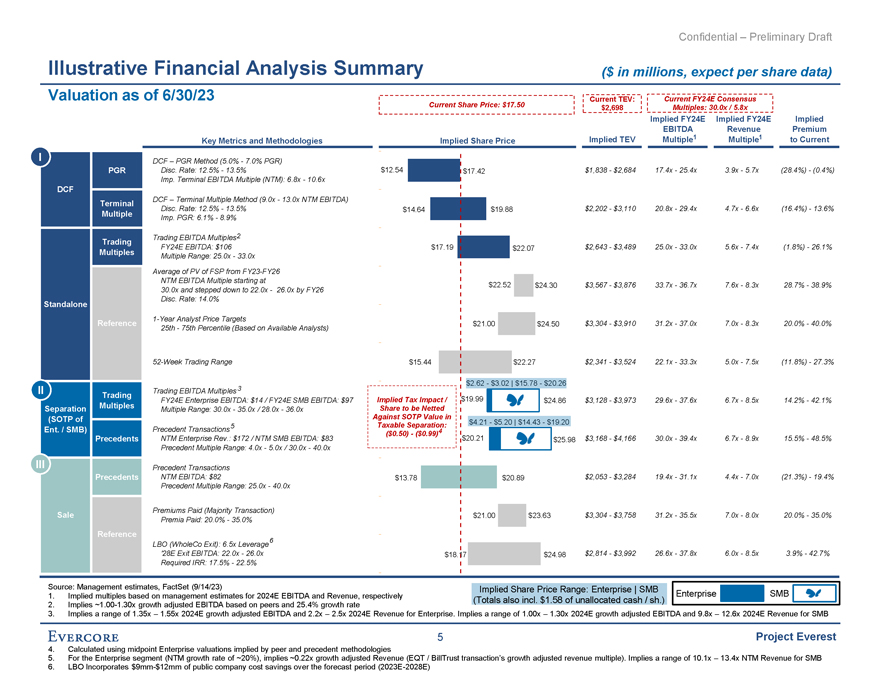

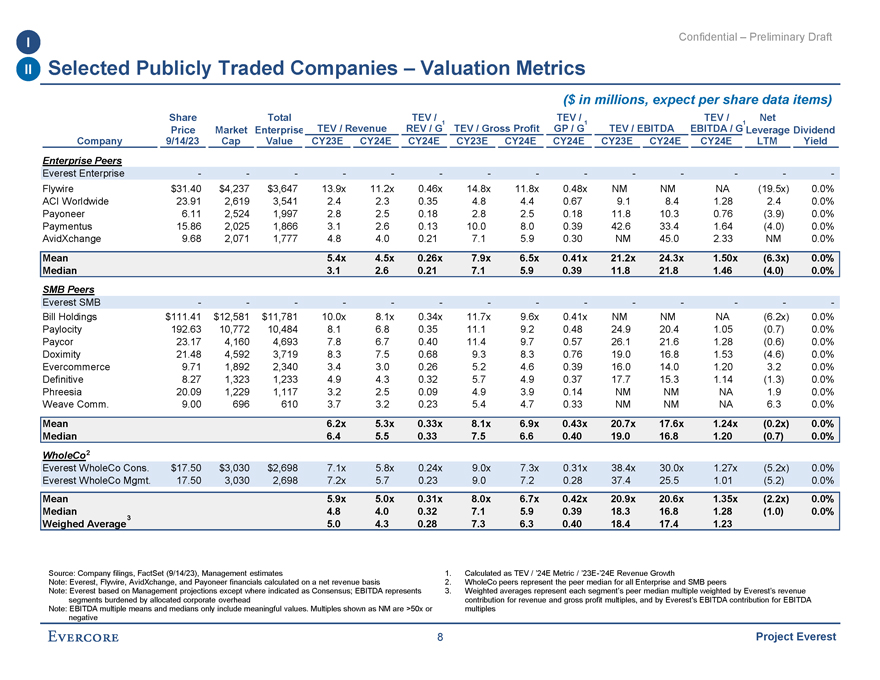

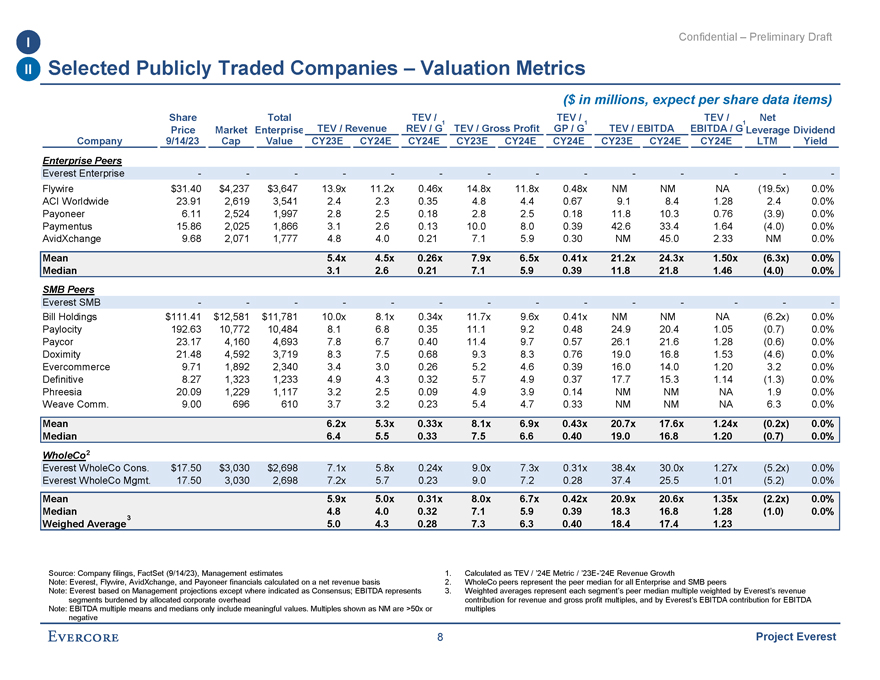

I Confidential – Preliminary Draft II Selected Publicly Traded Companies – Valuation Metrics ($ in millions, expect per share data items) Share Total TEV / TEV / TEV / Net 1 1 1 Price Market Enterprise TEV / Revenue REV / G TEV / Gross Profit GP / G TEV / EBITDA EBITDA / G Leverage Dividend Company 9/14/23 Cap Value CY23E CY24E CY24E CY23E CY24E CY24E CY23E CY24E CY24E LTM Yield Enterprise Peers Everest Enterprise Flywire $31.40 $4,237 $3,647 13.9x 11.2x 0.46x 14.8x 11.8x 0.48x NM NM NA (19.5x) 0.0% ACI Worldwide 23.91 2,619 3,541 2.4 2.3 0.35 4.8 4.4 0.67 9.1 8.4 1.28 2.4 0.0% Payoneer 6.11 2,524 1,997 2.8 2.5 0.18 2.8 2.5 0.18 11.8 10.3 0.76 (3.9) 0.0% Paymentus 15.86 2,025 1,866 3.1 2.6 0.13 10.0 8.0 0.39 42.6 33.4 1.64 (4.0) 0.0% AvidXchange 9.68 2,071 1,777 4.8 4.0 0.21 7.1 5.9 0.30 NM 45.0 2.33 NM 0.0% Mean 5.4x 4.5x 0.26x 7.9x 6.5x 0.41x 21.2x 24.3x 1.50x (6.3x) 0.0% Median 3.1 2.6 0.21 7.1 5.9 0.39 11.8 21.8 1.46 (4.0) 0.0% SMB Peers Everest SMB Bill Holdings $111.41 $12,581 $11,781 10.0x 8.1x 0.34x 11.7x 9.6x 0.41x NM NM NA (6.2x) 0.0% Paylocity 192.63 10,772 10,484 8.1 6.8 0.35 11.1 9.2 0.48 24.9 20.4 1.05 (0.7) 0.0% Paycor 23.17 4,160 4,693 7.8 6.7 0.40 11.4 9.7 0.57 26.1 21.6 1.28 (0.6) 0.0% Doximity 21.48 4,592 3,719 8.3 7.5 0.68 9.3 8.3 0.76 19.0 16.8 1.53 (4.6) 0.0% Evercommerce 9.71 1,892 2,340 3.4 3.0 0.26 5.2 4.6 0.39 16.0 14.0 1.20 3.2 0.0% Definitive 