| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-255934-03 |

| | | |

| Dated September 9, 2022 | | BMO 2022-C3 |

Collateral Term Sheet |

BMO 2022-C3 Mortgage Trust |

$726,702,946 (Approximate Mortgage Pool Balance) |

| |

$[ ] (Approximate Offered Certificates) |

| |

BMO Commercial Mortgage Securities LLC Depositor |

| |

Commercial Mortgage Pass-Through Certificates, Series 2022-C3 |

| |

|

Bank of Montreal Citi Real Estate Funding Inc. UBS AG Starwood Mortgage Capital LLC LMF Commercial, LLC ReadyCap Commercial, LLC Sutherland Asset I, LLC 3650 Real Estate Investment Trust 2 LLC Sabal Capital II, LLC Mortgage Loan Sellers |

BMO Capital Markets | UBS Securities LLC | Citigroup |

| Co-Lead Managers and Joint Bookrunners |

Regions Securities LLC

Co-Manager | Bancroft Capital, LLC Co-Manager | Drexel Hamilton, LLC

Co-Manager |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| Dated September 9, 2022 | | BMO 2022-C3 |

This material is for your information, and none of BMO Capital Markets Corp., Citigroup Global Markets Inc., UBS Securities LLC, Regions Securities LLC, Bancroft Capital, LLC and Drexel Hamilton, LLC (the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-255934) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or BMO Capital Markets Corp., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-866-864-7760. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2022-C3 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Investment Industry Regulatory Organization of Canada and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorized and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in the UK and Australia.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance | | Roll-up Aggregate Cut-off Date Balance | Roll-up Aggregate % of Cut-off Date Balance |

| BMO | 13 | 22 | $223,911,085 | 30.8% | $228,911,085 | 31.5% |

| CREFI | 4 | 6 | $103,800,000 | 14.3% | $103,800,000 | 14.3% |

| 3650 REIT | 6 | 18 | $83,898,574 | 11.5% | $83,898,574 | 11.5% |

| LMF | 4 | 4 | $77,666,340 | 10.7% | $77,666,340 | 10.7% |

| SMC | 2 | 8 | $37,985,415 | 5.2% | $70,485,415 | 9.7% |

| UBS AG | 2 | 6 | $67,000,000 | 9.2% | $67,000,000 | 9.2% |

| Sabal | 8 | 16 | $47,970,000 | 6.6% | $47,970,000 | 6.6% |

| ReadyCap | 8 | 8 | $46,971,532 | 6.5% | $46,971,532 | 6.5% |

| BMO, SMC | 1 | 1 | $37,500,000 | 5.2% | - | - |

| Total: | 48 | 89 | $726,702,946 | 100.0% | $726,702,946 | 100.0% |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $726,702,946 |

| | Number of Mortgage Loans: | 48 |

| | Number of Mortgaged Properties: | 89 |

| | Average Cut-off Date Balance per Mortgage Loan: | $15,139,645 |

| | Weighted Average Current Mortgage Rate: | 5.35217% |

| | 10 Largest Mortgage Loans as % of IPB: | 46.7% |

| | Weighted Average Remaining Term to Maturity: | 108 months |

| | Weighted Average Seasoning: | 3 months |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR: | 1.88x |

| | Weighted Average UW NOI Debt Yield: | 10.8% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”): | 53.7% |

| | Weighted Average Maturity Date/ARD LTV: | 51.9% |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 11.6% |

| | % of Mortgage Loans with Single Tenants: | 11.9% |

| % of Mortgage Loans secured by Multiple Properties: | 29.4% |

| Amortization | |

| | Weighted Average Original Amortization Term: | 353 months |

| | Weighted Average Remaining Amortization Term: | 352 months |

| | % of Mortgage Loans with Interest-Only: | 73.2% |

| | % of Mortgage Loans with Amortizing Balloon: | 13.8% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 12.9% |

| Lockboxes | |

| | % of Mortgage Loans with Hard Lockboxes: | 41.9% |

| | % of Mortgage Loans with Springing Lockboxes: | 35.7% |

| | % of Mortgage Loans with Soft (Residential); Hard (Commercial) Lockboxes: | 13.4% |

| | % of Mortgage Loans with Soft Springing Lockboxes: | 5.2% |

| | % of Mortgage Loans with No Lockboxes: | 2.1% |

| | % of Mortgage Loans with Soft Lockboxes: | 1.8% |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 85.7% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 38.3% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves: | 70.3% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves: | 51.2% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| | 3 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| Collateral Characteristics |

| Ten Largest Mortgage Loans |

| |

| No. | Loan Name | City, State | Mortgage Loan Seller | No.

of Prop. | Cut-off Date Balance | % of IPB | Square Feet / Rooms / Units | Property Type | UW

NCF DSCR | UW NOI Debt Yield | Cut-off Date LTV | Maturity Date/ARD LTV |

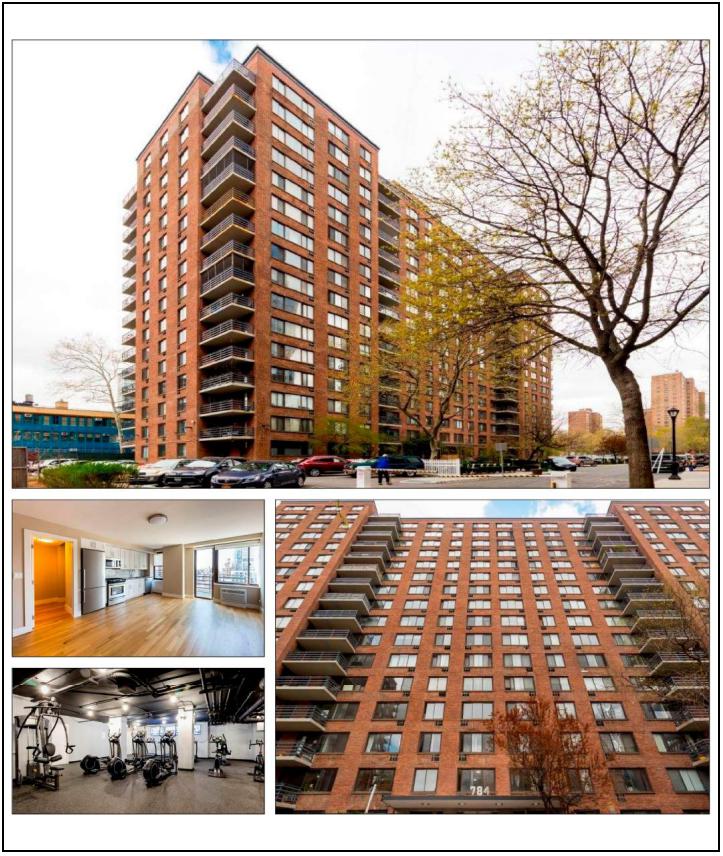

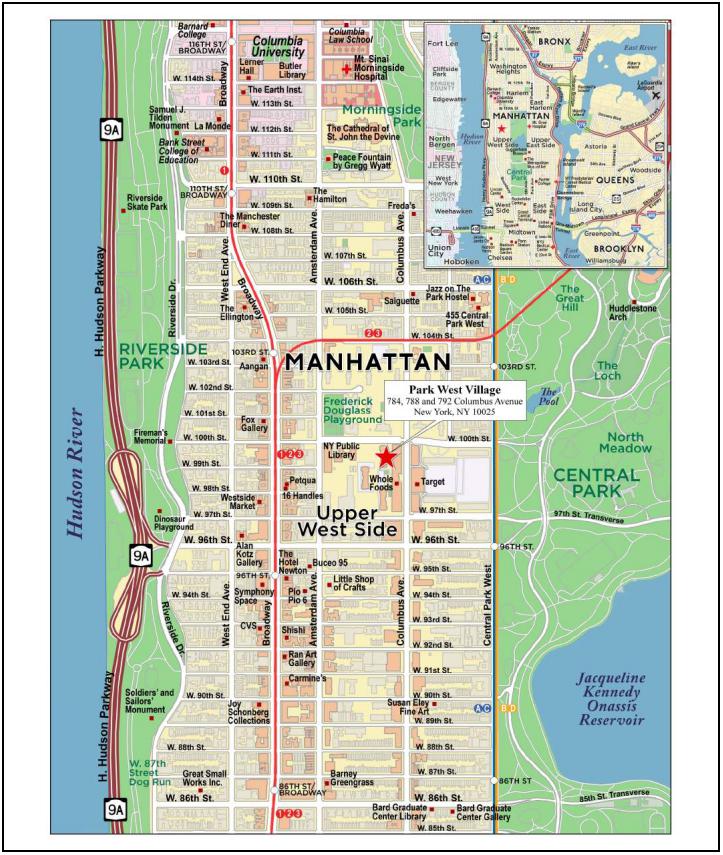

| 1 | Park West Village | New York, NY | BMO, SMC | 1 | $37,500,000 | 5.2% | 850 | Multifamily | 2.60x | 12.3% | 32.6% | 32.6% |

| 2 | Kingston Square Apartments | Indianapolis, IN | BMO | 1 | $37,000,000 | 5.1% | 523 | Multifamily | 1.53x | 9.2% | 59.5% | 59.5% |

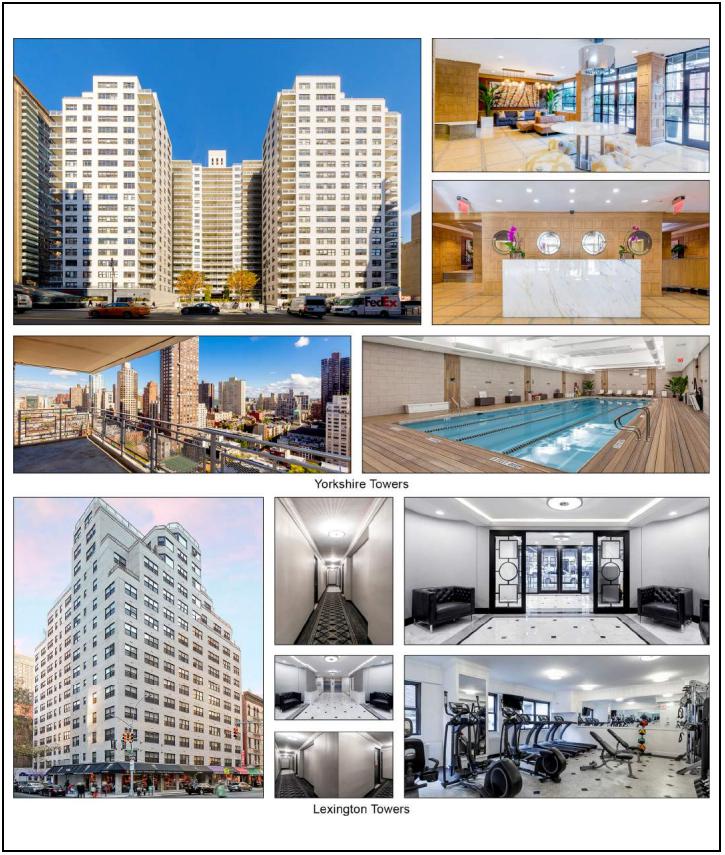

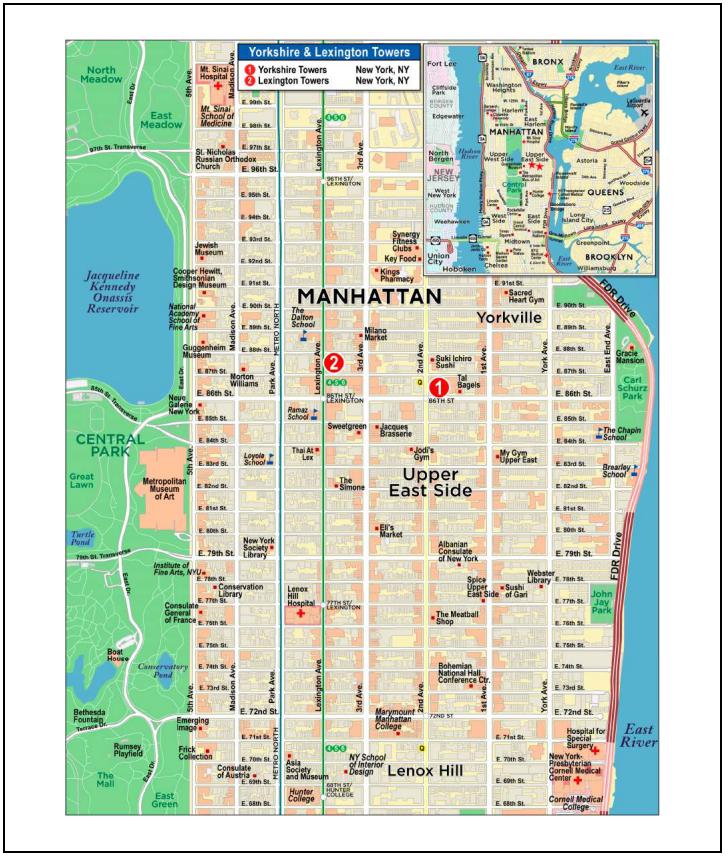

| 3 | Yorkshire & Lexington Towers | New York, NY | BMO | 2 | $37,000,000 | 5.1% | 808 | Multifamily | 3.61x | 11.1% | 33.3% | 33.3% |

