UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23645)

NEOS ETF Trust

(Exact name of registrant as specified in charter)

13 Riverside Avenue

Westport, CT 06880

(Address of principal executive offices) (Zip code)

Garrett Paolella, President

13 Riverside Avenue

Westport, CT 06880

(Name and address of agent for service)

(203) 298-7300

Registrant’s telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”), is filed herewith.

| | |

| FIS Christian Stock Fund | |

| PRAY (Principal U.S. Listing Exchange: NYSE Arca) |

| Annual Shareholder Report | May 31, 2024 |

This annual shareholder report contains important information about the FIS Christian Stock Fund for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://faithinvestorservices.com/pray/. You can also request this information by contacting us at 1-833-833-1311.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| FIS Christian Stock Fund | $76 | 0.68% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the 12-month period ended May 31, 2024, the Fund underperformed its benchmark, MSCI WORLD Index Net (USD). The Fund invests its asset in common stocks, real estate investment trusts (“REITs”) and short-term investments.

WHAT FACTORS INFLUENCED PERFORMANCE

The three sectors that detracted most from performance were health care, communication services and financials. In each case, this was a result of stock selection and also the amount of capital allocated to these sectors. The individual stocks having the largest detraction to fund performance were Humana, Inc. in health care, ON Semiconductor Corp. in technology and GFL Environmental, Inc. In an effort to focus on quality and given continued concerns about the banking sector, our under-allocation and also stock selection within financials detracted from performance.

The three sectors that contributed most to performance were information technology, consumer discretionary and consumer staples. Stock picking had the greatest impact as NVIDIA Corp. was the Fund’s largest holding throughout the period and it was also one of the very best performers in the broad stock market. Another helpful technology stock for the Fund was Palo Alto Networks, Inc. Their focus on cyber security is a long-term theme the portfolio managers find appealing. Reflecting healthy consumer spending, Toll Brothers, Inc. in housing and Casey’s General Stores, Inc. also added to performance.

| |

Top Contributors |

| ↑ | NVIDIA Corp. |

| ↑ | Toll Brothers, Inc. |

| ↑ | Palo Alto Networks, Inc. |

| ↑ | Casey’s General Stores, Inc. |

| ↑ | Holcim Ltd. |

| |

Top Detractors |

| ↓ | Humana, Inc. |

| ↓ | ON Semiconductor Corp. |

| ↓ | GFL Environmental, Inc. |

| ↓ | Polaris, Inc. |

| ↓ | NICE Ltd. |

For the 12-month period ended May 31, 2024, the Fund’s performance was 22.05% (Market) and 22.45% (NAV) as compared to its benchmark 24.92%.

| FIS Christian Stock Fund | PAGE 1 | TSR_AR_78433H204 |

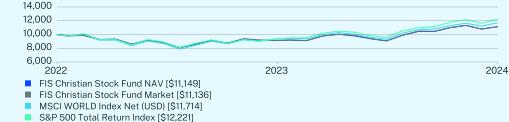

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investments. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(02/08/2022) |

FIS Christian Stock Fund NAV | 22.45 | 4.82 |

FIS Christian Stock Fund Market | 22.05 | 4.77 |

MSCI WORLD Index Net (USD) | 24.92 | 7.09 |

S&P 500 Total Return Index | 28.19 | 9.07 |

Visit https://faithinvestorservices.com/pray/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of fund shares. |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $53,537,445 |

Number of Holdings | 68 |

Net Advisory Fee | $251,201 |

Portfolio Turnover | 26% |

30-Day SEC Yield | 0.93% |

Visit https://faithinvestorservices.com/pray/ for more recent performance information.

| FIS Christian Stock Fund | PAGE 2 | TSR_AR_78433H204 |

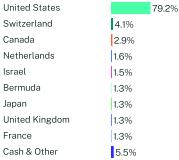

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

| |

Top 10 Issuers | |

First American Treasury Obligations Fund | 9.3% |

NVIDIA Corp. | 4.3% |

Toll Brothers, Inc. | 3.2% |

Palo Alto Networks, Inc. | 2.8% |

Intuitive Surgical, Inc. | 2.5% |

Casey’s General Stores, Inc. | 2.4% |

Holcim Ltd. | 2.4% |

Graphic Packaging Holding Co. | 2.1% |

HCA Healthcare, Inc. | 1.9% |

GFL Environmental, Inc. | 1.9% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://faithinvestorservices.com/pray/.

The Fund is distributed by Foreside Fund Services, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Faith Investor Services, LLC documents not be householded, please contact Faith Investor Services, LLC at 1-833-833-1311, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Faith Investor Services, LLC or your financial intermediary.

| FIS Christian Stock Fund | PAGE 3 | TSR_AR_78433H204 |

931891051114993189124111369187937811714926395341222121.012.111.911.411.36.25.75.02.712.779.24.12.91.61.51.31.31.31.35.5

| | |

| FIS Knights of Columbus Global Belief ETF | |

| KOCG (Principal U.S. Listing Exchange: NYSE Arca) |

| Annual Shareholder Report | May 31, 2024 |

This annual shareholder report contains important information about the FIS Knights of Columbus Global Belief ETF for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://faithinvestorservices.com/fis-kocaa-etf-kocg/. You can also request this information by contacting us at 1-833-833-1311.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| FIS Knights of Columbus Global Belief ETF | $84 | 0.75% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the 12-month period ended May 31, 2024, the Fund underperformed its benchmark, MSCI ACWI Net Total Return Index (USD). The Fund invests its asset in common stocks, real estate investment trusts (“REITs”) and short-term investments.

WHAT FACTORS INFLUENCED PERFORMANCE

For the year ended May 31, 2024, the Fund was impacted by several factors. First, restrictions prevented the Fund from owning many of the top performing benchmark names. Strategically, the Fund attempted to stay mostly neutral at the sector level, relying on the strength of our hybrid quantitative/fundamental process to drive stock selection, which was positive for the full period. Finally, a decision to reduce weight in the faltering Chinese market in the second half of 2023 was a significant driver of outperformance from Emerging Asia, the Fund’s strongest regional contributor. After a solid first quarter the Fund shifted toward more defensive positioning based on rising valuations, increased concentration, greater economic uncertainty and an over-emphasis on Federal policy. Outside of Technology and Media, the rest of the market shows broad-based weakness, particularly cyclicals and economically sensitive industries, which is suggestive of much slower growth expectations.

| |

Top Contributors |

| ↑ | Deckers Outdoor Corp. |

| ↑ | PDD Holdings, Inc. - ADR |

| ↑ | Caterpillar, Inc. |

| ↑ | DaVita, Inc |

| ↑ | Taiwan Semiconductor Manufacturing Co. Ltd. - ADR |

| |

Top Detractors |

| ↓ | Amazon.com, Inc. |

| ↓ | ICU Medical |

| ↓ | Genmab, Inc. |

| ↓ | Eli Lilly and Company |

| ↓ | Lululemon Athletica, Inc. |

For the 12-month period ended May 31, 2024, the Fund’s performance was 23.31% (Market) and 23.26% (NAV) as compared to its benchmark 23.56%.

| FIS Knights of Columbus Global Belief ETF | PAGE 1 | TSR_AR_78433H105 |

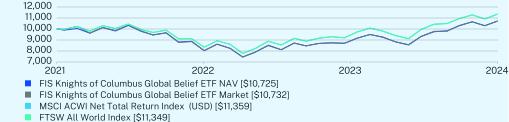

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investments. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(07/14/2021) |

FIS Knights of Columbus Global Belief ETF NAV | 23.26 | 2.46 |

FIS Knights of Columbus Global Belief ETF Market | 23.31 | 2.48 |

MSCI ACWI Net Total Return Index (USD) | 23.56 | 4.52 |

FTSW All World Index | 23.31 | 4.49 |

Visit https://faithinvestorservices.com/fis-kocaa-etf-kocg/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of fund shares. |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $23,760,172 |

