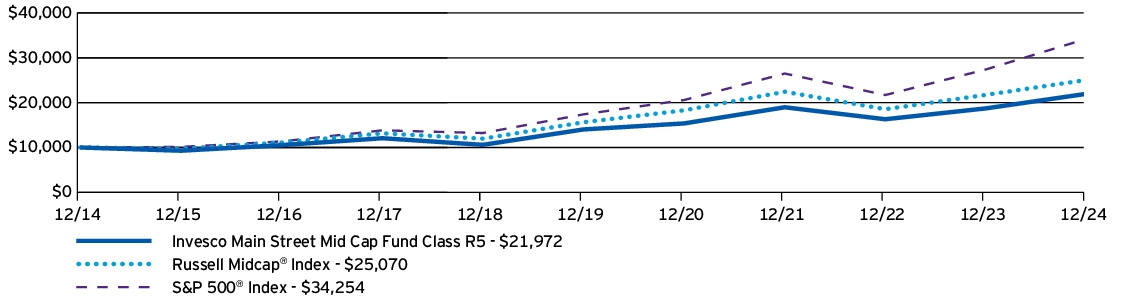

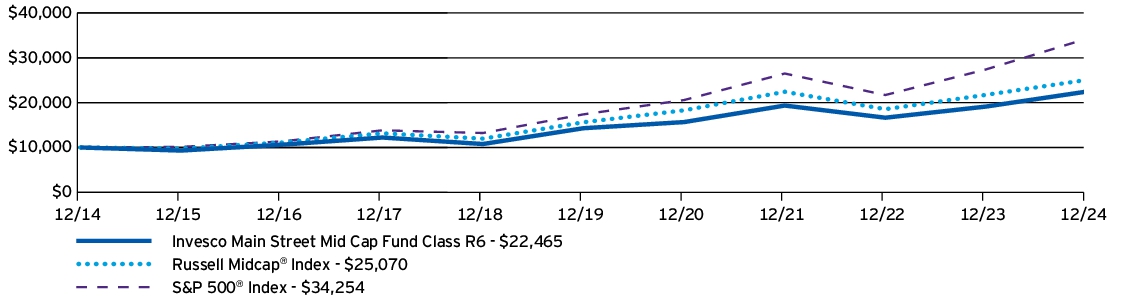

0000202032 aimgs:C000001325Member oef:WithoutSalesLoadMember 2015-01-01 2024-12-31 0000202032 aimgs:C000217950Member aimgs:GovernmentNationalMortgageAssociationTBA55006202054Member 2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

AIM Growth Series (Invesco Growth Series)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Glenn Brightman, Principal Executive Officer

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders.

(a) The Registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") is as follows:

Invesco Active Allocation Fund

Class A: OAAAX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Active Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Active Allocation Fund

(Class A) | $48 | 0.46%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, global risk assets outperformed defensive assets driven by a favorable macroeconomic environment, the beginning of a global monetary policy easing cycle and greater clarity with respect to fiscal policy following the conclusion of many major elections globally. These macroeconomic tailwinds supported global equity prices, particularly within the US, as well as the continuation of credit spreads tightening to cycle lows within investment grade, high yield and emerging market debt markets. Given this backdrop, an underweight to equities and overweight to fixed income assets was a headwind to Fund performance, as were certain factor tilts within equities, as well as allocations within fixed income to core and US Treasury bonds.

• For the fiscal year ended December 31, 2024, Class A shares of the Fund, excluding sales charge, returned 9.77%. For the same time period, the Custom Invesco Active Allocation Index returned 14.63%.

What contributed to performance?

Exposure to growth equities and the quality factor | The Fund's exposure to high quality securities (commonly referred to as 'growth' stocks) was rewarded with exposures within both the US large- and mid-cap space, as well as exposure internationally.

Exposure to high yield and floating rate credit | The Fund's exposure to high yield was beneficial as credit spreads continued to tighten, supported by resilient corporate fundamentals and strong investor demand for higher-coupon bond offerings. Floating rate exposure was rewarded as well, with the securities benefiting from an increasing interest rate environment, compared to their fixed-rate peers.

What detracted from performance?

Cyclical factor exposure within equities | Exposure to the small size and value factors was a detractor from Fund performance over the time period, as more defensive equity factors such as quality continued to be in demand led by US megacap technology stocks and strong momentum in investor demand for thematic artificial intelligence stocks.

Exposure to core and US Treasury bonds | The Fund's exposure to core and US Treasury bonds was a headwind, as long and moderate duration, as well as higher-grade fixed income, suffered compared to shorter duration, more credit sensitive counterparts. This was due to interest rates moving higher and the steepening of the yield curve that transpired significantly in the second half of the year.

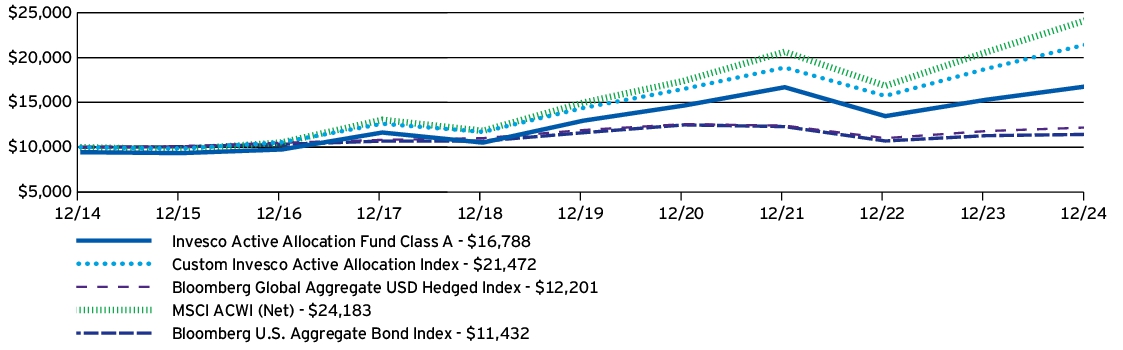

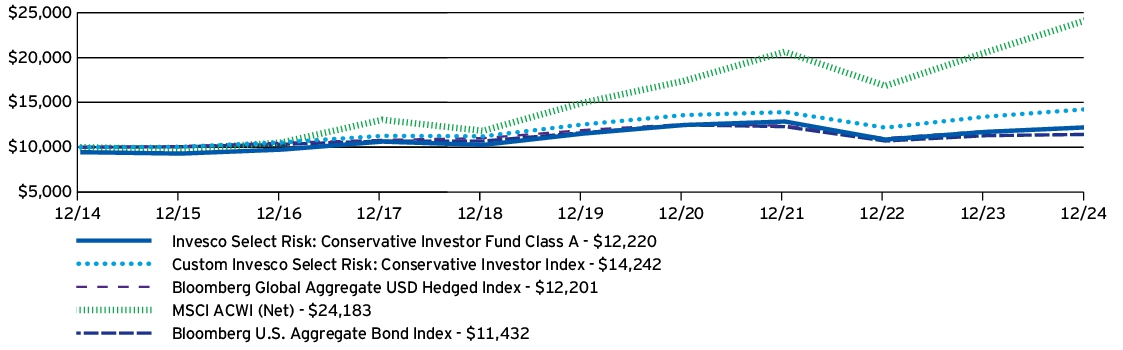

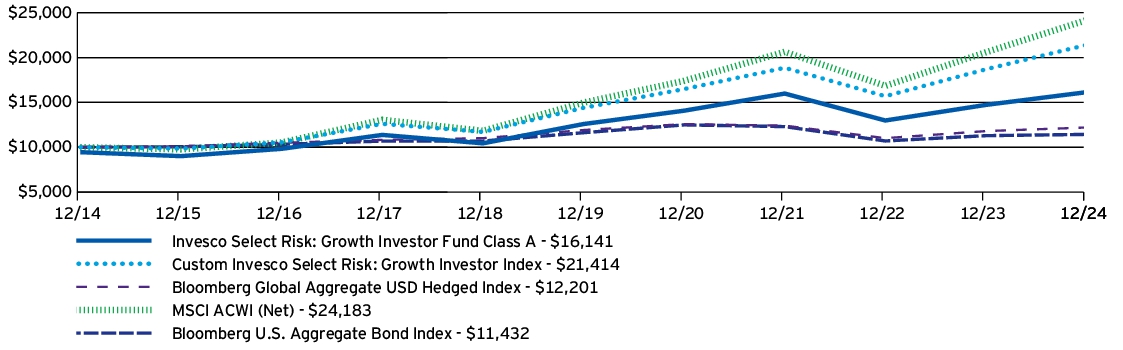

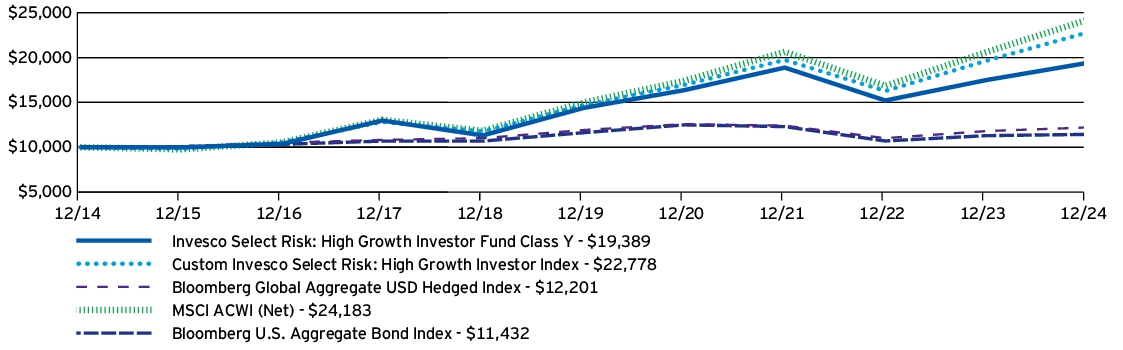

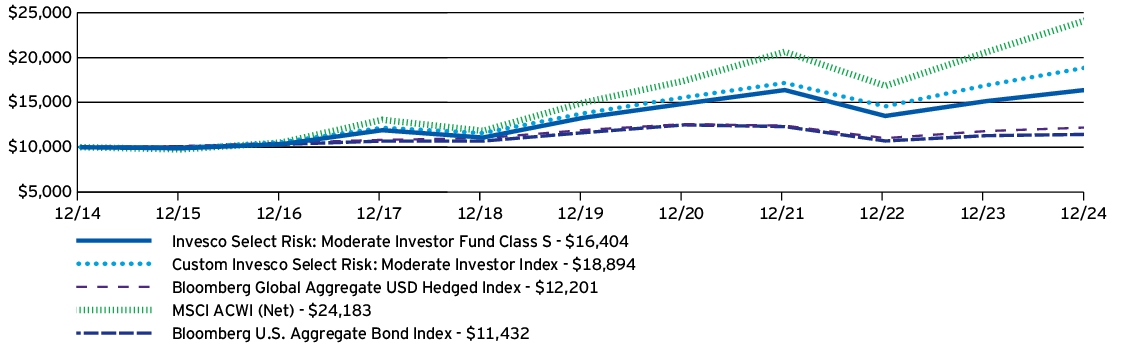

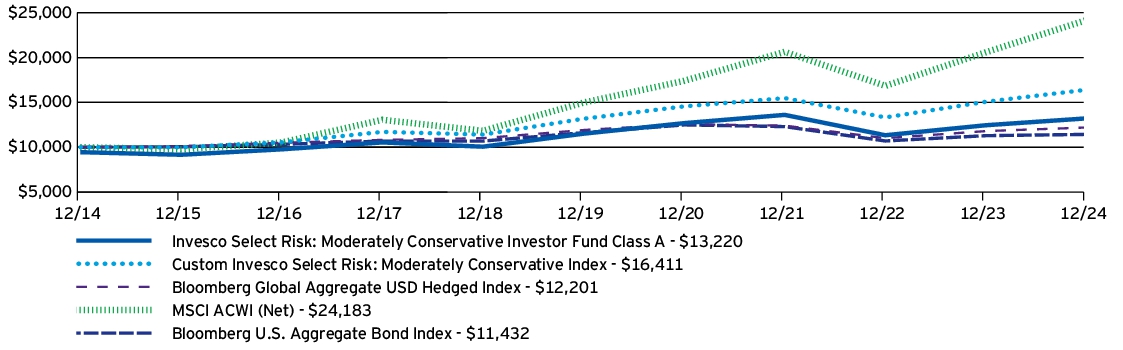

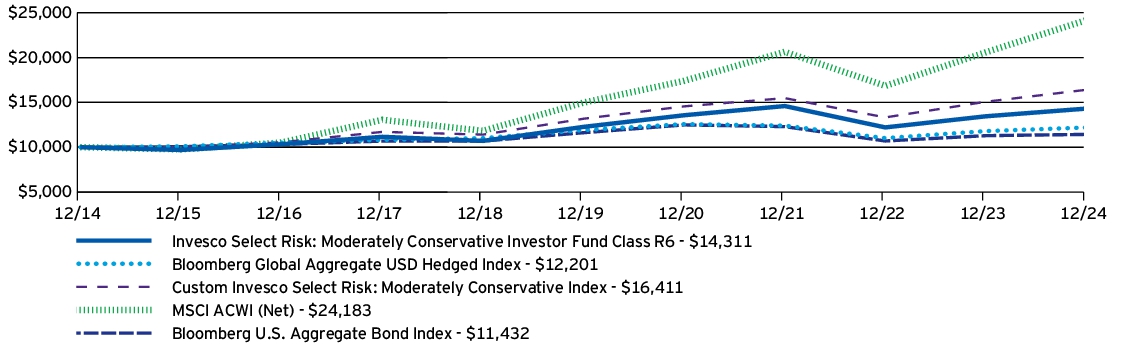

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Active Allocation Fund (Class A) —including sales charge | 3.75% | 4.12% | 5.32% |

| Invesco Active Allocation Fund (Class A) —excluding sales charge | 9.77% | 5.30% | 5.91% |

| Custom Invesco Active Allocation Index | 14.63% | 8.34% | 7.94% |

| Bloomberg Global Aggregate USD Hedged Index | 3.40% | 0.48% | 2.01% |

| MSCI ACWI (Net) | 17.49% | 10.06% | 9.23% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

The Custom Invesco Active Allocation Index is composed of 80% MSCI ACWI (Net) and 20% Bloomberg Global Aggregate USD Hedged Index.

Effective after the close of business on May 24, 2019, Class A shares of Oppenheimer Portfolio Series: Active Allocation Fund (the predecessor fund), were reorganized into Class A shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class A shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg Global Aggregate USD Hedged Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $1,899,296,008 |

| Total number of portfolio holdings | 27 |

| Total advisory fees paid | $1,648,323 |

| Portfolio turnover rate | 43% |

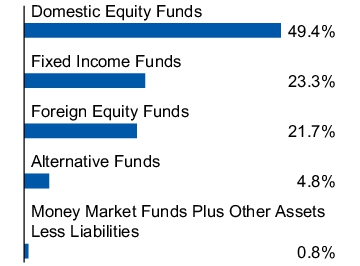

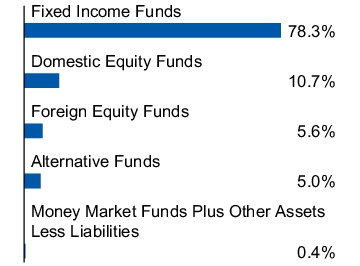

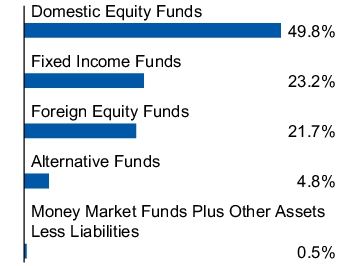

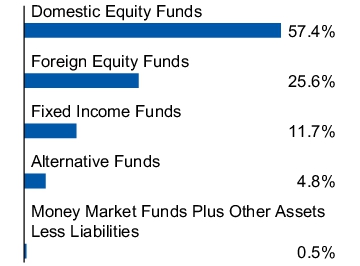

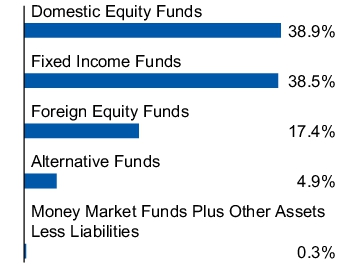

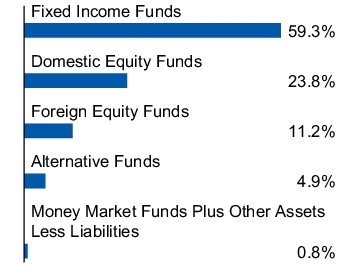

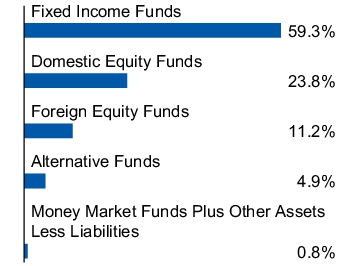

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Asset allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Active Allocation Fund

Class C: OAACX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Active Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Active Allocation Fund

(Class C) | $127 | 1.22%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, global risk assets outperformed defensive assets driven by a favorable macroeconomic environment, the beginning of a global monetary policy easing cycle and greater clarity with respect to fiscal policy following the conclusion of many major elections globally. These macroeconomic tailwinds supported global equity prices, particularly within the US, as well as the continuation of credit spreads tightening to cycle lows within investment grade, high yield and emerging market debt markets. Given this backdrop, an underweight to equities and overweight to fixed income assets was a headwind to Fund performance, as were certain factor tilts within equities, as well as allocations within fixed income to core and US Treasury bonds.

