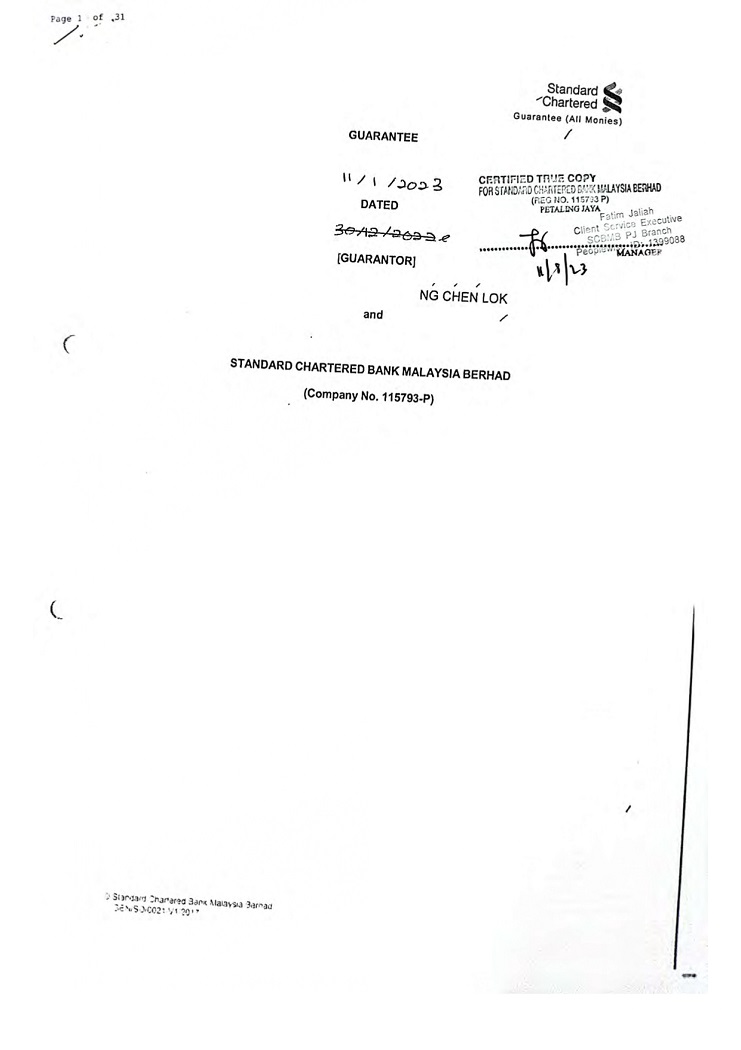

Exhibit 10.18

| (b) | holding beneficially of more than 50% of the issued share capital of the company (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital). |

“Financial Indebtedness” means any Indebtedness incurred for or in respect of:

| (b) | any amount raised by acceptance under any acceptance credit facility or dematerialised equivalent; |

| (c) | any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

| (d) | the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with GAAP, be treated as a finance or capital lease; |

| (e) | receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); |

| (f) | any amount raised under any other transaction (including any forward sale or purchase agreement) having the commercial effect of a borrowing; |

| (g) | any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value will be taken into account); |

| (h) | any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution; and |

| (i) | the amount of any liability in respect of any guarantee or indemnity for any of the items referred to in paragraphs (a) to (h) above. |

“GAAP” means in relation to each Guarantor, generally accepted accounting principles in its place of incorporation or establishment, including, where applicable, IFRS.

“Group” means, if the Guarantor is a member of a group of companies of which the Parent is the Holding Company, the Parent and its Subsidiaries from time to time.

“Guaranteed Obligations” means each Borrower’s obligations to pay all money and discharge all obligations now or in the future due, owing or incurred in any manner to the Bank by such Borrower (and, if more than one, by them jointly or jointly and severally), whether actually or contingently and whether alone or together with another or others and whether as principal or surety, together with interest, discount, commission and all other charges, costs and expenses for which such Borrower may be or become liable to the Bank.

“Holding Company” means, in relation to a person, any other person in respect of which the first named person is a Subsidiary.

“IFRS” means international accounting standards within the meaning of the IAS Regulation 1606/2002 to the extent applicable to the relevant financial statements.

“Obligors” means each Borrower and any person providing a guarantee of and/or Security Interest for the obligations of any Borrower and/or any other Obligor to the Bank.

“Parent” means, if the Guarantor is a member of a Group, the company referred to in Part 2 of Schedule 2.

“Party” means a party to this Guarantee.

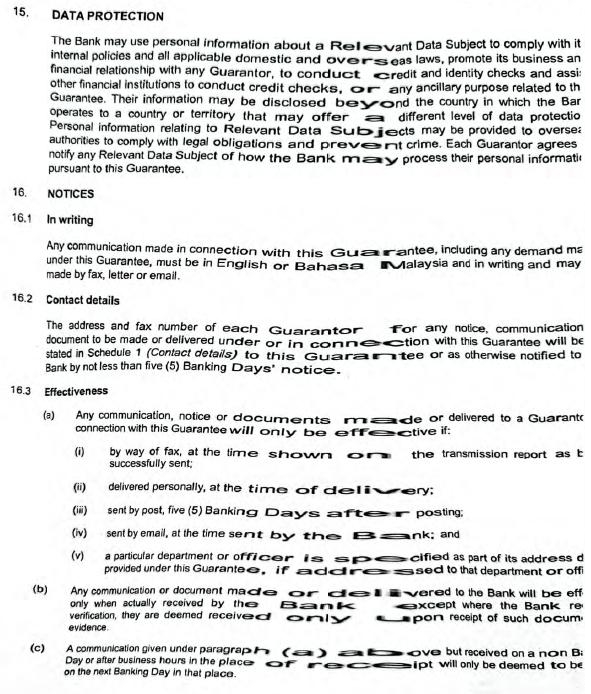

“Relevant Data Subject” means:

| (c) | any person authorised by a Guarantor to act on its behalf in relation to this Guarantee; and |

| (d) | any other person whose personal information is provided by a Guarantor to the Bank in relation to this Guarantee. |

“Security Interest” means a mortgage, charge, pledge, lien, security assignment or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect.

“Subsidiary” means in relation to a person, any other person:

| (a) | which is Controlled, directly or indirectly, by the first named person; |

| (b) | more than half the issued share capital of which is beneficially owned, directly or indirectly, by the first named person; or |

| (c) | which is a Subsidiary of another Subsidiary of the first named person. |

“TARGET2” means the Trans-European Automated Real-time Gross Settlement Express Transfer payment system which utilises a single shared platform and which was launched on 19 November 2007.

“TARGET Day” means any day on which TARGET2 is open for the settlement of payments in euro.

“Tax” means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any related penalty or interest).

| (a) | Any reference in this Guarantee to: |

| (i) | an “amendment” includes a supplement, variation, novation, restatement or re-enactment and “amended” will be construed accordingly; |

| (ii) | a “disposal” means a sale, transfer, grant, lease or other disposal, whether voluntary or involuntary and “dispose” will be construed accordingly; |

| (iii) | an “authorisation” includes an authorisation, consent, approval, resolution, licence, exemption, filing, registration or notarisation; |

| (iv) | “indebtedness” includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money; |

| (v) | a “regulation” includes any regulation, rule, official directive, request or guideline (whether or not having the force of law but; if not having the force of law, being of a type with which any person to which it applies is accustomed to comply) of any governmental, inter-governmental or supranational body, agency, department or regulatory, self-regulatory or other Authority or organisation; |

| (vi) | any statute or any section of any statute will be deemed to include reference to any statutory modification or re-enactment of it for the time being in force; |

| (vii) | any document is a reference to that document as amended (however fundamentally) and including any amendment providing for any increase in the amount of a facility or for an additional facility; |

| (viii) | a currency is to the lawful currency for the time being of the relevant country; |

| (ix) | a “month” is to a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month. If there is no numerically corresponding day in the following month, that period will end on the last Banking Day in that calendar month; |

| (x) | a “person” includes any individual, company, corporation, unincorporated association or body (including a partnership, trust, joint venture or consortium), government, state, agency, organisation or other entity whether or not having separate legal personality, and its and any subsequent successors in title, permitted transferees and permitted assigns, in each case, in accordance with their respective interests; and |

| (1) | common law, principles of equity and laws made by any legislative body; and |

| (2) | any regulation, rule, official directive, request or guideline (whether or not having the force of law) of any Authority. |

| (b) | Unless the context otherwise requires, words denoting the singular will include the plural and vice versa. |

| (c) | If more than one currency or currency unit are recognised at the same time by the central bank of any country as the lawful currency of that country, then: |

| (i) | any reference in this Guarantee to, and any obligations arising under this Guarantee in, the currency of that country will be converted into, or paid in, the currency or currency unit of that country designated by the Bank; and |

| (ii) | any conversion from one currency or currency unit to another will be at the official rate of exchange recognised by the central bank, rounded up or down by the Bank acting reasonably. |

| (d) | If a change in any currency of a country occurs, this Guarantee will be amended to the extent the Bank specifies to be necessary to reflect the change in currency and to put the Bank in the same position, so far as possible, as it would have been in if no change in currency had occurred. |

| 2. | GUARANTEE AND INDEMNITY |

| (a) | Each Guarantor irrevocably and unconditionally: |

| (i) | as principal obligor guarantees to the Bank the due and punctual performance and discharge by each Borrower of the Guaranteed Obligations of such Borrower as they fall due; |

| (ii) | undertakes with the Bank that, whenever a Borrower does not pay any amount forming part of the Guaranteed Obligations of such Borrower when due it must immediately on demand by the Bank pay that amount as if it were the principal obligor in respect of that amount; and |

| (iii) | agrees to indemnify the Bank immediately on demand against any cost, loss or liability suffered by the Bank if any of the Guaranteed Obligations or purported obligations guaranteed by it is or becomes unenforceable, invalid or illegal. The amount of the cost, loss or liability under this indemnity will be equal to the amount the Bank would otherwise have been entitled to recover. This indemnity constitutes a separate and independent obligation from any other obligations in this Guarantee, shall give rise to a separate and independent cause of action and shall remain in full force despite any waiver, indulgence, judgment or order given in respect of any sum due under this Guarantee. |

| (b) | Unless expressly provided otherwise in this Guarantee, where there is more than one Guarantor, each of the Guarantors will be jointly and severally liable for their respective obligations and liabilities arising under this Guarantee. The Bank may take action against, or release or compromise the liability of, any Guarantor, or grant time or other indulgence, without affecting the liability of any other Guarantor. |

| 3. | PRESERVATION OF GUARANTEE |

| (a) | This Guarantee is a continuing guarantee and will extend to the ultimate balance of the Guaranteed Obligations regardless of any intermediate payment or discharge or settlement of account in whole or in part. |

| (b) | The Bank may make multiple demands under this Guarantee. |

If any payment by a Borrower or any discharge given by the Bank (whether in respect of a Borrower’s obligations or any security for those obligations or otherwise) is avoided or reduced as a result of insolvency or any similar event:

| (a) | the Guarantors’ liability will continue as if the payment, discharge, avoidance or reduction had not occurred; and |

| (b) | the Bank will be entitled to recover the value or amount of that security or payment from the Guarantors as if the payment, discharge, avoidance or reduction had not occurred. |

