- WEBR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

SC 13E3 Filing

Weber (WEBR) SC 13E3Going private transaction

Filed: 17 Jan 23, 8:46am

Exhibit (c)(2) – Preliminary Working Draft; All Figures Subject to Change / Update – Project Cactus Discussion Materials November 1, 2022

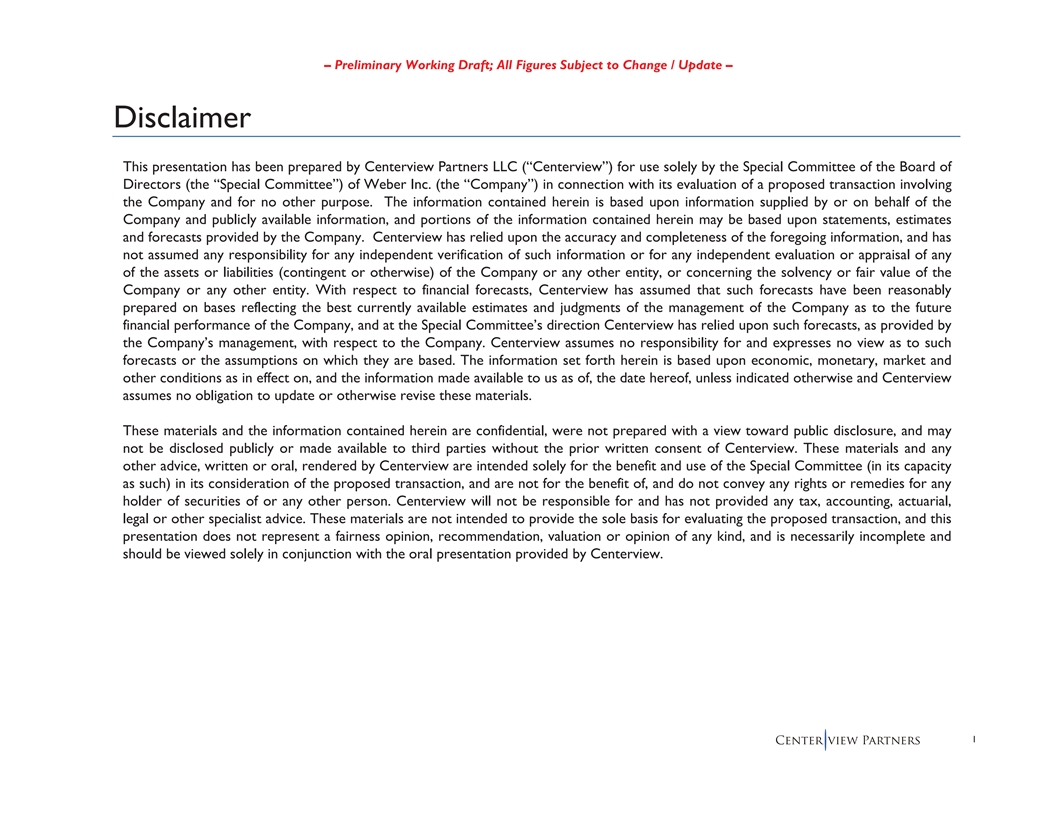

– Preliminary Working Draft; All Figures Subject to Change / Update – Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors (the “Special Committee”) of Weber Inc. (the “Company”) in connection with its evaluation of a proposed transaction involving the Company and for no other purpose. The information contained herein is based upon information supplied by or on behalf of the Company and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by the Company. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of the Company or any other entity, or concerning the solvency or fair value of the Company or any other entity. With respect to financial forecasts, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the management of the Company as to the future financial performance of the Company, and at the Special Committee’s direction Centerview has relied upon such forecasts, as provided by the Company’s management, with respect to the Company. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee (in its capacity as such) in its consideration of the proposed transaction, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. 1

ƒƒƒƒƒƒƒ – Preliminary Working Draft; All Figures Subject to Change / Update – Executive Summary On 10/24, BDT submitted a proposal to acquire the Class A shares that it does not currently own (~27.5mm) for $6.25 per share in cash – Since the announcement, Cactus has traded up to $6.72 per share For today’s meeting, we plan to discuss: Situation Update –––– Terms of BDT’s 10/24 proposal and key aspects of the proposal that A require further clarification B –––– Framework to contextualize BDT’s proposal C –– Considerations for timing, process and tactics Request Special Committee to authorize Centerview and S&C to engage with BDT and Cravath to clarify aspects of its proposal Continue advancing A/R financing process and finalize BDT Term Loan Centerview to follow-up with management to discuss the updated outlook Next Steps and continue our assessment (if / as needed) Centerview to present preliminary assessment of the outlook to the Special Committee Develop and align on response to BDT 2 Source: FactSet as of October 28, 2022.

