NEOS ETF Trust | ||||||

NEOS Enhanced Income 1-3 Month T-Bill ETF | | CSHI | | NYSE Arca | ||||

NEOS Enhanced Income Aggregate Bond ETF | | BNDI | | NYSE Arca | ||||

NEOS Nasdaq-100® High Income ETF | | QQQI | | NASDAQ | ||||

NEOS S&P 500® High Income ETF | | SPYI | | Cboe BZX Exchange, Inc. | ||||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23645)

NEOS ETF Trust

(Exact name of registrant as specified in charter)

13 Riverside Avenue

Westport, CT 06880

(Address of principal executive offices) (Zip code)

Garrett Paolella, President

13 Riverside Avenue

Westport, CT 06880

(Name and address of agent for service)

(203) 298-7300

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”), is filed herewith.

| NEOS Enhanced Income 1-3 Month T-Bill ETF |  |

| CSHI (Principal U.S. Listing Exchange: NYSE Arca) | ||

| Annual Shareholder Report | May 31, 2024 |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| NEOS Enhanced Income 1-3 Month T-Bill ETF | $39 | 0.38% |

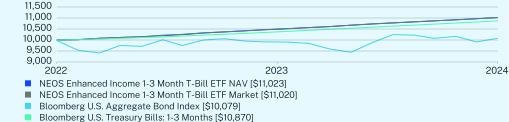

1 Year | Since Inception (08/30/2022) | |

NEOS Enhanced Income 1-3 Month T-Bill ETF NAV | 5.80 | 5.71 |

NEOS Enhanced Income 1-3 Month T-Bill ETF Market | 5.74 | 5.70 |

Bloomberg U.S. Aggregate Bond Index | 1.31 | 0.45 |

Bloomberg U.S. Treasury Bills: 1-3 Months | 5.51 | 4.87 |

| NEOS Enhanced Income 1-3 Month T-Bill ETF | PAGE 1 | TSR_AR_78433H501 |

Net Assets | $441,773,695 |

Number of Holdings | 23 |

Net Advisory Fee | $915,994 |

Portfolio Turnover | 0% |

30-Day SEC Yield | 5.06% |

30-Day SEC Yield Unsubsidized | 5.06% |

Distribution Yield | 5.54% |

Top 10 Issuers | (% of net assets) |

United States Treasury Bills | 99.8% |

First American Treasury Obligations Fund | 0.2% |

Northern U.S. Government Select Money Market Fund | 0.1% |

S&P 500 Index | 0.0% |

| NEOS Enhanced Income 1-3 Month T-Bill ETF | PAGE 2 | TSR_AR_78433H501 |

| NEOS Enhanced Income Aggregate Bond ETF |  |

| BNDI (Principal U.S. Listing Exchange: NYSE Arca) | ||

| Annual Shareholder Report | May 31, 2024 |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| NEOS Enhanced Income Aggregate Bond ETF | $55 | 0.55% |

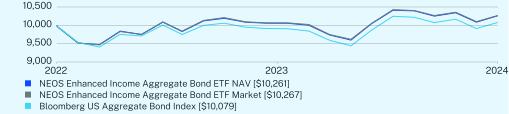

1 Year | Since Inception (08/30/2022) | |

NEOS Enhanced Income Aggregate Bond ETF NAV | 1.74 | 1.48 |

NEOS Enhanced Income Aggregate Bond ETF Market | 1.69 | 1.51 |

Bloomberg US Aggregate Bond Index | 1.31 | 0.45 |

| NEOS Enhanced Income Aggregate Bond ETF | PAGE 1 | TSR_AR_78433H402 |

Net Assets | $11,188,552 |

Number of Holdings | 10 |

Net Advisory Fee | $31,745 |

Portfolio Turnover | 1% |

30-Day SEC Yield | 2.88% |

30-Day SEC Yield Unsubsidized | 2.85% |

Distribution Yield | 5.06% |

Top 10 Issuers | (% of net assets) |

Vanguard Total Bond Market ETF | 49.9% |

iShares Core U.S. Aggregate Bond ETF | 49.8% |

First American Treasury Obligations Fund | 0.2% |

Northern U.S. Government Select Money Market Fund | 0.1% |

S&P 500 Index | 0.0% |

| NEOS Enhanced Income Aggregate Bond ETF | PAGE 2 | TSR_AR_78433H402 |

| NEOS Nasdaq-100® High Income ETF |  |

| QQQI (Principal U.S. Listing Exchange: NASDAQ) | ||

| Annual Shareholder Report | May 31, 2024 |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| NEOS Nasdaq-100® High Income ETF | $23* | 0.68% |

Top Contributors | |

| ↑ | NVIDIA Corp |

| ↑ | Meta Platforms Inc. CL A |

| ↑ | Qualcomm Inc |

Top Detractors | |

| ↓ | Adobe Inc. |

| ↓ | Intel Corp |

| ↓ | Tesla Inc. |

| NEOS Nasdaq-100® High Income ETF | PAGE 1 | TSR_AR_78433H675 |

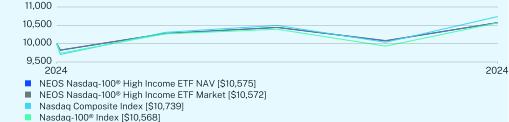

Since Inception (01/30/2024) | |

NEOS Nasdaq-100® High Income ETF NAV | 5.75 |

NEOS Nasdaq-100® High Income ETF Market | 5.72 |

NASDAQ Composite Index | 7.39 |

NASDAQ-100® Index | 5.68 |

Net Assets | $215,817,287 |

Number of Holdings | 104 |

Net Advisory Fee | $175,260 |

Portfolio Turnover | 3% |

30-Day SEC Yield | 0.28% |

30-Day SEC Yield Unsubsidized | 0.28% |

Distribution Yield | 14.56% |

Top 10 Issuers | (% of net assets) |

Microsoft Corp. | 8.7% |

Apple, Inc. | 8.1% |

NVIDIA Corp. | 7.6% |

Alphabet, Inc. | 5.7% |

Amazon.com, Inc. | 5.2% |

Meta Platforms, Inc. | 4.6% |

Broadcom, Inc. | 4.5% |

Costco Wholesale Corp. | 2.6% |

Tesla, Inc. | 2.5% |

Advanced Micro Devices, Inc. | 2.0% |

| NEOS Nasdaq-100® High Income ETF | PAGE 2 | TSR_AR_78433H675 |

| NEOS Nasdaq-100® High Income ETF | PAGE 3 | TSR_AR_78433H675 |

| NEOS S&P 500 High Income ETF |  |

| SPYI (Principal U.S. Listing Exchange: Cboe BZX) | ||

| Annual Shareholder Report | May 31, 2024 |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| NEOS S&P 500 High Income ETF | $73 | 0.68% |

Top Contributors | |

| ↑ | NVIDIA Corp |

| ↑ | Amazon.com Inc |

| ↑ | Meta Platforms Inc. CL A |

Top Detractors | |

| ↓ | Bristol-Myers Squibb Co |

| ↓ | Nike Inc. Class B. |

| ↓ | Pfizer Inc. |

| NEOS S&P 500 High Income ETF | PAGE 1 | TSR_AR_78433H303 |

1 Year | Since Inception (08/30/2022) | |

NEOS S&P 500® High Income ETF NAV | 15.79 | 12.58 |

NEOS S&P 500® High Income ETF Market | 15.76 | 12.66 |

S&P 500® Index | 28.19 | 18.53 |

Net Assets | $1,383,897,779 |

Number of Holdings | 506 |

Net Advisory Fee | $3,831,430 |

Portfolio Turnover | 14% |

30-Day SEC Yield | 0.84% |

30-Day SEC Yield Unsubsidized | 0.84% |

Distribution Yield | 12.11% |

Top 10 Issuers | (% of net assets) |

Microsoft Corp. | 7.1% |

Apple, Inc. | 6.5% |

NVIDIA Corp. | 6.3% |

Alphabet, Inc. | 4.5% |

Amazon.com, Inc. | 3.7% |

Meta Platforms, Inc. | 2.4% |

Berkshire Hathaway, Inc. | 1.8% |

Eli Lilly & Co. | 1.5% |

JPMorgan Chase & Co. | 1.4% |

Broadcom, Inc. | 1.4% |

| NEOS S&P 500 High Income ETF | PAGE 2 | TSR_AR_78433H303 |

| NEOS S&P 500 High Income ETF | PAGE 3 | TSR_AR_78433H303 |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. John Jacobs is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and/or other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. “Other services” refer to other services rendered by the registrant’s principal accountant to the Registrant other than those reported under the "audit services", "audit-related services", and "tax services”. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| FYE 5/31/24 | FYE 5/31/23 | |

| (a) Audit Fees | $42,000 | $30,000 |

| (b) Audit-Related Fees | None | None |

| (c) Tax Fees | $12,000 | $9,000 |

| (d) All Other Fees | None | None |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| FYE 5/31/24 | FYE 5/31/23 | |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not applicable

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 5/31/24 | FYE 5/31/23 |

| Registrant | None | None |

| Registrant’s Investment Adviser | None | None |

(h) Because no non-audit services were rendered, the audit committee of the board of trustees did not consider whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Sharon Cheever, John Jacobs, Richard Keary and Robert Sherry.

(b) Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7(a) of this Form. |

| (b) | Not Applicable. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

(a) The registrant’s Financial Statements are filed herewith.

NEOS ETF Trust | ||||||

NEOS Enhanced Income 1-3 Month T-Bill ETF | | CSHI | | NYSE Arca | ||||

NEOS Enhanced Income Aggregate Bond ETF | | BNDI | | NYSE Arca | ||||

NEOS Nasdaq-100® High Income ETF | | QQQI | | NASDAQ | ||||

NEOS S&P 500® High Income ETF | | SPYI | | Cboe BZX Exchange, Inc. | ||||

Page | |||

Statements of Changes in Net Assets | |||

Financial Highlights | |||

Notional Amount | Contracts | Value | |||||||

PURCHASED OPTIONS - 0.0%(a)(b)(c) | |||||||||

Put Options - 0.0%(c) | |||||||||

S&P 500 Index | |||||||||

Expiration: 06/13/2024; Exercise Price: $4,775.00(d) | $110,299,959 | 209 | $21,423 | ||||||

Expiration: 06/13/2024; Exercise Price: $4,600.00(d) | 110,299,959 | 209 | 14,108 | ||||||

Expiration: 06/13/2024; Exercise Price: $4,550.00(d) | 110,299,959 | 209 | 13,062 | ||||||

Expiration: 06/13/2024; Exercise Price: $4,500.00(d) | 110,299,959 | 209 | 12,017 | ||||||

Total Put Options | 60,610 | ||||||||

TOTAL PURCHASED OPTIONS (Cost $118,317) | 60,610 | ||||||||

Shares | |||||||||

SHORT-TERM INVESTMENTS - 100.1% | |||||||||

Money Market Funds - 0.3% | |||||||||

First American Treasury Obligations Fund - Class X, 5.22%(d)(e) | 1,088,487 | 1,088,487 | |||||||

Northern U.S. Government Select Money Market Fund, 5.03%(d)(e) | 379,829 | 379,829 | |||||||

