As filed with the U.S. Securities and Exchange Commission on December 26, 2024.

Registration No. 333-[•]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________________________________

SAGTEC GLOBAL LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrants name into English)

________________________________________________

British Virgin Islands | | 6209 | | Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

No 43-2, Jalan Besar Kepong,

Pekan Kepong, 52100 Kuala Lumpur

+603-3310 0089

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive office)

________________________________________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, New York 10168

800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________________________________________

Copies to:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

Telephone: (212) 588 0022 | | Stephen Older, Esq.

Carly Ginley, Esq.

McGuireWoods LLP

1251 Avenue of the Americas, 20th Floor

New York, NY 10020

Telephone: (212) 548 2100 |

________________________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED DECEMBER 26, 2024 |

Sagtec Global Limited [•] Ordinary Shares |

This is an initial public offering of our ordinary shares of no-par value (the “Ordinary Shares”). We are offering, on a firm commitment basis, [•] Ordinary Shares. We anticipate that the initial public offering price of the Ordinary Shares will be between US$[•] and US$[•] per Ordinary Share.

Prior to this offering, there has been no public market for our Ordinary Shares. We have applied to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “SAGT”. This offering is contingent upon the listing of our Ordinary Shares on the Nasdaq Capital Market and there can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq Capital Market. We will not close this offering unless such Ordinary Shares are listed on the Nasdaq Capital Market at the completion of this offering.

Throughout this prospectus, unless the context indicates otherwise, any references to “we”, “us”, “our”, “Sagtec (BVI),” “the Company,” or “our Company” are to Sagtec Global Limited, a British Virgin Islands holding company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 13 to read about factors you should consider before buying our Ordinary Shares.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see “Implications of Our Being an Emerging Growth Company” and “Implications of Our Being a Foreign Private Issuer” beginning on page 7 of this prospectus for more information.

We are a business company that is incorporated in the British Virgin Islands pursuant to the BVI Business Companies Act, 2004 (as amended) of the British Virgin Islands. As a holding company with no operations, we conduct all of our operations through our majority owned subsidiaries in Malaysia. The Ordinary Shares offered in this offering are shares of the holding company that is incorporated in the British Virgin Islands. You may never directly hold any equity interests in our operating subsidiaries.

Upon completion of this offering, our issued and outstanding shares will consist of [•] Ordinary Shares, assuming that the underwriter does not exercise any portion of its over-allotment option. We expect to be a controlled company as defined under the Nasdaq Stock Market Rules because, immediately after the completion of this offering, Mr. Ng Chen Lok, our Executive Director, Chairman and Chief Executive Officer, will own approximately [•]% of our total issued and outstanding Ordinary Shares, representing approximately [•]% of the total voting power, assuming that the underwriter does not exercise any portion of its over-allotment option.

As a result, this concentrated control may limit or preclude your ability to influence corporate matters for the foreseeable future, including the election of directors, amendments of our organizational documents, and any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction requiring shareholder approval. In addition, this may have anti-takeover effects and may prevent or discourage unsolicited acquisition proposals or offers for our capital stock that you may feel are in your best interest as one of our

Table of Contents

shareholders. As a “controlled company,” we are permitted to elect not to comply with certain corporate governance requirements. See “Implications of Our Being a “Controlled Company” beginning on page 7 of this prospectus for more information.

| | Per Share | | Total(4) |

Initial public offering price(1) | | US$ | | | US$ | |

Underwriting discounts and commissions(2) | | US$ | | | US$ | |

Proceeds to the Company before expenses(3) | | US$ | | | US$ | |

We have granted the underwriter an option, exercisable from time to time in whole or in part, to purchase up to [•] additional Ordinary Shares, representing 15% of the Ordinary Shares sold in the offering, from us at the initial public offering price, less underwriting discounts and commissions, during the 30-day period after the closing date of this offering solely to cover over-allotments, if any. If the underwriter exercises the option in full, the total underwriting discounts payable will be US$[•] and the total proceeds to us, before expenses, will be US$[•].

The underwriter expects to deliver the Ordinary Shares to the purchasers against payment in U.S. dollars in New York, New York on or about [•], 2025.

You should not assume that the information contained in the registration statement to which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares being registered in the registration statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

Sole Book-Running Manager

The Benchmark Company, LLC

The date of this prospectus is [•], 2025.

Table of Contents

TABLE OF CONTENTS

Until ______, 2025 (the 25th day after the date of this prospectus), all dealers that effect transactions in these Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

i

Table of Contents

ABOUT THIS PROSPECTUS

Neither we nor the underwriter has authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we nor the underwriter takes responsibility for, and provide no assurance about the reliability of, any information that others may give you. Please read this prospectus carefully. It describes our business, our financial condition and our results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

ii

Table of Contents

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Certain differences exist between IFRS and generally accepted accounting principles in the United States (“U.S. GAAP”) which might be material to the financial information herein. We have not prepared a reconciliation of our consolidated financial statements and related footnote disclosures between IFRS and U.S. GAAP. Potential investors should consult their own professional advisers for an understanding of the differences between IFRS and U.S. GAAP and how these differences might affect the financial information herein.

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Our financial year ends on December 31 of each year. References in this prospectus to a financial year, such as “financial year 2023,” relate to our financial year ended December 31 of that calendar year.

Financial Information in U.S. Dollars

Translations of amounts in the audited consolidated statement of financial position, audited consolidated statements of profit or loss and other comprehensive income/(loss), and audited consolidated statement of cash flows from RM into USD as of and for the year ended December 31, 2023 are solely for the convenience of the reader. Unless otherwise noted, all translations from RM into USD for the fiscal year ended December 31, 2023 were calculated at of USD1 = RM4.5892 or an average rate of USD1 = RM4.5679.

iii

Table of Contents

MARKET AND INDUSTRY DATA

Certain market data and forecasts used throughout this prospectus were obtained from market research, reports of governmental and international agencies and industry publications, gathered by the Company. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

iv

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “plan,” “expect,” “intend,” “should,” “seek,” “estimate,” “will,” “aim” and “anticipate,” or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

• our business and operating strategies and our various measures to implement such strategies;

• our operations and business prospects, including development and capital expenditure plans for our existing business;

• changes in policies, legislation, regulations or practices in the industry and those countries or territories in which we operate that may affect our business operations;

• our financial condition, results of operations and dividend policy;

• changes in political and economic conditions and competition in the area in which we operate, including a downturn in the general economy;

• the regulatory environment and industry outlook in general;

• future developments in the market for the development of software solutions and the actions of our competitors;

• catastrophic losses from man-made or natural disasters, such as fires, floods, windstorms, earthquakes, diseases, epidemics, other adverse weather conditions or natural disasters, war, international or domestic terrorism, civil disturbances and other political or social occurrences;

• the loss of key personnel and the inability to replace such personnel on a timely basis or on terms acceptable to us;

• the overall economic environment and general market and economic conditions in the jurisdictions in which we operate;

• our ability to execute our strategies;

• changes in the need for capital and the availability of financing and capital to fund those needs;

• our ability to anticipate and respond to changes in the markets in which we operate, and in client demands, trends and preferences;

v

Table of Contents

• exchange rate fluctuations, including fluctuations in the exchange rates of currencies that are used in our business;

• changes in interest rates or rates of inflation; and

• legal, regulatory and other proceedings arising out of our operations.

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

This prospectus contains certain data and information that we obtained from various government and private publications. Statistical data in these publications also include projections based on a number of assumptions. The markets for the development of software solutions may not grow at the rate projected by such market data, or at all. Failure of this industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our Ordinary Shares. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

vi

Table of Contents

DEFINITIONS

“Memorandum and Articles of Association” means the memorandum and articles of association of our Company adopted on our incorporation, as amended from time to time.

