0001859808 tsr:bench202411014226_1258Member 2021-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23703 |

| |

| MassMutual Advantage Funds |

| (Exact name of registrant as specified in charter) |

| 1295 State Street, Springfield, MA | 01111 |

| (Address of principal executive offices) | (Zip code) |

| | |

| Douglas Steele |

| 1295 State Street, Springfield, MA 01111 |

| (Name and address of agent for service) |

| |

| | | |

| Registrant’s telephone number, including area code: | (413) 744-1000 | |

| Date of fiscal year end: | 09/30/2024 | |

| | | |

| Date of reporting period: | 09/30/2024 | |

Item 1. Reports to Stockholders.

| (a) | The Reports to Stockholders are attached herewith. |

| | |

MassMutual Clinton Limited Term Municipal Fund | |

| Class I | MMZPX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Limited Term Municipal Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class I | $19 | 0.29% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg 5-Year Municipal Bond Index:

• Issue selection in total and particularly in local authority municipal bonds

• Issue selection in state general obligation issues

Top detractors to the Fund’s performance relative to the Bloomberg 5-Year Municipal Bond Index:

• Interest rate sensitivity including both duration and yield curve effects

• Sector allocation effect in total and, in particular, an underweight to gas forward issues

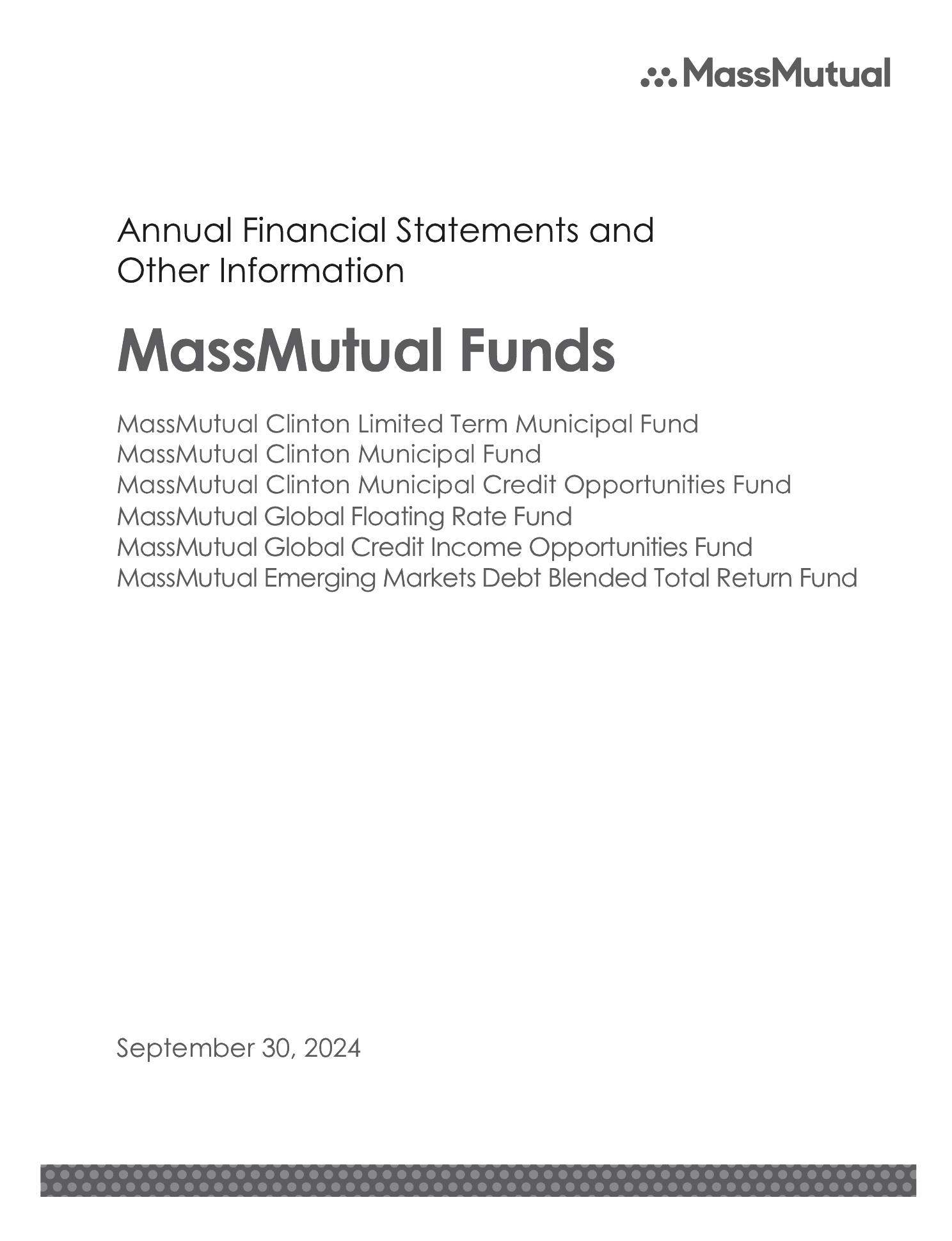

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT316 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class I - without sales charge | 1.62 |

Bloomberg Municipal Bond Index | 2.82 |

Bloomberg 5-Year Municipal Bond Index | 2.55 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $49.9 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 33 |

Total Advisory Fees Paid During the Reporting Period | $78,835 |

Portfolio Turnover Rate | 70% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

Texas | 16.8% |

New York | 13.2% |

Pennsylvania | 11.9% |

Illinois | 11.5% |

Virginia | 8.0% |

South Carolina | 7.1% |

California | 6.3% |

New Jersey | 5.9% |

Maryland | 5.4% |

Florida | 4.2% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT316 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT316 |

100001016210000102821000010255

| | |

MassMutual Clinton Limited Term Municipal Fund | |

| Class Y | MMZQX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Limited Term Municipal Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class Y | $26 | 0.39% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg 5-Year Municipal Bond Index:

• Issue selection in total and particularly in local authority municipal bonds

• Issue selection in state general obligation issues

Top detractors to the Fund’s performance relative to the Bloomberg 5-Year Municipal Bond Index:

• Interest rate sensitivity including both duration and yield curve effects

• Sector allocation effect in total and, in particular, an underweight to gas forward issues

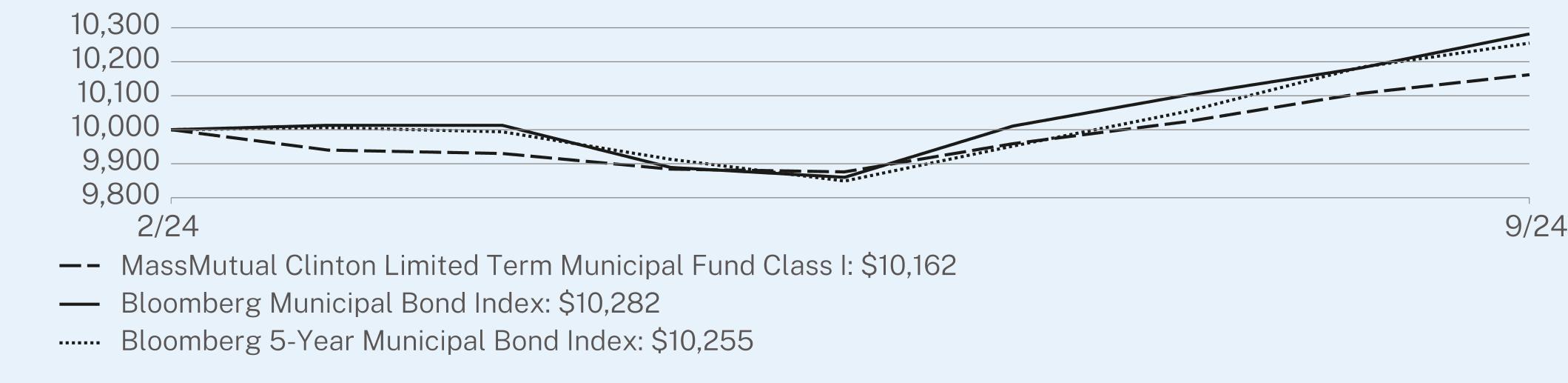

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT31Y |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class Y - without sales charge | 1.56 |

Bloomberg Municipal Bond Index | 2.82 |

Bloomberg 5-Year Municipal Bond Index | 2.55 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $49.9 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 33 |

Total Advisory Fees Paid During the Reporting Period | $78,835 |

Portfolio Turnover Rate | 70% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

