Exhibit 10.21

Individual/SME/Corporate

DATED THIS DAY OF 30 AUG 2021

BETWEEN

AFFIN ISLAMIC BANK BERHAD

[Registration No. 200501027372(709506-V)]

(Bank)

AND

THE CUSTOMER NAMED IN ITEM 1

OF SCHEDULE 1 HERETO

(Customer)

MASTER FACILITIES AGREEMENT

SOLICITORS

M/s. Manjit Singh Sachdev, Mohammad Radzi & Partners

Advocates & Solicitors

No. 1, 11th Floor, Wisma Havela Thakardas,

Jalan Tiong Nam, Off Jalan Raja Laut,

50350 Kuala Lumpur.

Tel: 03-2698 7533 Fax: 03-2692 0057

E-mail: manjs@mssmr.com

[File Ref: 204044/21/MS/ZU/REIN/AIBB/LDNT(e)]

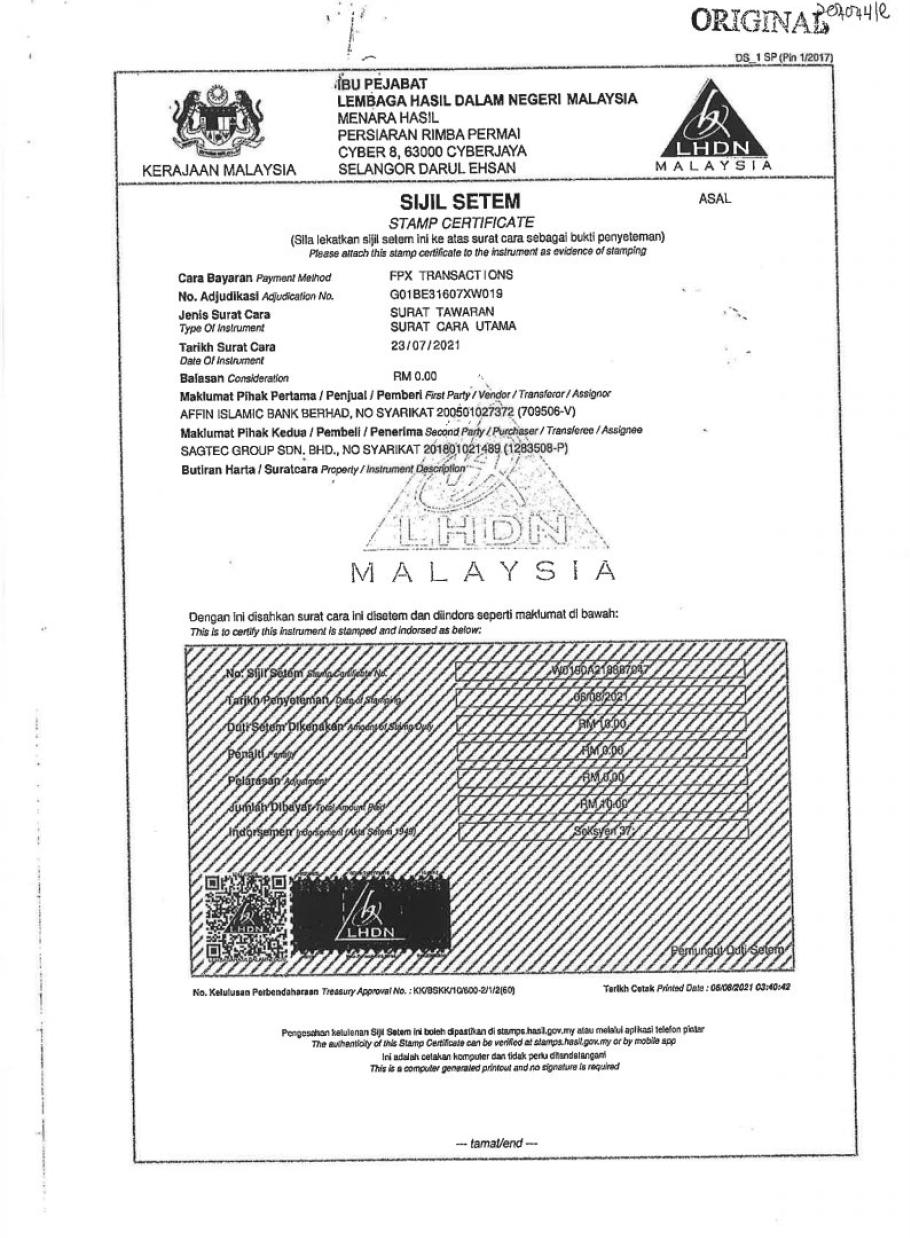

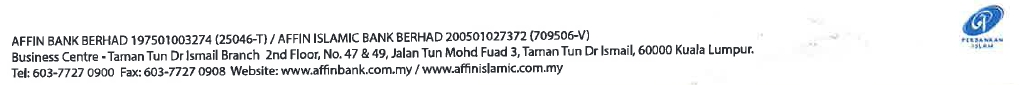

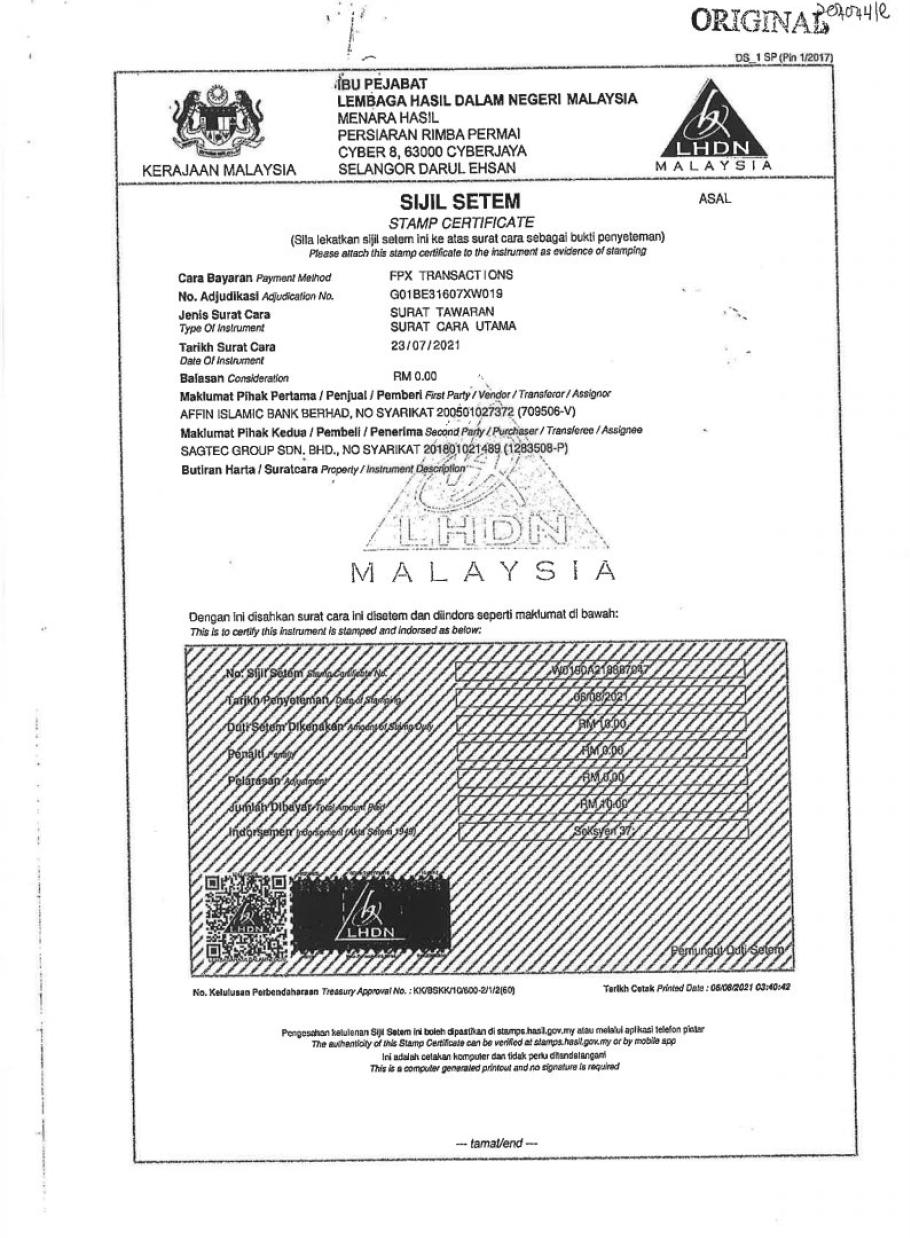

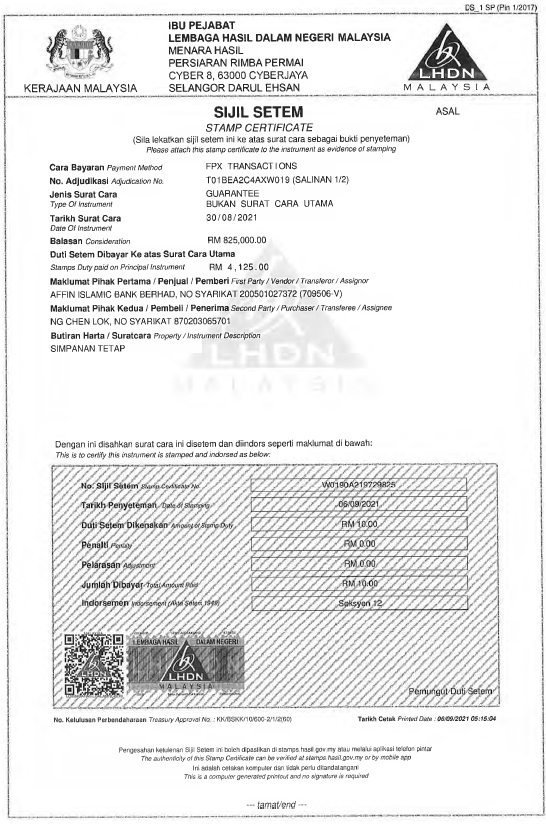

| | LEMBAGA HASIL DALAM NEGERI MALAYSIA

CAWANGAN KUALA LUMPUR BANDAR

TINGKAT 3,4,6,7,10,15 DAN 17, MENARA

OLYMPIA

NO.8, JALAN RAJA CHULAN

50200 KUALA LUMPUR

WILAYAH PERSEKUTUAN KUALA LUMPUR | | Telefon: 03-2059

3600

Fax: 03

2059

3600

www.hasil.gov.my |

Bil Surat Tuan:

204044/21/MS/ZU/REIN/AIBB/LDNT(E)

Tetuan/Tuan/Puan

SAGTEC GROUP SDN. BHD.

