – 4Q25: IND filing – 1H26: Initiate Phase 1/2 trial • IMPT-314 – 1Q26: patient data in 2L HCT eligible ABCL • ECHO Platform • IMPT-514 in r/r lupus nephritis – 2H23: IDE filing – Mid 2023: IND clearance – 1Q24: CTA filing – 3Q24: Phase 1 first cohort data – 1Q25: EOP1 meeting – 3Q25: Phase 2 pivotal data – 2Q26: BLA submission • IMPT-514 in severe systemic lupus erythematosus with extrarenal disease – 1Q24: IND amendment – 4Q24: Patient data • IMPT-514 in ANCA-associated vasculitis – 2Q24: IND amendment – 1H25: Patient data • IMPT-514 in secondary progressive MS – 3Q24: IND amendment – Mid 2025: Patient data (1): Pro forma runway per initial indication of interest. The company has since revised its proposal and has not given guidance on how that may impact the pro forma runway. Note: Pro forma cash runway includes concurrent PIPE proceeds where applicable. Bold indicates catalysts that could fall within the transaction window. Confidential 10

B. INITIAL INDICATIONS OF INTEREST FROM STRATEGIC WHO HAS BEEN PRIORITIZED

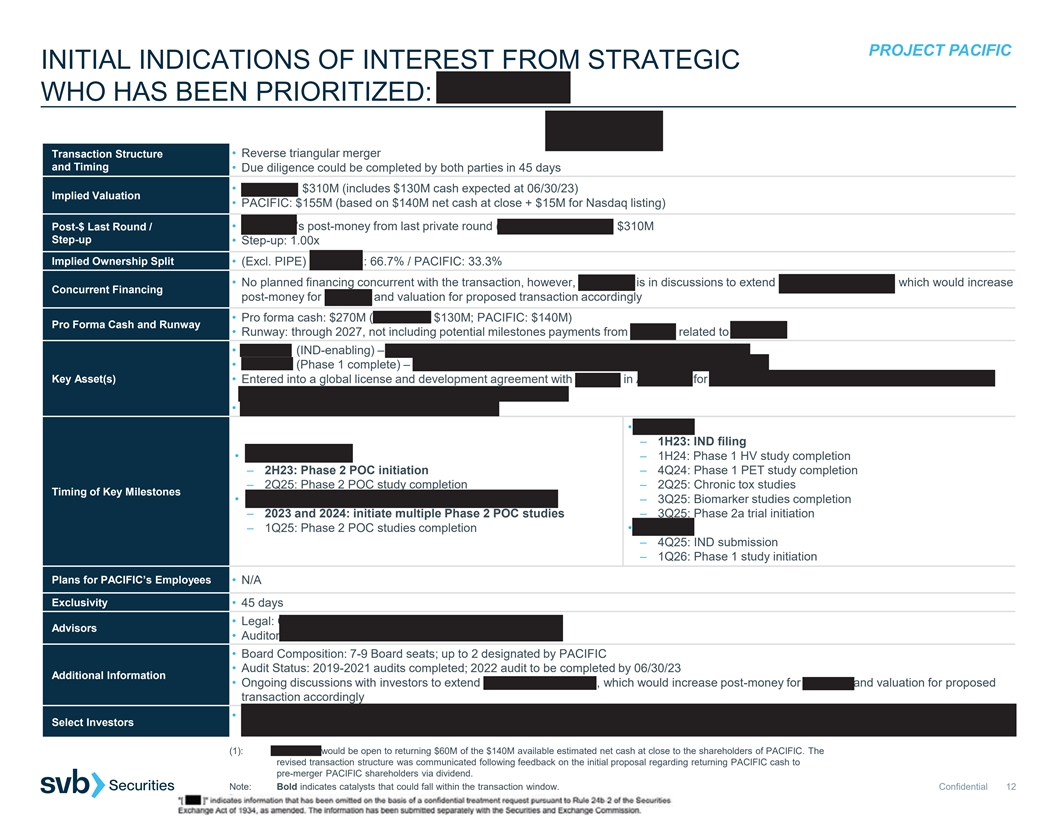

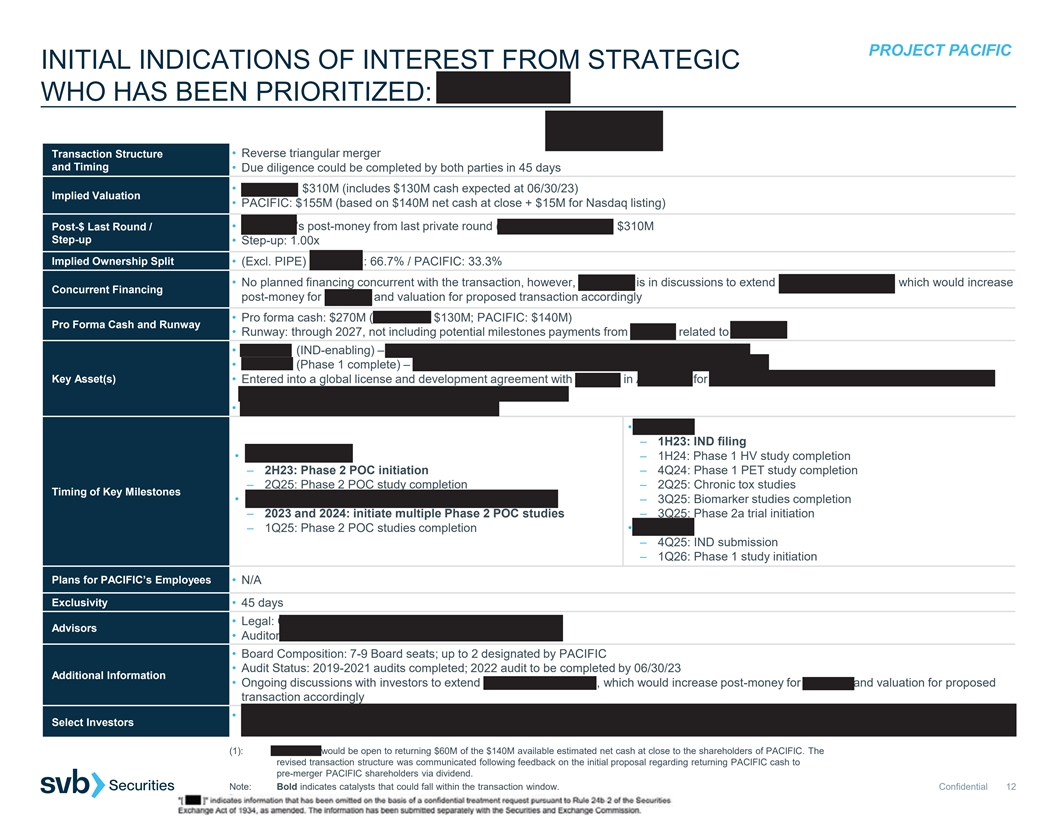

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST FROM STRATEGIC WHO HAS BEEN PRIORITIZED: PIPELINE (1) Transaction Structure • Reverse triangular merger and Timing • Due diligence could be completed by both parties in 45 days • PIPELINE: $310M (includes $130M cash expected at 06/30/23) Implied Valuation • PACIFIC: $155M (based on $140M net cash at close + $15M for Nasdaq listing) Post-$ Last Round / • PIPELINE’s post-money from last private round (Series C, April 2023): $310M Step-up • Step-up: 1.00x Implied Ownership Split • (Excl. PIPE) PIPELINE: 66.7% / PACIFIC: 33.3% • No planned financing concurrent with the transaction, however, PIPELINE is in discussions to extend Series C by $25-50M, which would increase Concurrent Financing post-money for Series C and valuation for proposed transaction accordingly • Pro forma cash: $270M (PIPELINE: $130M; PACIFIC: $140M) Pro Forma Cash and Runway • Runway: through 2027, not including potential milestones payments from Janssen related to PIPE-307 • PIPE-791 (IND-enabling) – LPA1 antagonist for multiple sclerosis (MS) and neuroinflammation • PIPE-307 (Phase 1 complete) – oral M1 antagonist for MS and major depressive disorder (MDD) Key Asset(s) • Entered into a global license and development agreement with Janssen in April 2023 for $50M upfront plus $1B milestones and tiered double- digit royalties as well as $25M equity investment from JJDC • PIPELINE retained ability to develop in r/r MS • PIPE-791 – 1H23: IND filing • PIPE-307 in r/r MS – 1H24: Phase 1 HV study completion – 2H23: Phase 2 POC initiation – 4Q24: Phase 1 PET study completion – 2Q25: Phase 2 POC study completion – 2Q25: Chronic tox studies Timing of Key Milestones • PIPE-307 in other neurological disorders, including MDD – 3Q25: Biomarker studies completion – 2023 and 2024: initiate multiple Phase 2 POC studies – 3Q25: Phase 2a trial initiation – 1Q25: Phase 2 POC studies completion • Calpain – 4Q25: IND submission – 1Q26: Phase 1 study initiation Plans for PACIFIC’s Employees • N/A Exclusivity • 45 days • Legal: Gunderson Dettmer (corporate) & Mintz Levin (IP) Advisors • Auditor: E&Y • Board Composition: 7-9 Board seats; up to 2 designated by PACIFIC • Audit Status: 2019-2021 audits completed; 2022 audit to be completed by 06/30/23 Additional Information • Ongoing discussions with investors to extend Series C by $25-50M, which would increase post-money for Series C and valuation for proposed transaction accordingly • JJDC, Casdin Capital, Franklin Templeton, Perceptive, Samsara, Suvretta, Cleva Pharma Capital (Brace Pharma), Hadean Ventures, Sectoral, Select Investors Versant, Baker Brothers, Hillhouse (1): PIPELINE would be open to returning $60M of the $140M available estimated net cash at close to the shareholders of PACIFIC. The revised transaction structure was communicated following feedback on the initial proposal regarding returning PACIFIC cash to pre-merger PACIFIC shareholders via dividend. Note: Bold indicates catalysts that could fall within the transaction window. Confidential 12