The Guarantors’ obligations and the Bank’s rights under this Guarantee will not be affected by an act or omission which, would reduce, release or prejudice any of the Guarantors’ obligations under this Guarantee (whether or not known to any of the Guarantors or the Bank). These Include:

| (a) | the existence of any claim of set-off or other rights which a Guarantor may have against a Borrower, the Bank or any other person or which a Borrower may have at any time against the Bank; |

| (b) | the Bank’s grant to a Borrower of any other credit facilities or the withdrawal or restriction by the Bank of any credit facilities or the failure to notify a Guarantor of any such granting, withdrawal or restriction; |

| (c) | any time, waiver or consent granted to, or composition with, a Borrower or any other person; |

| (d) | the taking, amendment, compromise, exchange, renewal or release of, or failure to perfect, take up or enforce any rights against or security over assets of, a Borrower or any other person or any non-presentation or non-observance of any formality or other requirements in respect of any instrument or any failure to realise the full value of any security; |

| (e) | any incapacity or lack of power, authority or legal personality of or dissolution or change in the members or status of a Borrower or any other person; |

| (f) | any amendment (however fundamental), increase in, waiver, release or replacement of any agreement, document or security; |

| (g) | any unenforceability, illegality or invalidity of any obligation of any person under any agreement, document or security; |

| (h) | any insolvency or reorganisation or similar proceedings of a Borrower; |

| (i) | any variation, renewal, increase, extension, compromise, discharge, dealing with, exchange or renewal of any right or remedy which the Bank may have now or after the date of this Guarantee against a Borrower or any other person; |

| (j) | any change in the constitution (whether by amalgamation, merger, reconstruction or otherwise) or ownership of a Borrower or the Bank or any other person. |

| (k) | any moratorium or other period staying or suspending by statute or the order of any court or any authority of all or any of the Bank’s rights remedies or recourse against the Borrower or the Guarantor; |

| (l) | any other dealing but for the provision of this Clause could affect or discharge any part of the liabilities of the Guarantor hereunder; or |

| (m) | any disposition, assurance, security or payment which may be avoided under the Companies Act 2016 or any statute relating to bankruptcy, winding-up or any analogous proceedings. |

Each Guarantor waives any right it may have of first requiring the Bank (or any trustee or agent on its behalf) to:

| (a) | proceed against any person; |

| (b) | enforce any other rights or security; or |

| (c) | claim payment from any person, |

before claiming from each Guarantor under this Guarantee.

| (a) | The Bank (or any trustee or agent on its behalf) may at any time without affecting the Guarantors’ liability under this Guarantee: |

| (i) | refrain from applying or enforcing any other moneys, security or rights held or received by the Bank (or any trustee or agent on its behalf) against those amounts; or |

| (ii) | apply and enforce the same in such manner and order as it sees fit (whether against those amounts or otherwise); and |

| (b) | hold in a suspense account any moneys received from a Guarantor or on account of the liability of the Guarantors under this Guarantee. |

Unless:

| (a) | all amounts which may be or become payable by each Borrower under or in connection with the Guaranteed Obligations have been irrevocably paid in full; or |

| (b) | the Bank otherwise requests, |

no Guarantor will, after a claim has been made under this Guarantee or by virtue of any payment or performance by it under this Guarantee:

| (i) | be subrogated to any rights, security or moneys held, received or receivable by the Bank (or any trustee or agent on its behalf); |

| (ii) | be entitled to any right of contribution or indemnity in respect of any payment made or moneys received on account of the Guarantor’s liability under this Guarantee; |

| (iii) | claim, rank, prove or vote as a creditor of a Borrower or its estate in competition with the Bank (or any trustee or agent on its behalf); or |

| (iv) | receive, claim or have the benefit of any payment, distribution or security from or on account of a Borrower, or exercise any right of set-off as against a Borrower. |

Each Guarantor must hold in trust for and immediately pay or transfer to the Bank any payment or distribution or benefit of security received by it contrary to this Clause or in accordance with any directions given by the Bank under this Clause. Each Guarantor irrevocably appoints the Bank as that Guarantor’s agent with authority to do all acts and execute all documents on behalf of that Guarantor to protect or preserve the Bank’s interest in such payment, distribution, benefit or security. Each Guarantor’s compliance with its obligations under this Clause will not reduce or affect in any manner the liability of that Guarantor under this Guarantee until all sums actually or contingently owing under the Finance Documents have been fully paid.

Each Guarantor hereby agrees to subordinate any and all indebtedness by the Borrower to that Guarantor, whether or not incurred pursuant to or arising out of this Guarantee to secure the moneys hereby secured, and all the Bank’s rights with respect to the Facilities and any other security held by the Bank.

This Guarantee is in addition to, and is not in any way prejudiced by, any other security now or subsequently held by the Bank.

| 4. | REPRESENTATIONS AND WARRANTIES |

Each Guarantor makes the following representations and warranties to the Bank from and after the date of this Guarantee and which are deemed to be repeated at all times (having regard to the circumstances existing at the time of repetition) so long as any sums are actually or contingently owing under or in connection with the Guaranteed Obligations.

| (a) | Where the Guarantor is a person other than an individual (but including a sole proprietor) it is duly incorporated or established and validly existing under the law of its jurisdiction of incorporation or establishment (as the case may be); and |

| (b) | Where the Guarantor is carrying on a business it and, if the Guarantor is a corporation, each of its Subsidiaries, has the power to own its assets and carry on its business as it is being conducted. |

The obligations expressed to be assumed by it in this Guarantee are legal, valid, binding and enforceable obligations.

The entry into and performance of this Guarantee by it and the transactions contemplated by this Guarantee do not and will not conflict with:

| (a) | any law or regulation or any official or judicial order applicable to it; |

| (b) | where the Guarantor is a corporation, partnership, club, association or society its constitutional documents; or |

| (c) | any agreement or instrument binding upon it or any of its assets. |

It has the power and capacity to enter into and perform, and if the Guarantor is a corporation, partnership, club, association or society, has taken all necessary action to authorise the entry into, performance and delivery of, this Guarantee and the transactions contemplated by this Guarantee.

| 4.5 | Validity and admissibility in evidence |

All authorisations required or desirable:

| (a) | to enable it to lawfully to enter into, exercise its rights under and comply with its obligations in this Guarantee; and |

| (b) | to make this Guarantee admissible in evidence in its jurisdiction of incorporation, establishment or domicile, |

have been obtained or effected and are in full force and effect.

| 4.6 | Governing law and enforcement |

| (a) | The choice of the governing law of this Guarantee will be recognised and enforced in the Guarantor’s jurisdiction of incorporation, establishment or domicile. |

| (b) | Any judgment obtained in the courts to whose non-exclusive jurisdiction the Parties have submitted in relation to this Guarantee will be recognised and enforced in the Guarantor’s jurisdiction of incorporation, establishment or domicile. |

| (c) | The service of any writ or summons or any legal process in respect of any such action or proceeding may be effected on the Guarantor by forwarding a copy of the writ, summons, statement of claim or other legal process by prepaid registered post (or other mode stipulated by law) to its address last notified to the Bank in writing. Where served by post, such writ, summons or statement of claim or such other legal process is taken to have been served on the Guarantor two (2) days after the date of posting. |

| 4.7 | Registration and stamp duty |

| (a) | The Guarantor must do all such things as may be necessary or appropriate to preserve or protect the rights and interests of the Bank created by, or arising from, this Guarantee, including the registration or notification of this Guarantee with each registry or Authority in any jurisdiction in accordance with applicable law and the payment of any stamp duty, registration, duty or similar Tax. |

| (b) | Save for the acts undertaken by the Guarantor under paragraph (a) above, it is not necessary that this Guarantee be filed, recorded or enrolled with any court or other Authority in the Guarantor’s jurisdiction of incorporation, establishment or domicile or that any stamp duty, registration duty or similar Tax or charge be paid on or In relation to this Guarantee or the transactions contemplated by this Guarantee. |

| (a) | Where the Guarantor or any other Obligor is a corporation, no event is continuing which constitutes a default under any document which is binding on the Guarantor, or any other Obligor or any of its or their Subsidiaries or to which the Guarantor’s, or any Obligor’s or its or their Subsidiaries’ assets are subject which might, In the Bank’s opinion, have a material adverse effect on its, or any other Obligor’s financial condition or prospects or the Guarantor’s ability to perform its obligations under this Guarantee. |

| (b) | Where the Guarantor is not a corporation, no event is continuing which constitutes a default under any document which is binding on the Guarantor or any other Obligor which is not a corporation or to which the Guarantor’s assets are subject which might, in the Bank’s opinion, have a material adverse effect on its or any other Obligor’s financial condition or prospects or the Guarantor’s ability to perform its obligations under this Guarantee. |

Where the Guarantor prepares or is legally obliged to prepare audited financial statements, consolidated where applicable, such financial statements most recently delivered to the Bank:

| (a) | have been prepared in accordance with the relevant GAAP / IFRS, as applicable, consistently applied; and |

| (b) | fairly represents (if prepared in accordance with IFRS) or gives a true and fair view of (if prepared in accordance with GAAP) its financial condition, consolidated where applicable, and operations as at the date to which they were drawn up and there has been no material adverse change in its business, operations, assets or financial condition since the date to which those accounts were drawn up. |

Except as previously disclosed to the Bank in writing, no litigation, arbitration or administrative proceedings are current or, to its knowledge, pending or threatened which, if adversely determined, in the Bank’s opinion, is likely to have a material adverse effect on its business, operations, assets, financial condition or prospects or its or any other Obligor’s ability to perform its obligations under this Guarantee.