– Preliminary Working Draft; All Figures Subject to Change / Update – Special Committee “Roadmap Dashboard” Focus for Today’s Discussion A B C Evaluate Fr F amework Reach BDT’ B s 10/24 C Contextualizing Proposal and Negotiate for Agreement Proposal BDT’s Proposal Develop with BDT Negotiation with BDT Response How does the What are Offer value vs. What are key BDT offer price BDT negotiation potential value terms of compare to Becomes dynamics in of executing on the proposal? recent stock Unfriendly selected other mgmt. outlook performance? transactions? BDT What other Economic and Process, timing Withdraws Items to clarify factors should Non-Economic and tactical Proposal with BDT be taken into Terms of BDT considerations consideration? proposal Assessment of Negotiation Levers Management Outlook Learnings from diligence Offer value / Premium No regulatory closing conditions Key drivers of outlook Majority of the minority vote Buyer bridge loan Potential risks / opportunities Reverse termination fee Minimal R&W Comparison vs. expectations Financing contingency / backstop Ticking construct Theoretical value of outlook 3

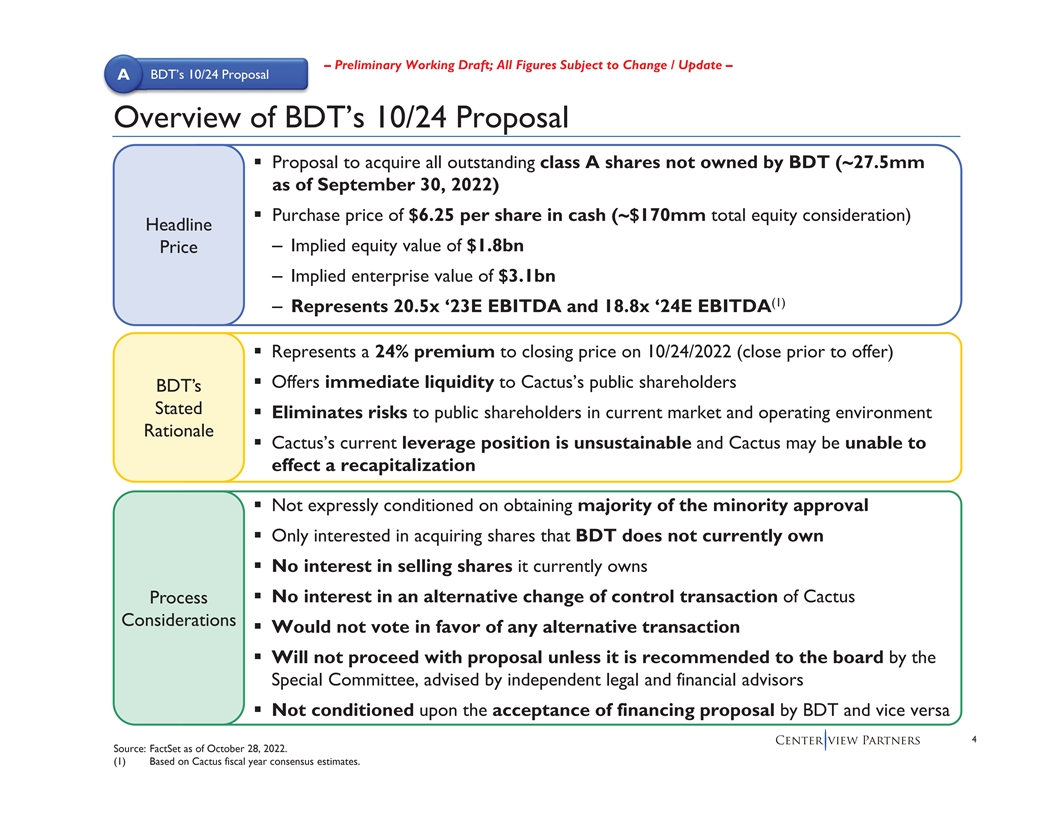

ƒƒƒƒƒƒƒƒƒƒƒƒƒ – Preliminary Working Draft; All Figures Subject to Change / Update – BDT’s 10/24 Proposal A Overview of BDT’s 10/24 Proposal Proposal to acquire all outstanding class A shares not owned by BDT (~27.5mm as of September 30, 2022) Purchase price of $6.25 per share in cash (~$170mm total equity consideration) Headline – Implied equity value of $1.8bn Price – Implied enterprise value of $3.1bn (1) – Represents 20.5x ‘23E EBITDA and 18.8x ‘24E EBITDA Represents a 24% premium to closing price on 10/24/2022 (close prior to offer) Offers immediate liquidity to Cactus’s public shareholders BDT’s Stated Eliminates risks to public shareholders in current market and operating environment Rationale Cactus’s current leverage position is unsustainable and Cactus may be unable to effect a recapitalization Not expressly conditioned on obtaining majority of the minority approval Only interested in acquiring shares that BDT does not currently own No interest in selling shares it currently owns No interest in an alternative change of control transaction of Cactus Process Considerations Would not vote in favor of any alternative transaction Will not proceed with proposal unless it is recommended to the board by the Special Committee, advised by independent legal and financial advisors Not conditioned upon the acceptance of financing proposal by BDT and vice versa 4 Source: FactSet as of October 28, 2022. (1) Based on Cactus fiscal year consensus estimates.