1,468,316 | |||||||||

U.S. Treasury Bills - 99.8% | Par | ||||||||

5.26%, 06/04/2024(f) | $34,452,000 | 34,446,985 | |||||||

5.29%, 06/06/2024(f) | 39,254,000 | 39,236,853 | |||||||

5.28%, 06/11/2024(f) | 35,504,000 | 35,462,464 | |||||||

5.29%, 06/20/2024(f) | 39,229,000 | 39,131,560 | |||||||

5.23%, 06/25/2024(f) | 34,157,000 | 34,047,136 | |||||||

5.26%, 06/27/2024(f) | 32,870,000 | 32,754,856 | |||||||

5.29%, 07/05/2024(f) | 35,893,000 | 35,724,881 | |||||||

5.30%, 07/09/2024(f) | 31,612,000 | 31,445,602 | |||||||

5.31%, 07/18/2024(f) | 31,612,000 | 31,404,434 | |||||||

5.30%, 08/01/2024(f) | 36,262,000 | 35,949,996 | |||||||

5.30%, 08/08/2024(f) | 37,085,000 | 36,728,737 | |||||||

5.29%, 08/20/2024(f) | 14,971,000 | 14,801,029 | |||||||

5.31%, 08/22/2024(f) | 39,795,000 | 39,332,494 | |||||||

440,467,027 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $441,814,451) | 441,935,343 | ||||||||

TOTAL INVESTMENTS - 100.1% (Cost $441,932,768) | $441,995,953 | ||||||||

Liabilities in Excess of Other Assets - (0.1)% | (222,258) | ||||||||

TOTAL NET ASSETS - 100.0% | $441,773,695 | ||||||||

(a) | Exchange-traded. |

(b) | 100 shares per contract. |

(c) | Represents less than 0.05% of net assets. |

(d) | All or a portion of security has been pledged as collateral. The total value of assets committed as collateral as of May 31, 2024 is $1,528,926. |

(e) | The rate shown represents the 7-day effective yield as of May 31, 2024. |

(f) | The rate shown is the effective yield as of May 31, 2024. |

1 |

Notional Amount | Contracts | Value | |||||||

WRITTEN OPTIONS - 0.0%(a)(b)(c) | |||||||||

Put Options - 0.0%(b) | |||||||||

S&P 500 Index | |||||||||

Expiration: 06/13/2024; Exercise Price: $4,750.00 | $ (110,299,959) | (209) | $(20,377) | ||||||

Expiration: 06/13/2024; Exercise Price: $4,825.00 | (110,299,959) | (209) | (24,557) | ||||||

Expiration: 06/13/2024; Exercise Price: $4,875.00 | (110,299,959) | (209) | (28,738) | ||||||

Expiration: 06/13/2024; Exercise Price: $4,925.00 | (110,299,959) | (209) | (36,053) | ||||||

Total Put Options | (109,725) | ||||||||

TOTAL WRITTEN OPTIONS (Premiums received $245,135) | (109,725) | ||||||||

(a) | Exchange-traded. |

(b) | Represents less than 0.05% of net assets. |

(c) | 100 shares per contract. |

2 |

Shares | Value | ||||||||

EXCHANGE TRADED FUNDS - 99.7% | |||||||||

iShares Core U.S. Aggregate Bond ETF(a) | 57,785 | $5,577,408 | |||||||

Vanguard Total Bond Market ETF(a) | 77,913 | 5,581,688 | |||||||

TOTAL EXCHANGE TRADED FUNDS (Cost $11,314,540) | 11,159,096 | ||||||||

Notional Amount | Contracts | ||||||||

PURCHASED OPTIONS - 0.0%(b)(c)(d) | |||||||||

Put Options - 0.0%(d) | |||||||||

S&P 500 Index | |||||||||

Expiration: 06/13/2024; Exercise Price: $4,800.00(e) | 3,694,257 | 7 | 753 | ||||||

Expiration: 06/13/2024; Exercise Price: $4,700.00(e) | 3,694,257 | 7 | 577 | ||||||

Expiration: 06/13/2024; Exercise Price: $4,650.00(e) | 3,694,257 | 7 | 543 | ||||||

Total Put Options | 1,873 | ||||||||

TOTAL PURCHASED OPTIONS (Cost $3,571) | 1,873 | ||||||||

Shares | |||||||||

SHORT-TERM INVESTMENTS - 0.3% | |||||||||

Money Market Funds - 0.3% | |||||||||

First American Treasury Obligations Fund - Class X, 5.22%(e)(f) | 16,829 | 16,829 | |||||||

Northern U.S. Government Select Money Market Fund, 5.03%(e)(f) | 14,771 | 14,771 | |||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $31,600) | 31,600 | ||||||||

TOTAL INVESTMENTS - 100.0% (Cost $11,349,711) | $11,192,569 | ||||||||

Liabilities in Excess of Other Assets - 0.0%(d) | (4,017) | ||||||||

TOTAL NET ASSETS - 100.0% | $11,188,552 | ||||||||

(a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

(b) | Exchange-traded. |

(c) | 100 shares per contract. |

(d) | Represents less than 0.05% of net assets. |

(e) | All or a portion of security has been pledged as collateral. The total value of assets committed as collateral as of May 31, 2024 is $38,182. |

(f) | The rate shown represents the 7-day effective yield as of May 31, 2024. |

3 |

Notional Amount | Contracts | Value | |||||||

WRITTEN OPTIONS - 0.0%(a)(b)(c) | |||||||||

Put Options - 0.0%(b) | |||||||||

S&P 500 Index | |||||||||

Expiration: 06/13/2024; Exercise Price: $4,900.00 | $ (3,694,257) | (7) | $ (1,068) | ||||||

Expiration: 06/13/2024; Exercise Price: $4,950.00 | (3,694,257) | (7) | (1,365) | ||||||

Expiration: 06/13/2024; Exercise Price: $4,980.00 | (3,694,257) | (7) | (1,610) | ||||||

Total Put Options | (4,043) | ||||||||

TOTAL WRITTEN OPTIONS (Premiums received $9,058) | (4,043) | ||||||||

(a) | Exchange-traded. |

(b) | Represents less than 0.05% of net assets. |

(c) | 100 shares per contract. |

4 |

Shares | Value | |||||

COMMON STOCKS - 100.8%(a) | ||||||

Automobiles - 2.5% | ||||||

Tesla, Inc.(b) | 29,960 | $5,335,277 | ||||

Beverages - 2.7% | ||||||

Coca-Cola Europacific Partners PLC | 6,848 | 504,766 | ||||

Keurig Dr. Pepper, Inc. | 21,828 | 747,609 | ||||

Monster Beverage Corp.(b) | 16,264 | 844,427 | ||||

PepsiCo, Inc. | 21,400 | 3,700,060 | ||||

5,796,862 | ||||||

Biotechnology - 4.0% | ||||||

Amgen, Inc. | 8,132 | 2,487,172 | ||||

Biogen, Inc.(b) | 2,140 | 481,371 | ||||

Gilead Sciences, Inc. | 19,688 | 1,265,348 | ||||

Moderna, Inc.(b) | 5,992 | 854,160 | ||||

Regeneron Pharmaceuticals, Inc.(b) | 1,712 | 1,678,034 | ||||

Vertex Pharmaceuticals, Inc.(b) | 3,852 | 1,753,970 | ||||

8,520,055 | ||||||

Broadline Retail - 6.2% | ||||||

Amazon.com, Inc.(b) | 63,050 | 11,124,542 | ||||

MercadoLibre, Inc.(b) | 428 | 738,548 | ||||

PDD Holdings, Inc. - ADR(b) | 10,700 | 1,602,646 | ||||

13,465,736 | ||||||

Chemicals - 1.4% | ||||||

Linde plc | 6,886 | 2,998,991 | ||||

Commercial Services & Supplies - 0.8% | ||||||

Cintas Corp. | 1,284 | 870,514 | ||||

Copart, Inc.(b) | 15,408 | 817,548 | ||||

1,688,062 | ||||||

Communications Equipment - 1.4% | ||||||

Cisco Systems, Inc. | 65,484 | 3,045,006 | ||||

Consumer Staples Distribution & Retail - 2.9% | ||||||

Costco Wholesale Corp. | 6,848 | 5,546,127 | ||||

Dollar Tree, Inc.(b) | 3,424 | 403,861 | ||||

Walgreens Boots Alliance, Inc. | 14,124 | 229,091 | ||||

6,179,079 | ||||||

Electric Utilities - 1.4% | ||||||

American Electric Power Co., Inc. | 8,132 | 733,913 | ||||

Constellation Energy Corp. | 5,136 | 1,115,796 | ||||

Exelon Corp. | 15,836 | 594,642 | ||||

Xcel Energy, Inc. | 8,560 | 474,652 | ||||

2,919,003 | ||||||

Electronic Equipment, Instruments & Components - 0.2% | ||||||

CDW Corp. | 2,140 | 478,547 | ||||

5 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Energy Equipment & Services - 0.2% | ||||||

Baker Hughes Co. | 15,836 | $530,189 | ||||

Entertainment - 2.5% | ||||||

Electronic Arts, Inc. | 4,280 | 568,726 | ||||

Netflix, Inc.(b) | 6,420 | 4,119,200 | ||||

Take-Two Interactive Software, Inc.(b) | 2,568 | 411,805 | ||||

Warner Bros. Discovery, Inc.(b) | 39,376 | 324,458 | ||||

5,424,189 | ||||||

Financial Services - 0.5% | ||||||

PayPal Holdings, Inc.(b) | 16,692 | 1,051,429 | ||||

Food Products - 1.0% | ||||||

Kraft Heinz Co. | 19,688 | 696,364 | ||||

Mondelez International, Inc. - Class A | 21,400 | 1,466,542 | ||||

2,162,906 | ||||||

Ground Transportation - 0.8% | ||||||

CSX Corp. | 30,816 | 1,040,040 | ||||

Old Dominion Freight Line, Inc. | 3,424 | 600,056 | ||||

1,640,096 | ||||||

Health Care Equipment & Supplies - 1.9% | ||||||

Dexcom, Inc.(b) | 5,992 | 711,670 | ||||

GE HealthCare Technologies, Inc. | 7,276 | 567,528 | ||||

IDEXX Laboratories, Inc.(b) | 1,284 | 638,084 | ||||

Intuitive Surgical, Inc.(b) | 5,564 | 2,237,395 | ||||

4,154,677 | ||||||

Hotels, Restaurants & Leisure - 2.7% | ||||||

Airbnb, Inc. - Class A(b) | 6,420 | 930,451 | ||||

Booking Holdings, Inc. | 428 | 1,616,278 | ||||

DoorDash, Inc. - Class A(b) | 5,992 | 659,779 | ||||

Marriott International, Inc. - Class A | 4,708 | 1,088,348 | ||||

Starbucks Corp. | 18,404 | 1,476,369 | ||||

5,771,225 | ||||||

Industrial Conglomerates - 0.9% | ||||||

Honeywell International, Inc. | 9,958 | 2,013,408 | ||||

Interactive Media & Services - 10.3% | ||||||

Alphabet, Inc. - Class A(b) | 35,961 | 6,203,273 | ||||

Alphabet, Inc. - Class C(b) | 34,339 | 5,973,612 | ||||

Meta Platforms, Inc. - Class A | 21,415 | 9,997,164 | ||||

22,174,049 | ||||||

IT Services - 0.3% | ||||||

Cognizant Technology Solutions Corp. - Class A | 8,132 | 537,932 | ||||

MongoDB, Inc.(b) | 856 | 202,067 | ||||

739,999 | ||||||

6 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Life Sciences Tools & Services - 0.1% | ||||||

