Exhibit 10.16

Dated this 28 day of 03, 2022

Given By

NG CHEN LOK

NRIC: 870203065701

(“Guarantor(s)”)

In Favor Of

CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD

197201000831 (12441-M)

(“CGC”)

GUARANTEE AGREEMENT

BY INDIVIDUALS / COMPANIES/

REGISTERED BUSINESS/

SOCIETY/PROFESSIONAL BODY/

CO-OPERATIVE

GUARANTEE AGREEMENT

(By Individuals/companies/registered business/Society/Professional Body/Co-operative)

| | | RECITALS |

| ARTICLE 1 | | DEFINITIONS AND INTERPRETATION |

| ARTICLE 2 | | INCORPORATION OF LETTER OF OFFER |

| ARTICLE 3 | | GUARANTEE |

| ARTICLE4 | | INDEMNITY |

| ARTICLE 5 | | LIABILITY |

| | Section 5.0 | Continuing Liability of the Guarantor(s) |

| ARTICLE 6 | | DISCRETION |

| | Section 6.0 | Indulgence |

| ARTICLE 7 | | SECURITY |

| | Section 7.0 | Securities held by CGC |

| ARTICLE 8 | | SUSPENSE ACCOUNT |

| | Section 8.0 | Suspense Account |

| ARTICLE 9 | | NO COMPETITION WITH CGC |

| | Section 9.0 | No Competition with CGC |

| ARTICLE 10 | | RIGHT OF SET-OFF |

| ARTICLE 11 | | WARRANTIES |

| | Section 11.0 | Representation of Warranties by Guarantor (s) |

| | Section 11.1 | Repetition |

| | Section 11.2 | No Prejudice To CGC’s Rights |

| ARTICLE 12 | | UNDERTAKINGS OF THE GUARANTOR |

| | Section 12.0 | Undertakings of the Guarantors |

| ARTICLE 13 | | MULTIPLE GUARANTORS |

| | Section 13.0 | Multiple Guarantors |

| ARTICLE 14 | | INDEBTEDNESS |

| | Section 14.0 | Certificate of Indebtedness |

| ARTICLE 15 | | ASSURANCE |

| | Section 15.0 | Further Assurance |

| ARTICLE 16 | | RIGHT TO RECOVER |

| | Section 16.0 | CGC’s Right To Recover Not To Be Affected |

| ARTICLE 17 | | PAYMENT BY GUARANTOR(S) |

| ARTICLE 18 | | RIGHT CUMULATIVE |

| ARTICLE 19 | | SEVERABILITY |

| ARTICLE 20 | | JURISDICTION |

| | Section 20.0 | Law and Jurisdiction |

| ARTICLE 21 | | LEGAL PROCESS |

| | Section 21.0 | Service of Legal Process |

| ARTICLE 22 | | NOTICES |

| ARTICLE 23 | | PRINCIPAL/SECONDARY INSTRUMENTS |

| | Section 23.0 | Principal/Secondary Instruments |

| ARTICLE 24 | | INDEPENDENT LEGAL ADVICE |

| ARTICLE 25 | | SCHEDULES |

GUARANTEE AGREEMENT

By Individuals/Companies

AN AGREEMENT made the day and year stated in Section 1 of the First Schedule hereto by the party whose name and description are stated in Section 3 of the First Schedule hereto (hereinafter referred to as “the Guarantor(s)”) in favour of CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD [Registration No. 197201000831 (12441-M)], a company incorporated in Malaysia and having its registered office at Level 14, Bangunan CGC, Kelana Business Centre, 97, Jalan SS7/2, 47301 Petaling Jaya, Selangor Darul Ehsan hereto (hereinafter referred to as “CGC”).

RECITALS

WHEREAS:-

| I. | The party whose name and particulars are set out in Section 2 of the First Schedule hereto (hereinafter called the “Customer” which expression shall, where the context so permits, include his or her or its heirs, personal representatives, estates, successors in title and permitted assigns) had applied to CGC for a working capital financing facility and CGC has granted and made available or agreed to grant and make available or to continue to grant and make available to the Customer financing facility at the amount stated in Section 4 of the First Schedule hereto (hereinafter referred to as “the Financing Facility”) (in accordance with the finance procedures of CGC and under the Islamic principle of Tawarruq for the Shariah compliant purpose (hereinafter referred to as “the Purpose”) and CGC has approved the said application subject to the terms and conditions hereinafter appearing. |

| II. | The Customer had entered into a Tawarruq Financing-i Facility made between CGC and the Customer by the acceptance of the letter of offer dated on the date more particularly identified in Section 5(a) of the First Schedule and accepted on the date more particularly identified in Section 5(b) of the First Schedule (hereinafter referred to as “the Letter of Offer”). |

| IlI. | By the terms of the Letter of Offer, it was agreed, inter alia, that the Guarantor(s) shall execute this Guarantee to guarantee the Guaranteed Amounts (as defined herein) and stated in Section 6 of the First Schedule. |

NOW THIS GUARANTEE WITNESSETH as follows -

ARTICLE I

DEFINITIONS AND INTERPRETATION

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Except where the context otherwise requires, the terms and expressions defined in the Letter of Offer and other Security Documents and not otherwise defined herein bear the same meanings where used in this Guarantee, and the following words and expressions where used in this Guarantee bear the meanings respectively set opposite them :- |

| | “CGC” | CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD [Registration No. 197201000831 (12441-M)], a company incorporated in Malaysia and having its registered office at Level 14, Bangunan CGC, Kelana Business Centre, 97, Jalan SS7/2, 47301 Petaling Jaya, Selangor Darul Ehsan as specified in Section 4 of the First Schedule hereto and includes its successors in title and assigns; |

| | | |

| | “Customer” | As specified in Section 2 of the First Schedule hereto and includes its successors-in-title and its permitted assigns; |

| | | |

| | “Financing Facility” | The financing facility under the principle of Tawarruq for the Shariah compliant purpose at the amount stated in Section 4 of the First Schedule to be made available to the Customer by CGC under the Letter of Offer referred to in Section 5 of the First Schedule hereof and includes any balance or part thereof; |

| | | |

| | “Letter of Offer” | The letter of offer dated on the date more particularly identified in Section 5(a) of the First Schedule and accepted on the date more particularly identified in Section 5(b) of the First Schedule executed between the Customer and CGC; |

| | | |

| | “Guarantor(s)” | As specified in Section 3 of the First Schedule of this Agreement and includes their respective personal representatives, heirs and successors-in-title; |

| | | |

| | “Guaranteed Amount” | the payment of the CGC’s Sale Price including the aggregate of all monies whether principal, profit, additional profit, costs, charges, commission or otherwise outstanding or payable or agreed to be payable by the Customer or any Security Party from time to time whether solely or jointly with any other persons and whether as principal debtor or surety and includes all liabilities and obligations whether present or future or actual or contingent for the payment of all monies by the Customer or any Security Party whatsoever and howsoever due and/or payable under the Security Documents at the amount as stated in Section 6 of the First Schedule herein; |

| | “Indebtedness” | the commitment of the Customer as to the CGC’s Sale Price equivalent to the Guaranteed Amounts to be paid under the Letter of Offer and all other moneys payable by the Customer pursuant to the Letter of Offer and other Security Documents relating to the Financing Facility (whether in respect of any installment, prepayment, premium, costs, expenses and other charges); |

| | | |

| | “Security Documents” | The Letter of Offer, this Guarantee and any other security documents as shall be applicable; |

| | | | |

| | “Security Party” | Subject to applicability: |

| | | | |

| | | 1. | The Customer in relation to the Letter of Offer; and The Guarantor(s)(s) in relation to this Guarantee; and |

| | | | |

| | | 2. | Any party or parties providing or which shall hereafter |

| | | | |

| | | 3. | from time to time provide any security or guarantee in favour of CGC to secure the payment of the Indebtedness. |

| 1.2 | The headings in this Guarantee are inserted for convenience only and shall not be taken read and construed as essential parts of this Guarantee. References to Clauses are to be construed as references to Clauses of this Guarantee. All references to provisions of statutes include such provisions as modified, re-certified or re-enacted. Words applicable to natural person include any body of persons, company, corporation, firm or partnership corporate or unincorporated and vice versa. Words importing the masculine gender shall include the feminine and neuter genders and vice versa. Words importing in the singular number shall include the plural number and vice versa. Where two or more persons or parties are included or comprised in any expression, agreement, covenant, term, stipulation and undertaking expressed to be made to such persons or parties shall, unless expressly stated to the contrary, be enforceable by them jointly and severally and agreements, covenants, terms, stipulations and undertakings expressed to be made by or on the part of such persons or parties shall be deemed to be made by and binding upon such persons or parties jointly and severally. |

ARTICLE 2

INCORPORATION OF FACILITY AGREEMENT

| 2.0 | TERMS OF FACILITY AGREEMENT INCORPORATED INTO THIS GUARANTEE |

All the provisions of the Letter of Offer are, whether repeated herein or not, incorporated into and form part of this Guarantee and all representations, warranties and covenants made therein by the Customer shall be deemed to have been made by the Guarantor(s) herein and references to the Customer in the Letter of Offer shall be read as if they were references to the Guarantor(s) in this Guarantee. Subject to such alterations or variations where necessary to make the provisions of the Letter of Offer consistent with the provisions of this Guarantee, in the event of any conflict or discrepancy between the provisions of the Letter of Offer and any of the provisions of this Guarantee, the provisions of this Guarantee shall prevail for the purposes of interpretation and enforcement of this Guarantee, but only to the extent of such inconsistency, conflict or discrepancy.

