As filed with the Securities and Exchange Commission on November 15, 2023

Registration No. 333-273360

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5

to

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ARCADIUM LITHIUM PLC

(Exact name of registrant as specified in its charter)

Bailiwick of Jersey | | | 2819 | | | 98-1737136 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

Suite 12, Gateway Hub

Shannon Airport House

Shannon, Co. Clare V14 E370

Ireland

Tel. +353 1 6875238

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Paul W. Graves

Chief Executive Officer

Suite 12, Gateway Hub

Shannon Airport House

Shannon, Co. Clare V14 E370

Ireland

Tel. +353 1 6875238

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Michael Kaplan William H. Aaronson Cheryl Chan Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 Tel.: (212) 450-4000 | | | Sara Ponessa General Counsel Livent Corporation 1818 Market Street, Suite 2550 Philadelphia, Pennsylvania 19103 Tel.: (215) 299-5900 | | | Brian J. Fahrney Joseph P. Michaels Sidley Austin LLP One South Dearborn Street Chicago, Illinois 60603 Tel.: (312) 853-7000 | | | John Sanders Chief Legal Officer and Company Secretary Allkem Limited Riparian Plaza—Level 35 71 Eagle Street Brisbane, Queensland 4000 Australia Tel.: +61 7 3064 3600 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and upon completion of the transactions described in the enclosed document.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | | ☒ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☐ | | | Smaller reporting company | | | ☐ |

| | | | | Emerging growth company | | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this proxy statement/prospectus is not complete and may be changed. Arcadium Lithium plc may not issue or distribute the securities offered by this proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission (“SEC”) is effective. This proxy statement/prospectus is not an offer to sell these securities and Arcadium Lithium plc is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY—SUBJECT TO COMPLETION, DATED NOVEMBER 15, 2023

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

To our Stockholders:

You are cordially invited to attend a special meeting of stockholders of Livent Corporation (“Livent”). The meeting will be held virtually via live webcast on [ ], 2023, at [ : ] Eastern time. The meeting can be accessed by visiting www.virtualshareholdermeeting.com/LTHM2023SM. There will be no physical location for stockholders to attend. Whether or not you plan to attend, please vote your shares as promptly as possible.

As you may be aware, on May 10, 2023, Livent entered into a Transaction Agreement, which was subsequently amended by the Amendment to Transaction Agreement, dated as of August 2, 2023 and the Second Amendment to Transaction Agreement, dated as of November 5, 2023 (and as may further be amended from time to time, the “Transaction Agreement”), with Allkem Limited, an Australian public company limited by shares (“Allkem”), and Arcadium Lithium plc, a public limited company incorporated under the laws of the Bailiwick of Jersey (originally incorporated as Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey and f/k/a Allkem Livent plc) (“NewCo”), which was subsequently joined by Lightning-A Merger Sub, Inc., a Delaware corporation (“Merger Sub”), providing for a combination of Livent and Allkem in a merger of equals transaction.

The Transaction Agreement provides that, if the transaction is approved by the Livent and Allkem shareholders, respectively, and the other conditions to closing the transaction are satisfied or waived at or prior to the closing of the transaction: (a) pursuant to a scheme of arrangement under Australian law (the “scheme”), each issued, fully paid ordinary share of Allkem will be exchanged for (i) where the Allkem shareholder has not elected to receive ordinary shares, par value $1.00 per share, of NewCo (each, a “NewCo Share”), one NewCo CHESS Depositary Instrument (a “CDI”) quoted on ASX representing a beneficial ownership interest (but not legal title) in one NewCo Share (with exceptions for certain jurisdictions in which Allkem shareholders may receive NewCo Shares unless they elect otherwise) and (ii) where the Allkem shareholder has elected to receive NewCo Shares, one NewCo Share (provided that, where an Allkem shareholder has a registered address in an ineligible jurisdiction, the Allkem shares of the ineligible Allkem shareholder will be transferred to a sale nominee prior to the scheme implementation, and the sale nominee will then be issued CDIs under the scheme and will subsequently sell all of the CDIs issued to it and remit a pro-rata share of the net proceeds of the sale of all of the CDIs issued to the sale nominee to each ineligible Allkem shareholder); and (b) as promptly as practicable after the scheme implementation, Merger Sub will merge with and into Livent, with Livent surviving the merger as a wholly owned subsidiary of NewCo (the “merger”), pursuant to which each share of Livent common stock, par value $0.001 per share (each, a “Livent Share”), other than certain excluded shares, will be converted into the right to receive 2.406 NewCo Shares. NewCo Shares are expected to be listed on the NYSE.

As a result of the transaction, each of Livent and Allkem will be a wholly owned subsidiary of NewCo, former Livent stockholders will become holders of NewCo Shares and former Allkem shareholders will become holders of NewCo Shares or CDIs. Immediately following the completion of the transaction, former Allkem shareholders are expected to own approximately 56% of NewCo and former Livent stockholders are expected to own approximately 44% of NewCo.

Together, Livent and Allkem expect to create a leading global lithium chemicals producer with the scale and global capabilities to better serve customers. The combined company will have a significant footprint of low-cost assets diversified across key geographies, products, and customers. We believe combining these two organizations will provide an enhanced value proposition for our customers, stockholders, employees and local communities, while maintaining our unwavering commitment to sustainability and responsible growth.

The Livent board of directors (the “Livent Board”) unanimously approved the Transaction Agreement and the transactions contemplated thereby and is calling the upcoming virtual special meeting at which Livent stockholders can vote upon a proposal to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger. The Livent Board unanimously recommends that you vote “FOR” each of the proposals to be considered at the Livent special meeting, including the adoption of the Transaction Agreement and the approval of the transactions contemplated thereby, including the merger. The enclosed Notice of Special Meeting includes further details about the Livent special meeting.

You are welcome to virtually attend the Livent special meeting on [ ], 2023, but regardless of whether you plan to attend, please vote your shares via the instructions on page 9 of the enclosed proxy statement/prospectus and on the enclosed proxy card. Your vote is very important because the transaction cannot be completed unless holders of a majority of the outstanding Livent Shares entitled to vote on the adoption of the Transaction Agreement and the approval of the transactions contemplated thereby, including the merger, vote in favor of such adoption and approval, respectively. A failure to vote your shares on the proposal to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger, will have the same effect as a vote against the proposal.

This document serves as (i) a proxy statement of Livent to solicit proxies for its special meeting of stockholders and (ii) a prospectus relating to the NewCo Shares to be issued to Livent stockholders as consideration in the merger. It contains answers to frequently asked questions and a summary of the important terms of the Livent special meeting, the Transaction Agreement and the transactions contemplated thereby, including the merger. A copy of the Transaction Agreement is attached as Annex A. We encourage you to read the proxy statement/prospectus, including its annexes and the documents incorporated by reference, carefully and in its entirety, including the section entitled “Risk Factors” beginning on page 37.

Thank you for your continued support.

Sincerely,

| | | /s/ Paul W. Graves | | | /s/ Pierre Brondeau | |

| | | Paul W. Graves | | | Pierre Brondeau | |

| | | President and Chief Executive Officer | | | Chairman of the Board |

Neither the SEC nor any state securities commission has approved or disapproved of the transactions described herein or the securities to be issued under this proxy statement/prospectus or determined that this proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this proxy statement/prospectus is [ ], 2023 and it is first being mailed to Livent stockholders on or about [ ], 2023.