Texas | 16.8% |

New York | 13.2% |

Pennsylvania | 11.9% |

Illinois | 11.5% |

Virginia | 8.0% |

South Carolina | 7.1% |

California | 6.3% |

New Jersey | 5.9% |

Maryland | 5.4% |

Florida | 4.2% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT31Y |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT31Y |

100001015610000102821000010255

| | |

MassMutual Clinton Limited Term Municipal Fund | |

| Class A | MMJDX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Limited Term Municipal Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class A | $43 | 0.64% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg 5-Year Municipal Bond Index:

• Issue selection in total and particularly in local authority municipal bonds

• Issue selection in state general obligation issues

Top detractors to the Fund’s performance relative to the Bloomberg 5-Year Municipal Bond Index:

• Interest rate sensitivity including both duration and yield curve effects

• Sector allocation effect in total and, in particular, an underweight to gas forward issues

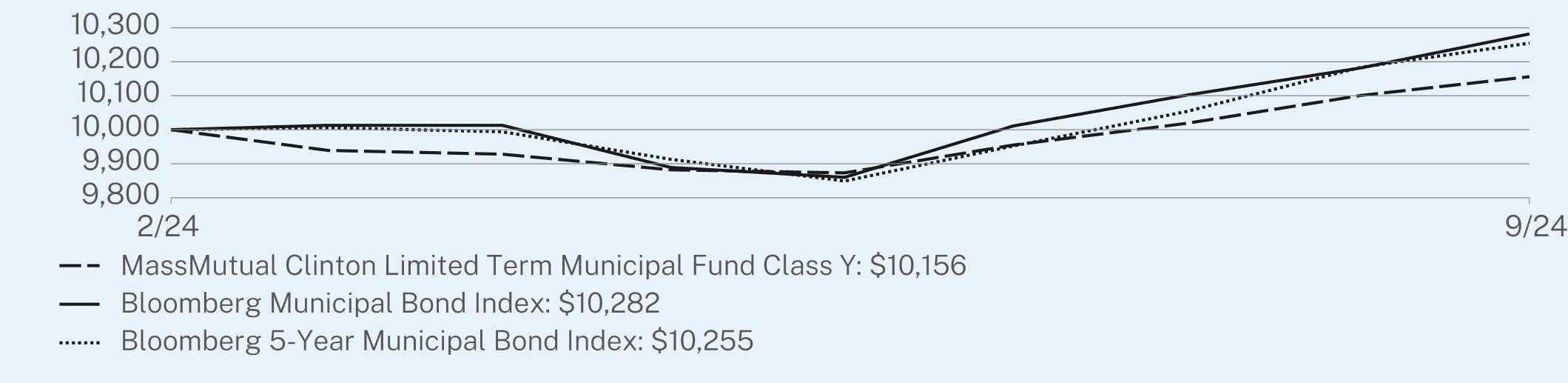

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT312 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class A - without sales charge | 1.39 |

Class A - with maximum sales charge | -1.15 |

Bloomberg Municipal Bond Index | 2.82 |

Bloomberg 5-Year Municipal Bond Index | 2.55 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $49.9 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 33 |

Total Advisory Fees Paid During the Reporting Period | $78,835 |

Portfolio Turnover Rate | 70% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

Texas | 16.8% |

New York | 13.2% |

Pennsylvania | 11.9% |

Illinois | 11.5% |

Virginia | 8.0% |

South Carolina | 7.1% |

California | 6.3% |

New Jersey | 5.9% |

Maryland | 5.4% |

Florida | 4.2% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT312 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT312 |

9750988510000102821000010255

| | |

MassMutual Clinton Municipal Fund | |

| Class I | MMZVX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Municipal Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class I | $27 | 0.41% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg Municipal Bond Index:

• Issue selection in state general obligation municipal bonds

• Overweight allocation to local authority municipal obligations of various issue types

Top detractors to the Fund’s performance relative to the Bloomberg Municipal Bond Index:

• Interest rate sensitivity including duration and yield curve effects

• Overweight allocation to local general obligation bonds

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

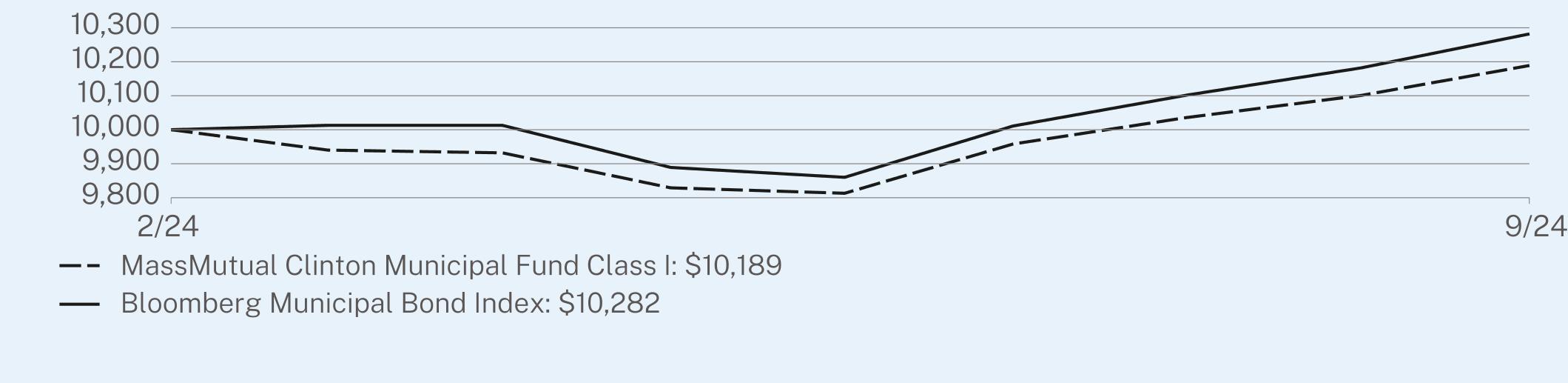

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT326 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class I - without sales charge | 1.89 |

Bloomberg Municipal Bond Index | 2.82 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $50.7 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 30 |

Total Advisory Fees Paid During the Reporting Period | $114,904 |

Portfolio Turnover Rate | 76% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

Texas | 25.8% |

New York | 17.4% |

Illinois | 14.5% |

Pennsylvania | 8.5% |

New Jersey | 7.3% |

Virginia | 5.8% |

Alabama | 5.0% |

Nebraska | 3.2% |

Michigan | 2.6% |

Arizona | 2.3% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT326 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT326 |

10000101891000010282

| | |

MassMutual Clinton Municipal Fund | |

| Class Y | MMZWX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Municipal Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class Y | $34 | 0.51% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg Municipal Bond Index:

• Issue selection in state general obligation municipal bonds

• Overweight allocation to local authority municipal obligations of various issue types

Top detractors to the Fund’s performance relative to the Bloomberg Municipal Bond Index:

• Interest rate sensitivity including duration and yield curve effects

• Overweight allocation to local general obligation bonds

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

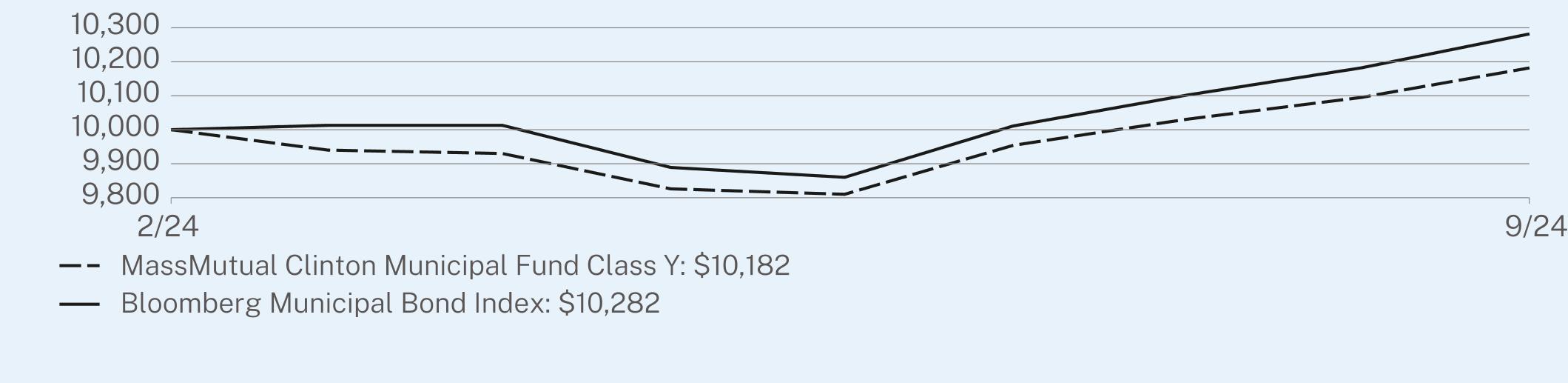

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT32Y |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class Y - without sales charge | 1.82 |

