UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23731

BONDBLOXX ETF TRUST

(Exact name of Registrant as specified in charter)

700 Larkspur Landing Circle, Suite 250, Larkspur, CA 94939

(Address of principal executive offices)(Zip code)

BondBloxx Investment Management Corporation

700 Larkspur Landing Circle, Suite 250,

Larkspur, CA 94939

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 896-5089

Date of fiscal year end:

October 31

Date of reporting period:

October 31, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

BondBloxxSM ETF Trust

Annual Report

October 31, 2023

BondBloxx USD High Yield Bond Industrial Sector ETF| XHYI |NYSE Arca

BondBloxx USD High Yield Bond Telecom, Media & Technology Sector ETF| XHYT |NYSE Arca

BondBloxx USD High Yield Bond Healthcare Sector ETF| XHYH |NYSE Arca

BondBloxx USD High Yield Bond Financial & REIT Sector ETF| XHYF |NYSE Arca

BondBloxx USD High Yield Bond Energy Sector ETF| XHYE |NYSE Arca

BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF| XHYC |NYSE Arca

BondBloxx USD High Yield Bond Consumer Non-Cyclicals Sector ETF| XHYD |NYSE Arca

BondBloxx USD High Yield Bond Sector Rotation ETF| HYSA |NYSE Arca

BondBloxx B Rated USD High Yield Corporate Bond ETF| XB |NYSE Arca

BondBloxx BB Rated USD High Yield Corporate Bond ETF| XBB |NYSE Arca

BondBloxx CCC Rated USD High Yield Corporate Bond ETF| XCCC |NYSE Arca

BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF| XEMD | Cboe BZX

BondBloxx Bloomberg Six Month Target Duration US Treasury ETF| XHLF |NYSE Arca

BondBloxx Bloomberg One Year Target Duration US Treasury ETF| XONE |NYSE Arca

BondBloxx Bloomberg Two Year Target Duration US Treasury ETF| XTWO |NYSE Arca

BondBloxx Bloomberg Three Year Target Duration US Treasury ETF| XTRE |NYSE Arca

BondBloxx Bloomberg Five Year Target Duration US Treasury ETF| XFIV |NYSE Arca

BondBloxx Bloomberg Seven Year Target Duration US Treasury ETF| XSVN |NYSE Arca

BondBloxx Bloomberg Ten Year Target Duration US Treasury ETF| XTEN |NYSE Arca

BondBloxx Bloomberg Twenty Year Target Duration US Treasury ETF| XTWY |NYSE Arca

BondBloxx Investment Management Corporation | bondbloxxetf.com | 800.896.5089

Table of Contents

BONDBLOXX ETF TRUST

Shareholder Letter (Unaudited)

Dear Shareholder,

The U.S. economy demonstrated remarkable resilience throughout 2023. Despite consensus expectations for a second-half recession driven by inflation and higher borrowing costs, economic indicators consistently outperformed projections. A notable example of this was that the U.S. economy grew almost 5% in the third quarter of 2023, the fastest expansion in nearly two years. A significant contributor to the economy’s ongoing resilience has been the enduring strength of the U.S. jobs market, which fueled continued household spending and caused businesses to restock to meet strong demand.

Inflation levels eased through most of 2023, allowing the Federal Reserve to halt further rate increases at its July, September, meetings as the U.S. economy continued to absorb prior adjustments. However, recent inflation data is still above the Fed’s 2% target, hovering in the low-to-mid 3% range for headline CPI. If in Q1 inflation remains persistent, the Fed could hold rates at these levels longer and have less reason to start cutting rates in the coming months.

Total return performance returned to positive in 2023 for most segments of the fixed income market, a welcome change from last year’s outlier year of [broad US fixed income market U.S. financial market losses. The U.S. high yield market experienced the best performance among broad fixed income asset classes for the second year in a row, outperforming U.S. Aggregate, U.S. Treasuries, investment grade corporates, and emerging markets sovereign debt. High yield performance was led by CCC-rated debt and the Consumer Cyclical industry sector.

Looking ahead, based on continued economic resilience and the Fed likely near the end of its rate hiking cycle, we believe now is the time for investors to increase their allocation to income, as we expect attractive forward returns in the coming year.

Within fixed income, we see opportunities for investors to look beyond broad-based benchmark ETFs to establish more precise exposures as away to seek outperformance.

At BondBloxx, we are committed to helping investors seize opportunities across fixed income markets. Our unique and innovative product suites span target duration U.S. Treasuries, credit rating and sector-specific high yield bonds, and short duration emerging markets.

Specific strategies we continue to view as compelling include:

| ■ | High yield corporates – to seek attractive income as well as total return outperformance potential from tactical credit quality and industry sector selection |

| ■ | BBB corporates – to take advantage of this rating category’s strong fundamentals as well as yield levels not seen in 15 years |

| ■ | Short-term U.S. Treasuries – to potentially generate higher income, manage cash positions, and maintain liquidity |

| ■ | Intermediate-term U.S. Treasuries – to capture attractive total return potential considering the possible end to the Fed rate hike cycle, a slowing U.S. economy, and a normalization of the yield curve |

| ■ | Shorter-duration emerging markets sovereign debt – to reduce both interest rate and spread duration risk while benefiting from attractive yields and total return potential. |

We are thankful for your investment and the trust you have placed in BondBloxx. We wish you a happy and prosperous New Year.

Joanna Gallegos

President, BondBloxx ETF Trust

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited)

High Yield Sectors

The U.S. economy showed remarkable resilience over the 12-month period ending October 31, 2023 in the face of higher interest rates, persistent inflation and numerous external shocks. Economic growth was fueled by steady consumer spending, as the enduring strength of the labor market shored up household confidence. Gross Domestic Product grew at an annualized pace of 5.2% in the third quarter of 2023 - the fastest expansion in close to two years. The U.S. unemployment rate held near historic lows throughout the period. Meanwhile, signs of weakness were evident in areas such as housing, industrial production, and manufacturing.

Inflation pressures in the U.S. eased substantially from the 40-year peak reached in mid-2022, as annual consumer price growth hovered between 3.0% and 4.0% by mid-2023, down from 9.1% at its peak. This favorable trend in consumer price growth during the period enabled the Federal Reserve to slow its interest rate tightening campaign, having kept its policy rate unchanged at three of the last four meetings. This follows an aggressive 525 basis points in total rate increases over the previous 18 months.

After a year of double-digit declines across most asset classes, most fixed income sectors generated positive returns during the 12-month period ending in October 2023, led by higher-income generating sectors such as U.S. high yield and emerging markets. The overall equity market rose over 10%, driven by the technology sector and potential impacts of artificial intelligence, while other equity sectors and small-cap stocks lagged.

U.S High yield bonds generated positive returns for the 12-month period ending October 31, 2023, as a strong U.S. economy kept corporate cash flows relatively healthy, investor expectations of a recession receded, and the Federal Reserve approached the end of its interest rate hiking program. Owing to rising yields beginning in late 2021, a higher level of income helped insulate the asset class from price shocks. As measured by the BofA ICE Cash Pay High Yield Constrained Index, a broad benchmark of the asset class, U.S. high yield returned +5.79% for the 12-month period ending October 31, 2023.

While all sectors of U.S. high yield reported positive returns during the period, a high level of variance was recorded among the different industry sectors, driven by macroeconomic trends and idiosyncratic events. Robust consumer spending led to outperformance in the consumer cyclicals sectors (+8.71%), while strong balance sheets and ratings upgrades drove outperformance in the energy sector (+7.37%). Conversely, the telecommunications and media sector lagged (+1.28%) due to competitive cost pressures and several issuer-specific balance sheet problems.

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Industrial Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

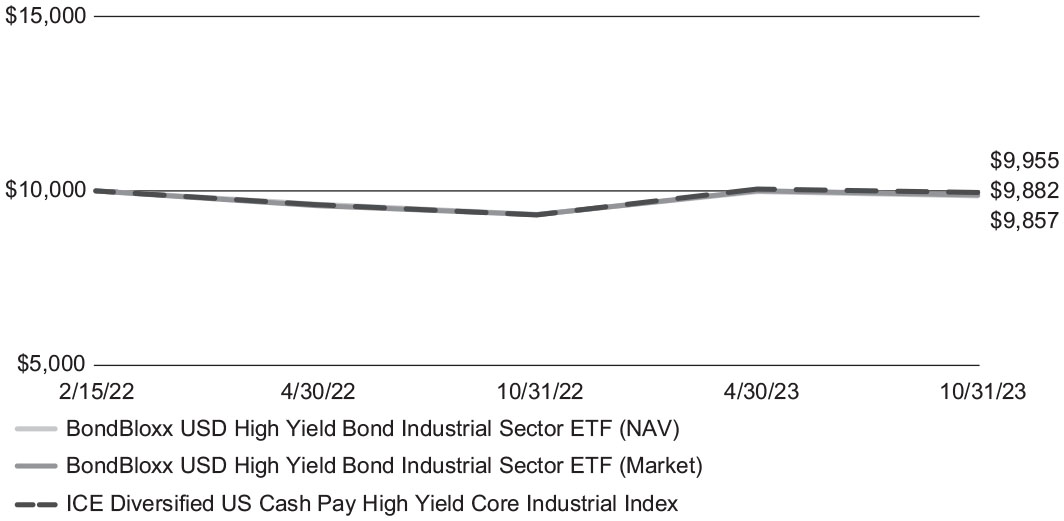

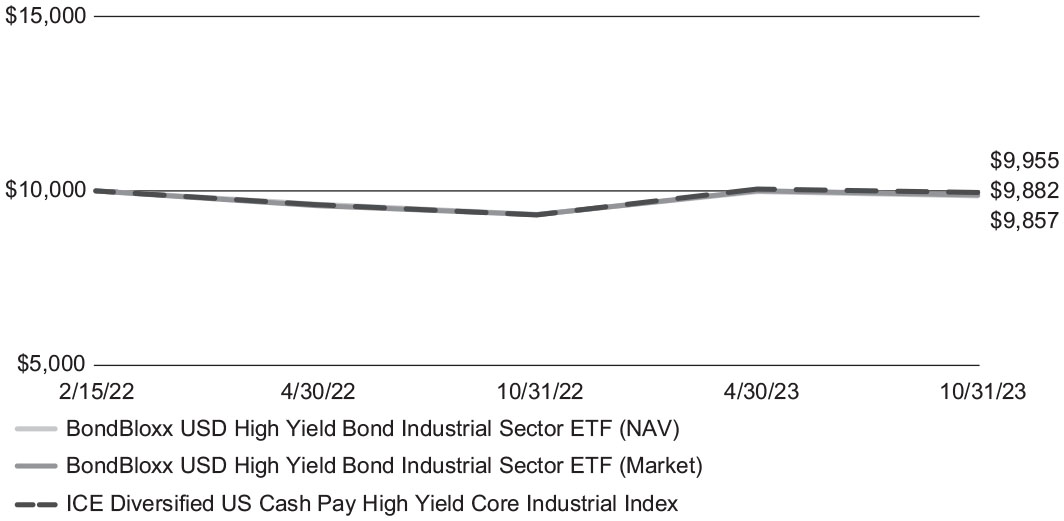

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Industrial Sector ETF (XHYI) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Core Industrial Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2023.

