UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2346

Fidelity Commonwealth Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | November 30 |

| |

Date of reporting period: | November 30, 2004 |

Item 1. Reports to Stockholders

Fidelity®

Nasdaq Composite® Index Tracking Stock

Annual Report

November 30, 2004

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | Ned Johnson's message to shareholders. |

Premium/Discount Analysis | <Click Here> | Information regarding the fund's NAV and market price. |

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The manager's review of fund performance, strategy and outlook. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Proxy Voting Results | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-800-FIDELITY to request a free copy of the proxy voting guidelines.

Nasdaq® and Nasdaq Composite® are trademarks of The Nasdaq Stock Market, Inc. (which with its Affiliates are the Corporations) and are licensed for use by Fidelity. The product has not been passed on by the Corporations as to its legality or suitability. The product is not issued, endorsed or sold by the Corporations. The Corporations make no warranties and bear no liability with respect to shares of the product.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind everyone where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission's forward pricing rules or were involved in so-called "market timing" activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that someone could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner - and in every other. But I underscore again that Fidelity has no so-called "agreements" that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short-term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee - which is returned to the fund and, therefore, to investors - - to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over-regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors' holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Premium/Discount

Analysis (Unaudited)

Shares of Fidelity® Nasdaq Composite® Index Tracking Stock (the fund) are listed on the Nasdaq stock market and can be bought and sold on the secondary market at market prices. Although the market price is expected to approximate the fund's NAV, it is possible that the market price and NAV will vary significantly. The closing market price is the daily closing price as reported on the Nasdaq stock market.

Premiums or discounts are the differences (expressed as a basis point differential with 1 basis point equaling 1/100 of 1%) between the fund's NAV and closing market price. A premium indicates that the closing market price is trading above the NAV. A discount indicates that the closing market price is trading below the NAV. A discrepancy may exist with respect to the timing of when the NAV is calculated and the determination of the closing market price.

The chart below presents information about the differences between the fund's daily closing market price and the fund's NAV.

Period Ended November 30, 2004

From commencement of operations* | | | |

to November 30, 2004 | Closing Market Price

Below NAV | Closing Market Price Above

or Equal to NAV |

| Basis Point Differential | Number of

Days | % of Total

Days | Number of

Days | % of Total

Days |

| 0 - <25 | 168 | 56.38% | 121 | 40.60% |

| 25 - <50 | 7 | 2.34% | 2 | 0.68% |

| 50 - <75 | 0 | - | 0 | - |

| 75 - <100 | 0 | - | 0 | - |

| 100 or greater | 0 | - | 0 | - |

| Total | 175 | 58.72% | 123 | 41.28% |

* September 25, 2003

Annual Report

Performance: The Bottom Line

The fund's net asset value ("NAV") performance is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing mutual fund shares as of the close of regular trading hours on the Nasdaq stock market, normally 4:00 p.m. Eastern time (or NYSE if Nasdaq is closed). The fund's market price performance is based on the daily closing price of the shares of the fund on the Nasdaq stock market.

Cumulative total returns reflect performance over the period shown generally by adding one year's return - positive or negative - to the next year's return. NAV and closing market price average annual returns reflect the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value), at NAV and Market Price, respectively, and assumes a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Cumulative Total Returns

Periods ended November 30, 2004 | Past 1

year | Life of

FundA |

Fidelity® Nasdaq Composite® Index Tracking Stock - NAV | 6.94% | 15.40% |

Fidelity Nasdaq Composite Index Tracking Stock - Market Price | 7.25% | 15.51% |

NASDAQ Composite® Index | 7.51% | 16.13% |

Average Annual Total Returns

Periods ended November 30, 2004 | Past 1

year | Life of

FundA |

Fidelity® Nasdaq Composite® Index Tracking Stock - NAV | 6.94% | 12.86% |

Fidelity Nasdaq Composite Index Tracking Stock - Market Price | 7.25% | 12.95% |

A From September 25, 2003.

Annual Report

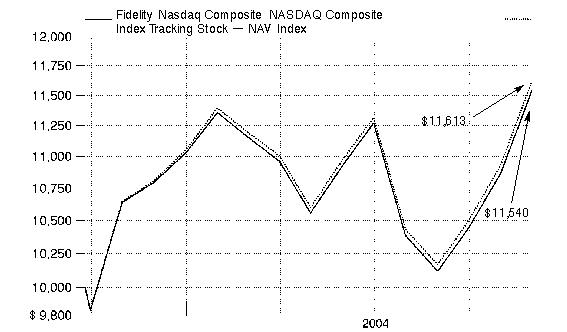

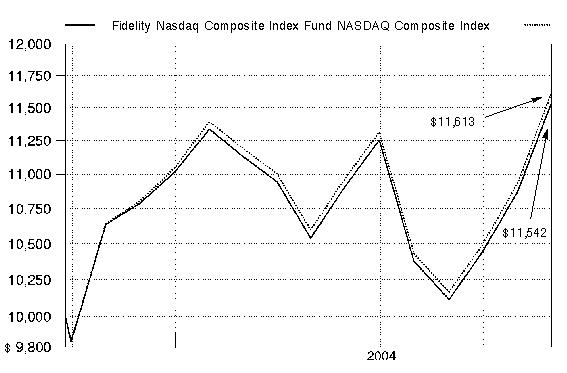

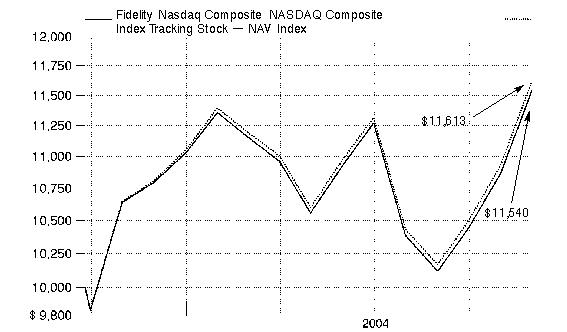

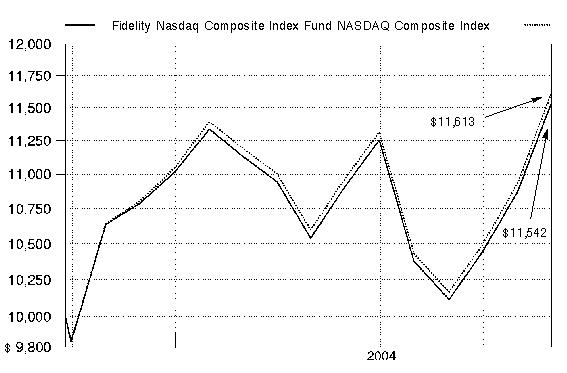

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Nasdaq Composite Index Tracking Stock - NAV on September 25, 2003, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the NASDAQ Composite® Index performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Comments from Jacques Perold, who oversees the Fidelity® Nasdaq Composite® Index Tracking Stock's investment management personnel as President of Geode Capital Management, LLC

Despite surging oil prices, a struggling job market and four interest rate hikes in a five-month span, U.S. equity markets posted solid results for the 12-month period ending November 30, 2004, and were closing in on a second straight year in the black. There was great disparity in the market during the past year. For instance, value stocks trounced their growth counterparts during the period. To illustrate, the Russell 1000® Value Index shot up 19.67%, while the Russell 1000 Growth Index rose only 5.83%. Meanwhile, small- and mid-cap stocks vastly outperformed larger-cap stocks. Energy was the best-performing sector of the market, propelled by a spike in oil prices. Conversely, technology stocks dipped lower in response to a slowdown in corporate capital spending. For the 12-month period overall, the Standard & Poor's 500SM Index returned 12.86% - slightly above its historical average. Elsewhere, the Dow Jones Industrial AverageSM rose 8.87% and the tech-heavy NASDAQ Composite® Index advanced 7.51%.

For the 12-month period ending November 30, 2004, the fund's return at net asset value was 6.94%, trailing the NASDAQ® and the 7.25% return of the fund's market price. The fund's peer group average, the LipperSM Growth Funds Average, returned 9.52% during the same time frame. Software giant Microsoft had the greatest positive impact on results. Microsoft's stock rose steadily as the company continued to generate solid earnings growth. It also announced well-received plans to return part of its cash hoard to shareholders in the form of higher quarterly dividends and a special one-time year-end payment of $3 per share. Online auction house eBay benefited from increasing revenues generated overseas and additional use of fixed-price sales to complement its more traditional auction business. Intel, the world's leading maker of semiconductors, was the biggest detractor from performance, falling after announcing a second-quarter decline in profit margins and an increase in inventories. Another laggard was VERITAS, a leading data-storage software maker. Its stock price fell by more than a third in early July after the firm warned of lower earnings on disappointing sales in the United States.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2004 to November 30, 2004).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

June 1, 2004 | Ending

Account Value

November 30, 2004 | Expenses Paid

During Period*

June 1, 2004

to November 30, 2004 |

Actual | $ 1,000.00 | $ 1,056.30 | $ 1.54 |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,023.48 | $ 1.52 |

*Expenses are equal to the Fund's annualized expense ratio of .30%; multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

Annual Report

Investment Changes

Top Ten Stocks as of November 30, 2004 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Microsoft Corp. | 9.2 | 9.5 |

Intel Corp. | 4.5 | 6.2 |

Cisco Systems, Inc. | 4.0 | 5.1 |

Dell, Inc. | 3.2 | 3.0 |

Amgen, Inc. | 2.4 | 2.3 |

eBay, Inc. | 2.4 | 1.9 |

QUALCOMM, Inc. | 2.1 | 1.8 |

Oracle Corp. | 2.1 | 2.0 |

Yahoo!, Inc. | 1.6 | 1.4 |

Comcast Corp. Class A | 1.3 | 1.3 |

| 32.8 | |

Market Sectors as of November 30, 2004 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Information Technology | 49.8 | 52.1 |

Consumer Discretionary | 13.8 | 12.9 |

Health Care | 12.9 | 13.5 |

Financials | 10.7 | 10.8 |

Industrials | 5.8 | 5.6 |

Telecommunication Services | 2.2 | 1.7 |

Consumer Staples | 1.6 | 1.4 |

Materials | 1.2 | 1.0 |

Energy | 0.6 | 0.4 |

Utilities | 0.2 | 0.2 |

Asset Allocation (% of fund's net assets) |

To match the NASDAQ Composite® Index, Fidelity Nasdaq Composite Index Tracking Stock seeks 100% investment exposure to stocks at all times.

