UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23665

Invesco Dynamic Credit Opportunity Fund

(Exact name of registrant as specified in charter)

1555 Peachtree Street, N.E., Suite 1800 Atlanta, Georgia 30309

(Address of principal executive offices) (Zip code)

Sheri Morris 1555 Peachtree Street, N.E., Suite 1800 Atlanta, Georgia 30309

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 2/28

Date of reporting period: 2/28/22

This Registrant is filing this amendment (“Amendment”) to its Form N-CSR for the year ended February 28, 2022, (the “Report”), originally filed with the Securities and Exchange Commission on May 6, 2022 (Accession Number 0001193125-22-143171) to amend Item 1 “Report to Stockholders” to correct the Class A Shares’ performance information appearing in the Management’s Discussion of Fund Performance. Items 1 (except as noted above) through 13(a)(1) of the Registrant’s Form N-CSR originally filed on May 6, 2022, are incorporated herein by reference. This Amendment should be read in conjunction with the Report. Except for Item 1 as noted above, this Amendment does not amend or update the Report in any way nor does it reflect events occurring after the filing of the Report.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not applicable.

| | |

| Annual Report to Shareholders | | February 28, 2022 |

Invesco Dynamic Credit Opportunity Fund*

*On November 1, 2021, Common Shares of Invesco Dynamic Credit Opportunities Fund (the predecessor fund), a listed closed-end fund, were reorganized into Class AX shares of the Fund.

Nasdaq:

A: XCRTX ∎ AX: XAXCX ∎ Y: XCRRX ∎ R6: XCYOX

Management’s Discussion of Fund Performance

| | | | |

Performance summary For the fiscal year ended February 28, 2022, Class A shares of Invesco Dynamic Credit Opportunity Fund (the Fund), at net asset value (NAV), outperformed the Credit Suisse Leveraged Loan Index, the Fund’s style-specific benchmark. Your Fund’s long-term performance appears later in this report. | |

Fund vs. Indexes | | | | |

Total returns, 2/28/21 to 2/28/22, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

Class A Shares | | | 10.53 | % |

| |

Class AX Shares | | | 10.81 | |

| |

Class Y Shares | | | 10.81 | |

| |

Class R6 Shares | | | 10.83 | |

| |

Credit Suisse Leveraged Loan Index▼ (Style-Specific Index) | | | 3.24 | |

| |

Source(s): ▼Bloomberg LP | | | | |

|

The returns shown prior to November 1, 2021 are those of Invesco Dynamic Credit Opportunities Fund (the predecessor fund), a listed closed-end fund. Common Shares of the predecessor fund were reorganized into Class AX shares of the Fund on November 1, 2021. | |

Market conditions and your Fund

For the fiscal year ended February 28, 2022, the broadly syndicated loan market, as represented by the Credit Suisse Leveraged Loan Index, returned 3.24%.1 Prices briefly weakened in late November 2021 as investors first became aware of the highly transmissible coronavirus (COVID-19) Omicron variant and naturally eschewed risk assets of all stripes. However, concerns eased in December as consensus emerged that Omicron posed lower risk of severity and, thus, lowered the risk of lasting economic disruption. In late February, Russia’s invasion of Ukraine roiled investor sentiment and cast a shadow of uncertainty over markets. While loans did not entirely escape the resulting broad market volatility, loans did outperform other risk assets, like stocks and high yield bonds for the first two months of 2022 and exhibited lower relative volatility.2

Relative stability in loan prices was aided by highly supportive demand in technicals throughout the fiscal year. Demand from retail/institutional buyers and even more impactfully from record CLO formation provided a steady bid for loan assets despite the choppy macro backdrop. Ascending interest rates remained at the forefront of market discussion amid rising inflation and an increasingly hawkish US Federal Reserve (the Fed) intent on managing that inflation through tighter financial conditions. We believe rising rates would likely bode well for continued loan appetite among income-oriented investors also seeking low interest rate sensitivity in the year ahead.

Fundamentally speaking, we observed that company issuers continued to exhibit healthy balance sheets, still improving earnings and high accessibility to capital markets during the fiscal year. Collectively, these trends minimized restructuring activity in the syndicated loan market over the fiscal year. We expect much of this to continue in what we expect to

be a fairly benign default backdrop go forward.

Direct lending proved to be resilient in 2021. Performance in the asset class returned to pre-pandemic levels on the heels of a strengthening economy. As the market found its footing, deal activity accelerated while yields held to historic levels.

As we begin 2022, we remain constructive on the direct lending asset class. Although we anticipate greater volatility in the broader markets, we believe that several dynamics should work in the asset class’s favor. On the demand side, private equity continues to amass meaningful capital which should support an active and robust M&A pipeline. Against a backdrop of likely Fed policy changes and continued inflationary pressure, the floating rate structure of the asset class offers protection in a rising rate environment. Lastly, as the broader equity and credit markets continue to encounter increased volatility, direct lending’s low correlation may create needed diversification for income seeking investors.

In the near-term, we can expect supply chain constraints and labor dynamics to continue to challenge business operating models, but we anticipate these dynamics abating in the second half of the fiscal year as global supply chains ramp up production.

With inflation and rates on the move, we believe that direct lending represents an asset class with stable risk-adjusted returns, low correlation to more volatile, liquid asset classes and protection against a rising rate environment.

Within stressed and distressed credit, our primary focus is on private companies where we believe significant inefficiencies exist. Our target companies, given their size, have less access to capital than larger companies and therefore offer a more robust, evergreen opportunity set. We have found this lack of cyclicality to be true over several decades of

experience and in stark contrast to how the cycle-dependent large capitalization distressed market operates. To that end, as the economy recovers, we continue to find event-driven stressed credit opportunities globally. Distressed-for-control opportunities continue to be episodic, which is not unusual for the asset class; and special situations opportunities remain robust.

In terms of 2022 and beyond, we expect global economies to continue to recover and grow with impacts from current inflationary pressures, labor and supply shortages, commodity price increases and rising rates to abate ultimately over the long-term horizon. We are cautious in the near to medium term around these risks as well as the continued potential for COVID-19 variants to impact economic growth through exacerbation of these trends as well as the potential for lock-downs in certain geographies.

During the fiscal year, the Fund employed leverage, which allowed us to enhance the Fund’s yield while keeping credit standards high relative to the benchmark. As of the close of the fiscal year, leverage accounted for 25% of the Fund’s NAV plus borrowings. Leverage involves borrowing at a floating short-term rate and reinvesting the proceeds at a higher rate. The common thread across the Fund’s strategies (broadly syndicated loans, direct lending and stressed & distressed credit) is its focus on senior secured, floating rating loans. Unlike other fixed-income asset classes, using leverage in conjunction with loans typically does not involve the same degree of risk from rising short-term interest rates since the income from loans generally adjusts to changes in interest rates, as do the rates which determine the Fund’s borrowing costs. (Similarly, should short-term rates fall, borrowing costs also would decline.) For more information about the Fund’s use of leverage, see the Notes to Financial Statements later in this report.

The loan asset class behaves differently from many traditional fixed-income investments. The interest income generated by a portfolio of loans is usually determined by a fixed credit spread over the base rate. Because loans generally have a very short duration due to its coupons or interest rates adjusting every 30 to 90 days as the base rate changes, the yield on the portfolio adjusts. Interest rate risk refers to the tendency for traditional fixed-income prices to decline when interest rates rise. For loans, however, interest rates and income are variable and the prices of loans are therefore less sensitive to interest rate changes than traditional fixed-income bonds. If interest rates rise faster than expected, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Fund’s investments or the market price of the Fund’s shares. We are monitoring interest rates, the market and economic and geopolitical factors that may impact the direction, speed and

| | |

| 2 | | Invesco Dynamic Credit Opportunity Fund |

magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the Fed and certain central banks.

Looking ahead to what we anticipate will be a multi-year period of ascending interest rates, we believe that loans can continue to offer high-income with low duration risk. If the case for loans at the start of 2021 was built on strong coupon plus upside potential from pandemic recovery, then we believe the case for loans in 2022 will be predicated upon strong coupon plus low duration sensitivity. In our view, exposure to loans can help investors not only generate strong yields for their portfolios, but also provide insulation to what we believe to be one of the key macroeconomic risks in 2022 – that of potentially significant inflation that could force the Fed to raise rates sooner and with greater magnitude than expected. For this reason, we believe loans continue to merit a core role in investors’ portfolios.

As always, we appreciate your continued participation in Invesco Dynamic Credit Opportunity Fund.

| 2 | Source: Standard & Poor’s Leveraged Loan Index |

Portfolio manager(s):

Scott Baskind

Nuno Caetano

Thomas Ewald

Ron Kantowitz

Philip Yarrow

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| 3 | | Invesco Dynamic Credit Opportunity Fund |

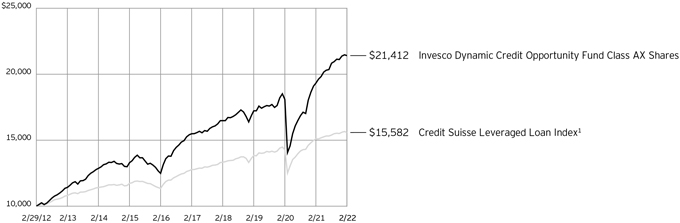

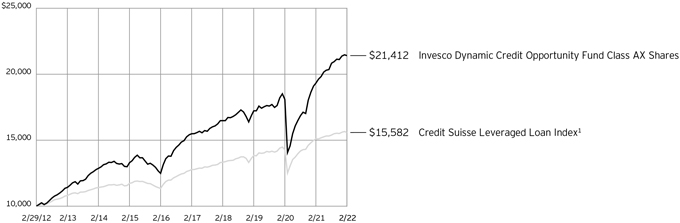

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 2/29/12

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects Fund expenses and management fees; performance of a market index does not.

Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

The returns shown prior to November 1, 2021 are those of Invesco Dynamic Credit Opportunities Fund (the predecessor fund), a listed closed-end fund. Common Shares of the predecessor fund were reorganized into Class AX shares of the Fund on November 1, 2021.

| | |

| 4 | | Invesco Dynamic Credit Opportunity Fund |

| | | | |

Average Annual Total Returns | |

As of 2/28/22, including maximum applicable sales charges | |

Class A Shares | | | | |

10 Years | | | 7.28 | % |

5 Years | | | 5.73 | |

1 Year | | | 6.96 | |

| |

Class AX Shares | | | | |

Inception (6/26/07) | | | 5.62 | % |

10 Years | | | 7.91 | |

5 Years | | | 6.69 | |

1 Year | | | 10.81 | |

| |

Class Y Shares | | | | |

10 Years | | | 7.91 | % |

5 Years | | | 6.69 | |

1 Year | | | 10.81 | |

| |

Class R6 Shares | | | | |

10 Years | | | 7.91 | % |

5 Years | | | 6.69 | |

1 Year | | | 10.83 | |

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The returns shown prior to November 1, 2021 are those of Invesco Dynamic Credit Opportunities Fund (the predecessor fund), a listed closed-end fund. Common Shares of the predecessor fund were reorganized into Class AX shares of the Fund on November 1, 2021.