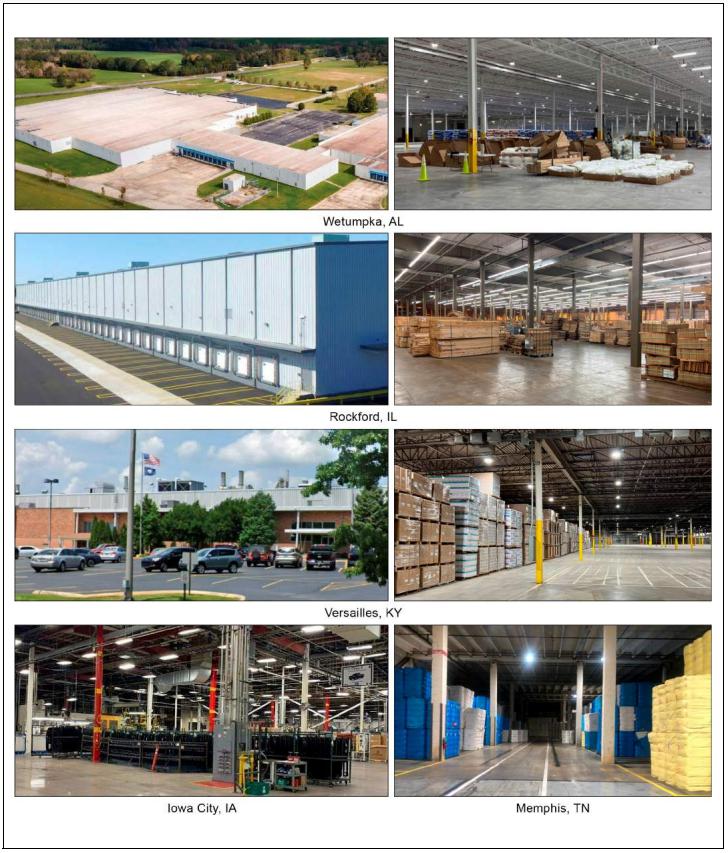

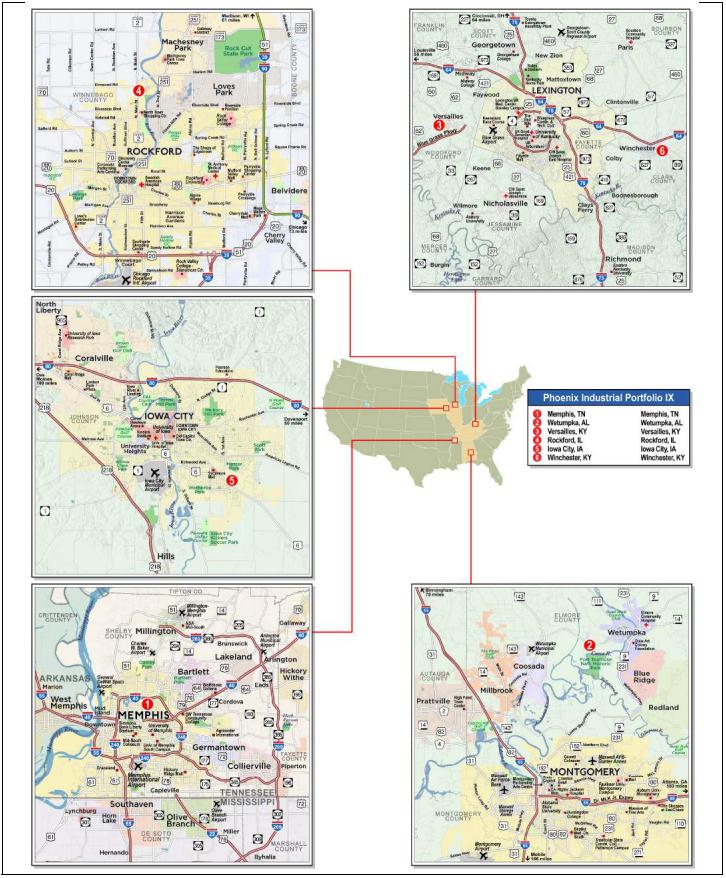

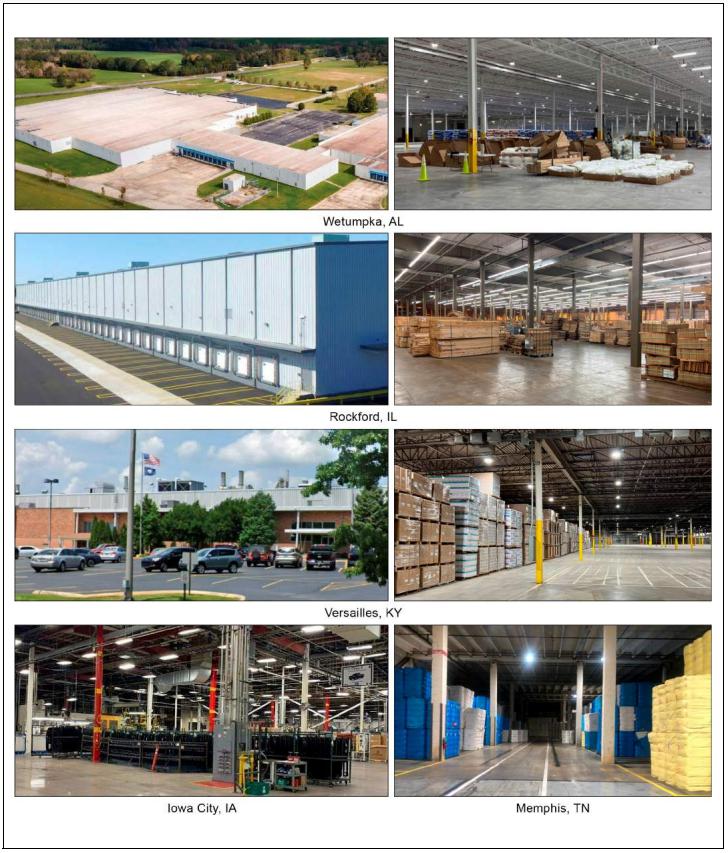

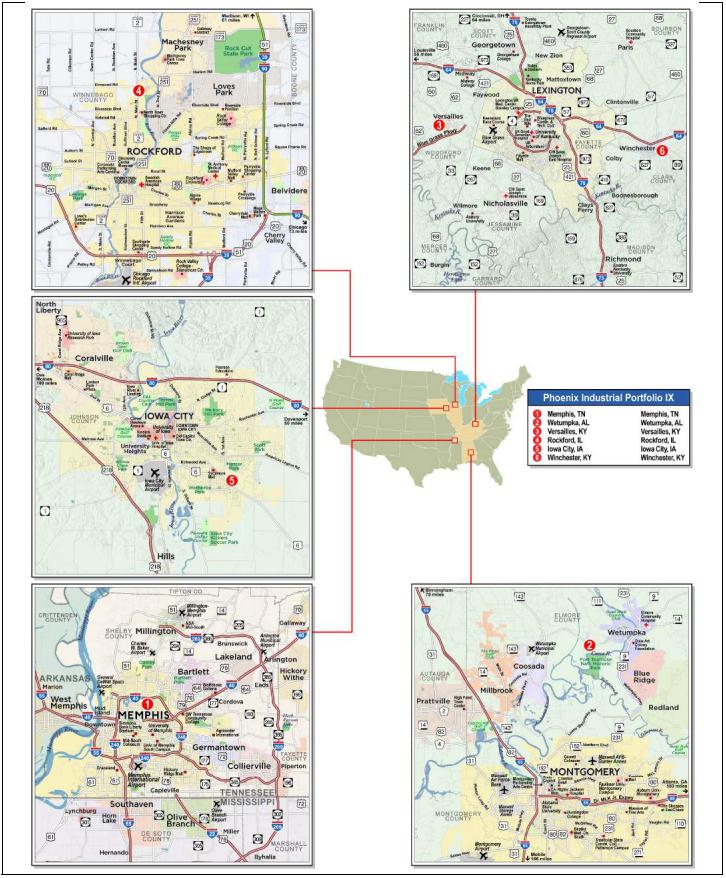

| 4 | Phoenix Industrial Portfolio IX | Various, Various | UBS AG | 5 | $37,000,000 | 5.1% | 3,760,303 | Industrial | 1.48x | 10.6% | 41.2% | 41.2% |

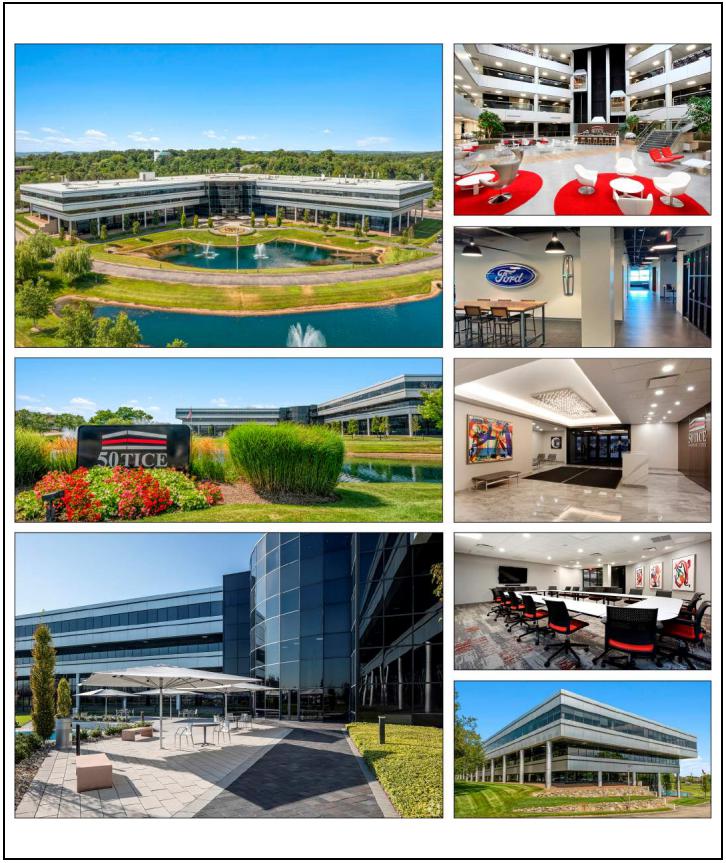

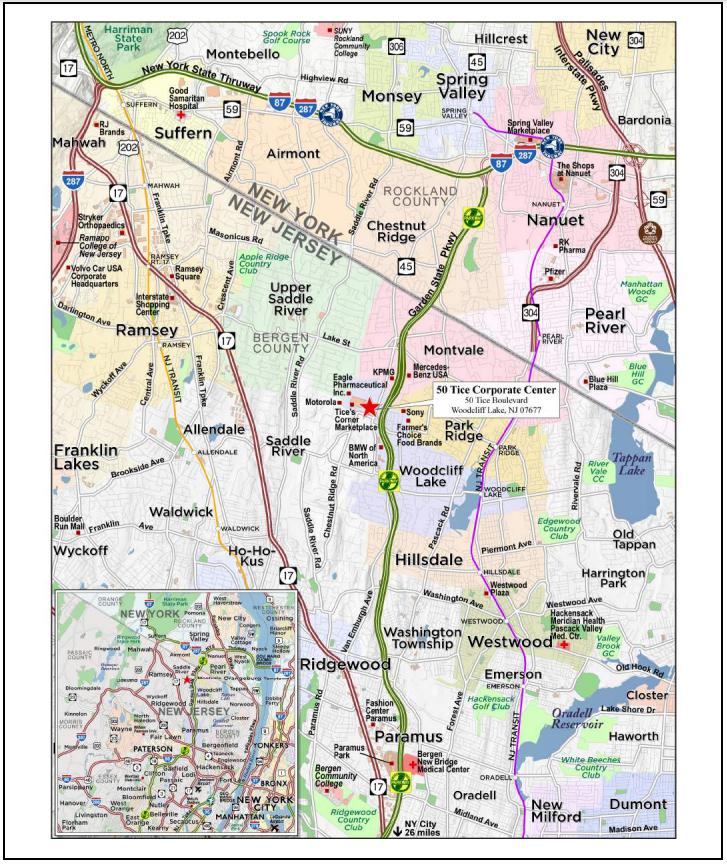

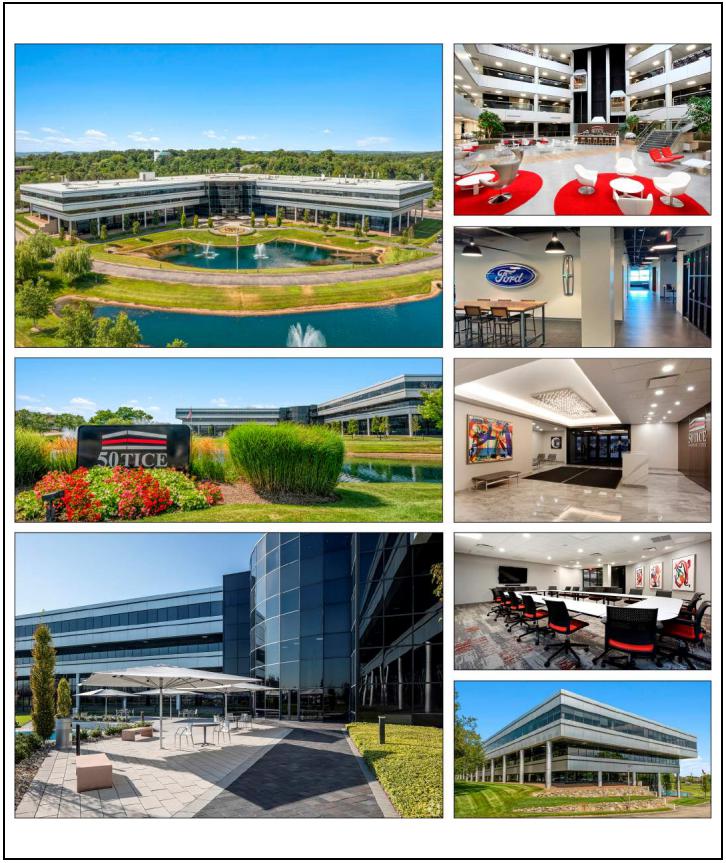

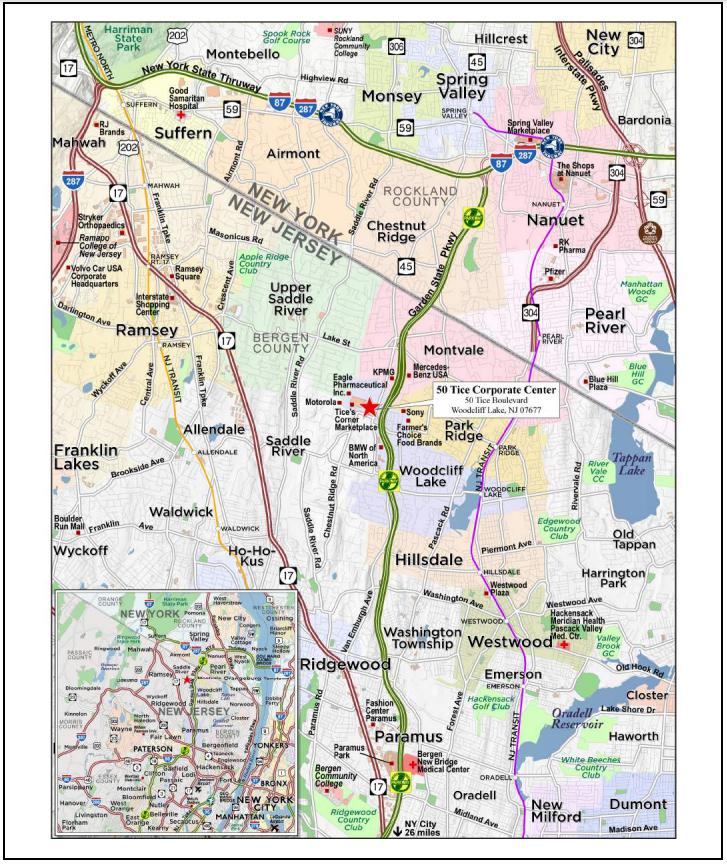

| 5 | 50 Tice Corporate Center | Woodcliff Lake, NJ | LMF | 1 | $36,500,000 | 5.0% | 256,459 | Office | 1.68x | 12.3% | 56.8% | 53.0% |