Number of Holdings | 86 |

Net Advisory Fee | $158,222 |

Portfolio Turnover | 37% |

30-Day SEC Yield | 1.00% |

Visit https://faithinvestorservices.com/fis-kocaa-etf-kocg/ for more recent performance information.

| FIS Knights of Columbus Global Belief ETF | PAGE 2 | TSR_AR_78433H105 |

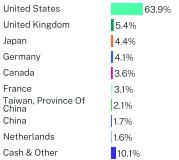

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

| |

Top 10 Issuers | |

Microsoft Corp. | 5.2% |

Apple, Inc. | 4.7% |

NVIDIA Corp. | 3.9% |

Alphabet, Inc. | 3.1% |

Meta Platforms, Inc. | 2.1% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 2.1% |

First American Treasury Obligations Fund | 1.8% |

Berkshire Hathaway, Inc. | 1.7% |

Broadcom, Inc. | 1.6% |

Visa, Inc. | 1.6% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://faithinvestorservices.com/fis-kocaa-etf-kocg/.

The Fund is distributed by Foreside Fund Services, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Faith Investor Services, LLC documents not be householded, please contact Faith Investor Services, LLC at 1-833-833-1311, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Faith Investor Services, LLC or your financial intermediary.

| FIS Knights of Columbus Global Belief ETF | PAGE 3 | TSR_AR_78433H105 |

888487011072588518704107329115919311359912692041134924.617.612.09.49.08.45.54.53.55.563.95.44.44.13.63.12.11.71.610.1

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. John Jacobs is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and/or other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. “Other services” refer to other services rendered by the Registrant’s principal accountant to the Registrant other than those reported under the “audit services”, “audit-related services”, and “tax services”. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 5/31/24 | FYE 5/31/23 |

| (a) Audit Fees | $21,000 | $20,000 |

| (b) Audit-Related Fees | None | None |

| (c) Tax Fees | $6,000 | $6,000 |

| (d) All Other Fees (Seed Audit) | None | None |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 5/31/24 | FYE 5/31/23 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not Applicable.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 5/31/24 | FYE 5/31/23 |

| Registrant | None | None |

| Registrant’s Investment Adviser | None | None |

(h) Because no non-audit services were rendered, the audit committee of the registrant’s board of trustees did not consider whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee, are as follows: Sharon Cheever, John Jacobs, Richard Keary and Robert Sherry.

Item 6. Investments.

(a) Schedule of Investments is included within the financial statements filed under Item 7(a) of this Form.

(b) Not Applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

(a) The Registrant’s Financial Statements are filed herewith.

Financial Statements

May 31, 2024

| | | | | | | |

NEOS ETF Trust | | | | | | |

FIS Christian Stock Fund | | | | PRAY | | | | NYSE Arca |

FIS Knights of Columbus Global Belief ETF | | | | KOCG | | | | NYSE Arca |

| | | | | | | |

Back to Table of Contents

FIS Christian Stock Fund

Schedule of Investments

as of May 31, 2024

| | | | | | | |

COMMON STOCKS - 88.6%

| | | | | | |

Aerospace & Defense - 0.8%

| | | | | | |

Huntington Ingalls Industries, Inc. | | | 1,610 | | | $407,491 |

Automobile Components - 1.0%

| | | | | | |

Gentex Corp. | | | 15,300 | | | 535,500 |

Automobiles - 0.1%

| | | | | | |

Dr. Ing. h.c.F. Porsche AG - ADR | | | 9,655 | | | 79,461 |

Banks - 1.2%

| | | | | | |

HDFC Bank Ltd. - ADR | | | 11,051 | | | 639,742 |

Biotechnology - 0.3%

| | | | | | |

BioMarin Pharmaceutical, Inc.(a) | | | 2,402 | | | 180,318 |

Capital Markets - 4.1%

| | | | | | |

Blue Owl Capital, Inc. - Class A | | | 31,985 | | | 575,410 |

FactSet Research Systems, Inc. | | | 1,960 | | | 792,350 |

Intercontinental Exchange, Inc. | | | 6,145 | | | 822,815 |

| | | | | | 2,190,575 |

Commercial Services & Supplies - 2.8%

|

GFL Environmental, Inc. | | | 32,149 | | | 1,011,729 |

Republic Services, Inc. | | | 2,749 | | | 509,087 |

| | | | | | 1,520,816 |

Construction Materials - 2.4%

| | | | | | |

Holcim Ltd.(a) | | | 72,590 | | | 1,271,777 |

Consumer Staples Distribution & Retail - 4.0%

|

Casey’s General Stores, Inc. | | | 3,920 | | | 1,300,578 |

Costco Wholesale Corp. | | | 1,050 | | | 850,384 |

| | | | | | 2,150,962 |

Containers & Packaging - 2.1%

| | | | | | |

Graphic Packaging Holding Co. | | | 39,200 | | | 1,110,144 |

Diversified Consumer Services - 1.1%

|

Grand Canyon Education, Inc.(a) | | | 4,145 | | | 590,497 |

Diversified Telecommunication Services - 2.1%

|

Cellnex Telecom SA - ADR | | | 19,405 | | | 356,858 |

Cogent Communications Holdings, Inc. | | | 12,740 | | | 754,463 |

| | | | | | 1,111,321 |

Electronic Equipment, Instruments & Components - 0.7%

|

Trimble, Inc.(a) | | | 6,875 | | | 382,800 |

Energy Equipment & Services - 2.9%

|

SBM Offshore NV | | | 56,533 | | | 868,417 |

Tenaris SA - ADR | | | 20,017 | | | 659,960 |

| | | | | | 1,528,377 |

| | | | | | | |

| | | | | | | |

Financial Services - 2.4%

| | | | | | |

Corpay, Inc.(a) | | | 2,211 | | | $591,818 |

Equitable Holdings, Inc. | | | 17,260 | | | 716,118 |

| | | | | | 1,307,936 |

Food Products - 1.5%

| | | | | | |

Bunge Global SA | | | 7,265 | | | 781,641 |

Ground Transportation - 2.1%

| | | | | | |

Canadian Pacific Kansas City Ltd. | | | 6,860 | | | 544,410 |

Old Dominion Freight Line, Inc. | | | 3,266 | | | 572,366 |

| | | | | | 1,116,776 |

Health Care Equipment & Supplies - 5.4%

|

Dexcom, Inc.(a) | | | 3,610 | | | 428,760 |

Edwards Lifesciences Corp.(a) | | | 6,468 | | | 562,004 |

Intuitive Surgical, Inc.(a) | | | 3,366 | | | 1,353,536 |

Stryker Corp. | | | 1,610 | | | 549,155 |

| | | | | | 2,893,455 |

Health Care Providers & Services - 3.7%

|

Chemed Corp. | | | 1,764 | | | 977,909 |

HCA Healthcare, Inc. | | | 3,000 | | | 1,019,250 |

| | | | | | 1,997,159 |

Hotels, Restaurants & Leisure - 1.1%

|

Domino’s Pizza, Inc. | | | 1,181 | | | 600,633 |

Household Durables - 5.0%

| | | | | | |

Lennar Corp. - Class A | | | 5,950 | | | 954,083 |

Toll Brothers, Inc. | | | 13,952 | | | 1,697,121 |

| | | | | | 2,651,204 |

Household Products - 0.7%

| | | | | | |

Energizer Holdings, Inc. | | | 13,020 | | | 372,632 |

Insurance - 3.7%

| | | | | | |

Aflac, Inc. | | | 7,492 | | | 673,306 |

AIA Group Ltd. - ADR | | | 19,641 | | | 612,013 |

Everest Re Group Ltd. | | | 1,817 | | | 710,320 |

| | | | | | 1,995,639 |

IT Services - 1.0%

| | | | | | |

Cognizant Technology Solutions Corp. - Class A | | | 8,278 | | | 547,590 |

Leisure Products - 0.0%(b)