Bloomberg Municipal Bond Index | 2.82 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $50.7 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 30 |

Total Advisory Fees Paid During the Reporting Period | $114,904 |

Portfolio Turnover Rate | 76% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

Texas | 25.8% |

New York | 17.4% |

Illinois | 14.5% |

Pennsylvania | 8.5% |

New Jersey | 7.3% |

Virginia | 5.8% |

Alabama | 5.0% |

Nebraska | 3.2% |

Michigan | 2.6% |

Arizona | 2.3% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT32Y |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT32Y |

10000101821000010282

| | |

MassMutual Clinton Municipal Fund | |

| Class A | MMZUX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Municipal Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class A | $51 | 0.76% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg Municipal Bond Index:

• Issue selection in state general obligation municipal bonds

• Overweight allocation to local authority municipal obligations of various issue types

Top detractors to the Fund’s performance relative to the Bloomberg Municipal Bond Index:

• Interest rate sensitivity including duration and yield curve effects

• Overweight allocation to local general obligation bonds

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

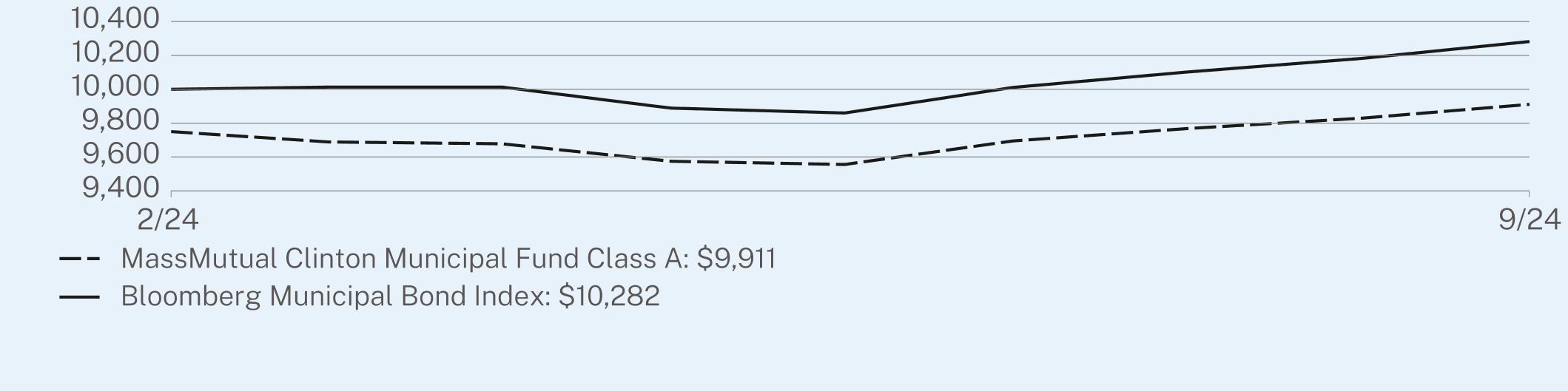

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT322 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class A - without sales charge | 1.65 |

Class A - with maximum sales charge | -0.89 |

Bloomberg Municipal Bond Index | 2.82 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $50.7 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 30 |

Total Advisory Fees Paid During the Reporting Period | $114,904 |

Portfolio Turnover Rate | 76% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

Texas | 25.8% |

New York | 17.4% |

Illinois | 14.5% |

Pennsylvania | 8.5% |

New Jersey | 7.3% |

Virginia | 5.8% |

Alabama | 5.0% |

Nebraska | 3.2% |

Michigan | 2.6% |

Arizona | 2.3% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT322 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT322 |

975099111000010282

| | |

MassMutual Clinton Municipal Credit Opportunities Fund | |

| Class I | MMJBX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Municipal Credit Opportunities Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class I | $36 | 0.54% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg Municipal 65% High Grade/35% High Yield Index:

• Issue selection in municipal bonds within the higher education sector

• Issue selection among municipal toll road issues

Top detractors to the Fund’s performance relative to the Bloomberg Municipal 65% High Grade/35% High Yield Index:

• Selection effect among local authority hospital, lifecare, and other revenue issues

• Interest rate sensitivity including both duration and yield curve effects

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

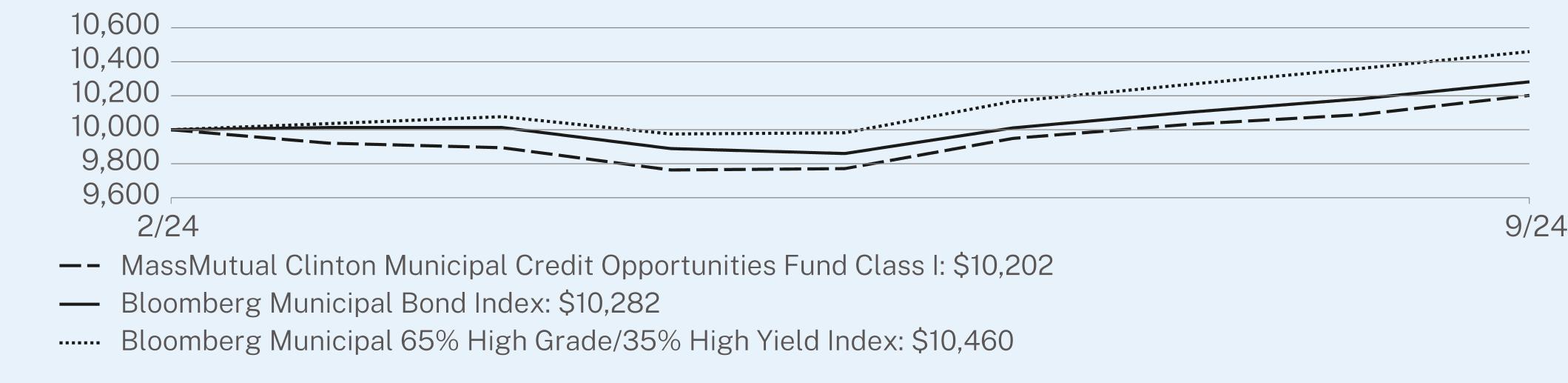

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT336 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class I - without sales charge | 2.02 |

Bloomberg Municipal Bond Index | 3.21 |

Bloomberg Municipal 65% High Grade/35% High Yield Index | 5.07 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $50.1 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 30 |

Total Advisory Fees Paid During the Reporting Period | $157,261 |

Portfolio Turnover Rate | 121% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

New York | 29.1% |

Illinois | 16.2% |

Florida | 8.2% |

Colorado | 6.3% |

Pennsylvania | 6.3% |

Alabama | 5.0% |

Tennessee | 4.5% |

Nebraska | 4.4% |

North Carolina | 4.2% |

Texas | 4.1% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT336 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT336 |

100001020210000102821000010460

| | |

MassMutual Clinton Municipal Credit Opportunities Fund | |

| Class Y | MMJCX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Municipal Credit Opportunities Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class Y | $43 | 0.64% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg Municipal 65% High Grade/35% High Yield Index:

• Issue selection in municipal bonds within the higher education sector

• Issue selection among municipal toll road issues

Top detractors to the Fund’s performance relative to the Bloomberg Municipal 65% High Grade/35% High Yield Index:

• Selection effect among local authority hospital, lifecare, and other revenue issues