It has complied in all material respects with all Tax laws in all jurisdictions in which it is subject to Tax and no claims are being asserted against it with respect to Tax which are likely to have in the Bank’s opinion a material adverse effect on its assets, financial condition or prospects or ability to perform its obligations under this Guarantee and where the Guarantor is carrying on a business, its business and operations.

| (a) | Its entry into this Guarantee, and the exercise by it of its rights and performance of its obligations under this Guarantee will constitute, private and commercial acts performed for private and commercial purposes. |

| (b) | It will not be entitled to claim immunity from suit, execution, attachment or other legal process in any proceedings taken in its jurisdiction of incorporation in relation to this Guarantee. |

Any information provided by the Guarantor in connection with this Guarantee was true and accurate in all material respects when it was provided to the Bank or as at the date (if any) at which it is stated and there are no other material facts or considerations the omission of which would make any such information provided be untrue or misleading.

| 5.1 | Authorisations and compliance with laws |

| (a) | Each Guarantor must obtain, maintain and comply with any authorisation required by any law or regulation to enable it to perform its obligations under, or for the validity or enforceability of, this Guarantee. |

| (b) | Each Guarantor must comply in all respects with all laws to which it is subject where failure to do so might In the Bank’s opinion have a material adverse effect on its business, assets, financial condition or prospects or its ability to perform its obligations under this Guarantee. |

Each Guarantor undertakes:

| (a) | that its obligations and liabilities under this Guarantee will at all times rank (except in respect of statutory preferential debts) at least pari passu with all its present and future unsecured indebtedness; and |

| (b) | not to take or receive any security in respect of the Guarantor’s liability under this Guarantee and the Guarantor agrees that in the event any such security is taken the same shall be held in trust for the Bank and shall be deposited with the Bank. |

| (a) | A Guarantor will not create or permit to subsist any Security Interest over any of its assets. |

| (b) | Where a Guarantor is a person other than an individual (but including a sole proprietor), it will not: |

| (i) | sell, transfer or otherwise dispose of any of its assets on terms by which they are or may be leased to or re-acquired by it or, where the Guarantor is a Group member, any other Group member; |

| (ii) | sell, transfer or otherwise dispose of any of its receivables on recourse terms; |

| (iii) | enter into any arrangement under which money or the benefit of a bank or other account may be applied, set-off or made subject to a combination of accounts; or |

| (iv) | enter into any preferential arrangement having a similar effect, |

in circumstances where the arrangement or transaction is entered into primarily as a method of raising Financial Indebtedness or of financing the acquisition of an asset.

(“Quasi-Security” means any transaction described in paragraph (b) above)

| (c) | Paragraphs (a) and (b) above do not apply to any: |

| (i) | netting or set-off arrangement entered into by any Group member or any Guarantor in the ordinary course of its banking arrangements for the purpose of netting debit and credit balances; |

| (ii) | lien arising by operation of law and in the ordinary course of trading or retention of title arrangement in the ordinary course of trading on standard terms and conditions of any supplier; |

| (iii) | Security Interest or Quasi-Security over goods and/or documents of title to goods arising in the ordinary course of letter of credit transactions in the ordinary course of trade; |

| (iv) | Security Interest or Quasi-Security in favour of the Bank; |

| (v) | Security Interest or Quasi-Security as advised by a Guarantor and approved by the Bank except to the extent that the principal amount secured by such Security Interest or Quasi-Security exceeds the relevant maximum principal amount as specified by the Bank in respect of such Security Interest or Quasi-Security; and |

| (vi) | Security Interest or Quasi-Security created with the prior written consent of the Bank provided that the principal amount is not increased at any time. |

| 5.4 | Disposals and acquisitions |

Where a Guarantor is carrying on a business, such Guarantor will not dispose of all or any part of its assets or make any acquisition or investment except where made in the ordinary course of trading and, in relation lo a disposal of assets only, of assets in exchange for other assets comparable or superior as to type and value.

Where a Guarantor is carrying on a business, such Guarantor must procure that no substantial change or disposal is made which will have an effect on the general nature of its business.

| 5.6 | Financial statements and other information |

A Guarantor must ensure that the Bank receives:

| (a) | where a Guarantor prepares or is legally obliged to prepare audited financial statements, consolidated where applicable, such financial statements for each of its financial years as soon as they become available; |

| (b) | information necessary to enable the Bank to comply with “know your customer” or similar identification procedures as the Bank may request from time to time; |

| (c) | details of any litigation, arbitration or other proceedings pending or threatened; and |

| (d) | any further information as the Bank may reasonably request from time to time in writing regarding such Guarantor. |

| 5.7 | Change of constitution or status |

| (a) | Where a Guarantor is a corporation, it must not undertake or permit any arrangement or reconstruction of its present constitution nor effect any changes to its constitutional documents; and |

| (b) | Where a Guarantor is a partnership, it must not permit any change in status or constituents nor effect any changes to its articles of partnership. |

without the prior written consent of the Bank.

| 6. | NO RELIANCE BY THE GUARANTOR |

Each Guarantor acknowledges that, in entering into this Guarantee, such Guarantor:

| (a) | has not relied on anything said or written statement, advice, opinion or information given in good faith by the Bank or on the Bank’s behalf and the Bank shall have no liability to such Guarantor; |

| (b) | has made its own decision, without relying on the Bank, on the chances of success or failure of the purpose for which each Borrower has incurred the Guaranteed Obligations and the Bank shall have no liability to such Guarantor; |

| (c) | has made, without relying on the Bank, its own independent investigation of each Borrower and each Borrower’s affairs and financial condition, and such Guarantor has come to its own decision, without relying on the Bank, as to the likelihood of the Borrower repaying the Guaranteed Obligations and the Bank shall have no liability to such Guarantor; and |

| (d) | agrees with the Bank for itself and as trustee for its officials, employees and agents that neither the Bank nor its officials, employees or agents shall have any liability for anything which the Bank, its officials, employees or agents may have done or failed to do in good faith. |

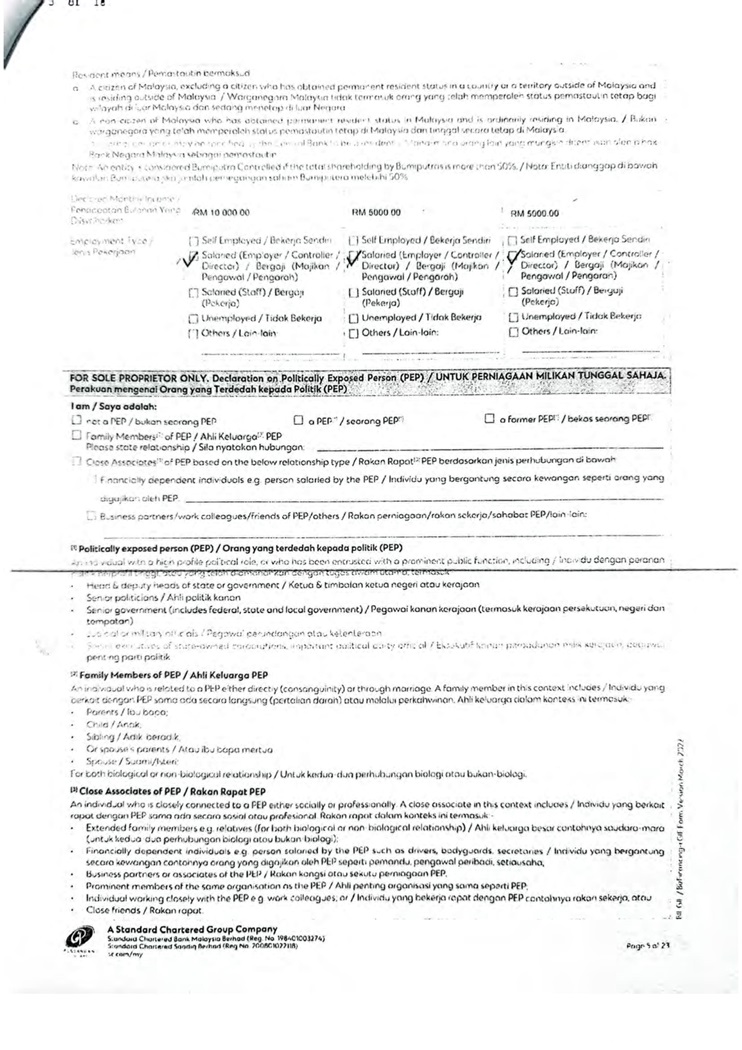

| 7.1 | Where a Guarantor is a partnership: |

| (a) | in the event that the constitution of the partnership changes, whether by dissolution, death, retirement, change in the members or any other change whatsoever, such Guarantor shall notify the Bank in writing of such change to its constitution immediately; and |

| (b) | in the event that the partnership’s constitution changes by virtue of the fact that a new partner has joined the partnership, if so requested by the Bank, such Guarantor shall procure that the new partner enters into such documentation as the Bank requests to create, perfect or protect any security intended to be created by this Guarantee. |

| 7.2 | Any person who stops being a partner for any reason remains liable for all debts and other liabilities owed by the partnership to the Bank which have occurred up to and including the date that such person ceased to be a partner. |

| 7.3 | If a Guarantor is a partnership this Guarantee shall apply to the ultimate balance of all the obligations under this Guarantee payable by such Guarantor in the name of the partnership until the Bank receives written notice of the dissolution of the partnership. |

| 7.4 | If the dissolution is due only to the: |

| (a) | retirement, removal or death of a partner or partners of the partnership; or |

| (b) | introduction of a further partner or partners; |

then (unless the Bank decides otherwise) this Guarantee shall continue and apply (in addition to all money and liabilities due, owing or incurred from or by the old partnership to the Bank) to all money and liabilities due, owing or incurred from or by the new partnership to the Bank as though there had been no change in the partnership or from or by any partner of the old partnership who carries on the business of the old partnership as a sole proprietor.

| 7.5 | If a Guarantor is a partnership, such Guarantor shall renew the partnership’s certificate of registration (if required under any applicable laws) on a timely basis and if the Bank requests, such Guarantor will promptly submit a copy of the same and every renewal thereof. |

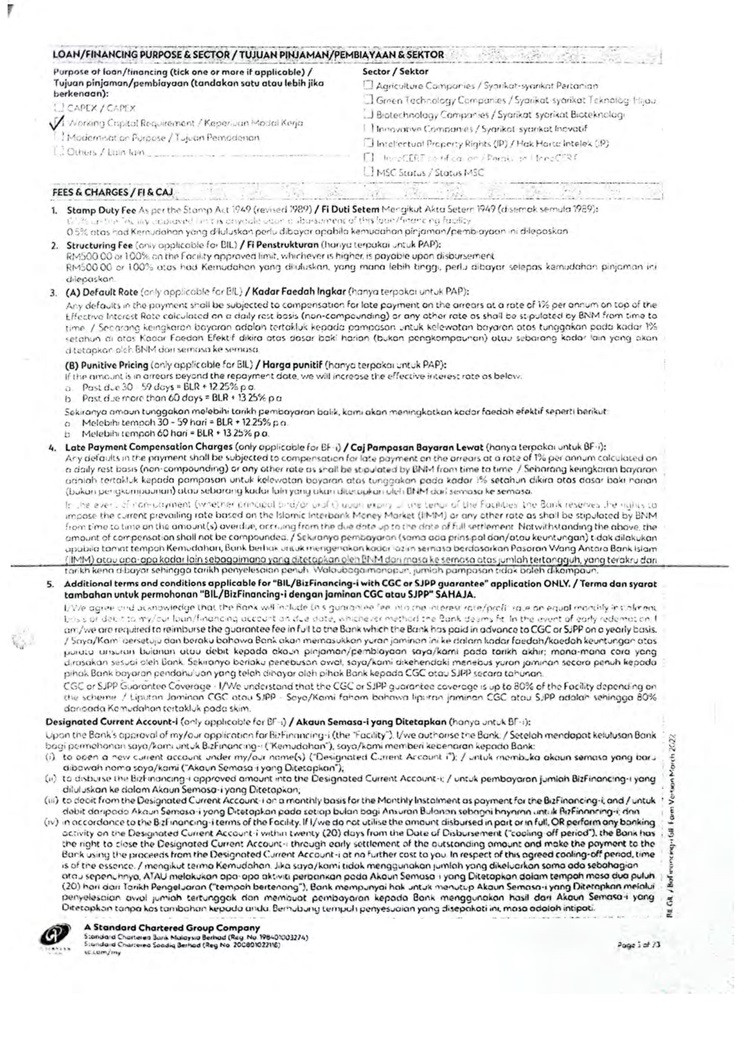

Each Guarantor must:

