Exhibit (c)(13) PROJECT PACIFIC SUMMARY OF INITIAL INDICATIONS OF INTEREST MAY 25, 2023 Confidential

PROJECT PACIFIC STRATEGIC PROCESS OUTREACH SUMMARY SUBMITTED PROPOSAL (N=8) (1) (1) (1) (1) (1) (1) (1) (1) POTENTIAL INVITE TO PROCESS (N=3) PASSED (N=1) FINANCIAL BUYERS TO CONSIDER CONTACTING (N=3) (1): Indicates executed CDA. Confidential 1

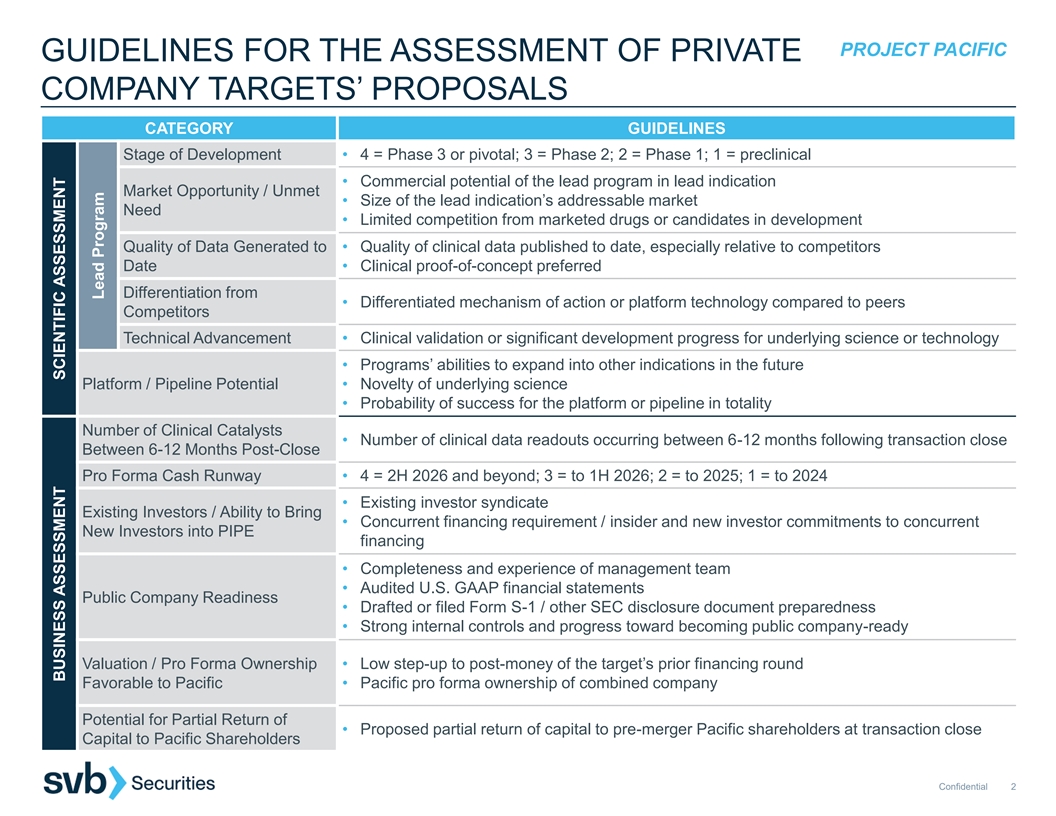

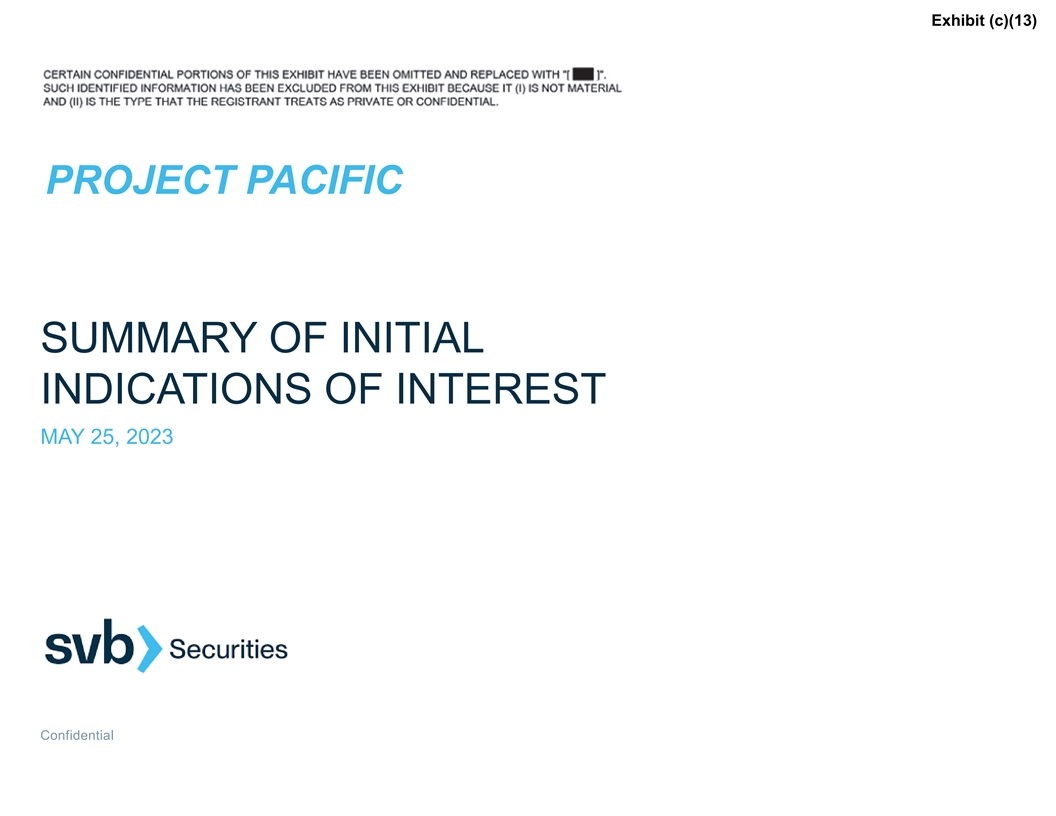

PROJECT PACIFIC GUIDELINES FOR THE ASSESSMENT OF PRIVATE COMPANY TARGETS’ PROPOSALS CATEGORY GUIDELINES Stage of Development • 4 = Phase 3 or pivotal; 3 = Phase 2; 2 = Phase 1; 1 = preclinical • Commercial potential of the lead program in lead indication Market Opportunity / Unmet • Size of the lead indication’s addressable market Need • Limited competition from marketed drugs or candidates in development Quality of Data Generated to • Quality of clinical data published to date, especially relative to competitors Date • Clinical proof-of-concept preferred Differentiation from • Differentiated mechanism of action or platform technology compared to peers Competitors Technical Advancement • Clinical validation or significant development progress for underlying science or technology • Programs’ abilities to expand into other indications in the future Platform / Pipeline Potential • Novelty of underlying science • Probability of success for the platform or pipeline in totality Number of Clinical Catalysts • Number of clinical data readouts occurring between 6-12 months following transaction close Between 6-12 Months Post-Close Pro Forma Cash Runway • 4 = 2H 2026 and beyond; 3 = to 1H 2026; 2 = to 2025; 1 = to 2024 • Existing investor syndicate Existing Investors / Ability to Bring • Concurrent financing requirement / insider and new investor commitments to concurrent New Investors into PIPE financing • Completeness and experience of management team • Audited U.S. GAAP financial statements Public Company Readiness • Drafted or filed Form S-1 / other SEC disclosure document preparedness • Strong internal controls and progress toward becoming public company-ready Valuation / Pro Forma Ownership • Low step-up to post-money of the target’s prior financing round Favorable to Pacific • Pacific pro forma ownership of combined company Potential for Partial Return of • Proposed partial return of capital to pre-merger Pacific shareholders at transaction close Capital to Pacific Shareholders Confidential 2 BUSINESS ASSESSMENT SCIENTIFIC ASSESSMENT Lead Program

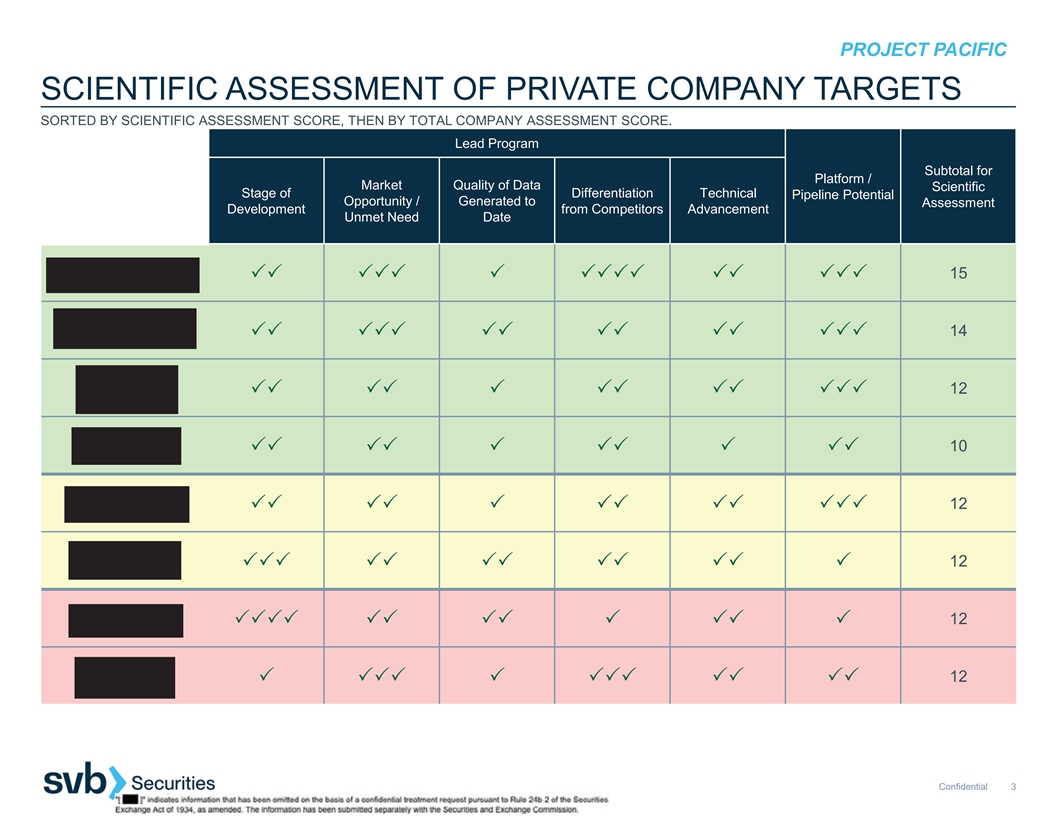

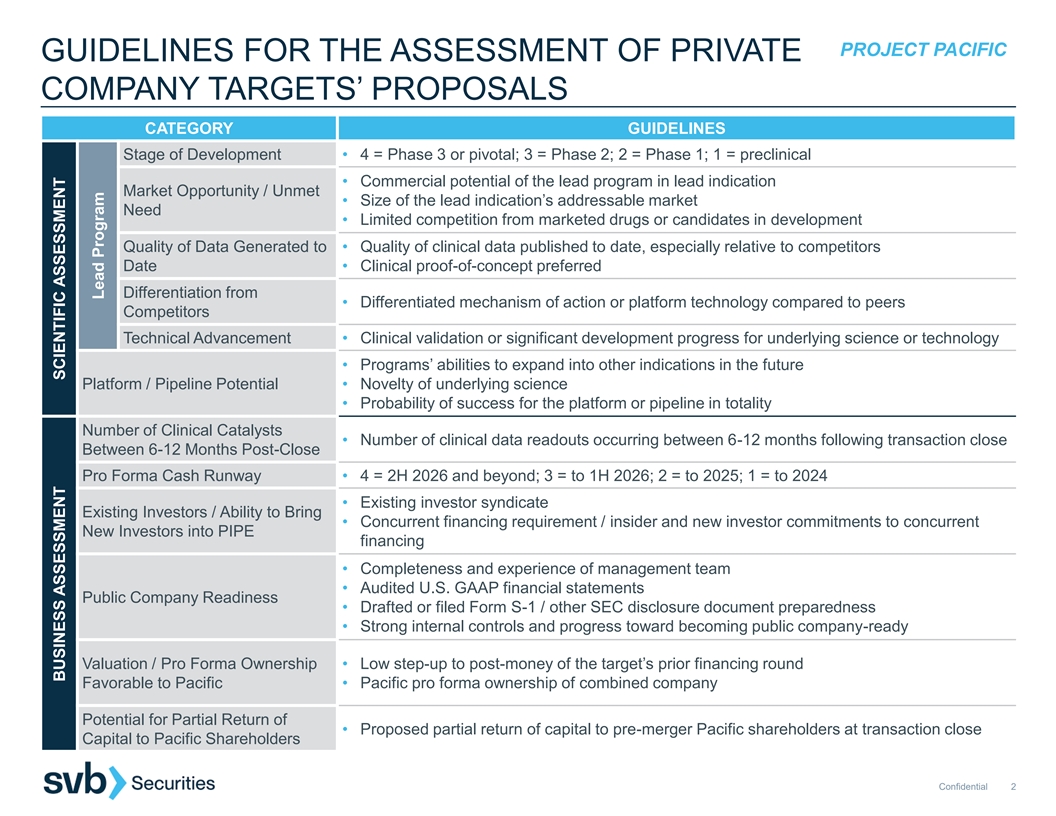

3 33 3333 33 3333 3 333 3 3 3 33 PROJECT PACIFIC SCIENTIFIC ASSESSMENT OF PRIVATE COMPANY TARGETS SORTED BY SCIENTIFIC ASSESSMENT SCORE, THEN BY TOTAL COMPANY ASSESSMENT SCORE. Lead Program Subtotal for Platform / Market Quality of Data Scientific Stage of Differentiation Technical Pipeline Potential Opportunity / Generated to Assessment Development from Competitors Advancement Unmet Need Date 15 33333333333333 14 33333333333333 12 3333333 10 333333 12 3333333 12 33333333333 12 33333333 12 3333333333 Confidential 3