• For the fiscal year ended December 31, 2024, Class C shares of the Fund, excluding sales charge, returned 9.00%. For the same time period, the Custom Invesco Active Allocation Index returned 14.63%.

What contributed to performance?

Exposure to growth equities and the quality factor | The Fund's exposure to high quality securities (commonly referred to as 'growth' stocks) was rewarded with exposures within both the US large- and mid-cap space, as well as exposure internationally.

Exposure to high yield and floating rate credit | The Fund's exposure to high yield was beneficial as credit spreads continued to tighten, supported by resilient corporate fundamentals and strong investor demand for higher-coupon bond offerings. Floating rate exposure was rewarded as well, with the securities benefiting from an increasing interest rate environment, compared to their fixed-rate peers.

What detracted from performance?

Cyclical factor exposure within equities | Exposure to the small size and value factors was a detractor from Fund performance over the time period, as more defensive equity factors such as quality continued to be in demand led by US megacap technology stocks and strong momentum in investor demand for thematic artificial intelligence stocks.

Exposure to core and US Treasury bonds | The Fund's exposure to core and US Treasury bonds was a headwind, as long and moderate duration, as well as higher-grade fixed income, suffered compared to shorter duration, more credit sensitive counterparts. This was due to interest rates moving higher and the steepening of the yield curve that transpired significantly in the second half of the year.

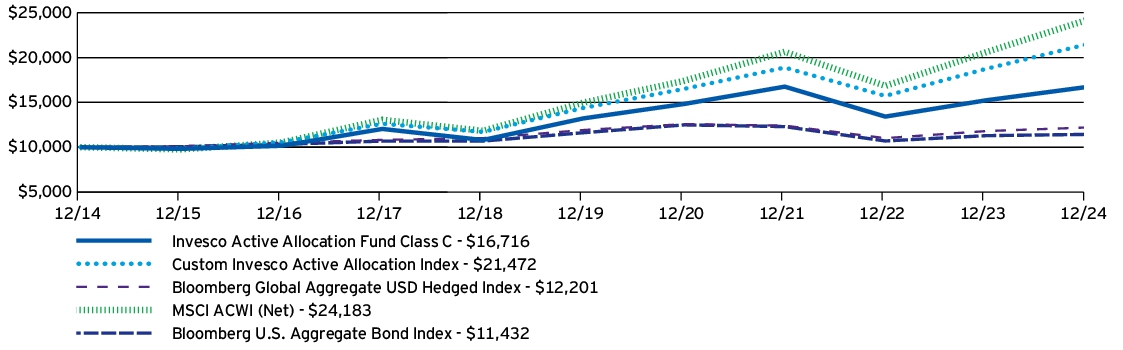

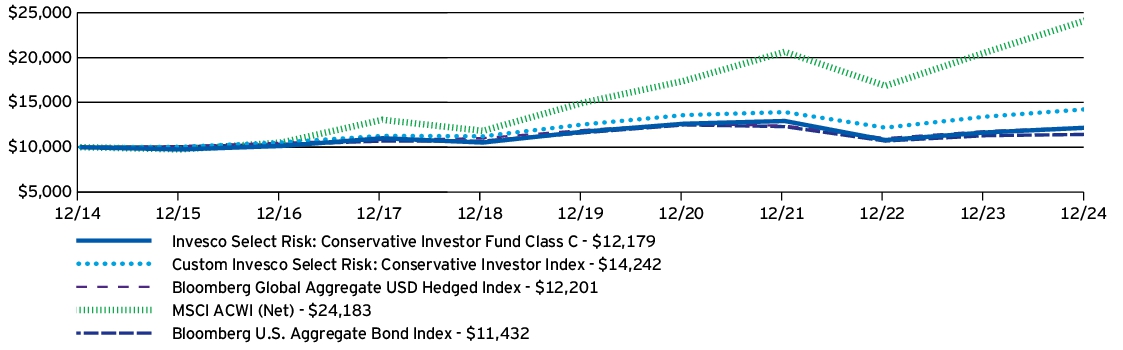

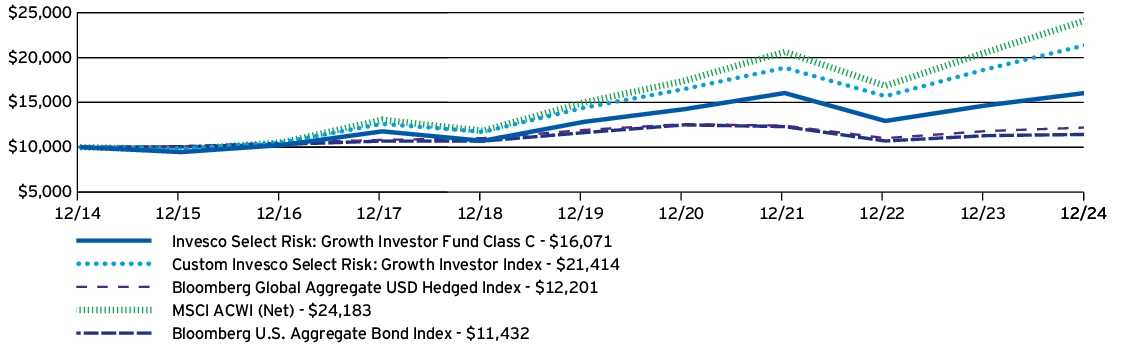

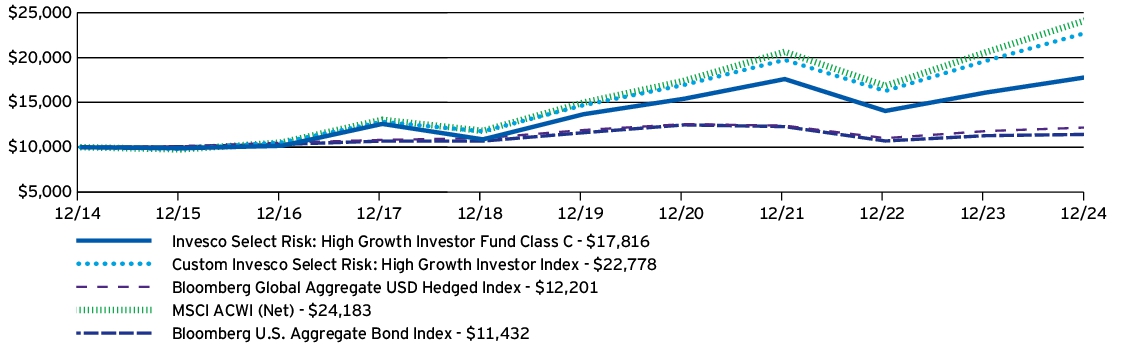

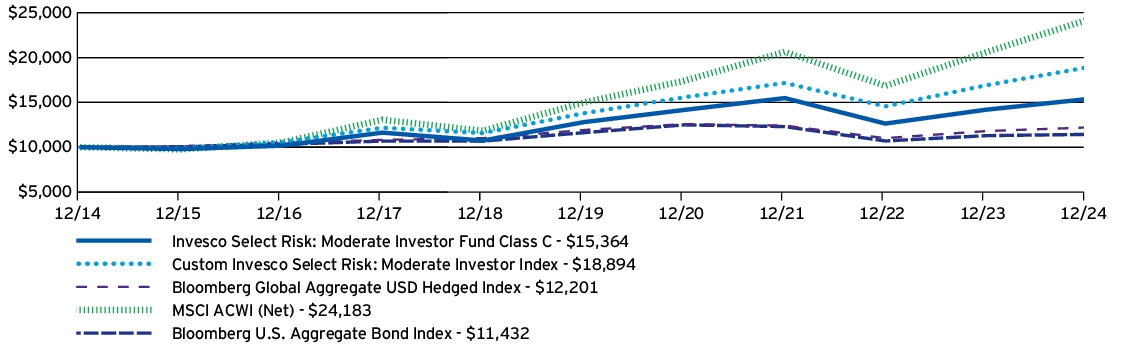

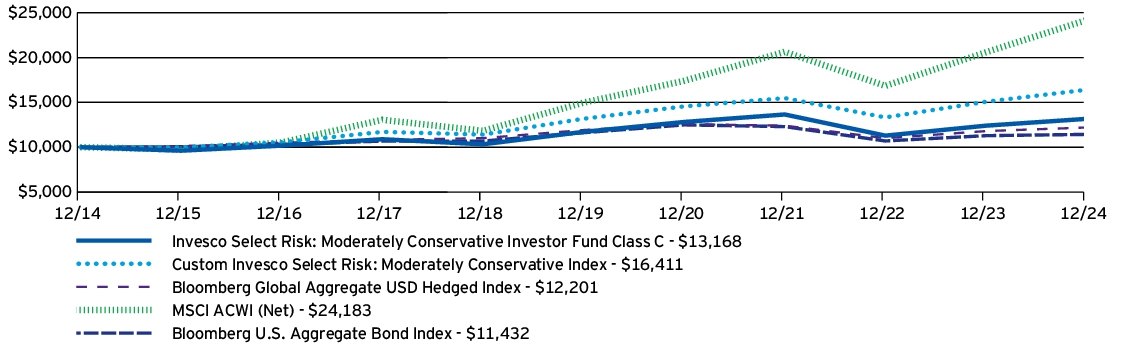

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Active Allocation Fund (Class C) —including sales charge | 8.00% | 4.51% | 5.27% |

| Invesco Active Allocation Fund (Class C) —excluding sales charge | 9.00% | 4.51% | 5.27% |

| Custom Invesco Active Allocation Index | 14.63% | 8.34% | 7.94% |

| Bloomberg Global Aggregate USD Hedged Index | 3.40% | 0.48% | 2.01% |

| MSCI ACWI (Net) | 17.49% | 10.06% | 9.23% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

The Custom Invesco Active Allocation Index is composed of 80% MSCI ACWI (Net) and 20% Bloomberg Global Aggregate USD Hedged Index.

Effective after the close of business on May 24, 2019, Class C shares of Oppenheimer Portfolio Series: Active Allocation Fund (the predecessor fund), were reorganized into Class C shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class C shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg Global Aggregate USD Hedged Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $1,899,296,008 |

| Total number of portfolio holdings | 27 |

| Total advisory fees paid | $1,648,323 |

| Portfolio turnover rate | 43% |

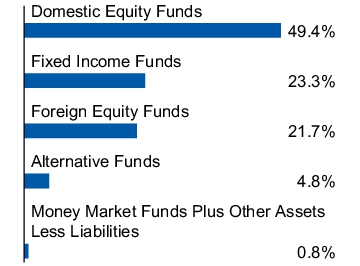

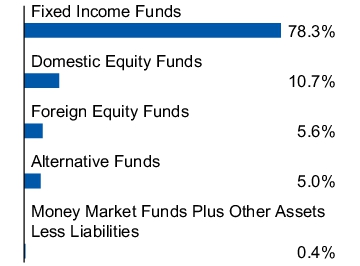

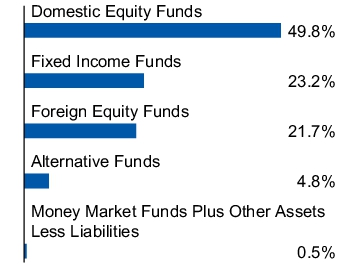

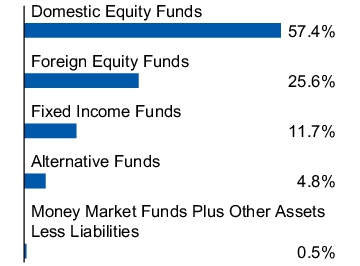

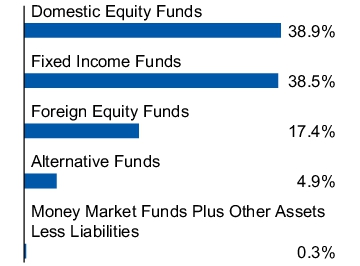

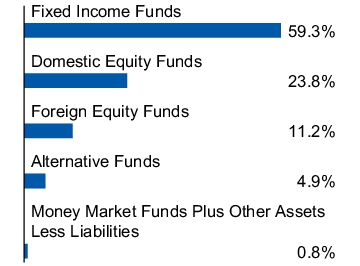

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Asset allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Active Allocation Fund

Class R: OAANX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Active Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Active Allocation Fund

(Class R) | $75 | 0.72%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, global risk assets outperformed defensive assets driven by a favorable macroeconomic environment, the beginning of a global monetary policy easing cycle and greater clarity with respect to fiscal policy following the conclusion of many major elections globally. These macroeconomic tailwinds supported global equity prices, particularly within the US, as well as the continuation of credit spreads tightening to cycle lows within investment grade, high yield and emerging market debt markets. Given this backdrop, an underweight to equities and overweight to fixed income assets was a headwind to Fund performance, as were certain factor tilts within equities, as well as allocations within fixed income to core and US Treasury bonds.

• For the fiscal year ended December 31, 2024, Class R shares of the Fund returned 9.48%. For the same time period, the Custom Invesco Active Allocation Index returned 14.63%.

What contributed to performance?

Exposure to growth equities and the quality factor | The Fund's exposure to high quality securities (commonly referred to as 'growth' stocks) was rewarded with exposures within both the US large- and mid-cap space, as well as exposure internationally.

Exposure to high yield and floating rate credit | The Fund's exposure to high yield was beneficial as credit spreads continued to tighten, supported by resilient corporate fundamentals and strong investor demand for higher-coupon bond offerings. Floating rate exposure was rewarded as well, with the securities benefiting from an increasing interest rate environment, compared to their fixed-rate peers.

What detracted from performance?

Cyclical factor exposure within equities | Exposure to the small size and value factors was a detractor from Fund performance over the time period, as more defensive equity factors such as quality continued to be in demand led by US megacap technology stocks and strong momentum in investor demand for thematic artificial intelligence stocks.

Exposure to core and US Treasury bonds | The Fund's exposure to core and US Treasury bonds was a headwind, as long and moderate duration, as well as higher-grade fixed income, suffered compared to shorter duration, more credit sensitive counterparts. This was due to interest rates moving higher and the steepening of the yield curve that transpired significantly in the second half of the year.