| (a) | immediately on demand by the Bank, pay all costs and expenses (including legal fees and any applicable Tax) incurred in connection with this Guarantee by the Bank or any attorney, manager, agent or other person appointed by the Bank under this Guarantee including any arising from any actual or alleged breach by any person of any law or regulation; and |

| (b) | keep each of the persons referred to in paragraph (a) above indemnified against any failure or delay in paying those costs or expenses. |

| (a) | Each Guarantor must make all payments under this Guarantee without any set-off or counterclaim and free from any deduction or withholding for or on account of any Tax. |

| (b) | If a Guarantor is required by law to make any such deduction or withholding, it must: |

| | | |

| | | (i) | pay to the Bank any additional amount as may be necessary to ensure that the Bank receives the full amount of the relevant payment as if that deduction or withholding had not been made; and |

| | | | |

| | | (ii) | supply promptly to the Bank evidence satisfactory to the Bank that it has accounted to the relevant Authority for that withholding or deduction. |

| (a) | If a Guarantor fails to pay any amount payable by it under this Guarantee on its due date, interest (“Default Interest”) will accrue daily on the entire overdue amount from the due date up to the date of actual payment (both before and after judgment) at a rate as may be advised by the Bank from time to time and will be immediately payable on demand by the Bank. |

| (b) | Default Interest (if unpaid) arising on an overdue amount will be compounded with the overdue amount on any basis that the Bank may select. |

| 10. | SET-OFF, LIEN AND RIGHT TO DEBIT |

The Bank may set-off any obligation due from a Guarantor under this Guarantee against any obligation owed by the Bank or the Bank’s Affiliates to such Guarantor (or where a Guarantor is a corporation, such Guarantor’s Affiliates) regardless of the place of payment, booking branch or currency of either obligation. If the obligations are in different currencies, the Bank may convert either obligation at a market rate of exchange in its usual course of business for the purpose of the set-off. For the purposes of this Clause, “obligation” includes any obligation whether matured or unmatured, actual or contingent, present or future. If the amount of any such obligation is unascertained, the Bank may estimate the amount for the purposes of the set-off.

The Bank shall have a lien on any securities or other properties in the possession of the Bank or any of its subsidiaries in or outside Malaysia whether deposited by the Guarantor for safe custody or otherwise and a right to hold such securities or other properties as security for the monies secured pursuant this Guarantee.

The Borrower will be notified in advance of the Bank’s intention to debit any of the Guarantor’s account(s) with the Bank in respect of any monies due and payable hereunder by the Guarantor.

| 11. | EVIDENCE AND CALCULATIONS |

Accounts maintained by the Bank in connection with the Guaranteed Obligations are prima facie evidence of the matters to which they relate for the purpose of any litigation or arbitration proceedings.

| 11.2 | Certificates and determinations |

Any certification or determination by the Bank of a rate or amount under this Guarantee will be, in the absence of manifest error, conclusive evidence of the matters to which it relates.

Any interest or fee accruing under this Guarantee accrues from day to day and is calculated on the basis of the actual number of days elapsed and a year of 360 or 365 days or otherwise, depending on what the Bank determines is market practice.

| 12. | AMENDMENTS AND WAIVERS |

No term of this Guarantee may be waived or amended except in writing by the Parties.

| 12.2 | Waivers and remedies cumulative |

The Bank’s failure to exercise, or delay in exercising, any right or remedy under this Guarantee or any other document entered into in connection with the Guaranteed Obligations will not operate as a waiver, nor will any single or partial exercise of any right or remedy prevent any further or other exercise or the exercise of any other right or remedy. The rights and remedies provided in this Guarantee are cumulative and not exclusive of any rights or remedies provided by law.

| 13. | CHANGES TO THE PARTIES |

| 13.1 | Assignments and transfers by the Guarantor |

No Guarantor is entitled to assign or transfer any of its rights and obligations under this Guarantee without the Bank’s prior consent.

| 13.2 | Assignments and transfers by the Bank |

The Bank may at any time assign or transfer any of its rights and obligations under this Guarantee to any other person or change its lending office without the prior consent of the Guarantors.

| 13.3 | Changes in Constitution |

The security, liabilities and/or obligations created by this Guarantee shall continue to be valid and binding notwithstanding, in the case of the Guarantor being an individual, the Guarantor’s death, bankruptcy, mental incapacity, or in the case of the Guarantor being a partnership, by reason of a change in the membership of a partnership (whether by death, resignation or admission of new partners) or in the case of the Guarantor being a corporation, the Guarantor’s change in name or style or by amalgamation, liquidation, winding up, reconstruction or any change in the constitution of the Guarantor.

| 14. | DISCLOSURE OF INFORMATION |

The Bank will keep information provided by, or relating to, any Guarantor confidential except that the Bank may disclose such information:

| (a) | to any of the Bank’s Affiliates; |

| (b) | to any of the Bank’s or the Bank’s Affiliates’ service providers or professional advisers, who is under a duty of confidentiality to the discloser to keep such information confidential; |

| (c) | to any actual or potential participant, sub-participant or transferee of the Bank’s rights or obligations under any transaction between the parties (or any of its agents or professional advisers) and any other person in connection with a transaction or potential transaction between the parties; |

| (d) | to any rating agency, insurer or insurance broker, or direct or indirect provider of credit protection; |

| (e) | as required by any law or any Authority; or |

| (f) | to the Central Credit Bureau, Bank Negara Malaysia (“BNM”) (including the Central Credit Reference Information System ((CCRIS), the Dishonoured Cheques Information System, the Financial Institutions Statistical System or any other database or system established by BNM), or any credit reference agency that the Bank uses for credit assessment or credit review of any Guarantor or any other bureau or company or person providing credit checks or who provides direct or indirect credit protection to the Bank or any of the Bank’s Affiliates whether or not established or approved by BNM or any other governmental or regulatory authority or body, Cagamas Berhad and/or Credit Guarantee Corporation. |

If any provision of this Guarantee is or becomes illegal, invalid or unenforceable in any respect under any law of any jurisdiction, neither the legality, validity or enforceability of the remaining provisions nor the legality, validity or enforceability of such provision under the law of any other jurisdiction will in any way be affected or impaired.

| 18. | RIGHTS OF THIRD PARTIES |

Unless stated otherwise in this Guarantee:

(a) a person not a Party has no right to enjoy or enforce any benefit under it; and

(b) the consent of any person not a Party is not required to amend this Guarantee.

This Guarantee may be executed in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of this Guarantee.

| 20. | GOVERNING LAW AND JURISDICTION |

| (a) | This Guarantee and all non-contractual obligations arising in any way out of or in connection with this Guarantee are governed by Malaysian law and each Guarantor irrevocably submits to the non-exclusive jurisdiction of the Malaysian courts. |

| (b) | In the event that the Guarantor is a non-resident or not incorporated in Malaysia, each Guarantor irrevocably appoints 1 of 2 as its process agent under this Guarantee for service of process in any proceedings before the Malaysian courts in connection with this Guarantee. If any person appointed as process agent is unable to act as process agent for that purpose, a new process agent must be appointed immediately and the relevant Guarantor must notify the Bank of the new process agent’s name and address. The Bank may appoint a new process agent if any Guarantor fails to comply and the Bank will notify such Guarantor of the name and address of the new process agent. |

[End of Clauses]

