UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23703 |

| |

| MassMutual Advantage Funds |

| (Exact name of registrant as specified in charter) |

| | |

| 1295 State Street, Springfield, MA | 01111 |

| (Address of principal executive offices) | (Zip code) |

| | |

| Paul LaPiana |

| 1295 State Street, Springfield, MA 01111 |

| (Name and address of agent for service) |

| | | |

| Registrant's telephone number, including area code: | (413) 744-1000 | |

| | | |

| Date of fiscal year end: | 9/30/2022 | |

| | | |

| Date of reporting period: | 9/30/2022 | |

| | |

| | |

| |

| | | | | | | | | |

Item 1. Reports to Stockholders.

| (a) | The Report to Stockholders is attached herewith. |

This material must be preceded or accompanied by a current prospectus (or summary prospectus, if available) for the applicable MassMutual Funds. Investors should consider a Fund’s investment objective, risks, and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus (or summary prospectus, if available). Read it carefully before investing.

MassMutual Funds Annual Report – President’s Letter to Shareholders (Unaudited) |

To Our Shareholders

Paul LaPiana

“At MassMutual, our goal is to help you build the future you want for yourself and your family. We want to help you with your retirement plans today, so you can feel more comfortable about tomorrow.”

September 30, 2022

Continued market volatility challenges retirement investors

I am pleased to present you with the MassMutual Funds Annual Report. During the fiscal year ended September 30, 2022, U.S. stocks were down over 15%, with investors concerned that stimulus-fueled recovery from the COVID-19 pandemic was over and that domestic monetary policy had turned toward combating heightened inflation. Stocks in foreign developed markets and emerging markets also experienced significant losses in the fiscal year, hurt by elevated energy prices, a strengthening U.S. dollar, and concerns that consumer spending and corporate earnings growth would slow. U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by aggressive interest rate hikes by the U.S. Federal Reserve Board that were aimed at reducing demand-driven inflationary pressures.

Suggestions for retirement investors under any market conditions

● | You are likely in it for the long term. Retirement planning involves what financial professionals refer to as “long-term investing,” since most people save and invest for retirement throughout their working years. Even in retirement, many individuals will systematically withdraw their retirement savings over a number of years, keeping a portion of their funds invested. Although the financial markets will go up and down, individuals who take a long-term approach to investing don’t focus on current headlines – because they realize that they have time to ride out the downturns. |

● | Keep contributing. While you have no control over the investment markets, you can control how often and how much you contribute to your retirement account. Saving as much as possible and increasing your contributions regularly is one way retirement investors can help boost their retirement savings, regardless of the performance of the stock and bond markets. |

● | Invest continually.1 Financial professionals often advise their clients to stay in the market, regardless of short-term results. Here’s why: Those who can invest in all market conditions have the potential to be rewarded even during market downturns, when more favorable prices may enable them to accumulate larger positions. |

● | Monitor your asset allocation and diversify. Stocks, bonds, and short-term/money market investments are asset classes that tend to behave differently, depending upon the economic and market environment. These broad asset classes contain an even greater array of asset sub-categories (such as small-cap stocks, international stocks, and high-yield bonds). Most financial professionals agree that investors can take advantage of different opportunities in the market and reduce the risk of over-exposure to one or two poorly performing asset types by selecting a number of investments that represent a mix of asset classes and sub-categories. |

Is this a good time to track your progress?

If you work with a financial professional, you may wish to consider checking in with him or her to help you determine if:

● | you are saving enough for retirement – and, if in retirement, you are withdrawing an appropriate amount each year, based on your personal circumstances; |

1 Systematic investing and asset allocation do not ensure a profit or protect against loss in a declining market. Systematic investing involves continuous investment in securities regardless of fluctuating price levels. Investors should consider their ability to continue investing through periods of low price levels.

(Continued)

1

MassMutual Funds Annual Report – President’s Letter to Shareholders (Unaudited) (Continued) |

● | your retirement account is invested appropriately for all market conditions, based on your goals and objectives, as well as your investment time horizon; and |

● | you are taking steps to help reduce your longevity risk, which is the chance that you could “run out” of retirement savings during your lifetime. |

Get to where you want to be

At MassMutual, our goal is to help you build the future you want for yourself and your family. We want to help you with your retirement plans today, so you can feel more comfortable about tomorrow. That’s why we continue to encourage you to maintain perspective when it comes to retirement investing, regardless of any headline-making events. MassMutual’s view is that changing market conditions have the potential to reward patient investors. Thank you for your continued confidence and trust in MassMutual.

Sincerely,

Paul LaPiana

President

MassMutual Funds

MML Investment Advisers, LLC

© 2022 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA 01111-0001. All rights reserved. www.MassMutual.com.

The MassMutual Global Floating Rate Fund, MassMutual Global Credit Income Opportunities Fund, MassMutual Emerging Markets Debt Blended Total Return Fund, and MassMutual Global Emerging Markets Equity Fund are distributed by ALPS Distributors, Inc. (ADI). MML Distributors, LLC (MMLD) serves as the exclusive wholesale marketing agent for all MassMutual Funds, as well as the distributor for all other MassMutual Funds, except the MassMutual High Yield Fund and MassMutual Short-Duration Bond Fund. MMLD Member FINRA and SIPC (www.FINRA.org and www.SIPC.org), 1295 State Street, Springfield, MA 01111-0001. Investment advisory services provided to all MassMutual Funds by MML Investment Advisers, LLC (MML Advisers). MMLD and MML Advisers are subsidiaries of MassMutual, Springfield, MA 01111-0001. ADI is not affiliated with MMLD, MML Advisers, or MassMutual.

The information provided is the opinion of MML Advisers and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Of course, past performance does not guarantee future results.

MM202310-303203

2

MassMutual Funds Annual Report – Economic and Market Overview (Unaudited) |

September 30, 2022

Continued market volatility challenges retirement investors

During the fiscal year ended September 30, 2022, U.S. stocks were down over 15%, with investors concerned that stimulus-fueled recovery from the COVID-19 pandemic was over and that domestic monetary policy had turned toward combating heightened inflation. Stocks in foreign developed markets and emerging markets also experienced significant losses in the fiscal year, hurt by elevated energy prices, a strengthening U.S. dollar, and concerns that consumer spending and corporate earnings growth would slow. U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by aggressive interest rate hikes by the U.S. Federal Reserve Board (the “Fed”) that were aimed at reducing demand-driven inflationary pressures.

Market Highlights

● | For the reporting period from October 1, 2021 through September 30, 2022, U.S. stocks were down over 15%, in a market environment where the Fed aggressively raised interest rates in an effort to combat heightened inflation. |

● | In the fourth quarter of 2021, expectations for strong economic and earnings growth in 2022, bolstered by the possibility of a $2 trillion economic stimulus and social spending plan, allowed investors to look past sharp increases in COVID-19 Omicron variant cases and heightened inflationary pressures. |

● | In the first quarter of 2022, investors in both stocks and bonds were challenged by a sharp rise in energy prices after Russia’s invasion of Ukraine, a stalled domestic economic stimulus plan, and the Fed raising interest rates for the first time since 2018. |

● | The second quarter of 2022 was another difficult quarter, as Fed interest rate hikes, investor concerns over high inflation, and concern about the potential of an impending global recession dominated the narrative. |

● | The third quarter of 2022 was an extension of the difficult second quarter, with continued inflationary pressures, weakening economic data, and aggressive Fed interest rate hikes. |

● | Foreign stocks in developed markets and emerging markets also experienced losses in the fiscal year, against the backdrop of Russia’s invasion of Ukraine (and the resulting economic sanctions that kept energy prices elevated), the strengthening U.S. dollar, and threatened consumer spending and corporate earnings growth. |

● | U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by an increase in short-term interest rates, heighted inflationary pressures, and the reversal of monetary and fiscal policy support. |

Market Environment

For the fiscal year beginning on October 1, 2021, global stock investors experienced significant losses. U.S. stocks fell sharply in the period in response, with the S&P 500 Index® (“S&P 500”)1 entering bear market territory after declining more than 20% from its previous highs. Investors sought safety from high inflation, rising interest rates, and the increasing possibility of a recession. Consumer sentiment fell sharply, down 17.2% in the period2, as high inflation – driven by rising energy, food, and housing costs – overwhelmed low unemployment and strong wage growth. As of August 2022, more Americans are borrowing to make ends meet in these inflationary times, resulting in consumer loan levels at record highs, having increased by 12.4% year-over-year3.

1 The S&P 500 Index measures the performance of 500 widely held stocks in the U.S. equity market. Standard and Poor’s chooses member companies for the index based on market size, liquidity, and industry group representation. Included are the stocks of industrial, financial, utility, and transportation companies. Since mid-1989, this composition has been more flexible and the number of issues in each sector has varied. It is market capitalization-weighted. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

2 June 24, 2022, University of Michigan: Consumer Sentiment (UMCSENT), retrieved from FRED, Federal Reserve Bank of St. Louis;

https://fred.stlouisfed.org/series/UMCSENT

3 Board of Governors of the Federal Reserve System (US), Consumer Loans, All Commercial Banks [CONSUMER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CONSUMER, October 11, 2022.

