- CAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Caterpillar (CAT) 8-K4Q 2019 Earnings Release

Filed: 31 Jan 20, 6:46am

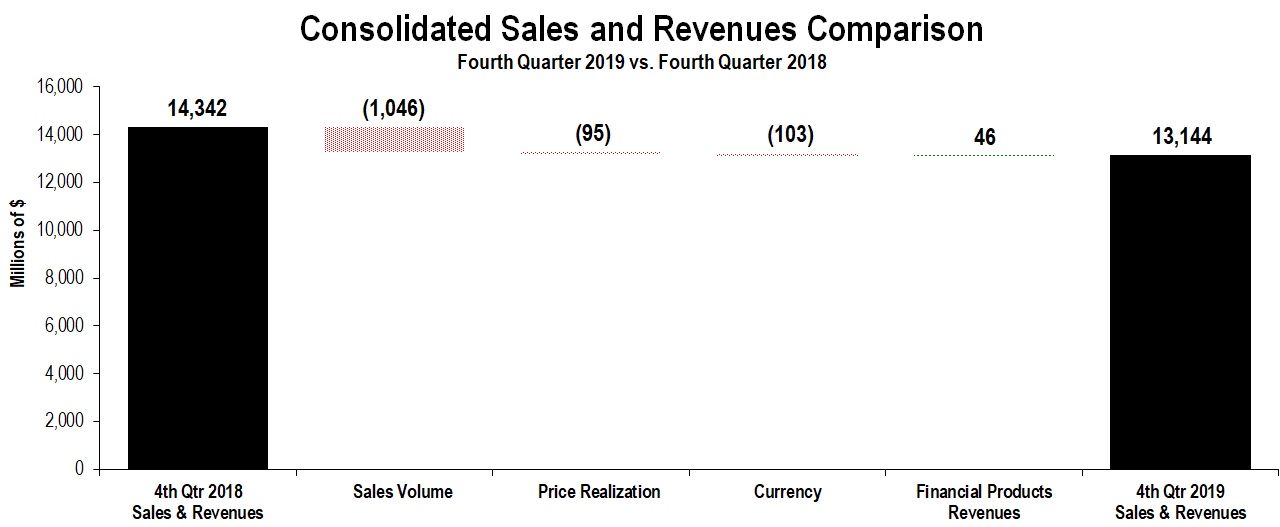

| ▪ | Fourth-quarter sales and revenues down 8%; full-year sales and revenues decreased 2% |

| ▪ | Strong operating cash flow; ended the year with $8.3 billion of enterprise cash |

| ▪ | Returned $1.3 billion to shareholders in the fourth quarter through dividends and share repurchases; returned about $6.2 billion in 2019 |

| ▪ | 2020 profit per share outlook range of $8.50 to $10.00 |

| Fourth Quarter | Full Year | |||||

| ($ in billions except profit per share) | 2019 | 2018 | 2019 | 2018 | ||

| Sales and Revenues | $13.1 | $14.3 | $53.8 | $54.7 | ||

| Profit Per Share | $1.97 | $1.78 | $10.74 | $10.26 | ||

| Adjusted Profit Per Share | $2.63 | $2.55 | $11.06 | $11.22 | ||

| Sales and Revenues by Segment | |||||||||||||||||||||||||||||

| (Millions of dollars) | Fourth Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment / Other | Fourth Quarter 2019 | $ Change | % Change | |||||||||||||||||||||

| Construction Industries | $ | 5,705 | $ | (565 | ) | $ | (86 | ) | $ | (32 | ) | $ | (2 | ) | $ | 5,020 | $ | (685 | ) | (12%) | |||||||||

| Resource Industries | 2,797 | (430 | ) | 17 | (22 | ) | 33 | 2,395 | (402 | ) | (14%) | ||||||||||||||||||

| Energy & Transportation | 6,287 | (25 | ) | (27 | ) | (47 | ) | (239 | ) | 5,949 | (338 | ) | (5%) | ||||||||||||||||

| All Other Segment | 129 | (10 | ) | — | — | 24 | 143 | 14 | 11% | ||||||||||||||||||||

| Corporate Items and Eliminations | (1,288 | ) | (16 | ) | 1 | (2 | ) | 184 | (1,121 | ) | 167 | ||||||||||||||||||

| Machinery, Energy & Transportation | 13,630 | (1,046 | ) | (95 | ) | (103 | ) | — | 12,386 | (1,244 | ) | (9%) | |||||||||||||||||

| Financial Products Segment | 812 | — | — | — | 34 | 846 | 34 | 4% | |||||||||||||||||||||

| Corporate Items and Eliminations | (100 | ) | — | — | — | 12 | (88 | ) | 12 | ||||||||||||||||||||

| Financial Products Revenues | 712 | — | — | — | 46 | 758 | 46 | 6% | |||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 14,342 | $ | (1,046 | ) | $ | (95 | ) | $ | (103 | ) | $ | 46 | $ | 13,144 | $ | (1,198 | ) | (8%) | ||||||||||

| Sales and Revenues by Geographic Region | |||||||||||||||||||||||||||||||||||||||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | |||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | |||||||||||||||||||||||||||

| Fourth Quarter 2019 | |||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,249 | (18%) | $ | 409 | 9% | $ | 850 | (20%) | $ | 1,475 | —% | $ | 4,983 | (12%) | $ | 37 | (5%) | $ | 5,020 | (12%) | ||||||||||||||||||||

| Resource Industries | 834 | (8%) | 313 | (33%) | 526 | (5%) | 603 | (23%) | 2,276 | (16%) | 119 | 38% | 2,395 | (14%) | |||||||||||||||||||||||||||

| Energy & Transportation | 2,287 | (11%) | 354 | (18%) | 1,578 | 5% | 947 | 26% | 5,166 | (2%) | 783 | (23%) | 5,949 | (5%) | |||||||||||||||||||||||||||

| All Other Segment | 2 | (88%) | — | —% | 5 | (17%) | 22 | 47% | 29 | (26%) | 114 | 27% | 143 | 11% | |||||||||||||||||||||||||||