| 1 | Insert the name of Process Agent |

| 2 | Insert the address of Process Agent |

SCHEDULES

SCHEDULE 1

CONTACT DETAILS

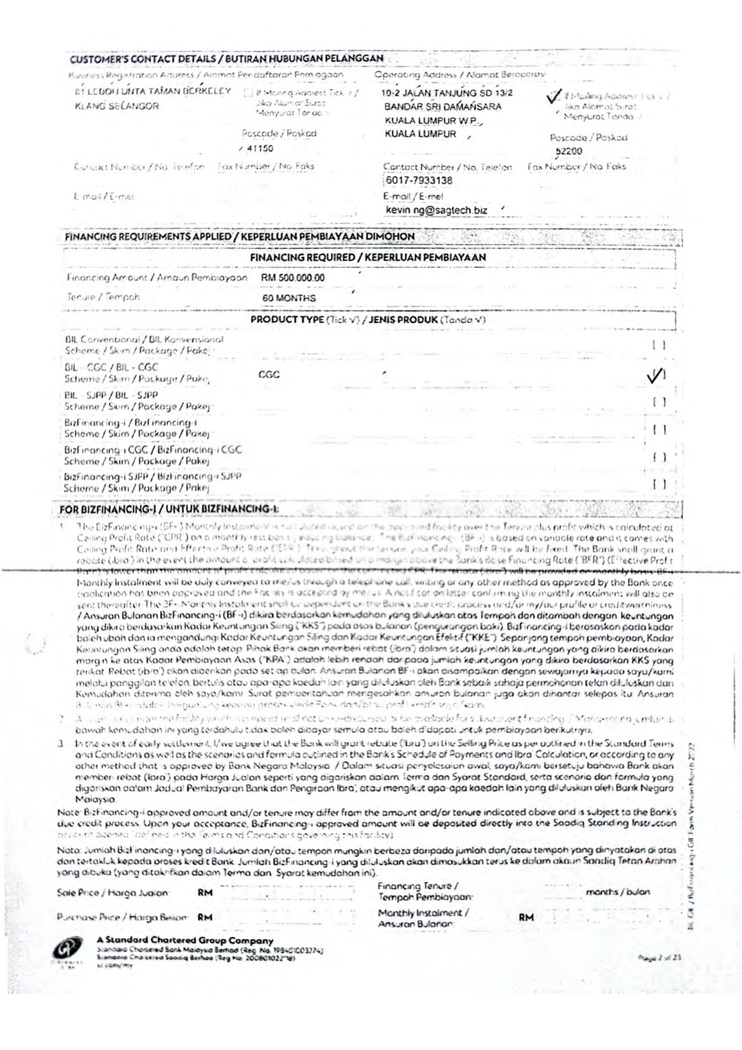

Guarantor 1

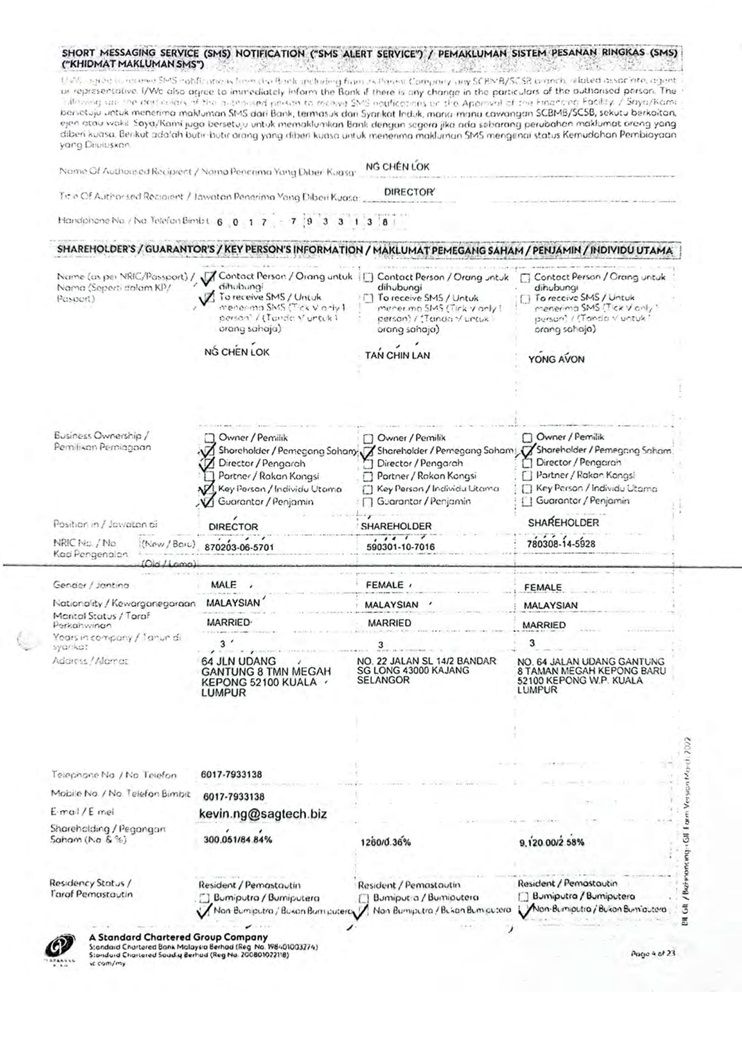

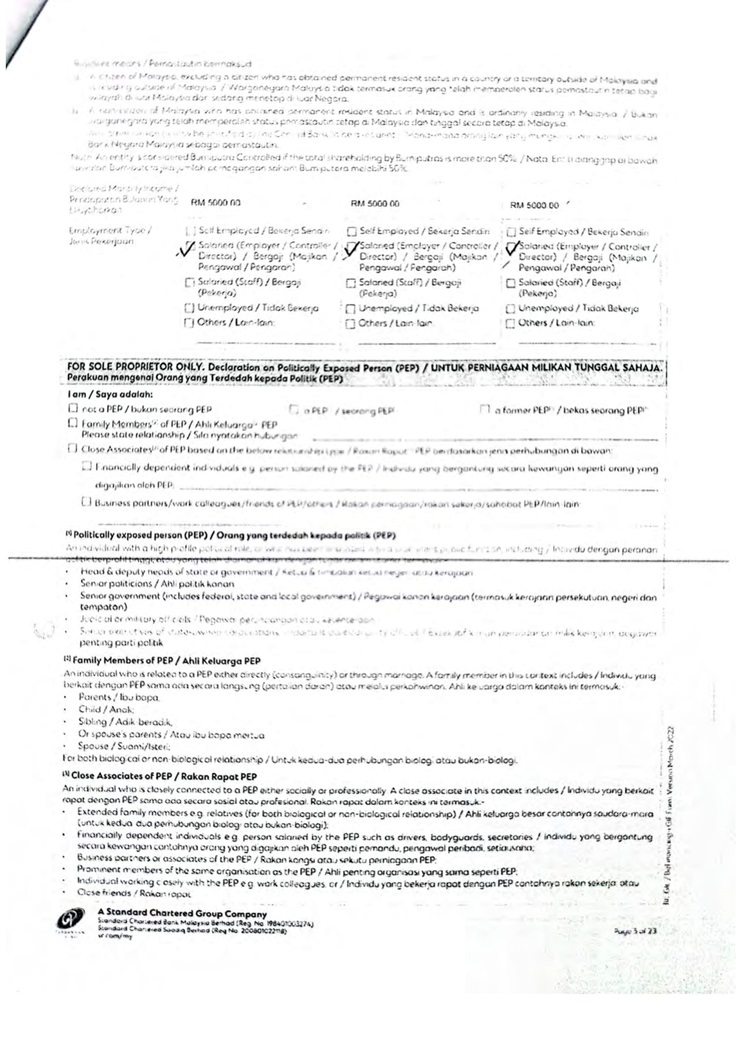

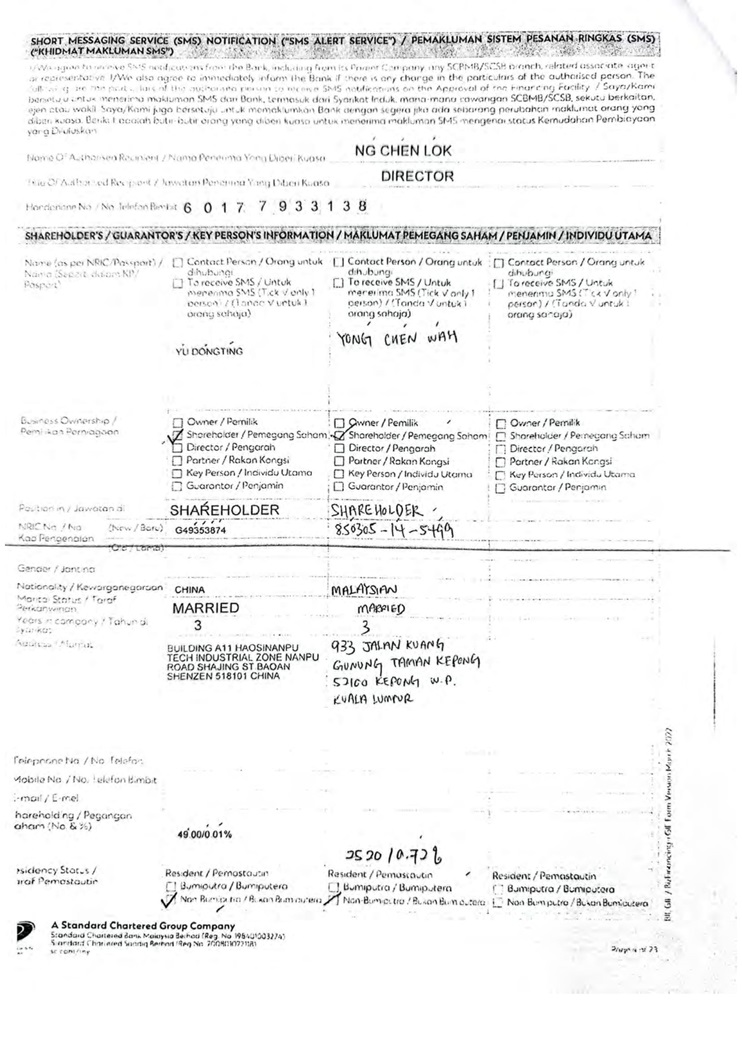

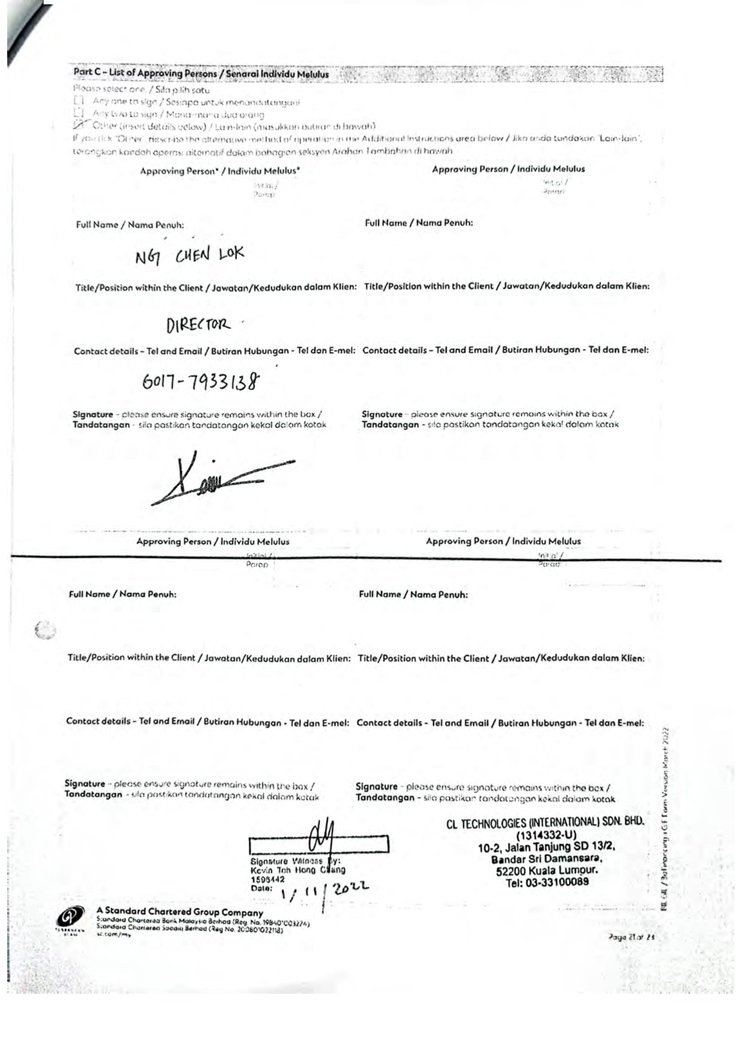

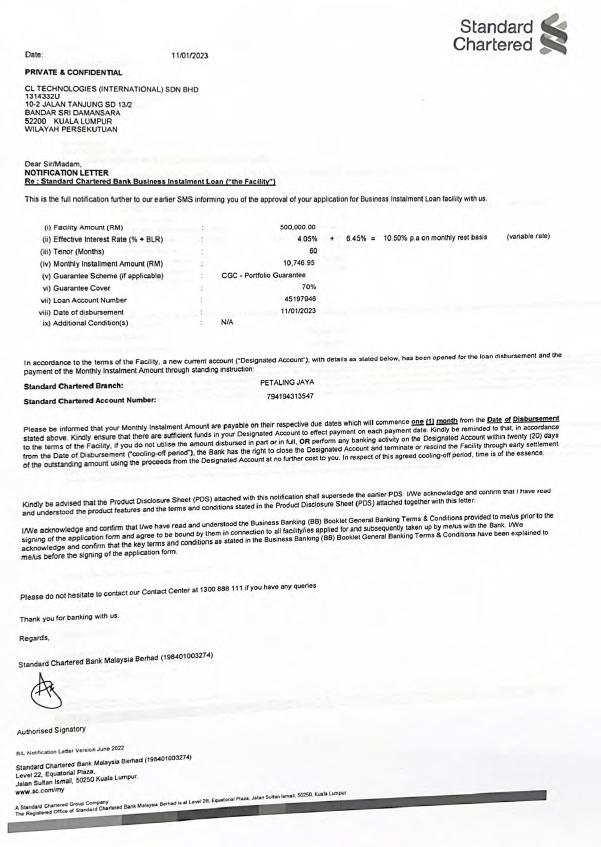

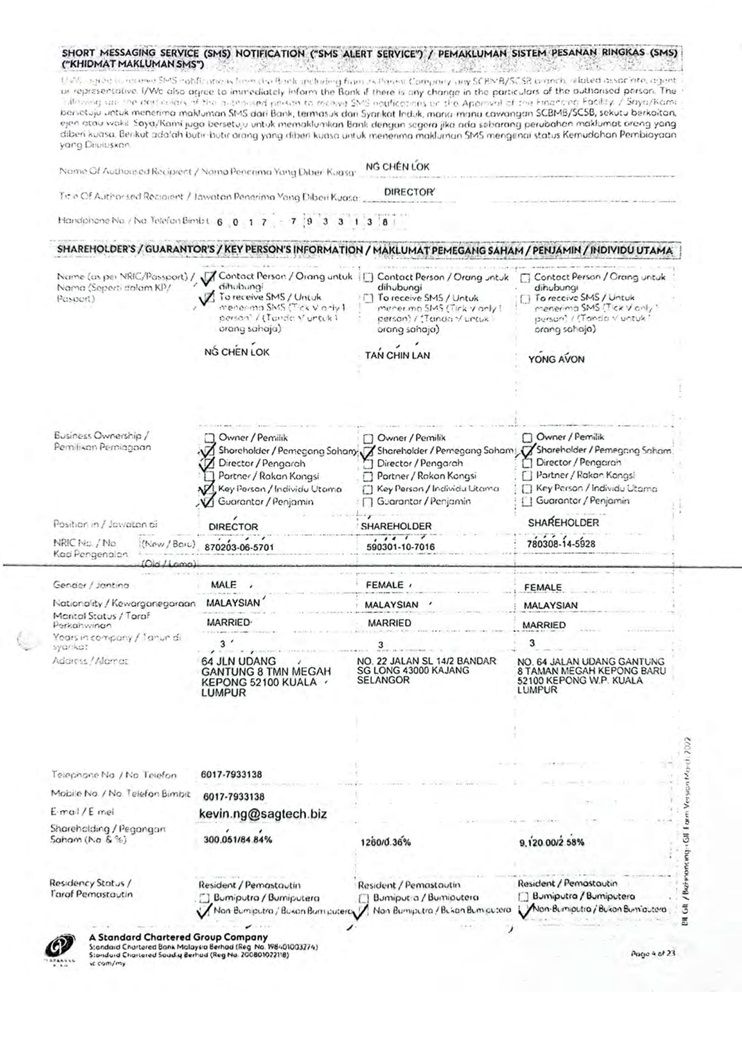

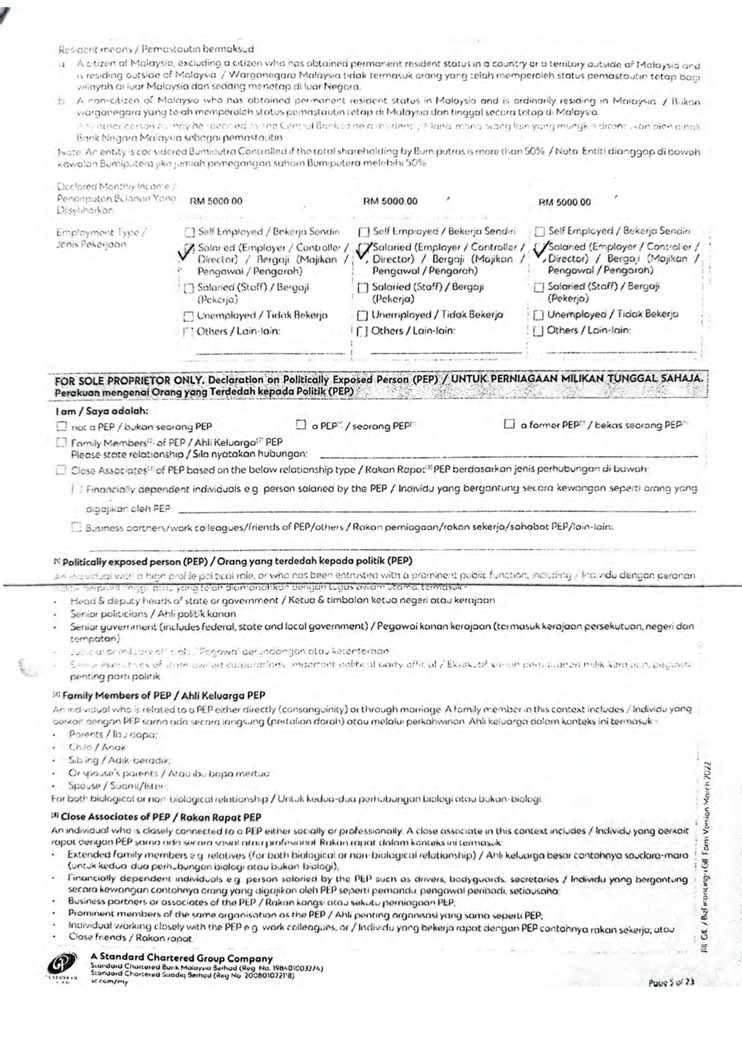

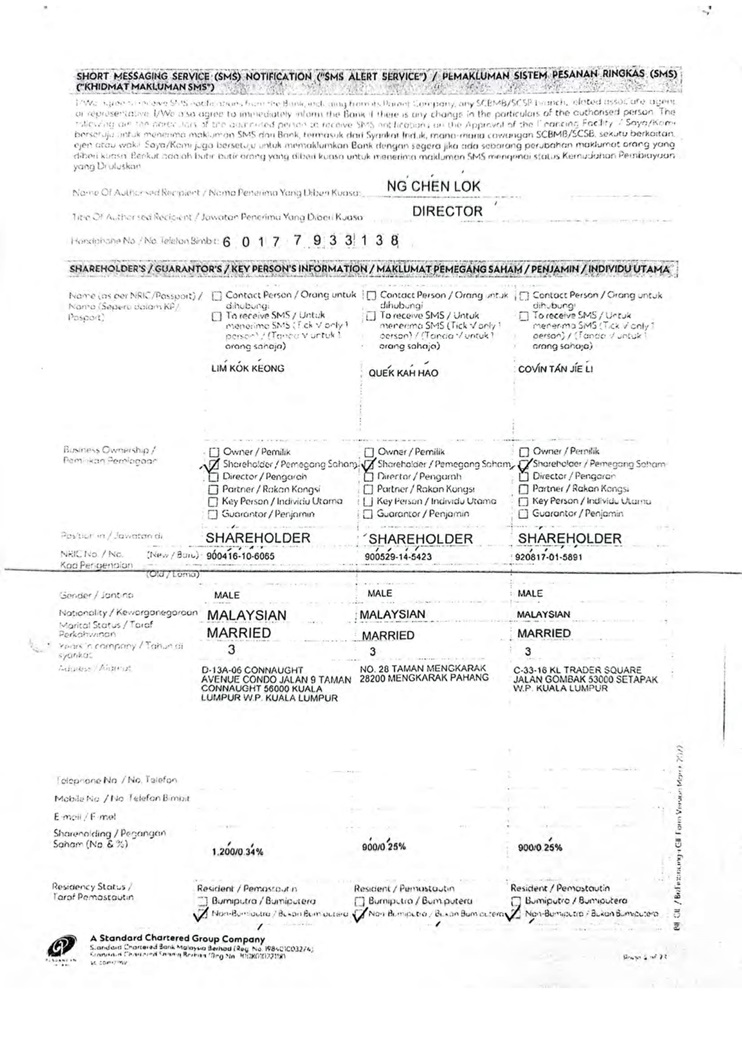