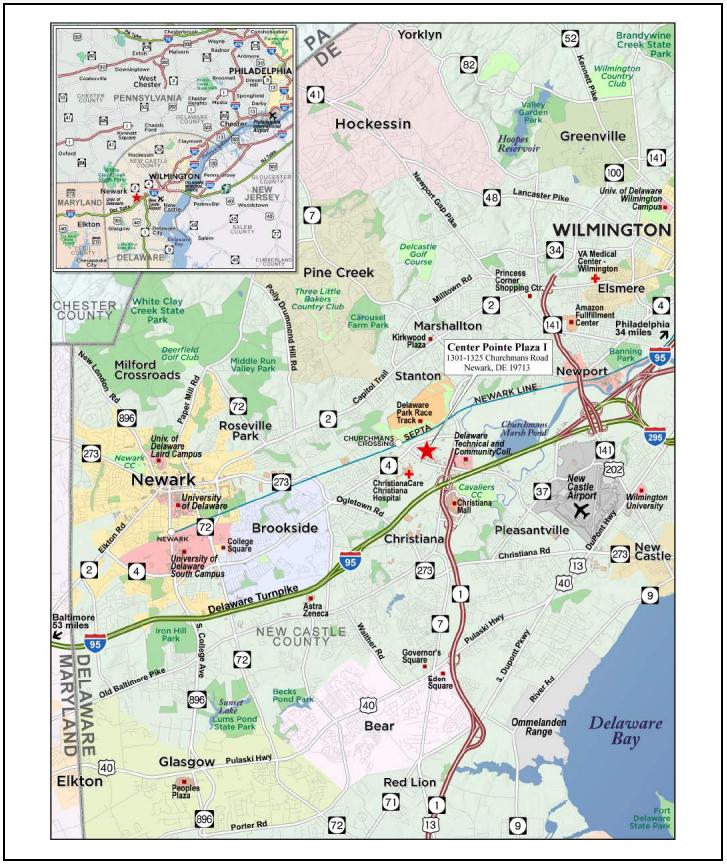

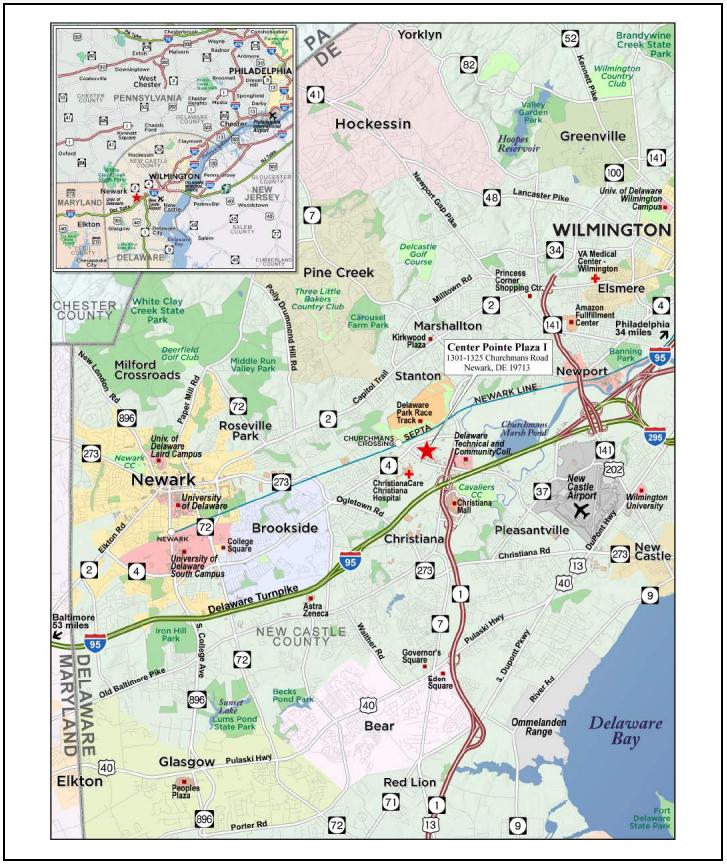

| 6 | Center Pointe Plaza I | Newark, DE | LMF | 1 | $34,966,340 | 4.8% | 238,348 | Retail | 1.27x | 9.6% | 66.2% | 56.5% |

| 7 | Bayou City Portfolio | Various, TX | SMC | 3 | $32,191,295 | 4.4% | 633 | Multifamily | 1.21x | 10.0% | 50.9% | 42.7% |

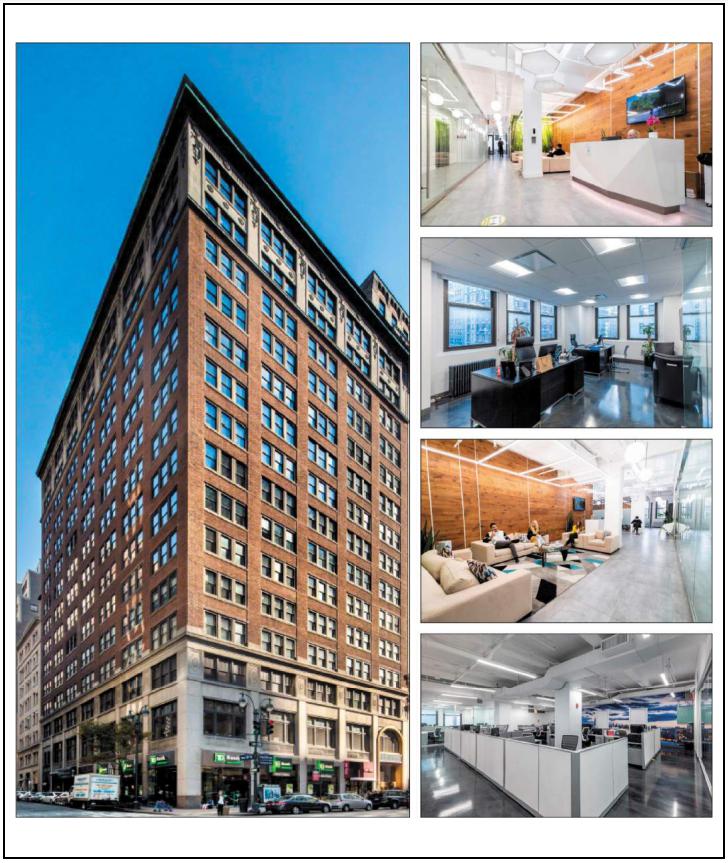

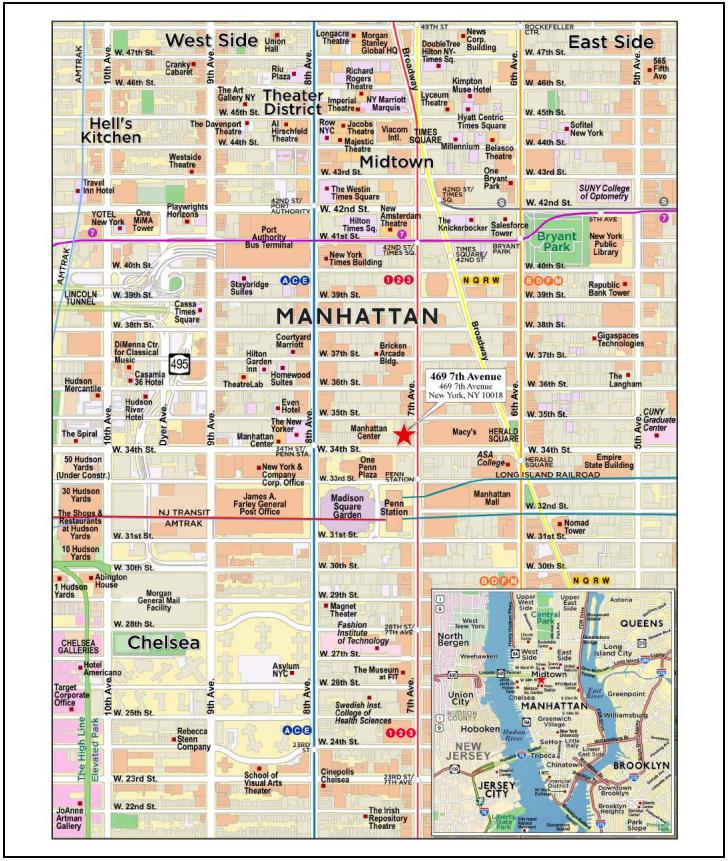

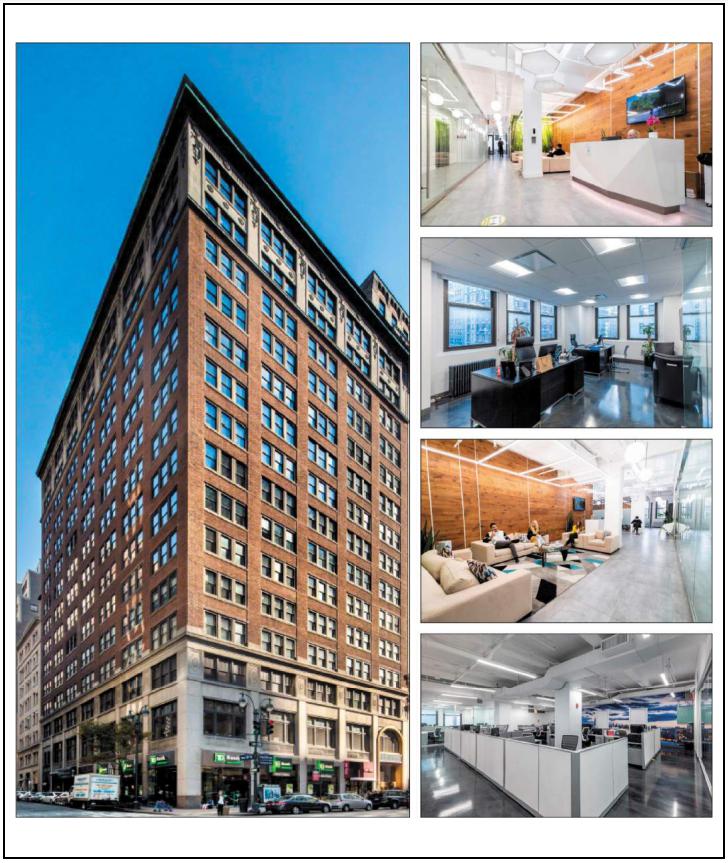

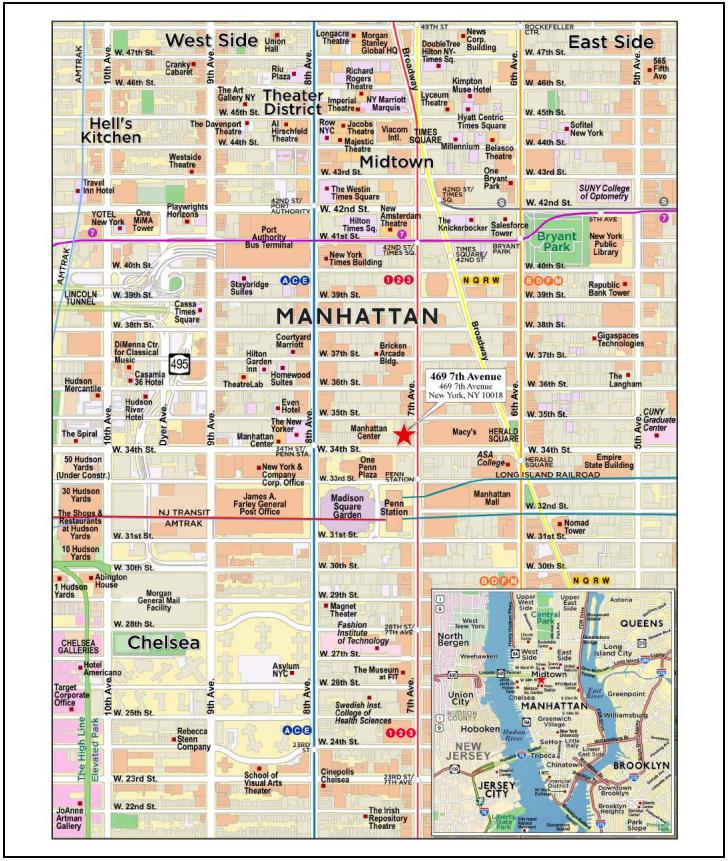

| 8 | 469 7th Avenue | New York, NY | UBS AG | 1 | $30,000,000 | 4.1% | 269,233 | Office | 1.41x | 9.4% | 52.4% | 52.4% |

