UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2546

Fidelity Commonwealth Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | September 30 |

| |

Date of reporting period: | September 30, 2006 |

Item 1. Reports to Stockholders

Fidelity®

Strategic Real Return

Fund

Annual Report

September 30, 2006

(2_fidelity_logos) (Registered_Trademark)

Contents

Note to Shareholders | <Click Here> | An explanation of the changes to the fund. |

Chairman's Message | <Click Here> | Ned Johnson's message to shareholders. |

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The managers' review of fund performance, strategy and outlook |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past year. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Proxy Voting Results | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the fund's most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Note to Shareholders:

Effective November 1, 2006, the real estate component of the Fidelity Strategic Real Return Composite Index - a hypothetical representation of the performance of the fund's unmanaged indexes used as a comparative benchmark - will be changed to reflect the fund's increased real estate common stock exposure. This modification will be made in order to improve the fund's opportunity for real return in periods of rising inflation, while also diversifying the fund's real estate debt exposure. The Dow Jones Wilshire Real Estate Securities IndexSM (12% weighting) will be added to the Composite index, which will continue to also include the Merrill Lynch® U.S. Real Estate Corporate Bond Index (8%), the Dow Jones-AIG Commodity IndexSM (25%), the Credit Suisse First Boston Leveraged Loan Index (25%) and the Lehman Brothers® U.S. Treasury Inflation-Protected Securities (TIPS) Index (30%). This new blend will no longer include an allocation to the FTSE NAREIT All REIT index, which was added to the Composite index on June 1, 2006, or the Morgan Stanley® REIT Preferred Index.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Stock and bond markets around the world have seen largely positive results year to date, although weakness in the technology sector and growth stocks in general have tempered performance. While financial markets are always unpredictable, there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of Strategic Real Return's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended September 30, 2006 | Past 1

year | Life of

fundA |

Strategic Real Return | 2.28% | 3.58% |

A From September 7, 2005

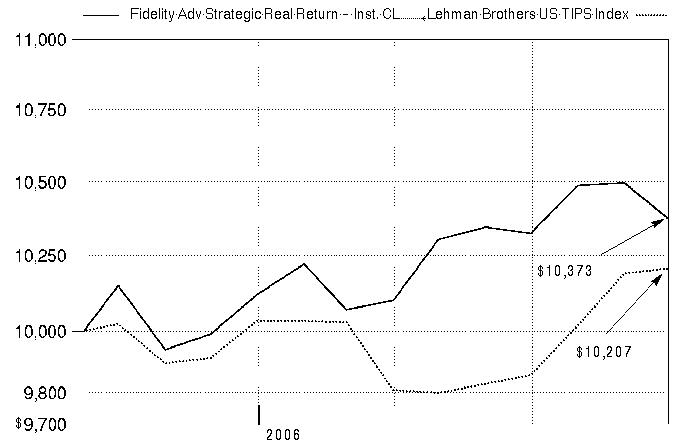

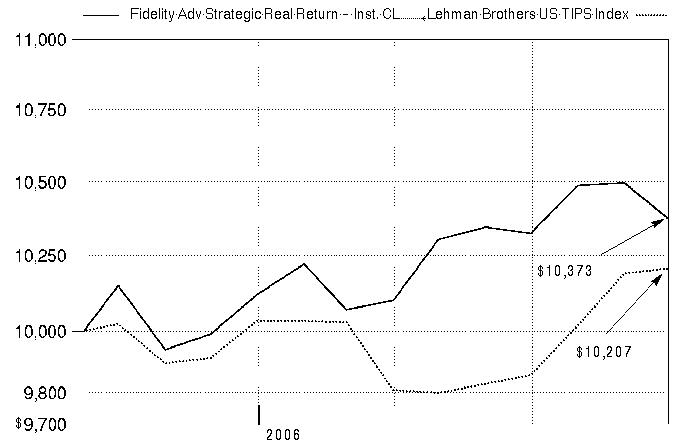

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Real Return on September 7, 2005, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Lehman Brothers® US TIPS Index performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Comments from Christopher Sharpe and Derek Young, Co-Managers of Fidelity® Strategic Real Return Fund