C. INITIAL INDICATIONS OF INTEREST FROM DE-PRIORITIZED STRATEGICS

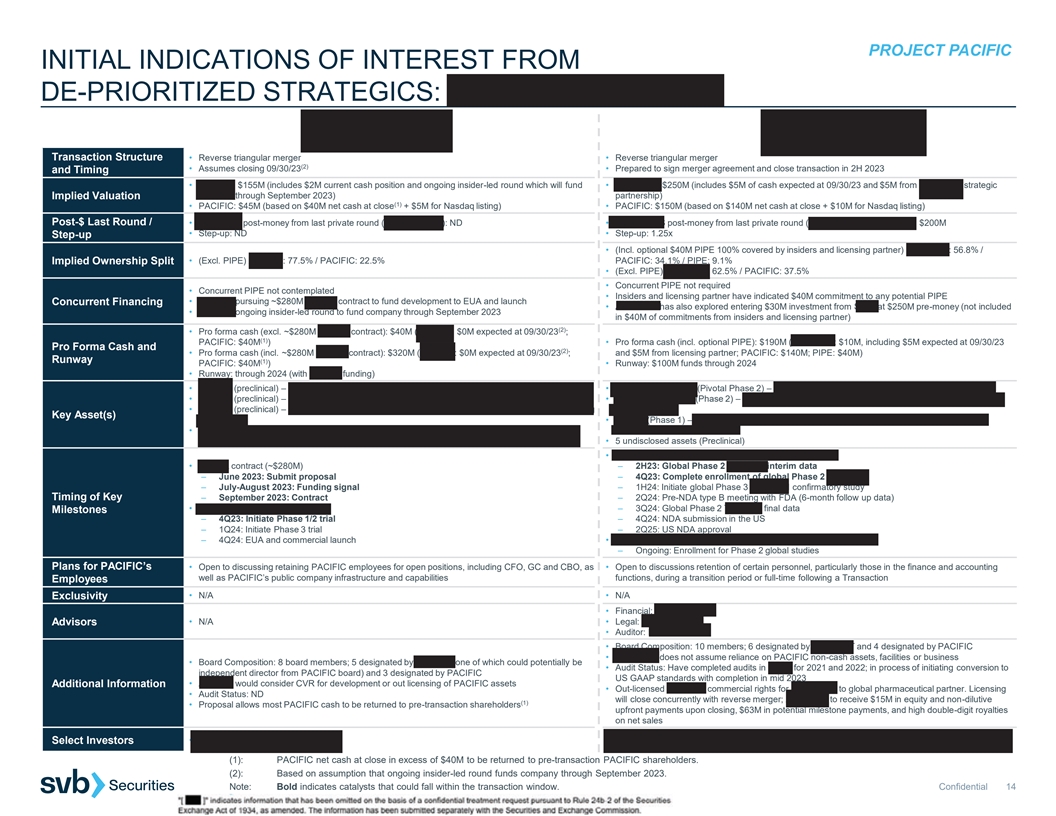

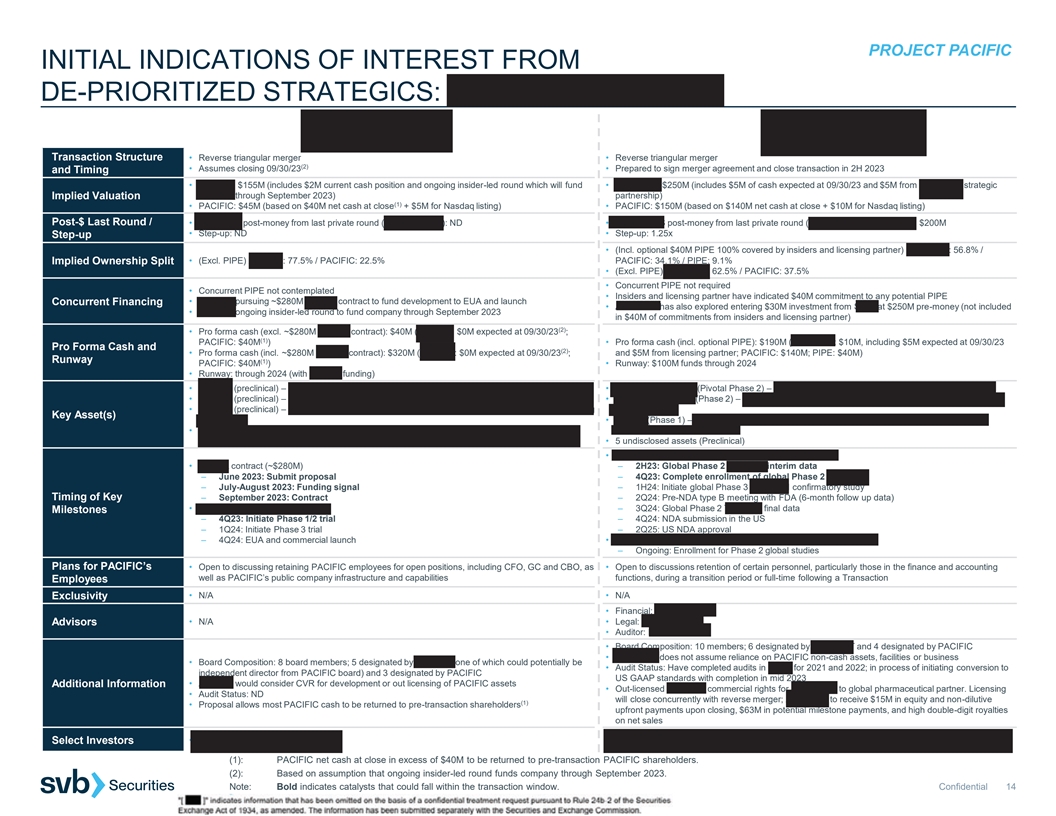

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST FROM DE-PRIORITIZED STRATEGICS: AERIUM | ANHEART Transaction Structure • Reverse triangular merger • Reverse triangular merger (2) • Assumes closing 09/30/23 • Prepared to sign merger agreement and close transaction in 2H 2023 and Timing • AERIUM: $155M (includes $2M current cash position and ongoing insider-led round which will fund • ANHEART: $250M (includes $5M of cash expected at 09/30/23 and $5M from ANHEART strategic AERIUM through September 2023) partnership) Implied Valuation (1) • PACIFIC: $45M (based on $40M net cash at close + $5M for Nasdaq listing) • PACIFIC: $150M (based on $140M net cash at close + $10M for Nasdaq listing) Post-$ Last Round / • AERIUM’S post-money from last private round (Series A, 2022): ND • ANHEART’S post-money from last private round (Series B, September 2021): $200M • Step-up: ND • Step-up: 1.25x Step-up • (Incl. optional $40M PIPE 100% covered by insiders and licensing partner) ANHEART: 56.8% / Implied Ownership Split • (Excl. PIPE) AERIUM: 77.5% / PACIFIC: 22.5% PACIFIC: 34.1% / PIPE: 9.1% • (Excl. PIPE) ANHEART: 62.5% / PACIFIC: 37.5% • Concurrent PIPE not required • Concurrent PIPE not contemplated • Insiders and licensing partner have indicated $40M commitment to any potential PIPE • AERIUM pursuing ~$280M BARDA contract to fund development to EUA and launch Concurrent Financing • ANHEART has also explored entering $30M investment from SDIC at $250M pre-money (not included • AERIUM ongoing insider-led round to fund company through September 2023 in $40M of commitments from insiders and licensing partner) (2) • Pro forma cash (excl. ~$280M BARDA contract): $40M (AERIUM: $0M expected at 09/30/23 ; (1) PACIFIC: $40M ) • Pro forma cash (incl. optional PIPE): $190M (ANHEART: $10M, including $5M expected at 09/30/23 Pro Forma Cash and (2) • Pro forma cash (incl. ~$280M BARDA contract): $320M (AERIUM: $0M expected at 09/30/23 ; and $5M from licensing partner; PACIFIC: $140M; PIPE: $40M) Runway (1) PACIFIC: $40M ) • Runway: $100M funds through 2024 • Runway: through 2024 (with BARDA funding) • AER003 (preclinical) – mAb antiviral treatment against SARS-CoV-2 occupying ACE2 footprint • Taletrectinib/AB-106 (Pivotal Phase 2) – ROS1 inhibitor for ROS1 fusion-positive NSCLC • AER004 (preclinical) – mAb antiviral treatment against SARS-CoV-2 • Safusidenib/AB-218 (Phase 2) – mIDH1 inhibitor for lower grade glioma, cholangiocarcinoma and • AER005 (preclinical) – mAb antiviral treatment against SARS-CoV-2 binding outside Receptor Binding other tumors Key Asset(s) Domain • AB-329 (Phase 1) – AXL inhibitor for combination with checkpoint inhibitors or chemotherapy in • Two mAbs