UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23731

BONDBLOXX ETF TRUST

(Exact name of registrant as specified in charter)

700 Larkspur Landing Circle, Suite 250, Larkspur, CA 94939

(Address of principal executive offices)(Zip code)

BondBloxx Investment Management Corporation

700 Larkspur Landing Circle, Suite 250

Larkspur, CA 94939

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 896-5089

Date of fiscal year end:

October 31

Date of reporting period:

October 31, 2022

ITEM 1. REPORTS TO STOCKHOLDERS.

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). |

BondBloxxSM ETF Trust

Annual Report

October 31, 2022

BondBloxx USD High Yield Bond Industrial Sector ETF | XHYI | NYSE Arca

BondBloxx USD High Yield Bond Telecom, Media & Technology Sector ETF | XHYT | NYSE Arca

BondBloxx USD High Yield Bond Healthcare Sector ETF | XHYH | NYSE Arca

BondBloxx USD High Yield Bond Financial & REIT Sector ETF | XHYF | NYSE Arca

BondBloxx USD High Yield Bond Energy Sector ETF | XHYE | NYSE Arca

BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF | XHYC | NYSE Arca

BondBloxx USD High Yield Bond Consumer Non-Cyclicals Sector ETF | XHYD | NYSE Arca

BondBloxx B Rated USD High Yield Corporate Bond ETF | XB | NYSE Arca

BondBloxx BB Rated USD High Yield Corporate Bond ETF | XBB | NYSE Arca

BondBloxx CCC Rated USD High Yield Corporate Bond ETF | XCCC | NYSE Arca

BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF | XEMD | Cboe BZX

BondBloxx Bloomberg Six Month Target Duration US Treasury ETF | XHLF | NYSE Arca

BondBloxx Bloomberg One Year Target Duration US Treasury ETF | XONE | NYSE Arca

BondBloxx Bloomberg Two Year Target Duration US Treasury ETF | XTWO | NYSE Arca

BondBloxx Bloomberg Three Year Target Duration US Treasury ETF | XTRE | NYSE Arca

BondBloxx Bloomberg Five Year Target Duration US Treasury ETF | XFIV | NYSE Arca

BondBloxx Bloomberg Seven Year Target Duration US Treasury ETF | XSVN | NYSE Arca

BondBloxx Bloomberg Ten Year Target Duration US Treasury ETF | XTEN | NYSE Arca

BondBloxx Bloomberg Twenty Year Target Duration US Treasury ETF | XTWY | NYSE Arca

This report is intended for the Funds’ shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current prospectus.

Table of Contents

BONDBLOXX ETF TRUST

Shareholder Letter (Unaudited)

Dear Valued Shareholders,

We are grateful to have earned your trust as a client this year. The following shareholder letter covers the period ended October 31, 2022.

In 2022, global equity and bond markets faced a variety of headwinds. Accelerating inflation, Russia’s invasion of Ukraine, and aggressive monetary tightening policies by the Federal Reserve (the “Fed”) were all contributors to one of the largest yearly declines in U.S. financial markets. Major U.S. stock indices moved decidedly into bear market territory, and the fixed income markets, which typically provide some diversification against declining equity prices, also declined as the Fed remained committed to raising rates to combat inflation.

U.S. inflation, as measured by the Consumer Price Index, reaching a forty-year high of 9.1% during the second quarter of 2022, prompted the Fed to acknowledge it misread the inflationary environment. The Fed has since accelerated its efforts to reduce inflation with a dedicated campaign to boost interest rates by raising the federal funds target rate range to 3.75%-4.00% at the end of November, from 0.25%-0.50% at the beginning of the year. These Fed actions and its continued hawkish tone regarding further rate hikes, in combination with the persistently high inflation data that has been released, caused significant volatility in the financial markets as the risk of recession rose and investors turned bearish, despite strong employment statistics and robust corporate balance sheets.

Amid these challenging market conditions, BondBloxx remained committed to our only mission, helping investors seize opportunities in fixed income markets. We are focused on expanding the universe of fixed income ETFs so that investors can design, build and manage portfolios with greater efficiency and precision. Towards that end, we engineered and launched 19 ETFs that offer investors unique market exposures to fixed income asset classes, including 7 high yield industry sector ETFs, 3 high yield credit rating category ETFs, 8 target duration U.S. Treasury ETFs, and 1 emerging market sovereign debt ETF.

We expect that the market environment over the next 10 years will bring a dramatic increase in portfolio allocations to bonds. As the only ETF issuer solely committed to making the fixed income investor our first and only priority, we believe that BondBloxx has just scratched the surface of the opportunities to empower investors with better products and technologies. We continually ask fixed income investors what they need and respond with thoughtfully designed tools that allow them to express active views in their portfolio construction. Now more than ever, the fixed income positioning decisions that investors make can have material performance and risk implications for their portfolios. The time has come to put fixed income first.

From everyone at BondBloxx I want to share our sincere appreciation for your support and partnership. We wish you a joyous holiday season and a new year full of health, happiness and success.

Joanna Gallegos

President, BondBloxx ETF Trust

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited)

High Yield Sectors

The key themes driving fixed income markets during 2022 were inflation pressures, rising interest rates, and a softening economic outlook - all against a backdrop of surging demand, cost pressures resulting from supply chain challenges, and impacts from Russia’s invasion of Ukraine.

As the economy continued to recover from the shutdowns due to the Covid-19 crisis, problems with global supply chains could not keep up with the surge in demand for goods and services. This led to rising price pressures and tight U.S. employment conditions. Russia’s invasion of Ukraine in Q1 2022 put additional upward pressure on prices, especially for oil and other commodity goods. U.S. inflation, as measured by the Consumer Price Index (“CPI”), was already growing by over +7% year-over-year at the end of 2021, and continued to accelerate in the early part of 2022, reaching a forty-year high of +9.1% in June, significantly above the target set by the U.S. Federal Reserve (“Fed”).

In an effort to combat surging inflation, the Fed embarked on an aggressive campaign of boosting policy rates, raising the Federal Funds Target Rate by +3.0%, from a level of 0.25% at the end of 2021 to 3.25% by October 31, 2022. The Fed’s actions and hawkish commentary regarding further interest rate actions, in combination with persistently high price pressures, caused economic growth to slow and financial markets to react negatively as investors turned more cautious. U.S. GDP slowed from the previous year, Treasury yields rose, yield spreads on credit securities widened, and equities reported negative returns.

U.S. high yield bonds traded down in 2022, generating negative returns, as the investment environment became more challenging as a result of aggressive Fed policy, higher prices and cost pressures, and an increasingly unfavorable outlook for economic growth. While higher than the previous year, high yield default rates remained below long-term averages throughout 2022, and supply-and-demand factors provided a positive backdrop as the amount of newly issued debt fell over 75% from the previous year.

As measured by the BofA Ice Cash Pay High Yield Constrained Index, a broad benchmark of the asset class, U.S. high yield returned -12.1% for the year-to-date period ending October 31, 2022. Returns were volatile, with strongly positive as well as negative months during this ten-month period.

U.S. high yield experienced a high level of variance between different industry sectors during 2022. Above-average oil prices helped support cash flows and balance sheets of many companies in the energy sector, insulating it from negative macroeconomic pressures relative to other sectors. Cost pressures and specific credit issues had a pronounced impact on the healthcare sector, while a slowing economic outlook and the growing risk of recession negatively impacted the consumer cyclical sector. Conversely, the diversified core industrial sector held up better than average.