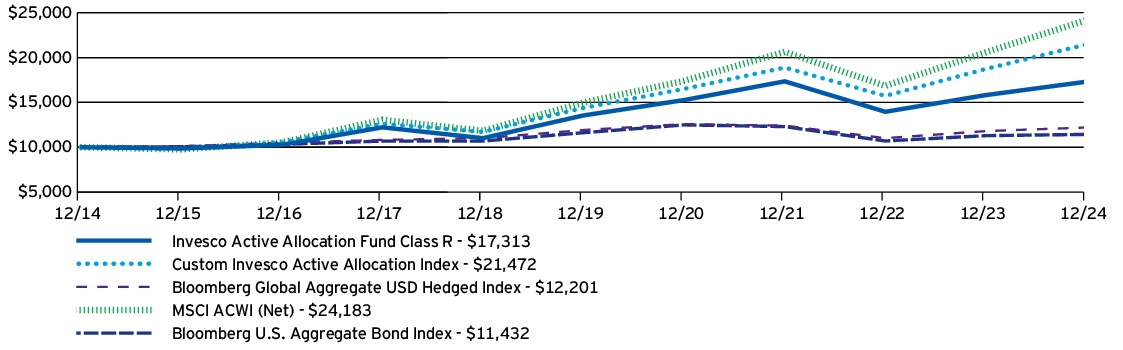

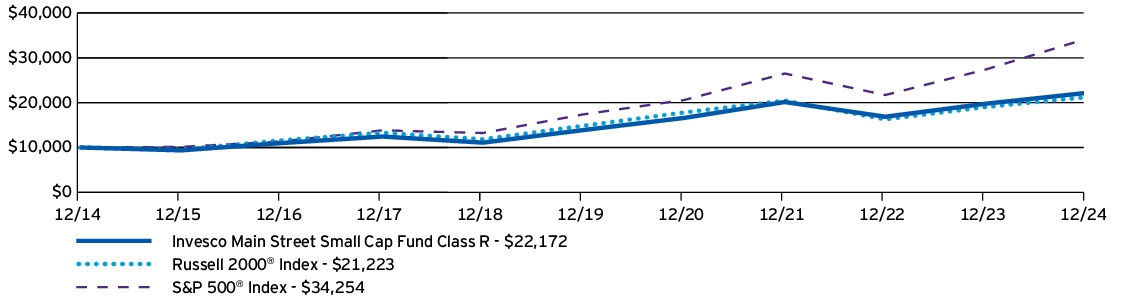

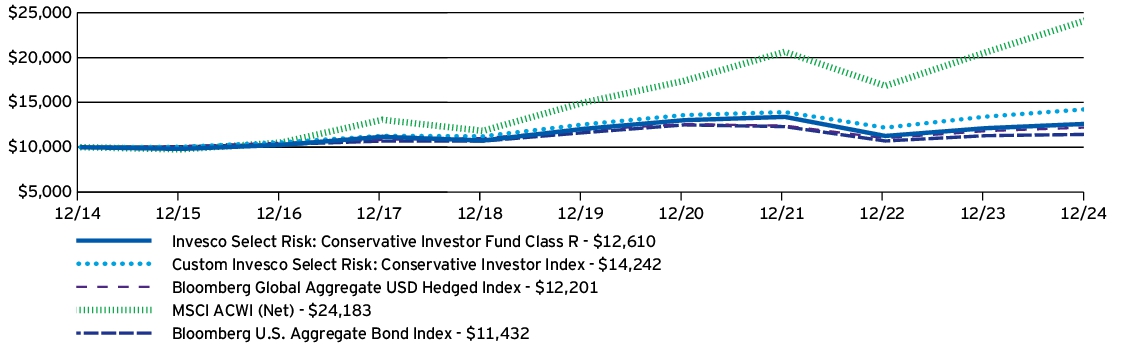

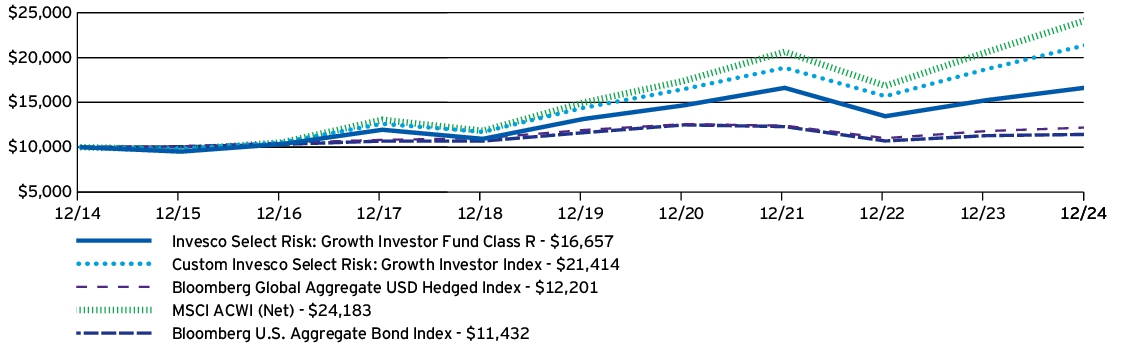

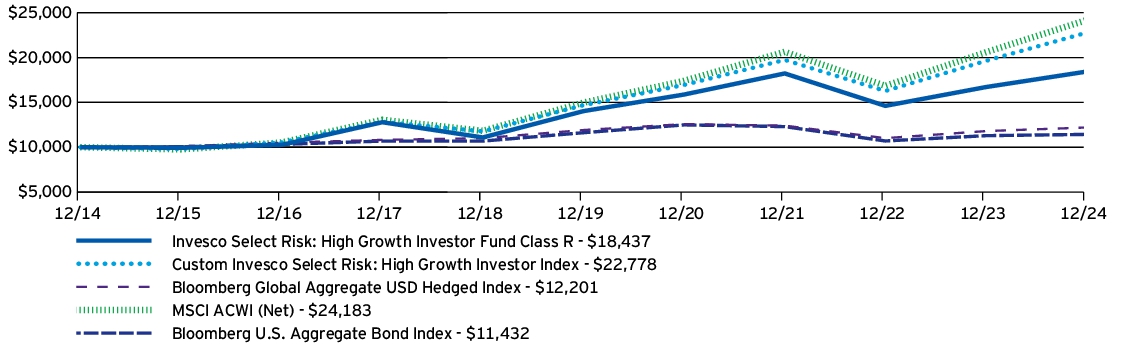

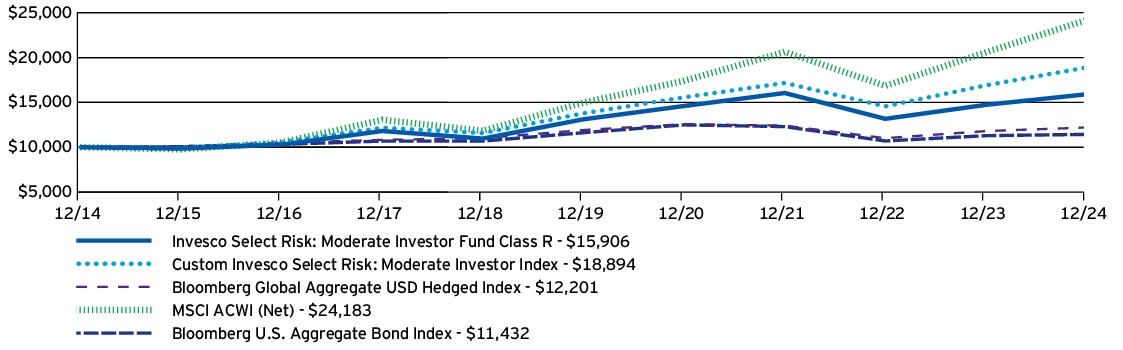

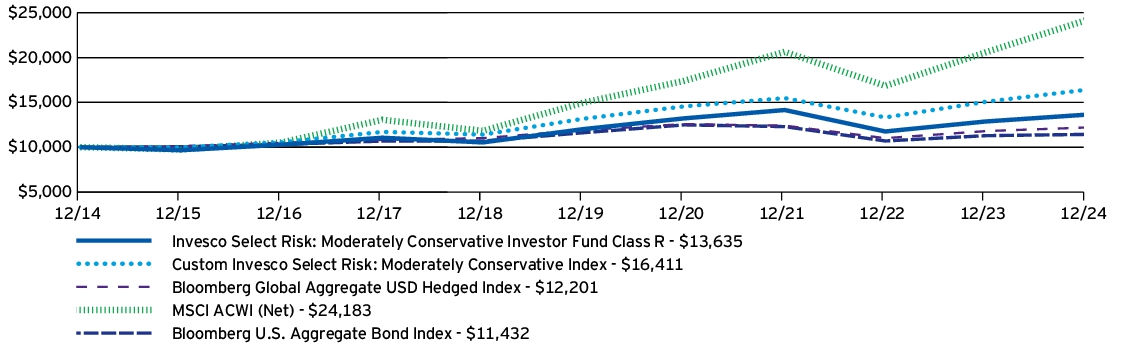

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Active Allocation Fund (Class R) | 9.48% | 5.03% | 5.64% |

| Custom Invesco Active Allocation Index | 14.63% | 8.34% | 7.94% |

| Bloomberg Global Aggregate USD Hedged Index | 3.40% | 0.48% | 2.01% |

| MSCI ACWI (Net) | 17.49% | 10.06% | 9.23% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

The Custom Invesco Active Allocation Index is composed of 80% MSCI ACWI (Net) and 20% Bloomberg Global Aggregate USD Hedged Index.

Effective after the close of business on May 24, 2019, Class R shares of Oppenheimer Portfolio Series: Active Allocation Fund (the predecessor fund), were reorganized into Class R shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class R shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg Global Aggregate USD Hedged Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $1,899,296,008 |

| Total number of portfolio holdings | 27 |

| Total advisory fees paid | $1,648,323 |

| Portfolio turnover rate | 43% |

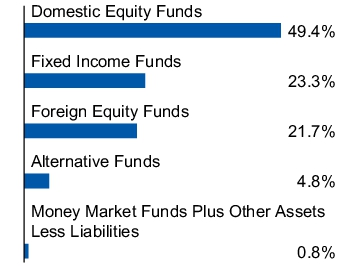

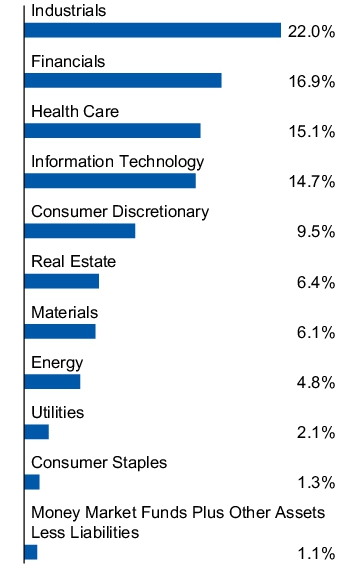

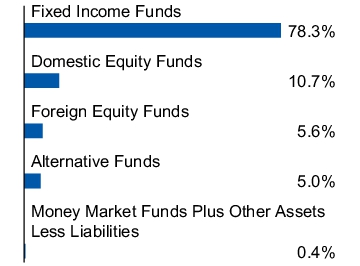

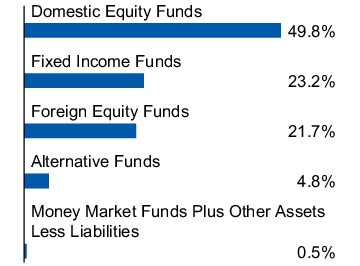

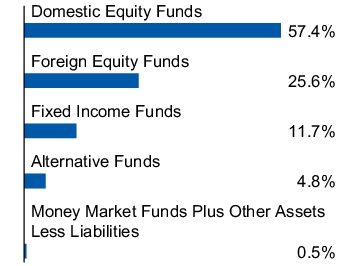

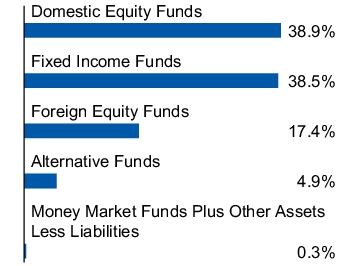

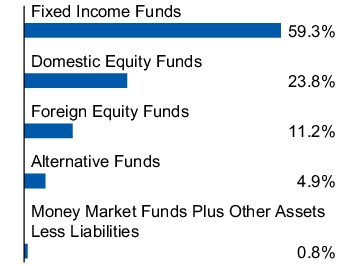

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Asset allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Active Allocation Fund

Class Y: OAAYX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Active Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Active Allocation Fund

(Class Y) | $23 | 0.22%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, global risk assets outperformed defensive assets driven by a favorable macroeconomic environment, the beginning of a global monetary policy easing cycle and greater clarity with respect to fiscal policy following the conclusion of many major elections globally. These macroeconomic tailwinds supported global equity prices, particularly within the US, as well as the continuation of credit spreads tightening to cycle lows within investment grade, high yield and emerging market debt markets. Given this backdrop, an underweight to equities and overweight to fixed income assets was a headwind to Fund performance, as were certain factor tilts within equities, as well as allocations within fixed income to core and US Treasury bonds.

• For the fiscal year ended December 31, 2024, Class Y shares of the Fund returned 10.00%. For the same time period, the Custom Invesco Active Allocation Index returned 14.63%.

What contributed to performance?

Exposure to growth equities and the quality factor | The Fund's exposure to high quality securities (commonly referred to as 'growth' stocks) was rewarded with exposures within both the US large- and mid-cap space, as well as exposure internationally.

Exposure to high yield and floating rate credit | The Fund's exposure to high yield was beneficial as credit spreads continued to tighten, supported by resilient corporate fundamentals and strong investor demand for higher-coupon bond offerings. Floating rate exposure was rewarded as well, with the securities benefiting from an increasing interest rate environment, compared to their fixed-rate peers.

What detracted from performance?

Cyclical factor exposure within equities | Exposure to the small size and value factors was a detractor from Fund performance over the time period, as more defensive equity factors such as quality continued to be in demand led by US megacap technology stocks and strong momentum in investor demand for thematic artificial intelligence stocks.

Exposure to core and US Treasury bonds | The Fund's exposure to core and US Treasury bonds was a headwind, as long and moderate duration, as well as higher-grade fixed income, suffered compared to shorter duration, more credit sensitive counterparts. This was due to interest rates moving higher and the steepening of the yield curve that transpired significantly in the second half of the year.