planned to be developed in combination; third to be developed as contingency for viral NSCLC and other solid tumors evolution • 5 undisclosed assets (Preclinical) • Taletrectinib/AB-106 in non-small cell lung cancer • BARDA contract (~$280M) – 2H23: Global Phase 2 TRUST-II interim data – June 2023: Submit proposal – 4Q23: Complete enrollment of global Phase 2 TRUST-II – July-August 2023: Funding signal – 1H24: Initiate global Phase 3 TRUST-III confirmatory study Timing of Key – September 2023: Contract – 2Q24: Pre-NDA type B meeting with FDA (6-month follow up data) • AER003 / AER004 / AER005 – 3Q24: Global Phase 2 TRUST-II final data Milestones – 4Q23: Initiate Phase 1/2 trial – 4Q24: NDA submission in the US – 1Q24: Initiate Phase 3 trial – 2Q25: US NDA approval – 4Q24: EUA and commercial launch • Safusidenib/AB-218 in lower grade glioma, cholangiocarcinoma – Ongoing: Enrollment for Phase 2 global studies Plans for PACIFIC’s • Open to discussing retaining PACIFIC employees for open positions, including CFO, GC and CBO, as • Open to discussions retention of certain personnel, particularly those in the finance and accounting well as PACIFIC’s public company infrastructure and capabilities functions, during a transition period or full-time following a Transaction Employees • N/A • N/A Exclusivity • Financial: Piper Sandler Advisors • N/A • Legal: WilmerHale • Auditor: Deloitte • Board Composition: 10 members; 6 designated by ANHEART and 4 designated by PACIFIC • ANHEART does not assume reliance on PACIFIC non-cash assets, facilities or business • Board Composition: 8 board members; 5 designated by AERIUM (one of which could potentially be • Audit Status: Have completed audits in China for 2021 and 2022; in process of initiating conversion to independent director from PACIFIC board) and 3 designated by PACIFIC US GAAP standards with completion in mid 2023 • AERIUM would consider CVR for development or out licensing of PACIFIC assets Additional Information • Out-licensed Japanese commercial rights for taletrectinib to global pharmaceutical partner. Licensing • Audit Status: ND will close concurrently with reverse merger; ANHEART to receive $15M in equity and non-dilutive (1) • Proposal allows most PACIFIC cash to be returned to pre-transaction shareholders upfront payments upon closing, $63M in potential milestone payments, and high double-digit royalties on net sales • Octagon Investments, Decheng Capital, Laurion Capital, Sage Partners, Innovent Biologics and Select Investors • Omega Funds, F-Prime Capital Cenova (1): PACIFIC net cash at close in excess of $40M to be returned to pre-transaction PACIFIC shareholders. (2): Based on assumption that ongoing insider-led round funds company through September 2023. Note: Bold indicates catalysts that could fall within the transaction window. Confidential 14

