- CAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Caterpillar (CAT) 8-K1Q Earnings Release

Filed: 20 Apr 05, 12:00am

|

The chart above graphically illustrates reasons for the change in Consolidated Sales and Revenues between 1st Quarter 2004 (at left) and 1st Quarter 2005 (at right). Items favorably impacting sales and revenues appear as upward stair steps with the corresponding dollar amounts above each bar. Caterpillar management utilizes these charts internally to visually communicate with its Board and employees. |

Sales and Revenues by Geographic Region | ||||||||||||||||||||||||

(Millions of dollars) | Total | % Change | North America | % Change | EAME | % Change | Latin America | % Change | Asia/ Pacific | % Change | ||||||||||||||

1st Quarter 2004 | ||||||||||||||||||||||||

| Machinery | $ | 4,152 | $ | 2,283 | $ | 963 | $ | 295 | $ | 611 | ||||||||||||||

Engines1 | 1,850 | 870 | 559 | 195 | 226 | |||||||||||||||||||

Financial Products2 | 478 | 336 | 84 | 30 | 28 | |||||||||||||||||||

| $ | 6,480 | $ | 3,489 | $ | 1,606 | $ | 520 | $ | 865 | |||||||||||||||

1st Quarter 2005 | ||||||||||||||||||||||||

| Machinery | $ | 5,400 | 30% | $ | 2,928 | 28% | $ | 1,355 | 41% | $ | 440 | 49% | $ | 677 | 11% | |||||||||

Engines1 | 2,389 | 29% | 1,200 | 38% | 743 | 33% | 157 | -19% | 289 | 28% | ||||||||||||||

Financial Products2 | 550 | 15% | 390 | 16% | 87 | 4% | 31 | 3% | 42 | 50% | ||||||||||||||

| $ | 8,339 | 29% | $ | 4,518 | 29% | $ | 2,185 | 36% | $ | 628 | 21% | $ | 1,008 | 17% | ||||||||||

1Does not include internal engine transfers of $619 million and $484 million in 2005 and 2004, respectively. Internal engine transfers are valued at prices comparable to those for unrelated parties. | ||||||||||||||||||||||||

2Does not include revenues earned from Machinery and Engines of $62 million and $39 million in 2005 and 2004, respectively. | ||||||||||||||||||||||||

| § | North America sales were up 28 percent over first quarter 2004, with sales volume up about 24 percent and the remainder due to improved price realization. Sales volume benefited from strong demand in all applications.Housing construction increased in response to low mortgage interest rates and there is a large backlog of unused permits. Nonresidential construction benefited from healthy business cash flows. Both coal and metals prices and production increased, driving sizable increases into mining deliveries. |

| § | EAME sales in first quarter 2005 were 41 percent higher than a year earlier. Volume, up about 29 percent, was the biggest contributor. The favorable impact of currency added about 6 percent and improved price realization added the remainder. Low interest rates in Europe are beginning to revive construction, and both Africa/Middle East (AME) and the CIS continued to benefit from high energy and metals prices and production.Both AME and the CIS are investing in new capacity and upgrading infrastructure. |

| § | Latin America first quarter sales were 49 percent higher than a year earlier. Volume contributed about 41 percent, improved price realization added about 7 percent and the remainder was due to currency. Mining benefited from higher prices and production while low interest rates, increased spending on infrastructure and better economic growth boosted construction. |

| § | Asia/Pacific sales were up 11 percent over first quarter 2004. Increased volume contributed about 8 percent, improved price realization added about 2 percent and the remainder was due to currency. Volume in China declined, but was largely offset by increases in Australia and Indonesia. Coal mining increased sharply in Australia and Indonesia, benefiting from higher coal prices. |

| § | North America sales were up 38 percent over first quarter 2004. Sales of on-highway truck engines increased 33 percent, as truck manufacturers successfully increased line rates to serve an ongoing expansion and replacement cycle driven by high average fleet age, high freight demand, and improved freight carrier profitability. Sales of engines to the petroleum sector increased 54 percent compared to last year, with widespread increases in sales of engines to gas compression, and Original Equipment Manufacturer (OEM) equipment for drilling and well servicing, supported by higher energy prices. Sales of engines to the marine sector increased 59 percent, benefiting from strengthening workboat activity. Sales of engines to the electric power sector gained 3 percent with increased demand for critical standby generator sets to support sustainability for telecommunications and financial service applications. Sales of reciprocating engines were partially offset by reduced turbine sales as fuel prices increased faster than electricity rates.Dealer inventories of reciprocating engines increased above selling rates due to higher levels of in-transit inventory with increasing volume. |

| § | EAME sales were up 33 percent over first quarter 2004. Sales of engines into the electric power sector increased 65 percent due to widespread increased demand for prime, cogeneration and standby systems, ongoing Middle East reconstruction demand, and sales resulting from the acquisition of Turbomach. Sales of engines to the industrial sector increased 26 percent due to strong demand for various types of OEM equipment and the favorable impact of currency. In addition, the comparison is with a reduced first quarter 2004 base that was impacted by the fourth quarter 2003 pre-buy of engines prior to the implementation of European Tier II emissions regulations. Sales of engines to the marine sector increased 73 percent, with increased demand for inland waterways workboats and larger engines for oceangoing vessels, as well as the favorable effects of currency.Dealer inventories increased above selling rates due to increasing volume, increased installation time associated with more complex applications, and some investment in inventory from previously reduced levels to serve ongoing demand increases. |