“Business Day” means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“BVI” means the British Virgin Islands.

“CAGR” means compound annual growth rate.

“CL Technologies” means CL Technologies (International) Sdn Bhd, a company incorporated in Malaysia on February 14, 2019, and a majority-owned subsidiary of our Company.

“Company,” “our Company,” or “Sagtec (BVI)” means Sagtec Global Limited (BVI Company No. 2135152), an exempted company incorporated in the British Virgin Islands with limited liability on October 31, 2023.

“Companies Act” means the means the BVI Business Companies Act, 2004 (as amended) of the BVI.

“COVID-19” means the Coronavirus Disease 2019.

“Directors” means the directors of our Company as at the date of this prospectus, unless otherwise stated.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“Executive Directors” means the executive Directors of our Company as at the date of this prospectus, unless otherwise stated.

“Executive Officers” means the executive officers of our Company as at the date of this prospectus, unless otherwise stated.

“Group,” “our Group,” “we,” “us,” or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors.

“Independent Director Nominees” means the independent non-executive director nominees of our Company as at the date of this prospectus, unless otherwise stated.

“Independent Third Party” means a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% owner of the Company.

“MOM” means the Ministry of Manpower of Malaysia.

“PRC” means the People’s Republic of China.

“RM” or “MYR” or “Malaysian Ringgit” means Malaysian Ringgit(s), the lawful currency of Malaysia.

“Sagtec” means Sagtec Group Sdn Bhd, a company incorporated in Malaysia on June 11, 2018, and a majority-owned subsidiary of our Company. On May 27, 2019, Sagtec changed its name from Signage Alliance Group Sdn Bhd to Sagtec Group Sdn Bhd

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Malaysia Companies Act” means the Companies Act 2016 of Malaysia, as amended, supplemented or modified from time to time.

“US$,” or “USD” or “United States Dollars” means United States dollar(s), the lawful currency of the United States of America.

vii

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Ordinary Shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements,”

Overview

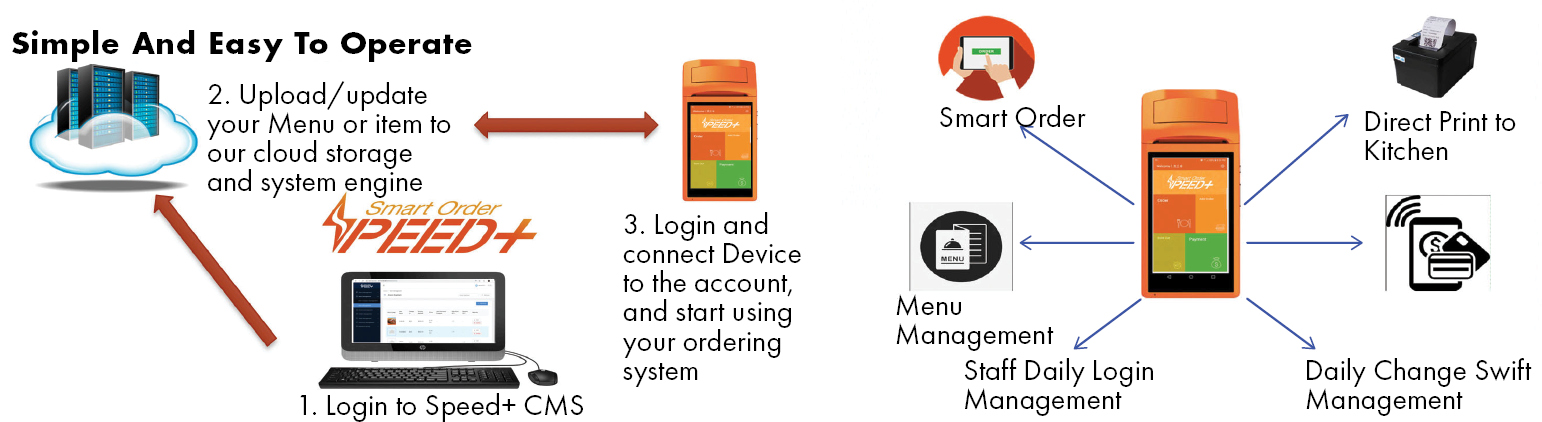

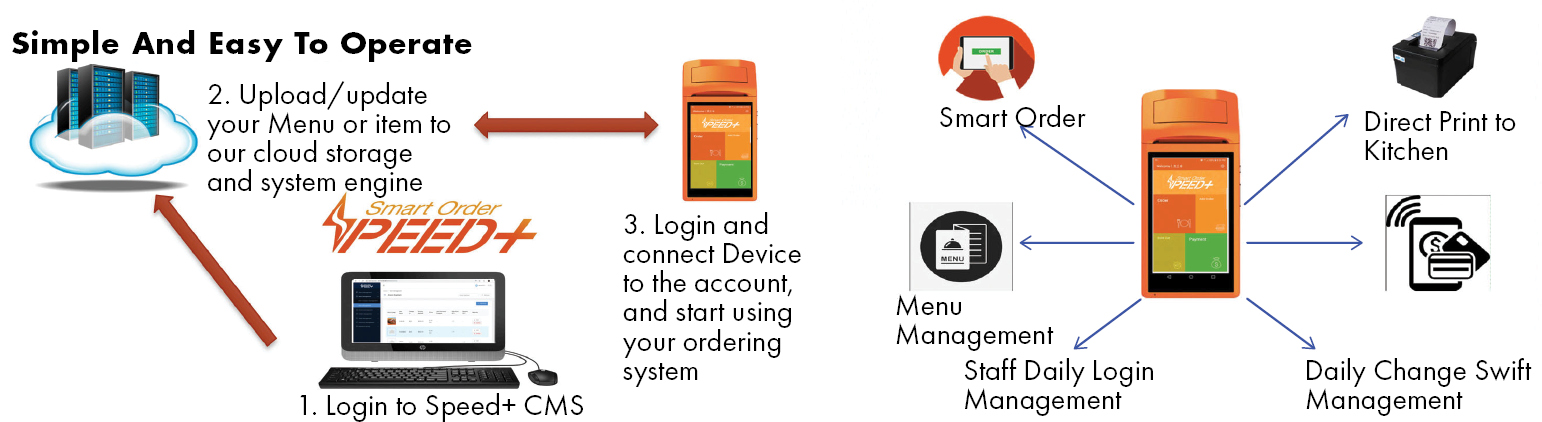

Our business was originally incorporated in Malaysia in 2018, and is principally involved in the provision of customizable software solutions encompassing several types of software such as a smart ordering system, Speed +, which is a smart solutions application software for the food and beverage industry. The Speed+ software is installed onto our existing Point of Sale (POS) machines, which are sourced from third-party suppliers. These POS machines, equipped with Speed+, are then leased to clients, providing a seamless and integrated solution for efficient order management and transaction processing. We also offer customizable software and application development for table ordering, QR ordering and self-service kiosk ordering. For the years ended December 31, 2022 and December 31, 2023, the provision of the Speed+ smart ordering system, QR Ordering system subscription (both under subscription services) contributed 10.22% and 12.31% of our revenue, respectively, while the provision of software development services contributed to 19.10% and 9.79% of our revenue, respectively. For the six months period ended June 30, 2023 and June 30, 2024, the provision of the Speed+ smart ordering system, QR Ordering system subscription (both under subscription services) contributed 19.89% and 33.03% of our revenue, respectively, while the provision of software development services contributed to 13.75% and 16.43% of our revenue, respectively.