ARTICLE 3

GUARANTEE

| 3.1 | In consideration of CGC entering into the Letter of Offer with the Customer to make available or continue to make available the Financing Facility upon the terms and subject to the conditions therein contained to the Customer at the request of the Customer and the Guarantor(s), the Guarantor(s) hereby unconditionally and irrevocably guarantees, as a continuing obligations, the payment to CGC on demand all the Guaranteed Amounts together with profit commission discount and all other banking charges and all costs charges and other expenses which CGC may incur in respect of perfecting the present guarantee or in enforcing or obtaining payment of such monies or in defending prosecuting or otherwise howsoever taking part in and also other payment and sums hereinafter mentioned or stipulated and other usual financing charges. |

| 3.2 | In the event of the Customer failing to observe and perform any of the covenants, undertakings, stipulations and terms contained in the Security Documents on the part of the Customer to be observed and performed, CGC shall, notwithstanding anything to the contrary contained in the Security Documents, be entitled to demand payment in full from the Guarantor(s) of the whole of the Guaranteed Amounts including the CGC Sale Price or such amount as may be outstanding including all costs and charges that are payable by the Customer pursuant to the Security Documents. |

ARTICLE 4

INDEMNITY

| 4.1 | As a separate, additional and continuing obligation, the Guarantor(s) unconditionally and irrevocably undertakes with CGC that, should the Guaranteed Amounts not be recoverable from the Guarantor(s) under Section 3.1 for any reason whatsoever (including, but not without prejudice to the generality of the foregoing, by reason of any provision of the Facility Agreement being or becoming void, unenforceable or otherwise invalid under applicable law) then, notwithstanding that may have been known to CGC, the Guarantor(s) will, as a sole, original independent obligor, upon first written demand by CGC under Section 3.1, make payment of the Guaranteed Amounts by way of a full indemnity and otherwise in such manner as is provided for under the Letter of Offeror this Guarantee. |

| 4.2 | The Guarantor(s) hereby further agree to undertake, confirm and covenant with CGC that, without derogation from any of the Guarantor(s)' obligations to CGC provided in this Guarantee, the Guarantor(s) will jointly and severally at all times indemnify and keep CGC indemnified against all losses actions proceedings claims demands costs damages and expenses (including legal costs on a full indemnity basis) which CGC may incur suffer or sustain by reason of any breach by the Customer of such covenants conditions or stipulations contained in the Security Documents. |

ARTICLE 5

LIABILITY

| 5.0 | CONTINUING LIABILITY OF THE GUARANTOR(S) |

| 5.1 | The Guarantor(s) hereby agrees and declares that this Guarantee is expressly intended to be and shall be a continuing guarantee for the payment of the Guaranteed Amounts until the Guaranteed Amounts, including contingent liabilities, have been fully settled and the expired guarantees/bonds/indemnities, documentary or other credits or any instruments whatever from time to time entered into by CGC for the account of the Customer and shall be irrevocable and the obligations of the Guarantor(s) shall not be discharged except by performance and then only to the extent of such performance. Such obligations shall not be subject to any prior notice to or demand to the Guarantor(s) with regard to any default of the Customer and shall not be impaired by any extension of time, forbearance or concession given to the Customer or any assertion of or failure to assert any right or remedy against the Customer or in respect of any security created by or in pursuance of the provisions of the Security Documents and/or any modifications or amplifications of the provisions contemplated by the terms thereof or any failure of the Customer to comply with any requirements of any law regulations or order in Malaysia or of any political sub-division or agency thereof. |

| 5.2 | Without prejudice to the generality of Clause 5.1, this Guarantee shall not be considered as satisfied by any intermediate payment or satisfaction of the whole or part of any sum or sums of money due and payable under the Letter of Offerbut shall be a continuing security and shall extend to cover any sum or sums of money whatsoever which shall for the time being constitute the amount due and payable from the Customer to CGC under the Letter of Offertogether with costs, charges and all other sums whatsoever payable by the Customer to CGC under or pursuant to the Security Documents. |

| 5.3 | (a) | Without prejudice to the rights of CGC against the Customer under the Letter of Offeror the Security Documents, as principal debtors, the Guarantor(s) shall, as between CGC on the one hand and the Guarantor(s) on the other hand be deemed principal debtors in respect of the Guarantor(s)' obligations hereunder and not be discharged nor shall the Guarantor(s)' liabilities be affected by any invalidity, irregularity or unenforceability of the Letter of Offeror any of the Security Documents. CGC shall, without reference to the Guarantor(s), be at liberty but shall not be bound to resort for the benefit of CGC to any other means of payment at any time as CGC may think fit without thereby diminishing the Guarantor(s)' liabilities and CGC may, so long as any moneys remain due and payable and unpaid by the Customer to CGC under the Letter of Offeror any of the Security Documents, exercise CGC's rights under this Guarantee for the payment of any such moneys due and payable to CGC before or after resorting to other means of payment as CGC may think fit. In addition, CGC shall be at liberty to require payment by the Guarantor(s) jointly and severally of any such moneys due and payable to CGC without taking proceedings first to enforce such payment against the Customer. |

| (b) | The Guarantor(s) hereby agree and confirm that all sums of money which may not be recoverable from the Customer by reason of any legal limitation or disability or incapacity of the Customer including, but not limited to, any defect, informality or deficiency in obtaining Financing Facility by the Customer or in the exercise thereof which might be a defence between the Customer and CGC, shall nevertheless be recoverable from the Guarantor(s) as principal debtors. |

| 5.4 | The Guarantor(s) shall not be discharged or released from this Guarantee by any arrangement entered into or any composition accepted by CGC modifying its rights and remedies under the Security Documents whether with or without the assent of the Guarantor(s) or by any alteration in the obligations, terms, stipulations, covenants and undertakings contained in the Security Documents or by any forbearance whether as to payment time performance or otherwise. |

| 5.5 | This Guarantee shall not be determined and the liabilities and/or obligations of the Guarantor(s) shall subsist notwithstanding that the Customer may at law have no power or authority to obtain financing or that CGC may not have a legal right to claim as the case may be or that it becomes impossible to proceed against the Customer or for any defect or illegality in the Security Documents or in any of the terms and conditions thereof. |

| 5.6 | The liabilities and/or obligations of the Guarantor(s) created by this Guarantee shall continue to be valid and binding for all Shariah compliant purposes whatsoever notwithstanding any change by amalgamation, reconstruction or otherwise which may be made in the constitution of CGC and/or the Customer and it is hereby expressly declared that no change of any sort whatsoever in relation to or affecting the Customer or any of the Guarantor(s), whether by retirement, expulsion, death or admission of any new partner/director/shareholder shall in any way affect the liabilities and/or obligations created hereunder in relation to any transaction whatsoever whether past, present or future. |

| 5.7 | This Guarantee shall be binding on the successors-in-title and personal representatives of the Guarantor(s) and on the successors-in-title and assigns of CGC. Provided that no Guarantor(s) shall assign any of his liabilities or obligations hereunder without the prior consent of CGC in writing which consent may be given refused or withheld by CGC absolutely or conditionally at its sole and absolute discretion without giving any reasons therefore whatsoever. |

| 5.8 | If the Guarantor(s) is a body corporate and pursuant to a scheme of arrangement, merger, reconstruction or similar process a new or other body corporate succeeds to the liabilities of such body corporate, the provisions of this Guarantee shall continue to apply fully as if such new or other body corporate had been named as the Guarantor(s) herein. |

ARTICLE 6

DISCRETION

| 6.1 | CGC shall be at liberty without thereby affecting its rights against the Guarantor(s) under this Guarantee to grant to the Customer any time or indulgence for the payment of moneys due and payable to CGC or for the observance of any term, stipulation, covenant or undertaking on the part of the Customer to be observed and performed under the terms of the Security Documents or to vary or substitute the securities held by CGC or to release any such securities or any part thereof. |

| 6.2 | CGC shall have full power at its discretion to give time for payment or to make any other arrangements with any other person or persons or corporations without prejudice to this present Guarantee or any liability thereunder. |

| 6.3 | Independently of any other terms, conditions and stipulations herein, it is hereby expressly agreed and declared that the obligations of each Guarantor(s) hereunder shall not be affected by any act, omission, fact, circumstance, matter or thing which, but for this provision, might operate to release or otherwise any Guarantor(s) from his obligations hereunder, (to the extent that such Guarantor(s) shall be liable as a sole and principal debtor for all amounts demanded from that Guarantor(s) by CGC hereunder) including, without limitation, and whether known or not known to such Guarantor(s):- |

| (a) | the taking, variation, compromise, renewal or release of, or refusal or neglect to perfect or enforce any rights, remedies or securities against the Customer or any other person including any Guarantor(s); or |

| (b) | the granting of any other facilities or financing facilities by CGC to the Customer; or |

| (c) | any amendment to or variation of the terms of the Security Documents or security; or |

| (d) | any irregularity, unenforceability, illegality or invalidity of any obligations of the Customer, or any person, under any other security or document to the intent that any Guarantor(s)'s obligations under this Guarantee shall be construed accordingly as if there were no such irregularity, unenforceability, illegality or invalidity; or |

| (e) | the renewal or review of the Financing Facility in any manner and on such terms and conditions as CGC may deem fit; or |

| (f) | dealing with exchanging, releasing or modifying or abstaining from perfecting or enforcing any securities or rights it may now or at any time hereafter or from time to time have from or against the Customer or any other person; or |

| (g) | compound with the Customer or any other person or Guarantor(s), if any. |

And each Guarantor(s) hereby expressly consents to all or any of the events herein before provided and declares that no further consent shall be required from him in respect thereof.

ARTICLE 7

SECURITY

| 7.0 | SECURITIES HELD BY CGC |

| 7.1 | This Guarantee shall be in addition to and shall not be in any way prejudiced or affected by any other guarantee or any collateral or other security now or hereafter held by CGC for all or any part of the moneys hereby guaranteed nor shall such other guarantee or any collateral or other security or lien to which CGC may be otherwise entitled or the liability of any person or persons or corporation not parties hereto for all or any part of the moneys hereby secured be in anyway prejudiced or affected by this Guarantee. |

| 7.2 | The Guarantor(s) hereby declare that they have not received any security from the Customer for the giving of this Guarantee and agrees that they will not so long as this Guarantee shall remain in force and so long as any moneys under the Letter of Offerand other Security Documents remain outstanding or there is any claim by CGC against the Customer in respect of their liabilities hereunder without obtaining CGC 's prior written consent and each Guarantor(s) agrees that in the event of his taking such security the same shall be a security to CGC hereunder and shall be held in trust for CGC and forthwith be deposited with CGC and each Guarantor(s) hereby irrevocably appoints CGC to be his attorney for the purpose of doing all acts and executing in his name all documents to protect CGC 's interest in such security. |

| 7.3 | Each Guarantor(s) hereby expressly agrees with CGC to subordinate any facility advanced by him to the Customer and his rights as financier thereunder to the Indebtedness and to all the rights of CGC with respect to the Indebtedness. Without prejudice to the generality of the foregoing each Guarantor hereby undertakes to CGC that at all times during the continuance of the Indebtedness, he will not, without the prior written consent of CGC, demand or accept from the Customer payment, of any financing facilities advanced by the Guarantor(s) to the Customer or any part thereof and, in the event of the Guarantor(s) accepting such payment, the moneys so received shall be deemed to be received in trust for CGC and shall forthwith be paid over to CGC. |