| § | Latin America sales decreased 19 percent versus first quarter 2004, with decreases in most sectors. Sales of marine engines decreased 60 percent, with all of the reduction due to the absence of a large marine project that occurred in 2004. Sales of electric power engines in Latin America decreased 9 percent, while sales of engines to the petroleum sector decreased 4 percent.Dealer inventory increased above selling rates primarily due to higher levels of in-transit inventory in the delivery process. |

| § | Asia/Pacific sales were up 28 percent over first quarter 2004 with increases in all sectors, led by a 36 percent increase in sales of petroleum engines, with all of the increase coming from turbines and turbine related services to support increased exploration and production. Sales of engines to the marine sector increased 49 percent with strong demand for oceangoing, pleasure craft and offshore supply vessels, followed by a 9 percent increase in sales of electric power engines.Current months of sales of dealer inventory are above first quarter 2004 due to higher levels of in-transit inventory in the delivery process. |

|

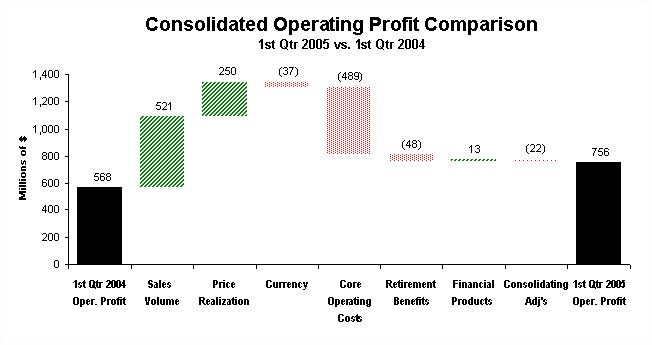

The chart above graphically illustrates reasons for the change in Consolidated Operating Profit between 1st Quarter 2004 (at left) and 1st Quarter 2005 (at right). Items favorably impacting operating profit appear as upward stair steps with the corresponding dollar amounts above each bar, while items negatively impacting operating profit appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Caterpillar management utilizes these charts internally to visually communicate with its Board and employees. |

Operating Profit by Principal Line of Business | |||||||||||||

(Millions of dollars) | 1st Quarter 2004 | 1st Quarter 2005 | Change $ | ||||||||||

Machinery1 | $ | 441 | $ | 496 | $ | 55 | |||||||

Engines1 | 41 | 183 | 142 | ||||||||||

| Financial Products | 111 | 124 | 13 | ||||||||||

Consolidating Adjustments | (25 | ) | (47 | ) | (22 | ) | |||||||

| Consolidated Operating Profit | $ | 568 | $ | 756 | $ | 188 | |||||||

1 | Caterpillar operations are highly integrated; therefore, the company uses a number of allocations to determine lines of business operating profit for Machinery and Engines. | ||||||||||||

| · | Machineryoperating profit of $496 million was up $55 million, or 12 percent, from first quarter 2004. The favorable impact of higher sales volume and improved price realization was partially offset by higher core operating costs, higher retirement benefits and the unfavorable impact of currency. |

| · | Enginesoperating profit of $183 million was up $142 million, or 346 percent, from first quarter 2004. The favorable impact of higher sales volume and improved price realization was partially offset by higher core operating costs, higher retirement benefits and the unfavorable impact of currency. |

| · | Financial Productsoperating profit of $124 million was up $13 million, or 12 percent, from first quarter 2004. The increase was primarily due to a $30 million impact from the growth of earning assets, partially offset by an $11 million increase in operating expenses primarily related to growth, at Cat Financial. |

| · | Other income/expensewasincome of $108 million compared with income of $61 million in first quarter 2004 for a favorable impact of $47 million. The change was primarily due to the favorable impact of currency gains of $41 million. This, combined with the $37 million unfavorable impact on operating profit, created anet favorable impact of currency on profit before tax of $4 million. |

| · | The provision for income taxes in the first quarter reflects an estimated annual tax rate of 29 percent for 2005. We are anticipating a 29 percent rate for the full year compared to 27 percent in 2004 primarily due to the impact of the phase-out provision of the American Jobs Creation Act permitting only 80 percent of Extraterritorial Income Exclusion (ETI) benefits in 2005 as well as a change in our geographic mix of profits. |

| · | The equity in profit/loss of unconsolidated affiliated companies favorably impacted profit by $8 million over first quarter 2004, primarily driven by increased profitability at Shin Caterpillar Mitsubishi Ltd. (SCM). |

| · | Economic growth in most countries is moderate and key inflation measures are well within target ranges. As a result, we expect central banks will remain cautious about raising interest rates, allowing the current recovery to continue throughout the year. We project the world economy will grow about 3.5 percent. |

| · | Investment sectors are generally faring better than consumer sectors this recovery. Business profits in many countries are at, or near, record shares of national incomes and companies are using profits to boost productivity. Low interest rates are encouraging companies to upgrade and expand aged capital equipment and, more recently, structures. Recoveries in nonresidential construction should strengthen this year, increasing the demand for reliable standby electrical power. |

| · | Housing prices are increasing significantly in many countries and this has begun to encourage construction to alleviate housing shortages. Low interest rates and rising employment should benefit residential construction in most regions. |

| · | Most governments have not invested enough in infrastructure for years, which is now creating inefficiencies, particularly in transportation. Governments have started to allocate more of the revenues rising from faster economic growth to infrastructure, and such construction should improve throughout the year. |

| · | Mining and energy companies underinvested in capacities for years due to unfavorable prices and capacities are now insufficient. Last year, prices surged above the minimums needed to make investment attractive and companies increased spending. Prices are expected to remain above those minimums this year and mining and energy companies should again increase investments. |

| · | Increased international trade and an aging ship fleet are driving strong growth in shipbuilding. Demand for support vessels to cope with more port congestion and increased offshore oil and gas production is also increasing. |