LIVENT CORPORATION

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF LIVENT CORPORATION:

You are cordially invited to attend a special meeting of stockholders (the “Livent Special Meeting”). We will hold the meeting virtually via live webcast on [ ], 2023, at [ : ] Eastern time. The meeting can be accessed by visiting www.virtualshareholdermeeting.com/LTHM2023SM. There will be no physical location for stockholders to attend. The purpose of the Livent Special Meeting is to consider and vote upon the following proposals:

| 1. | Livent Transaction Agreement Proposal. To adopt the Transaction Agreement, dated as of May 10, 2023, as amended by the Amendment to Transaction Agreement, dated as of August 2, 2023 and the Second Amendment to Transaction Agreement, dated as of November 5, 2023 (and as may be further amended from time to time, the “Transaction Agreement”), by and among Livent Corporation (“Livent”), Allkem Limited, an Australian public company limited by shares (“Allkem”), Arcadium Lithium plc, a public limited company incorporated under the laws of the Bailiwick of Jersey (originally incorporated as Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey and f/k/a Allkem Livent plc) (“NewCo”) and Lightning-A Merger Sub, Inc., a Delaware company (“Merger Sub”), pursuant to which, among other transactions, Merger Sub will merge with and into Livent, with Livent surviving the merger as a wholly owned subsidiary of NewCo (the “merger”), and each share of common stock, par value $0.001 per share, of Livent (the “Livent Shares”), other than certain excluded shares, will be converted into the right to receive 2.406 ordinary shares, par value $1.00 per share, of NewCo (the “NewCo Shares”), and approve the transactions contemplated by the Transaction Agreement, including the merger (the “Livent Transaction Agreement Proposal”). |

| 2. | Livent Advisory Compensation Proposal. To approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement (the “Livent Advisory Compensation Proposal”). |

| 3. | NewCo Advisory Governance Documents Proposals. To approve, in non-binding, advisory votes, certain provisions of the articles of association of NewCo (the “NewCo Advisory Governance Documents Proposals”). |

| 4. | Livent Adjournment Proposal. To approve one or more adjournments of the Livent Special Meeting to a later date or dates for any purpose if necessary or appropriate, including if necessary or appropriate to solicit additional proxies if there are insufficient votes to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger, at the time of the Livent Special Meeting (the “Livent Adjournment Proposal”). |

Accompanying this Notice of Special Meeting of Stockholders is a proxy statement/prospectus, which describes these proposals in more detail, and a form of proxy, which allows you to vote on these proposals. Please carefully review these materials, including the annexes to and information incorporated by reference into the proxy statement/prospectus. The Livent Board unanimously recommends that Livent stockholders vote “FOR” each of these proposals.

We welcome you to virtually attend the Livent Special Meeting, but whether or not you plan to attend, please submit your completed proxy via phone, mail or internet as soon as possible. Proxies are revocable and will not affect your right to vote during the special meeting in the event that you revoke the proxy and attend the virtual meeting. Instructions on how to vote are found in the sections titled “Information About the Livent Special Meeting—Voting of Proxies; Incomplete Proxies” and “Information about the Livent Special Meeting—Shares Held in Street Name and Broker Non-Votes” beginning on page 78 of the proxy statement/prospectus.

Only Livent stockholders of record as shown on our books at the close of business on [ ], 2023 will be entitled to vote at the Livent Special Meeting. Each Livent stockholder is entitled to one vote per Livent Share held by such Livent stockholder on all matters to be voted on at the meeting.

| | | | | BY ORDER OF THE BOARD OF DIRECTORS, | ||

| | | | | |||

| | | | | /s/ Sara Ponessa | ||

Dated: | | | [ ], 2023 | | | Sara Ponessa |

| | | Philadelphia, Pennsylvania | | | Vice President, General Counsel and Secretary |

This proxy statement/prospectus, which forms part of a registration statement on Form S-4 filed with the SEC by NewCo, constitutes a prospectus of NewCo under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the NewCo Shares to be issued to Livent stockholders pursuant to the Transaction Agreement.

This document also constitutes a proxy statement of Livent under Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It also constitutes a notice of meeting with respect to the Livent Special Meeting, at which Livent stockholders will be asked to consider and vote upon the Livent Transaction Agreement Proposal, the Livent Advisory Compensation Proposal, the NewCo Advisory Governance Documents Proposals and the Livent Adjournment Proposal, each as described in more detail herein under “Information About the Livent Special Meeting.” NewCo Shares and CDIs to be issued in the transaction to holders of Allkem shares will be issued pursuant to an exemption from the registration requirements provided by Section 3(a)(10) of the Securities Act based on the approval of the scheme by the Court.

NewCo has supplied all information contained in this proxy statement/prospectus relating to NewCo, Livent has supplied all information contained in or incorporated by reference into this proxy statement/prospectus relating to Livent and Allkem has supplied all information contained in this proxy statement/prospectus relating to Allkem.

No person has been authorized to provide you with information that is different from what is contained in or incorporated by reference into this proxy statement/prospectus. This proxy statement/prospectus is dated , 2023 and you should not assume that the information contained in this proxy statement/prospectus is accurate as of any date other than such date unless otherwise specifically provided herein. Further, you should not assume that the information incorporated by reference into this proxy statement/prospectus is accurate as of any date other than the date of the incorporated document. Neither the mailing of this proxy statement/prospectus to Livent stockholders nor the issuance by NewCo of NewCo Shares pursuant to the Transaction Agreement will create any implication to the contrary.

A copy of this document has been delivered to the Jersey Registrar of Companies (the “Registrar”) in accordance with Article 5 of the Companies (General Provisions) (Jersey) Order 2002, and the Registrar has given, and has not withdrawn, consent to its circulation. The Jersey Financial Services Commission (“JFSC”) has given, and has not withdrawn, its consent under Article 2 of the Control of Borrowing (Jersey) Order 1958 to the issue of NewCo Shares. The JFSC is protected by the Control of Borrowing (Jersey) Law 1947 against liability arising from the discharge of its functions under that law. It must be distinctly understood that, in giving these consents, neither the Registrar nor the JFSC takes any responsibility for the financial soundness of NewCo or for the correctness of any statements made, or opinions expressed, with regard to it. If you are in any doubt about the contents of this document you should consult your stockbroker, bank manager, solicitor, accountant or other financial adviser. The current directors of NewCo have taken all reasonable care to ensure that the facts stated in this document are true and accurate in all material respects, and that there are no other facts the omission of which would make misleading any statement in the document, whether of facts or of opinion. All such directors accept responsibility accordingly. It should be remembered that the price of securities and the income from them can go down as well as up.

Nothing in this document or anything communicated to holders or potential holders of the NewCo Shares or CDIs is intended to constitute or should be construed as advice on the merits of, the purchase of or subscription for, NewCo Shares or CDIs or the exercise of any rights attached to them for the purposes of the Financial Services (Jersey) Law 1998.

ii

This proxy statement/prospectus incorporates important business and financial information about Livent from other documents that Livent has filed with the SEC, and that are contained in or incorporated by reference into this proxy statement/prospectus. For a listing of documents incorporated by reference into this proxy statement/prospectus, please see the section entitled “Where You Can Find More Information” beginning on page 301 of this proxy statement/prospectus. This information is available for you to review on the SEC’s website at www.sec.gov.

Any person may request copies of this proxy statement/prospectus and any of the documents incorporated by reference into this proxy statement/prospectus or other information concerning Livent, without charge, by written or telephonic request directed to Livent Corporation, 1818 Market Street, Suite 2550, Philadelphia, Pennsylvania 19103, Telephone: (215) 299-5900; or Morrow Sodali, LLC, Livent’s proxy solicitor, by calling toll-free at (800) 662-5200 or via email at Livent@info.morrowsodali.com.

In order for you to receive timely delivery of the documents in advance of the Livent Special Meeting to be held on [ ], 2023 you must request the information no later than five business days prior to the date of the Livent Special Meeting (i.e., by [ ], 2023).

Neither Allkem nor NewCo currently file reports with the SEC. Following the effectiveness of the registration statement of which this proxy statement/prospectus forms a part, NewCo will file annual, quarterly and current reports and other information with the SEC. SEC filings of NewCo will be available to the public at the SEC website at www.sec.gov.

iii

Unless otherwise indicated or as the context otherwise requires, a reference in this proxy statement/prospectus to:

| • | “Allkem” refers to Allkem Limited, an Australian public company limited by shares; |

| • | “Allkem Board” refers to the board of directors of Allkem; |

| • | “Allkem Shareholder Approval” refers to the approval of the scheme at the scheme meeting by the Allkem shareholders in accordance with the Australian Corporations Act by (i) a majority in number of Allkem shareholders that are present and voting at the scheme meeting (either in person or by proxy or by corporate representative) and (ii) 75% or more of the votes cast on the resolution; and in the case of (i), such other threshold as approved by the Court; |

| • | “Allkem Shares” refers to the ordinary shares of Allkem; |

| • | “Antitrust Division” refers to the Antitrust Division of the U.S. Department of Justice; |

| • | “ASIC” refers to the Australian Securities and Investments Commission; |

| • | “ASX” refers to the ASX Limited (ABN 98 008 624 691) and where the context requires, the securities exchange that it operates; |

| • | “ATO” refers to the Australian Taxation Office; |

| • | “ATO Class Ruling” refers to a class ruling from the ATO in relation to rollover relief for Allkem shareholders who are Australian tax residents who are receiving the scheme consideration in connection with the scheme; |

| • | “Australian Accounting Standards” refers to the Australian Accounting Standards, consistently applied; |

| • | “Australian Corporations Act” refers to the Australian Corporations Act 2001 (Cth); |

| • | “butyllithium” refers to an organolithium compound which is used to initiate polymerization in the manufacturing of synthetic rubber and other polymers and as a chemical reagent in the synthesis of certain organic compounds; |