Inflation was an on-again, off-again concern for most of the 12-month period ending September 30, 2006, and, as might be expected, the indexes measuring the performance of Fidelity Strategic Real Return Fund's four component asset classes showed varied results. The Lehman Brothers® U.S. Treasury Inflation-Protected Securities (TIPS) Index rose 1.84%, slightly below the 2.10% increase in the Consumer Price Index for All Urban Consumers (CPI-U), which was consistent with a generally benign inflation picture for the year overall. Meanwhile, the Dow Jones-AIG Commodity IndexSM, which tracks a group of physical commodities traded on various world exchanges, fell 6.11%, as inflationary fears pushed prices for many basic commodities lower in many world markets. Floating-rate bank debt, as measured by the Credit Suisse First Boston (CSFB) Leveraged Loan Index, rose 6.44%, reflecting increased demand for an asset class with low default rates and increasing yields. Similarly, income-oriented real estate investments were robust performers, as demonstrated by the 7.22% return of a diversified composite comprising the FTSE NAREIT All REIT index (20%), the Morgan Stanley® REIT Preferred Index (40%) and the Merrill Lynch® U.S. Real Estate Corporate Bond Index (40%).

During the one-year period, Strategic Real Return was up 2.28%, compared with gains of 2.51% for the Fidelity Strategic Real Return Composite Index and 1.84% for the Lehman Brothers U.S. TIPS Index. Security selection in the fund's subportfolios was the primary driver of performance, but asset allocation also added value. The real estate subportfolio helped overall performance and outpaced its benchmark by a wide margin due mostly to astute security selection across its broad real estate investment universe. Our investment in floating-rate bank loans - primarily through the Fidelity Floating Rate Central Investment Portfolio - had healthy overall appreciation due to strong security selection and also slightly outperformed its benchmark. The Inflation-Protected Securities subportfolio - mostly made up of TIPS - achieved a return that was just below that of its index. Volatility of the commodities markets pushed the commodity-linked note subportfolio's return into negative territory during the period, but that return was offset somewhat by the subportfolio's investments in the Fidelity Ultra-Short Central Fund, a diversified pool of short-term assets designed to outperform cash-like investments with similar characteristics.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2006 to September 30, 2006).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

| Beginning

Account Value

April 1, 2006 | Ending

Account Value

September 30, 2006 | Expenses Paid

During Period*

April 1, 2006

to September 30, 2006 |

Class A | | | |

Actual | $ 1,000.00 | $ 1,026.00 | $ 5.08 |

Hypothetical A | $ 1,000.00 | $ 1,020.05 | $ 5.06 |

Class T | | | |

Actual | $ 1,000.00 | $ 1,025.90 | $ 5.23 |

Hypothetical A | $ 1,000.00 | $ 1,019.90 | $ 5.22 |

Class B | | | |

Actual | $ 1,000.00 | $ 1,023.00 | $ 8.77 |

Hypothetical A | $ 1,000.00 | $ 1,016.39 | $ 8.74 |

Class C | | | |

Actual | $ 1,000.00 | $ 1,022.00 | $ 9.38 |

Hypothetical A | $ 1,000.00 | $ 1,015.79 | $ 9.35 |

Strategic Real Return | | | |

Actual | $ 1,000.00 | $ 1,027.90 | $ 3.97 |

Hypothetical A | $ 1,000.00 | $ 1,021.16 | $ 3.95 |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 1,027.00 | $ 4.12 |

Hypothetical A | $ 1,000.00 | $ 1,021.01 | $ 4.10 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

| Annualized

Expense Ratio |

Class A | 1.00% |

Class T | 1.03% |

Class B | 1.73% |

Class C | 1.85% |

Strategic Real Return | .78% |

Institutional Class | .81% |

Annual Report

Investment Changes

The information in the Quality Diversification and Asset Allocation tables is based on the combined investments of the Fund and its pro-rata share of its investments in each Fidelity Central Fund.