Sales and Revenues Outlook - Midpoint of Range | ||||||||||

(Millions of dollars) | 2004 Actual | 2005 Outlook1 | % Change | |||||||

| Machinery and Engines | ||||||||||

| North America | $ | 14,521 | $ | 17,250 | 19 | % | ||||

| EAME | 7,505 | 9,000 | 20 | % | ||||||

| Latin America | 2,372 | 2,750 | 16 | % | ||||||

| Asia/Pacific | 3,938 | 4,150 | 5 | % | ||||||

| Total Machinery and Engines | 28,336 | 33,150 | 17 | % | ||||||

Financial Products2 | 1,970 | 2,300 | 17 | % | ||||||

| Total | $ | 30,306 | $ | 35,450 | 17 | % | ||||

1Based on the sales expectations by geographic region, the company forecasts Consolidated Sales and Revenues to increase in the range of 16 to 18 percent versus 2004. For purposes of this chart, numbers are shown at the middle of the outlook range (i.e., 17 percent). | ||||||||||

2Does not include revenues earned from Machinery and Engines of $200 million and $199 million in 2005 Outlook and 2004, respectively. | ||||||||||

| · | The U.S. economy appeared to grow above a 4 percent rate in the first quarter and employment is strengthening further. While inflation is gaining more attention, most inflation measures do not indicate an immediate problem. Consequently, we believe the Fed will continue gradually raising the Federal funds rate to about 4 percent by the end of the year. Overall, interest rates should continue to support growth, particularly in business investment, and the economy should grow close to 4 percent in 2005. |

| · | Housing activity continued to strengthen in the first quarter. The backlog of unused permits, increases in new home prices and low mortgage rates suggest another good year for housing. |

| · | Nonresidential construction recovered from a steep 3-year decline last year and a significant recovery is needed to bring the capacity of this sector in line with the size of the economy. Improved financial conditions and good business cash flows should drive a strong recovery this year. |

| · | Prices for metals and coal are well above year-earlier prices and production increased in the first quarter. Investment is increasing rapidly. |

| · | Trucking companies, which are experiencing improved profitability, should significantly increase purchases to handle strong freight demand and upgrade aging fleets. |

| · | The Canadian economy, benefiting from low interest rates and high commodity prices, should grow about 3 percent in 2005. |

| · | The Euro-zone economy slowed in the last half of 2004 and showed little improvement in the first quarter of 2005. Weak growth is forcing the European Central Bank to hold interest rates steady, and any rate hikes are not likely before the fourth quarter. Low interest rates are beginning to revive construction, particularly housing, and encourage some replacement buying. The U. K. and Central European economies are performing better, which should maintain overall European growth near 2 percent in 2005. |

| · | Both AME and the CIS are major beneficiaries of favorable commodity prices and increased production of metals and energy. We expect both regions will continue using higher incomes to increase capacity and improve infrastructures. The AME economy should grow over 5 percent in 2005 and the CIS economy more than 6 percent, the third consecutive year of good growth for both. |

| · | A positive impact of currency on sales is expected to contribute about 4 percent of the increase. |

| · | Latin American economies should grow about 4 percent in 2005, continuing the recovery that started in late 2003. Projected positives include higher commodity prices, low inflation and increased foreign direct investment. |

| · | Our outlook assumes that mines will invest heavily in new capacity and equipment. Better economic growth is causing some governments to increase infrastructure spending to correct for years of underinvestment. |

| · | We anticipate that interest rates will rise slightly this year and we expect regional growth to slow to about 6 percent. Interest rates are expected to support recoveries in consumer spending and business investment while competitive exchange rates are expected to further boost exports. We anticipate that continued economic growth will boost nonresidential construction and demand for standby electrical power. |

| · | Contract prices for coal, particularly coking coal, will increase substantially this year and we expect coal mining will again be a major contributor to sales. Metals mining should benefit from higher contract prices for iron ore and favorable base metals prices. |

| · | We expect continued growth in Financial Products, with revenues expected to increase primarily due to higher average earning assets in 2005. |

|

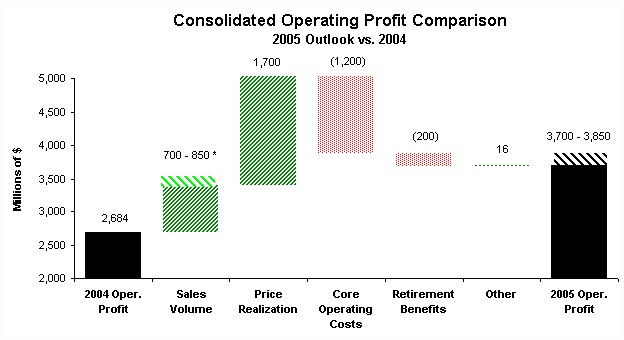

| * Denotes volume range |

| The chart above graphically illustrates reasons for the change in Consolidated Operating Profit between 2004 (at left) and 2005 Outlook (at right). Items favorably impacting operating profit appear as upward stair steps with the corresponding dollar amounts above each bar, while items negatively impacting operating profit appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Caterpillar management utilizes these charts internally to visually communicate with its Board and employees. |