ƒƒƒƒƒƒƒƒƒƒƒƒƒƒƒƒƒƒ – Preliminary Working Draft; All Figures Subject to Change / Update – BDT’s 10/24 Proposal A Key Aspects Of BDT’s 10/24 Proposal To Clarify What transaction structure is being contemplated (e.g., one-step merger vs. two-step tender offer) If a merger, will BDT deliver shareholder approval by written consent? What conversations have been had, if any, with Stephen family / other shareholders? Transaction Structure Does BDT anticipate asking or requiring the Stephen family to roll their B shares as part of the proposed transaction? What is the proposed treatment of outstanding pre-IPO profit interest units? What is the proposed treatment of unvested post-IPO incentive units and options? How will proposed transaction be financed? Equity or new debt financing? Who is providing the contemplated source(s) of financing? Proposed Transaction Are sources of capital (either equity or debt) already committed? “Sources” If debt financed, will BDT require a marketing period or inside date? Will BDT provide an equity backstop? Confirm shareholders that are part of the BDT group making the proposal Which shareholders constitute the 27.5mm shares proposed to be acquired by BDT? Proposed Transaction How are Byron Trott and MAD family trust shares treated in proposed transaction? “Uses” Confirm the proposed treatment of the Class B shares and what BDT expects unitholders to do in a transaction (e.g., convert to A shares or rollover B units) How does BDT envision the sequencing of solving for Cactus’s liquidity need, negotiating Capital covenant relief and effectuating a potential take-private transaction? Structure What is BDT’s proposed timeline to signing and closing? Timing What approvals are required? 5

– – Preliminary Working Draft; All Figures Subject to Change / Update – Contextualizing BDT’s C Proposal B Cactus Share Price Performance Post-IPO Cactus Share Price Implied Premium / (55%) (7%) (15%) +24% (7%) (Discount) vs. BDT Proposal $14.00 $7.35 Proposal: $6.70 $6.72 $6.25/sh $5.03 (1) IPO Price 20-Day VWAP Day Before BBG Rumor Price Before Proposal Current $24 (August 5, 2022) (October 10, 2022) (October 10, 2022) (October 24, 2022) (October 28, 2022) $20 $16 IPO @ $14.00 $12 $7.35 $8 20-Day VWAP: $6.70 $6.72 $5.03 $4 Aug-21 Sep-21 Oct-21 Dec-21 Jan-22 Mar-22 Apr-22 Jun-22 Jul-22 Aug-22 Oct-22 Source: FactSet as of October 28, 2022. 6 Note: Dollars. (1) Reflects closing price prior to BDT proposal.