| Corporate Items and Eliminations | (50 | ) | — | (5 | ) | (13 | ) | (68 | ) | (1,053 | ) | (1,121 | ) | ||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 5,322 | (14%) | 1,076 | (16%) | 2,954 | (6%) | 3,034 | —% | 12,386 | (9%) | — | —% | 12,386 | (9%) | |||||||||||||||||||||||||||

| Financial Products Segment | 554 | 2% | 74 | 9% | 102 | 21% | 116 | 1% | 846 | 4% | — | —% | 846 | 4% | |||||||||||||||||||||||||||

| Corporate Items and Eliminations | (50 | ) | (14 | ) | (9 | ) | (15 | ) | (88 | ) | — | (88 | ) | ||||||||||||||||||||||||||||

| Financial Products Revenues | 504 | 5% | 60 | 3% | 93 | 22% | 101 | 2% | 758 | 6% | — | —% | 758 | 6% | |||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 5,826 | (13%) | $ | 1,136 | (15%) | $ | 3,047 | (5%) | $ | 3,135 | —% | $ | 13,144 | (8%) | $ | — | —% | $ | 13,144 | (8%) | ||||||||||||||||||||

| Fourth Quarter 2018 | |||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,749 | $ | 374 | $ | 1,063 | $ | 1,480 | $ | 5,666 | $ | 39 | $ | 5,705 | |||||||||||||||||||||||||||

| Resource Industries | 906 | 466 | 554 | 785 | 2,711 | 86 | 2,797 | ||||||||||||||||||||||||||||||||||

| Energy & Transportation | 2,569 | 434 | 1,509 | 753 | 5,265 | 1,022 | 6,287 | ||||||||||||||||||||||||||||||||||

| All Other Segment | 16 | 2 | 6 | 15 | 39 | 90 | 129 | ||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (47 | ) | 1 | (3 | ) | (2 | ) | (51 | ) | (1,237 | ) | (1,288 | ) | ||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 6,193 | 1,277 | 3,129 | 3,031 | 13,630 | — | 13,630 | ||||||||||||||||||||||||||||||||||

| Financial Products Segment | 545 | 68 | 84 | 115 | 812 | — | 812 | ||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (66 | ) | (10 | ) | (8 | ) | (16 | ) | (100 | ) | — | (100 | ) | ||||||||||||||||||||||||||||

| Financial Products Revenues | 479 | 58 | 76 | 99 | 712 | — | 712 | ||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 6,672 | $ | 1,335 | $ | 3,205 | $ | 3,130 | $ | 14,342 | $ | — | $ | 14,342 | |||||||||||||||||||||||||||

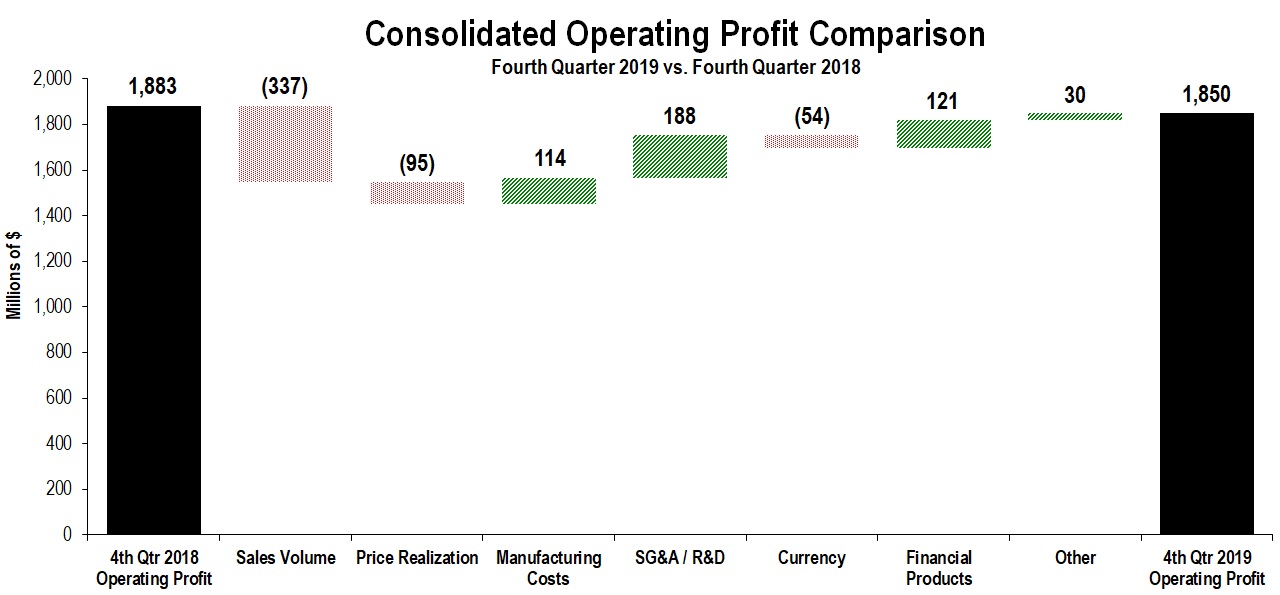

| Profit (Loss) by Segment | ||||||||||||||

| (Millions of dollars) | Fourth Quarter 2019 | Fourth Quarter 2018 | $ Change | % Change | ||||||||||

| Construction Industries | $ | 659 | $ | 845 | $ | (186 | ) | (22 | %) | |||||

| Resource Industries | 261 | 400 | (139 | ) | (35 | %) | ||||||||

| Energy & Transportation | 1,165 | 1,079 | 86 | 8 | % | |||||||||

| All Other Segment | (11 | ) | (47 | ) | 36 | 77 | % | |||||||

| Corporate Items and Eliminations | (325 | ) | (375 | ) | 50 | |||||||||

| Machinery, Energy & Transportation | 1,749 | 1,902 | (153 | ) | (8 | %) | ||||||||