3

MassMutual Funds Annual Report – Economic and Market Overview (Unaudited) (Continued) |

As a result, the broad market S&P 500 fell 15.47% for the period. The technology-heavy NASDAQ Composite Index4 performed even worse, dropping 26.25%. The more economically sensitive Dow Jones Industrial AverageSM5 was down 13.40%. During the reporting period, small-cap stocks underperformed their larger-cap peers, while value stocks outperformed their growth brethren. The communication services, consumer discretionary, and information technology sectors were all down by 20% or more. The energy sector was the strongest performer for the fiscal year, up 45.70%, aided by an 18% increase in the price of West Texas Intermediate (WTI) crude oil. The utilities sector also ended the period positively, gaining 5.58% for the period.

Developed international markets, as measured by the MSCI EAFE® Index6, trailed their domestic peers, ending the fiscal year down 25.13%. Emerging-market stocks, as measured by the MSCI Emerging Markets Index7, also fell sharply, ending down 28.11% for the period. Investors sold off developed international and emerging-market stocks on concerns that higher interest rates and commodity prices would impair consumer spending and corporate earnings growth.

Bond yields rose sharply during the fiscal year, with the 10-year U.S. Treasury bond yield rising from a low of 1.52% on October 1, 2021 to close the period at 3.83%. Rising yields generally produce falling bond prices; consequently, bond index returns suffered. The Bloomberg U.S. Aggregate Bond Index8 ended the period down 14.60%. Investment-grade corporate bonds fared even worse. The Bloomberg U.S. Corporate Bond Index9, which tracks investment-grade corporate bonds, ended the period with an 18.53% loss. The Bloomberg U.S. Corporate High-Yield Bond Index10 also ended in negative territory, declining 14.14% for the period.

Review and maintain your strategy

MassMutual is committed to helping people secure their long-term future and protect the ones they love. While the current market volatility, including the reality of market sell-offs, can test an investor’s mettle, we’d like to remind you that, as a retirement investor, it’s important to maintain perspective and have realistic expectations about the future performance of your investment accounts. As described in this report, financial markets can reverse suddenly with little or no notice. That’s why we continue to believe that retirement investors should create and maintain a plan that focuses on their goals, how long they have to invest, and how comfortable they are with market volatility. Our multi-managed and sub-advised mutual funds tap into the deep expertise of seasoned asset managers who are committed to helping long-term investors prepare for retirement – in all market conditions.

4 The NASDAQ Composite Index measures the performance of all domestic and international based common type stocks listed on the NASDAQ Stock Market. It includes common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. The index is market capitalization-weighted. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

5 The Dow Jones Industrial Average Index measures the performance of stocks of 30 U.S. blue-chip companies covering all industries with the exception of transportation and utilities. It is price-weighted. The Index does not reflect any deduction for fees or expenses and cannot be purchased directly by investors.

6 The MSCI EAFE Index measures the performance of the large- and mid-cap segments of developed markets, excluding the U.S. and Canada equity securities. It is free float-adjusted market-capitalization weighted. The Index does not reflect any deduction for fees or expenses and cannot be purchased directly by investors.

7 The MSCI Emerging Markets Index measures the performance of the large- and mid-cap segments of emerging market equity securities. It is free float-adjusted market-capitalization weighted. The Index does not reflect any deduction for fees or expenses and cannot be purchased directly by investors.

8 The Bloomberg U.S. Aggregate Bond Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market securities, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). It rolls up into other Bloomberg flagship indexes, such as the multi-currency Global Aggregate Index and the U.S. Universal Index, which includes high yield and emerging markets debt. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

9 The Bloomberg U.S. Corporate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market. It includes U.S. dollar-denominated securities publicly issued by U.S. and non-U.S. industrial, utility, and financial issuers that meet specified maturity, liquidity, and quality requirements. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

10 The Bloomberg U.S. Corporate High-Yield Bond Index measures the performance of U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bonds, including corporate bonds, fixed-rate bullet, putable, and callable bonds, SEC Rule 144A securities, original issue zeros, pay-in-kind bonds, fixed-rate and fixed-to-floating capital securities. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

4

MassMutual Funds Annual Report – Economic and Market Overview (Unaudited) (Continued) |

As always, we recommend that you work with a personal financial professional, who can help you define an investment strategy that aligns with your comfort level with respect to market volatility, how long you have to save and invest, and your specific financial goals. Thank you for your confidence in MassMutual.

© 2022 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA 01111-0001. All rights reserved. www.MassMutual.com.

The MassMutual Global Floating Rate Fund, MassMutual Global Credit Income Opportunities Fund, MassMutual Emerging Markets Debt Blended Total Return Fund, and MassMutual Global Emerging Markets Equity Fund are distributed by ALPS Distributors, Inc. (ADI). MML Distributors, LLC (MMLD) serves as the exclusive wholesale marketing agent for all MassMutual Funds, as well as the distributor for all other MassMutual Funds, except the MassMutual High Yield Fund and MassMutual Short-Duration Bond Fund. MMLD Member FINRA and SIPC (www.FINRA.org and www.SIPC.org), 1295 State Street, Springfield, MA 01111-0001. Investment advisory services are provided to all MassMutual Funds by MML Investment Advisers, LLC (MML Advisers). MMLD and MML Advisers are subsidiaries of MassMutual, Springfield, MA 01111-0001. ADI is not affiliated with MMLD, MML Advisers, or MassMutual.

The information provided is the opinion of MML Advisers and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Of course, past performance does not guarantee future results.

5

MassMutual Global Floating Rate Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Global Floating Rate Fund, and who is the Fund’s subadviser?

The Fund seeks a high level of current income. Preservation of capital is a secondary goal. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in income-producing floating rate debt securities, consisting of floating rate loans, bonds, and notes, issued primarily by North American and Western European companies. The Fund’s subadviser is Barings LLC (Barings) and its sub-subadviser is Baring International Investment Limited (BIIL).

The Fund is the successor to the Barings Global Floating Rate Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Barings and BIIL were the adviser and subadviser to the Predecessor Fund, respectively.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class I shares returned -6.44%, underperforming the -2.91% return of the Credit Suisse Global Loan Benchmark (the “benchmark”), a market-capitalization weighted average of the Credit Suisse Leveraged Loan Index and the Credit Suisse Western European Leveraged Loan Index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investable universe of the Western European leveraged loan market, with loans denominated in U.S. and Western European currencies.

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Performance for the Fund and its benchmark finished the final calendar year quarter of 2021 with a positive return and performance for the Fund was generally in-line with that of the market. Demand had increased for the asset class in 2021 and this was supportive for the positive performance to finish the calendar year. Coming into 2022, broader fixed income markets began to experience greater volatility due to rising interest rates among other factors. Performance for both the Fund and its benchmark was generally resilient to much of this initial volatility and in particular, relative to broader fixed income markets. One of the reasons for this is that the Fund invests in senior secured loans, which have a coupon that includes a floating-rate component. As a result, trading prices for the asset class tend to be less sensitive to increases in interest rates, on a historical basis, relative to asset classes with a fixed-rate coupon. This was a contributing factor to the more stable performance for the Fund and benchmark during the initial portion of the period.

Beginning in May 2022, both the Fund and benchmark began to experience more volatility in trading prices. This resulted in negative returns for May, June, and September – and positive returns for July and August. Performance during the negative months in this period was largely driven by negative investor sentiment that put downward pressure on trading prices; consequently, a large portion of the Fund’s underperformance occurred during those three months.

To provide further context to the Fund’s relative performance during the reporting period, double-B-rated loans outperformed their single-B and triple-C counterparts across the market, which can happen during periods of economic uncertainty. The Fund held an underweight allocation to double-B-rated loans, which was a notable detractor from relative results. The Fund also had a modest overweight allocation to triple-C-rated loans, which underperformed during the reporting period. While the overweight positioning was a detractor for the period, the loans held in the Fund in this category outperformed the benchmark in the same rating category, which offset some of the detraction.

Within industry sectors, the Fund’s holdings in various sectors modestly underperformed the benchmark during the reporting period. These underperforming sectors included information technology, service, and health care. Given the negative total return for the asset class for the period, the Fund’s exposure to cash provided a positive impact to relative results.

6

MassMutual Global Floating Rate Fund – Portfolio Manager Report (Unaudited) (Continued) |

At the Fund holdings level, top contributors to total return included TIBCO Software, a software provider; Travelex, a foreign exchange retailer; and Technicolor, a solutions provider for the communication and media/entertainment industries. Fund holdings that were top detractors included Carlson Travel, a business travel company; Quest Software, an enterprise software solutions provider; and Loyalty Ventures, a solutions provider for consumer loyalty programs.

The Fund’s derivative usage during the reporting period was primarily limited to currency forwards used to passively hedge currency exposure for non-U.S. dollar-denominated debt back to the Fund’s base currency (which is the U.S. dollar). This did not have a material impact on the Fund’s performance. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives can be used for hedging, speculation, or both.