Class A share performance reflects the maximum 3.25% sales charge. Class A shares, Class AX shares, Class Y shares and Class R6 shares have no early withdrawal charges, except that an early withdrawal charge of 1.00% may be imposed on certain repurchases of Class A shares made by the Fund within eighteen months of purchase upon which a sales charge was not paid; such charge is not reflected in the returns shown above. Class Y shares and Class R6 shares do not have a front-end sales charge or a CDSC, therefore performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower.

See current prospectus for more information.

| | |

| 5 | | Invesco Dynamic Credit Opportunity Fund |

Supplemental Information

Invesco Dynamic Credit Opportunity Fund’s investment objective is to seek a high level of current income, with a secondary objective of capital appreciation.

| ∎ | Unless otherwise stated, information presented in this report is as of February 28, 2022, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The Credit Suisse Leveraged Loan Index represents tradable, senior-secured, US dollar-denominated, non-investment grade loans. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

| | |

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. | | |

| | |

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE | | |

| | |

| 6 | | Invesco Dynamic Credit Opportunity Fund |

Fund Information

| | | | | |

Portfolio Composition† | | |

| By credit quality | | % of total investments |

| |

BBB- | | | | 1.92 | % |

BB | | | | 0.39 | |

BB- | | | | 2.32 | |

B+ | | | | 4.35 | |

B | | | | 12.70 | |

B- | | | | 17.80 | |

CCC+ | | | | 7.97 | |

CCC | | | | 3.03 | |

CCC- | | | | 1.21 | |

CC | | | | 0.18 | |

C | | | | 0.35 | |

D | | | | 1.51 | |

Non-Rated | | | | 37.94 | |

Equity | | | | 8.33 | |

†Source: Standard & Poor’s. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on Standard & Poor’s rating methodology, please visit standardandpoors.com and select “Understanding Ratings” under Rating Resources on the homepage.

Top Five Debt Issuers*

| | | | | | | |

| | | | | % of total net assets |

| | |

1. | | Groundworks LLC | | | | 3.83 | % |

2. | | Keg Logistics, LLC | | | | 3.70 | |

3. | | FDH Group Acquisition, Inc. | | | | 3.57 | |

4. | | PrimeFlight Aviation Services, Inc. | | | | 3.52 | |

5. | | MB2 Dental Solutions, LLC | | | | 3.33 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

| * | Excluding money market fund holdings, if any. |

Data presented here are as of February 28, 2022.

| | |

| 7 | | Invesco Dynamic Credit Opportunity Fund |

Consolidated Schedule of Investments

February 28, 2022

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Variable Rate Senior Loan Interests–116.79%(b)(c)(d) | | | | | | | | | | | | | | | | | | |

Aerospace & Defense–7.89% | | | | | | | | | | | | | | | | | | |

Aernnova Aerospace S.A.U. (Spain) | | | | | | | | | | | | | | | | | | |

Term Loan B-1 (3 mo. EURIBOR + 3.00%) | | | 3.00% | | | | 02/26/2027 | | | | EUR | | | | 726 | | | $ 771,294 |

Term Loan B-2 (3 mo. EURIBOR + 3.00%) | | | 3.00% | | | | 02/26/2027 | | | | EUR | | | | 183 | | | 194,735 |

Boeing Co., Revolver Loan(e)(f) | | | 0.00% | | | | 10/30/2022 | | | | | | | $ | 17,325 | | | 17,195,627 |

Dynasty Acquisition Co., Inc. | | | | | | | | | | | | | | | | | | |

Term Loan B-1 (1 mo. USD LIBOR + 3.50%) | | | 3.72% | | | | 04/08/2026 | | | | | | | | 713 | | | 693,277 |

Term Loan B-2 (1 mo. USD LIBOR + 3.50%) | | | 3.72% | | | | 04/08/2026 | | | | | | | | 382 | | | 371,227 |

FDH Group Acquisition, Inc., Term Loan A (3 mo. USD LIBOR + 7.00%)(e) | | | 8.00% | | | | 04/01/2024 | | | | | | | | 22,660 | | | 22,206,671 |

IAP Worldwide Services, Inc. | | | | | | | | | | | | | | | | | | |

Revolver Loan | | | | | | | | | | | | | | | | | | |

(Acquired 07/22/2014; Cost $1,444,403)(e)(f)(g) | | | 0.00% | | | | 07/18/2023 | | | | | | | | 1,444 | | | 1,444,403 |

Second Lien Term Loan (3 mo. USD LIBOR + 6.50%) (Acquired 07/22/2014-08/18/2014; Cost $1,551,891)(e)(g) | | | 8.00% | | | | 07/18/2023 | | | | | | | | 1,576 | | | 1,576,247 |

KKR Apple Bidco LLC, Second Lien Term Loan (1 mo. USD LIBOR + 5.75%) | | | 6.25% | | | | 09/21/2029 | | | | | | | | 348 | | | 350,697 |

Peraton Corp. | | | | | | | | | | | | | | | | | | |

First Lien Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 02/01/2028 | | | | | | | | 11 | | | 11,238 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | | | 8.50% | | | | 02/01/2029 | | | | | | | | 2,064 | | | 2,090,859 |

Propulsion (BC) Finco S.a.r.l. (Spain), Term Loan B(e)(h) | | | - | | | | 02/10/2029 | | | | | | | | 607 | | | 606,570 |

Spirit AeroSystems, Inc., Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 01/15/2025 | | | | | | | | 1,396 | | | 1,393,227 |

Vectra Co., First Lien Term Loan (3 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 03/08/2025 | | | | | | | | 196 | | | 186,272 |

| | | | | | | | | | | | | | | | | | | 49,092,344 |

| | | | | |

Air Transport–3.52% | | | | | | | | | | | | | | | | | | |

PrimeFlight Aviation Services, Inc. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan (1 mo. USD LIBOR + 6.25%)(e) | | | 7.25% | | | | 05/09/2024 | | | | | | | | 3,194 | | | 3,149,804 |

Incremental Delayed Draw Term Loan (1 mo. USD LIBOR + 6.25%)(e) | | | 7.25% | | | | 05/09/2024 | | | | | | | | 9,433 | | | 9,300,761 |

Term Loan (1 mo. USD LIBOR + 6.25%)(e) | | | 7.25% | | | | 05/09/2024 | | | | | | | | 9,584 | | | 9,449,412 |

| | | | | | | | | | | | | | | | | | | 21,899,977 |

| | | | | |

Automotive–6.36% | | | | | | | | | | | | | | | | | | |

BCA Marketplace (United Kingdom) | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan B (1 mo. GBP SONIA + 7.50%) | | | 7.94% | | | | 07/30/2029 | | | | GBP | | | | 4,668 | | | 6,241,590 |

Term Loan B (6 mo. GBP SONIA + 4.75%) | | | 5.12% | | | | 06/30/2028 | | | | GBP | | | | 1,055 | | | 1,396,342 |

DexKo Global, Inc. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan (1 mo. USD LIBOR + 3.75%) | | | 3.75% | | | | 09/30/2028 | | | | | | | | 12 | | | 12,042 |

Delayed Draw Term Loan(f) | | | 0.00% | | | | 09/30/2028 | | | | | | | | 7 | | | 6,569 |

Driven Holdings LLC, Term Loan B (1 mo. USD LIBOR + 3.25%)(e) | | | 3.52% | | | | 11/20/2028 | | | | | | | | 541 | | | 537,045 |

Muth Mirror Systems LLC | | | | | | | | | | | | | | | | | | |

Revolver Loan(e)(f) | | | 0.00% | | | | 04/23/2025 | | | | | | | | 1,677 | | | 1,620,175 |

Term Loan (3 mo. USD LIBOR + 5.25%)(e) | | | 6.25% | | | | 04/23/2025 | | | | | | | | 19,319 | | | 18,662,389 |

Panther BF Aggregator 2 L.P. (Canada), Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 04/30/2026 | | | | | | | | 25 | | | 25,020 |

PowerStop LLC, Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.25% | | | | 01/24/2029 | | | | | | | | 1,022 | | | 1,015,926 |

Transtar Industries, Inc. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan (Acquired 01/22/2021; Cost $1,196,907)(e)(f)(g) | | | 0.00% | | | | 01/22/2027 | | | | | | | | 1,224 | | | 1,223,616 |

Term Loan A (3 mo. USD LIBOR + 7.00%) (Acquired 01/22/2021; Cost $8,632,432)(e)(g) | | | 8.00% | | | | 01/22/2027 | | | | | | | | 8,782 | | | 8,825,769 |

| | | | | | | | | | | | | | | | | | | 39,566,483 |

| | | | | |

Beverage & Tobacco–1.03% | | | | | | | | | | | | | | | | | | |

AI Aqua Merger Sub, Inc. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan(h) | | | - | | | | 07/31/2028 | | | | | | | | 488 | | | 485,085 |

Incremental Term Loan(h) | | | - | | | | 07/30/2028 | | | | | | | | 2,147 | | | 2,134,375 |

Arctic Glacier U.S.A., Inc., Term Loan (3 mo. USD LIBOR + 3.50%) | | | 4.50% | | | | 03/20/2024 | | | | | | | | 517 | | | 482,267 |

City Brewing Co. LLC, Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 03/31/2028 | | | | | | | | 1,837 | | | 1,740,026 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 8 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Beverage & Tobacco–(continued) | | | | | | | | | | | | | | | | | | |

Waterlogic Holdings Ltd. (United Kingdom) | | | | | | | | | | | | | | | | | | |

Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.25% | | | | 08/04/2028 | | | | | | | $ | 1,308 | | | $ 1,303,060 |

Term Loan B (3 mo. EURIBOR + 4.25%) | | | 4.25% | | | | 08/04/2028 | | | | EUR | | | | 249 | | | 279,013 |

| | | | | | | | | | | | | | | | | | | 6,423,826 |

| | | | | |

Brokers, Dealers & Investment Houses–0.14% | | | | | | | | | | | | | | | | | | |

AqGen Island Intermediate Holdings, Inc. | | | | | | | | | | | | | | | | | | |

First Lien Term Loan B(h) | | | - | | | | 08/02/2028 | | | | | | | | 825 | | | 816,969 |

Second Lien Term Loan B(h) | | | - | | | | 08/05/2029 | | | | | | | | 33 | | | 32,382 |

| | | | | | | | | | | | | | | | | | | 849,351 |

| | | | | |

Building & Development–1.47% | | | | | | | | | | | | | | | | | | |

CRH Europe Distribution (Netherlands), Term Loan A (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 11/29/2025 | | | | EUR | | | | 773 | | | 868,502 |