| Financial Products Segment | 210 | 29 | 181 | 624 | % | |||||||||

| Corporate Items and Eliminations | (6 | ) | 54 | (60 | ) | |||||||||

| Financial Products | 204 | 83 | 121 | 146 | % | |||||||||

| Consolidating Adjustments | (103 | ) | (102 | ) | (1 | ) | ||||||||

| Consolidated Operating Profit | $ | 1,850 | $ | 1,883 | $ | (33 | ) | (2 | %) | |||||

| • | Other income (expense) in the fourth quarter of 2019 was expense of $373 million, compared with expense of $417 million in the fourth quarter of 2018. The decrease in expense was due to the favorable impact of commodity hedges, higher realized gains and lower unrealized losses on marketable securities at Insurance Services, which were partially offset by unfavorable pension and OPEB costs. |

| • | The provision for income taxes for the fourth quarter of 2019 reflected an annual effective tax rate of approximately 25% and a discrete tax benefit of $13 million, compared with approximately 24% and a net discrete tax benefit of $17 million for the fourth quarter of 2018. The increase from 2018 was largely driven by the application of U.S. tax reform provisions to the earnings of certain non-U.S. subsidiaries, which do not have a calendar fiscal year-end. These provisions did not apply to these subsidiaries in 2018. The change from the third-quarter 2019 estimated annual tax rate of 26% to the annual effective tax rate of approximately 25% resulted in a $54 million tax benefit in the fourth quarter of 2019. |

| CONSTRUCTION INDUSTRIES | |||||||||||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||||||||||

| Segment Sales | |||||||||||||||||||||||||||||||

| Fourth Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2019 | $ Change | % Change | ||||||||||||||||||||||||

| Total Sales | $ | 5,705 | $ | (565 | ) | $ | (86 | ) | $ | (32 | ) | $ | (2 | ) | $ | 5,020 | $ | (685 | ) | (12 | %) | ||||||||||

| Sales by Geographic Region | |||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | $ Change | % Change | ||||||||||||||||||||||||||||

| North America | $ | 2,249 | $ | 2,749 | $ | (500 | ) | (18 | %) | ||||||||||||||||||||||

| Latin America | 409 | 374 | 35 | 9 | % | ||||||||||||||||||||||||||

| EAME | 850 | 1,063 | (213 | ) | (20 | %) | |||||||||||||||||||||||||

| Asia/Pacific | 1,475 | 1,480 | (5 | ) | — | % | |||||||||||||||||||||||||

| External Sales | 4,983 | 5,666 | (683 | ) | (12 | %) | |||||||||||||||||||||||||

| Inter-segment | 37 | 39 | (2 | ) | (5 | %) | |||||||||||||||||||||||||

| Total Sales | $ | 5,020 | $ | 5,705 | $ | (685 | ) | (12 | %) | ||||||||||||||||||||||

| Segment Profit | |||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | Change | % Change | ||||||||||||||||||||||||||||

| Segment Profit | $ | 659 | $ | 845 | $ | (186 | ) | (22 | %) | ||||||||||||||||||||||

| Segment Profit Margin | 13.1 | % | 14.8 | % | (1.7 | pts) | |||||||||||||||||||||||||

| ▪ | In North America, sales decreased due to lower demand driven by the impact from changes in dealer inventories, while end-user demand was about flat. Dealers decreased inventories during the fourth quarter of 2019, compared with an increase during the fourth quarter of 2018. |

| ▪ | Sales were higher in Latin America. While construction activities remained at low levels, the increase was driven by road and residential construction activities. |

| ▪ | In EAME, the sales decrease was primarily due to the impact from changes in dealer inventories and lower end-user demand across most of the region. Dealers decreased inventories more during the fourth quarter of 2019 than during the fourth quarter of 2018. |

| ▪ | Sales in Asia/Pacific were about flat as unfavorable price realization was mostly offset by a few countries’ higher sales volume. |

| RESOURCE INDUSTRIES | |||||||||||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||||||||||

| Segment Sales | |||||||||||||||||||||||||||||||

| Fourth Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2019 | $ Change | % Change | ||||||||||||||||||||||||

| Total Sales | $ | 2,797 | $ | (430 | ) | $ | 17 | $ | (22 | ) | $ | 33 | $ | 2,395 | $ | (402 | ) | (14 | %) | ||||||||||||

| Sales by Geographic Region | |||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | $ Change | % Change | ||||||||||||||||||||||||||||

| North America | $ | 834 | $ | 906 | $ | (72 | ) | (8 | %) | ||||||||||||||||||||||

| Latin America | 313 | 466 | (153 | ) | (33 | %) | |||||||||||||||||||||||||

| EAME | 526 | 554 | (28 | ) | (5 | %) | |||||||||||||||||||||||||

| Asia/Pacific | 603 | 785 | (182 | ) | (23 | %) | |||||||||||||||||||||||||

| External Sales | 2,276 | 2,711 | (435 | ) | (16 | %) | |||||||||||||||||||||||||

| Inter-segment | 119 | 86 | 33 | 38 | % | ||||||||||||||||||||||||||

| Total Sales | $ | 2,395 | $ | 2,797 | $ | (402 | ) | (14 | %) | ||||||||||||||||||||||

| Segment Profit | |||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | Change | % Change | ||||||||||||||||||||||||||||

| Segment Profit | $ | 261 | $ | 400 | $ | (139 | ) | (35 | %) | ||||||||||||||||||||||

| Segment Profit Margin | 10.9 | % | 14.3 | % | (3.4 | pts) | |||||||||||||||||||||||||

| ENERGY & TRANSPORTATION | |||||||||||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||||||||||

| Segment Sales | |||||||||||||||||||||||||||||||

| Fourth Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2019 | $ Change | % Change | ||||||||||||||||||||||||

| Total Sales | $ | 6,287 | $ | (25 | ) | $ | (27 | ) | $ | (47 | ) | $ | (239 | ) | $ | 5,949 | $ | (338 | ) | (5 | %) | ||||||||||