Annual Report

Investments November 30, 2004

Showing Percentage of Net Assets

Common Stocks - 98.8% |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - 13.8% |

Auto Components - 0.2% |

Aftermarket Technology Corp. (a) | 1,437 | | $ 25,033 |

China Automotive Systems, Inc. (a) | 1,017 | | 16,211 |

Decoma International, Inc. Class A (sub. vtg.) | 1,920 | | 21,710 |

Dura Automotive Systems, Inc. Class A (sub. vtg.) (a) | 1,489 | | 13,550 |

Exide Technologies (a) | 1,055 | | 13,135 |

GenTek, Inc. (a) | 400 | | 19,596 |

Gentex Corp. | 3,308 | | 106,915 |

Hayes Lemmerz International, Inc. (a) | 1,319 | | 10,051 |

Keystone Automotive Industries, Inc. (a) | 944 | | 22,118 |

LKQ Corp. | 1,089 | | 19,537 |

Quantum Fuel Systems Technologies Worldwide, Inc. (a) | 412 | | 2,559 |

R&B, Inc. (a) | 662 | | 16,550 |

Sports Resorts International, Inc. (a) | 2,825 | | 8,108 |

Strattec Security Corp. (a) | 256 | | 16,128 |

Tesma International, Inc. Class A (sub. vtg.) | 506 | | 17,258 |

| | 328,459 |

Automobiles - 0.0% |

Nissan Motor Co. Ltd. sponsored ADR | 1,406 | | 29,484 |

Distributors - 0.0% |

Source Interlink Companies, Inc. (a) | 1,652 | | 21,559 |

Hotels, Restaurants & Leisure - 1.8% |

AFC Enterprises, Inc. (a) | 1,100 | | 26,488 |

Ambassadors Group, Inc. | 517 | | 17,981 |

Ameristar Casinos, Inc. | 1,221 | | 49,145 |

Applebee's International, Inc. | 3,084 | | 79,259 |

BJ's Restaurants, Inc. (a) | 1,288 | | 19,268 |

Bob Evans Farms, Inc. | 1,413 | | 35,678 |

Buffalo Wild Wings, Inc. | 475 | | 15,737 |

California Pizza Kitchen, Inc. (a) | 848 | | 21,242 |

CBRL Group, Inc. | 1,832 | | 74,691 |

Churchill Downs, Inc. | 736 | | 34,187 |

Cosi, Inc. (a) | 2,462 | | 16,126 |

Ctrip.com International Ltd. ADR | 155 | | 7,491 |

Empire Resorts, Inc. (a) | 1,095 | | 11,782 |

International Speedway Corp. Class A | 1,104 | | 53,975 |

Isle of Capri Casinos, Inc. (a) | 1,413 | | 34,661 |

Lone Star Steakhouse & Saloon, Inc. | 928 | | 25,047 |

Magna Entertainment Corp. Class A (a) | 3,517 | | 21,102 |

Monarch Casino & Resort, Inc. (a) | 515 | | 17,984 |

MTR Gaming Group, Inc. (a) | 1,720 | | 17,303 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - continued |

Hotels, Restaurants & Leisure - continued |

Multimedia Games, Inc. (a) | 1,166 | | $ 15,251 |

Navigant International, Inc. (a) | 1,024 | | 11,244 |

O'Charleys, Inc. (a) | 1,088 | | 20,672 |

P.F. Chang's China Bistro, Inc. (a) | 827 | | 46,510 |

Panera Bread Co. Class A (a) | 1,406 | | 56,156 |

Papa John's International, Inc. (a) | 864 | | 30,732 |

Penn National Gaming, Inc. (a) | 1,549 | | 81,741 |

Rare Hospitality International, Inc. (a) | 1,429 | | 42,813 |

Red Robin Gourmet Burgers, Inc. (a) | 848 | | 43,545 |

Ryan's Restaurant Group, Inc. (a) | 2,180 | | 33,289 |

Scientific Games Corp. Class A (a) | 3,646 | | 87,139 |

Shuffle Master, Inc. (a) | 1,034 | | 47,595 |

Smith & Wollensky Restaurant Group, Inc. (a) | 2,617 | | 12,143 |

Sonic Corp. (a) | 2,347 | | 68,462 |

Starbucks Corp. (a)(d) | 16,899 | | 950,738 |

Texas Roadhouse, Inc. Class A | 1,253 | | 31,826 |

The Cheesecake Factory, Inc. (a) | 2,174 | | 106,287 |

Wynn Resorts Ltd. (a) | 3,541 | | 205,697 |

| | 2,470,987 |

Household Durables - 0.5% |

Avatar Holdings, Inc. (a) | 544 | | 25,715 |

Bassett Furniture Industries, Inc. | 1,360 | | 26,806 |

Brillian Corp. (a) | 388 | | 1,195 |

California Coastal Communities, Inc. (a) | 798 | | 17,787 |

Craftmade International, Inc. | 720 | | 12,744 |

Dominion Homes, Inc. (a) | 560 | | 11,570 |

Dorel Industries, Inc. Class B (sub. vtg.) (a) | 1,104 | | 38,865 |

Flexsteel Industries, Inc. | 944 | | 16,529 |

Foamex International, Inc. (a) | 1,885 | | 7,672 |

Garmin Ltd. (d) | 4,473 | | 260,418 |

Helen of Troy Ltd. (a) | 1,141 | | 32,108 |

Hooker Furniture Corp. | 832 | | 19,427 |

Interface, Inc. Class A (a) | 3,081 | | 30,502 |

Kimball International, Inc. Class B | 1,517 | | 22,603 |

Lifetime Hoan Corp. | 488 | | 6,632 |

Palm Harbor Homes, Inc. (a) | 1,189 | | 18,560 |

Stanley Furniture Co., Inc. | 608 | | 27,968 |

Universal Electronics, Inc. (a) | 1,368 | | 24,966 |

| | 602,067 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - continued |

Internet & Catalog Retail - 3.7% |

1-800 CONTACTS, Inc. (a) | 736 | | $ 15,081 |

1-800-FLOWERS.com, Inc. Class A (a) | 1,916 | | 15,903 |

Alloy, Inc. (a) | 2,681 | | 12,065 |

Amazon.com, Inc. (a)(d) | 17,028 | | 675,671 |

Audible, Inc. (a) | 840 | | 23,486 |

Blue Nile, Inc. | 731 | | 18,845 |

Coldwater Creek, Inc. (a) | 2,076 | | 54,391 |

Drugstore.com, Inc. (a) | 3,485 | | 11,326 |

eBay, Inc. (a)(d) | 27,800 | | 3,126,110 |

GSI Commerce, Inc. (a) | 1,980 | | 29,957 |

IAC/InterActiveCorp (a)(d) | 26,693 | | 659,050 |

Insight Enterprises, Inc. (a) | 2,312 | | 46,772 |

J. Jill Group, Inc. (a) | 1,112 | | 19,204 |

Netflix, Inc. (a)(d) | 2,177 | | 24,774 |

Overstock.com, Inc. (a) | 832 | | 59,288 |

PC Mall, Inc. (a) | 611 | | 14,847 |

Priceline.com, Inc. (a) | 1,640 | | 39,147 |

Provide Commerce, Inc. | 467 | | 16,018 |

Stamps.com, Inc. | 1,662 | | 25,711 |

ValueVision Media, Inc. Class A (a) | 1,732 | | 19,641 |

| | 4,907,287 |

Leisure Equipment & Products - 0.1% |

Arctic Cat, Inc. | 848 | | 22,650 |

Concord Camera Corp. (a) | 1,604 | | 4,235 |

JAKKS Pacific, Inc. (a) | 1,325 | | 24,672 |

Radica Games Ltd. | 2,288 | | 21,942 |

RC2 Corp. (a) | 944 | | 29,538 |

SCP Pool Corp. | 2,263 | | 71,352 |

| | 174,389 |

Media - 4.3% |

ACME Communications, Inc. (a) | 1,948 | | 11,454 |

Alliance Atlantis Communications, Inc. Class B (non-vtg.) (a) | 1,700 | | 44,222 |

Beasley Broadcast Group, Inc. Class A (a) | 1,008 | | 17,690 |

Cadmus Communications Corp. | 1,483 | | 20,586 |

Carmike Cinemas, Inc. | 656 | | 24,561 |

Central European Media Enterprises Ltd. Class A (a) | 959 | | 30,170 |

Charter Communications, Inc. Class A (a)(d) | 13,665 | | 29,516 |

Comcast Corp.: | | | |

Class A (a) | 57,262 | | 1,720,150 |

Class A (special) (a) | 35,741 | | 1,059,721 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - continued |

Media - continued |

Crown Media Holdings, Inc. Class A (a) | 3,949 | | $ 34,988 |

Cumulus Media, Inc. Class A (a) | 2,184 | | 33,372 |

EchoStar Communications Corp. Class A | 9,283 | | 304,390 |

EMAK Worldwide, Inc. (a) | 1,085 | | 10,699 |

Emmis Communications Corp. Class A (a) | 2,072 | | 38,311 |

Fisher Communications, Inc. (a) | 400 | | 18,812 |

Gemstar-TV Guide International, Inc. (a) | 17,934 | | 97,740 |

Grey Global Group, Inc. | 48 | | 52,657 |

Harris Interactive, Inc. (a) | 2,921 | | 19,395 |

IMAX Corp. (a) | 1,695 | | 13,992 |

Insight Communications, Inc. Class A (a) | 2,585 | | 21,895 |

Knology, Inc. | 2,129 | | 7,324 |

Lakes Entertainment, Inc. (a) | 1,826 | | 25,473 |

Lamar Advertising Co. Class A (a) | 3,717 | | 146,598 |

Liberty Media International, Inc. Class A (a) | 5,881 | | 253,236 |

LodgeNet Entertainment Corp. (a) | 1,221 | | 18,828 |

MDC Partners, Inc. (a) | 980 | | 10,040 |

Mediacom Communications Corp. Class A (a) | 4,465 | | 23,307 |

Navarre Corp. (a) | 1,550 | | 26,397 |

New Frontier Media, Inc. (a) | 1,569 | | 12,693 |

NTL, Inc. (a) | 3,692 | | 256,889 |

Outdoor Channel Holdings, Inc. (a) | 1,000 | | 14,000 |

Pixar (a) | 2,184 | | 198,023 |

Private Media Group, Inc. (a)(d) | 4,801 | | 15,363 |

Radio One, Inc.: | | | |

Class A (a) | 992 | | 13,769 |

Class D (non-vtg.) (a) | 3,397 | | 47,388 |

Regent Communication, Inc. (a) | 2,793 | | 15,948 |

Reuters Group PLC sponsored ADR | 927 | | 40,862 |

Salem Communications Corp. Class A (a) | 848 | | 20,827 |

SBS Broadcasting SA (a) | 1,237 | | 42,590 |

Scholastic Corp. (a) | 1,565 | | 51,551 |

Sinclair Broadcast Group, Inc. Class A | 2,172 | | 15,660 |

Sirius Satellite Radio, Inc. (a)(d) | 52,034 | | 345,506 |

Spanish Broadcasting System, Inc. Class A (a) | 1,900 | | 20,311 |

TiVo, Inc. (a) | 3,177 | | 14,964 |

UnitedGlobalCom, Inc. Class A (a) | 17,017 | | 141,752 |

Value Line, Inc. | 448 | | 17,920 |

WPP Group PLC sponsored ADR | 909 | | 49,913 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - continued |