Core Operating Cost Change | |||

1st Quarter 2005 vs. 1st Quarter 2004 | |||

| Manufacturing Costs | $ | (439 | ) |

| SG&A | (46 | ) | |

| R&D | (4 | ) | |

| Total | $ | (489 | ) |

Machinery and Engines | ||||||||

Operating Profit as a % of Sales | ||||||||

Q1 '04 | Q2 '04 | Q3 '04 | Q4 '04 | Q1 '05 | ||||

| 8.0% | 9.7% | 7.9% | 7.6% | 8.7% | ||||

| · | In the United States, non-residential construction and mining have not yet regained prior peaks. Passage of a new highway bill should support further growth in highway construction. |

| · | In the Euro countries, economic recovery has not really started, even after four years of weak growth. However, low interest rates are boosting housing construction. |

| · | AME, Latin America and the CIS are seeing gains from better commodity prices. Their economies, along with construction, are recovering from years of weak growth. |

| · | Asian economies have demonstrated a long-term ability to grow rapidly, which requires more construction. We expect that to continue. |

| · | Finally, capacities in mining and energy are inadequate to meet today's requirements. Rebuilding adequate capacity and meeting future growth in demand for metals and energy will require significant further investment. |

| 1. | Consolidating Adjustments - Eliminations of transactions between Machinery and Engines and Financial Products. |

| 2. | Core Operating Costs - Machinery and Engines operating cost change adjusted for volume. It excludes the impact of currency and retirement benefits. |

| 3. | Currency - With respect to sales and revenues, currency represents the translation impact on sales resulting from changes in foreign currency exchange rates versus the U.S. dollar. With respect to operating profit, currency represents the net translation impact on sales and operating costs resulting from changes in foreign currency exchange rates versus the U.S. dollar. With respect to profit before tax, currency represents the net translation impact on sales, operating costs and other income/expense resulting from changes in foreign currency exchange rates versus the U.S. dollar. Also included in the currency impact on other income/expense are the effects of currency forward and option contracts entered into by the company to reduce the risk of fluctuations in exchangerates and the net effect of changes in foreign currency exchange rates on our foreign currency assets and liabilities. Currency includes the impacts on sales and operating profit for the Machinery and Engines lines of business only; currency impacts on the Financial Products line of business are included in the Financial Products portions of the respective analyses. |

| 4. | EAME - Geographic region including Europe, Africa, the Middle East and the Commonwealth of Independent States (CIS). |

| 5. | Earning Assets - These assets consist primarily of total net finance receivables plus retained interests in securitized trade receivables, plus equipment on operating leases, less accumulated depreciation at Cat Financial. Net finance receivables represent the gross receivables amount less unearned income and the allowance for credit losses. |

| 6. | Engines- A principal line of business including the design, manufacture, marketing and sales of engines for Caterpillar machinery, electric power generation systems; on-highway vehicles and locomotives; marine, petroleum, construction, industrial, agricultural and other applications; and related parts. Reciprocating engines meet power needs ranging from 5 to over 22,000 horsepower (4 to over 16 200 kilowatts). Turbines range from 1,200 to 20,500 horsepower (900 to 15 000 kilowatts). |

| 7. | Financial Products - A principal line of business consisting primarily of Caterpillar Financial Services Corporation (Cat Financial), Caterpillar Insurance Holdings, Inc. (Cat Insurance), Caterpillar Power Ventures Corporation (Cat Power Ventures) and their respective subsidiaries. Cat Financial provides a wide range of financing alternatives to customers and dealers for Caterpillar machinery and engines, Solar gas turbines, as well as other equipment and marine vessels. Cat Financial also extends loans to customers and dealers. Cat Insurance provides various forms of insurance to customers and dealers to help support the purchase and lease of our equipment. Cat Power Ventures is an active investor in independent power projects using Caterpillar power generation equipment and services. |

| 8. | Latin America - Geographic region including the Central and South American countries and Mexico. |

| 9. | Machinery - A principal line of business which includes the design, manufacture, marketing and sales of construction, mining and forestry machinery - track and wheel tractors, track and wheel loaders, pipelayers, motor graders, wheel tractor-scrapers, track and wheel excavators, backhoe loaders, log skidders, log loaders, off-highway trucks, articulated trucks, paving products, telescopic handlers, skid steer loaders and related parts. Also includes logistics services for other companies. |

| 10. | Machinery and Engines- Due to the highly integrated nature of operations, represents the aggregate total of the Machinery and Engines lines of business and includes primarily our manufacturing, marketing and parts distribution operations. |

| 11. | Price Realization - The impact of net price changes excluding currency. |

| 12. | Retirement Benefits- Cost of defined benefit pension plans, defined contribution plans and retirement healthcare and life insurance. |

| 13. | Sales Volume - With respect to sales and revenues, sales volume represents the impact of changes in the quantities sold for machines, engines and parts. With respect to operating profit, sales volume represents the impact of changes in the quantities sold for machines, engines and parts combined with the net operating profit impact of changes in the relative weighting of machines, engines and parts sales with respect to total sales. |

| 14. | 6 Sigma - On a technical level, 6 Sigma represents a measure of variation that achieves 3.4 defects per million opportunities. At Caterpillar, 6 Sigma represents a much broader cultural philosophy to drive continuous improvement throughout the value chain. It is a fact-based, data-driven methodology that we are using to improve processes, enhance quality, cut costs, grow our business and deliver greater value to our customers through Black Belt-led project teams. At Caterpillar, 6 Sigma goes beyond mere process improvement; it has become the way we work as teams to process business information, solve problems and manage our business successfully. |

Caterpillar Inc. Condensed Consolidated Statement of Results of Operations (Unaudited) (Dollars in millions except per share data) | |||||||||