|

Polaris, Inc. | | | 56 | | | 4,682 |

Life Sciences Tools & Services - 1.4%

|

Danaher Corp. | | | 2,819 | | | 723,919 |

Machinery - 1.9%

| | | | | | |

AGCO Corp. | | | 4,313 | | | 462,914 |

Parker-Hannifin Corp. | | | 1,000 | | | 531,520 |

| | | | | | 994,434 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

FIS Christian Stock Fund

Schedule of Investments

as of May 31, 2024 (Continued)

| | | | | | | | |

COMMON STOCKS - (Continued)

| |

Metals & Mining - 1.2%

| | | | | | | |

Freeport-McMoRan, Inc. | | | 11,850 | | | $624,850 | |

Multi-Utilities - 1.3%

| | | | | | | |

Engie SA - ADR | | | 40,199 | | | 680,167 | |

Oil, Gas & Consumable Fuels - 2.1%

| |

ConocoPhillips | | | 5,376 | | | 626,197 | |

EOG Resources, Inc. | | | 4,124 | | | 513,644 | |

| | | | | | 1,139,841 | |

Pharmaceuticals - 1.3%

| | | | | | | |

Zoetis, Inc. | | | 4,130 | | | 700,283 | |

Professional Services - 2.2%

| | | | | | | |

FTI Consulting, Inc.(a) | | | 2,352 | | | 505,210 | |

RELX PLC - ADR | | | 15,876 | | | 697,909 | |

| | | | | | 1,203,119 | |

Semiconductors & Semiconductor Equipment - 7.9%

| |

Broadcom, Inc. | | | 316 | | | 419,822 | |

NVIDIA Corp. | | | 2,121 | | | 2,325,316 | |

ON Semiconductor Corp.(a) | | | 12,003 | | | 876,699 | |

Skyworks Solutions, Inc. | | | 6,346 | | | 588,020 | |

| | | | | | 4,209,857 | |

Software - 6.9%

| | | | | | | |

Check Point Software Technologies Ltd.(a) | | | 5,293 | | | 796,597 | |

Datadog, Inc. - Class A(a) | | | 4,535 | | | 499,666 | |

Palo Alto Networks, Inc.(a) | | | 5,138 | | | 1,515,248 | |

ServiceNow, Inc.(a) | | | 1,380 | | | 906,563 | |

| | | | | | 3,718,074 | |

Specialty Retail - 3.6%

| | | | | | | |

Lowe’s Cos., Inc. | | | 4,518 | | | 999,788 | |

Valvoline, Inc.(a) | | | 22,974 | | | 932,745 | |

| | | | | | 1,932,533 | | | |

Technology Hardware, Storage & Peripherals - 4.5%

| |

FUJIFILM Holdings Corp. - ADR | | | 61,911 | | | 702,999 | |

Logitech International SA | | | 9,247 | | | 924,793 | |

NetApp, Inc. | | | 6,670 | | | 803,268 | |

| | | | | | 2,431,060 | | | |

Trading Companies & Distributors - 1.5%

| |

United Rentals, Inc. | | | 1,220 | | | 816,680 | |

Wireless Telecommunication Services - 0.6%

| |

Tele2 AB - Class B | | | 32,340 | | | 315,491 | |

TOTAL COMMON STOCKS (Cost $39,807,952) | | | | | | 47,459,436 | |

| | | | | | | | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - 1.6%

| |

American Tower Corp. | | | 2,352 | | | $460,381 | |

Americold Realty Trust, Inc. | | | 14,970 | | | 399,250 | |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $891,610) | | | | | | 859,631 | |

SHORT-TERM INVESTMENTS - 9.3%

| |

Money Market Funds - 9.3%

| | | | | | | |

First American Treasury Obligations Fund - Class X, 5.22%(c) | | | 4,960,830 | | | 4,960,830 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $4,960,830) | | | | | | 4,960,830 | |

TOTAL INVESTMENTS - 99.5% (Cost $45,660,392) | | | | | | $53,279,897 | |

Other Assets in Excess of

Liabilities - 0.5% | | | | | | 257,548 | | | |

TOTAL NET ASSETS - 100.0% | | | | | | $53,537,445 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Non-income producing security. |

(b)

| Represents less than 0.05% of net assets. |

(c)

| The rate shown represents the 7-day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

FIS Knights of Columbus Global Belief ETF

Schedule of Investments

as of May 31, 2024

| | | | | | | |

COMMON STOCKS - 97.3%

|

Aerospace & Defense - 2.0%

| | | | | | |

BAE Systems PLC | | | 15,710 | | | $278,428 |

Northrop Grumman Corp. | | | 424 | | | 191,127 |

| | | | | | 469,555 |

Automobiles - 3.3%

| | | | | | |

General Motors Co. | | | 5,192 | | | 233,588 |

Honda Motor Co. Ltd. | | | 17,480 | | | 196,830 |

Mercedes-Benz Group AG | | | 3,138 | | | 226,199 |

Tesla, Inc.(a) | | | 680 | | | 121,094 |

| | | | | | 777,711 |

Banks - 7.9%

| | | | | | |

BNP Paribas SA | | | 2,913 | | | 214,091 |

CaixaBank SA | | | 35,617 | | | 203,769 |

Citigroup, Inc. | | | 3,877 | | | 241,576 |

Citizens Financial Group, Inc. | | | 5,152 | | | 181,814 |

KB Financial Group, Inc. - ADR | | | 4,416 | | | 254,097 |

Lloyds Banking Group PLC | | | 333,626 | | | 235,834 |

United Overseas Bank Ltd. | | | 10,580 | | | 240,999 |

Wells Fargo & Co. | | | 5,220 | | | 312,782 |

| | | | | | 1,884,962 |

Broadline Retail - 1.4%

| | | | | | |

MercadoLibre, Inc.(a) | | | 94 | | | 162,205 |

PDD Holdings, Inc. - ADR(a) | | | 1,126 | | | 168,652 |

| | | | | | 330,857 |

Capital Markets - 1.2%

| | | | | | |

Goldman Sachs Group, Inc. | | | 610 | | | 278,477 |

Chemicals - 1.1%

| | | | | | |

Linde PLC | | | 573 | | | 249,553 |

Commercial Services & Supplies - 0.9%

|

Copart, Inc.(a) | | | 3,950 | | | 209,587 |

Communications Equipment - 0.9%

|

Motorola Solutions, Inc. | | | 549 | | | 200,336 |

Construction & Engineering - 2.2%

|

Quanta Services, Inc. | | | 1,240 | | | 342,165 |

Stantec, Inc. | | | 2,352 | | | 189,796 |

| | | | | | 531,961 |

Construction Materials - 0.8%

| | | | | | |

CRH PLC | | | 2,560 | | | 199,410 |

Consumer Finance - 1.4%

| | | | | | |

American Express Co. | | | 1,400 | | | 336,000 |

| | | | | | | |

| | | | | | | |

Consumer Staples Distribution & Retail - 1.8%

|

BJ’s Wholesale Club Holdings, Inc.(a) | | | 2,266 | | | $ 199,567 |

Target Corp. | | | 1,472 | | | 229,867 |

| | | | | | 429,434 |

Diversified Telecommunication Services - 0.9%

|

Deutsche Telekom AG | | | 9,096 | | | 220,105 |

Electric Utilities - 0.9%

| | | | | | |

Entergy Corp. | | | 1,881 | | | 211,594 |

Electrical Equipment - 0.8%

| | | | | | |

Fuji Electric Co. Ltd. | | | 3,060 | | | 181,990 |

Entertainment - 2.2%

| | | | | | |

Netflix, Inc.(a) | | | 430 | | | 275,897 |

Walt Disney Co. | | | 2,263 | | | 235,148 |

| | | | | | 511,045 |

Financial Services - 3.3%

| | | | | | |

Berkshire Hathaway, Inc.