| Sales by Application | |||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | $ Change | % Change | ||||||||||||||||||||||||||||

| Oil and Gas | $ | 1,523 | $ | 1,719 | $ | (196 | ) | (11 | %) | ||||||||||||||||||||||

| Power Generation | 1,294 | 1,271 | 23 | 2 | % | ||||||||||||||||||||||||||

| Industrial | 908 | 902 | 6 | 1 | % | ||||||||||||||||||||||||||

| Transportation | 1,441 | 1,373 | 68 | 5 | % | ||||||||||||||||||||||||||

| External Sales | 5,166 | 5,265 | (99 | ) | (2 | %) | |||||||||||||||||||||||||

| Inter-segment | 783 | 1,022 | (239 | ) | (23 | %) | |||||||||||||||||||||||||

| Total Sales | $ | 5,949 | $ | 6,287 | $ | (338 | ) | (5 | %) | ||||||||||||||||||||||

| Segment Profit | |||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | Change | % Change | ||||||||||||||||||||||||||||

| Segment Profit | $ | 1,165 | $ | 1,079 | $ | 86 | 8 | % | |||||||||||||||||||||||

| Segment Profit Margin | 19.6 | % | 17.2 | % | 2.4 | pts | |||||||||||||||||||||||||

| ▪ | Oil and Gas – Sales were lower mainly in North America. The sales decline was largely due to lower demand for reciprocating engines used in gas compression and lower turbine project deliveries. |

| ▪ | Power Generation – Sales increased slightly primarily due to higher deliveries for turbines in EAME. |

| ▪ | Industrial – Sales were about flat as slightly higher sales in North America were partially offset by lower sales in Latin America and EAME. |

| ▪ | Transportation – Sales were higher mainly due to stronger marine demand in EAME. |

| FINANCIAL PRODUCTS SEGMENT | |||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||

| Revenues by Geographic Region | |||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | $ Change | % Change | ||||||||||||||||||||

| North America | $ | 554 | $ | 545 | $ | 9 | 2 | % | |||||||||||||||

| Latin America | 74 | 68 | 6 | 9 | % | ||||||||||||||||||

| EAME | 102 | 84 | 18 | 21 | % | ||||||||||||||||||

| Asia/Pacific | 116 | 115 | 1 | 1 | % | ||||||||||||||||||

| Total Revenues | $ | 846 | $ | 812 | $ | 34 | 4 | % | |||||||||||||||

| Segment Profit | |||||||||||||||||||||||

| Fourth Quarter 2019 | Fourth Quarter 2018 | Change | % Change | ||||||||||||||||||||

| Segment Profit | $ | 210 | $ | 29 | $ | 181 | 624 | % | |||||||||||||||

| i. | Glossary of terms is included on the Caterpillar website at http://www.caterpillar.com/investors/. |

| ii. | Information on non-GAAP financial measures is included in the appendix on page 12. |

| iii. | Some amounts within this report are rounded to the millions or billions and may not add. In addition, the sum of the components reported across periods may not equal the total amount reported year-to-date due to rounding. |

| iv. | Caterpillar will conduct a teleconference and live webcast, with a slide presentation, beginning at 7:30 a.m. Central Time on Friday, January 31, 2020, to discuss its 2019 fourth-quarter and full-year financial results. The accompanying slides will be available before the webcast on the Caterpillar website at |

| Fourth Quarter | Full Year | |||||||||||||||

| (Millions of dollars) | 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Profit before taxes | $ | 1,365 | $ | 1,367 | $ | 7,812 | $ | 7,822 | ||||||||

| Mark-to-market losses | 468 | 495 | 468 | 495 | ||||||||||||

| Restructuring costs | — | 93 | — | 386 | ||||||||||||

| Adjusted profit before taxes | $ | 1,833 | $ | 1,955 | $ | 8,280 | $ | 8,703 | ||||||||

| Fourth Quarter | Full Year | ||||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||||

| Profit per share | $ | 1.97 | $ | 1.78 | $ | 10.74 | $ | 10.26 | |||||||||

Per share mark-to-market losses1 | $ | 0.65 | $ | 0.66 | $ | 0.64 | $ | 0.64 | |||||||||

| Per share U.S. tax reform impact | $ | — | $ | 0.09 | $ | (0.31 | ) | $ | (0.17 | ) | |||||||

Per share restructuring costs2 | $ | — | $ | 0.13 | $ | — | $ | 0.50 | |||||||||

| Per share deferred tax valuation allowance adjustment | $ | — | $ | (0.11 | ) | $ | — | $ | (0.01 | ) | |||||||

| Adjusted profit per share | $ | 2.63 | $ | 2.55 | $ | 11.06 | $ | 11.22 | |||||||||

1 At statutory tax rates. | |||||||||||||||||

2 2018 restructuring costs at statutory tax rates. 2019 restructuring costs are not material. | |||||||||||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Sales and revenues: | |||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 12,386 | $ | 13,630 | $ | 50,755 | $ | 51,822 | |||||||

| Revenues of Financial Products | 758 | 712 | 3,045 | 2,900 | |||||||||||

| Total sales and revenues | 13,144 | 14,342 | 53,800 | 54,722 | |||||||||||

| Operating costs: | |||||||||||||||

| Cost of goods sold | 9,117 | 9,987 | 36,630 | 36,997 | |||||||||||

| Selling, general and administrative expenses | 1,283 | 1,463 | 5,162 | 5,478 | |||||||||||

| Research and development expenses | 386 | 466 | 1,693 | 1,850 | |||||||||||

| Interest expense of Financial Products | 183 | 189 | 754 | 722 | |||||||||||

| Other operating (income) expenses | 325 | 354 | 1,271 | 1,382 | |||||||||||

| Total operating costs | 11,294 | 12,459 | 45,510 | 46,429 | |||||||||||

| Operating profit | 1,850 | 1,883 | 8,290 | 8,293 | |||||||||||

| Interest expense excluding Financial Products | 112 | 99 | 421 | 404 | |||||||||||

| Other income (expense) | (373 | ) | (417 | ) | (57 | ) | (67 | ) | |||||||

| Consolidated profit before taxes | 1,365 | 1,367 | 7,812 | 7,822 | |||||||||||

| Provision (benefit) for income taxes | 276 | 321 | 1,746 | 1,698 | |||||||||||

| Profit of consolidated companies | 1,089 | 1,046 | 6,066 | 6,124 | |||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 8 | 3 | 28 | 24 | |||||||||||

| Profit of consolidated and affiliated companies | 1,097 | 1,049 | 6,094 | 6,148 | |||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (1 | ) | 1 | 1 | 1 | ||||||||||

