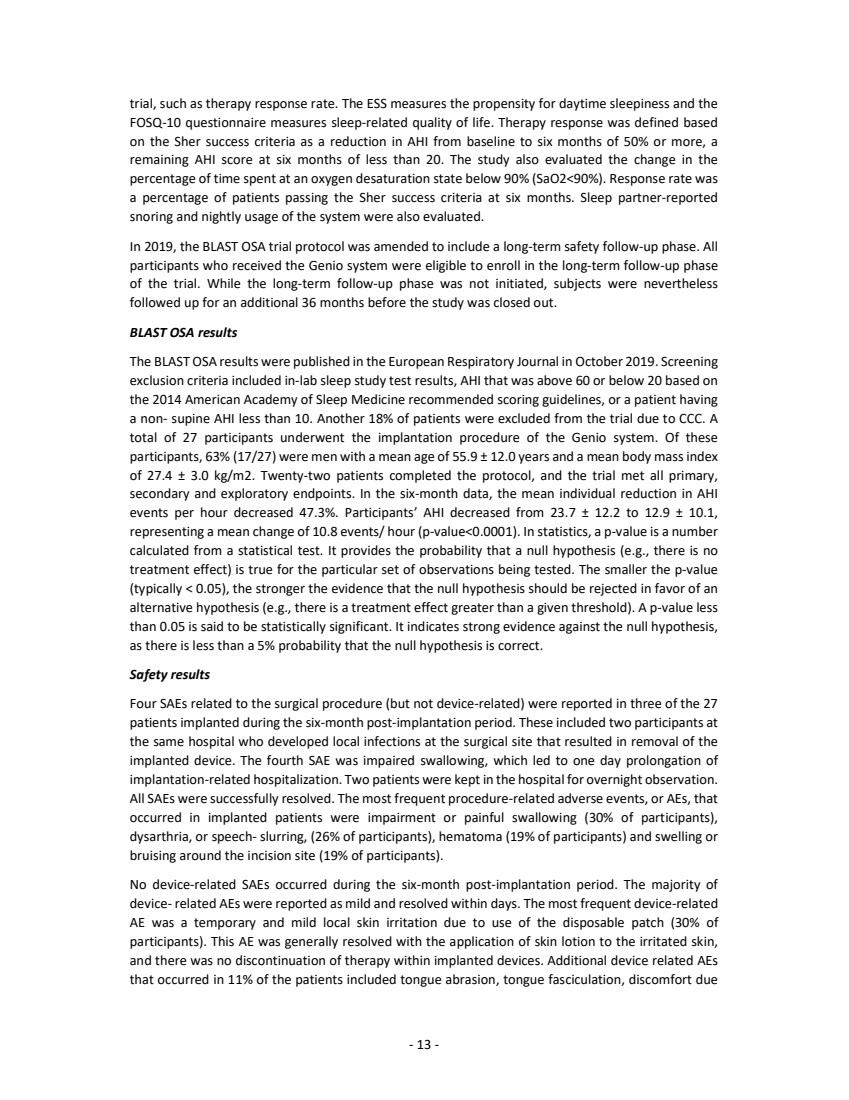

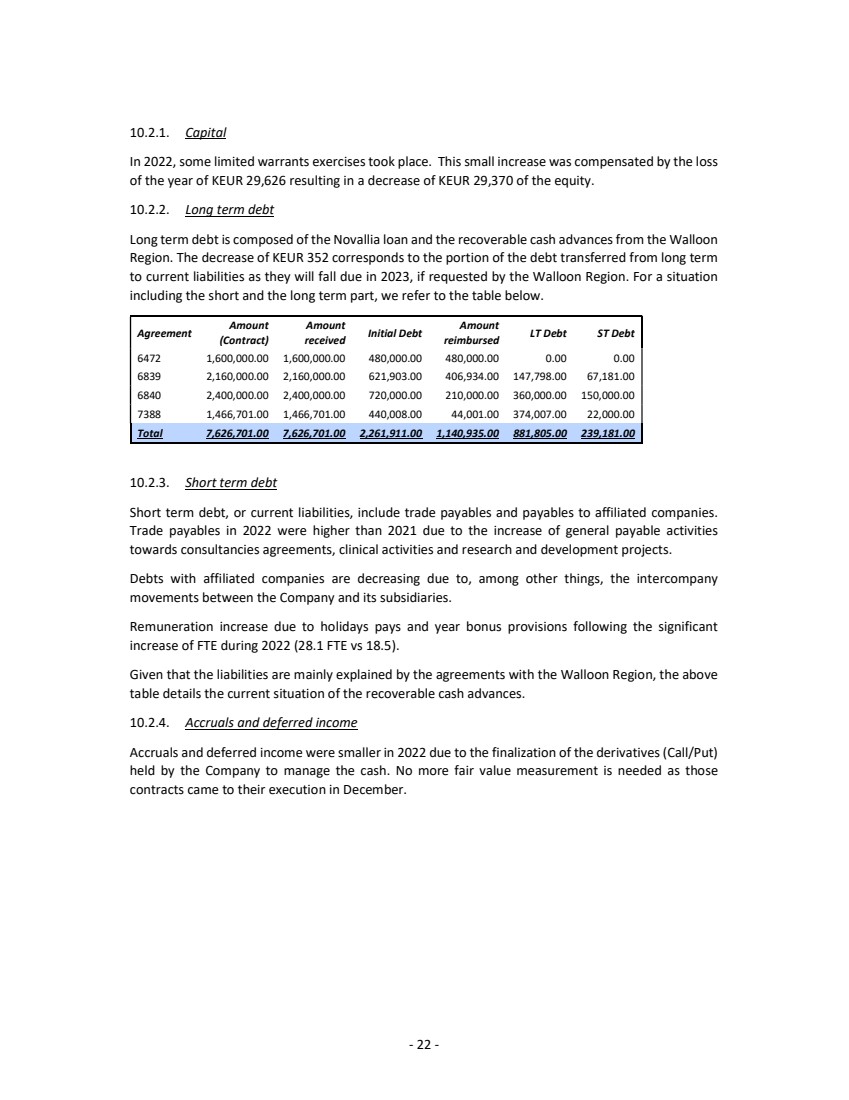

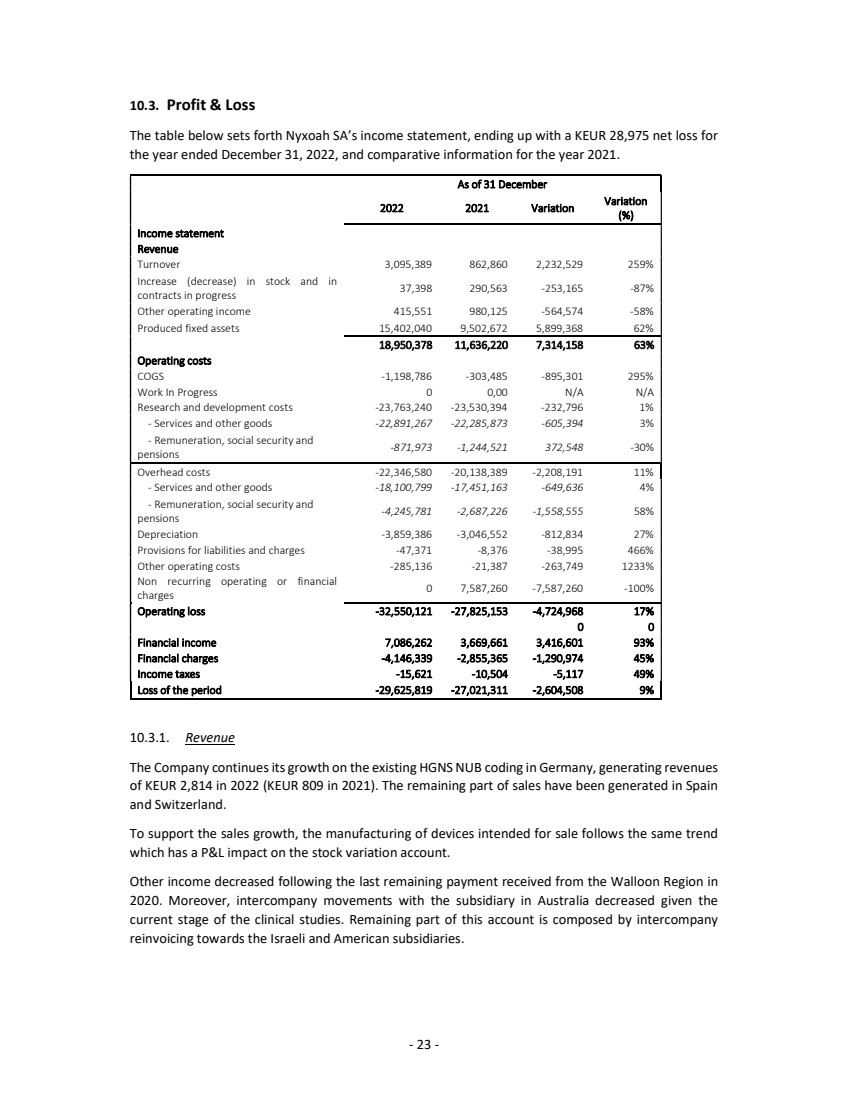

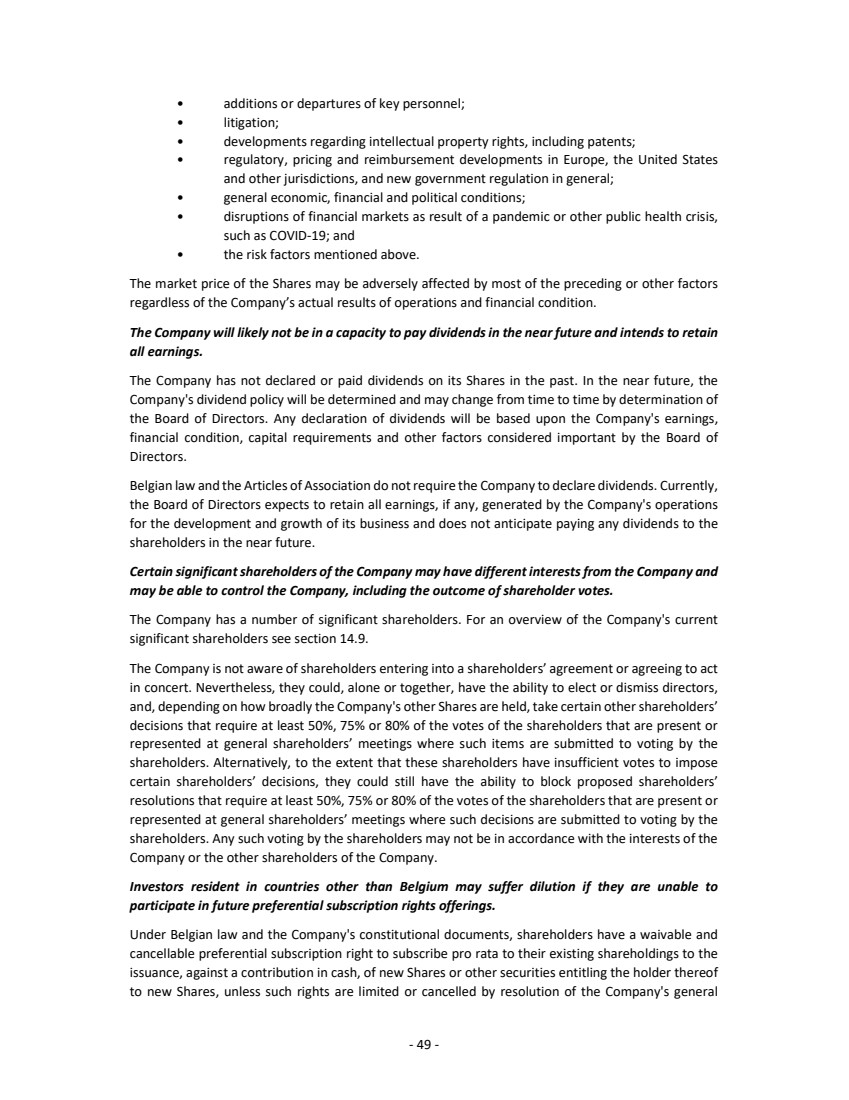

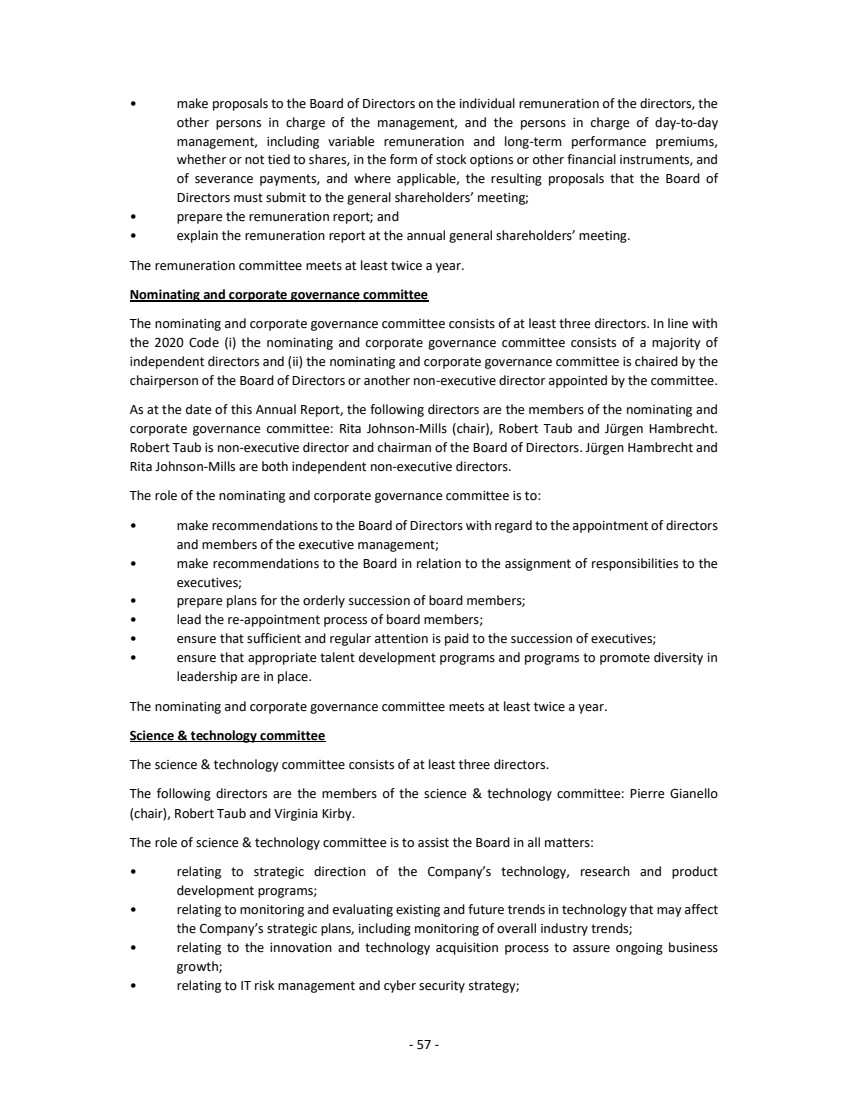

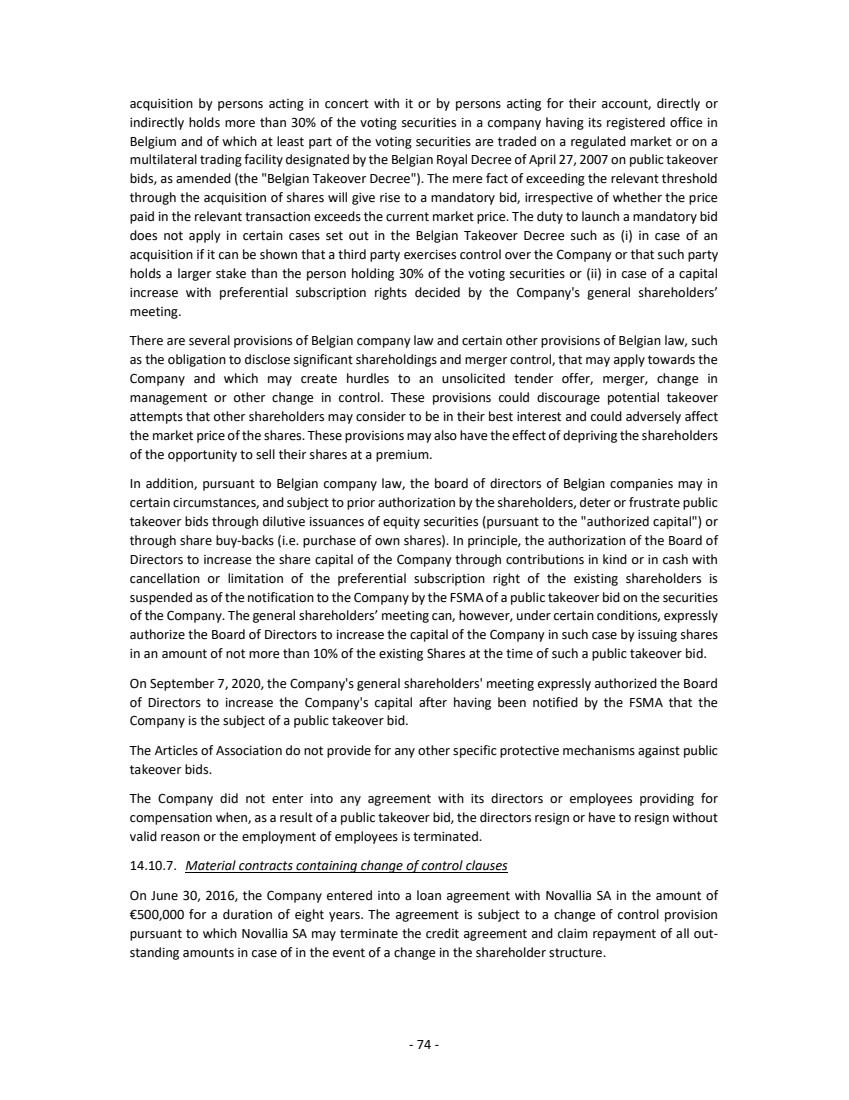

| - 23 - 10.3. Profit & Loss The table below sets forth Nyxoah SA’s income statement, ending up with a KEUR 28,975 net loss for the year ended December 31, 2022, and comparative information for the year 2021. As of 31 December 2022 2021 Variation Variation (%) Income statement Revenue Turnover 3,095,389 862,860 2,232,529 259% Increase (decrease) in stock and in contracts in progress 37,398 290,563 -253,165 -87% Other operating income 415,551 980,125 -564,574 -58% Produced fixed assets 15,402,040 9,502,672 5,899,368 62% 18,950,378 11,636,220 7,314,158 63% Operating costs COGS -1,198,786 -303,485 -895,301 295% Work In Progress 0 0,00 N/A N/A Research and development costs -23,763,240 -23,530,394 -232,796 1% - Services and other goods -22,891,267 -22,285,873 -605,394 3% - Remuneration, social security and pensions -871,973 -1,244,521 372,548 -30% Overhead costs -22,346,580 -20,138,389 -2,208,191 11% - Services and other goods -18,100,799 -17,451,163 -649,636 4% - Remuneration, social security and pensions -4,245,781 -2,687,226 -1,558,555 58% Depreciation -3,859,386 -3,046,552 -812,834 27% Provisions for liabilities and charges -47,371 -8,376 -38,995 466% Other operating costs -285,136 -21,387 -263,749 1233% Non recurring operating or financial charges 0 7,587,260 -7,587,260 -100% Operating loss -32,550,121 -27,825,153 -4,724,968 17% 0 0 Financial income 7,086,262 3,669,661 3,416,601 93% Financial charges -4,146,339 -2,855,365 -1,290,974 45% Income taxes -15,621 -10,504 -5,117 49% Loss of the period -29,625,819 -27,021,311 -2,604,508 9% 10.3.1. Revenue The Company continues its growth on the existing HGNS NUB coding in Germany, generating revenues of KEUR 2,814 in 2022 (KEUR 809 in 2021). The remaining part of sales have been generated in Spain and Switzerland. To support the sales growth, the manufacturing of devices intended for sale follows the same trend which has a P&L impact on the stock variation account. Other income decreased following the last remaining payment received from the Walloon Region in 2020. Moreover, intercompany movements with the subsidiary in Australia decreased given the current stage of the clinical studies. Remaining part of this account is composed by intercompany reinvoicing towards the Israeli and American subsidiaries. |