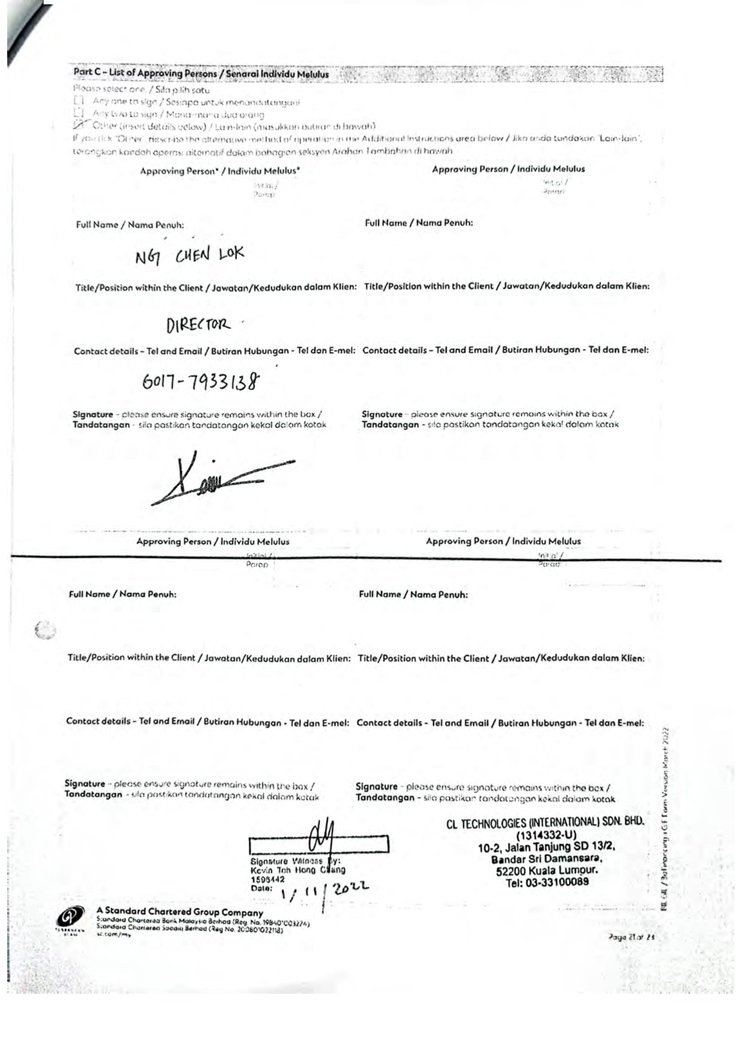

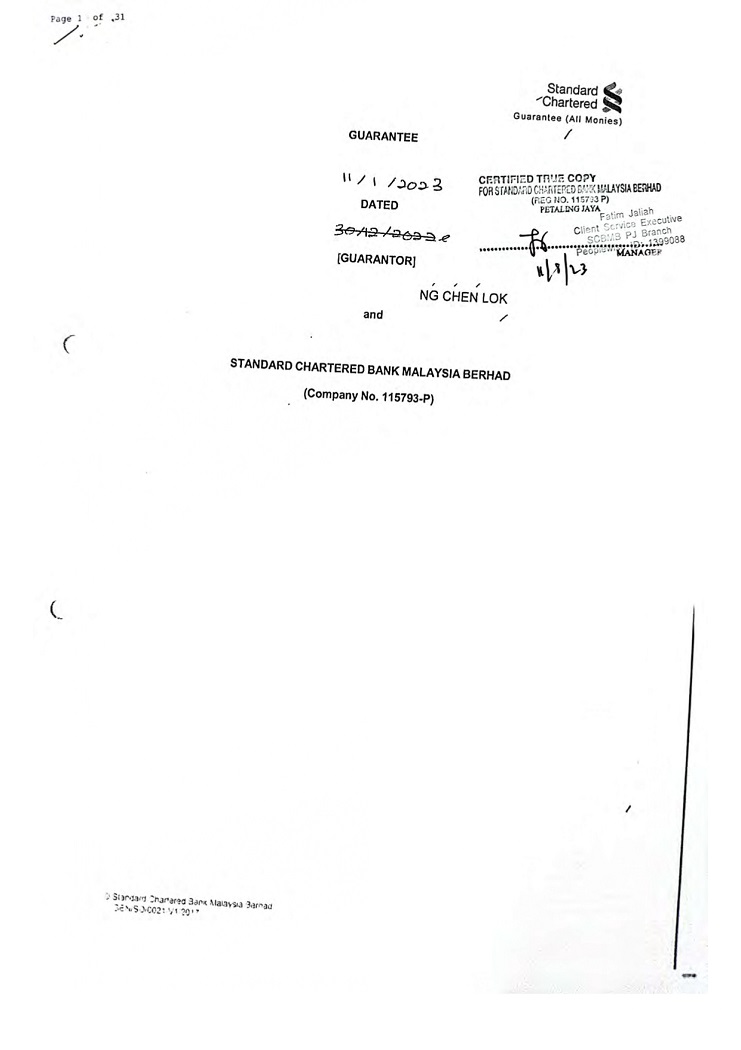

Name: NG CHEN LOK

Address: 64 JLN UDANG GANTUNG 8 TMN MEGAH KEPONG 52100 KUALA LUMPUR

Tel No: 6017-7933138

Fax No:

Guarantor 2

Name:

Address:

Tel No:

Fax No:

Guarantor 3

Name:

Address:

Tel No:

Fax No:

Part 2

PARENT COMPANY 3

| Name | |

| Company Number | |

| Registered address / place of business | |

| 3 | To insert the details of the parent company if the Guarantor is a member of a Group of Companies |