10-2, Jalan Tanjung SD 13/2, Bandar Sri Damansara,

52200 Kuala Lumpur

Wilayah Persekutuan Kuala Lumpur

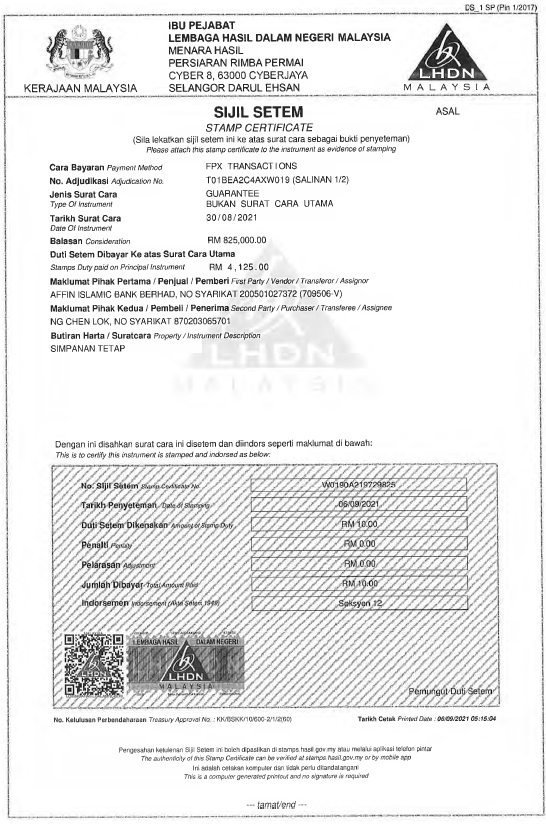

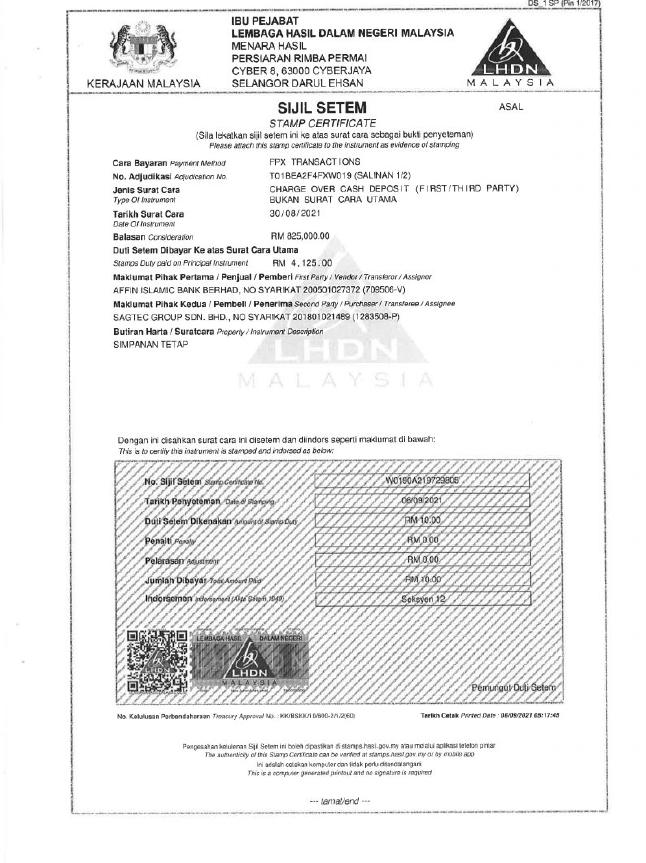

| Nombor Adjudikasi: T01BEA1E0BXW019 | Tarikh: 06/09/2021 |

Tuan,

NOTIS TAKSIRAN SEKURITI (DUTI AD VALOREM)

Jenis Surat Cara: MASTER FACILITIES AGREEMENT

Permohonan tuan bertarikh 30/08/2021 di bawah Seksyen 36, Akta Setem 1949 dirujuk.

| 2. | Dimaklumkan duti sebanyak RM 4,145.00 kena dibayar mengikut pengiraan seperti lampiran. |

| 3. | Sila jelaskan duti tersebut selewat-lewatnya pada 06/10/2021. Bayaran boleh dibuat kepada Pemungut Duti Setem: |

| a) | Secara elektronik melalui Financial Process Exchange (FPX) atau |

| b) | Di kaunter Pejabat Setem / Pusat Khidmat Hasil secara: |

| ● | Cek Akaun Anak Guam atau |

| 4. | Kelewatan membayar duti boleh dikenakan penalti di bawah Seksyen 47A, Akta Setem 1949. |

Sekian, terima kasih.

“BERKHIDMAT UNTUK NEGARA”

“BERSAMA MEMBANGUN NEGARA”

PEMUNGUT DUTI SETEM LHDNM

Cetakan komputer ini tidak memerlukan tandatangan.

| No Adjudikasi:T01BEA1E0BXW019 | Lampiran |

| PENGIRAAN DUTI YANG DIKENAKAN (PRINSIPAL) | | |

| Bhg. | A: | Sekuriti | | |

| | (a) | Jumlah Pinjaman/Bayaran | RM | 825,000.00 |

| Bhg | B: | Duti yang dikenakan | | |

| | (b) | Duti yang dikenakan ke atas (a) | RM | 4,125.00 |

| | (c) | Tolak amaun duti yang diremitkan / dikecualikan | RM | 0.00 |

| | (d) | Duti yang dikenakan | RM | 4,125.00 |

| | (e) | Penalti yang dikenakan** | RM | 0.00 |

| | (f) | Salinan | RM | 20.00 |

| | (g) | Jumlah besar duti yang kena dibayar | RM | 4,145.00 |

** Penalti

Sesuatu dokumen hendaklah disetemkan dalam tempoh 30 hari dari tarikh lanya disempurnakan dalam Malaysia atau dalam tempoh 30 hari selepas la diterima dalam Malaysia sekiranya la disempurnakan diluar Malaysia. Sekiranya la tidak disempurnakan dalam tempoh yang ditetapkan, penalti sebanyak:

| (a) RM25.00 atau 5% daripada duti yang berkurangan, yang mana lebih tinggi, sekiranya la disetemkan dalam tempoh 3 bulan selepas masa untuk penyeteman. | | (b) RM50.00 atau 10% daripada duti yang berkurangan, yang mana lebih tinggi, sekiranya la disetemkan selepas tempoh 3 bulan tetapi tidak lewat daripada 6 bulan selepas masa untuk penyeteman. | | (c) RM100.00 atau 20% daripada duti yang berkurangan, yang mana lebih tinggi, sekiranya la disetemkan selepas 6 bulan selepas masa untuk penyeteman. |

Salinan Kepada:

Manjit Singh Sachdev, Mohammad Radzi & Partners

No.1, 11th Floor, Wisma Havela Thakardas,

Jalan Tiong Nam, Off Jalan Raja Laut,

Kuala Lumpur.

50350 Kuala Lumpur

Wilayah Persekutuan Kuala Lumpur

Individual/SME/Corporate

“Customer” means the customer whose name and particulars as set out in Item 1 of Schedule 1 of this Agreement and includes its heirs, beneficiaries, successors in title and permitted assigns.

“Event of Default” means any of the events as set out in Clause 9 of this Agreement.

“Facility” means the Facility as set out in the Letter of Offer subject to the terms of this Agreement and includes any part of it.

“Facility Transaction” means the facility transactions as described in [Schedule 2].

“Indebtedness” means any amount due and payable to the Bank under the Facility.

“Letter of Offer” or “LO” means the letter of offer and standard or specific terms and conditions issued by the Bank and duly accepted by the Customer dated the day and year as set out in Item 2 of Schedule 1 of this Agreement and includes any supplemental, amendment, additional or variation the LO.

“Ringgit Malaysia” or “RM” means the lawful currency of Malaysia.

“Rules of Court 2012” means the Rules of Court 2012 and includes any amendment and variation to it.

“Security Documents” means the security documents as described in the LO and includes such other document given in favour of the Bank to secure the Indebtedness.

“Security Interests” means any mortgage, charge, pledge, lien, right of set off or any security interest created or arising.

“Security Party” means any party, other than the Customer, providing security or guarantee for the Facility and as set out in Item 3 of Schedule 1 hereto.

“Tenure” means the tenure as set out in the LO or such extension as may be granted by the Bank.