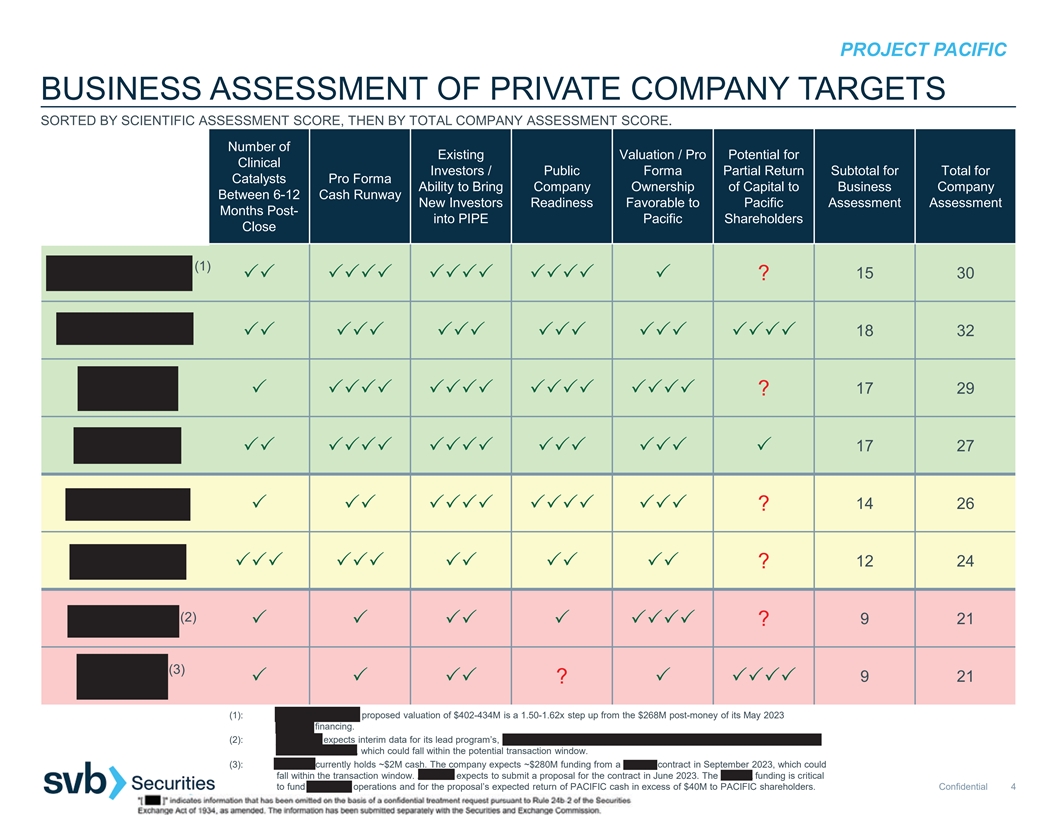

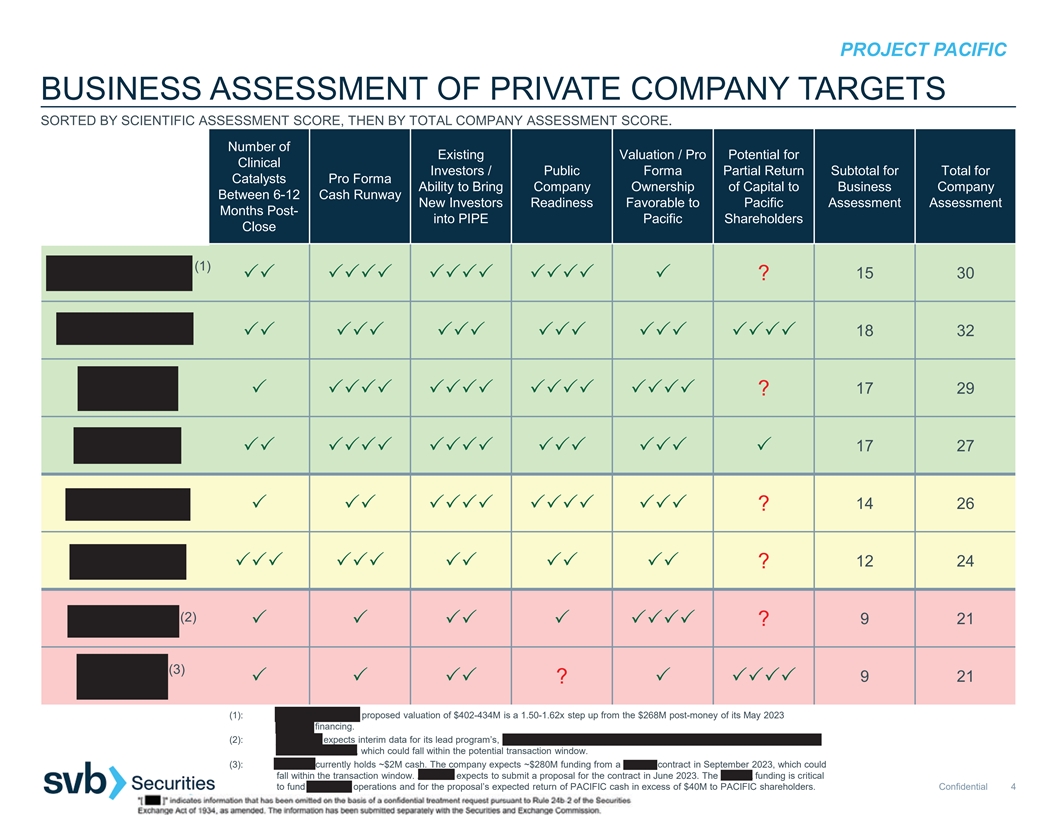

3 3 3 3 33 3 33 333 PROJECT PACIFIC BUSINESS ASSESSMENT OF PRIVATE COMPANY TARGETS SORTED BY SCIENTIFIC ASSESSMENT SCORE, THEN BY TOTAL COMPANY ASSESSMENT SCORE. Number of Existing Valuation / Pro Potential for Clinical Investors / Public Forma Partial Return Subtotal for Total for Catalysts Pro Forma Ability to Bring Company Ownership of Capital to Business Company Between 6-12 Cash Runway New Investors Readiness Favorable to Pacific Assessment Assessment Months Post- into PIPE Pacific Shareholders Close (1) 15 30 33333333333333 ? 18 32 333333333333333333 17 29 3333333333333333 ? 17 27 3333333333333333 14 26 33333333333 ? 12 24 333333333333 ? (2) 921 333333 ? (3) 921 33 ?3333 (1): BOUNDLESS BIO’s proposed valuation of $402-434M is a 1.50-1.62x step up from the $268M post-money of its May 2023 Series C financing. (2): ANHEART expects interim data for its lead program’s, taletrectinib (AB-106), Phase 2 pivotal TRUST-II trial in ROS1 fusion-positive NSCLC in 2H 2023, which could fall within the potential transaction window. (3): AERIUM currently holds ~$2M cash. The company expects ~$280M funding from a BARDA contract in September 2023, which could fall within the transaction window. AERIUM expects to submit a proposal for the contract in June 2023. The BARDA funding is critical to fund AERIUM’s operations and for the proposal’s expected return of PACIFIC cash in excess of $40M to PACIFIC shareholders. Confidential 4

PROJECT PACIFIC HOW COUNTERPARTIES ARE VALUING PACIFIC AND THEMSELVES $ IN USD MILLIONS. SORTED ALPHABETICALLY. PACIFIC VALUATION COUNTERPARTY PF OWNERSHIP ASSETS / PRO FORMA TARGET PIPE PARTY CASH LISTING TECHNOLOGY TOTAL VALUATION STEP-UP CASH RUNWAY (INSIDER COMMITMENT) PACIFIC PARTY PIPE (1) (2) $40 $5 - $45 $155 ND Through 2024 - 22.5% 77.5% - (3) (4) 140 10 - 150 250 1.25x Through 2024 $40 (100%) 34.1% 56.8% 9.1% Through 1H 140 5 - 145 357 1.10x - 28.9% 71.1% - 2025 140 - - 140 402-434 1.50-1.62x Into 2H 2026 - 24.4-25.8% 74.2-75.6% - 140 7 - 147 325 1.50x Into 2026 75-125 (ND) 24.6-26.9% 54.4-59.4% 13.7-20.9% (5) (5) Through early 40 10 - 50 257 1.00x 110 (68%) 12.0% 61.6% 26.4% 2026 (6) 140 15 - 155 310 1.00x Through 2027 - 33.3% 66.7% - (7) 140 15 - 155 250 1.35x Into 2H 2026 - 38.3% 61.7% - (1): PACIFIC net cash at close in excess of $40M to be returned to pre-transaction PACIFIC shareholders. (2): Pro forma runway includes ~$280M in non-dilutive funding from BARDA. (3): Runway through 2024 requires only $100M. (4): Concurrent PIPE not required. Insiders and licensing partner have indicated $40M commitment to any potential PIPE. (5): IMMPACT BIO plans to announce a share buyback upon announcement of the transaction for up to $100M to provide liquidity to PACIFIC stockholders seeking to exit the transaction. (6): Ongoing discussions with investors to extend Series C by $25-50M, which would increase post-money for Series C and valuation for proposed transaction accordingly. (7): Existing Q32 shareholders have a signed a letter committing at least $30 million for PIPE financing. This funding could be used to extend runway further or potentially return a portion of PACIFIC's cash to its shareholders. Confidential 5

