As requested, prices used in this report are based on the 12-month unweighted arithmetic average of the first-day-of-the-month price for each month in the period January through December 2020. For oil and NGL volumes, the average Brent spot price of $41.77 per barrel is adjusted for quality, transportation fees, and market differentials. All prices are held constant throughout the lives of the properties.

Operating costs used in this report are based on operating expense records of Bridge, the operator of the properties, and include only direct lease- and field-level costs. Operating costs have been divided into field-level costs, per-well costs, and per-unit-of-production costs. As requested, these costs do not include the per-well overhead expenses allowed under joint operating agreements, nor do they include the headquarters general and administrative overhead expenses of Bridge. Also as requested, operating costs are not escalated for inflation.

Capital costs used in this report were provided by Bridge and are based on authorizations for expenditure and actual costs from recent activity. Capital costs are included as required for workovers, a new development well, and production equipment. Based on our understanding of future development plans, a review of the records provided to us, and our knowledge of similar properties, we regard these estimated capital costs to be reasonable. Abandonment costs used in this report are Bridge’s estimates of the costs to abandon the wells and production facilities, net of any salvage value. As requested, capital costs and abandonment costs are not escalated for inflation.

For the purposes of this report, we did not perform any field inspection of the properties, nor did we examine the mechanical operation or condition of the wells and facilities. We have not investigated possible environmental liability related to the properties; therefore, our estimates do not include any costs due to such possible liability. Additionally, we have made no specific investigation of any firm transportation contracts that may be in place for these properties; our estimates of future revenue include the effects of such contracts only to the extent that the associated fees are accounted for in the historical field- and lease-level accounting statements.

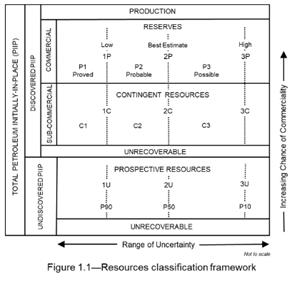

The reserves shown in this report are estimates only and should not be construed as exact quantities. Proved reserves are those quantities of oil and gas which, by analysis of engineering and geoscience data, can be estimated with reasonable certainty to be commercially recoverable; probable and possible reserves are those additional reserves which are sequentially less certain to be recovered than proved reserves. Estimates of reserves may increase or decrease as a result of market conditions, future operations, changes in regulations, or actual reservoir performance. In addition to the primary economic assumptions discussed herein, our estimates are based on certain assumptions including, but not limited to, that the properties will be developed consistent with current development plans as provided to us by Bridge, that the properties will be operated in a prudent manner, that no governmental regulations or controls will be put in place that would impact the ability of the interest owner to recover the reserves, and that our projections of future production will prove consistent with actual performance. If the reserves are recovered, the revenues therefrom and the costs related thereto could be more or less than the estimated amounts. Because of governmental policies and uncertainties of supply and demand, the sales rates, prices received for the reserves, and costs incurred in recovering such reserves may vary from assumptions made while preparing this report.

For the purposes of this report, we used technical and economic data including, but not limited to, well logs, geologic maps, well test data, production data, historical price and cost information, and property ownership interests. The reserves in this report have been estimated using deterministic methods; these estimates have been prepared in accordance with generally accepted petroleum engineering and evaluation principles set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the SPE (SPE Standards). We used standard engineering and geoscience methods, or a combination of methods, including performance analysis and analogy, that we considered to be appropriate and necessary to classify, categorize, and estimate reserves in accordance with the 2018 PRMS definitions and guidelines. As in all aspects of oil and gas evaluation, there are uncertainties inherent in the interpretation of engineering and geoscience data; therefore, our conclusions necessarily represent only informed professional judgment.

The data used in our estimates were obtained from Bridge, public data sources, and the nonconfidential files of Netherland, Sewell & Associates, Inc. and were accepted as accurate. Supporting work data are on file in our office.