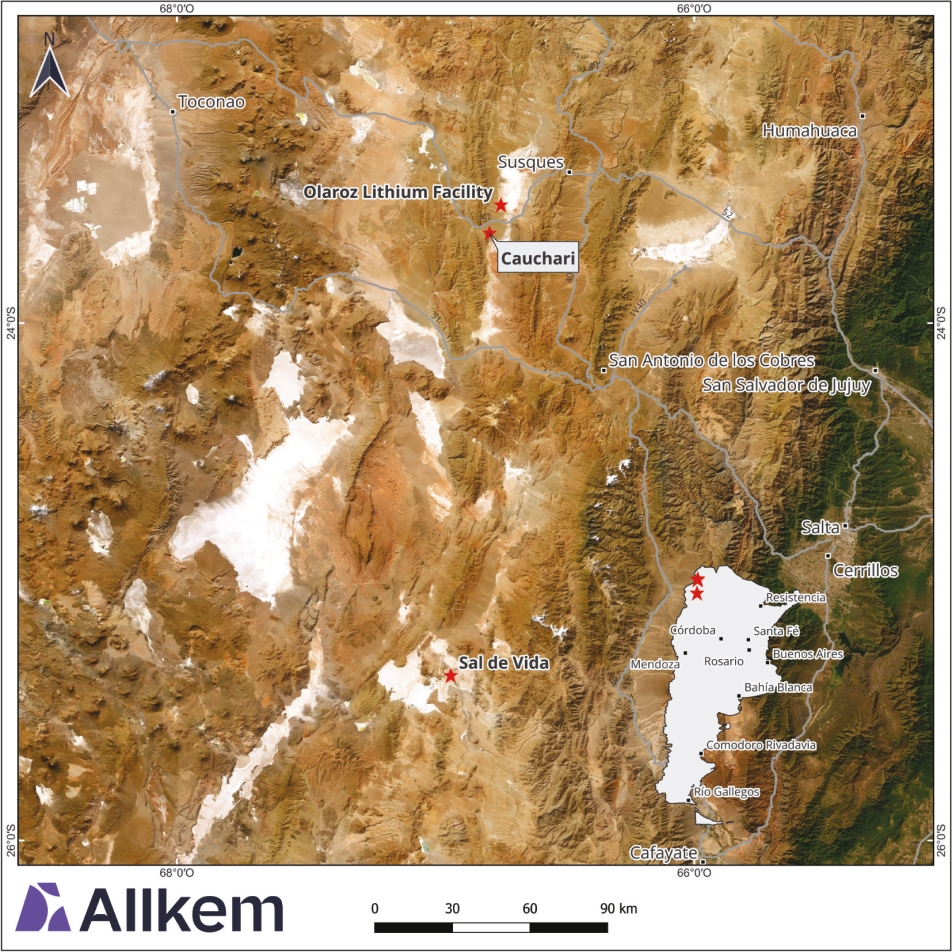

| • | “Cauchari” refers to Allkem’s Cauchari lithium brine project in Jujuy Province, Argentina; |

| • | “CDIs” refers to NewCo CHESS Depositary Instruments, each representing a beneficial ownership interest (but not legal title) in one NewCo Share; |

| • | “CHESS” refers to the Clearing House Electronic Subregister System; |

| • | “closing” refers to the closing of the transaction; |

| • | “Code” refers to the Internal Revenue Code of 1986, as amended; |

| • | “Competing Proposal” refers to, in the case of Livent and Allkem, as applicable, any inquiry, contract, proposal, offer or indication of interest from any third party relating to any transaction or series of related transactions (other than transactions only with the other of Allkem or Livent, respectively, or any of such other party’s subsidiaries) involving, directly or indirectly: (a) any acquisition (by asset purchase, equity purchase, merger, scheme of arrangement (solely in the case of Allkem) or otherwise) by any person or “group” (within the meaning of Section 13(d) of the Exchange Act) of any business or assets of such party or any of its subsidiaries (including capital stock of or ownership interest in any subsidiary) that constitute 20% or more of such party’s and its subsidiaries’ consolidated assets (by fair market value), or generated 20% or more of such party’s and its subsidiaries’ net revenue or earnings for the preceding 12 months, or any license, lease or long-term supply agreement having a similar economic effect, (b) any acquisition of beneficial ownership by any person or “group” (within the meaning of Section 13(d) of the Exchange Act) of 20% or more of the outstanding Livent Shares or Allkem Shares, respectively, or any other securities entitled to vote on the election of directors or any tender or exchange offer that if consummated would result in any person or “group” (within the meaning of Section 13(d) of the Exchange Act) beneficially owning 20% or more of the outstanding Livent Shares or Allkem Shares, respectively, entitled to vote on the election of directors or (c) any merger, consolidation, share exchange, business combination, scheme of arrangement (solely in the case of Allkem), recapitalization, liquidation, dissolution or similar |

iv

transaction involving such party, or any of its subsidiaries whose business or assets constitute 20% or more of such party’s and its subsidiaries’ consolidated assets (by fair market value), or generated 20% or more of such party’s and its subsidiaries’ net revenue or earnings for the preceding 12 months;

| • | “Court” refers to the Federal Court of Australia (Western Australian registry), or such other court of competent jurisdiction under the Australian Corporations Act as may be agreed to in writing by Livent and Allkem; |

| • | “deed poll” refers to the deed poll under which NewCo covenants in favor of the Allkem shareholders to perform the obligations attributed to NewCo under the scheme provided for under the Transaction Agreement; |

| • | “DGCL” refers to the Delaware General Corporation Law, as amended; |

| • | “effective time” refers to the effective time of the merger; |

| • | “end date” refers to February 10, 2024 (subject to extension by either party until May 10, 2024 in order to obtain required antitrust, investment screening or other regulatory approvals); |

| • | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| • | “First Court Hearing” refers to the hearing of the Court pursuant to Section 411(4)(a) of the Australian Corporations Act to consider and, if thought fit, approve the mailing of the scheme booklet (with or without amendment) and convene the scheme meeting; |

| • | “fiscal year 2023” refers, when used with respect to Livent, to Livent’s fiscal year ending December 31, 2023 and, when used with respect to Allkem, to Allkem’s fiscal year ending June 30, 2023; |

| • | “fiscal year 2024” refers, when used with respect to Livent, to Livent’s fiscal year ending December 31, 2024 and, when used with respect to Allkem, to Allkem’s fiscal year ending June 30, 2024; |

| • | “FTC” refers to the U.S. Federal Trade Commission; |

| • | “GAAP” refers to U.S. generally accepted accounting principles, consistently applied; |

| • | “HSR Act” refers to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder; |

| • | “IER” refers to a report, including any update or supplementary report, of the Independent Expert setting out whether or not the scheme is in the best interests of the Allkem shareholders; |

| • | “IFRS” refers to the International Financial Reporting Standards as issued by the International Accounting Standards Board, consistently applied; |

| • | “Independent Expert” refers to the independent expert appointed by Allkem to prepare the IER, which is Kroll Australia Pty Ltd; |

| • | “Intervening Event” refers to, in the case of Livent and Allkem, as applicable, an effect that is material to such party that occurs or arises after the date of the Transaction Agreement that was not known to or reasonably foreseeable by such party’s board of directors as of the date of the Transaction Agreement (or, if known or reasonably foreseeable, the magnitude or material consequences of which were not known or reasonably foreseeable by such party’s board of directors as of the date of the Transaction Agreement); provided, however, that in no event shall the following constitute an Intervening Event: (a) the receipt, existence or terms of an actual or possible Competing Proposal or Superior Proposal of such party, (b) any change, in and of itself, in the price or trading volume of Livent Shares or Allkem Shares, respectively (it being understood that the underlying facts giving rise or contributing to such change may be taken into account in determining whether there has been an Intervening Event, to the extent otherwise permitted by this definition), (c) any effect relating to such party or any of its subsidiaries that does not amount to a material adverse effect, individually or in the aggregate, (d) conditions (or changes in such conditions) in the lithium mining and chemicals industry (including changes in general market prices for lithium chemicals, lithium spodumene concentrate and related products (including pricing under futures contracts) and political or regulatory changes affecting the industry or any changes in applicable law), (e) any opportunity to acquire (by merger, joint venture, partnership, consolidation, scheme of arrangement (solely |