Profit 1 | $ | 1,098 | $ | 1,048 | $ | 6,093 | $ | 6,147 | |||||||

| Profit per common share | $ | 2.00 | $ | 1.80 | $ | 10.85 | $ | 10.39 | |||||||

Profit per common share — diluted 2 | $ | 1.97 | $ | 1.78 | $ | 10.74 | $ | 10.26 | |||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||||

| – Basic | 550.3 | 581.4 | 561.6 | 591.4 | |||||||||||

– Diluted 2 | 556.1 | 587.6 | 567.5 | 599.4 | |||||||||||

1 | Profit attributable to common shareholders. |

2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. |

| December 31, 2019 | December 31, 2018 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and short-term investments | $ | 8,284 | $ | 7,857 | |||

| Receivables – trade and other | 8,568 | 8,802 | |||||

| Receivables – finance | 9,336 | 8,650 | |||||

| Prepaid expenses and other current assets | 1,739 | 1,765 | |||||

| Inventories | 11,266 | 11,529 | |||||

| Total current assets | 39,193 | 38,603 | |||||

| Property, plant and equipment – net | 12,904 | 13,574 | |||||

| Long-term receivables – trade and other | 1,193 | 1,161 | |||||

| Long-term receivables – finance | 12,651 | 13,286 | |||||

| Noncurrent deferred and refundable income taxes | 1,411 | 1,439 | |||||

| Intangible assets | 1,565 | 1,897 | |||||

| Goodwill | 6,196 | 6,217 | |||||

| Other assets | 3,340 | 2,332 | |||||

| Total assets | $ | 78,453 | $ | 78,509 | |||

| Liabilities | |||||||

| Current liabilities: | |||||||

| Short-term borrowings: | |||||||

| -- Machinery, Energy & Transportation | $ | 5 | $ | — | |||

| -- Financial Products | 5,161 | 5,723 | |||||

| Accounts payable | 5,957 | 7,051 | |||||

| Accrued expenses | 3,750 | 3,573 | |||||

| Accrued wages, salaries and employee benefits | 1,629 | 2,384 | |||||

| Customer advances | 1,187 | 1,243 | |||||

| Dividends payable | 567 | 495 | |||||

| Other current liabilities | 2,155 | 1,919 | |||||

| Long-term debt due within one year: | |||||||

| -- Machinery, Energy & Transportation | 16 | 10 | |||||

| -- Financial Products | 6,194 | 5,820 | |||||

| Total current liabilities | 26,621 | 28,218 | |||||

| Long-term debt due after one year: | |||||||

| -- Machinery, Energy & Transportation | 9,141 | 8,005 | |||||

| -- Financial Products | 17,140 | 16,995 | |||||

| Liability for postemployment benefits | 6,599 | 7,455 | |||||

| Other liabilities | 4,323 | 3,756 | |||||

| Total liabilities | 63,824 | 64,429 | |||||

| Shareholders’ equity | |||||||

| Common stock | 5,935 | 5,827 | |||||

| Treasury stock | (24,217 | ) | (20,531 | ) | |||

| Profit employed in the business | 34,437 | 30,427 | |||||

| Accumulated other comprehensive income (loss) | (1,567 | ) | (1,684 | ) | |||

| Noncontrolling interests | 41 | 41 | |||||

| Total shareholders’ equity | 14,629 | 14,080 | |||||

| Total liabilities and shareholders’ equity | $ | 78,453 | $ | 78,509 | |||

| Twelve Months Ended December 31, | |||||||

| 2019 | 2018 | ||||||

| Cash flow from operating activities: | |||||||

| Profit of consolidated and affiliated companies | $ | 6,094 | $ | 6,148 | |||

| Adjustments for non-cash items: | |||||||

| Depreciation and amortization | 2,577 | 2,766 | |||||

| Actuarial (gain) loss on pension and postretirement benefits | 468 | 495 | |||||

| Provision (benefit) for deferred income taxes | 28 | 220 | |||||

| Other | 675 | 1,006 | |||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||

| Receivables – trade and other | 171 | (1,619 | ) | ||||

| Inventories | 274 | (1,579 | ) | ||||

| Accounts payable | (1,025 | ) | 709 | ||||

| Accrued expenses | 172 | 101 | |||||

| Accrued wages, salaries and employee benefits | (757 | ) | (162 | ) | |||

| Customer advances | (10 | ) | (183 | ) | |||

| Other assets – net | (93 | ) | 41 | ||||

| Other liabilities – net | (1,662 | ) | (1,385 | ) | |||

| Net cash provided by (used for) operating activities | 6,912 | 6,558 | |||||

| Cash flow from investing activities: | |||||||

| Capital expenditures – excluding equipment leased to others | (1,056 | ) | (1,276 | ) | |||

| Expenditures for equipment leased to others | (1,613 | ) | (1,640 | ) | |||

| Proceeds from disposals of leased assets and property, plant and equipment | 1,153 | 936 | |||||

| Additions to finance receivables | (12,777 | ) | (12,183 | ) | |||

| Collections of finance receivables | 12,183 | 10,901 | |||||

| Proceeds from sale of finance receivables | 235 | 477 | |||||

| Investments and acquisitions (net of cash acquired) | (47 | ) | (392 | ) | |||

| Proceeds from sale of businesses and investments (net of cash sold) | 41 | 16 | |||||