Illumina, Inc.(b) | 2,568 | $267,791 | ||||

Machinery - 0.4% | ||||||

PACCAR, Inc. | 8,560 | 920,200 | ||||

Media - 1.8% | ||||||

Charter Communications, Inc. - Class A(b) | 2,140 | 614,437 | ||||

Comcast Corp. - Class A | 62,916 | 2,518,528 | ||||

Sirius XM Holdings, Inc. | 61,632 | 173,802 | ||||

Trade Desk, Inc. - Class A(b) | 7,276 | 675,067 | ||||

3,981,834 | ||||||

Oil, Gas & Consumable Fuels - 0.2% | ||||||

Diamondback Energy, Inc. | 2,568 | 511,700 | ||||

Pharmaceuticals - 0.3% | ||||||

AstraZeneca PLC - ADR | 8,988 | 701,244 | ||||

Professional Services - 1.3% | ||||||

Automatic Data Processing, Inc. | 6,420 | 1,572,387 | ||||

Paychex, Inc. | 5,564 | 668,570 | ||||

Verisk Analytics, Inc. | 2,140 | 540,949 | ||||

2,781,906 | ||||||

Real Estate Management & Development - 0.2% | ||||||

CoStar Group, Inc.(b) | 6,420 | 501,851 | ||||

Semiconductors & Semiconductor Equipment - 25.2%(c) | ||||||

Advanced Micro Devices, Inc.(b) | 25,359 | 4,232,417 | ||||

Analog Devices, Inc. | 7,704 | 1,806,511 | ||||

Applied Materials, Inc. | 12,903 | 2,775,177 | ||||

ASML Holding NV | 1,284 | 1,233,089 | ||||

Broadcom, Inc. | 7,289 | 9,683,801 | ||||

GLOBALFOUNDRIES, Inc.(b) | 8,988 | 440,412 | ||||

Intel Corp. | 66,854 | 2,062,446 | ||||

KLA Corp. | 2,140 | 1,625,394 | ||||

Lam Research Corp. | 2,140 | 1,995,422 | ||||

Marvell Technology, Inc. | 14,124 | 971,872 | ||||

Microchip Technology, Inc. | 8,560 | 832,289 | ||||

Micron Technology, Inc. | 17,976 | 2,247,000 | ||||

NVIDIA Corp. | 15,026 | 16,473,455 | ||||

NXP Semiconductors NV | 3,852 | 1,048,129 | ||||

ON Semiconductor Corp.(b) | 6,848 | 500,178 | ||||

QUALCOMM, Inc. | 17,976 | 3,668,003 | ||||

Texas Instruments, Inc. | 14,210 | 2,771,092 | ||||

54,366,687 | ||||||

7 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Software - 15.8% | ||||||

Adobe, Inc.(b) | 6,921 | $3,078,184 | ||||

ANSYS, Inc.(b) | 1,284 | 407,606 | ||||

Atlassian Corp. - Class A(b) | 2,568 | 402,817 | ||||

Autodesk, Inc.(b) | 3,424 | 690,278 | ||||

Cadence Design Systems, Inc.(b) | 4,280 | 1,225,407 | ||||

Crowdstrike Holdings, Inc. - Class A(b) | 3,424 | 1,074,006 | ||||

Datadog, Inc. - Class A(b) | 4,708 | 518,727 | ||||

Fortinet, Inc.(b) | 11,984 | 710,891 | ||||

Intuit, Inc. | 4,280 | 2,467,163 | ||||

Microsoft Corp. | 45,046 | 18,699,946 | ||||

Palo Alto Networks, Inc.(b) | 5,136 | 1,514,658 | ||||

Roper Technologies, Inc. | 1,712 | 912,085 | ||||

Synopsys, Inc.(b) | 2,140 | 1,200,112 | ||||

Workday, Inc. - Class A(b) | 3,424 | 724,005 | ||||

Zscaler, Inc.(b) | 2,140 | 363,714 | ||||

33,989,599 | ||||||

Specialty Retail - 0.7% | ||||||

O’Reilly Automotive, Inc.(b) | 856 | 824,550 | ||||

Ross Stores, Inc. | 5,564 | 777,625 | ||||

1,602,175 | ||||||

Technology Hardware, Storage & Peripherals - 8.1% | ||||||

Apple, Inc. | 91,143 | 17,522,242 | ||||

Textiles, Apparel & Luxury Goods - 0.3% | ||||||

Lululemon Athletica, Inc.(b) | 1,712 | 534,127 | ||||

Trading Companies & Distributors - 0.3% | ||||||

Fastenal Co. | 9,416 | 621,268 | ||||

Wireless Telecommunication Services - 1.5% | ||||||

T-Mobile US, Inc. | 18,404 | 3,219,964 | ||||

TOTAL COMMON STOCKS (Cost $212,517,490) | 217,611,373 | |||||

SHORT-TERM INVESTMENTS - 0.8% | ||||||

Money Market Funds - 0.8% | ||||||

First American Treasury Obligations Fund - Class X, 5.22%(d) | 1,671,393 | 1,671,393 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $1,671,393) | 1,671,393 | |||||

TOTAL INVESTMENTS - 101.6% (Cost $214,188,883) | $219,282,766 | |||||

Liabilities in Excess of Other Assets - (1.6)% | (3,465,479) | |||||

TOTAL NET ASSETS - 100.0% | $215,817,287 | |||||

8 |

(a) | All or a portion of security has been pledged as collateral. The total value of assets committed as collateral as of May 31, 2024 is $217,611,373. |

(b) | Non-income producing security. |

(c) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

(d) | The rate shown represents the 7-day effective yield as of May 31, 2024. |

9 |

Notional Amount | Contracts | Value | |||||||

WRITTEN OPTIONS - (1.3)%(a)(b) | |||||||||

Call Options - (1.3)% | |||||||||

NASDAQ-100 Index | |||||||||

Expiration: 07/19/2024; Exercise Price: $18,700.00 | $(81,561,260) | (44) | $ (1,651,100) | ||||||

Expiration: 07/19/2024; Exercise Price: $18,950.00 | (81,561,260) | (44) | (1,115,180) | ||||||

Total Call Options | (2,766,280) | ||||||||

TOTAL WRITTEN OPTIONS (Premiums received $2,723,595) | (2,766,280) | ||||||||

(a) | Exchange-traded. |

(b) | 100 shares per contract. |

10 |

Shares | Value | |||||

COMMON STOCKS - 98.3%(a) | ||||||

Aerospace & Defense - 1.4% | ||||||

Axon Enterprise, Inc.(b) | 982 | $276,600 | ||||

Boeing Co.(b) | 17,624 | 3,130,199 | ||||

General Dynamics Corp. | 6,476 | 1,941,311 | ||||

Howmet Aerospace, Inc. | 12,066 | 1,021,387 | ||||

Huntington Ingalls Industries, Inc. | 554 | 140,217 | ||||

L3Harris Technologies, Inc. | 5,960 | 1,339,987 | ||||

Lockheed Martin Corp. | 6,394 | 3,007,354 | ||||

Northrop Grumman Corp. | 3,636 | 1,639,000 | ||||

RTX Corp. | 48,203 | 5,196,765 | ||||

Textron, Inc. | 6,050 | 530,040 | ||||

TransDigm Group, Inc. | 771 | 1,035,630 | ||||

19,258,490 | ||||||

Air Freight & Logistics - 0.4% | ||||||

C.H. Robinson Worldwide, Inc. | 975 | 84,211 | ||||

Expeditors International of Washington, Inc. | 3,687 | 445,758 | ||||

FedEx Corp. | 6,520 | 1,655,819 | ||||

United Parcel Service, Inc. - Class B | 23,313 | 3,238,875 | ||||

5,424,663 | ||||||

Automobile Components - 0.1% | ||||||

Aptiv PLC(b) | 6,521 | 542,939 | ||||

BorgWarner, Inc. | 6,520 | 232,503 | ||||

775,442 | ||||||

Automobiles - 1.5% | ||||||

Ford Motor Co. | 132,812 | 1,611,010 | ||||

General Motors Co. | 45,655 | 2,054,018 | ||||

Tesla, Inc.(b) | 93,328 | 16,619,850 | ||||

20,284,878 | ||||||

Banks - 3.6% | ||||||

Bank of America Corp. | 233,519 | 9,338,425 | ||||

Citigroup, Inc. | 64,798 | 4,037,563 | ||||

Citizens Financial Group, Inc. | 14,800 | 522,292 | ||||

Comerica, Inc. | 3,498 | 179,237 | ||||

Fifth Third Bancorp | 22,754 | 851,455 | ||||

Huntington Bancshares, Inc. | 48,382 | 673,477 | ||||

JPMorgan Chase & Co. | 98,004 | 19,858,551 | ||||

KeyCorp | 31,270 | 449,350 | ||||

M&T Bank Corp. | 3,747 | 568,045 | ||||

PNC Financial Services Group, Inc. | 12,068 | 1,899,383 | ||||

Regions Financial Corp. | 31,178 | 603,294 | ||||

Truist Financial Corp. | 45,120 | 1,703,280 | ||||

US Bancorp | 50,893 | 2,063,711 | ||||

Wells Fargo & Co. | 123,603 | 7,406,292 | ||||

50,154,355 | ||||||

11 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Beverages - 1.4% | ||||||

Brown-Forman Corp. - Class B | 3,747 | $171,837 | ||||

Coca-Cola Co. | 131,739 | 8,290,335 | ||||

Constellation Brands, Inc. - Class A | 3,746 | 937,362 | ||||

Keurig Dr. Pepper, Inc. | 31,479 | 1,078,156 | ||||

Molson Coors Beverage Co. - Class B | 3,747 | 205,373 | ||||

Monster Beverage Corp.(b) | 23,557 | 1,223,080 | ||||

PepsiCo, Inc. | 45,678 | 7,897,726 | ||||

19,803,869 | ||||||

Biotechnology - 2.0% | ||||||

AbbVie, Inc. | 59,447 | 9,585,234 | ||||

Amgen, Inc. | 17,406 | 5,323,625 | ||||

Biogen, Inc.(b) | 3,679 | 827,554 | ||||

Gilead Sciences, Inc. | 42,194 | 2,711,809 | ||||

Incyte Corp.(b) | 3,747 | 216,539 | ||||

Moderna, Inc.(b) | 9,292 | 1,324,575 | ||||

Regeneron Pharmaceuticals, Inc.(b) | 3,136 | 3,073,782 | ||||

Vertex Pharmaceuticals, Inc.(b) | 8,562 | 3,898,621 | ||||

26,961,739 | ||||||

Broadline Retail - 3.8% | ||||||

Amazon.com, Inc.(b) | 294,211 | 51,910,589 | ||||

eBay, Inc. | 17,180 | 931,500 | ||||

Etsy, Inc.(b) | 975 | 61,883 | ||||

52,903,972 | ||||||

Building Products - 0.5% | ||||||

A.O. Smith Corp. | 975 | 81,549 | ||||

Allegion PLC | 973 | 118,531 | ||||

Builders FirstSource, Inc.(b) | 3,378 | 543,149 | ||||

Carrier Global Corp. | 28,244 | 1,784,738 | ||||

Johnson Controls International PLC | 22,777 | 1,637,894 | ||||

Masco Corp. | 6,443 | 450,494 | ||||

Trane Technologies PLC | 6,487 | 2,124,233 | ||||

6,740,588 | ||||||

Capital Markets - 2.6% | ||||||

Ameriprise Financial, Inc. | 3,066 | 1,338,646 | ||||

Bank of New York Mellon Corp. | 25,637 | 1,528,222 | ||||

BlackRock, Inc. | 3,604 | 2,782,396 | ||||

Blackstone, Inc. | 23,095 | 2,782,948 | ||||

Cboe Global Markets, Inc. | 3,118 | 539,383 | ||||

Charles Schwab Corp. | 48,894 | 3,582,952 | ||||

CME Group, Inc. | 11,641 | 2,362,890 | ||||

FactSet Research Systems, Inc. | 530 | 214,258 | ||||

Franklin Resources, Inc. | 8,894 | 209,898 | ||||

Goldman Sachs Group, Inc. | 9,289 | 4,240,614 | ||||

Intercontinental Exchange, Inc. | 17,919 | 2,399,354 | ||||

12 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Capital Markets - (Continued) | ||||||