v

in the case of Allkem), acquisition of equity or assets or otherwise), directly or indirectly, any assets, securities, properties or businesses from, or enter into any licensing, collaborating or similar arrangements with, any other person or (f) the fact that such party or any of its subsidiaries exceeds (or fails to meet) internal or published projections or guidance or any matter relating thereto or of consequence thereof (it being understood that the underlying facts giving rise or contributing to such change may be taken into account in determining whether there has been an Intervening Event, to the extent otherwise permitted by this definition);

| • | “Irish IntermediateCo” refers to an Irish private company limited by shares that will be formed in connection with the transaction; |

| • | “IRS” refers to the U.S. Internal Revenue Service; |

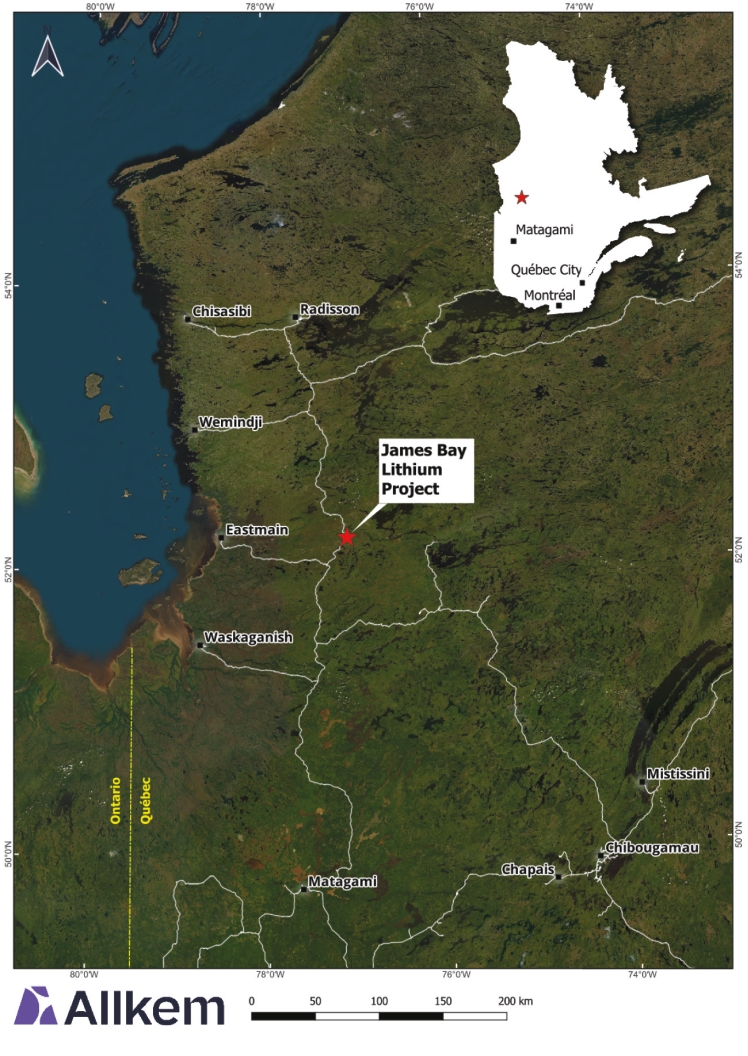

| • | “James Bay” refers to Allkem’s James Bay lithium spodumene project in Québec, Canada; |

| • | “Jersey Companies Law” refers to the Companies (Jersey) Law 1991; |

| • | “Jersey law” refers to the laws of the Bailiwick of Jersey; |

| • | “kMT” refers to a thousand metric tons; |

| • | “LCE” refers to lithium carbonate equivalent; |

| • | “lithium carbonate” refers to an inorganic compound, derived mainly from lithium brine reservoirs or spodumene-bearing ores; |

| • | “lithium hydroxide” refers to an inorganic compound, derived mainly from spodumene-bearing ores or lithium carbonate, that is used mainly in lithium-ion batteries for energy storage applications; |

| • | “Livent” refers to Livent Corporation, a Delaware corporation; |

| • | “Livent Adjournment Proposal” refers to the proposal to approve one or more adjournments of the Livent Special Meeting to a later date or dates for any purpose if necessary or appropriate, including if necessary or appropriate to solicit additional proxies if there are insufficient votes to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger, at the time of the Livent Special Meeting; |

| • | “Livent Advisory Compensation Proposal” refers to the proposal to approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement; |

| • | “Livent Board” refers to the board of directors of Livent; |

| • | “Livent Director RSUs” refers to any outstanding time-vested restricted stock unit held by any Livent non-employee directors; |

| • | “Livent Option” refers to any outstanding time-vested stock option with respect to Livent Shares; |

| • | “Livent Proposals” refers to, collectively, the Livent Transaction Agreement Proposal, the Livent Advisory Compensation Proposal, the NewCo Advisory Governance Documents Proposals and the Livent Adjournment Proposal; |

| • | “Livent PSUs” refers to the outstanding performance-based restricted stock units of Livent; |

| • | “Livent RSUs” refers to the outstanding time-vested restricted stock units of Livent; |

| • | “Livent Shares” refers to the shares of common stock of Livent, par value $0.001 per share; |

| • | “Livent Special Meeting” refers to the special meeting of Livent stockholders described in this proxy statement/prospectus; |

| • | “Livent Stockholder Approval” refers to the affirmative vote of a majority of the outstanding Livent Shares entitled to vote on the Livent Transaction Agreement Proposal, including the adoption of the Transaction Agreement and approval of the transactions contemplated thereby, at the Livent Special Meeting in favor of such adoption and approval, respectively; |

vi

| • | “Livent Transaction Agreement Proposal” refers to the proposal to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger; |

| • | “merger” refers to the merger of Merger Sub with and into Livent, with Livent as the surviving company, as part of the transaction; |

| • | “merger consideration” refers to the right to receive, with respect to each Livent Share (other than certain excluded shares), 2.406 NewCo Shares in the merger; |

| • | “Merger Exchange Ratio” refers to 2.406 NewCo Shares for each Livent Share; |

| • | “Merger Sub” refers to Lightning-A Merger Sub, Inc., a Delaware corporation; |

| • | “Mt Cattlin” refers to Allkem’s Mt Cattlin spodumene operation or project in Ravensthorpe, Western Australia; |

| • | “Naraha” refers to the lithium hydroxide plant in Naraha, Japan of which Allkem owns a 75% economic interest; |

| • | “NewCo” refers to Arcadium Lithium plc, a public limited company incorporated under the Laws of the Bailiwick of Jersey (originally incorporated as Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey and f/k/a Allkem Livent plc); |

| • | “NewCo Advisory Governance Documents Proposals” refers to, collectively, the proposals to approve, in non-binding, advisory votes, certain provisions of the NewCo articles of association; |

| • | “NewCo articles of association” refers to the amended and restated articles of association of NewCo, which will become effective immediately prior to the scheme effectiveness, substantially in the applicable form attached as Annex B; |

| • | “NewCo memorandum of association” refers to the amended and restated memorandum of association of NewCo, which will become effective immediately prior to the scheme effectiveness, substantially in the applicable form attached as Annex B; |

| • | “NewCo Organizational Documents” refers to the NewCo articles of association and the NewCo memorandum of association; |

| • | “NewCo Parties” refers to NewCo, Merger Sub and, following the execution of a joinder agreement to the Transaction Agreement, Irish IntermediateCo; |

| • | “NewCo Shares” refers to ordinary shares, par value $1.00 per share, of NewCo; |

| • | “NYSE” refers to the New York Stock Exchange; |

| • | “Olaroz” refers to the Olaroz lithium facility in Jujuy Province, Argentina of which Allkem owns a 66.5% equity interest; |

| • | “pegmatite,” which includes the mineral spodumene, refers to naturally occurring igneous, or magmatic, rock formations that typically have a coarse grained texture and are mined for rare earth commodities; |