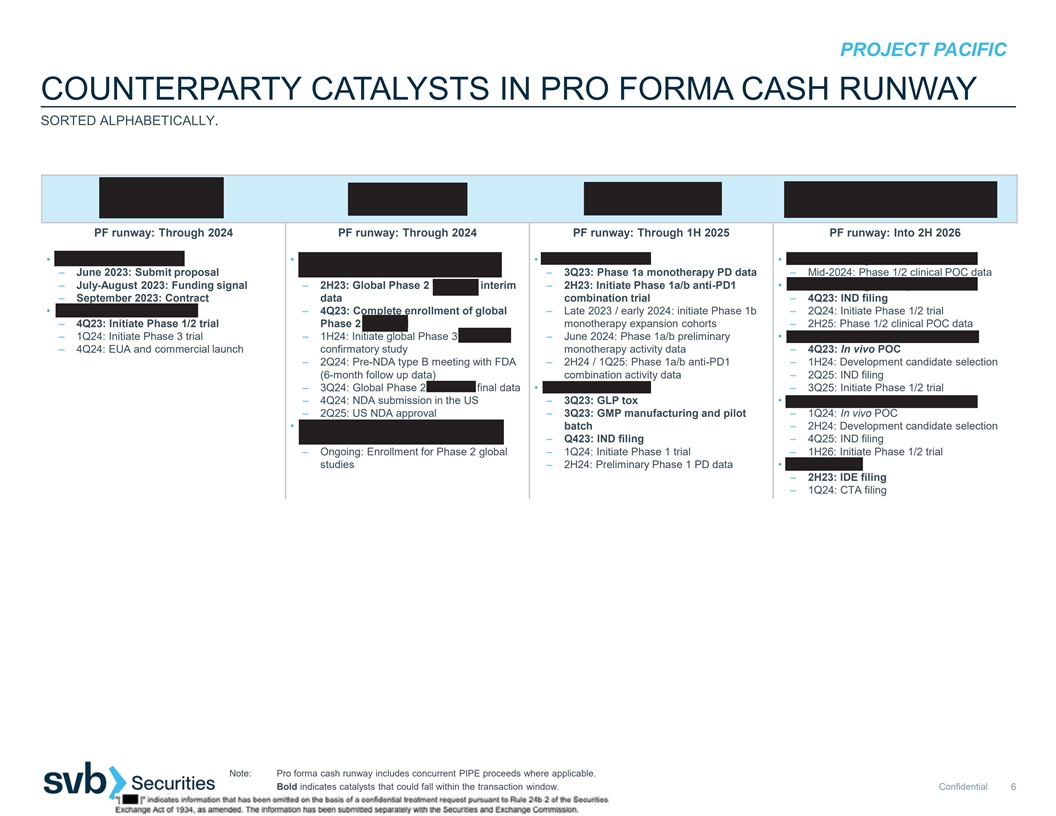

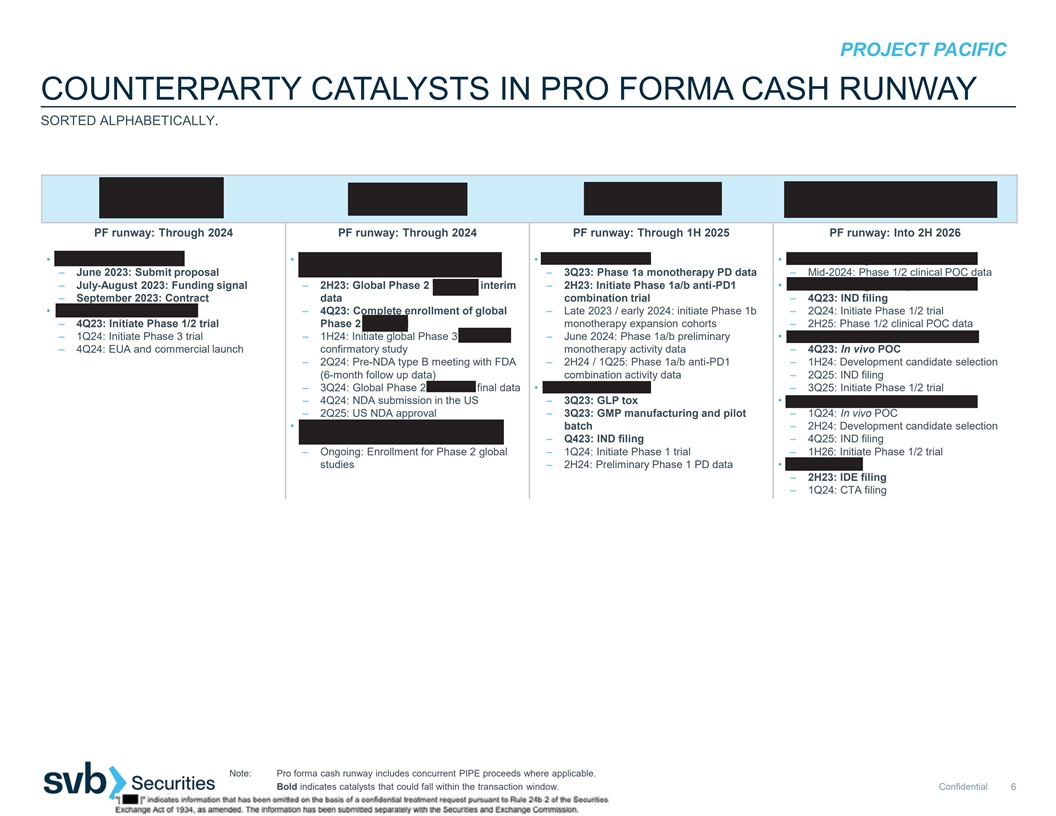

PROJECT PACIFIC COUNTERPARTY CATALYSTS IN PRO FORMA CASH RUNWAY SORTED ALPHABETICALLY. PF runway: Through 2024 PF runway: Through 2024 PF runway: Through 1H 2025 PF runway: Into 2H 2026 • BARDA contract (~$280M) • Taletrectinib/AB-106 in non-small cell lung • AB248 in solid tumors • BBI-355 in oncogene amplified cancers – June 2023: Submit proposal cancer – 3Q23: Phase 1a monotherapy PD data – Mid-2024: Phase 1/2 clinical POC data – July-August 2023: Funding signal – 2H23: Global Phase 2 TRUST-II interim – 2H23: Initiate Phase 1a/b anti-PD1 • BBI-825 in oncogene amplified cancers – September 2023: Contract data combination trial – 4Q23: IND filing • AER003 / AER004 / AER005 – 4Q23: Complete enrollment of global – Late 2023 / early 2024: initiate Phase 1b – 2Q24: Initiate Phase 1/2 trial – 4Q23: Initiate Phase 1/2 trial Phase 2 TRUST-II monotherapy expansion cohorts – 2H25: Phase 1/2 clinical POC data – 1Q24: Initiate Phase 3 trial – 1H24: Initiate global Phase 3 TRUST-III – June 2024: Phase 1a/b preliminary • ecDTx 3 in oncogene amplified cancers – 4Q24: EUA and commercial launch confirmatory study monotherapy activity data – 4Q23: In vivo POC – 2Q24: Pre-NDA type B meeting with FDA – 2H24 / 1Q25: Phase 1a/b anti-PD1 – 1H24: Development candidate selection (6-month follow up data) combination activity data – 2Q25: IND filing – 3Q24: Global Phase 2 TRUST-II final data • AB821 in solid tumors – 3Q25: Initiate Phase 1/2 trial – 4Q24: NDA submission in the US – 3Q23: GLP tox • ecDTx 4 in oncogene amplified cancers – 2Q25: US NDA approval – 3Q23: GMP manufacturing and pilot – 1Q24: In vivo POC • Safusidenib/AB-218 in lower grade glioma, batch – 2H24: Development candidate selection cholangiocarcinoma – Q423: IND filing – 4Q25: IND filing – Ongoing: Enrollment for Phase 2 global – 1Q24: Initiate Phase 1 trial – 1H26: Initiate Phase 1/2 trial studies – 2H24: Preliminary Phase 1 PD data • ECHO Platform – 2H23: IDE filing – 1Q24: CTA filing Note: Pro forma cash runway includes concurrent PIPE proceeds where applicable. Bold indicates catalysts that could fall within the transaction window. Confidential 6

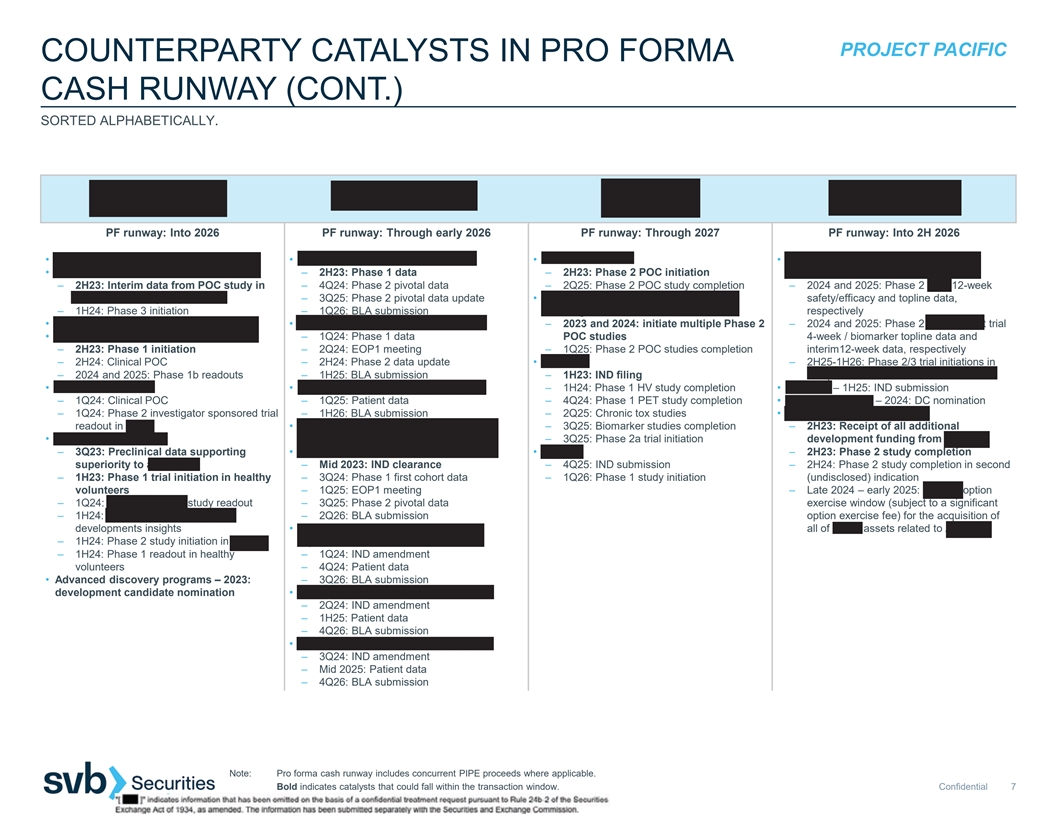

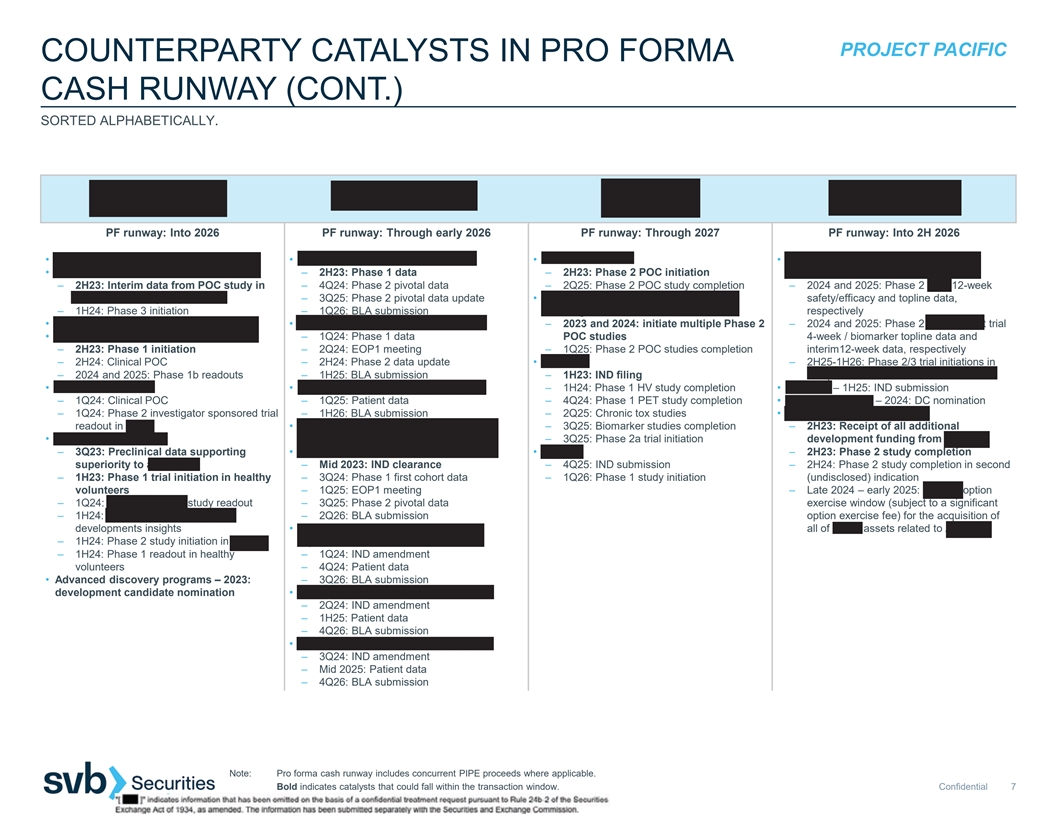

PROJECT PACIFIC COUNTERPARTY CATALYSTS IN PRO FORMA CASH RUNWAY (CONT.) SORTED ALPHABETICALLY. PF runway: Into 2026 PF runway: Through early 2026 PF runway: Through 2027 PF runway: Into 2H 2026 • Felzartamab – 2Q23: reproductive tox data • IMPT-314 in ≥3L CAR-T naïve ABCL • PIPE-307 in r/r MS • ADX-097 in complement-mediated renal • Felzartamab in PMN – 2H23: Phase 1 data – 2H23: Phase 2 POC initiation diseases – 2H23: Interim data from POC study in – 4Q24: Phase 2 pivotal data – 2Q25: Phase 2 POC study completion – 2024 and 2025: Phase 2 AAV 12-week aCD20-refractory population – 3Q25: Phase 2 pivotal data update • PIPE-307 in other neurological disorders, safety/efficacy and topline data, – 1H24: Phase 3 initiation – 1Q26: BLA submission including MDD respectively • Felzartamab in IgAN – 2Q23: Clinical POC • IMPT-314 in CAR-T experienced ABCL – 2023 and 2024: initiate multiple Phase 2 – 2024 and 2025: Phase 2 renal basket trial • Felzartamab in LN – 1Q24: Phase 1 data POC studies 4-week / biomarker topline data and – 2H23: Phase 1 initiation – 2Q24: EOP1 meeting – 1Q25: Phase 2 POC studies completion interim12-week data, respectively – 2H24: Clinical POC – 2H24: Phase 2 data update • PIPE-791 – 2H25-1H26: Phase 2/3 trial initiations in – 2024 and 2025: Phase 1b readouts – 1H25: BLA submission – 1H23: IND filing complement-mediated renal diseases • Felzartamab in AMR • IMPT-314 in 2L HCT unintended ABCL – 1H24: Phase 1 HV study completion • ADX-096 – 1H25: IND submission – 1Q24: Clinical POC – 1Q25: Patient data – 4Q24: Phase 1 PET study completion • Novel nanobodies – 2024: DC nomination – 1Q24: Phase 2 investigator sponsored trial – 1H26: BLA submission – 2Q25: Chronic tox studies • ADX-914 in atopic dermatitis readout in AMR • IMPT-314 – 1Q26: patient data in 2L HCT – 3Q25: Biomarker studies completion – 2H23: Receipt of all additional • HIB210 in severe IMDs eligible ABCL – 3Q25: Phase 2a trial initiation development funding from Horizon – 3Q23: Preclinical data supporting • IMPT-514 in r/r lupus nephritis • Calpain – 2H23: Phase 2 study completion superiority to avacopan – Mid 2023: IND clearance – 4Q25: IND submission – 2H24: Phase 2 study completion in second – 1H23: Phase 1 trial initiation in healthy – 3Q24: Phase 1 first cohort data – 1Q26: Phase 1 study initiation (undisclosed) indication volunteers – 1Q25: EOP1 meeting – Late 2024 – early 2025: Horizon option – 1Q24: NHP chronic tox study readout – 3Q25: Phase 2 pivotal data exercise window (subject to a significant – 1H24: Subcutaneous formulation – 2Q26: BLA submission option exercise fee) for the acquisition of developments insights • IMPT-514 in severe systemic lupus all of Q32’s assets related to ADX-914 – 1H24: Phase 2 study initiation in AAV erythematosus with extrarenal disease – 1H24: Phase 1 readout in healthy – 1Q24: IND amendment volunteers – 4Q24: Patient data • Advanced discovery programs – 2023: – 3Q26: BLA submission development candidate nomination • IMPT-514 in ANCA-associated vasculitis – 2Q24: IND amendment – 1H25: Patient data – 4Q26: BLA submission • IMPT-514 in secondary progressive MS – 3Q24: IND amendment – Mid 2025: Patient data – 4Q26: BLA submission Note: Pro forma cash runway includes concurrent PIPE proceeds where applicable. Bold indicates catalysts that could fall within the transaction window. Confidential 7