- Class B(a) | | | 999 | | | 413,985 |

Visa, Inc. - Class A | | | 1,380 | | | 375,995 |

| | | | | | 789,980 |

Food Products - 2.5%

| | | | | | |

Campbell Soup Co. | | | 3,172 | | | 140,773 |

General Mills, Inc. | | | 3,328 | | | 228,800 |

Mondelez International, Inc.

- Class A | | | 3,417 | | | 234,167 |

| | | | | | 603,740 |

Ground Transportation - 1.0%

| | | | | | |

Union Pacific Corp. | | | 1,063 | | | 247,488 |

Health Care Equipment & Supplies - 4.1%

|

Hoya Corp. | | | 1,658 | | | 201,098 |

Insulet Corp.(a) | | | 661 | | | 117,123 |

Intuitive Surgical, Inc.(a) | | | 600 | | | 241,272 |

Medtronic PLC | | | 2,066 | | | 168,110 |

Sonova Holding AG | | | 755 | | | 238,346 |

| | | | | | 965,949 |

Health Care Providers & Services - 2.1%

|

Cencora, Inc. | | | 1,283 | | | 290,689 |

DaVita, Inc.(a) | | | 1,359 | | | 199,936 |

| | | | | | 490,625 |

Hotels, Restaurants & Leisure - 0.8%

|

Darden Restaurants, Inc. | | | 1,288 | | | 193,702 |

Industrial Conglomerates - 2.0%

|

3M Co. | | | 2,248 | | | 225,115 |

Siemens AG | | | 1,292 | | | 247,221 |

| | | | | | 472,336 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

FIS Knights of Columbus Global Belief ETF

Schedule of Investments

as of May 31, 2024 (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Insurance - 3.8%

| | | | | | |

American International Group, Inc. | | | 3,053 | | | $240,638 |

Hartford Financial Services Group, Inc. | | | 2,554 | | | 264,211 |

Manulife Financial Corp. | | | 9,098 | | | 236,268 |

Mapfre SA | | | 69,256 | | | 166,157 |

| | | | | | 907,274 |

Interactive Media & Services - 6.3%

|

Alphabet, Inc. - Class A(a) | | | 4,248 | | | 732,780 |

Meta Platforms, Inc. - Class A | | | 1,081 | | | 504,643 |

Tencent Holdings Ltd. | | | 5,655 | | | 260,077 |

| | | | | | 1,497,500 |

IT Services - 0.8%

| | | | | | |

Infosys Ltd. - ADR | | | 11,568 | | | 193,764 |

Machinery - 1.0%

| | | | | | |

Caterpillar, Inc. | | | 724 | | | 245,088 |

Metals & Mining - 0.9%

| | | | | | |

BHP Group Ltd. | | | 7,568 | | | 224,023 |

Multi-Utilities - 1.0%

| | | | | | |

Veolia Environnement SA | | | 7,301 | | | 243,327 |

Oil, Gas & Consumable Fuels - 4.5%

|

Canadian Natural Resources Ltd. | | | 3,603 | | | 276,737 |

Cheniere Energy, Inc. | | | 1,118 | | | 176,409 |

ConocoPhillips | | | 1,996 | | | 232,494 |

Equinor ASA | | | 5,598 | | | 161,439 |

Shell PLC | | | 5,890 | | | 210,839 |

| | | | | | 1,057,918 |

Paper & Forest Products - 0.7%

|

Suzano SA - ADR | | | 18,088 | | | 169,123 |

Personal Care Products - 1.2%

|

Unilever PLC | | | 5,200 | | | 283,298 |

Pharmaceuticals - 2.2%

| | | | | | |

Ipsen SA | | | 2,140 | | | 280,176 |

Zoetis, Inc. | | | 1,396 | | | 236,706 |

| | | | | | 516,882 |

Real Estate Management & Development - 0.9%

|

Mitsui Fudosan Co. Ltd. | | | 23,352 | | | 214,061 |

Semiconductors & Semiconductor Equipment - 9.2%

|

ASML Holding NV | | | 392 | | | 370,573 |

Broadcom, Inc. | | | 295 | | | 391,922 |

NVIDIA Corp. | | | 848 | | | 929,688 |

| | | | | | | |

| | | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 3,312 | | | $500,245 |

| | | | | | 2,192,428 |

Software - 8.4%

| | | | | | |

Microsoft Corp. | | | 2,976 | | | 1,235,427 |

Salesforce, Inc. | | | 977 | | | 229,048 |

SAP SE | | | 1,611 | | | 290,248 |

ServiceNow, Inc.(a) | | | 368 | | | 241,750 |

| | | | | | 1,996,473 |

Specialty Retail - 1.8%

| | | | | | |

TJX Cos., Inc. | | | 2,687 | | | 277,030 |

Ulta Beauty, Inc.(a) | | | 402 | | | 158,826 |

| | | | | | 435,856 |

Technology Hardware, Storage & Peripherals - 5.3%

|

Apple, Inc. | | | 5,824 | | | 1,119,664 |

Xiaomi Corp. - Class B(a)(b) | | | 60,310 | | | 134,753 |

| | | | | | 1,254,417 |

Textiles, Apparel & Luxury Goods - 1.7%

|

Deckers Outdoor Corp.(a) | | | 241 | | | 263,634 |

Lululemon Athletica, Inc.(a) | | | 423 | | | 131,972 |

| | | | | | 395,606 |

Trading Companies & Distributors - 2.1%

|

Ferguson PLC | | | 1,264 | | | 255,884 |

ITOCHU Corp. | | | 5,168 | | | 243,691 |

| | | | | | 499,575 |

TOTAL COMMON STOCKS (Cost $18,808,407) | | | | | | 23,113,010 |

REAL ESTATE INVESTMENT TRUSTS - 0.6%

|

VICI Properties, Inc. | | | 4,976 | | | 142,861 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $165,204) | | | | | | 142,861 |

SHORT-TERM INVESTMENTS - 1.8%

|

Money Market Funds - 1.8%

| | | | | | |

First American Treasury Obligations Fund - Class X, 5.22%(c) | | | 439,340 | | | 439,340 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $439,340) | | | | | | 439,340 |

TOTAL INVESTMENTS - 99.7%

(Cost $19,412,951) | | | | | | $23,695,211 |

Other Assets in Excess of

Liabilities - 0.3% | | | | | | 64,961 |

TOTAL NET ASSETS - 100.0% | | | | | | $23,760,172 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

FIS Knights of Columbus Global Belief ETF

Schedule of Investments

as of May 31, 2024 (Continued)

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

ASA - Advanced Subscription Agreement

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Non-income producing security. |

(b)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of May 31, 2024, the value of these securities total $134,753 or 0.6% of the Fund’s net assets. |

(c)

| The rate shown represents the 7-day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