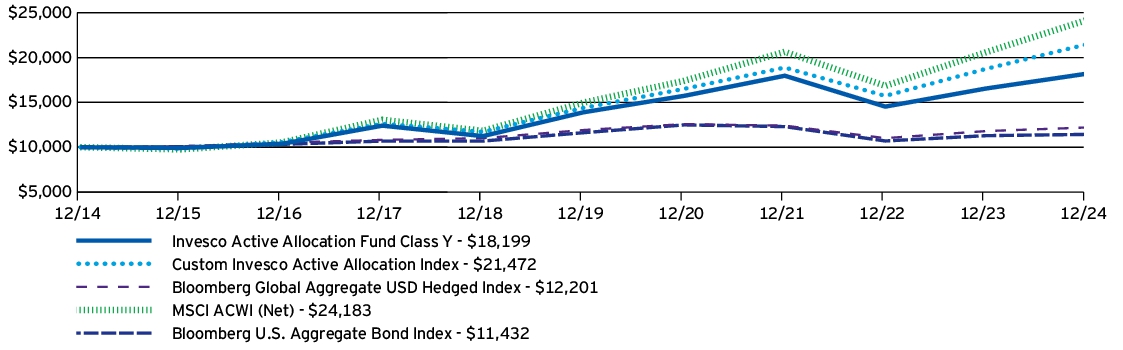

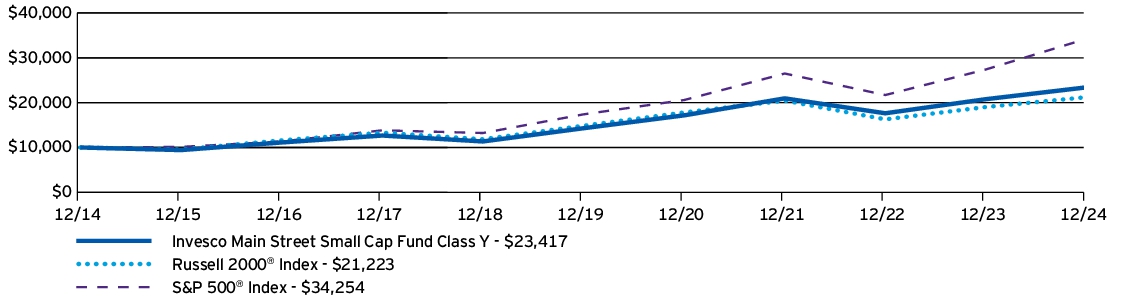

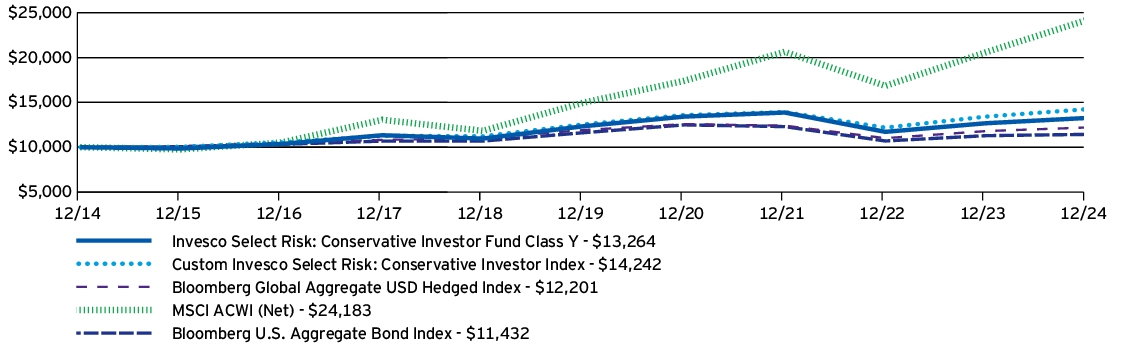

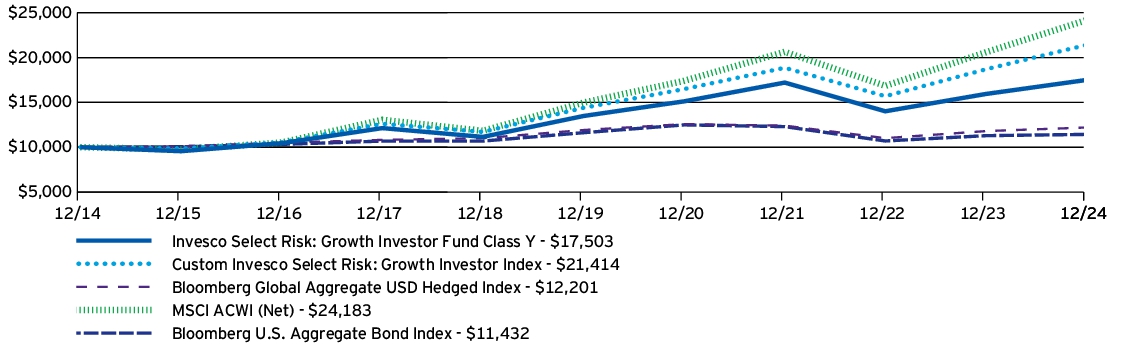

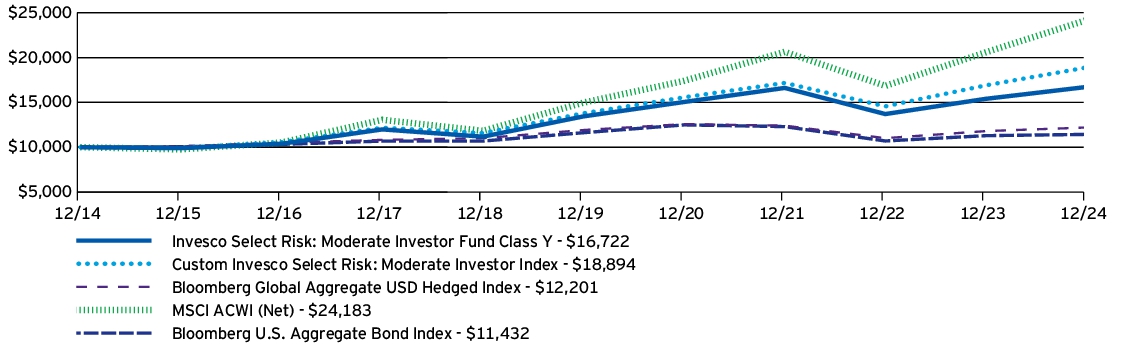

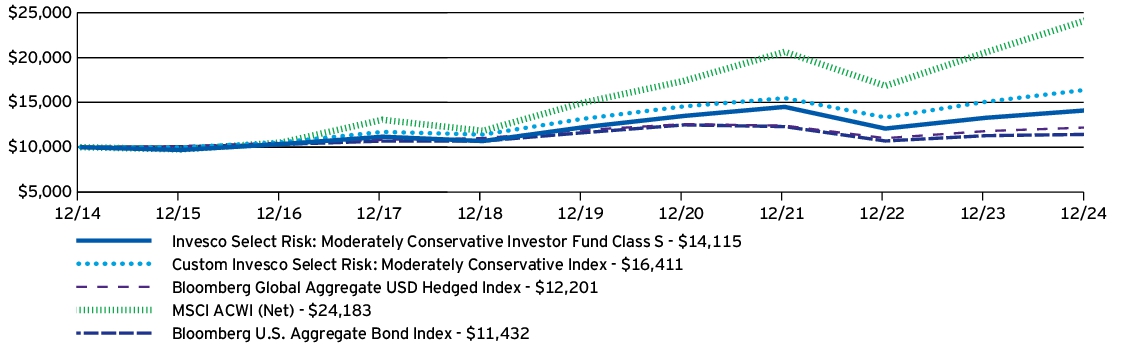

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Active Allocation Fund (Class Y) | 10.00% | 5.55% | 6.17% |

| Custom Invesco Active Allocation Index | 14.63% | 8.34% | 7.94% |

| Bloomberg Global Aggregate USD Hedged Index | 3.40% | 0.48% | 2.01% |

| MSCI ACWI (Net) | 17.49% | 10.06% | 9.23% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

The Custom Invesco Active Allocation Index is composed of 80% MSCI ACWI (Net) and 20% Bloomberg Global Aggregate USD Hedged Index.

Effective after the close of business on May 24, 2019, Class Y shares of Oppenheimer Portfolio Series: Active Allocation Fund (the predecessor fund), were reorganized into Class Y shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class Y shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg Global Aggregate USD Hedged Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $1,899,296,008 |

| Total number of portfolio holdings | 27 |

| Total advisory fees paid | $1,648,323 |

| Portfolio turnover rate | 43% |

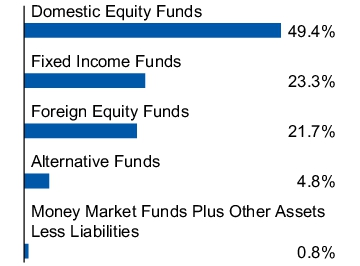

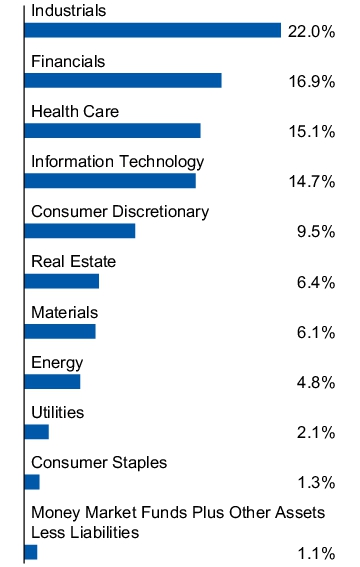

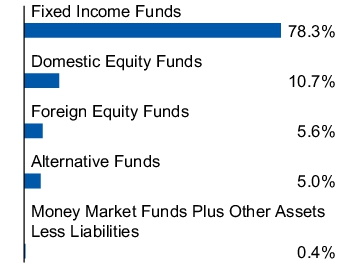

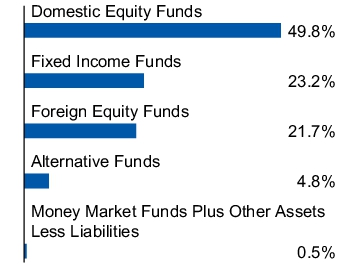

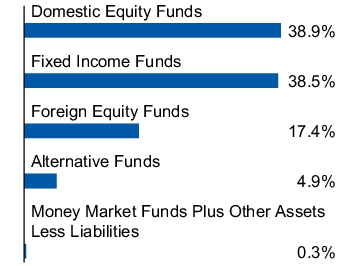

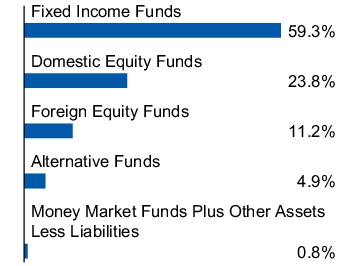

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Asset allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Active Allocation Fund

Class R5: PAAJX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Active Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Active Allocation Fund

(Class R5) | $18 | 0.17% |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, global risk assets outperformed defensive assets driven by a favorable macroeconomic environment, the beginning of a global monetary policy easing cycle and greater clarity with respect to fiscal policy following the conclusion of many major elections globally. These macroeconomic tailwinds supported global equity prices, particularly within the US, as well as the continuation of credit spreads tightening to cycle lows within investment grade, high yield and emerging market debt markets. Given this backdrop, an underweight to equities and overweight to fixed income assets was a headwind to Fund performance, as were certain factor tilts within equities, as well as allocations within fixed income to core and US Treasury bonds.

• For the fiscal year ended December 31, 2024, Class R5 shares of the Fund returned 10.05%. For the same time period, the Custom Invesco Active Allocation Index returned 14.63%.

What contributed to performance?

Exposure to growth equities and the quality factor | The Fund's exposure to high quality securities (commonly referred to as 'growth' stocks) was rewarded with exposures within both the US large- and mid-cap space, as well as exposure internationally.

Exposure to high yield and floating rate credit | The Fund's exposure to high yield was beneficial as credit spreads continued to tighten, supported by resilient corporate fundamentals and strong investor demand for higher-coupon bond offerings. Floating rate exposure was rewarded as well, with the securities benefiting from an increasing interest rate environment, compared to their fixed-rate peers.

What detracted from performance?

Cyclical factor exposure within equities | Exposure to the small size and value factors was a detractor from Fund performance over the time period, as more defensive equity factors such as quality continued to be in demand led by US megacap technology stocks and strong momentum in investor demand for thematic artificial intelligence stocks.

Exposure to core and US Treasury bonds | The Fund's exposure to core and US Treasury bonds was a headwind, as long and moderate duration, as well as higher-grade fixed income, suffered compared to shorter duration, more credit sensitive counterparts. This was due to interest rates moving higher and the steepening of the yield curve that transpired significantly in the second half of the year.

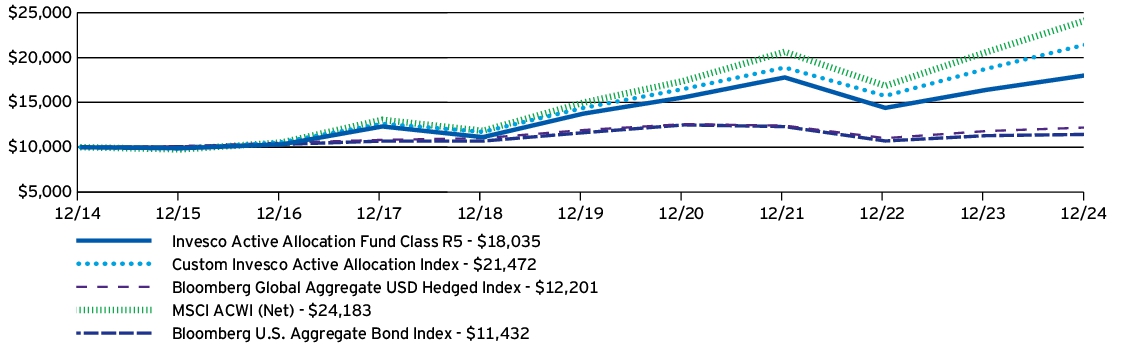

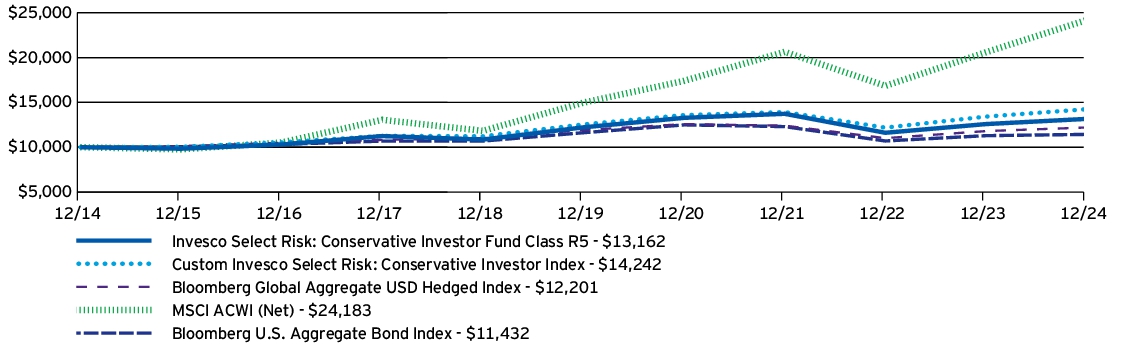

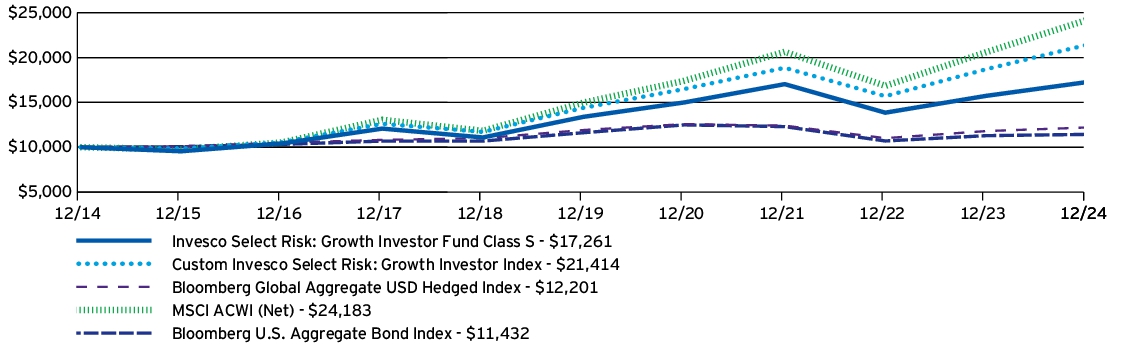

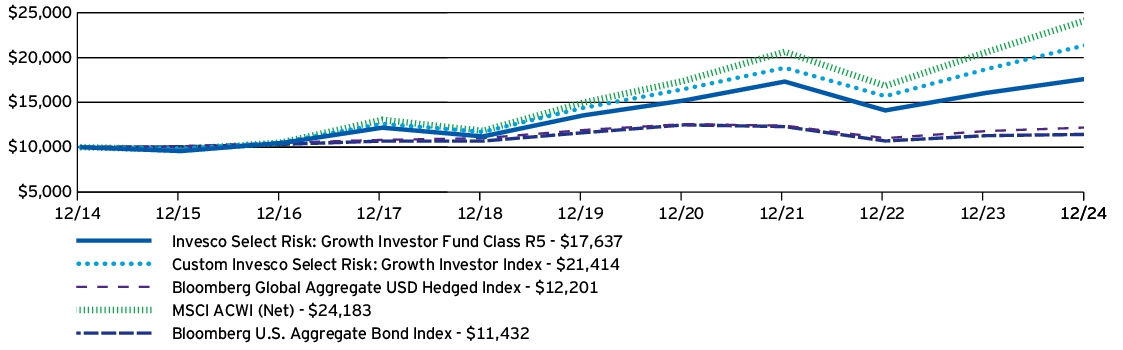

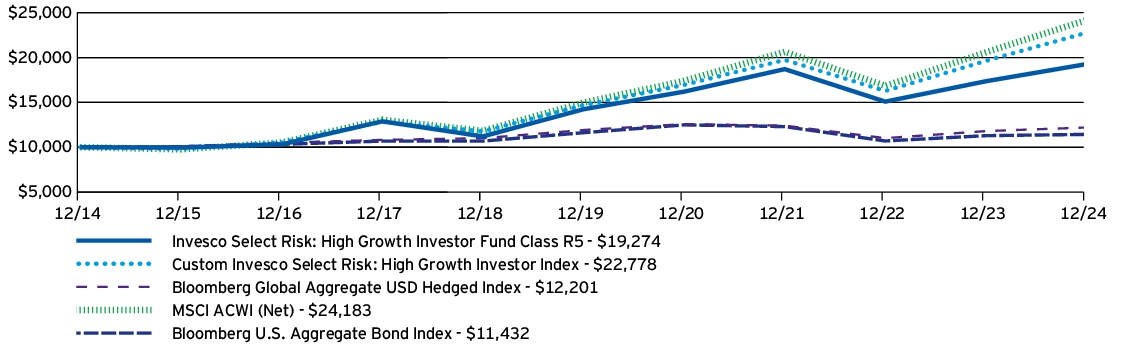

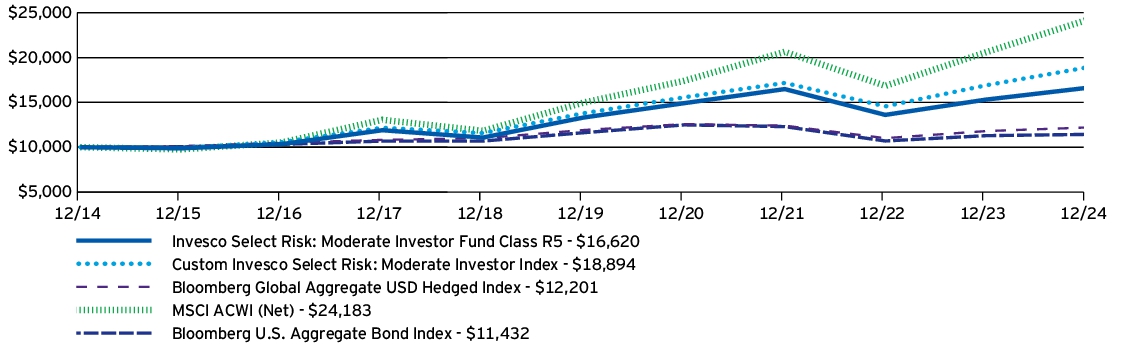

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Active Allocation Fund (Class R5) | 10.05% | 5.58% | 6.07% |