Subadviser outlook

Barings notes that global markets faced a range of headwinds during the reporting period. In Barings’ view, inflation, and the steps that central banks are taking to mitigate inflationary pressure, remain top of mind for many investors, in terms of impacts to both the consumer and corporations. Barings believes that, while some companies will be negatively impacted by these elements, overall, borrowers from the senior secured loan market came into this environment in a healthy financial position. In Barings’ view, over the past three years, companies were generally prudent with their liquidity positions by maintaining cash balances, and took advantage of stable primary markets to refinance debt and push out maturities. Barings expects that this will help to provide such companies with flexibility to navigate an uncertain environment. Additionally, higher interest rates are accretive to coupons being paid to investors in the market as a floating-rate asset class. Though Barings anticipates that volatility may persist in the near term, Fund management ultimately believes that the overall market and the Fund are both well positioned to navigate the challenging months ahead, given the position of strength they held coming into the period.

MassMutual Global Floating Rate Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/22 |

Bank Loans | 86.5% |

Corporate Debt | 6.9% |

Common Stock | 0.5% |

Warrants | 0.0% |

Total Long-Term Investments | 93.9% |

Other Assets and Liabilities | 6.1% |

Net Assets | 100.0% |

| | |

7

MassMutual Global Floating Rate Fund – Portfolio Manager Report (Unaudited) (Continued) |

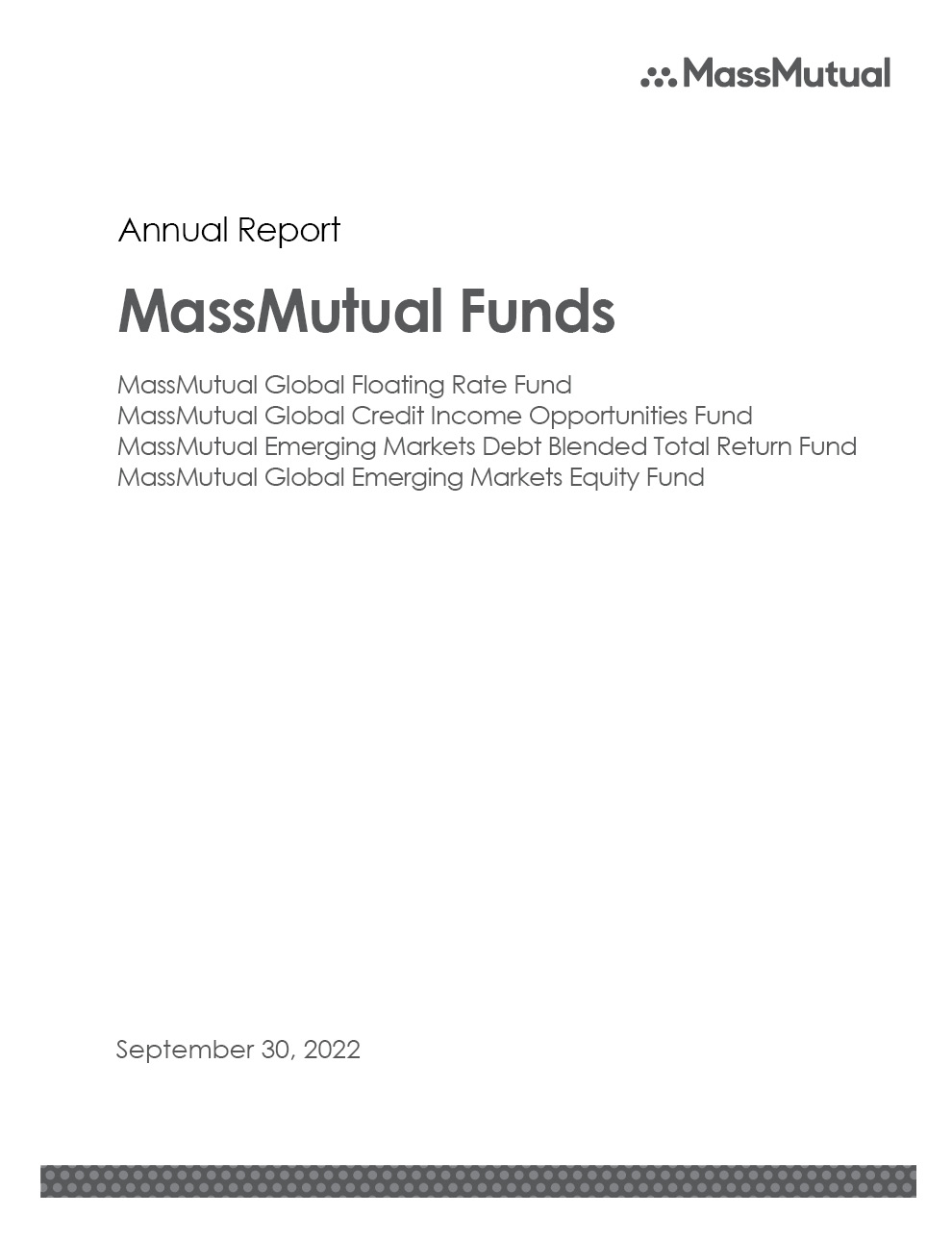

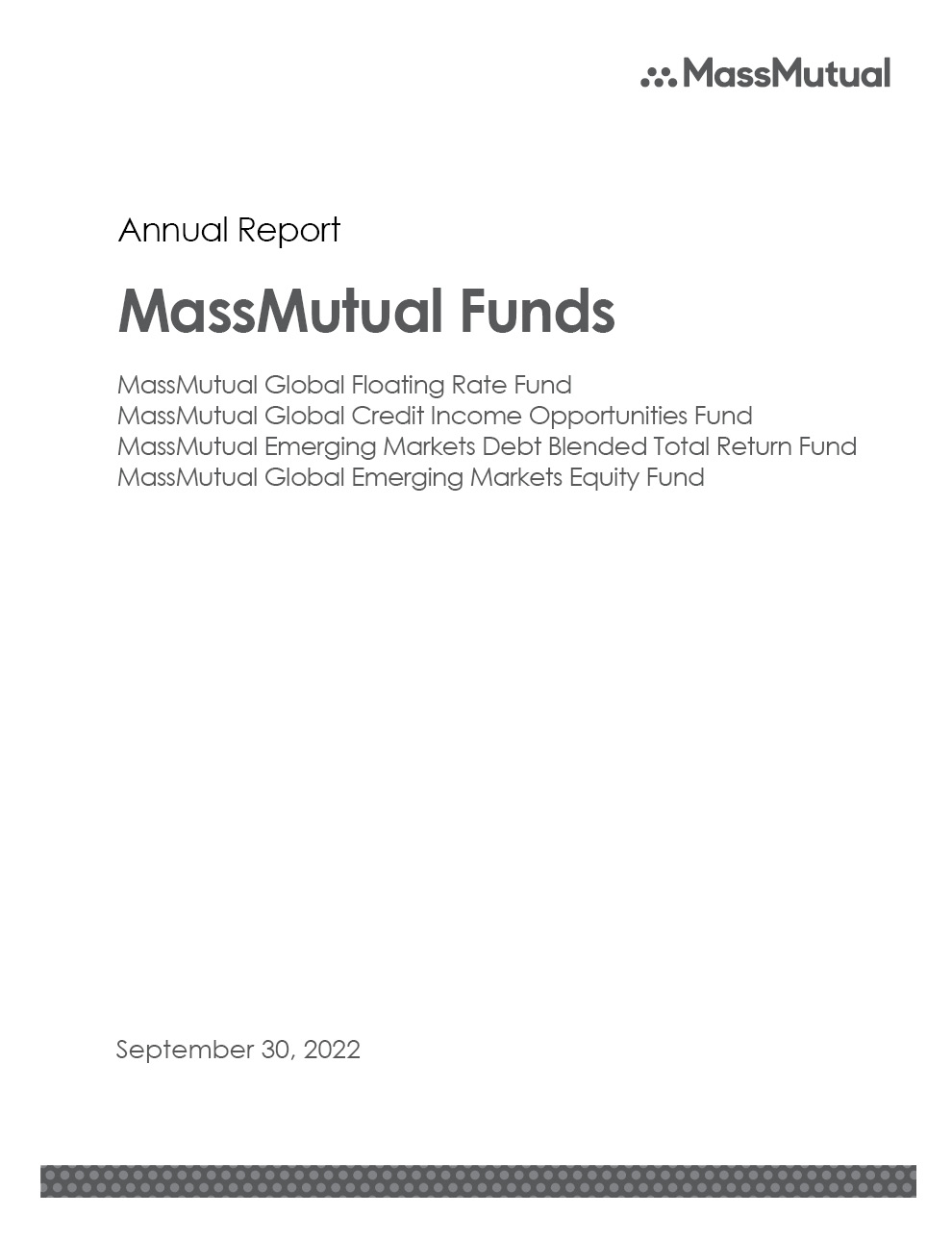

GROWTH OF $10,000 INVESTMENT - Class I

The graph above illustrates a representative class of the Fund’s historical performance+ for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns+ (for the periods ended 09/30/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | Since Inception

09/16/2013 |

Class I | 09/16/2013 | -6.44% | 2.19% | 3.03% |

Class Y | 09/16/2013 | -6.45% | 2.17% | 3.01% |

Class L | 09/16/2013 | -6.76% | 1.90% | 2.73% |

Class L (sales load deducted)* | 09/16/2013 | -10.42% | 1.28% | 2.39% |

Class C | 09/16/2013 | -7.46% | 1.14% | 1.98% |

Class C (CDSC fees deducted)* | 09/16/2013 | -8.36% | 1.14% | 1.98% |

Credit Suisse Global Loan Benchmark | | -2.91% | 3.07% | 3.61% |

* Class L (sales load deducted) returns include the 3.00% maximum sales charge and Class C (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 12 months shown.