– – Preliminary Working Draft; All Figures Subject to Change / Update – C Contextualizing BDT’s Proposal B Premia in Selected Precedent Minority “Squeeze Out” Transactions (1) Selected Precedent Minority “Squeeze Out” Transactions Implied Initial Bid Premium to Initial to Final Bid Premium to % of Equity Enterprise Unaffected 20-Day Final Bid Unaffected 20-Day (2) (3) (4) (3) Date Target Acquiror Owned Value Price VWAP % Increase Price VWAP Jun-22 Convey TPG Capital 75% $1.1 66% 48% 17% 143% 106% Nov-20 Urovant Sumitovant Biopharma 72% 0.7 55% 53% 30% 96% 103% Aug-20 Akcea Ionis Pharmaceuticals 76% 1.5 42% 39% 13% 59% 59% Aug-20 Hudson Dufry AG 57% 1.1 24% 9% 23% 50% 59% Nov-19 AVX KYOCERA Corp 72% 2.9 30% 27% 12% 45% 42% Jun-18 Foundation Medicine Roche 57% 5.3 30% 38% 3% 29% 40% Nov-16 Synutra Investor Group 64% 0.8 54% 30% 2% 58% 33% Sep-16Federal-Mogul Icahn 82%4.441%65%32%101%136% (5) Mar-16 Crown Media Hallmark 90% 2.1 2% 13% -% 2% 13% Sep-13 Cornerstone Therapeutics Chiesi Farmaceutici 58% 0.3 22% 20% 45% 78% 74% Mar-13 Sauer-Danfoss Danfoss 76% 2.6 24% 24% 19% 49% 48% 25th Percentile 61% 24% 22% 7% 47% 41% Median 72% 30% 30% 17% 58% 59% 75th Percentile 76% 48% 43% 27% 87% 89% Source: FactSet as of October 28, 2022. Note: Dollars in billions. (1) All cash, minority “squeeze out” transactions with U.S. targets and over $100mm in equity consideration over the last 10 years with offers from only single acquiror. Excludes transactions in real-estate, energy, financial institutions and oil and gas industries (n=11). (2) Reflects unaffected date of first bid. (3) Reflects 20 trading days. (4) Reflects unaffected date of transaction announcement. 7 (5) On June 24, 2013, Crown Media filed an amendment to its Schedule 13D disclosing it was evaluating a “short-form merger to eliminate the minority stockholders”. Final price reflects 151% premium to share price on June 24, 2013.

– – Preliminary Working Draft; All Figures Subject to Change / Update – Contextualizing BDT’s C Proposal B Reflects Management Forecast as of 10/28/22 Illustrative Analysis At Various Prices 30% premia 10/24 BDT 58% premia Proposal Share Price $6.25 $7.00 $8.00 $9.00 $10.00 $11.00 % Premium / (Discount) to: Current Price (10/28/22) $6.72 (7%) +4% +19% +34% +49% +64% Closing Price Prior to 10/24 Proposal $5.03 +24% +39% +59% +79% +99% +119% (1) 20-Day VWAP $6.70 (7%) +4% +19% +34% +49% +64% Price Before BBG Rumor (10/10/22) $7.35 (15%) (5%) +9% +22% +36% +50% Implied Equity Value $1,821 $2,040 $2,332 $2,630 $2,930 $3,230 (2) Plus: Net Debt 1,268 1,268 1,268 1,268 1,268 1,268 Implied Enterprise Value ($mm) $3,089 $3,308 $3,599 $3,897 $4,197 $4,498 Implied EV / EBITDA (Management) (3) 2022E ($3) n.a. n.a. n.a. n.a. n.a. n.a. 2023E 130 23.8x 25.4x 27.7x 30.0x 32.3x 34.6x 2024E 222 13.9x 14.9x 16.2x 17.6x 18.9x 20.3x Implied EV / EBITDA (Consensus) 2022E $37 82.5x 88.4x 96.1x 104.1x 112.1x 120.1x 2023E 151 20.5x 21.9x 23.9x 25.8x 27.8x 29.8x 2024E 164 18.8x 20.1x 21.9x 23.7x 25.5x 27.4x Source: Management and FactSet as of October 28, 2022. Note: Dollars in millions, except per share amounts. (1) Reflects 20 trading days as of BBG Rumor date. 8 (2) Net debt excludes NCI that is related to Up-C structure. (3) Negative multiples presented as “n.a.”.