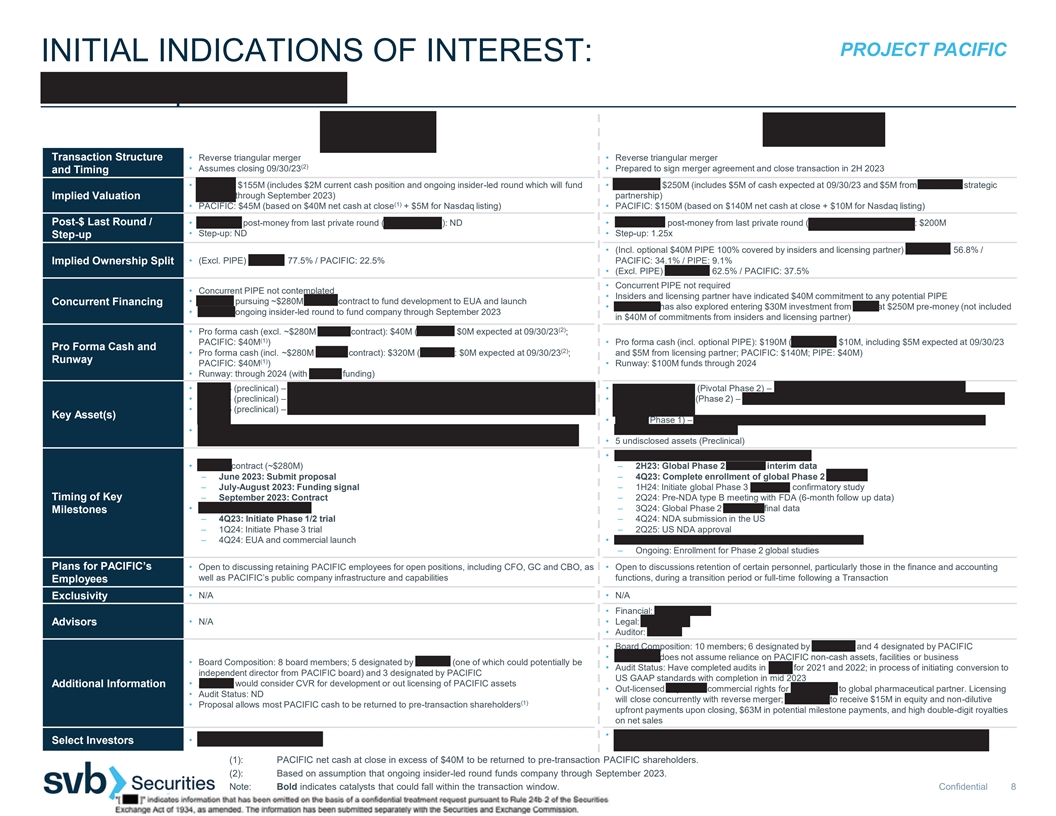

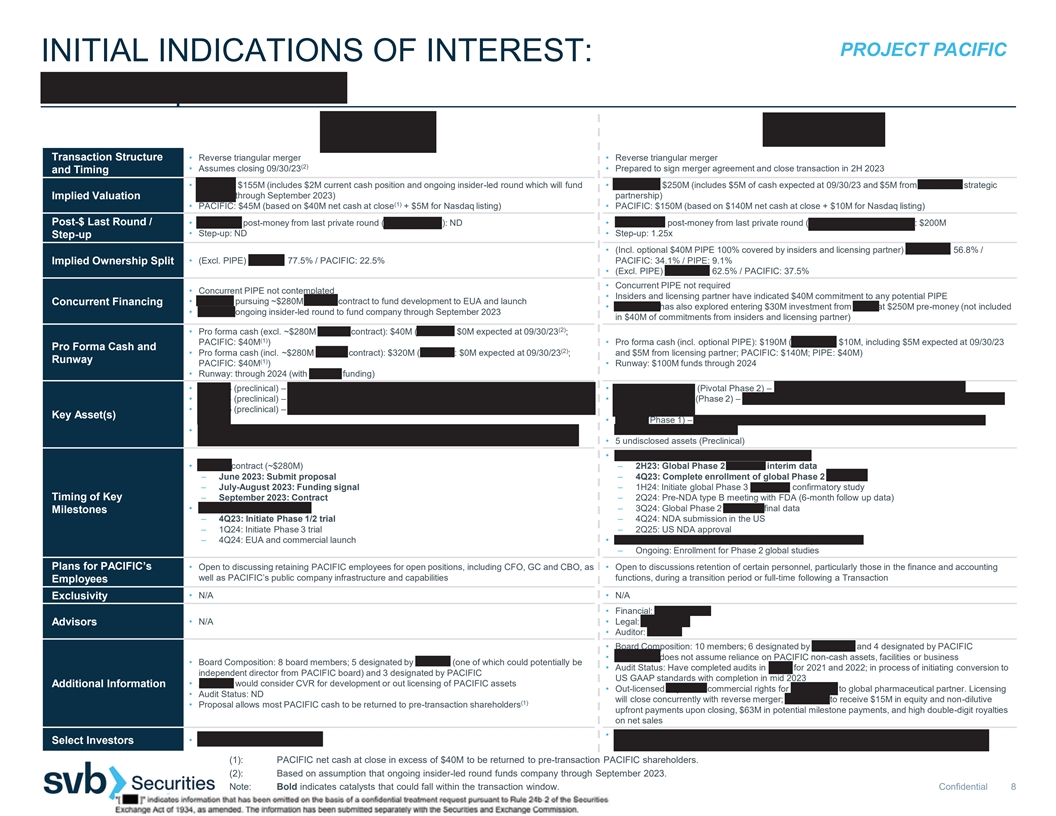

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST: AERIUM | ANHEART Transaction Structure • Reverse triangular merger • Reverse triangular merger (2) • Assumes closing 09/30/23 • Prepared to sign merger agreement and close transaction in 2H 2023 and Timing • AERIUM: $155M (includes $2M current cash position and ongoing insider-led round which will fund • ANHEART: $250M (includes $5M of cash expected at 09/30/23 and $5M from ANHEART strategic AERIUM through September 2023) partnership) Implied Valuation (1) • PACIFIC: $45M (based on $40M net cash at close + $5M for Nasdaq listing) • PACIFIC: $150M (based on $140M net cash at close + $10M for Nasdaq listing) Post-$ Last Round / • AERIUM’S post-money from last private round (Series A, 2022): ND • ANHEART’S post-money from last private round (Series B, September 2021): $200M • Step-up: ND • Step-up: 1.25x Step-up • (Incl. optional $40M PIPE 100% covered by insiders and licensing partner) ANHEART: 56.8% / Implied Ownership Split • (Excl. PIPE) AERIUM: 77.5% / PACIFIC: 22.5% PACIFIC: 34.1% / PIPE: 9.1% • (Excl. PIPE) ANHEART: 62.5% / PACIFIC: 37.5% • Concurrent PIPE not required • Concurrent PIPE not contemplated • Insiders and licensing partner have indicated $40M commitment to any potential PIPE • AERIUM pursuing ~$280M BARDA contract to fund development to EUA and launch Concurrent Financing • ANHEART has also explored entering $30M investment from SDIC at $250M pre-money (not included • AERIUM ongoing insider-led round to fund company through September 2023 in $40M of commitments from insiders and licensing partner) (2) • Pro forma cash (excl. ~$280M BARDA contract): $40M (AERIUM: $0M expected at 09/30/23 ; (1) PACIFIC: $40M ) • Pro forma cash (incl. optional PIPE): $190M (ANHEART: $10M, including $5M expected at 09/30/23 Pro Forma Cash and (2) • Pro forma cash (incl. ~$280M BARDA contract): $320M (AERIUM: $0M expected at 09/30/23 ; and $5M from licensing partner; PACIFIC: $140M; PIPE: $40M) Runway (1) PACIFIC: $40M ) • Runway: $100M funds through 2024 • Runway: through 2024 (with BARDA funding) • AER003 (preclinical) – mAb antiviral treatment against SARS-CoV-2 occupying ACE2 footprint • Taletrectinib/AB-106 (Pivotal Phase 2) – ROS1 inhibitor for ROS1 fusion-positive NSCLC • AER004 (preclinical) – mAb antiviral treatment against SARS-CoV-2 • Safusidenib/AB-218 (Phase 2) – mIDH1 inhibitor for lower grade glioma, cholangiocarcinoma and • AER005 (preclinical) – mAb antiviral treatment against SARS-CoV-2 binding outside Receptor Binding other tumors Key Asset(s) Domain • AB-329 (Phase 1) – AXL inhibitor for combination with checkpoint inhibitors or chemotherapy in • Two mAbs planned to be developed in combination; third to be developed as contingency for viral NSCLC and other solid tumors evolution • 5 undisclosed assets (Preclinical) • Taletrectinib/AB-106 in non-small cell lung cancer • BARDA contract (~$280M) – 2H23: Global Phase 2 TRUST-II interim data – June 2023: Submit proposal – 4Q23: Complete enrollment of global Phase 2 TRUST-II – July-August 2023: Funding signal – 1H24: Initiate global Phase 3 TRUST-III confirmatory study Timing of Key – September 2023: Contract – 2Q24: Pre-NDA type B meeting with FDA (6-month follow up data) • AER003 / AER004 / AER005 – 3Q24: Global Phase 2 TRUST-II final data Milestones – 4Q23: Initiate Phase 1/2 trial – 4Q24: NDA submission in the US – 1Q24: Initiate Phase 3 trial – 2Q25: US NDA approval – 4Q24: EUA and commercial launch • Safusidenib/AB-218 in lower grade glioma, cholangiocarcinoma – Ongoing: Enrollment for Phase 2 global studies Plans for PACIFIC’s • Open to discussing retaining PACIFIC employees for open positions, including CFO, GC and CBO, as • Open to discussions retention of certain personnel, particularly those in the finance and accounting well as PACIFIC’s public company infrastructure and capabilities functions, during a transition period or full-time following a Transaction Employees • N/A • N/A Exclusivity • Financial: Piper Sandler Advisors • N/A • Legal: WilmerHale • Auditor: Deloitte • Board Composition: 10 members; 6 designated by ANHEART and 4 designated by PACIFIC • ANHEART does not assume reliance on PACIFIC non-cash assets, facilities or business • Board Composition: 8 board members; 5 designated by AERIUM (one of which could potentially be • Audit Status: Have completed audits in China for 2021 and 2022; in process of initiating conversion to independent director from PACIFIC board) and 3 designated by PACIFIC US GAAP standards with completion in mid 2023 • AERIUM would consider CVR for development or out licensing of PACIFIC assets Additional Information • Out-licensed Japanese commercial rights for taletrectinib to global pharmaceutical partner. Licensing • Audit Status: ND will close concurrently with reverse merger; ANHEART to receive $15M in equity and non-dilutive (1) • Proposal allows most PACIFIC cash to be returned to pre-transaction shareholders upfront payments upon closing, $63M in potential milestone payments, and high double-digit royalties on net sales • Octagon Investments, Decheng Capital, Laurion Capital, Sage Partners, Innovent Biologics and Select Investors • Omega Funds, F-Prime Capital Cenova (1): PACIFIC net cash at close in excess of $40M to be returned to pre-transaction PACIFIC shareholders. (2): Based on assumption that ongoing insider-led round funds company through September 2023. Note: Bold indicates catalysts that could fall within the transaction window. Confidential 8