Icebox Holdco III, Inc. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan(f) | | | 0.00% | | | | 12/15/2028 | | | | | | | | 305 | | | 303,310 |

Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 12/21/2029 | | | | | | | | 489 | | | 489,404 |

Term Loan B(h) | | | - | | | | 12/22/2028 | | | | | | | | 1,476 | | | 1,466,001 |

LHS Borrow LLC (Leaf Home Solutions), Term Loan B(e)(h) | | | - | | | | 02/17/2029 | | | | | | | | 2,119 | | | 2,098,324 |

Mayfair Mall LLC, Term Loan(e)(h) | | | - | | | | 04/20/2023 | | | | | | | | 1,258 | | | 1,150,974 |

Modulaire (United Kingdom), Term Loan B (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 10/08/2028 | | | | EUR | | | | 1,295 | | | 1,412,703 |

SRS Distribution, Inc., Incremental Term Loan(h) | | | - | | | | 06/04/2028 | | | | | | | | 392 | | | 387,992 |

Werner FinCo L.P., Term Loan (3 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 07/24/2024 | | | | | | | | 972 | | | 970,935 |

| | | | | | | | | | | | | | | | | | | 9,148,145 |

| | | | | |

Business Equipment & Services–15.52% | | | | | | | | | | | | | | | | | | |

Aegion Corp., Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.50% | | | | 05/17/2028 | | | | | | | | 922 | | | 924,226 |

Allied Universal Holdco LLC | | | | | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 05/12/2028 | | | | | | | | 1,201 | | | 1,186,466 |

Term Loan B(h) | | | - | | | | 05/12/2028 | | | | EUR | | | | 96 | | | 105,672 |

AutoScout24 (Speedster Bidco GmbH) (Germany), Second Lien Term Loan (3 mo. EURIBOR + 6.00%) | | | 6.00% | | | | 03/31/2028 | | | | EUR | | | | 3,053 | | | 3,393,973 |

Blackhawk Network Holdings, Inc., Second Lien Term Loan (3 mo. USD LIBOR + 7.00%) | | | 7.13% | | | | 06/15/2026 | | | | | | | | 384 | | | 382,536 |

Blucora, Inc., Term Loan (1 mo. USD LIBOR + 4.00%)(e) | | | 5.00% | | | | 05/22/2024 | | | | | | | | 718 | | | 718,186 |

Checkout Holding Corp. | | | | | | | | | | | | | | | | | | |

PIK Term Loan, 9.50% PIK Rate, 2.00% Cash Rate (Acquired 02/15/2019-02/28/2022; Cost $ 701,280)(g)(i) | | | 9.50% | | | | 08/15/2023 | | | | | | | | 702 | | | 299,622 |

Term Loan (1 mo. USD LIBOR + 7.50%) (Acquired 02/15/2019-11/12/2020; Cost $ 443,446)(g) | | | 8.50% | | | | 02/15/2023 | | | | | | | | 463 | | | 423,536 |

Constant Contact, Second Lien Term Loan (1 mo. USD LIBOR + 7.50%)(e) | | | 8.25% | | | | 02/15/2029 | | | | | | | | 1,513 | | | 1,483,184 |

CRCI Longhorn Holdings, Inc., Second Lien Term Loan (3 mo. USD LIBOR + 7.25%) | | | 7.43% | | | | 08/08/2026 | | | | | | | | 86 | | | 85,919 |

Creation Technologies, Inc., Term Loan B (1 mo. USD LIBOR + 5.50%)(e) | | | 6.00% | | | | 10/05/2028 | | | | | | | | 1,392 | | | 1,376,486 |

CV Intermediate Holdco Corp. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan (1 mo. USD LIBOR + 5.75%)(e) | | | 6.75% | | | | 03/31/2026 | | | | | | | | 8,208 | | | 8,125,078 |

Revolver Loan(e)(f) | | | 0.00% | | | | 03/31/2026 | | | | | | | | 1,262 | | | 1,248,964 |

Term Loan B (1 mo. USD LIBOR + 5.75%)(e) | | | 6.75% | | | | 03/31/2026 | | | | | | | | 8,453 | | | 8,367,279 |

Dakota Holding Corp., Second Lien Term Loan (1 mo. USD LIBOR +

6.75%)(e) | | | 7.50% | | | | 04/07/2028 | | | | | | | | 1,249 | | | 1,261,705 |

Dun & Bradstreet Corp. (The) | | | | | | | | | | | | | | | | | | |

Revolver Loan(e)(f) | | | 0.00% | | | | 09/11/2025 | | | | | | | | 3,814 | | | 3,470,445 |

Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 02/06/2026 | | | | | | | | 11 | | | 10,864 |

Ensono L.P., Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 05/19/2028 | | | | | | | | 222 | | | 220,339 |

Garda World Security Corp. (Canada) | | | | | | | | | | | | | | | | | | |

Incremental Term Loan(h) | | | - | | | | 02/11/2029 | | | | | | | | 1,508 | | | 1,495,660 |

Term Loan (1 mo. USD LIBOR + 4.25%) | | | 4.43% | | | | 10/30/2026 | | | | | | | | 1,023 | | | 1,014,531 |

GI Revelation Acquisition LLC, First Lien Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 05/12/2028 | | | | | | | | 2,099 | | | 2,076,372 |

INDIGOCYAN Midco Ltd. (Jersey), Term Loan B (3 mo. GBP LIBOR + 4.75%) | | | 5.31% | | | | 06/23/2024 | | | | GBP | | | | 8,170 | | | 10,819,631 |

Karman Buyer Corp., Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 10/28/2027 | | | | | | | | 2,249 | | | 2,229,128 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 9 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Business Equipment & Services–(continued) | | | | | | | | | | | | | | | | | | |

Lamark Media Group LLC | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan(e)(f) | | | 0.00% | | | | 10/14/2027 | | | | | | | $ | 1,528 | | | $ 1,527,935 |

Revolver Loan (3 mo. USD LIBOR + 5.75%)(e) | | | 6.75% | | | | 10/14/2027 | | | | | | | | 458 | | | 453,797 |

Revolver Loan(e)(f) | | | 0.00% | | | | 10/14/2027 | | | | | | | | 560 | | | 554,640 |

Term Loan B(e) | | | 6.75% | | | | 10/14/2027 | | | | | | | | 7,130 | | | 7,059,061 |

Monitronics International, Inc. | | | | | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 7.50%) | | | 8.75% | | | | 03/29/2024 | | | | | | | | 7,941 | | | 6,671,622 |

Term Loan (1 mo. USD LIBOR + 5.00%) | | | 7.50% | | | | 07/03/2024 | | | | | | | | 5,859 | | | 5,888,462 |

NAS LLC | | | | | | | | | | | | | | | | | | |

Incremental Term Loan(e) | | | 5.25% | | | | 06/03/2024 | | | | | | | | 2,815 | | | 2,828,955 |

Revolver Loan (3 mo. USD LIBOR + 5.50%)(e) | | | 8.75% | | | | 06/01/2024 | | | | | | | | 184 | | | 184,822 |

Revolver Loan(e)(f) | | | 0.00% | | | | 06/01/2024 | | | | | | | | 739 | | | 739,291 |

Term Loan(e) | | | 7.00% | | | | 06/03/2024 | | | | | | | | 8,988 | | | 9,032,984 |

Orchid Merger Sub II LLC, Term Loan B(e)(h) | | | - | | | | 05/15/2027 | | | | | | | | 2,742 | | | 2,646,099 |

Protect America, Revolver Loan (1 mo. USD LIBOR + 3.00%)(e) | | | 3.18% | | | | 09/01/2024 | | | | | | | | 2,782 | | | 2,656,738 |

Solera | | | | | | | | | | | | | | | | | | |

Term Loan B(h) | | | - | | | | 06/02/2028 | | | | | | | | 168 | | | 166,816 |

Term Loan B (1 mo. GBP SONIA + 5.25%) | | | 5.69% | | | | 06/05/2028 | | | | GBP | | | | 1,393 | | | 1,851,915 |

Spin Holdco, Inc., Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 03/04/2028 | | | | | | | | 20 | | | 19,862 |

Thevelia (US) LLC, First Lien Term Loan B(h) | | | - | | | | 02/10/2029 | | | | | | | | 1,208 | | | 1,196,209 |

UnitedLex Corp., Term Loan (1 mo. USD LIBOR + 5.75%)(e) | | | 8.00% | | | | 03/20/2027 | | | | | | | | 949 | | | 953,925 |

Virtusa Corp., Incremental Term Loan B(h) | | | - | | | | 02/08/2029 | | | | | | | | 1,398 | | | 1,386,121 |

| | | | | | | | | | | | | | | | | | | 96,539,056 |

| | | | | |

Cable & Satellite Television–3.35% | | | | | | | | | | | | | | | | | | |

CSC Holdings LLC, Incremental Term Loan (3 mo. USD LIBOR + 2.25%) | | | 2.44% | | | | 01/15/2026 | | | | | | | | 1 | | | 344 |

Lightning Finco Ltd. (United Kingdom) | | | | | | | | | | | | | | | | | | |

Term Loan B-1 (6 mo. USD LIBOR + 5.75%)(e) | | | 6.50% | | | | 09/01/2028 | | | | | | | | 18,375 | | | 18,007,643 |

Term Loan B-2 (6 mo. USD LIBOR + 5.75%)(e) | | | 5.18% | | | | 09/01/2028 | | | | | | | | 2,227 | | | 2,182,744 |

ORBCOMM, Inc., Term Loan B (1 mo. USD LIBOR + 4.25%) | | | 5.00% | | | | 09/01/2028 | | | | | | | | 684 | | | 679,604 |

| | | | | | | | | | | | | | | | | | | 20,870,335 |

| | | | | |

Chemicals & Plastics–1.67% | | | | | | | | | | | | | | | | | | |

Aruba Investments, Inc. | | | | | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 11/24/2027 | | | | | | | | 127 | | | 127,134 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | | | 8.50% | | | | 11/24/2028 | | | | | | | | 1,459 | | | 1,458,812 |

Arxada (Switzerland), Term Loan B(h) | | | - | | | | 07/03/2028 | | | | | | | | 197 | | | 195,748 |

BASF Construction Chemicals (Germany), Term Loan B-3(h) | | | - | | | | 09/29/2027 | | | | | | | | 125 | | | 125,243 |

Caldic B.V. (Netherlands), Term Loan B(h) | | | - | | | | 02/04/2029 | | | | | | | | 676 | | | 671,430 |

Colouroz Investment LLC (Germany) | | | | | | | | | | | | | | | | | | |

PIK First Lien Term Loan B-2, 0.75% PIK Rate, 5.25% Cash Rate(i) | | | 0.75% | | | | 09/21/2023 | | | | | | | | 1,738 | | | 1,724,974 |