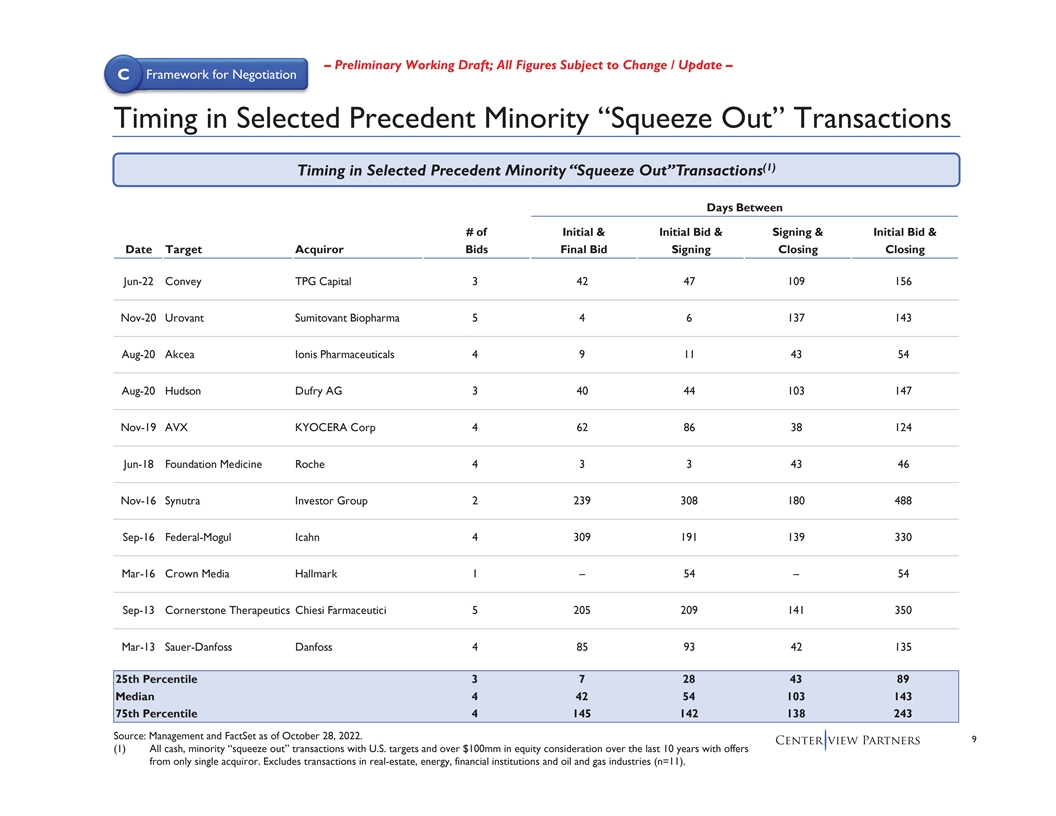

– Preliminary Working Draft; All Figures Subject to Change / Update – Framework for Negotiation C Timing in Selected Precedent Minority “Squeeze Out” Transactions (1) Timing in Selected Precedent Minority “Squeeze Out” Transactions Days Between # of Initial & Initial Bid & Signing & Initial Bid & Date Target Acquiror Bids Final Bid Signing Closing Closing Jun-22 Convey TPG Capital 3 42 47 109 156 Nov-20 Urovant Sumitovant Biopharma 5 4 6 137 143 Aug-20 Akcea Ionis Pharmaceuticals 4 9 11 43 54 Aug-20 Hudson Dufry AG 3 40 44 103 147 Nov-19 AVX KYOCERA Corp 4 62 86 38 124 Jun-18 Foundation Medicine Roche 4 3 3 43 46 Nov-16 Synutra Investor Group 2 239 308 180 488 Sep-16Federal-MogulIcahn 4 309 191 139 330 Mar-16 Crown Media Hallmark 1 – 54 – 54 Sep-13 Cornerstone Therapeutics Chiesi Farmaceutici 5 205 209 141 350 Mar-13 Sauer-Danfoss Danfoss 4 85 93 42 135 25th Percentile 3 7 28 43 89 Median 4 42 54 103 143 75th Percentile 4 145 142 138 243 Source: Management and FactSet as of October 28, 2022. 9 (1) All cash, minority “squeeze out” transactions with U.S. targets and over $100mm in equity consideration over the last 10 years with offers from only single acquiror. Excludes transactions in real-estate, energy, financial institutions and oil and gas industries (n=11).