| Custom Invesco Active Allocation Index | 14.63% | 8.34% | 7.94% |

| Bloomberg Global Aggregate USD Hedged Index | 3.40% | 0.48% | 2.01% |

| MSCI ACWI (Net) | 17.49% | 10.06% | 9.23% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

The Custom Invesco Active Allocation Index is composed of 80% MSCI ACWI (Net) and 20% Bloomberg Global Aggregate USD Hedged Index.

Class R5 shares incepted on May 24, 2019. Performance shown on and prior to that date is that of Oppenheimer Portfolio Series: Active Allocation Fund's (the predecessor fund) Class A shares at net asset value and includes 12b-1 fees applicable to Class A shares. Share class returns will differ from the predecessor fund because of different expenses.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg Global Aggregate USD Hedged Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $1,899,296,008 |

| Total number of portfolio holdings | 27 |

| Total advisory fees paid | $1,648,323 |

| Portfolio turnover rate | 43% |

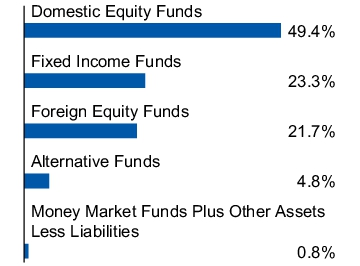

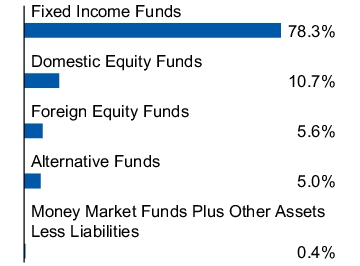

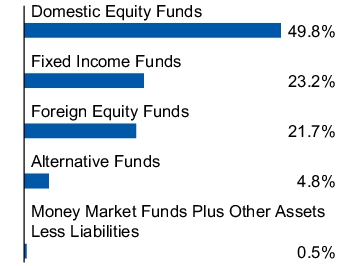

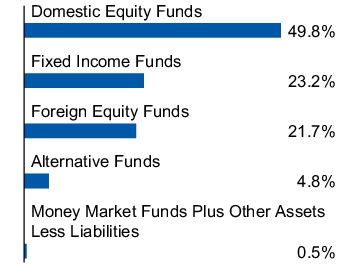

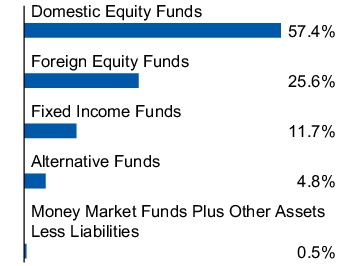

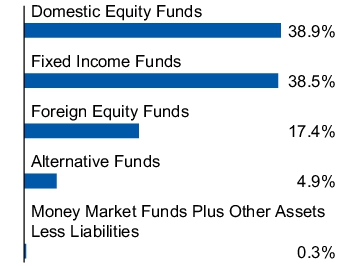

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Asset allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective after the close of business on September 30, 2024, the Fund has limited public sales of its Class R5 shares to certain investors who were previously invested in Class R5 shares of the Fund.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Active Allocation Fund

Class R6: PAAQX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Active Allocation Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Active Allocation Fund

(Class R6) | $16 | 0.15% |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, global risk assets outperformed defensive assets driven by a favorable macroeconomic environment, the beginning of a global monetary policy easing cycle and greater clarity with respect to fiscal policy following the conclusion of many major elections globally. These macroeconomic tailwinds supported global equity prices, particularly within the US, as well as the continuation of credit spreads tightening to cycle lows within investment grade, high yield and emerging market debt markets. Given this backdrop, an underweight to equities and overweight to fixed income assets was a headwind to Fund performance, as were certain factor tilts within equities, as well as allocations within fixed income to core and US Treasury bonds.

• For the fiscal year ended December 31, 2024, Class R6 shares of the Fund returned 10.08%. For the same time period, the Custom Invesco Active Allocation Index returned 14.63%.

What contributed to performance?

Exposure to growth equities and the quality factor | The Fund's exposure to high quality securities (commonly referred to as 'growth' stocks) was rewarded with exposures within both the US large- and mid-cap space, as well as exposure internationally.

Exposure to high yield and floating rate credit | The Fund's exposure to high yield was beneficial as credit spreads continued to tighten, supported by resilient corporate fundamentals and strong investor demand for higher-coupon bond offerings. Floating rate exposure was rewarded as well, with the securities benefiting from an increasing interest rate environment, compared to their fixed-rate peers.

What detracted from performance?

Cyclical factor exposure within equities | Exposure to the small size and value factors was a detractor from Fund performance over the time period, as more defensive equity factors such as quality continued to be in demand led by US megacap technology stocks and strong momentum in investor demand for thematic artificial intelligence stocks.

Exposure to core and US Treasury bonds | The Fund's exposure to core and US Treasury bonds was a headwind, as long and moderate duration, as well as higher-grade fixed income, suffered compared to shorter duration, more credit sensitive counterparts. This was due to interest rates moving higher and the steepening of the yield curve that transpired significantly in the second half of the year.

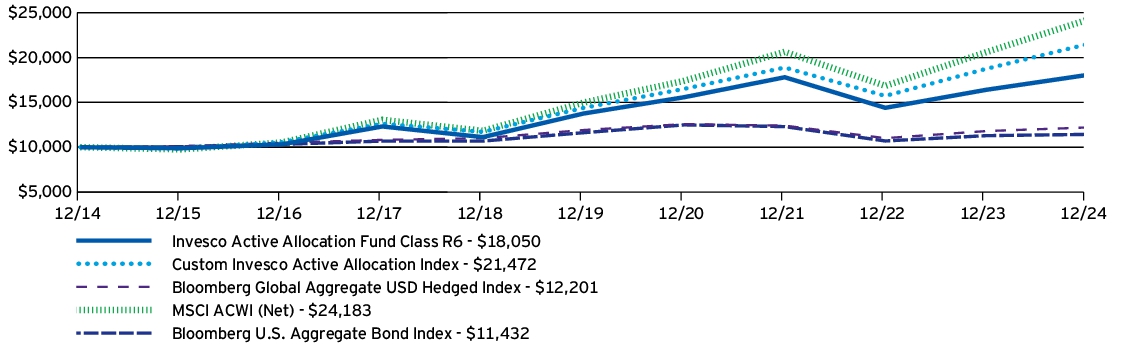

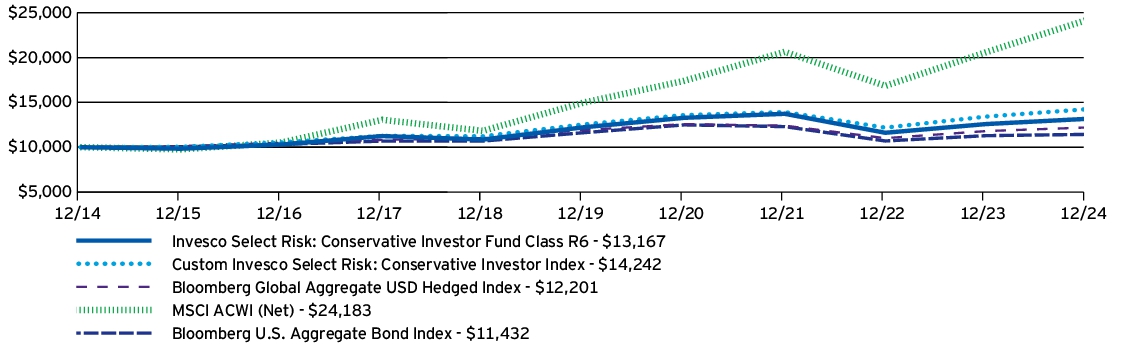

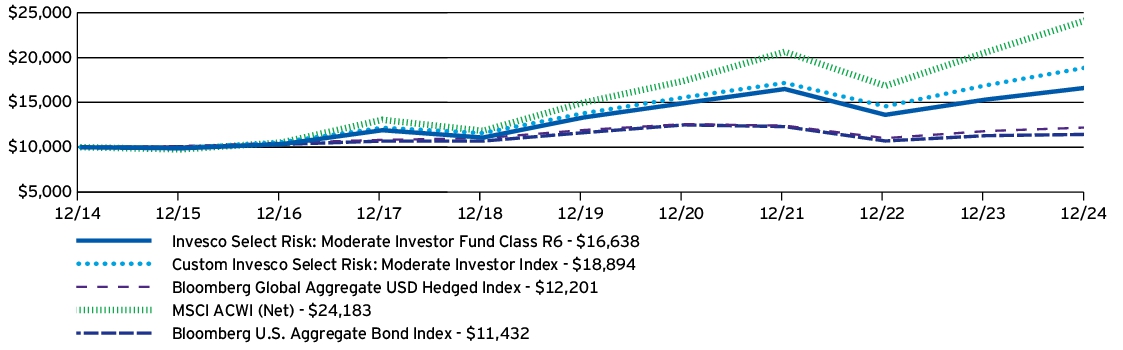

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Active Allocation Fund (Class R6) | 10.08% | 5.59% | 6.08% |

| Custom Invesco Active Allocation Index | 14.63% | 8.34% | 7.94% |

| Bloomberg Global Aggregate USD Hedged Index | 3.40% | 0.48% | 2.01% |

| MSCI ACWI (Net) | 17.49% | 10.06% | 9.23% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

The Custom Invesco Active Allocation Index is composed of 80% MSCI ACWI (Net) and 20% Bloomberg Global Aggregate USD Hedged Index.

Class R6 shares incepted on May 24, 2019. Performance shown on and prior to that date is that of Oppenheimer Portfolio Series: Active Allocation Fund's (the predecessor fund) Class A shares at net asset value and includes 12b-1 fees applicable to Class A shares. Share class returns will differ from the predecessor fund because of different expenses.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg Global Aggregate USD Hedged Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $1,899,296,008 |

| Total number of portfolio holdings | 27 |

| Total advisory fees paid | $1,648,323 |

| Portfolio turnover rate | 43% |

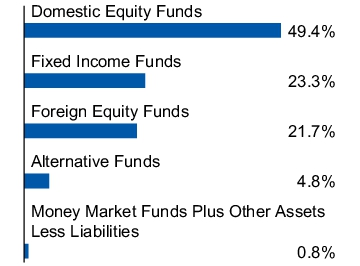

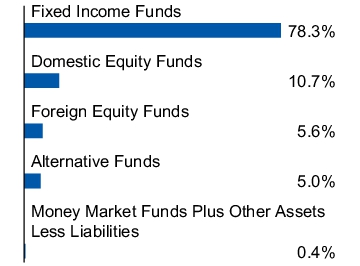

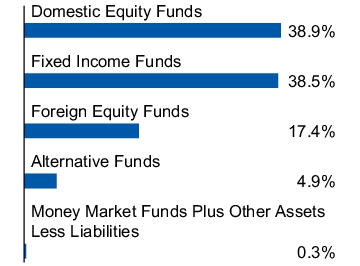

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Asset allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Convertible Securities Fund

Class A: CNSAX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Convertible Securities Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Convertible Securities Fund

(Class A) | $101 | 0.96%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, the Fund performed favorably. Stronger than anticipated economic growth alongside a continuing, albeit bumpy, disinflation trend created a favorable backdrop for equity and credit markets. Convertibles fared well in this environment, supported by strong equity performance.

• For the fiscal year ended December 31, 2024, Class A shares of the Fund, excluding sales charge, returned 9.74%. For the same time period, the ICE BofA US Convertible Index returned 11.14%.

What contributed to performance?

BrightSpring Health Services, Inc. | BrightSpring Health Services offers a home and community-based health care services platform. The company posted strong revenue growth alongside improving sentiment for the sector.

Insmed, Inc. | Insmed is a biopharmaceutical company. The company benefited from positive clinical results in May, bolstering equity performance.

What detracted from performance?

Rocket Lab USA, Inc. | An underweight position to Rocket Lab hurt the Fund after the spacecraft and satellite company posted stronger than expected earnings in the third quarter. We sold the holding during the fiscal year.

Uber Technologies, Inc. | An overweight position to Uber detracted from relative performance as the ride hailing service saw mixed performance over the year. We sold the holding during the fiscal year.