PIK First Lien Term Loan C, 0.75% PIK Rate, 5.25% Cash Rate(i) | | | 0.75% | | | | 09/21/2023 | | | | | | | | 259 | | | 256,767 |

PIK First Lien Term Loan, 0.75% PIK Rate, 5.00% Cash Rate(i) | | | 0.75% | | | | 09/21/2023 | | | | EUR | | | | 27 | | | 29,958 |

PIK Second Lien Term Loan B-2, 5.75% PIK Rate, 5.25% Cash Rate(i) | | | 5.75% | | | | 09/21/2024 | | | | | | | | 30 | | | 29,562 |

Eastman Tire Additives, Term Loan B (1 mo. USD LIBOR + 5.25%)(e) | | | 6.00% | | | | 11/01/2028 | | | | | | | | 1,293 | | | 1,292,583 |

Fusion | | | | | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 6.50%)(e) | | | 7.50% | | | | 12/30/2026 | | | | | | | | 1,181 | | | 1,210,165 |

Term Loan B(e)(h) | | | - | | | | 02/01/2029 | | | | | | | | 784 | | | 779,992 |

ICP Group Holdings LLC, Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | | | 8.50% | | | | 12/29/2028 | | | | | | | | 304 | | | 299,807 |

Perstorp Holding AB (Sweden), Term Loan B (3 mo. USD LIBOR + 4.75%) | | | 4.91% | | | | 02/27/2026 | | | | | | | | 1,776 | | | 1,775,635 |

Proampac PG Borrower LLC, First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 11/03/2025 | | | | | | | | 428 | | | 425,723 |

| | | | | | | | | | | | | | | | | | | 10,403,533 |

| | | | | |

Clothing & Textiles–0.16% | | | | | | | | | | | | | | | | | | |

ABG Intermediate Holdings 2 LLC, Second Lien Term Loan (h) | | | - | | | | 12/10/2029 | | | | | | | | 654 | | | 657,799 |

Gloves Buyer, Inc., Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 12/29/2027 | | | | | | | | 184 | | | 183,348 |

International Textile Group, Inc., First Lien Term Loan (3 mo. USD LIBOR + 5.00%) | | | 5.21% | | | | 05/01/2024 | | | | | | | | 191 | | | 176,931 |

| | | | | | | | | | | | | | | | | | | 1,018,078 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 10 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Conglomerates–0.32% | | | | | | | | | | | | | | | | | | |

APi Group DE, Inc., Incremental Term Loan (h) | | | - | | | | 01/01/2029 | | | | | | | $ | 1,280 | | | $ 1,274,553 |

Safe Fleet Holdings LLC | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan (3 mo. USD LIBOR + 6.75%) | | | 7.75% | | | | 02/02/2026 | | | | | | | | 298 | | | 296,003 |

Term Loan B(h) | | | - | | | | 02/17/2029 | | | | | | | | 395 | | | 392,005 |

| | | | | | | | | | | | | | | | | | | 1,962,561 |

| | | | | |

Containers & Glass Products–6.54% | | | | | | | | | | | | | | | | | | |

Berlin Packaging LLC, Term Loan B-5 (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 03/11/2028 | | | | | | | | 1,029 | | | 1,024,133 |

Brook & Whittle Holding Corp. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan (1 mo. USD LIBOR + 3.00%) | | | 6.25% | | | | 12/05/2028 | | | | | | | | 14 | | | 14,377 |

Delayed Draw Term Loan(f) | | | 0.00% | | | | 12/05/2028 | | | | | | | | 138 | | | 136,963 |

Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 12/05/2028 | | | | | | | | 575 | | | 572,066 |

Hoffmaster Group, Inc., First Lien Term Loan B-1 (1 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 11/21/2023 | | | | | | | | 3,616 | | | 3,382,522 |

Keg Logistics LLC | | | | | | | | | | | | | | | | | | |

Revolver Loan(e)(f) | | | 0.00% | | | | 11/23/2027 | | | | | | | | 1,862 | | | 1,834,042 |

Term Loan A (1 mo. USD LIBOR + 6.00%)(e) | | | 7.00% | | | | 11/23/2027 | | | | | | | | 21,462 | | | 21,139,765 |

Keter Group B.V. (Netherlands), Term Loan B-5(h) | | | - | | | | 10/01/2023 | | | | EUR | | | | 1,763 | | | 1,943,657 |

Klockner Pentaplast of America, Inc. | | | | | | | | | | | | | | | | | | |

Term Loan B (3 mo. EURIBOR + 4.75%) | | | 4.75% | | | | 02/12/2026 | | | | EUR | | | | 2,070 | | | 2,168,936 |

Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.55% | | | | 02/12/2026 | | | | | | | | 295 | | | 277,463 |

LABL, Inc. | | | | | | | | | | | | | | | | | | |

Term Loan B(h) | | | - | | | | 10/31/2028 | | | | EUR | | | | 2,621 | | | 2,934,486 |

Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 5.50% | | | | 10/31/2028 | | | | | | | | 3,199 | | | 3,187,306 |

Libbey Glass, Inc., PIK Term Loan, 6.00% PIK Rate, 5.00% Cash Rate

(Acquired 11/13/2020-01/13/2022; Cost $1,204,396)(g)(i) | | | 6.00% | | | | 11/12/2025 | | | | | | | | 1,301 | | | 1,350,946 |

Mold-Rite Plastics LLC | | | | | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%)(e) | | | 4.25% | | | | 10/04/2028 | | | | | | | | 12 | | | 11,963 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.00%)(e) | | | 7.50% | | | | 10/04/2029 | | | | | | | | 405 | | | 398,735 |

Pretium Packaging, Second Lien Term Loan B (1 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 09/30/2029 | | | | | | | | 345 | | | 344,412 |

| | | | | | | | | | | | | | | | | | | 40,721,772 |

| | | | | |

Cosmetics & Toiletries–0.67% | | | | | | | | | | | | | | | | | | |

Anastasia Parent LLC, Term Loan (3 mo. USD LIBOR + 3.75%) | | | 3.97% | | | | 08/11/2025 | | | | | | | | 554 | | | 482,902 |

KDC/One (Canada), Term Loan (3 mo. EURIBOR + 5.00%) | | | 5.00% | | | | 12/22/2025 | | | | EUR | | | | 692 | | | 772,830 |

Rodenstock (Germany), Term Loan B (3 mo. EURIBOR + 5.00%) | | | 5.00% | | | | 06/29/2028 | | | | EUR | | | | 2,601 | | | 2,907,582 |

| | | | | | | | | | | | | | | | | | | 4,163,314 |

| | | | | |

Drugs–0.55% | | | | | | | | | | | | | | | | | | |

Endo LLC, Term Loan (1 mo. USD LIBOR + 5.00%) | | | 5.75% | | | | 03/27/2028 | | | | | | | | 3,504 | | | 3,397,496 |

| | | | | |

Ecological Services & Equipment–4.18% | | | | | | | | | | | | | | | | | | |

Anticimex (Sweden), Incremental Term Loan B (e)(h) | | | - | | | | 11/16/2028 | | | | | | | | 671 | | | 666,346 |

Groundworks LLC | | | | | | | | | | | | | | | | | | |

First Lien Delayed Draw Term Loan(e) | | | 6.00% | | | | 01/17/2026 | | | | | | | | 5,797 | | | 5,786,799 |

First Lien Incremental Revover Loan(e)(f) | | | 0.00% | | | | 01/17/2026 | | | | | | | | 520 | | | 518,804 |

First Lien Incremental Term Loan (3 mo. USD LIBOR + 5.00%)(e) | | | 6.00% | | | | 01/17/2026 | | | | | | | | 13,160 | | | 13,137,496 |

Second Lien Delayed Draw Term Loan(e) | | | 6.00% | | | | 01/17/2026 | | | | | | | | 4,404 | | | 4,397,023 |

Patriot Container Corp., First Lien Term Loan (1 mo. USD LIBOR + 3.75%)(e) | | | 4.75% | | | | 03/20/2025 | | | | | | | | 1 | | | 1,241 |

TruGreen L.P., Second Lien Term Loan (1 mo. USD LIBOR + 7.50%)(e) | | | 9.25% | | | | 11/02/2028 | | | | | | | | 1,509 | | | 1,520,539 |

| | | | | | | | | | | | | | | | | | | 26,028,248 |

| | | | | |

Electronics & Electrical–10.64% | | | | | | | | | | | | | | | | | | |

Barracuda Networks, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.50% | | | | 10/30/2028 | | | | | | | | 200 | | | 200,032 |

Boxer Parent Co., Inc., Term Loan B (3 mo. EURIBOR + 4.00%) | | | 4.00% | | | | 10/02/2025 | | | | EUR | | | | 132 | | | 146,641 |

Civica (United Kingdom), Term Loan B-1 (3 mo. GBP LIBOR + 4.75%) | | | 5.01% | | | | 10/14/2024 | | | | GBP | | | | 2,188 | | | 2,886,632 |

Delta Topco, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 7.25%) | | | 8.00% | | | | 12/01/2028 | | | | | | | | 637 | | | 636,838 |

Devoteam (Castillon S.A.S. - Bidco) (France), Term Loan B (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 12/09/2027 | | | | EUR | | | | 1,113 | | | 1,245,813 |

Digi International, Inc., Term Loan B(h) | | | - | | | | 12/01/2028 | | | | | | | | 1,548 | | | 1,549,989 |

Emerald Technologies AcquisitionCo, Inc., Term Loan B(e)(h) | | | - | | | | 12/29/2027 | | | | | | | | 313 | | | 311,950 |

Hyland Software, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.25%) | | | 7.00% | | | | 07/07/2025 | | | | | | | | 372 | | | 375,306 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 11 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Electronics & Electrical–(continued) | | | | | | | | | | | | | | | | | | |

Imperva, Inc. | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan (3 mo. USD LIBOR + 7.75%) | | | 8.75% | | | | 01/11/2027 | | | | | | | $ | 1,768 | | | $ 1,771,023 |

Term Loan (3 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 01/10/2026 | | | | | | | | 106 | | | 105,637 |

Infinite Electronics, Second Lien Term Loan (1 mo. USD LIBOR + 7.00%) | | | 7.51% | | | | 03/02/2029 | | | | | | | | 552 | | | 552,279 |

Learning Pool (United Kingdom) | | | | | | | | | | | | | | | | | | |

Term Loan (Acquired 01/07/2022; Cost $642,046)(e)(g)(h) | | | - | | | | 08/17/2028 | | | | GBP | | | | 479 | | | 633,383 |

Term Loan 2 (Acquired 01/07/2022; Cost $623,956)(e)(g)(h) | | | - | | | | 08/17/2028 | | | | | | | | 633 | | | 623,797 |