| 7.4 | All moneys received from or on account of the Customer or from any other person or estate or from the realization of any security or otherwise for the purpose of being applied in reduction of the Indebtedness or other moneys due thereunder shall be treated for all purposes as payments in gross and not as appropriated or attributable to any specific part or item of the Indebtedness or other moneys due thereunder even if appropriated thereto by the person otherwise entitled so to appropriate. All securities now or at any time held by CGC shall be treated as securities for the Indebtedness and other moneys due. The Guarantor(s) will make no claim to any securities held by CGC or any part thereof unless and until the Guarantor(s) shall have paid to CGC all moneys due and payable from the Guarantor(s) under this Guarantee and CGC shall have received the full amount of the Indebtedness together with all other moneys due under the Security Documents. |

| 7.5 | Nothing contained in this Guarantee shall be deemed to render it obligatory upon CGC either at law or in equity to grant the Financing Facility or any part thereof or any other facility to the Customer and the Guarantor(s)' liabilities under this Guarantee shall not be discharged or released by virtue of CGC refusing to grant the Financing Facility or any part thereof or any other accommodation or facility whatsoever to the Customer. |

| 7.6 | The liabilities and obligations of the Guarantor(s) under this Guarantee shall remain in force notwithstanding any act, omission, neglect, event or matter whatsoever, except the proper and valid payment of all moneys whatsoever payable under this Guarantee and the performance and observance of all duties and obligations of the Guarantor(s) signed by CGC and without prejudice to its generality, the foregoing shall apply in relation to anything which would have discharged the Guarantor(s) (wholly or in part) or which would have afforded the Guarantor(s) any legal or equitable defence and in relation to any winding up or dissolution of or any change in construction or corporate identity or loss by the Customer or any other person. |

ARTICLE 8

SUSPENSE ACCOUNT

Any money received hereunder may be placed and kept to the credit of a non-interest bearing suspense account for so long as CGC may think fit without any obligation in the meantime to apply the same or any part thereof in or towards discharge of the amount of any moneys or liabilities due by the Customer to CGC under the Security Documents. Notwithstanding any such payment, in the event of any proceedings in or analogous to liquidation, composition in respect of the whole or any part of such moneys and liabilities shall be in the same manner as if this Guarantee had not been given.

ARTICLE 9

NO COMPETITION WITH CGC

| 9.0 | NO COMPETITION WITH CGC |

Until all moneys and liabilities due or incurred by the Customer for CGC shall have been discharged, no Guarantor(s) shall, by paying off any sum recoverable hereunder or by any other means or on any other ground, claim set-off or counter-claim against the Customer in respect of any liability on the part of such Guarantor(s) to the Customer or claim proof on competition with CGC in respect of any payment by such Guarantor(s) hereunder or be entitled to claim or have the benefit of any set-off, counter-claim proof against or dividend composition or payment by the Customer or the benefit of any other security which CGC may now or hereafter hold for any money or liabilities due or incurred by the Customer to CGC or to have any share therein.

ARTICLE 10

RIGHT OF SET-OFF

Where any moneys become payable by the Guarantor(s) to CGC, whether under this Guarantee or any one of the Security Documents, CGC shall be at liberty to set-off amount of such liability against any sum in any Guarantor(s)’ accounts with CGC and CGC may combine, consolidate or merge all or any of any Guarantor(s)’ accounts with and liabilities to CGC and set-off or transfer any sum standing to the credit of any such accounts in or towards the satisfaction of such Guarantor(s)’ liabilities as aforesaid at CGC’s discretion subject to prior notice given to the Guarantor(s).

ARTICLE 11

WARRANTIES

| 11.0 | REPRESENTATIONS AND WARRANTIES BY GUARANTOR(S) |

The Guarantor(s) hereby represents and warrants to CGC as follows:

| (a) | Contractual obligations: that the Financing Facility and this Guarantee when executed will constitute legal, valid and binding obligations of the Guarantor(s) enforceable in accordance with its terms; |

| (b) | Authorisations and consents: that all acts, conditions and things which are required or advisable to be done for or in connection with the execution, delivery, performance, legality or enforceability of this Guarantee in accordance with its terms have been done, performed and have happened in due and strict compliance with all applicable laws and regulations; |

| (c) | Proceedings: that there are no proceedings current or pending before any court or to the knowledge of the Guarantor(s) threatened against or affecting the Guarantor(s) and no pending proceedings are before any government agency or administrative body or to the knowledge of the Guarantor(s) threatened against the Guarantor(s) which if adversely determined would materially or adversely affect the financial condition or operation of the Guarantor(s) or impair the right to carry on the business of the Guarantor(s) substantially as now conducted or the ability of the Guarantor(s) to discharge the Indebtedness due hereunder or to perform its obligations under this Guarantee and to the best of the knowledge and belief of the Guarantor(s), the Guarantor(s) has complied with all applicable statutes and regulations of all government authorities having jurisdiction over the Guarantor(s); |

| (d) | Material Adverse Change: that there is no material adverse change in the financial condition, operating environment, management of the Guarantor(s) or other conditions which will materially affect the ability of the Guarantor(s) to perform the obligations of the Guarantor(s) under this Guarantee; |

| (e) | Where the Guarantor(s) is a Limited Company or other Corporation: |

| (i) | Status: that the Guarantor(s) is a company duly incorporated with limited liability and validly existing under the laws of Malaysia as a separate legal entity and has full power and authority to own assets and to carry on the business as it is now being carried out; |

| (ii) | Powers: that the execution, delivery and performance of this Guarantee and the Guarantor(s); (a) is or will when executed be within the corporate powers of the Guarantor(s); (b) has been duly authorised by all necessary governmental approvals; and (c) does not or will not contravene (i) any law or any contractual restriction or regulation or any order or decree of any governmental authority, agency or court binding on the Guarantor(s) or any licence, permit or consent by which the Guarantor(s) or any of its assets is bound or affected; or (ii) any provision of its Constitution or constituted documents; |

| (iii) | Dissolution: no steps have been taken or are being taken (a) to appoint a receiver or a receiver and manager or liquidator to take over or wind-up the Guarantor(s); (b) for any proposal by the Guarantor(s) to be placed under judicial management or to pass any resolution or make any application for the Guarantor(s) to be placed under judicial management; or (c) to propose to enter into or permit the entry of any arrangement or composition (voluntary or otherwise) with any creditors of the Guarantor(s); and no declaration has been made by any competent court or authority in respect of a moratorium on the payment of indebtedness or other suspension of payments generally (if applicable); |

| (iv) | No default: neither the signing nor delivery of this Guarantee nor the performance of any of the transactions contemplated herein will: |

| (a) | contravene or constitute a default under any provision contained in any agreement, instrument, law, judgment, order, licence, permit or consent by which the Guarantor(s) or any of its assets is bound or affected; or |

| (b) | cause any limitation on it or the powers of its directors, whether imposed by or contained in any document which contains or establishes its constitution or in any law, order, judgment, agreement, instrument or otherwise, to be exceeded; |

| (f) | Where the Guarantor(s) is a Natural Person or Individual: |

| (i) | Status: that the Guarantor(s) has the power or capacity to execute, deliver and perform the terms of this Guarantee; |

| (ii) | Powers: that the execution, delivery and performance of this Guarantor(s) (a) has been duly authorised by all necessary governmental approvals; and (b) does not or will not contravene any law or any contractual restriction or regulation or any order or decree of any governmental authority, agency or court binding on the Guarantor(s) or any licence, permit or consent by which the Guarantor(s) or any of his/her assets is bound or affected |

| (iii) | Bankruptcy: no bankruptcy proceedings have been commenced against the Guarantor(s); |

| (iv) | No default: neither the signing nor delivery of this Guarantee nor the performance of any of the transactions contemplated herein will contravene or constitute a default under any provision contained in any agreement, instrument, law, judgement, order, licence, permit or consent by which the Guarantor(s) or any of its assets is bound or affected. |

| (g) | Registration etc: no registration, recording, filing or notarisation of this Guarantee and no payment of any duty or tax (save for stamp duty in Malaysia) and no other action whatsoever is necessary or desirable to ensure the validity, enforceability or priority in Malaysia of the liabilities and obligations of the Guarantor(s) or the rights of CGC; |

| (h) | Material adverse effect: no event has occurred which constitutes, or that with the giving of notice and/or the lapse of time and/or a relevant determination would constitute, a contravention of, or default under, any agreement or instrument by which the Guarantor(s) or any of the Guarantor(s)’ assets is bound or affected, being a contravention or default which might either have an adverse effect on the business, assets or condition of the Guarantor(s) or adversely affect the Guarantor(s)’ ability to observe or perform the Guarantor(s)’ obligations under this Guarantee; |

| (i) | Payment of tax: all necessary returns have been delivered by or on behalf of the Guarantor(s) to the relevant taxation authorities and the Guarantor(s) is not in default in the payment of any taxes of a material amount, and no material claim is being asserted with respect to taxes which is not disclosed in the financial statements referred to in paragraph U) below (where the Guarantor(s) is a limited company or other corporation); |

| (j) | Financial statements: (where the Guarantor(s) is a limited company or other corporation), the audited financial statements (including the income statement and balance sheet) of the Guarantor(s) have been prepared on a basis consistently applied and give a true and fair view of the results of its operations for that year and the state of its affairs at the date, and in particular accurately disclose all the liabilities (actual or contingent) of the Guarantor(s); |

| (k) | Full disclosure: the Guarantor(s) has fully disclosed in writing to CGC all facts relating to the Guarantor(s) which the Guarantor(s) knows or should reasonably know and which are material for disclosure to CGC in context of the Financing Facility and the Facility Agreement; |

| (l) | the Guarantor(s) fully understands the nature and effect of this Guarantee and hereby acknowledges that the Guarantor(s) has not relied upon any representations, warranties or advice whatsoever expressly or impliedly made by CGC or its officers, employees or agents and hereby absolves CGC or its officers, employees or agents from any liability and/or responsibility in respect of any negligence, misrepresentation and/or misstatement. The Guarantor(s) further declares that the Guarantor(s) has read this Guarantee in its entirety, understands the nature and effect of the contents of this Guarantee and is signing this Guarantee of its own free will and consent; and |

| (m) | Commercial nature of transaction: that the transactions on the part of Guarantor(s) which are contemplated in this Guarantee represent transactions of a purely commercial nature by the Guarantor(s) and are not, in any sense, public or governmental acts. |