+ The Fund is the successor to the Barings Global Floating Rate Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Performance shown for Class L shares prior to December 13, 2021 reflects the performance of Class A shares of the Predecessor Fund.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

8

MassMutual Global Credit Income Opportunities Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Global Credit Income Opportunities Fund, and who is the Fund’s subadviser?

The Fund seeks an absolute return, primarily through current income and secondarily through capital appreciation. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in debt instruments (consisting of loans, bonds, and notes). The Fund may invest in a wide range of debt instruments of issuers based in U.S. and non-U.S. markets, including emerging markets, as well as over-the-counter and exchange-traded derivatives. The Fund’s subadviser is Barings LLC (Barings) and its sub-subadviser is Baring International Investment Limited (BIIL).

The Fund is the successor to the Barings Global Credit Income Opportunities Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Barings and BIIL were the adviser and subadviser to the Predecessor Fund, respectively.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class I shares returned -13.23%, significantly underperforming the 6.37% return* of the 3 Month USD LIBOR (London Interbank Offered Rate) (the “benchmark”), which measures the performance of the U.S. dollar-denominated ICE LIBOR rate with a maturity of 3 months. LIBOR indicates the interest rate that banks pay when they borrow from each other on an unsecured basis. It is fundamental to the operation of both the United Kingdom and international financial markets, including markets in interest rate derivatives contracts. It is used to determine payments made under derivatives by a wide range of counterparties including small businesses, large financial institutions, and public authorities.

* Return shown for the benchmark reflects the benchmark’s return for the reporting period, plus 500 basis points (5.00%).

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

In terms of performance relative to the benchmark, the main driver of the Fund’s underperformance was that its investments in debt were marked-to-market, whereas a large portion of the benchmark is static and not subject to this volatility. (“Mark-to-market” involves recording the price or value of a security to calculate its profits or losses.) During the reporting period, volatility increased across global markets for various reasons – such as inflation, central bank actions to lower inflation, and geopolitical uncertainty.

The Fund invests in below-investment-grade debt that includes investments in fixed-rate corporate bonds, floating-rate corporate loans, and collateralized loan obligations (CLOs), which are typically floating-rate securities backed by a pool of floating-rate corporate loans. One of the elements that detracted from the Fund’s total return during the period was its exposure to fixed-rate corporate bonds. With the increases in interest rates during the period, trading levels for fixed-rate assets underperformed. On the other hand, the Fund’s exposure to floating-rate corporate loans, whose trading prices tend to be less sensitive to increases in interest rates on a historical basis, helped to offset its fixed-rate exposure. While the Fund’s investments in CLOs were also in floating-rate instruments, that market underperformed floating-rate corporate loans, so those holdings detracted from total returns.

Across sectors, despite an overall lower weighting, holdings within the housing sector detracted from the Fund’s total return. Fund holdings within the health care sector also hampered results. The Fund’s holdings in emerging markets underperformed during the period due to some of the additional headwinds facing companies in emerging markets, such as the housing sector in China or companies exposed to Russia or Ukraine. However, the Fund’s exposure to emerging markets was notably lower than its developed market exposure during the fiscal period. Finally, given the negative total return across markets during the period, the Fund’s cash exposure was a positive contributor to total return.

9

MassMutual Global Credit Income Opportunities Fund – Portfolio Manager Report (Unaudited) (Continued) |

At the Fund holdings level, top detractors included Quest Software, an enterprise software solutions provider; Yuzhou Group, a Chinese property developer; and Bausch Health, a specialty pharmaceutical manufacturer. The Fund’s top contributors to total return included Tourmaline, a Canadian natural gas producer; Innovation Group, a claims management provider; and Travelex, a foreign exchange retailer.

The Fund’s derivative usage during the reporting period was primarily limited to currency forwards used to passively hedge currency exposure for non-U.S. dollar-denominated debt back to the Fund’s base currency (which is the U.S. dollar). This did not have a material impact on the Fund’s performance. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives can be used for hedging, speculation, or both.

Subadviser outlook

Barings notes that global markets faced a range of headwinds during the reporting period. In Barings’ view, inflation, and the steps that central banks are taking to mitigate inflationary pressure, remain top of mind for many investors in terms of impacts to both the consumer and corporations. Barings believes that, while some companies will be negatively impacted by these elements, overall, borrowers from the high-yield credit markets came into this environment in a healthy financial position. In Barings’ view, over the past three years, companies were generally prudent with their liquidity positions by maintaining cash balances, and took advantage of stable primary markets to refinance debt and push out maturities. Barings expects that this will help to provide such companies with flexibility to navigate an uncertain environment. Though Barings anticipates that volatility may persist in the near term, Fund management ultimately believes that the high-yield credit markets and the Fund are both well positioned to navigate the challenging months ahead, given the position of strength they held coming into the period.

MassMutual Global Credit

Income Opportunities Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/22 |

Bank Loans | 39.8% |

Corporate Debt | 38.6% |

Non-U.S. Government Agency Obligations | 9.2% |

Common Stock | 0.4% |

Purchased Options | 0.4% |

Warrants | 0.0% |

Total Long-Term Investments | 88.4% |

Short-Term Investments and Other Assets and Liabilities | 11.6% |

Net Assets | 100.0% |

| | |

10

MassMutual Global Credit Income Opportunities Fund – Portfolio Manager Report (Unaudited) (Continued) |

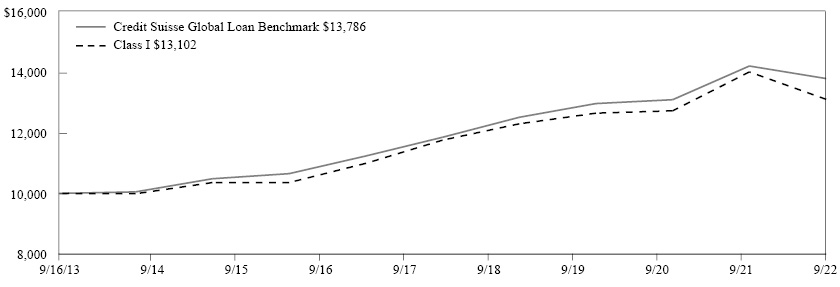

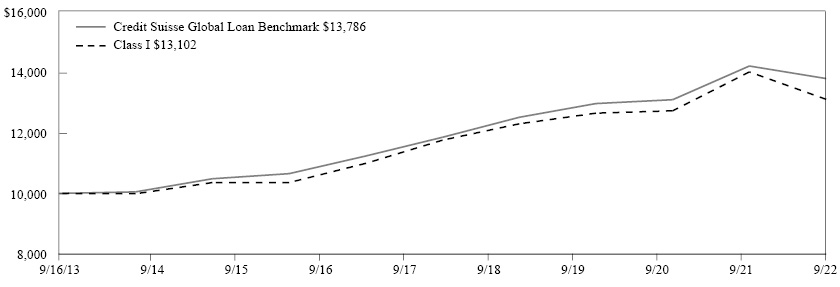

GROWTH OF $10,000 INVESTMENT - Class I

The graph above illustrates a representative class of the Fund’s historical performance+ for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns+ (for the periods ended 09/30/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | Since Inception

09/16/2013 |

Class I | 09/16/2013 | -13.23% | 0.77% | 2.91% |

Class Y | 09/16/2013 | -13.26% | 0.76% | 2.91% |

Class L | 09/16/2013 | -13.48% | 0.51% | 2.65% |

Class L (sales load deducted)* | 09/16/2013 | -17.72% | -0.31% | 2.22% |

Class C | 09/16/2013 | -14.13% | -0.23% | 1.89% |

Class C (CDSC fees deducted)* | 09/16/2013 | -14.95% | -0.23% | 1.89% |

3 Month USD LIBOR +500 bps | | 6.37% | 6.50% | 6.12% |

* Class L (sales load deducted) returns include the 4.00% maximum sales charge and Class C (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 12 months shown.

+ The Fund is the successor to the Barings Global Credit Income Opportunities Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Performance shown for Class L shares prior to December 13, 2021 reflects the performance of Class A shares of the Predecessor Fund.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

11

MassMutual Emerging Markets Debt Blended Total Return Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Emerging Markets Debt Blended Total Return Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve maximum total return, consistent with preservation of capital and prudent investment management, through high current income generation and, where appropriate, capital appreciation by investing in debt securities, derivatives, and other instruments that are economically tied to emerging market countries or countries with relatively low gross national product per capita and with the potential for rapid economic growth. Under normal circumstances, the Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in (i) securities denominated in currencies of the emerging market countries, (ii) fixed income securities or debt instruments issued by emerging market entities or sovereign nations, and/or (iii) debt instruments denominated in or based on the currencies, interest rates, or issues of emerging market countries. The Fund’s subadviser is Barings LLC (Barings) and its sub-subadviser is Baring International Investment Limited (BIIL).