LogMeIn, Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 4.89% | | | | 08/28/2027 | | | | | | | | 4,185 | | | 4,123,297 |

Mavenir Systems, Inc., Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.25% | | | | 08/13/2028 | | | | | | | | 2,229 | | | 2,212,573 |

Maverick Bidco, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.75%)(e) | | | 7.50% | | | | 05/18/2029 | | | | | | | | 92 | | | 92,417 |

McAfee Enterprise | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 8.25%) | | | 9.00% | | | | 07/27/2029 | | | | | | | | 1,138 | | | 1,128,295 |

Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 5.75% | | | | 07/27/2028 | | | | | | | | 3,001 | | | 2,977,789 |

McAfee LLC | | | | | | | | | | | | | | | | | | |

First Lien Term Loan B(h) | | | - | | | | 02/03/2029 | | | | | | | | 4,105 | | | 4,055,415 |

Term Loan B(h) | | | - | | | | 02/02/2029 | | | | EUR | | | | 2,658 | | | 2,949,536 |

Mediaocean LLC, Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 12/15/2028 | | | | | | | | 1,064 | | | 1,059,568 |

Natel Engineering Co., Inc., Term Loan (3 mo. USD LIBOR + 6.25%) | | | 7.25% | | | | 04/29/2026 | | | | | | | | 3,758 | | | 3,679,457 |

Native Instruments (Germany), Term Loan (3 mo. EURIBOR + 6.00%)(e) | | | 6.25% | | | | 03/03/2028 | | | | EUR | | | | 1,267 | | | 1,398,915 |

Oberthur Tech (France) | | | | | | | | | | | | | | | | | | |

Term Loan B-4 (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 01/10/2026 | | | | EUR | | | | 2,899 | | | 3,237,156 |

Term Loan B-4 (3 mo. EURIBOR + 4.50%) (Acquired 07/23/2021; Cost $1,122,283)(g) | | | 4.50% | | | | 01/10/2026 | | | | EUR | | | | 956 | | | 1,066,977 |

Oberthur Technologies of America Corp., Term Loan B (3 mo. USD LIBOR + 4.50%)

(Acquired 04/01/2021; Cost $1,071,117)(g) | | | 5.25% | | | | 01/09/2026 | | | | | | | | 1,081 | | | 1,076,784 |

Optiv, Inc. | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan (3 mo. USD LIBOR + 7.25%) | | | 8.25% | | | | 01/31/2025 | | | | | | | | 773 | | | 767,423 |

Term Loan (3 mo. USD LIBOR + 3.25%) | | | 4.25% | | | | 02/01/2024 | | | | | | | | 6,455 | | | 6,389,151 |

Project Leopard Holdings, Inc. | | | | | | | | | | | | | | | | | | |

Incremental Term Loan (3 mo. USD LIBOR + 4.75%) | | | 5.75% | | | | 07/05/2024 | | | | | | | | 2,849 | | | 2,846,300 |

Term Loan (3 mo. USD LIBOR + 4.75%) | | | 5.75% | | | | 07/05/2024 | | | | | | | | 819 | | | 817,997 |

Quest Software US Holdings, Inc. | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan (3 mo. SOFR + 7.50%) | | | 8.15% | | | | 01/20/2030 | | | | | | | | 219 | | | 214,583 |

Term Loan B(h) | | | - | | | | 01/19/2029 | | | | | | | | 5,063 | | | 4,999,044 |

RealPage, Inc., Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 3.75% | | | | 04/24/2028 | | | | | | | | 269 | | | 266,894 |

Renaissance Holding Corp., Second Lien Term Loan (3 mo. USD LIBOR + 7.00%) | | | 7.21% | | | | 05/29/2026 | | | | | | | | 632 | | | 630,784 |

Riverbed Technology, Inc., PIK Term Loan, 2.00% PIK Rate, 7.00% Cash Rate

(Acquired 12/06/2021-12/30/2021; Cost $7,157,207)(g)(i) | | | 2.00% | | | | 12/08/2026 | | | | | | | | 5,722 | | | 5,274,327 |

Sandvine Corp., Second Lien Term Loan (1 mo. USD LIBOR + 8.00%) | | | 8.21% | | | | 11/02/2026 | | | | | | | | 322 | | | 320,278 |

Ultimate Software Group, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 5.25%) | | | 5.75% | | | | 05/03/2027 | | | | | | | | 242 | | | 241,388 |

UST Holdings Ltd., Term Loan B(h) | | | - | | | | 10/15/2028 | | | | | | | | 1,084 | | | 1,073,033 |

Veritas US, Inc., Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 6.00% | | | | 09/01/2025 | | | | | | | | 707 | | | 698,927 |

WebPros, Term Loan (1 mo. USD LIBOR + 5.25%) | | | 5.75% | | | | 02/18/2027 | | | | | | | | 1,582 | | | 1,584,389 |

| | | | | | | | | | | | | | | | | | | 66,222,017 |

| | | | | |

Financial Intermediaries–0.50% | | | | | | | | | | | | | | | | | | |

Edelman Financial Center LLC (The), Second Lien Term Loan (3 mo. USD LIBOR + 6.75%) | | | 6.96% | | | | 07/20/2026 | | | | | | | | 207 | | | 207,637 |

GEO Group, Inc. (The), Term Loan (3 mo. USD LIBOR + 2.00%) | | | 2.75% | | | | 03/22/2024 | | | | | | | | 108 | | | 100,203 |

TMF Group Holdco B.V. (Netherlands), Incremental Second Lien Term Loan (3 mo. EURIBOR + 6.88%) | | | 6.88% | | | | 05/04/2026 | | | | EUR | | | | 2,518 | | | 2,822,422 |

| | | | | | | | | | | | | | | | | | | 3,130,262 |

| | | | | |

Food Products–6.50% | | | | | | | | | | | | | | | | | | |

Biscuit Intl (Cookie Acq S.A.S., De Banketgroep Holding) (France) | | | | | | | | | | | | | | | | | | |

First Lien Term Loan (3 mo. EURIBOR + 4.00%) | | | 4.00% | | | | 02/15/2027 | | | | EUR | | | | 2,609 | | | 2,791,689 |

Term Loan B(h) | | | - | | | | 02/14/2027 | | | | EUR | | | | 1,403 | | | 1,496,530 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 12 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Food Products–(continued) | | | | | | | | | | | | | | | | | | |

BrightPet | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan(e)(f) | | | 0.00% | | | | 10/05/2026 | | | | | | | $ | 1,206 | | | $ 1,206,025 |

Incremental Term Loan B (3 mo. USD LIBOR + 6.25%)(e) | | | 7.25% | | | | 10/05/2026 | | | | | | | | 4,282 | | | 4,296,294 |

Revolver Loan (3 mo. USD LIBOR + 6.25%)(e) | | | 7.25% | | | | 10/05/2026 | | | | | | | | 519 | | | 520,763 |

Revolver Loan (3 mo. USD LIBOR + 6.25%)(e) | | | 7.25% | | | | 10/05/2026 | | | | | | | | 557 | | | 558,923 |

Revolver Loan(e)(f) | | | 0.00% | | | | 10/05/2026 | | | | | | | | 347 | | | 347,175 |

Revolver Loan(e)(f) | | | 0.00% | | | | 10/05/2026 | | | | | | | | 44 | | | 44,090 |

Term Loan B (3 mo. USD LIBOR + 6.25%)(e) | | | 7.25% | | | | 10/05/2026 | | | | | | | | 4,165 | | | 4,178,877 |

Florida Food Products LLC | | | | | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 5.00%) | | | 5.75% | | | | 10/18/2028 | | | | | | | | 4,908 | | | 4,810,379 |

Second Lien Term Loan (1 mo. USD LIBOR + 8.00%) | | | 8.75% | | | | 10/08/2029 | | | | | | | | 1,028 | | | 1,000,733 |

H-Food Holdings LLC | | | | | | | | | | | | | | | | | | |

Incremental Term Loan B-3 (1 mo. USD LIBOR + 5.00%) | | | 6.00% | | | | 05/23/2025 | | | | | | | | 164 | | | 162,205 |

Term Loan (3 mo. USD LIBOR + 3.69%) | | | 3.90% | | | | 05/23/2025 | | | | | | | | 20 | | | 19,287 |

Shearer’s Foods LLC, Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | | | 8.75% | | | | 09/22/2028 | | | | | | | | 223 | | | 222,650 |

Teasdale Foods, Inc., Term Loan B (3 mo. USD LIBOR + 6.00%)(e) | | | 7.00% | | | | 12/18/2025 | | | | | | | | 16,438 | | | 15,075,593 |

Valeo Foods (Jersey) Ltd. (United Kingdom), First Lien Term Loan B (6 mo. GBP SONIA + 5.00%) | | | 5.05% | | | | 06/28/2028 | | | | GBP | | | | 2,805 | | | 3,715,519 |

| | | | | | | | | | | | | | | | | | | 40,446,732 |

| | | | | |

Food Service–0.34% | | | | | | | | | | | | | | | | | | |

Financiere Pax S.A.S., Term Loan B (3 mo. EURIBOR + 4.75%) | | | 4.75% | | | | 07/01/2026 | | | | EUR | | | | 2,011 | | | 2,083,134 |

NPC International, Inc., Second Lien Term Loan(j)(k) | | | 0.00% | | | | 04/18/2025 | | | | | | | | 344 | | | 6,878 |

| | | | | | | | | | | | | | | | | | | 2,090,012 |

| | | | | |

Health Care–8.11% | | | | | | | | | | | | | | | | | | |

Acacium (United Kingdom) | | | | | | | | | | | | | | | | | | |

Term Loan (6 mo. GBP SONIA + 5.25%) | | | 5.69% | | | | 05/19/2028 | | | | GBP | | | | 3,083 | | | 4,112,360 |

Term Loan(e)(h) | | | - | | | | 06/08/2028 | | | | | | | | 955 | | | 945,660 |

Ascend Learning LLC | | | | | | | | | | | | | | | | | | |

First Lien Term Loan(h) | | | - | | | | 11/18/2028 | | | | | | | | 190 | | | 187,394 |

Second Lien Term Loan (1 mo. USD LIBOR + 5.75%) | | | 6.25% | | | | 12/10/2029 | | | | | | | | 646 | | | 646,758 |

athenahealth, Inc. | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan B(f) | | | 0.00% | | | | 02/15/2029 | | | | | | | | 898 | | | 891,209 |

Term Loan B(h) | | | - | | | | 01/26/2029 | | | | | | | | 5,300 | | | 5,258,132 |

Curium BidCo S.a.r.l. (Luxembourg), Term Loan (1 mo. USD LIBOR + 4.25%) | | | 5.00% | | | | 12/02/2027 | | | | | | | | 315 | | | 312,743 |

