Summary Financial Statements

Notes to the Financial Statements

1. Significant Accounting Policies (continued)

Derivative liabilities include currency and interest rate swaps measured at fair value. Unrealized changes in fair value are recorded in the Statement of Remeasurement Gains and Losses. A derivative that has positive fair market value is presented as a financial asset on the Statement of Financial Position.

Other liabilities include unamortized debt-related costs, which is comprised of premiums, discounts and debt issue costs. These costs are deferred and amortized using the effective interest rate method.

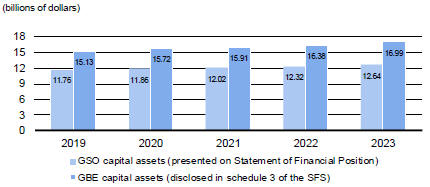

Non-financial assets

Non-financial assets are acquired, constructed or developed assets that do not normally provide resources to discharge existing liabilities, but instead are normally employed to deliver government services, may be consumed and are not for sale in the normal course of operations. Non-financial assets are recorded at cost and expensed as they are consumed.

Inventories held for consumption are recorded at cost and are expensed as they are consumed.

Tangible capital assets include all amounts directly attributable to the acquisition, construction, development, betterment or retirement of the asset. During construction, these assets are recorded based on their percentage of completion and are disclosed as work in progress. Amortization is generally on a straight-line basis over the estimated useful life of the asset and commences when the asset is put in service. Intangible assets, items inherited by right of the Crown such as Crown lands, forests, water and mineral resources, works of art and historical treasures are not recognized as assets in these financial statements as an estimate of their future economic benefits cannot be reasonably and verifiably quantified.

Tangible capital assets procured through P3s are valued at the total of the nominal value of progress payments made during or on completion of construction and the present value of the future capital payments, discounted to the date the asset is available for use, using the Government’s borrowing rate for general debt at the time the agreement is signed.

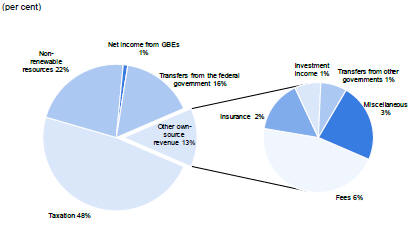

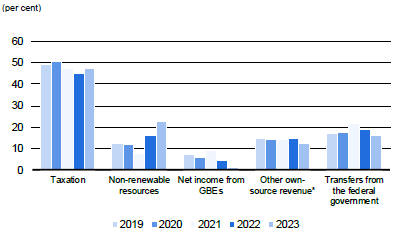

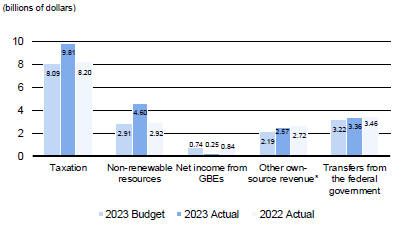

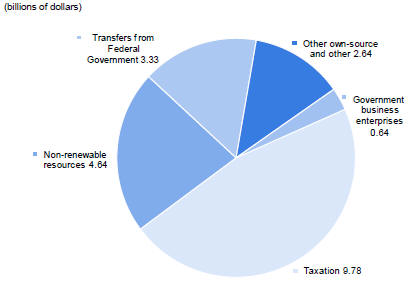

Revenue

Revenue, recorded on the accrual basis, represents economic resources earned by the Government from taxes and other sources that are used to deliver public services.

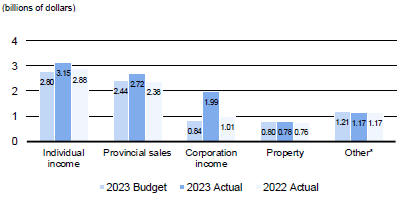

Taxation revenue is recognized when the tax has been authorized by the legislature and the taxable event occurs. The taxable event differs for each type of tax; for example, taxation revenue is recognized when taxpayers earn income, purchase products and services, or are in possession of real property. Tax concessions are recorded as a reduction in taxation revenue.

For individual and corporation income taxes, cash received from the federal government, adjusted for assessment data from the federal government when it provides a more reliable estimate, is used as the basis for recording the tax revenue.

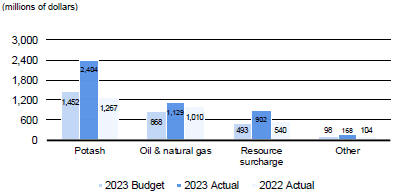

Non-renewable resources revenue is recognized based on the production, sales or profits generated from the specific non-renewable resource. Oil and natural gas revenue is based primarily on price and production; resource surcharge revenue is based on sales volumes and prices; and potash revenue is based primarily on profits generated.

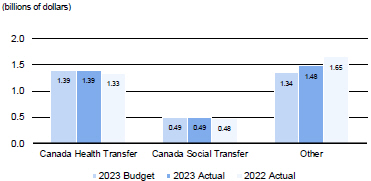

Transfers from the federal government are recognized as revenue in the period the transfer is authorized and eligibility criteria are met, except when and to the extent that the transfer stipulations give rise to an obligation that meets the definition of a liability. Transfers meeting the definition of a liability are recorded as unearned revenue and recognized as the stipulations are met.

Expense

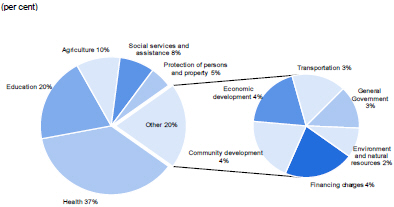

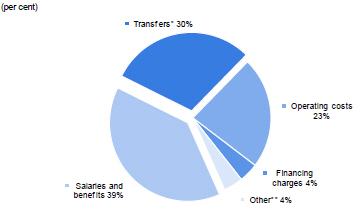

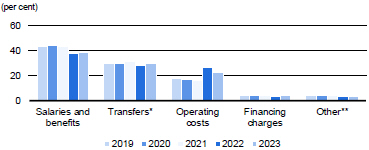

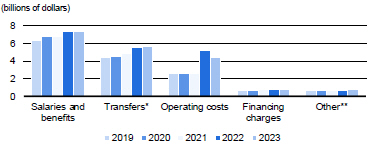

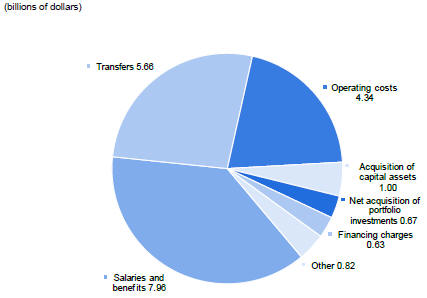

Expenses, recorded on the accrual basis, represent the Government’s cost to deliver public services and are classified by theme in the Statement of Operations and by object in Schedule 15, while Schedule 17 discloses expense themes by object. Transfers are recognized as expenses in the period the transfer is authorized and eligibility criteria are met.

Expenses classified by theme, which are based on the major functional groupings of activities, are as follows:

The agriculture theme includes expenses to assist and improve the agriculture and food industry through development activities including research, education, regulation and investment in the sector as well as providing direct support to farmers through loans, income stabilization and insurance programs.

The community development theme includes expenses to maintain and develop engaged and vibrant communities, including financial assistance and infrastructure funding to local governments and other authorities, which in turn provide community services. Community development also includes funding directed to specific community services such as sport, culture, arts, and heritage that improve quality of life.

| | |

| 54 | | Government of Saskatchewan Public Accounts 2022-23 |