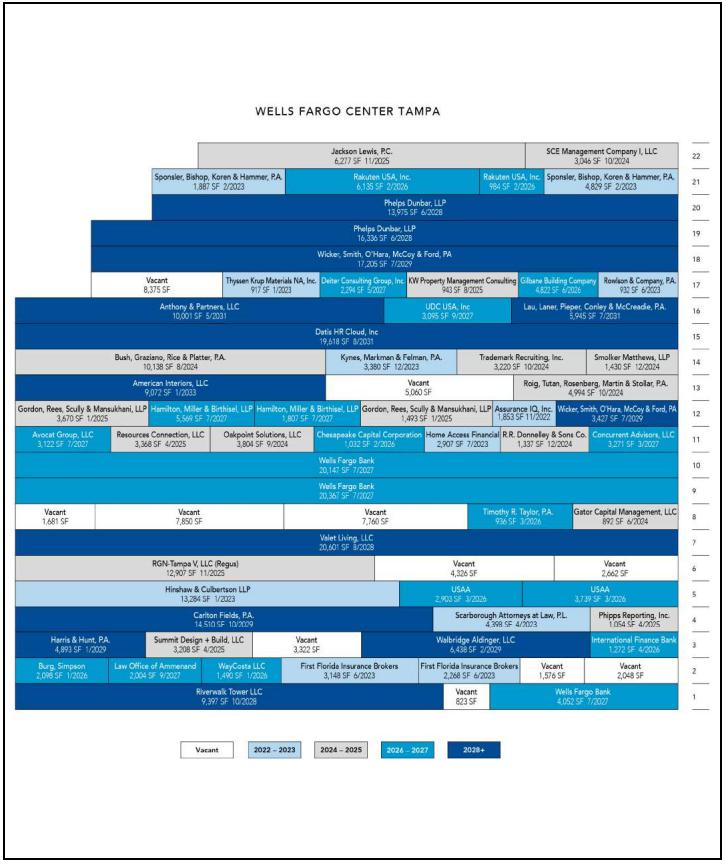

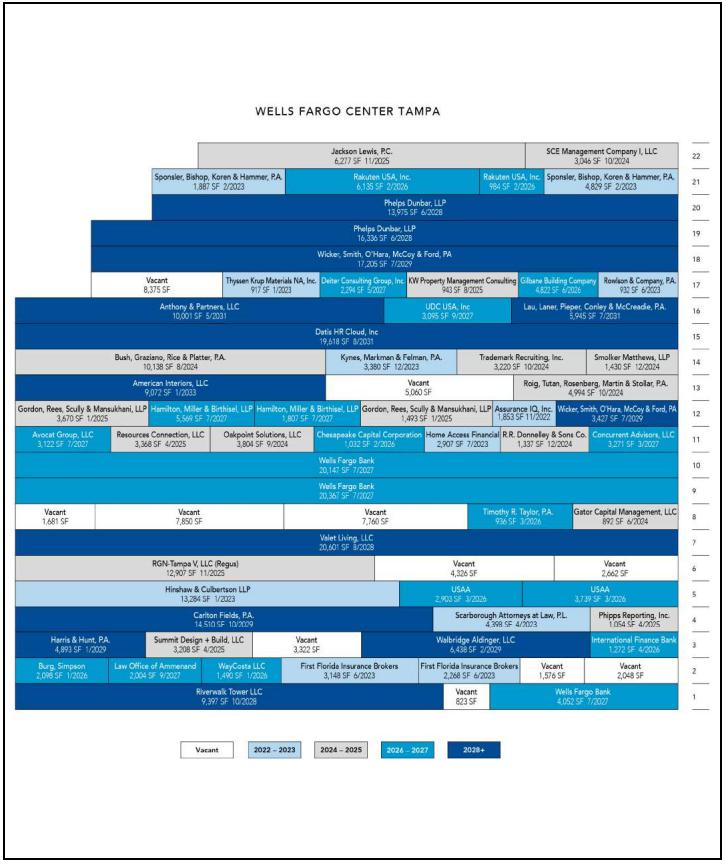

| 9 | Wells Fargo Center Tampa | Tampa, FL | CREFI | 1 | $30,000,000 | 4.1% | 389,624 | Office | 1.60x | 10.2% | 59.4% | 59.4% |

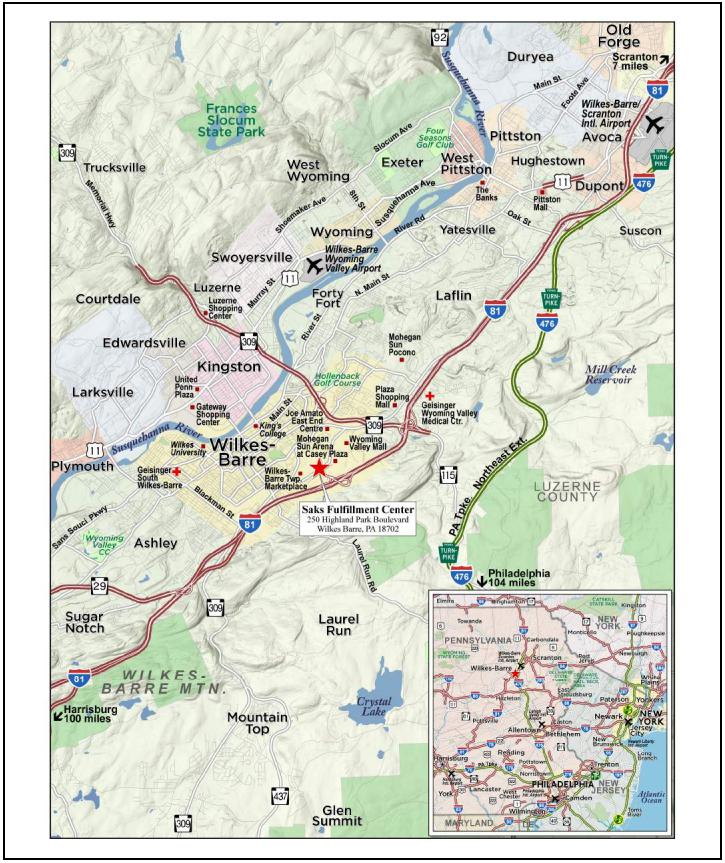

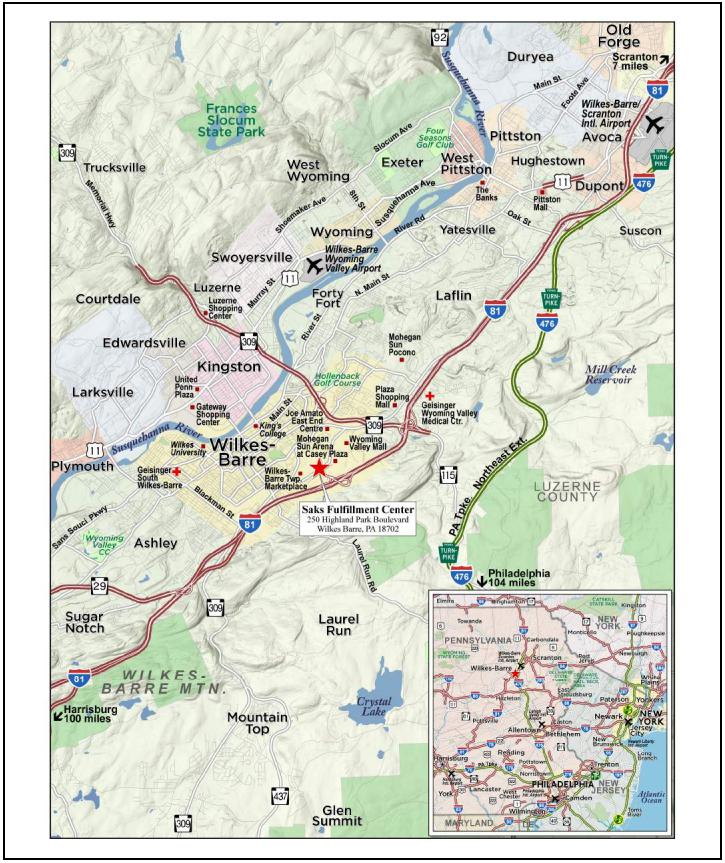

| 10 | Saks Fulfillment Center | Wilkes Barre, PA | BMO | 1 | $27,500,000 | 3.8% | 822,771 | Industrial | 1.71x | 10.7% | 53.1% | 53.1% |

| | | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | �� | 4 | $111,500,000 | 15.3% | | | 2.58x | 10.9% | 41.8% | 41.8% |

| | Top 5 Total/Weighted Average | | 10 | $185,000,000 | 25.5% | | | 2.18x | 11.1% | 44.6% | 43.9% |

| | Top 10 Total/Weighted Average | | 17 | $339,657,635 | 46.7% | | | 1.84x | 10.6% | 50.1% | 47.9% |

| | Non-Top 10 Total/Weighted Average | | 72 | $387,045,312 | 53.3% | | | 1.92x | 11.0% | 56.8% | 55.4% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| |

No. | Loan Name | | Trust Cut-off Date Balance | Aggregate Pari Passu Loan Cut-off Date Balance | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Loan(s) Securitizations | Related Pari Passu Loan(s) Original Balance |

| 1 | Park West Village | BMO, SMC | $37,500,000 | $150,000,000 | BBCMS 2022-C17 | KeyBank | KeyBank | BBCMS 2022-C17 Future Securitization(s) | $47,500,000 $102,500,000 |

| 2 | Kingston Square Apartments | BMO | $37,000,000 | $14000,000 | BMO 2022-C3 | Midland | Midland | Future Securitization(s) | $14,000,000 |

| 3 | Yorkshire & Lexington Towers | BMO | $37,000,000 | $281,000,000 | CGCMT 2022-GC48 | Midland | Rialto | BBCMS 2022-C16 BMO 2022-C2 CGCMT 2022-GC48 BBCMS 2022-C17 Future Securitization(s) | $65,000,000 $70,000,000 $60,000,000 $20,000,000 $66,000,000 |

| 4 | Phoenix Industrial Portfolio IX | UBS AG | $37,000,000 | $38,000,000 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $38,000,000 |

| 8 | 469 7th Avenue | UBS AG | $30,000,000 | $68,000,000 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $68,000,000 |

| 9 | Wells Fargo Center Tampa | CREFI | $30,000,000 | $43,000,000 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $43,000,000 |

| 10 | Saks Fulfillment Center | BMO | $27,500,000 | $32,500,000 | BMO 2022-C3 | Midland | Midland | BBCMS 2022-C17 Future Securitizations(s) | $22,500,000 $10,000,000 |

| 16 | La Habra Marketplace | 3650 REIT | $20,000,000 | $75,000,000 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $75,000,000 |

| 17 | Central States Industrial Portfolio | 3650 REIT | $20,000,000 | $39,900,000 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $39,900,000 |

| 19 | Icon One Daytona | 3650 REIT | $15,000,000 | $35,000,000 | 3650R 2021-PF1 | Midland | 3650 REIT | 3650 2021-PF1 Future Securitizations(s) | $25,000,000 $15,000,000 |

| 20 | Lakeshore Marketplace | 3650 REIT | $11,848,574 | $9,656,588 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $9,656,588 |

| 22 | Bell Works | BMO | $10,000,000 | $200,000,000 | BMARK 2022-B35 | KeyBank | KeyBank | BMARK 2022-B35 BBCMS 2022-C16 CGCMT 2022-GC48 BBCMS 2022-C17 Future Securitization(s) | $50,000,000 $40,000,000 $40,000,000 $25,000,000 $15,000,000 |

| 23 | 111 River Street | BMO | $10,000,000 | $67,500,000 | BMO 2022-C1 | KeyBank | KeyBank | BMO 2022-C1 BMO 2022-C2 CGCMT 2022-GC48 | $37,500,000 $22,000,000 $8,000,000 |

| 24 | Art Ovation Hotel | 3650 REIT | $10,000,000 | $47,500,000 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $47,500,000 |

| 25 | 3455 Veterans Hwy | BMO | $10,000,000 | $20,000,000 | BMO 2022-C3 | Midland | Midland | Future Securitizations(s) | $20,000,000 |

| 30 | A&R Hospitality Portfolio | BMO | $7,250,000 | $55,750,000 | BBCMS 2022-C17 | KeyBank | Argentic | BBCMS 2022-C17 Future Securitizations(s) | $40,000,000 $15,750,000 |

| | | | | | | | | | |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW

NCF DSCR | UW

NOI Debt Yield | Cut-off Date LTV | Maturity Date/ARD LTV |

| Multifamily | Garden | 14 | $110,147,594 | 15.2% | 1.53x | 9.2% | 58.0% | 54.5% |

| | High Rise | 3 | 74,500,000 | 10.3 | 3.10x | 11.7% | 32.9% | 32.9% |

| | Age Restricted | 1 | 5,450,000 | 0.7 | 2.28x | 9.3% | 64.9% | 64.9% |

| | Townhomes | 1 | 3,251,125 | 0.4 | 1.22x | 7.8% | 68.4% | 63.4% |

| | Mid Rise | 1 | 1,644,107 | 0.2 | 1.54x | 8.7% | 60.9% | 60.9% |

| | Subtotal: | 20 | $194,992,827 | 26.8% | 2.14x | 10.1% | 48.8% | 46.7% |

| Office | CBD | 3 | $70,000,000 | 9.6% | 2.02x | 10.8% | 52.5% | 52.5% |

| | Suburban | 4 | 64,400,000 | 8.9 | 1.64x | 11.0% | 59.0% | 55.9% |

| | Medical | 1 | 27,000,000 | 3.7 | 1.57x | 10.2% | 56.3% | 56.3% |

| | Subtotal: | 8 | $161,400,000 | 22.2% | 1.79x | 10.8% | 55.7% | 54.5% |

| Industrial | Warehouse/Distribution | 14 | $42,333,161 | 5.8% | 1.58x | 10.5% | 49.1% | 49.1% |