Ethypharm (France), Term Loan B (3 mo. GBP SONIA + 4.50%) | | | 4.79% | | | | 04/17/2028 | | | | GBP | | | | 2,270 | | | 2,920,674 |

Global Medical Response, Inc. | | | | | | | | | | | | | | | | | | |

Term Loan (3 mo. USD LIBOR + 4.25%) | | | 5.25% | | | | 03/14/2025 | | | | | | | | 1,134 | | | 1,130,545 |

Term Loan (1 mo. USD LIBOR + 4.25%) | | | 5.25% | | | | 10/02/2025 | | | | | | | | 738 | | | 735,346 |

ICU Medical, Inc., Term Loan B(h) | | | - | | | | 12/15/2028 | | | | | | | | 183 | | | 181,762 |

MB2 Dental Solutions LLC | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan (3 mo. USD LIBOR + 6.00%)(e) | | | 7.00% | | | | 01/29/2027 | | | | | | | | 8,731 | | | 8,739,303 |

Delayed Draw Term Loan (3 mo. USD LIBOR + 6.00%)(e) | | | 7.00% | | | | 01/29/2027 | | | | | | | | 3,151 | | | 3,153,680 |

Term Loan B (3 mo. USD LIBOR + 6.00%)(e) | | | 7.00% | | | | 01/29/2027 | | | | | | | | 8,761 | | | 8,769,216 |

MedAssets Software Intermediate Holdings, Inc. | | | | | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 11/19/2028 | | | | | | | | 1,695 | | | 1,686,642 |

Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 11/22/2029 | | | | | | | | 638 | | | 632,704 |

MJH Healthcare Holdings LLC, Term Loan B(e)(h) | | | - | | | | 01/25/2029 | | | | | | | | 735 | | | 730,351 |

Nidda Healthcare Holding AG (Germany), Term Loan F (3 mo. GBP SONIA + 4.50%) | | | 4.95% | | | | 08/21/2026 | | | | GBP | | | | 2,088 | | | 2,730,621 |

Revint Intermediate II LLC, Term Loan (1 mo. USD LIBOR + 4.25%) | | | 4.75% | | | | 10/15/2027 | | | | | | | | 1,924 | | | 1,921,202 |

Sharp Midco LLC, Term Loan B (1 mo. USD LIBOR + 4.00%)(e) | | | 4.50% | | | | 12/15/2028 | | | | | | | | 550 | | | 548,368 |

Stamina BidCo B.V. (Netherlands), Term Loan B (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 11/02/2028 | | | | EUR | | | | 631 | | | 704,219 |

Summit Behavioral Healthcare LLC, First Lien Term Loan (1 mo. USD LIBOR + 4.75%)(e) | | | 5.50% | | | | 11/24/2028 | | | | | | | | 2,112 | | | 2,072,277 |

TTF Holdings LLC, Term Loan B (1 mo. USD LIBOR + 4.25%)(e) | | | 5.00% | | | | 03/31/2028 | | | | | | | | 411 | | | 409,745 |

Unified Womens Healthcare L.P., Term Loan B (1 mo. USD LIBOR + 4.25%) | | | 5.00% | | | | 12/17/2027 | | | | | | | | 583 | | | 581,868 |

Women’s Care Holdings, Inc. LLC, Second Lien Term Loan (1 mo. USD LIBOR + 8.25%) | | | 9.00% | | | | 01/15/2029 | | | | | | | | 431 | | | 430,159 |

| | | | | | | | | | | | | | | | | | | 50,432,938 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 13 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Home Furnishings–2.39% | | | | | | | | | | | | | | | | | | |

Hilding Anders AB (Sweden) | | | | | | | | | | | | | | | | | | |

PIK Term Loan, 12.00% PIK Rate(i) | | | 12.00% | | | | 12/31/2024 | | | | EUR | | | | 34 | | | $ 7,947 |

Term Loan | | | 0.00% | | | | 12/31/2024 | | | | EUR | | | | 5,480 | | | 61,527 |

Term Loan B (3 mo. EURIBOR + 5.00%) | | | 5.00% | | | | 11/29/2024 | | | | EUR | | | | 9,013 | | | 7,516,067 |

Hunter Douglas, Inc., First Lien Term Loan(h) | | | - | | | | 02/09/2029 | | | | EUR | | | | 2,060 | | | 2,295,850 |

Serta Simmons Bedding LLC | | | | | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 7.50%) | | | 7.69% | | | | 08/10/2023 | | | | | | | $ | 1,281 | | | 1,293,116 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.50%) | | | 8.50% | | | | 08/10/2023 | | | | | | | | 3,200 | | | 3,087,547 |

VC GB Holdings, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 07/01/2029 | | | | | | | | 566 | | | 551,380 |

Weber-Stephen Products LLC, Incremental Term Loan(e)(h) | | | - | | | | 10/30/2027 | | | | | | | | 74 | | | 71,833 |

| | | | | | | | | | | | | | | | | | | 14,885,267 |

| | | | | |

Industrial Equipment–3.39% | | | | | | | | | | | | | | | | | | |

Apex Tool Group LLC, Term Loan B (1 mo. SOFR + 5.50%) | | | 5.75% | | | | 02/08/2029 | | | | | | | | 1,280 | | | 1,276,211 |

Brush (United Kingdom) | | | | | | | | | | | | | | | | | | |

Term Loan (3 mo. EURIBOR + 7.00%)(e) | | | 7.00% | | | | 06/09/2028 | | | | EUR | | | | 4,208 | | | 4,618,165 |

Term Loan A (1 mo. GBP SONIA +7.00%)(e) | | | 7.27% | | | | 06/09/2028 | | | | GBP | | | | 3,621 | | | 4,760,905 |

CIRCOR International, Inc., Term Loan(h) | | | - | | | | 12/20/2028 | | | | | | | | 1,187 | | | 1,180,430 |

DXP Enterprises, Inc., Term Loan (1 mo. USD LIBOR + 4.75%) | | | 5.75% | | | | 12/16/2027 | | | | | | | | 616 | | | 613,293 |

Engineered Machinery Holdings, Inc., Second Lien Incremental Term Loan (1 mo. USD LIBOR + 6.00%) | | | 6.75% | | | | 05/21/2029 | | | | | | | | 207 | | | 208,663 |

Kantar (United Kingdom) | | | | | | | | | | | | | | | | | | |

Revolver Loan(e)(f) | | | 0.00% | | | | 06/04/2026 | | | | | | | | 2,500 | | | 2,300,000 |

Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 5.18% | | | | 12/04/2026 | | | | | | | | 1,474 | | | 1,469,079 |

Term Loan B-2 (1 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 12/04/2026 | | | | | | | | 1,380 | | | 1,374,351 |

New VAC US LLC, Term Loan B (3 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 03/08/2025 | | | | | | | | 1,265 | | | 1,241,438 |

Robertshaw US Holding Corp., Second Lien Term Loan (3 mo. USD LIBOR + 8.00%) | | | 9.00% | | | | 02/28/2026 | | | | | | | | 613 | | | 482,759 |

S2P Acquisiton Borrower, Inc., First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | | | 4.21% | | | | 08/14/2026 | | | | | | | | 488 | | | 485,716 |

Thyssenkrupp Elevators (Vertical Midco GmbH) (Germany), Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 07/31/2027 | | | | | | | | 860 | | | 855,811 |

Victory Buyer LLC, Second Lien Term Loan B(e)(h) | | | - | | | | 11/15/2029 | | | | | | | | 259 | | | 255,867 |

| | | | | | | | | | | | | | | | | | | 21,122,688 |

| | | | | |

Leisure Goods, Activities & Movies–11.80% | | | | | | | | | | | | | | | | | | |

AMC Entertainment, Inc., Term Loan B-1 (3 mo. USD LIBOR + 3.00%) | | | 3.12% | | | | 04/22/2026 | | | | | | | | 4,693 | | | 4,268,954 |

Carnival Corp., Incremental Term Loan (1 mo. USD LIBOR + 3.25%) | | | 4.00% | | | | 10/18/2028 | | | | | | | | 4,760 | | | 4,714,162 |

Crown Finance US, Inc. | | | | | | | | | | | | | | | | | | |

Incremental Term Loan (1 mo. USD LIBOR + 8.25%) | | | 9.25% | | | | 05/23/2024 | | | | | | | | 429 | | | 457,134 |

Revolver Loan (3 mo. USD LIBOR + 5.00%) | | | 5.49% | | | | 05/23/2024 | | | | | | | | 796 | | | 770,245 |

Term Loan (3 mo. EURIBOR + 2.63%) | | | 2.63% | | | | 02/28/2025 | | | | EUR | | | | 457 | | | 398,779 |

Term Loan (1 mo. USD LIBOR + 2.50%) | | | 3.50% | | | | 02/28/2025 | | | | | | | | 3,205 | | | 2,490,169 |

Term Loan (1 mo. USD LIBOR + 2.75%) | | | 3.75% | | | | 09/30/2026 | | | | | | | | 2,733 | | | 2,066,640 |

Term Loan B-1 (3 mo. USD LIBOR + 7.00%) | | | 7.00% | | | | 05/23/2024 | | | | | | | | 4,071 | | | 4,826,157 |

Dorna Sports S.L. (Spain), Term Loan B-2 (3 mo. USD LIBOR + 3.00%)

(Acquired 01/28/2021; Cost $875,838)(g) | | | 3.22% | | | | 04/12/2024 | | | | | | | | 890 | | | 889,846 |

Fitness International LLC, Term Loan B (3 mo. USD LIBOR + 3.25%) | | | 4.25% | | | | 04/18/2025 | | | | | | | | 1,106 | | | 1,033,183 |

Hornblower Holdings LLC, Term Loan(h) | | | - | | | | 11/25/2025 | | | | | | | | 440 | | | 456,557 |

Invictus Media S.L.U. (Spain) | | | | | | | | | | | | | | | | | | |

Revolver Loan (Acquired 04/30/2021; Cost $1,141,475)(e)(g)(k) | | | 0.00% | | | | 06/28/2024 | | | | EUR | | | | 1,079 | | | 1,190,729 |

Second Lien Term Loan (Acquired 05/17/2021-06/28/2021; Cost $2,692,619)(g)(k) | | | 0.00% | | | | 12/26/2025 | | | | EUR | | | | 3,197 | | | 3,136,050 |

Term Loan A-1 (Acquired 07/24/2019-06/28/2021; Cost $2,667,494)(g)(k) | | | 0.00% | | | | 06/26/2024 | | | | EUR | | | | 2,386 | | | 2,640,950 |

Term Loan A-2 (Acquired 07/24/2019-06/28/2021; Cost $649,817)(g)(k) | | | 0.00% | | | | 06/26/2024 | | | | EUR | | | | 582 | | | 644,136 |

Term Loan B-1 (Acquired 05/31/2018-07/28/2021; Cost $3,038,283)(g)(k) | | | 0.00% | | | | 06/26/2025 | | | | EUR | | | | 2,676 | | | 2,962,283 |