Invesco Ltd. | 14,535 | $228,345 | ||||

MarketAxess Holdings, Inc. | 527 | 104,836 | ||||

Moody’s Corp. | 3,746 | 1,487,125 | ||||

Morgan Stanley | 42,476 | 4,155,852 | ||||

MSCI, Inc. | 973 | 481,810 | ||||

Nasdaq, Inc. | 11,362 | 670,699 | ||||

Northern Trust Corp. | 6,197 | 522,035 | ||||

Raymond James Financial, Inc. | 5,933 | 728,276 | ||||

S&P Global, Inc. | 9,299 | 3,975,415 | ||||

State Street Corp. | 9,275 | 701,097 | ||||

T. Rowe Price Group, Inc. | 6,426 | 757,176 | ||||

35,794,227 | ||||||

Chemicals - 1.4% | ||||||

Air Products and Chemicals, Inc. | 6,416 | 1,711,147 | ||||

Albemarle Corp. | 3,280 | 402,095 | ||||

Celanese Corp. | 974 | 148,087 | ||||

CF Industries Holdings, Inc. | 3,748 | 298,828 | ||||

Corteva, Inc. | 23,071 | 1,290,592 | ||||

Dow, Inc. | 23,043 | 1,327,968 | ||||

DuPont de Nemours, Inc. | 14,266 | 1,172,095 | ||||

Eastman Chemical Co. | 975 | 98,797 | ||||

Ecolab, Inc. | 6,520 | 1,513,944 | ||||

FMC Corp. | 975 | 59,426 | ||||

International Flavors & Fragrances, Inc. | 6,521 | 627,190 | ||||

Linde PLC | 15,053 | 6,555,883 | ||||

LyondellBasell Industries NV - Class A | 6,520 | 648,218 | ||||

Mosaic Co. | 9,536 | 294,948 | ||||

PPG Industries, Inc. | 6,520 | 856,793 | ||||

Sherwin-Williams Co. | 6,520 | 1,980,776 | ||||

18,986,787 | ||||||

Commercial Services & Supplies - 0.6% | ||||||

Cintas Corp. | 2,868 | 1,944,418 | ||||

Copart, Inc.(b) | 28,737 | 1,524,785 | ||||

Republic Services, Inc. | 6,157 | 1,140,215 | ||||

Rollins, Inc. | 6,520 | 297,899 | ||||

Veralto Corp. | 6,370 | 627,955 | ||||

Waste Management, Inc. | 11,724 | 2,470,598 | ||||

8,005,870 | ||||||

Communications Equipment - 0.7% | ||||||

Arista Networks, Inc.(b) | 6,520 | 1,940,678 | ||||

Cisco Systems, Inc. | 137,359 | 6,387,193 | ||||

F5, Inc.(b) | 833 | 140,752 | ||||

Juniper Networks, Inc. | 9,294 | 331,517 | ||||

Motorola Solutions, Inc. | 3,747 | 1,367,318 | ||||

10,167,458 | ||||||

13 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Construction & Engineering - 0.1% | ||||||

Quanta Services, Inc. | 3,682 | $1,016,011 | ||||

Construction Materials - 0.1% | ||||||

Martin Marietta Materials, Inc. | 862 | 493,133 | ||||

Vulcan Materials Co. | 3,509 | 897,497 | ||||

1,390,630 | ||||||

Consumer Finance - 0.6% | ||||||

American Express Co. | 17,953 | 4,308,720 | ||||

Capital One Financial Corp. | 11,931 | 1,642,063 | ||||

Discover Financial Services | 8,461 | 1,037,826 | ||||

Synchrony Financial | 14,052 | 615,478 | ||||

7,604,087 | ||||||

Consumer Staples Distribution & Retail - 2.0% | ||||||

Costco Wholesale Corp. | 14,460 | 11,711,009 | ||||

Dollar General Corp. | 6,378 | 873,212 | ||||

Dollar Tree, Inc.(b) | 6,227 | 734,475 | ||||

Kroger Co. | 20,804 | 1,089,505 | ||||

Sysco Corp. | 16,963 | 1,235,246 | ||||

Target Corp. | 14,741 | 2,301,955 | ||||

Walgreens Boots Alliance, Inc. | 23,314 | 378,153 | ||||

Walmart, Inc. | 144,123 | 9,477,528 | ||||

27,801,083 | ||||||

Containers & Packaging - 0.2% | ||||||

Amcor PLC | 48,326 | 491,475 | ||||

Avery Dennison Corp. | 972 | 221,218 | ||||

Ball Corp. | 9,294 | 645,282 | ||||

International Paper Co. | 11,447 | 516,145 | ||||

Packaging Corp. of America | 973 | 178,536 | ||||

Westrock Co. | 6,521 | 349,787 | ||||

2,402,443 | ||||||

Distributors - 0.1% | ||||||

Genuine Parts Co. | 3,615 | 521,066 | ||||

LKQ Corp. | 6,520 | 280,556 | ||||

Pool Corp. | 537 | 195,226 | ||||

996,848 | ||||||

Diversified Telecommunication Services - 0.7% | ||||||

AT&T, Inc. | 241,595 | 4,401,861 | ||||

Verizon Communications, Inc. | 142,691 | 5,871,735 | ||||

10,273,596 | ||||||

Electric Utilities - 1.7% | ||||||

Alliant Energy Corp. | 6,520 | 335,715 | ||||

American Electric Power Co., Inc. | 17,281 | 1,559,610 | ||||

Constellation Energy Corp. | 9,294 | 2,019,121 | ||||

14 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Electric Utilities - (Continued) | ||||||

Duke Energy Corp. | 25,674 | $2,659,056 | ||||

Edison International | 11,977 | 920,432 | ||||

Entergy Corp. | 6,267 | 704,975 | ||||

Evergy, Inc. | 6,520 | 356,383 | ||||

Eversource Energy | 11,504 | 681,382 | ||||

Exelon Corp. | 33,758 | 1,267,613 | ||||

FirstEnergy Corp. | 17,139 | 690,016 | ||||

NextEra Energy, Inc. | 68,390 | 5,472,568 | ||||

NRG Energy, Inc. | 6,461 | 523,341 | ||||

PG&E Corp. | 71,238 | 1,320,753 | ||||

Pinnacle West Capital Corp. | 974 | 76,810 | ||||

PPL Corp. | 23,565 | 691,161 | ||||

Southern Co. | 36,754 | 2,945,466 | ||||

Xcel Energy, Inc. | 17,615 | 976,752 | ||||

23,201,154 | ||||||

Electrical Equipment - 0.7% | ||||||

AMETEK, Inc. | 6,520 | 1,105,662 | ||||

Eaton Corp. PLC | 12,067 | 4,016,501 | ||||

Emerson Electric Co. | 17,887 | 2,006,206 | ||||

GE Vernova, Inc.(b) | 8,849 | 1,556,539 | ||||

Generac Holdings, Inc.(b) | 858 | 126,306 | ||||

Hubbell, Inc. | 745 | 289,723 | ||||

Rockwell Automation, Inc. | 3,255 | 838,260 | ||||

9,939,197 | ||||||

Electronic Equipment, Instruments & Components - 0.6% | ||||||

Amphenol Corp. - Class A | 19,921 | 2,636,943 | ||||

CDW Corp. | 3,530 | 789,379 | ||||

Corning, Inc. | 25,600 | 953,856 | ||||

Jabil, Inc. | 3,433 | 408,184 | ||||

Keysight Technologies, Inc.(b) | 3,747 | 518,884 | ||||

TE Connectivity Ltd. | 9,295 | 1,391,461 | ||||

Teledyne Technologies, Inc.(b) | 656 | 260,399 | ||||

Trimble, Inc.(b) | 8,435 | 469,661 | ||||

Zebra Technologies Corp. - Class A(b) | 712 | 222,386 | ||||

7,651,153 | ||||||

Energy Equipment & Services - 0.3% | ||||||

Baker Hughes Co. | 33,960 | 1,136,981 | ||||

Halliburton Co. | 28,708 | 1,053,583 | ||||

Schlumberger NV | 48,110 | 2,207,768 | ||||

4,398,332 | ||||||

Entertainment - 1.3% | ||||||

Electronic Arts, Inc. | 6,521 | 866,510 | ||||

Live Nation Entertainment, Inc.(b) | 3,625 | 339,807 | ||||

Netflix, Inc.(b) | 14,390 | 9,232,912 | ||||

15 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Entertainment - (Continued) | ||||||

Take-Two Interactive Software, Inc.(b) | 3,746 | $600,709 | ||||

Walt Disney Co. | 61,866 | 6,428,496 | ||||

Warner Bros. Discovery, Inc.(b) | 73,970 | 609,513 | ||||

18,077,947 | ||||||

Financial Services - 4.4% | ||||||

Berkshire Hathaway, Inc. - Class B(b) | 61,832 | 25,623,181 | ||||

Corpay, Inc.(b) | 972 | 260,175 | ||||

Fidelity National Information Services, Inc. | 19,835 | 1,505,080 | ||||

Fiserv, Inc.(b) | 19,953 | 2,988,161 | ||||

Global Payments, Inc. | 8,595 | 875,401 | ||||

Jack Henry & Associates, Inc. | 972 | 160,069 | ||||

Mastercard, Inc. - Class A | 28,094 | 12,559,985 | ||||

PayPal Holdings, Inc.(b) | 36,521 | 2,300,458 | ||||

Visa, Inc. - Class A | 53,662 | 14,620,748 | ||||

60,893,258 | ||||||

Food Products - 0.7% | ||||||

Archer-Daniels-Midland Co. | 17,375 | 1,084,895 | ||||

Bunge Global SA | 3,689 | 396,900 | ||||

Campbell Soup Co. | 3,748 | 166,336 | ||||

Conagra Brands, Inc. | 14,841 | 443,449 | ||||

General Mills, Inc. | 19,675 | 1,352,656 | ||||

Hershey Co. | 3,745 | 740,873 | ||||

Hormel Foods Corp. | 9,002 | 278,882 | ||||

J.M. Smucker Co. | 974 | 108,737 | ||||

Kellogg Co. | 6,520 | 393,417 | ||||

Kraft Heinz Co. | 26,017 | 920,221 | ||||

Lamb Weston Holdings, Inc. | 3,675 | 324,466 | ||||

McCormick & Co., Inc. | 6,520 | 470,874 | ||||

Mondelez International, Inc. - Class A | 45,430 | 3,113,318 | ||||

Tyson Foods, Inc. - Class A | 8,950 | 512,388 | ||||

10,307,412 | ||||||

Gas Utilities - 0.0%(c) | ||||||

Atmos Energy Corp. | 3,738 | 433,309 | ||||

Ground Transportation - 1.0% | ||||||

CSX Corp. | 65,682 | 2,216,768 | ||||

JB Hunt Transport Services, Inc. | 973 | 156,410 | ||||

Norfolk Southern Corp. | 6,473 | 1,455,130 | ||||

Old Dominion Freight Line, Inc. | 5,818 | 1,019,605 | ||||

Uber Technologies, Inc.(b) | 68,458 | 4,419,648 | ||||

Union Pacific Corp. | 20,127 | 4,685,968 | ||||

13,953,529 | ||||||

16 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Health Care Equipment & Supplies - 2.4% | ||||||