Media - continued |

XM Satellite Radio Holdings, Inc. Class A (a) | 8,554 | | $ 315,728 |

Young Broadcasting, Inc. Class A (a) | 944 | | 9,213 |

| | 5,776,394 |

Multiline Retail - 0.5% |

Conn's, Inc. | 1,181 | | 20,939 |

Dollar Tree Stores, Inc. (a) | 4,830 | | 134,419 |

Fred's, Inc. Class A | 2,006 | | 34,764 |

Kmart Holding Corp. (a)(d) | 3,881 | | 399,083 |

Tuesday Morning Corp. (a) | 1,784 | | 59,746 |

| | 648,951 |

Specialty Retail - 2.4% |

AC Moore Arts & Crafts, Inc. (a) | 928 | | 26,717 |

America's Car Mart, Inc. (a) | 339 | | 12,441 |

American Eagle Outfitters, Inc. | 3,124 | | 130,489 |

bebe Stores, Inc. | 1,632 | | 59,209 |

Bed Bath & Beyond, Inc. (a) | 12,663 | | 505,608 |

Big 5 Sporting Goods Corp. | 1,136 | | 30,933 |

Brookstone Co., Inc. (a) | 1,178 | | 21,557 |

Cache, Inc. (a) | 734 | | 12,118 |

Casual Male Retail Group, Inc. (a) | 2,060 | | 8,899 |

Charlotte Russe Holding, Inc. (a) | 1,192 | | 13,887 |

Charming Shoppes, Inc. (a) | 5,503 | | 51,453 |

Cost Plus, Inc. (a) | 912 | | 28,983 |

Deb Shops, Inc. | 784 | | 19,326 |

Dress Barn, Inc. (a) | 1,405 | | 24,124 |

Electronics Boutique Holding Corp. (a) | 1,157 | | 45,065 |

Finish Line, Inc. Class A | 994 | | 18,290 |

Goody's Family Clothing, Inc. | 1,752 | | 17,064 |

Guitar Center, Inc. (a) | 1,024 | | 49,541 |

Gymboree Corp. (a) | 1,237 | | 14,584 |

Hibbett Sporting Goods, Inc. (a) | 1,104 | | 27,346 |

Hollywood Entertainment Corp. (a) | 2,617 | | 33,210 |

Hot Topic, Inc. (a) | 2,056 | | 33,657 |

Jos. A. Bank Clothiers, Inc. (a) | 540 | | 14,202 |

Kirkland's, Inc. (a) | 976 | | 9,370 |

Monro Muffler Brake, Inc. (a) | 816 | | 20,033 |

Movie Gallery, Inc. | 1,413 | | 24,629 |

O'Reilly Automotive, Inc. (a) | 2,216 | | 96,485 |

Pacific Sunwear of California, Inc. (a) | 2,996 | | 66,541 |

Party City Corp. (a) | 905 | | 11,575 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - continued |

Specialty Retail - continued |

PETCO Animal Supplies, Inc. (a) | 2,360 | | $ 85,338 |

PETsMART, Inc. | 6,127 | | 209,972 |

Pomeroy IT Solutions, Inc. (a) | 1,021 | | 13,947 |

Rent-A-Center, Inc. (a) | 3,252 | | 82,893 |

Restoration Hardware, Inc. (a) | 2,172 | | 11,055 |

Ross Stores, Inc. | 6,036 | | 162,368 |

Select Comfort Corp. (a) | 1,445 | | 28,163 |

Sharper Image Corp. (a) | 704 | | 13,489 |

Shoe Carnival, Inc. (a) | 884 | | 11,527 |

Stage Stores, Inc. (a) | 816 | | 33,448 |

Staples, Inc. | 20,821 | | 664,398 |

Stein Mart, Inc. (a) | 1,291 | | 21,469 |

Steiner Leisure Ltd. (a) | 896 | | 24,120 |

TBC Corp. (a) | 1,072 | | 28,590 |

The Children's Place Retail Stores, Inc. (a) | 1,285 | | 40,683 |

The Pantry, Inc. (a) | 1,230 | | 33,850 |

Tractor Supply Co. (a) | 1,847 | | 58,587 |

Trans World Entertainment Corp. (a) | 2,389 | | 26,948 |

Tweeter Home Entertainment Group, Inc. (a) | 1,752 | | 11,230 |

Urban Outfitters, Inc. (a) | 3,354 | | 142,545 |

West Marine, Inc. (a) | 960 | | 22,176 |

Wet Seal, Inc. Class A (a) | 1,493 | | 2,478 |

Wilsons Leather Experts, Inc. (a) | 1,704 | | 8,520 |

| | 3,165,130 |

Textiles, Apparel & Luxury Goods - 0.3% |

Cherokee, Inc. | 700 | | 20,580 |

Columbia Sportswear Co. (a) | 1,656 | | 94,226 |

Deckers Outdoor Corp. (a) | 929 | | 40,430 |

Fossil, Inc. (a) | 3,108 | | 84,071 |

Haggar Corp. | 1,152 | | 25,459 |

K-Swiss, Inc. Class A | 1,120 | | 30,343 |

Oshkosh B'Gosh, Inc. Class A | 608 | | 12,464 |

Perry Ellis International, Inc. (a) | 528 | | 10,080 |

Quaker Fabric Corp. (a) | 2,220 | | 12,765 |

Steven Madden Ltd. (a) | 704 | | 13,277 |

Tandy Brands Accessories, Inc. | 1,080 | | 15,432 |

Warnaco Group, Inc. (a) | 1,944 | | 38,627 |

| | 397,754 |

TOTAL CONSUMER DISCRETIONARY | | 18,522,461 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER STAPLES - 1.6% |

Beverages - 0.1% |

Coca-Cola Bottling Co. Consolidated | 336 | | $ 17,613 |

Hansen Natural Corp. (a) | 600 | | 20,280 |

MGP Ingredients, Inc. | 1,334 | | 12,460 |

Robert Mondavi Corp. Class A (a) | 512 | | 28,826 |

| | 79,179 |

Food & Staples Retailing - 1.1% |

Arden Group, Inc. Class A | 286 | | 28,243 |

Casey's General Stores, Inc. | 1,988 | | 38,508 |

Central European Distribution Corp. (a) | 792 | | 20,822 |

Costco Wholesale Corp. (d) | 19,421 | | 943,861 |

Fresh Brands, Inc. (a) | 1,192 | | 9,059 |

Ingles Markets, Inc. Class A | 1,873 | | 23,956 |

Nash-Finch Co. | 336 | | 12,469 |

NeighborCare, Inc. (a) | 1,768 | | 49,663 |

Pathmark Stores, Inc. (a) | 1,980 | | 10,910 |

Performance Food Group Co. (a) | 1,656 | | 43,453 |

Topps Co., Inc. | 2,044 | | 20,379 |

United Natural Foods, Inc. (a) | 1,604 | | 45,121 |

Whole Foods Market, Inc. | 2,566 | | 232,916 |

Wild Oats Markets, Inc. (a) | 1,684 | | 12,057 |

| | 1,491,417 |

Food Products - 0.2% |

Alico, Inc. | 262 | | 14,609 |

Bridgford Foods Corp. (a) | 2,028 | | 16,792 |

Cal-Maine Foods, Inc. | 1,186 | | 15,688 |

Farmer Brothers Co. | 800 | | 21,248 |

Gold Kist, Inc. Delaware | 2,080 | | 29,080 |

Hain Celestial Group, Inc. (a) | 1,549 | | 30,097 |

J&J Snack Foods Corp. (a) | 464 | | 21,780 |

Lancaster Colony Corp. | 1,205 | | 52,634 |

Lance, Inc. | 1,588 | | 29,600 |

Peet's Coffee & Tea, Inc. (a) | 688 | | 17,393 |

Sanderson Farms, Inc. | 840 | | 31,290 |

SunOpta, Inc. (a) | 3,052 | | 18,529 |

| | 298,740 |

Household Products - 0.0% |

Central Garden & Pet Co. Class A (a) | 704 | | 27,245 |

WD-40 Co. | 720 | | 21,031 |

| | 48,276 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER STAPLES - continued |

Personal Products - 0.2% |

Chattem, Inc. (a) | 1,088 | | $ 39,407 |

Elizabeth Arden, Inc. (a) | 976 | | 22,253 |

Inter Parfums, Inc. | 991 | | 16,579 |

Mannatech, Inc. | 1,876 | | 43,148 |

Nature's Sunshine Products, Inc. | 1,462 | | 24,474 |

Reliv International, Inc. | 2,639 | | 21,561 |

USANA Health Sciences, Inc. (a) | 864 | | 25,669 |

| | 193,091 |

Tobacco - 0.0% |

Star Scientific, Inc. (a) | 3,450 | | 22,736 |

TOTAL CONSUMER STAPLES | | 2,133,439 |

ENERGY - 0.6% |

Energy Equipment & Services - 0.3% |

Cal Dive International, Inc. (a) | 1,429 | | 61,533 |

Dawson Geophysical Co. (a) | 1,110 | | 25,919 |

Global Industries Ltd. (a) | 4,946 | | 42,437 |

Gulfmark Offshore, Inc. (a) | 1,096 | | 22,808 |

Horizon Offshore, Inc. (a) | 3,229 | | 1,130 |

Hydril Co. (a) | 672 | | 31,524 |

Lufkin Industries, Inc. | 704 | | 28,343 |

Patterson-UTI Energy, Inc. | 6,088 | | 121,760 |

Seabulk International, Inc. (a) | 1,800 | | 21,456 |

Tesco Corp. (a) | 1,784 | | 18,367 |

Torch Offshore, Inc. (a) | 3,145 | | 6,224 |

| | 381,501 |

Oil & Gas - 0.3% |

APCO Argentina, Inc. | 481 | | 16,354 |

Atlas America, Inc. | 574 | | 18,219 |

ATP Oil & Gas Corp. (a) | 1,236 | | 17,613 |

Brigham Exploration Co. (a) | 2,341 | | 21,888 |

Canada Southern Petroleum Ltd. (ltd. vtg.) (a) | 1,265 | | 7,797 |

Clayton Williams Energy, Inc. (a) | 496 | | 11,353 |

Crosstex Energy, Inc. | 733 | | 29,518 |

Delta Petroleum Corp. (a) | 1,695 | | 26,662 |

Dorchester Minerals LP | 1,237 | | 29,874 |

Double Eagle Petroleum Co. (a) | 842 | | 16,891 |

Enterra Energy Trust | 1,156 | | 21,270 |

FX Energy, Inc. (a) | 3,253 | | 32,660 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