Term Loan B-2 (Acquired 05/31/2018-07/28/2021; Cost $1,824,544)(g)(k) | | | 0.00% | | | | 06/26/2025 | | | | EUR | | | | 1,603 | | | 1,774,290 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 14 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Leisure Goods, Activities & Movies–(continued) | | | | | | | | | | | | | | | | | | |

Merlin (Motion Finco S.a.r.l. and LLC) (United Kingdom) | | | | | | | | | | | | | | | | | | |

Term Loan B-1 (1 mo. USD LIBOR + 3.25%) | | | 3.47% | | | | 11/12/2026 | | | | | | | $ | 161 | | | $ 158,326 |

Term Loan B-2 (1 mo. USD LIBOR + 3.25%) | | | 3.47% | | | | 11/12/2026 | | | | | | | | 19 | | | 18,760 |

Parques Reunidos (Spain) | | | | | | | | | | | | | | | | | | |

Incremental Term Loan B-2 (3 mo. EURIBOR + 7.50%) | | | 7.50% | | | | 09/17/2026 | | | | EUR | | | | 9,376 | | | 10,579,799 |

Revolver Loan(e)(h) | | | - | | | | 03/16/2026 | | | | EUR | | | | 529 | | | 530,783 |

Revolver Loan(e)(f) | | | 0.00% | | | | 03/16/2026 | | | | EUR | | | | 1,930 | | | 1,936,679 |

Term Loan B (3 mo. EURIBOR + 3.75%) | | | 3.75% | | | | 09/16/2026 | | | | EUR | | | | 1,442 | | | 1,579,090 |

Royal Caribbean Cruises | | | | | | | | | | | | | | | | | | |

Revolver Loan(f) | | | 0.00% | | | | 10/12/2022 | | | | | | | | 1,886 | | | 1,850,714 |

Revolver Loan(f) | | | 0.00% | | | | 04/05/2024 | | | | | | | | 3,562 | | | 3,281,750 |

Revolver Loan(e)(f) | | | 0.00% | | | | 04/12/2024 | | | | | | | | 1,213 | | | 1,125,101 |

Term Loan(h) | | | - | | | | 04/05/2022 | | | | | | | | 1,136 | | | 1,130,726 |

Scenic (Columbus Capital B.V.) (Australia), Term Loan B (3 mo. EURIBOR + 3.75%) | | | 3.75% | | | | 02/27/2027 | | | | EUR | | | | 1,200 | | | 1,263,496 |

USF S&H Holdco LLC | | | | | | | | | | | | | | | | | | |

Term Loan A (3 mo. USD LIBOR + 15.00%)(e) | | | 15.00% | | | | 06/30/2025 | | | | | | | | 667 | | | 666,853 |

Term Loan A(e)(f) | | | 0.00% | | | | 06/30/2025 | | | | | | | | 1,000 | | | 1,000,278 |

Term Loan B (3 mo. USD LIBOR + 3.00%)(e) | | | 8.50% | | | | 06/30/2025 | | | | | | | | 10,678 | | | 10,677,541 |

Vue International Bidco PLC (United Kingdom), Term Loan B-1 (3 mo. EURIBOR + 4.75%) | | | 4.75% | | | | 07/03/2026 | | | | EUR | | | | 2,791 | | | 2,918,729 |

| | | | | | | | | | | | | | | | | | | 73,438,889 |

| | | | | |

Lodging & Casinos–4.49% | | | | | | | | | | | | | | | | | | |

Aimbridge Acquisition Co., Inc., First Lien Term Loan (1 mo. USD LIBOR + 4.75%) | | | 5.50% | | | | 02/02/2026 | | | | | | | | 1,971 | | | 1,959,994 |

B&B Hotels S.A.S. (France) | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan A-1 (3 mo. EURIBOR + 8.50%) | | | 8.50% | | | | 07/31/2027 | | | | EUR | | | | 2,217 | | | 2,371,042 |

Term Loan B-3-A (3 mo. EURIBOR + 3.88%) | | | 3.88% | | | | 07/31/2026 | | | | EUR | | | | 2,821 | | | 3,049,261 |

Term Loan B-4 (6 mo. EURIBOR + 5.50%) | | | 5.50% | | | | 07/31/2026 | | | | EUR | | | | 2,619 | | | 2,930,814 |

Caesars Resort Collection LLC, Incremental Term Loan (1 mo. USD LIBOR + 3.50%) | | | 3.71% | | | | 07/21/2025 | | | | | | | | 68 | | | 67,602 |

Everi Payments, Inc., Term Loan (1 mo. USD LIBOR + 2.50%) | | | 3.01% | | | | 07/31/2028 | | | | | | | | 180 | | | 178,542 |

Fertitta Entertainment LLC, Term Loan (SOFR + 4.00%) | | | 4.50% | | | | 01/31/2029 | | | | | | | | 456 | | | 454,294 |

HotelBeds (United Kingdom) | | | | | | | | | | | | | | | | | | |

Term Loan B (6 mo. EURIBOR + 4.25%) | | | 4.25% | | | | 09/12/2025 | | | | EUR | | | | 6,321 | | | 6,555,026 |

Term Loan C (6 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 09/12/2027 | | | | EUR | | | | 937 | | | 972,933 |

Term Loan D (3 mo. EURIBOR + 5.50%) | | | 5.50% | | | | 09/12/2027 | | | | EUR | | | | 5,774 | | | 6,061,072 |

Scientific Games Lottery | | | | | | | | | | | | | | | | | | |

Term Loan B(h) | | | - | | | | 01/31/2029 | | | | EUR | | | | 1,354 | | | 1,509,129 |

Term Loan B(h) | | | - | | | | 02/04/2029 | | | | | | | | 1,814 | | | 1,805,367 |

| | | | | | | | | | | | | | | | | | | 27,915,076 |

| | | | | |

Nonferrous Metals & Minerals–0.76% | | | | | | | | | | | | | | | | | | |

American Rock Salt Co. LLC, Second Lien Term Loan (1 mo. USD LIBOR + 7.25%)(e) | | | 8.00% | | | | 06/11/2029 | | | | | | | | 96 | | | 96,669 |

Corialis Group Ltd. (United Kingdom), Term Loan B (1 mo. GBP SONIA + 4.40%) | | | 4.66% | | | | 05/24/2028 | | | | GBP | | | | 678 | | | 890,682 |

Form Technologies LLC | | | | | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.50% | | | | 07/19/2025 | | | | | | | | 2,584 | | | 2,577,987 |

Term Loan (1 mo. USD LIBOR + 9.00%)(e) | | | 10.00% | | | | 10/22/2025 | | | | | | | | 1,137 | | | 1,150,850 |

| | | | | | | | | | | | | | | | | | | 4,716,188 |

| | | | | |

Oil & Gas–3.16% | | | | | | | | | | | | | | | | | | |

Glass Mountain Pipeline Holdings LLC, Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.50% | | | | 10/28/2027 | | | | | | | | 284 | | | 252,520 |

Gulf Finance LLC, Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.75% | | | | 08/25/2026 | | | | | | | | 2,090 | | | 1,941,964 |

HGIM Corp., Term Loan (3 mo. USD LIBOR + 6.00%)

(Acquired 07/02/2018; Cost $3,232,960)(g) | | | 7.00% | | | | 07/02/2023 | | | | | | | | 1,469 | | | 1,424,571 |

McDermott International Ltd. | | | | | | | | | | | | | | | | | | |

LOC(f) | | | 0.00% | | | | 06/30/2024 | | | | | | | | 4,083 | | | 3,368,716 |

LOC (3 mo. USD LIBOR + 4.00%) (Acquired 12/31/2020; Cost $1,782,599)(e)(g) | | | 4.09% | | | | 06/30/2024 | | | | | | | | 1,801 | | | 1,504,073 |

PIK Term Loan, 3.00% PIK Rate, 1.21% Cash Rate (Acquired 04/04/2018-02/28/2022; Cost $1,821,728)(g)(i) | | | 3.00% | | | | 06/30/2025 | | | | | | | | 927 | | | 443,870 |

Term Loan (1 mo. USD LIBOR + 3.00%) (Acquired 06/30/2020; Cost $183,612)(e)(g) | | | 3.21% | | | | 06/30/2024 | | | | | | | | 180 | | | 112,599 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 15 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal Amount (000)(a) | | | Value |

Oil & Gas–(continued) | | | | | | | | | | | | | | | | | | |

Petroleum GEO-Services ASA (Norway), Term Loan (1 mo. USD LIBOR + 7.50%) | | | 7.72% | | | | 03/19/2024 | | | | | | | $ | 5,643 | | | $ 4,916,116 |

QuarterNorth Energy, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 8.00%)

(Acquired 08/03/2021; Cost $5,449,641)(g) | | | 9.00% | | | | 08/27/2026 | | | | | | | | 5,552 | | | 5,593,279 |

Southcross Energy Partners L.P., Revolver Loan(f) | | | 0.00% | | | | 01/31/2025 | | | | | | | | 78 | | | 76,270 |

| | | | | | | | | | | | | | | | | | | 19,633,978 |

| | | | | |

Publishing–2.30% | | | | | | | | | | | | | | | | | | |

Adtalem Global Education, Inc., Term Loan B (1 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 08/12/2028 | | | | | | | | 812 | | | 805,354 |

Cengage Learning, Inc., Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.75% | | | | 06/29/2026 | | | | | | | | 3,393 | | | 3,392,296 |

Dotdash Meredith, Inc., Term Loan B (1 mo. SOFR + 4.00%) | | | 4.50% | | | | 11/25/2028 | | | | | | | | 3,489 | | | 3,475,414 |

McGraw-Hill Education, Inc., Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.55% | | | | 07/30/2028 | | | | | | | | 3,612 | | | 3,582,951 |

Micro Holding L.P., Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.75% | | | | 09/13/2024 | | | | | | | | 3,052 | | | 3,035,686 |

| | | | | | | | | | | | | | | | | | | 14,291,701 |

| | | | | |

Radio & Television–0.16% | | | | | | | | | | | | | | | | | | |

Diamond Sports Holdings LLC, Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 5.50% | | | | 08/24/2026 | | | | | | | | 2,608 | | | 990,295 |

Nexstar Broadcasting, Inc., Term Loan B-4 (1 mo. USD LIBOR + 2.50%) | | | 2.61% | | | | 09/18/2026 | | | | | | | | 1 | | | 537 |

| | | | | | | | | | | | | | | | | | | 990,832 |

| | | | | |

Retailers (except Food & Drug)–1.89% | | | | | | | | | | | | | | | | | | |

Bass Pro Group LLC, Term Loan B-2 (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 03/06/2028 | | | | | | | | 285 | | | 284,059 |