NEOS ETF Trust

Statements of Assets and Liabilities

May 31, 2024

| | | | | | | |

ASSETS:

| |

Investments, at value | | | $53,279,897 | | | $23,695,211 |

Dividends and interest receivable | | | 156,334 | | | 79,930 |

Foreign currency, at value | | | 131,813 | | | — |

Total assets | | | 53,568,044 | | | 23,775,141 |

LIABILITIES:

| |

Payable to adviser | | | 30,599 | | | 14,969 |

Total liabilities | | | 30,599 | | | 14,969 |

NET ASSETS | | | $53,537,445 | | | $23,760,172 |

NET ASSETS CONSISTS OF:

| |

Paid-in capital | | | $48,647,683 | | | $22,993,704 |

Total distributable earnings | | | 4,889,762 | | | 766,468 |

Total net assets | | | $53,537,445 | | | $23,760,172 |

Net assets | | | $53,537,445 | | | $23,760,172 |

Shares issued and outstanding(a) | | | 1,960,000 | | | 920,000 |

Net asset value per share | | | $27.32 | | | $25.83 |

COST:

| |

Investments, at cost | | | $45,660,392 | | | $19,412,951 |

Foreign currency, at cost | | | $131,426 | | | $— |

(a)

| Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

NEOS ETF Trust

Statements of Operations

For the Year Ended May 31, 2024

| | | | | | | |

INVESTMENT INCOME:

| | | | | | |

Dividend income | | | $512,070 | | | $416,387 |

Less: Dividend withholding taxes | | | (20,102) | | | (32,243) |

Interest income | | | 162,828 | | | 41,701 |

Total investment income | | | 654,796 | | | 425,845 |

|

EXPENSES:

| | | | | | |

Investment advisory fee | | | 251,201 | | | 158,222 |

Total expenses | | | 251,201 | | | 158,222 |

NET INVESTMENT INCOME | | | 403,595 | | | 267,623 |

|

REALIZED AND UNREALIZED GAIN

| | | | | | |

Net realized loss from:

| | | | | | |

Investments | | | (348,647) | | | (413,789) |

Foreign currency transaction | | | (1,408) | | | (7,896) |

Net realized loss | | | (350,055) | | | (421,685) |

Net change in unrealized appreciation on:

| | | | | | |

Investments | | | 7,126,181 | | | 4,632,618 |

Foreign currency translation | | | 2,099 | | | 836 |

Net change in unrealized appreciation | | | 7,128,280 | | | 4,633,454 |

Net realized and unrealized gain | | | 6,778,225 | | | 4,211,769 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $7,181,820 | | | $4,479,392 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

NEOS ETF Trust

Statements of Changes in Net Assets

| | | | | | | |

OPERATIONS:

|

Net investment income | | | $403,595 | | | $258,514 | | | $267,623 | | | $398,365 |

Net realized loss | | | (350,055) | | | (2,538,155) | | | (421,685) | | | (1,973,953) |

Net change in unrealized appreciation | | | 7,128,280 | | | 1,577,456 | | | 4,633,454 | | | 1,121,300 |

Net increase (decrease) in net assets from operations | | | 7,181,820 | | | (702,185) | | | 4,479,392 | | | (454,288) |

DISTRIBUTIONS TO SHAREHOLDERS:

|

Distributions to shareholders | | | (293,011) | | | (246,634) | | | (322,880) | | | (352,859) |

Total distributions to shareholders | | | (293,011) | | | (246,634) | | | (322,880) | | | (352,859) |

CAPITAL TRANSACTIONS:

| | | | | | | | | | | | |

Subscriptions | | | 23,931,108 | | | 3,215,233 | | | 674,262 | | | 189,931 |

Redemptions | | | — | | | (4,008,482) | | | — | | | (1,272,618) |

Net increase (decrease) in net assets from capital transactions | | | 23,931,108 | | | (793,249) | | | 674,262 | | | (1,082,687) |

NET INCREASE (DECREASE) IN NET ASSETS | | | 30,819,917 | | | (1,742,068) | | | 4,830,774 | | | (1,889,834) |

NET ASSETS:

|

Beginning of the year | | | 22,717,528 | | | 24,459,596 | | | 18,929,398 | | | 20,819,232 |

End of the year | | | $53,537,445 | | | $22,717,528 | | | $23,760,172 | | | $18,929,398 |

SHARES TRANSACTIONS

|

Subscriptions | | | 950,000 | | | 150,000 | | | 30,000 | | | 10,000 |

Redemptions | | | — | | | (190,000) | | | — | | | (60,000) |

Total increase (decrease) in shares outstanding | | | 950,000 | | | (40,000) | | | 30,000 | | | (50,000) |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

FIS Christian Stock Fund

Financial Highlights

| | | | | | | |

PER SHARE DATA:

| | | | | | | | | |

Net asset value, beginning of period | | | $22.49 | | | $23.29 | | | $25.00 |

|

INVESTMENTS OPERATIONS:

| | | | | | | | | |

Net investment income(b) | | | 0.28 | | | 0.26 | | | 0.16 |

Net realized and unrealized gain (loss) on investments | | | 4.76 | | | (0.80) | | | (1.88) |

Total from investment operations | | | 5.04 | | | (0.54) | | | (1.72) |

|

LESS DISTRIBUTIONS FROM:

| | | | | | | | | |

From net investment income | | | (0.21) | | | (0.26) | | | — |

Total distributions | | | (0.21) | | | (0.26) | | | — |

ETF transaction fees per share | | | 0.00(c) | | | — | | | 0.01 |

Net asset value, end of period | | | $27.32 | | | $22.49 | | | $23.29 |

TOTAL RETURN(d) | | | 22.45% | | | (2.29)% | | | (6.82)% |

|

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | |

Net assets, end of period (in thousands) | | | $53,537 | | | $22,718 | | | $24,460 |

Ratio of expenses to average net assets(e) | | | 0.68% | | | 0.68% | | | 0.68% |

Ratio of net investment income to average net assets(e) | | | 1.09% | | | 1.18% | | | 2.14% |

Portfolio turnover rate(d)(f) | | | 26% | | | 27% | | | 14% |

| | | | | | | | | | |

(a)

| Inception date of the Fund was February 8, 2022. |

(b)

| Net investment income per share has been calculated based on average shares outstanding during the year or period. |

(c)

| Amount represents less than $0.005 per share. |

(d)

| Not annualized for periods less than one year. |

(e)

| Annualized for periods less than one year. |

(f)

| Portfolio turnover rate exclude in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

FIS Knights of Columbus Global Belief ETF

Financial Highlights

| | | | | | | |

PER SHARE DATA:

| | | | | | | | | |

Net asset value, beginning of period | | | $21.27 | | | $22.15 | | | $25.00 |

|

INVESTMENTS OPERATIONS:

| | | | | | | | | |

Net investment income(b) | | | 0.30 | | | 0.44 | | | 0.31 |

Net realized and unrealized gain (loss) on investments | | | 4.61 | | | (0.92) | | | (3.09) |

Total from investment operations | | | 4.91 | | | (0.48) | | | (2.78) |

|

LESS DISTRIBUTIONS FROM:

| | | | | | | | | |

From net investment income | | | (0.35) | | | (0.40) | | | (0.07) |

Total distributions | | | (0.35) | | | (0.40) | | | (0.07) |

Net asset value, end of period | | | $25.83 | | | $21.27 | | | $22.15 |

TOTAL RETURN(c) | | | 23.26% | | | (2.06)% | | | (11.16)% |

|

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | |

Net assets, end of period (in thousands) | | | $23,760 | | | $18,929 | | | $20,819 |

Ratio of expenses to average net assets(d) | | | 0.75% | | | 0.75% | | | 0.75% |

Ratio of net investment income to average net assets(d) | | | 1.27% | | | 2.15% | | | 1.44% |

Portfolio turnover rate(c)(e) | | | 37% | | | 39% | | | 35% |

| | | | | | | | | | |

(a)

| Inception date of the Fund was July 14, 2021. |

(b)

| Net investment income per share has been calculated based on average shares outstanding during the year or period. |

(c)

| Not annualized for periods less than one year. |

(d)

| Annualized for periods less than one year. |

(e)

| Portfolio turnover rate exclude in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

NEOS ETF Trust

Notes to the Financial Statements

May 31, 2024

NOTE 1 – ORGANIZATION

The NEOS ETF Trust (the “Trust”), formerly the SHP ETF Trust, was organized as a Delaware statutory trust on February 1, 2021 and is authorized to issue multiple series or portfolios. The Trust is an open-end investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust currently consists of thirteen operational exchange-traded funds (“ETFs”), two of which are presented herein, FIS Christian Stock Fund (the “Christian Stock Fund”), formerly the FIS Biblically Responsible Risk Managed ETF, and FIS Knights of Columbus Global Belief ETF (the “Knights of Columbus ETF”) (collectively, the “Funds” or individually, a “Fund”). These financial statements relate only to the Funds. The Funds are each a diversified series of the Trust. The investment objective of the Knights of Columbus ETF is to seek income and long-term growth of capital; the investment objective of the Christian Stock Fund is to seek long-term growth of capital and income.