88888888 9 99999999 888888 99999 88888 9 – Preliminary Working Draft; All Figures Subject to Change / Update – Framework for Negotiation C Non-Economic Terms in Selected Precedent Minority “Squeeze Out” Transactions (1) Non-Economic Terms in Selected Precedent Minority “Squeeze Out” Transactions Structure Non-Economic Terms Go-Shop Majority of Written No Financing Reverse Date Target Acquiror Merger or Tender? Provision? Minority? Consent? Contingency? Termination Fee? Jun-22 Convey TPG Capital Merger 88 999 Nov-20 Urovant Sumitovant Biopharma Merger Aug-20 Akcea Ionis Pharmaceuticals Tender (2) Aug-20 Hudson Dufry AG Merger 8888 Nov-19 AVX KYOCERA Corp Tender 88 Jun-18 Foundation Medicine Roche Tender 888 Nov-16 Synutra Investor Group Merger 99 99 Sep-16Federal-MogulIcahn Tender Mar-16 Crown Media Hallmark Tender 888 Sep-13 Cornerstone Therapeutics Chiesi Farmaceutici Merger Mar-13 Sauer-Danfoss Danfoss Tender % of Deals 18% 55% 9% 91% 27% Source: Management and FactSet as of October 28, 2022. Note: Dollars in billions. (1) All-cash, minority “squeeze out” transactions with U.S. targets and over $100mm in equity consideration over the last 10 years. Excludes transactions in real-estate, energy, financial institutions and oil and gas industries (n=11). (2) Acquisition was conditioned upon completion of an equity rights offering by Dufry, which required the approval of its shareholders. 10 Merger agreement included an additional reverse termination fee payable to Hudson if Dufry failed to gain approval of its equity rights offering, which was to provide capital to consummate the merger.

– Preliminary Working Draft; All Figures Subject to Change / Update – Framework for Negotiation C Process In Context Of Key Upcoming Dates Key Upcoming Dates (Week of) October November December January February March 24 31714 21 28512 19 262 916 23 30613 20 27613 20 27 3/31 11/26 10/24 12/8 12/31 2/14 Projected Liquidity BDT Q4’22 Covenant Q1’23 trough required Proposal Earnings test Reporting liquidity deadline Draw on BDT Term Loan and complete A/R financing process 60 days 90 days 120 days since initial since initial since initial proposal proposal proposal 11

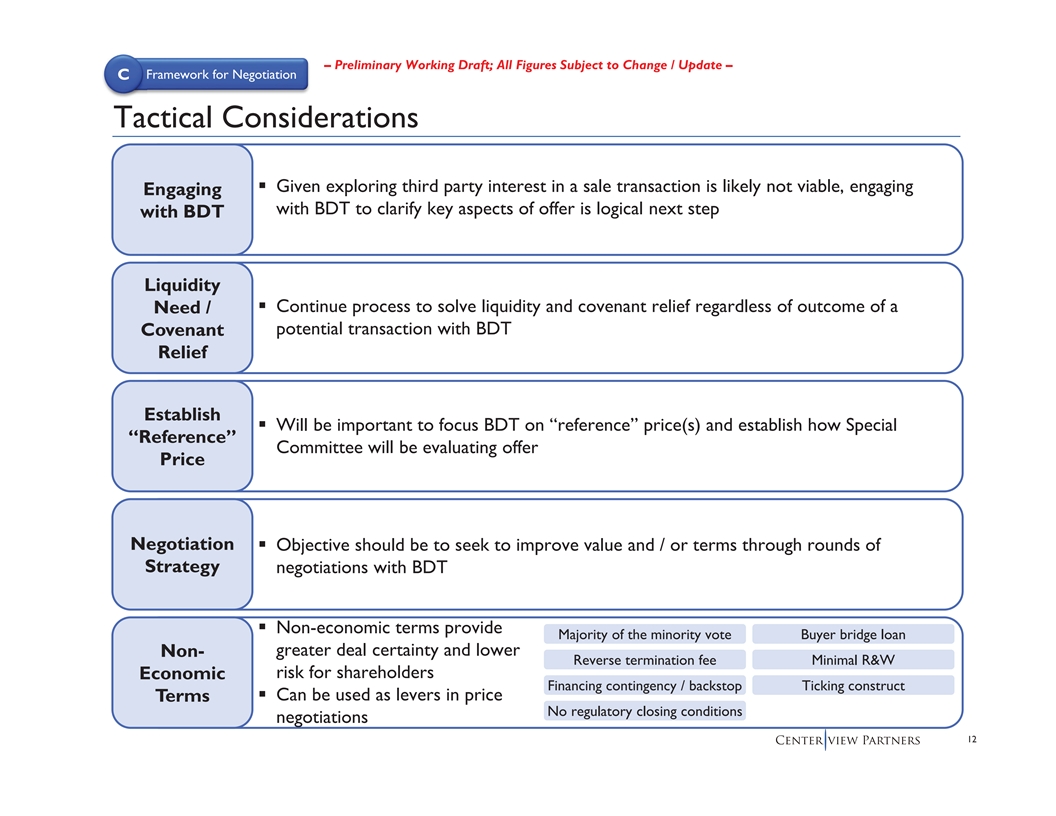

ƒƒƒƒƒƒ – Preliminary Working Draft; All Figures Subject to Change / Update – Framework for Negotiation C Tactical Considerations Given exploring third party interest in a sale transaction is likely not viable, engaging Engaging with BDT to clarify key aspects of offer is logical next step with BDT Liquidity Continue process to solve liquidity and covenant relief regardless of outcome of a Need / potential transaction with BDT Covenant Relief Establish Will be important to focus BDT on “reference” price(s) and establish how Special “Reference” Committee will be evaluating offer Price Negotiation Objective should be to seek to improve value and / or terms through rounds of Strategy negotiations with BDT Non-economic terms provide Majority of the minority vote Buyer bridge loan greater deal certainty and lower Non- Reverse termination fee Minimal R&W risk for shareholders Economic Financing contingency / backstop Ticking construct Terms Can be used as levers in price No regulatory closing conditions negotiations 12

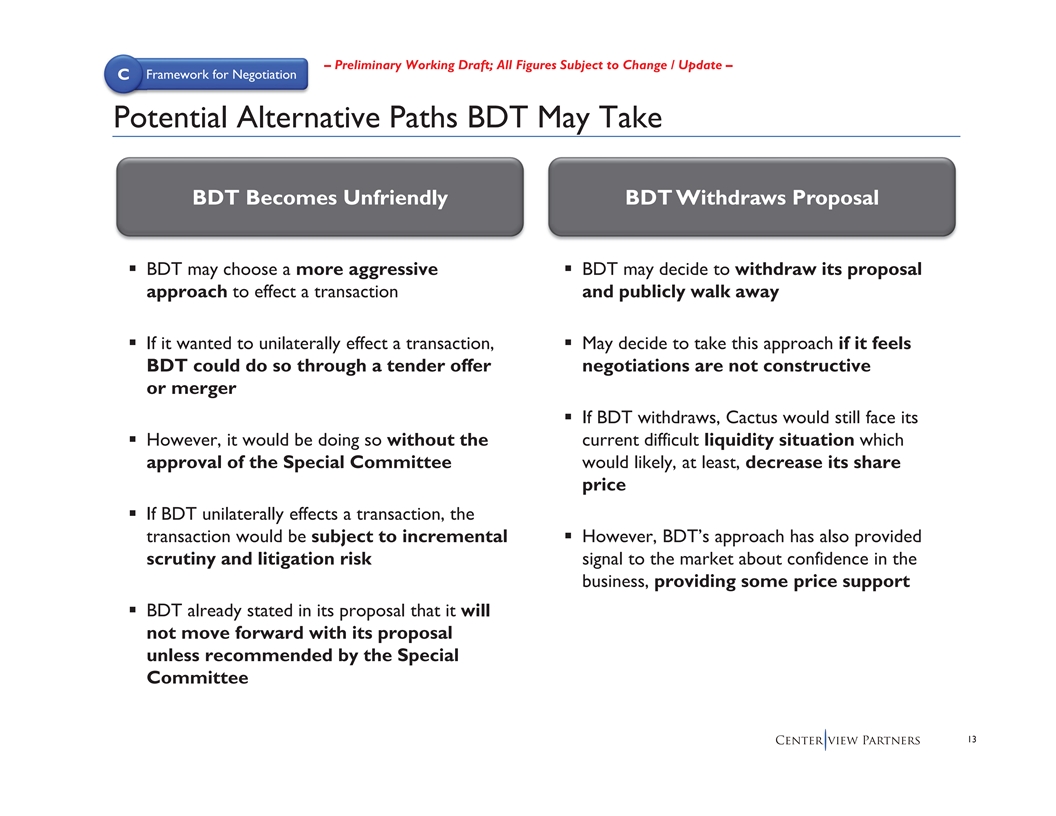

ƒƒƒƒ ƒƒƒƒƒ – Preliminary Working Draft; All Figures Subject to Change / Update – Framework for Negotiation C Potential Alternative Paths BDT May Take BDT Becomes Unfriendly BDT Withdraws Proposal BDT may choose a more aggressive BDT may decide to withdraw its proposal approach to effect a transaction and publicly walk away If it wanted to unilaterally effect a transaction, May decide to take this approach if it feels BDT could do so through a tender offer negotiations are not constructive or merger If BDT withdraws, Cactus would still face its However, it would be doing so without the current difficult liquidity situation which approval of the Special Committee would likely, at least, decrease its share price If BDT unilaterally effects a transaction, the transaction would be subject to incremental However, BDT’s approach has also provided scrutiny and litigation risk signal to the market about confidence in the business, providing some price support BDT already stated in its proposal that it will not move forward with its proposal unless recommended by the Special Committee 13