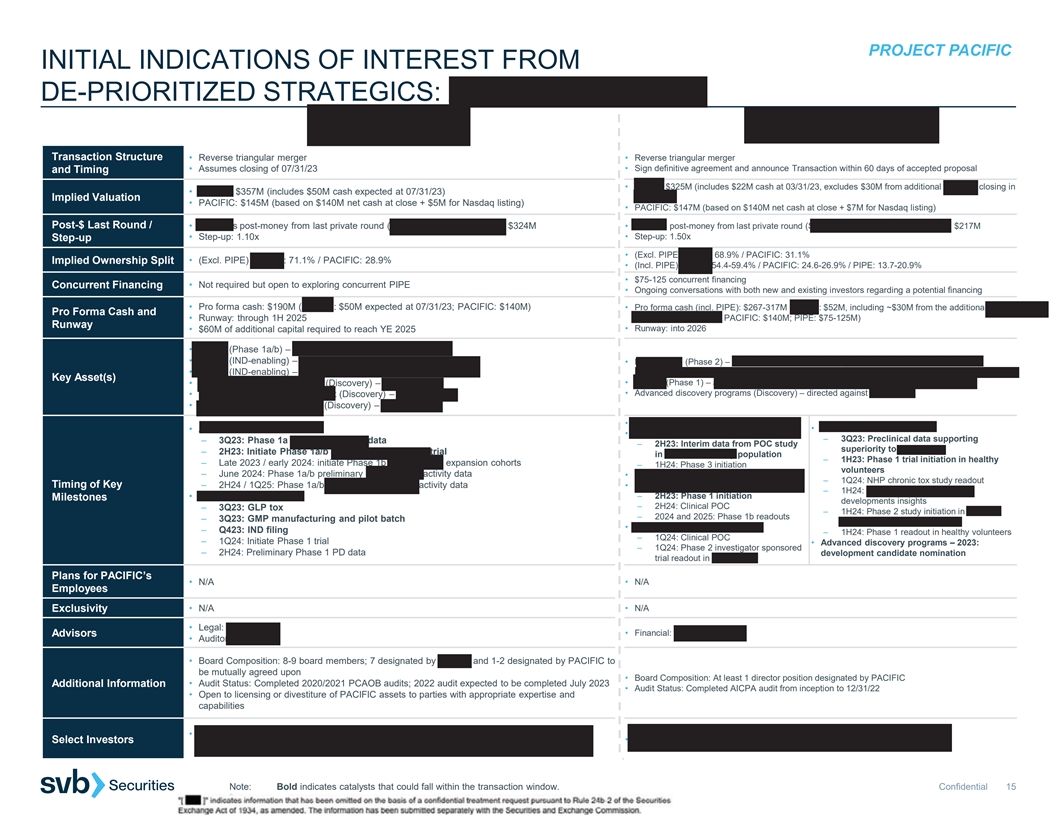

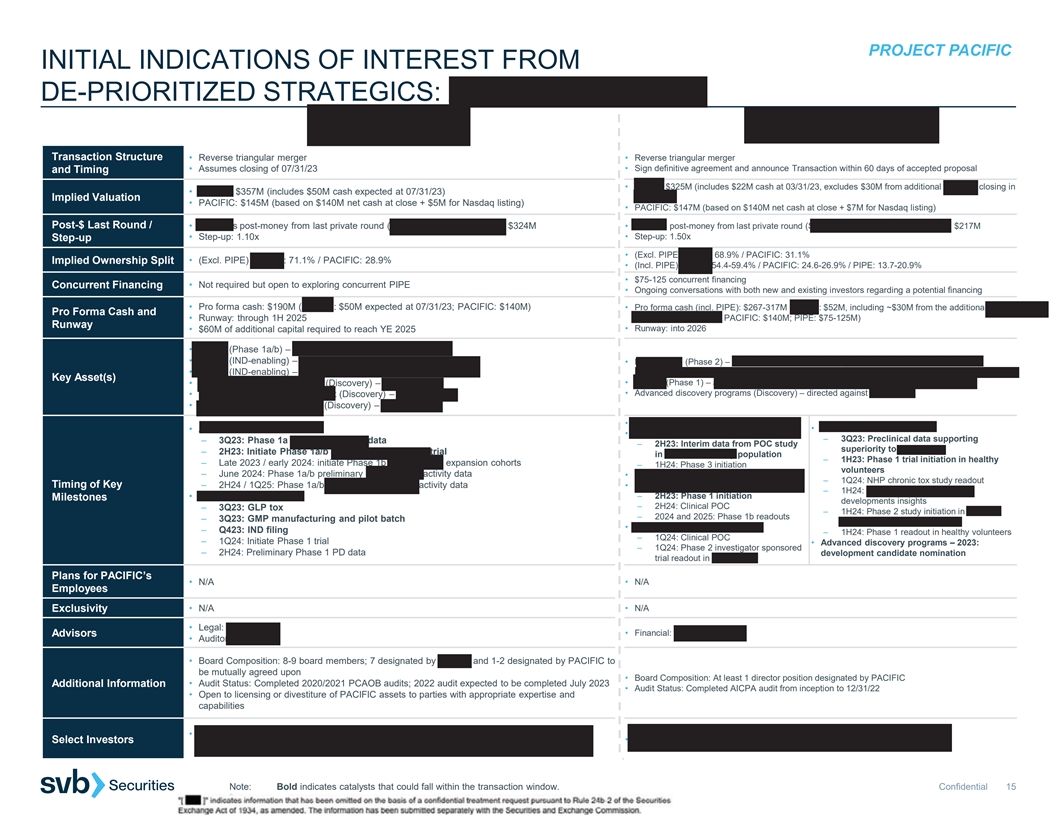

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST FROM DE-PRIORITIZED STRATEGICS: ASHER BIO | HI BIO Transaction Structure • Reverse triangular merger • Reverse triangular merger • Assumes closing of 07/31/23 • Sign definitive agreement and announce Transaction within 60 days of accepted proposal and Timing • HI-BIO: $325M (includes $22M cash at 03/31/23, excludes $30M from additional Series A closing in • ASHER: $357M (includes $50M cash expected at 07/31/23) May 2023) Implied Valuation • PACIFIC: $145M (based on $140M net cash at close + $5M for Nasdaq listing) • PACIFIC: $147M (based on $140M net cash at close + $7M for Nasdaq listing) Post-$ Last Round / • ASHER’s post-money from last private round (Series B, September 2021): $324M • HI-BIO’s post-money from last private round (Series A extension, November 2022): $217M • Step-up: 1.10x • Step-up: 1.50x Step-up • (Excl. PIPE) HI-BIO: 68.9% / PACIFIC: 31.1% Implied Ownership Split • (Excl. PIPE) ASHER: 71.1% / PACIFIC: 28.9% • (Incl. PIPE) HI-BIO: 54.4-59.4% / PACIFIC: 24.6-26.9% / PIPE: 13.7-20.9% • $75-125 concurrent financing • Not required but open to exploring concurrent PIPE Concurrent Financing • Ongoing conversations with both new and existing investors regarding a potential financing • Pro forma cash: $190M (ASHER: $50M expected at 07/31/23; PACIFIC: $140M) • Pro forma cash (incl. PIPE): $267-317M (HI-BIO: $52M, including ~$30M from the additional Series Pro Forma Cash and • Runway: through 1H 2025 A closing in May 2023; PACIFIC: $140M; PIPE: $75-125M) Runway • $60M of additional capital required to reach YE 2025 • Runway: into 2026 • AB248 (Phase 1a/b) – CD8-targeted IL2 for solid tumors • AB821 (IND-enabling) – CD8-targeted IL21 for solid tumors • Felzartamab (Phase 2) – anti-CD38 antibody for primary membranous nephropathy (PMN), • AB359 (IND-enabling) – CD8-targeted IL2 for chronic viral infection immunoglobulin A nephropathy (IgAN), antibody-mediated rejection (AMR) and lupus nephritis (LN) Key Asset(s) • HIB210 (Phase 1) – anti-C5aR1 antibody for severe immune-mediated diseases (IMDs) • Cell therapy-targeted IL-2 / 21 (Discovery) – for cancer • Advanced discovery programs (Discovery) – directed against mast cells • Myeloid-targeted immune agonist (Discovery) – for cancer • CD4+ T cell-targeted cytokine (Discovery) – for cancer • Felzartamab – 2Q23: reproductive tox data • AB248 in solid tumors • HIB210 in severe IMDs • Felzartamab in PMN – 3Q23: Preclinical data supporting – 3Q23: Phase 1a monotherapy PD data – 2H23: Interim data from POC study superiority to avacopan – 2H23: Initiate Phase 1a/b anti-PD1 combination trial in aCD20-refractory population – 1H23: Phase 1 trial initiation in healthy – Late 2023 / early 2024: initiate Phase 1b monotherapy expansion cohorts – 1H24: Phase 3 initiation volunteers – June 2024: Phase 1a/b preliminary monotherapy activity data • Felzartamab in IgAN – 2Q23: Clinical POC – 1Q24: NHP chronic tox study readout Timing of Key – 2H24 / 1Q25: Phase 1a/b anti-PD1 combination activity data • Felzartamab in LN – 1H24: Subcutaneous formulation – 2H23: Phase 1 initiation • AB821 in solid tumors Milestones developments insights – 2H24: Clinical POC – 3Q23: GLP tox – 1H24: Phase 2 study initiation in ANCA- – 2024 and 2025: Phase 1b readouts – 3Q23: GMP manufacturing and pilot batch associated vasculitis (AAV) • Felzartamab in AMR – Q423: IND filing – 1H24: Phase 1 readout in healthy volunteers – 1Q24: Clinical POC – 1Q24: Initiate Phase 1 trial • Advanced discovery programs – 2023: – 1Q24: Phase 2 investigator sponsored – 2H24: Preliminary Phase 1 PD data development candidate nomination trial readout in AMR Plans for PACIFIC’s • N/A • N/A Employees Exclusivity • N/A • N/A • Legal: Goodwin • Financial: Goldman Sachs Advisors • Auditor: PWC • Board Composition: 8-9 board members; 7 designated by ASHER and 1-2 designated by PACIFIC to be mutually agreed upon • Board Composition: At least 1 director position designated by PACIFIC Additional Information • Audit Status: Completed 2020/2021 PCAOB audits; 2022 audit expected to be completed July 2023 • Audit Status: Completed AICPA audit from inception to 12/31/22 • Open to licensing or divestiture of PACIFIC assets to parties with appropriate expertise and capabilities • Third Rock Ventures, Wellington, RA Capital, Invus Public Equities, Boxer Capital, Mission Bay Select Investors • ARCH Venture Partners, Monograph Capital, Jeito Capital, MorphoSys Capital, Janus Henderson, Logos, Marshall Wace, Y-Combinator Note: Bold indicates catalysts that could fall within the transaction window. Confidential 15