The Fund is the successor to the Barings Emerging Markets Debt Blended Total Return Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Barings and BIIL were the adviser and subadviser to the Predecessor Fund, respectively.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class I shares returned -30.50%, significantly underperforming the -20.95% return of the Custom Emerging Markets Debt Blended Total Return Index (the “benchmark”), which is a blend of 50% JPMorgan Government Bond Index – Emerging Markets Global Diversified (GBI-EMGD), 30% JPMorgan EMBI Global Diversified, and 20% JPMorgan CEMBI Broad Diversified.

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

During the reporting period, the Fund’s exposure to Russia, Ukraine, Belarus, and China hampered performance. In Russia, Ukraine, and Belarus, the Fund was positioned poorly for the escalation of events that led to Russia’s invasion of Ukraine – a scenario that had been discredited by many market participants until it became a reality. The Fund’s losses in China primarily came from its exposure to the real estate sector, an important sector for the Chinese economy, representing approximately 25% of gross domestic product (GDP). The Chinese government has allowed a substantial market sell-off of the sector since late 2021. On the other hand, during the reporting period, the Fund benefited from select currency positions.

The Fund uses derivative instruments in managing its portfolio, both from a hedging perspective as well as to gain exposure to credit risk, local interest rate risk, and currency risk. Currency derivatives (primarily currency forwards) and interest rate derivatives (U.S. Treasury futures and interest rate swaps) contributed to performance during the reporting period, while credit derivatives (short credit default swaps) detracted from returns during the period. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives can be used for hedging, speculation, or both.

Subadviser outlook

Barings expects that market participants will continue to pay close attention to global central banks’ efforts to bring persistent inflation rates down to target levels. As of the end of the reporting period, asset prices continued to face downward pressure, due, in Barings’ view, in part to the uncertain market environment; hawkish central banks; inflation that has shown some signs of peaking, but has yet to come down meaningfully; potential recession in Europe; a slowdown in China; and the lingering conflict between Russia and Ukraine. Commodity prices, which initially increased earlier in the reporting period due to concern that Russia would be completely cut off from the global supply chain, moderated over the last few months of the period – led by oil prices, which at fiscal period-end, were under $100 per barrel. The U.S. dollar continued to strengthen throughout the fiscal period, as markets fled to safety and the U.S. Federal Reserve adopted a hawkish stance. Many emerging-market countries

12

MassMutual Emerging Markets Debt Blended Total Return Fund – Portfolio Manager Report (Unaudited) (Continued) |

lowered their financing needs over the last few years – and for some, trade balances have significantly improved since the onset of the pandemic. Global central banks were active in hiking interest rates during the fiscal period – putting pressure on local rates, although, in Barings’ view, there have been some signs that inflation may be peaking in some countries.

In this challenging environment, with many unknowns on the horizon, Fund management believes that rigorous credit and country selection will continue to be a differentiator in performance. Ultimately, their view is that those managers who closely assess risk and take a bottom-up, fundamental approach to investing could be well positioned to uncover opportunities.

MassMutual Emerging Markets

Debt Blended Total Return Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/22 |

Sovereign Debt Obligations | 53.9% |

Corporate Debt | 42.0% |

Purchased Options | 0.0% |

Total Long-Term Investments | 95.9% |

Short-Term Investments and Other Assets and Liabilities | 4.1% |

Net Assets | 100.0% |

| | |

13

MassMutual Emerging Markets Debt Blended Total Return Fund – Portfolio Manager Report (Unaudited) (Continued) |

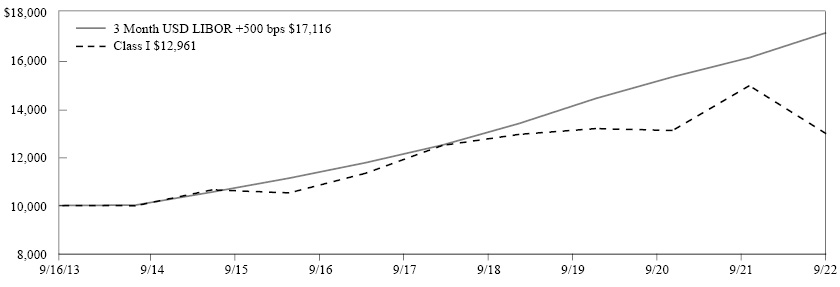

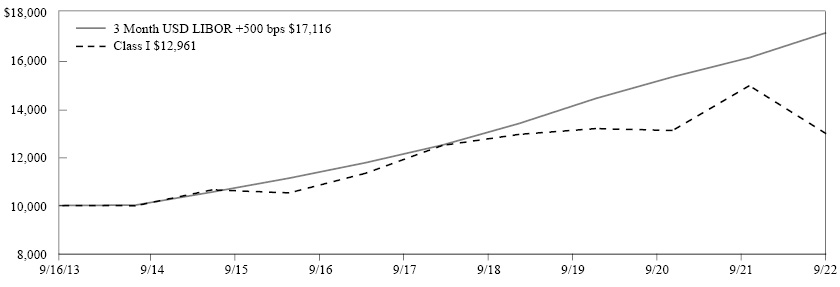

GROWTH OF $10,000 INVESTMENT - Class I

The graph above illustrates a representative class of the Fund’s historical performance+ for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns+ (for the periods ended 09/30/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | Since Inception

10/21/2015 |

Class I | 10/21/2015 | -30.50% | -2.02% | 1.20% |

Class Y | 10/21/2015 | -30.59% | -2.06% | 1.17% |

Class L | 10/21/2015 | -30.66% | -2.27% | 0.94% |

Class L (sales load deducted)* | 10/21/2015 | -34.05% | -3.06% | 0.35% |

Class C | 10/21/2015 | -31.20% | -2.99% | 0.21% |

Class C (CDSC fees deducted)* | 10/21/2015 | -31.84% | -2.99% | 0.21% |

Custom Emerging Markets Debt Blended Total Return Index | | -20.95% | -2.64% | 0.47% |

* Class L (sales load deducted) returns include the 4.00% maximum sales charge and Class C (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 12 months shown.

+ The Fund is the successor to the Barings Emerging Markets Debt Blended Total Return Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Performance shown for Class L shares prior to December 13, 2021 reflects the performance of Class A shares of the Predecessor Fund.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

14

MassMutual Global Emerging Markets Equity Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Global Emerging Markets Equity Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve long-term capital growth. Under normal market conditions, the Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity and equity-related securities, including convertible securities, preferred stocks, options, and warrants, of issuers that are economically tied to one or more emerging market countries. The Fund may invest in fixed income securities or debt instruments issued by emerging market entities or sovereign nations. The Fund’s subadviser is Barings LLC (Barings) and its sub-subadviser is Baring International Investment Limited (BIIL).

The Fund is the successor to the Barings Global Emerging Markets Equity Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Barings and BIIL were the adviser and subadviser to the Predecessor Fund, respectively.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class I shares returned -27.26%, outperforming the -28.11% return of the MSCI Emerging Markets Index (the “benchmark”), which measures the performance of the large- and mid-cap segments of emerging market equity securities. It is free float-adjusted market-capitalization weighted.

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

During the reporting period, the Fund’s performance declined in absolute terms, as inflationary pressures, monetary tightening, and global economic slowdown worries dominated the headlines and contributed to weakness across equity markets worldwide. Equity markets also suffered significant sell-offs in the immediate aftermath of Russia’s invasion of Ukraine.

Against this backdrop, all sectors within the Fund posted negative absolute returns over the period. Fund holdings in the more defensive sectors, such as consumer staples, outperformed, whereas Fund holdings within sectors more tied to the economic cycle, such as communication services, lagged the benchmark. Growth-style equities outperformed their value counterparts over the period. While this was a headwind for Fund management’s growth-at-a-reasonable-price approach, the Fund still managed to outperform its benchmark for the reporting period.

The Fund’s top-performing holdings on a relative basis included Indonesian bank BNI, Brazilian supermarket Atacadão, United Arab Emirates real estate developer Emaar Properties, and Brazilian insurer BB Seguridade. Fund holdings that were the largest detractors during the reporting period included Russian retailer X5 and Russian banking group Sberbank (both of which were fair-value adjusted to zero following Russia’s invasion of Ukraine) and Chinese wind power company Longyuan Power.

Subadviser outlook

In the short term, Barings believes that global markets are likely to remain volatile as investors closely monitor developments in Ukraine and the impact on various commodity markets. Barings expects that this could continue to put upward pressure on inflation at a time when supply-side bottlenecks have not yet been fully resolved. Consequently, Barings believes that the U.S. Federal Reserve Board could remain biased towards front-loading monetary tightening.

The COVID news flow in China will continue to ebb and flow, and Barings anticipates that future short-term disruptions to the economy (particularly as the result of mandatory lockdowns) cannot be ruled out. However, in Fund management’s view, continued policy stimulus could lead to a rebound in Chinese economic activity in the closing months of 2022.

In Barings’ opinion, the absolute valuations of emerging-market equities and their relative valuations versus developed equities appear to be attractive, suggesting investor expectations for the asset class remain overly depressed.

Fund management expects to continue their process of building new positions in or adding to existing positions in companies with strong and sustainable business franchises where Barings’ proprietary bottom-up research identifies a significant degree of undervaluation relative to their future growth potential.