Faith Investor Services, LLC (the “Adviser”) is the investment adviser to each Fund.

Capital Insight Partners, LLC acts as the sub-adviser to the Christian Stock Fund.

Knights of Columbus Asset Advisors LLC acts as the sub-adviser to the Knights of Columbus ETF.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Trust follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies” including Accounting Standards Update 2013-08.

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. These financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

A.

| Investment Valuation. The net asset value (“NAV”) of each Fund’s shares is calculated each business day as of the close of regular trading on the New York Stock Exchange (“NYSE”), generally 4:00 p.m., Eastern Time. NAV per share is computed by dividing the net assets of each Fund by each Fund’s number of shares outstanding. |

When calculating the NAV of each Fund’s shares, securities held by the Funds are valued at market quotations when reliable market quotations are readily available. Exchange traded securities and instruments (including equity securities, depositary receipts and ETFs) are generally valued at the last reported sale price on the principal exchange on which such securities are traded (at the NASDAQ Official Closing Price for NASDAQ listed securities), as of the close of regular trading on the NYSE on the day the securities are being valued or, if there are no sales, at the mean of the most recent bid and asked prices. Over-the-counter securities and instruments not traded on an exchange are generally valued at the last traded price. Investments in open-end regulated investment companies are valued at NAV. In the absence of a recorded transaction sale price; or if the last sale price is unavailable, securities are valued at the mean between last bid and ask, as quoted. If an ask price is unavailable, the last bid price is used. Such valuations would typically be categorized as Level 1 or Level 2 in the fair value hierarchy described below.

When reliable market quotations are not readily available, securities are priced at their fair value as determined in good faith by the Adviser in accordance with the Trust’s valuation guidelines. Pursuant to Rule 2a-5 under the 1940 Act, each Fund has designated the Adviser as its “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable. The Funds may use fair value pricing in a variety of circumstances, including but not limited to, situations when the value of a security has been materially affected by events occurring after the close of the market on which such security is principally traded (such as a corporate action or other news that may materially affect the price of such security) or trading in such security has been suspended or halted. Such valuations would typically be categorized as Level 2 or Level 3 in the fair value hierarchy

Back to Table of Contents

NEOS ETF Trust

Notes to the Financial Statements

May 31, 2024 (Continued)

described below. Fair value pricing involves subjective judgments and it is possible that a fair value determination for a security is materially different than the value that could be realized upon the sale of such security. As of May 31, 2024, there were no securities held by either Fund that were internally fair valued and/or valued using a Level 2 or Level 3 valuation.

The Funds disclose the fair value of their investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Funds (observable inputs) and (2) the Funds’ own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the hierarchy are as follows:

Level 1 –

Quoted prices in active markets for identical assets that the Funds have the ability to access.

Level 2 –

Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 –

Significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value each Fund’s investments as of May 31, 2024:

FIS Christian Stock Fund

| | | | | | | | | | | | | |

Assets:

| | | | | | | | | | | | |

Common Stocks | | | $47,459,436 | | | $ — | | | $ — | | | $47,459,436 |

Real Estate Investment Trusts | | | 859,631 | | | — | | | — | | | 859,631 |

Money Market Funds | | | 4,960,830 | | | — | | | — | | | 4,960,830 |

Total Assets | | | $53,279,897 | | | $ — | | | $ — | | | $53,279,897 |

| | | | | | | | | | | | | |

Refer to the Schedule of Investments for industry classifications.

FIS Knights of Columbus Global Belief ETF

| | | | | | | | | | | | | |

Assets:

| | | | | | | | | | | | |

Common Stocks | | | $23,113,010 | | | $ — | | | $ — | | | $23,113,010 |

Real Estate Investment Trusts | | | 142,861 | | | — | | | — | | | 142,861 |

Money Market Funds | | | 439,340 | | | — | | | — | | | 439,340 |

Total Assets | | | $23,695,211 | | | $— | | | $— | | | $23,695,211 |

| | | | | | | | | | | | | |

Refer to the Schedule of Investments for industry classifications.

B.

| Foreign Currency Translation. The books and records of the Funds are maintained in U.S. dollars. The Funds’ assets and liabilities in foreign currencies are translated into U.S. dollars at the prevailing exchange rate at the valuation date. Transactions denominated in foreign currencies are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The Funds’ income earned and expenses incurred in foreign denominated currencies are translated into U.S. dollars at the prevailing exchange rate on the date of such activity. |

The Funds do not isolate that portion of the results of operations arising from changes in the foreign exchange rates on investments from the fluctuations that result from changes in the market prices of investments held

Back to Table of Contents

NEOS ETF Trust

Notes to the Financial Statements

May 31, 2024 (Continued)

or sold during the period. Accordingly, such foreign currency gains (losses) are included in the reported net realized gain (loss) on investments in securities and net change in unrealized appreciation (depreciation) on investments in securities on the Statements of Operations.

Net realized gains (losses) on foreign currency transactions reported on the Statements of Operations arise from sales of foreign currency, including foreign exchange contracts, net currency gains and losses realized between the trade and settlement dates on securities transactions and the difference in the amounts of dividends and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid. Net changes in unrealized appreciation (depreciation) on translation of assets and liabilities denominated in foreign currencies reported on the Statements of Operations arise from changes (due to the changes in the exchange rate) in the value of foreign currency and assets and liabilities (other than investments) denominated in foreign currencies, which are held at year end.

C.

| Use of Estimates. The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statement. Actual results could differ from those estimates. |

D.

| Federal Income Taxes. Each Fund intends to qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended. If so qualified, the Funds will not be subject to federal income tax to the extent each Fund distributes substantially all its taxable net investment income and net capital gains to its shareholders. Therefore, no provision for federal income tax should be required. Management of the Funds is required to determine whether a tax position taken by the Funds is more likely than not to be sustained upon examination by the applicable taxing authority. Based on its analysis, Management has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements as of May 31, 2024. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. Management of the Funds are required to determine whether a tax position taken by the Funds is more likely than not to be sustained upon examination by the applicable taxing authority. Based on its analysis, Management has concluded that the Funds do not have any unrecognized tax benefits or uncertain tax positions that would require a provision for income tax. Accordingly, the Funds did not incur any interest or penalties for the year ended May 31, 2024. |

E.

| Distributions to Shareholders. Each Fund expects to declare and distribute all of its net investment income, if any, to shareholders as dividends annually. The Funds will distribute net realized capital gains, if any, at least annually. The Funds may distribute such income dividends and capital gains more frequently, if necessary, to reduce or eliminate federal excise or income taxes on the Funds. The amount of any distribution will vary, and there is no guarantee the Funds will pay either an income dividend or a capital gains distribution. |

F.

| Reclassification of Capital Accounts. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share and are primarily due to differing book and tax treatments for in-kind redemptions. For the year ended May 31, 2024, there were no adjustments between distributable earnings (accumulated loss) and paid-in capital. |

NOTE 3 – INVESTMENT ADVISORY AND OTHER AGREEMENTS

Management

The Adviser acts as each Fund’s investment adviser pursuant to an investment advisory agreement with the Trust (the “Investment Advisory Agreement”).