| • | “Sal de Vida” refers to Allkem’s Sal de Vida lithium brine project or operation in Catamarca Province, Argentina; |

| • | “sanction date” refers to the first day on which the Court hears the application for an order under section 411(4)(b) of the Australian Corporations Act approving the scheme or, if the application is adjourned or subject to appeal for any reason, the first day on which the adjourned or appealed application is heard; |

| • | “Sarbanes-Oxley Act” refers to the Sarbanes-Oxley Act of 2002; |

| • | “scheme” refers to the scheme of arrangement provided for under the Transaction Agreement; |

| • | “scheme booklet” refers to a document prepared by Allkem in relation to the scheme explaining the effect of the scheme and setting out certain prescribed information including notice of the scheme meeting; |

| • | “scheme consideration” refers to the right to receive, with respect to each Allkem Share, one CDI or, in certain cases, one NewCo Share, in the scheme; |

vii

| • | “scheme effectiveness” refers to the scheme becoming effective under the Australian Corporations Act, which will occur on the date on which the Court order approving the scheme is filed with ASIC; |

| • | “Scheme Exchange Ratio” refers to one NewCo Share or CDI for each Allkem Share; |

| • | “scheme implementation” refers to the issue of the scheme consideration (comprising NewCo Shares and CDIs) to former Allkem shareholders followed by the transfer of all of the Allkem Shares to NewCo, each in accordance with the terms and conditions of the scheme; |

| • | “scheme meeting” refers to the meeting of Allkem shareholders (and any adjournment thereof) ordered by the Court to be convened under subsection 411(1) of the Australian Corporations Act to consider and vote on the scheme; |

| • | “Scheme Record Date” refers to 7:00 pm (Sydney time) on the second ASX trading day after scheme effectiveness, or such other date and time as may be agreed to in writing by Allkem and Livent; |

| • | “SEC” refers to the Securities and Exchange Commission; |

| • | “Second Court Hearing” refers to the hearing of the Court pursuant to Section 411(4)(b) of the Australian Corporations Act to approve the scheme; |

| • | “Securities Act” refers to the Securities Act of 1933, as amended; |

| • | “spodumene” or “lithium bearing spodumene” refers to a naturally occurring lithium bearing ore, derived mainly from mining of lithium-bearing pegmatite formations. Spodumene is typically used in concentrated form as feedstock for lithium carbonate or hydroxide production, and valued based on its lithium content among other factors; |

| • | “Superior Proposal” refers to, in case of Livent or Allkem, as applicable, a bona fide written proposal that is not solicited after the date of the Transaction Agreement in breach of the Transaction Agreement and is made after the date of the Transaction Agreement by any person or “group” (within the meaning of Section 13(d) of the Exchange Act) (other than the other party or any of its affiliates) to acquire, directly or indirectly, (a) businesses or assets of Livent or Allkem, respectively, or any of their subsidiaries, as applicable (including capital stock of or ownership interest in any subsidiary) that account for all or substantially all of the fair market value of such party and its subsidiaries’ assets or that generated all or substantially all of such party and its subsidiaries’ net revenue or earnings for the preceding 12 months, respectively, or (b) all or substantially all of the outstanding Livent Shares or Allkem Shares, respectively, in each case whether by way of merger, amalgamation, scheme of arrangement (solely in the case of Allkem), share exchange, tender offer, exchange offer, recapitalization, consolidation, sale of equity or assets or otherwise, that in the good-faith determination of such party’s board of directors, after consultation with its financial and legal advisors, if consummated, would result in a transaction more favorable to such party’s stockholders than the transaction (after taking into account the time likely to be required to consummate such proposal, the sources, availability and terms of any financing, financing market conditions and the existence of a financing contingency, the likelihood of termination, the timing or certainty of closing, the identity of the person or persons making the proposal and any adjustments or revisions to the terms of the Transaction Agreement offered by the other party in response to such proposal or otherwise), after considering all factors such party’s board of directors deems relevant; |

| • | “tantalum” refers to tantalum pentoxide (Ta2O5) and tantalum pentoxide bearing ore; |

| • | “transaction” refers to the collective transactions contemplated by the Transaction Agreement, including the merger and the scheme; |

| • | “Transaction Agreement” refers to the Transaction Agreement, dated as of May 10, 2023, as amended by the Amendment to Transaction Agreement, dated as of August 2, 2023 and the Second Amendment to Transaction Agreement, dated as of November 5, 2023, and as may be further amended from time to time, among Livent, Allkem, NewCo and Merger Sub; |

| • | “transaction consideration” refers to the merger consideration and the scheme consideration, collectively; |

| • | “Treasury Regulations” refers to the U.S. Treasury regulations promulgated under the Code; |

| • | “TSX” refers to the Toronto Stock Exchange; |

viii

| • | “U.K.” refers to the United Kingdom of Great Britain and Northern Ireland; and |

| • | “U.S.” refers to the United States of America. |

ix

AND THE LIVENT SPECIAL MEETING

The following questions and answers are intended to briefly address some questions that you, as a Livent stockholder, may have regarding the transaction, the Transaction Agreement and the Livent Special Meeting. These questions and answers may not address all questions that may be important to you as a Livent stockholder. Please refer to the section entitled “Summary” beginning on page 17 of this proxy statement/prospectus and the more detailed information contained elsewhere in this proxy statement/prospectus, the annexes and the exhibits to and the information incorporated by reference into this proxy statement/prospectus, which you should read carefully and in their entirety. You may obtain the information incorporated by reference into this proxy statement/prospectus without charge by following the instructions under the section entitled “Where You Can Find More Information” beginning on page 301 of this proxy statement/prospectus.

| Q: | Why am I receiving this proxy statement/prospectus and proxy card? |

Livent and Allkem have agreed to combine in a merger of equals transaction under the terms of the Transaction Agreement that are summarized in this proxy statement/prospectus. The Transaction Agreement provides that, if the transaction is approved by Livent’s stockholders and the other conditions to closing the transaction are satisfied or waived at or prior to the closing of the transaction, each of Livent and Allkem will become a wholly owned subsidiary of NewCo and each Livent Share (other than Livent Shares held as treasury stock by Livent or Livent Shares held by any of its subsidiaries) will be converted into the right to receive 2.406 NewCo Shares (which are expected to be listed and traded on the NYSE under the symbol “ALTM”). Livent is holding a virtual special meeting of its stockholders (the “Livent Special Meeting”) to ask its stockholders to consider and vote upon a proposal to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger.

In addition to the Livent Transaction Agreement Proposal, Livent stockholders are also being asked (i) to consider and vote upon a proposal to approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement, (ii) to consider and vote upon proposals to approve, in non-binding, advisory votes, certain provisions of the NewCo articles of association and (iii) to approve one or more adjournments of the Livent Special Meeting to a later date or dates for any purpose if necessary or appropriate, including if necessary or appropriate to solicit additional proxies if there are insufficient votes to approve the Livent Transaction Agreement Proposal at the time of the Livent Special Meeting.

This proxy statement/prospectus includes important information about the transaction, the Transaction Agreement, a copy of which is attached as Annex A to this proxy statement/prospectus, and the Livent Special Meeting. Livent stockholders should read this information carefully and in its entirety. The enclosed voting materials allow stockholders to vote their Livent Shares without attending the Livent Special Meeting.

| Q: | How does the Livent Board recommend that I vote at the Livent Special Meeting? |

| A: | The Livent Board unanimously recommends that Livent stockholders vote “FOR” the Livent Transaction Agreement Proposal, “FOR” the Livent Advisory Compensation Proposal, “FOR” the NewCo Advisory Governance Documents Proposals and “FOR” the Livent Adjournment Proposal. See the section entitled “The Transaction—Recommendation of the Livent Board; Livent’s Reasons for the Transaction” beginning on page 98 of this proxy statement/prospectus. |

| Q: | What is the vote required to approve each proposal at the Livent Special Meeting? |

| A: | Approval of the Livent Transaction Agreement Proposal requires the affirmative vote of the holders of a majority of the outstanding Livent Shares entitled to vote on the proposal. Because the affirmative vote required to approve the Livent Transaction Agreement Proposal is based upon the total number of outstanding Livent Shares, if you fail to submit a proxy or vote virtually at the Livent Special Meeting, you abstain or you do not provide your bank, broker or other nominee with instructions, as applicable, this will have the same effect as a vote “AGAINST” the Livent Transaction Agreement Proposal. |

Approval of the Livent Advisory Compensation Proposal on a non-binding, advisory basis requires the affirmative vote of the majority of Livent Shares entitled to vote at the meeting which are represented at the meeting.