Abbott Laboratories | 57,319 | $5,857,429 | ||||

Align Technology, Inc.(b) | 972 | 250,008 | ||||

Baxter International, Inc. | 17,013 | 579,973 | ||||

Becton Dickinson and Co. | 9,017 | 2,091,673 | ||||

Boston Scientific Corp.(b) | 48,578 | 3,671,039 | ||||

Cooper Cos., Inc. | 3,925 | 370,167 | ||||

Dexcom, Inc.(b) | 11,988 | 1,423,815 | ||||

Edwards Lifesciences Corp.(b) | 20,032 | 1,740,580 | ||||

GE HealthCare Technologies, Inc. | 12,066 | 941,148 | ||||

Hologic, Inc.(b) | 6,520 | 481,046 | ||||

IDEXX Laboratories, Inc.(b) | 1,161 | 576,959 | ||||

Insulet Corp.(b) | 972 | 172,229 | ||||

Intuitive Surgical, Inc.(b) | 11,538 | 4,639,661 | ||||

Medtronic PLC | 45,076 | 3,667,834 | ||||

ResMed, Inc. | 3,711 | 765,691 | ||||

Solventum Corp.(b) | 4,033 | 239,318 | ||||

STERIS PLC | 3,041 | 677,778 | ||||

Stryker Corp. | 11,328 | 3,863,867 | ||||

Teleflex, Inc. | 654 | 136,732 | ||||

Zimmer Biomet Holdings, Inc. | 6,226 | 716,924 | ||||

32,863,871 | ||||||

Health Care Providers & Services - 2.4% | ||||||

Cardinal Health, Inc. | 6,520 | 647,240 | ||||

Cencora, Inc. | 3,746 | 848,731 | ||||

Centene Corp.(b) | 17,373 | 1,243,733 | ||||

Cigna Corp. | 9,054 | 3,120,190 | ||||

CVS Health Corp. | 42,756 | 2,548,258 | ||||

DaVita, Inc.(b) | 4 | 588 | ||||

Elevance Health, Inc. | 6,520 | 3,510,890 | ||||

HCA Healthcare, Inc. | 6,077 | 2,064,661 | ||||

Henry Schein, Inc.(b) | 975 | 67,607 | ||||

Humana, Inc. | 3,366 | 1,205,432 | ||||

Labcorp Holdings, Inc. | 973 | 189,647 | ||||

McKesson Corp. | 3,514 | 2,001,539 | ||||

Molina Healthcare, Inc.(b) | 809 | 254,495 | ||||

Quest Diagnostics, Inc. | 974 | 138,279 | ||||

UnitedHealth Group, Inc. | 31,079 | 15,395,604 | ||||

Universal Health Services, Inc. - Class B | 847 | 160,761 | ||||

33,397,655 | ||||||

Hotels, Restaurants & Leisure - 1.6% | ||||||

Airbnb, Inc. - Class A(b) | 14,347 | 2,079,311 | ||||

Booking Holdings, Inc. | 488 | 1,842,859 | ||||

Caesars Entertainment, Inc.(b) | 6,305 | 224,206 | ||||

Carnival Corp.(b) | 33,920 | 511,513 | ||||

17 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Hotels, Restaurants & Leisure - (Continued) | ||||||

Chipotle Mexican Grill, Inc.(b) | 384 | $1,201,736 | ||||

Darden Restaurants, Inc. | 3,333 | 501,250 | ||||

Domino’s Pizza, Inc. | 487 | 247,678 | ||||

Expedia Group, Inc.(b) | 3,514 | 396,590 | ||||

Hilton Worldwide Holdings, Inc. | 8,543 | 1,713,726 | ||||

Las Vegas Sands Corp. | 9,295 | 418,554 | ||||

Marriott International, Inc. - Class A | 6,757 | 1,562,016 | ||||

McDonald’s Corp. | 23,348 | 6,044,564 | ||||

MGM Resorts International(b) | 8,767 | 352,170 | ||||

Norwegian Cruise Line Holdings Ltd.(b) | 14,229 | 236,201 | ||||

Royal Caribbean Cruises Ltd.(b) | 6,520 | 962,874 | ||||

Starbucks Corp. | 37,419 | 3,001,752 | ||||

Wynn Resorts Ltd. | 974 | 92,413 | ||||

Yum! Brands, Inc. | 8,879 | 1,220,241 | ||||

22,609,654 | ||||||

Household Durables - 0.3% | ||||||

D.R. Horton, Inc. | 9,168 | 1,355,031 | ||||

Garmin Ltd. | 3,746 | 613,782 | ||||

Lennar Corp. - Class A | 6,520 | 1,045,482 | ||||

Mohawk Industries, Inc.(b) | 4 | 488 | ||||

NVR, Inc.(b) | 41 | 314,910 | ||||

PulteGroup, Inc. | 6,320 | 741,462 | ||||

4,071,155 | ||||||

Household Products - 1.3% | ||||||

Church & Dwight Co., Inc. | 6,520 | 697,705 | ||||

Clorox Co. | 3,384 | 445,199 | ||||

Colgate-Palmolive Co. | 26,393 | 2,453,493 | ||||

Kimberly-Clark Corp. | 9,295 | 1,239,024 | ||||

Procter & Gamble Co. | 79,271 | 13,043,250 | ||||

17,878,671 | ||||||

Independent Power and Renewable Electricity Producers - 0.0%(c) | ||||||

AES Corp. | 22,603 | 487,999 | ||||

Industrial Conglomerates - 0.9% | ||||||

3M Co. | 17,615 | 1,763,966 | ||||

General Electric Co. | 36,657 | 6,053,537 | ||||

Honeywell International, Inc. | 20,804 | 4,206,361 | ||||

12,023,864 | ||||||

Insurance - 2.1% | ||||||

Aflac, Inc. | 17,355 | 1,559,694 | ||||

Allstate Corp. | 6,520 | 1,092,230 | ||||

American International Group, Inc. | 23,021 | 1,814,515 | ||||

Aon PLC - Class A | 6,112 | 1,721,384 | ||||

Arch Capital Group Ltd.(b) | 11,831 | 1,214,215 | ||||

18 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Insurance - (Continued) | ||||||

Arthur J Gallagher & Co. | 6,323 | $1,601,806 | ||||

Assurant, Inc. | 731 | 126,807 | ||||

Brown & Brown, Inc. | 6,520 | 583,605 | ||||

Chubb Ltd. | 12,068 | 3,268,256 | ||||

Cincinnati Financial Corp. | 3,746 | 440,455 | ||||

Everest Group Ltd. | 605 | 236,513 | ||||

Globe Life, Inc. | 973 | 80,525 | ||||

Hartford Financial Services Group, Inc. | 9,170 | 948,636 | ||||

Loews Corp. | 3,748 | 287,846 | ||||

Marsh & McLennan Cos., Inc. | 15,156 | 3,146,082 | ||||

MetLife, Inc. | 20,262 | 1,466,361 | ||||

Principal Financial Group, Inc. | 6,380 | 523,415 | ||||

Progressive Corp. | 19,744 | 4,169,538 | ||||

Prudential Financial, Inc. | 11,657 | 1,402,920 | ||||

Travelers Cos., Inc. | 6,500 | 1,402,050 | ||||

W.R. Berkley Corp. | 6,152 | 498,497 | ||||

Willis Towers Watson PLC | 3,096 | 790,378 | ||||

28,375,728 | ||||||

Interactive Media & Services - 6.9% | ||||||

Alphabet, Inc. - Class A(b) | 191,836 | 33,091,710 | ||||

Alphabet, Inc. - Class C(b) | 161,625 | 28,116,285 | ||||

Match Group, Inc.(b) | 8,741 | 267,737 | ||||

Meta Platforms, Inc. - Class A | 71,423 | 33,342,399 | ||||

94,818,131 | ||||||

IT Services - 0.9% | ||||||

Accenture PLC - Class A | 20,369 | 5,749,965 | ||||

Akamai Technologies, Inc.(b) | 3,746 | 345,531 | ||||

Cognizant Technology Solutions Corp. - Class A | 16,921 | 1,119,324 | ||||

EPAM Systems, Inc.(b) | 805 | 143,234 | ||||

Gartner, Inc.(b) | 972 | 407,919 | ||||

International Business Machines Corp. | 30,922 | 5,159,336 | ||||

VeriSign, Inc.(b) | 973 | 169,613 | ||||

13,094,922 | ||||||

Leisure Products - 0.0%(b) | ||||||

Hasbro, Inc. | 3,478 | 207,915 | ||||

Life Sciences Tools & Services - 1.2% | ||||||

Agilent Technologies, Inc. | 9,046 | 1,179,689 | ||||

Bio-Rad Laboratories, Inc. - Class A(b) | 291 | 83,476 | ||||

Bio-Techne Corp. | 3,746 | 289,154 | ||||

Charles River Laboratories International, Inc.(b) | 713 | 148,618 | ||||

Danaher Corp. | 20,786 | 5,337,845 | ||||

Illumina, Inc.(b) | 3,746 | 390,633 | ||||

IQVIA Holdings, Inc.(b) | 5,860 | 1,283,867 | ||||

19 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Life Sciences Tools & Services - (Continued) | ||||||

Mettler-Toledo International, Inc.(b) | 303 | $425,439 | ||||

Revvity, Inc. | 975 | 106,529 | ||||

Thermo Fisher Scientific, Inc. | 12,026 | 6,830,527 | ||||

Waters Corp.(b) | 826 | 255,151 | ||||

West Pharmaceutical Services, Inc. | 972 | 322,131 | ||||

16,653,059 | ||||||

Machinery - 1.6% | ||||||

Caterpillar, Inc. | 17,052 | 5,772,443 | ||||

Cummins, Inc. | 3,634 | 1,023,807 | ||||

Deere & Co. | 8,705 | 3,262,286 | ||||

Dover Corp. | 3,610 | 663,590 | ||||

Fortive Corp. | 11,529 | 858,219 | ||||

IDEX Corp. | 972 | 202,798 | ||||

Illinois Tool Works, Inc. | 8,791 | 2,134,015 | ||||

Ingersoll Rand, Inc. | 12,068 | 1,122,927 | ||||

Nordson Corp. | 756 | 177,448 | ||||

Otis Worldwide Corp. | 12,068 | 1,197,146 | ||||

PACCAR, Inc. | 17,237 | 1,852,978 | ||||

Parker-Hannifin Corp. | 3,449 | 1,833,213 | ||||

Pentair PLC | 3,746 | 304,849 | ||||

Snap-on, Inc. | 736 | 200,825 | ||||

Stanley Black & Decker, Inc. | 3,746 | 326,539 | ||||

Westinghouse Air Brake Technologies Corp. | 3,747 | 634,105 | ||||

Xylem, Inc. | 6,672 | 940,885 | ||||

22,508,073 | ||||||

Media - 0.6% | ||||||

Charter Communications, Inc. - Class A(b) | 3,064 | 879,736 | ||||

Comcast Corp. - Class A | 135,528 | 5,425,186 | ||||

Fox Corp. - Class A | 6,764 | 232,885 | ||||

Fox Corp. - Class B | 3,497 | 111,694 | ||||

Interpublic Group of Cos., Inc. | 11,970 | 375,499 | ||||

News Corp. - Class A | 11,923 | 324,186 | ||||

News Corp. - Class B | 975 | 27,183 | ||||

Omnicom Group, Inc. | 3,748 | 348,414 | ||||

Paramount Global - Class B | 15,063 | 179,400 | ||||

7,904,183 | ||||||

Metals & Mining - 0.4% | ||||||

Freeport-McMoRan, Inc. | 48,151 | 2,539,002 | ||||

Newmont Corp. | 37,616 | 1,577,615 | ||||

Nucor Corp. | 6,740 | 1,138,049 | ||||

Steel Dynamics, Inc. | 3,753 | 502,414 | ||||

5,757,080 | ||||||

20 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Multi-Utilities - 0.6% | ||||||