• Interest rate sensitivity including both duration and yield curve effects

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

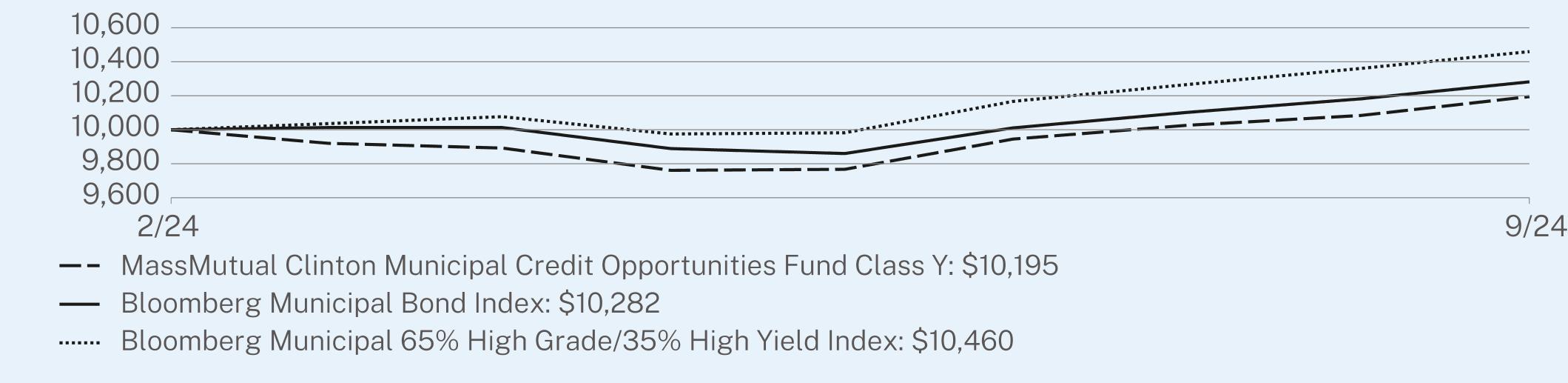

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT33Y |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class Y - without sales charge | 1.95 |

Bloomberg Municipal Bond Index | 3.21 |

Bloomberg Municipal 65% High Grade/35% High Yield Index | 5.07 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $50.1 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 30 |

Total Advisory Fees Paid During the Reporting Period | $157,261 |

Portfolio Turnover Rate | 121% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

New York | 29.1% |

Illinois | 16.2% |

Florida | 8.2% |

Colorado | 6.3% |

Pennsylvania | 6.3% |

Alabama | 5.0% |

Tennessee | 4.5% |

Nebraska | 4.4% |

North Carolina | 4.2% |

Texas | 4.1% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT33Y |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT33Y |

100001019510000102821000010460

| | |

MassMutual Clinton Municipal Credit Opportunities Fund | |

| Class A | MMJAX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Clinton Municipal Credit Opportunities Fund (the “Fund”) for the period of February 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment1 | Costs paid as a percentage of a $10,000 investment1 |

| Class A | $59 | 0.89% |

| 1 | The expenses shown in this table are for less than a full reporting period. The expenses paid over a full reporting period would be higher. |

HOW DID THE FUND PERFORM?

The municipal bond market has realized strong gains over the trailing one-year period. The market benefited from sharply lower yields, although much of the decrease occurred in the fourth quarter of 2023. More recently, the third quarter of 2024 was likewise a period of lower market yields, in response to lower inflation data. This led the U.S. Federal Reserve to cut its policy interest rate by 0.50% in September 2024. During the period, the market also benefited from strong demand, driven by greater investor interest due to lower inflation (higher real tax-equivalent yields), desire to access higher yields in the near term against an outlook of lower yields, and a potentially higher tax environment in 2025.

Top contributors to the Fund’s performance relative to the Bloomberg Municipal 65% High Grade/35% High Yield Index:

• Issue selection in municipal bonds within the higher education sector

• Issue selection among municipal toll road issues

Top detractors to the Fund’s performance relative to the Bloomberg Municipal 65% High Grade/35% High Yield Index:

• Selection effect among local authority hospital, lifecare, and other revenue issues

• Interest rate sensitivity including both duration and yield curve effects

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

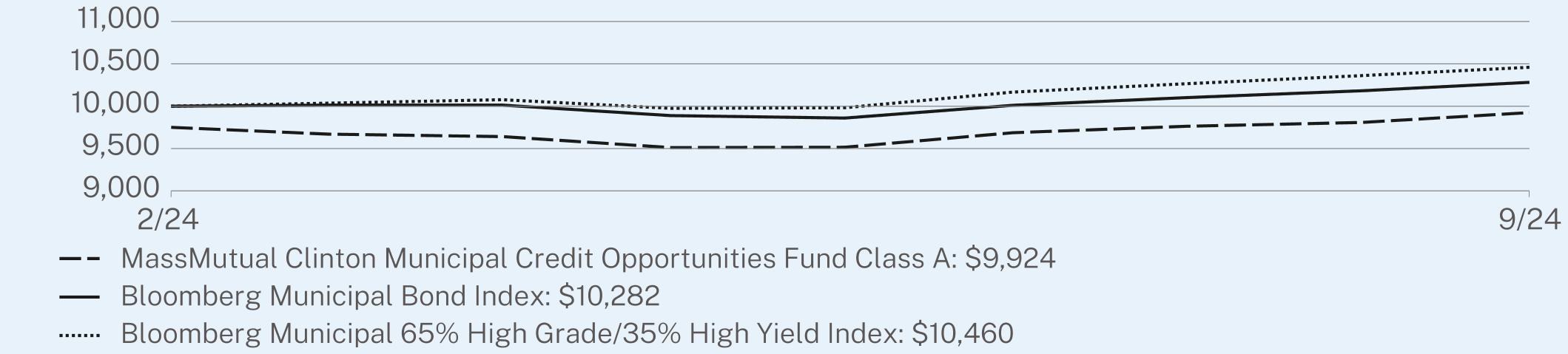

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (February 1, 2024 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-IT332 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| |

| | Since Inception

(02/01/2024) |

Class A - without sales charge | 1.78 |

Class A - with maximum sales charge | -0.76 |

Bloomberg Municipal Bond Index | 2.82 |

Bloomberg Municipal 65% High Grade/35% High Yield Index | 4.60 |

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $50.1 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 30 |

Total Advisory Fees Paid During the Reporting Period | $157,261 |

Portfolio Turnover Rate | 121% |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Municipal Obligations | 100.0% |

| |

Largest States

(% of Total Investments) | |

New York | 29.1% |

Illinois | 16.2% |

Florida | 8.2% |

Colorado | 6.3% |

Pennsylvania | 6.3% |

Alabama | 5.0% |

Tennessee | 4.5% |

Nebraska | 4.4% |

North Carolina | 4.2% |

Texas | 4.1% |

| MM202912-309770 | PAGE 2 | TSR-AR-IT332 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-IT332 |

9750992410000102821000010460

| | |

MassMutual Global Floating Rate Fund | |

| Class I | BXFIX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Global Floating Rate Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $77 | 0.74% |

HOW DID THE FUND PERFORM?

Global bond markets were broadly, and strongly, positive for the trailing one-year period. During the period, central banks responded to lower inflation data and began to lower policy interest rates, which was favorable for bond prices and returns. Macroeconomic sentiment centered, particularly more recently, on a soft-landing scenario in the U.S., providing a supportive credit risk environment. During the period, narrowing credit spreads were a positive return driver in the global bond market, in addition to the response to lower bond market yields. This resulted in broad gains across varied market sectors, including government bonds, investment grade and high yield corporate securities, mortgage- and asset-backed instruments, and emerging market issues.

Top contributors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s investment in U.S. bank loans contributed more than European loans

• Despite the more recent fall in yields, coupon income was additive

• Selection among B and CCC rated loans

Top detractors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s allocation and selection among European bank loans as U.S. bank loans outperformed