1

Approval of each of the NewCo Advisory Governance Documents Proposals on a non-binding, advisory basis requires the affirmative vote of the majority of Livent Shares entitled to vote at the meeting which are represented at the meeting.

Approval of the Livent Adjournment Proposal requires the affirmative vote of the majority of Livent Shares entitled to vote at the meeting which are represented at the meeting.

For purposes of the Livent Special Meeting, an abstention as to a particular matter occurs when either (a) a Livent stockholder affirmatively votes to “ABSTAIN” as to that matter or (b) a Livent stockholder attends the Livent Special Meeting and does not vote as to such matter. For purposes of the Livent Special Meeting, a failure to be represented as to particular Livent Shares and a particular matter occurs when either (a) the holder of record of such Livent Shares neither attends the meeting nor returns a proxy with respect to such Livent Shares or (b) such Livent Shares are held in “street name” and the beneficial owner does not instruct the owner’s bank, broker or other nominee on how to vote such Livent Shares with respect to such matter (i.e., a broker non-vote).

For the Livent Transaction Agreement Proposal, an abstention or a failure to be represented, either virtually or by proxy, at the Livent Special Meeting will have the same effect as a vote “AGAINST” the Transaction Agreement Proposal.

For the Livent Advisory Compensation Proposal, if a Livent stockholder fails to vote or instruct his or her bank, broker or other nominee on how to vote and is not represented at the Livent Special Meeting, it will have no effect on the vote count for the Livent Advisory Compensation Proposal. An abstention will have the same effect as a vote “AGAINST” the Livent Advisory Compensation Proposal.

For each of the NewCo Advisory Governance Documents Proposals, if a Livent stockholder fails to vote or instruct his or her bank, broker or other nominee on how to vote and is not represented at the Livent Special Meeting, it will have no effect on the vote count for the NewCo Advisory Governance Documents Proposals. An abstention will have the same effect as a vote “AGAINST” the NewCo Advisory Governance Documents Proposals.

For the Livent Adjournment Proposal, an abstention will have the same effect as a vote “AGAINST” the proposal, but a failure to be represented will not have any effect on the Livent Adjournment Proposal.

| Q: | Does my vote matter? |

| A: | Yes. The transaction cannot be completed unless the Livent Transaction Agreement Proposal is approved by the Livent stockholders. For Livent stockholders, if you fail to submit a proxy or vote virtually at the Livent Special Meeting, or vote to abstain, or you do not provide your bank, broker or other nominee with instructions, as applicable, this will have the same effect as a vote “AGAINST” the Livent Transaction Agreement Proposal. |

See the section entitled “Information About the Livent Special Meeting” beginning on page 75 of this proxy statement/prospectus.

| Q: | What will I receive if the transaction is completed? |

| A: | If the transaction is completed, each outstanding Livent Share (other than Livent Shares held as treasury stock by Livent or Livent Shares held by any of its subsidiaries) will be converted into the right to receive 2.406 NewCo Shares. The issuance of the NewCo Shares to holders of Livent Shares will be registered with the SEC and the NewCo Shares are expected to be listed and traded on the NYSE under the symbol “ALTM.” See the section entitled “The Transaction Agreement—Merger Consideration” beginning on page 146 of this proxy statement/prospectus. |

| Q: | What equity stakes will former Livent stockholders and former Allkem shareholders hold in NewCo? |

| A: | Under the Transaction Agreement and based on the Merger Exchange Ratio of Livent Shares for NewCo Shares, the Scheme Exchange Ratio of Allkem Shares for NewCo Shares or CDIs, and Allkem’s and Livent’s respective fully diluted shares as of the date of the Transaction Agreement, it is expected that Livent stockholders will own approximately 44%, and Allkem shareholders will own approximately 56%, respectively, of NewCo immediately following the effective time. |

2

| Q: | What is the value of a NewCo Share? |

| A: | Prior to the effective time, there has not been and will not be an established public trading market for NewCo Shares, and the market price of NewCo Shares will be unknown until the commencement of trading following the effective time. The NewCo Shares will reflect the combination of Livent and Allkem based upon the respective exchange ratios for Allkem Shares and Livent Shares, which, in the case of Allkem is one NewCo Share or one CDI for each Allkem Share, and in the case of Livent is 2.406 NewCo Shares for each Livent Share. The exchange ratios are fixed and will not fluctuate up or down based on the market price of Livent Shares, the market price of Allkem Shares or changes in currency exchange rates prior to the completion of the transaction. |

| Q: | After the transaction, where can I trade my NewCo Shares? |

| A: | At and as of the closing of the transaction, it is expected that the NewCo Shares will be listed and traded on the NYSE under the symbol “ALTM.” |

Allkem Shares will not be traded on the ASX following the closing of the transaction, but interests in NewCo Shares will be quoted and traded on the financial market operated by the ASX in the form of CDIs under the ASX symbol “LTM.”

| Q: | What will holders of Livent equity awards receive in the transaction? |

| A: | Upon completion of the merger, outstanding Livent equity awards will be treated as follows: |

| • | Livent RSUs. At the effective time, each Livent RSU will be assumed by NewCo and will be subject to substantially the same terms and conditions as applied to the related Livent RSU immediately prior to the effective time, except that the Livent Shares subject to such Livent RSUs will be converted into the right to receive, upon vesting, a number of NewCo Shares equal to the product of (A) the number of Livent Shares underlying such Livent RSUs immediately prior to the effective time, multiplied by (B) 2.406. Following such assumption, each assumed Livent RSU that is unvested and outstanding as of the date of signing of the Transaction Agreement will vest on a pro rata basis and, to the extent of such vesting, will be exchanged into the right to receive the merger consideration at the effective time or as soon as practicable thereafter. |

| • | Livent PSUs. At the effective time, each Livent PSU will fully vest, with the number of Livent Shares subject to such Livent PSUs determined based on the achievement of the higher of target and actual performance. At the effective time or as soon as practicable thereafter, each Livent PSU will be canceled in exchange for the right to receive the merger consideration. |

| • | Livent Options. At the effective time, each Livent Option will be assumed by NewCo and will be subject to substantially the same terms and conditions as applied to the related Livent Option immediately prior to the effective time, except that (x) each such assumed Livent Option will be converted into a stock option to acquire a number of NewCo Shares equal to the product of (A) the number of Livent Shares underlying such assumed Livent Options immediately prior to the effective time, multiplied by (B) 2.406; and (y) the exercise price per NewCo Share will be equal to the product of (A) the original exercise price per Livent Share when such assumed Livent Option was granted, divided by (B) 2.406. |

| • | Livent Director RSUs. Immediately prior to the effective time, any Livent Director RSUs will vest in full and be cancelled and converted into the right to receive an amount in cash equal to (A) the number of Livent Shares subject to such Livent Director RSUs immediately prior to the effective time, multiplied by (B) the higher of (i) the first available closing price of the merger consideration and (ii) the closing price per Livent Share as reported in the New York Stock Exchange, on the last trading day preceding the closing date. |

Following the effective time, to the extent provided in the applicable award agreement, assumed Livent equity awards will vest, to the extent unvested, on a “double-trigger” basis in the event of an award holder’s termination of employment by NewCo without “cause” or by the holder for “good reason,” in each case within two years following the effective time. For additional information on the treatment of Livent equity awards, see the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction—Treatment of Livent Equity Awards” beginning on page 149 of this proxy statement/prospectus.