“Transaction Documents” means any or all the following documents:

| (c) | Security Documents; and/or |

| (d) | any other documents as designated by the Bank. |

| (a) | The headings in this Agreement are inserted for convenience only and shall not be taken or read as essential parts of this Agreement. |

| (b) | References to clauses or schedules refers to the clauses or schedules of this Agreement. |

Individual/SME/Corporate

| (c) | All references to provisions of any legislation, act or statute include references to any amendments, any statutory modification, re-enactment, regulations, proclamations, by- laws, published rulings, policy statements or guidelines issued under the legislation, act or statute. |

| (d) | References to this Agreement or any agreement or instruments shall include all amendments, variations and modifications to this Agreement as shall from time to time be in force. |

| (e) | Words importing the singular number shall include the plural number and the same applies in reverse. |

| (f) | Where two or more persons or parties are included or comprised in any expression, agreements, covenants, terms, stipulations and undertakings expressed to be made by them, it shall be considered as having been made by and be binding upon such persons or parties jointly and severally. |

| (g) | Words importing the masculine gender shall include the feminine and neuter gender and the same applies in reverse. |

| (h) | A reference to a document includes any amendment or supplement to, or replacement or novation of that document. |

| (i) | Any reference to “laws of Malaysia” shall include, without limitation, any act, ordinance, statutory or municipal, rule, regulation, ruling, decree, or order enacted or issued by the Parliament of Malaysia. it shall also include regulations made by any bureau, minister, agency, court, regulatory body, authority or legislative body (including, without limitation, BNM or any taxing, fiscal or other monetary authority). |

| (j) | The “winding-up” of a person includes the amalgamation, reconstruction, re- organization, administration, scheme of arrangement or presentation of a petition with a view to winding-up or cessation of business of that person and the dissolution, liquidation, merger or consolidation of that person. |

| (k) | Any reference to a ‘person’ includes any individual, company, corporation, firm, partnership, joint venture, association, organisation, trust, state or agency of a state (in each case, whether or not having separate legal personality). It also includes any political sub-division, bureau, minister, agency, court, regulatory body, authority or legislative body (including, without limitation, BNM or any taxing, fiscal or other monetary authority). Reference to a person or party includes that person’s or party’s heirs, beneficiaries, successors in title and permitted assigns. |

| (l) | Any reference to ‘Material Adverse Effect’ means any event or events that would, in the opinion of the Bank, have an adverse effect on the business, financial condition, operations or properties of the Customer. It includes the inability of the Customer to perform its obligations under the Transaction Documents. It also includes the validity or enforceability of the Transaction Documents which may affect the Bank’s right and remedies under the Transaction Documents. |

| (m) | The ‘certificate’ includes statement, confirmation and notification. |

Individual/SME/Corporate

At the request of the Customer, the Bank agrees to make available to the Customer the Facility, subject to the terms and conditions of this Agreement.

| (a) | The Facility shall be used by the Customer towards the purposes as set out in the LO. |

| (b) | The Customer shall not utilise the Facility for any purpose other than the purposes as stated in the LO unless allowed by the Bank. |

| (c) | The Bank shall not be under any obligation to ensure that the Facility is utilised towards the purposes as set out in this Agreement. |

The Facility shall have the tenure as set out in the LO.

The Bank’s obligation to make available the Facility shall be subject to the Bank being satisfied that the Conditions Precedent have been complied with and fulfilled by the Customer.

| 3.2 | Waiver of Conditions Precedent |

| (a) | The Conditions Precedent are inserted for the benefit of the Bank and may be waived by the Bank in whole or in part with or without terms or conditions. Any waiver shall not affect the right of the Bank to insist on the Customer’s compliance with any such waived conditions at any subsequent time to ensure the future availability of the Facility. |

| (b) | PROVIDED ALWAYS that notwithstanding the non-fulfilment of any of the Conditions Precedent, the Bank may, without prejudice to all its rights and remedies in this Agreement and subject to such conditions as the Bank may impose, disburse the Facility or any part of it. |

The Customer hereby undertakes to pay the Indebtedness in the manner and at the time as set out in this Agreement. The Customer further undertakes to pay any other amount due and payable to the Bank under this Agreement and/or the Transaction Documents as and when it falls due.

Individual/SME/Corporate

The Customer may make early settlement to the Bank of the Indebtedness in full or partially, subject to the following conditions:

| (a) | the Bank shall have received from the Customer not less than thirty (30) Business Days or such other period as may be prescribed by the Bank from time to time, prior written notice (“Early Settlement Notice”) of its intention to make early settlement specifying the relevant amount to be paid and the date of such payment failing which the Bank may factor in such associated costs in reducing ibra’ accordingly; |

| (b) | the Customer has paid in full all other monies due and outstanding under this Agreement and/or the Transaction Documents; |

| (c) | the amount payable by the Customer in respect of such early settlement shall be determined by the Bank in accordance with the principles of Shariah; |

| (d) | any Early Settlement Notice once given shall be binding on the Customer and the Customer shall pay the amount as determined by the Bank on the date specified in such Early Settlement Notice. |

The Customer may pay the Indebtedness in advance. Any extra payment by Customer will be treated as advance payment and may be made without the Customer giving any prior notice. The advance payments shall be utilized towards payment of the indebtedness as and when it becomes due.

| 5.3 | No Re-utilisation on Amount Prepaid |

Unless permitted by the LO, no amount prepaid may be made available for re-utilisation.

| 6.1 | Execution of Security Documents |

For better securing the payment of the Indebtedness or any part of it which is outstanding and all monies due and payable to the Bank, the Customer shall execute and shall procure the Security Party to execute the Security Documents as security for the obligation to make timely payment of the indebtedness.

Individual/SME/Corporate

| (a) | The security created under the Security Documents are intended to be a continuing security for all monies now or in future payable by the Customer to the Bank under this Agreement and/or the Transaction Documents. |

| (b) | Any security given in favour of the Bank under the Facility shall not affect any security already given by the Customer to the Bank or any security which may in future be given by the Customer to the Bank. |

| 6.3 | Covenant to Provide Further Security |

| (a) | The Customer shall at any time if and when required by the Bank execute or procure the execution in favour of the Bank or to any other person as the Bank shall direct such other mortgages, charges, assignments, transfers or agreements as the Bank shall require and on such agreed terms with the Bank, to additionally or further secure all monies and liabilities agreed to be paid under the terms of the Transaction Documents. |

| (b) | The Customer shall when required by the Bank deposit with the Bank the documents of title of any or all immovable properties belonging/registered in the Customer’s name for any tenure and all or any debentures, shares, stocks or securities of the Customer on such agreed terms with the Bank. |

| 7. | REPRESENTATIONS AND WARRANTIES |

| 7.1 | Representations and Warranties of Customer |

The Customer and/or the Security Party acknowledges that the Bank has entered into this Agreement in full reliance of the representations and warranties of the Customer in the following terms:

| (a) | the Customer and/or where applicable, the Security Party each has the power or capacity to execute, deliver and perform the terms of the Transaction Documents and the Customer and where applicable, the Security Party has taken all the necessary actions to authorize the execution, delivery and performance of the Transaction Documents; |

| (b) | each of the Transaction Documents constitutes the legal, valid and binding obligations of the Customer and where applicable, the Security Party in accordance with their respective terms; |

| (c) | that the execution, delivery and performance of each of the Transaction Documents by the Customer and/or, the Security Party do not and will not breach the provisions of: |

| (i) | any law, regulation, or any order, or decree of any government authority, agency or court to which any of them is subject; and |

Individual/SME/Corporate

| (ii) | any contract, undertaking or instrument to which any of them is a party or which are binding upon any of them or any of their assets. It will not result in the creation, imposition of, or any obligation to create, or impose, any mortgage, lien, pledge or charge on any of their assets pursuant to the provisions of any contract, undertaking or instrument; |

| (d) | all Consents which are required or advisable to be obtained in connection with the execution, delivery, performance, legality or enforceability of any of the Transaction Documents have been obtained and are in full force and effect; |

| (e) | they are not in default under any agreement to which they are parties or by which they may be bound. There is also no litigation, arbitration, or administrative proceedings which are presently current, or pending, or threatened which might materially affect their solvency or might affect their ability to perform their respective obligations under the Transaction Documents; |

| (f) | no bankruptcy or winding-up proceedings have been commenced or entered against the Customer and where applicable, any Security Party; |

| (g) | no steps have been taken or are being taken to appoint a receiver, receiver and manager, or liquidator to take over or to wind-up the Customer and where applicable, the Security Party; |

| (h) | the Customer and where applicable, each Security Party has filed all tax returns which they are required by law to file. The Customer has also paid or made adequate provisions for the payment of all taxes, assessments, fees and other governmental charges on any of their properties or assets, income or franchise; |

| (i) | there is no Material Adverse Effect in the financial conditions, operating environment or management of the Customer and/or where applicable, each Security Party or other conditions which will materially affect the ability of the Customer and where applicable, the Security Party to perform its obligations under the Transaction Documents; |

| (j) | the financial statements of the Customer and/or where applicable, each Security Party which have previously been submitted to the Bank are complete and correct and fairly represents its financial conditions and are in accordance with generally accepted accounting principles applied on a consistent basis; |

| (k) | the information furnished by the Customer and/or where applicable, each Security Party in connection with the Facility does not contain any untrue statement or omission of any fact. All opinions or projections given to the Bank honestly given; |

| (1) | there is no default by any of the relevant parties of any of the terms of the Transaction Documents; |

| (m) | the execution, delivery and performance of the Transaction Documents is within the powers of the Customer and/or the Security Party and does not breach any law or regulation in particular, the prohibition of financings to persons connected with directors under the Companies Act 2016 to which the Customer and/or such Security Party is subject. |

Individual/SME/Corporate

| 7.2 | Continuing Nature of Representations and Warranties |

The representations and warranties set out herein will remain in force and complied with in all material respects so long as any sums remains available for utilization by the Customer or remains payable under this Agreement.