BONDBLOXX ETF TRUST

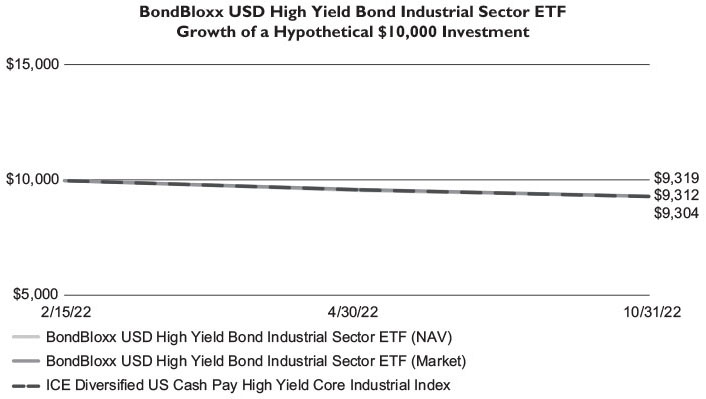

BondBloxx USD High Yield Bond Industrial Sector ETF

Fund Performance Overview (Unaudited) (Continued)

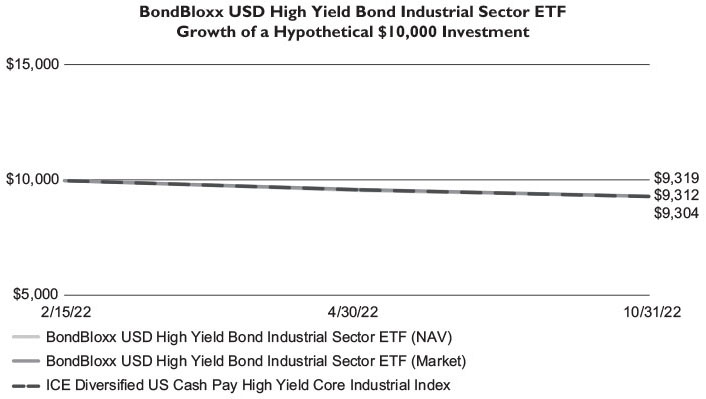

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Industrial Sector ETF (XHYI) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Core Industrial Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx USD High Yield Bond | | Since |

| Industrial Sector ETF | | Inception(2) |

| Net Asset Value | | (6.81)% |

| Market Value | | (6.88)% |

| ICE Diversified US Cash Pay High Yield | | |

| Core Industrial Index | | (6.96)% |

| (1) | The ICE Diversified US Cash Pay High Yield Core Industrial Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the industrial sector, including the basic materials, capital goods, transportation and services subsectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYI were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

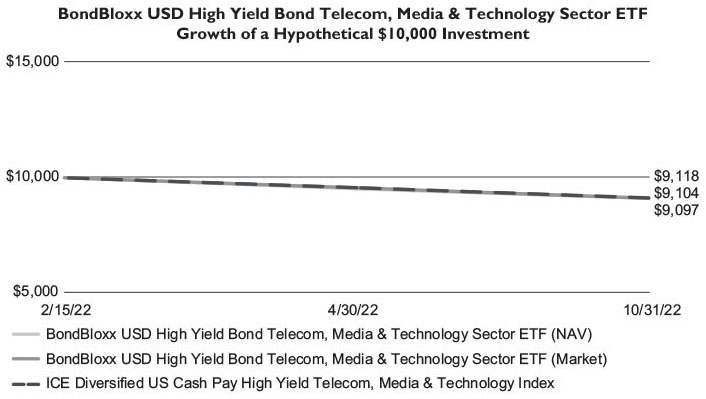

BondBloxx USD High Yield Bond Telecom, Media & Technology Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

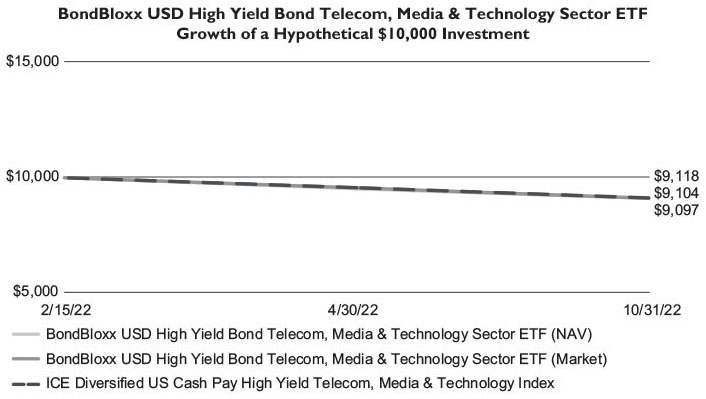

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Telecom, Media & Technology Sector ETF (XHYT) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Telecom, Media & Technology Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx USD High Yield Bond | | Since |

| Telecom, Media & Technology Sector ETF | | Inception(2) |

| Net Asset Value | | (8.96)% |

| Market Value | | (9.03)% |

| ICE Diversified US Cash Pay High Yield | | |

| Telecom, Media & Technology Index | | (8.82)% |

| (1) | The ICE Diversified US Cash Pay High Yield Telecom, Media & Technology Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the telecom, media and technology sector, including the telecommunications, technology & electronics, and media sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYT were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

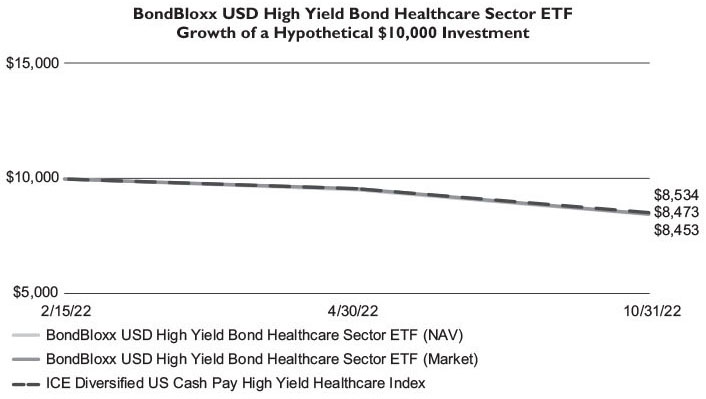

BondBloxx USD High Yield Bond Healthcare Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

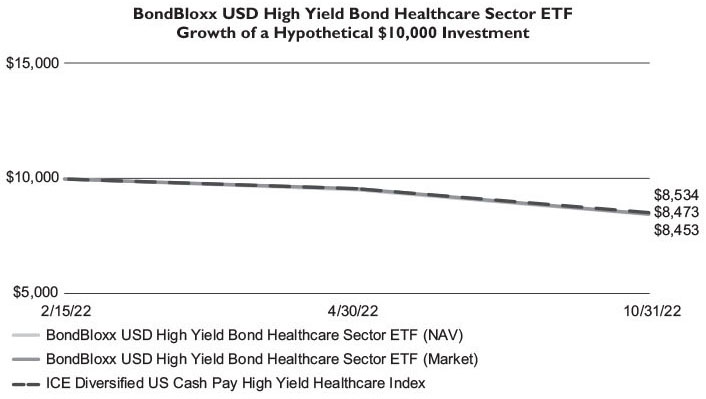

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Healthcare Sector ETF (XHYH) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Healthcare Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx USD High Yield Bond | | Since |

| Healthcare Sector ETF | | Inception(2) |

| Net Asset Value | | (15.19)% |

| Market Value | | (15.47)% |

| ICE Diversified US Cash Pay High Yield | | |

| Healthcare Index | | (14.66)% |

| (1) | The ICE Diversified US Cash Pay High Yield Healthcare Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the healthcare sector, including the health facilities, health services, managed care, medical products, and pharmaceuticals sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYH were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

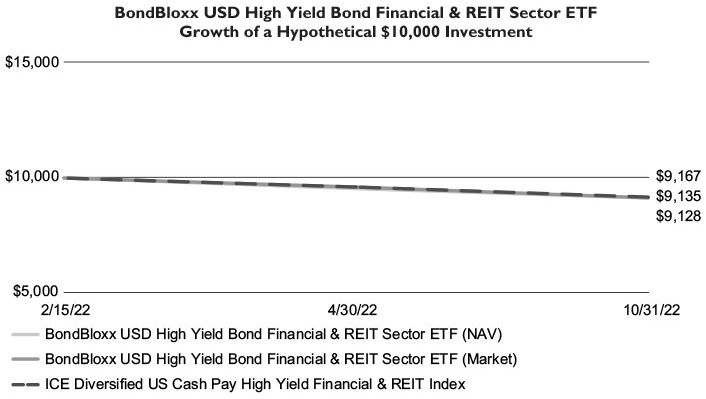

BondBloxx USD High Yield Bond Financial & REIT Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