3

| Q: | Do any of the Livent directors or executive officers have interests in the transaction that may differ from or be in addition to my interests as a Livent stockholder? |

| A: | Livent’s directors and executive officers have certain interests in the transaction that may be different from, or in addition to, the interests of Livent stockholders generally. These interests include, among other things: |

| • | for Livent’s non-employee directors, the treatment of outstanding Livent Director RSUs, which will vest in full and be cancelled and converted into the right to receive an amount in cash. The estimated amount that would be realized by each of Livent’s eight non-employee directors in respect of his or her unvested outstanding Livent Director RSUs if the transaction were to be completed on November 30, 2023 is $127,535. Livent’s non-employee directors only hold Livent Director RSUs and do not hold any other types of equity incentive awards; |

| • | for Livent’s executive officers, the treatment of outstanding equity awards described in the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction—Treatment of Livent Equity Awards” beginning on page 149 of this proxy statement/prospectus; based on the assumptions described thereunder, the estimated aggregate value of accelerated equity awards that would be realized by each of Messrs. Paul W. Graves and Gilberto Antoniazzi and Ms. Sara Ponessa is $6,165,407, $1,607,455 and $1,171,701, respectively; for a detailed breakdown of each executive officer’s holding of the equity awards, please see the tabular disclosure under such section; |

| • | for each of Livent’s executive officers, the entitlement to receive certain severance benefits under their individual executive severance agreements with Livent upon a termination of employment by Livent without “cause” or by such individual for “good reason,” in each case within the 24-month period following a “change in control” of Livent; the estimated aggregate value of severance benefits that would be provided to each of Messrs. Graves and Antoniazzi and Ms. Ponessa in connection with such a termination is $12,938,249, $5,200,467 and $3,133,436, respectively; |

| • | for each of Mr. Antoniazzi and Ms. Ponessa, the entitlement to receive a cash retention bonus payment in the amount of $250,000 under a retention program established in connection with the transaction, as described in the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction—Livent Retention Program” beginning on page 118 of this proxy statement/prospectus; |

| • | for each of Livent’s executive officers, the entitlement to receive a transaction bonus upon the closing of the merger (subject to continued service through such event) of $500,000 for Mr. Graves and $200,000 for each of Mr. Antoniazzi and Ms. Ponessa, as described in the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction—Livent Transaction Bonus Program” beginning on page 118 of this proxy statement/prospectus; and |

| • | continued indemnification and directors’ and officers’ liability insurance. |

The Livent Board was aware of and considered these potential interests, among other matters, in evaluating and negotiating the Transaction Agreement and the transactions contemplated thereby and in recommending to holders of Livent Shares that they vote to approve the Livent Transaction Agreement Proposal, the Livent Advisory Compensation Proposal, the NewCo Advisory Governance Documents Proposals and the Livent Adjournment Proposal.

For more information on and quantification of these interests, see the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction” beginning on page 115 of this proxy statement/prospectus. For more information on Livent’s directors’ and executive officers’ security ownership of Livent, see the section entitled “Security Ownership of Certain Beneficial Holders, Directors and Management of Livent.”

| Q: | Will my NewCo Shares acquired in the transaction receive a dividend? |

| A: | Once you exchange your Livent Shares after the closing of the transaction, as a holder of NewCo Shares, you will receive the same dividends on NewCo Shares that all other holders of NewCo Shares or CDIs will receive with any dividend record date that occurs after the transaction is completed. Any dividend payments will be made at the discretion of the board of directors of NewCo and will depend upon many factors, including the |

4

financial condition of NewCo, earnings, legal requirements, applicable restrictions in debt agreements that limit the ability to pay dividends to stockholders and other factors the board of directors of NewCo may deem relevant. See “Description of NewCo Shares — Dividends” for more information on NewCo’s dividend policy.

| Q: | Will dividends paid by NewCo be subject to tax withholding? |

| A: | Dividend Withholding Tax (“DWT”) (which is currently 25%) must be deducted from dividends paid by an Irish tax resident company such as NewCo, unless a shareholder is entitled to an exemption and has submitted a properly completed exemption form to NewCo’s registrar, Computershare Investor Services (Jersey) Limited. |

Further details on DWT exemptions and all relevant forms can be obtained from the Irish Revenue Commissioners’ website at www.revenue.ie. The information on such website does not constitute a part of, and is not incorporated by reference into, this proxy statement/prospectus.

For a more complete description of material tax consequences of the transaction to holders of Livent Shares, please see the sections entitled “The Transaction—Material U.S. Federal Income Tax Considerations for U.S. Holders,” beginning on page 132, and “The Transaction—Irish Tax Considerations,” beginning on page 139 of this proxy statement/prospectus.

| Q: | What are the material U.S. federal income tax consequences of the transaction to U.S. holders of Livent Shares? |

| A: | In connection with the filing of the registration statement of which this proxy statement/prospectus forms a part, Davis Polk & Wardwell LLP (“Davis Polk”) has rendered to NewCo its opinion, dated October 30, 2023, to the effect that, based upon and subject to the assumptions, exceptions, limitations and qualifications set forth herein and in the federal income tax opinion filed as an exhibit to the registration statement of which this proxy statement/prospectus forms a part (including, for the avoidance of doubt, the assumption that market conditions between the date of such opinion and the effective time do not impact the relative valuation of Livent and Allkem for purposes of Treasury Regulations Section 1.367(a)-3(c) and Section 7874(a)(2)(B) of the Code), and representations from Livent, Allkem, and NewCo, (i) either (A) the merger will qualify as a reorganization under Section 368(a) of the Code, or (B) the merger and the scheme, taken together, will qualify as an exchange described in Section 351(a) of the Code, (ii) the transfer of Livent Shares, other than certain excluded shares, by Livent stockholders pursuant to the merger (other than by any Livent stockholder who is a U.S. person and would be a “five-percent transferee shareholder” (within the meaning of Treasury Regulations Section 1.367(a)-3(c)(5)(ii)) of NewCo following the merger that does not enter into a five year gain recognition agreement in the form provided in Treasury Regulations Section 1.367(a)-8(c)) should qualify for an exception to Section 367(a)(1) of the Code (the tax treatment described in clauses (i) and (ii) together, the “Intended U.S. Shareholder Tax Treatment”) and (iii) the merger and scheme will not result in NewCo being treated as a “surrogate foreign corporation” within the meaning of Section 7874(a)(2)(B) of the Code or a “domestic corporation” pursuant to Section 7874(b) of the Code (the tax treatment described in this clause (iii), the “Intended Section 7874 Tax Treatment”, and together with the Intended U.S. Shareholder Tax Treatment, the “Intended U.S. Tax Treatment”). |

As a condition to the scheme implementation, Livent will have requested and received from Davis Polk or, if Davis Polk is unable or unwilling, Sidley Austin LLP (“Sidley Austin”), its opinion to Livent, which will be dated as of the sanction date and based on the facts, representations and assumptions set forth or referred to in the opinion, that the transaction qualifies for the Intended U.S. Shareholder Tax Treatment, with the modification that clause (i) of the Intended U.S. Shareholder Tax Treatment is satisfied for purposes of this condition in the Transaction Agreement by the conclusion that either (A) the merger should qualify as a reorganization under Section 368(a) of the Code, or (B) the merger and the scheme, taken together, should qualify as an exchange described in Section 351(a) of the Code (as so modified, the “Transaction Agreement U.S. Tax Treatment”). Livent may, under the terms of the Transaction Agreement, waive this condition in whole or in part, but is under no obligation to do so. It is not a condition to the scheme implementation that a tax opinion address the Intended Section 7874 Tax Treatment.

If the merger and the scheme qualify for the Intended U.S. Tax Treatment, if a U.S. holder of Livent Shares exchanges all of its Livent Shares for NewCo Shares in the transaction, and the U.S. holder is not a “five-percent

5

transferee shareholder” (as defined above) that does not file with the IRS a gain recognition agreement as described in applicable Treasury Regulations, the U.S. holder should not recognize any gain or loss with respect to its Livent Shares, except to the extent of any cash the U.S. holder may receive in lieu of a fractional NewCo Share.

For a more complete description of the material U.S. federal income tax consequences of the transaction to U.S. holders of Livent Shares, please see the section entitled “The Transaction—Material U.S. Federal Income Tax Considerations for U.S. Holders” beginning on page 132 of this proxy statement/prospectus.

| Q: | When is the transaction expected to be completed? |

| A: | Subject to the satisfaction or waiver of the closing conditions described under the section entitled “The Transaction Agreement—Conditions That Must Be Satisfied or Waived for the Transaction to Occur” beginning on page 167 of this proxy statement/prospectus, including the approval of the Livent Transaction Agreement Proposal by Livent stockholders at the Livent Special Meeting, Livent and Allkem expect that the transaction will be completed by the end of calendar year 2023. However, it is possible that factors outside the control of one or both companies could result in the transaction being completed at a different time or not at all. |

| Q: | Who will serve on the NewCo board of directors following the transaction? |

| A: | Upon the closing of the transaction, the board of directors of NewCo will be comprised of 12 members. Under the Transaction Agreement, the composition of the NewCo board of directors will be as follows: |

| • | six current Allkem directors (each of whom will be nominated by Allkem prior to the scheme effectiveness, and including Mr. Peter Coleman, the current Chairman of the Allkem Board); and |

| • | six current Livent directors (each of whom will be nominated by Livent prior to the scheme effectiveness, and including Mr. Paul W. Graves, the current Chief Executive Officer of Livent). |

Pursuant to the Transaction Agreement, Livent has nominated the following current Livent directors for the NewCo board of directors: (i) Michael F. Barry, (ii) Paul W. Graves, (iii) Christina Lampe-Önnerud, (iv) Pablo Marcet, (v) Steven T. Merkt and (vi) Robert C. Pallash, and Allkem has nominated the following current Allkem directors for the NewCo board of directors: (i) Peter Coleman, (ii) Alan Fitzpatrick, (iii) Florencia Heredia, (iv) Leanne Heywood, (v) Fernando Oris de Roa and (vi) John Turner. The current Chairman of the Allkem Board, Mr. Peter Coleman, will serve as the Chair of the NewCo board of directors.