Three Months Ended | |||||||||

March 31, | |||||||||

2005 | 2004 | ||||||||

Sales and revenues: | |||||||||

Sales of Machinery and Engines | $ | 7,789 | $ | 6,002 | |||||

| Revenues of Financial Products | 550 | 478 | |||||||

Total sales and revenues | 8,339 | 6,480 | |||||||

Operating costs: | |||||||||

Cost of goods sold | 6,215 | 4,701 | |||||||

Selling, general and administrative expenses | 744 | 673 | |||||||

Research and development expenses | 241 | 231 | |||||||

Interest expense of Financial Products | 170 | 119 | |||||||

Other operating expenses | 213 | 188 | |||||||

Total operating costs | 7,583 | 5,912 | |||||||

Operating profit | 756 | 568 | |||||||

Interest expense excluding Financial Products | 65 | 57 | |||||||

Other income (expense) | 108 | 61 | |||||||

Consolidated profit before taxes | 799 | 572 | |||||||

Provision for income taxes | 232 | 158 | |||||||

Profit of consolidated companies | 567 | 414 | |||||||

Equity in profit (loss) of unconsolidated affiliated companies | 14 | 6 | |||||||

Profit | $ | 581 | $ | 420 | |||||

Profit per common share | $ | 1.70 | $ | 1.23 | |||||

Profit per common share - diluted1 | $ | 1.63 | $ | 1.19 | |||||

Weighted average common shares outstanding (millions) | |||||||||

- Basic | 342.1 | 342.6 | |||||||

- Diluted1 | 356.6 | 355.7 | |||||||

Cash dividends declared per common share | $ | - | $ | - | |||||

1Diluted by assumed exercise of stock options, using the treasury stock method. | |||||||||

Certain amounts from prior periods have been reclassified to conform to current financial statement presentation. | |||||||||

Caterpillar Inc. | ||||||||||

Condensed Consolidated Statement of Financial Position | ||||||||||

(Unaudited) | ||||||||||

(Millions of dollars) | ||||||||||

Mar. 31, | Dec. 31, | |||||||||

2005 | 2004 | |||||||||

Assets | ||||||||||

| Current assets: | ||||||||||

| Cash and short-term investments | $ | 517 | $ | 445 | ||||||

| Receivables - trade and other | 7,517 | 7,459 | ||||||||

| Receivables - finance | 5,188 | 5,182 | ||||||||

| Deferred and refundable income taxes | 443 | 398 | ||||||||

| Prepaid expenses | 1,329 | 1,369 | ||||||||

| Inventories | 5,230 | 4,675 | ||||||||

| Total current assets | 20,224 | 19,528 | ||||||||

| Property, plant and equipment - net | 7,551 | 7,682 | ||||||||

| Long-term receivables - trade and other | 780 | 764 | ||||||||

| Long-term receivables - finance | 10,300 | 9,903 | ||||||||

| Investments in unconsolidated affiliated companies | 558 | 517 | ||||||||

| Deferred income taxes | 665 | 674 | ||||||||

| Intangible assets | 310 | 315 | ||||||||

| Goodwill | 1,450 | 1,450 | ||||||||

| Other assets | 2,321 | 2,258 | ||||||||

Total assets | $ | 44,159 | $ | 43,091 | ||||||

Liabilities | ||||||||||

| Current liabilities: | ||||||||||

| Short-term borrowings: | ||||||||||

| -- Machinery and Engines | $ | 101 | $ | 93 | ||||||

| -- Financial Products | 3,164 | 4,064 | ||||||||

| Accounts payable | 3,978 | 3,990 | ||||||||

| Accrued expenses | 1,800 | 1,847 | ||||||||

| Accrued wages, salaries and employee benefits | 1,437 | 1,730 | ||||||||

| Customer advances | 631 | 555 | ||||||||

| Dividends payable | - | 141 | ||||||||

Deferred and current income taxes payable | 416 | 259 | ||||||||

| Long-term debt due within one year: | ||||||||||

| -- Machinery and Engines | 29 | 6 | ||||||||

| -- Financial Products | 3,231 | 3,525 | ||||||||

| Total current liabilities | 14,787 | 16,210 | ||||||||

| Long-term debt due after one year: | ||||||||||

| -- Machinery and Engines | 3,819 | 3,663 | ||||||||

| -- Financial Products | 14,090 | 12,174 | ||||||||

| Liability for postemployment benefits | 2,984 | 2,986 | ||||||||

| Deferred income taxes and other liabilities | 687 | 591 | ||||||||

Total liabilities | 36,367 | 35,624 | ||||||||

Stockholders' equity | ||||||||||

| Common stock | 1,308 | 1,231 | ||||||||

| Treasury stock | (3,554 | ) | (3,277 | ) | ||||||

| Profit employed in the business | 10,518 | 9,937 | ||||||||

| Accumulated other comprehensive income | (480 | ) | (424 | ) | ||||||

Total stockholders' equity | 7,792 | 7,467 | ||||||||

Total liabilities and stockholders' equity | $ | 44,159 | $ | 43,091 | ||||||

Certain amounts from prior periods have been reclassified to conform to current financial statement presentation. | ||||||||||

Caterpillar Inc. | |||||||||

Condensed Consolidated Statement of Cash Flow | |||||||||

(Unaudited) | |||||||||

(Millions of dollars) | |||||||||

Three Months Ended | |||||||||

March 31, | |||||||||

Cash flow from operating activities: | 2005 | 2004 | |||||||

Profit | $ | 581 | $ | 420 | |||||

| Adjustments for non-cash items: | |||||||||

Depreciation and amortization | 372 | 350 | |||||||

Other | (68 | ) | (37 | ) | |||||

| Changes in assets and liabilities: | |||||||||

Receivables - trade and other | (228 | ) | (2,498 | ) | |||||

Inventories | (555 | ) | (631 | ) | |||||

Accounts payable and accrued expenses | 96 | 243 | |||||||

Other - net | (19 | ) | (50 | ) | |||||

Net cash provided by (used for) operating activities | 179 | (2,203 | ) | ||||||

Cash flow from investing activities: | |||||||||

Capital expenditures -- excluding equipment leased to others | (165 | ) | (106 | ) | |||||