The Guarantor(s) hereby acknowledges that CGC has entered into this Guarantee on the basis of and in full reliance of the above representations and warranties and CGC agrees covenants undertakes and confirms that each of the representations and warranties contained in the preceding sub-section shall survive and continue to have full force and effect after the execution of this Guarantee. The Guarantor(s) hereby warrants to CGC that the above representations and warranties will be true and correct and fully observed on each date the Financing Facility is utilised until the Indebtedness due hereunder have been discharged and fully settled subject always the Financing Facility continues to be made available by CGC to the Customer.

| 11.2 | NO PREJUDICE TO CGC’S RIGHTS |

CGC’s rights and remedies in relation to any misrepresentation or breach of warranty shall not be prejudiced by any investigation by or on behalf of CGC into the affairs of the Guarantor(s) or by the execution or the performance of this Guarantee or by any other act or thing which may be done by or on behalf of CGC in connection with this Guarantor(s) or which might, apart from this section, prejudice such rights or remedies

ARTICLE 12

UNDERTAKINGS OF THE GUARANTOR

| 12.0 | UNDERTAKINGS OF THE GUARANTOR |

| 12.1 | The Guarantor(s) undertakes with CGC that from the date of this Guarantee until all its liabilities under this Guarantee have been discharged: |

| (a) | the liabilities of the Guarantor(s) under this Guarantee will rank at least equally and rateably (pari passu) in point of priority and security with all its other unsecured liabilities (both actual and contingent) except: |

| (i) | liabilities which are subject to liens or rights of set off arising in the normal course of trading and the aggregate amount of which is not material; and |

| (ii) | liabilities which are preferred solely by laws of Malaysia and not by reason of any security interest, and the Guarantor(s) shall not create or permit to exist over all or any part of its business or assets any security interest other than those permitted under this Section without the prior written consent of CGC; |

| (b) | it will deliver to CGC: |

| (i) | as soon as they become available (and in any event within one hundred and fifty (150) days after the end of each of its financial year) copies of its consolidated financial statements for the period which shall contain an income statement and a balance sheet and be audited and certified by a firm of independent auditors; |

| (ii) | within sixty (60) days after the end of each quarterly unaudited consolidated financial statements for that period which shall contain an income statement and a balance sheet and shall be accompanied by confirmation by the Guarantor(s) that the aforesaid quarterly consolidated financial statements have been prepared in accordance with generally accepted accounting principles in Malaysia and give a true and fair view of the results of its/their operations for those period(s); and |

| (iii) | promptly, such additional financial or other information as CGC may from time to time request; |

| (c) | the Guarantor(s) will maintain in full force and effect all relevant authorizations (governmental and otherwise) and will promptly obtain any further authorization which may become necessary to enable it to perform any of the transactions contemplated by this Guarantee; |

| (d) | the Guarantor(s) will immediately notify CGC upon becoming aware of the revocation or variation of any authorization; |

| (e) | if the Guarantor(s) becomes aware of the occurrence of an Event of Default it will forthwith notify CGC and provide CGC with full details of any steps which the Customer is taking, or is considering taking, in order to remedy or mitigate the effect of the Event of Default or otherwise in connection with it; |

| (f) | the Guarantor(s) will punctually pay all the Guaranteed Amounts when due and payable except for amounts which the Guarantor(s) contests in good faith; |

| (g) | the Guarantor(s) will carry out and operate its business and affairs with due diligence and efficiency and in accordance with sound financial and industrial standards and practices and take out or maintain valid insurances in respect of all its assets and business against all risks which are normally insured by other companies carrying on similar business for such amounts as would in the circumstances be considered prudent by such other companies and will not do or omit to do or suffer anything to be done which render any policies of insurance taken out by it void or voidable; |

| (h) | the Guarantor(s) will, by written notice, inform CGC of: |

| (i) | any legal proceedings, litigation or claim, involving the Guarantor(s) which has adversely affected the Guarantor(s)’ ability to fulfill its obligations under this Guarantee or its financial position; |

| (ii) | any dispute between the Guarantor(s) and any Government or statutory body in respect of any of the Guarantor(s)’ lands and other assets which has adversely affect the Guarantor(s)’ ability to fulfill its obligations under this Guarantee or its financial position; and |

| (iii) | any matter which has adversely affected or may adversely affect the Guarantor(s)’ ability to fulfill its obligations under this Guarantee or its financial position; |

| (i) | the Guarantor(s) shall not take or accept any security interest or other security from the Customer or, in relation to the Guaranteed Amounts, from any third party, without first obtaining CGC’s written consent and the Guarantor(s) hereby agrees that in the event of such security is taken the same shall be held in trust for CGC and shall be deposited with CGC; |

| (j) | until all the Guaranteed Amounts due or incurred by the Customer to CGC shall have been paid or discharged in full, the Guarantor(s) shall not by paying off any sum recoverable hereunder or by any other means or on any ground, claim any set-off or counterclaim against the Customer in respect of any liability from the Customer to the Guarantor(s) or any claim or prove in competition with CGC in respect of any payment by the Customer be entitled to claim or have the benefit of any set-off or counter claim or proof against or dividend composition or payment by the Guarantor(s) hereunder or its estate or the benefit of any other security which CGC may now or hereafter hold for any money or liabilities or incurred by the Customer to it or to have any share herein; |

| (k) | if, notwithstanding sections (h) and (i) above, the Guarantor(s) may (notwithstanding payment to CGC by the Guarantor(s) or any other person of any of the Guaranteed Amounts) rank as creditors and prove in the winding up of the Customer for the whole amount outstanding against the Customer or such ultimate balance and CGC may and shall be entitled to receive and retain the whole of the dividends to the exclusion of all the Guarantor(s)’ rights as guarantor and no money or dividend so received by CGC shall be treated as received in respect of this Guarantee or otherwise in relation to the Guarantor(s) but the full amount hereby guarantee shall be payable by the Guarantor(s) until CGC shall have received from all sources one hundred sen in the Ringgit on the ultimate balance outstanding against the Customer; |

| (l) | until all monies due or payable by the Customer to CGC shall have been fully paid and all its liabilities to CGC shall have been satisfied and discharged, the Guarantor(s) shall not: |

| (i) | in respect of any monies which may have been paid by the Guarantor(s), seek to enforce payment or to exercise any other rights or legal remedies of whatsoever kind which may be due and payable howsoever to the Guarantor(s) in respect of the amount so paid, against the Customer; |

| (ii) | prove in competition with CGC for any monies due and payable by the Customer on any account whatsoever and/or in respect of any monies due or payable from the Customer to the Guarantor(s) but will give to CGC the benefit of any proof which the Guarantor(s) may be able to make in the liquidation of the Customer or in any arrangement or composition with the creditors |

| (iii) | take any steps to enforce any rights against the Customer or receive or claim or have the benefit of any payment or distribution from or on account of the Customer pursuant to this Guarantee, CGC may at its sole discretion instruct the Guarantor(s) to take any steps referred to in this sub-paragraph and any monies or other benefit thereby obtained by the Guarantor(s) will thereafter be held by the Guarantor(s) in trust for CGC; and |

| (m) | to subordinate any and all indebtedness of the Customer to the Guarantor(s), whether or not incurred pursuant to or arising out of this Guarantee, to secure the Guaranteed Amount. Without prejudice to the generality of the foregoing, the Guarantor(s) hereby undertakes to CGC that at all times during the continuance of the Financing Facility or this Guarantee for so long as any monies shall remain payable under the Financing Facility or this Guarantee, the Guarantor(s) shall not without CGC’s prior consent in writing, claim demand accept or receive from the Customer, by set off or in any other manner, payment of any financing facility by the Guarantor(s) to the Customer or any part thereof and shall in the event of the Guarantor(s) accepting such payment, the monies so received shall be deemed to be received in trust for CGC and shall forthwith be paid over to CGC. |

| 12.2 | The Guarantor(s) hereby undertakes that not later than execution of this Guarantee, the Guarantor(s) shall, if the Guarantor(s) is not represented by advocates and solicitors in this transaction, deliver to CGC a statutory declaration duly executed by the Guarantor(s) before a commissioner for oaths stating that the Guarantor(s) is executing this Guarantee with full knowledge and understanding of the nature and effect of the contents hereof and of its own free will. |

ARTICLE 13

MULTIPLE GUARANTORS

| (a) | Where the Guarantee is given by or on behalf of more than one person, the expression “the Guarantor(s)” shall be construed as referring to each such person individually and any one or more of such person collectively, and all agreements, obligations, liabilities, representations, warranties and undertakings of the Guarantor(s) contained or implied in this Guarantee are joint and several and shall be construed accordingly. The expression “the Guarantor(s)” herein extends to all persons who are intended to or have agreed to be guarantors of the Customer in relation to all persons who are intended to or have agreed to be guarantors of the Customer in relation to Guaranteed Amounts notwithstanding that they have not co-jointly affixed their signatures to one single copy of this Guarantee so long as they sign individual copies of this Guarantee and notwithstanding that such signing may be at different times and places. |

| (b) | Each of the parties comprising the Guarantor(s) hereby agrees and consents severally to be bound by this Guarantee, notwithstanding that any others whom it is intended should sign or be bound by this Guarantee may not do so or be effectively bound hereby, and notwithstanding that this Guarantee may be invalid or unenforceable against any one or more of the parties comprising the Guarantee, whether or not the deficiency is known to CGC and notwithstanding the obligations of any other of them hereunder has determined or been discounted for any reason whatsoever. |

CGC shall be entitled to release any one or more of the parties comprising the Guarantor(s) from this Guarantee, to compound with or otherwise vary or agree to vary the liability of, or to grant time or other indulgence to, or make other arrangements with, any one or more of the parties comprising the Guarantor(s), without prejudicing or affecting CGC’s rights, powers and remedies against any others of the parties comprising the Guarantor(s).

| (c) | CGC shall be entitled to release any one or more of the parties comprising the Guarantor(s) from this Guarantee, to compound with or otherwise vary or agree to vary the liability of, or to grant time or other indulgence to, or make other arrangements with, any one or more of the parties comprising the Guarantor(s), without prejudicing or affecting CGC’s rights, powers and remedies against any others of the parties comprising the Guarantor(s). |

| (d) | Any notice served pursuant to this Guarantee on any party comprising the Guarantor(s). |

| (e) | CGC may make a demand under this Guarantee on any one or more of the persons comprising the Guarantor(s) without being required to make a demand at the same time or at any other on any person comprising the Guarantor(s). |

ARTICLE 14

INDEBTEDNESS

| 14.0 | CERTIFICATE OF INDEBTEDNESS |

Any statement of account furnished by CGC which is duly certified by an authorized officer or agent of CGC or computer generated notices which do not require signatures issued by CGC, or any admission or acknowledgement in writing by the Customer or any person on behalf of the Customer of the amount of the Guaranteed Amounts in relation to the subject matter of this Guarantee or any judgement or award obtained by CGC against the Customer, shall be binding and conclusive evidence against the Guarantor(s) for whatever purpose including as being conclusive evidence of the Guaranteed Amounts in a court of law, save for manifest error.