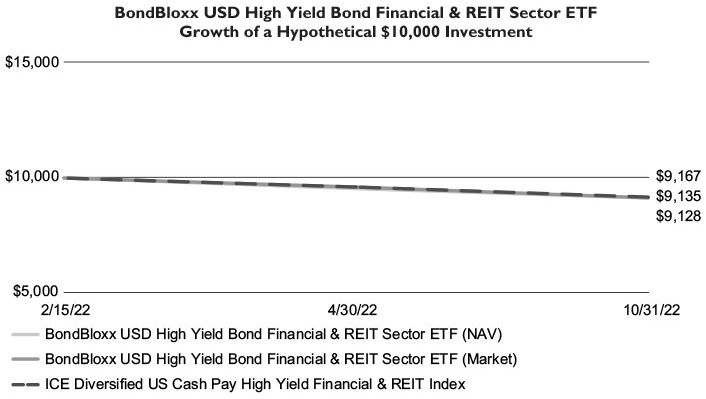

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Financial & REIT Sector ETF (XHYF) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Financial & REIT Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx USD High Yield Bond | | Since |

| Financial & REIT Sector ETF | | Inception(2) |

| Net Asset Value | | (8.65)% |

| Market Value | | (8.72)% |

| ICE Diversified US Cash Pay High Yield | | |

| Financial & REIT Index | | (8.33)% |

| (1) | The ICE Diversified US Cash Pay High Yield Financial & REIT Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the financial sector, including the banking, financial services, and insurance sub-sectors, and the REIT sector. The REIT sector is comprised solely of debt issued by real estate investment trusts. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYF were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

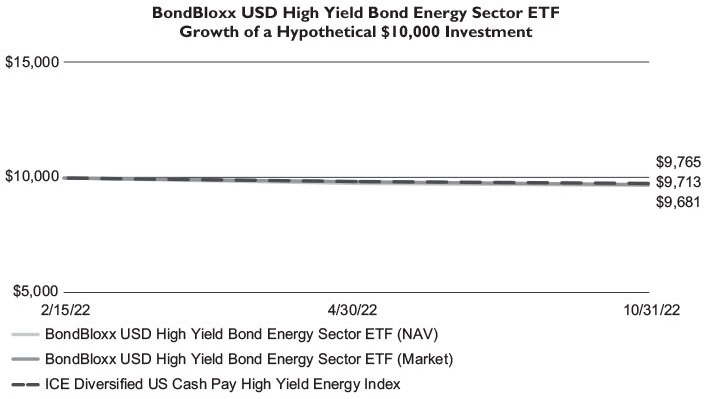

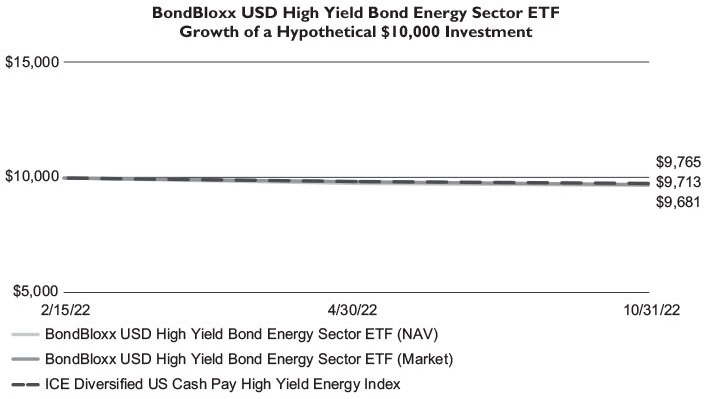

BondBloxx USD High Yield Bond Energy Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Energy Sector ETF (XHYE) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Energy Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx USD High Yield Bond | | Since |

| Energy Sector ETF | | Inception(2) |

| Net Asset Value | | (2.84)% |

| Market Value | | (3.19)% |

| ICE Diversified US Cash Pay High Yield | | |

| Energy Index | | (2.35)% |

| (1) | The ICE Diversified US Cash Pay High Yield Energy Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the energy sector, including the exploration & production, gas distribution, oil field equipment & services, and oil refining & marketing sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYE were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

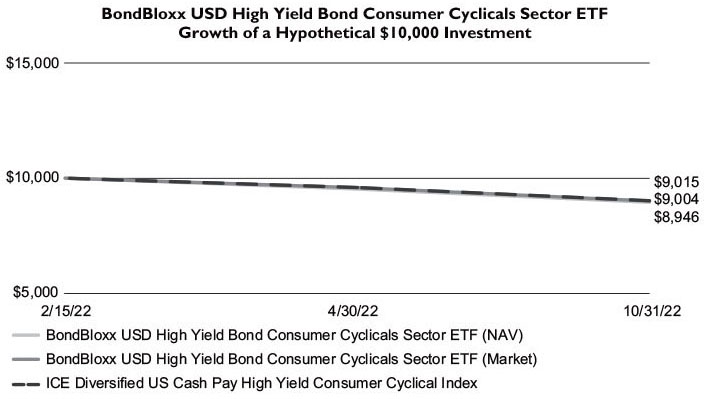

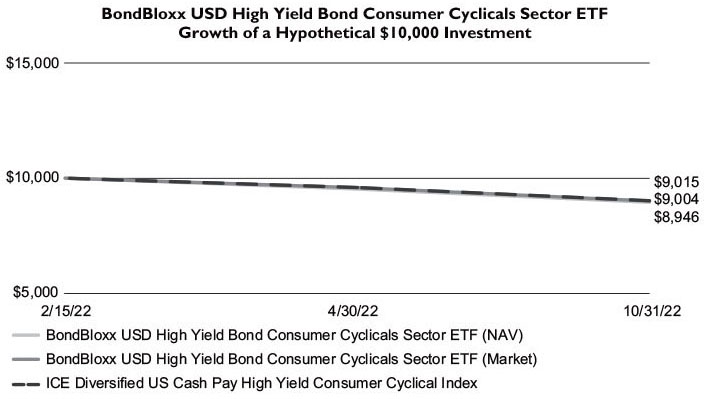

BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF (XHYC) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Consumer Cyclical Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx USD High Yield Bond | | Since |

| Consumer Cyclicals Sector ETF | | Inception(2) |

| Net Asset Value | | (9.96)% |

| Market Value | | (10.54)% |

| ICE Diversified US Cash Pay High Yield | | |

| Consumer Cyclical Index | | (9.85)% |

| (1) | The ICE Diversified US Cash Pay High Yield Consumer Cyclical Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the consumer cyclicals sector (companies whose performance is generally more closely connected to the business cycle and current economic conditions), including the automotive, leisure, real estate development & management, department stores, and specialty retail subsectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYC were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