Ameren Corp. | 6,521 | $478,446 | ||||

CenterPoint Energy, Inc. | 20,388 | 622,038 | ||||

CMS Energy Corp. | 9,043 | 569,076 | ||||

Consolidated Edison, Inc. | 11,448 | 1,082,408 | ||||

Dominion Energy, Inc. | 28,282 | 1,524,965 | ||||

DTE Energy Co. | 6,200 | 722,486 | ||||

NiSource, Inc. | 12,068 | 350,696 | ||||

Public Service Enterprise Group, Inc. | 16,880 | 1,278,829 | ||||

Sempra | 20,386 | 1,570,334 | ||||

WEC Energy Group, Inc. | 9,294 | 753,093 | ||||

8,952,371 | ||||||

Oil, Gas & Consumable Fuels - 3.8% | ||||||

APA Corp. | 9,265 | 282,860 | ||||

Chevron Corp. | 59,373 | 9,636,238 | ||||

ConocoPhillips | 39,838 | 4,640,330 | ||||

Coterra Energy, Inc. | 25,391 | 724,151 | ||||

Devon Energy Corp. | 20,552 | 1,008,692 | ||||

Diamondback Energy, Inc. | 3,747 | 746,627 | ||||

EOG Resources, Inc. | 19,796 | 2,465,592 | ||||

EQT Corp. | 12,065 | 495,751 | ||||

Exxon Mobil Corp. | 151,115 | 17,719,745 | ||||

Hess Corp. | 8,851 | 1,363,939 | ||||

Kinder Morgan, Inc. | 65,128 | 1,269,345 | ||||

Marathon Oil Corp. | 19,771 | 572,568 | ||||

Marathon Petroleum Corp. | 11,926 | 2,106,251 | ||||

Occidental Petroleum Corp. | 20,821 | 1,301,313 | ||||

ONEOK, Inc. | 19,756 | 1,600,236 | ||||

Phillips 66 | 14,416 | 2,048,658 | ||||

Targa Resources Corp. | 6,430 | 760,219 | ||||

Valero Energy Corp. | 11,376 | 1,787,625 | ||||

Williams Cos., Inc. | 40,224 | 1,669,698 | ||||

52,199,838 | ||||||

Passenger Airlines - 0.2% | ||||||

American Airlines Group, Inc.(b) | 20,682 | 237,843 | ||||

Delta Air Lines, Inc. | 20,554 | 1,048,665 | ||||

Southwest Airlines Co. | 19,883 | 533,660 | ||||

United Airlines Holdings, Inc.(b) | 9,534 | 505,206 | ||||

2,325,374 | ||||||

Personal Care Products - 0.1% | ||||||

Kenvue, Inc. | 57,161 | 1,103,207 | ||||

The Estee Lauder Companies, Inc. - Class A | 6,520 | 804,307 | ||||

1,907,514 | ||||||

21 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Pharmaceuticals - 4.0% | ||||||

Bristol-Myers Squibb Co. | 68,153 | $2,800,407 | ||||

Catalent, Inc.(b) | 3,747 | 201,551 | ||||

Eli Lilly & Co. | 26,063 | 21,380,521 | ||||

Johnson & Johnson | 81,571 | 11,964,019 | ||||

Merck & Co., Inc. | 84,987 | 10,669,268 | ||||

Pfizer, Inc. | 191,380 | 5,484,951 | ||||

Viatris, Inc. | 39,918 | 423,131 | ||||

Zoetis, Inc. | 14,717 | 2,495,414 | ||||

55,419,262 | ||||||

Professional Services - 0.6% | ||||||

Automatic Data Processing, Inc. | 12,361 | 3,027,456 | ||||

Broadridge Financial Solutions, Inc. | 3,300 | 662,541 | ||||

Dayforce, Inc.(b) | 3,746 | 185,277 | ||||

Equifax, Inc. | 3,376 | 781,173 | ||||

Jacobs Solutions, Inc. | 3,416 | 475,986 | ||||

Leidos Holdings, Inc. | 3,579 | 526,292 | ||||

Paychex, Inc. | 9,295 | 1,116,887 | ||||

Paycom Software, Inc. | 682 | 99,108 | ||||

Robert Half International, Inc. | 974 | 62,560 | ||||

Verisk Analytics, Inc. | 3,678 | 929,725 | ||||

7,867,005 | ||||||

Real Estate Management & Development - 0.1% | ||||||

CBRE Group, Inc. - Class A(b) | 9,204 | 810,596 | ||||

CoStar Group, Inc.(b) | 12,068 | 943,356 | ||||

1,753,952 | ||||||

Semiconductors & Semiconductor Equipment - 11.6% | ||||||

Advanced Micro Devices, Inc.(b) | 53,710 | 8,964,199 | ||||

Analog Devices, Inc. | 16,868 | 3,955,377 | ||||

Applied Materials, Inc. | 28,238 | 6,073,429 | ||||

Broadcom, Inc. | 14,407 | 19,140,420 | ||||

Enphase Energy, Inc.(b) | 3,558 | 455,068 | ||||

First Solar, Inc.(b) | 3,150 | 856,044 | ||||

Intel Corp. | 143,334 | 4,421,854 | ||||

KLA Corp. | 3,552 | 2,697,851 | ||||

Lam Research Corp. | 3,490 | 3,254,216 | ||||

Microchip Technology, Inc. | 17,469 | 1,698,511 | ||||

Micron Technology, Inc. | 36,807 | 4,600,875 | ||||

Monolithic Power Systems, Inc. | 665 | 489,194 | ||||

NVIDIA Corp. | 79,263 | 86,898,405 | ||||

NXP Semiconductors NV | 8,552 | 2,326,999 | ||||

ON Semiconductor Corp.(b) | 14,273 | 1,042,500 | ||||

Qorvo, Inc.(b) | 974 | 95,832 | ||||

QUALCOMM, Inc. | 37,050 | 7,560,052 | ||||

Skyworks Solutions, Inc. | 3,746 | 347,104 | ||||

22 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Semiconductors & Semiconductor Equipment - (Continued) | ||||||

Teradyne, Inc. | 3,746 | $527,961 | ||||

Texas Instruments, Inc. | 29,223 | 5,698,777 | ||||

161,104,668 | ||||||

Software - 10.3% | ||||||

Adobe, Inc.(b) | 14,629 | 6,506,394 | ||||

ANSYS, Inc.(b) | 2,866 | 909,812 | ||||

Autodesk, Inc.(b) | 6,297 | 1,269,475 | ||||

Cadence Design Systems, Inc.(b) | 8,771 | 2,511,225 | ||||

Fair Isaac Corp.(b) | 344 | 443,736 | ||||

Fortinet, Inc.(b) | 20,465 | 1,213,984 | ||||

Gen Digital, Inc. | 17,805 | 442,098 | ||||

Intuit, Inc. | 8,894 | 5,126,857 | ||||

Microsoft Corp. | 236,857 | 98,326,446 | ||||

Oracle Corp. | 53,608 | 6,282,321 | ||||

Palo Alto Networks, Inc.(b) | 9,327 | 2,750,626 | ||||

PTC, Inc.(b) | 3,315 | 584,236 | ||||

Roper Technologies, Inc. | 3,145 | 1,675,530 | ||||

Salesforce, Inc. | 31,800 | 7,455,192 | ||||

ServiceNow, Inc.(b) | 6,175 | 4,056,543 | ||||

Synopsys, Inc.(b) | 3,746 | 2,100,757 | ||||

Tyler Technologies, Inc.(b) | 586 | 281,491 | ||||

141,936,723 | ||||||

Specialty Retail - 1.7% | ||||||

AutoZone, Inc.(b) | 245 | 678,635 | ||||

Bath & Body Works, Inc. | 6,472 | 336,156 | ||||

Best Buy Co., Inc. | 3,748 | 317,905 | ||||

CarMax, Inc.(b) | 3,747 | 263,264 | ||||

Home Depot, Inc. | 33,798 | 11,317,936 | ||||

Lowe’s Cos., Inc. | 17,993 | 3,981,671 | ||||

O’Reilly Automotive, Inc.(b) | 826 | 795,653 | ||||

Ross Stores, Inc. | 9,295 | 1,299,069 | ||||

TJX Companies, Inc. | 37,508 | 3,867,075 | ||||

Tractor Supply Co. | 3,156 | 900,375 | ||||

Ulta Beauty, Inc.(b) | 686 | 271,032 | ||||

24,028,771 | ||||||

Technology Hardware, Storage & Peripherals - 6.8% | ||||||

Apple, Inc. | 467,251 | 89,829,005 | ||||

Hewlett Packard Enterprise Co. | 42,690 | 753,478 | ||||

HP, Inc. | 28,682 | 1,046,893 | ||||

NetApp, Inc. | 6,227 | 749,918 | ||||

Seagate Technology Holdings PLC | 3,748 | 349,464 | ||||

Super Micro Computer, Inc.(b) | 991 | 777,449 | ||||

Western Digital Corp.(b) | 9,482 | 713,900 | ||||

94,220,107 | ||||||

23 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Textiles, Apparel & Luxury Goods - 0.4% | ||||||