ARTICLE 15

ASSURANCE

The Guarantor(s) shall immediately upon demand by CGC and at the Guarantor(s)’ entire cost and expense make, execute, do and perform all such further assurances documents acts and things as CGC shall, from time to time, reasonably require to perfect the security afforded or created or intended to be afforded or created hereunder.

ARTICLE 16

RIGHT TO RECOVER

| 16.0 | CGC’S RIGHT TO RECOVER NOT TO BE AFFECTED |

No assurance or security or payment which may be avoided on the winding up, liquidation, reorganization or otherwise of the Customer and/or the Guarantor(s) and no release, settlement or discharge which may have been given or made on the faith of any assurance, security or payment shall prejudice the right of CGC to recover from the Guarantor(s) to the full extent hereof as if such assurance, security, payment, release, settlement or discharge (as the case may be) had never been granted, given or made.

ARTICLE 17

PAYMENT BY GUARANTOR(S)

| 17.0 | PAYMENT BY GUARANTOR(S) |

All payments and payments whatsoever to be made by the Guarantor(s) hereunder shall be made without any set-off or counterclaim and free and clear of any restrictions or conditions and without regard to any bilateral, multilateral or whatsoever payment or clearing agreement and free and clear of and without deduction for any taxes, levies, imposts, duties, charges, fees, deductions or withholdings of any nature now or hereunder imposed by any competent governmental or other authority. If any Guarantor(s) is compelled by law or otherwise to deduct any such taxes, levies, duties, charges or fees or to make any such deductions or withholdings, that Guarantor(s) shall pay such additional amounts as may be necessary in order that the net amounts received by CGC hereunder after such deductions or withholdings shall equal the amounts which CGC would have received had no such deductions or withholdings been required to be made.

ARTICLE 18

RIGHT CUMULATIVE

The rights remedies powers and privileges herein provided are cumulative and not exclusive of any rights remedies powers and privileges provided by any law.

ARTICLE 19

SEVERABILITY

Any term condition stipulation, provision, covenant or undertaking contained herein which is illegal, prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such illegality, prohibition or unenforceability without invalidating the remaining provisions hereof and any such illegality, prohibition or unenforceability in any jurisdiction shall not invalidate or render illegal, void or unenforceable any such term, condition, stipulation, provision, covenant or undertaking in any other jurisdiction.

ARTICLE 20

JURISDICTION

This Guarantee shall be governed by and construed in accordance with the laws of Malaysia but in enforcing this Guarantee, CGC shall be at liberty to initiate and take action or proceedings or otherwise against the Guarantor(s) in Malaysia and/or elsewhere as CGC may deem fit and the parties hereto hereby agree that where any actions or proceedings are initiated and taken in Malaysia they shall submit to the non-exclusive jurisdiction of the Courts of Malaysia in all matters connected with the obligations and liabilities of the parties hereto under or arising out of this instrument and the service of any writ or summons or any legal process in respect of any such action or proceeding may be effected on the Guarantor(s) (where the Guarantor(s) is a resident) by forwarding a copy of the writ or summons statement of claim or other legal process by prepaid registered post (or such other mode as stipulated by law) to its addresses for the time being.

ARTICLE 21

LEGAL PROCESS

| 21.0 | SERVICE OF LEGAL PROCESS |

Service of any writ of summons or any legal process in respect of any action arising out of or in connection with this Guarantee and/or other Security Documents may be affected by forwarding a copy of the writ of summons and statement of claim or other legal process by prepaid registered post to the respective registered offices and/or last known address of the parties hereto.

ARTICLE 22

NOTICES

| 22.1 | Any notice request or demand requiring to be served by any party hereto to the other under the provisions of this Guarantee shall be in writing and shall be deemed to be sufficiently served :- |

| (a) | if it is sent by the party giving the notice or his or its solicitors by ordinary post or in a registered letter addressed to the parties to be served at his or its address herein before mentioned or at such other address as the other parties might have notified the party giving the notice at his or its new address and in such case it shall be deemed (whether it is actually delivered or not) to have been received three (3) business days after posting, postage or prepaid received; or |

| (b) | if it is given by the party giving the notice or his or its solicitors and despatched by hand to the party to be served on or his or its solicitors it shall be deemed to have been received when delivered; or |

| (c) | if it is sent by facsimile transmission, immediately after transmission thereof if the date of transmission is a working day, and if such a date is not a working day, then the notice by or facsimile shall be deemed to be served on them immediately on the following working day. |

| 22.2 | Any period to be calculated hereunder from the date of receipt of any notice after which an act is authorized or required shall include the date of receipt of such notice. In additions, for the purposes of computing any grace period hereunder, reference to any given number of business days shall be computed by reference to the specified period of time in Malaysia. |

ARTICLE 23

PRINCIPAL/SECONDARY INSTRUMENTS

| 23.0 | It is hereby agreed and declared that this Guarantee, the Letter of Offerand other Security Documents are instruments employed in one transaction namely to secure the Indebtedness together with all of the moneys payable under the Letter of Offerand for the purpose of Section 4 (3) of the Stamp Act 1949, the Letter of Offershall be deemed to be the principal instrument and this Guarantee, and other Security Documents are secondary and auxiliary instruments. |

ARTICLE 24

INDEPENDENT LEGAL ADVICE

| 24.0 | The Guarantor(s) acknowledges that the Guarantor(s) has been advised by CGC to obtain separate independent legal advice with respect to entering into this Guarantee, and that the Guarantor(s) has obtained such independent legal advice or has expressly waived its right to obtain such advice, and that the Guarantor(s) hereby declares that the Guarantor(s) is entering into this Guarantee with full knowledge and understanding of the nature and effect of the contents hereof and of its own free will and consent. |

ARTICLE 25

SCHEDULES

The First Schedule hereto is to be taken and construed as an essential part of this Guarantee.

[End of clauses]

IN WITNESS WHEREOF the parties have hereunto set their respective hands the day and year first above written.

| Signatory(ies) to this document are advised to seek independent legal advice on the legal implications, nature and effect of this document before signing this document. By signing this Guarantee, the Guarantor(s) declares that the Guarantor(s) has read this Guarantee in its entirely, understands the nature and effect of its contents and is signing this Guarantee of its own free will and consent. |

| * For Individual Guarantor(s) | | | |

| | | | |

| Signed by Guarantor(s) | ) | | |

| in the presence of:- | ) | | |

| | | | |

| | | /s/ NG CHEN LOK |

| | | Name: NG CHEN LOK |

| | | New NRIC No: 870203065701 |

| | | Old NRIC No.: |

| | | |

| | | | |

| Signed by Guarantor(s) | ) | | |

| in the presence of:- | ) | | |

| | | | Name: |

| | | | New NRIC No: |

| | | | Old NRIC No.: |

| | | | |

| * For Registered Business Guarantor(s) | | | |

| SIGNED for and on behalf of the | ) | | |

| Guarantor(s) in the presence of:- | ) | | |

| | | | |

| | | | Partner |

| | | | Name: |

| | | | NRIC No.: |

* For Corporate Guarantor(s)

SIGNED for and on behalf of the Guarantor(s) in a manner authorised by its constitution under its Common Seal which said Seal was hereunto duly affixed on the 20 in the presence of : | ) ) ) ) ) ) ) | | |

| | | | |

| Director | | | Director/Secretary |

| Name: | | | Name: |

| NRIC No.: | | | NRIC No.: |

SIGNED for and on behalf of the Guarantor(s) in a manner authorised by its constitution or Companies Act 2016 (if no

constitution) on the 20 in the presence of : | ) ) ) ) ) ) ) | | |

| | | | |

| Director | | | Director/Secretary |

| Name: | | | Name: |

| NRIC No.: | | | NRIC No.: |

| THE FIRST SCHEDULE |

| |

| (which is to be taken read and construed as an integral part of this Agreement) |

Section

No. | Item | Particulars |

| | | |

| 1. | The day and year of this Guarantee Agreement | |

| | | |

| 2. | Name And Descriptions / Particulars of Customer | *Individual Customer: |

| | | Name: |

| | | NRIC No.: |

| | | Residential Address: |

| | | |

| | | *Registered Business Customer |

| | | |

| | | Name: CL TECHNOLOGIES (INTERNATIONAL) |

| | | SDN. BHO. |

| | | Registration No.: [201901005005(1314332U)] |

| | | |

| | Address: 10-2 JALAN TANJUNG SD 13/2, BANDAR SRI DAMANSARA 52200 KUALA LUMPUR WILAYAH PERSEKUTUAN | Address:81 LEBOH UNTA TAMAN BERKELEY 41150 KLANG SELANGOR

|

| | | *Company Customer: |

| | | |

| | | Name: CL TECHNOLOGIES (INTERNATIONAL) |

| | | SDN. BHD. |

| | | Company No.: [201901005005(1314332U)] |

| | | |

| | Business Address: 10-2 JALAN TANJUNG SD 13/2, | Business Address: 81 LEBOH UNTA TAMAN BERKELEY 41150 KLANG SELANGOR |

| | BANDAR SRI DAMANSARA

52200 KUALA LUMPUR

WILAYAH PERSEKUTUAN | Registered Address: 81 LEBOH UNTA TAMAN BERKELEY 41150 KLANG SELANGOR |

| | | |

| | | *Professional Body |

| | | Name: |

| | | Membership No: |

| | | Registered Office: |

| | | Business Address: |

| | | |

| | | *Society |

| | | Name: |

| | | Registration Number: |

| | | Registered Office: |

| | | Business Address: |

| | | |

| | | *Co-operative |

| | | Name: |

| | | Registration Number: |

| | | Registered Office: |

| | | Business Address: |

| | | |

| 3. | Name And Description of the Guarantors | *Individual Guarantor(s) Name: NG CHEN LOK NRIC No.: 870203065701 Residential Address: A 2482 TAMAN TAS PUTRA JALAN KAMPUNG BHARU 25100 KUANTAN PAHANG MALAYSIA |