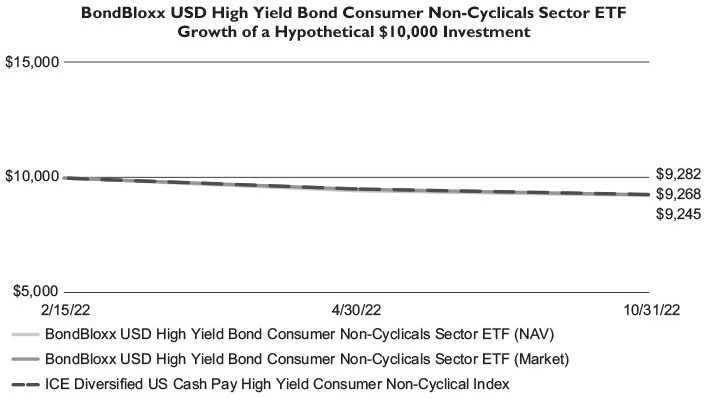

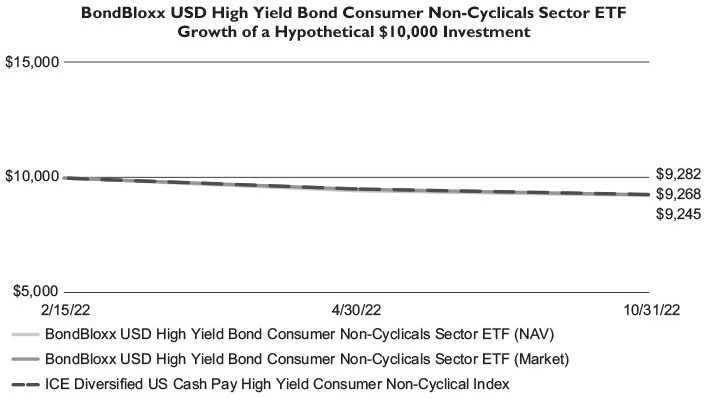

BondBloxx USD High Yield Bond Consumer Non-Cyclicals Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Consumer Non-Cyclicals Sector ETF (XHYD) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Consumer Non-Cyclical Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx USD High Yield Bond | | Since |

| Consumer Non-Cyclicals Sector ETF | | Inception(2) |

| Net Asset Value | | (7.32)% |

| Market Value | | (7.55)% |

| ICE Diversified US Cash Pay High Yield | | |

| Consumer Non-Cyclical Index | | (7.18)% |

| (1) | The ICE Diversified US Cash Pay High Yield Consumer Non-Cyclical Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the consumer non-cyclicals sector (companies whose performance is generally less closely connected to the business cycle and current economic conditions), including the consumer goods, discount stores, food & drug retail, restaurants, and utilities sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYD were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited) (Continued)

High Yield Ratings

The key themes driving fixed income markets during 2022 were inflation pressures, rising interest rates, and a softening economic outlook - all against a backdrop of surging demand, cost pressures resulting from supply chain challenges, and impacts from Russia’s invasion of Ukraine.

As the economy continued to recover from the shutdowns due to the Covid-19 crisis, problems with global supply chains could not keep up with the surge in demand for goods and services. This led to rising price pressures and tight U.S. employment conditions. Russia’s invasion of Ukraine in Q1 2022 put additional upward pressure on prices, especially for oil and other commodity goods. U.S. inflation, as measured by the Consumer Price Index (“CPI”), was already growing by over +7% year-over-year at the end of 2021, and continued to accelerate in the early part of 2022, reaching a forty-year high of +9.1% in June, significantly above the target set by the U.S. Federal Reserve (“Fed”).

In an effort to combat surging inflation, the Fed embarked on an aggressive campaign of boosting policy rates, raising the Federal Funds Target Rate by +3.0%, from a level of 0.25% at the end of 2021 to 3.25% by October 31, 2022. The Fed’s actions and hawkish commentary regarding further interest rate actions, in combination with persistently high price pressures, caused economic growth to slow and financial markets to react negatively as investors turned more cautious. U.S. GDP slowed from the previous year, Treasury yields rose, yield spreads on credit securities widened, and equities reported negative returns.

U.S. high yield bonds traded down in 2022, generating negative returns, as the investment environment became more challenging as a result of aggressive Fed policy, higher prices and cost pressures, and an increasingly unfavorable outlook for economic growth. While higher than the previous year, high yield default rates remained below long-term averages throughout 2022, and supply-and-demand factors provided a positive backdrop as the amount of newly issued debt fell over 75% from the previous year.

As measured by the BofA Ice Cash Pay High Yield Constrained Index, a broad benchmark of the asset class, U.S. high yield returned -12.1% for the year-to-date period ending October 31, 2022. Returns were volatile, with strongly positive as well as negative months during this ten-month period.

Lower rated high yield bonds underperformed in 2022 as investors shifted away from riskier assets on growing fears of falling corporate cash flows and tighter borrowing conditions. The ICE CCC US Cash Pay High Yield Constrained Index was down nearly -16% for the period from December 31, 2021 to October 31, 2022. High yield securities with higher credit ratings were less impacted by risk-averse investors, with BB and single-B rated high yield bonds returning -12% and -11%, respectively, as measured by ICE Index Services.

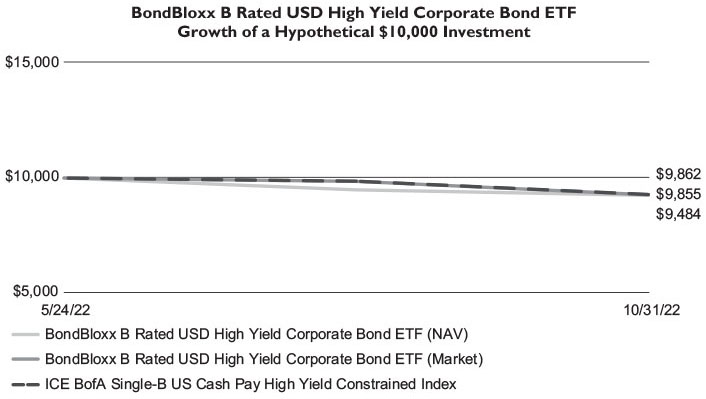

BONDBLOXX ETF TRUST

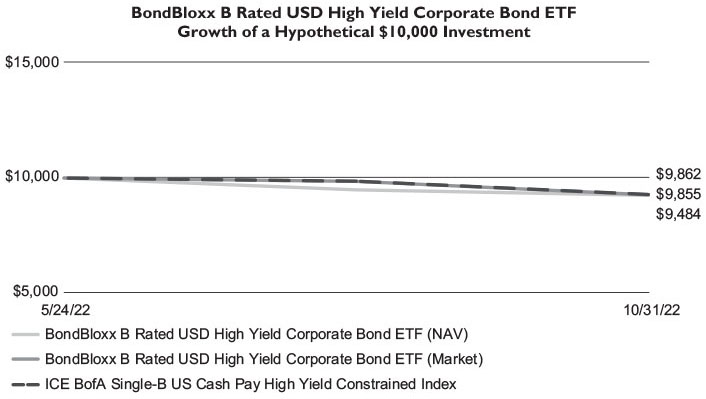

BondBloxx B Rated USD High Yield Corporate Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx B Rated USD High Yield Corporate Bond ETF (XB) at net asset value and market price as compared to the ICE BofA Single-B US Cash Pay High Yield Constrained Index(1) from the Fund’s inception date (May 24, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx B Rated USD High Yield | | Since |

| Corporate Bond ETF | | Inception(2) |

| Net Asset Value | | (1.45)% |

| Market Value | | (5.16)% |

| ICE BofA Single-B US Cash Pay High Yield | | |

| Constrained Index | | (1.38)% |

| (1) | The ICE BofA Single-B US Cash Pay High Yield Constrained Index contains all bonds in the ICE BofA US Cash Pay High Yield Index (the “Underlying Index”) that are rated B1 through B3, based on an average of Moody’s Investors Services Inc. (“Moody’s”), S&P Global Ratings (“S&P”) and Fitch Ratings, Inc. (“Fitch”), but caps issuer exposure at 2%. |

| (2) | The Fund commenced operations on May 24, 2022. Shares of XB were listed on the NYSE Arca, Inc. on May 26, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

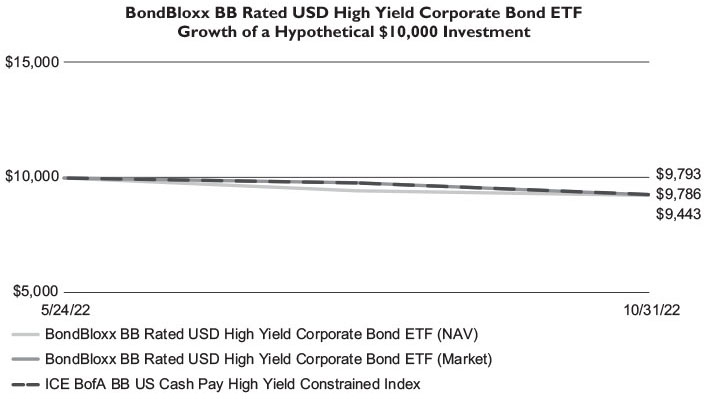

BondBloxx BB Rated USD High Yield Corporate Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