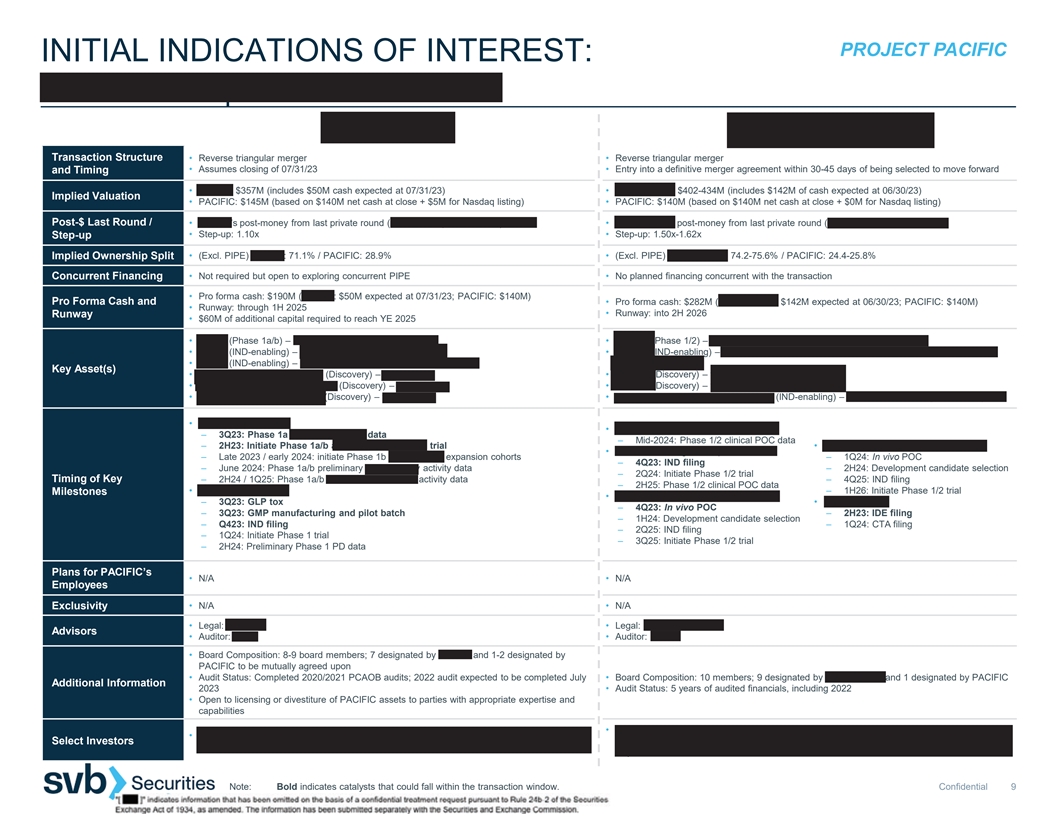

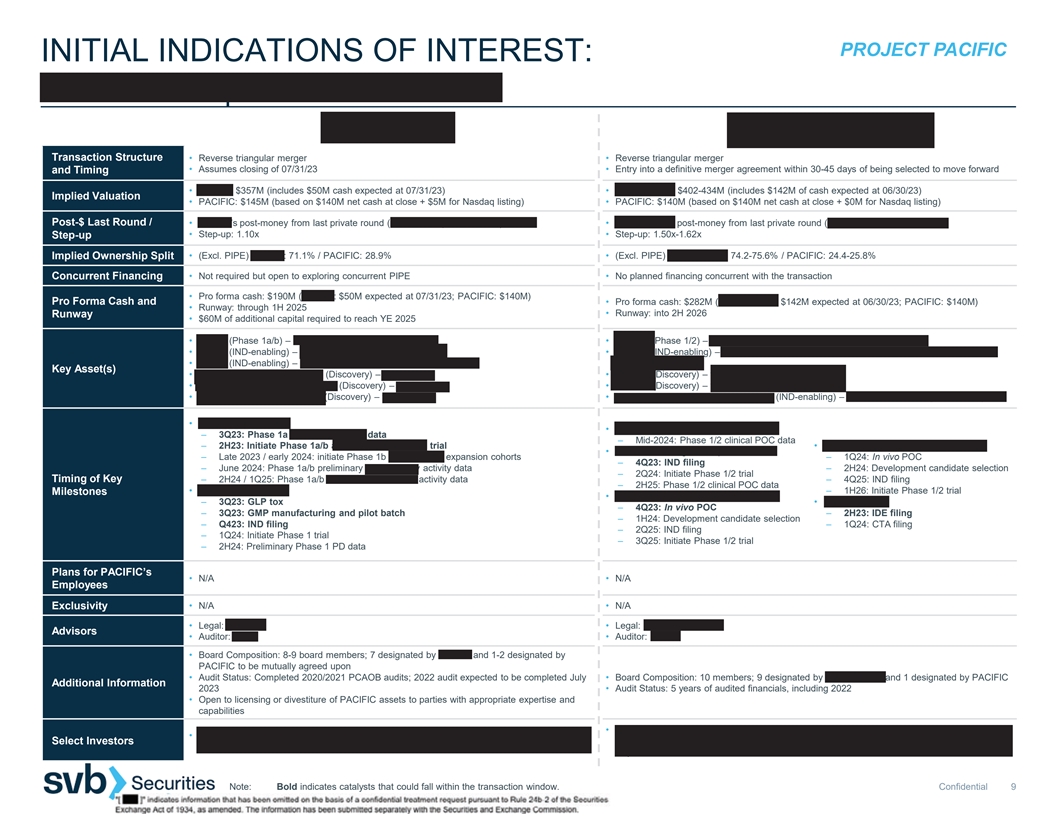

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST: ASHER BIO | BOUNDLESS BIO Transaction Structure • Reverse triangular merger • Reverse triangular merger • Assumes closing of 07/31/23 • Entry into a definitive merger agreement within 30-45 days of being selected to move forward and Timing • ASHER: $357M (includes $50M cash expected at 07/31/23) • BOUNDLESS: $402-434M (includes $142M of cash expected at 06/30/23) Implied Valuation • PACIFIC: $145M (based on $140M net cash at close + $5M for Nasdaq listing) • PACIFIC: $140M (based on $140M net cash at close + $0M for Nasdaq listing) Post-$ Last Round / • ASHER’s post-money from last private round (Series B, September 2021): $324M • BOUNDLESS’ post-money from last private round (Series C, May 2023): $268M • Step-up: 1.10x • Step-up: 1.50x-1.62x Step-up • (Excl. PIPE) ASHER: 71.1% / PACIFIC: 28.9% • (Excl. PIPE) BOUNDLESS: 74.2-75.6% / PACIFIC: 24.4-25.8% Implied Ownership Split Concurrent Financing • Not required but open to exploring concurrent PIPE • No planned financing concurrent with the transaction • Pro forma cash: $190M (ASHER: $50M expected at 07/31/23; PACIFIC: $140M) Pro Forma Cash and • Pro forma cash: $282M (BOUNDLESS: $142M expected at 06/30/23; PACIFIC: $140M) • Runway: through 1H 2025 • Runway: into 2H 2026 Runway • $60M of additional capital required to reach YE 2025 • AB248 (Phase 1a/b) – CD8-targeted IL2 for solid tumors • BBI-355 (Phase 1/2) – oral CHK1 inhibitor for oncogene amplified cancers • AB821 (IND-enabling) – CD8-targeted IL21 for solid tumors • BBI-825 (IND-enabling) – extrachromosomal DNA directed therapies (exDTx) for oncogene • AB359 (IND-enabling) – CD8-targeted IL2 for chronic viral infection amplified cancers Key Asset(s) • Cell therapy-targeted IL-2 / 21 (Discovery) – for cancer • ecDTx 3 (Discovery) – for oncogene amplified cancers • Myeloid-targeted immune agonist (Discovery) – for cancer • ecDTx 4 (Discovery) – for oncogene amplified cancers • CD4+ T cell-targeted cytokine (Discovery) – for cancer • ECHO / ecDNA Harboring Oncogenes (IND-enabling) – patient selection diagnostic assay • AB248 in solid tumors • BBI-355 in oncogene amplified cancers – 3Q23: Phase 1a monotherapy PD data – Mid-2024: Phase 1/2 clinical POC data – 2H23: Initiate Phase 1a/b anti-PD1 combination trial • ecDTx 4 in oncogene amplified cancers • BBI-825 in oncogene amplified cancers – Late 2023 / early 2024: initiate Phase 1b monotherapy expansion cohorts – 1Q24: In vivo POC – 4Q23: IND filing – June 2024: Phase 1a/b preliminary monotherapy activity data – 2H24: Development candidate selection – 2Q24: Initiate Phase 1/2 trial Timing of Key – 2H24 / 1Q25: Phase 1a/b anti-PD1 combination activity data – 4Q25: IND filing – 2H25: Phase 1/2 clinical POC data • AB821 in solid tumors – 1H26: Initiate Phase 1/2 trial Milestones • ecDTx 3 in oncogene amplified cancers – 3Q23: GLP tox • ECHO Platform – 4Q23: In vivo POC – 3Q23: GMP manufacturing and pilot batch – 2H23: IDE filing – 1H24: Development candidate selection – Q423: IND filing – 1Q24: CTA filing – 2Q25: IND filing – 1Q24: Initiate Phase 1 trial – 3Q25: Initiate Phase 1/2 trial – 2H24: Preliminary Phase 1 PD data Plans for PACIFIC’s • N/A • N/A Employees Exclusivity • N/A • N/A • Legal: Goodwin • Legal: Latham & Watkins Advisors • Auditor: PWC • Auditor: KPMG • Board Composition: 8-9 board members; 7 designated by ASHER and 1-2 designated by PACIFIC to be mutually agreed upon • Audit Status: Completed 2020/2021 PCAOB audits; 2022 audit expected to be completed July • Board Composition: 10 members; 9 designated by BOUNDLESS and 1 designated by PACIFIC Additional Information 2023 • Audit Status: 5 years of audited financials, including 2022 • Open to licensing or divestiture of PACIFIC assets to parties with appropriate expertise and capabilities • Leaps by Bayer, RA Capital, Sectoral, Piper Heartland, ARCH Venture, Nextech Invest, Fidelity, • Third Rock Ventures, Wellington, RA Capital, Invus Public Equities, Boxer Capital, Mission Bay Wellington, Boxer, Redmile, Surveyor, PFM, Vertex Ventures, Logos, City Hill, GT Healthcare Select Investors Capital, Janus Henderson, Logos, Marshall Wace, Y-Combinator Capital, Alexandria Venture Investments Note: Bold indicates catalysts that could fall within the transaction window. Confidential 9