Holdings Distribution (% of fund's net assets) |

| As of

September 30, 2006 | As of

March 31, 2006 |

Commodity-Linked Notes and Related Investments* | 24.7% | 27.3% |

Inflation-Protected Investments | 29.5% | 27.2% |

Floating Rate High Yield | 24.7% | 23.9% |

Real Estate Investments | 18.5% | 14.8% |

Cash & Cash Equivalents | 1.8% | 0.9% |

* Includes Fidelity Ultra-Short Central Fund held in connection with commodity-linked notes and related investments. Investments in commodity-linked notes provide indirect exposure to futures contracts on physical commodities via the Dow Jones-AIG Commodity Index, the majority of which trade on U.S. exchanges. The value of commodity-linked notes will change directly based on the performance of the index. |

Quality Diversification (% of fund's net assets) |

As of September 30, 2006 | As of March 31, 2006 |

| U.S. Government and

U.S. Government

Agency Obligations 30.8% | |  | U.S. Government and

U.S. Government

Agency Obligations 28.9% | |

| AAA 4.7% | |  | AAA 4.8% | |

| AA 0.9% | |  | AA 1.1% | |

| A 2.5% | |  | A 1.9% | |

| BBB 7.9% | |  | BBB 5.0% | |

| BB and Below 22.0% | |  | BB and Below 22.8% | |

| Structured Notes

(including

Commodity-Linked

Notes) 13.8% | |  | Structured Notes

(including

Commodity-Linked

Notes) 13.8% | |

| Equities 7.6% | |  | Equities 7.6% | |

| Short-Term

Investments and

Net Other Assets 9.8% | |  | Short-Term

Investments and

Net Other Assets 14.1% | |

We have used ratings from Moody's® Investors Services, Inc. Where Moody's ratings are not available, we have used S&P® ratings. |

Asset Allocation (% of fund's net assets) |

As of September 30, 2006 * | As of March 31, 2006 ** |

| Stocks 7.6% | |  | Stocks 7.6% | |

| U.S. Government and

U.S. Government

Agency Obligations 30.8% | |  | U.S. Government and

U.S. Government

Agency Obligations 28.9% | |

| Corporate Bonds 12.8% | |  | Corporate Bonds 8.0% | |

| Asset-Backed

Securities 6.8% | |  | Asset-Backed

Securities 6.1% | |

| Structured Notes

(including Commodity- Linked Notes) 7.3% | |  | Structured Notes

(including Commodity- Linked Notes 8.7% | |

| Floating Rate Loans 20.0% | |  | Floating Rate Loans 21.2% | |

| CMOs and Other Mortgage Related Securities 4.3% | |  | CMOs and Other Mortgage Related Securities 4.6% | |

| Other Investments 0.6% | |  | Other Investments 0.8% | |

| Short-Term

Investments and

Net Other Assets 9.8% | |  | Short-Term

Investments and

Net Other Assets 14.1% | |

* Foreign investments | 7.1% | | ** Foreign investments | 7.0% | |

* Futures and Swaps | 0.5% | | ** Futures and Swaps | 1.1% | |

* U.S. Treasury

Inflation-Indexed

Securities | 29.5% | | ** U.S. Treasury

Inflation-Indexed

Securities | 27.1% | |

For an unaudited list of holdings for each Fidelity Equity and Fixed-Income Central Fund, visit fidelity.com and/or advisor.fidelity.com, as applicable. The reports are located just after the Fund's financial statements and quarterly reports. |

Annual Report

Investments September 30, 2006

Showing Percentage of Net Assets

Corporate Bonds - 8.3% |

| Principal Amount | | Value

(Note 1) |

Convertible Bonds - 0.6% |

FINANCIALS - 0.6% |

Real Estate Investment Trusts - 0.5% |

American Financial Realty Trust 4.375% 7/15/24 | | $ 11,510,000 | | $ 10,728,506 |