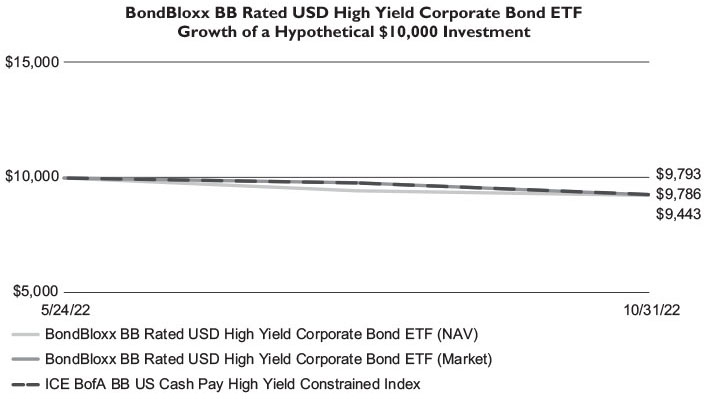

The following graph depicts the hypothetical $10,000 investment in the BondBloxx BB Rated USD High Yield Corporate Bond ETF (XBB) at net asset value and market price as compared to the ICE BofA BB US Cash Pay High Yield Constrained Index(1) from the Fund’s inception date (May 24, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx BB Rated USD High Yield | | Since |

| Corporate Bond ETF | | Inception(2) |

| Net Asset Value | | (2.07)% |

| Market Value | | (5.57)% |

| ICE BofA BB US Cash Pay High Yield | | |

| Constrained Index | | (2.14)% |

| (1) | The ICE BofA BB US Cash Pay High Yield Constrained Index contains all bonds in the ICE BofA US Cash Pay High Yield Index (the “Underlying Index”) that are rated BB1 though BB3, based on an average of Moody’s Investors Services, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) and Fitch Ratings, Inc. (“Fitch”), but caps issuer exposure at 2%. |

| (2) | The Fund commenced operations on May 24, 2022. Shares of XBB were listed on the NYSE Arca, Inc. on May 26, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

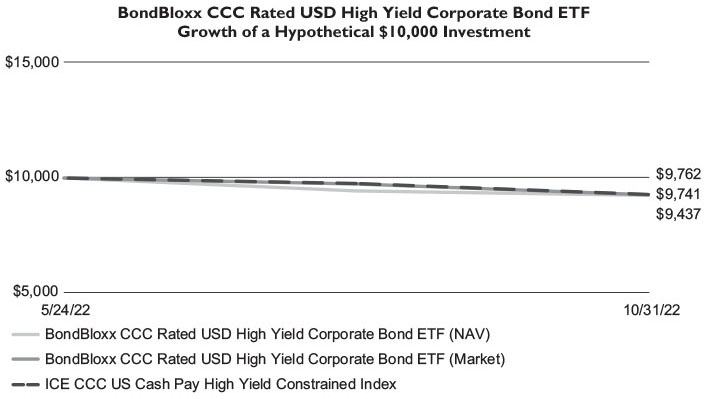

BondBloxx CCC Rated USD High Yield Corporate Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

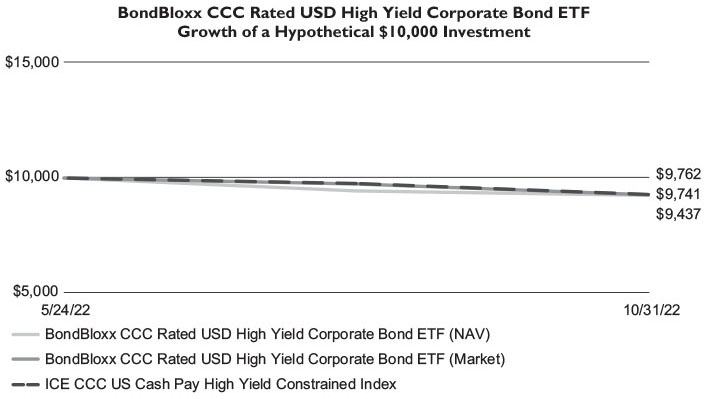

The following graph depicts the hypothetical $10,000 investment in the BondBloxx CCC Rated USD High Yield Corporate Bond ETF (XCCC) at net asset value and market price as compared to the ICE CCC US Cash Pay High Yield Constrained Index(1) from the Fund’s inception date (May 24, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx CCC Rated USD High Yield | | Since |

| Corporate Bond ETF | | Inception(2) |

| Net Asset Value | | (2.59)% |

| Market Value | | (5.63)% |

| ICE CCC US Cash Pay High Yield | | |

| Constrained Index | | (2.38)% |

| (1) | The ICE CCC US Cash Pay High Yield Constrained Index contains all bonds in the ICE BofA US Cash Pay High Yield Index (the “Underlying Index”) that are rated CCC1 through CCC3, based on an average of Moody’s Investors Services, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) and Fitch Ratings, Inc. (“Fitch”), but caps issuer exposure at 2%. |

| (2) | The Fund commenced operations on May 24, 2022. Shares of XCCC were listed on the NYSE Arca, Inc. on May 26, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited) (Continued)

Emerging Markets

The key themes driving fixed income markets during 2022 were inflation pressures, rising interest rates, and a softening economic outlook - all against a backdrop of surging demand, cost pressures resulting from supply chain challenges, and impacts from Russia’s invasion of Ukraine.

As the economy continued to recover from the shutdowns due to the Covid-19 crisis, problems with global supply chains could not keep up with the surge in demand for goods and services. This led to rising price pressures and tight U.S. employment conditions. Russia’s invasion of Ukraine in Q1 2022 put additional upward pressure on prices, especially for oil and other commodity goods. U.S. inflation, as measured by the Consumer Price Index (“CPI”), was already growing by over +7% year-over-year at the end of 2021, and continued to accelerate in the early part of 2022, reaching a forty-year high of +9.1% in June, significantly above the target set by the U.S. Federal Reserve (“Fed”).

In an effort to combat surging inflation, the Fed embarked on an aggressive campaign of boosting policy rates, raising the Federal Funds Target Rate by +3.0%, from a level of 0.25% at the end of 2021 to 3.25% by October 31, 2022. The Fed’s actions and hawkish commentary regarding further interest rate actions, in combination with persistently high price pressures, caused economic growth to slow and financial markets to react negatively as investors turned more cautious. U.S. GDP slowed from the previous year, Treasury yields rose, yield spreads on credit securities widened, and equities reported negative returns.

The performance of emerging markets debt during 2022 was driven by rising inflation, tighter global monetary policy, a stronger U.S. dollar, and growing risk of recession. The geopolitical and inflationary shock from Russia’s invasion of Ukraine in Q1 2022 added to a risk-averse investment environment that affected emerging markets debt. During the year-to-date period ending October 31, 2022, U.S. dollar-denominated emerging markets debt returned -23.8%, as measured by the JP Morgan EMBI Global Diversified Index. While most of this negative return was due to rising U.S. Treasury yields, returns were adversely impacted by a +1.74% rise in the yield spread between emerging markets debt and equivalent Treasuries over this period.

Securities with shorter-dated maturities did not experience the same level of negative performance as longer dated bonds, as evidenced by the -18.7% return of the JP Morgan EMBI Global Diversified 1-10 Liquid Index, which excludes securities with maturities over ten years. On average, the sovereign debt of countries based in the Middle East fared better than the rest of the asset class, as the rise in oil prices bolstered their fiscal health. Conversely, countries based in Europe were harder hit on average by the increase in oil and commodity prices. Countries based in Africa, Asia, and Latin American in aggregate performed closer to the average.