BondBloxx USD High Yield Bond Industrial Sector ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | Since |

| Industrial Sector ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 5.77% | | (0.84)% |

| Market Value | | 6.12% | | (0.70)% |

| ICE Diversified US Cash Pay High Yield | | | | |

| Core Industrial Index | | 7.00% | | (0.26)% |

| (1) | The ICE Diversified US Cash Pay High Yield Core Industrial Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the industrial sector, including the basic materials, capital goods, transportation and services subsectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYI were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.35%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Telecom, Media & Technology Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

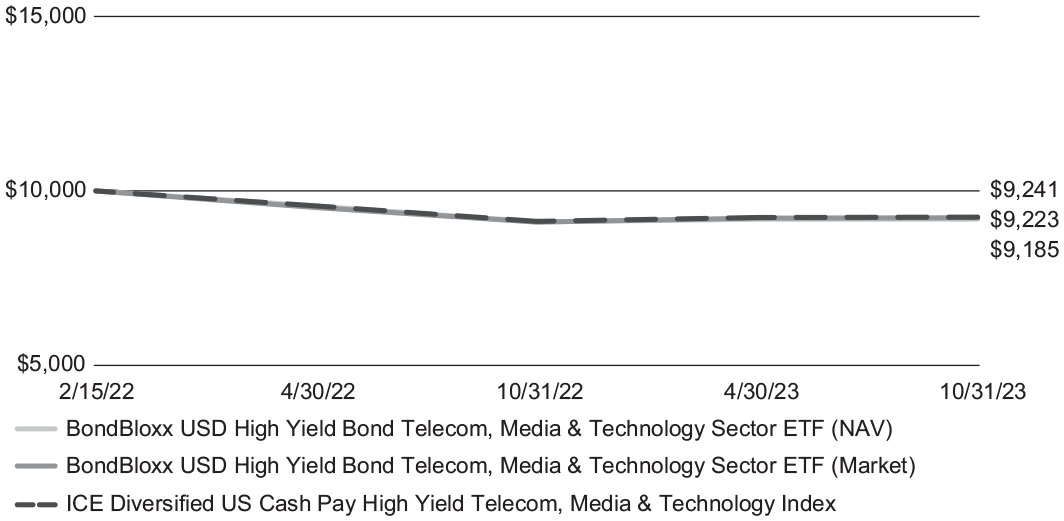

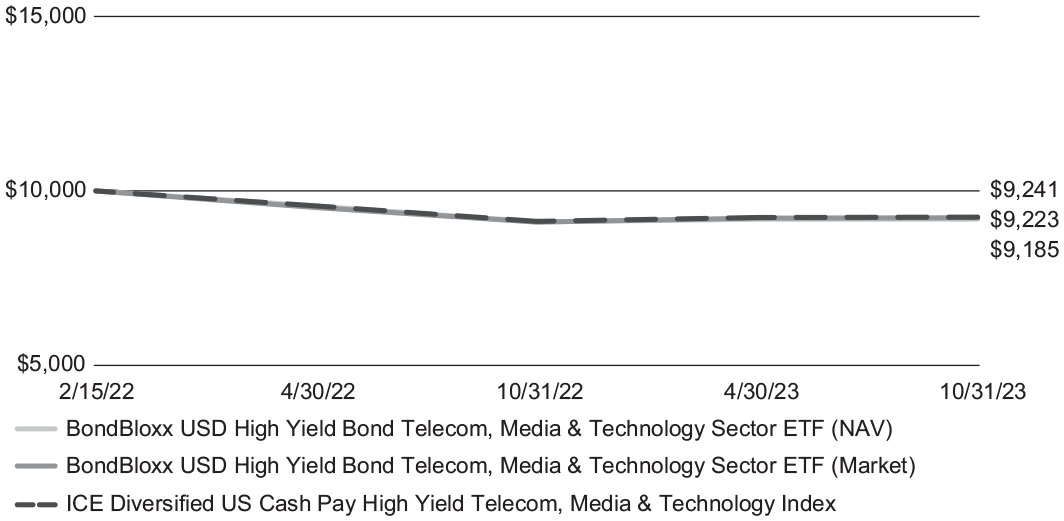

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Telecom, Media & Technology Sector ETF (XHYT) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Telecom, Media & Technology Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2023.

BondBloxx USD High Yield Bond Telecom, Media & Technology Sector ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | Since |

| Telecom, Media & Technology Sector ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 0.89% | | (4.86)% |

| Market Value | | 1.39% | | (4.64)% |

| ICE Diversified US Cash Pay High Yield | | | | |

| Telecom, Media & Technology Index | | 1.35% | | (4.52)% |

| (1) | The ICE Diversified US Cash Pay HighYieldTelecom, Media &Technology Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the telecom, media and technology sector, including the telecommunications, technology & electronics, and media sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYT were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.35%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Healthcare Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

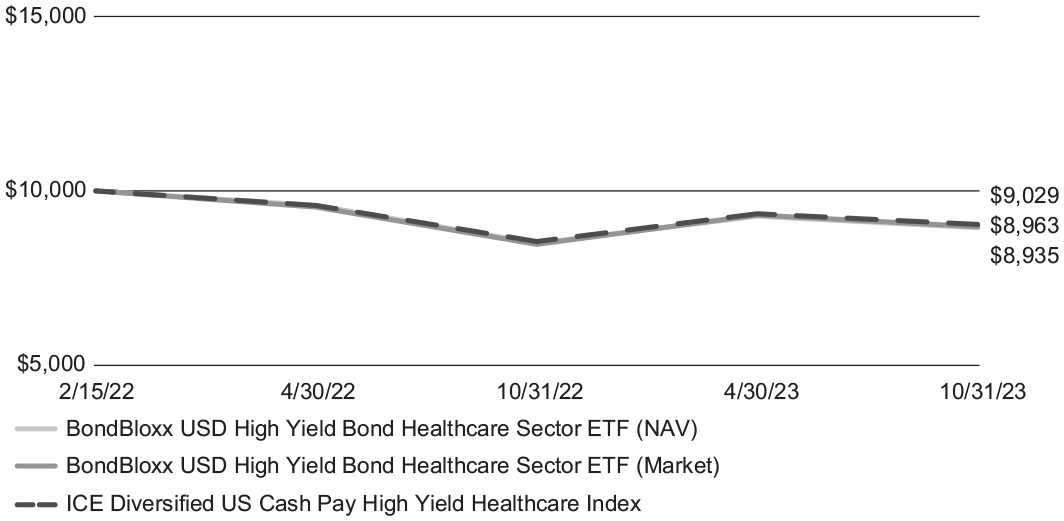

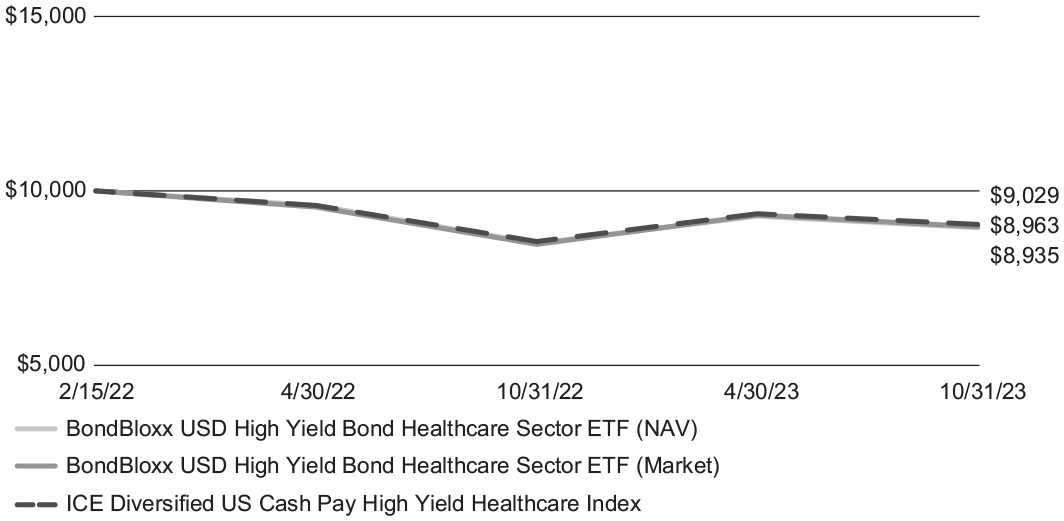

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Healthcare Sector ETF (XHYH) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Healthcare Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2023.

BondBloxx USD High Yield Bond Healthcare Sector ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | Since |

| Healthcare Sector ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 5.36% | | (6.38)% |

| Market Value | | 6.03% | | (6.23)% |

| ICE Diversified US Cash Pay High Yield | | | | |

| Healthcare Index | | 5.80% | | (5.81)% |

| (1) | The ICE Diversified US Cash Pay High Yield Healthcare Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the healthcare sector, including the health facilities, health services, managed care, medical products, and pharmaceuticals sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYH were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.35%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Financial & REIT Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

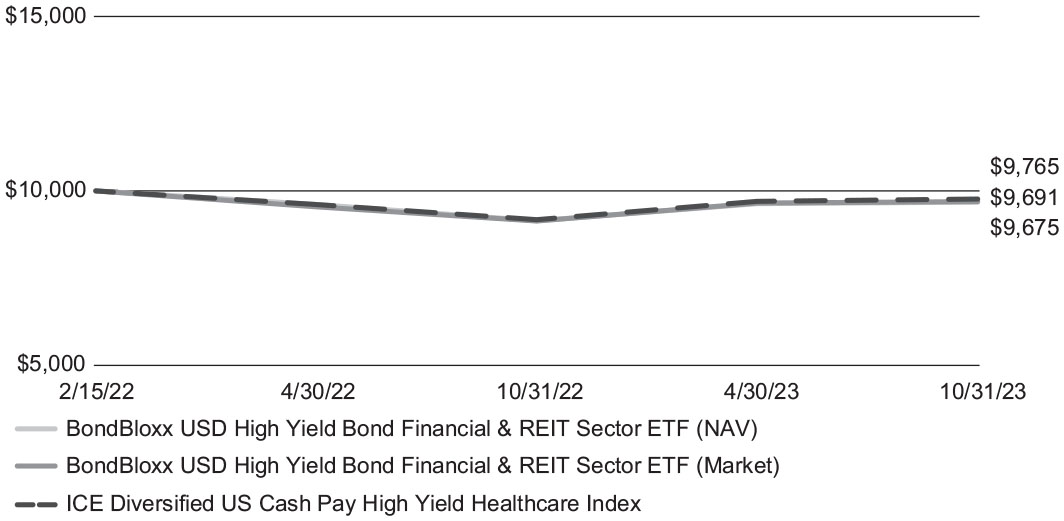

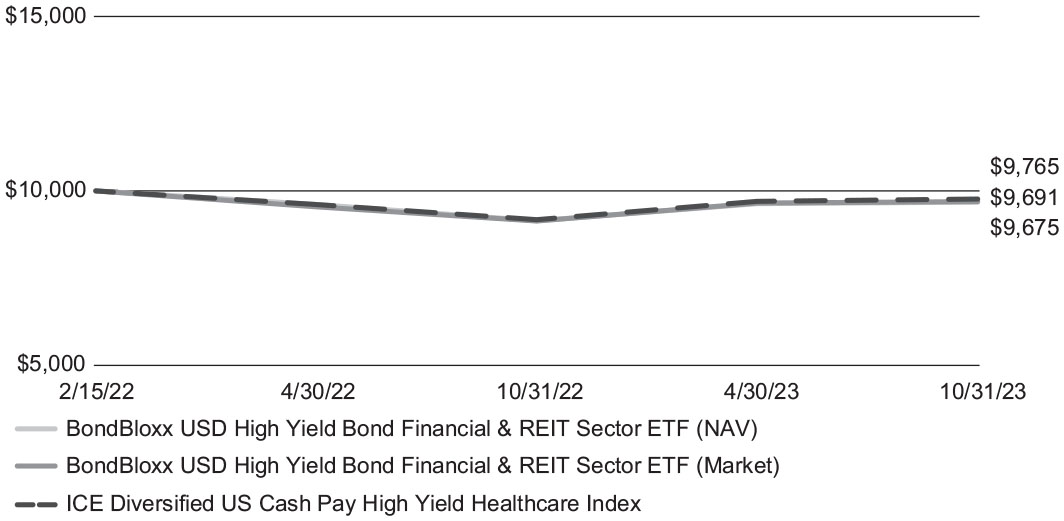

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Financial & REIT Sector ETF (XHYF) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Financial & REIT Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2023.

BondBloxx USD High Yield Bond Financial & REIT Sector ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | Since |

| Financial & REIT Sector ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 5.91% | | (1.91)% |

| Market Value | | 6.17% | | (1.83)% |

| ICE Diversified US Cash Pay High Yield | | | | |

| Financial & REIT Index | | 6.53% | | (1.38)% |

| (1) | The ICE Diversified US Cash Pay High Yield Financial & REIT Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the financial sector, including the banking, financial services, and insurance sub-sectors, and the REIT sector. The REIT sector is comprised solely of debt issued by real estate investment trusts. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYF were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.35%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

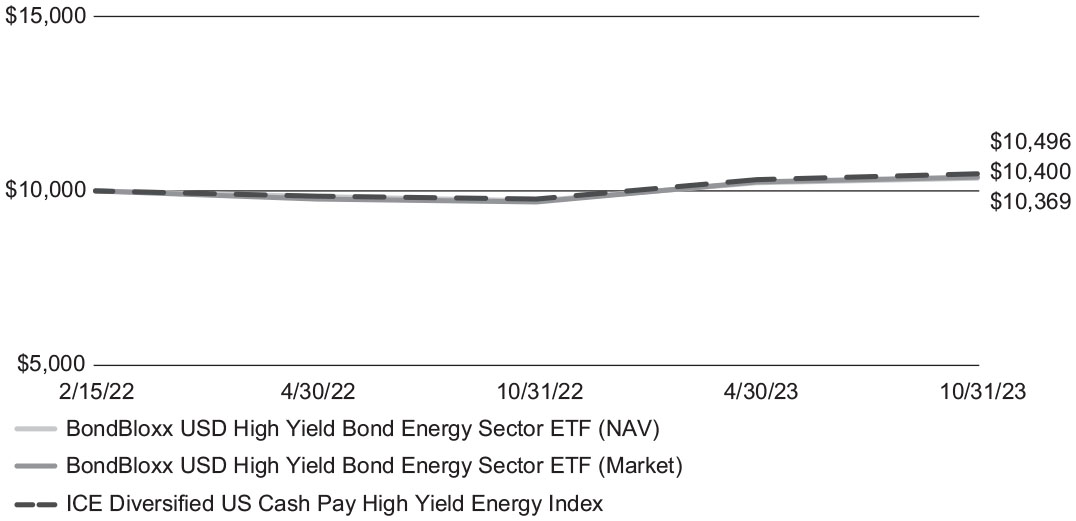

BondBloxx USD High Yield Bond Energy Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