ENERGY - continued |

Oil & Gas - continued |

Golar LNG Ltd. (Nasdaq) (a) | 2,437 | | $ 36,143 |

Ivanhoe Energy, Inc. (a) | 6,330 | | 16,386 |

Knightsbridge Tankers Ltd. (d) | 717 | | 27,848 |

Marine Petroleum Trust | 655 | | 18,897 |

Mission Resources Corp. (a) | 2,663 | | 16,537 |

Petroleum Development Corp. (a) | 889 | | 36,556 |

Syntroleum Corp. (a) | 2,835 | | 19,647 |

TC Pipelines LP | 672 | | 25,872 |

The Exploration Co. of Delaware, Inc. (a) | 2,761 | | 16,842 |

Top Tankers, Inc. | 856 | | 19,303 |

| | 484,130 |

TOTAL ENERGY | | 865,631 |

FINANCIALS - 10.7% |

Capital Markets - 1.1% |

American Capital Strategies Ltd. | 3,947 | | 126,067 |

Ameritrade Holding Corp. (a) | 15,791 | | 219,969 |

Calamos Asset Management, Inc. Class A | 644 | | 15,276 |

Gladstone Capital Corp. | 848 | | 20,801 |

Harris & Harris Group, Inc. (a) | 1,311 | | 19,350 |

Investors Financial Services Corp. | 2,693 | | 118,061 |

Knight Trading Group, Inc. (a) | 5,199 | | 59,321 |

MarketAxess Holdings, Inc. | 900 | | 17,640 |

MFC Bancorp Ltd. (a) | 960 | | 20,112 |

Northern Trust Corp. | 8,983 | | 422,560 |

Sanders Morris Harris Group, Inc. | 1,048 | | 15,982 |

SEI Investments Co. | 4,329 | | 169,307 |

T. Rowe Price Group, Inc. | 5,070 | | 299,941 |

TradeStation Group, Inc. (a) | 1,932 | | 14,335 |

| | 1,538,722 |

Commercial Banks - 5.8% |

1st Source Corp. | 1,088 | | 28,560 |

Alabama National Bancorp, Delaware | 642 | | 40,594 |

Alliance Financial Corp. | 627 | | 17,713 |

Amcore Financial, Inc. | 832 | | 27,065 |

American National Bankshares, Inc. | 876 | | 21,550 |

American River Bankshares | 768 | | 17,971 |

AmericanWest Bancorp (a) | 845 | | 17,745 |

Associated Banc-Corp. | 4,638 | | 154,121 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Commercial Banks - continued |

Banc Corp. (a) | 2,553 | | $ 20,067 |

BancFirst Corp. | 328 | | 23,285 |

BancTrust Financial Group, Inc. | 1,168 | | 24,878 |

Bank of Granite Corp. | 880 | | 19,096 |

Bank of the Ozarks, Inc. | 768 | | 27,379 |

Banner Corp. | 784 | | 25,888 |

BNC Bancorp | 1,168 | | 19,506 |

BOK Financial Corp. (a) | 2,324 | | 113,411 |

Boston Private Financial Holdings, Inc. | 880 | | 23,839 |

Capital Bank Corp. | 1,040 | | 17,316 |

Capital City Bank Group, Inc. | 464 | | 20,416 |

Capital Corp. of the West | 269 | | 13,851 |

Cascade Bancorp | 1,082 | | 23,588 |

Cascade Financial Corp. | 1,118 | | 21,264 |

Cathay General Bancorp | 2,078 | | 80,460 |

Center Bancorp, Inc. | 1,058 | | 13,627 |

Center Financial Corp., California | 38 | | 782 |

Central Coast Bancorp (a) | 968 | | 22,506 |

Century Bancorp, Inc. Class A (non-vtg.) | 528 | | 16,400 |

Chemical Financial Corp. | 944 | | 39,554 |

Chester Valley Bancorp, Inc. | 956 | | 20,438 |

Citizens Banking Corp. | 1,624 | | 57,002 |

City Holding Co. | 608 | | 22,447 |

CNB Financial Corp. | 1,305 | | 19,262 |

CoBiz, Inc. | 1,422 | | 31,284 |

Colony Bankcorp, Inc. | 846 | | 26,649 |

Columbia Bancorp | 592 | | 21,460 |

Columbia Bancorp, Oregon | 1,280 | | 24,640 |

Columbia Banking Systems, Inc. | 873 | | 22,165 |

Commerce Bancshares, Inc. | 3,030 | | 148,197 |

Community Bank of Northern Virginia | 632 | | 10,554 |

Community Banks, Inc. | 540 | | 15,833 |

Community Trust Bancorp, Inc. | 624 | | 20,892 |

Compass Bancshares, Inc. | 5,246 | | 244,254 |

CVB Financial Corp. | 1,979 | | 53,789 |

East West Bancorp, Inc. | 2,106 | | 87,336 |

Eastern Virgina Bankshares, Inc. | 889 | | 21,149 |

Farmers Capital Bank Corp. | 576 | | 21,888 |

Fidelity Southern Corp. | 1,248 | | 22,626 |

Fifth Third Bancorp | 23,624 | | 1,189,705 |

Financial Institutions, Inc. | 704 | | 17,952 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Commercial Banks - continued |

First Bancorp, North Carolina | 768 | | $ 21,750 |

First Charter Corp. | 1,349 | | 36,949 |

First Citizen Bancshares, Inc. | 320 | | 43,541 |

First Citizens Banc Corp. (d) | 784 | | 18,032 |

First Community Bancorp, California | 656 | | 27,565 |

First Community Bancshares, Inc. | 368 | | 13,108 |

First Financial Bancorp, Ohio | 2,084 | | 35,595 |

First Financial Bankshares, Inc. | 544 | | 23,664 |

First Financial Corp., Indiana | 576 | | 20,920 |

First Indiana Corp. | 992 | | 22,985 |

First M&F Corp. | 671 | | 22,814 |

First Mariner Bancorp, Inc. (a) | 928 | | 15,952 |

First Merchants Corp. | 624 | | 16,817 |

First Midwest Bancorp, Inc., Delaware | 1,928 | | 72,377 |

First Oak Brook Bancshares, Inc. | 624 | | 20,467 |

First of Long Island Corp. | 464 | | 22,796 |

First South Bancorp, Inc., Virginia | 768 | | 19,576 |

First United Corp. | 940 | | 19,129 |

FirstMerit Corp. | 3,076 | | 84,190 |

Flag Financial Corp. | 1,600 | | 22,800 |

FNB Corp., North Carolina | 976 | | 19,081 |

FNB Corp., Virginia | 624 | | 18,096 |

FNB Financial Services Corp. | 1,072 | | 22,512 |

Foothill Independent Bancorp | 1,034 | | 23,854 |

Frontier Financial Corp., Washington | 432 | | 17,220 |

Fulton Financial Corp. | 4,780 | | 107,072 |

GB&T Bancshares, Inc. | 800 | | 20,296 |

German American Bancorp | 1,008 | | 17,136 |

Glacier Bancorp, Inc. | 980 | | 33,918 |

Gold Banc Corp., Inc. | 1,739 | | 26,015 |

Great Southern Bancorp, Inc. | 571 | | 23,411 |

Greater Bay Bancorp | 2,104 | | 61,121 |

Greater Community Bancorp | 1,292 | | 19,122 |

Grupo Financiero Galicia SA sponsored ADR (a) | 1,938 | | 14,051 |

Hancock Holding Co. | 1,375 | | 46,750 |

Hanmi Financial Corp. | 1,025 | | 38,110 |

Harleysville National Corp., Pennsylvania | 856 | | 24,105 |

Heartland Financial USA, Inc. | 768 | | 16,950 |

Heritage Commerce Corp. (a) | 1,429 | | 27,951 |

Huntington Bancshares, Inc. | 9,623 | | 233,454 |

Independent Bank Corp., Massachusetts | 640 | | 22,118 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Commercial Banks - continued |

Independent Bank Corp., Michigan | 704 | | $ 21,190 |

Integra Bank Corp. | 880 | | 20,134 |

Interchange Financial Services Corp. | 816 | | 21,787 |

International Bancshares Corp. | 2,243 | | 88,711 |

Lakeland Bancorp, Inc. | 1,114 | | 20,219 |

LNB Bancorp, Inc. | 1,104 | | 22,113 |

LSB Bancshares, Inc. | 1,072 | | 18,063 |

Main Street Banks, Inc. | 704 | | 22,303 |

MB Financial, Inc. | 1,338 | | 56,464 |

MBT Financial Corp. | 1,088 | | 25,949 |

Mercantile Bankshares Corp. | 3,324 | | 171,186 |

Merchants Bancshares, Inc. | 815 | | 24,206 |

Mid-State Bancshares | 928 | | 27,692 |

Nara Bancorp, Inc. | 969 | | 20,116 |

National Bankshares, Inc. | 444 | | 22,959 |

National Penn Bancshares, Inc. | 1,240 | | 35,712 |

NBT Bancorp, Inc. | 1,333 | | 33,845 |

Northern States Financial Corp. | 770 | | 21,175 |

Old Point Financial Corp. | 681 | | 20,845 |

Omega Financial Corp. | 523 | | 18,467 |

Pacific Capital Bancorp | 1,542 | | 50,901 |

Pennrock Financial Services Corp. | 512 | | 20,731 |

Penns Woods Bancorp, Inc. | 497 | | 24,751 |

Peoples Bancorp, Inc. | 528 | | 16,542 |

Pinnacle Financial Partners, Inc. (a) | 1,038 | | 25,255 |

Popular, Inc. | 11,140 | | 295,210 |

Premierwest Bancorp (a) | 2,062 | | 22,909 |

PrivateBancorp, Inc. | 864 | | 29,756 |

Prosperity Bancshares, Inc. | 688 | | 19,512 |

Provident Bankshares Corp. | 1,262 | | 46,366 |

Republic Bancorp, Inc. | 2,896 | | 45,004 |

Republic Bancorp, Inc., Kentucky Class A | 1,008 | | 27,972 |

Republic First Bancorp, Inc. (a) | 1,411 | | 21,588 |

Riggs National Corp. | 1,248 | | 25,110 |

Royal Bancshares of Pennsylvania, Inc. Class A | 718 | | 20,822 |

Rurban Financial Corp. (a)(d) | 1,208 | | 16,984 |

S&T Bancorp, Inc. | 960 | | 35,242 |

Sandy Spring Bancorp, Inc. | 480 | | 17,434 |

SCBT Financial Corp. | 320 | | 11,834 |

Seacoast Banking Corp., Florida | 912 | | 20,082 |

Shore Bancshares, Inc. | 400 | | 12,744 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Commercial Banks - continued |