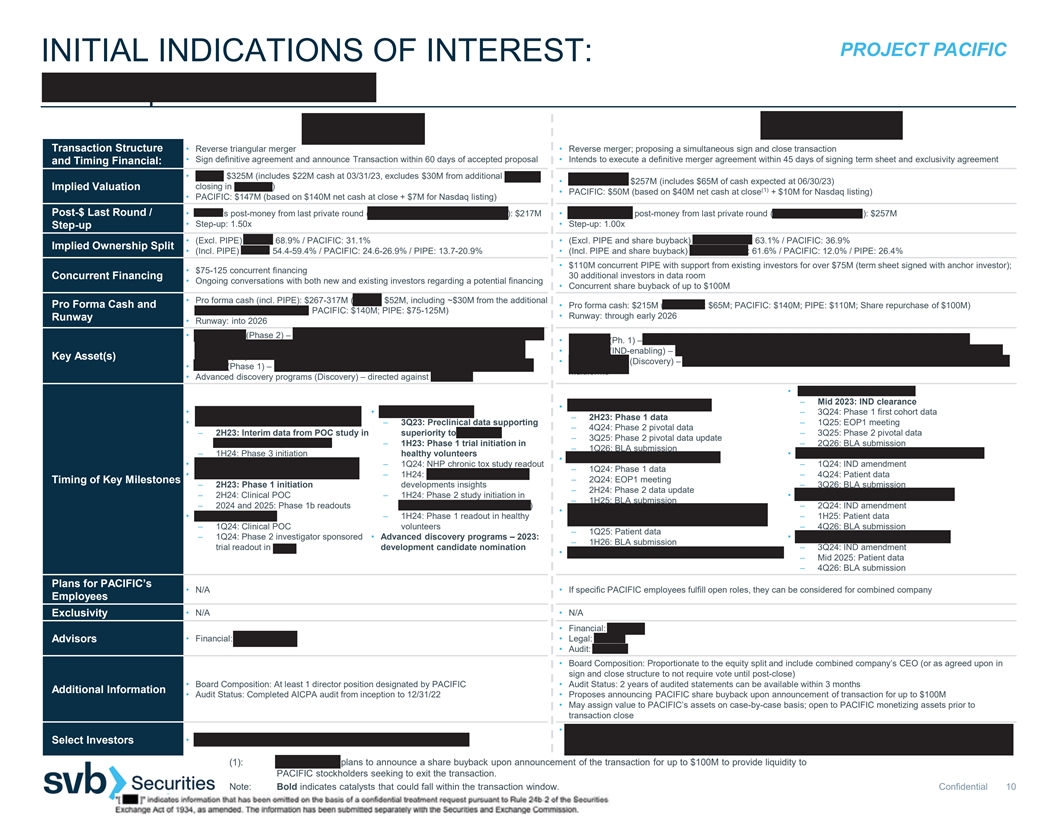

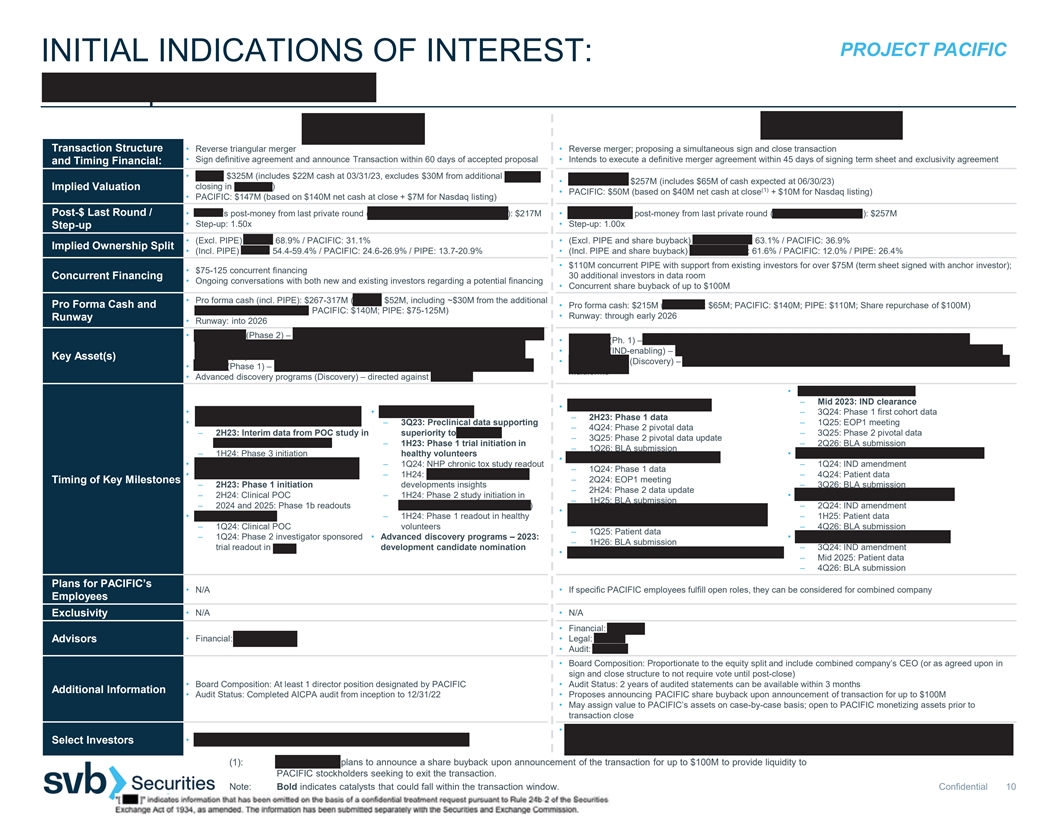

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST: HI-BIO | IMMPACT BIO Transaction Structure • Reverse triangular merger • Reverse merger; proposing a simultaneous sign and close transaction • Sign definitive agreement and announce Transaction within 60 days of accepted proposal • Intends to execute a definitive merger agreement within 45 days of signing term sheet and exclusivity agreement and Timing Financial: • HI-BIO: $325M (includes $22M cash at 03/31/23, excludes $30M from additional Series A • IMMPACT BIO: $257M (includes $65M of cash expected at 06/30/23) closing in May 2023) Implied Valuation (1) • PACIFIC: $50M (based on $40M net cash at close + $10M for Nasdaq listing) • PACIFIC: $147M (based on $140M net cash at close + $7M for Nasdaq listing) Post-$ Last Round / • HI-BIO’s post-money from last private round (Series A extension, November 2022): $217M • IMMPACT BIO’s post-money from last private round (Series B, January 2022): $257M • Step-up: 1.50x • Step-up: 1.00x Step-up • (Excl. PIPE) HI-BIO: 68.9% / PACIFIC: 31.1% • (Excl. PIPE and share buyback) IMMPACT BIO: 63.1% / PACIFIC: 36.9% Implied Ownership Split • (Incl. PIPE) HI-BIO: 54.4-59.4% / PACIFIC: 24.6-26.9% / PIPE: 13.7-20.9% • (Incl. PIPE and share buyback) IMMPACT BIO: 61.6% / PACIFIC: 12.0% / PIPE: 26.4% • $110M concurrent PIPE with support from existing investors for over $75M (term sheet signed with anchor investor); • $75-125 concurrent financing 30 additional investors in data room Concurrent Financing • Ongoing conversations with both new and existing investors regarding a potential financing • Concurrent share buyback of up to $100M • Pro forma cash (incl. PIPE): $267-317M (HI-BIO: $52M, including ~$30M from the additional Pro Forma Cash and • Pro forma cash: $215M (IMMPACT: $65M; PACIFIC: $140M; PIPE: $110M; Share repurchase of $100M) Series A closing in May 2023; PACIFIC: $140M; PIPE: $75-125M) • Runway: through early 2026 Runway • Runway: into 2026 • Felzartamab (Phase 2) – anti-CD38 antibody for primary membranous nephropathy (PMN), • IMPT-314 (Ph. 1) – CD19/CD20 bispecific CAR T cell therapy for aggressive B-cell lymphoma (ABCL) immunoglobulin A nephropathy (IgAN), antibody-mediated rejection (AMR) and lupus • IMPT-514 (IND-enabling) – CD19/CD20 bispecific CAR T cell therapy for autoimmune diseases nephritis (LN) Key Asset(s) • TGF-β platform (Discovery) – TGF-β in combination with a binder for IL13 receptor α2 (IL13Ra2) for glioblastoma • HIB210 (Phase 1) – anti-C5aR1 antibody for severe immune-mediated diseases (IMDs) multiforme • Advanced discovery programs (Discovery) – directed against mast cells • IMPT-514 in r/r lupus nephritis – Mid 2023: IND clearance • IMPT-314 in ≥3L CAR-T naïve ABCL • Felzartamab – 2Q23: reproductive tox data • HIB210 in severe IMDs – 3Q24: Phase 1 first cohort data – 2H23: Phase 1 data • Felzartamab in PMN – 3Q23: Preclinical data supporting – 1Q25: EOP1 meeting – 4Q24: Phase 2 pivotal data – 2H23: Interim data from POC study in superiority to avacopan – 3Q25: Phase 2 pivotal data – 3Q25: Phase 2 pivotal data update aCD20-refractory population – 1H23: Phase 1 trial initiation in – 2Q26: BLA submission – 1Q26: BLA submission – 1H24: Phase 3 initiation healthy volunteers • IMPT-514 in severe SLE with extrarenal disease • IMPT-314 in CAR-T experienced ABCL • Felzartamab in IgAN – 2Q23: Clinical POC – 1Q24: NHP chronic tox study readout – 1Q24: IND amendment – 1Q24: Phase 1 data • Felzartamab in LN – 1H24: Subcutaneous formulation – 4Q24: Patient data – 2Q24: EOP1 meeting Timing of Key Milestones – 2H23: Phase 1 initiation developments insights – 3Q26: BLA submission – 2H24: Phase 2 data update – 2H24: Clinical POC – 1H24: Phase 2 study initiation in • IMPT-514 in ANCA-associated vasculitis – 1H25: BLA submission – 2024 and 2025: Phase 1b readouts ANCA-associated vasculitis (AAV) – 2Q24: IND amendment • IMPT-314 in 2L hematopoietic cell transplant (HCT) • Felzartamab in AMR – 1H24: Phase 1 readout in healthy – 1H25: Patient data unintended ABCL – 1Q24: Clinical POC volunteers – 4Q26: BLA submission – 1Q25: Patient data – 1Q24: Phase 2 investigator sponsored • Advanced discovery programs – 2023: • IMPT-514 in secondary progressive MS – 1H26: BLA submission trial readout in AMR development candidate nomination – 3Q24: IND amendment • IMPT-314 – 1Q26: patient data in 2L HCT eligible ABCL – Mid 2025: Patient data – 4Q26: BLA submission Plans for PACIFIC’s • N/A • If specific PACIFIC employees fulfill open roles, they can be considered for combined company Employees • N/A • N/A Exclusivity • Financial: Jefferies • Financial: Goldman Sachs • Legal: Cooley Advisors • Audit: Deloitte • Board Composition: Proportionate to the equity split and include combined company’s CEO (or as agreed upon in sign and close structure to not require vote until post-close) • Board Composition: At least 1 director position designated by PACIFIC • Audit Status: 2 years of audited statements can be available within 3 months Additional Information • Audit Status: Completed AICPA audit from inception to 12/31/22 • Proposes announcing PACIFIC share buyback upon announcement of transaction for up to $100M • May assign value to PACIFIC’s assets on case-by-case basis; open to PACIFIC monetizing assets prior to transaction close • Bukwang Pharmaceutical, Decheng Capital, Foresite Capital Management, FutuRx, Hayan Health Networks, JJDC, • ARCH Venture Partners, Monograph Capital, Jeito Capital, MorphoSys JVC Investment Partners, Novartis Venture Fund, OrbiMed, RM Global Partners, RMGLOBAL Healthcare Fund, Select Investors Surveyor Capital, Takeda Ventures, venBio (1): IMMPACT BIO plans to announce a share buyback upon announcement of the transaction for up to $100M to provide liquidity to PACIFIC stockholders seeking to exit the transaction. Note: Bold indicates catalysts that could fall within the transaction window. Confidential 10

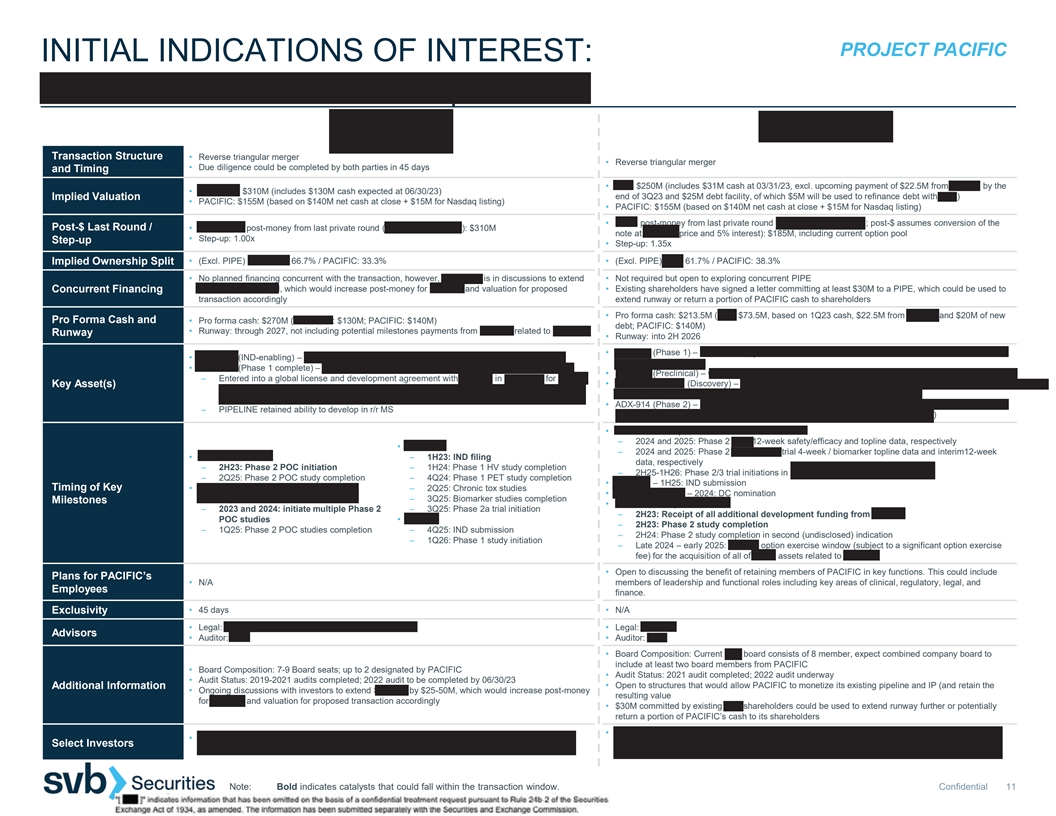

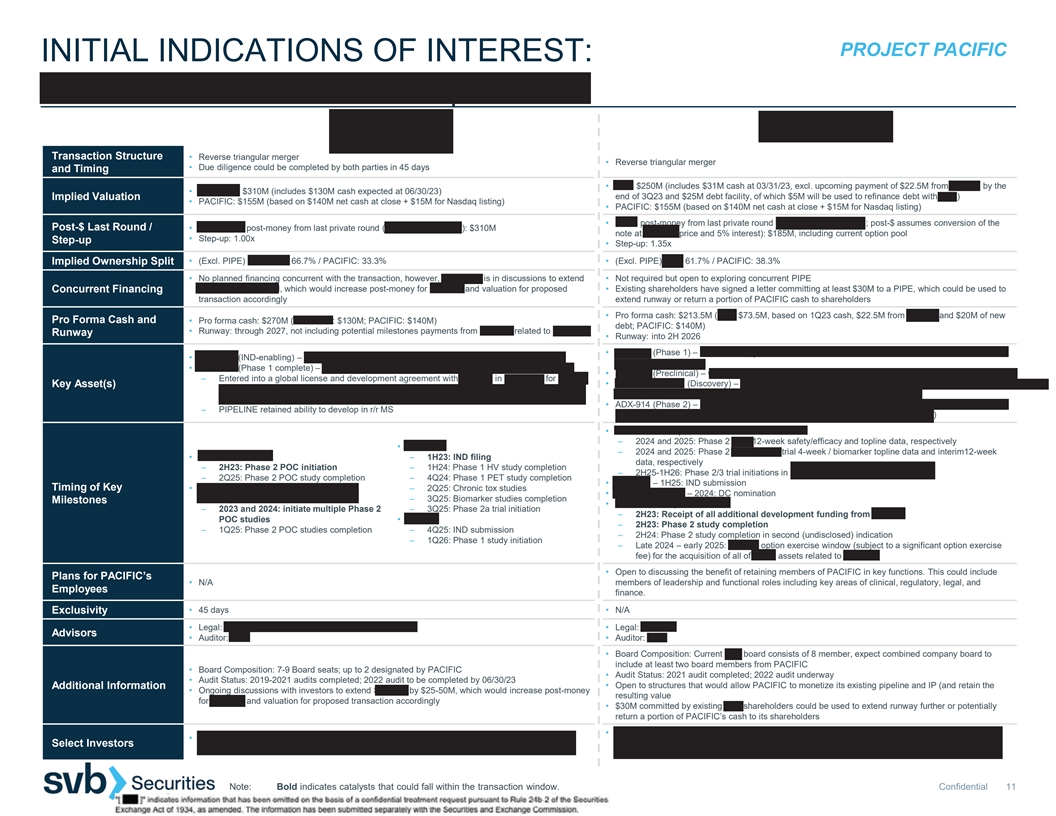

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST: PIPELINE THERAPEUTICS | Q32 BIO Transaction Structure • Reverse triangular merger • Reverse triangular merger • Due diligence could be completed by both parties in 45 days and Timing • Q32: $250M (includes $31M cash at 03/31/23, excl. upcoming payment of $22.5M from Horizon by the • PIPELINE: $310M (includes $130M cash expected at 06/30/23) Implied Valuation end of 3Q23 and $25M debt facility, of which $5M will be used to refinance debt with SVB) • PACIFIC: $155M (based on $140M net cash at close + $15M for Nasdaq listing) • PACIFIC: $155M (based on $140M net cash at close + $15M for Nasdaq listing) • Q32’s post-money from last private round (Convertible note, 2022; post-$ assumes conversion of the Post-$ Last Round / • PIPELINE’s post-money from last private round (Series C, April 2023): $310M note at Series B price and 5% interest): $185M, including current option pool • Step-up: 1.00x Step-up • Step-up: 1.35x • (Excl. PIPE) PIPELINE: 66.7% / PACIFIC: 33.3% • (Excl. PIPE) Q32: 61.7% / PACIFIC: 38.3% Implied Ownership Split • No planned financing concurrent with the transaction, however, PIPELINE is in discussions to extend • Not required but open to exploring concurrent PIPE Series C by $25-50M, which would increase post-money for Series C and valuation for proposed • Existing shareholders have signed a letter committing at least $30M to a PIPE, which could be used to Concurrent Financing transaction accordingly extend runway or return a portion of PACIFIC cash to shareholders • Pro forma cash: $213.5M (Q32: $73.5M, based on 1Q23 cash, $22.5M from Horizon and $20M of new Pro Forma Cash and • Pro forma cash: $270M (PIPELINE: $130M; PACIFIC: $140M) debt; PACIFIC: $140M) • Runway: through 2027, not including potential milestones payments from Janssen related to PIPE-307 Runway • Runway: into 2H 2026 • ADX-097 (Phase 1) – C3d-mAb fH complement inhibitor for multiple complement-mediated diseases 1-5 • PIPE-791 (IND-enabling) – LPA1 antagonist for multiple sclerosis (MS) and neuroinflammation of the kidney and IgG4 • PIPE-307 (Phase 1 complete) – oral M1 antagonist for MS and major depressive disorder (MDD) • ADX-096 (Preclinical) – C3d-mAb CR1 complement inhibitor for complement-mediated diseases 1-10 – Entered into a global license and development agreement with Janssen in April 2023 for $50M • Novel nanobodies (Discovery) – C3d-fab fH/CR1 complement inhibitors and next-gen targeted Key Asset(s) upfront plus $1B milestones and tiered double-digit royalties as well as $25M equity investment complement inhibitors for neuromuscular and neurodegenerative diseases from JJDC • ADX-914 (Phase 2) – IL-7/TSLP receptor mAb for atopic dermatitis (collaboration and option deal with – PIPELINE retained ability to develop in r/r MS Horizon in August 2022 for $55M upfront and up to $645M milestones and royalties) • ADX-097 in complement-mediated renal diseases – 2024 and 2025: Phase 2 AAV 12-week safety/efficacy and topline data, respectively • PIPE-791 – 2024 and 2025: Phase 2 renal basket trial 4-week / biomarker topline data and interim12-week • PIPE-307 in r/r MS – 1H23: IND filing data, respectively – 2H23: Phase 2 POC initiation – 1H24: Phase 1 HV study completion – 2H25-1H26: Phase 2/3 trial initiations in complement-mediated renal diseases – 2Q25: Phase 2 POC study completion – 4Q24: Phase 1 PET study completion • ADX-096 – 1H25: IND submission Timing of Key • PIPE-307 in other neurological disorders, – 2Q25: Chronic tox studies • Novel nanobodies – 2024: DC nomination including MDD – 3Q25: Biomarker studies completion Milestones • ADX-914 in atopic dermatitis – 2023 and 2024: initiate multiple Phase 2 – 3Q25: Phase 2a trial initiation – 2H23: Receipt of all additional development funding from Horizon POC studies • Calpain – 2H23: Phase 2 study completion – 1Q25: Phase 2 POC studies completion – 4Q25: IND submission – 2H24: Phase 2 study completion in second (undisclosed) indication – 1Q26: Phase 1 study initiation – Late 2024 – early 2025: Horizon option exercise window (subject to a significant option exercise fee) for the acquisition of all of Q32’s assets related to ADX-914 • Open to discussing the benefit of retaining members of PACIFIC in key functions. This could include Plans for PACIFIC’s • N/A members of leadership and functional roles including key areas of clinical, regulatory, legal, and Employees finance. • 45 days • N/A Exclusivity • Legal: Gunderson Dettmer (corporate) & Mintz Levin (IP) • Legal: Goodwin Advisors • Auditor: E&Y • Auditor: E&Y • Board Composition: Current Q32 board consists of 8 member, expect combined company board to include at least two board members from PACIFIC • Board Composition: 7-9 Board seats; up to 2 designated by PACIFIC • Audit Status: 2021 audit completed; 2022 audit underway • Audit Status: 2019-2021 audits completed; 2022 audit to be completed by 06/30/23 • Open to structures that would allow PACIFIC to monetize its existing pipeline and IP (and retain the Additional Information • Ongoing discussions with investors to extend Series C by $25-50M, which would increase post-money resulting value for Series C and valuation for proposed transaction accordingly • $30M committed by existing Q32 shareholders could be used to extend runway further or potentially return a portion of PACIFIC’s cash to its shareholders • Atlas Venture, OrbiMed, Acorn, Osage University Partners, Abingworth, Sanofi Ventures, CU • JJDC, Casdin Capital, Franklin Templeton, Perceptive, Samsara, Suvretta, Cleva Pharma Capital Select Investors Healthcare Innovation Fund, Children’s Hospital Colorado Center for Innovation, Columbia, Harvard, (Brace Pharma), Hadean Ventures, Sectoral, Versant, Baker Brothers, Hillhouse BMS Note: Bold indicates catalysts that could fall within the transaction window. Confidential 11