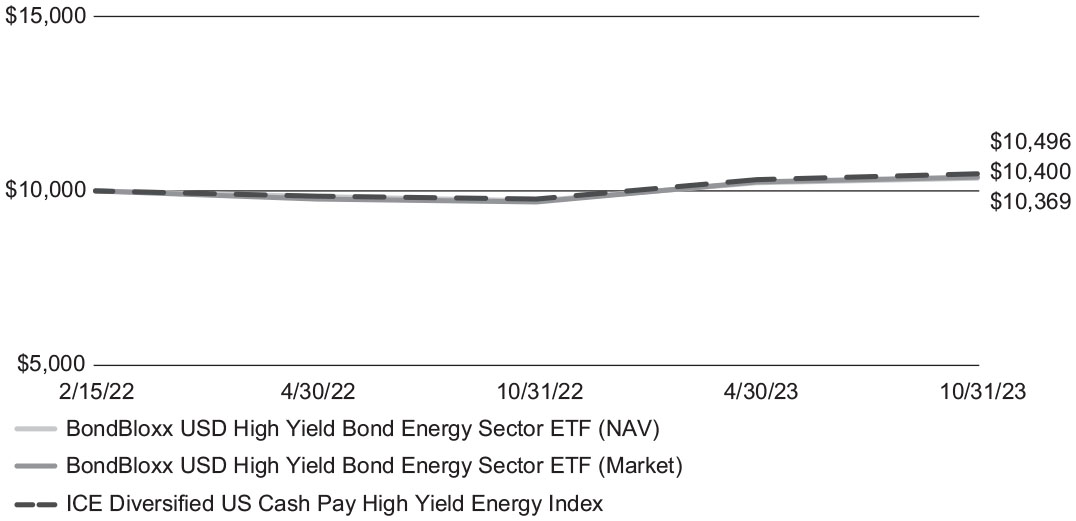

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Energy Sector ETF (XHYE) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Energy Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2023.

BondBloxx USD High Yield Bond Energy Sector ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | Since |

| Energy Sector ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 6.73% | | 2.15% |

| Market Value | | 7.43% | | 2.33% |

| ICE Diversified US Cash Pay High Yield | | | | |

| Energy Index | | 7.48% | | 2.88% |

| (1) | The ICE Diversified US Cash Pay High Yield Energy Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the energy sector, including the exploration & production, gas distribution, oil field equipment & services, and oil refining & marketing sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYE were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.35%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

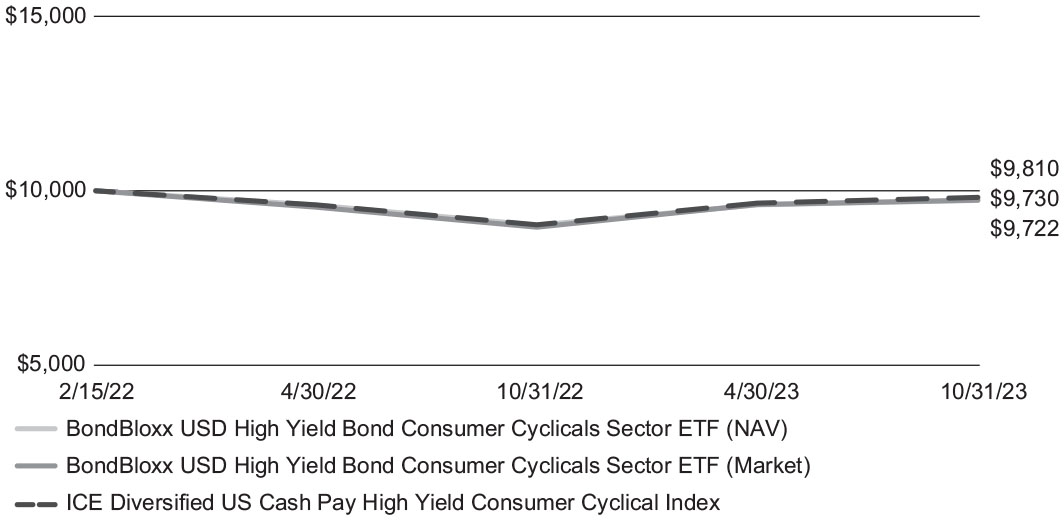

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

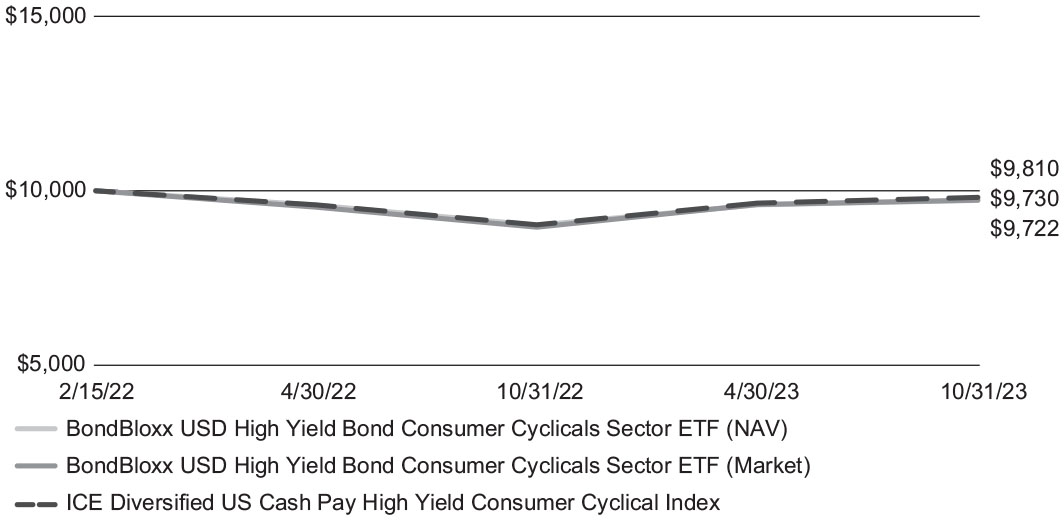

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF (XHYC) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Consumer Cyclical Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2023.

BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | Since |

| Consumer Cyclicals Sector ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 7.98% | | (1.64)% |

| Market Value | | 8.77% | | (1.59)% |

| ICE Diversified US Cash Pay High Yield | | | | |

| Consumer Cyclical Index | | 8.81% | | (1.12)% |

| (1) | The ICE Diversified US Cash Pay High Yield Consumer Cyclical Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the consumer cyclicals sector (companies whose performance is generally more closely connected to the business cycle and current economic conditions), including the automotive, leisure, real estate development & management, department stores, and specialty retail subsectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYC were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.35%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

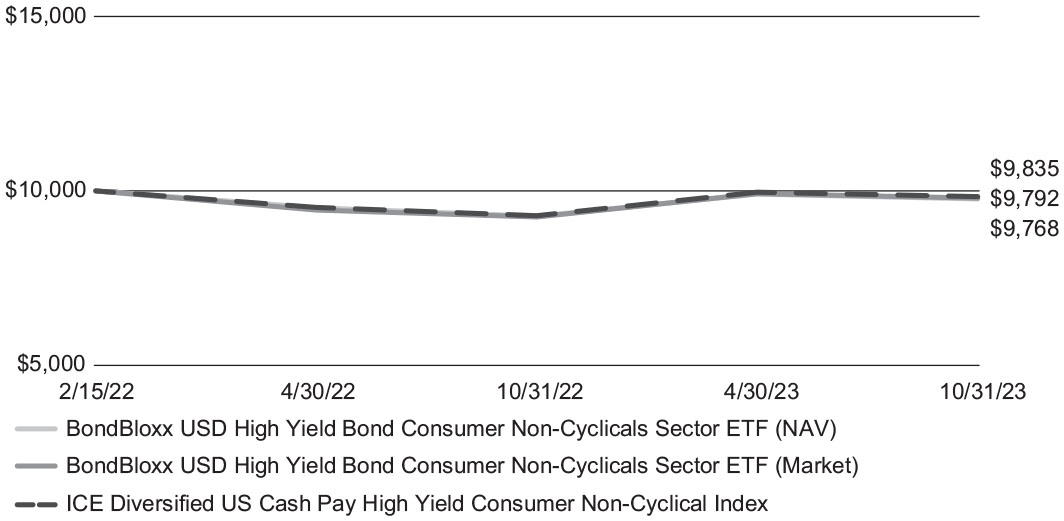

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Consumer Non-Cyclicals Sector ETF Growth

Fund Performance Overview (Unaudited) (Continued)

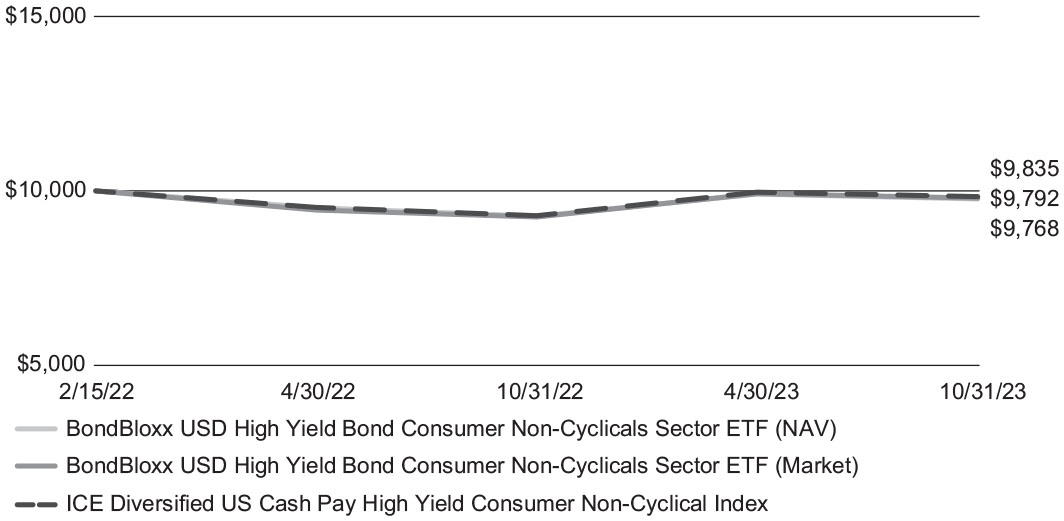

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Consumer Non-Cyclicals Sector ETF (XHYD) at net asset value and market price as compared to the ICE Diversified US Cash Pay High Yield Consumer Non-Cyclical Index(1) from the Fund’s inception date (February 15, 2022(2)) to October 31, 2023.

BondBloxx USD High Yield Bond Consumer Non-Cyclicals Sector ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | Since |

| Consumer Non-Cyclicals Sector ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 5.40% | | (1.36)% |

| Market Value | | 5.92% | | (1.23)% |

| ICE Diversified US Cash Pay High Yield | | | | |

| Consumer Non-Cyclical Index | | 5.96% | | (0.97)% |

| (1) | The ICE Diversified US Cash Pay High Yield Consumer Non-Cyclical Index is a rules-based index consisting of U.S. dollar-denominated below investment grade bonds (as determined by ICE Data Indices, LLC or its affiliates (collectively “Index Provider” or “IDI”)) that contains issuers from the consumer non-cyclicals sector (companies whose performance is generally less closely connected to the business cycle and current economic conditions), including the consumer goods, discount stores, food & drug retail, restaurants, and utilities sub-sectors. |

| (2) | The Fund commenced operations on February 15, 2022. Shares of XHYD were listed on the NYSE Arca, Inc. on February 17, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.35%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

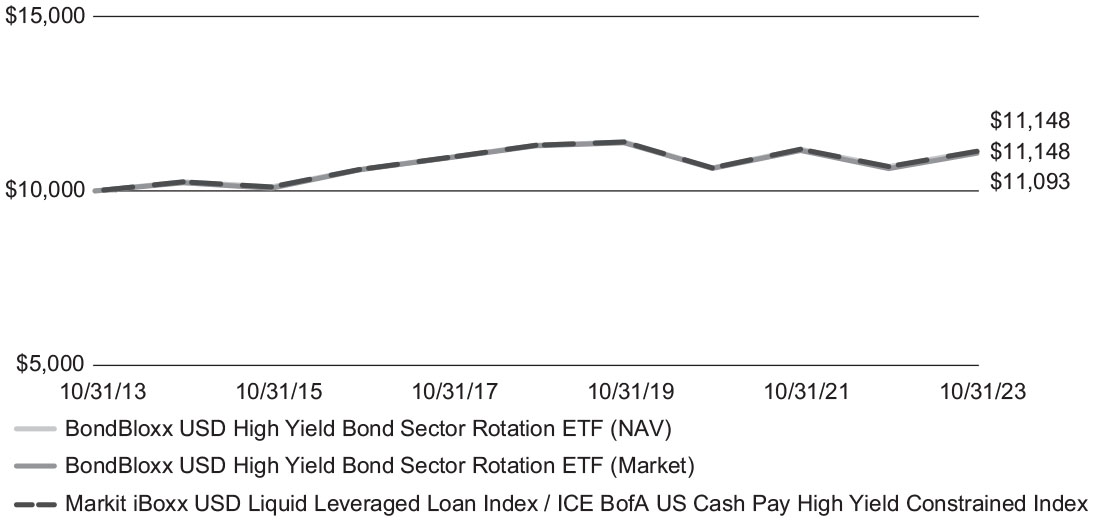

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Sector Rotation ETF Growth

Fund Performance Overview (Unaudited) (Continued)