Capital Insight Partners, LLC acts as the sub-adviser to the Christian Stock Fund and Knights of Columbus Asset Advisors LLC acts as the sub-adviser to the Knights of Columbus ETF (the “Sub-Advisers”) pursuant to investment sub-advisory agreements with the Adviser (the “Sub-Advisory-Agreements”).

Back to Table of Contents

NEOS ETF Trust

Notes to the Financial Statements

May 31, 2024 (Continued)

Under the terms of the Investment Advisory Agreement between the Trust, on behalf of the Funds, and the Adviser, the Adviser provides investment management services to the Funds and oversees the day-to-day operations of the Funds, subject to the supervision of the Board of Trustees (the “Board”) and the officers of the Trust. The Adviser administers the Funds’ business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services. The Adviser, on behalf of the Funds, has entered into Sub-Advisory Agreements with each of the Sub-Advisers. The Sub-Advisers are responsible for the day-to-day management of their specific Fund’s portfolios, subject to the supervision and oversight of the Adviser and the Board. The Adviser oversees the Sub-Advisers for compliance with the Funds’ investment objectives, policies, strategies and restrictions. The Board oversees the Adviser and the Sub-Advisers, establishes policies that they must follow in their advisory activities, and oversees the hiring and termination of sub-advisers recommended by the Adviser.

Pursuant to the Investment Advisory Agreement, the Christian Stock Fund pays the Adviser a monthly unitary management fee at an annual rate of 0.68% and the Knights of Columbus ETF pays the Adviser a monthly unitary management fee at the annual rate of 0.75%, based on each Fund’s average daily net assets. For the year ended May 31, 2024, Christian Stock Fund and Knights of Columbus ETF incurred $251,201 and $158,222, respectively, in management fees.

Pursuant to each Sub-Advisory Agreement, the Adviser compensates the Sub-Advisers out of the management fees it receives from the Funds.

Under the Investment Advisory Agreement, the Adviser pays all operating expenses of the Funds, except for certain expenses, including but not limited to, interest expenses, taxes, brokerage expenses, future Rule 12b-1 fees (if any), acquired fund fees and expenses, and the management fee payable to the Adviser under the Investment Advisory Agreement.

Administrator, Custodian, Transfer Agent and Accounting Agent

U.S. Bancorp Fund Services, LLC dba U.S. Bank Global Fund Services (“Fund Services”), an indirect wholly-owned subsidiary of U.S. Bancorp, serves as the Funds’ administrator and, in that capacity performs various administrative and accounting services for the Funds. Fund Services also serves as the Funds’ fund accountant, transfer agent, dividend disbursing agent and registrar. Fund Services prepares various federal and state regulatory filings, reports and returns for the Funds, including regulatory compliance monitoring and financial reporting; prepares reports and materials to be supplied to the trustees; monitors the activities of the Funds’ custodian, transfer agent and accountants; reviews the Funds’ advisory fee expense accrual and coordinates the preparation and payment of the advisory fees. U.S. Bank, N.A. (“U.S. Bank”), an affiliate of Fund Services, serves as the Funds’ custodian (the “Custodian”). For the year ended May 31, 2024, there were no fees incurred from the service providers described above as the Adviser bore all such costs.

Distributor and Fund Officers

Foreside Fund Services, LLC (the “Distributor”) serves as the principal underwriter for shares of the Funds and acts as each Fund’s distributor in a continuous public offering of the Funds’ shares and serves as the distributor of Creation Units for the Funds. Shares are continuously offered for sale by the Trust through the Distributor only in Creation Units, as described further in Note 7. Shares in less than Creation Units are not distributed by the Distributor. The Distributor is a broker-dealer registered under the Securities Exchange Act of 1934, as amended, and a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”).

Foreside Fund Officer Services, LLC, an affiliate of the Distributor, provides the Trust with a Chief Compliance Officer and Principal Financial Officer.

NOTE 4 – RELATED PARTIES

As of May 31, 2024, certain officers of the Trust were affiliated with the Distributor, and received no fees from the Trust for serving as officers.

Back to Table of Contents

NEOS ETF Trust

Notes to the Financial Statements

May 31, 2024 (Continued)

NOTE 5 – PURCHASES AND SALES OF SECURITIES

The costs of purchases and sales of securities, excluding short-term securities and in-kind transactions, during the year ended May 31, 2024, were as follows:

| | | | | | | |

Christian Stock Fund | | | $8,924,247 | | | $9,156,106 |

Knights of Columbus ETF | | | 7,862,947 | | | 7,528,423 |

| | | | | | | |

The costs of purchases and sales of in-kind transactions, during the year ended May 31, 2024, were as follows:

| | | | | | | |

Christian Stock Fund | | | $21,652,112 | | | $ — |

Knights of Columbus ETF | | | 622,736 | | | — |

| | | | | | | |

NOTE 6 – TAX MATTERS

The tax character of the distributions paid during the years ended May 31, 2024 and 2023 are as follows:

| | | | | | | |

Christian Stock Fund | | | $293,011 | | | $246,634 |

Knights of Columbus ETF | | | 322,880 | | | 352,859 |

| | | | | | | |

Net capital losses incurred after October 31 and late year losses incurred after December 31 and within the taxable year are deemed to arise on the first business day of each Fund’s next taxable year. For the year ended May 31, 2024, the Funds did not have any late year losses nor post October losses. Capital loss carry forwards will retain their character as either short-term or long-term capital losses. At May 31, 2024, the following capital loss carry forwards were available:

| | | | | | | | | | |

Christian Stock Fund | | | $1,448,411 | | | $1,533,575 | | | $2,981,986 |

Knights of Columbus ETF | | | $1,973,895 | | | $1,703,371 | | | $3,677,266 |

| | | | | | | | | | |

As of May 31, 2024, the components of accumulated earnings (losses) for income tax purposes were as follows:

| | | | | | | |

Federal income tax cost of investments | | | $45,663,388 | | | $19,414,172 |

Aggregate gross unrealized appreciation | | | 9,058,817 | | | 5,002,942 |

Aggregate gross unrealized (depreciation) | | | (1,442,308) | | | (721,903) |

Net unrealized appreciation (depreciation) | | | 7,616,509 | | | 4,281,039 |

Undistributed Ordinary Income | | | 255,039 | | | 163,187 |

Undistributed Long Term Capital Gains | | | — | | | — |

Distributable Earnings | | | 255,039 | | | 163,187 |

Accumulated capital and other gain/(loss) | | | (2,981,786) | | | (3,677,758) |

Total distributable earnings (accumulated loss) | | | 4,889,762 | | | 766,468 |

| | | | | | | |

NOTE 7 – SHARE TRANSACTIONS

Each Fund currently offers one class of shares, which has no front-end sales loads, no deferred sales charges, and no redemption fees. The standard fixed transaction fees for the Christian Stock Fund are $500 and for the Knights of Columbus ETF are $1,000, payable to the Custodian. Additionally, a variable transaction fee may be charged by the

Back to Table of Contents

NEOS ETF Trust

Notes to the Financial Statements

May 31, 2024 (Continued)

Funds of up to a maximum of 2% of the value of the Creation Units (inclusive of any transaction fees charged), for each creation or redemption. Variable transaction fees are imposed to compensate the Funds for the transaction costs associated with creation and redemption transactions. The Adviser may adjust or waive the transaction fees from time to time. The Funds may each issue an unlimited number of shares of beneficial interest, with no par value. All shares of the Funds have equal rights and privileges.