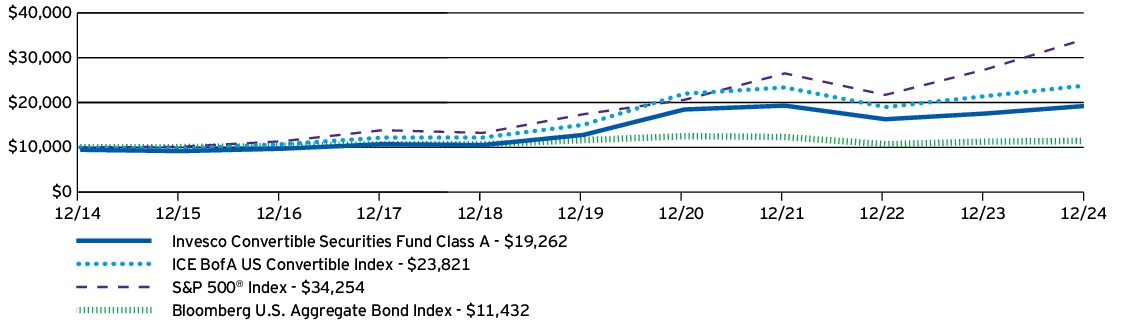

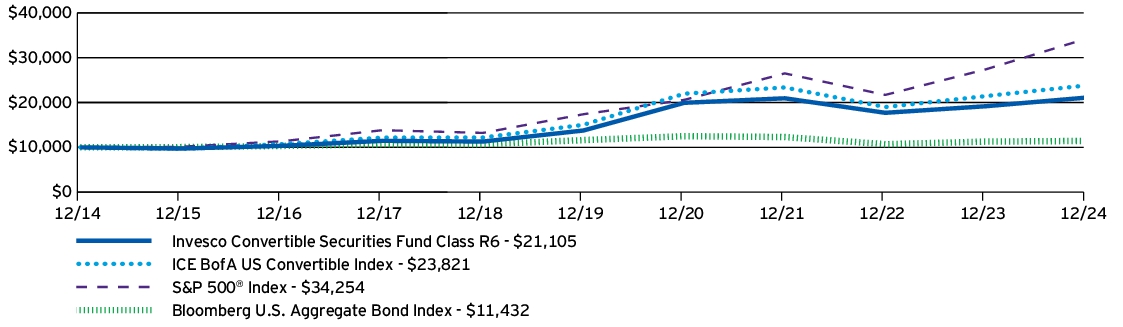

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Convertible Securities Fund (Class A) —including sales charge | 3.69% | 7.34% | 6.77% |

| Invesco Convertible Securities Fund (Class A) —excluding sales charge | 9.74% | 8.55% | 7.38% |

| ICE BofA US Convertible Index | 11.14% | 9.66% | 9.07% |

| S&P 500® Index | 25.02% | 14.53% | 13.10% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

Prior to July 1, 2022, index returns reflect no deduction for fees, expenses or taxes. Effective July 1, 2022, index returns reflect no deduction for taxes, but include transaction costs, which may be higher or lower than the actual transaction costs incurred by the Fund.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the ICE BofA US Convertible Index to the S&P 500® Index and Bloomberg U.S. Aggregate Bond Index to reflect that the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities markets.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $739,282,669 |

| Total number of portfolio holdings | 173 |

| Total advisory fees paid | $3,991,359 |

| Portfolio turnover rate | 87% |

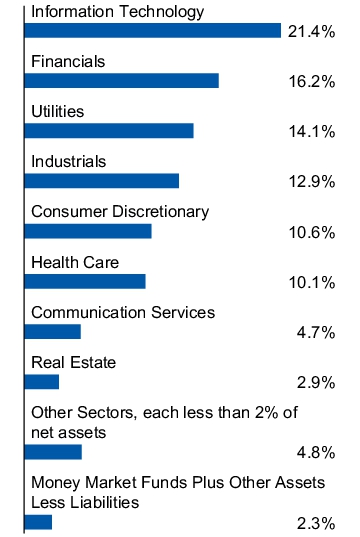

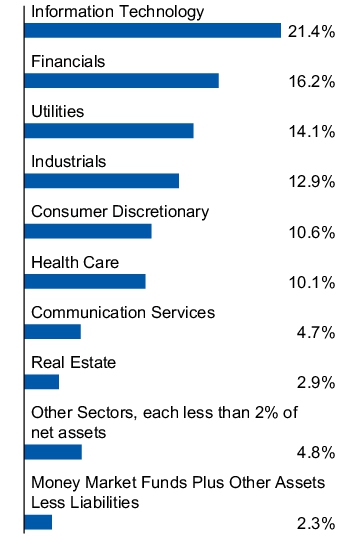

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Wells Fargo & Co., Class A, Series L, Conv. Pfd., 7.50%, | 2.97% |

| Bank of America Corp., Series L, Conv. Pfd., 7.25%, | 2.94% |

| Boeing Co. (The), Conv. Pfd., 6.00%, 10/15/2027 | 2.39% |

| Coinbase Global, Inc., Conv., 0.25%, 04/01/2030 | 2.25% |

| Southern Co. (The), Conv., 4.50%, 06/15/2027 | 1.57% |

| Rivian Automotive, Inc., Conv., 4.63%, 03/15/2029 | 1.53% |

| Uber Technologies, Inc., Series 2028, Conv., 0.88%, 12/01/2028 | 1.48% |

| Live Nation Entertainment, Inc., Conv., 3.13%, 01/15/2029 | 1.38% |

| Akamai Technologies, Inc., Conv., 0.38%, 09/01/2027 | 1.38% |

| Welltower OP LLC, Conv., 3.13%, 07/15/2029 | 1.33% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Convertible Securities Fund

Class C: CNSCX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Convertible Securities Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Convertible Securities Fund

(Class C) | $178 | 1.70%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, the Fund performed favorably. Stronger than anticipated economic growth alongside a continuing, albeit bumpy, disinflation trend created a favorable backdrop for equity and credit markets. Convertibles fared well in this environment, supported by strong equity performance.

• For the fiscal year ended December 31, 2024, Class C shares of the Fund, excluding sales charge, returned 8.86%. For the same time period, the ICE BofA US Convertible Index returned 11.14%.

What contributed to performance?

BrightSpring Health Services, Inc. | BrightSpring Health Services offers a home and community-based health care services platform. The company posted strong revenue growth alongside improving sentiment for the sector.

Insmed, Inc. | Insmed is a biopharmaceutical company. The company benefited from positive clinical results in May, bolstering equity performance.

What detracted from performance?

Rocket Lab USA, Inc. | An underweight position to Rocket Lab hurt the Fund after the spacecraft and satellite company posted stronger than expected earnings in the third quarter. We sold the holding during the fiscal year.

Uber Technologies, Inc. | An overweight position to Uber detracted from relative performance as the ride hailing service saw mixed performance over the year. We sold the holding during the fiscal year.

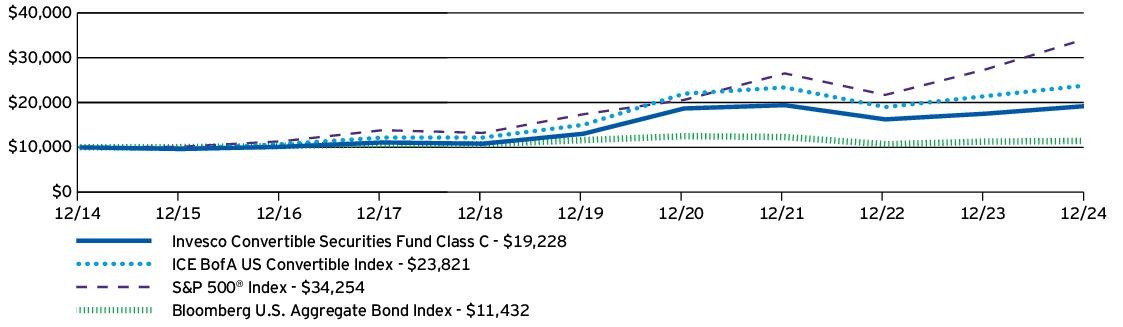

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Convertible Securities Fund (Class C) —including sales charge | 7.86% | 7.75% | 6.76% |

| Invesco Convertible Securities Fund (Class C) —excluding sales charge | 8.86% | 7.75% | 6.76% |

| ICE BofA US Convertible Index | 11.14% | 9.66% | 9.07% |

| S&P 500® Index | 25.02% | 14.53% | 13.10% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

Prior to July 1, 2022, index returns reflect no deduction for fees, expenses or taxes. Effective July 1, 2022, index returns reflect no deduction for taxes, but include transaction costs, which may be higher or lower than the actual transaction costs incurred by the Fund.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the ICE BofA US Convertible Index to the S&P 500® Index and Bloomberg U.S. Aggregate Bond Index to reflect that the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities markets.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $739,282,669 |

| Total number of portfolio holdings | 173 |

| Total advisory fees paid | $3,991,359 |

| Portfolio turnover rate | 87% |

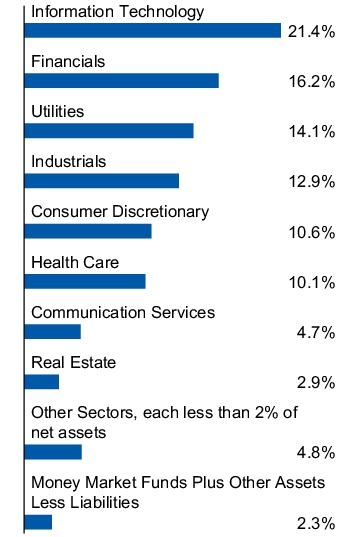

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Wells Fargo & Co., Class A, Series L, Conv. Pfd., 7.50%, | 2.97% |

| Bank of America Corp., Series L, Conv. Pfd., 7.25%, | 2.94% |

| Boeing Co. (The), Conv. Pfd., 6.00%, 10/15/2027 | 2.39% |

| Coinbase Global, Inc., Conv., 0.25%, 04/01/2030 | 2.25% |

| Southern Co. (The), Conv., 4.50%, 06/15/2027 | 1.57% |

| Rivian Automotive, Inc., Conv., 4.63%, 03/15/2029 | 1.53% |

| Uber Technologies, Inc., Series 2028, Conv., 0.88%, 12/01/2028 | 1.48% |

| Live Nation Entertainment, Inc., Conv., 3.13%, 01/15/2029 | 1.38% |

| Akamai Technologies, Inc., Conv., 0.38%, 09/01/2027 | 1.38% |

| Welltower OP LLC, Conv., 3.13%, 07/15/2029 | 1.33% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Convertible Securities Fund

Class Y: CNSDX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Convertible Securities Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Convertible Securities Fund

(Class Y) | $75 | 0.71%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, the Fund performed favorably. Stronger than anticipated economic growth alongside a continuing, albeit bumpy, disinflation trend created a favorable backdrop for equity and credit markets. Convertibles fared well in this environment, supported by strong equity performance.

• For the fiscal year ended December 31, 2024, Class Y shares of the Fund returned 9.95%. For the same time period, the ICE BofA US Convertible Index returned 11.14%.

What contributed to performance?

BrightSpring Health Services, Inc. | BrightSpring Health Services offers a home and community-based health care services platform. The company posted strong revenue growth alongside improving sentiment for the sector.

Insmed, Inc. | Insmed is a biopharmaceutical company. The company benefited from positive clinical results in May, bolstering equity performance.

What detracted from performance?

Rocket Lab USA, Inc. | An underweight position to Rocket Lab hurt the Fund after the spacecraft and satellite company posted stronger than expected earnings in the third quarter. We sold the holding during the fiscal year.

Uber Technologies, Inc. | An overweight position to Uber detracted from relative performance as the ride hailing service saw mixed performance over the year. We sold the holding during the fiscal year.

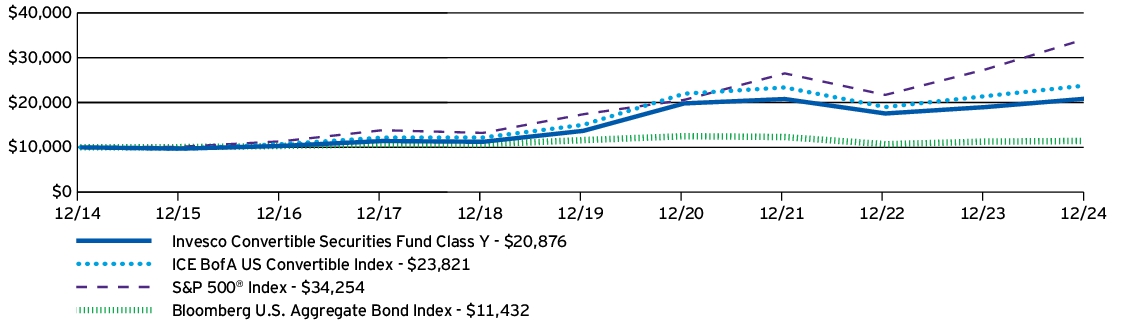

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Convertible Securities Fund (Class Y) | 9.95% | 8.82% | 7.64% |

| ICE BofA US Convertible Index | 11.14% | 9.66% | 9.07% |

| S&P 500® Index | 25.02% | 14.53% | 13.10% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

Prior to July 1, 2022, index returns reflect no deduction for fees, expenses or taxes. Effective July 1, 2022, index returns reflect no deduction for taxes, but include transaction costs, which may be higher or lower than the actual transaction costs incurred by the Fund.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the ICE BofA US Convertible Index to the S&P 500® Index and Bloomberg U.S. Aggregate Bond Index to reflect that the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities markets.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $739,282,669 |

| Total number of portfolio holdings | 173 |

| Total advisory fees paid | $3,991,359 |

| Portfolio turnover rate | 87% |

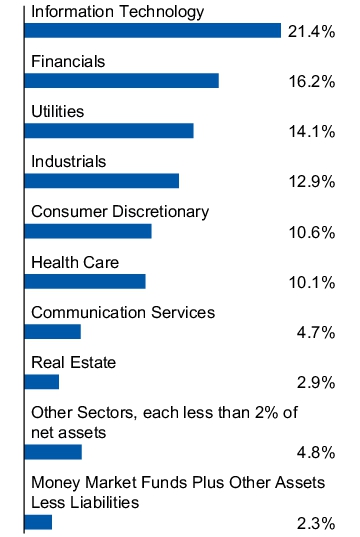

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Wells Fargo & Co., Class A, Series L, Conv. Pfd., 7.50%, | 2.97% |

| Bank of America Corp., Series L, Conv. Pfd., 7.25%, | 2.94% |

| Boeing Co. (The), Conv. Pfd., 6.00%, 10/15/2027 | 2.39% |

| Coinbase Global, Inc., Conv., 0.25%, 04/01/2030 | 2.25% |

| Southern Co. (The), Conv., 4.50%, 06/15/2027 | 1.57% |

| Rivian Automotive, Inc., Conv., 4.63%, 03/15/2029 | 1.53% |

| Uber Technologies, Inc., Series 2028, Conv., 0.88%, 12/01/2028 | 1.48% |

| Live Nation Entertainment, Inc., Conv., 3.13%, 01/15/2029 | 1.38% |

| Akamai Technologies, Inc., Conv., 0.38%, 09/01/2027 | 1.38% |

| Welltower OP LLC, Conv., 3.13%, 07/15/2029 | 1.33% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Convertible Securities Fund

Class R5: CNSIX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Convertible Securities Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Convertible Securities Fund

(Class R5) | $70 | 0.67%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, the Fund performed favorably. Stronger than anticipated economic growth alongside a continuing, albeit bumpy, disinflation trend created a favorable backdrop for equity and credit markets. Convertibles fared well in this environment, supported by strong equity performance.

• For the fiscal year ended December 31, 2024, Class R5 shares of the Fund returned 10.01%. For the same time period, the ICE BofA US Convertible Index returned 11.14%.

What contributed to performance?

BrightSpring Health Services, Inc. | BrightSpring Health Services offers a home and community-based health care services platform. The company posted strong revenue growth alongside improving sentiment for the sector.

Insmed, Inc. | Insmed is a biopharmaceutical company. The company benefited from positive clinical results in May, bolstering equity performance.

What detracted from performance?

Rocket Lab USA, Inc. | An underweight position to Rocket Lab hurt the Fund after the spacecraft and satellite company posted stronger than expected earnings in the third quarter. We sold the holding during the fiscal year.

Uber Technologies, Inc. | An overweight position to Uber detracted from relative performance as the ride hailing service saw mixed performance over the year. We sold the holding during the fiscal year.

