2023-24 FIRST QUARTER HIGHLIGHTS

Overview

At first quarter (Q1), a $485.5 million surplus is forecast, $532.0 million lower than the $1.0 billion surplus projected in the 2023-24 Budget.

Higher-than-budgeted expense is being forecast at Q1 largely due to higher pension expense and higher than expected spending to fight wildfires and to safely evacuate those impacted by the fires. Lower Non-Renewable Resources revenue at Q1 compared to budget, largely resulting from lower potash and oil prices and slower-than-budgeted production growth, has also contributed to the bottom-line forecast at first quarter.

The plan to retire up to $1 billion in operating debt remains unchanged at first quarter, as higher opening cash balances due to a strong year end in 2022-23 have offset the drop in the projected surplus.

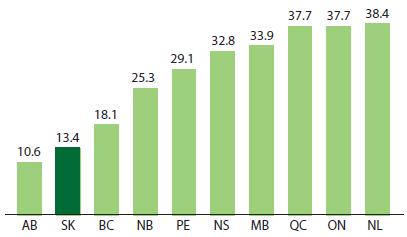

Saskatchewan’s net-debt-to-Gross Domestic Product (GDP) is projected to be 13.4 per cent at the end of fiscal year 2023-24 and is currently ranked second-lowest among the provinces, after only Alberta.

Revenue

Revenue at first quarter is forecast to be $123.7 million, or 0.6 per cent, lower than budgeted.

Lower projected revenue at Q1 compared to budget is primarily due to a $528.9 million decrease in forecast Non-Renewable Resources revenue. The main contributors to lower resource revenue are lower potash prices and lower-than-budgeted production growth, a decrease in the Resource Surcharge driven primarily by reduced potash prices, and lower oil prices and production.

These decreases are largely offset at first quarter by a combined increase of $405.2 million across all other major revenue categories. These increases include higher than budgeted Taxation revenue due to ongoing strength in consumption and, as a result, Provincial Sales Tax (PST) revenue. There are also increases in Government Business Enterprise (GBE) net income, Other Own-Source Revenue and Federal Transfers.

Expense

At first quarter, expense is forecast to be $408.2 million, or 2.2 per cent, higher than budgeted.

Higher expense is largely due to a $317.3 million increase, which is primarily pension expense affecting the Education, General Government, and Financing Charges themes. Also contributing to a higher first quarter expense forecast are higher costs related to wildfire and evacuation response activities and Provincial Disaster Assistance Program claims.

Debt

Gross debt at first quarter is forecast to be $30.9 billion, at March 31, 2024, which is $61.2 million higher than forecast at budget.

The increase consists primarily of $59.5 million in debt for GBE capital projects. This debt is considered self-supporting because the GBEs, which include certain Crown corporations, use their cash flows to repay debt.

At first quarter, operating debt is forecast to be $7.5 billion at the end of the 2023-24 fiscal year, the same as budgeted, and $988.0 million lower than the prior fiscal year (2022-23).

Saskatchewan has one of the lowest net-debt to GDP ratios among Canadian provinces at 13.4 per cent. Net-debt is now forecast to be $14.3 billion at the end of 2023-24, an increase of $220.0 million from budget.

Economy

Saskatchewan led the nation in economic growth in 2022 with real GDP growth of 5.7 per cent. Real GDP is expected to grow by 1.8 per cent in 2023, second highest among the provinces, and by 1.2 per cent in 2024, third highest, according to the most recent average of private sector forecasts.

Many aspects of the economy have shown strength to start 2023. The labour market has been particularly strong so far hitting record highs for the provincial working-age population, labour force, employment (including full-time), and the off-reserve Indigenous population in July 2023. Year-to-date, the seasonally-adjusted unemployment rate averaged 4.6 per cent over the first seven months of 2023, the second lowest rate among provinces. Saskatchewan also had the second highest employment rate (proportion of population being employed) among provinces, 63.9 per cent year-to-date.