Shares of the Funds are listed and traded on the NYSE Arca, Inc. (the “Exchange”). Market prices for the Shares may be different from their net asset value (“NAV”). The Funds will issue and redeem Shares on a continuous basis at NAV only in large blocks of Shares, typically 10,000 Shares, called “Creation Units.” Creation Unit transactions are conducted in exchange for the deposit or delivery of a designated basket of in-kind securities and/or cash. Once created, shares generally will trade in the secondary market in amounts less than a Creation Unit and at market prices that change throughout the day. Except when aggregated in Creation Units, shares are not redeemable securities of the Funds. Shares of the Funds may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System (“Clearing Process”) of the National Securities Clearing Corporation (“NSCC”) or (ii) a participant in the Depository Trust Company (“DTC”) and, in each case, must have executed a Participant Agreement with the Funds’ Distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem shares directly from the Funds. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

NOTE 8 – BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of the date of these financial statements, Capital Insight Partners, LLC the sub-adviser to the Christian Stock Fund, has voting power of 937,855 shares of the Christian Stock Fund, representing 47.85% of the shares outstanding. Knights of Columbus Asset Advisors LLC the sub-adviser to the Knights of Columbus ETF, owned 800,000 shares of the Knights of Columbus ETF, representing 89.96% of the shares outstanding.

NOTE 9 – PRINCIPAL RISKS

As with all ETFs, shareholders of the Funds are subject to the risk that their investment could lose money. The Funds are subject to the principal risks, any of which may adversely affect each Fund’s NAV, trading price, yield, total return and ability to meet their investment objectives. A description of principal risks is included in each prospectus under the heading “Principal Risks of Investing in the Fund”.

NOTE 10 – GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Trust, on behalf of the Funds, enters into contracts with third-party service providers that contain a variety of representations and warranties and that provide general indemnifications. Additionally, under the Trust organizational documents, the officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. The Funds’ maximum exposure under these arrangements is unknown, as it involves possible future claims that may or may not be made against the Funds. The Adviser is of the view that the risk of loss to the Funds in connection with the Funds’ indemnification obligations is remote; however, there can be no assurance that such obligations will not result in material liabilities that adversely affect the Funds.

NOTE 11 – SUBSEQUENT EVENTS

Management has evaluated subsequent events and transactions for potential recognition or disclosure through the date the financial statements were issued and has determined that there are no material events that would require recognition of disclosure in the Funds’ financial statements.

Back to Table of Contents

NEOS ETF Trust

Report of Independent Registered Public Accounting Firm

To the Shareholders of FIS Christian Stock Fund and

FIS Knights of Columbus Global Belief ETF and

Board of Trustees of NEOS ETF Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of FIS Christian Stock Fund (formerly FIS Biblically Responsible Risk Managed ETF) and FIS Knights of Columbus Global Belief ETF (the “Funds”), each a series of NEOS ETF Trust (formerly SHP ETF Trust), as of May 31, 2024, and the related statements of operations for the year then ended, the statements of changes in net assets and financial highlights for each of the two years in the period then ended (collectively referred to as the “financial statements”) and related notes. In our opinion, the financial statements present fairly, in all material respects, the financial position of the Funds as of May 31, 2024, the results of their operations for the year then ended, the changes in net assets and financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Funds’ financial highlights for the periods ended May 31, 2022 were audited by other auditors whose report dated July 27, 2022, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2024, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more of the Funds in the NEOS ETF Trust since 2023.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

July 29, 2024

Back to Table of Contents

NEOS ETF Trust

Other Non-Audited Information

TAX INFORMATION

For the fiscal year ended May 31, 2024, certain dividends paid by the Funds may be subject to reduced tax rates, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from ordinary income designated as qualified dividend income was as follows:

| | | | | |

FIS Christian Stock Fund | | | 100.00% | |

FIS Knights of Columbus Global Belief ETF | | | 100.00% | |

| | | | | |

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the year ended May 31, 2024 were as follows:

| | | | | |

FIS Christian Stock Fund | | | 75.98% | |

FIS Knights of Columbus Global Belief ETF | | | 41.19% | |

| | | | | |

For the year ended May 31, 2024, the percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Code Section 871(k)(2)(C) for the Funds were as follows:

| | | | | |

FIS Christian Stock Fund | | | 0.00% | |

FIS Knights of Columbus Global Belief ETF | | | 0.00% | |

| | | | | |

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

Information regarding how often shares of the Funds traded on the Exchange at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Funds are available on the Funds’ website at www.faithinvestorservices.com.

HOUSEHOLDING

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of the prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

DISCLOSURE OF PORTFOLIO HOLDINGS

NEOS ETF Trust files its complete schedules of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year to date as exhibits to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov. It may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330. In addition, the Funds’ full portfolio holdings are updated daily and available on the Funds website at www.faithinvestorservices.com.

PROXY VOTING POLICIES AND PROCEDURES

A description of the policies and procedures the Funds uses to determine how to vote proxies relating to portfolio securities is provided in the Statements of Additional Information (“SAIs”). The SAIs are available without charge upon request by calling toll-free at (833) 833-1311, by accessing the SEC’s website at http://www.sec.gov, or by accessing the Funds’ website at www.faithinvestorservices. com. Information on how the Funds’ voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available without charge, upon request, by calling (833) 833-1311 or by accessing the website of the SEC.

Back to Table of Contents

NEOS ETF Trust

Changes in and Disagreements with Accountants for Open-End Management Investment Companies (Unaudited)

An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must disclose the information concerning changes in and disagreements with accountants and on accounting and financial disclosure required by Item 304 of Regulation S-K [17 CFR 229.304].

Response: This is not applicable to the Registrant.

Back to Table of Contents

NEOS ETF Trust

Proxy Disclosures for Open-End Management Investment Companies (Unaudited)

If any matter was submitted during the period covered by the report to a vote of shareholders of an open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A], through the solicitation of proxies or otherwise, the company must furnish the following information:

(1)

| The date of the meeting and whether it was an annual or special meeting. |

(2)

| If the meeting involved the election of directors, the name of each director elected at the meeting and the name of each other director whose term of office as a director continued after the meeting. |

(3)

| A brief description of each matter voted upon at the meeting and the number of votes cast for, against or withheld, as well as the number of abstentions and broker non-votes as to each such matter, including a separate tabulation with respect to each matter or nominee for office. |

Response: This is not applicable to the Registrant.

Back to Table of Contents

NEOS ETF Trust

Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies (Unaudited)

Unless the following information is disclosed as part of the financial statements included in Item 7, an open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must disclose the aggregate remuneration paid by the company during the period covered by the report to:

(1)

| All directors and all members of any advisory board for regular compensation; |

(2)

| Each director and each member of an advisory board for special compensation; |

(4)

| Each person of whom any officer or director of the Fund is an affiliated person |

Response: Each current Independent Trustee is paid an annual retainer of $19,000 for his or her services as a Board member to the Trust, together with out-of-pocket expenses in accordance with the Board’s policy on travel and other business expenses relating to attendance at meetings.

Independent Trustee fees are paid by the adviser to each series of the Trust through the applicable adviser’s unitary management fee, and not by the Fund. Annual Trustee fees may be reviewed periodically and changed by the Board.

The Trust does not have a bonus, profit sharing, pension or retirement plan.

Back to Table of Contents

NEOS ETF Trust

Statement Regarding Basis for Approval of Investment Advisory Contract (Unaudited)

If the board of directors approved any investment advisory contract during the Fund’s most recent fiscal half-year, discuss in reasonable detail the material factors and the conclusions with respect thereto that formed the basis for the board’s approval. Include the following in the discussion:

(1)