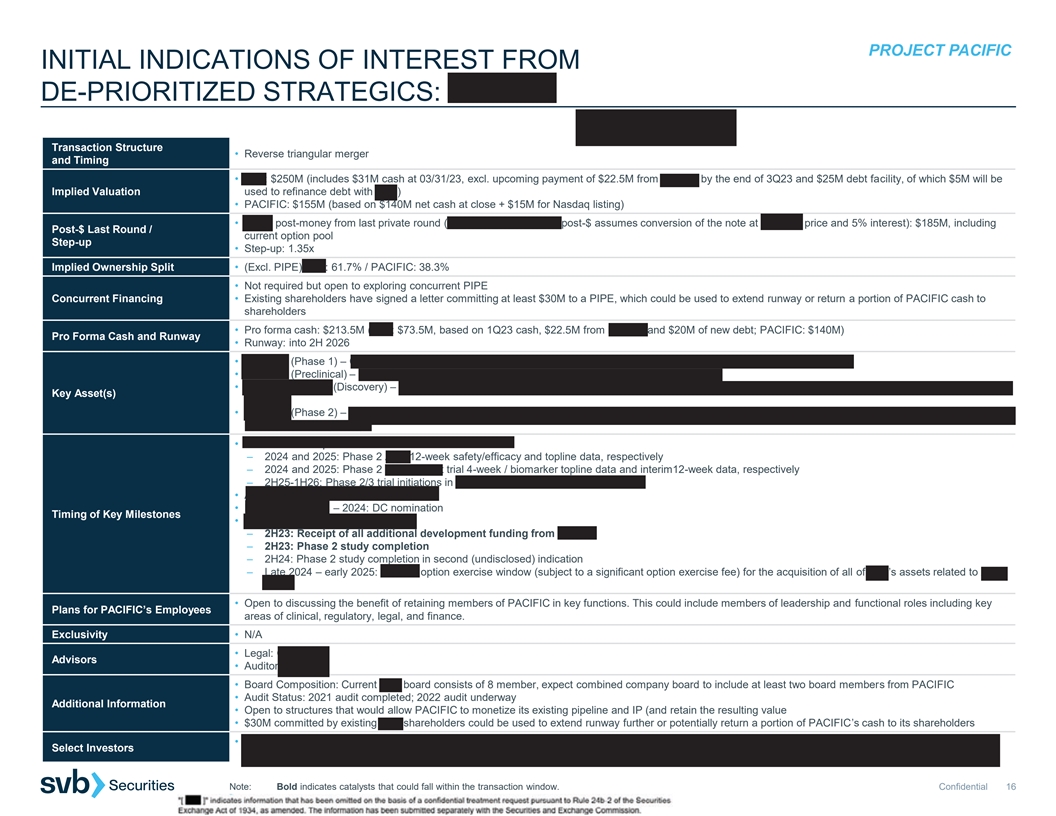

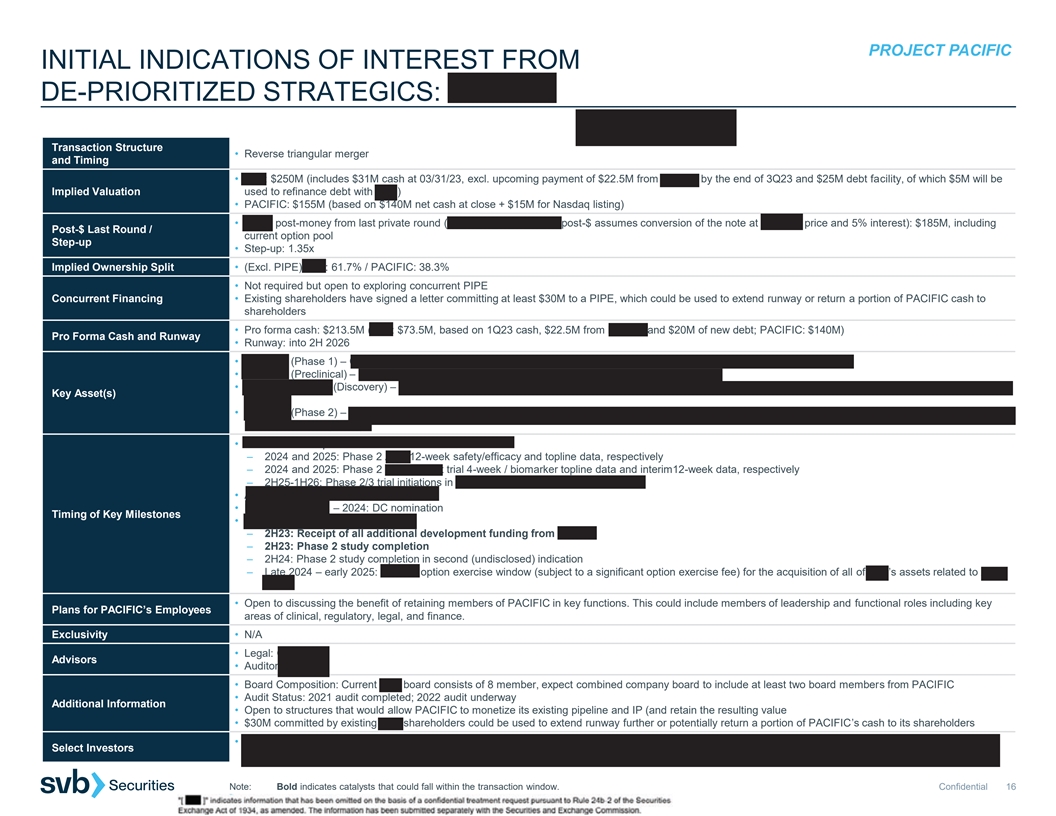

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST FROM DE-PRIORITIZED STRATEGICS: Q32 BIO Transaction Structure • Reverse triangular merger and Timing • Q32: $250M (includes $31M cash at 03/31/23, excl. upcoming payment of $22.5M from Horizon by the end of 3Q23 and $25M debt facility, of which $5M will be Implied Valuation used to refinance debt with SVB) • PACIFIC: $155M (based on $140M net cash at close + $15M for Nasdaq listing) • Q32’s post-money from last private round (Convertible note, 2022; post-$ assumes conversion of the note at Series B price and 5% interest): $185M, including Post-$ Last Round / current option pool Step-up • Step-up: 1.35x Implied Ownership Split • (Excl. PIPE) Q32: 61.7% / PACIFIC: 38.3% • Not required but open to exploring concurrent PIPE Concurrent Financing • Existing shareholders have signed a letter committing at least $30M to a PIPE, which could be used to extend runway or return a portion of PACIFIC cash to shareholders • Pro forma cash: $213.5M (Q32: $73.5M, based on 1Q23 cash, $22.5M from Horizon and $20M of new debt; PACIFIC: $140M) Pro Forma Cash and Runway • Runway: into 2H 2026 • ADX-097 (Phase 1) – C3d-mAb fH complement inhibitor for multiple complement-mediated diseases of the kidney and IgG4 1-5 • ADX-096 (Preclinical) – C3d-mAb CR1 complement inhibitor for complement-mediated diseases 1-10 • Novel nanobodies (Discovery) – C3d-fab fH/CR1 complement inhibitors and next-gen targeted complement inhibitors for neuromuscular and neurodegenerative Key Asset(s) diseases • ADX-914 (Phase 2) – IL-7/TSLP receptor mAb for atopic dermatitis (collaboration and option deal with Horizon in August 2022 for $55M upfront and up to $645M milestones and royalties) • ADX-097 in complement-mediated renal diseases – 2024 and 2025: Phase 2 AAV 12-week safety/efficacy and topline data, respectively – 2024 and 2025: Phase 2 renal basket trial 4-week / biomarker topline data and interim12-week data, respectively – 2H25-1H26: Phase 2/3 trial initiations in complement-mediated renal diseases • ADX-096 – 1H25: IND submission • Novel nanobodies – 2024: DC nomination Timing of Key Milestones • ADX-914 in atopic dermatitis – 2H23: Receipt of all additional development funding from Horizon – 2H23: Phase 2 study completion – 2H24: Phase 2 study completion in second (undisclosed) indication – Late 2024 – early 2025: Horizon option exercise window (subject to a significant option exercise fee) for the acquisition of all of Q32’s assets related to ADX- 914 • Open to discussing the benefit of retaining members of PACIFIC in key functions. This could include members of leadership and functional roles including key Plans for PACIFIC’s Employees areas of clinical, regulatory, legal, and finance. Exclusivity • N/A • Legal: Goodwin Advisors • Auditor: E&Y • Board Composition: Current Q32 board consists of 8 member, expect combined company board to include at least two board members from PACIFIC • Audit Status: 2021 audit completed; 2022 audit underway Additional Information • Open to structures that would allow PACIFIC to monetize its existing pipeline and IP (and retain the resulting value • $30M committed by existing Q32 shareholders could be used to extend runway further or potentially return a portion of PACIFIC’s cash to its shareholders • Atlas, OrbiMed, Acorn, Osage University Partners, Abingworth, Sanofi Ventures, CU Healthcare Innovation Fund, Children’s Hospital Colorado Center for Select Investors Innovation, Columbia, Harvard, BMS Note: Bold indicates catalysts that could fall within the transaction window. Confidential 16