Sierra Bancorp | 900 | | $ 18,900 |

Signature Bank, New York | 1,067 | | 33,514 |

Silicon Valley Bancshares (a) | 1,429 | | 59,989 |

Simmons First National Corp. Class A | 800 | | 23,200 |

Sky Financial Group, Inc. | 3,908 | | 113,176 |

Slade's Ferry Bancorp | 171 | | 3,471 |

South Financial Group, Inc. | 3,250 | | 102,976 |

Southern Community Financial Corp. | 1,720 | | 18,920 |

Southwest Bancorp of Texas, Inc. | 2,442 | | 59,731 |

Southwest Bancorp, Inc., Oklahoma | 1,024 | | 27,494 |

State Financial Services Corp. Class A | 704 | | 20,768 |

Sterling Bancshares, Inc. | 2,060 | | 30,035 |

Sterling Financial Corp., Pennsylvania | 1,000 | | 29,290 |

Suffolk Bancorp | 416 | | 13,803 |

Summit Bancshares, Inc. | 672 | | 22,882 |

Sun Bancorp, Inc., New Jersey (a) | 672 | | 16,699 |

Susquehanna Bancshares, Inc., Pennsylvania | 1,709 | | 44,434 |

Taylor Capital Group, Inc. | 832 | | 28,721 |

Texas Capital Bancshares, Inc. (a) | 1,405 | | 28,971 |

Texas Regional Bancshares, Inc. Class A | 1,656 | | 58,887 |

Trico Bancshares | 1,056 | | 25,291 |

Trustco Bank Corp., New York | 3,177 | | 44,796 |

Trustmark Corp. | 1,880 | | 57,904 |

UCBH Holdings, Inc. | 1,700 | | 77,078 |

UMB Financial Corp. (a) | 624 | | 34,950 |

Umpqua Holdings Corp. | 2,197 | | 56,177 |

Union Bankshares Corp. | 464 | | 17,405 |

United Bankshares, Inc., West Virginia | 1,445 | | 55,300 |

United Community Banks, Inc., Georgia (a) | 1,540 | | 44,136 |

United Security Bancshares, Inc. | 496 | | 14,816 |

United Security Bancshares, California | 848 | | 21,107 |

Unizan Financial Corp. | 960 | | 24,749 |

Vail Banks, Inc. (d) | 1,381 | | 17,981 |

Virginia Financial Group, Inc. | 496 | | 16,988 |

Washington Trust Bancorp, Inc. | 736 | | 21,653 |

WesBanco, Inc. | 720 | | 22,759 |

West Bancorp., Inc. | 924 | | 16,022 |

West Coast Bancorp, Oregon | 848 | | 22,311 |

Westamerica Bancorp. | 1,365 | | 79,388 |

Westbank Corp. | 1,085 | | 19,986 |

Western Sierra Bancorp (a) | 648 | | 25,920 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Commercial Banks - continued |

Whitney Holding Corp. | 1,672 | | $ 77,146 |

Wilshire Bancorp, Inc. (a) | 548 | | 17,859 |

Wintrust Financial Corp. | 640 | | 38,298 |

Yadkin Valley Bank & Trust Co. | 1,280 | | 18,240 |

Yardville National Bancorp | 752 | | 25,049 |

Zions Bancorp | 3,765 | | 250,373 |

| | 7,824,752 |

Consumer Finance - 0.3% |

ACE Cash Express, Inc. (a) | 255 | | 6,802 |

Advanta Corp.: | | | |

Class A | 399 | | 8,930 |

Class B | 757 | | 18,077 |

Asta Funding, Inc. | 1,024 | | 22,487 |

Collegiate Funding Services, Inc. | 1,210 | | 15,609 |

CompuCredit Corp. (a) | 2,168 | | 51,967 |

Credit Acceptance Corp. (a) | 2,196 | | 54,351 |

Education Lending Group, Inc. (a) | 1,438 | | 20,218 |

First Cash Financial Services, Inc. (a) | 842 | | 21,926 |

QC Holdings, Inc. | 870 | | 15,077 |

United Panam Financial Corp. (a) | 848 | | 16,833 |

WFS Financial, Inc. (a) | 1,736 | | 80,776 |

World Acceptance Corp. (a) | 992 | | 25,584 |

| | 358,637 |

Diversified Financial Services - 0.1% |

Encore Capital Group, Inc. (a) | 1,502 | | 37,670 |

eSpeed, Inc. Class A (a) | 1,429 | | 15,991 |

First Albany Companies, Inc. | 1,121 | | 10,302 |

Instinet Group, Inc. (a) | 12,047 | | 72,162 |

Medallion Financial Corp. | 2,220 | | 20,846 |

| | 156,971 |

Insurance - 1.4% |

Alfa Corp. | 3,261 | | 49,404 |

American National Insurance Co. | 1,104 | | 112,222 |

American Physicians Capital, Inc. (a) | 608 | | 20,252 |

Arch Capital Group Ltd. (a) | 1,403 | | 54,647 |

Argonaut Group, Inc. (a) | 1,453 | | 28,886 |

Baldwin & Lyons, Inc. Class B | 832 | | 21,632 |

Ceres Group, Inc. (a) | 3,225 | | 16,125 |

Cincinnati Financial Corp. | 6,852 | | 306,970 |

Direct General Corp. | 720 | | 20,520 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Insurance - continued |

Donegal Group, Inc. Class A | 228 | | $ 4,902 |

EMC Insurance Group | 800 | | 17,368 |

Enstar Group, Inc. (a) | 207 | | 12,813 |

Erie Indemnity Co. Class A | 2,472 | | 128,989 |

FPIC Insurance Group, Inc. (a) | 864 | | 28,538 |

Harleysville Group, Inc. | 1,317 | | 31,661 |

Infinity Property & Casualty Corp. | 880 | | 32,560 |

IPC Holdings Ltd. | 2,024 | | 86,162 |

Kansas City Life Insurance Co. | 544 | | 26,895 |

Max Re Capital Ltd. | 1,912 | | 36,443 |

Millea Holdings, Inc. ADR | 641 | | 45,428 |

National Western Life Insurance Co. Class A (a) | 128 | | 20,760 |

Navigators Group, Inc. (a) | 480 | | 13,560 |

Ohio Casualty Corp. (a) | 2,648 | | 56,879 |

Philadelphia Consolidated Holding Corp. (a) | 896 | | 61,152 |

PMA Capital Corp. Class A (a) | 1,688 | | 16,796 |

Presidential Life Corp. | 1,533 | | 25,616 |

Quanta Capital Holdings Ltd. (a) | 2,300 | | 21,574 |

SAFECO Corp. | 5,538 | | 268,427 |

Safety Insurance Group, Inc. | 1,008 | | 27,720 |

Selective Insurance Group, Inc. | 1,121 | | 50,210 |

State Auto Financial Corp. | 1,720 | | 46,096 |

The Midland Co. (a) | 880 | | 27,984 |

Triad Guaranty, Inc. (a) | 592 | | 35,520 |

United Fire & Casualty Co. | 448 | | 29,837 |

Universal American Financial Corp. (a) | 2,617 | | 34,937 |

USI Holdings Corp. (a) | 2,052 | | 23,557 |

| | 1,843,042 |

Real Estate - 0.2% |

Capital Automotive (SBI) | 1,285 | | 43,317 |

Elbit Medical Imaging Ltd. (a) | 1,814 | | 17,795 |

Gladstone Commercial Corp. | 1,304 | | 21,829 |

Investors Real Estate Trust | 2,633 | | 27,804 |

Monmouth Real Estate Investment Corp. Class A | 2,628 | | 21,734 |

Price Legacy Corp. | 2,067 | | 39,480 |

Saxon Capital, Inc. | 1,777 | | 40,338 |

Tarragon Realty Investors, Inc. (a) | 1,192 | | 17,153 |

| | 229,450 |

Thrifts & Mortgage Finance - 1.8% |

Accredited Home Lenders Holding Co. (a) | 960 | | 41,232 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Thrifts & Mortgage Finance - continued |

Anchor BanCorp Wisconsin, Inc. | 992 | | $ 28,976 |

Bank Mutual Corp. | 2,975 | | 36,682 |

BankUnited Financial Corp. Class A (a) | 1,072 | | 32,953 |

Beverly Hills Bancorp, Inc. | 2,657 | | 26,331 |

Brookline Bancorp, Inc., Delaware | 2,180 | | 35,316 |

Camco Financial Corp. | 1,218 | | 18,550 |

Capitol Federal Financial | 2,693 | | 95,009 |

CFS Bancorp, Inc. | 1,277 | | 17,597 |

Charter Financial Corp. | 800 | | 32,728 |

Citizens First Bancorp, Inc. | 864 | | 22,507 |

Citizens South Banking Corp. | 1,509 | | 19,768 |

City Bank Lynnwood | 544 | | 20,966 |

Clifton Savings Bancorp, Inc. | 1,057 | | 13,635 |

Commercial Capital Bancorp, Inc. | 2,246 | | 53,590 |

Cooperative Bankshares, Inc. | 720 | | 19,872 |

Corus Bankshares, Inc. | 992 | | 48,281 |

Dime Community Bancorp, Inc. | 1,629 | | 29,892 |

E-Loan, Inc. (a) | 3,693 | | 9,971 |

ESB Financial Corp. | 1,570 | | 22,153 |

FFLC Bancorp, Inc. | 799 | | 26,071 |

Fidelity Bankshares, Inc. | 720 | | 29,542 |

First Busey Corp. | 912 | | 18,650 |

First Federal Bancshares of Arkansas, Inc. | 993 | | 21,618 |

First Financial Holdings, Inc. | 528 | | 17,287 |

First Financial Service Corp. | 736 | | 18,871 |

First Niagara Financial Group, Inc. | 3,959 | | 57,168 |

First Pactrust Bancorp, Inc. | 800 | | 20,720 |

First Place Financial Corp. | 944 | | 21,240 |

Flushing Financial Corp. | 976 | | 20,740 |

FMS Financial Corp. | 848 | | 15,111 |

Harbor Florida Bancshares, Inc. | 960 | | 33,696 |

Heritage Financial Corp., Washington | 998 | | 21,667 |

HMN Financial, Inc. | 751 | | 24,002 |

Horizon Financial Corp. | 1,205 | | 24,715 |

Hudson City Bancorp, Inc. | 8,109 | | 325,820 |

Hudson River Bancorp, Inc. | 1,184 | | 23,976 |

Independence Community Bank Corp. | 3,510 | | 149,105 |

KNBT Bancorp, Inc. | 1,259 | | 21,554 |

LSB Corp. | 1,057 | | 19,512 |

MAF Bancorp., Inc. | 1,565 | | 71,834 |

MASSBANK Corp. | 578 | | 21,444 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