The Customer hereby covenants, agrees and undertakes with the Bank that so long as the Facility and any other obligations under this Agreement remains outstanding the Customer shall:

| (a) | Conduct of Business: carry out and operate its business and affairs with due diligence and efficiency and in accordance with sound financial and industrial standards and practices in accordance with its constitutional documents; |

| (i) | maintain in full force and effect all relevant authorisations (governmental and otherwise) and will promptly obtain any further authorisation which may become necessary to enable it to own its assets, carry on its business and perform its obligations under any of the Transactions Documents; and |

| (ii) | promptly carry out any registration, filing or notarisation of this Agreement and/or the Transaction Documents, pay any duty or tax and take any action which may be necessary or desirable to ensure the validity or enforceability in Malaysia of the liabilities and obligations of the Customer or the rights of the Bank under the Transaction Documents; |

| (c) | Shariah compliant purposes: utilise the Facility for purposes that are in compliance with Shariah and the utilisation of the Facility shall be governed by and construed by such rules and directives (whether or not having the force of law) required by BNM or other appropriate authority; |

| (d) | Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities: ensure that it has never and would not: |

| (i) | engage, directly or indirectly, in a transaction that involves proceeds of any unlawful activity; |

| (ii) | acquire, receive, possess, disguise, transfer, convert, exchange, carry, dispose, use, remove from or bring into Malaysia proceeds of any unlawful activity; or |

Individual/SME/Corporate

| (iii) | conceal, disguise or prevent the establishment of the true nature, origin, location, movement, disposition, title of, rights with respect to, or ownership of, proceeds of any unlawful activity; and |

the Customer confirms to the Bank that it is not involved in any money laundering activity;

| (e) | Information: furnish to the Bank all such information as the Bank shall reasonably request concerning the use of the Facility and any factors materially affecting the business of the Customer; |

| (f) | Preparation of Accounts |

| (i) | prepare the financial statements in accordance with generally accepted accounting principles in Malaysia. The financial statements shall give a true and fair view of the operations of the Customer for the period in question. It shall also disclose all the liabilities (actual or contingent) of the Customer: |

| (ii) | furnish to the Bank as soon as available but in any event not later than six (6) months from the end of each financial year, copies of complete financial statements of the Customer including the balance sheet and profit and loss account audited and certified by a qualified auditor, and |

| (iii) | furnish to the Bank such other financial information as the Bank may request; |

| (g) | Performance of Obligations: |

| (i) | inform the Bank of any legal proceedings, litigation and claims, against it; |

| (ii) | punctually pay all its indebtedness when due; |

| (iii) | perform all its other obligations under the LO, this Agreement and the Transaction Documents; |

| (h) | Event of Default: if it becomes aware of the occurrence of an Event of Default, forthwith notify the Bank and provide the Bank with full details of any steps which it is taking, or is considering taking, in order to remedy or mitigate the effect of the Event of Default; |

| (i) | Ranking: ensure that its liabilities under the Transaction Documents to which it is a party rank and will rank at least equally and without partiality (pari passu) in point of priority and security with all its other liabilities (both actual and contingent) except; |

| (i) | liabilities which are subject to liens or rights of set off arising in the normal course of trading and the aggregate amount of which is not material; |

| (ii) | liabilities which are preferred solely by the laws of Malaysia; and |

Individual/SME/Corporate

| (iii) | any security interest created which is disclosed to the Bank prior to the date of this Agreement; |

| (j) | Adverse Changes: promptly notify the Bank of:- |

| (i) | any material event or adverse change in the condition (financial or otherwise) of the Customer; |

| (ii) | any litigation or other proceedings of any nature being threatened or initiated against the Customer before any court tribunal or administrative agency which may have a Material Adverse Effect; |

| (iii) | any dispute between the Customer and any government or statutory body on the Customer’s assets which may have a Material Adverse Effect; and |

all such notification to be given to the Bank not later than ten (10) Business Days after the Customer has knowledge of the above.;

| (k) | No Default: ensure that no Event of Default under any agreement or arrangement expressly referred to in this Agreement shall have happened and be continuing and which might adversely affect the Customer’s ability from performing the obligations under this Agreement and the Transaction Documents; |

| (l) | Satisfactory Account: operate an active and satisfactory account and observe the approved limits of the Facility at all times; |

| (m) | Change tax in Status: immediately inform the Bank in the event there is a change in the Customer’s tax residential status; |

| (n) | Change in Law: immediately inform the Bank in the event that there are any extraordinary circumstances or change in law or other governmental action in Malaysia occurring which shall make it improbable for the business of the Customer to be carried out; |

| (o) | Authorised Signatories: forthwith notify the Bank if any of its authorised signatories are no longer authorised to act on the Customer’s behalf; |

| (p) | Taxes and Outgoings: pay all quit rents, rates, outgoings, assessments and governmental charges promptly and deliver copies of the relevant receipts to the Bank. |

| (q) | Indemnity: indemnify and keep the Bank fully and completely indemnified and harmless at all times from and against any liabilities, claims, demands, damages, losses, proceedings, costs or expenses which the Bank may incur and/or suffer and/or sustain as a result of the Bank granting the Facility to the Customer, unless directly caused by the Bank’s negligence, default or fraud. |

| (r) | Change in business: inform the Bank in the event there is any addition to, deletion, variation or change in the nature of its present business in any manner; |

Individual/SME/Corporate

| (s) | Subordination of third party financings/advances: subordinate all third party financing/advances including but not limited to its existing shareholders’ or directors’ and related companies’ financing/advances or loans (if any) to the Bank. |

The Customer hereby covenants, agrees and undertakes with the Bank that so long as the Facility or any obligation of the Customer under this Agreement remains outstanding, the Customer shall not, without prior consent in writing from the Bank (consent not unreasonably withheld):

| (a) | Indebtedness: incur, create, assume, guarantee or permit to exist or guarantee any indebtedness other than the Indebtedness created pursuant to this Agreement or any other indebtedness disclosed by the Customer and approved by the Bank prior to the date of this Agreement; |

| (b) | Security Interests: create or permit to exist over all or any part of its business or assets or undertakings any Security Interest other than those permitted under the Transaction Documents; |

| (i) | enter into any partnership, profit-sharing or royalty agreement or other similar arrangement whereby the business of the Customer or its operations are managed by another person, firm or company; |

| (ii) | enter into any transaction with any person, firm or company or establish any transaction where the Customer might pay more than the ordinary commercial price for any purchase or might receive less than the full ex-works commercial price (subject to normal trade discount) for its products; |

| (d) | Disposal of Assets: sell, transfer, lease or otherwise dispose of all or a substantial part of its capital, assets or undertake or permit any merger; |

| (e) | Customer being a corporate or company: where the Customer is a company: |

| (i) | make any financing/loans or advances or grant any credit or give any guarantee to any of its directors, shareholders or related companies except in the ordinary course of business and on commercial terms on ordinary commercial terms and on the basis of arm’s length transactions; |

| (ii) | reduce or in any way whatsoever alter (other than by way of an increase) its authorised or issued or paid-up share capital whether by varying the amount, structure, value or the rights attached or convert any of its share capital into stock by consolidating, dividing or subdividing all or any of its shares; |

Individual/SME/Corporate

| (o) | Account: in the opinion of the Bank the Customer’s account with the Bank is or has not been operated satisfactorily; or |

| (p) | Takaful: default is made in effecting, maintaining or renewing any takaful contract as required to be effected, maintained or renewed by the Customer; or |

| (q) | Creditors: the Customer shall make an assignment, arrangement or composition for the benefit of the creditors of the Customer or allow any judgement against the Customer to remain unsatisfied for a period of fourteen (14) days or more; or |

| (r) | Legal Proceedings: any legal proceedings, a suit or action of any kind (whether criminal or civil) be commenced or threatened to be commenced against the Customer; or |

| (s) | Bad Cheque Offender: the Customer has been listed as a bad cheque offender by the Dishonoured Cheques Information System (DCHEQS) set up by BNM; |

| (t) | the above is in addition to any other events of default stated in the applicable Schedules, if any, |

then at once or at any time thereafter the Bank may at its discretion, by notice to the Customer declare that an Event of Default shall have occurred whereupon notwithstanding anything to the contrary provided in this Agreement, the Customer shall be obligated to pay the Indebtedness which remains outstanding.

For the purpose of this clause, each of the above paragraphs is to be read independently and no one Event of Default limits the generality of any other Event of Default.

| 9.2 | Enforcement of Security |

At any time after the occurrence of the Event of Default, the Bank shall be entitled (but not obligated) to enforce its remedies under any of the Transaction Documents.

Upon occurrence of an Event of Default, the Bank shall have the right to exercise all or any of the remedies available under this Agreement and any Security Documents. The Bank shall be entitled to exercise such remedies concurrently, including pursuing all remedies available under the Security Documents and/or the Transaction Documents. At the same time or concurrently the Bank may commence legal action to recover the amount due by the Customer to the Bank. In the event the Bank does not wish to exercise such remedies concurrently the Bank may also institute civil suits against the Customer or any party providing security to recover the Indebtedness or to dispose of or realise any security provided.