Biomed Realty LP 4.5% 10/1/26 (b) | | 1,000,000 | | 997,500 |

Essex Portfolio LP 3.625% 11/1/25 (b) | | 600,000 | | 741,780 |

New Plan Excel Realty Trust 3.7% 9/15/26 (b) | | 1,000,000 | | 994,290 |

Washington (REIT) 3.875% 9/15/26 | | 750,000 | | 752,130 |

| | 14,214,206 |

Real Estate Management & Development - 0.1% |

Affordable Resources Communities LP 7.5% 8/15/25 (b) | | 2,250,000 | | 2,250,000 |

ERP Operating LP 3.85% 8/15/26 | | 2,000,000 | | 2,031,380 |

| | 4,281,380 |

TOTAL FINANCIALS | | 18,495,586 |

Nonconvertible Bonds - 7.7% |

CONSUMER DISCRETIONARY - 1.1% |

Hotels, Restaurants & Leisure - 0.1% |

Felcor Lodging LP 9% 6/1/11 | | 1,500,000 | | 1,588,125 |

Host Marriott LP 7% 8/15/12 | | 800,000 | | 808,000 |

Landry's Seafood Restaurants, Inc. 7.5% 12/15/14 | | 1,700,000 | | 1,627,750 |

| | 4,023,875 |

Household Durables - 1.0% |

Beazer Homes USA, Inc.: | | | | |

8.125% 6/15/16 | | 1,000,000 | | 970,000 |

8.375% 4/15/12 | | 400,000 | | 400,000 |

D.R. Horton, Inc. 6.5% 4/15/16 | | 1,000,000 | | 981,232 |

K. Hovnanian Enterprises, Inc.: | | | | |

6% 1/15/10 | | 400,000 | | 372,500 |

6.25% 1/15/16 | | 700,000 | | 616,000 |

7.5% 5/15/16 | | 500,000 | | 467,500 |

7.75% 5/15/13 | | 5,300,000 | | 4,876,000 |

KB Home: | | | | |

6.25% 6/15/15 | | 4,600,000 | | 4,230,477 |

7.75% 2/1/10 | | 1,700,000 | | 1,695,750 |

Kimball Hill, Inc. 10.5% 12/15/12 | | 2,700,000 | | 2,423,250 |

Meritage Homes Corp. 6.25% 3/15/15 | | 2,000,000 | | 1,700,000 |

Ryland Group, Inc. 6.875% 6/15/13 | | 1,000,000 | | 1,002,089 |

Standard Pacific Corp. 9.25% 4/15/12 | | 1,900,000 | | 1,833,500 |

Corporate Bonds - continued |

| Principal Amount | | Value

(Note 1) |

Nonconvertible Bonds - continued |

CONSUMER DISCRETIONARY - continued |

Household Durables |

Stanley-Martin Communities LLC 9.75% 8/15/15 | | $ 2,400,000 | | $ 1,884,000 |

Technical Olympic USA, Inc.: | | | | |

7.5% 3/15/11 | | 2,250,000 | | 1,800,000 |

8.25% 4/1/11 (b) | | 500,000 | | 460,000 |

WCI Communities, Inc.: | | | | |

7.875% 10/1/13 | | 650,000 | | 547,625 |

9.125% 5/1/12 | | 2,350,000 | | 2,103,250 |

| | 28,363,173 |

TOTAL CONSUMER DISCRETIONARY | | 32,387,048 |

FINANCIALS - 6.2% |

Real Estate Investment Trusts - 5.2% |

AMB Property LP 3.5% 3/1/09 | | 1,000,000 | | 959,122 |

American Health Properties, Inc. 7.5% 1/15/07 | | 2,975,000 | | 2,992,493 |

Archstone-Smith Operating Trust 3% 6/15/08 | | 6,050,000 | | 5,825,176 |

Archstone-Smith Trust 5% 8/15/07 | | 4,525,000 | | 4,506,601 |