| | Flex | 3 | 28,831,653 | 4.0 | 1.56x | 10.1% | 50.1% | 49.4% |

| | Warehouse | 1 | 27,500,000 | 3.8 | 1.71x | 10.7% | 53.1% | 53.1% |

| | Manufacturing | 4 | 26,041,998 | 3.6 | 1.43x | 10.8% | 40.2% | 36.5% |

| | Cold Storage | 1 | 4,570,952 | 0.6 | 1.59x | 9.4% | 68.1% | 68.1% |

| | Manufacturing/Warehouse/Distribution | 1 | 1,282,137 | 0.2 | 1.59x | 9.4% | 68.1% | 68.1% |

| | Subtotal: | 24 | $130,559,900 | 18.0% | 1.57x | 10.5% | 49.2% | 48.4% |

| Retail | Anchored | 5 | $89,749,914 | 12.4% | 1.66x | 10.1% | 65.0% | 60.1% |

| | Single Tenant | 3 | 31,320,100 | 4.3 | 2.21x | 11.5% | 51.2% | 51.2% |

| | Unanchored | 1 | 6,500,000 | 0.9 | 2.06x | 11.9% | 54.2% | 54.2% |

| | Subtotal: | 9 | $127,570,014 | 17.6% | 1.82x | 10.5% | 61.0% | 57.6% |

| Hospitality | Limited Service | 8 | $23,583,319 | 3.2% | 2.21x | 16.1% | 57.3% | 52.7% |

| | Extended Stay | 4 | 15,857,766 | 2.2 | 2.54x | 16.6% | 50.8% | 50.2% |

| | Full Service | 1 | 10,000,000 | 1.4 | 1.45x | 14.7% | 50.8% | 56.8% |

| | Subtotal: | 13 | $49,441,085 | 6.8% | 2.16x | 16.0% | 53.9% | 52.7% |

| Mixed Use | Multifamily/Retail | 3 | $28,720,000 | 4.0% | 1.38x | 9.0% | 66.2% | 66.2% |

| | Subtotal: | 3 | $28,720,000 | 4.0% | 1.38x | 9.0% | 66.2% | 66.2% |

| Self Storage | Self Storage | 7 | $28,225,000 | 3.9% | 2.34x | 10.3% | 50.0% | 50.0% |

| Manufactured Housing | Manufactured Housing | 5 | $5,794,120 | 0.8% | 1.63x | 11.8% | 50.8% | 43.0% |

| Total / Weighted Average: | 89 | $726,702,946 | 100.0% | 1.88x | 10.8% | 53.7% | 51.9% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

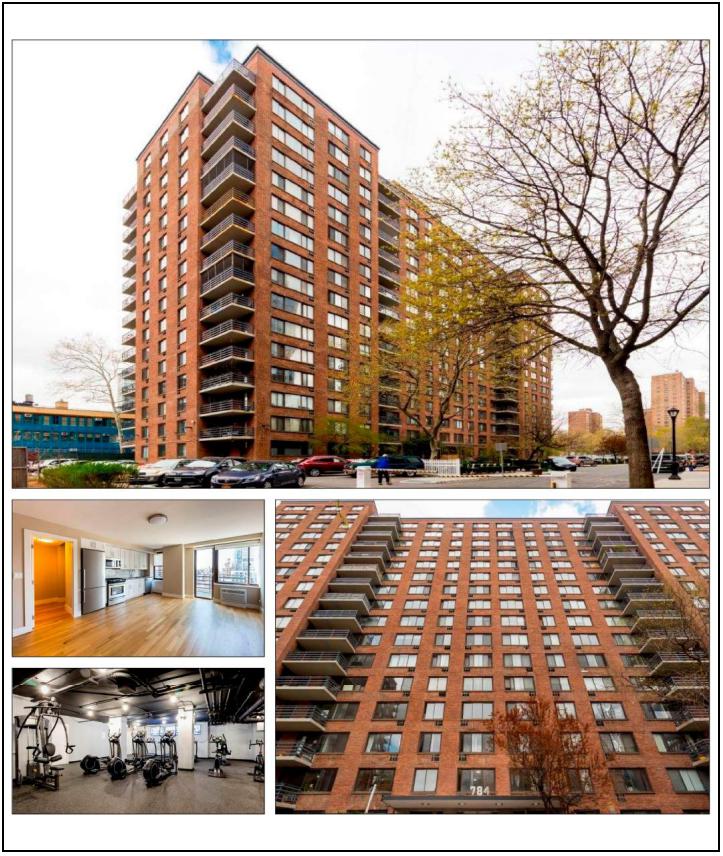

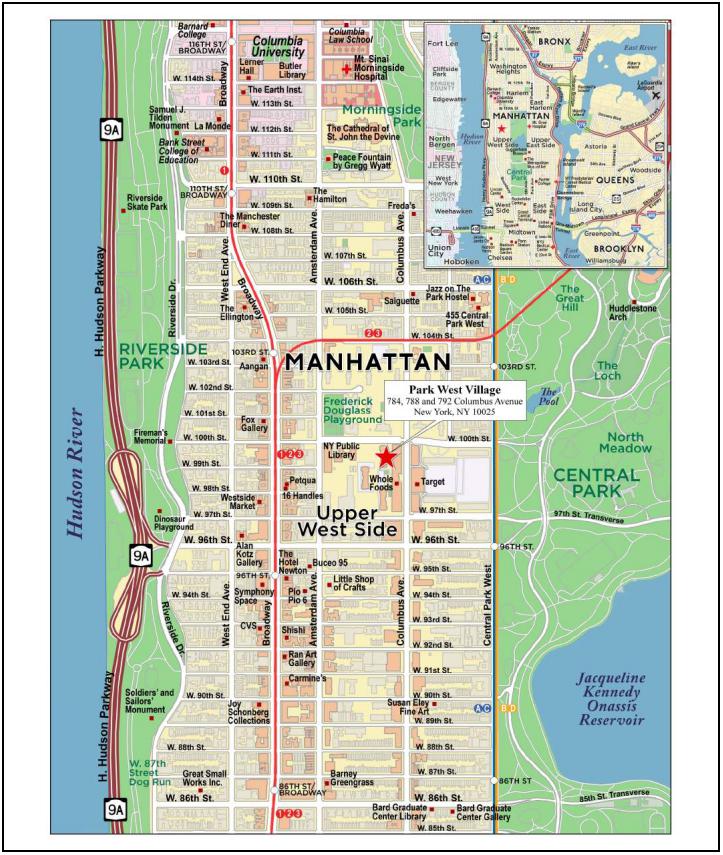

| No. 1 – Park West Village |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | BMO, SMC | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $37,500,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $37,500,000 | | Property Type – Subtype: | Multifamily – High Rise |

| % of IPB: | 5.2% | | Net Rentable Area (Units): | 850 |

| Loan Purpose: | Refinance | | Location: | New York, NY |

| Borrowers: | CF PWV LLC and SM PWV LLC | | Year Built / Renovated: | 1950, 1958, 1963 / 2014 |

| Borrower Sponsors: | Meyer Chetrit and | | Occupancy: | 94.7% |

| | Amended and Restated 2013 | | Occupancy Date: | 7/22/2022 |

| | LG Revocable Trust | | 4th Most Recent NOI (As of): | $16,725,571 (12/31/2019) |

| Interest Rate: | 4.65000% | | 3rd Most Recent NOI (As of): | $14,592,031 (12/31/2020) |

| Note Date: | 8/3/2022 | | 2nd Most Recent NOI (As of): | $13,357,008 (12/31/2021) |

| Maturity Date: | 8/6/2027 | | Most Recent NOI (As of)(5): | $15,491,417 (TTM 5/31/2022) |

| Interest-only Period: | 60 months | | UW Economic Occupancy: | 91.3% |

| Original Term: | 60 months | | UW Revenues: | $32,787,176 |

| Original Amortization Term: | None | | UW Expenses: | $9,786,898 |

| Amortization Type: | Interest Only | | UW NOI(5): | $23,000,278 |

| Call Protection(2): | L(26),D(29),O(5) | | UW NCF(5): | $23,000,278 |

| Lockbox / Cash Management: | Soft (Residential); Hard | | Appraised Value / Per Unit: | $575,000,000 / $676,471 |

| | (Commercial) / In Place | | Appraisal Date: | 1/20/2022 |

| Additional Debt(1): | Yes | | | |

| Additional Debt Balance(1)(3): | $150,000,000 / $177,500,000 | | | |

| Additional Debt Type(1)(3): | Pari Passu / Subordinate | | | |

| | | | | |

| Escrows and Reserves(4) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | | Senior Loan | Whole Loan |

| Taxes: | $919,476 | $459,738 | N/A | | Cut-off Date Loan / Unit: | $220,588 | $429,412 |

| Insurance: | $0 | Springing | N/A | | Maturity Date Loan / Unit: | $220,588 | $429,412 |

| Replacement Reserves: | $850,000 | $0 | N/A | | Cut-off Date LTV: | 32.6% | 63.5% |

| Other Reserves: | $12,778,500 | Springing | N/A | | Maturity Date LTV: | 32.6% | 63.5% |

| | | | | | UW NCF DSCR(5): | 2.60x | 1.34x |

| | | | | | UW NOI Debt Yield(5): | 12.3% | 6.3% |

| | | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Tot | al | | Uses | Proceeds | % of Tot | al |

| Senior Loan | $187,500,000 | 49.2 | % | | Existing Loan Payoff | $321,864,741 | 84.5 | % |

| Subordinate Notes | 177,500,000 | 46.6 | | | Closing Costs | 44,400,316 | 11.7 | |

| Sponsor Equity | 15,813,033 | 4.2 | | | Upfront Reserves | 14,547,976 | 3.8 | |

| Total Sources | $380,813,033 | 100.0 | % | | Total Uses | $380,813,033 | 100.0 | % |

| (1) | The Park West Village Senior Loan (as defined below), with an original aggregate principal balance of $187,500,000, is part of the Park West Village Whole Loan (as defined below). The Financial Information in the chart above reflects the Park West Village Senior Loan and the Park West Village Whole Loan. For additional information, see “The Loan” below. |

| (2) | Defeasance of the Park West Village Whole Loan is permitted at any time after the earlier to occur of (a) the end of the two-year period commencing on the closing date of the securitization of the last promissory note representing a portion of the Park West Village Whole Loan to be securitized and (b) September 6, 2025. The assumed defeasance lockout period of 26 payments is based on the closing date of this transaction in October 2022. The actual lockout period may be longer. |

| (3) | The subordinate notes consist of (i) the B-A Note with an original principal balance of $66,500,000 and (ii) the B-B note with an original principal balance of $111,000,000, which is junior to the B-A Note in right of payment. The B-A note was contributed to the BBCMS 2022-C17 trust and backs only the related loan-specific certificates issued by the BBCMS 2022-C17 trust. For additional information, see “The Loan” below. |

| (4) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. |

| (5) | UW NOI is greater than Most Recent NOI due in part to the borrower sponsors recently renovating 29 units, which has increased rents at the Park West Village Property (as defined below). Additionally, the UW NOI and UW NCF include disbursements from a Supplemental Income Reserve (as defined below) of $4,920,000. The Park West Village Senior Loan UW NCF DSCR and Park West Village Whole Loan UW NCF DSCR excluding credit for the upfront Supplemental Income Reserve are 2.05x and 1.05x respectively. The Park West Village Senior Loan UW NOI Debt Yield and Park West Village Whole Loan UW NOI Debt Yield excluding credit for the upfront Supplemental Income Reserve are 9.6% and 5.0%, respectively. Please refer to “Escrows and Reserves” below. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

The Loan. The Park West Village mortgage loan (the “Park West Village Mortgage Loan”) is part of a whole loan (the “Park West Village Whole Loan”) that is evidenced by 12 pari passu senior promissory notes in the aggregate original principal amount of $187,500,000 (collectively, the “Park West Village Senior Loan”), one subordinate promissory Note B-A in the original principal amount of $66,500,000 (the “Park West Village Note B-A” or the “Park West Village Note B-A Subordinate Companion Loan”) and one further subordinate promissory Note B-B in the original principal amount of $111,000,000 (the “Park West Village Note B-B” or the “Park West Village Note B-B Subordinate Companion Loan” and together with the Park West Village Note B-A, the “Park West Village Subordinate Companion Notes” or “Park West Village Subordinate Companion Loans”). The Park West Village Senior Loan was co-originated on August 3, 2022 by Bank of Montreal (“BMO”), Starwood Mortgage Capital LLC (“SMC”) and Citi Real Estate Funding Inc. (“CREFI”). The Park West Village Note B-A Subordinate Companion Loan was originated on August 3, 2022 by BMO. The Park West Village Note B-B Subordinate Companion Loan was originated on August 3, 2022 by Park West Village Grand Avenue Partners, LLC, an affiliate of Oaktree Capital Management (“PWV Grand Avenue”). The Park West Village Whole Loan is secured by a first lien mortgage on the borrowers’ fee simple interest in three, 16-story multifamily buildings consisting of 850 residential units and one commercial unit located in the Upper West Side neighborhood of New York, New York (collectively, the “Park West Village Property”).