Deckers Outdoor Corp.(b) | 504 | $551,336 | ||||

Lululemon Athletica, Inc.(b) | 3,260 | 1,017,087 | ||||

NIKE, Inc. - Class B | 40,128 | 3,814,166 | ||||

Ralph Lauren Corp. | 3 | 561 | ||||

Tapestry, Inc. | 6,508 | 283,033 | ||||

5,666,183 | ||||||

Tobacco - 0.6% | ||||||

Altria Group, Inc. | 59,460 | 2,750,025 | ||||

Philip Morris International, Inc. | 51,465 | 5,217,522 | ||||

7,967,547 | ||||||

Trading Companies & Distributors - 0.2% | ||||||

Fastenal Co. | 17,920 | 1,182,361 | ||||

United Rentals, Inc. | 946 | 633,262 | ||||

W.W. Grainger, Inc. | 615 | 566,698 | ||||

2,382,321 | ||||||

Water Utilities - 0.0%(c) | ||||||

American Water Works Co., Inc. | 3,747 | 489,995 | ||||

Wireless Telecommunication Services - 0.2% | ||||||

T-Mobile US, Inc. | 17,028 | 2,979,219 | ||||

TOTAL COMMON STOCKS (Cost $1,232,261,124) | 1,359,455,137 | |||||

REAL ESTATE INVESTMENT TRUSTS - 1.9%(a) | ||||||

Alexandria Real Estate Equities, Inc. | 3,746 | 445,774 | ||||

American Tower Corp. | 14,777 | 2,892,450 | ||||

AvalonBay Communities, Inc. | 3,633 | 700,007 | ||||

Boston Properties, Inc. | 3,666 | 222,416 | ||||

Camden Property Trust | 974 | 99,981 | ||||

Crown Castle, Inc. | 14,326 | 1,468,415 | ||||

Digital Realty Trust, Inc. | 9,181 | 1,334,367 | ||||

Equinix, Inc. | 2,958 | 2,256,895 | ||||

Equity Residential | 11,442 | 744,073 | ||||

Essex Property Trust, Inc. | 894 | 232,252 | ||||

Extra Space Storage, Inc. | 6,261 | 906,405 | ||||

Federal Realty Investment Trust | 972 | 98,124 | ||||

Healthpeak Properties, Inc. | 17,568 | 349,603 | ||||

Host Hotels & Resorts, Inc. | 23,050 | 413,517 | ||||

Invitation Homes, Inc. | 17,941 | 624,167 | ||||

Iron Mountain, Inc. | 9,027 | 728,389 | ||||

Kimco Realty Corp. | 20,244 | 391,924 | ||||

Mid-America Apartment Communities, Inc. | 3,282 | 438,836 | ||||

Prologis, Inc. | 31,078 | 3,433,808 | ||||

Public Storage | 3,746 | 1,025,767 | ||||

Realty Income Corp. | 20,388 | 1,081,787 | ||||

24 |

Shares | Value | |||||

REAL ESTATE INVESTMENT TRUSTS - (Continued) | ||||||

Regency Centers Corp. | 3,746 | $230,005 | ||||

SBA Communications Corp. | 3,155 | 620,525 | ||||

Simon Property Group, Inc. | 9,294 | 1,406,275 | ||||

UDR, Inc. | 9,181 | 354,570 | ||||

Ventas, Inc. | 12,068 | 606,538 | ||||

VICI Properties, Inc. | 34,252 | 983,375 | ||||

Welltower, Inc. | 17,660 | 1,830,812 | ||||

Weyerhaeuser Co. | 23,395 | 702,552 | ||||

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $26,373,384) | 26,623,609 | |||||

CONTINGENT VALUE RIGHTS - 0.0%(c) | ||||||

Abiomed, Inc.(b)(d) | 2 | 0 | ||||

TOTAL CONTINGENT VALUE RIGHTS (Cost $0) | 0 | |||||

SHORT-TERM INVESTMENTS - 1.1% | ||||||

Money Market Funds - 1.1% | ||||||

First American Treasury Obligations Fund - Class X, 5.22%(e) | 15,840,504 | 15,840,504 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $15,840,504) | 15,840,504 | |||||

TOTAL INVESTMENTS - 101.3% (Cost $1,274,475,012) | $1,401,919,250 | |||||

Liabilities in Excess of Other Assets - (1.3)% | (18,021,471) | |||||

TOTAL NET ASSETS - 100.0% | $1,383,897,779 | |||||

(a) | All or a portion of security has been pledged as collateral. The total value of assets committed as collateral as of May 31, 2024 is $1,386,078,746. |

(b) | Non-income producing security. |

(c) | Represents less than 0.05% of net assets. |

(d) | Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $0 or 0.0% of net assets as of May 31, 2024. |

(e) | The rate shown represents the 7-day effective yield as of May 31, 2024. |

25 |

Notional Amount | Contracts | Value | |||||||

WRITTEN OPTIONS - (1.1)% (a)(b) | |||||||||

Call Options - (1.1)% | |||||||||

S&P 500 Index | |||||||||

Expiration: 07/19/2024; Exercise Price: $5,320.00 | $(593,719,875) | (1,125) | $(9,253,125) | ||||||

Expiration: 07/19/2024; Exercise Price: $5,370.00 | (593,719,875) | (1,125) | (6,350,625) | ||||||

Total Call Options | (15,603,750) | ||||||||

TOTAL WRITTEN OPTIONS (Premiums received $14,400,742) | (15,603,750) | ||||||||

(a) | Exchange-traded. |

(b) | 100 shares per contract. |

26 |

NEOS Enhanced Income 1-3 Month T-Bill ETF | NEOS Enhanced Income Aggregate Bond ETF | NEOS Nasdaq-100® High Income ETF | NEOS S&P 500® High Income ETF | |||||||||

ASSETS: | ||||||||||||

Investments, at value | $441,995,953 | $11,192,569 | $219,282,766 | $1,401,919,250 | ||||||||

Dividends and interest receivable | 28,499 | 241 | 125,394 | 1,654,606 | ||||||||

Receivable for investments sold | — | — | 3,666,308 | 20,073,788 | ||||||||

Receivable for fund shares sold | — | — | 10,081,880 | 4,949,630 | ||||||||

Deposit at broker for option contracts | — | 4,709 | — | — | ||||||||

Other assets | — | — | — | 3 | ||||||||

Total assets | 442,024,452 | 11,197,519 | 233,156,348 | 1,428,597,277 | ||||||||

LIABILITIES: | ||||||||||||

Written option contracts, at value | 109,725 | 4,043 | 2,766,280 | 15,603,750 | ||||||||

Payable to adviser | 141,032 | 4,924 | 96,582 | 734,459 | ||||||||

Payable for investments purchased | — | — | 14,476,199 | 28,361,289 | ||||||||

Total liabilities | 250,757 | 8,967 | 17,339,061 | 44,699,498 | ||||||||

NET ASSETS | $441,773,695 | $11,188,552 | $215,817,287 | $1,383,897,779 | ||||||||

Net Assets Consists of: | ||||||||||||

Paid-in capital | $441,652,803 | $11,346,378 | $211,287,214 | $1,312,552,099 | ||||||||

Total distributable earnings/(accumulated losses) | 120,892 | (157,826) | 4,530,073 | 71,345,680 | ||||||||

Total net assets | $441,773,695 | $11,188,552 | $215,817,287 | $1,383,897,779 | ||||||||

Net assets | $441,773,695 | $11,188,552 | $215,817,287 | $1,383,897,779 | ||||||||

Shares issued and outstanding(a) | 8,870,000 | 240,000 | 4,280,000 | 27,960,000 | ||||||||

Net asset value per share | $49.81 | $46.62 | $50.42 | $49.50 | ||||||||

COST: | ||||||||||||

Investments, at cost | $441,932,768 | $11,349,711 | $214,188,883 | $1,274,475,012 | ||||||||

PROCEEDS: | ||||||||||||

Written options premium | $245,135 | $9,058 | $2,723,595 | $14,400,742 | ||||||||

(a) | Unlimited shares authorized without par value. |

27 |

NEOS Enhanced Income 1-3 Month T-Bill ETF | NEOS Enhanced Income Aggregate Bond ETF | NEOS Nasdaq-100® High Income ETF(a) | NEOS S&P 500® High Income ETF | |||||||||

INVESTMENT INCOME: | ||||||||||||

Dividend income | $— | $185,831 | $227,839 | $8,584,194 | ||||||||

Less: Dividend withholding taxes | — | — | (349) | (1,718) | ||||||||

Interest income | 12,946,933 | 1,994 | 25,834 | 370,061 | ||||||||

Total investment income | 12,946,933 | 187,825 | 253,324 | 8,952,537 | ||||||||

EXPENSES: | ||||||||||||

Investment advisory fee | 915,994 | 33,466 | 175,260 | 3,831,430 | ||||||||

Total expenses | 915,994 | 33,466 | 175,260 | 3,831,430 | ||||||||

Expense waiver by Adviser | — | (1,721) | — | — | ||||||||

Net expenses | 915,994 | 31,745 | 175,260 | 3,831,430 | ||||||||

NET INVESTMENT INCOME | 12,030,939 | 156,080 | 78,064 | 5,121,107 | ||||||||

REALIZED AND UNREALIZED GAIN/(LOSS) | ||||||||||||

Net realized gain/(loss) from: | ||||||||||||

Investments | (2,094,707) | (62,094) | (69,815) | (4,068,221) | ||||||||

In-kind redemptions | (242) | — | — | 3,122,739 | ||||||||

Written option contracts expired or closed | 3,556,051 | 103,092 | (451,310) | (46,414,338) | ||||||||

Net realized gain/(loss) | 1,461,102 | 40,998 | (521,125) | (47,359,820) | ||||||||

Net change in unrealized appreciation/(depreciation) on: | ||||||||||||

Investments | 88,127 | (128,929) | 5,093,883 | 126,898,467 | ||||||||

Written option contracts | 104,594 | 4,027 | (42,685) | (1,209,356) | ||||||||

Net change in unrealized appreciation/(depreciation) | 192,721 | (124,902) | 5,051,198 | 125,689,111 | ||||||||

Net realized and unrealized gain/(loss) | 1,653,823 | (83,904) | 4,530,073 | 78,329,291 | ||||||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $13,684,762 | $72,176 | $4,608,137 | $83,450,398 | ||||||||

(a) | The Fund commenced investment operations on January 30, 2024. |

28 |

NEOS Enhanced Income 1-3 Month T-Bill ETF | NEOS Enhanced Income Aggregate Bond ETF | |||||||||||

Year ended May 31, 2024 | Period ended May 31, 2023(a) | Year ended May 31, 2024 | Period ended May 31, 2023(a) | |||||||||

OPERATIONS: | ||||||||||||

Net investment income | $12,030,939 | $644,812 | $156,080 | $16,864 | ||||||||

Net realized gain | 1,461,102 | 290,414 | 40,998 | 16,541 | ||||||||

Net change in unrealized appreciation/(depreciation) | 192,721 | 5,874 | (124,902) | (27,225) | ||||||||

Net increase in net assets from operations | 13,684,762 | 941,100 | 72,176 | 6,180 | ||||||||

DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||||||

Distributions to shareholders | (13,553,733) | (951,625) | (202,156) | (34,026) | ||||||||

Return of capital | (1,282,823) | (29,184) | (112,364) | (9,004) | ||||||||

Total distributions to shareholders | (14,836,556) | (980,809) | (314,520) | (43,030) | ||||||||

CAPITAL TRANSACTIONS: | ||||||||||||

Subscriptions | 413,865,914 | 101,652,426 | 9,497,973 | 1,969,773 | ||||||||

Redemptions | (71,049,803) | (1,503,339) | — | — | ||||||||

Net increase in net assets from capital transactions | 342,816,111 | 100,149,087 | 9,497,973 | 1,969,773 | ||||||||

NET INCREASE IN NET ASSETS | 341,664,317 | 100,109,378 | 9,255,629 | 1,932,923 | ||||||||

NET ASSETS: | ||||||||||||

Beginning of the year | 100,109,378 | — | 1,932,923 | — | ||||||||

End of the year | $441,773,695 | $100,109,378 | $11,188,552 | $1,932,923 | ||||||||

SHARES TRANSACTIONS | ||||||||||||

Subscriptions | 8,290,000 | 2,030,000 | 200,000 | 40,000 | ||||||||

Redemptions | (1,420,000) | (30,000) | — | — | ||||||||

Total increase in shares outstanding | 6,870,000 | 2,000,000 | 200,000 | 40,000 | ||||||||