15

MassMutual Global Emerging Markets Equity Fund – Portfolio Manager Report (Unaudited) (Continued) |

MassMutual Global Emerging

Markets Equity Fund

Largest Holdings

(% of Net Assets) on 9/30/22 |

Taiwan Semiconductor Manufacturing Co. Ltd. | 7.2% |

Samsung Electronics Co. Ltd. | 6.7% |

Tencent Holdings Ltd. | 5.5% |

Alibaba Group Holding Ltd. | 4.0% |

Reliance Industries Ltd. GDR | 4.0% |

HDFC Bank Ltd. ADR | 3.8% |

Meituan Class B | 2.8% |

Infosys Ltd. ADR | 2.7% |

Yum China Holdings, Inc. | 2.3% |

Hana Financial Group, Inc. | 2.2% |

| | 41.2% |

| | |

MassMutual Global Emerging

Markets Equity Fund

Sector Table

(% of Net Assets) on 9/30/22 |

Financial | 28.4% |

Technology | 19.0% |

Communications | 18.2% |

Consumer, Cyclical | 11.5% |

Energy | 5.3% |

Industrial | 5.1% |

Basic Materials | 5.1% |

Utilities | 2.8% |

Consumer, Non-cyclical | 2.0% |

Mutual Funds | 1.2% |

Total Long-Term Investments | 98.6% |

Short-Term Investments and Other Assets and Liabilities | 1.4% |

Net Assets | 100.0% |

| | |

16

MassMutual Global Emerging Markets Equity Fund – Portfolio Manager Report (Unaudited) (Continued) |

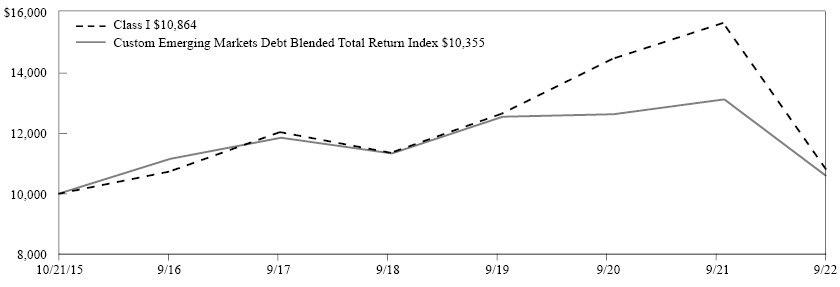

GROWTH OF $10,000 INVESTMENT - Class I

The graph above illustrates a representative class of the Fund’s historical performance+ for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns+ (for the periods ended 09/30/2022) | |

| Inception Date

of Class | 1 Year | Since Inception

09/18/2018 |

Class I | 09/18/2018 | -27.26% | -1.29% |

Class Y | 09/18/2018 | -27.26% | -1.29% |

Class L | 09/18/2018 | -27.45% | -1.55% |

Class L (sales load deducted)* | 09/18/2018 | -28.16% | -1.55% |

Class C | 09/18/2018 | -28.00% | -2.29% |

Class C (CDSC fees deducted)* | 09/18/2018 | -28.70% | -2.29% |

MSCI Emerging Markets Index | | -28.11% | -1.27% |

* Class L (sales load deducted) returns include the 4.00% maximum sales charge and Class C (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 12 months shown.

+ The Fund is the successor to the Barings Global Emerging Markets Equity Fund (the “Predecessor Fund”), a mutual fund with substantially similar investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on December 13, 2021. The performance provided is that of the Predecessor Fund prior to December 13, 2021, and is that of the Fund after December 13, 2021. Performance shown for Class L shares prior to December 13, 2021 reflects the performance of Class A shares of the Predecessor Fund.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

17

MassMutual Global Floating Rate Fund – Portfolio of Investments |

September 30, 2022 |

| | | Number of

Shares | | | Value | |

| EQUITIES — 0.5% |

| COMMON STOCK — 0.5% |

| Communications — 0.0% |

| Telecommunications — 0.0% |

| Vantiva SA (a) | | | 88,751 | | | $ | 88,583 | |

| Consumer, Cyclical — 0.2% |

| Entertainment — 0.1% |

| Technicolor Creative Studios SA (a) | | | 88,751 | | | | 169,612 | |

| Leisure Time — 0.1% |

| Carlson Travel, Inc. (a) | | | 43,227 | | | | 360,210 | |

| | | | | | | | 529,822 | |

| Consumer, Non-cyclical — 0.2% |

| Food — 0.1% |

| CTI Foods Holding Co., LLC (a) (b) (c) | | | 4,657 | | | | 432,123 | |

| Health Care – Services — 0.1% |

| Don Jersey Topco Ltd. (Acquired 8/03/20 - 1/11/22, Cost $233,833) (a) (b) (c) (d) | | | 333,090 | | | | 191,906 | |

| | | | | | | | 624,029 | |

| Energy — 0.1% |

| Oil & Gas — 0.0% |

| Sabine Oil & Gas Holdings LLC (a) | | | 394 | | | | 5,122 | |

| | | | | | | | 5,122 | |

| Oil & Gas Services — 0.1% |

| KCA Deutag International Ltd. (a) | | | 7,834 | | | | 464,815 | |

| | | | | | | | 469,937 | |

| Industrial — 0.0% |

| Transportation — 0.0% |

| Bahia De Las Isletas SL, Class A2 (Acquired 1/12/22, Cost $0) (a) (b) (c) (d) | | | 688 | | | | — | |

| Bahia De Las Isletas SL, Class A3 (Acquired 1/12/22, Cost $0) (a) (b) (c) (d) | | | 98 | | | | — | |

| Bahia De Las Isletas SL, Class B2 (Acquired 1/12/22, Cost $0) (a) (b) (c) (d) | | | 876 | | | | — | |

| Bahia De Las Isletas SL, Class B3 (a) | | | 125 | | | | 1,348 | |

| | | | | | | | 1,348 | |

| | | Number of

Shares | | | Value | |

| Technology — 0.0% |

| Software — 0.0% |

| Travelex Topco Ltd. (Acquired 8/06/20 - 4/07/22, Cost $0) (a) (b) (c) (d) | | | 2,999 | | | $ | — | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $1,871,397) | | | | | | | 1,713,719 | |

| | | | | | | | | |

| TOTAL EQUITIES (Cost $1,871,397) | | | | | | | 1,713,719 | |

| | | | Principal

Amount | | | | | |

| BONDS & NOTES — 93.4% |

| BANK LOANS — 86.5% |

| Advertising — 2.4% |

| Clear Channel Outdoor Holdings, Inc., Term Loan B, 3 mo. USD LIBOR + 3.500% | | | | | | | | |

| 6.306% VRN 8/21/26 | | $ | 2,427,034 | | | | 2,160,813 | |

| CMG Media Corp., 2021 Term Loan, 1 mo. USD LIBOR + 3.500% | | | | | | | | |

| 6.615% VRN 12/17/26 | | | 1,451,123 | | | | 1,355,596 | |

| Dotdash Meredith, Inc., Term Loan B, | | | | | | | | |

| 0.000%12/01/28(e) | | | 1,146,230 | | | | 1,020,144 | |

| Summer (BC) Holdco B SARL, USD Term Loan B1, 3 mo. USD LIBOR + 5.000% | | | | | | | | |

| 8.144% VRN 12/04/26 | | | 3,449,348 | | | | 3,220,828 | |

| | | | | | | | 7,757,381 | |

| Aerospace & Defense — 0.3% |

| TransDigm, Inc., 2020 Term Loan F, 3 mo. USD LIBOR + 2.250% | | | | | | | | |

| 5.924% VRN 12/09/25 | | | 1,004,382 | | | | 960,732 | |

| Airlines — 2.0% |

| Air Canada, 2021 Term Loan B, 3 mo. USD LIBOR + 3.500% | | | | | | | | |

| 6.421% VRN 8/11/28 | | | 1,526,745 | | | | 1,449,048 | |

| American Airlines, Inc., 2018 Term Loan B, 1 mo. USD LIBOR + 1.750% | | | | | | | | |

| 4.830% VRN 6/27/25 | | | 697,082 | | | | 675,298 | |

| American Airlines, Inc., 2021 Term Loan, 3 mo. USD LIBOR + 4.750% | | | | | | | | |

| 7.460% VRN 4/20/28 | | | 1,013,025 | | | | 979,595 | |

| Kestrel Bidco, Inc., Term Loan B, 1 mo. USD LIBOR + 3.000% | | | | | | | | |

| 5.993% VRN 12/11/26 | | | 2,565,166 | | | | 2,251,574 | |

The accompanying notes are an integral part of the financial statements.