The Park West Village Mortgage Loan is evidenced by the non-controlling Notes A-4, A-9 and A-10, with an aggregate principal balance as of the Cut-off Date of $37,500,000. The remaining Park West Village pari passu senior promissory notes and the Park West Village Note B-A were contributed to or are expected to be contributed to other securitization trusts, as set forth in the table below, and the Park West Village Note B-B is currently held by PWV Grand Avenue. The Park West Village Senior Loan is senior in right of payment to the Park West Village Subordinate Companion Loans, and the Park West Village Note B-A Subordinate Companion Loan is senior in right of payment to the Park West Village Note B-B Subordinate Companion Loan. The Park West Village Note B-B will be the initial controlling note and PWV Grand Avenue, as the holder of such initial controlling note, will be entitled to exercise certain control rights with respect to the Park West Village Whole Loan under the related co-lender agreement. The Park West Village Note B-A will become the controlling note if the Note B-B Control Appraisal Period (as defined in the related co-lender agreement) has occurred and is continuing, and the Note A-1 will become the controlling note if both the Note B-B Control Appraisal Period and the Note B-A Control Appraisal Period (as defined in the related co-lender agreement) have occurred and are continuing, as further described in the table below. The Park West Village Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BBCMS 2022-C17 securitization into which the Note A-1, which is the lead note, was contributed. For additional information, see “Subordinate Debt” below. The relationship between the holders of the Park West Village Whole Loan is governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Park West Village Pari Passu-AB Whole Loan” in the Preliminary Prospectus.

| Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | | Note Holder | Controlling

Piece |

| A-1(1) | $17,500,000 | $17,500,000 | | BBCMS 2022-C17 | Yes |

| A-2(2) | $32,500,000 | $32,500,000 | | BMO | No |

| A-3(2) | $7,500,000 | $7,500,000 | | BMO | No |

| A-4 | $5,000,000 | $5,000,000 | | BMO 2022-C3 | No |

| A-5(2) | $17,500,000 | $17,500,000 | | CREFI | No |

| A-6(2) | $15,000,000 | $15,000,000 | | CREFI | No |

| A-7(2) | $15,000,000 | $15,000,000 | | CREFI | No |

| A-8(2) | $15,000,000 | $15,000,000 | | CREFI | No |

| A-9 | $17,500,000 | $17,500,000 | | BMO 2022-C3 | No |

| A-10 | $15,000,000 | $15,000,000 | | BMO 2022-C3 | No |

| A-11 | $15,000,000 | $15,000,000 | | BBCMS 2022-C17 | No |

| A-12 | $15,000,000 | $15,000,000 | | BBCMS 2022-C17 | No |

| Total Senior Loan | $187,500,000 | $187,500,000 | | | |

| B-A(1) | $66,500,000 | $66,500,000 | | BBCMS 2022-C17 (Loan Specific) | Yes |

| B-B(1) | $111,000,000 | $111,000,000 | | PWV Grand Avenue | Yes |

| Whole Loan | $365,000,000 | $365,000,000 | | | |

| (1) | The initial controlling note is Note B-B, but if a Note B-B Control Appraisal Period (as defined in the related co-lender agreement), for the Park West Village Whole Loan is continuing, the controlling note will be Note B-A. If a Note B-A Control Appraisal Period and a Note B-B Control Appraisal Period (each, as defined in the related co-lender agreement) are continuing, the controlling note will be Note A-1. Note B-A was contributed to the BBCMS 2022-C17 securitization trust and backs only the related loan-specific certificates issued by the BBCMS 2022-C17 securitization trust. The loan-specific controlling class representative designated pursuant to the pooling and servicing agreement for the BBCMS 2022-C17 securitization will be entitled to exercise the rights of the controlling note if Note B-A becomes the controlling note, and the directing certificateholder for the pooled certificates issued by the BBCMS 2022-C17 securitization trust will be entitled to exercise the rights of the controlling note if Note |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

A-1 becomes the controlling note, in each case to the extent provided in the related co-lender agreement and the pooling and servicing agreement for the BBCMS 2022-C17 securitization. See “Description of the Mortgage Pool—The Whole Loans—The Park West Village Pari Passu-AB Whole Loan” in the Preliminary Prospectus.

| (2) | Expected to be contributed to one or more future securitization(s). |

The Property. The Park West Village Property consists of three, 16-story multifamily buildings comprised of 850 residential units totaling 643,708 square feet and one commercial unit totaling 1,039 square feet. The commercial tenant at the Park West Village Property has a remaining weighted average lease term of approximately 0.8 years. The Park West Village Property is located in the Upper West Side neighborhood and is situated approximately 0.5 miles from the 96th Street and 103rd Street subway stations with access to the A, B, and C subway lines. The Park West Village Property was built in 1950, 1958, and 1963 and renovated in 2014, and features a range of studio, one-bedroom, two-bedroom, three-bedroom, and four-bedroom residential units. Of the 850 residential units, 418 of the units are rent-stabilized. The Park West Village Property units all feature hardwood flooring, nearly nine-foot ceiling heights, full kitchen appliances, and certain units include a private balcony. Renovated units feature granite or marble countertop kitchens, stainless steel appliances including a refrigerator, dishwasher, microwave, and gas-fired stove and oven, and washer and dryer. Community spaces include an outdoor children’s playground, dog run, valet services, and onsite surface parking.

The sole commercial tenant, Carol Maryan Architect, P.C. (“Carol Maryan Architect”), occupies 1,039 square feet (100.0% of the commercial NRA and 0.2% of the total NRA, 100.0% of the underwritten commercial base rent and 0.3% of the total underwritten base rent) with a lease expiration of July 31, 2023. Carol Maryan Architect is a boutique architectural firm founded by Carol Maryan in 1983. Carol Maryan Architect provides architectural and interior designs to an array of clients, including private individuals, corporations, developers, creative services firms, and public entities.

Borrower Sponsors’ Renovation Plan. The information set forth below regarding the borrower sponsors’ renovation plans reflects forward-looking statements and certain projections provided by the borrower sponsors, assuming, among other things, that the borrowers will complete certain projected renovations by December 1, 2024 and that all of the newly renovated and currently unoccupied units will be leased at current market rate rent and all of the currently occupied units will continue to be leased at the current contractual rental rates. We cannot assure you that such assumptions and projections provided by the borrower sponsors will materialize in the future as expected or at all.

The borrower sponsors have identified 325 units that will be renovated, which consist of 270 units that are projected to receive a light renovation and 55 units that are projected to receive a major renovation. The 55 major renovation units will be combined into 27 units post-renovation. Of the 55 units projected to receive major renovations, 28 units are rent-stabilized, all of which are currently vacant. Major renovations will feature the combination of two or three units into one larger unit or a significant floor plan alteration and are expected to take approximately four to six months to complete. Light renovation units will feature aesthetic and systems upgrades, such as new appliances, countertops, lighting upgrades and removal of carpeting. At origination, the borrowers deposited $7,858,500 into a unit upgrade reserve with the lender, to be disbursed to pay or reimburse the borrowers for unit renovation costs pursuant to the Park West Village Whole Loan documents. See “Escrows and Reserves” below.

The major renovation units are projected to receive an average renovation of approximately $48,109 per unit and are anticipated to increase rent from $46.18 per square foot in-place to $81.00 per square foot. The borrower sponsors have completed 12 major renovations to date, which have been combined into a total of seven units. These major renovations have achieved average annual rent increases from $29.39 per square foot to $72.82 per square foot.

The light renovation units are projected to receive an average renovation of $19,306 per unit and are anticipated to increase rent from $65.31 per square foot in-place to $81.00 per square foot. The borrower sponsors have completed 17 light renovations to date. These light renovations have achieved average annual rent increases from $38.24 per square foot to $85.59 per square foot.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

The following table presents detailed information with respect to the current market rate units at the Park West Village Property:

| As Is Market Rate Unit Summary |

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (SF)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per SF(1) | Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per SF(2) |

| Studio | 166 | 38.4 | % | 464 | $2,869 | $6.19 | $3,243 | $5.85 |

| 1 Bedroom | 164 | 38.0 | | 836 | $4,505 | $5.39 | $4,768 | $5.08 |

| 2 Bedroom | 89 | 20.6 | | 918 | $5,140 | $5.62 | $5,355 | $5.39 |

| 3 Bedroom | 12 | 2.8 | | 1,264 | $7,708 | $6.05 | $8,977 | $5.74 |

| 4 Bedroom | 1 | 0.2 | | 1,832 | $7,500 | $4.09 | $7,500 | $4.09 |

| Total/Wtd. Avg. | 432 | 100.0 | % | 724 | $4,091 | $5.67 | $4,477 | $5.37 |

| (1) | Based on the underwritten rent roll as of July 22, 2022. |

The following table presents detailed information with respect to the current rent-stabilized units at the Park West Village Property:

| As Is Rent-Stabilized Unit Summary |

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (SF)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per SF(1) | Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per SF(2) |

| Studio | 115 | 27.5 | % | 469 | $1,175 | $2.52 | $1,318 | $2.49 |

| 1 Bedroom | 225 | 53.8 | | 842 | $1,337 | $1.58 | $1,417 | $1.60 |

| 2 Bedroom | 77 | 18.4 | | 1,119 | $1,779 | $1.58 | $1,843 | $1.51 |

| 3 Bedroom | 1 | 0.2 | | 1,153 | $3,000 | $2.60 | $3,000 | $2.60 |

| Total/Wtd. Avg. | 418 | 100.0 | % | 791 | $1,378 | $1.73 | $1,473 | $1.72 |

| (1) | Based on the underwritten rent roll as of July 22, 2022. |

The following table presents detailed information with respect to the projected post-renovation market rate units at the Park West Village Property:

| Projected Post-Renovation Market Rate Unit Summary |

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (SF)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per SF(1) | Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per SF(2) |

| Studio | 155 | 38.3 | % | 464 | $3,085 | $6.66 | $3,243 | $5.85 |

| 1 Bedroom | 153 | 37.8 | | 837 | $5,450 | $6.51 | $4,768 | $5.08 |

| 2 Bedroom | 85 | 21.0 | | 910 | $6,108 | $6.71 | $5,355 | $5.39 |

| 3 Bedroom | 11 | 2.7 | | 1,298 | $8,835 | $6.80 | $8,977 | $5.74 |

| 4 Bedroom | 1 | 0.2 | | 1,832 | $12,366 | $6.75 | $7,500 | $4.09 |

| 5 Bedroom | NAP | NAP | NAP | NAP | NAP | NAP | NAP |

| Total/Wtd. Avg. | 405 | 100.0 | % | 724 | $4,792 | $6.62 | $4,477 | $5.37 |

| (1) | Based on the underwritten rent roll as of July 22, 2022. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

The following table presents detailed information with respect to the projected post-renovation rent-stabilized units at the Park West Village Property:

| Projected Post-Renovation Rent-Stabilized Unit Summary |

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (SF)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per SF(1) | Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per SF(2) |

| Studio | 105 | 25.2 | % | 465 | $1,292 | $2.78 | $1,318 | $2.49 |

| 1 Bedroom | 212 | 50.8 | | 847 | $1,468 | $1.73 | $1,417 | $1.60 |

| 2 Bedroom | 88 | 21.1 | | 1,163 | $3,241 | $2.79 | $1,843 | $1.51 |

| 3 Bedroom | 10 | 2.4 | | 1,529 | $9,872 | $6.46 | $3,000 | $2.60 |

| 4 Bedroom | 1 | 0.2 | | 1,700 | $11,473 | $6.75 | NAP | NAP |

| 5 Bedroom | 1 | 0.2 | | 2,642 | $17,831 | $6.75 | NAP | NAP |

| Total/Wtd. Avg. | 417 | 100.0 | % | 840 | $2,063 | $2.46 | $1,473 | $1.72 |

| (1) | Based on the underwritten rent roll as of July 22, 2022. |

COVID-19 Update. As of July 22, 2022, the Park West Village Property is open and operating. As of the date of this term sheet, the Park West Village Whole Loan is not subject to any forbearance, modification or debt service relief request. The first payment date of the Park West Village Whole Loan was September 6, 2022.

Environmental. According to the Phase I report dated January 20, 2022, there was no evidence of any recognized environmental conditions at the Park West Village Property. The Phase I environmental assessment, however, identified historical recognized environmental conditions at the Park West Village Property.

The following table presents certain information relating to the historical and current occupancy of the Park West Village Property:

| Historical and Current Multifamily Occupancy(1) |

| 2019 | 2020 | 2021 | Current(2) |

| 94.2% | 91.2% | 87.9% | 94.7% |

| (1) | Historical occupancies are as of July 31 of each respective year. |

| (2) | Current occupancy is as of July 22, 2022. |

| Operating History and Underwritten Net Cash Flow |

| | 2019 | 2020 | 2021 | TTM(1) | Underwritten | Per Unit | % | (2) |

| Residential Base Rent | $24,956,720 | $22,792,744 | $22,129,703 | $24,536,542 | $28,419,283 | $33,434 | 83.9 | % |

| Commercial Base Rent | 71,777 | 70,353 | 75,268 | 74,908 | 79,852 | 94 | 0.2 | |

| Gross Potential Rent | $25,028,497 | $22,863,097 | $22,204,971 | $24,611,451 | $28,499,136 | $33,528 | 84.2 | % |

| Total Reimbursements | 2,945 | 17,850 | 0 | 0 | 11,355 | 13 | 0.0 | |

| Supplemental Income Reserve(3) | 0 | 0 | 0 | 0 | 4,919,913 | 5,788 | 14.5 | |

| Total Other Income | 567,004 | 760,807 | 477,438 | 424,187 | 424,187 | 499 | 1.3 | |

| Net Rental Income | $25,598,446 | $23,641,754 | $22,682,409 | $25,035,638 | $33,854,591 | $39,829 | 100.0 | % |

| (Vacancy/Credit Loss) | (2,062) | (2,942) | 0 | 0 | (1,067,415) | (1,256) | (3.2) | |

| Effective Gross Income | $25,596,385 | $23,638,812 | $22,682,409 | $25,035,638 | $32,787,176 | $38,573 | 96.8 | % |

| Total Expenses | $8,870,813 | $9,046,781 | $9,325,401 | $9,544,221 | $9,786,898 | $11,514 | 29.8 | % |

| Net Operating Income(3) | $16,725,571 | $14,592,031 | $13,357,008 | $15,491,417 | $23,000,278 | $27,059 | 70.2 | % |

| Total Capex/RR(4) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Net Cash Flow | $16,725,571 | $14,592,031 | $13,357,008 | $15,491,417 | $23,000,278 | $27,059 | 70.2 | % |

| (1) | TTM represents the trailing 12 months ending May 2022. |

| (2) | % column represents percent of Net Rental Income for all revenue lines and represents percent of Effective Gross Income for the remainder of the fields. |

| (3) | The Underwritten Net Operating Income is greater than the TTM Net Operating Income due in part to (i) the borrower sponsors recently renovating 29 units, which has increased rents at the Park West Village Property and (ii) disbursements from the Supplemental Income Reserve. Please refer to “Escrows and Reserves” below. |

| (4) | The borrower sponsors funded five years’ worth of Capex/RR at origination. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

The Market. The Park West Village Property is located in New York, New York, within the New York, NY-NJ-PA Metropolitan Statistical Area. According to the appraisal, the unemployment rate from 2011 through 2021 in New York City increased at an average annual rate of 0.3% and is expected to decrease at an average annual rate of 4.7% between 2022 and 2026. The estimated 2021 median annual household income in New York City was $68,261. The leading industries in New York City are education and health, professional and business, government, and trade, transportation and utilities. The largest employer in New York City is Northwell Health, which employs 68,088 people. The Park West Village Property is located on the blocks bound by Columbus Avenue, Amsterdam Avenue, West 97th Street and West 100th Street. The buildings at 784 Columbus Avenue and 792 Columbus Avenue have street frontage on West 97th and 100th Streets, respectively. The building at 788 Columbus Avenue does not have street frontage; however, all three of the Park West Village Property buildings are accessible from Columbus Avenue via a breezeway through the development to the east of the subject buildings, which comprises the entire blockfront of Columbus Avenue from West 97th Street to West 100th Street. The Upper West Side is primarily residential in nature, with adequate retail to support the area. Manhattan’s central business district is located to the southeast of the Upper West Side. Immediately to the south is the Clinton area, which is characterized by a wide range of uses including residential, office buildings and the Theater District. The neighborhood bordering the Upper West Side to the north is known as Morningside Heights, which is primarily residential and home to Columbia University. The Park West Village Property benefits from its proximity to Columbus Avenue, as well as Broadway, which is dense with prime retail and commercial space.