| Proceeds from sale of securities | 574 | 442 | |||||

| Investments in securities | (597 | ) | (506 | ) | |||

| Other – net | (24 | ) | 13 | ||||

| Net cash provided by (used for) investing activities | (1,928 | ) | (3,212 | ) | |||

| Cash flow from financing activities: | |||||||

| Dividends paid | (2,132 | ) | (1,951 | ) | |||

| Common stock issued, including treasury shares reissued | 238 | 313 | |||||

| Common shares repurchased | (4,047 | ) | (3,798 | ) | |||

| Excess tax benefit from stock-based compensation | — | — | |||||

| Proceeds from debt issued (original maturities greater than three months) | 9,841 | 8,907 | |||||

| Payments on debt (original maturities greater than three months) | (8,297 | ) | (7,829 | ) | |||

| Short-term borrowings – net (original maturities three months or less) | (138 | ) | 762 | ||||

| Other – net | (3 | ) | (54 | ) | |||

| Net cash provided by (used for) financing activities | (4,538 | ) | (3,650 | ) | |||

| Effect of exchange rate changes on cash | (44 | ) | (126 | ) | |||

| Increase (decrease) in cash and short-term investments and restricted cash | 402 | (430 | ) | ||||

| Cash and short-term investments and restricted cash at beginning of period | 7,890 | 8,320 | |||||

| Cash and short-term investments and restricted cash at end of period | $ | 8,292 | $ | 7,890 | |||

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 12,386 | $ | 12,386 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 758 | — | 887 | (129 | ) | 2 | |||||||||||

| Total sales and revenues | 13,144 | 12,386 | 887 | (129 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 9,117 | 9,119 | — | (2 | ) | 3 | |||||||||||

| Selling, general and administrative expenses | 1,283 | 1,120 | 173 | (10 | ) | 3 | |||||||||||

| Research and development expenses | 386 | 386 | — | — | |||||||||||||

| Interest expense of Financial Products | 183 | — | 187 | (4 | ) | 4 | |||||||||||

| Other operating (income) expenses | 325 | 12 | 323 | (10 | ) | 3 | |||||||||||

| Total operating costs | 11,294 | 10,637 | 683 | (26 | ) | ||||||||||||

| Operating profit | 1,850 | 1,749 | 204 | (103 | ) | ||||||||||||

| Interest expense excluding Financial Products | 112 | 111 | — | 1 | 4 | ||||||||||||

| Other income (expense) | (373 | ) | (489 | ) | 12 | 104 | 5 | ||||||||||

| Consolidated profit before taxes | 1,365 | 1,149 | 216 | — | |||||||||||||

| Provision (benefit) for income taxes | 276 | 218 | 58 | — | |||||||||||||

| Profit of consolidated companies | 1,089 | 931 | 158 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 8 | 8 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 153 | — | (153 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 1,097 | 1,092 | 158 | (153 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (1 | ) | (6 | ) | 5 | — | |||||||||||

Profit 7 | $ | 1,098 | $ | 1,098 | $ | 153 | $ | (153 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 13,630 | $ | 13,630 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 712 | — | 835 | (123 | ) | 2 | |||||||||||

| Total sales and revenues | 14,342 | 13,630 | 835 | (123 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 9,987 | 9,988 | — | (1 | ) | 3 | |||||||||||

| Selling, general and administrative expenses | 1,463 | 1,230 | 244 | (11 | ) | 3 | |||||||||||

| Research and development expenses | 466 | 466 | — | — | |||||||||||||

| Interest expense of Financial Products | 189 | — | 198 | (9 | ) | 4 | |||||||||||

| Other operating (income) expenses | 354 | 44 | 310 | — | |||||||||||||

| Total operating costs | 12,459 | 11,728 | 752 | (21 | ) | ||||||||||||

| Operating profit | 1,883 | 1,902 | 83 | (102 | ) | ||||||||||||

| Interest expense excluding Financial Products | 99 | 111 | — | (12 | ) | 4 | |||||||||||

| Other income (expense) | (417 | ) | (467 | ) | (40 | ) | 90 | 5 | |||||||||

| Consolidated profit before taxes | 1,367 | 1,324 | 43 | — | |||||||||||||

| Provision (benefit) for income taxes | 321 | 300 | 21 | — | |||||||||||||

| Profit of consolidated companies | 1,046 | 1,024 | 22 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 3 | 3 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 17 | — | (17 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 1,049 | 1,044 | 22 | (17 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | (4 | ) | 5 | — | ||||||||||||

Profit 7 | $ | 1,048 | $ | 1,048 | $ | 17 | $ | (17 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 50,755 | $ | 50,755 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 3,045 | — | 3,571 | (526 | ) | 2 | |||||||||||

| Total sales and revenues | 53,800 | 50,755 | 3,571 | (526 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 36,630 | 36,634 | — | (4 | ) | 3 | |||||||||||

| Selling, general and administrative expenses | 5,162 | 4,444 | 737 | (19 | ) | 3 | |||||||||||

| Research and development expenses | 1,693 | 1,693 | — | — | |||||||||||||

| Interest expense of Financial Products | 754 | — | 786 | (32 | ) | 4 | |||||||||||

| Other operating (income) expenses | 1,271 | 14 | 1,297 | (40 | ) | 3 | |||||||||||

| Total operating costs | 45,510 | 42,785 | 2,820 | (95 | ) | ||||||||||||

| Operating profit | 8,290 | 7,970 | 751 | (431 | ) | ||||||||||||

| Interest expense excluding Financial Products | 421 | 429 | — | (8 | ) | 4 | |||||||||||

| Other income (expense) | (57 | ) | (560 | ) | 80 | 423 | 5 | ||||||||||

| Consolidated profit before taxes | 7,812 | 6,981 | 831 | — | |||||||||||||

| Provision (benefit) for income taxes | 1,746 | 1,512 | 234 | — | |||||||||||||

| Profit of consolidated companies | 6,066 | 5,469 | 597 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 28 | 28 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 575 | — | (575 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 6,094 | 6,072 | 597 | (575 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | (21 | ) | 22 | — | ||||||||||||