18

MassMutual Global Floating Rate Fund – Portfolio of Investments (Continued) |

| | | Principal

Amount | | | Value | |

United Airlines, Inc., 2021 Term Loan B, 3 mo. USD LIBOR + 3.750% | | | | | | | | |

6.533% VRN 4/21/28 | | $ | 1,184,068 | | | $ | 1,127,991 | |

| | | | | | | | 6,483,506 | |

Apparel — 0.4% |

Crocs, Inc., Term Loan B, | | | | | | | | |

0.000% 2/19/29 (e) | | | 1,205,265 | | | | 1,131,442 | |

Auto Parts & Equipment — 0.7% |

Clarios Global LP | | | | | | | | |

2021 EUR Term Loan B, 1 mo. EURIBOR + 3.250% | | | | | | | | |

3.935% VRN 4/30/26 EUR (f) | | | 947,090 | | | | 831,199 | |

2021 USD Term Loan B, 1 mo. USD LIBOR + 3.250% | | | | | | | | |

6.365% VRN 4/30/26 | | | 1,470,424 | | | | 1,387,713 | |

| | | | | | | | 2,218,912 | |

Banks — 0.1% |

AqGen Ascensus, Inc., 2021 2nd Lien Term Loan, 3 mo. USD LIBOR + 6.500% | | | | | | | | |

8.813% VRN 8/02/29 | | | 250,358 | | | | 224,070 | |

Beverages — 0.9% |

Amphora Finance Ltd., 2018 GBP Term Loan B, 3 mo. GBP LIBOR + 4.750% | | | | | | | | |

6.641% VRN 5/23/25 GBP (f) | | | 500,000 | | | | 464,764 | |

Sunshine Investments B.V. | | | | | | | | |

2022 EUR Term Loan, 3 mo. EURIBOR + 4.250% | | | | | | | | |

4.571% VRN 7/12/29 EUR (f) | | | 779,000 | | | | 705,566 | |

2022 USD Term Loan, 3 mo. SOFR CME + 4.250% | | | | | | | | |

6.962% VRN 7/12/29 | | | 152,728 | | | | 145,600 | |

Triton Water Holdings, Inc., Term Loan, 3 mo. USD LIBOR + 3.500% | | | | | | | | |

7.174% VRN 3/31/28 | | | 1,626,751 | | | | 1,456,170 | |

| | | | | | | | 2,772,100 | |

Biotechnology — 0.3% |

Advanz Pharma Corp., 2021 EUR Term Loan B, 1 mo. EURIBOR + 4.750% | | | | | | | | |

5.435% VRN 6/01/28 EUR (f) | | | 1,000,000 | | | | 899,196 | |

Building Materials — 1.4% |

CP Atlas Buyer, Inc., 2021 Term Loan B, 1 mo. USD LIBOR + 3.500% | | | | | | | | |

6.615% VRN 11/23/27 | | | 1,239,626 | | | | 1,074,755 | |

| | | Principal

Amount | | | Value | |

LSF10 XL Bidco S.C.A., 2021 EUR Term Loan B4, 3 mo. EURIBOR + 3.675% | | | | | | | | |

4.868% VRN 4/12/28 EUR (f) | | $ | 853,470 | | | $ | 668,461 | |

Quikrete Holdings, Inc., 2016 1st Lien Term Loan, 1 mo. USD LIBOR + 2.625% | | | | | | | | |

5.740% VRN 2/01/27 | | | 1,210,029 | | | | 1,159,607 | |

Vector WP Holdco, Inc., Term Loan B, 1 mo. USD LIBOR + 5.000% | | | | | | | | |

8.000% VRN 10/12/28 | | | 1,571,053 | | | | 1,504,283 | |

| | | | | | | | 4,407,106 | |

Chemicals — 4.6% |

Colouroz Investment 1 GmbH | | | | | | | | |

Initial EUR Term Loan, 3 mo. EURIBOR + 4.250% | | | | | | | | |

5.000% VRN 9/21/23 EUR (f) | | | 206,799 | | | | 166,910 | |

EUR Term Loan B3, 3 mo. EURIBOR + 4.250% | | | | | | | | |

5.000% VRN 9/21/23 EUR (f) | | | 14,980 | | | | 12,090 | |

Consolidated Energy Finance, SA, Term Loan B, 3 mo. USD LIBOR + 2.500% | | | | | | | | |

5.293% VRN 5/07/25 | | | 1,234,583 | | | | 1,179,027 | |

CPC Acquisition Corp., Term Loan, 3 mo. USD LIBOR + 3.750% | | | | | | | | |

7.424% VRN 12/29/27 | | | 2,472,409 | | | | 1,918,169 | |

Flint Group GmbH | | | | | | | | |

EUR Term Loan B5, 3 mo. EURIBOR + 4.250% | | | | | | | | |

5.000% VRN 9/21/23 EUR (f) | | | 64,065 | | | | 51,707 | |

2017 EUR Incremental B6, 3 mo. EURIBOR + 4.250% | | | | | | | | |

5.000% VRN 9/21/23 EUR (f) | | | 3,703 | | | | 2,988 | |

2017 EUR Incremental B7, 3 mo. EURIBOR + 4.250% | | | | | | | | |

5.000% VRN 9/21/23 EUR (f) | | | 344,963 | | | | 278,423 | |

EUR Add on Term Loan B4, 3 mo. EURIBOR + 4.250% | | | | | | | | |

5.000% VRN 9/21/23 EUR (f) | | | 101,054 | | | | 81,562 | |

USD Term Loan C, 3 mo. USD LIBOR + 4.250% | | | | | | | | |

7.009% VRN 9/21/23 | | | 596,452 | | | | 481,635 | |

Flint Group US LLC, USD 1st Lien Term Loan B2, 3 mo. USD LIBOR + 4.250% | | | | | | | | |

7.009% VRN 9/21/23 | | | 3,735,522 | | | | 3,016,434 | |

GEON Performance Solutions, LLC, 2021 Term Loan, 1 mo. USD LIBOR + 4.500% | | | | | | | | |

7.613% VRN 8/18/28 | | | 552,338 | | | | 531,625 | |

The accompanying notes are an integral part of the financial statements.

19

MassMutual Global Floating Rate Fund – Portfolio of Investments (Continued) |

| | | Principal

Amount | | | Value | |

Kraton Corp., 2022 USD Term Loan, 3 mo. SOFR CME + 3.250% | | | | | | | | |

6.718% VRN 3/15/29 | | $ | 400,143 | | | $ | 384,638 | |

LSF11 A5 Holdco LLC, Term Loan, | | | | | | | | |

0.000% 10/13/28 (e) | | | 1,437,222 | | | | 1,333,024 | |

New Arclin U.S. Holding Corp. | | | | | | | | |

2021 Delayed Draw Term Loan, 3 mo. USD LIBOR + 1.000% | | | | | | | | |

1.000% VRN 10/02/28 (g) | | | 112,911 | | | | 103,925 | |

2021 Term Loan, 1 mo. USD LIBOR + 3.750% | | | | | | | | |

6.865% VRN 9/30/28 | | | 767,637 | | | | 706,548 | |

Nobian Finance B.V., EUR Term Loan B, 3 mo. EURIBOR + 3.200% | | | | | | | | |

3.200% VRN 7/01/26 EUR (f) | | | 446,583 | | | | 350,796 | |

Olympus Water U.S. Holding Corp., 2021 USD Term Loan B, 3 mo. USD LIBOR + 3.750% | | | | | | | | |

7.438% VRN 11/09/28 | | | 424,835 | | | | 386,600 | |

PMHC II, Inc., 2022 Term Loan B, 3 mo. SOFR CME + 4.250% | | | | | | | | |

6.977% VRN 4/23/29 | | | 1,544,632 | | | | 1,240,293 | |

Polar US Borrower LLC, 2018 1st Lien Term Loan, 3 mo. USD LIBOR + 4.750%, 3 mo. Prime + 3.750% | | | | | | | | |

7.205% - 10.000% VRN 10/15/25 | | | 1,226,572 | | | | 989,439 | |

Trinseo Materials Operating S.C.A., 2021 Term Loan B2, 1 mo. USD LIBOR + 2.500% | | | | | | | | |

5.615% VRN 5/03/28 | | | 1,481,250 | | | | 1,354,884 | |

| | | | | | | | 14,570,717 | |

Commercial Services — 5.3% |

Albion Financing 3 SARL, EUR Term Loan, 3 mo. EURIBOR + 5.250% | | | | | | | | |

5.375% VRN 8/17/26 EUR (f) | | | 640,000 | | | | 582,937 | |

APX Group, Inc., 2021 Term Loan B, 1 mo. USD LIBOR + 3.250% | | | | | | | | |

6.264% VRN 7/10/28 | | | 1,217,161 | | | | 1,148,038 | |

AVSC Holding Corp. | | | | | | | | |

2020 Term Loan B1, 3 mo. USD LIBOR + 3.250% | | | | | | | | |

6.394% VRN 3/03/25 | | | 2,192,795 | | | | 1,914,134 | |

2020 Term Loan B2, 3 mo. USD LIBOR + 4.500% | | | | | | | | |

7.644% VRN 10/15/26 | | | 510,549 | | | | 450,243 | |

BCP V Modular Services Holdings IV Ltd., EUR Term Loan B, 3 mo. EURIBOR + 4.500% | | | | | | | | |

5.693% VRN 12/15/28 EUR (f) | | | 1,000,000 | | | | 859,014 | |

| | | Principal

Amount | | | Value | |

Cimpress Public Ltd. Co., USD Term Loan B, 1 mo. USD LIBOR + 3.500% | | | | | | | | |