Our products and services such as our smart ordering system, Speed +, as well as any software and application development for table ordering, QR ordering and self-service kiosk ordering, are marketed to the bulk of our customers in Malaysia, who belong to the food and beverage (“F&B”) industry. However, the customizable nature of our software and application development services which further extends to customer relationship management and invoicing software is offered to businesses across different industries, with a focus on F&B but also extending to other industries such as Geotechnology, beauty products and property consulting.

Apart from our product, Speed+, we also sell food ordering kiosk machines designed to improve the dining experience for both customers and businesses. These kiosk solutions combine innovative technology with user-friendly interfaces, allowing patrons to effortlessly browse menus, customize orders, and make secure payments. They are designed to improve efficiency, reduce labor costs, and gather valuable data on customer preferences and ordering patterns. For the years ended December 31, 2022 and December 31, 2023, the sale of food ordering kiosk machines contributed 16.12% and 25.29% of our revenue, respectively. For the six months period ended June 30, 2024, the sale of food ordering kiosk machines contributed 14.92% of our revenue.

Beyond the F&B industry, we serve a broader clientele as a trusted partner. Our software development services showcase our commitment to understanding and addressing the unique needs of our clients. Our experienced software development team creates tailored solutions, often starting with a comprehensive software development blueprint in the form of a white paper. Whether it involves developing applications or addressing complex software development projects, our in-house programmers bring over a combined 14 years of experience and expertise. For specialized or complex projects, we collaborate with trusted outsourcing partners to ensure our clients have access to the right skills and resources.

In a digital age where social media plays a crucial role in brand presence, we offer social media management services. Responsible for overseeing the social media accounts of Key Opinion Leaders (KOLs) and influencers, we attempt to ensure that these digital influencers maintain a current and engaging online presence. By leveraging data analysis, including demographic data, comments, post likes, and other metrics, we fine-tune content strategies in order to obtain the maximum impact. For the years ended December 31, 2022 and December 31, 2023, our social media management services contributed 11.98% and 9.50% of our revenue, respectively. For the six months period ended June 30, 2023 and June 30, 2024, our social media management services contributed 21.25% and 9.54% of our revenue, respectively. We further provide additional products and services through the sale of power-bank charging stations through our majority owned subsidiary, CL Technologies. Recognizing the trend in demand for portable power-bank charging for mobile devices, we have developed additional expertise in providing power-bank charging stations across 300 locations in Malaysia, working with shopping malls, parks and other public areas. For the years ended December 31, 2022 and December 31, 2023, the

1

Table of Contents

sale of power-bank charging stations through its majority owned subsidiary, CL Technologies, contributed 12.45% and 23.44% of our revenue, respectively. For the six months period ended June 30, 2024, the sale of power-bank charging stations through its majority owned subsidiary, CL Technologies, contributed 13.34% of our revenue.

Our expertise extends beyond software development. We also offer a comprehensive data management service. By efficiently handling clients’ incoming raw data, including tasks like sorting, filtering, and reorganizing data within servers, we help clients easily access the information they need, streamlining their operations and decision-making. For the years ended December 31, 2022 and December 31, 2023, our data management services contributed 20.98% and 15.62% of our revenue, respectively. For the six months period ended June 30, 2023 and June 30, 2024, our data management services contributed 28.47% and 12.74% of our revenue, respectively.

For the year ended December 31, 2023, business in Malaysia contributed to 100% of our Group’s revenue. We also believe that our financial results reflect our strong market position. For the year ended December 31, 2022, our revenue was RM13,000,026 (USD2,832,744), and our net profit was RM2,363,584 (USD515,032). For the year ended December 31, 2023, our revenue was RM29,280,649 (USD6,380,339), and our net profit was RM4,656,301 (USD1,014,622). This is a growth of 125.24% in revenue and 97.00% in net profit respectively. The cost of sales increased from RM7,959,225 (USD1,734,036) in the year ended December 31, 2022 to RM21,112,777 (USD4,600,536) in year ended December 31, 2023. For the six months period ended June 30, 2023, our revenue was RM7,104,161 (USD1,506,012), and our net loss was RM917,279 (USD194,454). For the six months period ended June 30, 2024, our revenue was RM19,655,442 (USD4,166,761), and our net profit was RM1,922,099 (USD407,466). This is a growth of 176.68% in revenue and 309.54% in net profit respectively. The cost of sales increased from RM6,875,096 (USD1,457,452) in the six months period ended June 30, 2023 to RM16,167,137 (USD3,427,273) in the six months period ended June 30, 2024.

Competitive Strengths

We have strong and stable relationships with our suppliers and customers.

Since the inception of our business in 2018, we have developed stable relationships with our key suppliers and customers in each region we serve. We have strived to maintain stable business relationships with our major customers. For the years ended December 31, 2022 and 2023, our top five customers accounted for 75.82% and 66.30% of total revenue respectively and three of our top five customers have done business with us for more than three years.

We have an experienced management team.

We have an experienced management team, led by Mr. Ng Chen Lok, our Executive Director, Chairman and Chief Executive Officer, who has been instrumental in spearheading the growth of our Group. Mr. Ng Chen Lok has over 10 years of experience in the software development industry in Malaysia and is primarily responsible for the planning and execution of our Group’s business strategies and managing our Group’s customer relationships. Our Group is also supported by an experienced management team with over 10 years of experience in the software development industry. For more information, please see the section titled “Management — Executive Directors and Officers.”

Our product, Speed +, provides comprehensive and customizable solutions for our customers

As a software company, we eschew the traditional cons associated with software sales, such as expensive software purchases, high upfront costs for hardware, a lack of updates for purchased software, and limited flexibility to cater to business needs. Instead, our product, Speed+, offers a comprehensive all-in-one solution for our customers, through our subscription-based model, which is both affordable and simple to install and operate. Benefits include cloud-based software with regular updates provided to our customers, bundling hardware devices pre-installed with our software into our subscription package, as well as customizable features which allow our customers to choose and pay for the features which they require, reducing costs. Further, we offer a flexible and cost-effective payment option via our subscription-based model, allowing our customers to pay either monthly or yearly, limiting upfront costs incurred by our customers and reducing the barrier to entry to utilize our services.

We also offer related services, making our company a one-stop solution for their information technology requirements.

Recognizing our customers’ requirements, we also provide auxiliary services such as customizable software development solutions ranging from web to mobile applications, data analytics services which are designed to process and analyze data effectively, catering to various needs, with a specialty in topographic data feature extraction services.

2

Table of Contents

We also offer social media management and server management services, which focus on enhancing our customers’ brand visibility and the seamless operation of our customers’ IT infrastructure respectively. We also offer related services such as sales of food ordering kiosk machines and QR code ordering system subscriptions.

Growth Strategies

Strengthening our local presence

We plan to strengthen our local presence by increasing awareness of the benefits associated with leveraging technology in the F&B industry to replace conventional methods of sales management, while simultaneously enhancing customer engagement and support through initiatives such as 24/7 help desks, on-site training, dedicated account managers, and multilingual support; we will also implement customer success programs, loyalty and referral initiatives, flexible subscription models, and pricing tiers, all aimed at maximizing the value clients receive from our POS systems and software solutions, building a strong user community, and ultimately solidifying our position as a trusted provider of reliable software technology solutions.

Increasing the features our product range

We plan to expand the technological features found in our software services by broadening our product range to include new software products that address emerging market needs, such as AI, machine learning, blockchain, and cybersecurity, while continuously updating existing products with new features and improvements based on customer feedback and technological advancements; additionally, we will allocate significant resources to research and development to stay ahead of technological trends, drive innovation within the company, and strengthen our market presence, thereby solidifying our position as a provider of reliable software technology solutions.