*Corporate Guarantor(s)

| | Company’s Name: Company No.: Registered Office: Business Address: |

| | | |

| 4. | The Financing Facility | RM100,000.00 |

| 5. | The Letter of Offer | 21-March-2022 |

| 6. | Guaranteed Amounts | RM133,476.31 |

******** END OF SCHEDULE ********

| CL TECHNOLOGIES (INTERNATIONAL) SDN. BHD. [201901005005(1314332U)]/1000604905 |

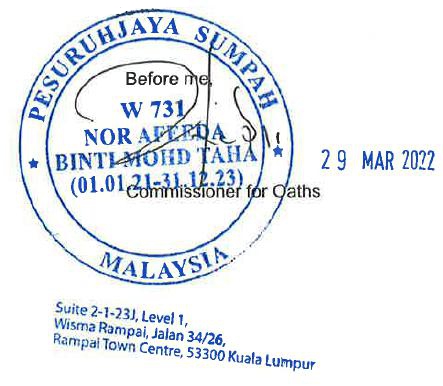

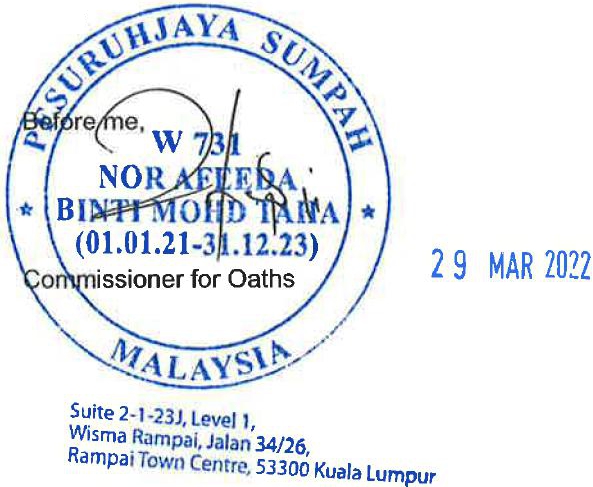

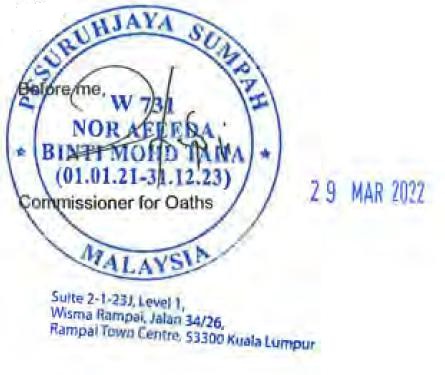

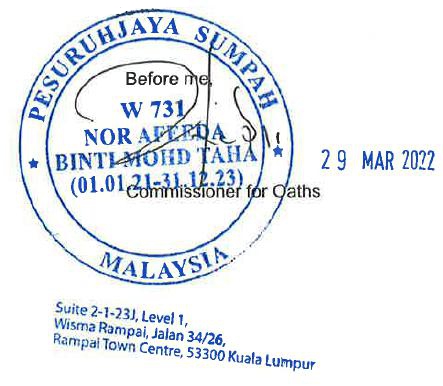

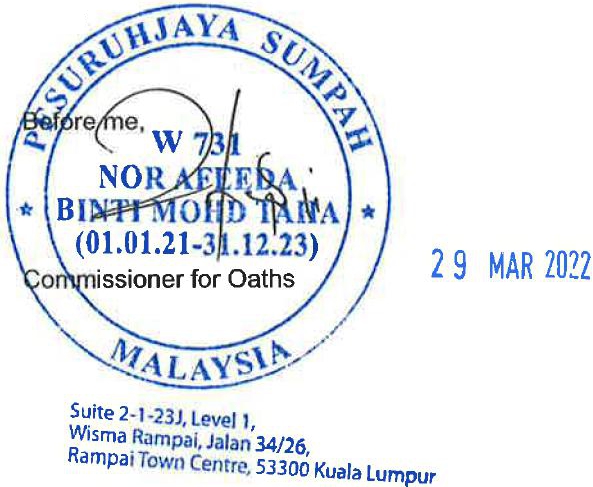

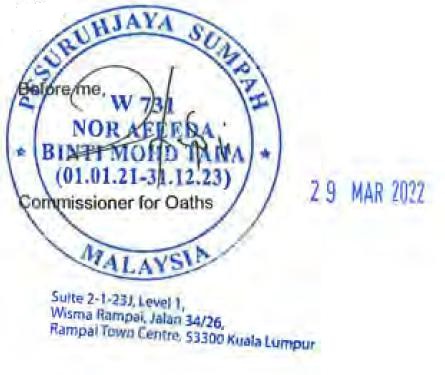

And I/we make this declaration conscientiously believing the same to be true and by virtue of the provisions of the Statutory Declarations Act, 1960.

| SUBSCRIBED and SOLEMNLY DECLARED | ) | | | |

| By | ) | | | |

| And 29 MAR 2022 | ) | | | |

| at this day of | ) | | | |

| | | | | |

| /s/ NG CHEN LOK | | | | |

| Name: NG CHEN LOK | | | | |

| (NRIC No. 870203-06-570) | | | | |

| Designation: Manager Director | | | | |

DS_1 SP (Pin 1/2017)

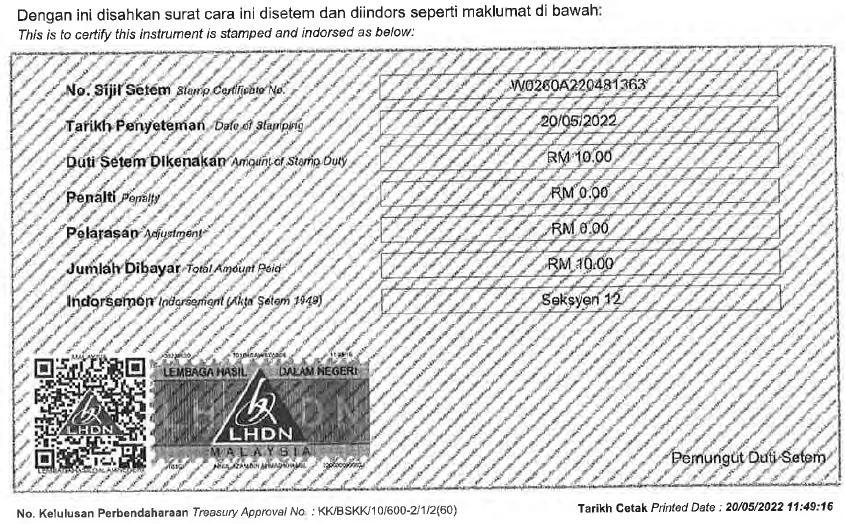

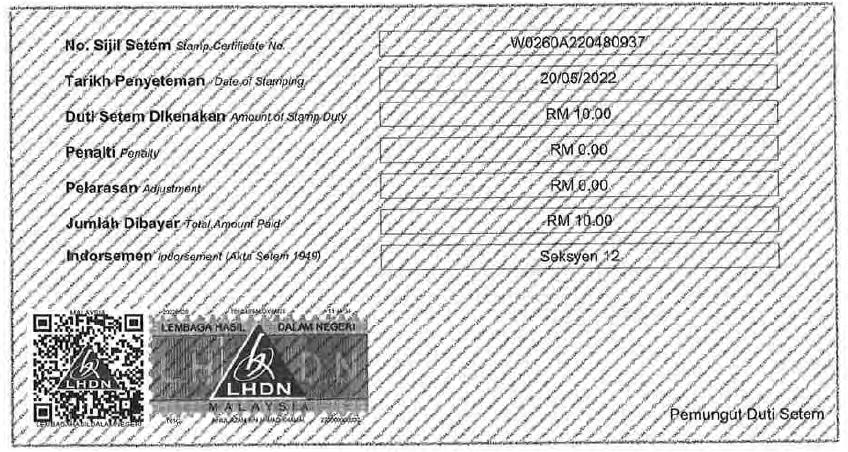

| IBU PEJABAT

LEMBAGA HASIL DALAM NEGERI MALAYSIA MENARA HASIL PERSIARAN RIMBA PERMAI CYBER 8, 63000 CYBERJAYA SELANGOR DARUL EHSAN |  |