FINANCIALS - continued |

Thrifts & Mortgage Finance - continued |

MutualFirst Financial, Inc. | 864 | | $ 20,347 |

NASB Financial, Inc. | 544 | | 21,787 |

NetBank, Inc. | 2,204 | | 22,635 |

NewAlliance Bancshares, Inc. | 4,808 | | 72,264 |

NewMil Bancorp, Inc. | 752 | | 22,643 |

Northeast Pennsylvania Financial Corp. | 960 | | 16,310 |

Northwest Bancorp, Inc. | 1,736 | | 44,910 |

Pamrapo Bancorp, Inc. | 733 | | 17,592 |

Parkvale Financial Corp. | 816 | | 25,467 |

Partners Trust Financial Group, Inc. | 2,012 | | 22,514 |

People's Bank, Connecticut | 3,908 | | 155,382 |

Provident Bancorp, Inc., Delaware | 1,697 | | 22,502 |

PVF Capital Corp. | 294 | | 4,204 |

Riverview Bancorp, Inc. | 969 | | 20,873 |

Severn Bancorp, Inc. | 560 | | 22,372 |

Sound Federal Bancorp, Inc. | 1,407 | | 21,388 |

Sterling Financial Corp., Washington (a) | 942 | | 37,633 |

TierOne Corp. | 848 | | 21,039 |

Timberland Bancorp, Inc. | 837 | | 20,507 |

United Community Financial Corp., Ohio | 1,456 | | 16,729 |

Washington Federal, Inc. | 3,173 | | 85,576 |

Waypoint Financial Corp. | 1,189 | | 33,019 |

Willow Grove Bancorp, Inc. | 976 | | 17,597 |

| | 2,395,642 |

TOTAL FINANCIALS | | 14,347,216 |

HEALTH CARE - 12.9% |

Biotechnology - 7.2% |

Abgenix, Inc. (a) | 4,002 | | 40,620 |

AEterna Zentaris Laboratories, Inc. (a) | 3,264 | | 20,807 |

Affymetrix, Inc. (a) | 2,520 | | 85,554 |

Albany Molecular Research, Inc. (a) | 1,485 | | 15,919 |

Alexion Pharmaceuticals, Inc. (a) | 1,157 | | 23,927 |

Alkermes, Inc. (a) | 4,109 | | 56,663 |

Amgen, Inc. (a) | 53,096 | | 3,187,884 |

Amylin Pharmaceuticals, Inc. (a) | 4,137 | | 84,312 |

Angiotech Pharmaceuticals, Inc. (a) | 3,649 | | 67,476 |

Aphton Corp. (a) | 2,415 | | 7,970 |

Arena Pharmaceuticals, Inc. (a) | 2,044 | | 11,447 |

ARIAD Pharmaceuticals, Inc. (a) | 1,964 | | 11,332 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Biotechnology - continued |

Array Biopharma, Inc. (a) | 1,043 | | $ 8,719 |

Avant Immunotherapeutics, Inc. (a) | 7,617 | | 14,091 |

Axonyx, Inc. (a) | 2,023 | | 14,889 |

Biogen Idec, Inc. (a) | 13,975 | | 820,053 |

BioMarin Pharmaceutical, Inc. (a) | 2,937 | | 15,654 |

Biopure Corp. Class A (a)(d) | 2,325 | | 1,186 |

Celgene Corp. (a) | 6,922 | | 189,801 |

Cell Genesys, Inc. (a) | 2,044 | | 15,003 |

Cell Therapeutics, Inc. (a)(d) | 2,837 | | 21,221 |

Cephalon, Inc. (a) | 2,296 | | 109,129 |

Cepheid, Inc. (a) | 2,568 | | 23,651 |

Chiron Corp. (a) | 8,087 | | 263,394 |

Ciphergen Biosystems, Inc. (a) | 1,461 | | 4,704 |

Corgentech, Inc. | 1,034 | | 18,819 |

Corixa Corp. (a) | 2,809 | | 10,534 |

Cubist Pharmaceuticals, Inc. (a) | 1,716 | | 20,592 |

CuraGen Corp. (a) | 3,177 | | 19,157 |

Curis, Inc. (a) | 2,737 | | 11,085 |

CV Therapeutics, Inc. (a) | 1,349 | | 29,246 |

Cytogen Corp. (a) | 1,020 | | 10,047 |

Cytokinetics, Inc. | 1,082 | | 9,305 |

deCODE genetics, Inc. (a) | 3,017 | | 19,611 |

Dendreon Corp. (a) | 2,405 | | 23,593 |

Digene Corp. (a) | 897 | | 21,692 |

Diversa Corp. (a) | 2,421 | | 20,506 |

DOV Pharmaceutical, Inc. (a) | 1,000 | | 18,510 |

Dyax Corp. (a) | 1,604 | | 12,720 |

Dynavax Technologies Corp. | 970 | | 6,809 |

Encysive Pharmaceuticals, Inc. (a) | 2,585 | | 28,047 |

Enzon Pharmaceuticals, Inc. (a) | 2,027 | | 27,446 |

Exact Sciences Corp. (a) | 1,016 | | 3,515 |

Exelixis, Inc. (a) | 3,677 | | 32,983 |

Eyetech Pharmaceuticals, Inc. | 1,597 | | 64,391 |

Gen-Probe, Inc. (a) | 2,064 | | 82,354 |

Genaera Corp. (a) | 3,056 | | 11,032 |

Gene Logic, Inc. (a) | 2,341 | | 7,889 |

Genelabs Technologies, Inc. (a) | 9,488 | | 6,736 |

Genencor International, Inc. (a) | 2,645 | | 42,849 |

Genitope Corp. | 944 | | 14,896 |

Genta, Inc. (a) | 3,437 | | 4,468 |

Genzyme Corp. - General Division (a) | 9,655 | | 540,777 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Biotechnology - continued |

Geron Corp. (a) | 1,668 | | $ 11,593 |

Gilead Sciences, Inc. (a) | 18,126 | | 624,622 |

GTx, Inc. | 1,569 | | 21,025 |

Harvard Bioscience, Inc. (a) | 2,140 | | 8,496 |

Human Genome Sciences, Inc. (a) | 5,855 | | 64,405 |

ICOS Corp. (a) | 2,773 | | 66,968 |

ID Biomedical Corp. (a) | 1,836 | | 29,879 |

Idenix Pharmaceuticals, Inc. | 1,940 | | 28,033 |

Ilex Oncology, Inc. (a) | 1,864 | | 46,339 |

ImClone Systems, Inc. (a) | 3,372 | | 142,366 |

ImmunoGen, Inc. (a) | 2,633 | | 20,590 |

Immunomedics, Inc. (a) | 2,681 | | 7,534 |

Incyte Corp. (a) | 3,677 | | 37,763 |

Indevus Pharmaceuticals, Inc. (a) | 2,633 | | 18,194 |

InterMune, Inc. (a) | 1,541 | | 19,124 |

Introgen Therapeutics, Inc. (a)(d) | 1,688 | | 11,782 |

Invitrogen Corp. (a) | 2,120 | | 128,260 |

Isis Pharmaceuticals, Inc. (a) | 3,161 | | 14,920 |

Keryx Biopharmaceuticals, Inc. (a) | 1,264 | | 15,459 |

La Jolla Pharmaceutical Co. (a) | 2,301 | | 3,244 |

Lexicon Genetics, Inc. (a) | 3,549 | | 24,949 |

LifeCell Corp. (a) | 1,168 | | 12,077 |

Ligand Pharmaceuticals, Inc. Class B (a) | 3,381 | | 37,867 |

Luminex Corp. (a) | 1,980 | | 17,840 |

MannKind Corp. | 1,270 | | 19,939 |

Marshall Edwards, Inc. | 2,395 | | 21,699 |

Martek Biosciences (a) | 1,009 | | 39,220 |

Maxim Pharmaceuticals, Inc. (a) | 1,761 | | 5,125 |

Maxygen, Inc. (a) | 1,820 | | 18,364 |

Medarex, Inc. (a) | 3,997 | | 43,567 |

MedImmune, Inc. (a) | 10,540 | | 280,364 |

Memory Pharmaceuticals Corp. | 664 | | 4,150 |

Millennium Pharmaceuticals, Inc. (a) | 12,908 | | 162,899 |

Myogen, Inc. | 1,567 | | 12,787 |

Myriad Genetics, Inc. (a) | 1,517 | | 29,187 |

Nabi Biopharmaceuticals (a) | 2,376 | | 34,214 |

Nanogen, Inc. (a) | 1,562 | | 7,013 |

Neogen Corp. (a) | 960 | | 20,774 |

Neopharm, Inc. (a) | 1,168 | | 13,607 |

Neose Technologies, Inc. (a) | 1,429 | | 9,989 |

Neurochem, Inc. (a) | 1,455 | | 29,175 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Biotechnology - continued |

Neurocrine Biosciences, Inc. (a) | 1,509 | | $ 69,414 |

Neurogen Corp. (a) | 1,980 | | 17,325 |

Northfield Laboratories, Inc. (a)(d) | 1,473 | | 27,545 |

Novavax, Inc. (a) | 1,868 | | 6,389 |

NPS Pharmaceuticals, Inc. (a) | 1,672 | | 29,946 |

Nuvelo, Inc. (a) | 1,381 | | 13,465 |

ONYX Pharmaceuticals, Inc. (a) | 1,553 | | 48,578 |

OraSure Technologies, Inc. (a) | 1,900 | | 13,604 |

Orchid BioSciences, Inc. (a) | 784 | | 8,397 |

Oscient Pharmaceuticals Corp. (a) | 2,988 | | 9,741 |

OSI Pharmaceuticals, Inc. (a) | 1,784 | | 84,883 |

Peregrine Pharmaceuticals, Inc. (a) | 7,380 | | 9,373 |

Pharmacopeia Drug Discovery, Inc. (a) | 664 | | 3,838 |

Pharmacyclics, Inc. (a) | 1,239 | | 12,910 |

Pharmion Corp. | 1,182 | | 50,046 |

PRAECIS Pharmaceuticals, Inc. (a) | 2,969 | | 6,265 |

Progenics Pharmaceuticals, Inc. (a) | 752 | | 11,242 |

Protein Design Labs, Inc. (a) | 4,281 | | 77,572 |

QIAGEN NV (a) | 5,919 | | 63,984 |

QLT, Inc. (a) | 4,036 | | 65,409 |

Regeneron Pharmaceuticals, Inc. (a) | 2,277 | | 20,994 |

Renovis, Inc. | 859 | | 12,456 |

Rigel Pharmaceuticals, Inc. (a) | 1,024 | | 25,620 |

Savient Pharmaceuticals, Inc. (a) | 3,549 | | 7,808 |

SciClone Pharmaceuticals, Inc. (a) | 2,044 | | 8,340 |

Seattle Genetics, Inc. (a) | 2,028 | | 13,851 |

Senomyx, Inc. | 1,630 | | 16,137 |

Sequenom, Inc. (a) | 3,869 | | 3,443 |

Serologicals Corp. (a) | 1,232 | | 28,755 |

Sirna Therapeutics, Inc. (a) | 2,022 | | 6,248 |

Stratagene Corp. (a) | 917 | | 6,290 |

Tanox, Inc. (a) | 2,072 | | 28,697 |

Targeted Genetics Corp. (a) | 5,774 | | 7,622 |

Techne Corp. (a) | 1,768 | | 65,681 |

Telik, Inc. (a) | 1,720 | | 32,869 |

Third Wave Technologies, Inc. (a) | 3,437 | | 27,702 |

Transkaryotic Therapies, Inc. (a) | 1,899 | | 43,316 |

Trimeris, Inc. (a) | 941 | | 11,678 |

United Therapeutics Corp. (a) | 944 | | 41,545 |

Vasogen, Inc. (a) | 1,762 | | 8,409 |

Vertex Pharmaceuticals, Inc. (a) | 3,677 | | 39,050 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Biotechnology - continued |