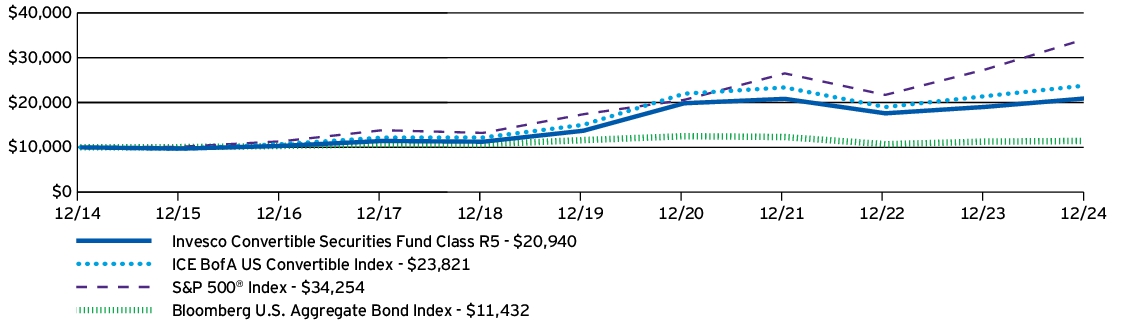

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Convertible Securities Fund (Class R5) | 10.01% | 8.84% | 7.67% |

| ICE BofA US Convertible Index | 11.14% | 9.66% | 9.07% |

| S&P 500® Index | 25.02% | 14.53% | 13.10% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

Prior to July 1, 2022, index returns reflect no deduction for fees, expenses or taxes. Effective July 1, 2022, index returns reflect no deduction for taxes, but include transaction costs, which may be higher or lower than the actual transaction costs incurred by the Fund.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the ICE BofA US Convertible Index to the S&P 500® Index and Bloomberg U.S. Aggregate Bond Index to reflect that the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities markets.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $739,282,669 |

| Total number of portfolio holdings | 173 |

| Total advisory fees paid | $3,991,359 |

| Portfolio turnover rate | 87% |

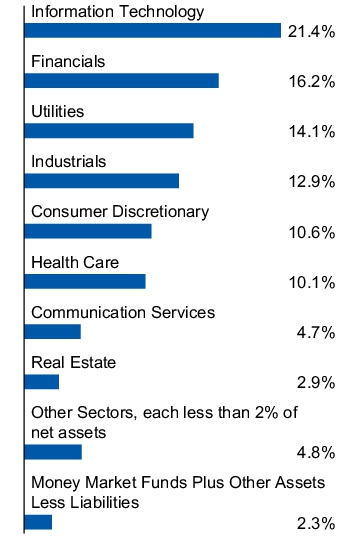

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Wells Fargo & Co., Class A, Series L, Conv. Pfd., 7.50%, | 2.97% |

| Bank of America Corp., Series L, Conv. Pfd., 7.25%, | 2.94% |

| Boeing Co. (The), Conv. Pfd., 6.00%, 10/15/2027 | 2.39% |

| Coinbase Global, Inc., Conv., 0.25%, 04/01/2030 | 2.25% |

| Southern Co. (The), Conv., 4.50%, 06/15/2027 | 1.57% |

| Rivian Automotive, Inc., Conv., 4.63%, 03/15/2029 | 1.53% |

| Uber Technologies, Inc., Series 2028, Conv., 0.88%, 12/01/2028 | 1.48% |

| Live Nation Entertainment, Inc., Conv., 3.13%, 01/15/2029 | 1.38% |

| Akamai Technologies, Inc., Conv., 0.38%, 09/01/2027 | 1.38% |

| Welltower OP LLC, Conv., 3.13%, 07/15/2029 | 1.33% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective after the close of business on September 30, 2024, the Fund has limited public sales of its Class R5 shares to certain investors who were previously invested in Class R5 shares of the Fund.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Convertible Securities Fund

Class R6: CNSFX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Convertible Securities Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Convertible Securities Fund

(Class R6) | $63 | 0.60%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, the Fund performed favorably. Stronger than anticipated economic growth alongside a continuing, albeit bumpy, disinflation trend created a favorable backdrop for equity and credit markets. Convertibles fared well in this environment, supported by strong equity performance.

• For the fiscal year ended December 31, 2024, Class R6 shares of the Fund returned 10.08%. For the same time period, the ICE BofA US Convertible Index returned 11.14%.

What contributed to performance?

BrightSpring Health Services, Inc. | BrightSpring Health Services offers a home and community-based health care services platform. The company posted strong revenue growth alongside improving sentiment for the sector.

Insmed, Inc. | Insmed is a biopharmaceutical company. The company benefited from positive clinical results in May, bolstering equity performance.

What detracted from performance?

Rocket Lab USA, Inc. | An underweight position to Rocket Lab hurt the Fund after the spacecraft and satellite company posted stronger than expected earnings in the third quarter. We sold the holding during the fiscal year.

Uber Technologies, Inc. | An overweight position to Uber detracted from relative performance as the ride hailing service saw mixed performance over the year. We sold the holding during the fiscal year.

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Convertible Securities Fund (Class R6) | 10.08% | 8.93% | 7.76% |

| ICE BofA US Convertible Index | 11.14% | 9.66% | 9.07% |

| S&P 500® Index | 25.02% | 14.53% | 13.10% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

Prior to July 1, 2022, index returns reflect no deduction for fees, expenses or taxes. Effective July 1, 2022, index returns reflect no deduction for taxes, but include transaction costs, which may be higher or lower than the actual transaction costs incurred by the Fund.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the ICE BofA US Convertible Index to the S&P 500® Index and Bloomberg U.S. Aggregate Bond Index to reflect that the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities markets.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $739,282,669 |

| Total number of portfolio holdings | 173 |

| Total advisory fees paid | $3,991,359 |

| Portfolio turnover rate | 87% |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Wells Fargo & Co., Class A, Series L, Conv. Pfd., 7.50%, | 2.97% |

| Bank of America Corp., Series L, Conv. Pfd., 7.25%, | 2.94% |

| Boeing Co. (The), Conv. Pfd., 6.00%, 10/15/2027 | 2.39% |

| Coinbase Global, Inc., Conv., 0.25%, 04/01/2030 | 2.25% |

| Southern Co. (The), Conv., 4.50%, 06/15/2027 | 1.57% |

| Rivian Automotive, Inc., Conv., 4.63%, 03/15/2029 | 1.53% |

| Uber Technologies, Inc., Series 2028, Conv., 0.88%, 12/01/2028 | 1.48% |

| Live Nation Entertainment, Inc., Conv., 3.13%, 01/15/2029 | 1.38% |

| Akamai Technologies, Inc., Conv., 0.38%, 09/01/2027 | 1.38% |

| Welltower OP LLC, Conv., 3.13%, 07/15/2029 | 1.33% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Income Advantage International Fund

Class A: GTNDX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Income Advantage International Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Income Advantage International Fund

(Class A) | $129 | 1.25%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, international equities experienced a mixed but generally positive performance that contained periods of volatility. This included a sharp sell-off in early August and another large drawdown in October, in response to a strengthening US dollar. The fiscal year ended with another drawdown in December due to geopolitical tensions and wavering global central bank policy.

• For the fiscal year ended December 31, 2024, Class A shares of the Fund, excluding sales charge, returned 6.80%. For the same time period, the MSCI ACWI ex-USA® Index (Net) returned 5.53%.

What contributed to performance?

Options-Based Income Exposure | The defensive and income-producing options and cash/cash equivalent components of the Fund's investments in equity-linked notes helped mitigate heightened market volatility and drawdowns relative to the MSCI ACWI ex-USA® Index (Net). Equity-linked notes are comprised primarily of returns attributable to coupon income received from selling embedded options and returns attributable to price changes in referenced equities, and cash or cash equivalents.

Passive Index Security Exposure | The Fund’s low tracking error to the MSCI ACWI ex-USA Index® contributed to the Fund's performance during the period.

What detracted from performance?

Detractors | There were no detractors during the fiscal year.

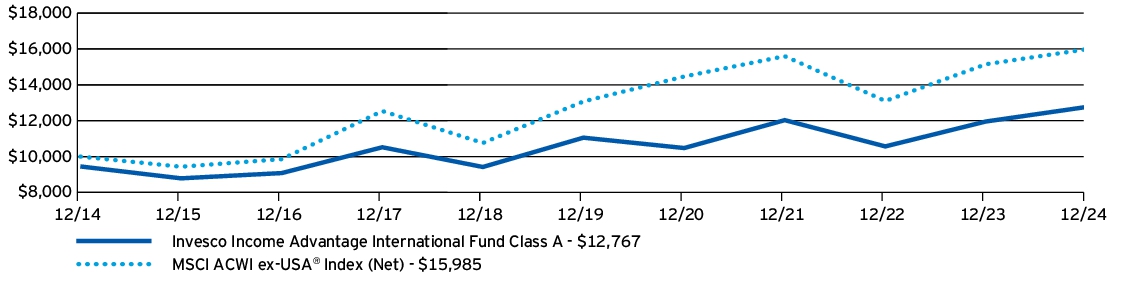

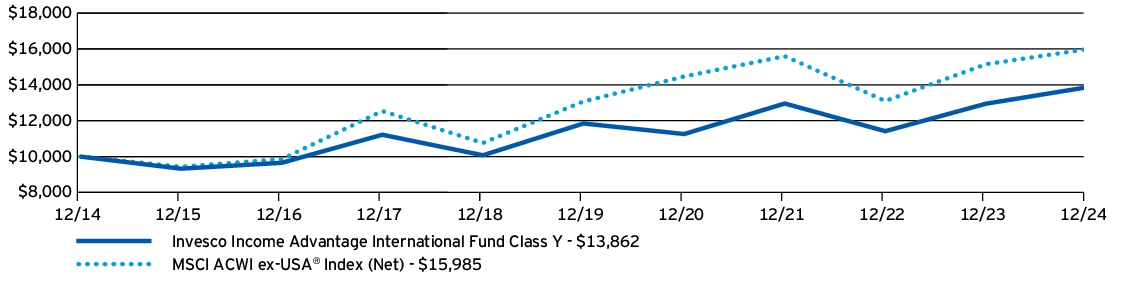

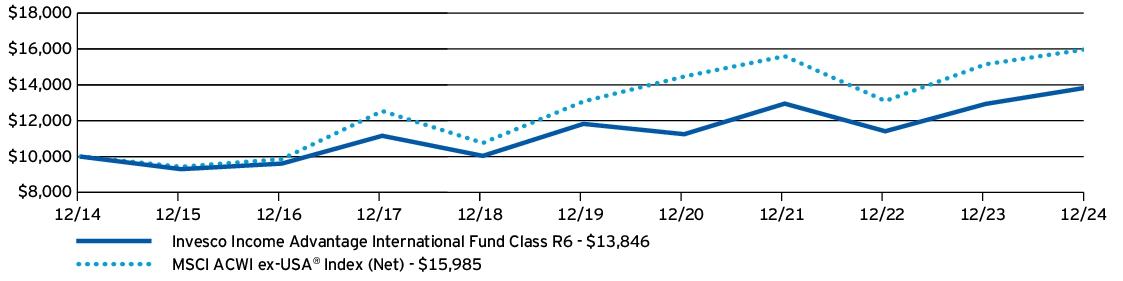

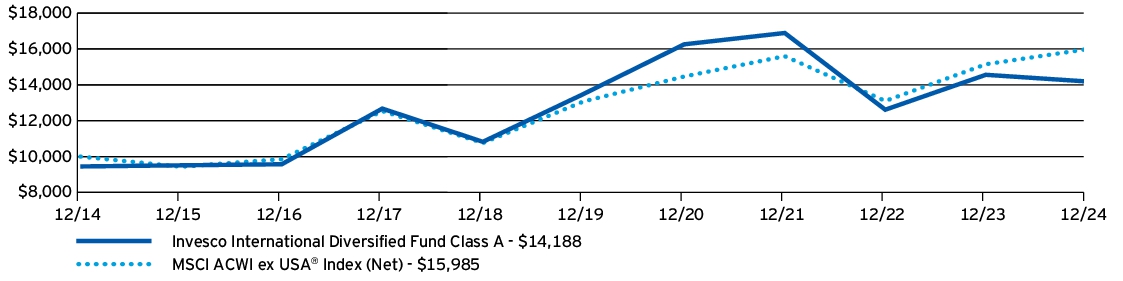

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage International Fund (Class A) —including sales charge | 0.94% | 1.76% | 2.47% |

| Invesco Income Advantage International Fund (Class A) —excluding sales charge | 6.80% | 2.93% | 3.06% |

| MSCI ACWI ex-USA® Index (Net) | 5.53% | 4.10% | 4.80% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $55,651,265 |

| Total number of portfolio holdings | 1,271 |

| Total advisory fees paid | $168,609 |

| Portfolio turnover rate | 72% |

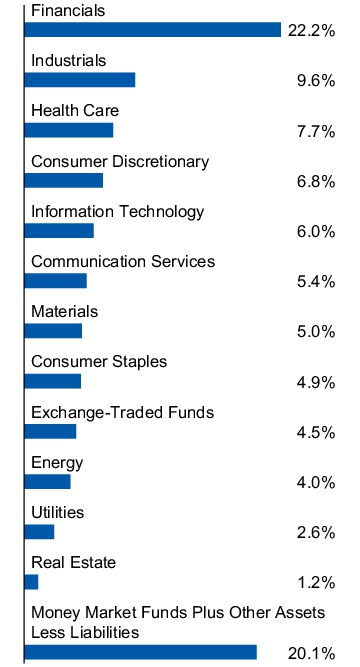

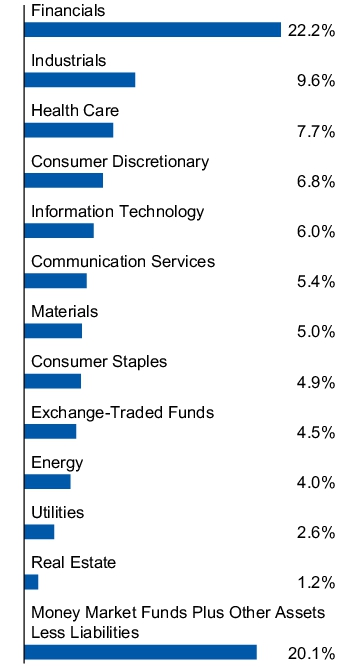

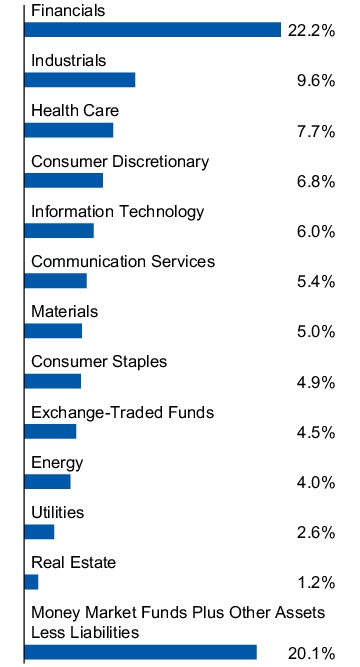

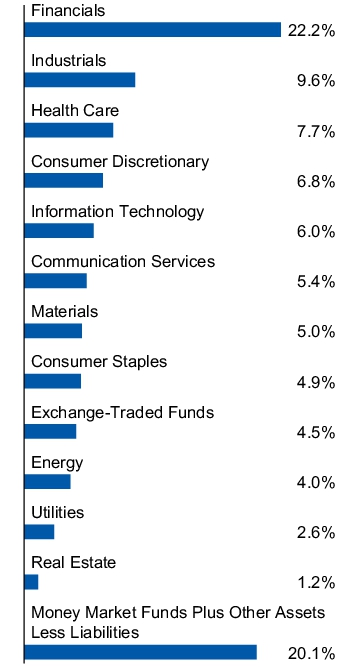

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| iShares Core MSCI Emerging Markets ETF | 4.48% |

| Royal Bank of Canada (MSCI EAFE Index), 142.71%, 02/03/2025 | 1.21% |

| Novartis AG | 1.17% |

| Deutsche Telekom AG | 1.04% |

| Novo Nordisk A/S, Class B | 1.03% |

| Canadian Imperial Bank of Commerce (MSCI EAFE Index), 132.75%, 01/21/2025 | 1.03% |

| Roche Holding AG | 0.96% |

| J.P. Morgan Structured Products B.V. (MSCI EAFE Index) , 01/03/2025 | 0.93% |

| Tencent Holdings Ltd. | 0.82% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 0.74% |

| * Excluding money market fund holdings, if any. | |

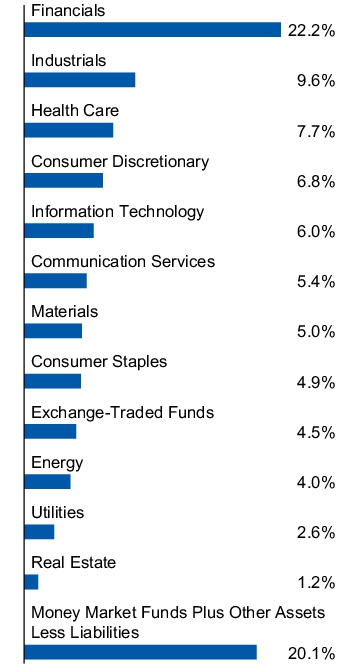

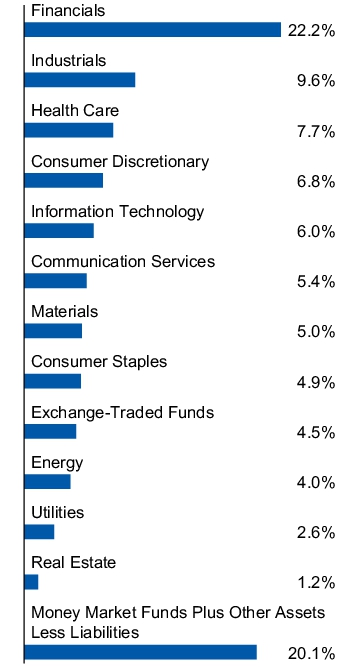

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

At a meeting held December 11, 2024, the Board of Trustees approved a Plan of Liquidation and Dissolution, which authorizes the termination, liquidation and dissolution of the Fund. In order to effect such liquidation, the Fund will be closed to investments by new accounts after the close of business on January 17, 2025. The Fund will be liquidated on or about March 20, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Income Advantage International Fund

Class C: GNDCX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Income Advantage International Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Income Advantage International Fund

(Class C) | $206 | 2.00%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• During the fiscal year ended December 31, 2024, international equities experienced a mixed but generally positive performance that contained periods of volatility. This included a sharp sell-off in early August and another large drawdown in October, in response to a strengthening US dollar. The fiscal year ended with another drawdown in December due to geopolitical tensions and wavering global central bank policy.