Arden Realty LP: | | | | |

5.2% 9/1/11 | | 500,000 | | 500,141 |

5.25% 3/1/15 | | 600,000 | | 598,319 |

7% 11/15/07 | | 1,400,000 | | 1,424,357 |

Avalon Properties, Inc. 6.875% 12/15/07 | | 2,000,000 | | 2,028,858 |

AvalonBay Communities, Inc.: | | | | |

5% 8/1/07 | | 2,025,000 | | 2,012,599 |

5.5% 1/15/12 | | 1,000,000 | | 1,005,163 |

Brandywine Operating Partnership LP: | | | | |

4.5% 11/1/09 | | 840,000 | | 816,939 |

6% 4/1/16 | | 1,000,000 | | 1,011,142 |

BRE Properties, Inc. 5.75% 9/1/09 | | 4,500,000 | | 4,543,578 |

Camden Property Trust: | | | | |

4.7% 7/15/09 | | 1,000,000 | | 987,495 |

7% 11/15/06 | | 3,407,000 | | 3,412,741 |

Colonial Properties Trust 7% 7/14/07 | | 2,750,000 | | 2,779,222 |

Commercial Net Lease Realty, Inc. 6.15% 12/15/15 | | 400,000 | | 406,277 |

Developers Diversified Realty Corp.: | | | | |

3.875% 1/30/09 | | 2,000,000 | | 1,933,200 |

5.375% 10/15/12 | | 500,000 | | 494,883 |

Duke Realty LP 7.75% 11/15/09 | | 1,000,000 | | 1,065,483 |

Corporate Bonds - continued |

| Principal Amount | | Value

(Note 1) |

Nonconvertible Bonds - continued |

FINANCIALS - continued |

Real Estate Investment Trusts |

Equity One, Inc.: | | | | |

6% 9/15/16 | | $ 1,000,000 | | $ 1,006,877 |

6.25% 1/15/17 | | 1,000,000 | | 1,022,974 |

Evans Withycombe Residential LP 7.625% 4/15/07 | | 510,000 | | 514,023 |

Health Care Property Investors, Inc.: | | | | |

4.875% 9/15/10 | | 700,000 | | 679,856 |

6.3% 9/15/16 | | 4,500,000 | | 4,530,092 |

Health Care REIT, Inc. 6.2% 6/1/16 | | 1,000,000 | | 1,006,853 |

Healthcare Realty Trust, Inc.: | | | | |

5.125% 4/1/14 | | 500,000 | | 476,356 |

8.125% 5/1/11 | | 608,000 | | 661,096 |

HMB Capital Trust V 8.99% 12/15/36 (b)(c) | | 4,300,000 | | 4,300,000 |

Hospitality Properties Trust 6.75% 2/15/13 | | 1,250,000 | | 1,314,065 |

HRPT Properties Trust: | | | | |

5.99% 3/16/11 (c) | | 4,000,000 | | 4,005,832 |

6.5% 1/15/13 | | 1,000,000 | | 1,039,883 |

iStar Financial, Inc.: | | | | |

5.73% 9/15/09 (b)(c) | | 1,000,000 | | 999,872 |

5.94% 3/16/09 (c) | | 500,000 | | 503,360 |

5.95% 10/15/13 (b) | | 1,000,000 | | 1,005,340 |

6.64% 3/12/07 (c) | | 1,200,000 | | 1,205,849 |

Kimco Realty Corp.: | | | | |

7.46% 5/29/07 | | 1,250,000 | | 1,265,150 |

7.86% 11/1/07 | | 480,000 | | 490,485 |

Merry Land & Investment Co., Inc. 6.69% 10/30/06 | | 3,000,000 | | 3,002,205 |

Nationwide Health Properties, Inc.: | | | | |

6% 5/20/15 | | 230,000 | | 227,848 |

6.5% 7/15/11 | | 3,500,000 | | 3,578,967 |

7.23% 11/8/06 | | 1,110,000 | | 1,111,541 |