Vicuron Pharmaceuticals, Inc. (a) | 2,632 | | $ 46,297 |

Vion Pharmaceuticals, Inc. (a) | 4,066 | | 19,273 |

XOMA Ltd. (a) | 3,485 | | 6,970 |

Zymogenetics, Inc. (a) | 2,196 | | 49,937 |

| | 9,609,331 |

Health Care Equipment & Supplies - 2.2% |

Abaxis, Inc. (a) | 1,200 | | 15,048 |

Abiomed, Inc. (a) | 2,092 | | 31,757 |

Advanced Neuromodulation Systems, Inc. (a) | 848 | | 30,613 |

Aksys Ltd. (a)(d) | 1,668 | | 11,025 |

Align Technology, Inc. (a) | 2,821 | | 29,818 |

American Medical Systems Holdings, Inc. (a) | 1,509 | | 57,583 |

Analogic Corp. | 544 | | 24,654 |

Anika Therapeutics, Inc. (a) | 1,319 | | 12,465 |

Animas Corp. | 768 | | 12,442 |

Arrow International, Inc. | 1,880 | | 56,851 |

Arthrocare Corp. (a) | 1,056 | | 31,965 |

Aspect Medical Systems, Inc. (a) | 1,272 | | 31,037 |

BioLase Technology, Inc. (d) | 1,108 | | 10,016 |

Biomet, Inc. | 10,764 | | 515,273 |

Biosite, Inc. (a) | 784 | | 43,661 |

BioVeris Corp. (a) | 1,050 | | 6,489 |

Bruker BioSciences Corp. (a) | 4,771 | | 21,994 |

Cardiac Science, Inc. (a) | 4,173 | | 8,847 |

Cardiodynamics International Corp. (a) | 3,081 | | 14,080 |

Closure Medical Corp. (a) | 752 | | 13,378 |

CNS., Inc. | 1,368 | | 16,512 |

Conceptus, Inc. (a) | 1,176 | | 10,502 |

CONMED Corp. (a) | 1,349 | | 39,081 |

CTI Molecular Imaging, Inc. (a) | 2,161 | | 28,914 |

Cyberonics, Inc. (a) | 1,008 | | 18,719 |

Cytyc Corp. (a) | 4,795 | | 128,698 |

Dade Behring Holdings, Inc. (a) | 1,640 | | 88,052 |

Datascope Corp. | 688 | | 27,582 |

DENTSPLY International, Inc. | 3,188 | | 167,721 |

Encore Medical Corp. (a) | 2,044 | | 12,867 |

Endocardial Solutions, Inc. (a) | 2,285 | | 25,980 |

Epix Pharmaceuticals, Inc. (a) | 1,024 | | 18,022 |

Exactech, Inc. (a) | 784 | | 14,771 |

Foxhollow Technologies, Inc. | 902 | | 23,362 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Health Care Equipment & Supplies - continued |

Given Imaging Ltd. (a)(d) | 1,389 | | $ 46,268 |

Hologic, Inc. (a) | 1,200 | | 29,988 |

I-Flow Corp. (a) | 1,593 | | 32,704 |

ICU Medical, Inc. (a) | 704 | | 17,565 |

IDEXX Laboratories, Inc. (a) | 1,429 | | 73,736 |

Illumina, Inc. (a) | 2,618 | | 19,897 |

Immucor, Inc. (a) | 1,137 | | 36,555 |

INAMED Corp. (a) | 1,708 | | 91,634 |

Integra LifeSciences Holdings Corp. (a) | 1,157 | | 39,326 |

IntraLase Corp. | 1,034 | | 18,457 |

Intuitive Surgical, Inc. (a) | 1,293 | | 46,457 |

Kensey Nash Corp. (a) | 624 | | 19,506 |

Kyphon, Inc. (a) | 1,752 | | 42,153 |

Laserscope, Inc. (a) | 1,120 | | 36,422 |

Matthews International Corp. Class A | 1,397 | | 51,507 |

Merit Medical Systems, Inc. (a) | 1,065 | | 12,098 |

Micro Therapeutics, Inc. (a) | 2,633 | | 10,479 |

Molecular Devices Corp. (a) | 816 | | 17,160 |

Nutraceutical International Corp. (a) | 1,309 | | 20,983 |

NuVasive, Inc. | 985 | | 9,358 |

Ocular Sciences, Inc. (a) | 1,221 | | 58,991 |

Orthofix International NV (a) | 608 | | 23,062 |

Orthologic Corp. (a) | 2,793 | | 16,004 |

Orthovita, Inc. (a) | 3,341 | | 12,863 |

Palomar Medical Technologies, Inc. (a) | 844 | | 19,015 |

PolyMedica Corp. | 992 | | 35,266 |

Possis Medical, Inc. (a) | 960 | | 11,078 |

Quidel Corp. (a) | 2,108 | | 13,597 |

Regeneration Technologies, Inc. (a) | 1,320 | | 12,276 |

Respironics, Inc. (a) | 1,397 | | 77,366 |

SonoSight, Inc. (a) | 784 | | 23,402 |

Staar Surgical Co. (a) | 1,112 | | 6,594 |

Stereotaxis, Inc. | 1,830 | | 17,843 |

SurModics, Inc. (a) | 736 | | 22,154 |

Syneron Medical Ltd. | 919 | | 24,859 |

Synovis Life Technologies, Inc. (a) | 509 | | 6,032 |

Thoratec Corp. (a) | 2,517 | | 25,170 |

TriPath Imaging, Inc. (a) | 1,868 | | 13,412 |

Urologix, Inc. (a) | 832 | | 5,924 |

Utah Medical Products, Inc. | 640 | | 13,920 |

Varian, Inc. (a) | 1,413 | | 52,917 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Health Care Equipment & Supplies - continued |

Vascular Solutions, Inc. (a) | 1,263 | | $ 13,085 |

Ventana Medical Systems, Inc. (a) | 752 | | 44,932 |

Vital Signs, Inc. | 656 | | 24,541 |

Wright Medical Group, Inc. (a) | 1,509 | | 39,913 |

Young Innovations, Inc. | 544 | | 17,375 |

Zoll Medical Corp. (a) | 448 | | 15,201 |

| | 2,918,824 |

Health Care Providers & Services - 1.9% |

Accredo Health, Inc. (a) | 2,072 | | 56,089 |

Advisory Board Co. (a) | 339 | | 12,079 |

Alderwoods Group, Inc. (a) | 2,617 | | 27,688 |

Allied Healthcare International, Inc. (a) | 915 | | 4,923 |

Allscripts Healthcare Solutions, Inc. (a) | 2,466 | | 24,290 |

Amedisys, Inc. (a) | 715 | | 23,538 |

America Service Group, Inc. (a) | 495 | | 12,400 |

American Healthways, Inc. (a) | 1,387 | | 46,256 |

AmSurg Corp. (a) | 1,416 | | 36,405 |

Andrx Corp. (a) | 3,324 | | 59,167 |

Cerner Corp. (a) | 1,581 | | 83,350 |

Computer Programs & Systems, Inc. | 656 | | 14,170 |

Corvel Corp. (a) | 480 | | 15,226 |

Cross Country Healthcare, Inc. (a) | 1,652 | | 29,323 |

D & K Healthcare Resources, Inc. | 961 | | 6,977 |

Dendrite International, Inc. (a) | 1,812 | | 30,931 |

Eclipsys Corp. (a) | 2,209 | | 42,965 |

eResearchTechnology, Inc. (a) | 2,227 | | 32,826 |

Express Scripts, Inc. (a) | 3,171 | | 228,185 |

First Health Group Corp. (a) | 3,781 | | 67,377 |

Genesis HealthCare Corp. (a) | 880 | | 28,380 |

Gentiva Health Services, Inc. (a) | 1,684 | | 28,039 |

HealthExtras, Inc. (a) | 1,836 | | 29,321 |

Henry Schein, Inc. (a) | 1,704 | | 111,067 |

ICON PLC sponsored ADR (a) | 560 | | 20,910 |

IDX Systems Corp. (a) | 1,301 | | 45,691 |

LabOne, Inc. (a) | 768 | | 23,155 |

LCA-Vision, Inc. | 636 | | 20,861 |

Lifeline Systems, Inc. (a) | 1,056 | | 28,565 |

LifePoint Hospitals, Inc. (a) | 1,597 | | 58,738 |

Lincare Holdings, Inc. (a) | 4,137 | | 159,647 |

Magellan Health Services, Inc. (a) | 1,166 | | 41,567 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Health Care Providers & Services - continued |

Matria Healthcare, Inc. (a) | 880 | | $ 30,800 |

Medcath Corp. (a) | 1,384 | | 30,060 |

Merge Technologies, Inc. (a) | 765 | | 14,742 |

National Medical Health Card Systems, Inc. (a) | 508 | | 10,866 |

Odyssey Healthcare, Inc. (a) | 1,565 | | 20,893 |

Omnicell, Inc. (a) | 1,204 | | 12,943 |

Option Care, Inc. | 1,288 | | 22,179 |

PAREXEL International Corp. (a) | 1,309 | | 27,005 |

Patterson Companies, Inc. (a) | 5,610 | | 229,225 |

PDI, Inc. (a) | 672 | | 15,637 |

Per-Se Technologies, Inc. (a) | 1,505 | | 20,754 |

Pharmaceutical Product Development, Inc. (a) | 2,280 | | 96,011 |

PRA International | 906 | | 20,530 |

Priority Healthcare Corp. Class B (a) | 1,656 | | 34,610 |

PSS World Medical, Inc. (a) | 3,309 | | 41,409 |

Psychiatric Solutions, Inc. (a) | 942 | | 30,662 |

ResCare, Inc. (a) | 1,900 | | 28,500 |

SFBC International, Inc. (a) | 648 | | 25,162 |

Stewart Enterprises, Inc. Class A (a) | 5,583 | | 41,426 |

Sun Healthcare Group, Inc. (a) | 1,524 | | 11,430 |

Symbion, Inc. | 735 | | 14,083 |

TLC Vision Corp. (a) | 3,081 | | 36,085 |

TriZetto Group, Inc. (a) | 2,537 | | 17,962 |

United Surgical Partners International, Inc. (a) | 1,253 | | 49,456 |

VCA Antech, Inc. (a) | 3,536 | | 65,628 |

Ventiv Health, Inc. (a) | 1,720 | | 33,299 |

VistaCare, Inc. Class A (a) | 784 | | 13,324 |

Vital Images, Inc. (a) | 548 | | 8,872 |

VitalWorks, Inc. (a) | 2,793 | | 11,256 |

WebMD Corp. (a) | 13,188 | | 95,613 |

| | 2,560,528 |

Pharmaceuticals - 1.6% |

aaiPharma, Inc. (a)(d) | 1,265 | | 3,909 |

Able Laboratories, Inc. (a) | 752 | | 16,356 |

Acusphere, Inc. (d) | 2,301 | | 15,187 |

Adolor Corp. (a) | 1,445 | | 19,984 |

Advancis Pharmaceutical Corp. | 459 | | 1,198 |

American Pharmaceutical Partners, Inc. (a)(d) | 3,160 | | 93,947 |

Antigenics, Inc. (a) | 2,140 | | 20,159 |

Atherogenics, Inc. (a) | 1,832 | | 43,437 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Pharmaceuticals - continued |