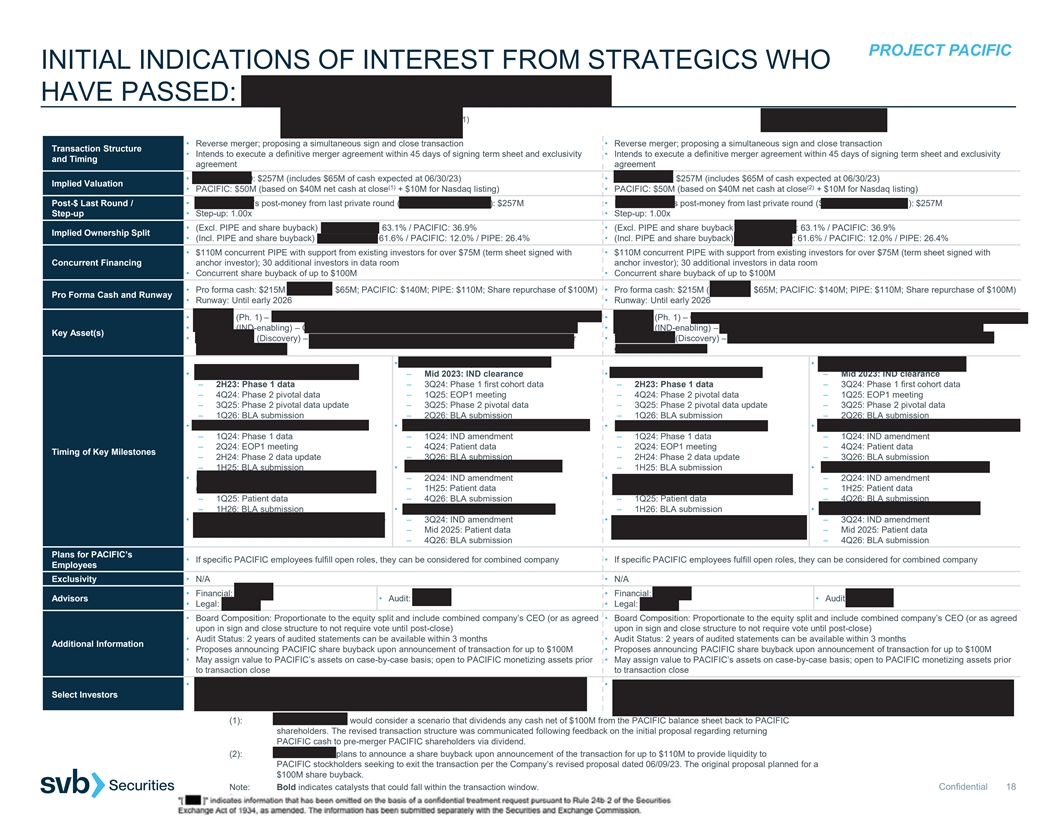

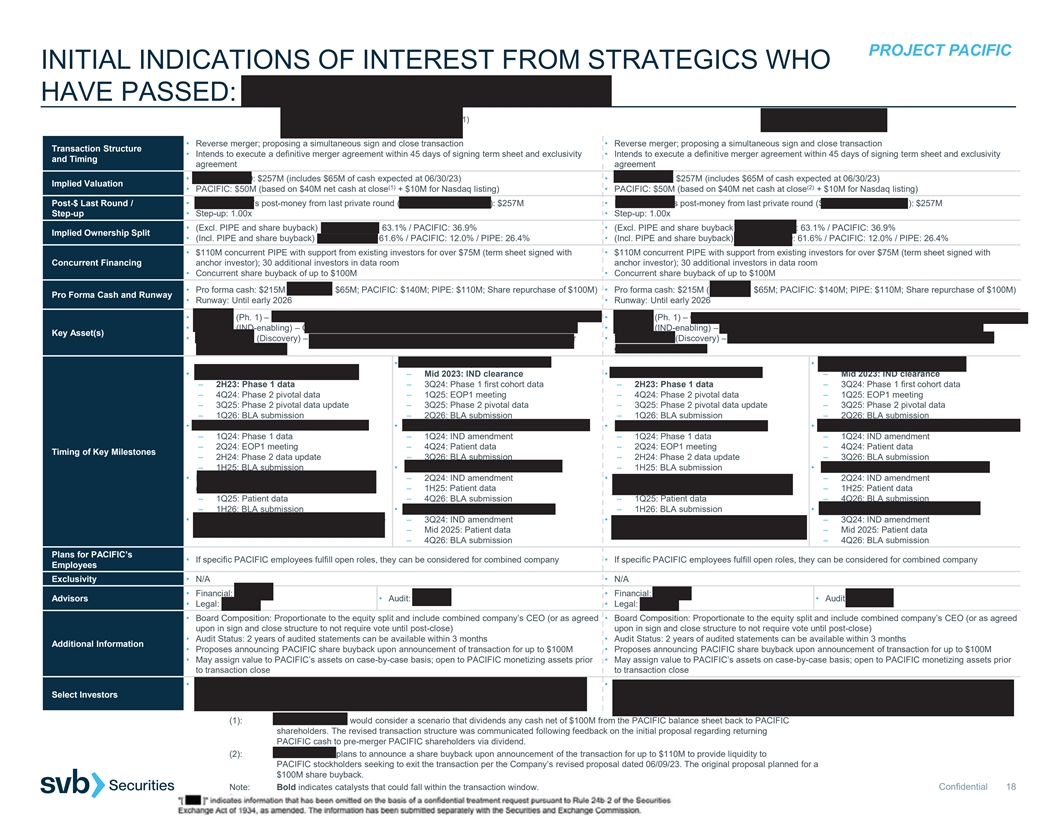

D. INITIAL INDICATION OF INTEREST FROM STRATEGIC WHO HAS PASSED

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST FROM STRATEGICS WHO HAVE PASSED: BOUNDLESS BIO | IMMPACT (1) • Reverse merger; proposing a simultaneous sign and close transaction • Reverse merger; proposing a simultaneous sign and close transaction Transaction Structure • Intends to execute a definitive merger agreement within 45 days of signing term sheet and exclusivity • Intends to execute a definitive merger agreement within 45 days of signing term sheet and exclusivity and Timing agreement agreement • IMMPACT BIO: $257M (includes $65M of cash expected at 06/30/23) • IMMPACT BIO: $257M (includes $65M of cash expected at 06/30/23) Implied Valuation (1) (2) • PACIFIC: $50M (based on $40M net cash at close + $10M for Nasdaq listing) • PACIFIC: $50M (based on $40M net cash at close + $10M for Nasdaq listing) Post-$ Last Round / • IMMPACT BIO’s post-money from last private round (Series B, January 2022): $257M • IMMPACT BIO’s post-money from last private round (Series B, January 2022): $257M Step-up • Step-up: 1.00x • Step-up: 1.00x • (Excl. PIPE and share buyback) IMMPACT BIO: 63.1% / PACIFIC: 36.9% • (Excl. PIPE and share buyback) IMMPACT BIO: 63.1% / PACIFIC: 36.9% Implied Ownership Split • (Incl. PIPE and share buyback) IMMPACT BIO: 61.6% / PACIFIC: 12.0% / PIPE: 26.4% • (Incl. PIPE and share buyback) IMMPACT BIO: 61.6% / PACIFIC: 12.0% / PIPE: 26.4% • $110M concurrent PIPE with support from existing investors for over $75M (term sheet signed with • $110M concurrent PIPE with support from existing investors for over $75M (term sheet signed with Concurrent Financing anchor investor); 30 additional investors in data room anchor investor); 30 additional investors in data room • Concurrent share buyback of up to $100M • Concurrent share buyback of up to $100M • Pro forma cash: $215M (IMMPACT: $65M; PACIFIC: $140M; PIPE: $110M; Share repurchase of $100M) • Pro forma cash: $215M (IMMPACT: $65M; PACIFIC: $140M; PIPE: $110M; Share repurchase of $100M) Pro Forma Cash and Runway • Runway: Until early 2026 • Runway: Until early 2026 • IMPT-314 (Ph. 1) – CD19/CD20 bispecific CAR T cell therapy for aggressive B-cell lymphoma (ABCL) • IMPT-314 (Ph. 1) – CD19/CD20 bispecific CAR T cell therapy for aggressive B-cell lymphoma (ABCL) • IMPT-514 (IND-enabling) – CD19/CD20 bispecific CAR T cell therapy for autoimmune diseases • IMPT-514 (IND-enabling) – CD19/CD20 bispecific CAR T cell therapy for autoimmune diseases Key Asset(s) • TGF-β platform (Discovery) – TGF-β in combination with a binder for IL13 receptor α2 (IL13Ra2) for • TGF-β platform (Discovery) – TGF-β in combination with a binder for IL13 receptor α2 (IL13Ra2) for glioblastoma multiforme glioblastoma multiforme • IMPT-514 in r/r lupus nephritis • IMPT-514 in r/r lupus nephritis • IMPT-314 in ≥3L CAR-T naïve ABCL – Mid 2023: IND clearance • IMPT-314 in ≥3L CAR-T naïve ABCL – Mid 2023: IND clearance – 2H23: Phase 1 data – 3Q24: Phase 1 first cohort data – 2H23: Phase 1 data – 3Q24: Phase 1 first cohort data – 4Q24: Phase 2 pivotal data – 1Q25: EOP1 meeting – 4Q24: Phase 2 pivotal data – 1Q25: EOP1 meeting – 3Q25: Phase 2 pivotal data update – 3Q25: Phase 2 pivotal data – 3Q25: Phase 2 pivotal data update – 3Q25: Phase 2 pivotal data – 1Q26: BLA submission – 2Q26: BLA submission – 1Q26: BLA submission – 2Q26: BLA submission • IMPT-314 in CAR-T experienced ABCL • IMPT-514 in severe SLE with extrarenal disease • IMPT-314 in CAR-T experienced ABCL • IMPT-514 in severe SLE with extrarenal disease – 1Q24: Phase 1 data – 1Q24: IND amendment – 1Q24: Phase 1 data – 1Q24: IND amendment – 2Q24: EOP1 meeting – 4Q24: Patient data – 2Q24: EOP1 meeting – 4Q24: Patient data Timing of Key Milestones – 2H24: Phase 2 data update – 3Q26: BLA submission – 2H24: Phase 2 data update – 3Q26: BLA submission – 1H25: BLA submission • IMPT-514 in ANCA-associated vasculitis – 1H25: BLA submission • IMPT-514 in ANCA-associated vasculitis • IMPT-314 in 2L hematopoietic cell transplant – 2Q24: IND amendment • IMPT-314 in 2L hematopoietic cell transplant – 2Q24: IND amendment (HCT) unintended ABCL – 1H25: Patient data (HCT) unintended ABCL – 1H25: Patient data – 1Q25: Patient data – 4Q26: BLA submission – 1Q25: Patient data – 4Q26: BLA submission – 1H26: BLA submission • IMPT-514 in secondary progressive MS – 1H26: BLA submission • IMPT-514 in secondary progressive MS • IMPT-314 – 1Q26: patient data in 2L HCT eligible – 3Q24: IND amendment • IMPT-314 – 1Q26: patient data in 2L HCT eligible – 3Q24: IND amendment ABCL – Mid 2025: Patient data ABCL – Mid 2025: Patient data – 4Q26: BLA submission – 4Q26: BLA submission Plans for PACIFIC’s • If specific PACIFIC employees fulfill open roles, they can be considered for combined company • If specific PACIFIC employees fulfill open roles, they can be considered for combined company Employees Exclusivity • N/A • N/A • Financial: Jefferies • Financial: Jefferies Advisors • Audit: Deloitte • Audit: Deloitte • Legal: Cooley • Legal: Cooley • Board Composition: Proportionate to the equity split and include combined company’s CEO (or as agreed • Board Composition: Proportionate to the equity split and include combined company’s CEO (or as agreed upon in sign and close structure to not require vote until post-close) upon in sign and close structure to not require vote until post-close) • Audit Status: 2 years of audited statements can be available within 3 months • Audit Status: 2 years of audited statements can be available within 3 months Additional Information • Proposes announcing PACIFIC share buyback upon announcement of transaction for up to $100M • Proposes announcing PACIFIC share buyback upon announcement of transaction for up to $100M • May assign value to PACIFIC’s assets on case-by-case basis; open to PACIFIC monetizing assets prior • May assign value to PACIFIC’s assets on case-by-case basis; open to PACIFIC monetizing assets prior to transaction close to transaction close • Bukwang Pharmaceutical, Decheng Capital, Foresite Capital Management, FutuRx, Hayan Health • Bukwang Pharmaceutical, Decheng Capital, Foresite Capital Management, FutuRx, Hayan Health Select Investors Networks, JJDC, JVC Investment Partners, Novartis Venture Fund, OrbiMed, RM Global Partners, Networks, JJDC, JVC Investment Partners, Novartis Venture Fund, OrbiMed, RM Global Partners, RMGLOBAL Healthcare Fund, Surveyor Capital, Takeda Ventures, venBio RMGLOBAL Healthcare Fund, Surveyor Capital, Takeda Ventures, venBio (1): BOUNDLESS BIO would consider a scenario that dividends any cash net of $100M from the PACIFIC balance sheet back to PACIFIC shareholders. The revised transaction structure was communicated following feedback on the initial proposal regarding returning PACIFIC cash to pre-merger PACIFIC shareholders via dividend. (2): IMMPACT BIO plans to announce a share buyback upon announcement of the transaction for up to $110M to provide liquidity to PACIFIC stockholders seeking to exit the transaction per the Company’s revised proposal dated 06/09/23. The original proposal planned for a $100M share buyback. Note: Bold indicates catalysts that could fall within the transaction window. Confidential 18