Strategic Partnerships:

We also plan to form alliances with hardware manufacturers, payment processors, and other complementary service providers to offer bundled solutions that provide added value to customers. This would also include identifying new verticals that can benefit from specialized POS solutions, such as fitness centers, spas, or automotive services.

Summary of Risk Factors

Investing in our Ordinary Shares involves risks. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 13 of this prospectus, which you should carefully consider before making a decision to purchase Ordinary Shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment.

We face numerous risks that could materially affect our business, results of operations or financial condition. These risks include but are not limited to the following:

Risks Related to Doing Business in Malaysia:

• Our operations are subject to various laws and regulations in Malaysia.

• We are subject to foreign exchange control policies in Malaysia.

Risks Related to Our Business and Industry:

• We may not be able to successfully implement our business strategies and future plans.

• We have derived a substantial portion of our revenue from sales to a limited number of customers, which may expose us to risks relating to customer concentration.

• We have derived a substantial portion of our balance of accounts from a limited number of suppliers, which may expose us to risks relating to supplier concentration.

3

Table of Contents

• We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdictions which we intend to expand our business in.

• We are dependent on the need to continually maintain a wide range of software technological solutions which are relevant to our customers’ needs.

• Our continued success is dependent on our key management personnel and our experienced and skilled personnel, and our business may be severely disrupted if we are unable to retain them or to attract suitable replacements.

• Our reputation and profitability may be adversely affected if there are major malfunctions in our software solutions sold to our customers.

• A significant failure or deterioration in our quality control systems could have a material adverse effect on our business and operating results.

• Increased competition in the sale of software solutions in Malaysia and the region may affect our ability to maintain our market share and growth.

• Our business is subject to supply chain interruptions.

• Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19.

• We may be affected by an outbreak of other infectious diseases.

• We are exposed to risks arising from fluctuations of foreign currency exchange rates.

• We and/or our customers may not be able to obtain the necessary approvals or certifications for the use of our software solutions in Malaysia.

• We are subject to environmental, health and safety regulations and penalties, and may be adversely affected by new and changing laws and regulations.

• Our insurance policies may be inadequate to cover our assets, operations and any loss arising from business interruptions.

• We may be harmed by negative publicity.

• We are exposed to risks in respect of acts of war, terrorist attacks, epidemics, political unrest, adverse weather conditions and other uncontrollable events.

Risks Related to our Securities and This Offering:

• An active trading market for our Ordinary Shares may not be established or, if established, may not continue and the trading price for our Ordinary Shares may fluctuate significantly.

• We may not maintain the listing of our Ordinary Shares on Nasdaq Capital Market which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions.

• The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to investors.

• Certain recent initial public offerings of companies with public floats comparable to the anticipated public float of our Company have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares.

4

Table of Contents

• If securities or industry analysts do not publish research or reports about our business causing us to lose visibility in the financial markets or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline.

• Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment.

• Short selling may drive down the market price of our Ordinary Shares.

• Because our public offering price per share is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution.

• The initial public offering price for our Ordinary Shares may not be indicative of prices that will prevail in the trading market and such market prices may be volatile.

• You must rely on the judgment of our management as to the uses of the net proceeds from this offering, and such uses may not produce income or increase our share price.

• If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences.

• Our controlling shareholder, Mr. Ng Chen Lok, has substantial influence over the Company. His interests may not be aligned with the interests of our other shareholders, and he could prevent or cause a change of control or other transactions.

• As a “controlled company” under the rules of Nasdaq Capital Market, we may choose to exempt our Company from certain corporate governance requirements that could have an adverse effect on our public shareholders.

• As a company incorporated in the BVI, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under Nasdaq corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

• You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under British Virgin Islands law.

• Certain judgments obtained against us or our auditor by our shareholders may not be enforceable.

• We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements applicable to other public companies that are not emerging growth companies.

• We are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies.

• We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us.

• We will incur significantly increased costs and devote substantial management time as a result of the listing of our Ordinary Shares on Nasdaq Capital Market.

Corporate Information

Sagtec Global Limited was incorporated in the British Virgin Islands as a British Virgin Islands business company on October 31, 2023, with BVI company number 2135152. Our registered office in the British Virgin Islands is at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands. Our principal executive office is at No 43-2, Jalan Besar Kepong, Pekan Kepong, 52100 Kuala Lumpur. Our telephone number at this location is +603-3310 0089. Our principal website address is https://www.sagtec-global.com/. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 E. 42nd Street, 18th Floor, New York, New York 10168.