Individual/SME/Corporate

| 10.1 | Application of Proceeds |

If after the security created under the Security Documents becomes enforceable or upon a declaration of an Event of Default, all monies received by the Bank from any proceeding instituted or step taken under any of the Security Documents shall (subject to the payment of debts which by law have priority, if any), be applied by the Bank:

| (a) | firstly, in payment of any rents, taxes, assessments, fees, lawful outgoings and other fees due and payable to the relevant authority; |

| (b) | secondly, in payment of any costs, charges, expenses and liabilities incurred by the Bank and every person appointed by the Bank in realising any security under the Security Documents; |

| (c) | thirdly, in and towards payment to the Bank of all profit/ljarah then due and remaining unpaid under any or all of the Transaction Documents; |

| (d) | fourthly, in and towards payment of the principal sum due and remaining unpaid under any or all of the Transaction Documents; |

| (e) | fifthly, in and towards payment to the Bank of all other monies due and remaining unpaid under any or all of the Transaction Documents; |

| (f) | sixthly, in and towards payment to the Bank of all other monies due and remaining unpaid; |

| (g) | seventhly, in payment of any surplus to the Customer or other persons entitled to such surplus. |

PROVIDED ALWAYS that the Bank may alter the above order of payment or keep such amounts in a non-profit bearing Shariah-compliant suspense account. Such alteration or payment will not affect the right of the Bank to receive the full amount to which the Bank would have been entitled if the primary order had been observed, or any lesser amount which is ultimately realised from the security.

| 10.2 | Deficiency in Proceeds |

If the amount realised by the Bank on the sale of the properties or assets pursuant to Clause 10.1, after deduction and payment from such sale of all fees, costs, charges and other outgoings arising out of such realisation is less than the amount due to the Bank (whether or not the Bank is the purchaser), the Customer or the Security Party shall on demand pay to the Bank, the difference between the amount due to the Bank and the amount realised regardless of whether the banker-customer relationship between the Bank and the Customer has ceased or been terminated. Until payment of such differential amount, the Customer or the Security Party shall pay late payment compensation charges on the differential sum until the date of actual payment made.

Individual/SME/Corporate

| 11. | COMPENSATION FOR LATE PAYMENT |

| 11.1 | Compensation for Late Payment (Ta’widh) |

| (a) | In addition to and without prejudice to the Bank’s rights powers and remedies in this Agreement and the Security Documents, the Customer shall be liable to pay the Bank compensation on any amount overdue as follows: |

| (i) | if the default occurs during the tenure of the Facility, at the rate of one per centum (1%) per annum on such overdue instalment under the Facility or on such outstanding balance of the principal sum and earned profit (if any) (subject to rebate, if applicable). The same rate applies where the entire Facility is recalled/accelerated (as the case may be) or brought to court for judgement prior to maturity; and |

| (ii) | if the default occurs after the maturity of the Facility as provided or upon judgment, whichever is earlier, at the rate which is the prevailing daily overnight Islamic Interbank Money Market rate on such outstanding balance of the principal sum and earned profit (if any) (subject to rebate, if applicable); |

| (iii) | at all times, the rate to apply in any of the circumstances above has to be allowed by the Bank’s Shariah Committee and the Shariah Advisory Council of BNM. |

| (b) | It is further agreed that the compensation shall not be compounded. |

| (c) | The compensation at the abovementioned rate shall be payable by the Customer after as well as before any judgment or order of court. |

A statement of account in writing stating the amount payable by the Customer under this Agreement and/or the Transaction Documents issued by any authorised officer of the Bank shall in the absence of manifest error be conclusive evidence.

| 12.1 | Payment Clear from Deduction |

All payments to be made under the Transaction Documents shall be calculated and be made without (and free and clear of any deduction for) set-off or counterclaim and in immediately available and transferable funds for commodities value on the due date thereof.

Individual/SME/Corporate

| 12.2 | All Payment Received to be Payment in Gross |

All monies received from the Customer or from the Security Party or any third party whether from the realisation of the security created by the Security Documents or otherwise shall be treated as payments in gross. It will not be attributable to any specific part of the monies covenanted to be paid even if appropriated by the Bank. The Customer or any other person or persons claiming under the Customer shall have no claim to the securities held by the Bank unless and until the Bank has received the full amount due to the Bank by the Customer.

All payments by the Customer under this Agreement and/or the Transaction Documents shall be made in full without any deduction or withholding (whether in respect of set off, counterclaim, duties, taxes, charges) unless the deduction or withholding is required by law, in which event the Customer shall:

| (a) | ensure that the deduction or withholding does not exceed the minimum amount legally required; |

| (b) | forthwith pay to the Bank such additional amount so that the net amount received by the Bank will equal the full amount which would have been received by it had no such deduction or withholding been made; |

| (c) | pay to the relevant taxation or other authorities within the period for payment permitted by applicable law the full amount of the deduction or withholding; |

| (d) | furnish to the Bank, within the period for payment permitted by the applicable law, either: |

| (i) | an official receipt of the relevant taxation authorities in respect of all amounts so deducted or withheld as aforesaid; or |

| (ii) | if such receipts are not issued by the relevant taxation authorities on payments to them of amounts so deducted or withheld, a certificate of deduction or equivalent evidence of the relevant deduction or withholding. |

| (a) | The Customer shall at all times fully indemnify and keep the Bank indemnified against any action, proceeding, claim, expense, loss, damage or liability which the Bank may incur as a consequence of any Event of Default or otherwise in connection with this Agreement and/or the Transaction Documents unless directly caused by the Bank’s negligence, default or fraud. |

Individual/SME/Corporate

| (b) | Any certificate issued by the Bank in connection with the above shall, in the absence of manifest error, be conclusive. |

| (c) | The indemnity shall also extend to any expenses, fees (including legal fees on solicitors and client basis) or other sums payable in connection with the enforcement of any of the rights of the Bank under this Agreement or the Transaction Documents. |

The foregoing indemnities are separate and independent from the Customer’s other obligations under this Agreement.

The Customer shall on demand pay:

| (a) | to the Bank all expenses, in each case on the basis of a full indemnity, (including legal and out-of-pocket expenses) incurred by the Bank in connection with the negotiation, preparation or completion of the Transaction Documents; |

| (b) | any expenses covenanted to be paid by the Customer under this Agreement which are paid by the Bank on behalf of the Customer and form part of the Indebtedness; and |

| (c) | if any amount due under the Transaction Documents shall be required to be recovered through any process of law, or placed in the hands of solicitors for recovery, to pay all the solicitors’ fees and expenses on a solicitor-client basis. |

For the purpose of sub-clauses (a) to (c) above, the Bank shall, subject to compliance with Shariah principles and with prior notice to the Customer, have the right to debit any account of the Customer with the Bank. Such monies shall be secured under the Security Documents and shall be subject to the applicable compensation for late payment.

The Customer shall pay all stamp duties and taxes to which this Agreement, the Transaction Documents or any related documents may be subject. The Customer agrees to indemnify the Bank and keep the Bank indemnified from and against any expense, damage, loss or liability which any of them may incur as a result of any delay or omission by the Customer to pay such duties.

| 15. | ASSIGNMENT AND TRANSFER |

| (a) | Save and except if the assignment and/or transfer is to the detriment of the Customer, the Bank shall (subject to compliance with Shariah principles) be entitled after giving due notice to the Customer, to assign its rights and/or transfer its obligations under this Agreement or any part of this Agreement and/or transfer its obligations, and |

| (i) | for this purpose may disclose to a potential assignee or transferee or any other person who derives or may derive rights or obligations under or by reference to this Agreement such information about the Customer as shall have been made available to the Bank; and |

Individual/SME/Corporate

| (ii) | where the Bank transfers its obligations (in whole or in part), the Customer shall execute such documents as are reasonably necessary to release the Bank to the extent of the transfer and join the transferee as a party to this Agreement; |

| (b) | All costs and expenses incurred by the Bank and/or the assignee/transferee pursuant to or incidental to such assignment/transfer which arises from breach by the Customer or the Security Party of the term of the Facility or upon occurrence of the Event of Default shall be borne by the Customer or the Security Party. |

| (c) | All costs and expenses incurred by the Bank and/or the assignee/transferee pursuant to or incidental to such assignment/transfer which do not arise from breach by the Customer or the Security Party of the terms of the Facility, shall be borne by the Bank. |

| 15.2 | No Assignment or Transfer by Customer |

The Customer may not assign or transfer any of its rights and/or transfer any of its obligations under this Agreement and/or under the Transaction Documents to which it is a party without the prior written consent of the Bank.

| 16.1 | Evidence of Indebtedness |

In any proceedings relating to this Agreement and the Facility, a statement as to any amount due to the Bank which is certified as being correct by an authorized officer of the Bank shall, in the absence of manifest error, be conclusive evidence that such amount is in fact due and payable.

Any changes in the Customer or the Security Party by way of amalgamation, reconstruction or otherwise shall not affect their liabilities or obligations in the Transaction Documents.

| 16.3 | Rights cumulative, waivers |

The rights of the Bank under this Agreement are cumulative and may be exercised as often as the Bank considers it reasonably appropriate. The rights of the Bank in relation to the Facility shall not be capable of being waived or varied except in writing. No failure or delay in exercising nor any omission to exercise any rights or remedy of the Bank under this Agreement upon any breach of the Customer shall affect such right or remedy nor regarded as the Bank waiving its right or remedy or accepting such a breach.