• Cash allocation as the asset class return was strong in the period

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

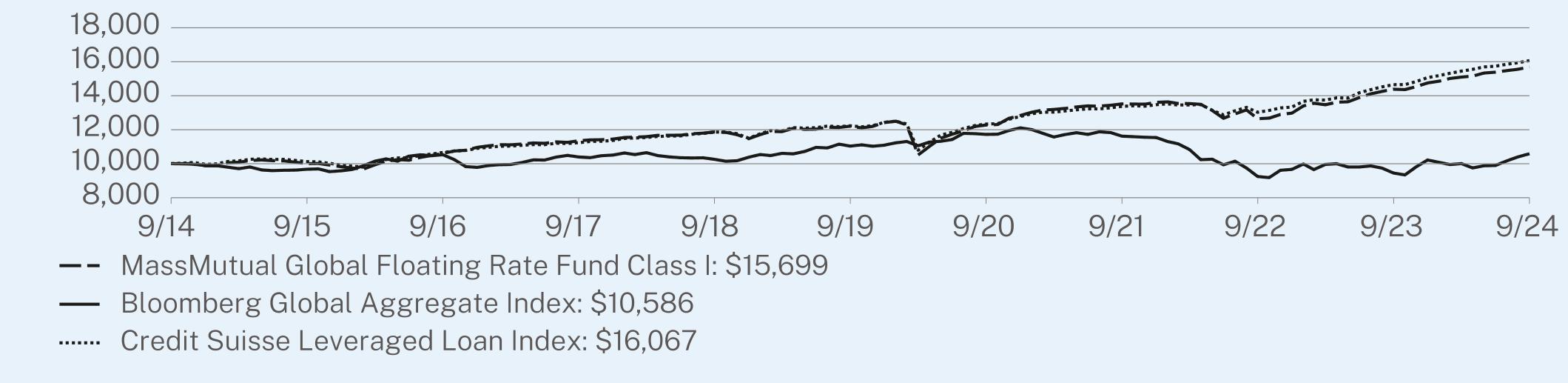

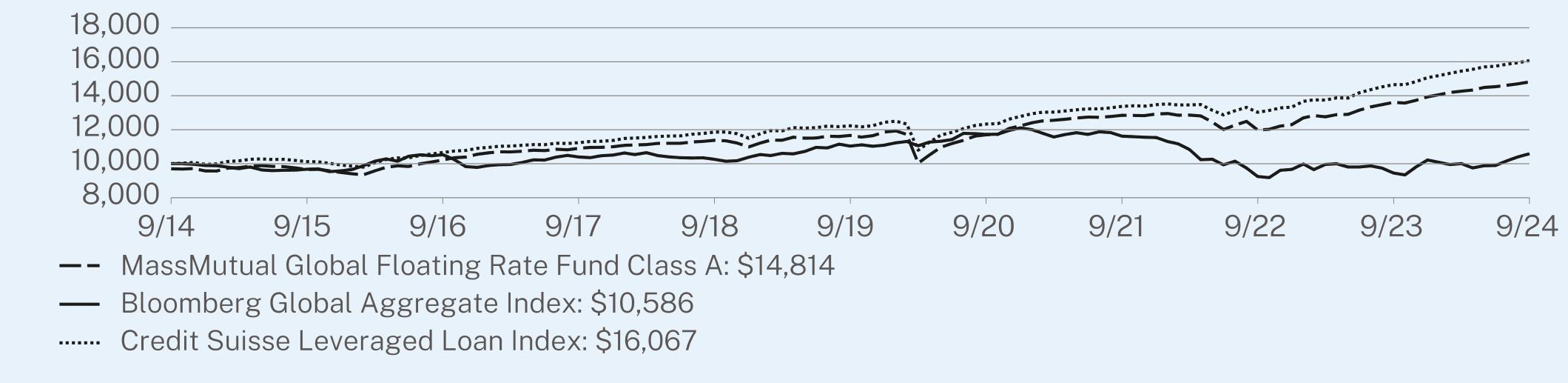

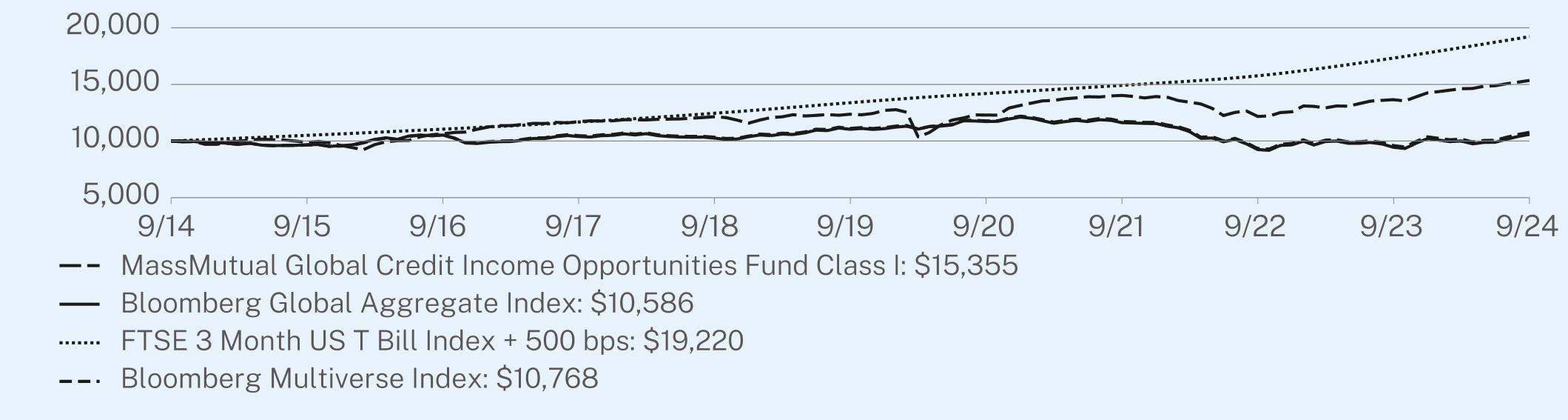

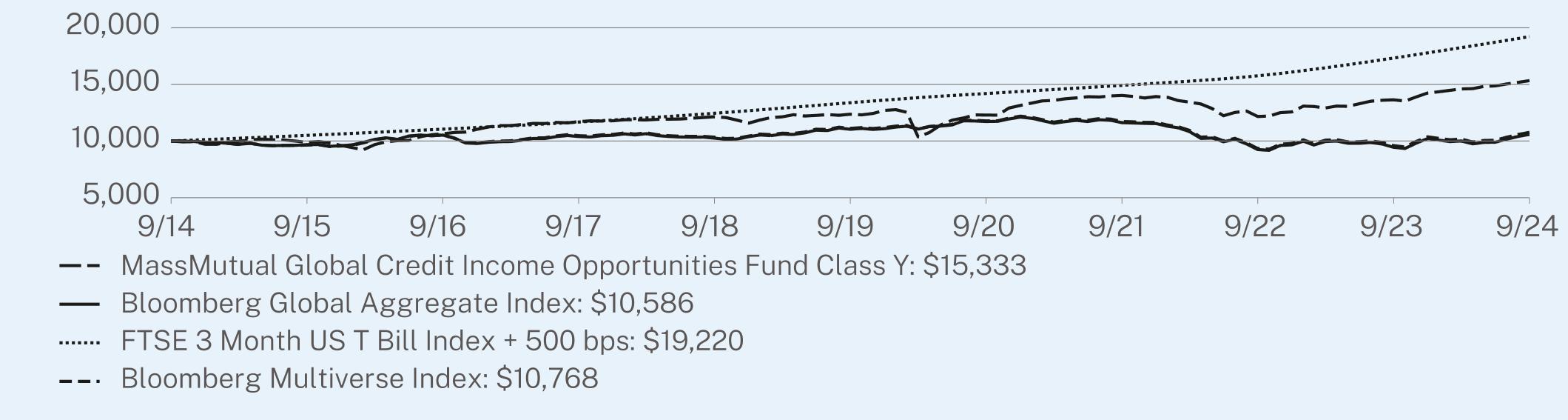

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (October 1, 2014 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-2BCA4 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class I - without sales charge | 9.13 | 5.16 | 4.61 |

Bloomberg Global Aggregate Index1 | 11.99 | -0.83 | 0.57 |

Credit Suisse Leveraged Loan Index | 9.65 | 5.60 | 4.86 |

| 1 | Effective July 24, 2024, the Bloomberg Global Aggregate Index replaced the Credit Suisse Leveraged Loan Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The Fund continues to use the Credit Suisse Leveraged Loan Index as a supplemental benchmark that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests. |

The Fund is the successor to the Barings Global Floating Rate Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021.

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $127.5 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 253 |

Total Advisory Fees Paid During the Reporting Period | $891,432 |

Portfolio Turnover Rate | 61% |

| MM202912-309770 | PAGE 2 | TSR-AR-2BCA4 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Bank Loans | 87.7% |

Corporate Debt | 6.3% |

Repurchase Agreement | 5.1% |

Common Stock | 0.9% |

Warrants | 0.0% |

Rights | 0.0% |

| |

Largest Countries

(% of Total Investments) | |

United States | 65.8% |

United Kingdom | 9.4% |

Germany | 4.8% |

France | 2.1% |

Belgium | 2.0% |

Switzerland | 1.6% |

Netherlands | 1.5% |

Sweden | 1.2% |

Canada | 1.1% |

Spain | 1.0% |

HOW HAS THE FUND CHANGED?

The following is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s prospectus, including any applicable supplements, at https://www.massmutual.com/product-performance/mutual-funds or upon request at 1-888-309-3539 or fundinfo@massmutual.com.

Effective February 1, 2024, the Class L shares of the Fund were re-named as Class A shares.