5

Table of Contents

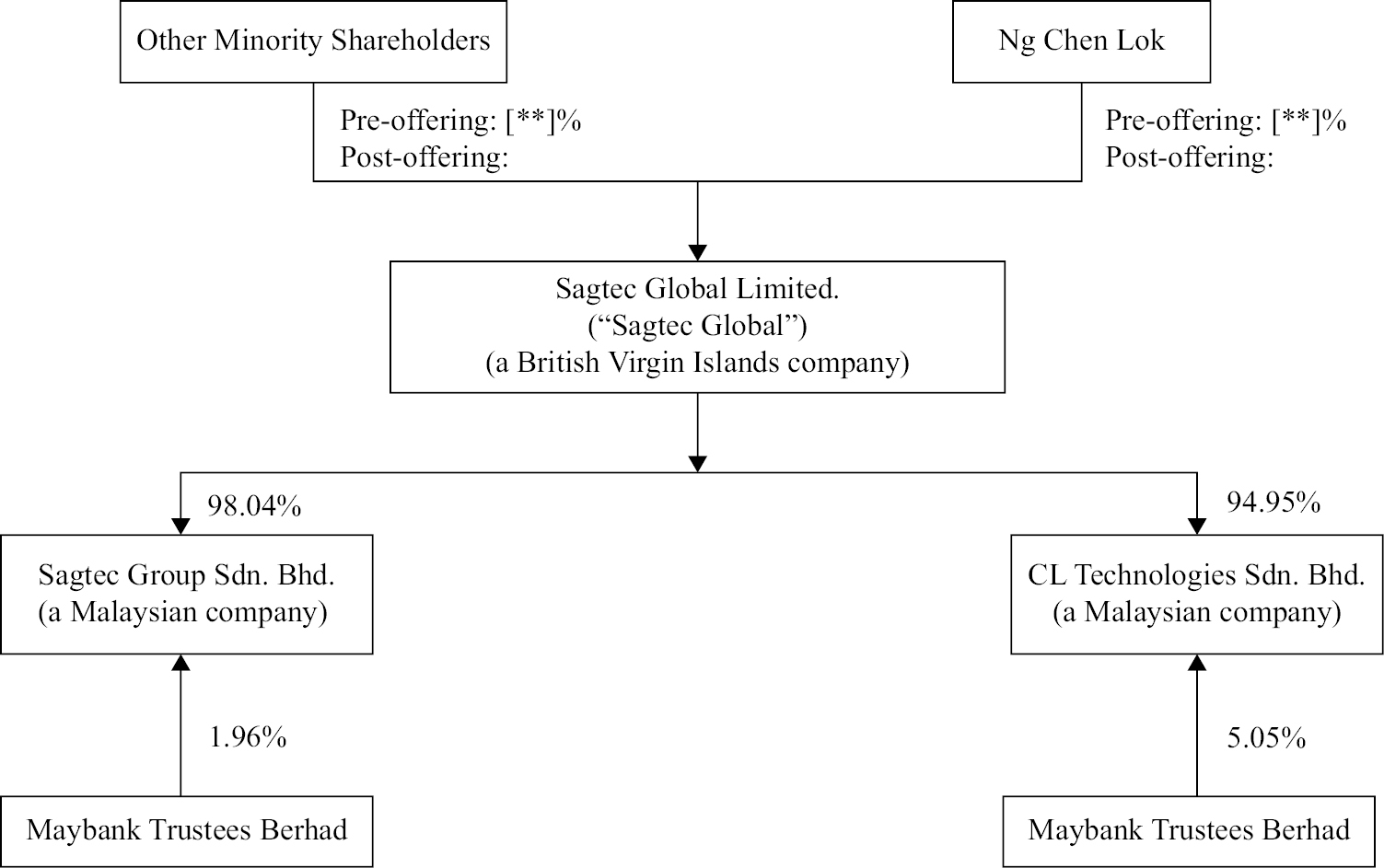

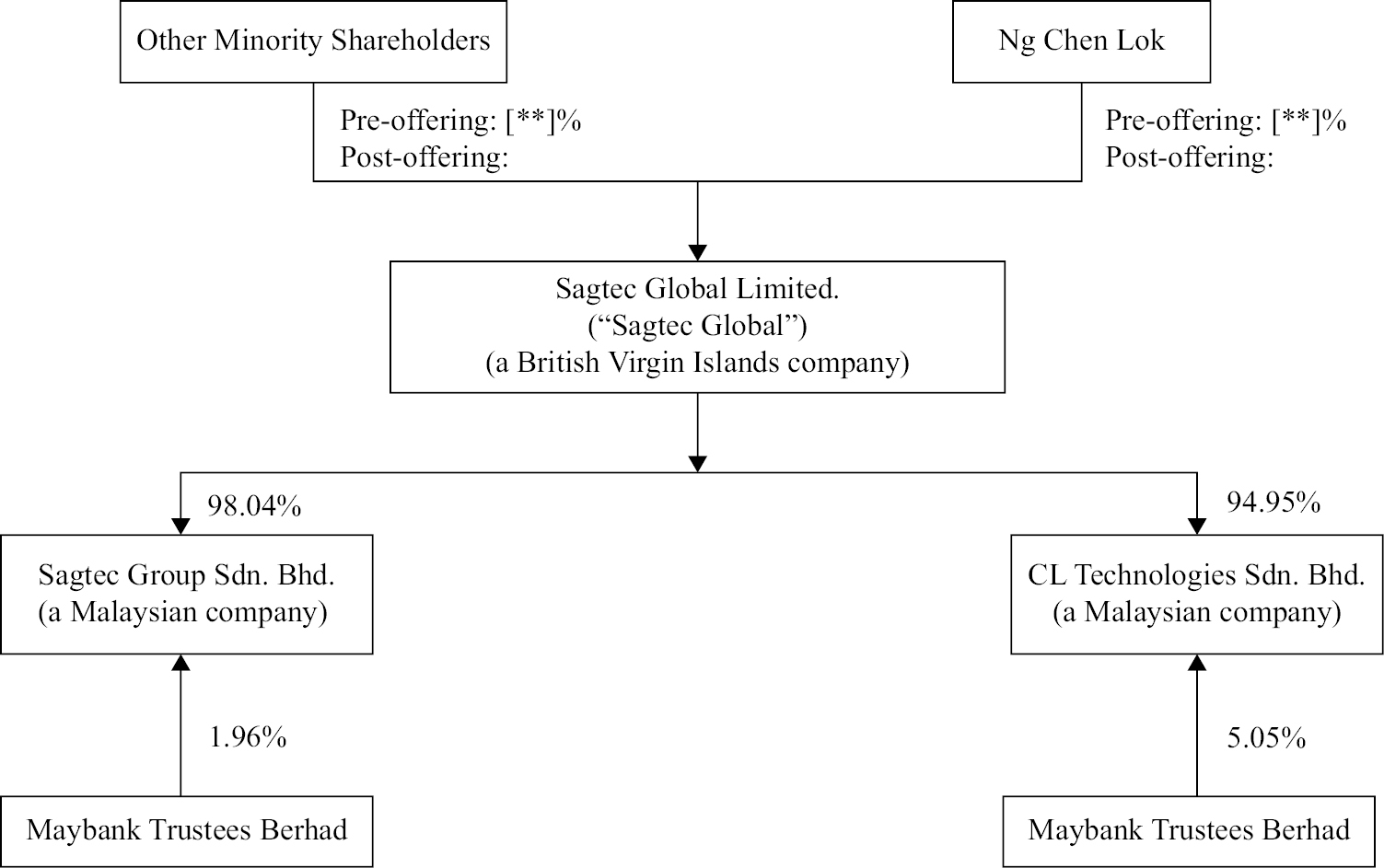

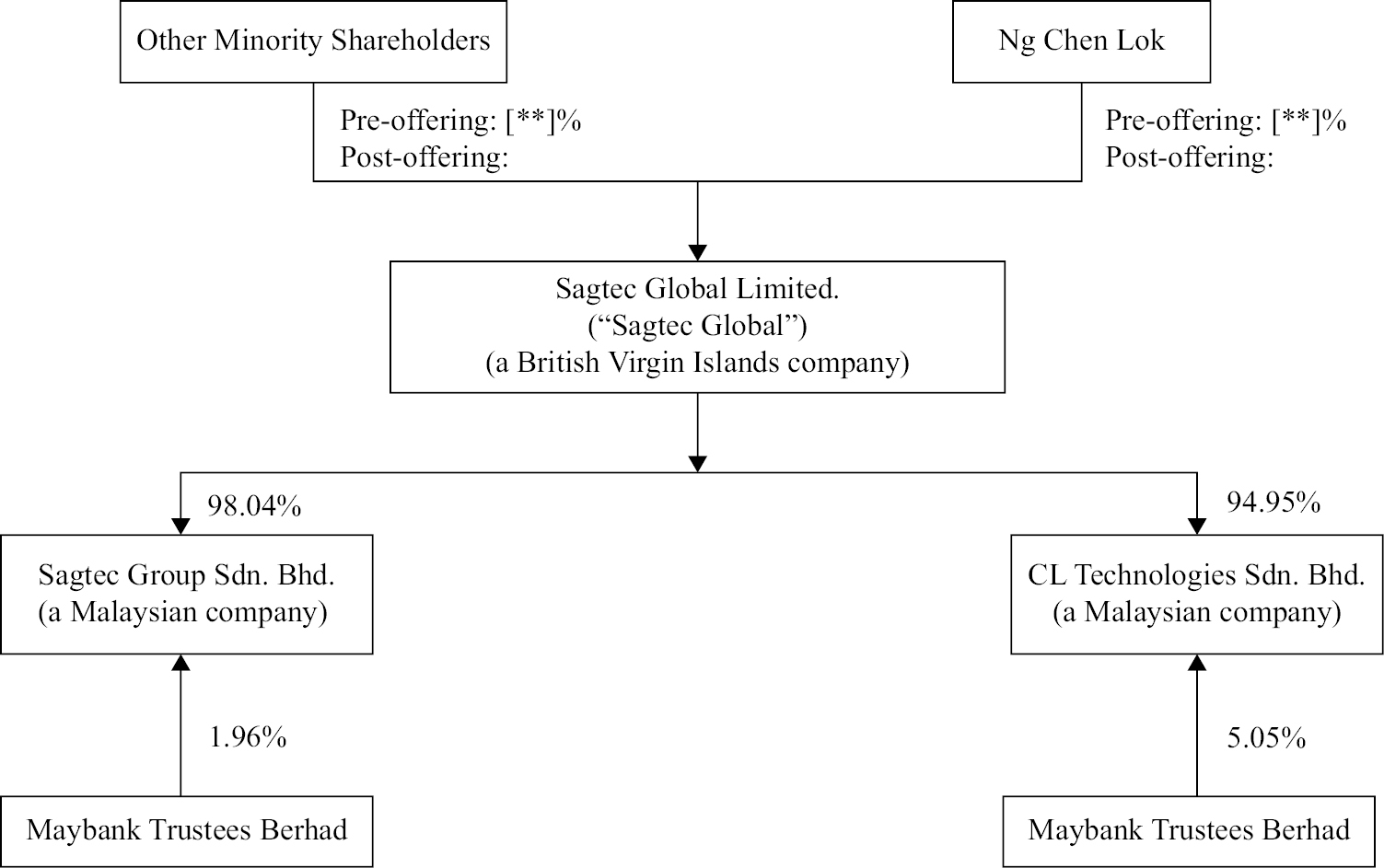

Corporate Structure

The chart below sets forth our corporate structure as of the date of this prospectus.