• For the fiscal year ended December 31, 2024, Class C shares of the Fund, excluding sales charge, returned 6.00%. For the same time period, the MSCI ACWI ex-USA® Index (Net) returned 5.53%.

What contributed to performance?

Options-Based Income Exposure | The defensive and income-producing options and cash/cash equivalent components of the Fund's investments in equity-linked notes helped mitigate heightened market volatility and drawdowns relative to the MSCI ACWI ex-USA® Index (Net). Equity-linked notes are comprised primarily of returns attributable to coupon income received from selling embedded options and returns attributable to price changes in referenced equities, and cash or cash equivalents.

Passive Index Security Exposure | The Fund’s low tracking error to the MSCI ACWI ex-USA Index® contributed to the Fund's performance during the period.

What detracted from performance?

Detractors | There were no detractors during the fiscal year.

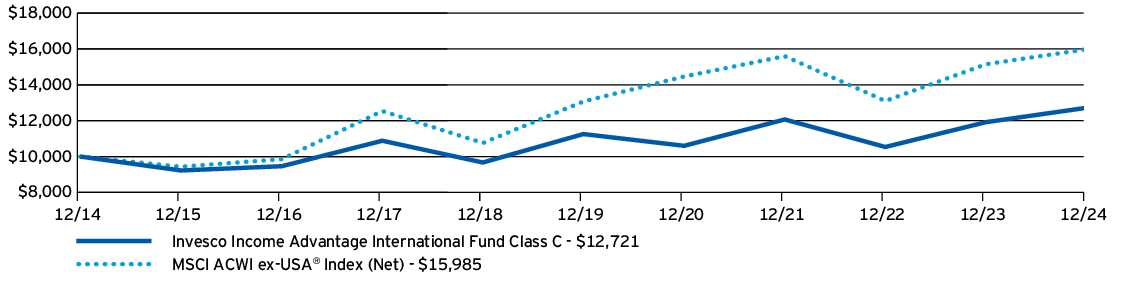

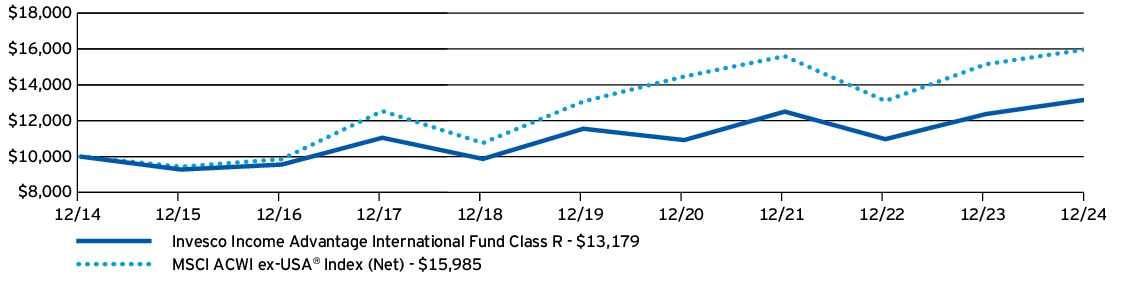

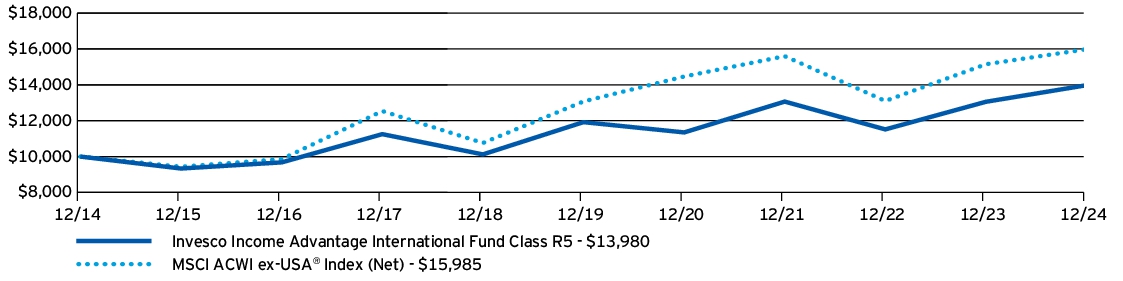

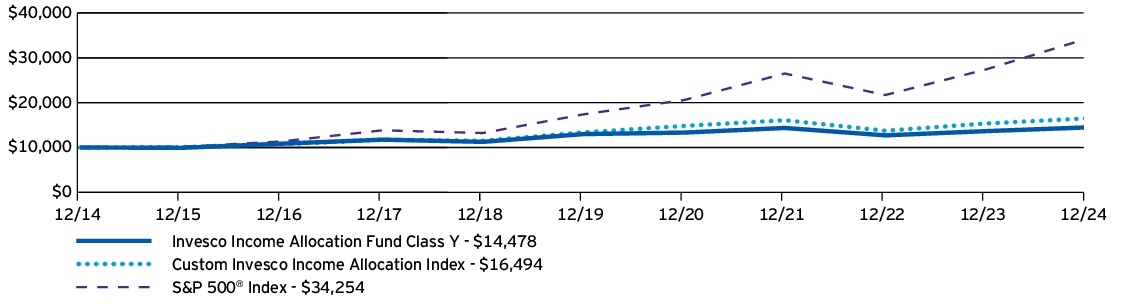

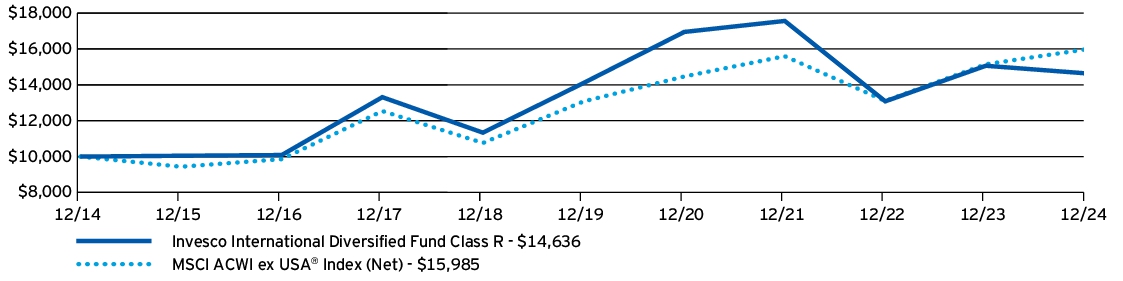

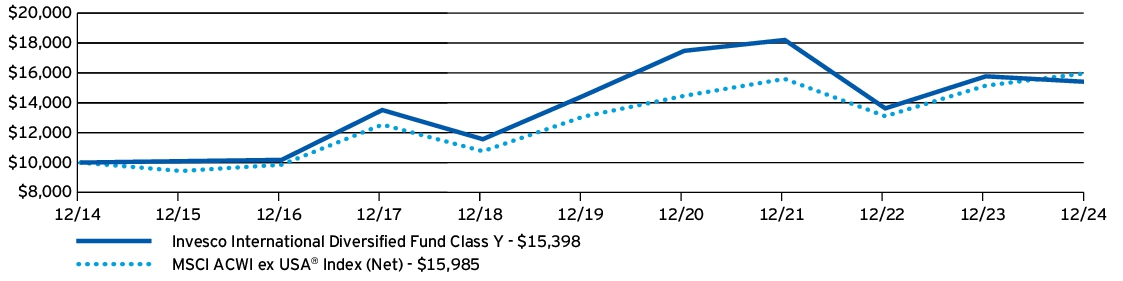

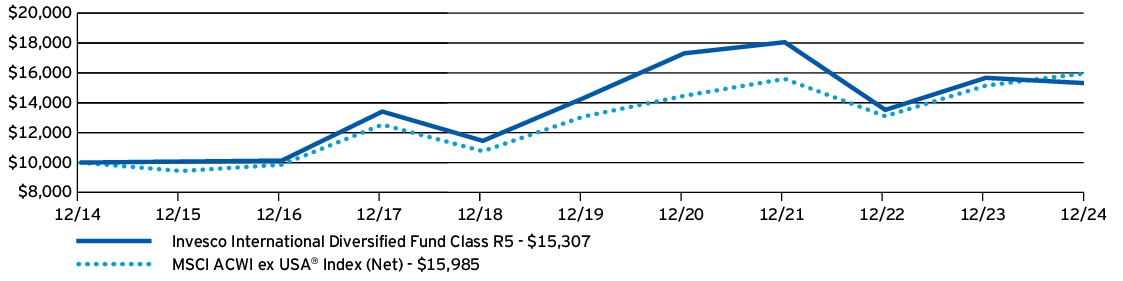

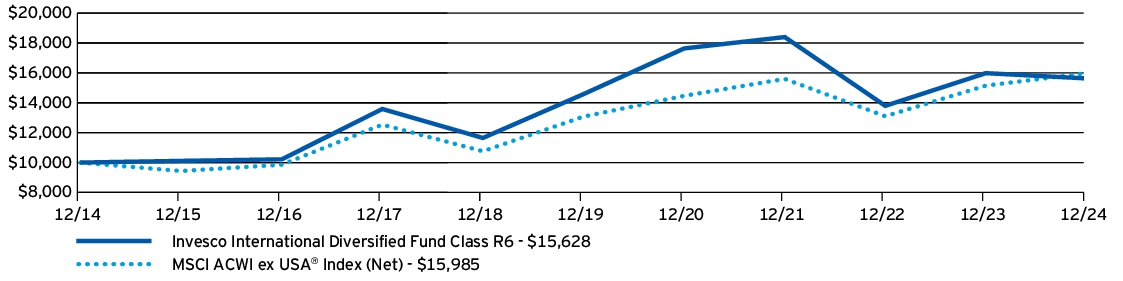

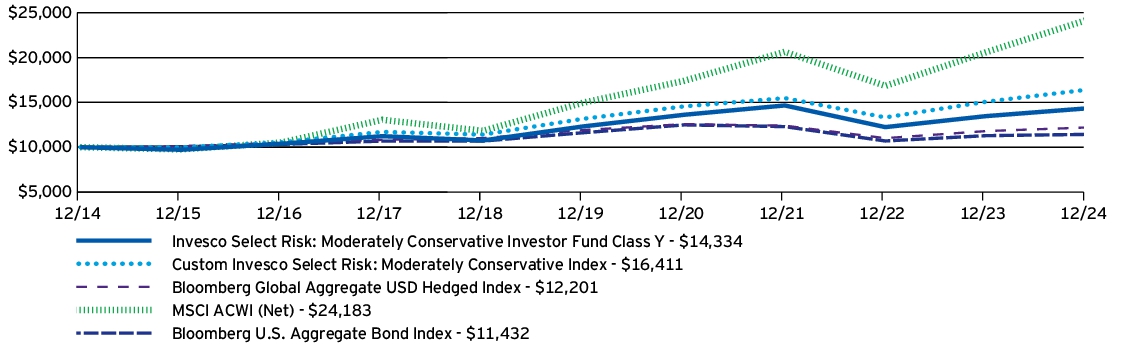

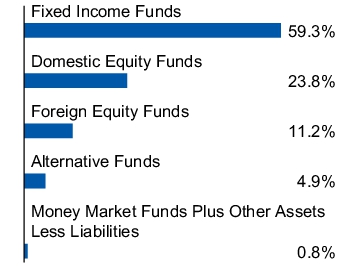

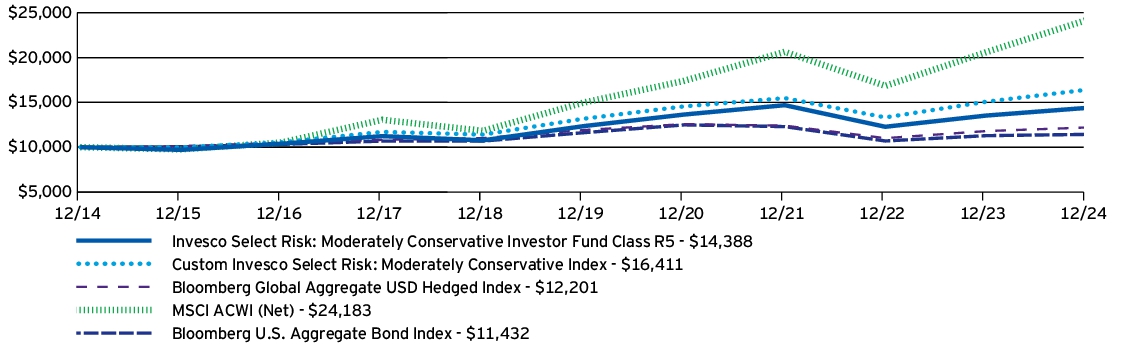

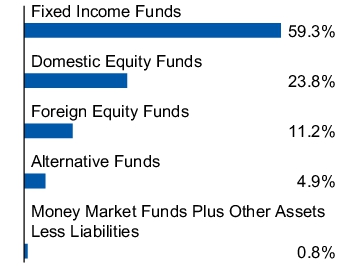

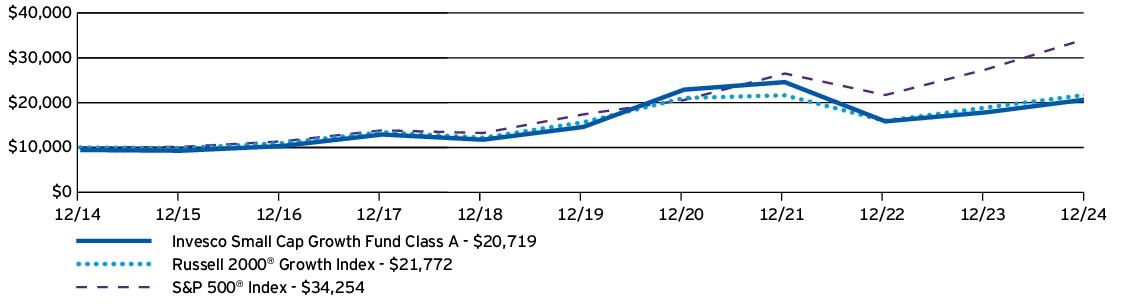

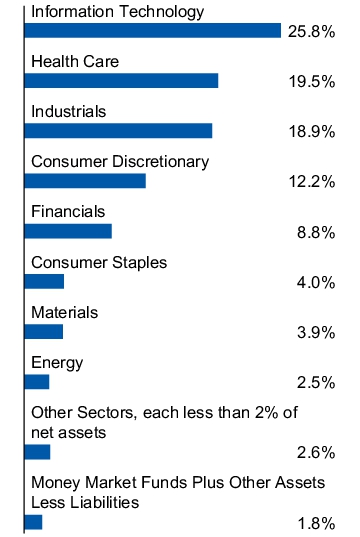

How Has The Fund Historically Performed?