Effective February 1, 2024, the maximum front-end sales charge on Class A shares of the Fund increased from 3.00% to 4.25%.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-2BCA4 |

100001000010611113501186912207122831352012649143861569910000967410528103961025911038117261162092469453105861000010123106651123711863122331233513378130271465216067

| | |

MassMutual Global Floating Rate Fund | |

| Class Y | BXFYX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Global Floating Rate Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $76 | 0.73% |

HOW DID THE FUND PERFORM?

Global bond markets were broadly, and strongly, positive for the trailing one-year period. During the period, central banks responded to lower inflation data and began to lower policy interest rates, which was favorable for bond prices and returns. Macroeconomic sentiment centered, particularly more recently, on a soft-landing scenario in the U.S., providing a supportive credit risk environment. During the period, narrowing credit spreads were a positive return driver in the global bond market, in addition to the response to lower bond market yields. This resulted in broad gains across varied market sectors, including government bonds, investment grade and high yield corporate securities, mortgage- and asset-backed instruments, and emerging market issues.

Top contributors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s investment in U.S. bank loans contributed more than European loans

• Despite the more recent fall in yields, coupon income was additive

• Selection among B and CCC rated loans

Top detractors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s allocation and selection among European bank loans as U.S. bank loans outperformed

• Cash allocation as the asset class return was strong in the period

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

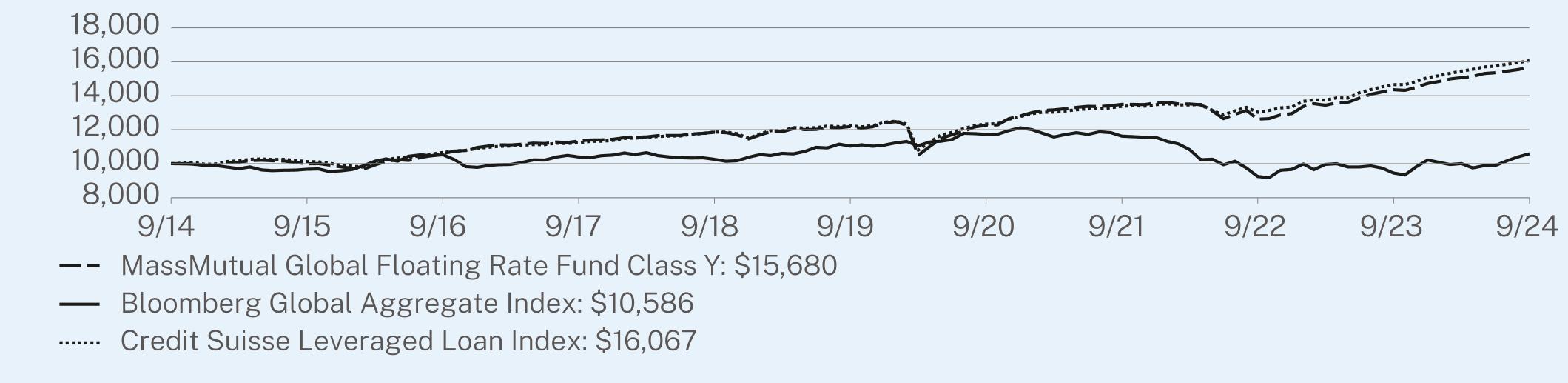

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (October 1, 2014 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-2BCAY |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class Y - without sales charge | 9.22 | 5.17 | 4.60 |

Bloomberg Global Aggregate Index1 | 11.99 | -0.83 | 0.57 |

Credit Suisse Leveraged Loan Index | 9.65 | 5.60 | 4.86 |

| 1 | Effective July 24, 2024, the Bloomberg Global Aggregate Index replaced the Credit Suisse Leveraged Loan Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The Fund continues to use the Credit Suisse Leveraged Loan Index as a supplemental benchmark that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests. |

The Fund is the successor to the Barings Global Floating Rate Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021.

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $127.5 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 253 |

Total Advisory Fees Paid During the Reporting Period | $891,432 |

Portfolio Turnover Rate | 61% |

| MM202912-309770 | PAGE 2 | TSR-AR-2BCAY |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Bank Loans | 87.7% |

Corporate Debt | 6.3% |

Repurchase Agreement | 5.1% |

Common Stock | 0.9% |

Warrants | 0.0% |

Rights | 0.0% |

| |

Largest Countries

(% of Total Investments) | |

United States | 65.8% |

United Kingdom | 9.4% |

Germany | 4.8% |

France | 2.1% |

Belgium | 2.0% |

Switzerland | 1.6% |

Netherlands | 1.5% |

Sweden | 1.2% |

Canada | 1.1% |

Spain | 1.0% |

HOW HAS THE FUND CHANGED?

The following is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s prospectus, including any applicable supplements, at https://www.massmutual.com/product-performance/mutual-funds or upon request at 1-888-309-3539 or fundinfo@massmutual.com.

Effective February 1, 2024, the Class L shares of the Fund were re-named as Class A shares.

Effective February 1, 2024, the maximum front-end sales charge on Class A shares of the Fund increased from 3.00% to 4.25%.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-2BCAY |

10000999410603113391185712186122601349412623143561568010000967410528103961025911038117261162092469453105861000010123106651123711863122331233513378130271465216067

| | |

MassMutual Global Floating Rate Fund | |

| Class A | BXFAX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Global Floating Rate Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $102 | 0.98% |

HOW DID THE FUND PERFORM?

Global bond markets were broadly, and strongly, positive for the trailing one-year period. During the period, central banks responded to lower inflation data and began to lower policy interest rates, which was favorable for bond prices and returns. Macroeconomic sentiment centered, particularly more recently, on a soft-landing scenario in the U.S., providing a supportive credit risk environment. During the period, narrowing credit spreads were a positive return driver in the global bond market, in addition to the response to lower bond market yields. This resulted in broad gains across varied market sectors, including government bonds, investment grade and high yield corporate securities, mortgage- and asset-backed instruments, and emerging market issues.

Top contributors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s investment in U.S. bank loans contributed more than European loans

• Despite the more recent fall in yields, coupon income was additive

• Selection among B and CCC rated loans

Top detractors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s allocation and selection among European bank loans as U.S. bank loans outperformed

• Cash allocation as the asset class return was strong in the period

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (October 1, 2014 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-2BCA1 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A - without sales charge | 8.83 | 4.90 | 4.33 |

Class A - with maximum sales charge | 4.60 | 4.26 | 4.01 |

Bloomberg Global Aggregate Index1 | 11.99 | -0.83 | 0.57 |

Credit Suisse Leveraged Loan Index | 9.65 | 5.60 | 4.86 |

| 1 | Effective July 24, 2024, the Bloomberg Global Aggregate Index replaced the Credit Suisse Leveraged Loan Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The Fund continues to use the Credit Suisse Leveraged Loan Index as a supplemental benchmark that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests. |

The Fund is the successor to the Barings Global Floating Rate Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021.

Performance results reflect any applicable waivers or expense limitations in effect during these periods, without which performance would have been lower. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained at https://www.massmutual.com/product-performance/mutual-funds or by calling 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

WHAT ARE SOME KEY FUND STATISTICS? (as of September 30, 2024)

| |

Total Net Assets (Millions) | $127.5 |

Total Number of Portfolio Holdings (includes derivative positions, if any) | 253 |

Total Advisory Fees Paid During the Reporting Period | $891,432 |

Portfolio Turnover Rate | 61% |

| MM202912-309770 | PAGE 2 | TSR-AR-2BCA1 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Derivative values, if any, are excluded from the table(s) below.

| |

Portfolio Characteristics

(% of Total Investments) | |

Bank Loans | 87.7% |

Corporate Debt | 6.3% |

Repurchase Agreement | 5.1% |

Common Stock | 0.9% |

Warrants | 0.0% |

Rights | 0.0% |

| |

Largest Countries

(% of Total Investments) | |

United States | 65.8% |

United Kingdom | 9.4% |

Germany | 4.8% |

France | 2.1% |

Belgium | 2.0% |

Switzerland | 1.6% |

Netherlands | 1.5% |

Sweden | 1.2% |

Canada | 1.1% |

Spain | 1.0% |

HOW HAS THE FUND CHANGED?

The following is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s prospectus, including any applicable supplements, at https://www.massmutual.com/product-performance/mutual-funds or upon request at 1-888-309-3539 or fundinfo@massmutual.com.

Effective February 1, 2024, the Class L shares of the Fund were re-named as Class A shares.