Recent Developments

We are in the process of finalizing our results for the year ended December 31, 2024. Set forth below are certain preliminary estimates of our results of operations for the year ended December 31, 2024 as compared to our historical results of operations for the corresponding period ended December 31, 2023. The preliminary estimates set forth below are based only on currently available information and do not present all necessary information for an understanding of our financial condition as of December 31, 2024 or our results of operations for the year ended December 31, 2024. We have provided a range, rather than a specific amount, for the preliminary estimates for this unaudited financial data primarily because our financial closing procedures for the year ended December 31, 2024 are not yet complete and, as a result, our final results upon completion of our closing procedures may vary from the preliminary estimates. All of the preliminary estimated financial information set forth below has been prepared by and is the responsibility of management. Onestop Assurance PAC has not audited, reviewed, compiled or performed any procedures with respect to the preliminary estimated financial information set forth below. Accordingly, Onestop Assurance PAC does not express an opinion or any other form of assurance with respect thereto. We expect to complete our financial statements for the year ended December 31, 2024 subsequent to the completion of this offering. While we are currently unaware of any items that would require us to make adjustments to the financial information set forth below, it is possible that we or our independent registered public accounting firm may identify such items as we complete our financial statements and any resulting changes could be material. Accordingly, undue reliance should not be placed on these preliminary estimates. These preliminary estimates are not necessarily indicative of any future period and should be read together with “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and our financial statements and related notes included in this Registration Statement.

We estimate that for the year ended December 31, 2024:

• our Total revenues, net will be between $9.50 million and $10.00 million, as compared to $6.38 million for the year ended December 31, 2023;

6

Table of Contents

• our Total operating expenses will be between $0.90 million and $1.00 million, as compared to $0.45 million for the year ended December 31, 2023; and

• our Net income will be between $1.50 million and $2.00 million, as compared to $1.01 million for the year ended December 31, 2023.

Implications of Our Being a “Controlled Company”

Upon the completion of this offering, we will be a “controlled company” as defined under the Nasdaq Stock Market Listing Rules as Mr. Ng Chen Lok, our Chairman of the Board, Executive Director and Chief Executive Officer, will hold [•]% of our total issued and outstanding Ordinary Shares and will be able to exercise [•]% of the total voting power of our authorized and issued shares, assuming that the underwriter does not exercise any portion of its over-allotment option. For so long as we remain a “controlled company,” we are permitted to elect not to comply with certain corporate governance requirements. If we rely on these exemptions, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. While we presently plan to comply voluntarily with the corporate governance listing standards of the Nasdaq, we may choose to rely on the exemptions in the future.

Implications of Our Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

• being permitted to provide only two financial years of selected financial information (rather than five years) and only two years of audited financial statements (rather than three years), in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; and

• an exemption from compliance with the auditor attestation requirement of the Sarbanes-Oxley Act, on the effectiveness of our internal control over financial reporting.

We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year in which the fifth anniversary of the completion of this offering occurs, (2) the last day of the fiscal year in which we have total annual gross revenue of at least US$1.235 billion, (3) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which means the market value of our Ordinary Shares that are held by non-affiliates exceeds US$700.0 million as of the prior December 31, and (4) the date on which we have issued more than US$1.0 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of any of the available exemptions. We have included two years of selected financial data in this prospectus in reliance on the first exemption described above. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock.

Implications of Our Being a Foreign Private Issuer

Upon completion of this offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

• the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

• the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

7

Table of Contents

• the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission, or the SEC, of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither emerging growth companies nor foreign private issuers.

In addition, as a company incorporated in the British Virgin Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the corporate governance listing requirements of the Nasdaq. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing requirements of the Nasdaq. Following this offering, we can rely on home country practice to be exempted from certain of the corporate governance requirements of the Nasdaq, namely (i) a majority of the Directors on our Board are not required to be independent Directors; (ii) there will not be a necessity to have regularly scheduled executive sessions with independent Directors; and (iii) there will be no requirement for the Company to obtain shareholder approval prior to an issuance of securities in connection with (a) the acquisition of stock or assets of another company; (b) equity-based compensation of officers, directors, employees or consultants; (c) a change of control; and (d) transactions other than public offerings. While we presently plan to comply voluntarily with the corporate governance listing standards of the Nasdaq, we may choose to rely on the exemptions in the future.

8

Table of Contents

The Offering

Ordinary Shares offered by us | | [•] Ordinary Shares |

Offering Price | | The initial public offering price will be between US$[•] to US$[•] per Ordinary Share. |

Over-allotment option | | We have granted the underwriter an option, exercisable from time to time in whole or in part, to purchase up to [•] additional Ordinary Shares, representing 15% of the Ordinary Shares sold in the offering, from us at the initial public offering price, less underwriting discounts and commissions, during the 30-day period after the closing date of this offering solely to cover over-allotments, if any |

Warrants | | We have also granted the underwriter warrants equal to five percent (5.0%) of the number of Ordinary Shares sold in this offering (including any Ordinary Shares sold pursuant to the exercise of the over-allotment option), which shall carry a term of five (5) years, shall not be exercisable for a period of six months from the closing of this offering and shall be exercisable on a cashless basis at a price equal to 100% of the public offering price. |

Ordinary Shares issued and outstanding prior to this offering | |

[•] Ordinary Shares assuming the underwriter does not exercise any portion if its over-allotment option and [•] Ordinary Shares assuming the underwriter fully exercises its over-allotment option

|

Ordinary Shares to be issued and outstanding immediately after this offering | |

[•] Ordinary Shares

|

Use of proceeds | | We currently intend to use the net proceeds from this offering to expand our business operations in Malaysia, for marketing and promotion campaigns, for product research and development efforts, and to create a fixed asset reserve for procurement of Point of Sale systems, with the balance being used for working capital purposes. See “Use of Proceeds.” |

Dividend policy | | We do not intend to pay any dividends on our Ordinary Shares for the foreseeable future. Instead, we anticipate that all of our earnings, if any, will be used for the operation and growth of our business. See “Dividends and Dividend Policy” for more information. |

Lock-up | | We and each of our Directors and Executive Officers and 5% or greater shareholders have agreed, for a period of six (6) months from the closing of this offering, and the remainder of our shareholders have agreed, for a period of ninety (90) days from the closing of this offering, subject to certain exceptions, not to not to directly or indirectly (a) offer, sell, or otherwise transfer or dispose of, directly or indirectly, any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable for shares of capital stock of the Company; or (b) file or caused to be filed any registration statement with the SEC relating to the offering of any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable for shares of capital stock of the Company. See “Shares Eligible for Future Sale” and “Underwriting — Lock-Up Agreements.” |

Risk factors | | Investing in our Ordinary Shares involves risks. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Ordinary Shares. |

9

Table of Contents

Listing | | We have applied to list the Ordinary Shares on the Nasdaq Capital Market. This offering is contingent upon the listing of our Ordinary Shares on the Nasdaq Capital Market. There can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq Capital Market. We will not close this offering unless such Ordinary Shares will be listed on the Nasdaq Capital Market at the completion of this offering. |

Proposed trading symbol | | SAGT |

Transfer agent | | VStock Transfer LLC |

10

Table of Contents

Summary Financial Data

The following tables present our summary financial data. We have derived the summary statements of operations data for the fiscal years ended December 31, 2022 and 2023 and the summary balance sheet data as of December 31, 2022 and 2023 from our audited financial statements included elsewhere in this prospectus. We have derived the summary statements of operations data for the six months ended June 30, 2023 and 2024 and the summary balance sheet data as of June 30, 2024 from our unaudited financial statements included elsewhere in this prospectus. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results for any prior period are not necessarily indicative of our future results. The summary financial data in this section are not intended to replace our financial statements and related notes included elsewhere in this prospectus.