Expenditures for equipment leased to others | (238 | ) | (240 | ) | |||||

Proceeds from disposals of property,plant and equipment | 131 | 147 | |||||||

Additions to finance receivables | (2,251 | ) | (1,866 | ) | |||||

Collections of finance receivables | 1,597 | 1,472 | |||||||

Proceeds from the sale of finance receivables | 10 | - | |||||||

Collections of retained interests in securitized trade receivables | - | 2,001 | |||||||

Investments and acquisitions (net of cash acquired) | 1 | (13 | ) | ||||||

Other - net | (28 | ) | (6 | ) | |||||

Net cash provided by (used for) investing activities | (943 | ) | 1,389 | ||||||

Cash flow from financing activities: | |||||||||

Dividends paid | (141 | ) | (127 | ) | |||||

Common stock issued, including treasury shares reissued | 154 | 69 | |||||||

Treasury shares purchased | (357 | ) | (250 | ) | |||||

Proceeds from long-term debt issued | 2,513 | 1,808 | |||||||

Payments on long-term debt | (1,359 | ) | (913 | ) | |||||

Short-term borrowings - net | (3 | ) | 220 | ||||||

Net cash provided by financing activities | 807 | 807 | |||||||

Effect of exchange rate changes on cash | 29 | 33 | |||||||

Increase (decrease) in cash and short-term investments | 72 | 26 | |||||||

Cash and short-term investments at beginning of period | 445 | 342 | |||||||

Cash and short-term investments at end of period | $ | 517 | $ | 368 | |||||

All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. | |||||||||

Non-cash operating and investing activities: | |||||||||

| Trade receivables of $0 and $2,346 million were exchanged for retained interest in securitized trade receivables during the three months ended March 31, 2005 and 2004, respectively. | |||||||||

Certain amounts from prior periods have been reclassified to conform to current financial statement presentation. | |||||||||

Caterpillar Inc. Supplemental Data for Results of Operations For The Three Months Ended March 31, 2005 (Unaudited) (Millions of dollars) | |||||||||||||||||

Supplemental Consolidating Data | |||||||||||||||||

Consolidated | Machinery and Engines 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

Sales and revenues: | |||||||||||||||||

Sales of Machinery and Engines | $ | 7,789 | $ | 7,789 | $ | - | $ | - | |||||||||

Revenues of Financial Products | 550 | - | 612 | (62 | )2 | ||||||||||||

Total sales and revenues | 8,339 | 7,789 | 612 | (62 | ) | ||||||||||||

Operating costs: | |||||||||||||||||

Cost of goods sold | 6,215 | 6,215 | - | - | |||||||||||||

Selling, general and administrative expenses | 744 | 648 | 107 | (11 | )3 | ||||||||||||

Research and development expenses | 241 | 241 | - | - | |||||||||||||

Interest expense of Financial Products | 170 | - | 173 | (3 | )4 | ||||||||||||

Other operating expenses | 213 | 6 | 208 | (1 | )3 | ||||||||||||

Total operating costs | 7,583 | 7,110 | 488 | (15 | ) | ||||||||||||

Operating profit | 756 | 679 | 124 | (47 | ) | ||||||||||||

Interest expense excluding Financial Products | 65 | 66 | - | (1 | )4 | ||||||||||||

Other income (expense) | 108 | 54 | 8 | 46 | 5 | ||||||||||||

Consolidated profit before taxes | 799 | 667 | 132 | - | |||||||||||||

Provision for income taxes | 232 | 186 | 46 | - | |||||||||||||

Profit of consolidated companies | 567 | 481 | 86 | - | |||||||||||||

Equity in profit (loss) of unconsolidated affiliated companies | 14 | 12 | 2 | - | |||||||||||||

Equity in profit of Financial Products' subsidiaries | - | 88 | - | (88 | )6 | ||||||||||||

Profit | $ | 581 | $ | 581 | $ | 88 | $ | (88 | ) | ||||||||

1Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. | |||||||||||||||||

2Elimination of Financial Products revenues earned from Machinery and Engines. | |||||||||||||||||

3Elimination of net expenses recorded by Machinery and Engines paid to Financial Products. | |||||||||||||||||

4Elimination of interest expense recorded between Financial Products and Machinery and Engines. | |||||||||||||||||

5Elimination of discount recorded by Machinery and Engines on receivables sold to Financial Products and of interest earned between Machinery and Engines and Financial Products. | |||||||||||||||||

6Elimination of Financial Products profit due to equity method of accounting. | |||||||||||||||||

Caterpillar Inc. Supplemental Data for Results of Operations For The Three Months Ended March 31, 2004 (Unaudited) (Millions of dollars) | ||||||||||||||||||

Supplemental Consolidating Data | ||||||||||||||||||

Consolidated | Machinery and Engines1 | Financial Products | Consolidating Adjustments | |||||||||||||||

Sales and revenues: | ||||||||||||||||||

Sales of Machinery and Engines | $ | 6,002 | $ | 6,002 | $ | - | $ | - | ||||||||||

Revenues of Financial Products | 478 | - | 517 | (39 | )2 | |||||||||||||

Total sales and revenues | 6,480 | 6,002 | 517 | (39 | ) | |||||||||||||

Operating costs: | ||||||||||||||||||

Cost of goods sold | 4,701 | 4,701 | - | - | ||||||||||||||

Selling, general and administrative expenses | 673 | 586 | 99 | (12 | )3 | |||||||||||||

