All employment gains were in full-time jobs and were most prevalent in industries, such as, professional, scientific and technical services (up 5,100 jobs), educational services (up 3,800 jobs), and transportation and warehousing (up 3,200 jobs). The unemployment rate was 4.4 per cent seasonally-adjusted in October, the lowest among Canadian provinces, and averaged 4.8 per cent over the first ten months of 2023, second lowest among the provinces.

Economic forecasts indicate that Saskatchewan is well positioned to manage through existing economic risks including persistent inflation, rising interest rates, falling commodity prices, and a global economy that faces geopolitical challenges, as well as continued risk of economic recession for our key trade partners.

Non-renewable resources

In the wake of the slowing global economy, the demand and prices for some commodities continue to decline from their peak in 2022, which results in downward pressure on commodity price expectations at mid-year.

Oil production is forecast to be 166.8 million barrels in 2023, which is 1.6 per cent lower than at budget, the result of lower investment expectations. Oil production is expected to expand to 167.0 million barrels in 2024, and production growth is expected to average 2.2 per cent annually from 2025 to 2028.

The average benchmark West Texas Intermediate (WTI) oil price is expected to average U.S. $79.00 per barrel in 2023, down from U.S. $80.00 per barrel expected at budget and is expected to average U.S. $81.00 per barrel in 2024.

Potash sales are now expected to be 5.9 per cent lower than previously forecast at Budget. Potash from Russia and Belarus is entering markets despite Western sanctions, resulting in reduced prices. Potash consumers are more price conscious, even though agriculture prices and operating margins are above historical averages.

Saskatchewan potash sales are now forecast to total 23.5 Mt KCI (14.4 MtK20) in 2023, lower than the 25.0 Mt KCI (15.3 Mt K20) expected at Budget. The average price in 2023 is now expected to be US$263 per KCL tonne ($663 per K20 tonne), down from US$368 per KCI tonne ($816 per K20 tonne) at budget.

Crop Production

The crop production outlook remains positive over the medium term. Production declined by 20 per cent in 2023 due to drought and is expected to rebound by 26.9 per cent in 2024. The strong outlook extends across the medium term, where crop production is expected to grow by an average of 1.8 per cent annually from 2025 to 2028.

GDP

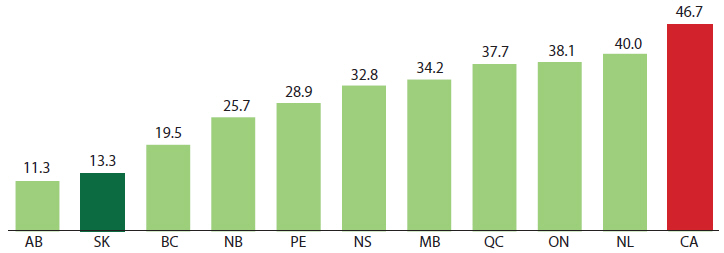

Saskatchewan’s economy experienced the strongest growth among the provinces in 2022, with real GDP growth of 6.0 per cent. An average of nine private sector forecasts has Saskatchewan’s real GDP growing by 1.6 per cent in 2023 and 1.3 per cent in 2024, both the second highest growth among the provinces.

Slight upward revisions to the private sector forecasts since budget reflect changes to the timing of a mild recession in Canada and the United States, which is now expected to occur in 2024 contrary to earlier expectations for a recession to occur in mid-2023.

Nominal GDP is expected to decrease by 1.2 per cent in 2023, compared to the 1.7 per cent increase projected by private sector forecasts at budget, primarily due to price levels in the resource sector being weaker compared to peak levels in 2022.