Individual/SME/Corporate

Time, wherever mention in this Agreement, shall be of essence.

| (a) | Any notice, demand or other communication (including computer generated notices/statements that do not require any signature) from the Bank under this Agreement shall be given in writing to the Customer at the Customer’s address, facsimile numbers or electronically (including email) as stated in the Letter of Offer and/or last appearing in the Bank’s records. The notices may be given or made by post, facsimile, electronically (including email), personal delivery or such other mode as may be determined by the Bank. |

| (b) | The notices or other communications are given to the Customer: |

| (i) | in the case of post, five (5) days after the date of posting; |

| (ii) | in the case of facsimile, on the day of transmission; |

| (iii) | in the case of electronic mail, on the day it is sent provided that the Bank has not received a failed or undeliverable message from the host provider on the data of transmission; and |

| (iv) | in the case of personal delivery, at the time of delivery. |

| (c) | The Customer expressly agrees with the Bank to inform the Bank immediately of any change in the contact information such as correspondence address, phone number, facsimile number and/or email address of the Customer. Any change in the Customer’s contact information such as address, phone number, facsimile number and/or email address is not binding on the Bank unless the Customer has given notice in writing to the Bank and/or via other channels provided by the Bank. |

| 16.6 | Service of legal process |

| (a) | The service of any legal process pursuant to the Rules of Court 2012 may be given by prepaid registered post sent to the respective address of the parties provided in this Agreement. Such legal process shall be considered to have been duly served after the expiration of five (5) Business Days from the date it is posted and if delivered by hand, on the day it was delivered. |

| (c) | No change in the address for service shall be effective unless the Customer has given to the Bank actual notice of the change of the address. Anything done by the Bank before the notice of change of address is received by the Bank will be valid and effective. |

Individual/SME/Corporate

Any term or condition in this Agreement which turns out to be illegal or invalid, shall not cause the remaining terms or conditions to be likewise illegal or invalid.

| 16.8 | Modification and indulgence |

Subject to compliance with Shariah principles, the Bank may at any time (by letter or other form of agreement), without in any way affecting this Agreement:

| (a) | grant to the Customer or any Security Party any time or indulgence; and/or |

| (b) | renew any bill, notes or any negotiable securities; and/or |

| (c) | deal with, exchange, release or modify or abstain from perfecting or enforcing any securities or other guarantees or rights it may now or from time to time have from or against the Customer or any Security Party or any other person; and/or |

| (d) | compound with the Customer or any Security Party or any other person; and/or |

| (e) | enter into any settlement arrangement with the Customer, Security Party, or any other person; and/or |

| (f) | conduct credit checks on the Customer or the Security Party at anytime during the tenure of the financing. |

| (a) | Subject to Shariah principles, it is hereby expressly agreed and declared by the parties that notwithstanding any of the provisions of this Agreement to the contrary, the provisions and terms of this Agreement may at any time and from time to time be varied or amended by the Bank by giving prior notice (together with the reasons for such variation or amendment) of at least twenty one (21) calendar days to the Customer. |

| (b) | If the Customer is not agreeable to the amended terms and conditions of this Agreement, the Customer shall notify the Bank in writing of the same within twenty-one (21) calendar days from the date of notice by the Bank and redeem the Facility by paying the Indebtedness and all sums due to the Bank in full. |

| (c) | In the event the Customer continues to maintain the Facility twenty-one (21) calendar days after the notice of any amendment to the terms and conditions of this Agreement by the Bank, the Customer shall be considered to have accepted the amendments to the terms and conditions of this Agreement. |

Individual/SME/Corporate

| 16.10 | Disclosure of information |

The Customer hereby agrees and permits the Bank to disclose any information relating to the Customer, the Facility or the Transaction Documents to:

| (a) | the Central Credit Unit, Dishonoured Cheques Information System (DCHEQS) and Central Credit Reference Information System (CCRIS) of BNM or such other authority having jurisdiction over the Bank; or |

| (b) | any party (including professional advisers and debt collection agent) pursuant to any enforcement, preservation and/or attempted enforcement or preservation of this Agreement; or |

| (c) | any party providing security or any surety; or |

| (d) | any party or authority, if required by any law, regulation or by-law or pursuant to any order from any court of competent jurisdiction; or |

| (e) | companies which are now or which in the future may be subsidiaries within the banking group of the Bank, subject to the provisions of the Islamic Financial Services Act 2013 [Act 759] and any regulations from BNM; and |

| (f) | any credit reporting agencies. |

The full Privacy Notice is contained in the Bank official website at www.affinislamic.com.my.

The Customer hereby expressly consents to permit the Bank to conduct credit check on the Customer for the purpose of this Agreement at the Central Credit Bureau, Central Credit Reference Information System (CCRIS), CTOS Sdn Bhd, Dishonoured Cheques Information System (DCHEQS), Financial Information Services Sdn Bhd (FIS), RAM Credit Information Sdn Bhd or any registered credit reporting agencies.

| 16.11 | Bank Negara Malaysia |

The Facility shall be at all times governed by such rules, regulations and/or directives (whether or not having the force of law) required or imposed upon the Bank from time to time and at any time by BNM or any other authority having jurisdiction over the Bank.

All sums of money herein offered and to be received by the Bank shall be in Ringgit Malaysia or such other currency to be determined by the Bank.

Where request is made by the Customer for Malay version of this Agreement, the Bank shall provide the Customer with such Malay version accordingly.

Individual/SME/Corporate

Any money received hereunder may be placed and kept to the credit of a non-income bearing Shariah-compliant suspense account for so long as the Bank thinks fit. The Bank is not obliged to apply the money to discharge the liabilities due under this Agreement. In the event of any proceedings in bankruptcy, liquidation, composition or arrangement the Bank may prove for and agree to accept any dividend or composition as declared by the relevant authority.

| 16.15 | Right to Consolidate Accounts |

Subject to compliance with Shariah principles, the Bank shall have the right to consolidate any or all accounts of the Customer with the Bank and such right may be exercised by the Bank following an occurrence of an Event of Default. The Customer shall not be entitled to require the release of any security provided to the Bank except on payment by the Customer to the Bank of all monies under the Facility or other account where the Customer is a guarantor or security provider.

| 16.16 | Terms of Letter of Offer Incorporated |

All the provisions, terms and conditions stated in the LO is an integral part of this Agreement. In the event of any conflict or discrepancy between this Agreement and the LO, the LO shall prevail for the purpose of interpretation and enforcement of this Agreement but only to the extent of such conflict or discrepancy.

The Customer hereby agrees that the Bank may, subject to compliance with Shariah principles, at any time after an Event of Default, combine or consolidate existing accounts of the Customer in credit in Ringgit or other currency. Where the account is a joint account with a third party, consent must be obtained from the third party. The purpose of the consolidation is to use the amount in credit to set-off any part of the Indebtedness. Where such combination or set-off requires the conversion of one currency into another currency the rate shall be calculated at the then prevailing spot rate of exchange of the Bank with prior notice of at least seven (7) calendar days to the Customer. Any set-off and/or combination or consolidation of existing accounts of the Customer is to be with prior notice of at least seven (7) calendar days to the Customer.

This Agreement is governed by the laws of Malaysia and the parties agree to submit to the jurisdiction of the Courts in Malaysia.

This Agreement shall be binding upon the successors-in-title assigns, heirs, personal representatives of the Customer and on the successors-in-title and assigns of the Bank.

Individual/SME/Corporate

If:

| (i) | the Bank grants any additional financing facility at the request of the Customer; or |

| (ii) | the total monies and liabilities due and payable to the Bank shall at any time exceed the limit of the Facility for which the Security Documents have been stamped to secure, |

the Bank shall be at liberty at any time to upstamp this Agreement for the excess amount. Such monies paid by the Bank shall be payable on demand by the Customer. Subject to compliance with Shariah principles, the Bank shall have the right to debit any account of the Customer with the Bank for that purpose. Such monies shall be secured under the Security Documents in addition to the monies secured with the same priority and shall be subject to the applicable compensation for late payment.

Any sum set out payable by any party to any other party in this Agreement shall be exclusive of any tax. The Bank’s charges also exclude any tax. However, if in future such a service tax is imposed, the Bank will be entitled to recover from the Customer any tax that the Bank is required by law to collect.

| 16.22 | Whistle-Blowing & Business Ethics |

| (a) | The Customer shall, as soon as reasonably possible, inform any of the officers of the Bank in writing, upon having knowledge of any director, officer or employee of the Bank, asking for or receiving from the Customer or its Affiliates, any Gratification in relation to this Agreement, and the Customer or its Affiliates knows that such Gratification is not for the benefit of the Bank. |

| (b) | The Customer undertakes that neither it nor its Affiliate nor anyone acting on its direction or authority shall, give or offer, or agree to give or offer, any Gratification in relation to this Agreement as an inducement or reward to any director, officer or employee of the Bank or any other person, for doing or refrain from doing any act under this Agreement. |

| (c) | In the event there is evidence that the Customer, its Affiliate or anyone acting under its direction or authority is in breach of clause (a) or (b) above, the Bank may terminate this Agreement by giving written notice to the Customer. Upon such termination, the Bank shall be entitled to claim all losses, costs, damages and expenses incurred by the Bank arising from such termination. |

| (d) | Subject to any written law and with the exception of written requests from the Customer’s internal auditors or lawyers for information required by any laws, the Bank shall keep confidential any information disclosed or received including the identity of the person giving the information and all the circumstances relating to the information. |

Individual/SME/Corporate

| (e) | The Customer shall also whistle-blow in the event of any malpractice or wrong-doing by the Bank’s staff or employees toward them or their staff, agents or contractors. |

| (f) | For the purpose of this clause: |

“Affiliate” means in relation to the Customer, any person or entity owned and controlled by the Customer, or any person or entity that controls the Customer.

“Gratification” includes any gift, money, property or thing of value or any service, favour or other thing of value, or any service, favour or other intangible benefit or consideration of any kind, or any other similar advantage.

| 16.23 | Additional Provisions Applicable to the Facility |

The additional provisions set out in the schedules and appendices of this Agreement shall be read as part and parcel of this Agreement. The additional provisions shall be applicable in full force and effect in all respect as if the said provisions were spelt out and stated in this Agreement. In the event of any conflict or discrepancies between the additional provisions with this Agreement, the additional provisions shall prevail for interpretation and enforcement but only to the extent such conflict or discrepancies.

The transaction arising from this Agreement shall at all times be subject to all prevailing guidelines, procedures, terms, rules, directives, regulations (whether or not having the force of law) in order to ensure industry practices are met. In the event of any conflict or discrepancies between the guidelines, procedures, terms, rules, directives, regulations with the provisions of this Agreement, the guidelines, procedures, terms, rules, directives, and regulations shall prevail but only to the extent of the conflict or discrepancies.

| 16.25 | Foreign Exchange Administration Rules (FEA) |

The Customer shall comply with the provisions of the Islamic Financial Services Act, 2013, the Foreign Exchange Administration Rules issued by Bank Negara Malaysia and other applicable regulations, notices and guidelines. The Customer shall arrange, coordinate, manage and obtain all the necessary Consents required in connection with the execution, performance, validity or enforceability of the Transaction Documents.