Axcan Pharma, Inc. (a) | 2,100 | | $ 37,026 |

Barrier Therapeutics, Inc. | 908 | | 15,145 |

Bone Care International, Inc. (a) | 1,096 | | 25,559 |

Connetics Corp. (a) | 1,477 | | 30,884 |

Cypress Bioscience, Inc. (a) | 1,643 | | 19,141 |

DepoMed, Inc. (a) | 3,286 | | 15,313 |

Discovery Laboratories, Inc. (a) | 2,060 | | 14,379 |

Discovery Partners International, Inc. (a) | 2,268 | | 10,433 |

Endo Pharmaceuticals Holdings, Inc. (a) | 5,038 | | 103,178 |

Eon Labs, Inc. (a) | 3,792 | | 102,232 |

First Horizon Pharmaceutical Corp. (a) | 1,716 | | 33,565 |

Flamel Technologies SA sponsored ADR (a) | 850 | | 17,842 |

Guilford Pharmaceuticals, Inc. (a) | 2,060 | | 11,618 |

Hollis-Eden Pharmaceuticals, Inc. (a) | 833 | | 8,447 |

Impax Laboratories, Inc. (a) | 2,408 | | 30,148 |

InKine Pharmaceutical, Inc. (a) | 3,097 | | 16,213 |

Inspire Pharmaceuticals, Inc. (a) | 1,525 | | 27,313 |

Kos Pharmaceuticals, Inc. (a) | 1,547 | | 65,856 |

Medicines Co. (a) | 2,104 | | 52,474 |

MGI Pharma, Inc. (a) | 2,794 | | 75,410 |

Nektar Therapeutics (a) | 3,011 | | 56,261 |

New River Pharmaceuticals, Inc. | 1,034 | | 16,182 |

NitroMed, Inc. (d) | 1,311 | | 27,400 |

Noven Pharmaceuticals, Inc. (a) | 1,232 | | 22,521 |

Novogen Ltd. sponsored ADR (a) | 354 | | 7,558 |

Pain Therapeutics, Inc. (a) | 2,338 | | 17,605 |

Penwest Pharmaceuticals Co. (a) | 893 | | 11,118 |

Perrigo Co. | 3,189 | | 57,530 |

Pharmos Corp. (a)(d) | 7,632 | | 30,528 |

Pozen, Inc. (a) | 1,304 | | 9,050 |

Salix Pharmaceuticals Ltd. (a) | 1,632 | | 24,725 |

Santarus, Inc. | 1,511 | | 14,732 |

Sepracor, Inc. (a) | 4,410 | | 196,289 |

Shire Pharmaceuticals Group PLC sponsored ADR | 1,946 | | 58,438 |

SuperGen, Inc. (a) | 2,044 | | 14,758 |

Taro Pharmaceutical Industries Ltd. (a) | 1,173 | | 34,768 |

Teva Pharmaceutical Industries Ltd. sponsored ADR | 18,606 | | 507,572 |

Theravance, Inc. | 1,730 | | 30,448 |

Vivus, Inc. (a) | 3,421 | | 20,115 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Pharmaceuticals - continued |

Warner Chilcott PLC ADR | 212 | | $ 13,803 |

Zila, Inc. (a) | 3,853 | | 17,146 |

| | 2,114,900 |

TOTAL HEALTH CARE | | 17,203,583 |

INDUSTRIALS - 5.8% |

Aerospace & Defense - 0.3% |

Applied Signal Technology, Inc. | 720 | | 27,331 |

BE Aerospace, Inc. (a) | 2,905 | | 30,784 |

Ceradyne, Inc. (a) | 746 | | 36,852 |

Elbit Systems Ltd. (d) | 1,848 | | 41,451 |

Engineered Support Systems, Inc. | 976 | | 53,680 |

Innovative Solutions & Support, Inc. (a) | 615 | | 18,825 |

Invision Technologies, Inc. (a) | 864 | | 41,887 |

Kaman Corp. Class A | 1,620 | | 19,440 |

KVH Industries, Inc. (a) | 573 | | 5,787 |

Mercury Computer Systems, Inc.(a) | 1,040 | | 32,760 |

MTC Technologies, Inc. (a) | 704 | | 21,641 |

SI International, Inc. (a) | 643 | | 18,608 |

Sypris Solutions, Inc. | 1,040 | | 16,921 |

| | 365,967 |

Air Freight & Logistics - 0.5% |

C.H. Robinson Worldwide, Inc. | 3,356 | | 180,385 |

EGL, Inc. (a) | 2,152 | | 72,608 |

Expeditors International of Washington, Inc. | 4,539 | | 241,747 |

Forward Air Corp. (a) | 1,024 | | 47,462 |

Hub Group, Inc. Class A (a) | 453 | | 19,706 |

Pacer International, Inc. (a) | 1,672 | | 32,704 |

UTI Worldwide, Inc. | 1,088 | | 74,996 |

| | 669,608 |

Airlines - 0.3% |

FLYi, Inc. (a) | 2,373 | | 4,461 |

Frontier Airlines, Inc. (a) | 1,461 | | 17,138 |

JetBlue Airways Corp. (a)(d) | 4,121 | | 98,945 |

MAIR Holdings, Inc. (a) | 2,373 | | 21,832 |

Mesa Air Group, Inc. (a) | 1,752 | | 12,299 |

Northwest Airlines Corp. (a) | 4,285 | | 43,878 |

Republic Airways Holdings, Inc. | 1,063 | | 12,225 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

INDUSTRIALS - continued |

Airlines - continued |

Ryanair Holdings PLC sponsored ADR (a) | 2,607 | | $ 102,064 |

SkyWest, Inc. | 2,616 | | 49,782 |

| | 362,624 |

Building Products - 0.1% |

Aaon, Inc. (a) | 832 | | 13,229 |

American Woodmark Corp. | 687 | | 27,638 |

Apogee Enterprises, Inc. | 1,652 | | 24,086 |

Quixote Corp. | 528 | | 11,067 |

Universal Forest Products, Inc. | 784 | | 33,837 |

| | 109,857 |

Commercial Services & Supplies - 2.3% |

Apollo Group, Inc. Class A (a) | 7,826 | | 623,732 |

Asset Acceptance Capital Corp. | 1,545 | | 31,842 |

Bright Horizons Family Solutions, Inc. (a) | 576 | | 36,144 |

Career Education Corp. (a) | 4,274 | | 166,259 |

Carlisle Holdings Ltd. (non-vtg.) | 3,225 | | 21,995 |

Casella Waste Systems, Inc. Class A (a) | 1,272 | | 19,220 |

Century Business Services, Inc. (a) | 5,042 | | 21,681 |

Charles River Associates, Inc. (a) | 512 | | 22,088 |

Cintas Corp. | 7,263 | | 324,801 |

Coinstar, Inc. (a) | 1,168 | | 30,391 |

Copart, Inc. (a) | 4,201 | | 90,742 |

Corinthian Colleges, Inc. (a) | 3,568 | | 62,172 |

Corporate Executive Board Co. | 1,820 | | 122,086 |

CoStar Group, Inc. (a) | 816 | | 35,741 |

DiamondCluster International, Inc. Class A (a) | 1,220 | | 14,921 |

Duratek, Inc. (a) | 873 | | 20,088 |

Educate, Inc. | 1,774 | | 23,417 |

Education Management Corp. (a) | 2,918 | | 96,703 |

Electro Rent Corp. | 1,752 | | 24,843 |

Exponent, Inc. (a) | 749 | | 20,815 |

FirstService Corp. (a) | 737 | | 23,783 |

G&K Services, Inc. Class A | 992 | | 40,751 |

General Binding Corp. (a) | 1,018 | | 13,570 |

Gevity HR, Inc. | 960 | | 17,002 |

Greg Manning Auctions, Inc. (a) | 1,285 | | 14,739 |

Healthcare Services Group, Inc. | 682 | | 14,145 |

Heidrick & Struggles International, Inc. (a) | 1,024 | | 35,226 |

Herman Miller, Inc. | 2,948 | | 72,412 |

Hudson Highland Group, Inc. (a) | 522 | | 14,256 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

INDUSTRIALS - continued |

Commercial Services & Supplies - continued |

Huron Consulting Group, Inc. | 768 | | $ 16,243 |

ICT Group, Inc. (a) | 882 | | 7,541 |

Insurance Auto Auctions, Inc. (a) | 605 | | 13,425 |

Integrated Alarm Services Group, Inc. (a)(d) | 1,620 | | 6,820 |

Intersections, Inc. | 716 | | 12,888 |

Kelly Services, Inc. Class A (non-vtg.) | 1,640 | | 49,856 |

Kforce, Inc. (a) | 1,836 | | 21,995 |

Laureate Education, Inc. (a) | 1,864 | | 73,423 |

Layne Christensen Co. (a) | 473 | | 9,176 |

Learning Tree International, Inc. (a) | 1,056 | | 13,865 |

LECG Corp. | 768 | | 15,014 |

McGrath RentCorp. | 672 | | 28,399 |

Mobile Mini, Inc. (a) | 800 | | 24,232 |

Monster Worldwide, Inc. (a) | 4,830 | | 136,158 |

NCO Group, Inc. (a) | 1,189 | | 29,856 |

On Assignment, Inc. (a) | 1,797 | | 9,380 |

PICO Holdings, Inc. (a) | 579 | | 11,933 |

Portfolio Recovery Associates, Inc. (a) | 704 | | 26,400 |

PRG-Schultz International, Inc. (a) | 3,533 | | 19,078 |

Princeton Review, Inc. (a) | 2,204 | | 13,092 |

Resources Connection, Inc. (a) | 1,088 | | 49,352 |

School Specialty, Inc. (a) | 800 | | 30,400 |

SOURCECORP, Inc. (a) | 832 | | 13,836 |

Stericycle, Inc. (a) | 1,525 | | 63,730 |

Strayer Education, Inc. | 586 | | 62,983 |

Teletech Holdings, Inc. (a) | 3,565 | | 34,830 |

Tetra Tech, Inc. (a) | 2,328 | | 35,479 |

United Stationers, Inc. (a) | 1,301 | | 62,292 |

Vertrue, Inc. (a) | 576 | | 19,987 |

Waste Industries USA, Inc. | 1,800 | | 20,646 |

Waste Services, Inc. (a) | 2,579 | | 9,514 |

West Corp. (a) | 2,385 | | 82,616 |

| | 3,080,004 |

Construction & Engineering - 0.0% |

Insituform Technologies, Inc. Class A (a) | 1,189 | | 27,751 |