New Plan Excel Realty Trust 7.35% 6/15/07 | | 1,750,000 | | 1,772,820 |

Omega Healthcare Investors, Inc.: | | | | |

7% 4/1/14 | | 3,800,000 | | 3,771,500 |

7% 1/15/16 | | 1,658,000 | | 1,637,275 |

ProLogis Trust 7.1% 4/15/08 | | 1,500,000 | | 1,537,137 |

Rouse Co. LP/TRC, Inc. 6.75% 5/1/13 (b) | | 3,500,000 | | 3,495,450 |

Senior Housing Properties Trust 8.625% 1/15/12 | | 3,600,000 | | 3,861,000 |

Shurgard Storage Centers, Inc.: | | | | |

5.875% 3/15/13 | | 2,000,000 | | 2,048,292 |

7.75% 2/22/11 | | 1,000,000 | | 1,081,731 |

Corporate Bonds - continued |

| Principal Amount | | Value

(Note 1) |

Nonconvertible Bonds - continued |

FINANCIALS - continued |

Real Estate Investment Trusts |

Simon Property Group LP: | | | | |

5.375% 8/28/08 | | $ 3,000,000 | | $ 2,998,254 |

7% 6/15/28 (c) | | 960,000 | | 985,485 |

7.125% 9/20/07 | | 1,500,000 | | 1,519,265 |

Simon Property Group, Inc. 3.75% 1/30/09 | | 2,000,000 | | 1,930,870 |

Spieker Properties LP 7.25% 5/1/09 | | 2,600,000 | | 2,727,858 |

Tanger Properties LP 9.125% 2/15/08 | | 1,760,000 | | 1,839,200 |

The Rouse Co. 8% 4/30/09 | | 3,000,000 | | 3,123,693 |

Thornburg Mortgage, Inc. 8% 5/15/13 | | 6,450,000 | | 6,321,000 |

Trustreet Properties, Inc. 7.5% 4/1/15 | | 2,200,000 | | 2,183,500 |

United Dominion Realty Trust: | | | | |

4.5% 3/3/08 | | 1,750,000 | | 1,723,055 |

6.05% 6/1/13 | | 2,500,000 | | 2,539,373 |

Ventas Realty LP: | | | | |

6.5% 6/1/16 | | 2,660,000 | | 2,613,450 |

6.625% 10/15/14 | | 7,775,000 | | 7,755,563 |

6.75% 6/1/10 | | 2,400,000 | | 2,451,000 |

6.75% 4/1/17 | | 2,000,000 | | 2,002,500 |

8.75% 5/1/09 | | 1,920,000 | | 2,025,600 |

9% 5/1/12 | | 6,400,000 | | 7,136,000 |

Vornado Realty Trust 5.625% 6/15/07 | | 2,645,000 | | 2,642,432 |

Washington (REIT) 6.898% 2/25/18 | | 3,200,000 | | 3,268,230 |

Western Investment Real Estate Trust 7.2% 9/15/08 | | 500,000 | | 516,117 |

| | 150,759,963 |

Real Estate Management & Development - 0.8% |

American Real Estate Partners/American Real Estate Finance Corp.: | | | | |

7.125% 2/15/13 | | 1,240,000 | | 1,224,500 |

8.125% 6/1/12 | | 1,000,000 | | 1,022,500 |

Colonial Realty LP 6.05% 9/1/16 | | 1,000,000 | | 1,009,439 |

EOP Operating LP: | | | | |

4.65% 10/1/10 | | 8,500,000 | | 8,246,836 |

6.1081% 10/1/10 (c) | | 700,000 | | 706,446 |

6.763% 6/15/07 | | 3,192,000 | | 3,218,861 |

7.5% 4/19/29 | | 2,000,000 | | 2,239,950 |

ERP Operating LP 6.625% 3/15/12 | | 3,000,000 | | 3,174,885 |

First Industrial LP 5.75% 1/15/16 | | 1,000,000 | | 989,365 |