The Park West Village Property is situated in the Upper West Side multifamily submarket. According to CoStar, as of February 2022, the Upper West Side multifamily submarket had an overall vacancy rate of 2.2%, with net absorption totaling 11 units. The vacancy rate decreased 1.7% over the past 12 months. Rental rates increased by 5.9% for the past 12 months and ended at $4,760 per unit per month. A total of 336 units are still under construction at the end of the first quarter of 2022.

According to the appraisal, the 2021 population for New York City was approximately 8,305,600 and is forecasted to grow to approximately 8,317,700 in 2022, and approximately 8,335,900 in 2026.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

The following table presents certain information relating to comparable multifamily rental property to the Park West Village Property:

| Comparable Rental Summary(1) |

| Property / Location | Year Built | Occupancy | # of Units | Unit Mix | Average SF per Unit | Average Rent per SF | Average Rent per Unit |

| Park West Village(2) | 1950, 1958, 1963 | 94.7% | 850 | Studio | 466 | $4.79 | $2,226 |

| 784, 788 and 792 Columbus Avenue | 1 Bed | 840 | $3.22 | $2,711 |

| New York, NY | 2 Bed | 1,011 | $3.63 | $3,663 |

| | 3 Bed | 1,255 | $5.79 | $7,316 |

| | 4 Bed | 1,832 | $4.09 | $7,500 |

| West 96th Apartments | 1987 | 95.2% | 207 | 1 Bed | 733 | $6.28 | $4,606 |

| 750 Columbus Avenue | | | | 2 Bed | 1,006 | $6.25 | $6,287 |

| New York, NY | | | | 3 Bed | 1,421 | $6.23 | $8,853 |

| The Westmont Apartments | 1986 | 100.0% | 163 | Studio | 610 | $5.75 | $3,509 |

| 730 Columbus Avenue | | | | 1 Bed | 802 | $5.59 | $4,479 |

| New York, NY | | | | 2 Bed | 1095 | $5.81 | $6,360 |

| | | | | 3 Bed | 1,403 | $5.67 | $7,951 |

| Stonehenge Village | 1930 | 94.5% | 414 | Studio | 515 | $5.92 | $3,050 |

| 160 West 97th Street | | | | 1 Bed | 686 | $6.41 | $4,400 |

| New York, NY | | | | 2 Bed | 951 | $5.96 | $5,667 |

| | | | | 3 Bed | 1,123 | $5.79 | $6,500 |

| The Greystone | 1923 | 98.6% | 366 | Studio | 321 | $9.14 | $2,938 |

| 212 West 91st Street | | | | 1 Bed | 583 | $6.53 | $3,809 |

| New York, NY | | | | 2 Bed | 955 | $6.13 | $5,850 |

| Columbus Square | 2009 | 93.7% | 710 | Studio | 445 | $8.13 | $3,616 |

| 808 Columbus Avenue | | | | 1 Bed | 649 | $7.67 | $4,979 |

| New York, NY | | | | 2 Bed | 970 | $7.46 | $7,235 |

| | | | | 3 Bed | 1,376 | $6.28 | $8,640 |

| The Paris New York | 1931 | 98.9% | 176 | Studio | 516 | $6.19 | $3,195 |

| 752 West End Avenue | | | | 1 Bed | 501 | $6.13 | $3,070 |

| New York, NY | | | | 2 Bed | 1,065 | $5.97 | $6,362 |

| | | | | 3 Bed | 1,894 | $5.33 | $10,095 |

| The Lyric | 1996 | 98.6% | 285 | Studio | 527 | $6.86 | $3,618 |

| 255 West 94th Street | | | | 1 Bed | 677 | $6.95 | $4,701 |

| New York, NY | | | | 2 Bed | 1,077 | $6.80 | $7,320 |

| (1) | Source: Appraisal, unless otherwise indicated. |

| (2) | Based on underwritten rent roll dated as of July 22, 2022. Average Rent per SF and Average Rent per Unit reflect average monthly in-place rent for occupied units. |

The Borrowers. The borrowers under the Park West Village Whole Loan are CF PWV LLC and SM PWV LLC, as tenants-in-common, each a single-purpose Delaware limited liability company with two independent directors. Legal counsel to the borrowers delivered a non-consolidation opinion in connection with the origination of the Park West Village Whole Loan.

The Borrower Sponsors. The borrower sponsors and non-recourse carveout guarantors are Meyer Chetrit and Amended and Restated 2013 LG Revocable Trust, a trust established by Laurance Gluck. Meyer Chetrit is one of the controllers of The Chetrit Group. The Chetrit Group is an experienced, privately held New York City real estate development firm controlled by two brothers: Joseph and Meyer Chetrit. The Chetrit Group, which is headquartered in Manhattan, has ownership interests in over 14 million square feet of commercial and residential real estate across the United States, including New York, Chicago, Miami, and Los Angeles, as well as internationally.

Laurence Gluck is the founder of Stellar Management, a real estate development and management firm founded in 1985. Based in New York City, Stellar Management owns and manages a portfolio of over 13,000 apartments in 100 buildings located across New York City and over three million square feet of office space. Prior to founding Stellar Management, Laurence Gluck served as a real estate attorney at Proskauer, Rose, Goetz & Mendelsohn and later as a partner at Dreyer & Traub. Laurence Gluck also formerly served as a member of the Board of Governors of the Real Estate Board of New York.

Property Management. The Park West Village Property is managed by PWV Management LLC, an affiliate of the borrowers.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

Escrows and Reserves. At origination of the Park West Village Whole Loan, the borrowers deposited approximately (i) $919,476 into a real estate tax reserve account, (ii) $850,000 into a replacement reserve account, (iii) $7,858,500 into a unit upgrade reserve account and (iv) $4,920,000 into a supplemental income reserve account.

Tax Escrows – The borrowers are required to deposit into a real estate tax reserve, on a monthly basis, 1/12th of the taxes that the lender estimates will be payable over the next-ensuing 12-month period (initially estimated to be approximately $459,738).

Insurance Escrows – The borrowers are required to deposit into an insurance reserve, on a monthly basis, 1/12th of the amount which will be sufficient to pay the insurance premiums due for the renewal of coverage afforded by such policies; provided, however, such insurance reserve has been conditionally waived so long as (i) no event of default under the Park West Village Whole Loan is continuing and (ii) the borrowers maintain a blanket policy meeting the requirements of the Park West Village Whole Loan documents. The borrowers are currently maintaining a blanket policy.

Supplemental Income Reserve – The borrowers deposited $4,920,000 into a supplemental income reserve account (the “Supplemental Income Reserve”) at origination of the Park West Village Whole Loan. Unless and until the Park West Village Property (excluding the amount on deposit in the Supplemental Income Reserve) achieves a 6.25% “transient” Park West Village Whole Loan debt yield (calculated on the basis of annualized net cash flow for a three-month period ending with the most recently completed month), the lender may require the borrowers to make additional Supplemental Income Reserve deposits if and to the extent the lender determines, in its reasonable discretion on a quarterly basis after July 6, 2023 during the Park West Village Whole Loan term, that additional supplemental income reserve deposits are required in order to achieves (when the additional deposit and all other deposits in the Supplemental Income Reserve account are added to net cash flow for the Park West Village Property) a 6.25% transient Park West Village Whole Loan debt yield for the following 12, 9, 6 or 3 months (such applicable 12-, 9-, 6- or 3- month period depending on the quarter with respect to which such determination by the lender is made). The guarantors provided a related carry guaranty of certain carry costs, including real estate taxes, insurance premiums, debt service and operating expenses, for any period until the Park West Village Property achieves a 6.25% transient Park West Village Whole Loan debt yield (excluding the amount on deposit in the Supplemental Income Reserve). The obligations of the guarantors under such carry guaranty are limited to the additional Supplemental Income Reserve deposit amounts as and when due.

So long as no event of default under the Park West Village Whole Loan is continuing, on each payment date, the lender is required to transfer the Monthly Supplemental Income Reserve Disbursement Amount (as defined below) from the Supplemental Income Reserve to the cash management account. Such funds deposited into the cash management account will be required to be applied with all other funds then on deposit in the cash management account in the order of priority set forth in the Park West Village Whole Loan documents, as described under “Lockbox / Cash Management” below. So long as no event of default under the Park West Village Whole Loan is continuing, upon such time as the lender has reasonably determined that the Park West Village Property (excluding the amount on deposit in the Supplemental Income Reserve) has achieved a 6.25% or higher for one calendar quarter “transient” Park West Village Whole Loan debt yield (calculated on the basis of annualized net cash flow for a three-month period ending with the most recently completed month), then upon the borrowers’ written request, all of the funds in the Supplemental Income Reserve will be required to be disbursed to the borrowers; provided, however, if a Cash Trap Period (as defined below) is then continuing, then such funds will not be disbursed to the borrowers, and such funds will instead be deposited into the excess cash reserve account, to be applied in accordance with the terms of the Park West Village Whole Loan documents.

“Monthly Supplemental Income Reserve Disbursement Amount” means 1/12th of (x) the initial Supplemental Income Reserve deposit with respect to the first 12 payment dates occurring during the term of the Park West Village Whole Loan, and (y) each Supplemental Income Reserve additional deposit amount with respect to the 12 payment dates following the date that the borrowers are required to deposit such Supplemental Income Reserve additional deposit amount pursuant to the terms of the Park West Village Whole Loan documents; provided that, if at any time the lender reassesses the Supplemental Income Reserve additional deposit amount in accordance with the terms of the Park West Village Whole Loan documents, the Monthly Supplemental Income Reserve Disbursement Amount will be adjusted so that all of funds in the Supplemental Income Reserve will be disbursed in equal monthly installments ending on such Supplemental Income Reserve reassessment date (i.e., so that there will be no funds in the Supplemental Income Reserve on deposit on such Supplemental Income Reserve reassessment date).

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 1 – Park West Village |

Lockbox / Cash Management. The Park West Village Whole Loan is structured with a hard lockbox for commercial tenants and a soft lockbox for residential tenants, and in place cash management. The borrowers are required to deposit all rents collected from residential tenants into the lockbox account within three days of receipt. The borrowers are required to deliver a tenant direction letter to commercial tenants to deposit all rents directly to the lockbox account. The borrowers are required to cause all amounts deposited into the lockbox account to be transferred on each business day to a cash management account controlled by the lender. Absent an event of default under the Park West Village Whole Loan documents, funds on deposit in the cash management account are applied on each monthly payment date in amounts and in the order of priority set forth in the Park West Village Whole Loan Documents, including any required tax and insurance reserve deposits, deposit account bank fees, monthly debt service on the Park West Village Whole Loan, other amounts payable to the lender under the Park West Village Whole Loan, operating expenses and extraordinary expenses reflected in the annual budget or otherwise approved by lender, with the remaining funds in the cash management account to be disbursed to the borrowers unless a Cash Trap Period is then continuing, in which event the remaining funds will be deposited into an excess cash reserve account under the lender’s control, and released to the borrower when the Cash Trap Period ends. Upon an event of default under the Park West Village Whole Loan documents, the lender will apply funds in such priority as it may determine.

A “Cash Trap Period” means a period commencing upon the earliest to occur of (i) an event of default; (ii) any bankruptcy action of the borrowers, principal, guarantor or manager has occurred; and (iii) the failure by the borrowers, after stabilization (i.e. until a Park West Village Whole Loan debt yield of at least 6.25% has been achieved (without taking into account any disbursement of Supplemental Income Reserve funds) for one calendar quarter, provided no event of default then exists), to maintain a Park West Village Whole Loan debt service coverage ratio of at least 1.20x and will be cured upon (a) with respect to clause (i) above, the lender accepts a cure of the event of default; (b) in the case of a bankruptcy action by or against manager only, the borrowers replace the manager with a qualified replacement as defined in the Park West Village Whole Loan documents; or (c) with respect to clause (iii) above, the Park West Village Whole Loan debt service coverage ratio is equal to or greater than 1.25x for one calendar quarter.