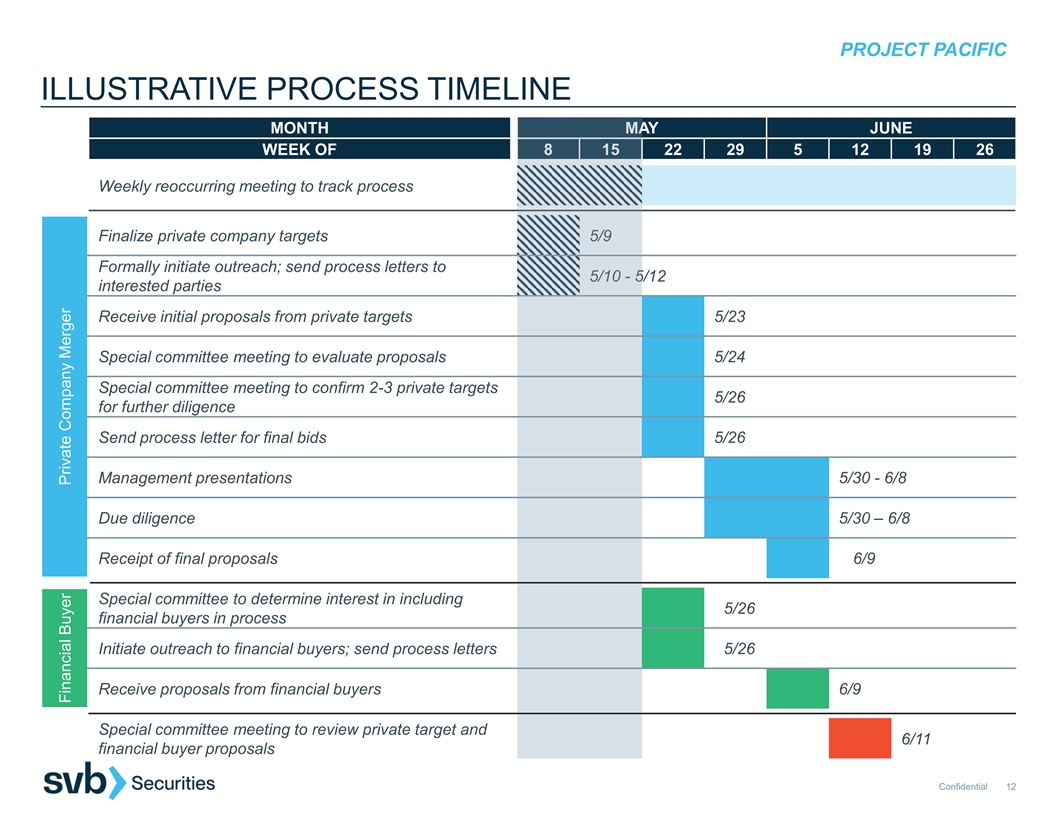

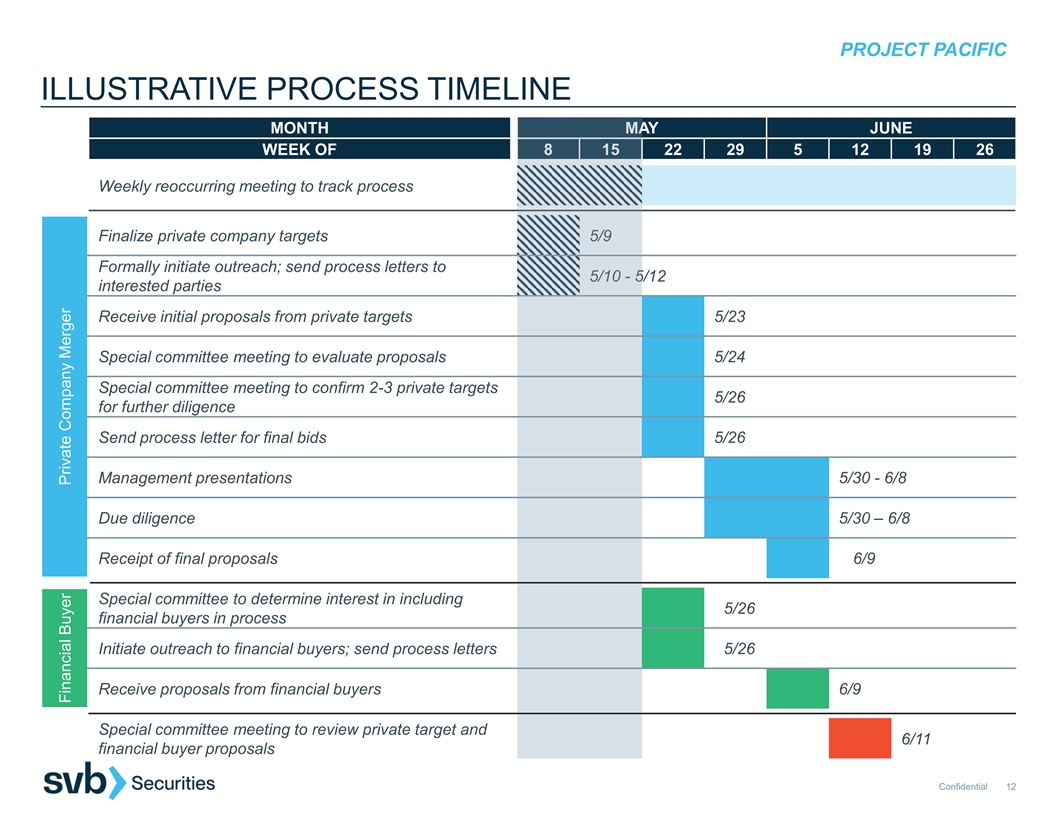

PROJECT PACIFIC ILLUSTRATIVE PROCESS TIMELINE MONTH M MA AY JUNE WEEK OF 8 8 15 15 22 29 5 12 19 26 Weekly reoccurring meeting to track process Finalize private company targets 5 5/9 /9 Formally initiate outreach; send process letters to 5/10 - 5/10 - 5 5/12 interested parties Receive initial proposals from private targets 5/23 Special committee meeting to evaluate proposals 5/24 Special committee meeting to confirm 2-3 private targets 5/26 for further diligence Send process letter for final bids 5/26 Management presentations 5/30 - 6/8 Due diligence 5/30 – 6/8 Receipt of final proposals 6/9 Special committee to determine interest in including 5/26 financial buyers in process Initiate outreach to financial buyers; send process letters 5/26 Receive proposals from financial buyers 6/9 Special committee meeting to review private target and 6/11 financial buyer proposals Confidential 12 Financial Buyer Private Company Merger

APPENDIX

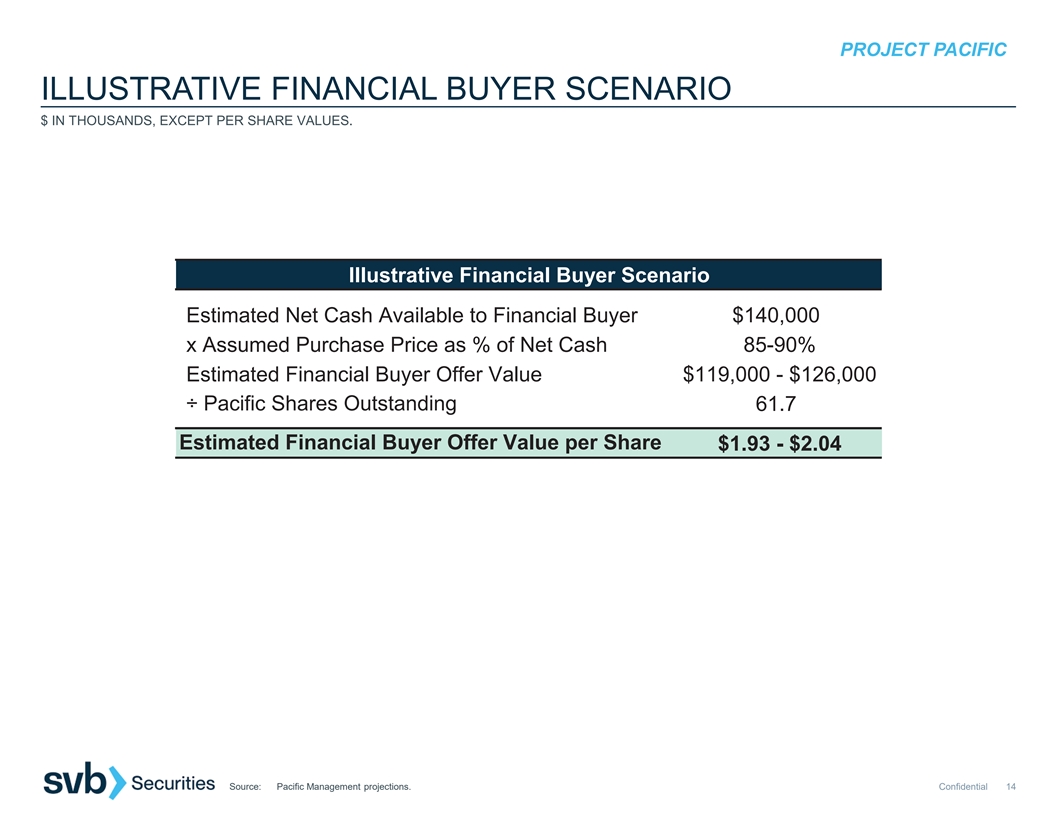

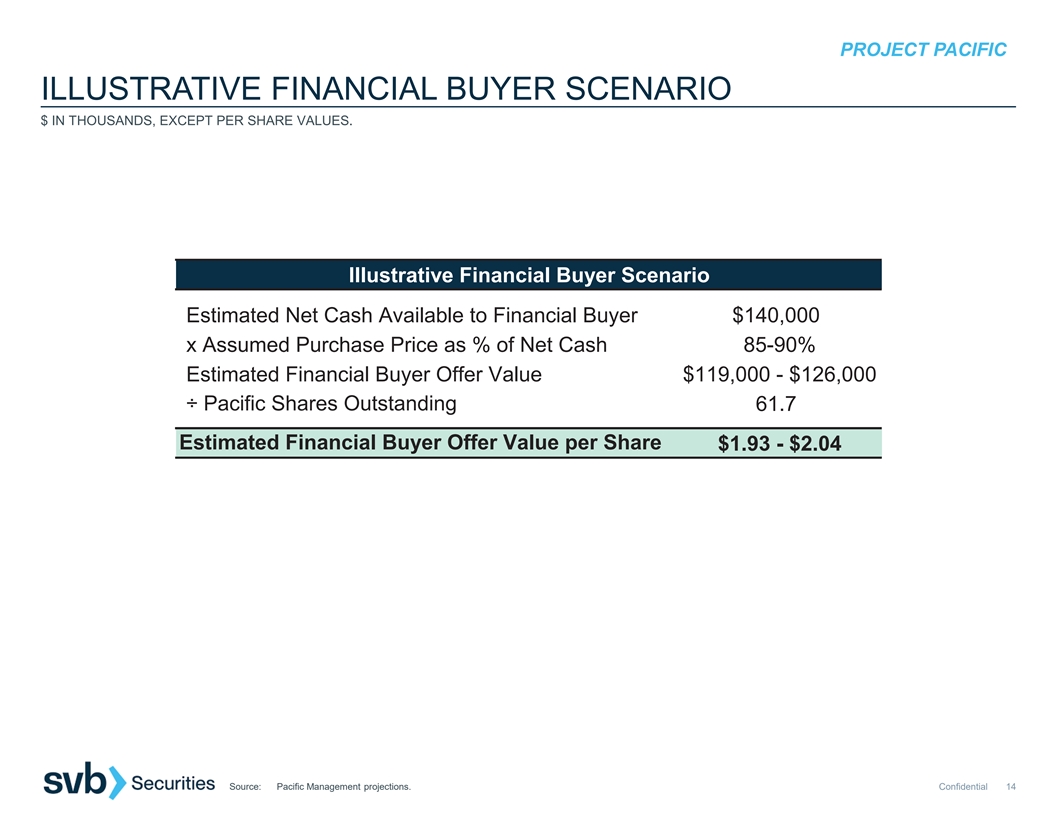

PROJECT PACIFIC ILLUSTRATIVE FINANCIAL BUYER SCENARIO $ IN THOUSANDS, EXCEPT PER SHARE VALUES. Illustrative Financial Buyer Scenario Estimated Net Cash Available to Financial Buyer $140,000 x Assumed Purchase Price as % of Net Cash 85-90% Estimated Financial Buyer Offer Value $119,000 - $126,000 ÷ Pacific Shares Outstanding 61.7 Estimated Financial Buyer Offer Value per Share $1.93 - $2.04 Source: Pacific Management projections. Confidential 14