Statement of Operations Data: | | Year ended

December 31, | | Six months ended

June 30, |

2022

$ | | 2023

$ | | 2023

$ | | 2024

$ |

Revenue | | 1,949,351 | | | 5,293,337 | | | 1,384,277 | | | 4,166,761 | |

Revenue from related parties | | 883,393 | | | 1,087,002 | | | 121,735 | | | — | |

Total revenue | | 2,832,744 | | | 6,380,339 | | | 1,506,012 | | | 4,166,761 | |

| | | | | | | | | | | | | |

Cost of sales | | (1,734,011 | ) | | (4,600,536 | ) | | (1,457,452 | ) | | (3,427,273 | ) |

Cost of sales from related parties | | (327 | ) | | — | | | — | | | — | |

Total cost of sales | | (1,734,338 | ) | | (4,600,536 | ) | | (1,457,452 | ) | | (3,427,273 | ) |

| | | | | | | | | | | | | |

Gross profit | | 1,098,406 | | | 1,779,803 | | | 48,560 | | | 739,488 | |

Selling and administrative expenses | | (253,711 | ) | | (470,005 | ) | | (296,590 | ) | | (138,726 | ) |

Selling and administrative expenses from related parties | | (140,241 | ) | | (124,476 | ) | | (75,844 | ) | | (83,312 | ) |

Disposal gain | | — | | | 144,405 | | | 140,486 | | | — | |

(Loss)/Income from operations before income tax | | 704,454 | | | 1,329,727 | | | (183,388 | ) | | 517,450 | |

Other income | | 2,691 | | | 18,565 | | | 5,763 | | | 34,140 | |

Finance costs | | (7,932 | ) | | (35,843 | ) | | (13,860 | ) | | (25,723 | ) |

(Loss)/Profit before income tax | | 699,213 | | | 1,312,449 | | | (191,485 | ) | | 525,867 | |

Income tax expenses | | (184,181 | ) | | (297,827 | ) | | (2,969 | ) | | (118,401 | ) |

| | | | | | | | | | | | | |

Net (Loss)/Profit for the period, representing total comprehensive income for the period | | 515,032 | | | 1,014,622 | | | (194,454 | ) | | 407,466 | |

| | | | | | | | | | | | | |

(Loss)/Profit attributable to: | | | | | | | | | | | | |

Equity owners of the Company | | 538,338 | | | 975,390 | | | (193,235 | ) | | 395,274 | |

Non-controlling interests | | (23,306 | ) | | 39,232 | | | (1,219 | ) | | 12,192 | |

Total | | 515,032 | | | 1,014,622 | | | (194,454 | ) | | 407,466 | |

| | | | | | | | | | | | | |

Weighted Average Number of Common Shares Outstanding – Basic and Diluted | | 10,800,000 | | | 10,800,000 | | | 10,800,000 | | | 10,800,000 | |

Basic and Diluted Net Income per

Share | | 0.0498 | | | 0.0903 | | | (0.0179 | ) | | 0.0366 | |

11

Table of Contents

Balance Sheet Data: | | As of June 30, 2024 |

Actual

$ | | As

adjusted(3)

$ |

Non-current assets | | 2,776,794 | | |

Trade receivables, net | | 1,051,639 | | |

Other receivables(1) | | 249,881 | | |

Cash and short term deposits(2) | | 425,518 | | |

Total assets | | 4,503,832 | | |

| | | | | |

Amount due to shareholder | | 15 | | |

Other payables | | 107,725 | | |

Deferred revenue | | 162,083 | | |

Provisions | | 101,573 | | |

Tax payable | | 468,250 | | |

Lease liabilities | | 10,387 | | |

Bank overdraft | | 114,816 | | |

Bank borrowings | | 150,240 | | |

Non-current liabilities | | 815,015 | | |

Total liabilities | | 1,930,104 | | |

Total equity | | 2,573,728 | | |

12

Table of Contents

RISK FACTORS

Investing in our shares is highly speculative and involves a significant degree of risk. You should carefully consider the following risks, as well as other information contained in this prospectus, before making an investment in our Company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

This prospectus also contains forward-looking statements having direct and/or indirect implications on our future performance. Our actual results may differ materially from those anticipated by these forward-looking statements due to certain factors, including the risks and uncertainties faced by us, as described below and elsewhere in this prospectus.

Risks Related to Doing Business in Malaysia

Our operations are subject to various laws and regulations in Malaysia.

Our operations in Malaysia are subject to a variety of laws and regulations, including those pertaining to business licenses, intellectual property rights, employment, personal data and privacy, dividends, unmanned aircraft, distribution trade services, and cybersecurity. For more information, please consult the “Regulatory Environment” section in this prospectus. Compliance with these laws necessitates certain registrations, certificates, and/or licenses.

Based on our experience, some of the laws and regulations of the place where we operate our business are subject to amendments, uncertainty in interpretation and administrative actions from time to time. Consequently, we cannot guarantee that we will be able to secure all necessary registrations, certificates, and/or licenses for the execution of our business plans or the launch of new services or products. Non-compliance with these laws and regulations could result in fines, administrative penalties, and/or legal action against us, potentially damaging our reputation and impacting our financial status or operational results.

We are subject to foreign exchange control policies in Malaysia.

The ability of our subsidiaries to pay dividends or make other payments to us may be restricted by the foreign exchange control policies in the countries where we operate. For example, there are foreign exchange policies in Malaysia which support the monitoring of capital flows into and out of the country in order to preserve its financial and economic stability. The foreign exchange policies are administered by the Foreign Exchange Administration, an arm of the Bank Negara Malaysia (the Central Bank of Malaysia) (“BNM”). The foreign exchange policies monitor and regulate both residents and non-residents of Malaysia. Under the current Foreign Exchange Administration rules issued by BNM, nonresidents are free to repatriate any amount of funds from Malaysia in foreign currency other than the currency of Israel at any time (subject to limited exceptions), including capital, divestment proceeds, profits, dividends, rental, fees and interest arising from investment in Malaysia, subject to any withholding tax. In the event BNM or any other country where we operate introduces any restrictions in the future, our ability to repatriate dividends or other payments from our subsidiaries in Malaysia or in such other countries may be affected. Since we are a BVI holding company and rely principally on dividends and other payments from our subsidiaries for our cash requirements, any restrictions on such dividends or other payments could materially and adversely affect our liquidity, financial condition and results of operations.

Risks Related to Our Business and Industry

We may not be able to successfully implement our business strategies and future plans.

As part of our business strategies and future plans, we intend to expand our software technology portfolio and increase our storage facilities and capabilities as well as consider potential business opportunities through mergers and acquisitions and joint ventures. While we have planned such expansion based on our outlook regarding our business prospects, there is no assurance that such expansion plans will be commercially successful or that the actual outcome of those expansion plans will match our expectations. The success and viability of our expansion plans are dependent upon our ability to successfully predict the types of software technology which are in demand amongst our customers,

13

Table of Contents

hire and retain skilled employees to carry out our business strategies and future plans and implement strategic business development and marketing plans effectively and upon an increase in demand for our products and services by existing and new customers in the future.