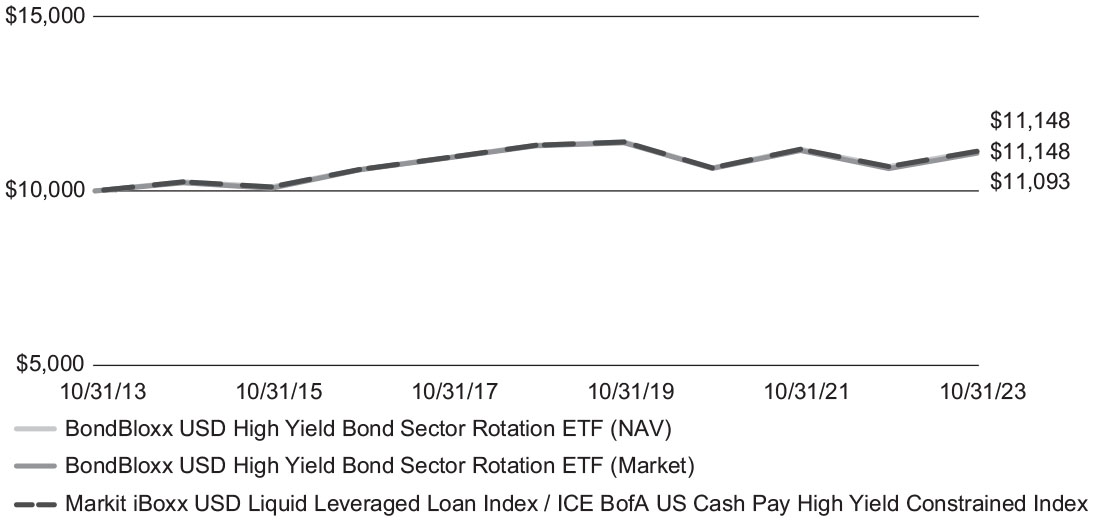

The following graph depicts the hypothetical $10,000 investment in the BondBloxx USD High Yield Bond Sector Rotation ETF (HYSA) at net asset value and market price as compared to a blended index Markit iBoxx USD Liquid Leveraged Loan Index and ICE BofA US Cash Pay High Yield Constrained Index(1) for the ten year period ended October 31, 2023.

BondBloxx USD High Yield Bond Sector Rotation ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx USD High Yield Bond | | | | | | | | | | Since |

| Sector Rotation ETF | | 1 year | | 3 years | | 5 years | | 10 years | | Inception(2) |

| Net Asset Value | | 4.14% | | 1.48% | | (0.31)% | | 1.09% | | 1.44% |

| Market Value | | 4.19% | | 1.36% | | (0.38)% | | 1.04% | | 1.41% |

| Markit iBoxx USD Liquid Leveraged Loan Index / ICE BofA US Cash Pay High Yield | | | | | | | | | | |

| Constrained Index | | 4.14% | | 1.48% | | (0.31)% | | 1.09% | | 1.44% |

The Fund acquired the assets and liabilities of the Highland/iBoxx Senior Loan ETF (the “Predecessor ETF”), a series of the NexPoint Funds I, at the close of business on September 15, 2023. As a result of the reorganization, the Fund is the accounting successor of the Predecessor ETF. Performance results shown in the graph and the performance table above for the periods prior to September 16, 2023, reflect the performance of the Predecessor ETF.

| (1) | The Markit iBoxx USD Liquid Leveraged Loan Index, is comprised of about 100 of the most liquid, tradable leveraged loans, as identified by Markit’s Loans Liquidity service. Markit iBoxx USD Liquid Leveraged Loan Index is the Predecessor ETF’s index benchmark for the period from commencement of operations, November 6, 2012, through the acquisition on September 15, 2023. |

The ICE BofA US Cash Pay High Yield Constrained Index is a rules-based index consisting of U.S. dollar-denominated below investment grade corporate debt, currently in a coupon paying period, that is publicly issued in the U.S. domestic market. ICE BofA US Cash Pay High Yield Constrained Index began on September 16, 2023. This Fund is actively managed and does not seek to track the performance of the ICE BofA US Cash Pay High Yield Constrained Index.

| (2) | The Fund commenced operations on November 6, 2012. The Fund was acquired as from the Predecessor ETF of the close of business on September 15, 2023. Shares of HYSA were listed on the NYSE Arca, Inc. on September 18, 2023. Prior to September 16, 2023, the Predecessor Fund was advised by a different investment adviser, had a different investment objective and policies and was a passively-managed fund that sought to track the performance of the Markit iBoxx USD Liquid Leveraged Loan Index. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

BONDBLOXX ETF TRUST

BondBloxx USD High Yield Bond Sector Rotation ETF Growth

Fund Performance Overview (Unaudited) (Continued)

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.55%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited) (Continued)

High Yield Ratings

The U.S. economy showed remarkable resilience over the 12-month period ending October 31, 2023 in the face of higher interest rates, persistent inflation and numerous external shocks. Economic growth was fueled by steady consumer spending, as the enduring strength of the labor market shored up household confidence. Gross Domestic Product grew at an annualized pace of 5.2% in the third quarter of 2023 - the fastest expansion in close to two years. The U.S. unemployment rate held near historic lows throughout the period. Meanwhile, signs of weakness were evident in areas such as housing, industrial production, and manufacturing.

Inflation pressures in the U.S. eased substantially from the 40-year peak reached in mid-2022, as annual consumer price growth hovered between 3.0% and 4.0% by mid-2023, down from 9.1% at its peak. This favorable trend in consumer price growth during the period enabled the Federal Reserve to slow its interest rate tightening campaign, having kept its policy rate unchanged at three of the last four meetings. This follows an aggressive 525 basis points in total rate increases over the previous 18 months.

After a year of double-digit declines across most asset classes, most fixed income sectors generated positive returns during the 12-month period ending in October 2023, led by higher-income generating sectors such as U.S. high yield and emerging markets. The overall equity market rose over 10%, driven by the technology sector and potential impacts of artificial intelligence, while other equity sectors and small-cap stocks lagged.

U.S high yield bonds generated positive returns for the 12-month period ending October 31, 2023, as a strong U.S. economy kept corporate cash flows relatively healthy, investor expectations of a recession receded, and the Federal Reserve approached the end of its interest rate hiking program. Owing to rising yields beginning in late 2021, a higher level of income helped insulate the asset class from price shocks. As measured by the BofA ICE Cash Pay High Yield Constrained Index, a broad benchmark of the asset class, U.S. high yield returned +5.79% for the 12-month period ending October 31, 2023.

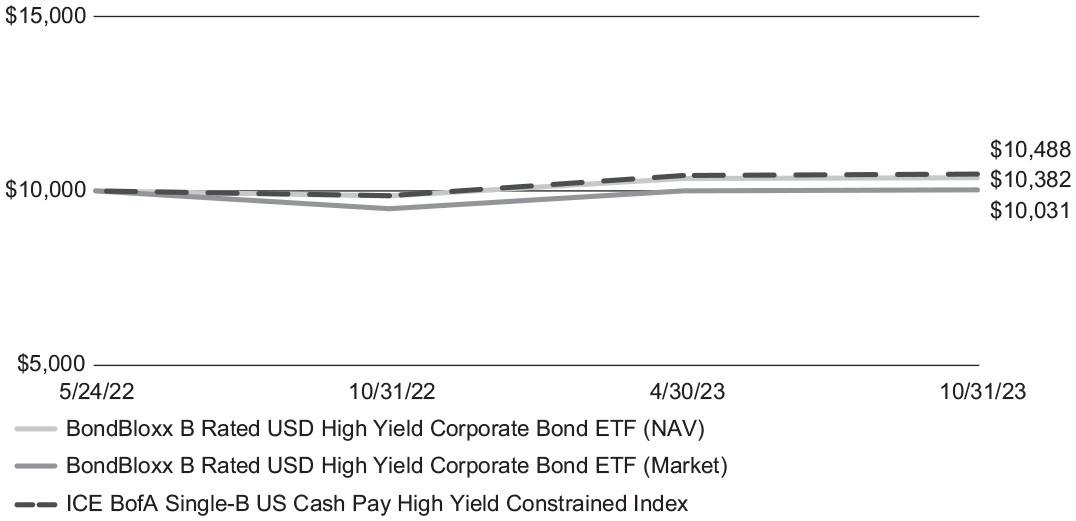

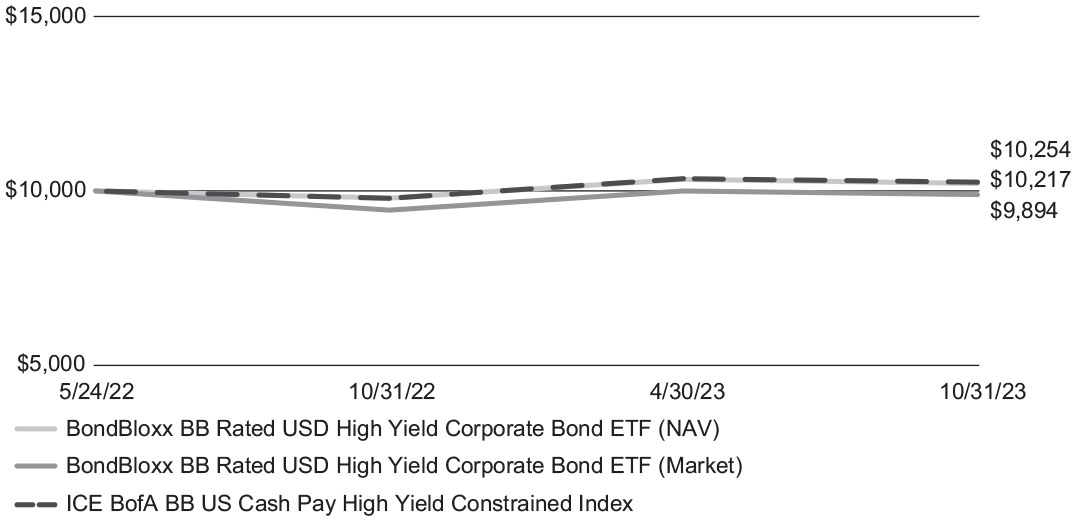

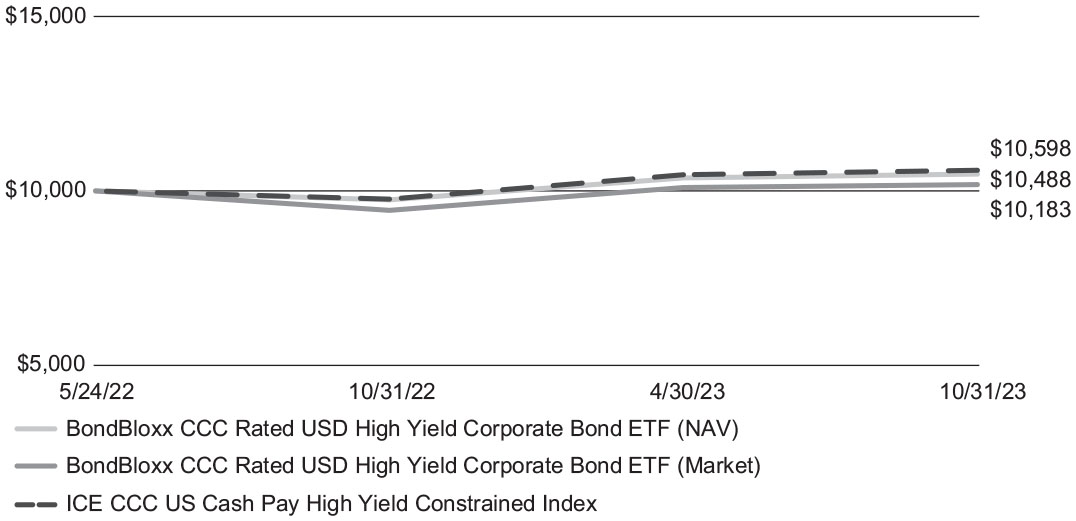

Lower-rated high yield bonds outperformed for the 12-month period, as fears of recession in the U.S. abated and higher yields provided a comfortable cushion against interest rate fears and security price volatility. The ICE CCC US Cash Pay High Yield Constrained Index returned +8.30% for the period from November 1, 2022 to October 31, 2023. While generating positive returns, securities bonds with higher credit ratings were negatively impacted by interest rates, with BB and single-B rated high yield bonds returning +4.68% and +6.23%, respectively, as measured by ICE Index Services.