SCHEDULE 3

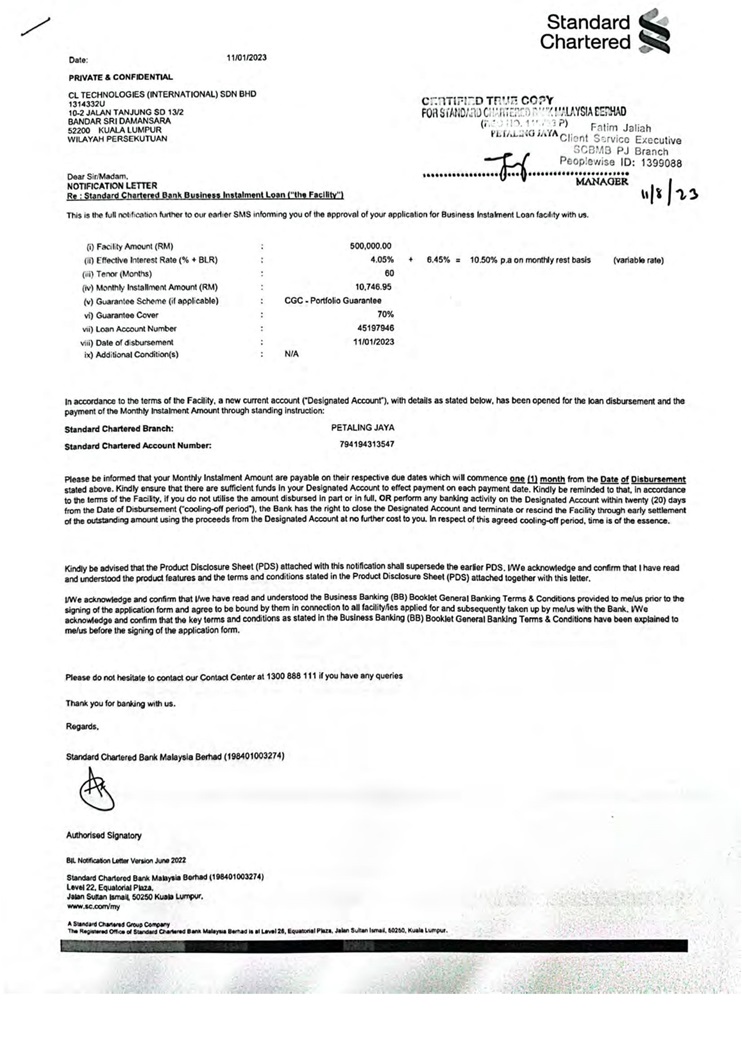

BORROWER

Name and NRIC number (for

individuals) / company

number (for corporations) /

business registration

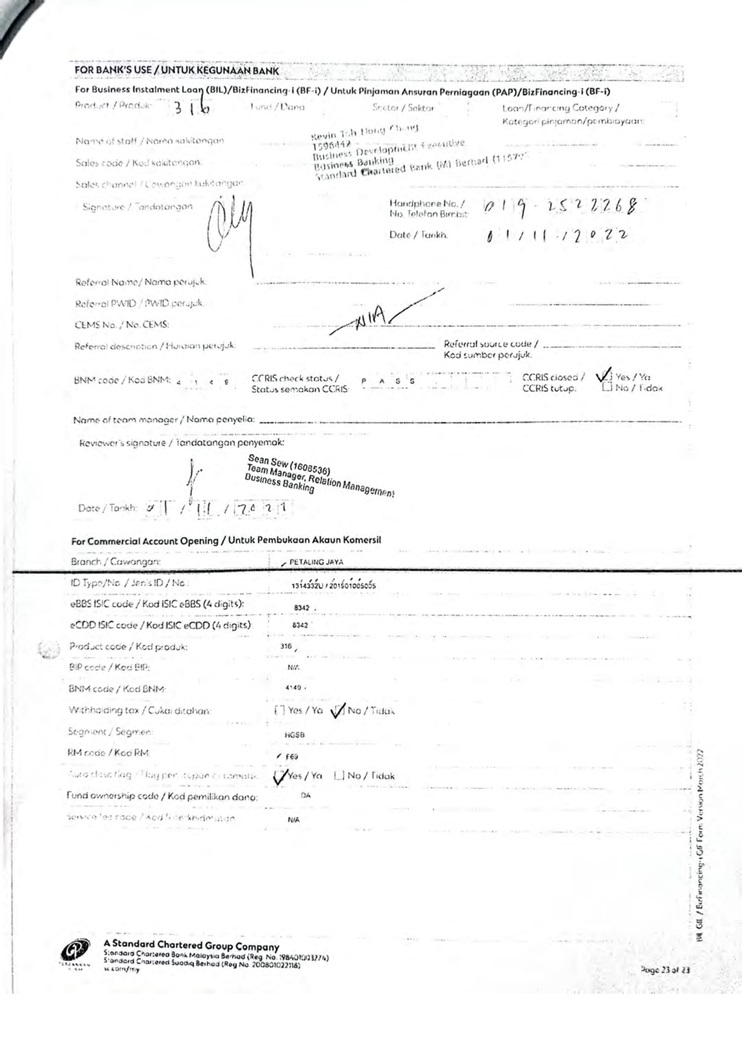

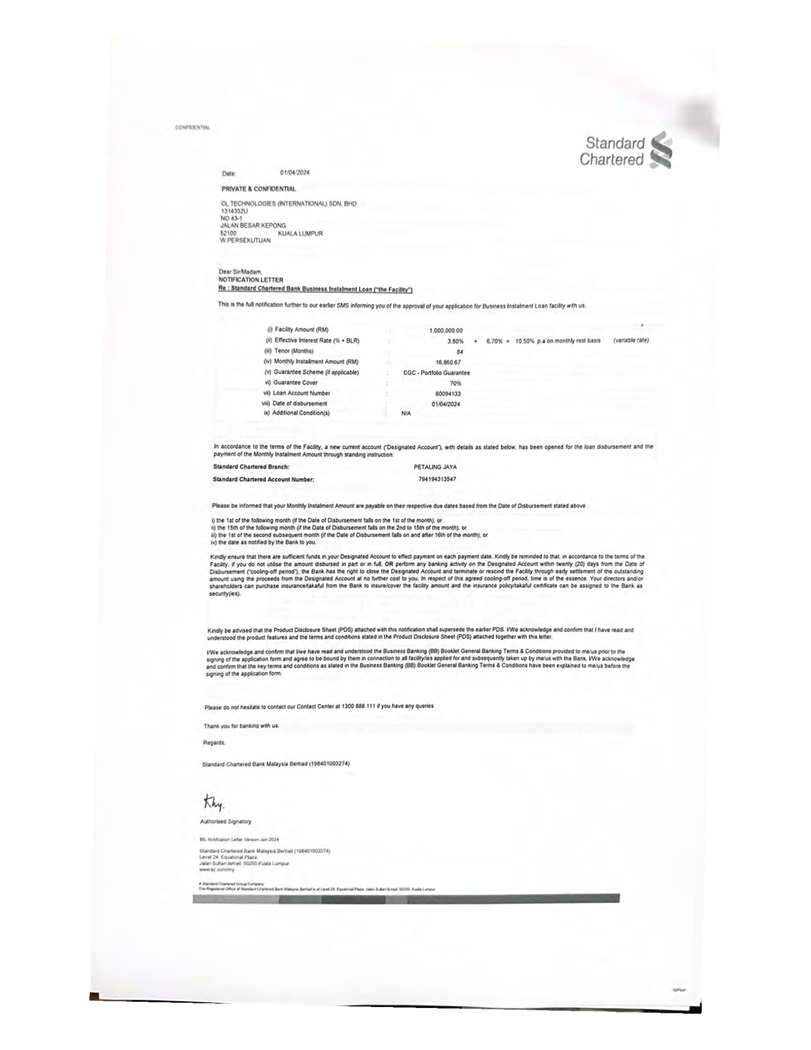

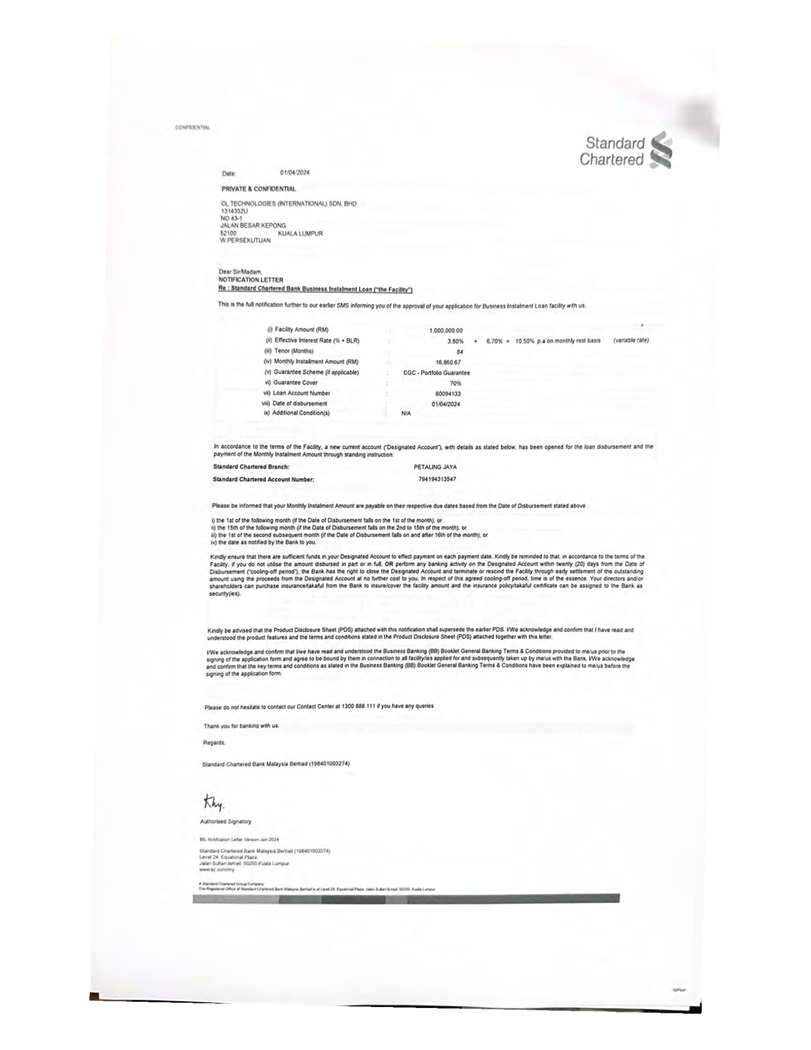

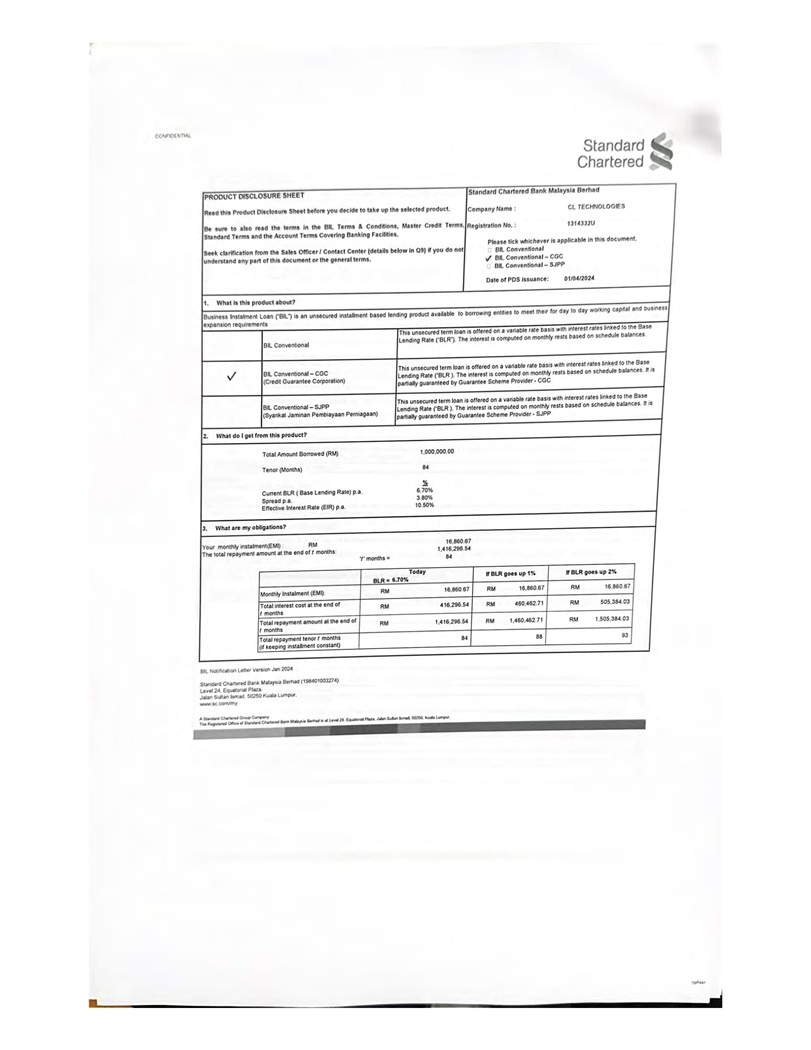

number (where applicable) | CL TECHNOLOGIES (INTERNATIONAL) SDN. BHD. 1314332U / 201901005005 |

Residential address (for

individuals) / registered

address or place of

business (for corporations,

sole proprietors and partnerships) | 81 LEBOH UNTA TAMAN BERKELEY 41150 KLANG SELANGOR |

SIGNATURES

| THE GUARANTOR | | | |

| | | | |

| Execution by a Company | | | |

| | | | |

| The common seal of the Guarantor | ) | | |

| was hereunto affixed in accordance with its | ) | | |

| constitution in the presence of: | ) | | |

| | ) | | |

| | | |

| | | | |

| | | Director | |

| | | | |

| | | Name: | |

| | | | |

| | | NRIC NO.: | |

| | | | |

| | | |

| | | | |

| | | Director/Secretary | |

| | | | |

| | | Name: | |

| | | | |

| | | NRIC NO.: | |

| WARNING TO GUARANTOR WHO IS AN INDIVIDUAL/PARTNERSHIP/SOLE PROPRIETOR |

| |

| You should seek independent legal advice before signing this Guarantee. |

| |

| By signing this Guarantee, you confirm that you have fully understood the contents of this Guarantee and agree to be legally bound by its terms and you may become liable to the Bank instead of, or as well as, the Borrower. |

| |

| In agreeing to be the Guarantor, you are liable for all sums of monies due and owing by the Borrower to the Bank. |

Execution by an Individual

Guarantor 1

| Signed and delivered | ) | |

| by the Guarantor | ) | |

| in the presence of:- | ) | /s/ NG CHEN LOK |

| | | Name: NG CHEN LOK |

| | | NRIC No: 870203-06-5701 |

| Witness’ signature | /s/ Kevin Toh Hong Chang | | /s/ Kevin Toh Hong Chang |

| Full name | Kevin Toh Hong Chang | | Signature Witness By: |

| NRIC No. | 961123-10-5965 | | Kevin Toh Hong Chang |

| Address | 1596442 | | 1596442 |

| Occupation | Business Development Executive Business Banking Standard Chartered Bank (M) Berhad (115793 P) | | Date: 1/11/2022 |

Guarantor 2

| Signed and delivered | ) | |

| by the Guarantor | ) | |

| in the presence of:- | ) | |

| | | Name: |

| | | NRIC No: |

| Witness’ signature | | |

| Full name | | |

| NRIC No. | | |

| Address | | |

| Occupation | | |

Guarantor 3

| Signed and delivered | ) | | |

| by the Guarantor | ) | | |

| in the presence of:- | ) | | |

| | | Name: | |

| | | NRIC NO: | |

| Witness’ signature | | |

| Full name | | |

| NRIC No. | | |

| Address | | |

| Occupation | | |

Guarantor 4

| Signed and delivered | ) | | |

| by the Guarantor | ) | | |

| in the presence of:- | ) | | |

| | | Name: | |