BONDBLOXX ETF TRUST

BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

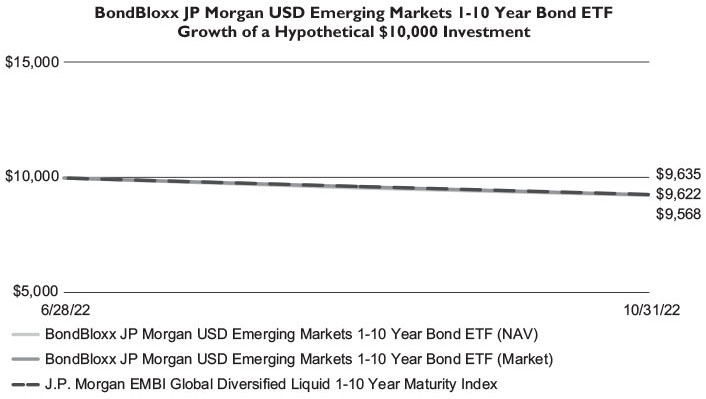

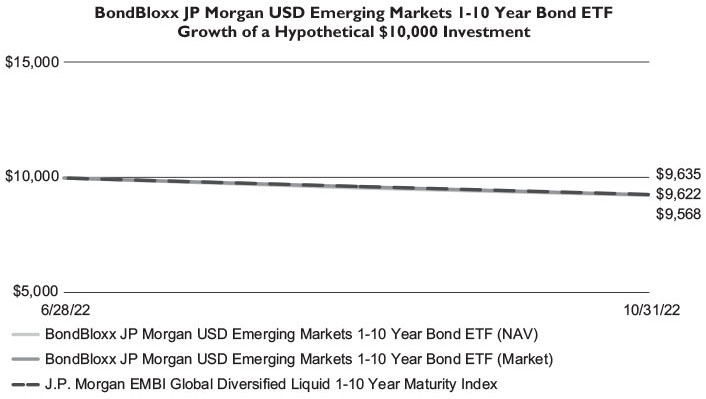

The following graph depicts the hypothetical $10,000 investment in the BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD) at net asset value and market price as compared to the J.P. Morgan EMBI Global Diversified Liquid 1-10 Year Maturity Index(1) from the Fund’s inception date (June 28, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx JP Morgan USD Emerging Markets | | Since |

| 1-10 Year Bond ETF | | Inception(2) |

| Net Asset Value | | (3.78)% |

| Market Value | | (4.32)% |

| J.P. Morgan EMBI Global Diversified Liquid | | |

| 1-10 Year Maturity Index | | (3.65)% |

| (1) | The J.P. Morgan EMBI Global Diversified Liquid 1-10 Year Maturity Index contains all bonds with at least $1 billion in face amount outstanding in the J.P. Morgan EMBI Global Diversified Index (the ��Underlying Index”) that have an average life below 10 years at each month-end rebalance. The Underlying Index is a broad, diverse U.S. dollar-denominated emerging markets debt benchmark that tracks the total return of actively-traded external debt instruments in emerging market countries. |

| (2) | The Fund commenced operations on June 28, 2022. Shares of XEMD were listed on the Cboe BZX, Inc. on June 30, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited) (Continued)

U.S. Treasury

The key themes driving fixed income markets during 2022 were inflation pressures, rising interest rates, and a softening economic outlook - all against a backdrop of surging demand, cost pressures resulting from supply chain challenges, and impacts from Russia’s invasion of Ukraine.

As the economy continued to recover from the shutdowns due to the Covid-19 crisis, problems with global supply chains could not keep up with the surge in demand for goods and services. This led to rising price pressures and tight U.S. employment conditions. Russia’s invasion of Ukraine in Q1 2022 put additional upward pressure on prices, especially for oil and other commodity goods. U.S. inflation, as measured by the Consumer Price Index (“CPI”), was already growing by over +7% year-over-year at the end of 2021, and continued to accelerate in the early part of 2022, reaching a forty-year high of +9.1% in June, significantly above the target set by the U.S. Federal Reserve (“Fed”).

In an effort to combat surging inflation, the Fed embarked on an aggressive campaign of boosting policy rates, raising the Federal Funds Target Rate by +3.0%, from a level of 0.25% at the end of 2021 to 3.25% by October 31, 2022. The Fed’s actions and hawkish commentary regarding further interest rate actions, in combination with persistently high price pressures, caused economic growth to slow and financial markets to react negatively as investors turned more cautious. U.S. GDP slowed from the previous year, Treasury yields rose, yield spreads on credit securities widened, and equities reported negative returns.

Yields on Treasuries rose in 2022 as bond prices fell on investor reaction to Fed policy actions, Fed commentary, and inflationary data. Shorter-dated issues, which are the most sensitive to Fed policy actions, saw the most significant upward yield moves. From December 31, 2021, to October 31, 2022, the yield on the 2-year Treasury rose by +3.75%, from 0.73% to 4.49%. Longer-dated securities, which encompass market expectations of economic growth and inflation further into the future, saw less severe yield increases.

The yield on the 10-year note rose by +2.54%, from 1.51% to 4.05%, for the same period, while the 30-year bond yield rose from 1.90% to 4.17%. The difference in yield between the 10-year and 2-year Treasuries, a common measure of the steepness of the Treasury yield curve, ended the period at -0.44%, the lowest level since 2000.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg Six Month Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

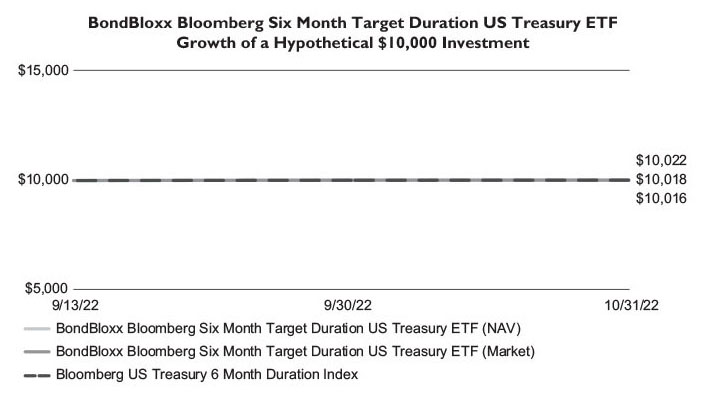

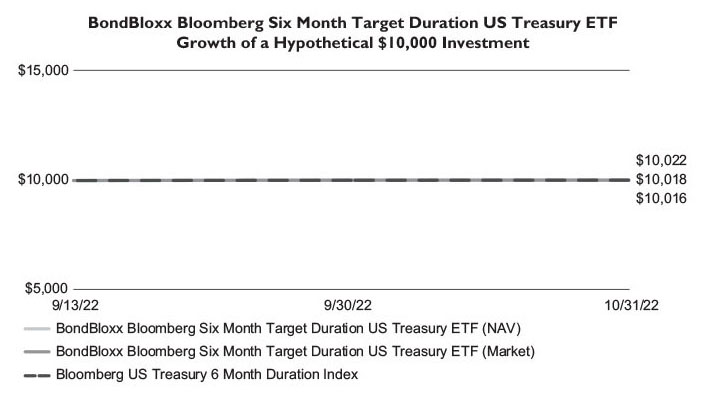

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Six Month Target Duration US Treasury ETF (XHLF) at net asset value and market price as compared to the Bloomberg US Treasury 6 Month Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg Six Month | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | 0.18% |

| Market Value | | 0.22% |

| Bloomberg US Treasury 6 Month | | |

| Duration Index | | 0.16% |

| (1) | The Bloomberg US Treasury 6 Month Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Bill Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 6 month target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XHLF were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