BONDBLOXX ETF TRUST

BondBloxx B Rated USD High Yield Corporate Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

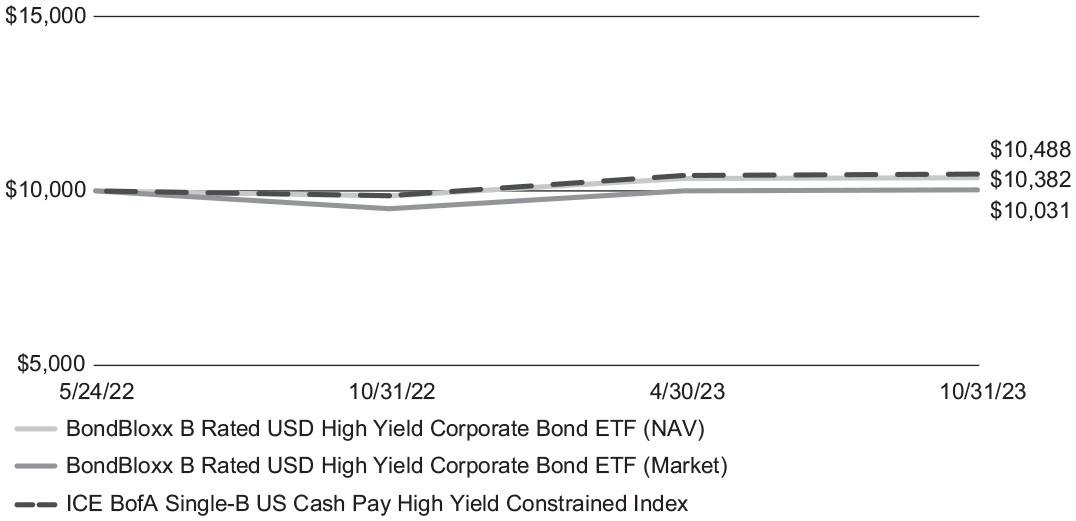

The following graph depicts the hypothetical $10,000 investment in the BondBloxx B Rated USD High Yield Corporate Bond ETF (XB) at net asset value and market price as compared to the ICE BofA Single-B US Cash Pay High Yield Constrained Index(1) from the Fund’s inception date (May 24, 2022(2)) to October 31, 2023.

BondBloxx B Rated USD High Yield Corporate Bond ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx B Rated USD High Yield | | | | Since |

| Corporate Bond ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 5.35% | | 2.64% |

| Market Value | | 5.77% | | 0.22% |

| ICE BofA Single-B US Cash Pay High Yield | | | | |

| Constrained Index | | 6.35% | | 3.37% |

| (1) | The ICE BofA Single-B US Cash Pay High Yield Constrained Index contains all bonds in the ICE BofA US Cash Pay High Yield Index (the “Underlying Index”) that are rated B1 through B3, based on an average of Moody’s Investors Services Inc. (“Moody’s”), S&P Global Ratings (“S&P”) and Fitch Ratings, Inc. (“Fitch”), but caps issuer exposure at 2%. |

| (2) | The Fund commenced operations on May 24, 2022. Shares of XB were listed on the NYSE Arca, Inc. on May 26, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.30%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx BB Rated USD High Yield Corporate Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

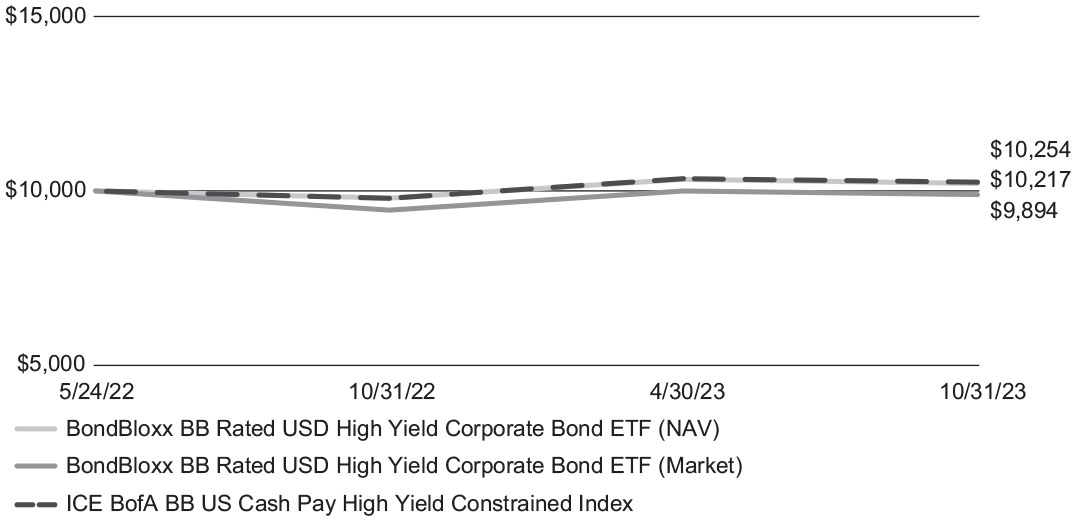

The following graph depicts the hypothetical $10,000 investment in the BondBloxx BB Rated USD High Yield Corporate Bond ETF (XBB) at net asset value and market price as compared to the ICE BofA BB US Cash Pay High Yield Constrained Index(1) from the Fund’s inception date (May 24, 2022(2)) to October 31, 2023.

BondBloxx BB Rated USD High Yield Corporate Bond ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx BB Rated USD High Yield | | | | Since |

| Corporate Bond ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 4.33% | | 1.50% |

| Market Value | | 4.78% | | (0.74)% |

| ICE BofA BB US Cash Pay High Yield | | | | |

| Constrained Index | | 4.79% | | 1.76% |

| (1) | The ICE BofA BB US Cash Pay High Yield Constrained Index contains all bonds in the ICE BofA US Cash Pay High Yield Index (the “Underlying Index”) that are rated BB1 though BB3, based on an average of Moody’s Investors Services, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) and Fitch Ratings, Inc. (“Fitch”), but caps issuer exposure at 2%. |

| (2) | The Fund commenced operations on May 24, 2022. Shares of XBB were listed on the NYSE Arca, Inc. on May 26, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.20%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx CCC Rated USD High Yield Corporate Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

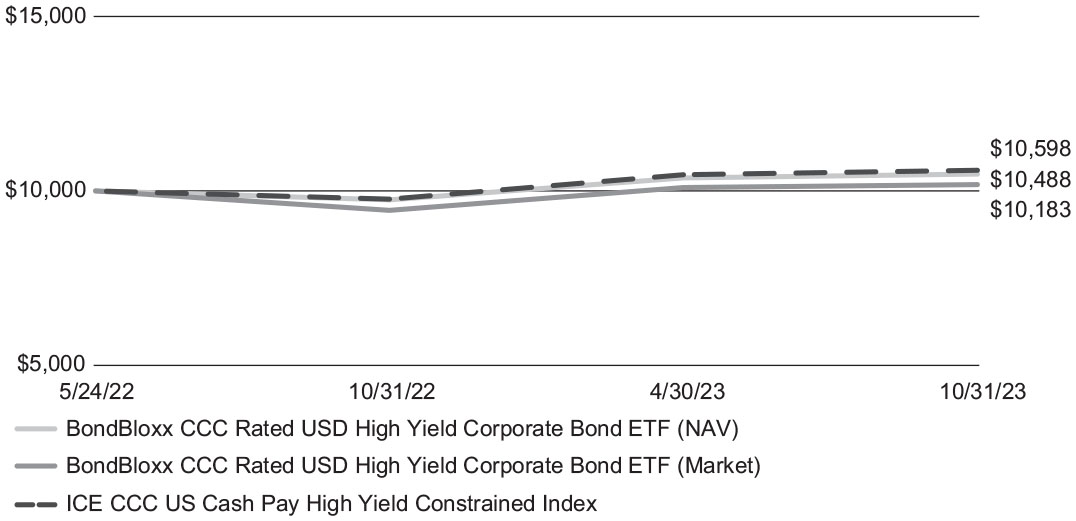

The following graph depicts the hypothetical $10,000 investment in the BondBloxx CCC Rated USD High Yield Corporate Bond ETF (XCCC) at net asset value and market price as compared to the ICE CCC US Cash Pay High Yield Constrained Index(1) from the Fund’s inception date (May 24, 2022(2)) to October 31, 2023.

BondBloxx CCC Rated USD High Yield Corporate Bond ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx CCC Rated USD High Yield | | | | Since |

| Corporate Bond ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 7.66% | | 3.37% |

| Market Value | | 7.91% | | 1.28% |

| ICE CCC US Cash Pay High Yield | | | | |

| Constrained Index | | 8.57% | | 4.12% |

| (1) | The ICE CCC US Cash Pay High Yield Constrained Index contains all bonds in the ICE BofA US Cash Pay High Yield Index (the “Underlying Index”) that are rated CCC1 through CCC3, based on an average of Moody’s Investors Services, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) and Fitch Ratings, Inc. (“Fitch”), but caps issuer exposure at 2%. |

| (2) | The Fund commenced operations on May 24, 2022. Shares of XCCC were listed on the NYSE Arca, Inc. on May 26, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.40%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited) (Continued)

Emerging Markets

The U.S. economy showed remarkable resilience over the 12-month period ending October 31, 2023 in the face of higher interest rates, persistent inflation and numerous external shocks. Economic growth was fueled by steady consumer spending, as the enduring strength of the labor market shored up household confidence. Gross Domestic Product grew at an annualized pace of 5.2% in the third quarter of 2023 - the fastest expansion in close to two years. The U.S. unemployment rate held near historic lows throughout the period. Meanwhile, signs of weakness were evident in areas such as housing, industrial production, and manufacturing.

Inflation pressures in the U.S. eased substantially from the 40-year peak reached in mid-2022, as annual consumer price growth hovered between 3.0% and 4.0% by mid-2023, down from 9.1% at its peak. This favorable trend in consumer price growth during the period enabled the Federal Reserve to slow its interest rate tightening campaign, having kept its policy rate unchanged at three of the last four meetings. This follows an aggressive 525 basis points in total rate increases over the previous 18 months.

After a year of double-digit declines across most asset classes, most fixed income sectors generated positive returns during the 12-month period ending in October 2023, led by higher-income generating sectors such as U.S. high yield and emerging markets. The overall equity market rose over 10%, driven by the technology sector and potential impacts of artificial intelligence, while other equity sectors and small-cap stocks lagged.

Emerging markets debt generated strong positive returns during the 12-month period ending October 31, 2023, with the JP Morgan EMBI Global Diversified 1-10 Liquid Index returning +8.96% for the period. Returns in emerging markets debt were driven by resiliency across commodity markets, especially oil, and positive progress on debt restructuring talks from several distressed issuers. Additionally, returns were bolstered by a declining dollar, as the Federal Reserve nears the end of its interest rate hikes, lower forecasts of a recession in the U.S., and attractive yields in the asset class, cushioning investors from price volatility.

BONDBLOXX ETF TRUST

BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF Growth

Fund Performance Overview (Unaudited) (Continued)

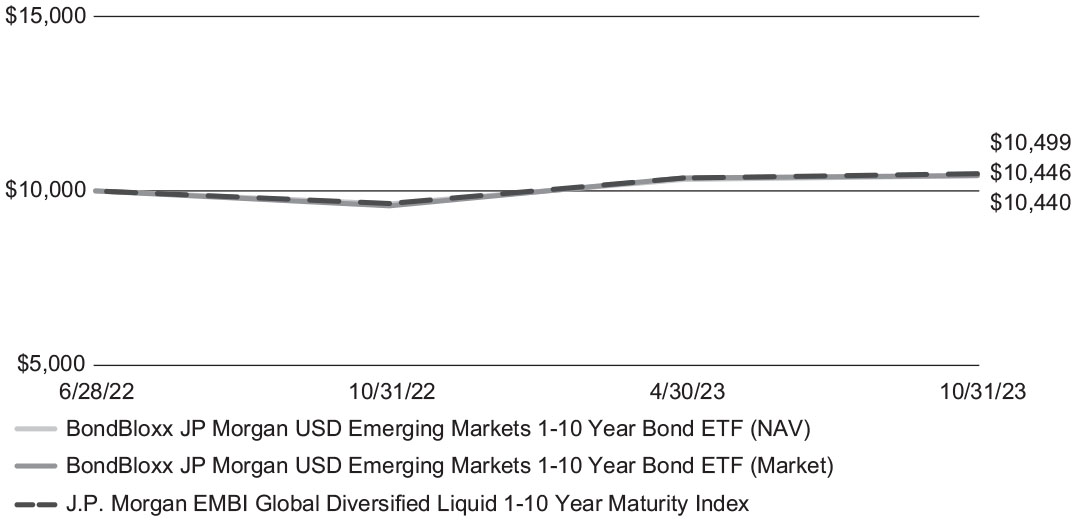

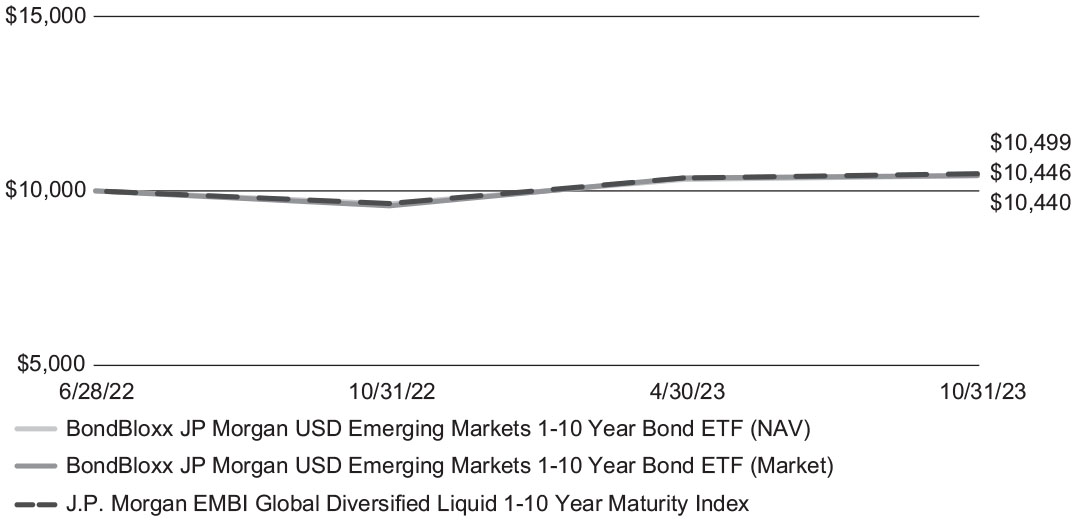

The following graph depicts the hypothetical $10,000 investment in the BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD) at net asset value and market price as compared to the J.P. Morgan EMBI Global Diversified Liquid 1-10 Year Maturity Index(1) from the Fund’s inception date (June 28, 2022(2)) to October 31, 2023.

BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx JP Morgan USD Emerging Markets | | | | Since |

| 1-10 Year Bond ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 8.50% | | 3.26% |

| Market Value | | 9.17% | | 3.32% |

| J.P. Morgan EMBI Global Diversified Liquid | | | | |

| 1-10 Year Maturity Index | | 8.96% | | 3.69% |

| (1) | The J.P. Morgan EMBI Global Diversified Liquid 1-10 Year Maturity Index contains all bonds with at least $1 billion in face amount outstanding in the J.P. Morgan EMBI Global Diversified Index (the “Underlying Index”) that have an average life below 10 years at each month-end rebalance. The Underlying Index is a broad, diverse U.S. dollar-denominated emerging markets debt benchmark that tracks the total return of actively-traded external debt instruments in emerging market countries. |

| (2) | The Fund commenced operations on June 28, 2022. Shares of XEMD were listed on the Cboe BZX, Inc. on June 30, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.29%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

Fund Performance Overview (Unaudited) (Continued)

U.S. Treasury

The U.S. economy showed remarkable resilience over the 12-month period ending October 31, 2023 in the face of higher interest rates, persistent inflation and numerous external shocks. Economic growth was fueled by steady consumer spending, as the enduring strength of the labor market shored up household confidence. Gross Domestic Product grew at an annualized pace of 5.2% in the third quarter of 2023 - the fastest expansion in close to two years. The U.S. unemployment rate held near historic lows throughout the period. Meanwhile, signs of weakness were evident in areas such as housing, industrial production, and manufacturing.

Inflation pressures in the U.S. eased substantially from the 40-year peak reached in mid-2022, as annual consumer price growth hovered between 3.0% and 4.0% by mid-2023, down from 9.1% at its peak. This favorable trend in consumer price growth during the period enabled the Federal Reserve to slow its interest rate tightening campaign, having kept its policy rate unchanged at three of the last four meetings. This follows an aggressive 525 basis points in total rate increases over the previous 18 months.

After a year of double-digit declines across most asset classes, most fixed income sectors generated positive returns during the 12-month period ending in October 2023, led by higher-income generating sectors such as U.S. high yield and emerging markets. The overall equity market rose over 10%, driven by the technology sector and potential impacts of artificial intelligence, while other equity sectors and small-cap stocks lagged.

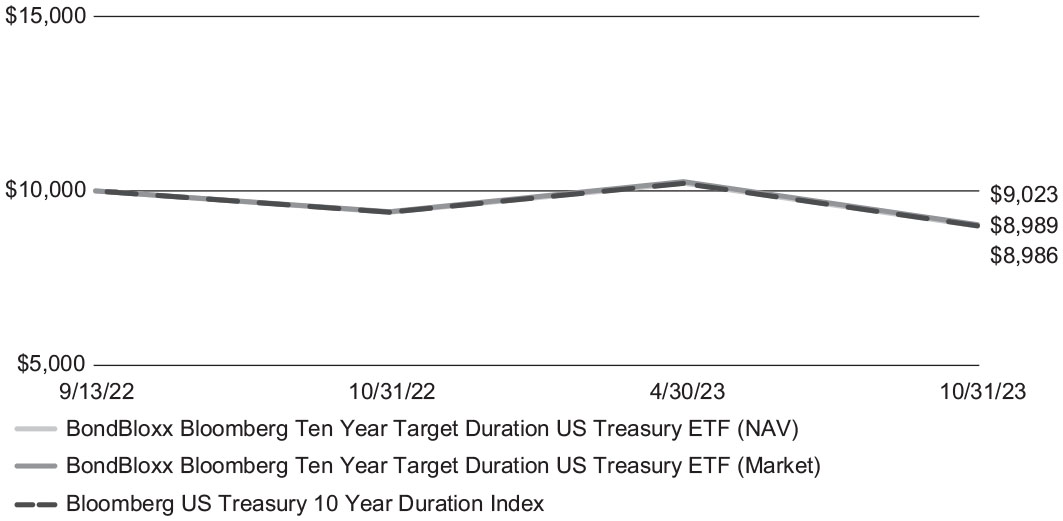

Yields on U.S. Treasuries rose during the period from October 31, 2022 to October 21, 2023 as the Federal Reserve raised interest rates in an effort to contain inflation. During the 12-month period, the Fed raised its target policy rate from 3.25% to 5.50%, completing a cumulative +5.25% in rate increases that began in early 2022. While annual inflation came down significantly from a peak of 9.1% in mid-2022 to 3.0% in mid-2023, annual price growth remained above the Fed’s oft-stated 2.0% target, which drove fears of entrenched inflation as well as additional Fed actions.

During the 12-month period, the yield on the benchmark 2-year Treasury rose by +0.60%, from 4.49% to 5.09%. The yield on the benchmark 10-year note rose by +0.88%, from 4.05% to 4.93%.

Shorter-dated Treasury securities earned positive returns during the period, as the income generated by interest payments more than compensated investors for downward security price movement. Meanwhile, returns were negative in longer maturities. For example, the Bloomberg US Treasury One Year Duration Index generated a return of +4.05% while the Bloomberg US Treasury Ten Year Duration Index returned -4.20% over the period.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg Six Month Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

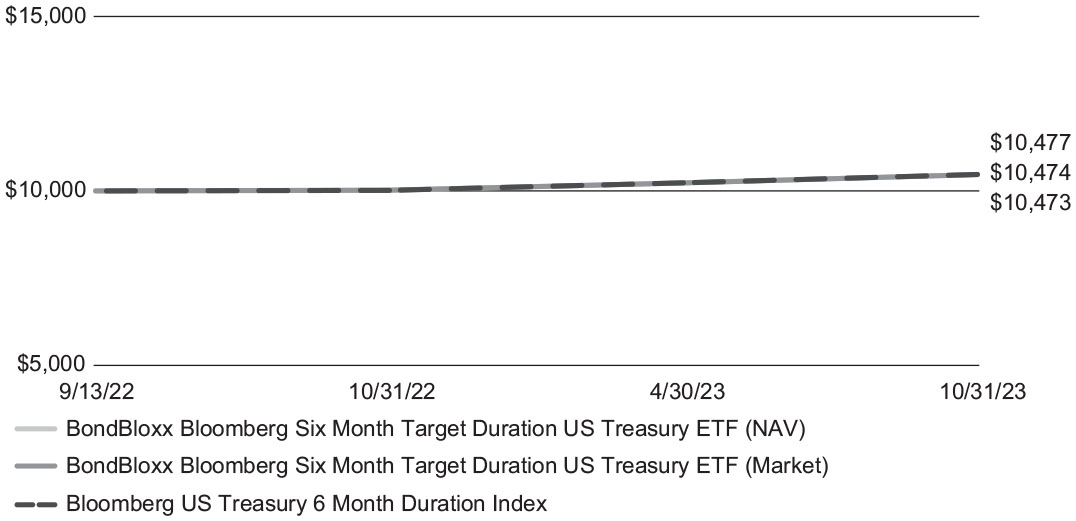

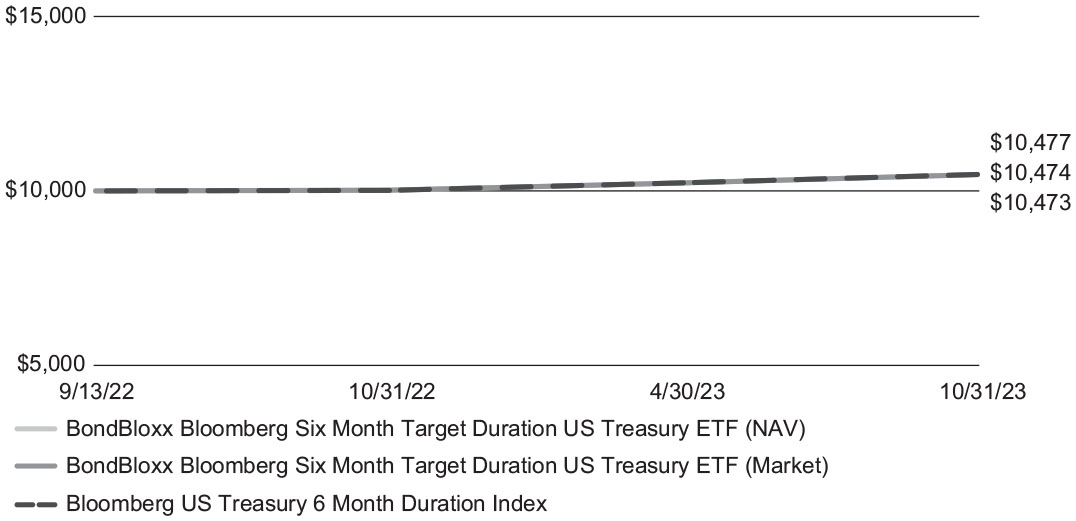

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Six Month Target Duration US Treasury ETF (XHLF) at net asset value and market price as compared to the Bloomberg US Treasury 6 Month Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2023.

BondBloxx Bloomberg Six Month Target Duration US Treasury ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx Bloomberg Six Month | | | | Since |

| Target Duration US Treasury ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 4.55% | | 4.17% |

| Market Value | | 4.50% | | 4.19% |

| Bloomberg US Treasury 6 Month | | | | |

| Duration Index | | 4.60% | | 4.20% |

| (1) | The Bloomberg US Treasury 6 Month Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Bill Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 6 month target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XHLF were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.03%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg One Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

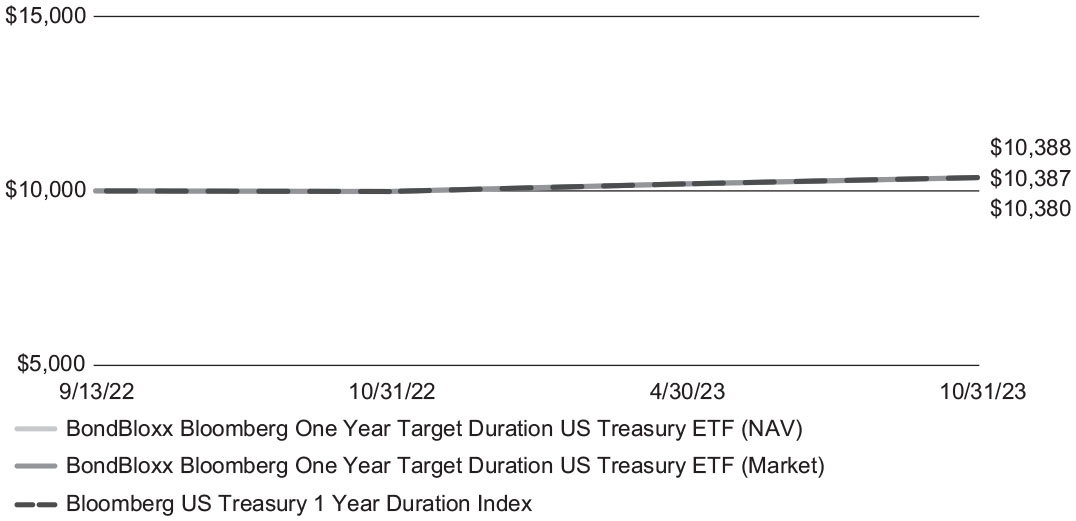

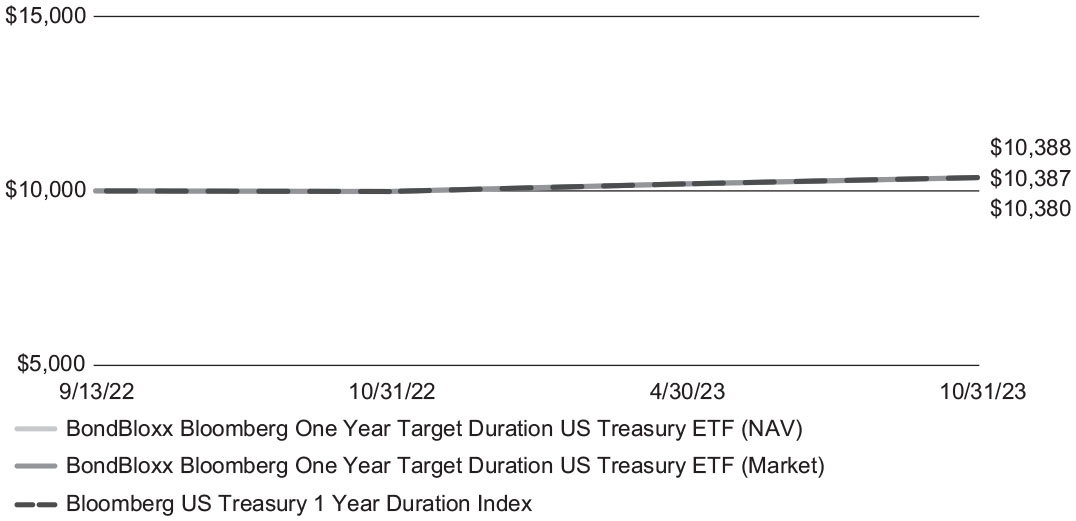

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg One Year Target Duration US Treasury ETF (XONE) at net asset value and market price as compared to the Bloomberg US Treasury 1 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2023.

BondBloxx Bloomberg OneYear Target Duration US Treasury ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx Bloomberg One Year | | | | Since |

| Target Duration US Treasury ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 4.01% | | 3.35% |

| Market Value | | 4.02% | | 3.44% |

| Bloomberg US Treasury 1 Year | | | | |

| Duration Index | | 4.05% | | 3.42% |

| (1) | The Bloomberg US Treasury 1 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Short Treasury Index and Bloomberg US Treasury Index (each an “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 1 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XONE were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.03%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg Two Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

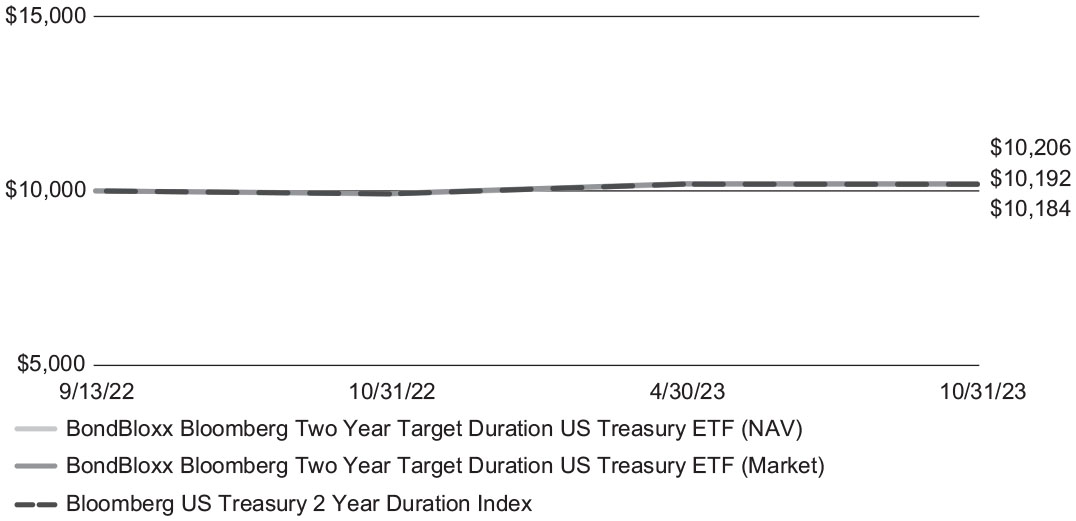

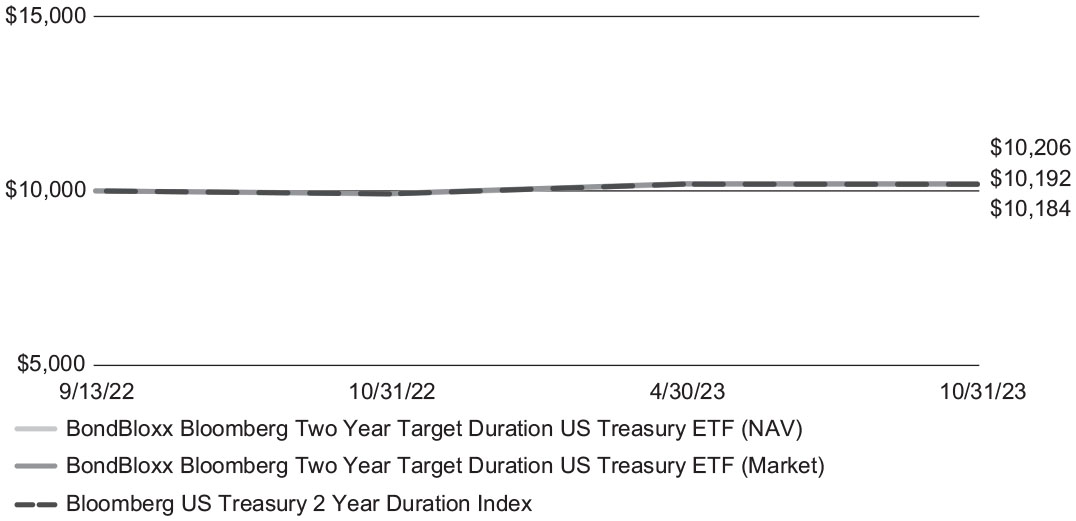

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Two Year Target Duration US Treasury ETF (XTWO) at net asset value and market price as compared to the Bloomberg US Treasury 2 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2023.

BondBloxx Bloomberg TwoYear Target Duration US Treasury ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx Bloomberg Two Year | | | | Since |

| Target Duration US Treasury ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 2.76% | | 1.62% |

| Market Value | | 2.82% | | 1.83% |

| Bloomberg US Treasury 2 Year | | | | |

| Duration Index | | 2.81% | | 1.69% |

| (1) | The Bloomberg US Treasury 2 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 2 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XTWO were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.05%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg Three Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

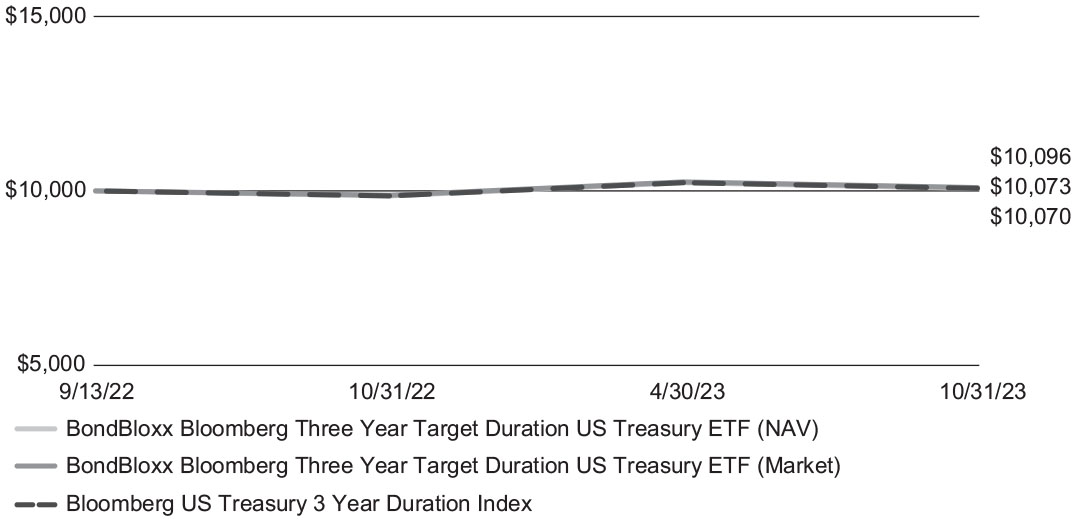

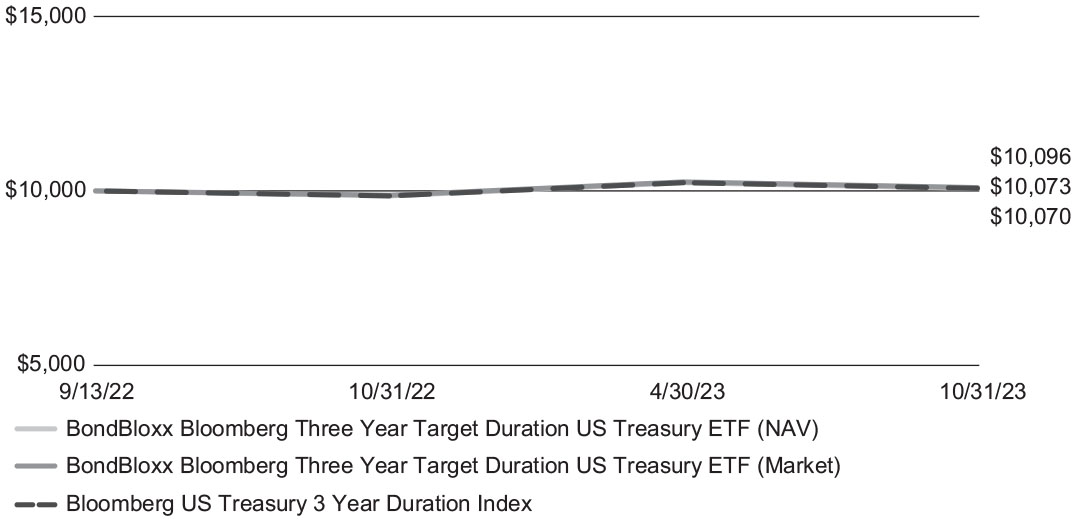

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Three Year Target Duration US Treasury ETF (XTRE) at net asset value and market price as compared to the Bloomberg US Treasury 3 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2023.

BondBloxx Bloomberg ThreeYear Target Duration US Treasury ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx Bloomberg Three Year | | | | Since |

| Target Duration US Treasury ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 2.18% | | 0.62% |

| Market Value | | 2.24% | | 0.86% |

| Bloomberg US Treasury 3 Year | | | | |

| Duration Index | | 2.21% | | 0.64% |

| (1) | The Bloomberg US Treasury 3 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 3 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XTRE were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.05%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg Five Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

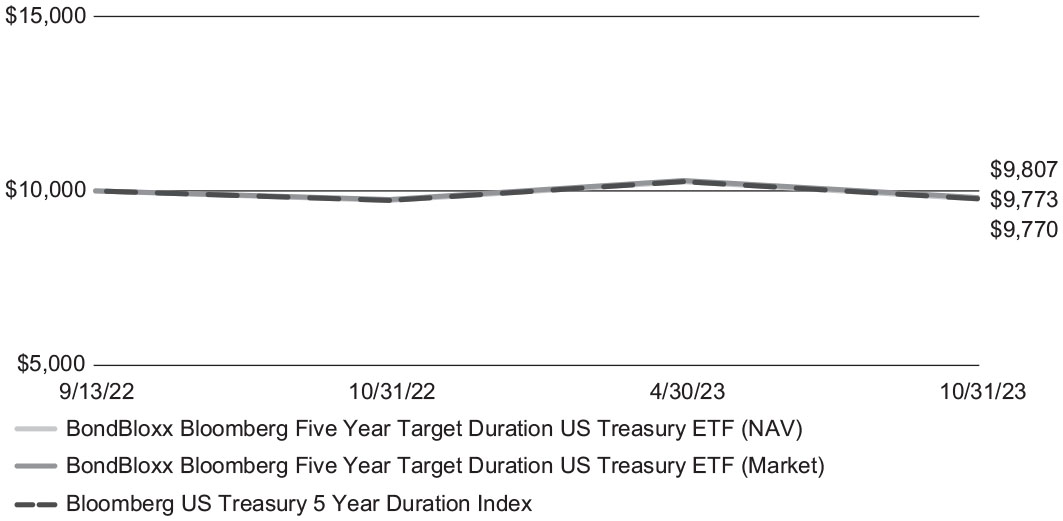

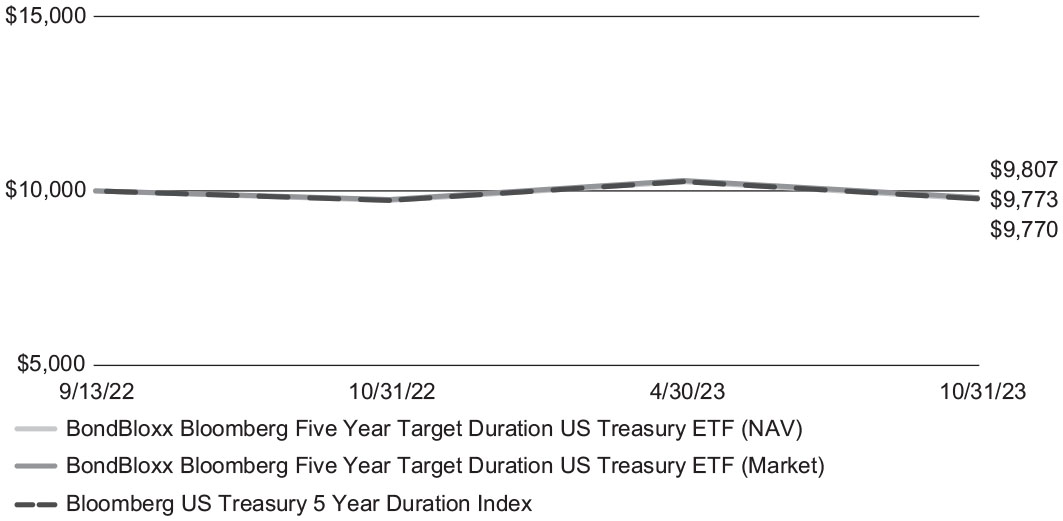

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Five Year Target Duration US Treasury ETF (XFIV) at net asset value and market price as compared to the Bloomberg US Treasury 5Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2023.