For more information on the governance of NewCo following the completion of the transaction, see “Management and Corporate Governance of NewCo” beginning on page 289 of this proxy statement/prospectus.

| Q: | Where will NewCo be located, where will NewCo be domiciled and who will serve in senior leadership roles following the transaction? |

| A: | Following the transaction, NewCo and its subsidiaries will maintain a critical presence in the same locations from which Livent and Allkem currently operate and NewCo’s headquarters will be in North America in a location mutually determined by Livent and Allkem prior to the scheme effectiveness. NewCo is incorporated in the Bailiwick of Jersey, and is a resident of Ireland for tax purposes and expects to continue to be an Irish tax resident following the transaction. Pursuant to the Transaction Agreement, the current Chairman of the Allkem Board, Mr. Peter Coleman, will assume the role of Chair of NewCo after the transaction, and Livent’s current Chief Executive Officer, Mr. Paul W. Graves, and its current Chief Financial Officer, Mr. Gilberto Antoniazzi, will assume the roles of Chief Executive Officer and Chief Financial Officer, respectively, of NewCo after the transaction. Pursuant to the Transaction Agreement, the other executive leadership of NewCo as of the effective time were contemplated to be mutually determined by Livent and Allkem prior to the scheme effectiveness and the parties have since made this determination, including that Livent’s current General Counsel, Ms. Sara Ponessa, will assume the role of General Counsel of NewCo, as well as determining the rest of the broader senior management team of NewCo as of the effective time, consisting of an approximately equal split of employees from each of Allkem and Livent. For additional information on NewCo’s directors and executive officers, see “Management and Corporate Governance of NewCo” beginning on page 289 of this proxy statement/prospectus. |

6

| Q: | How will my rights as a holder of NewCo Shares following the transaction differ from my current rights as a holder of Livent Shares? |

| A: | Pursuant to the terms of the Transaction Agreement, immediately prior to the closing of the transaction, NewCo’s articles of association will be amended to be in substantially the applicable form attached as Annex B to this proxy statement/prospectus. As a result, the rights of Livent stockholders who become shareholders of NewCo following the transaction will be governed by the laws of the Bailiwick of Jersey and the NewCo Organizational Documents. For more information, see the section entitled “Comparison of the Rights of Holders of Livent Shares and NewCo Shares” beginning on page 269 of this proxy statement/prospectus. |

| Q: | Who can vote at the Livent Special Meeting? |

| A: | All holders of record of Livent Shares as of the close of business on [ ], 2023 (the “Merger Record Date”), the record date for the Livent Special Meeting, are entitled to receive notice of, and to vote at, the Livent Special Meeting. Each holder of Livent Shares is entitled to cast one vote on each matter properly brought before the Livent Special Meeting for each Livent Share that such holder owned of record as of the Merger Record Date. |

| Q: | When and where is the Livent Special Meeting? |

| A: | The Livent Special Meeting of Livent stockholders will be a virtual meeting conducted exclusively via live webcast online starting at [ : ] a.m. Eastern time (with log-in beginning at [ : ] a.m. Eastern time) on [ ], 2023. Livent stockholders will be able to attend the Livent Special Meeting online only and vote shares electronically at the meeting by going to www.virtualshareholdermeeting.com/LTHM2023SM and entering the 16-digit control number included on the proxy card that Livent stockholders received. Because the Livent Special Meeting is completely virtual and being conducted via live webcast, Livent stockholders will not be able to attend the meeting in person. On or about [ ], Livent commenced mailing this proxy statement/prospectus and the enclosed form of proxy card to its stockholders entitled to vote at the Livent Special Meeting. For additional information about the Livent Special Meeting, see the section entitled “Information About the Livent Special Meeting” beginning on page 75 of this proxy statement/prospectus. |

| Q: | Why am I being asked to consider and vote on a proposal to approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement? |

| A: | Under SEC rules, Livent is required to seek a non-binding, advisory vote with respect to the compensation that may be paid or become payable to its named executive officers in connection with the transactions contemplated by the Transaction Agreement. |

| Q: | Why am I being asked to consider and vote on a proposal to approve, in non-binding, advisory votes, certain provisions of the NewCo articles of association? |

| A: | Under SEC rules, Livent is required to seek a non-binding, advisory vote with respect to certain provisions of the NewCo articles of association that represent a change from the corresponding provisions of Allkem’s current governing documents. |

| Q: | What will happen if Livent stockholders do not approve the transaction-related compensation or the amendments to the NewCo articles of association? |

| A: | Approval of the Livent Advisory Compensation Proposal and the NewCo Advisory Governance Documents Proposals is not a condition to completion of the transaction. Accordingly, you may vote against any or all of these proposals and vote in favor of the Livent Transaction Agreement Proposal. The Livent Advisory Compensation Proposal and the NewCo Advisory Governance Documents Proposals votes are each an advisory vote and will not be binding on Livent or NewCo following the transaction. If the transaction is completed, the transaction-related compensation may be paid to Livent’s named executive officers to the extent payable in accordance with the terms of their compensation agreements and arrangements even if Livent’s stockholders do not approve, in a non-binding, advisory vote, the Livent Advisory Compensation Proposal and the provisions of the NewCo articles of association will apply in accordance with their terms even if Livent’s stockholders do not approve, in non-binding, advisory votes, any or all of the NewCo Advisory Governance Documents Proposals. |

7

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| A: | If your Livent Shares are registered directly in your name with the transfer agent of Livent, EQ Shareowner Services, you are considered the shareholder of record with respect to those Livent Shares. As the shareholder of record, you have the right to vote, or to grant a proxy for your vote directly to Livent or to a third party to vote, at the Livent Special Meeting. |

If your Livent Shares are held by a bank, broker or other nominee, you are considered the beneficial owner of shares held in “street name,” and your bank, broker or other nominee is considered the shareholder of record with respect to those shares. You should check the voting form used by your bank, broker or other nominee to determine whether you may give voting instructions by telephone or the internet and must instruct such bank, broker or other nominee on how to vote such shares by following the instructions that the bank, broker or other nominee provides you along with this proxy statement/prospectus. Your bank, broker or other nominee, as applicable, may have an earlier deadline by which you must provide instructions to it as to how to vote your Livent Shares, so you should read carefully the materials provided to you by your bank, broker or other nominee. If you are a beneficial owner of Livent Shares, you are invited to attend the Livent Special Meeting; however, you may not vote your shares held in street name by returning a proxy card directly to Livent, by voting by telephone or internet or by voting virtually at the Livent Special Meeting unless you obtain a “legal proxy” from your bank, broker or other nominee that holds your shares, giving you the right to vote your Livent Shares at the Livent Special Meeting.

| Q: | If my Livent Shares are held in “street name” by my bank, broker or other nominee, will my bank, broker or other nominee automatically vote those shares for me? |

| A: | No. If your Livent Shares are held in “street name” in a stock brokerage account or by a bank or other nominee, your broker, bank or other nominee will only be permitted to vote your Livent Shares if you instruct it how to vote. You must provide your broker, bank or other nominee with instructions on how to vote your Livent Shares in order to vote. Please follow the voting instructions provided by your broker, bank or other nominee. Please note that you may not vote Livent Shares held in street name by returning a proxy card directly to Livent, by voting by telephone or internet or by voting virtually at the Livent Special Meeting unless you obtain a “legal proxy,” which you must obtain from your broker, bank or other nominee. |