(a) | Inception date of the Fund was August 30, 2022. |

29 |

NEOS Nasdaq-100® High Income ETF | NEOS S&P 500® High Income ETF | ||||||||

Period ended May 31, 2024(a) | Year ended May 31, 2024 | Period ended May 31, 2023(b) | |||||||

OPERATIONS: | |||||||||

Net investment income | $78,064 | $5,121,107 | $45,704 | ||||||

Net realized gain/(loss) | (521,125) | (47,359,820) | 70,319 | ||||||

Net change in unrealized appreciation | 5,051,198 | 125,689,111 | 552,119 | ||||||

Net increase in net assets from operations | 4,608,137 | 83,450,398 | 668,142 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS: | |||||||||

Distributions to shareholders | (78,064) | (9,548,376) | (188,945) | ||||||

Return of capital | (4,355,312) | (62,890,517) | (246,419) | ||||||

Total distributions to shareholders | (4,433,376) | (72,438,893) | (435,364) | ||||||

CAPITAL TRANSACTIONS: | |||||||||

Subscriptions | 215,642,525 | 1,362,850,824 | 26,285,280 | ||||||

Redemptions | — | (15,527,100) | (955,508) | ||||||

ETF transaction fees (See Note 7) | 1 | — | — | ||||||

Net increase in net assets from capital transactions | 215,642,526 | 1,347,323,724 | 25,329,772 | ||||||

NET INCREASE IN NET ASSETS | 215,817,287 | 1,358,335,229 | 25,562,550 | ||||||

NET ASSETS: | |||||||||

Beginning of the year | — | 25,562,550 | — | ||||||

End of the year | $215,817,287 | $1,383,897,779 | $25,562,550 | ||||||

SHARES TRANSACTIONS | |||||||||

Subscriptions | 4,280,000 | 27,750,000 | 550,000 | ||||||

Redemptions | — | (320,000) | (20,000) | ||||||

Total increase in shares outstanding | 4,280,000 | 27,430,000 | 530,000 | ||||||

(a) | Inception date of the Fund was January 30, 2024. |

(b) | Inception date of the Fund was August 30, 2022. |

30 |

Year ended May 31, 2024 | Period ended May 31, 2023(a) | |||||

PER SHARE DATA: | ||||||

Net asset value, beginning of period | $50.05 | $50.00 | ||||

INVESTMENTS OPERATIONS: | ||||||

Net investment income(b) | 2.49 | 1.73 | ||||

Net realized and unrealized gain on investments | 0.34 | 0.32 | ||||

Total from investment operations | 2.83 | 2.05 | ||||

LESS DISTRIBUTIONS FROM: | ||||||

From net investment income | (2.61) | (1.31) | ||||

From net realized gains | (0.20) | (0.63) | ||||

Return of capital | (0.26) | (0.06) | ||||

Total distributions | (3.07) | (2.00) | ||||

Net asset value, end of period | $49.81 | $50.05 | ||||

Total Return(c) | 5.80% | 4.18% | ||||

SUPPLEMENTAL DATA AND RATIOS: | ||||||

Net assets, end of period (in thousands) | $441,774 | $100,109 | ||||

Ratio of expenses to average net assets(d) | 0.38% | 0.38% | ||||

Ratio of net investment income to average net assets(d) | 4.99% | 4.58% | ||||

Portfolio turnover rate(c)(e) | 0% | 0% | ||||

(a) | Inception date of the Fund was August 30, 2022. |

(b) | Net investment income per share has been calculated based on average shares outstanding during the year or period. |

(c) | Not annualized for periods less than one year. |

(d) | Annualized for periods less than one year. |

(e) | Portfolio turnover rate excludes in-kind transactions and short-term options. |

31 |

Year ended May 31, 2024 | Period ended May 31, 2023(a) | |||||

PER SHARE DATA: | ||||||

Net asset value, beginning of period | $48.32 | $49.77 | ||||

INVESTMENTS OPERATIONS: | ||||||

Net investment income(b) | 1.27 | 0.78 | ||||

Net realized and unrealized loss on investments | (0.47) | (0.40) | ||||

Total from investment operations | 0.80 | 0.38 | ||||

LESS DISTRIBUTIONS FROM: | ||||||

From net investment income | (1.46) | (0.72) | ||||

From net realized gains | (0.24) | (0.73) | ||||

Return of capital | (0.80) | (0.38) | ||||

Total distributions | (2.50) | (1.83) | ||||

Net asset value, end of period | $46.62 | $48.32 | ||||

Total Return(c) | 1.74% | 0.85% | ||||

SUPPLEMENTAL DATA AND RATIOS: | ||||||

Net assets, end of period (in thousands) | $11,189 | $1,933 | ||||

Ratio of expenses to average net assets: | ||||||

Before expense waivers(d) | 0.58% | 0.58% | ||||

After expense waivers(d) | 0.55% | 0.55% | ||||

Ratio of net investment income to average net assets(d) | 2.71% | 2.14% | ||||

Portfolio turnover rate(c)(e) | 1% | 0% |

(a) | Inception date of the Fund was August 30, 2022. |

(b) | Net investment income per share has been calculated based on average shares outstanding during the year or period. |

(c) | Not annualized for periods less than one year. |

(d) | Annualized for periods less than one year. |

(e) | Portfolio turnover rate exclude in-kind transactions and short-term options. |

32 |

Period ended May 31, 2024(a) | |||

PER SHARE DATA: | |||

Net asset value, beginning of period | $50.00 | ||

INVESTMENTS OPERATIONS: | |||

Net investment income(b) | 0.05 | ||

Net realized and unrealized gain on investments | 2.77 | ||

Total from investment operations | 2.82 | ||

LESS DISTRIBUTIONS FROM: | |||

From net investment income | (0.04) | ||

Return of capital | (2.36) | ||

Total distributions | (2.40) | ||

ETF transaction fees per share | 0.00(c) | ||

Net asset value, end of period | $50.42 | ||

Total Return(d) | 5.78% | ||

SUPPLEMENTAL DATA AND RATIOS: | |||

Net assets, end of period (in thousands) | $215,817 | ||

Ratio of expenses to average net assets(e) | 0.68% | ||

Ratio of net investment income to average net assets(e) | 0.30% | ||

Portfolio turnover rate(d)(f) | 3% |

(a) | Inception date of the Fund was January 30, 2024. |

(b) | Net investment income per share has been calculated based on average shares outstanding during the period. |

(c) | Amount represents less than $0.005 per share. |

(d) | Not annualized for periods less than one year. |

(e) | Annualized for periods less than one year. |

(f) | Portfolio turnover rate exclude in-kind transactions and short-term options. |

33 |

Year ended May 31, 2024 | Period ended May 31, 2023(a) | |||||

PER SHARE DATA: | ||||||

Net asset value, beginning of period | $48.23 | $49.67 | ||||

INVESTMENTS OPERATIONS: | ||||||

Net investment income(b) | 0.44 | 0.49 | ||||

Net realized and unrealized gain on investments | 6.71 | 2.34 | ||||

Total from investment operations | 7.15 | 2.83 | ||||

LESS DISTRIBUTIONS FROM: | ||||||

From net investment income | (0.79) | (0.44) | ||||

From net realized gains | (0.32) | (1.40) | ||||

Return of capital | (4.77) | (2.43) | ||||

Total distributions | (5.88) | (4.27) | ||||

Net asset value, end of period | $49.50 | $48.23 | ||||

Total Return(c) | 15.79% | 6.31% | ||||

SUPPLEMENTAL DATA AND RATIOS: | ||||||

Net assets, end of period (in thousands) | $1,383,898 | $25,563 | ||||

Ratio of expenses to average net assets(d) | 0.68% | 0.68% | ||||

Ratio of net investment income to average net assets(d) | 0.91% | 1.37% | ||||

Portfolio turnover rate(c)(e) | 14% | 21% |

(a) | Inception date of the Fund was August 30, 2022. |

(b) | Net investment income per share has been calculated based on average shares outstanding during the year or period. |

(c) | Not annualized for periods less than one year. |

(d) | Annualized for periods less than one year. |

(e) | Portfolio turnover rate exclude in-kind transactions and short-term options. |

34 |

| A. | Investment Valuation. The net asset value (“NAV”) of each Fund’s shares is calculated each business day as of the close of regular trading on the New York Stock Exchange (“NYSE”), generally 4:00 p.m., Eastern Time. NAV per share is computed by dividing the net assets of each Fund by each Fund’s number of shares outstanding. |

35 |

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Purchased Options* | $ — | $60,610 | $ — | $60,610 | ||||||||

Money Market Funds | 1,468,316 | — | — | 1,468,316 | ||||||||

U.S. Treasury Bills | — | 440,467,027 | — | 440,467,027 | ||||||||

Total Assets | $1,468,316 | $440,527,637 | $— | $441,995,953 | ||||||||

Liabilities: | ||||||||||||

Written Options* | — | (109,725) | — | (109,725) | ||||||||

Total Liabilities | $— | $(109,725) | $— | $(109,725) |

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Exchange Traded Funds | $11,159,096 | $ — | $ — | $11,159,096 | ||||||||

Purchased Options* | — | 1,873 | — | 1,873 | ||||||||

Money Market Funds | 31,600 | — | — | 31,600 | ||||||||

Total Assets | $11,190,696 | $1,873 | $— | $11,192,569 | ||||||||

Liabilities: | ||||||||||||

Written Options* | — | (4,043) | — | (4,043) | ||||||||

Total Liabilities | $ — | $(4,043) | $ — | $(4,043) |

36 |

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Common Stocks** | $217,611,373 | $ — | $ — | $ 217,611,373 | ||||||||

Money Market Funds | 1,671,393 | — | — | 1,671,393 | ||||||||

Total Assets | $219,282,766 | $— | — | $219,282,766 | ||||||||

Liabilities: | ||||||||||||

Written Options* | — | (2,766,280) | — | (2,766,280) | ||||||||

Total Liabilities | $— | $(2,766,280) | $ — | $(2,766,280) | ||||||||

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Common Stocks** | $1,359,455,137 | $ — | $ — | $1,359,455,137 | ||||||||

Real Estate Investment Trusts | 26,623,609 | — | — | 26,623,609 | ||||||||

Contingent Value Rights | — | — | 0*** | 0*** | ||||||||

Money Market Funds | 15,840,504 | — | — | 15,840,504 | ||||||||

Total Assets | $1,401,919,250 | $— | $0*** | $1,401,919,250 | ||||||||

Liabilities: | ||||||||||||

Written Options* | — | (15,603,750) | — | (15,603,750) | ||||||||

Total Liabilities | $— | $(15,603,750) | $— | $(15,603,750) | ||||||||

| * | The tables above are based on market values or unrealized appreciation/(depreciation) rather than the notional amounts of derivatives. The uncertainties surrounding the valuation inputs for a derivative are likely to be more significant to a Fund’s NAV than the uncertainties surrounding inputs for a non-derivative security with the same market value. |

| ** | See Schedule of Investments for segregation by industry. |

| *** | Represents amount less than $0.50. |

Description | Fair Value as of May 31, 2024 | Valuation Technique | Unobservable Input | Input Values | ||||||||

Contingent Value Rights* | $ 0** | Projected Final Distribution | Discount of Projected Distribution | $ 35.00 | ||||||||