Profit 7 | $ | 6,093 | $ | 6,093 | $ | 575 | $ | (575 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 51,822 | $ | 51,822 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 2,900 | — | 3,362 | (462 | ) | 2 | |||||||||||

| Total sales and revenues | 54,722 | 51,822 | 3,362 | (462 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 36,997 | 36,998 | — | (1 | ) | 3 | |||||||||||

| Selling, general and administrative expenses | 5,478 | 4,675 | 825 | (22 | ) | 3 | |||||||||||

| Research and development expenses | 1,850 | 1,850 | — | — | |||||||||||||

| Interest expense of Financial Products | 722 | — | 756 | (34 | ) | 4 | |||||||||||

| Other operating (income) expenses | 1,382 | 144 | 1,259 | (21 | ) | 3 | |||||||||||

| Total operating costs | 46,429 | 43,667 | 2,840 | (78 | ) | ||||||||||||

| Operating profit | 8,293 | 8,155 | 522 | (384 | ) | ||||||||||||

| Interest expense excluding Financial Products | 404 | 448 | — | (44 | ) | 4 | |||||||||||

| Other income (expense) | (67 | ) | (391 | ) | (16 | ) | 340 | 5 | |||||||||

| Consolidated profit before taxes | 7,822 | 7,316 | 506 | — | |||||||||||||

| Provision (benefit) for income taxes | 1,698 | 1,574 | 124 | — | |||||||||||||

| Profit of consolidated companies | 6,124 | 5,742 | 382 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 24 | 24 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 362 | — | (362 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 6,148 | 6,128 | 382 | (362 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | (19 | ) | 20 | — | ||||||||||||

Profit 7 | $ | 6,147 | $ | 6,147 | $ | 362 | $ | (362 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | ||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | |||||||||||||

| Cash flow from operating activities: | ||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 6,094 | $ | 6,072 | $ | 597 | $ | (575 | ) | 2 | ||||||

| Adjustments for non-cash items: | ||||||||||||||||

| Depreciation and amortization | 2,577 | 1,713 | 864 | — | ||||||||||||

| Undistributed profit of Financial Products | — | (550 | ) | — | 550 | 3 | ||||||||||

| Actuarial (gain) loss on pension and postretirement benefits | 468 | 468 | — | — | ||||||||||||

| Provision (benefit) for deferred income taxes | 28 | 15 | 13 | — | ||||||||||||

| Other | 675 | 456 | (215 | ) | 434 | 4 | ||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||

| Receivables – trade and other | 171 | 4 | 15 | 152 | 4, 5 | |||||||||||

| Inventories | 274 | 250 | — | 24 | 4 | |||||||||||

| Accounts payable | (1,025 | ) | (983 | ) | 20 | (62 | ) | 4 | ||||||||

| Accrued expenses | 172 | 187 | (13 | ) | (2 | ) | 4 | |||||||||

| Accrued wages, salaries and employee benefits | (757 | ) | (772 | ) | 15 | — | ||||||||||

| Customer advances | (10 | ) | (8 | ) | — | (2 | ) | 4 | ||||||||

| Other assets – net | (93 | ) | (166 | ) | 38 | 35 | 4 | |||||||||

| Other liabilities – net | (1,662 | ) | (1,815 | ) | 169 | (16 | ) | 4 | ||||||||

| Net cash provided by (used for) operating activities | 6,912 | 4,871 | 1,503 | 538 | ||||||||||||

| Cash flow from investing activities: | ||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (1,056 | ) | (1,036 | ) | (20 | ) | — | |||||||||

| Expenditures for equipment leased to others | (1,613 | ) | (38 | ) | (1,616 | ) | 41 | 4 | ||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 1,153 | 164 | 1,092 | (103 | ) | 4 | ||||||||||

| Additions to finance receivables | (12,777 | ) | — | (14,270 | ) | 1,493 | 5 | |||||||||

| Collections of finance receivables | 12,183 | — | 13,537 | (1,354 | ) | 5 | ||||||||||

| Net intercompany purchased receivables | — | — | 640 | (640 | ) | 5 | ||||||||||

| Proceeds from sale of finance receivables | 235 | — | 235 | — | ||||||||||||

| Net intercompany borrowings | — | 900 | 3 | (903 | ) | 6 | ||||||||||

| Investments and acquisitions (net of cash acquired) | (47 | ) | (47 | ) | — | — | ||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 41 | 3 | 38 | — | ||||||||||||

| Proceeds from sale of securities | 574 | 33 | 541 | — | ||||||||||||

| Investments in securities | (597 | ) | (28 | ) | (569 | ) | — | |||||||||

| Other – net | (24 | ) | 1 | (25 | ) | — | ||||||||||

| Net cash provided by (used for) investing activities | (1,928 | ) | (48 | ) | (414 | ) | (1,466 | ) | ||||||||

| Cash flow from financing activities: | ||||||||||||||||

| Dividends paid | (2,132 | ) | (2,132 | ) | (25 | ) | 25 | 7 | ||||||||

| Common stock issued, including treasury shares reissued | 238 | 238 | — | — | ||||||||||||

| Common shares repurchased | (4,047 | ) | (4,047 | ) | — | — | ||||||||||

| Net intercompany borrowings | — | (3 | ) | (900 | ) | 903 | 6 | |||||||||

| Proceeds from debt issued > 90 days | 9,841 | 1,479 | 8,362 | — | ||||||||||||

| Payments on debt > 90 days | (8,297 | ) | (12 | ) | (8,285 | ) | — | |||||||||

| Short-term borrowings – net < 90 days | (138 | ) | 5 | (143 | ) | — | ||||||||||

| Other – net | (3 | ) | (3 | ) | — | — | ||||||||||

| Net cash provided by (used for) financing activities | (4,538 | ) | (4,475 | ) | (991 | ) | 928 | |||||||||

| Effect of exchange rate changes on cash | (44 | ) | (40 | ) | (4 | ) | — | |||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 402 | 308 | 94 | — | ||||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 7,890 | 6,994 | 896 | — | ||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 8,292 | $ | 7,302 | $ | 990 | $ | — | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ profit after tax due to equity method of accounting. |