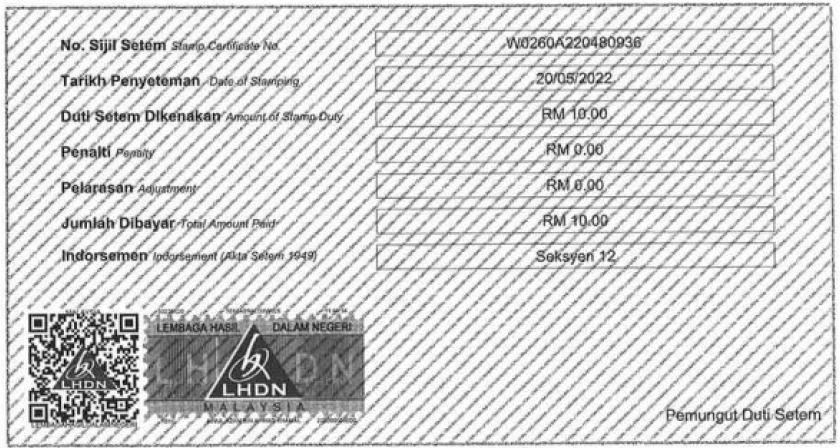

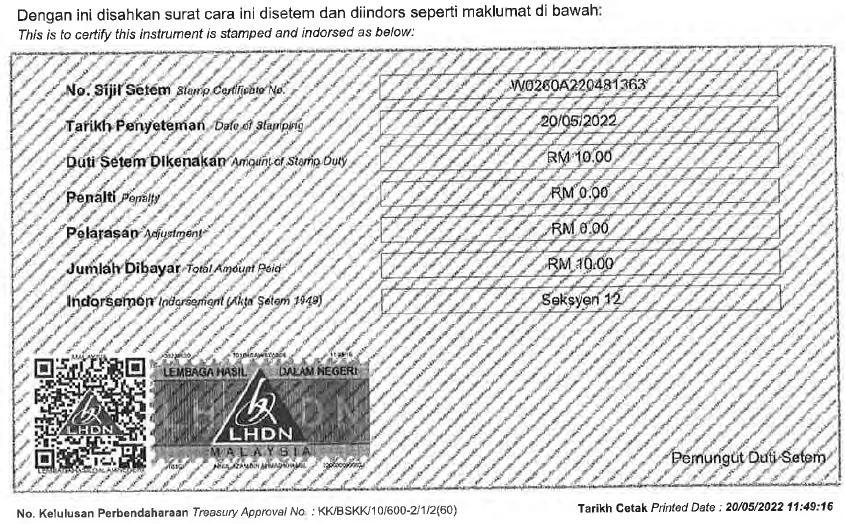

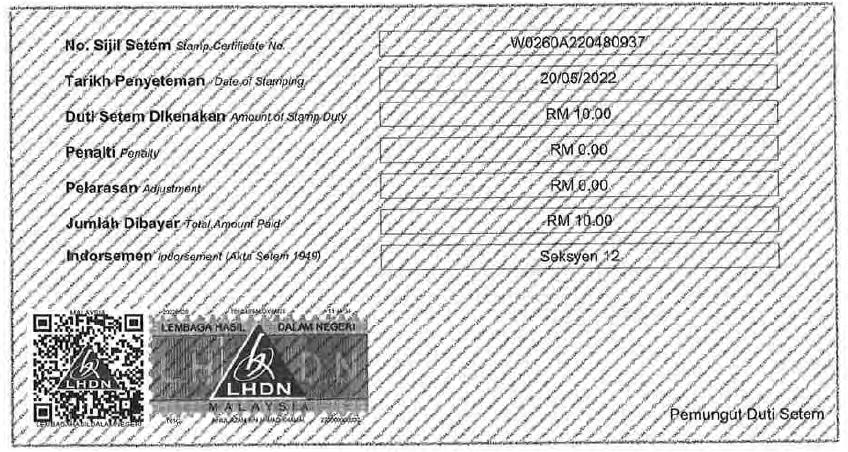

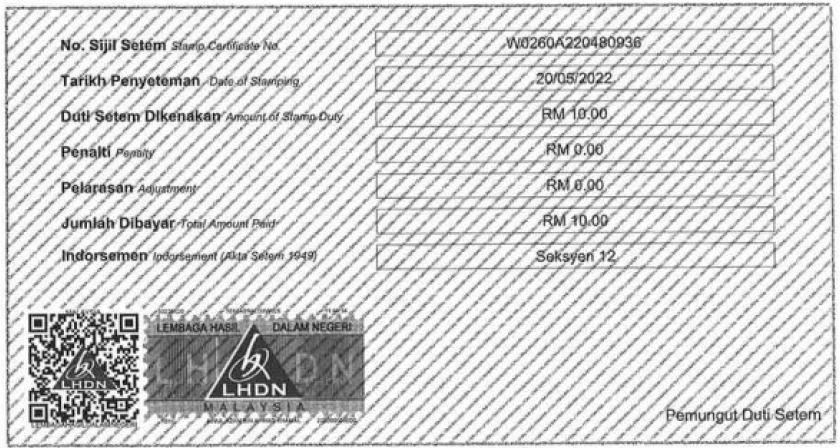

| SIJIL SETEM

STAMP CERTIFICATE | ASAL |

(Sila lekatkan sijil setem ini ke atas surat cara sebagai bukti penyeteman)

Please attach this stamp certificate to the instrument as evidence of stamping

| Cara Bayaran Payment Method | FPX TRANSACTIONS |

| No. Adjudikasi Adjudication No. | T01C4BA948XW026 (SALINAN 1/1) |

| Jenis Surat Cara | GUARANTEE AGREEMENT |

| Type Of Instrument | BUKAN SURAT CARA UTAMA |

| Tarikh Surat Cara | 28/03/2022 |

| Date Of Instrument | |

| Balasan Consideration | RM 100,000.00 |

| Duti Setem Dibayar Ke atas Surat Cara Utama | |

| Stamps Duty paid on Principal Instrument | RM 500 . 00 |

| Maklumat Pihak Pertama / Penjual / Pemberi First Party / Vendor / Transferor / Assignor |

| CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD, NO SYARIKAT 197201000831 (12441-M) |

| Maklumat Pihak Kedua / Pembeli / Penerima Second Party / Purchaser / Transferee / Assignee |

| NG CHEN LOK, NO KP 870203065701 |

| Butiran Harta / Suratcara Property / Instrument Description |

| TIDAK BERKENAAN |

Pengesahan ketulenan Sijil Selem ini boleh dipastikan di stamps.hasil gov.my atau melalui aplikasi lelefon pintar

The authenticity of this Stamp Certificate can be verified at stamps hasil.gov.my or by mobile app

lni adalah cetakan komputer dan tidak perlu ditandatangani

This is a computer generated printout and no signature is required

--- tamat/end ---

| |  |

| | | |

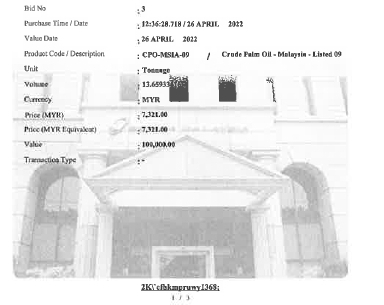

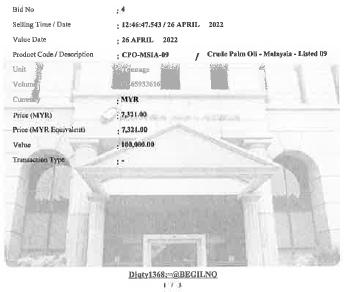

| BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. | | BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. |

| | | |

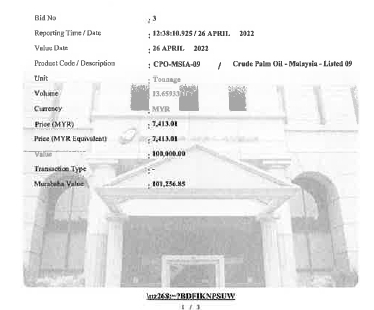

Certificate Number : CPO26APR22-0004614-000 | | Certificate Number : CPO26APR22-0004614-000 |

| | | |

| | Commodity Information |

This is to certify that the following transaction has been executed

through the BURSA Suq Al-Silo’ in accordance with the

Rules of Bursa Malaysia Islamic Services Sdn. Bhd. | | Commodity Supplying Participant | Commodity Volume | Specified Location |

| | | | | GENTING PLANTATIONS BERHAD | 13.65933616 | Lahad Datu Tank 3 |

| Buyer | : | CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD | (908) | | | | |

| Owner | : | BANK NEGARA MALAYSIA | (000) | | | | |

Notes:

| 1. | This e-Certificate has the benefit of, and is generated pursuant to, the Rules of Bursa Malaysia Islamic Services Sdn. Bhd. (“Rules”). The Rules form an integral part hereof. |

| 2. | This e-Certiticate is valid only in the BURSA Suq Al-Sita’ BMIS will not be responsible and be held liable for any loss or damage arising from any unauthorised use of this e-Certificate. |

| 3, | This e-Certi:ficate is governed by, and construed in accordance with, the laws of Malaysia so long as it does not contradict with Shariah principles. |

| 4. | This e-Certificate is a computer generated and does not require any signature. |

| 5. | In the absence of manifest error by BMIS, the contents of this e-Certificate are conclusive and binding upon the Participants named herein. |

| 6. | Any expression used in this e-Certificate bas the same meaning as in the Rules. |

| |  |

| | | |

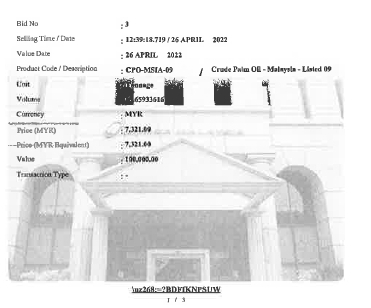

| BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. | | BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. |

| | | |

Certificate Number : CPO26APR22-0004614-000 | | Certificate Number : CPO26APR22-0004614-000 |

| | | |

| | Commodity Information |

This is to certify that the following transaction has been executed

through the BURSA Suq Al-Sila’ in accordance with the

Rules of Bursa Malaysia Islamic Services Sdn. Bhd. | | Commodity Supplying Participant | Commodity Volume | Specified Location |

| | | | | GENTING PLANTATIONS BERHAD | 13.65933616 | Lahad Datu Tank 3 |

| Seller | : | BANK NEGARA MALAYSIA | (000) | | | | |

| Buyer | : | CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD | (908) | | | | |

Notes:

| 1. | This e-Certificate has the benefit of, and is generated pursuant to, the Rules of Bursa Malaysia lslamic Services Sdn. Bhd. (“Rules”). The Rules form an integral part hereof. |

| 2 | This e-Certificate is valid only in the BURSA Suq Al-Sila’. BMIS will not be responsible and be held liable for any loss or damage arising from any unauthorised use of this e-Certificate. |

| 3. | This e-Certificate is governed by, and construed in accordance with, the laws of Malaysia so long as it does not contradict with Shariah principles. |

| 4 | This e-Certificate is a computer generated and does not require any signature. |

| 5. | In the absence of manifest error by BMIS, the contents of this e-Certificate are conclusive and binding upon the Participants named herein. |

| 6. | Any expression used in this e-Certificate has the same meaning as in the Rules. |

| BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. | | BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. |

| | | |

Certificate Number : CPO26APR22-0004614-000 | | Certificate Number : CPO26APR22-0004614-000 |

| | | |

| | Commodity Information |

This is to certify that the following transaction has been executed

through the BURSA Suq Al-Sila’ in accordance with the

Rules of Bursa Malaysia Islamic Services Sdn. Bhd. | | Commodity Supplying Participant | Commodity Volume | Specified Location |

| | | | | GENTING PLANTATIONS BERHAD | 13.65933616 | Lahad Datu Tank 3 |

| Seller | : | CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD | (908) | | | | |

| Buyer | : | Bursa Malaysia Islamic Services | | | | | |

Notes:

| 1. | This e-Certificate has the benefit of, and is generated pursuant to, the Rules of Bursa Malaysia Islamic Services Sdn, Bhd, (“Rules”), The Rules form an integral part hereof. |

| 2. | This e-Certificate is valid only in the BURSA Suq Al-Sila’. BMIS will not be responsible and be held liable for any loss or damage arising from any unauthorised use of this e-Certificate. |

| 3. | This e-Certificate is governed by, and construed in accordance with, the laws of Malaysia so long as it does not contradict with Shariah principles. |

| 4. | This e-Certificate is a computer generated and does not require any signature. |

| 5. | In the absence of manifest error by BMIS, the contents of this e-Certificate are conclusive and binding upon the Participants named herein. |

| 6 | Any expression used in this e-Certificate has the same meaning as in the Rules. |