8.27 1,323 1,233 4.9 4.3 0.32 5.7 4.9 0.37 17.7 15.3 1.14 (1.3) 0.0% Phreesia 20.09 1,229 1,117 3.2 2.5 0.09 4.9 3.9 0.14 NM NM NA 1.9 0.0% Weave Comm. 9.00 696 610 3.7 3.2 0.23 5.4 4.7 0.33 NM NM NA 6.3 0.0% Mean 6.2x 5.3x 0.33x 8.1x 6.9x 0.43x 20.7x 17.6x 1.24x (0.2x) 0.0% Median 6.4 5.5 0.33 7.5 6.6 0.40 19.0 16.8 1.20 (0.7) 0.0% WholeCo2 Everest WholeCo Cons. $17.50 $3,030 $2,698 7.1x 5.8x 0.24x 9.0x 7.3x 0.31x 38.4x 30.0x 1.27x (5.2x) 0.0% Everest WholeCo Mgmt. 17.50 3,030 2,698 7.2x 5.7 0.23 9.0 7.2 0.28 37.4 25.5 1.01 (5.2) 0.0% Mean 5.9x 5.0x 0.31x 8.0x 6.7x 0.42x 20.9x 20.6x 1.35x (2.2x) 0.0% Median 3 4.8 4.0 0.32 7.1 5.9 0.39 18.3 16.8 1.28 (1.0) 0.0% Weighed Average 5.0 4.3 0.28 7.3 6.3 0.40 18.4 17.4 1.23 Source: Company filings, FactSet (9/14/23), Management estimates 1. Calculated as TEV / ’24E Metric / ’23E-’24E Revenue Growth Note: Everest, Flywire, AvidXchange, and Payoneer financials calculated on a net revenue basis 2. WholeCo peers represent the peer median for all Enterprise and SMB peers Note: Everest based on Management projections except where indicated as Consensus; EBITDA represents 3. Weighted averages represent each segment’s peer median multiple weighted by Everest’s revenue segments burdened by allocated corporate overhead contribution for revenue and gross profit multiples, and by Everest’s EBITDA contribution for EBITDA Note: EBITDA multiple means and medians only include meaningful values. Multiples shown as NM are >50x or multiples negative 8 Project Everest