Effective February 1, 2024, the maximum front-end sales charge on Class A shares of the Fund increased from 3.00% to 4.25%.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, scan the QR code or visit https://www.massmutual.com/product-performance/mutual-funds. |

| MM202912-309770 | PAGE 3 | TSR-AR-2BCA1 |

9700966010223109081137811664117051285011982136121481410000967410528103961025911038117261162092469453105861000010123106651123711863122331233513378130271465216067

| | |

MassMutual Global Floating Rate Fund | |

| Class C | BXFCX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the MassMutual Global Floating Rate Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.massmutual.com/product-performance/mutual-funds. You can also request this information by contacting us at 1-888-309-3539 or by sending an email request to fundinfo@massmutual.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

This example shows the expenses you would have paid over the past year, based on a hypothetical $10,000 investment. This table reflects any applicable waivers or expense limitations.

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $180 | 1.73% |

HOW DID THE FUND PERFORM?

Global bond markets were broadly, and strongly, positive for the trailing one-year period. During the period, central banks responded to lower inflation data and began to lower policy interest rates, which was favorable for bond prices and returns. Macroeconomic sentiment centered, particularly more recently, on a soft-landing scenario in the U.S., providing a supportive credit risk environment. During the period, narrowing credit spreads were a positive return driver in the global bond market, in addition to the response to lower bond market yields. This resulted in broad gains across varied market sectors, including government bonds, investment grade and high yield corporate securities, mortgage- and asset-backed instruments, and emerging market issues.

Top contributors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s investment in U.S. bank loans contributed more than European loans

• Despite the more recent fall in yields, coupon income was additive

• Selection among B and CCC rated loans

Top detractors to the Fund’s performance relative to the Credit Suisse Leveraged Loan Index:

• The Fund’s allocation and selection among European bank loans as U.S. bank loans outperformed

• Cash allocation as the asset class return was strong in the period

Performance shown is past performance and does not guarantee future results. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

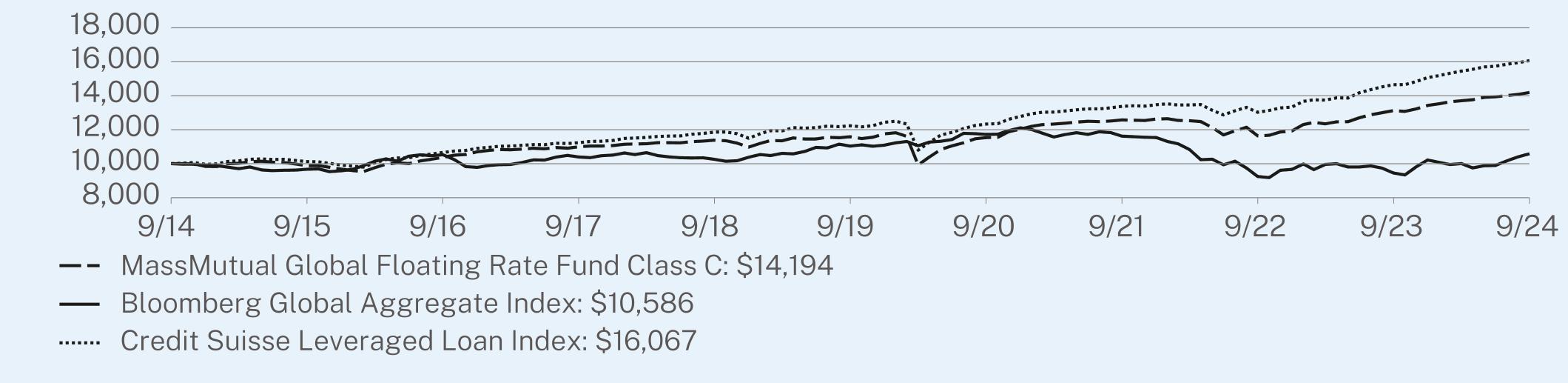

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT (October 1, 2014 through September 30, 2024)

This graph shows the performance of a hypothetical $10,000 investment in the share class noted over a ten-year period or since inception, if shorter, as compared to the performance of a broad-based securities market index, and, if applicable, one or more indexes that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests or is a better comparison for the Fund’s investment strategy. This graph includes the deduction of the maximum applicable sales charge, if any.

| MM202912-309770 | PAGE 1 | TSR-AR-2BCA3 |

The index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

AVERAGE ANNUAL TOTAL RETURNS (%) (as of September 30, 2024)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C - without sales charge | 8.14 | 4.14 | 3.56 |