Claire’s Stores, Inc., Term Loan (1 mo. USD LIBOR + 6.50%) | | | 6.71% | | | | 12/18/2026 | | | | | | | | 733 | | | 727,566 |

CNT Holdings I Corp. (1-800 Contacts), Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.50% | | | | 11/06/2028 | | | | | | | | 712 | | | 710,857 |

Kirk Beauty One GmbH (Germany) | | | | | | | | | | | | | | | | | | |

Term Loan B-1 (3 mo. EURIBOR + 5.50%) | | | 5.50% | | | | 04/08/2026 | | | | EUR | | | | 1,621 | | | 1,769,806 |

Term Loan B-2 (3 mo. EURIBOR + 5.50%) | | | 5.50% | | | | 04/08/2026 | | | | EUR | | | | 933 | | | 1,018,967 |

Term Loan B-3 (3 mo. EURIBOR + 5.50%) | | | 5.50% | | | | 04/08/2026 | | | | EUR | | | | 1,351 | | | 1,474,599 |

Term Loan B-4 (3 mo. EURIBOR + 5.50%) | | | 5.50% | | | | 04/08/2026 | | | | EUR | | | | 2,863 | | | 3,126,289 |

Term Loan B-5 (3 mo. EURIBOR + 5.50%) | | | 5.50% | | | | 04/08/2026 | | | | EUR | | | | 637 | | | 695,461 |

PetSmart, Inc., Term Loan (1 mo. USD LIBOR+ 3.75%) | | | 4.50% | | | | 02/11/2028 | | | | | | | | 89 | | | 88,346 |

Savers, Inc., Term Loan B (1 mo. USD LIBOR + 5.50%) | | | 6.25% | | | | 04/21/2028 | | | | | | | | 1,884 | | | 1,874,786 |

| | | | | | | | | | | | | | | | | | | 11,770,736 |

| | | | | |

Surface Transport–0.68% | | | | | | | | | | | | | | | | | | |

ASP LS Acquisition Corp., Incremental Term Loan B (1 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 05/07/2028 | | | | | | | | 491 | | | 490,279 |

Hurtigruten (Explorer II AS) (Norway), Term Loan B (3 mo. EURIBOR + 3.50%) | | | 4.00% | | | | 02/24/2025 | | | | EUR | | | | 2,370 | | | 2,470,834 |

Novae LLC | | | | | | | | | | | | | | | | | | |

Delayed Draw Term Loan(f) | | | 0.00% | | | | 02/03/2029 | | | | | | | | 286 | | | 284,437 |

Term Loan B (3 mo. SOFR+ 5.00%) | | | 5.75% | | | | 02/03/2029 | | | | | | | | 1,001 | | | 995,531 |

| | | | | | | | | | | | | | | | | | | 4,241,081 |

| | | | | |

Telecommunications–4.36% | | | | | | | | | | | | | | | | | | |

CCI Buyer, Inc., Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 12/13/2027 | | | | | | | | 4,462 | | | 4,421,700 |

Cincinnati Bell, Inc., Term Loan B-2 (3 mo. SOFR + 3.25%) | | | 3.75% | | | | 11/17/2028 | | | | | | | | 29 | | | 28,676 |

Colorado Buyer, Inc. | | | | | | | | | | | | | | | | | | |

First Lien Incremental Term Loan (6 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 05/01/2024 | | | | | | | | 2,475 | | | 2,450,603 |

Term Loan (3 mo. USD LIBOR + 3.00%) | | | 4.00% | | | | 05/01/2024 | | | | | | | | 7 | | | 7,309 |

Crown Subsea Communications Holding, Inc., Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.50% | | | | 04/27/2027 | | | | | | | | 721 | | | 723,890 |

Eagle Broadband Investments LLC (Mega Broadband), Term Loan (1 mo. USD LIBOR + 3.00%) | | | 3.75% | | | | 11/12/2027 | | | | | | | | 166 | | | 164,745 |

Intelsat Jackson Holdings S.A. (Luxembourg) | | | | | | | | | | | | | | | | | | |

Term Loan B(h) | | | - | | | | 01/27/2029 | | | | | | | | 7,204 | | | 7,114,070 |

Term Loan B-3 | | | 0.00% | | | | 11/27/2023 | | | | | | | | 36 | | | 36,364 |

Term Loan B-4 (1 mo. PRIME + 5.50%) | | | 8.75% | | | | 01/02/2024 | | | | | | | | 4 | | | 4,052 |

MLN US HoldCo LLC | | | | | | | | | | | | | | | | | | |

First Lien Term Loan B (3 mo. USD LIBOR + 4.50%) | | | 4.61% | | | | 11/30/2025 | | | | | | | | 3,598 | | | 3,495,060 |

Second Lien Term Loan B (3 mo. USD LIBOR + 8.75%) | | | 8.86% | | | | 11/30/2026 | | | | | | | | 2,202 | | | 2,036,874 |

Telesat LLC, Term Loan B-5 (1 mo. USD LIBOR + 2.75%) | | | 2.96% | | | | 12/07/2026 | | | | | | | | 2,338 | | | 1,685,717 |

U.S. Telepacific Corp.(e) | | | 9.25% | | | | 05/01/2026 | | | | | | | | 1,815 | | | 1,337,256 |

ViaSat, Inc., First Lien Term Loan B(e)(h) | | | - | | | | 02/23/2029 | | | | | | | | 1,000 | | | 984,111 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 16 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity Date | | | Principal

Amount

(000)(a) | | | Value |

Telecommunications–(continued) | | | | | | | | | | | | | | |

Windstream Services LLC, Term Loan B (1 mo. USD LIBOR + 6.25%) | | | 7.25% | | | | 09/21/2027 | | | $ | 2,651 | | | $ 2,649,726 |

| | | | | | | | | | | | | | | 27,140,153 |

Utilities–1.95% | | | | | | | | | | | | | | |

Eastern Power LLC, Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.75% | | | | 10/02/2025 | | | | 3,956 | | | 2,625,190 |

Generation Bridge LLC | | | | | | | | | | | | | | |

Term Loan B (1 mo. USD LIBOR + 5.00%)(e) | | | 5.75% | | | | 12/01/2028 | | | | 1,404 | | | 1,404,836 |

Term Loan C (1 mo. USD LIBOR + 5.00%)(e) | | | 5.75% | | | | 12/01/2028 | | | | 29 | | | 29,267 |

Heritage Power LLC, Term Loan (1 mo. USD LIBOR + 6.00%) | | | 7.00% | | | | 07/30/2026 | | | | 2,919 | | | 1,922,300 |

Lightstone Holdco LLC | | | | | | | | | | | | | | |

Term Loan B (3 mo. USD LIBOR + 3.75%) (Acquired 02/07/2018; Cost $4,361,267)(g) | | | 4.75% | | | | 01/30/2024 | | | | 4,311 | | | 3,616,888 |

Term Loan C (3 mo. USD LIBOR + 3.75%) (Acquired 02/07/2018; Cost $245,982)(g) | | | 4.75% | | | | 01/30/2024 | | | | 243 | | | 203,998 |

Nautilus Power LLC, Term Loan (3 mo. USD LIBOR + 4.25%) | | | 5.25% | | | | 05/16/2024 | | | | 2,383 | | | 2,009,684 |

USIC Holding, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.50%) | | | 7.25% | | | | 05/07/2029 | | | | 325 | | | 324,174 |

| | | | | | | | | | | | | | | 12,136,337 |

Total Variable Rate Senior Loan Interests (Cost $748,090,193) | | | | | | | | | | | | | | 726,689,406 |

| | | | | | |

| | | Shares | | | |

Common Stocks & Other Equity Interests–11.04%(l) | | | | | | |

Aerospace & Defense–0.73% | | | | | | |

IAP Worldwide Services, Inc. (Acquired 07/18/2014-08/18/2014; Cost $239,759)(e)(g) | | | 221 | | | 4,527,246 |

| | |

Automotive–0.00% | | | | | | |

ThermaSys Corp. | | | 980,474 | | | 29,414 |

| | |

Building & Development–0.00% | | | | | | |

Lake at Las Vegas Joint Venture LLC, Class A(e) | | | 2,338 | | | 0 |

Lake at Las Vegas Joint Venture LLC, Class B(e) | | | 28 | | �� | 0 |

| | | | | | | 0 |

| | |

Business Equipment & Services–1.22% | | | | | | |

Checkout Holding Corp. (Acquired 02/15/2019; Cost $2,863,607)(g) | | | 8,573 | | | 6,966 |

My Alarm Center LLC, Class A (Acquired 03/09/2021-12/03/2021;

Cost $6,303,839)(e)(g) | | | 47,742 | | | 7,614,948 |

| | | | | | | 7,621,914 |

| | |

Containers & Glass Products–0.03% | | | | | | |

Libbey Glass, Inc. (Acquired 11/13/2020-02/10/2022; Cost $57,040)(e)(g) | | | 13,883 | | | 159,654 |

| | |

Electronics & Electrical–0.05% | | | | | | |

Riverbed Technology, Inc. | | | 32,799 | | | 323,890 |

| | |

Financial Intermediaries–0.00% | | | | | | |

RJO Holdings Corp.(e) | | | 2,144 | | | 2,144 |

RJO Holdings Corp., Class A(e) | | | 1,142 | | | 1,142 |

RJO Holdings Corp., Class B(e) | | | 3,334 | | | 34 |

| | | | | | | 3,320 |

| | |

Health Care–0.02% | | | | | | |

Envigo RMS Holding Corp.(e) | | | 4,854 | | | 121,877 |

| | |

Industrial Equipment–0.18% | | | | | | |

North American Lifting Holdings, Inc. | | | 62,889 | | | 1,092,696 |

| | |

Leisure Goods, Activities & Movies–1.63% | | | | | | |

Crown Finance US, Inc., Wts., expiring 11/23/2025 (Acquired 12/09/2020; Cost $0)(g) | | | 173,934 | | | 42,700 |

USF S&H Holdco LLC(e)(m) | | | 11,114 | | | 10,075,244 |

| | | | | | | 10,117,944 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 17 | | Invesco Dynamic Credit Opportunity Fund |

| | | | | | |

| | | Shares | | | Value |

Lodging & Casinos–0.88% | | | | | | |

Bally’s Corp.(n) | | | 134,154 | | | $ 4,832,227 |

Caesars Entertainment, Inc.(n) | | | 7,897 | | | 664,848 |

| | | | | | | 5,497,075 |

| | |

Oil & Gas–4.39% | | | | | | |

Aquadrill LLC(e) | | | 94,427 | | | 3,611,833 |

HGIM Corp. (Acquired 07/02/2018-08/31/2021; Cost $1,044,725)(g) | | | 11,834 | | | 88,755 |

HGIM Corp., Wts., expiring 07/02/2043 (Acquired 07/02/2018; Cost $662,459)(g) | | | 7,505 | | | 56,288 |