3 | Elimination of non-cash adjustment for the undistributed earnings from Financial Products. |

4 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. |

5 | Reclassification of Financial Products' cash flow activity from investing to operating for receivables that arose from the sale of inventory. |

6 | Elimination of net proceeds and payments to/from Machinery, Energy & Transportation and Financial Products. |

7 | Elimination of dividend from Financial Products to Machinery, Energy & Transportation. |

| Supplemental Consolidating Data | ||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | |||||||||

| Cash flow from operating activities: | ||||||||||||

| Profit of consolidated and affiliated companies | 6,148 | 6,128 | 382 | (362 | ) | 2 | ||||||

| Adjustments for non-cash items: | ||||||||||||

| Depreciation and amortization | 2,766 | 1,895 | 871 | — | ||||||||

| Actuarial (gain) loss on pension and postretirement benefits | 495 | 495 | — | — | ||||||||

Provision (benefit) for deferred income taxes | 220 | 149 | 71 | — | ||||||||

| Other | 1,006 | 434 | 178 | 394 | 3 | |||||||

| Financial Products' dividend in excess of profit | — | 57 | — | (57 | ) | 4 | ||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||

| Receivables – trade and other | (1,619 | ) | (396 | ) | 6 | (1,229 | ) | 3, 5 | ||||

| Inventories | (1,579 | ) | (1,528 | ) | — | (51 | ) | 3 | ||||

| Accounts payable | 709 | 771 | (55 | ) | (7 | ) | 3 | |||||

| Accrued expenses | 101 | 71 | 30 | — | ||||||||

| Accrued wages, salaries and employee benefits | (162 | ) | (141 | ) | (21 | ) | — | |||||

| Customer advances | (183 | ) | (183 | ) | — | — | ||||||

| Other assets – net | 41 | 16 | (14 | ) | 39 | 3 | ||||||

| Other liabilities – net | (1,385 | ) | (1,421 | ) | 75 | (39 | ) | 4 | ||||

| Net cash provided by (used for) operating activities | 6,558 | 6,347 | 1,523 | (1,312 | ) | |||||||

| Cash flow from investing activities: | ||||||||||||

| Capital expenditures – excluding equipment leased to others | (1,276 | ) | (1,168 | ) | (108 | ) | — | |||||

| Expenditures for equipment leased to others | (1,640 | ) | (53 | ) | (1,667 | ) | 80 | 3 | ||||

| Proceeds from disposals of leased assets and property, plant and equipment | 936 | 152 | 811 | (27 | ) | 3 | ||||||

| Additions to finance receivables | (12,183 | ) | — | (13,595 | ) | 1,412 | 5, 6 | |||||

| Collections of finance receivables | 10,901 | — | 12,513 | (1,612 | ) | 5 | ||||||

| Net intercompany purchased receivables | — | — | (1,046 | ) | 1,046 | 5 | ||||||

| Proceeds from sale of finance receivables | 477 | — | 477 | — | ||||||||

| Net intercompany borrowings | — | 112 | 31 | (143 | ) | 7 | ||||||

| Investments and acquisitions (net of cash acquired) | (392 | ) | (392 | ) | — | — | ||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 16 | 22 | — | (6 | ) | 6 | ||||||

| Proceeds from sale of securities | 442 | 162 | 280 | — | ||||||||

| Investments in securities | (506 | ) | (24 | ) | (482 | ) | — | |||||

| Other – net | 13 | 2 | 10 | 1 | 8 | |||||||

| Net cash provided by (used for) investing activities | (3,212 | ) | (1,187 | ) | (2,776 | ) | 751 | |||||

| Cash flow from financing activities: | ||||||||||||

| Dividends paid | (1,951 | ) | (1,951 | ) | (419 | ) | 419 | 9 | ||||

| Common stock issued, including treasury shares reissued | 313 | 313 | 1 | (1 | ) | 8 | ||||||

| Common shares repurchased | (3,798 | ) | (3,798 | ) | — | — | ||||||

| Net intercompany borrowings | — | (31 | ) | (112 | ) | 143 | 7 | |||||

| Proceeds from debt issued > 90 days | 8,907 | 57 | 8,850 | — | ||||||||

| Payments on debt > 90 days | (7,829 | ) | (7 | ) | (7,822 | ) | — | |||||

| Short-term borrowings – net < 90 days | 762 | — | 762 | — | ||||||||

| Other – net | (54 | ) | (54 | ) | — | — | ||||||

| Net cash provided by (used for) financing activities | (3,650 | ) | (5,471 | ) | 1,260 | 561 | ||||||

| Effect of exchange rate changes on cash | (126 | ) | (111 | ) | (15 | ) | — | |||||

| Increase (decrease) in cash and short-term investments and restricted cash | (430 | ) | (422 | ) | (8 | ) | — | |||||

| Cash and short-term investments and restricted cash at beginning of period | 8,320 | 7,416 | 904 | — | ||||||||

| Cash and short-term investments and restricted cash at end of period | 7,890 | 6,994 | 896 | — | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ profit after tax due to equity method of accounting. |

3 | Elimination of non-cash adjustment and changes in assets and liabilities related to consolidated reporting. |

4 | Elimination of Financial Products’ dividend to Machinery, Energy & Transportation in excess of Financial Products’ profit. |

5 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. |

6 | Elimination of proceeds received from Financial Products related to Machinery, Energy & Transportation's sale of businesses and investments. |

7 | Elimination of net proceeds and payments to/from Machinery, Energy & Transportation and Financial Products. |

8 | Elimination of change in investment and common stock related to Financial Products. |

9 | Elimination of dividend from Financial Products to Machinery, Energy & Transportation. |