Subordinate Debt. The Park West Village Property also secures the Park West Village Note B-A Subordinate Companion Loan, which has a Cut-off Date principal balance of $66,500,000 and the Park West Village Note B-B Subordinate Companion Loan, which has a Cut-off Date principal balance of $111,000,000. The Park West Village Subordinate Companion Loans accrue interest at 4.65000% per annum. The Park West Village Senior Loan is senior in right of payment to the Park West Village Note B-A Subordinate Companion Loan and the Park West Village Note B-B Subordinate Companion Loan, and the Park West Village Note B-A Subordinate Companion Loan is senior in right of payment to the Park West Village Note B-B Subordinate Companion Loan.

| Whole Loan Metrics |

| | % of Whole Loan | Cumulative Cut-off Date LTV | Cumulative UW NOI Debt Yield(1) | Cumulative UW NCF DSCR(1) |

| A Notes | 51.4% | 32.6% | 12.3% | 2.60x |

| B-A Note | 18.2% | 44.2% | 9.1% | 1.92x |

| B-B Note | 30.4% | 63.5% | 6.3% | 1.34x |

| (1) | The UW NOI and UW NCF includes disbursements from a Supplemental Income Reserve of $4,920,000. Please refer to “Escrows and Reserves” above. |

Mezzanine Debt. None.

Partial Release. Not permitted.

Ground Lease. None.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 17 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

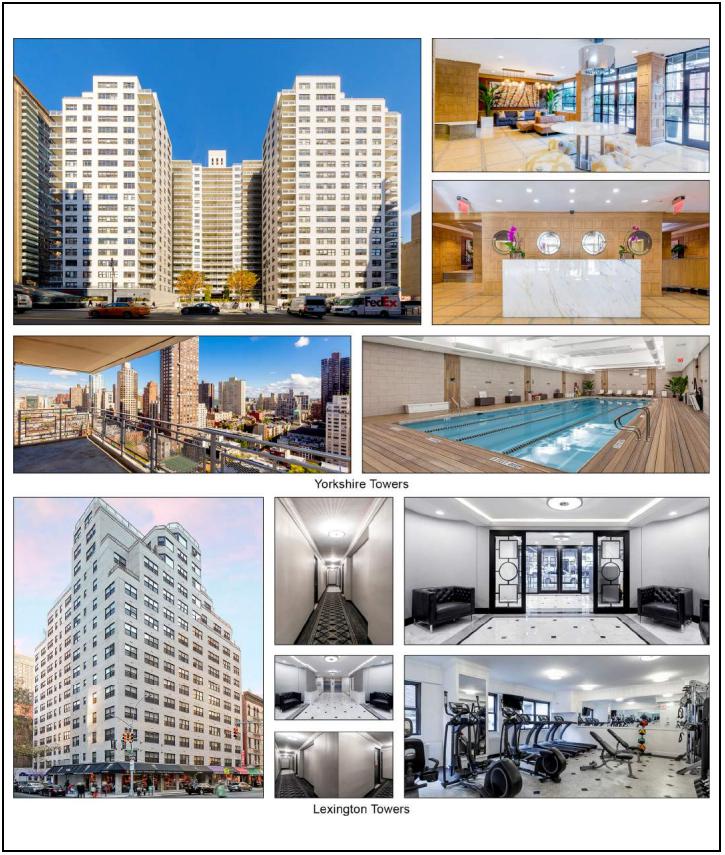

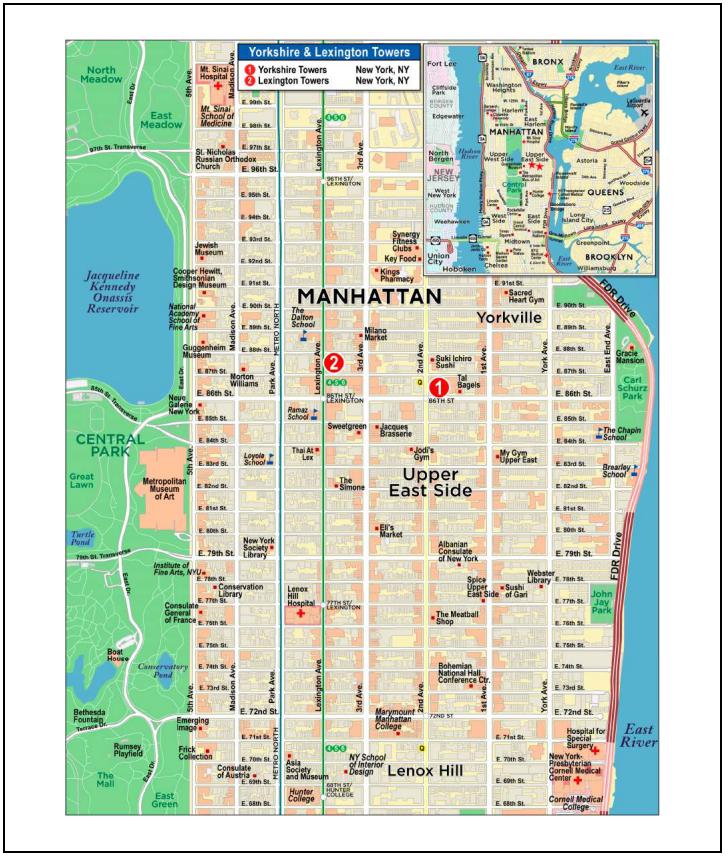

| No. 2 – Kingston Square Apartments |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 18 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 2 – Kingston Square Apartments |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 19 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 2 – Kingston Square Apartments |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | BMO | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $37,000,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $37,000,000 | | Property Type – Subtype: | Multifamily – Garden |

| % of IPB: | 5.1% | | Net Rentable Area (Units): | 523 |

| Loan Purpose: | Recapitalization | | Location: | Indianapolis, IN |

| Borrower: | Kingston Property Owner LLC | | Year Built / Renovated: | 1963, 1992, 1995 / 2020-2022 |

| Borrower Sponsor: | Joel Werzberger | | Occupancy: | 96.9% |

| Interest Rate: | 5.82000% | | Occupancy Date: | 8/18/2022 |

| Note Date: | 8/25/2022 | | 4th Most Recent NOI (As of): | $3,413,361 (12/31/2019) |

| Maturity Date: | 9/6/2032 | | 3rd Most Recent NOI (As of): | $3,414,143 (12/31/2020) |

| Interest-only Period: | 120 months | | 2nd Most Recent NOI (As of): | $4,206,794 (12/31/2021) |

| Original Term: | 120 months | | Most Recent NOI (As of): | $4,433,434 (TTM 7/31/2022) |

| Original Amortization Term: | None | | UW Economic Occupancy: | 95.0% |

| Amortization Type: | Interest Only | | UW Revenues: | $6,548,668 |

| Call Protection(2): | L(25),D(91),O(4) | | UW Expenses: | $1,853,250 |

| Lockbox / Cash Management: | Springing / Springing | | UW NOI: | $4,695,418 |

| Additional Debt(1): | Yes | | UW NCF: | $4,590,818 |

| Additional Debt Balance(1): | $14,000,000 | | Appraised Value / Per Unit: | $85,700,000 / $163,862 |

| Additional Debt Type(1): | Pari Passu | | Appraisal Date: | 8/1/2022 |

| | | | | |

| Escrows and Reserves(3) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / Unit: | $97,514 |

| Taxes: | $154,550 | $25,069 | N/A | | Maturity Date Loan / Unit: | $97,514 |

| Insurance: | $0 | Springing | N/A | | Cut-off Date LTV: | 59.5% |

| Replacement Reserves: | $0 | $8,717 | N/A | | Maturity Date LTV: | 59.5% |

| Deferred Maintenance: | $110,375 | $0 | N/A | | UW NCF DSCR: | 1.53x |

| | | | | | UW NOI Debt Yield: | 9.2% |

| | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Tot | al |

| Mortgage Loan | $51,000,000 | 77.3 | % | | Loan Payoff | $35,230,067 | 53.4 | % |

| Borrower Sponsor Equity(4) | 15,000,000 | 22.7 | | | Partnership Buyout(4) | 15,000,000 | 22.7 | |

| | | | | Principal Equity Distribution | 14,898,788 | 22.6 | |

| | | | | Closing Costs | 606,220 | 0.9 | |

| | | | | Upfront Reserves | 264,925 | 0.4 | |

| Total Sources | $66,000,000 | 100.0 | % | | Total Uses | $66,000,000 | 100.0 | % |

| (1) | The Kingston Square Apartments Mortgage Loan (as defined below) is part of a whole loan evidenced by four pari passu notes with an aggregate original principal balance of $51,000,000. Financial Information in the chart above reflects the Cut-off Date balance of the Kingston Square Apartments Whole Loan (as defined below). For additional information, see “The Loan” below. |

| (2) | Defeasance of the Kingston Square Apartments Whole Loan is permitted at any time after the earlier to occur of (a) the end of the two-year period commencing on the closing date of the securitization of the last promissory note representing a portion of the Kingston Square Apartments Whole Loan to be securitized and (b) August 25, 2026. The assumed defeasance lockout period of 25 payments is based on the closing date of this transaction in October 2022. The actual lockout period may be longer. |

| (3) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. |

| (4) | Borrower Sponsor Equity contributed in order to effectuate a recapitalization of the borrower by buying out a 50% owner. |

The Loan. The second largest mortgage loan (the “Kingston Square Apartments Mortgage Loan”) is part of a whole loan (the “Kingston Square Apartments Whole Loan”) that is secured by the borrower’s fee interest in a 523-unit, garden-style multifamily property located in Indianapolis, Indiana (the “Kingston Square Apartments Property”). The Kingston Square Apartments Whole Loan is comprised of four pari passu notes, with an aggregate outstanding principal balance as of the Cut-off Date of $51,000,000. The Kingston Square Apartments Mortgage Loan is evidenced by the controlling Note A-1 and the non-controlling note A-3 with an aggregate outstanding principal balance as of the Cut-off Date of $37,000,000 and represents approximately 5.1% of the Initial Pool Balance.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 20 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 2 – Kingston Square Apartments |

The Kingston Square Apartments Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BMO 2022-C3 securitization. The Kingston Square Apartments Whole Loan was originated on August 25, 2022 by Bank of Montreal (“BMO”) and accrues interest at a fixed rate of 5.82000% per annum. The Kingston Square Apartments Whole Loan has an initial term of 120 months, a remaining term of 119 months and is interest-only for the full term. The scheduled maturity date of the Kingston Square Apartments Whole Loan is the due date that occurs in September 2032. The proceeds of the Kingston Square Apartments Whole Loan were used to recapitalize the Kingston Square Apartments Property, pay origination costs, fund upfront reserves and return equity to the borrower sponsors.

The table below summarizes the promissory notes that comprise the Kingston Square Apartments Whole Loan. The relationship between the holders of the Kingston Square Apartments Whole Loan is governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” in the Preliminary Prospectus.

| Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | | Note Holder | Controlling Piece |

| A-1 | $30,000,000 | $30,000,000 | | BMO 2022-C3 | Yes |

| A-2(1) | $10,000,000 | $10,000,000 | | BMO | No |

| A-3 | $7,000,000 | $7,000,000 | | BMO 2022-C3 | No |

| A-4(1) | $4,000,000 | $4,000,000 | | BMO | No |

| Whole Loan | $51,000,000 | $51,000,000 | | | |

| (1) | Expected to be contributed to one or more future securitization(s). |

The Property. The Kingston Square Apartments Property consists of 25, two-story multifamily buildings, totaling 523 residential units and four, one-to-two-story non-residential buildings. The Kingston Square Apartments Property is located in Indianapolis, Indiana and is situated approximately one mile from Interstate 465, approximately three miles from Interstate 70, approximately five miles from U.S. Route 40, and approximately eight miles from Interstates 74 and 65. The Kingston Square Apartments Property was built in 1963, 1992, and 1995, and features a range of studio, one-bedroom, two-bedroom, and three-bedroom residential units. The Kingston Square Apartments Property units all feature faux-wood vinyl, vinyl tile and carpet flooring, air conditioning, full kitchen appliances, laminate countertops and certain units include a private balcony or patio. Community spaces include a barbecue/picnic area, business center, clubhouse, fitness center, playground, and pool. The Kingston Square Apartments Property consists of 753 parking spaces resulting in a ratio of approximately 1.4 parking spaces per unit.

The following table presents detailed information with respect to the unit mix at the Kingston Square Apartments Property:

| Unit Mix Summary(1) |

| Unit Type | No. of Units | % of Total | Average Unit Size (SF) | Average Monthly Rental Rate | Average Monthly Rental Rate per SF | Average Monthly Market Rental Rate | Average Monthly Market Rental Rate per SF |

| Studio Standard | 68 | 13.0 | % | 650 | $786 | $1.21 | $788 | $1.21 |

| Studio Lavish | 4 | 0.8 | | 650 | $773 | $1.19 | $799 | $1.23 |

| 1 Bedroom Standard | 212 | 40.5 | | 700 | $859 | $1.23 | $876 | $1.25 |

| 1 Bedroom Lavish | 4 | 0.8 | | 700 | $931 | $1.33 | $876 | $1.25 |

| 2 Bedroom Standard | 140 | 26.8 | | 800 | $996 | $1.24 | $1,016 | $1.27 |

| 2 Bedroom Lavish | 4 | 0.8 | | 800 | $1,041 | $1.30 | $1,240 | $1.55 |

| 2 Bedroom Townhome | 28 | 5.4 | | 950 | $1,215 | $1.28 | $1,240 | $1.30 |

| 3 Bedroom Lavish | 63 | 12.0 | | 1,050 | $1,301 | $1.24 | $1,326 | $1.26 |

| Total/Wtd. Avg. | 523 | 100.0 | % | 776 | $963 | $1.24 | $978 | $1.26 |

| (1) | Based on the underwritten rent roll as of August 18, 2022. Average Monthly Rental Rate and Average Monthly Rental Rate per SF reflect average monthly in-place rent for occupied units. |

COVID-19 Update. As of August 15, 2022, the Kingston Square Apartments Property was open and operating. As of the date of this term sheet, the Kingston Square Apartments Whole Loan is not subject to any forbearance, modification or debt service relief request. The first payment date of the Kingston Square Apartments Whole Loan was September 6, 2022.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 21 | |

| Structural and Collateral Term Sheet | | BMO 2022-C3 |

| |

| No. 2 – Kingston Square Apartments |

Environmental. According to the Phase I report dated August 4, 2022, there was no evidence of any recognized environmental conditions at the Kingston Square Apartments Property.

The following table presents certain information relating to the historical and current occupancy of the Kingston Square Apartments Property: