Summary of Unaudited Pro Forma Condensed Combined Financial Information, page 44

| 3. | Please revise to disclose the number of shares issued and outstanding under the minimum cash redemption scenario in the pro forma balance sheet information both here and on page 209. |

Response: In response to the Staff’s comment, the Company has revised the sections in the Second Amendment titled “Summary of the Proxy Statement/Prospectus – Summary Unaudited Pro Forma Condensed Combined Financial Information” on page 44 and “Unaudited Pro Forma Condensed Combined Financial Information – Basis of Pro Forma Presentation” on page 206.

Risk Factors

Financial, Tax and Accounting-Related Risks

Nuvini S.A. had identified material weaknesses in internal control over financial

reporting, page 87

| 4. | We note your revised disclosures in response to prior comment 4. Please further revise this risk factor header to state, as you have on page 268, that Nuvini S.A has identified material weaknesses in its internal control over financial reporting “and information technology general controls and, as a result restated its previous period’s financial statements.” |

Response: In response to the Staff’s comment, the Company has revised the sections in the Second Amendment titled “Summary of the Proxy Statement/Prospectus – Risk Factor Summary” on page 40 and “Risk Factors – Financial, Tax and Accounting-Related Risks– Nuvini S.A. has identified material weaknesses in its internal control over financial reporting and information technology general controls and, as a result, restated its previous period’s financial statements. If Nuvini S.A. fails to remediate such material weaknesses (and any other ones) or establish and maintain effective internal controls over financial reporting, Nuvini S.A. may be unable to accurately report its results of operations, meet its reporting obligations and/or prevent fraud.” on page 87.

Unaudited Pro Forma Condensed Combined Financial Information Basis of Pro Forma Presentation, page 205

| 5. | We note from your revised disclosures in response to comment 9 that if the Minimum Cash Condition is not satisfied and such condition is not waived by Nuvini, the Business Combination will not be completed. Please tell us whether Nuvini has any intent to waive the minimum cash condition and if so, revise to clarify how such waiver might impact the pro forma financial information provided. |

Response: In response to the Staff’s comment, the Company has revised the sections in the Second Amendment titled “Summary of the Proxy Statement/Prospectus – Summary Unaudited Pro Forma Condensed Combined Financial Information” on page 44 and “Notes to Unaudited Pro Forma Condensed Combined Financial Information – Basis of Pro Forma Presentation” on page 206.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements Earnings (loss) per share, page 215

| 6. | Please explain why subscription rights and contingent consideration to be settled in equity are excluded from the pro forma weighted average shares outstanding as indicate in note (4). In your response, tell us the number of shares to be issued for each and the impact on pro forma net loss per share. |

Response: In response to the Staff’s comment, the Company has revised the section in the Second Amendment titled “Notes to Unaudited Pro Forma Condensed Combined Financial Information – Note 1. Adjustments to Unaudited Pro Forma Condensed Combined Statement of Financial Information” on page 216. In particular, the Company has revised note 4 in the table under the “Earnings (loss) per share” (“EPS”) to disclose the number of subscription rights and contingent consideration to be settled in equity, which are both deemed to be potentially dilutive shares under IAS 33–Earnings Per Share. The subscription rights will be settled in 9,980,309 New Nuvini Ordinary Shares and the contingent consideration will be settled in an estimated 14,415,571 New Nuvini Ordinary Shares. Upon evaluation by the Company, the subscription rights and contingent consideration are excluded from the pro forma EPS calculation for their anti-dilutive impacts.

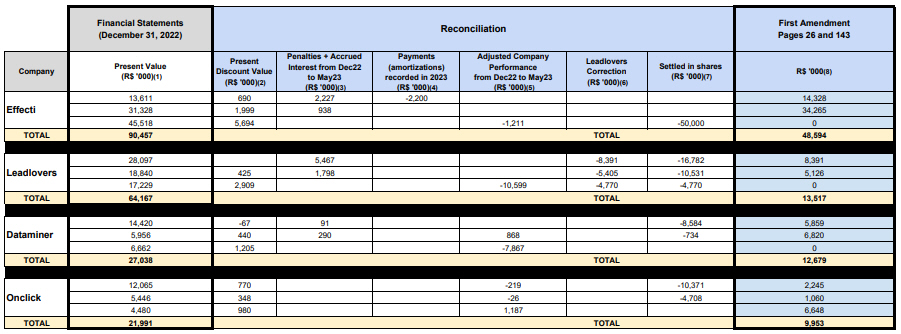

The Company’s contingent consideration arrangements are subject to time-based conditions and performance-based conditions that are not related to the consummation of the Business Combination, but are rather dependent on the future performance of the Company’s subsidiaries. As the performance-based and time-based conditions were not met for the period ended December 31, 2022, no pro forma adjustment was made to show the settlement of contingent consideration. Therefore, the estimated number of New Nuvini Ordinary Shares arising therefrom were not considered as issued and outstanding, and were not included in computing the weighted average number of New Nuvini Ordinary Shares outstanding. As the number of New Nuvini Ordinary Shares to be issued under the contingent consideration arrangements is dependent upon the future performance of the Company’s subsidiaries, the Company used its best estimate in computing the issued New Nuvini Ordinary Shares.

4