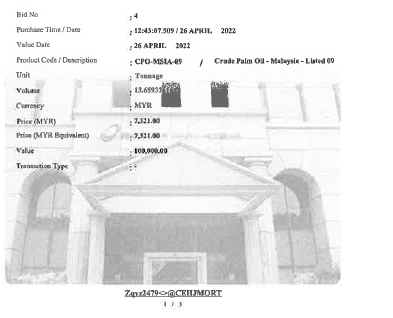

| BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. | | BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. |

| | | |

Certificate Number : CPO26APR22-0004759-000 | | Certificate Number: CPO26APR22-0004759-000 |

| | | |

| | Commodity Information |

This is to certify that the following transaction has been executed

through the BURSA Suq Al-Sila’ in accordance with the

Rules of Bursa Malaysia Islamic Services Sdn. Bhd. | | Commodity Supplying Participant | Commodity Volume | Specified Location |

| | | | | GENTING PLANTATIONS BERHAD | 13.65933616 | Lahad Datu Tank 3 |

| Buyer | : | CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD | (908) | | | | |

| Owner | : | CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD | (908) | | | | |

Notes:

| 1. | Thls e-Certificate has the benefit of, and is generated pursuant to, the Rules of Bursa Malaysia Islamic Services Sdn. Bhd. (“Rules”). The Rules form an integral part hereof. |

| 2 | This e-Certificate is valid only in the BURSA Suq Al-Sila’. BMIS wil1 not be responsible and be held liable for any loss or damage arising from any unauthorised use of this e-Certificate. |

| 3. | This e-Certificate is governed by, and construed in accordance with, the laws of Malaysia so long as it does not contradict with Shariah principles. |

| 4. | This e-Certificate is a computer generated and does not require any signature. |

| 5. | In the absence of manifest error by BMIS, the contents of this e-Certificate are conclusive and binding upon the Participants named herein. |

| 6. | Any expression used in this e-Certificate has the same meaning as in the Rules. |

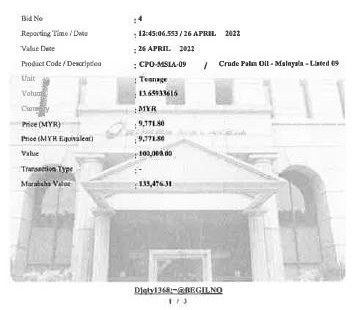

| |  |

| BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. | | BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. |

| | | |

Certificate Number : CPO26APR22-0004759-000 | | Certificate Number : CPO26APR22-0004759-000 |

| | | |

| | Commodity Information |

This is to certify that the following transaction has been executed

through the BURSA Suq Al-Sila’ in accordance with the

Rules of Bursa Malaysia Islamic Services Sdn. Bhd. | | Commodity Supplying Participant | Commodity Volume | Specified Location |

| | | | | GENTING PLANTATIONS BERHAD | 13.65933616 | Lahad Datu Tank 3 |

| Seller | : | CREDIT GUARANTEE CORPORATION MALAYSIA BERHAD | (908) | | | | |

| Buyer | : | CL TECHNOLOGIES (lNTERNATIONAL) SDN. BHD. - 1000604905 | (000) | | | | |

Notes:

| 1. | This e-Certificate has the benefit of, and is generated pursuant to, the Rules of Bursa Malaysia Islamic Services Sdn. Bhd.(“Rules”). The Rules form an integral part hereof. |

| 2. | This e-Certificate is valid only in the BURSA Suq Al-Sila’. BMIS will not be responsible and be held liable for any loss or damage arising from any unauthorised use of this e-Certificate. |

| 3. | This e-Certificate is governed by, end construed in accordance with, the laws of Malaysia so long as it does not contradict with Shariah principles. |

| 4. | This e-Certificate is a computer generated and does not require any signature. |

| 5. | In the absence of manifest error by BMIS, the contents of this e-Certificate are conclusive and binding upon the Participants named herein. |

| 6. | Any expression used in this e-Certificate has the same meaning as in the Rules. |

| |  |

| BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. | | BURSA MALAYSIA ISLAMIC SERVICES SDN.BHD. |

| | | |

Certificate Number : CPO26APR22-0004759-000 | | Certificate Number : CPO26APR22-0004759-000 |

| | | |

| | Commodity Information |

This is to certify that the following transaction has been executed

through the BURSA Suq Al-Sila’ in accordance with the

Rules of Bursa Malaysia Islamic Services Sdn. Bbd. | | Commodity Supplying Participant | Commodity Volume | Specified Location |

| | | | | GENTING PLANTATIONS BERHAD | 13.65933616 | Lahad Datu Tank 3 |

| Seller | : | CL TECHNOLOGIES (INTERNATIONAL) SDN. BHD. - 1000604905 | (000) | | | | |

| Buyer | : | Bursa Malaysia Islamic Services | | | | | |

Notes:

| 1. | This e-Certificate has the benefit of, and is generated pursuant to, the Rules of Bursa Malaysia Islamic Services Sdn. Bhd. (“Rules”). The Rules form an integral part hereof. |

| 2. | This e-Certificate is valid only in the BURSA Suq Al-Sila’. BMIS will not be responsible and be held liable for any loss or damage arising from any unauthorised use of this e-Certificate. |

| 3. | This e-Certificate is governed by, and construed in accordance with, the laws of Malaysia so Long as it does not contradict with Shariah principles. |

| 4, | This e-Certificate is a computer generated and does not require any signature. |

| 5. | In the absence of manifest error by BMIS, the contents of this e-Certificate are conclusive and binding upon the Participants named herein. |

| 6. | Any expression used in this e-Certificate has the same meaning as in the Rules. |

| Ref | : CGC/BizMula-i (BNM) - Revised 1/2018/CGC MAIN BRANCH/HALIMJ |

| Date | : 21-March-2022 |

CL TECHNOLOGIES (INTERNATIONAL) SDN. BHD. [201901005005(1314332U)]

10-2 JALAN TANJUNG SD 13/2

BANDAR SRI DAMANSARA

52200 KUALA LUMPUR

WILAYAH PERSEKUTUAN

Dear Sir/Madam,

Re: LETTER OF OFFER

We refer to your application and are pleased to offer you the following financing facility subject to the terms and conditions contained in this letter, in the Annexures and Appendices (collectively, “this Letter of Offer”):-

1. DETAILS OF THE FINANCING FACILITY

| Product Name | BizMula-i (BNM) - Revised 1/2018 |

Application No. | 1000604905 |

| Approved Financing Amount | RM100,000.00 |

| Purpose of financing | WORKING CAPITAL for Shariah compliant purpose |

| CGC’s Purchase Price | RM100,000.00 |

CGC’s Sale Price* The CGC’s Sale Price for the commodity Asset comprises: (i) the CGC’s Purchase Price; (ii) the added mark up equivalent to the profit portion calculated as the Prescribed Rate below; and (iii) the CGC’s Sale Price shall be denominated in Ringgit Malaysia | RM133,476.31 |

| | Credit Guarantee Corporation Malaysia Berhad Registration Number / 197201000831 (12441-M) www.cgc.com.my | | Main Branch Level 1, Bangunan CGC, Kelana Business Centre, 97, Jalan SS7/2, 47301 Petaling Jaya, Selangor Darul Ehsan. Tel: +603 - 78048100 Fax: +603 - 78061290 | | Client Service Centre: +603 - 78800088 POWERING MALAYSIAN SMEs |

CL TECHNOLOGIES (INTERNATIONAL) SDN. BHD. [201901005005(1314332U)]/1000604905

Prescribed Rate | a. | Ceiling OR Contracted Profit Rate (“CPR”) | 12.00% per annum |

| b. | Effective Profit Rate (“EPR”) | 7.00% per annum |

| | The prevailing BNM Funding Rate is 0.25% and may be subject to change at the sole discretion of Bank Negara Malaysia (“BNM”). ‘The CGC’s Sale Price is contracted at Ceiling or Contracted Profit Rate (“CPR”). Nevertheless, the monthly instalment of the CGC’s Sale Price is based on the Effective Profit Rate (“EPR”). Credit Guarantee Corporation Malaysia Berhad (“CGC”) shall grant ibra’ (rebate) on the difference between the amount of profit calculated based on the CPR and the amount of profit calculated based on the EPR. The EPR may be varied based on periodic review at the discretion of CGC and BNM provided always that it shall not exceed the CPR. |

| Source of Fund | BANK NEGARA MALAYSIA |

| Type of Fund | All Economic Sectors Facility For Small & Medium Enterprises |

| Facility Type | Tawarruq Term Financing Facility |

| Tenure | 60 months |

Monthly Instalment (RM) | 1 to 59 = 1980, 60 to 60 = 1988.55 |

Quantity of the Commodity | To be disclosed in the Murabahah Sale ‘Aqd |

Trading Platform | Bursa Suq Al-Sila’ |

Kindly note that capitalised terms used herein shall have the meaning as defined in Annexure IV annexed to this Letter of Offer. For the purposes of this Letter of Offer, ‘month’ means that period of time which ends on the same date as it commences in the previous month but if there is no numerically corresponding date in the following month, then the period shall end on the last day of that month and “months” and ·monthly” shall be construed accordingly.

CL TECHNOLOGIES (INTERNATIONAL) SDN. BHD. [201901005005(1314332U)]/1000604905

| 2. | MODE OF PAYMENT OF CGC’S SALE PRICE |

| (a) | Payment for the CGC’s Sale Price shall be made monthly with or without demand at the Prescribed Rate prescribed by CGC within the Tenure in accordance with the provisions of this Letter of Offer and in the following manner:- |

| (i) | in the event the Financing Facility is processed for disbursement directly to the Customer or the supplier (whichever is applicable) on or before the fifteenth (15th) day of the Month, the first instalment shall be made on or before the twenty fifth (25th) day of the same Month; or |

| (ii) | in the event the Financing Facility is processed for disbursement directly to the Customer or the supplier (whichever is applicable) after the fifteenth (15th) day of the Month, the first instalment shall be made on or before the twenty fifth (25th) day of the following Month; and |

| (iii) | thereafter, each subsequent instalment shall be made on or before the twenty fifth (25th) day of each and every Month until full settlement of the Financing Facility. |

| (b) | The payment shall be made via standing instruction/recurrence payment/auto debit to CGC’s CIMB Islamic account using the account number as stated in the Notification Letter of Disbursement. |

| (c) | The monthly instalment will become payable even if the Financing Facility may not be fully disbursed or utilised. |

| 3. | RIGHT TO WITHHOLD RELEASE OF FINANCING FACILITY |

| (a) | CGC reserves the right not to release the Financing Facility or refuse any utilisation or disbursement of the Financing Facility:- |