Appendix

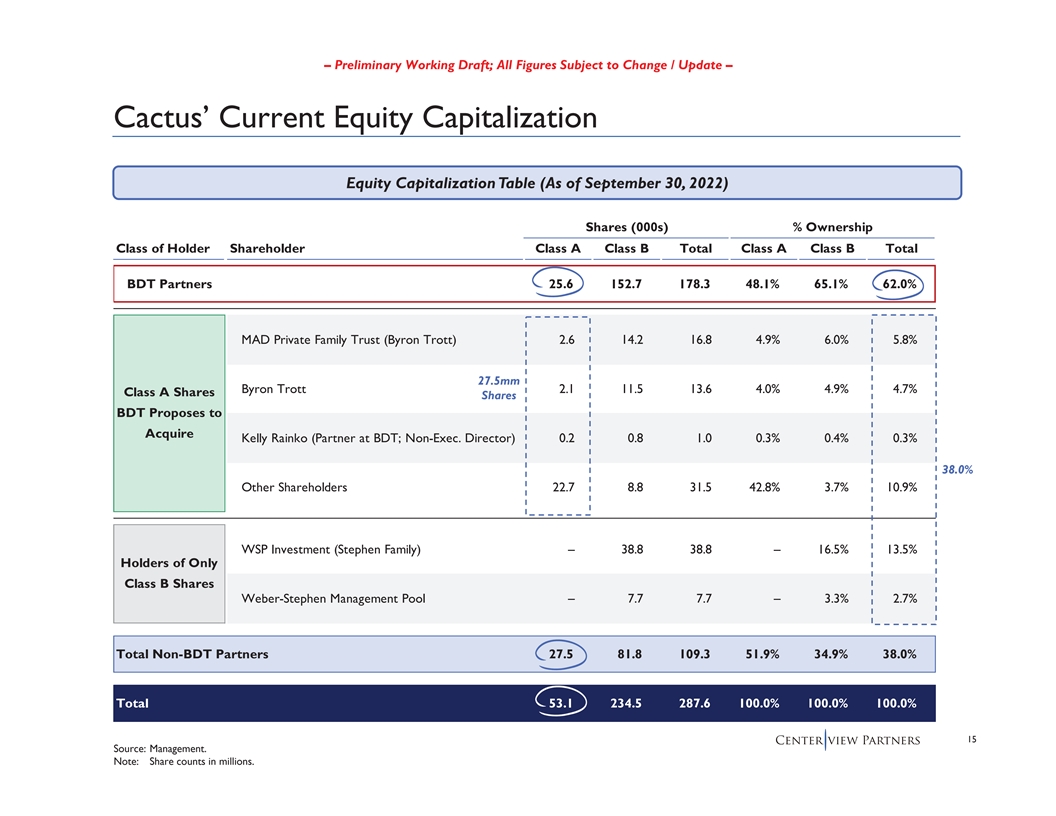

– Preliminary Working Draft; All Figures Subject to Change / Update – Cactus’ Current Equity Capitalization Equity Capitalization Table (As of September 30, 2022) Shares (000s) % Ownership Class of Holder Shareholder Class A Class B Total Class A Class B Total BDT Partners 25.6 152.7 178.3 48.1% 65.1% 62.0% MAD Private Family Trust (Byron Trott) 2.6 14.2 16.8 4.9% 6.0% 5.8% 27.5mm Byron Trott 2.1 11.5 13.6 4.0% 4.9% 4.7% Class A Shares Shares BDT Proposes to Acquire Kelly Rainko (Partner at BDT; Non-Exec. Director) 0.2 0.8 1.0 0.3% 0.4% 0.3% 38.0% Other Shareholders 22.7 8.8 31.5 42.8% 3.7% 10.9% WSP Investment (Stephen Family) – 38.8 38.8 – 16.5% 13.5% Holders of Only Class B Shares Weber-Stephen Management Pool – 7.7 7.7 – 3.3% 2.7% Total Non-BDT Partners 27.5 81.8 109.3 51.9% 34.9% 38.0% Total 53.1 234.5 287.6 100.0% 100.0% 100.0% 15 Source: Management. Note: Share counts in millions.