This Agreement forms part of the several instruments employed in one transaction within the meaning of Section 4(3) of the Stamp Act 1949 [Act 378] to secure the payment of the Indebtedness and all other monies payable by the Customer to the Bank. For the purpose of the said section, this Agreement shall be considered as the principal instrument and other documents shall be considered as subsidiary or auxiliary instrument(s).

[End of Clauses]

Individual/SME/Corporate

Individual/SME/Corporate

SCHEDULE 1

Main Terms and Particulars of Facility

| Item | Description | Particulars |

| 1. | Customer | [Name of Customer: | ]SAGTEC GROUP SDN. BHD. |

| | | [Company number: | ]201801021489 (1283508-P) |

| | | [Registered address: | ]181, Leboh Unta, Taman |

| | | | Berkeley, 41150 Klang, Selangor |

| | | |

| 2. | Letter of Offer | 16th July 2021 |

| | | |

| 3. | Security Party | [Name of Security Party:] |

| | | [Company number: ] |

| | | [Registered address: ] |

| | | |

| | | [Name of Security Party: NG CHEN LOK (NRIC No. 870203-06-5701) of No. 64, Jalan Udang Gantung 8, Taman Megah, Kepong, 52100 Kuala Lumpur |

| | | |

| | | [Name of Security Party: SYARIKAT JAMINAN PEMBIAYAAN PERNIAGAAN (SJPP) |

SCHEDULE 2

TERMS AND CONDITIONS OF TAWARRUQ CASH LINE-i FACILITY

In this Schedule, each of the following expressions has, except where the context otherwise requires, the meaning shown opposite it:

“Agency Fee” means the agency fee payable by the Customer to the Bank in the amount and/or in the manner as stated in the Letter of Offer.

“Bank’s Purchase Price” means the amount as stated in the Purchase Undertaking equivalent to the amount of the Facility.

“Bank’s Sale Price” means the amount as calculated based on the Ceiling Profit Rate which is payable by the Customer to the Bank on deferred payment term.

“Ceiling Profit Rate” means the ceiling profit rate as set out in the Letter of Offer.

“Commodity” means such Shariah compliant commodity acceptable to the Bank as particularly described in the Murabahah Sale Contract or as referred to in the Murabahah Sale Confirmation (as the case maybe).

“Commodity Supplier” in relation to the Tawarruq Transaction, means the commodity supplier as acceptable to the Bank.

“Effective Profit Rate” means the effective profit rate as set out in the Letter of Offer.

“Facility Transaction” means Tawarruq Transaction.

“Letter of Agency” in relation to the Tawarruq Transaction, means the letter of agency issued by the Customer in favour of the Bank in the form as set out in Annexure 3 of this Schedule or any other form acceptable to the Bank duly completed.

“Murabahah Sale Confirmation” means the confirmation in writing issued by the Bank to signify the conclusion of the Tawarruq Transaction subject to the terms of this Agreement.

“Murabahah Sale Contract” in relation to the Tawarruq Transaction, means the murabahah sale contract entered into between the Bank and the Customer in the form as set out in Annexure 2 of this Schedule or any other form acceptable to the Bank duly completed.

“Purchase Undertaking” in relation to the Tawarruq Transaction, means the letter of purchase undertaking issued by the Customer in favour of the Bank in the form as set out in Annexure 1 of this Schedule or any other form acceptable to the Bank duly completed.

“Tawarruq Transaction” means the transactions as stipulated under Clause 2 of this Schedule.

| (a) | The Customer shall enter into the Tawarruq Transaction prior to disbursement of the Facility. |

| (b) | In accordance with the Shariah concept of Tawarruq, the Tawarruq Transaction as follows shall take place: |

| (i) | Pursuant to the Purchase Undertaking, the Bank will, purchase the Commodity from Commodity Supplier at the Bank’s Purchase Price; |

| (ii) | Pursuant to the Murabahah Sale Contract (if applicable), the Bank will, at the request of the Customer, sell the Commodity to the Customer at the Bank’s Sale Price on deferred payment terms; and |

| (iii) | Pursuant to the Letter of Agency, the Customer will appoint the Bank as agent to act for and on behalf of the Customer to sell and conclude the sale of the Commodity to the Commodity Supplier (who shall not be the same commodity supplier in Clause 2(b)(i) above, except where the sale is on random basis) at the Bank’s Purchase Price. |

| (iv) | In accordance with the Letter of Agency, the Bank, acting as agent of the Customer, will sell the Commodity to the Commodity Supplier (who shall not be the same commodity supplier in Clause 2(b)(i) above, except where the sale is on random basis) at the Bank’s Purchase Price which is equivalent to the amount of the Facility. The proceeds from the sale will be made available to the Customer subject to the terms and conditions of the Facility. |

| (v) | Alternatively, the sale of the Commodity by the Bank to the Customer may be concluded by way of verbal contract as follows:- |

| (aa) | the sale of the commodity will be concluded verbally between the Bank and the Customer; |

| (bb) | upon conclusion of the verbal murabahah sale transaction of the Commodity, the Bank will issue confirmation of murabahah sale transaction which will provide the agreed Bank’s Sale Price payable on deferred payment term; and |

| (cc) | if the parties conclude the murabahah sale transaction by way of verbal contract, the parties are no longer required to enter into the Murabahah Sale Contract. |

| (c) | In relation to the agency created under the Letter of Agency, the Customer shall pay to the Bank the Agency Fee subject to the terms and conditions as stated in the Letter of Offer and the Letter of Agency. |

| (a) | The Facility will be made available for utilisation into a designated current account-i of the Customer with the Bank (“Account”). |

| (b) | The utilisation of such amount from the Account shall be effected from time to time by cheques drawn on the Bank by the Customer or by such other modes as may be agreed to between the Customer and the Bank from time to time. |

| (c) | The availability of the Facility in the Account in the above stated manner by the Bank shall be deemed to be effective payment of the same to the Customer of the Bank’s Purchase Price. |

| 3.2 | Payment by the Customer |

| (a) | The Customer shall pay to the Bank the Bank’s Sale Price in the amount, at the time and in the manner as specified in Clause (b) below or any other manner as determined by the Bank from time to time with prior notice to the Customer. |

| (b) | Unless otherwise provided in the Murabahah Sale Contract or the Murabahah Sale Confirmation (as the case maybe), the Customer agrees that the payment of the Bank’s Sale Price shall be effected as follows:- |

| (aa) | The profit margin under the Bank’s Sale Price shall be realized on a monthly basis by debiting the Account as long as it is still within the drawing limit; and |

| (bb) | If the Account is already fully utilized, the Customer shall be required to service the monthly profit through payments made directly to the Bank. |

The principal portion of the Bank’s Sale Price shall be payable in one lump sum at the end of the Tenure.

| (c) | The Bank’s Sale Price is calculated based on the Ceiling Profit Rate. However, the monthly payment of the Bank’s Sale Price shall be calculated based on the Effective Profit Rate which will not exceed the Ceiling Profit Rate. The Bank shall grant rebate for the differential between the Ceiling Profit Rate and Effective Profit Rate. |

| (d) | Where any payment is due to be made by the Customer under this Agreement on a day which is not a Business Day, then in such case, the due date for payment shall be made on the immediately preceding Business Day. |

| 3.3 | Review and Renewal of Facility |

| (a) | The Facility is granted conditional upon the Customer conducting the Account with the Bank satisfactorily at all times. |

| (b) | The Facility shall be subject to review from time to time in the manner as determined by the Bank. |

| (c) | Pursuant to the review, the Bank shall have the right, subject to Shariah principle, to terminate the Facility, accelerate the Bank’s Sale Price and/or vary the terms of the Facility with twenty-one (21) calendar days prior notice to the Customer. |

| (d) | If the Customer is not agreeable to the amended terms and conditions of this Agreement, the Customer shall notify the Bank in writing of the same within twenty-one (21) calendar days from the date of notice by the Bank. |

| (e) | In the event the Customer continues to maintain the Facility, twenty-one (21) calendar days after the notice of any amendment to the terms and conditions of this Agreement by the Bank, the Customer shall be considered to have accepted the amendments to the terms and conditions of this Agreement. |

| (f) | Notwithstanding all the above or the tenure of the Facility, the entire Facility shall become due and payable on demand. |

| (g) | The Bank may at its discretion, upon request by the Customer to renew the Facility, grant a renewal of the Facility subject to the new Tenure and upon such terms and conditions as may be deemed fit by the Bank. |

| (h) | On such renewal, all proceeds of the new or renewed Facility shall first be applied towards the payment of all amounts then outstanding and due to the Bank under the existing facility without further notice or demand. |

| (i) | Any request for renewal may be made by the Customer within the period as determined by the Bank from time to time prior to the maturity of the existing facility in the form substantially set out in Annexure 4 of this Schedule or any other form acceptable to the Bank. |

| (j) | Any renewal, once approved by the Bank, shall be affected by the Customer and the Bank executing the fresh Tawarruq Transaction. |

| (a) | The Bank shall grant rebate to the Customer if any of the following shall occur: |

| (i) | The Customer makes early settlement or early redemption, including those arising from prepayments; |

| (ii) | The Customer makes settlement of the original financing contract due to financing restructuring exercise; |

| (iii) | The Customer makes settlement of the Facility in the case of default; or |

| (iv) | The Customer makes settlement of the Facility in the event of termination or cancellation of financing before the maturity date. |

| (b) | Rebate shall be calculated based on the following formula: |

Deferred profit (at the point of settlement of financing) - Early Settlement Charges (if any).

| (ii) | For non-delivery/non-possession of asset |

Deferred profit (at the point of settlement of financing) + Undisbursed principal or Cost of Purchase - Early Settlement Charges(if any).