Further, the implementation of our business strategies and future plans may require substantial capital expenditure and additional financial resources and commitments. There is no assurance that these business strategies and future plans will achieve the expected results or outcome such as an increase in revenue that will be commensurate with our investment costs or the ability to generate any costs savings, increased operational efficiency and/or productivity improvements to our operations. There is also no assurance that we will be able to obtain financing on terms that are favorable, if at all. If the results or outcome of our future plans do not meet our expectations, if we fail to achieve a sufficient level of revenue or if we fail to manage our costs efficiently, we may not be able to recover our investment costs and our business, financial condition, results of operations and prospects may be adversely affected.

Our controlling shareholder, Mr. Ng Chen Lok, has substantial influence over the Company. His interests may not be aligned with the interests of our other shareholders, and he could prevent or cause a change of control or other transactions.

Immediately prior to the completion of this offering, Mr. Ng Chen Lok will own an aggregate of approximately [•]% of our issued and outstanding Ordinary Shares, assuming the underwriter does not exercise any portion of its over-allotment option. Upon completion of this offering, Mr. Ng Chen Lok will own [•]% of our issued and outstanding Ordinary Shares, assuming the underwriter does not exercise any portion of its over-allotment option.

Accordingly, our controlling shareholder could have considerable influence or control over the outcome of any corporate transactions or other matters submitted to the shareholders for approval, including (i) mergers, consolidations, (ii) the election or removal of Directors, (iii) the sale of all or substantially all of our assets, (iv) making amendments to our Memorandum and Articles of Association, (v) whether to issue additional shares, including to him, (vi) employment, including compensation arrangements, and (vii) the power to prevent or cause a change in control. The interests of our largest shareholder may differ from the interests of our other shareholders. Without the consent of our controlling shareholder, we may be prevented from entering into transactions that could be beneficial to us or our other shareholders. The concentration in the ownership of our shares may cause a material decline in the value of our shares. For more information regarding our principal shareholders and their affiliated entities, see “Principal Shareholders.”

We have derived a substantial portion of our revenue from sales to a limited number of customers, which may expose us to risks relating to customer concentration.

Our customers include both enterprises and individuals. We have derived a substantial portion of our revenue from sales to a limited number of customers. For the years ended December 31 2022 and 2023, our top five customers accounted for 75.82% and 66.30% of our total revenue, respectively. Although we continually seek to diversify our customer base, we cannot assure you that the proportion of revenue contribution from our major customers to our total revenue will decrease in the future. Dependence on a limited number of major customers to our total revenue exposes us to risks of substantial losses if any of them reduces or ceases business collaboration with us. Specifically, any one of the following events, among others, may cause material fluctuations or declines in our revenue, and have a material and adverse effect on our business, results of operations, financial condition and prospects:

• a decline in the business of one or more of our major customers;

• the decision by one or more of the major customers to shift to our competitors;

• the reduction in the price of our services and products agreed by one or more of our major customers;

• the failure or inability of any of the major customers to make timely payment to us; or

• regulatory development that may negatively affect the business of one or more of our major customers or digital asset mining activities in general.

It may not be possible for us to accurately predict the future demand from our major customers, and it may fail to maintain relationships with these major customers or to do business with them at the same or increased levels. If any of the foregoing were to occur, and we are unable to expand our business with other existing customers or attract new customers in a timely manner or at all, our business, financial condition, results of operations and prospects may be materially and adversely affected.

14

Table of Contents

We have derived a substantial portion of our balance of accounts from a limited number of suppliers, which may expose us to risks relating to supplier concentration.

During the years ended December 31, 2022 and 2023, two vendors accounted for 25.84% and 34.69% of our cost of sales. Although we continually seek to diversify our supplier base, we cannot assure you that we will be able to continue doing business with the same suppliers, given that our dependence on a limited number of suppliers exposes us to risks of substantial losses should our suppliers reduce or cease business collaboration with us. It may not be possible for us to accurately predict the future supply from our suppliers, and it may fail to maintain relationships with our major suppliers or to do business with them at the same or increased levels. If any of the foregoing were to occur, and we are unable to attract new suppliers in a timely manner or at all, our business, financial condition, results of operations and prospects may be materially and adversely affected.

We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdictions which we intend to expand our business in.

We and our customers and suppliers are governed by the laws, regulations, and government policies in each of the various jurisdictions in which we and our customers and suppliers operate or into which we intend to expand our business and operations. Our business and future growth are dependent on the political, regulatory, social and economic conditions in these jurisdictions, which are beyond our control. Any economic downturn, changes in policies, currency and interest rate fluctuations, capital controls or capital restrictions, labor laws, changes in environmental protection laws and regulations, duties and taxation and limitations on imports and exports in these countries may materially and adversely affect our business, financial condition, results of operations and prospects.

Generally, we fund the development of our software technology via our internal resources and short and long-term financing from banks and other financial institutions. Any disruption, uncertainty and volatility in the global credit markets may limit our ability to obtain the required working capital and financing for our business at reasonable terms and finance costs. If all or a substantial portion of our credit facilities are withdrawn and we are unable to secure alternative funding on acceptable commercial terms, our operations and financial position will be adversely affected. The interest rates for most of our credit facilities are subject to review from time to time by the relevant financial institutions. Given that we rely on these credit facilities to finance our development of our software technology, and other associated costs, and that interest expenses represent a significant percentage of our expenses, any increase in the interest rates of the credit facilities extended to us may have a material adverse impact on our profitability.

In addition, such fluctuations and volatility in the global credit markets could limit credit lines of our current and potential customers from banks or financial institutions. Accordingly, such customers may not be able to obtain sufficient financing to purchase our software technology solutions, or we may be required to lower our rates in order to cater to our customers’ current situation. This may have an adverse impact on our revenue and financial performance.

We are dependent on the need to continually maintain a wide range of software technological solutions which are relevant to our customers’ needs.

The needs and preferences of our customers in terms of features and specifications of software technology solutions may change as a result of evolving laws, regulations, standards and requirements and new developments in technology. Our future success depends on our ability to obtain and provide software technology solutions that meet the evolving market demands of our customers. The preferences, requirements and purchasing patterns of our customers can change rapidly due to technological developments in their respective industries. There is no assurance that we will be able to respond to changes in the specifications of our customers in a timely manner. Our success depends on our ability to adapt our software solutions to the requirements and specifications of our customers. There is also no assurance that we will be able to respond to changes sufficiently and promptly in customer preferences to make corresponding adjustments to our products or services, and failing to do so may have a material and adverse effect on our business, financial condition, results of operations and prospects.

Our revenue relies on customer demand for our software technology solutions. Depending on the progress of technological development of the current programs and systems we use for development of our software solutions, our existing software may become prematurely obsolete or phased out. Any change in customer demand for our products may have an adverse impact on our product sales, which may in turn lead to technological obsolescence. In that case, our business, financial condition, results of operations and prospects may be materially and adversely affected.

15

Table of Contents

Our continued success is dependent on our key management personnel and our experienced and skilled personnel, and our business may be severely disrupted if we are unable to retain them or to attract suitable replacements.

Since the commencement of our business, our Executive Director, Chairman and Chief Executive Officer, Mr. Ng Chen Lok has been instrumental in expanding our business from a three-person operation specializing in software development (Speed+ Point of Sales System) for the F&B industry in June 2018 to providing our current wide range of software solutions today. We rely on the wide network and contacts of Mr. Ng Chen Lok, which was built over the past decade, in particular, sourcing for new customers through his existing contacts.