| | | NRIC NO: | |

| Witness’ signature | | |

| Full name | | |

| NRIC No. | | |

| Address | | |

| Occupation | | |

Guarantor 5

| Signed and delivered | ) | | |

| by the Guarantor | ) | | |

| in the presence of:- | ) | | |

| | | Name: | |

| | | NRIC NO: | |

| Witness’ signature | | |

| Full name | | |

| NRIC No. | | |

| Address | | |

| Occupation | | |

Guarantor 6

| Signed and delivered | ) | | |

| by the Guarantor | ) | | |

| in the presence of:- | ) | | |

| | | Name: | |

| | | NRIC NO: | |

| Witness’ signature | | |

| Full name | | |

| NRIC No. | | |

| Address | | |

| Occupation | | |

OPTION A4

SOLICITORS CERTIFICATE

I of a solicitor of the courts of Malaysia have explained the terms and content of this Guarantee to

(in [his/her] capacity as Guarantor) and believe that [he/she] understands their effect.

Signed:

Date:

OR

OPTION B 5

INDEPENDENT ADVICE

I/We confirm that I/we have been advised to obtain independent legal advice as to the nature and effect of this Guarantee but have declined to do so.

Guarantor 1

| Signature of Guarantor: | /s/ NG CHEN LOK | | /s/ Kevin Toh Hong Chang |

| Name of Guarantor: NG CHEN LOK | | Signature Witness By: |

| Date: 1/11/2022 | | Kevin Toh Hong Chang |

| | | | 1596442 |

| | | | Date: 1/11/2022 |

| 4 | Use option A if the Guarantor (who is an individual) has obtained separate legal advice. |

| 5 | Use option B if Guarantor (who is an individual) refuses to obtain independent legal advice. |

Guarantor 2

Signature of Guarantor:

Name of Guarantor:

Date:

Guarantor 3

Signature of Guarantor:

Name of Guarantor:

Date:

Guarantor 4

Signature of Guarantor:

Name of Guarantor:

Date:

Guarantor 5

Signature of Guarantor:

Name of Guarantor:

Date:

Guarantor 6

Signature of Guarantor:

Name of Guarantor:

Date:

| Execution by a Partnership | | | |

| | | | |

| Signed and delivered | ) | | |

| for and on behalf of the partners | ) | Authorised Signatory | |

| in the firm of | ) | | |

| under a power of attorney dated | ) | Full Name | |

| in the presence of | ) | | |

| | ) | NRIC NO: | |

| Witness’ signature | | |

| Full name | | |

| NRIC No. | | |

| Address | | |

| Occupation | | |

| Execution by Sole Proprietor | | | |

| | | | |

| Signed and delivered by6 | ) | | |

| ) | | |

| | ) | | |

| for and on behalf of and trading as 7 | ) | | |

| ) | | |

| in the presence of:- | ) | | |

| Witness’ signature | | |

| Full name | | |

| NRIC No. | | |

| Address | | |

| Occupation | | |

| THE BANK | |  |

| | |

| Signed by | ) |

| for and on behalf of | ) |

| | ) |

| Standard Chartered Bank Malaysia Berhad | |

| (Company No. 115793-P) | |

| 6 | Insert name and business registration number / NRIC No. of sole proprietor |

| 7 | Insert name of Guarantor |