Research and development expenses | 231 | 231 | - | - | ||||||||||||||

Interest expense of Financial Products | 119 | - | 122 | (3 | )4 | |||||||||||||

Other operating expenses | 188 | 2 | 185 | 1 | 3 | |||||||||||||

Total operating costs | 5,912 | 5,520 | 406 | (14 | ) | |||||||||||||

Operating profit | 568 | 482 | 111 | (25 | ) | |||||||||||||

Interest expense excluding Financial Products | 57 | 58 | - | (1 | )4 | |||||||||||||

Other income (expense) | 61 | 34 | 3 | 24 | 5 | |||||||||||||

Consolidated profit before taxes | 572 | 458 | 114 | - | ||||||||||||||

Provision for income taxes | 158 | 119 | 39 | - | ||||||||||||||

Profit of consolidated companies | 414 | 339 | 75 | - | ||||||||||||||

Equity in profit (loss) of unconsolidated affiliated companies | 6 | 5 | 1 | - | ||||||||||||||

Equity in profit of Financial Products' subsidiaries | - | 76 | - | (76 | )6 | |||||||||||||

Profit | $ | 420 | $ | 420 | $ | 76 | $ | (76 | ) | |||||||||

1Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. | ||||||||||||||||||

2Elimination of Financial Products revenues earned from Machinery and Engines. | ||||||||||||||||||

3Elimination of net expenses recorded by Machinery and Engines paid to Financial Products. | ||||||||||||||||||

4Elimination of interest expense recorded between Financial Products and Machinery and Engines. | ||||||||||||||||||

5Elimination of discount recorded by Machinery and Engines on receivables sold to Financial Products and of interest earned between Machinery and Engines and Financial Products. | ||||||||||||||||||

6Elimination of Financial Products profit due to equity method of accounting. | ||||||||||||||||||

Certain amounts from prior periods have been reclassified to conform to 2005 financial statement presentation. | ||||||||||||||||||

Caterpillar Inc. Supplemental Data for Cash Flow For The Three Months Ended March 31, 2005 (Unaudited) (Millions of dollars) | ||||||||||||||||||

Supplemental Consolidating Data | ||||||||||||||||||

Consolidated | Machinery and Engines1 | Financial Products | Consolidating Adjustments | |||||||||||||||

Cash flow from operating activities: | ||||||||||||||||||

Profit | $ | 581 | $ | 581 | $ | 88 | $ | (88 | )2 | |||||||||

| Adjustments for non-cash items: | ||||||||||||||||||

Depreciation and amortization | 372 | 213 | 159 | - | ||||||||||||||

Undistributed profit of Financial Products | - | (88 | ) | - | 88 | 3 | ||||||||||||

Other | (68 | ) | (69 | ) | (46 | ) | 47 | 4 | ||||||||||

| Changes in assets and liabilities: | ||||||||||||||||||

Receivables - trade and other | (228 | ) | (216 | ) | 24 | (36 | )4/5 | |||||||||||

Inventories | (555 | ) | (555 | ) | - | - | ||||||||||||

Accounts payable and accrued expenses | 96 | 48 | 79 | (31 | )4 | |||||||||||||

Other - net | (19 | ) | (28 | ) | 9 | - | ||||||||||||

Net cash provided by (used for) operating activities | 179 | (114 | ) | 313 | (20 | ) | ||||||||||||

Cash flow from investing activities: | ||||||||||||||||||

Capital expenditures - excluding equipment leased to others | (165 | ) | (158 | ) | (7 | ) | - | |||||||||||

Expenditures for equipment leased to others | (238 | ) | - | (238 | ) | - | ||||||||||||

Proceeds from disposals of property, plant and equipment | 131 | 4 | 127 | - | ||||||||||||||

Additions to finance receivables | (2,251 | ) | - | (7,090 | ) | 4,839 | 5 | |||||||||||

Collections of finance receivables | 1,597 | - | 6,414 | (4,817 | )5 | |||||||||||||

Proceeds from the sale of finance receivables | 10 | - | 10 | - | ||||||||||||||

Net intercompany borrowings | - | (109 | ) | (569 | ) | 678 | 6 | |||||||||||

Investments and acquisitions (net of cash acquired) | 1 | 1 | - | - | ||||||||||||||

Other - net | (28 | ) | (8 | ) | (20 | ) | - | |||||||||||

Net cash used for investing activities | (943 | ) | (270 | ) | (1,373 | ) | 700 | |||||||||||

Cash flow from financing activities: | ||||||||||||||||||

Dividends paid | (141 | ) | (141 | ) | - | - | ||||||||||||

Common stock issued, including treasury shares reissued | 154 | 154 | - | - | ||||||||||||||

Treasury shares purchased | (357 | ) | (357 | ) | - | - | ||||||||||||

Net intercompany borrowings | - | 569 | 109 | (678 | )6 | |||||||||||||

Proceeds from long-term debt issued | 2,513 | 194 | 2,319 | |||||||||||||||

Payments on long-term debt | (1,359 | ) | - | (1,359 | ) | - | ||||||||||||

Short-term borrowings - net | (3 | ) | 8 | (11 | ) | - | ||||||||||||

Net cash provided by financing activities | 807 | 427 | 1,058 | (678 | ) | |||||||||||||

Effect of exchange rate changes on cash | 29 | 33 | (2 | ) | (2 | )7 | ||||||||||||

Increase (decrease) in cash and short-term investments | 72 | 76 | (4 | ) | - | |||||||||||||

Cash and short-term investments at beginning of period | 445 | 270 | 175 | - | ||||||||||||||

Cash and short-term investments at end of period | $ | 517 | $ | 346 | $ | 171 | $ | - | ||||||||||

1Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. | ||||||||||||||||||

2Elimination of Financial Products profit after tax due to equity method of accounting. | ||||||||||||||||||

3Non-cash adjustment for the undistributed earnings from Financial Products. | ||||||||||||||||||

4Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||||||||||||||||

5Reclassification of Cat Financial’s cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||||||||||||||||

6Net proceeds and payments to/from Machinery and Engines and Financial Products. | ||||||||||||||||||

7Elimination of the effect of exchange on intercompany balances. | ||||||||||||||||||

Caterpillar Inc. Supplemental Data for Cash Flow For The Three Months Ended March 31, 2004 (Unaudited) (Millions of dollars) | ||||||||||||||||||

Supplemental Consolidating Data | ||||||||||||||||||

Consolidated | Machinery and Engines1 | Financial Products | Consolidating Adjustments | |||||||||||||||

Cash flow from operating activities: | ||||||||||||||||||

Profit | $ | 420 | $ | 420 | $ | 76 | $ | (76 | )2 | |||||||||

| Adjustments for non-cash items: | ||||||||||||||||||

Depreciation and amortization | 350 | 202 | 148 | |||||||||||||||

Undistributed profit of Financial Products | - | (76 | ) | - | 76 | 3 | ||||||||||||

Other | (37 | ) | (25 | ) | (34 | ) | 22 | 4 | ||||||||||

| Changes in assets and liabilities: | ||||||||||||||||||

Receivables - trade and other | (2,498 | ) | (143 | ) | 96 | (2,451 | )4/5 | |||||||||||

Inventories | (631 | ) | (631 | ) | - | - | ||||||||||||

Accounts payable and accrued expenses | 243 | 211 | (39 | ) | 71 | 4 | ||||||||||||

Other - net | (50 | ) | (107 | ) | 30 | 27 | 4 | |||||||||||

Net cash provided by (used for) operating activities | (2,203 | ) | (149) | 277 | (2,331 | ) | ||||||||||||

Cash flow from investing activities: | ||||||||||||||||||

Capital expenditures - excluding equipment leased to others | (106 | ) | (101 | ) | (5 | ) | - | |||||||||||

Expenditures for equipment leased to others | (240 | ) | - | (240 | ) | - | ||||||||||||

Proceeds from disposals of property, plant and equipment | 147 | 7 | 140 | - | ||||||||||||||

Additions to finance receivables | (1,866 | ) | - | (3,394 | ) | 1,528 | 5 | |||||||||||

Collections of finance receivables | 1,472 | - | 2,731 | (1,259 | )5 | |||||||||||||

Proceeds from the sale of finance receivables | - | - | 264 | (264 | )5 | |||||||||||||

Additions to retained interests in securitized trade receivables | - | - | (2,322 | ) | 2,322 | 6 | ||||||||||||

Collections of retained interests in securitizedtrade receivables | 2,001 | - | 2,001 | - | ||||||||||||||

Net intercompany borrowings | - | 209 | (6 | ) | (203 | )7 | ||||||||||||

Investments and acquisitions (net of cash acquired) | (13 | ) | (13 | ) | - | - | ||||||||||||

Other - net | (6 | ) | (5 | ) | (1 | ) | - | |||||||||||

Net cash provided by (used for) investing activities | 1,389 | 97 | (832 | ) | 2,124 | |||||||||||||

Cash flow from financing activities: | ||||||||||||||||||

| Dividends paid | (127 | ) | (127 | ) | - | - | ||||||||||||

| Common stock issued, including treasury shares reissued | 69 | 69 | - | - | ||||||||||||||

Treasury shares purchased | (250 | ) | (250 | ) | - | - | ||||||||||||

Net intercompany borrowings | - | 6 | (209 | ) | 203 | 7 | ||||||||||||

Proceeds from long-term debt issued | 1,808 | 255 | 1,553 | - | ||||||||||||||

Payments on long-term debt | (913 | ) | (25 | ) | (888 | ) | - | |||||||||||

Short-term borrowings - net | 220 | 91 | 129 | - | ||||||||||||||

Net cash provided by financing activities | 807 | 19 | 585 | 203 | ||||||||||||||

Effect of exchange rate changes on cash | 33 | 33 | (4 | ) | 4 | 8 | ||||||||||||

Increase (decrease) in cash and short-term investments | 26 | - | 26 | - | ||||||||||||||

Cash and short-term investments at beginning of period | 342 | 220 | 122 | - | ||||||||||||||

Cash and short-term investments at end of period | $ | 368 | $ | 220 | $ | 148 | $ | - | ||||||||||

1Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. | ||||||||||||||||||

2Elimination of Financial Products profit after tax due to equity method of accounting. | ||||||||||||||||||

3Non-cash adjustment for the undistributed earnings from Financial Products. | ||||||||||||||||||

4Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. Receivables amounts include adjustment for consolidated non-cash receipt of retained interests in securitized trade receivables. | ||||||||||||||||||

5Reclassification of Cat Financial’s cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||||||||||||||||

6Elimination of Cat Financial’s additions to retained interests in securitized trade receivables that arose from an intercompany purchase of receivables. | ||||||||||||||||||

7Net proceeds and payments to/from Machinery and Engines and Financial Products. | ||||||||||||||||||

8Elimination of the effect of exchange on intercompany balances. | ||||||||||||||||||

| Certain amounts have been reclassified to conform to the 2005 financial statement presentation. | ||||||||||||||||||

| · | Any sudden drop in consumer or business confidence; |

| · | Delays in legislation needed to fund public construction; |

| · | Regulatory or legislative changes that slow activity in key industries; and/or |

| · | Unexpected collapses in stock markets. |