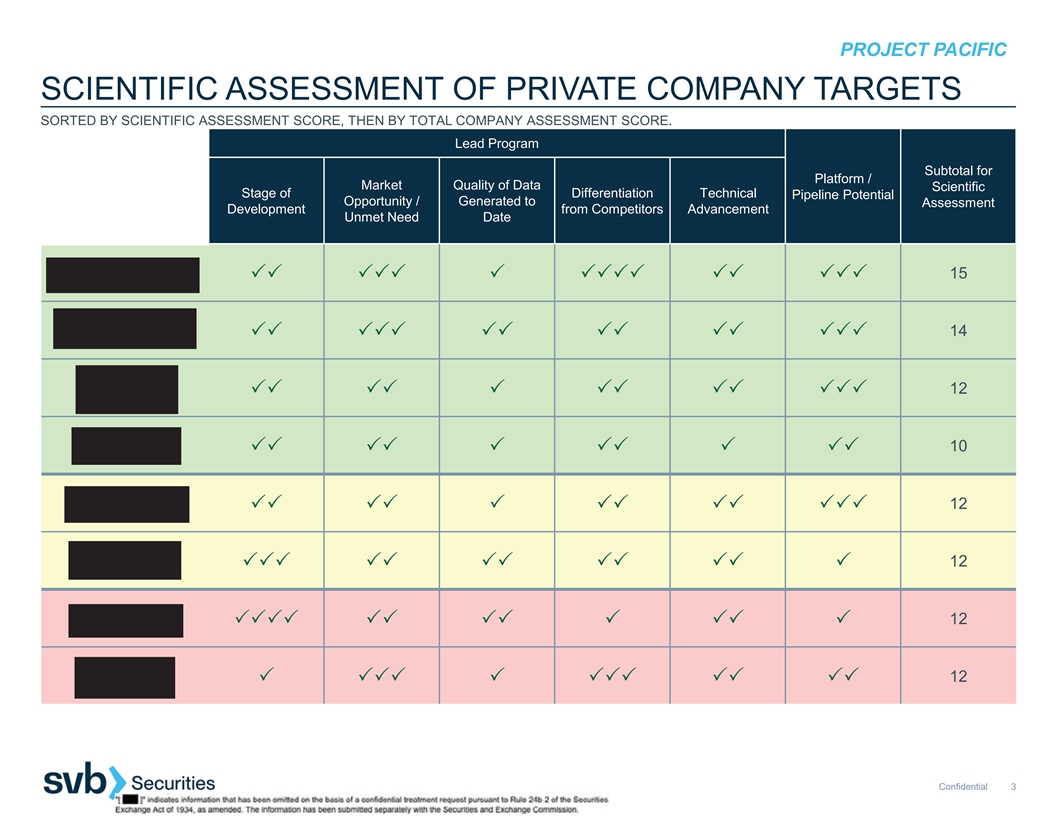

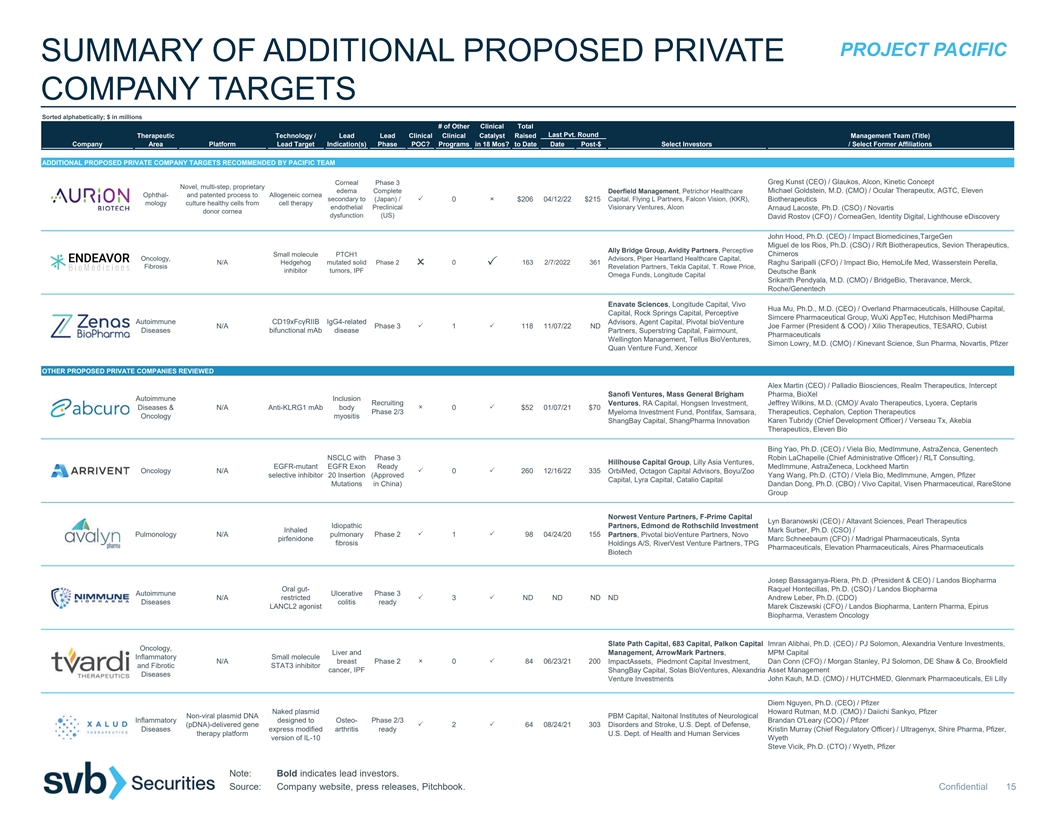

2 3333333 3 33233323 2 PROJECT PACIFIC SUMMARY OF ADDITIONAL PROPOSED PRIVATE COMPANY TARGETS Sorted alphabetically; $ in millions # of Other Clinical Total Last Pvt. Round Therapeutic Technology / Lead Lead Clinical Clinical Catalyst Raised Management Team (Title) Company Area Platform Lead Target Indication(s) Phase POC? Programs in 18 Mos? to Date Date Post-$ Select Investors / Select Former Affiliations ADDITIONAL PROPOSED PRIVATE COMPANY TARGETS RECOMMENDED BY PACIFIC TEAM Greg Kunst (CEO) / Glaukos, Alcon, Kinetic Concept Corneal Phase 3 Novel, multi-step, proprietary edema Complete Deerfield Management, Petrichor Healthcare Michael Goldstein, M.D. (CMO) / Ocular Therapeutix, AGTC, Eleven Ophthal- and patented process to Allogeneic cornea Aurion Biotechnologies secondary to (Japan) / 0 $206 04/12/22 $215 Capital, Flying L Partners, Falcon Vision, (KKR), Biotherapeutics mology culture healthy cells from cell therapy endothelial Preclinical Visionary Ventures, Alcon Arnaud Lacoste, Ph.D. (CSO) / Novartis donor cornea dysfunction (US) David Rostov (CFO) / CorneaGen, Identity Digital, Lighthouse eDiscovery John Hood, Ph.D. (CEO) / Impact Biomedicines,TargeGen Miguel de los Rios, Ph.D. (CSO) / Rift Biotherapeutics, Sevion Therapeutics, Ally Bridge Group, Avidity Partners, Perceptive Chimeros Small molecule PTCH1 Oncology, Advisors, Piper Heartland Healthcare Capital, Endeavor BioMedicines N/A Hedgehog mutated solid Phase 2 0 163 2/7/2022 361 Raghu Saripalli (CFO) / Impact Bio, HemoLife Med, Wasserstein Perella, Fibrosis Revelation Partners, Tekla Capital, T. Rowe Price, inhibitor tumors, IPF Deutsche Bank Omega Funds, Longitude Capital Srikanth Pendyala, M.D. (CMO) / BridgeBio, Theravance, Merck, Roche/Genentech Enavate Sciences, Longitude Capital, Vivo Hua Mu, Ph.D., M.D. (CEO) / Overland Pharmaceuticals, Hillhouse Capital, Capital, Rock Springs Capital, Perceptive Simcere Pharmaceutical Group, WuXi AppTec, Hutchison MediPharma Autoimmune CD19xFcγRIIB IgG4-related Advisors, Agent Capital, Pivotal bioVenture Zenas Biopharma N/A Phase 3 1 118 11/07/22 ND Joe Farmer (President & COO) / Xilio Therapeutics, TESARO, Cubist Diseases bifunctional mAb disease Partners, Superstring Capital, Fairmount, Pharmaceuticals Wellington Management, Tellus BioVentures, Simon Lowry, M.D. (CMO) / Kinevant Science, Sun Pharma, Novartis, Pfizer Quan Venture Fund, Xencor OTHER PROPOSED PRIVATE COMPANIES REVIEWED Alex Martin (CEO) / Palladio Biosciences, Realm Therapeutics, Intercept Sanofi Ventures, Mass General Brigham Pharma, BioXel Autoimmune Inclusion Recruiting Ventures, RA Capital, Hongsen Investment, Jeffrey Wilkins, M.D. (CMO)/ Avalo Therapeutics, Lycera, Ceptaris Abcuro Diseases & N/A Anti-KLRG1 mAb body 0 $52 01/07/21 $70 Phase 2/3 Myeloma Investment Fund, Pontifax, Samsara, Therapeutics, Cephalon, Ception Therapeutics Oncology myositis Karen Tubridy (Chief Development Officer) / Verseau Tx, Akebia ShangBay Capital, ShangPharma Innovation Therapeutics, Eleven Bio Bing Yao, Ph.D. (CEO) / Viela Bio, MedImmune, AstraZenca, Genentech NSCLC with Phase 3 Robin LaChapelle (Chief Administrative Officer) / RLT Consulting, Hillhouse Capital Group, Lilly Asia Ventures, EGFR-mutant EGFR Exon Ready MedImmune, AstraZeneca, Lockheed Martin Arrivent Oncology N/A 0 260 12/16/22 335 OrbiMed, Octagon Capital Advisors, Boyu/Zoo selective inhibitor 20 Insertion (Approved Yang Wang, Ph.D. (CTO) / Viela Bio, MedImmune, Amgen, Pfizer Capital, Lyra Capital, Catalio Capital Mutations in China) Dandan Dong, Ph.D. (CBO) / Vivo Capital, Visen Pharmaceutical, RareStone Group Norwest Venture Partners, F-Prime Capital Lyn Baranowski (CEO) / Altavant Sciences, Pearl Therapeutics Idiopathic Partners, Edmond de Rothschild Investment Inhaled Mark Surber, Ph.D. (CSO) / Avalyn Pulmonology N/A pulmonary Phase 2 1 98 04/24/20 155 Partners, Pivotal bioVenture Partners, Novo pirfenidone Marc Schneebaum (CFO) / Madrigal Pharmaceuticals, Synta fibrosis Holdings A/S, RiverVest Venture Partners, TPG Pharmaceuticals, Elevation Pharmaceuticals, Aires Pharmaceuticals Biotech Josep Bassaganya-Riera, Ph.D. (President & CEO) / Landos Biopharma Oral gut- Raquel Hontecillas, Ph.D. (CSO) / Landos Biopharma Autoimmune Ulcerative Phase 3 Nimmune Bio N/A restricted 3 ND ND ND ND Andrew Leber, Ph.D. (CDO) Diseases colitis ready LANCL2 agonist Marek Ciszewski (CFO) / Landos Biopharma, Lantern Pharma, Epirus Biopharma, Verastem Oncology Slate Path Capital, 683 Capital, Palkon Capital Imran Alibhai, Ph.D. (CEO) / PJ Solomon, Alexandria Venture Investments, Oncology, Liver and MPM Capital Management, ArrowMark Partners, Inflammatory Small molecule Tvardi Therapeutics N/A breast Phase 2 0 84 06/23/21 200 ImpactAssets, Piedmont Capital Investment, Dan Conn (CFO) / Morgan Stanley, PJ Solomon, DE Shaw & Co, Brookfield and Fibrotic STAT3 inhibitor cancer, IPF ShangBay Capital, Solas BioVentures, Alexandria Asset Management Diseases Venture Investments John Kauh, M.D. (CMO) / HUTCHMED, Glenmark Pharmaceuticals, Eli Lilly Diem Nguyen, Ph.D. (CEO) / Pfizer Naked plasmid Howard Rutman, M.D. (CMO) / Daiichi Sankyo, Pfizer Non-viral plasmid DNA PBM Capital, Naitonal Institutes of Neurological Inflammatory designed to Osteo- Phase 2/3 Brandan O'Leary (COO) / Pfizer Xalud Therapeutics (pDNA)-delivered gene 2 64 08/24/21 303 Disorders and Stroke, U.S. Dept. of Defense, Diseases express modified arthritis ready Kristin Murray (Chief Regulatory Officer) / Ultragenyx, Shire Pharma, Pfizer, therapy platform U.S. Dept. of Health and Human Services version of IL-10 Wyeth Steve Vicik, Ph.D. (CTO) / Wyeth, Pfizer Note: Bold indicates lead investors. Source: Company website, press releases, Pitchbook. Confidential 15