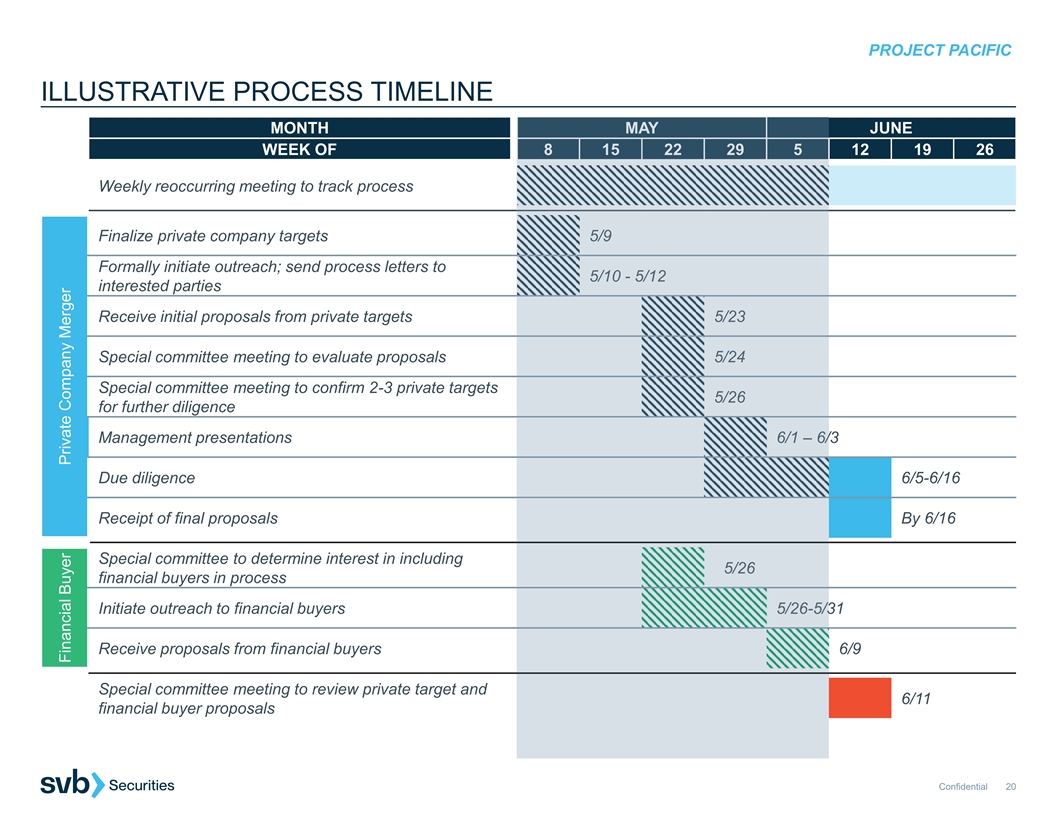

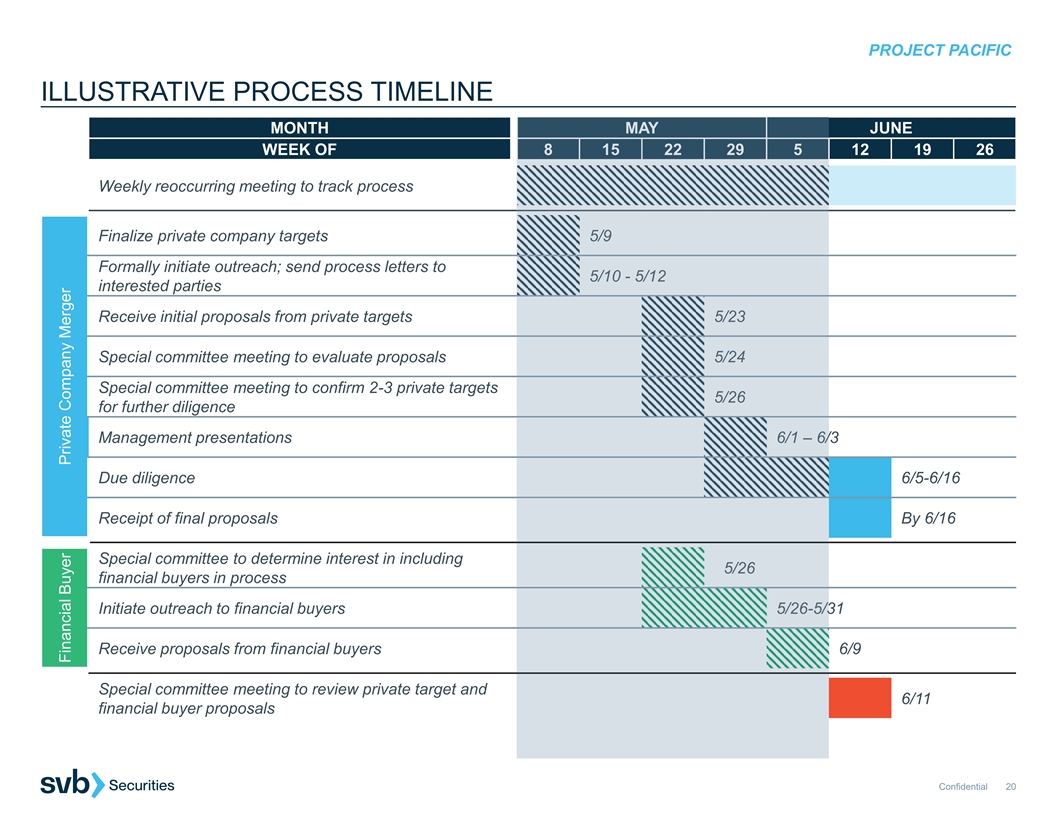

E. ILLUSTRATIVE PROCESS TIMELINE

PROJECT PACIFIC ILLUSTRATIVE PROCESS TIMELINE MONTH M MA AY Y JUNE WEEK OF 8 8 15 15 2 22 2 2 29 9 5 5 12 19 26 Weekly reoccurring meeting to track process Finalize private company targets 5 5/9 /9 Formally initiate outreach; send process letters to 5/10 - 5/10 - 5 5/ /12 12 interested parties Receive initial proposals from private targets 5/ 5/23 23 Special committee meeting to evaluate proposals 5 5/ /24 24 Special committee meeting to confirm 2-3 private targets 5/26 5/26 for further diligence Management presentations 6/ 6/1 1 –– 6/3 6/ Due diligence 6/5-6/16 Receipt of final proposals By 6/16 Special committee to determine interest in including 5/26 5/26 financial buyers in process Initiate outreach to financial buyers 5/ 5/26 26- -5/3 5/31 Receive proposals from financial buyers 6/9 Special committee meeting to review private target and 6/11 financial buyer proposals Confidential 20 Financial Buyer Private Company Merger