6.615% VRN 5/17/28 | | $ | 214,689 | | | $ | 196,440 | |

CoreLogic, Inc. | | | | | | | | |

Term Loan, 1 mo. USD LIBOR + 3.500% | | | | | | | | |

6.625% VRN 6/02/28 | | | 1,317,145 | | | | 984,566 | |

2nd Lien Term Loan, 1 mo. USD LIBOR + 6.500% | | | | | | | | |

9.625% VRN 6/04/29 | | | 532,670 | | | | 356,889 | |

EAB Global, Inc., 2021 Term Loan, 3 mo. USD LIBOR + 3.500% | | | | | | | | |

6.306% VRN 8/16/28 | | | 496,250 | | | | 463,994 | |

Eagle Bidco Ltd. | | | | | | | | |

2021 EUR Term Loan B, 3 mo. EURIBOR + 3.500% | | | | | | | | |

4.728% VRN 3/20/28 EUR (f) | | | 900,000 | | | | 806,630 | |

2021 GBP Term Loan B, 1 mo. GBP LIBOR + 4.500% | | | | | | | | |

6.688% VRN 3/20/28 GBP (f) | | | 500,000 | | | | 510,124 | |

Element Materials Technology Group US Holdings, Inc. | | | | | | | | |

2022 USD Term Loan, 3 mo. USD LIBOR + 4.250% | | | | | | | | |

7.903% VRN 7/06/29 | | | 298,254 | | | | 279,240 | |

2022 USD Delayed Draw Term Loan, 3 mo. USD LIBOR + 4.250% | | | | | | | | |

7.904% VRN 7/06/29 | | | 137,656 | | | | 128,880 | |

Ensono, LP, 2021 Term Loan, 1 mo. USD LIBOR + 3.750% | | | | | | | | |

6.865% VRN 5/26/28 | | | 893,506 | | | | 763,948 | |

Fugue Finance B.V., EUR Term Loan, 3 mo. EURIBOR + 3.250% | | | | | | | | |

3.742% VRN 9/01/24 EUR (f) | | | 1,000,000 | | | | 908,585 | |

Lernen Bidco Ltd., EUR Term Loan B1, 6 mo. EURIBOR + 4.250% | | | | | | | | |

4.250% VRN 10/24/25 EUR (f) | | | 2,000,000 | | | | 1,794,315 | |

Prometric Holdings, Inc., 1st Lien Term Loan, 1 mo. USD LIBOR + 3.000% | | | | | | | | |

6.115% VRN 1/29/25 | | | 982,188 | | | | 904,841 | |

Sabre GLBL, Inc. | | | | | | | | |

2021 Term Loan B2, 1 mo. USD LIBOR + 3.500% | | | | | | | | |

6.615% VRN 12/17/27 | | | 480,178 | | | | 428,760 | |

2021 Term Loan B1, 1 mo. USD LIBOR + 3.500% | | | | | | | | |

6.615% VRN 12/17/27 | | | 301,230 | | | | 268,974 | |

The accompanying notes are an integral part of the financial statements.

20

MassMutual Global Floating Rate Fund – Portfolio of Investments (Continued) |

| | | Principal

Amount | | | Value | |

Techem Verwaltungsgesellschaft 675 mbH, EUR Term Loan B4, 6 mo. EURIBOR + 2.375% | | | | | | | | |

2.638% VRN 7/15/25 EUR (f) | | $ | 1,000,000 | | | $ | 897,442 | |

Verisure Holding AB, 2021 EUR Term Loan, 6 mo. EURIBOR + 3.250% | | | | | | | | |

3.473% VRN 3/27/28 EUR (f) | | | 1,875,000 | | | | 1,644,647 | |

Wand NewCo 3, Inc., 2020 Term Loan, 1 mo. USD LIBOR + 3.000% | | | | | | | | |

6.115% VRN 2/05/26 | | | 487,310 | | | | 450,518 | |

| | | | | | | | 16,743,159 | |

Computers — 3.5% |

Ahead DB Holdings LLC, 2021 Term Loan B, 3 mo. USD LIBOR + 3.750% | | | | | | | | |

7.430% VRN 10/18/27 | | | 1,440,166 | | | | 1,370,865 | |

Magenta Buyer LLC, 2021 USD 1st Lien Term Loan, 1 mo. USD LIBOR + 4.750% | | | | | | | | |

7.870% VRN 7/27/28 | | | 2,129,285 | | | | 1,916,356 | |

McAfee, LLC, 2022 USD Term Loan B, 1 mo. SOFR CME + 3.750% | | | | | | | | |

6.362% VRN 3/01/29 | | | 1,275,626 | | | | 1,160,131 | |

Netsmart Technologies, Inc., 2020 Term Loan B, 1 mo. USD LIBOR + 4.000% | | | | | | | | |

7.115% VRN 10/01/27 | | | 985,000 | | | | 938,213 | |

Panther Commercial Holdings LP, Term Loan, 3 mo. USD LIBOR + 4.500% | | | | | | | | |

7.306% VRN 1/07/28 | | | 1,481,250 | | | | 1,361,832 | |

Redstone Holdco 2 LP, 2021 Term Loan, 3 mo. USD LIBOR + 4.750% | | | | | | | | |

7.533% VRN 4/27/28 | | | 2,906,588 | | | | 2,142,155 | |

Surf Holdings LLC, USD Term Loan, 3 mo. USD LIBOR + 3.500% | | | | | | | | |

6.668% VRN 3/05/27 | | | 489,704 | | | | 472,261 | |

Vision Solutions, Inc. | | | | | | | | |

2021 Incremental Term Loan, 3 mo. USD LIBOR + 4.000% | | | | | | | | |

6.783% VRN 4/24/28 | | | 1,175,022 | | | | 1,022,269 | |

2021 2nd Lien Term Loan, 3 mo. USD LIBOR + 7.250% | | | | | | | | |

10.033% VRN 4/23/29 | | | 770,186 | | | | 637,814 | |

| | | | | | | | 11,021,896 | |

Cosmetics & Personal Care — 0.7% |

Coty, Inc., 2018 USD Term Loan B, 1 mo. USD LIBOR + 2.250% | | | | | | | | |

4.935% VRN 4/07/25 | | | 811,022 | | | | 786,837 | |

| | | Principal

Amount | | | Value | |

Hoffmaster Group, Inc., 2018 1st Lien Term Loan, 3 mo. USD LIBOR + 4.000% | | | | | | | | |

7.674% VRN 11/21/23 | | $ | 1,395,758 | | | $ | 1,257,410 | |

Journey Personal Care Corp., 2021 Term Loan B, 3 mo. USD LIBOR + 4.250% | | | | | | | | |

7.924% VRN 3/01/28 | | | 295,172 | | | | 185,466 | |

| | | | | | | | 2,229,713 | |

Distribution & Wholesale — 0.5% |

Ammeraal Beltech Holding B.V., 2018 EUR 1st Lien Term Loan, 3 mo. EURIBOR + 3.750% | | | | | | | | |

4.943% VRN 7/30/25 EUR (f) | | | 1,000,000 | | | | 852,643 | |

Fluid-Flow Products, Inc., Term Loan, 3 mo. USD LIBOR + 3.750% | | | | | | | | |

7.424% VRN 3/31/28 | | | 724,771 | | | | 693,062 | |

| | | | | | | | 1,545,705 | |

Diversified Financial Services — 2.3% |

AllSpring Buyer LLC, Term Loan B, 3 mo. USD LIBOR + 3.000% | | | | | | | | |

6.688% VRN 11/01/28 | | | 808,109 | | | | 783,057 | |

Astra Acquisition Corp., 2021 1st Lien Term Loan, 1 mo. USD LIBOR + 5.250% | | | | | | | | |

8.365% VRN 10/25/28 | | | 860,275 | | | | 726,933 | |

Castlelake Aviation Ltd., Term Loan B, 3 mo. USD LIBOR + 2.750% | | | | | | | | |

6.043% VRN 10/22/26 | | | 1,135,245 | | | | 1,095,273 | |

Deerfield Dakota Holding LLC, 2021 USD 2nd Lien Term Loan, 1 mo. USD LIBOR + 6.750% | | | | | | | | |

9.865% VRN 4/07/28 | | | 1,000,000 | | | | 965,000 | |

Edelman Financial Center LLC | | | | | | | | |

2021 Term Loan B, 1 mo. USD LIBOR + 3.500% | | | | | | | | |

6.615% VRN 4/07/28 | | | 1,232,481 | | | | 1,128,238 | |

2018 2nd Lien Term Loan, 1 mo. USD LIBOR + 6.750% | | | | | | | | |

9.865% VRN 7/20/26 | | | 1,000,000 | | | | 880,000 | |

Spa Holdings, 2022 EUR Term Loan B, 3 mo. EURIBOR + 3.500% | | | | | | | | |

4.693% VRN 2/04/28 EUR (f) | | | 1,400,000 | | | | 1,230,747 | |

VFH Parent LLC, 2022 Term Loan B, | | | | | | | | |

0.000% 1/13/29 (e) | | | 524,050 | | | | 500,960 | |

| | | | | | | | 7,310,208 | |

Electric — 0.9% |

Arvos BidCo SARL | | | | | | | | |

USD 1st Lien Term Loan B2, 3 mo. USD LIBOR + 5.500% | | | | | | | | |

6.500% VRN 8/29/23 | | | 122,736 | | | | 66,891 | |