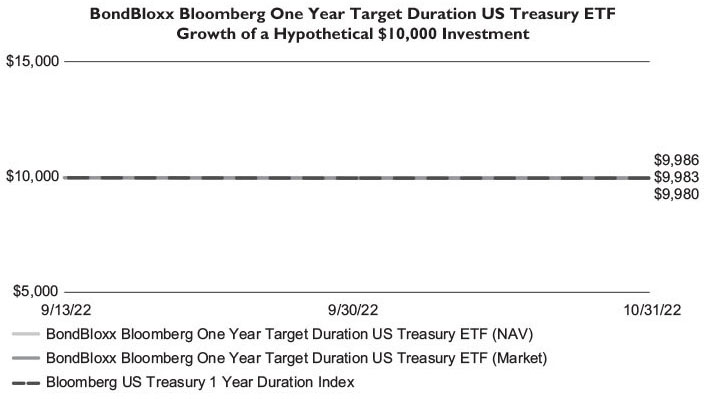

BondBloxx Bloomberg One Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

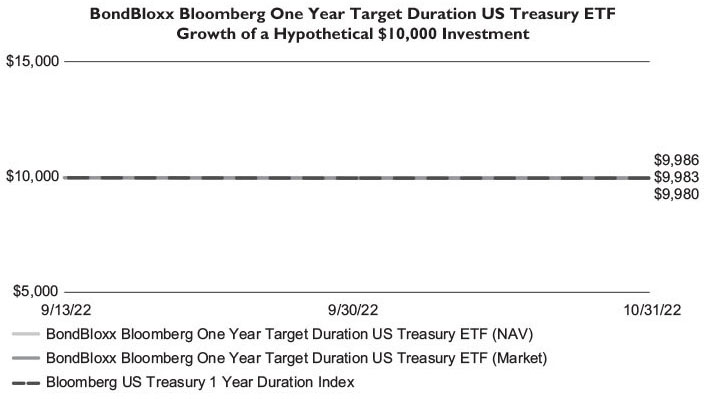

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg One Year Target Duration US Treasury ETF (XONE) at net asset value and market price as compared to the Bloomberg US Treasury 1 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg One Year | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | (0.20)% |

| Market Value | | (0.14)% |

| Bloomberg US Treasury 1 Year | | |

| Duration Index | | (0.17)% |

| (1) | The Bloomberg US Treasury 1 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Short Treasury Index and Bloomberg US Treasury Index (each an “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 1 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XONE were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

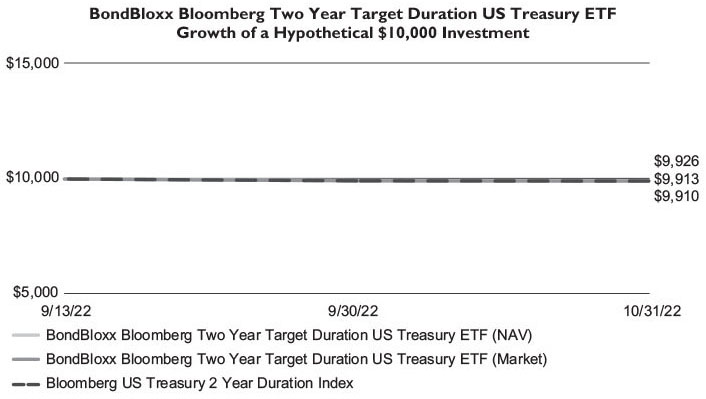

BondBloxx Bloomberg Two Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

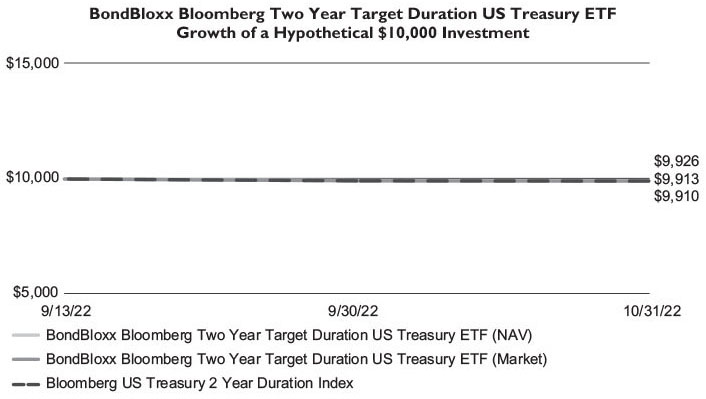

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Two Year Target Duration US Treasury ETF (XTWO) at net asset value and market price as compared to the Bloomberg US Treasury 2 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg Two Year | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | (0.90)% |

| Market Value | | (0.74)% |

| Bloomberg US Treasury 2 Year | | |

| Duration Index | | (0.87)% |

| (1) | The Bloomberg US Treasury 2 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 2 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XTWO were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

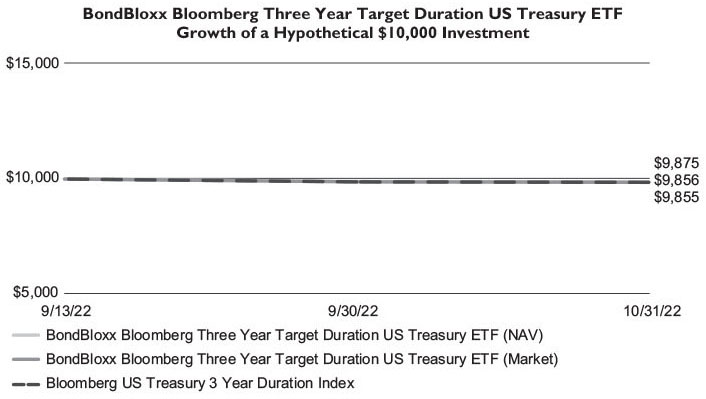

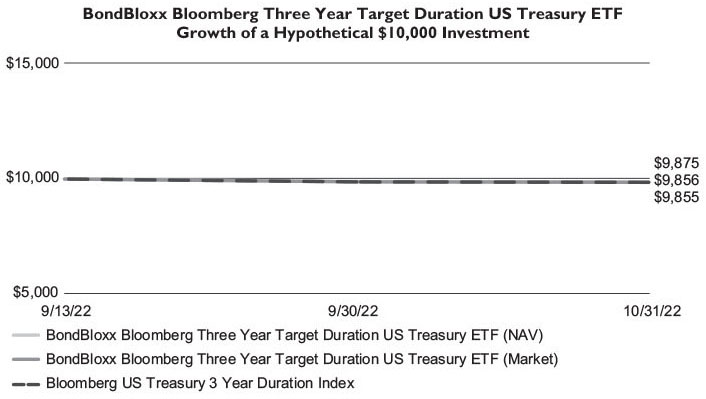

BondBloxx Bloomberg Three Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Three Year Target Duration US Treasury ETF (XTRE) at net asset value and market price as compared to the Bloomberg US Treasury 3 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg Three Year | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | (1.44)% |

| Market Value | | (1.25)% |

| Bloomberg US Treasury 3 Year | | |

| Duration Index | | (1.45)% |

| (1) | The Bloomberg US Treasury 3 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 3 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XTRE were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