| (c) | Rebate shall not be construed in any manner as cash rebate payable to the Customer, but shall be reflected as a reduction in the profit element of the installment of the Bank’s Sale Price. |

| (d) | Rebate shall only be granted in the manner as determined by the Bank upon receipt of the settlement/redemption sum. |

| | 3.5 | Changes in Circumstances |

Where any one or more of the following occur:

| (a) | the introduction, imposition or variation of any law, order, rule, regulation or official directive (whether or not having the force of law); or |

| (b) | any change in the interpretation or application any law, order, rule, regulation or official directive (whether or not having the force of law); or |

| (c) | any compliance with any directive, guideline, circular, note or request (whether or not having the force of law) from or agreement with or requirement of BNM or other fiscal, monetary or other authority or agency, |

| (d) | makes it unlawful or impractical without breaching any such law, order, rule, regulation or official directive for the Bank to maintain, fund or give effect to its obligations under this Agreement, then – |

| (i) | the Bank’s obligation (if any) in respect of any future availability of the Facility shall forthwith be terminated and the Facility shall be cancelled to such extent; and |

| (ii) | the Customer shall upon being so notified, be obliged to pre-pay the Bank’s Sale Price or any part of the same together with any amount due under the Facility on such date as the Bank shall certify to be necessary to comply with such law, order, rule or regulation. |

If–

| (a) | any part of the Customer’s assets shall be acquired, seized or otherwise appropriated or nationalised; or |

| (b) | the Customer shall have been prevented from exercising his normal control and possession over the Customer’s assets, |

by any person acting or purporting to act under the authority of the government, then –

| (i) | any compensation received by the Customer arising from such events described in sub-paragraphs (a) and (b) above shall first be used to pay all amount due under the Facility; or |

| (ii) | unless the Customer can provide evidence that the Customer has the ability to perform its obligations under this Agreement to the satisfaction of the Bank, the Bank may, at its discretion, terminate the Facility with prior notice of twenty-one (21) calendar days to the Customer and Customer shall then be obliged to pay the Bank’s Sale Price together with any other sum due under the Facility. |

Any notification by the Bank concerning any of the matters referred to in Clause 3.5.1 and 3.5.2 above shall, save for any obvious error be conclusive and binding on the Customer.

The Customer shall at all times fully indemnify and keep the Bank indemnified against all and any action, proceeding, claim, expense, loss, damage or liability which the Bank may incur as a consequence of or arising from or connected to the Customer’s control, possession or use of the Commodity, including but not limited to any damage or injury to persons or property and the costs and liabilities arising from such claims.

ANNEXURE 1

Form of Purchase Undertaking

Letterhead of the Customer

Date:

| To: | Affin Islamic Bank Berhad |

Dear Sirs,

PURCHASE UNDERTAKING

| Customer: | ___________ (“Customer”) |

| Facility: | ___________ from Affin Islamic Bank Berhad (“Bank”) (“Facility”) |

| Facility Agreement: | Master Facilities Agreement dated ___________ entered into between the Customer and Affin Islamic Bank Berhad (“Facility Agreement”) |

We refer to the Facility Agreement. All capitalised terms defined in the Facility Agreement shall have the same meanings when used in this Purchase Undertaking.

| 1. | Pursuant to the Facility Agreement, the Bank has agreed at our request to make available or continue to make available the Facility to us. It is one of the conditions for the granting of the Facility by the Bank that we execute this undertaking. |

| 2. | We irrevocably undertake that upon completion of your purchase from the Commodity Supplier of the Commodity at the Bank’s Purchase Price on the Purchase Date, we will purchase the Commodity from you at the Bank’s Sale Price on the following terms: |

Commodity: | Any Shariah compliant commodity. |

| Bank’s Purchase Price: | RM |

| Purchase Date: | |

| Bank’s Sale Price: | RM |

| Tenure: | |

| 3. | We also irrevocably undertake to execute the relevant document(s) (in connection with the purchase of the Commodity) with you and to promptly deliver the same to you. |

| 4. | In the event we refuse to honour our undertaking to purchase the Commodity and/or to execute the relevant document(s) (in connection with the purchase of the Commodity), we shall compensate the Bank based on the Bank’s Purchase Price together with any cost incurred by the Bank incidental to the purchase of the Commodity. |

| 5. | This undertaking shall be automatically revoked upon full satisfaction or cancellation of the Facility. |

| 6. | Pursuant to Paragraph 6 of the General Exemptions of the First Schedule of the Stamp Act 1949 to which this Purchase Undertaking is an additional instrument strictly required for the purpose of compliance with the Shariah Principle, this Purchase Undertaking is exempted from stamp duty. |

Thank you.

REMINDER: The Customer is hereby reminded to read and understand the terms and conditions of this Purchase Undertaking before signing below. In the event there are any terms and conditions in this Purchase Undertaking that the Customer does not understand, the Customer is hereby advised to discuss further with the Bank’s staff, representative or agent before signing below.

For and on behalf of

insert name of customer

___________________

Authorized Signatory

ANNEXURE 2

Form of Murabahah Sale Contract

(This Murabahah Sale Contract is not required to be executed if the Customer and the Bank enter into the verbal contract)

DATED:

THIS MURABAHAH SALE CONTRACT is made between the following parties:

| (1) | AFFIN ISLAMIC BANK BERHAD (“Bank”); and |

| (2) | The party as stated Item 1 of the Appendix to this Murabahah Sale Contract, as represented by the Bank, as agent (“Customer”). |

WHEREAS:

| (A) | Pursuant to the Purchase Undertaking dated the day and year as stated in Item 2 of the Appendix to this Murabahah Sale Contract (“Purchase Undertaking”), the Bank has purchased the Commodity as stated in Item 3 of the Appendix to this Murabahah Sale Contract (“Commodity”) from a commodity supplier at the Bank’s Purchase Price as stated in Item 4 of the Appendix to this Murabahah Sale Contract (“Bank’s Purchase Price”) subject to the terms of the Purchase Undertaking. |

| (B) | Further and pursuant to the Purchase Undertaking, the Customer has irrevocably agreed and undertaken to purchase from the Bank the Commodity at the agreed sale price as set out in Item 5 of the Appendix to this Murabahah Sale Contract (“Bank’s Sale Price”), payable on deferred terms subject to the terms of this Murabahah Sale Contract. |

NOW IT IS AGREED as follow:

| 1. | DEFINITIONS AND INTERPRETATION |

In this Murabahah Sale Contract, unless the context otherwise requires and save as specifically defined in this Murabahah Sale Contract, words and expressions as defined in the Master Facilities Agreement executed between the Customer and the Bank in relation to this Murabahah Sale Contract (“Facility Agreement”), shall have the same meaning when used in this Murabahah Sale Contract. Further, in this Murabahah Sale Contract, the following terms and expression shall have the meanings set opposite them:

“Bank’s Sale Price” | the applicable selling price in respect of the Commodity, as set out in Item 5 of the Appendix to this Murabahah Sale Contract. |

“Commodity” | the Shariah compliant Commodity as described in Item 3 of the Appendix to this Murabahah Sale Contract. |

“Purchase Undertaking” | the purchase order delivered by the Customer to the Bank as described in Item 2 of the Appendix to this Murabahah Sale Contract. |

| 1.2 | Construction and interpretation |

Except where the context otherwise requires, any reference to construction of certain words and interpretation or certain words or phrases as defined in the Facility Agreement, shall have the same meaning when used in this Murabahah Sale Contract.

The Bank sells, and the Customer purchases, the Commodity at the Bank’s Sale Price payable in the manner as agreed between both the Customer and the Bank and subject to the terms of this Murabahah Sale Contract.

| 3.1 | Transfer of ownership and risk |

The ownership and risk of the Commodity shall pass from the Bank to the Customer upon the execution of this Murabahah Sale Contract.

The Commodity is sold by the Bank to the Customer on an “as is where is” basis.

The Bank does not and shall not be deemed to give any warranty or representation in relation to the Commodity whether arising by implication, by common law, by statute or otherwise and without prejudice to the generality of the foregoing, any such warranty or representation is expressly excluded to the extent permitted by law.

The Customer waives any claims it may have against the Bank in respect of any loss which the Customer may suffer by reason of, or arising out of or in connection with this Murabahah Sale Contract or otherwise in connection with any of the Commodity other than with respect to losses, claims, damages or liabilities finally judicially determined to have resulted primarily from the negligence or misconduct of the Bank. In particular, the Customer shall have no remedy against the Bank in respect of the quality, condition, quantity, description, title or otherwise of the Commodity.

This Murabahah Sale Contract may be executed in counterparts (including by facsimile transmission) and this has the same effect as if the signatures on the counterparts were on a single copy of this Murabahah Sale Contract.

| 5. | INCORPORATION OF FACILITY AGREEMENT |

The Parties agree that the terms and conditions of the Facility Agreement are deemed incorporated into this Murabahah Sale Contract which shall form part of this Murabahah Sale Contract. In the event of inconsistency between the Facility Agreement and the Murabahah Sale Contract, the terms of this Murabahah Sale Contract shall prevail for the purpose of interpretation and enforcement of this Murabahah Sale Contract.

| (a) | IT IS DECLARED THAT this Murabahah Sale Contract constitute one of the several instruments relating to Islamic facilities where pursuant to Section 4(3) of the Stamp Act, 1949, the Facility Agreement shall be deemed as the principal instrument and this Murabahah Sale Contract shall be deemed as the subsidiary instrument. |

| (b) | Pursuant to Paragraph 6 of the General Exemptions of the First Schedule of the Stamp Act 1949 to which this Murabahah Sale Contract is an additional instrument strictly required for the purpose of compliance with the Shariah Principle, this Murabahah Sale Contract is exempted from stamp duty. |

[End of clauses]