Class C - with maximum sales charge | 7.14 | 4.14 | 3.56 |

Bloomberg Global Aggregate Index1 | 11.99 | -0.83 | 0.57 |

Credit Suisse Leveraged Loan Index | 9.65 | 5.60 | 4.86 |

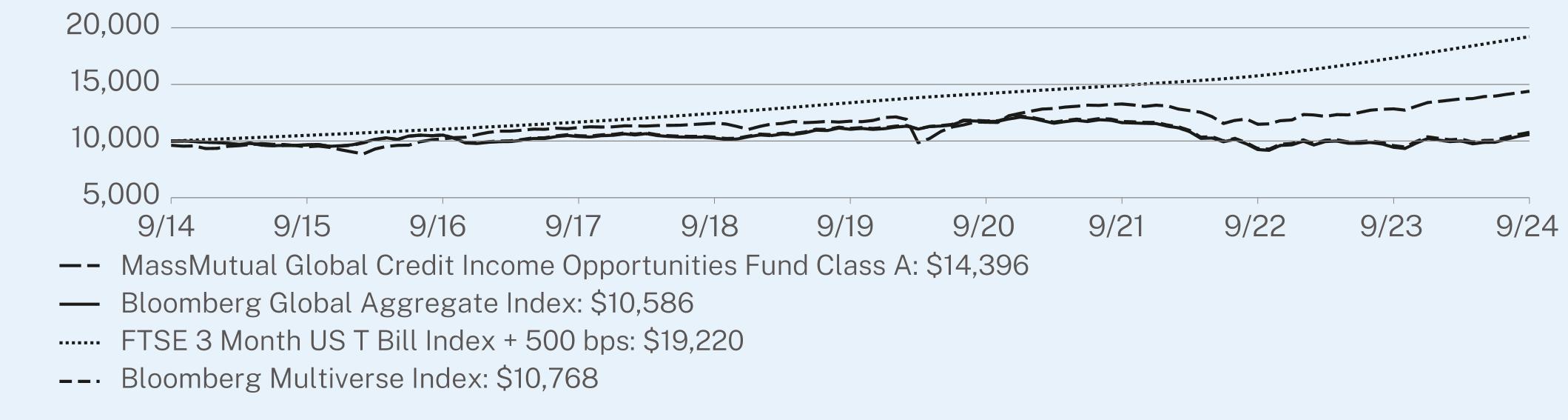

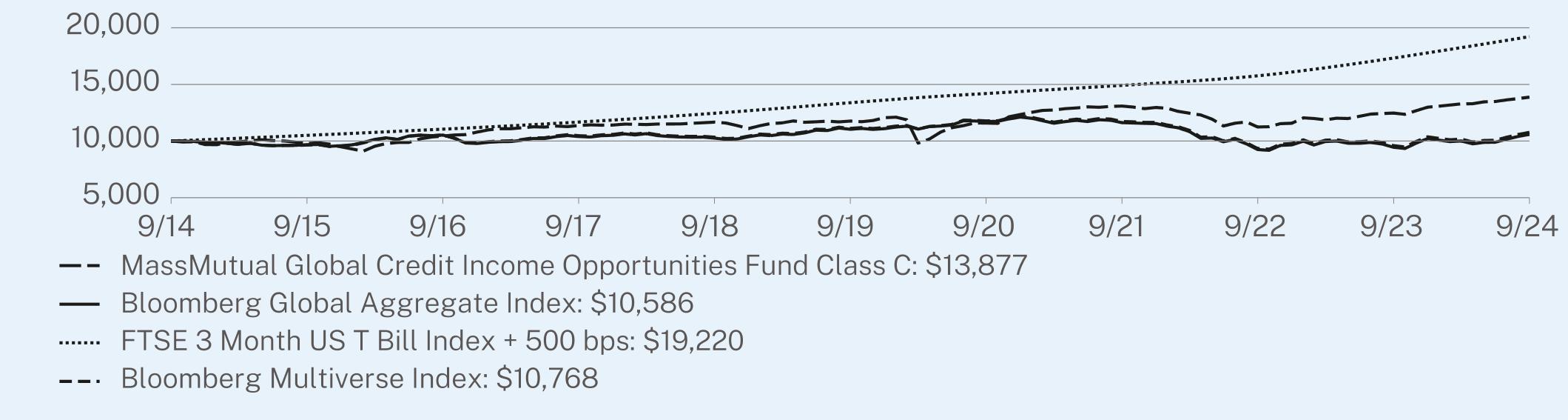

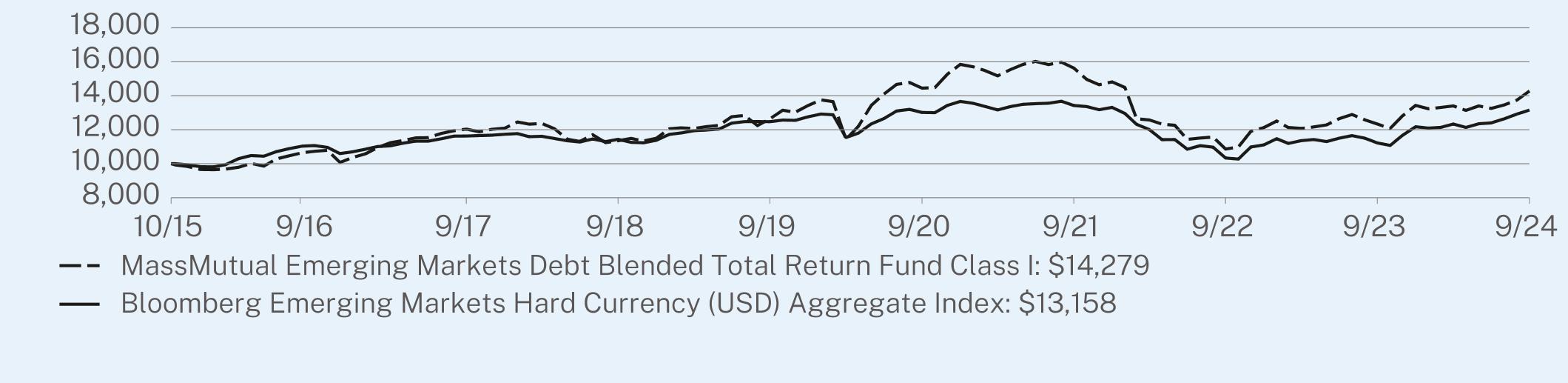

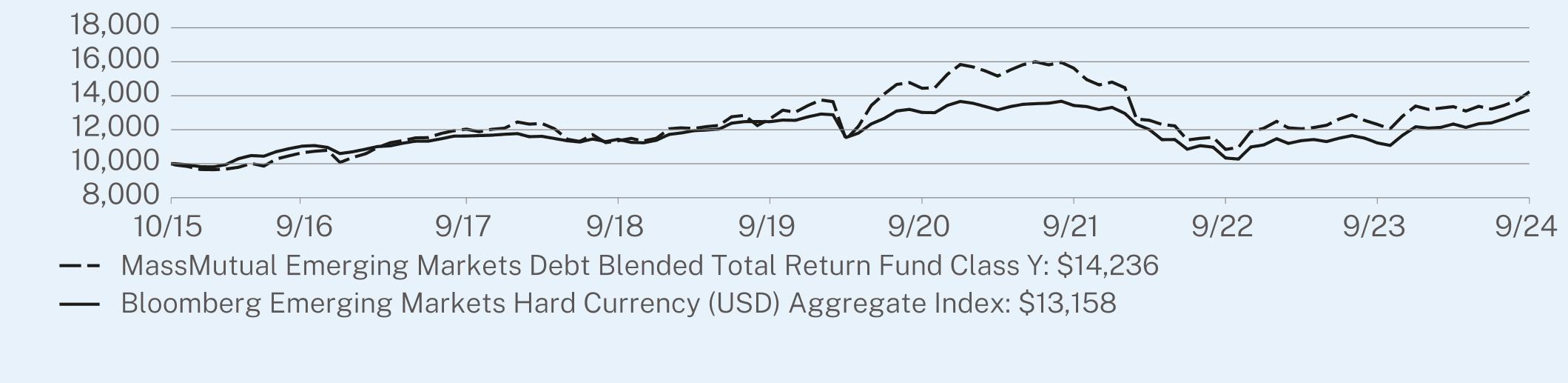

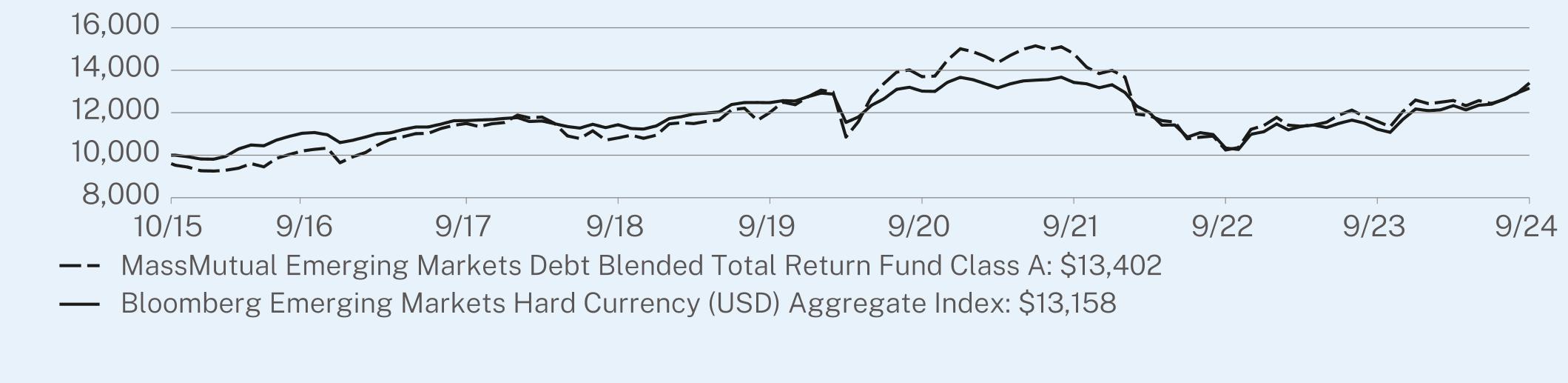

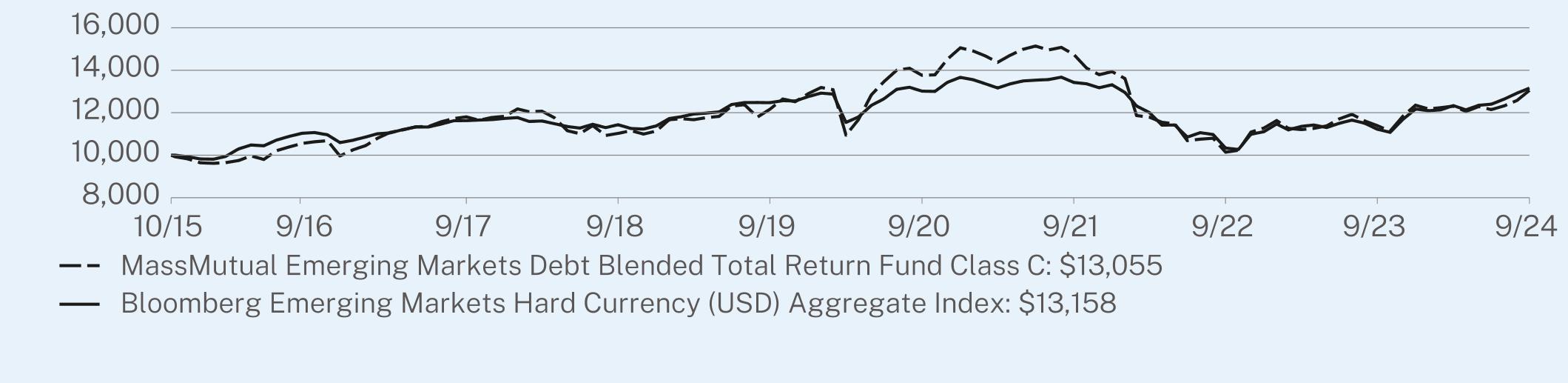

| 1 | Effective July 24, 2024, the Bloomberg Global Aggregate Index replaced the Credit Suisse Leveraged Loan Index as a broad measure of market performance in accordance with new regulatory disclosure requirements. The Fund continues to use the Credit Suisse Leveraged Loan Index as a supplemental benchmark that MML Investment Advisers, LLC believes more closely reflects the market segments in which the Fund invests. |