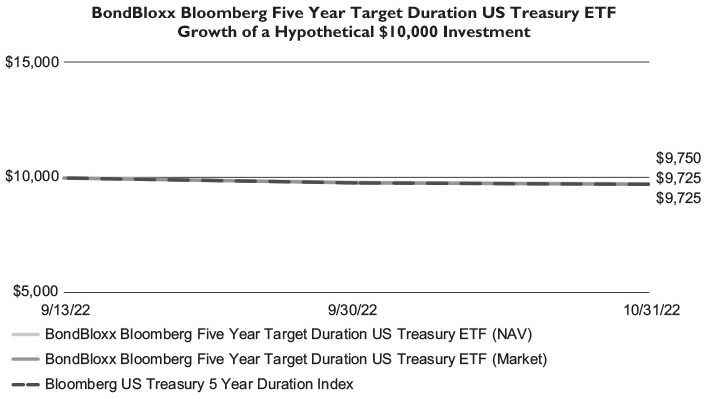

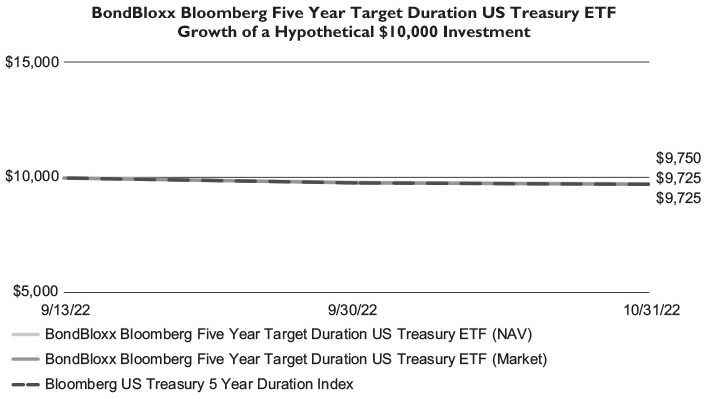

BondBloxx Bloomberg Five Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Five Year Target Duration US Treasury ETF (XFIV) at net asset value and market price as compared to the Bloomberg US Treasury 5 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg Five Year | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | (2.75)% |

| Market Value | | (2.50)% |

| Bloomberg US Treasury 5 Year | | |

| Duration Index | | (2.75)% |

| (1) | The Bloomberg US Treasury 5 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 5 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XFIV were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

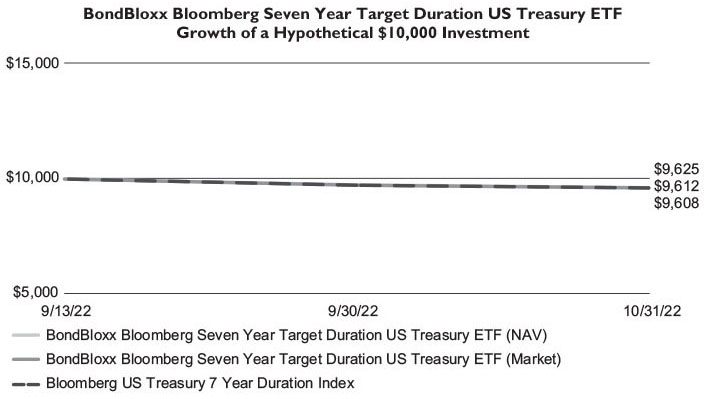

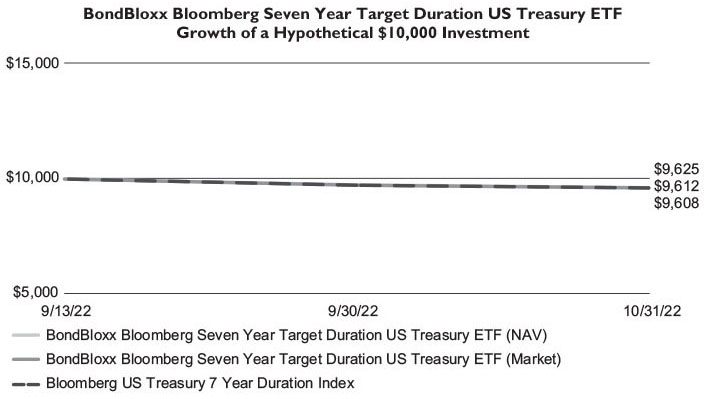

BondBloxx Bloomberg Seven Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Seven Year Target Duration US Treasury ETF (XSVN) at net asset value and market price as compared to the Bloomberg US Treasury 7 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg Seven Year | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | (3.92)% |

| Market Value | | (3.75)% |

| Bloomberg US Treasury 7 Year | | |

| Duration Index | | (3.88)% |

| (1) | The Bloomberg US Treasury 7 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 7 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XSVN were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg Ten Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Ten Year Target Duration US Treasury ETF (XTEN) at net asset value and market price as compared to the Bloomberg US Treasury 10 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg Ten Year | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | (6.17)% |

| Market Value | | (6.03)% |

| Bloomberg US Treasury 10 Year | | |

| Duration Index | | (6.17)% |

| (1) | The Bloomberg US Treasury 10 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 10 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XTEN were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

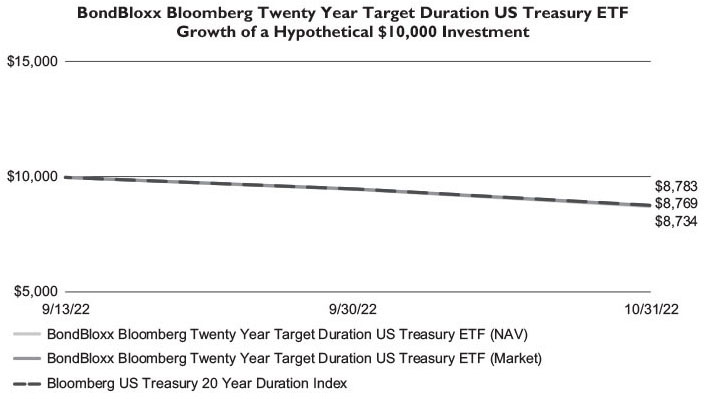

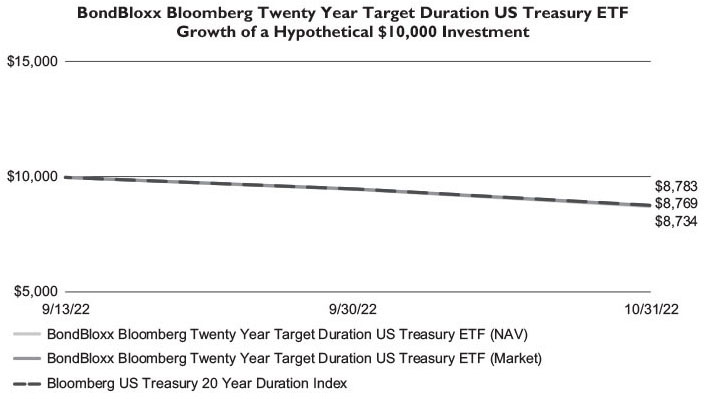

BondBloxx Bloomberg Twenty Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Twenty Year Target Duration US Treasury ETF (XTWY) at net asset value and market price as compared to the Bloomberg US Treasury 20 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2022.

| Cumulative Total Returns as of October 31, 2022 | | |

| BondBloxx Bloomberg Twenty Year | | Since |

| Target Duration US Treasury ETF | | Inception(2) |

| Net Asset Value | | (12.31)% |

| Market Value | | (12.66)% |

| Bloomberg US Treasury 20 Year | | |

| Duration Index | | (12.17)% |

| (1) | The Bloomberg US Treasury 20 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 20 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XTWY were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

BONDBLOXX ETF TRUST

Fund Expense Examples (Unaudited)

As a shareholder, you incur two types of costs: (1) transaction costs for purchasing and selling shares; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. This example is intended to help you compare the cost of owning shares of the Fund with the cost of investing in other funds. The example assumes that you invest $1,000 in the Fund at the beginning of the period (May 1, 2022) or on the date of each Fund’s commencement of investment operations, if later,(5)(6)(7) and held for the entire period until October 31, 2022. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

Actual Expenses

The first line under each Fund in the tables below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the tables below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratios

for the Period | | | Expenses

Paid During

the Period(1) | |

| Fund | | 5/1/2022 | | | 10/31/2022 | | | 10/31/2022 | | | 10/31/2022 | |

| BondBloxx USD High Yield Bond | | | | | | | | | | | | | | | |

| Industrial Sector ETF | | | | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 969.19 | | | 0.35% | | | $ | 1.74 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.44 | | | 0.35% | | | $ | 1.79 | |

| | | | | | | | | | | | | | | | |

| BondBloxx USD High Yield Bond | | | | | | | | | | | | | | | |

| Telecom, Media & Technology Sector ETF | | | | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 952.44 | | | 0.35% | | | $ | 1.72 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.44 | | | 0.35% | | | $ | 1.79 | |