BondBloxx Bloomberg FiveYear Target Duration US Treasury ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx Bloomberg Five Year | | | | Since |

| Target Duration US Treasury ETF | | 1 year | | Inception(2) |

| Net Asset Value | | 0.46% | | (2.04)% |

| Market Value | | 0.59% | | (1.71)% |

| Bloomberg US Treasury 5 Year | | | | |

| Duration Index | | 0.49% | | (2.01)% |

| (1) | The Bloomberg US Treasury 5 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 5 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XFIV were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

As stated in the current prospectus, the expense ratio is 0.05%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

BONDBLOXX ETF TRUST

BondBloxx Bloomberg Seven Year Target Duration US Treasury ETF Growth

Fund Performance Overview (Unaudited) (Continued)

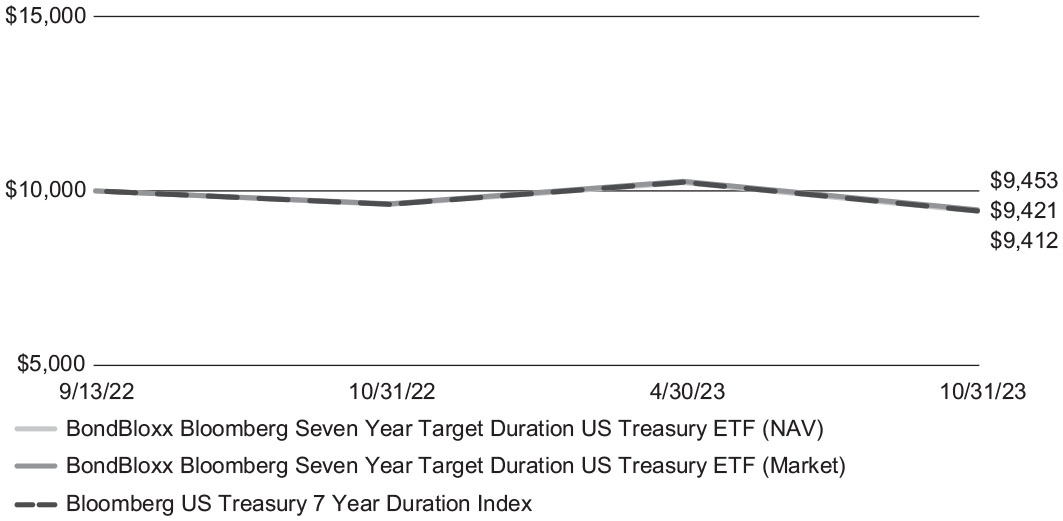

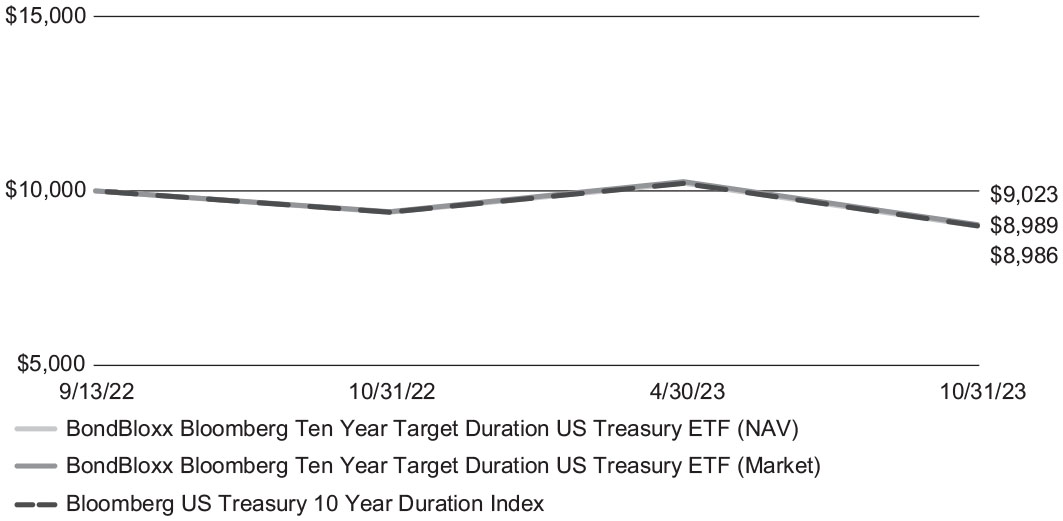

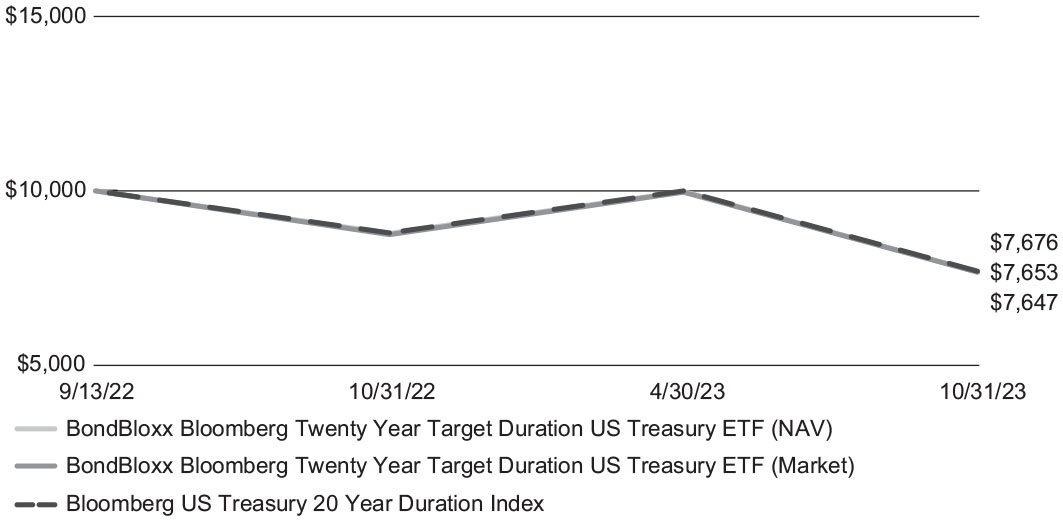

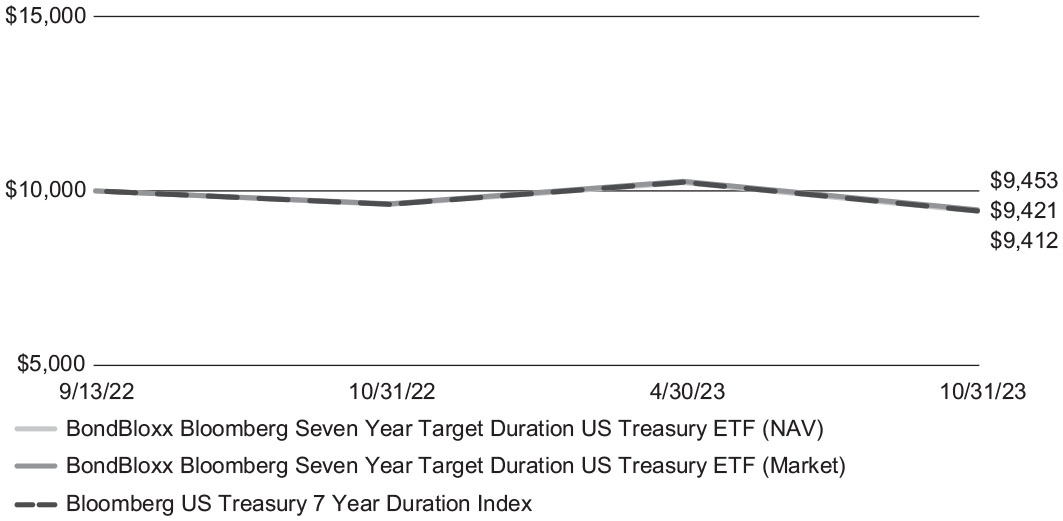

The following graph depicts the hypothetical $10,000 investment in the BondBloxx Bloomberg Seven Year Target Duration US Treasury ETF (XSVN) at net asset value and market price as compared to the Bloomberg US Treasury 7 Year Duration Index(1) from the Fund’s inception date (September 13, 2022(2)) to October 31, 2023.

BondBloxx Bloomberg SevenYear Target Duration US Treasury ETF

Growth of a Hypothetical $10,000 Investment

| Average Annual Total Returns as of October 31, 2023 | | | | |

| BondBloxx Bloomberg Seven Year | | | | Since |

| Target Duration US Treasury ETF | | 1 year | | Inception(2) |

| Net Asset Value | | (2.04)% | | (5.22)% |

| Market Value | | (1.79)% | | (4.88)% |

| Bloomberg US Treasury 7 Year | | | | |

| Duration Index | | (1.99)% | | (5.14)% |

| (1) | The Bloomberg US Treasury 7 Year Duration Index is comprised of certain U.S. Treasury notes and bonds that are included in the Bloomberg US Treasury Index (the “Underlying Index”). The Index is constructed using two underlying “duration buckets” of U.S. Treasury notes and bonds included in the Underlying Index that are weighted by market capitalization of their component securities and then blended according to the weighting required to match the 7 year target duration of the Index at the monthly rebalancing date. |

| (2) | The Fund commenced operations on September 13, 2022. Shares of XSVN were listed on the NYSE Arca, Inc. on September 15, 2022. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit https://bondbloxxetf.com/.

Net asset value (“NAV”) returns are based on the dollar value of a single share of the Fund, calculated using the value of the underlying assets of the Fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the NewYork Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times. Total return reflects reinvestment of distributions on ex-date for NAV returns and payment date for market value returns. The market price of the Fund’s shares may differ significantly from their NAV during periods of market volatility. The referenced indices are shown for informational purposes only and are not meant to represent the Fund. One cannot invest directly in an index.

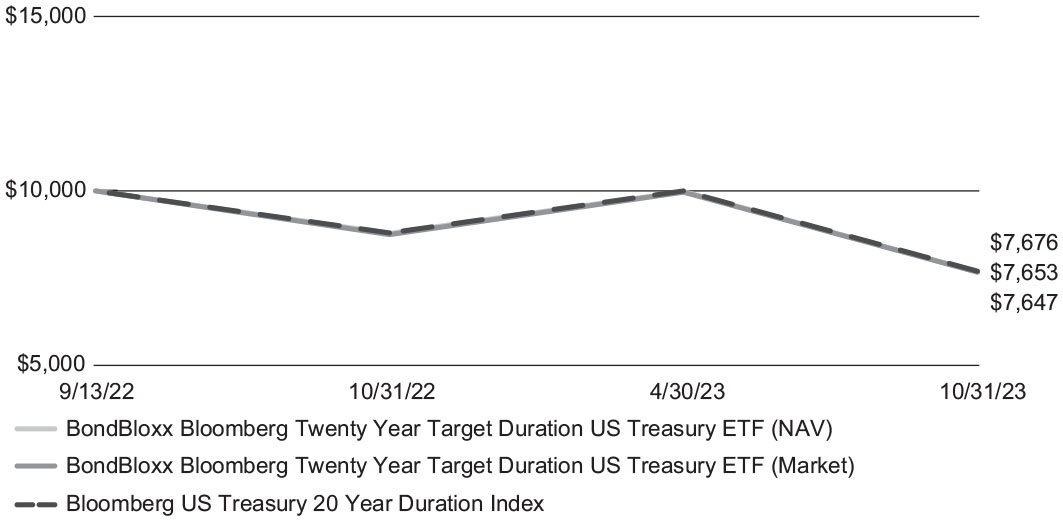

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.