| | 21,832,782 |

Corporate Bonds - continued |

| Principal Amount | | Value

(Note 1) |

Nonconvertible Bonds - continued |

FINANCIALS - continued |

Thrifts & Mortgage Finance - 0.2% |

Saxon Capital, Inc. 12% 5/1/14 (b) | | $ 4,750,000 | | $ 6,246,250 |

TOTAL FINANCIALS | | 178,838,995 |

HEALTH CARE - 0.2% |

Health Care Providers & Services - 0.2% |

Skilled Healthcare Group, Inc. 11% 1/15/14 (b) | | 2,000,000 | | 2,140,000 |

Tenet Healthcare Corp. 7.375% 2/1/13 | | 4,000,000 | | 3,620,000 |

| | 5,760,000 |

MATERIALS - 0.1% |

Paper & Forest Products - 0.1% |

Plum Creek Timberlands LP 5.875% 11/15/15 | | 2,000,000 | | 1,978,352 |

TELECOMMUNICATION SERVICES - 0.1% |

Wireless Telecommunication Services - 0.1% |

American Tower Corp. 7.125% 10/15/12 | | 2,500,000 | | 2,556,250 |

TOTAL NONCONVERTIBLE BONDS | | 221,520,645 |

TOTAL CORPORATE BONDS (Cost $238,346,424) | 240,016,231 |

U.S. Treasury Inflation Protected Obligations - 29.5% |

|

U.S. Treasury Inflation-Indexed Bonds: | | | | |

2% 1/15/26 | | 95,779,310 | | 91,849,737 |

2.375% 1/15/25 | | 80,524,557 | | 81,799,721 |

3.625% 4/15/28 | | 24,658,172 | | 30,553,830 |

3.875% 4/15/29 | | 26,364,288 | | 34,056,101 |

U.S. Treasury Inflation-Indexed Notes: | | | | |

0.875% 4/15/10 | | 62,194,602 | | 58,943,237 |

1.625% 1/15/15 | | 47,442,738 | | 45,117,899 |

1.875% 7/15/13 | | 75,203,573 | | 73,233,994 |

1.875% 7/15/15 | | 38,329,837 | | 37,104,339 |

2% 1/15/14 | | 55,265,729 | | 54,198,064 |

2% 7/15/14 | | 20,618,259 | | 20,200,649 |

2% 1/15/16 | | 59,820,420 | | 58,412,907 |

2.375% 4/15/11 | | 19,888,104 | | 19,907,842 |

U.S. Treasury Inflation Protected Obligations - continued |

| Principal Amount | | Value

(Note 1) |

U.S. Treasury Inflation-Indexed Notes: - continued | | | | |

2.5% 7/15/16 | | $ 16,121,120 | | $ 16,320,000 |

3% 7/15/12 | | 34,761,297 | | 36,072,222 |

3.375% 1/15/12 | | 44,428,482 | | 46,763,304 |

3.5% 1/15/11 | | 18,589,008 | | 19,467,198 |

3.625% 1/15/08 | | 26,493,793 | | 26,706,438 |

3.875% 1/15/09 | | 49,815,310 | | 51,238,639 |

4.25% 1/15/10 | | 49,127,047 | | 51,942,715 |

TOTAL U.S. TREASURY INFLATION PROTECTED OBLIGATIONS (Cost $854,969,249) | 853,888,836 |

Asset-Backed Securities - 0.4% |

|

Ameriquest Mortgage Securities, Inc. Series 2004-R10 Class M1, 6.03% 11/25/34 (c) | | 105,000 | | 105,614 |

Conseco Finance Securitizations Corp.: | | | | |

Series 2002-1 Class M2, 9.546% 12/1/33 | | 1,500,000 | | 857,464 |

Series 2002-2 Class M2, 9.163% 3/1/33 | | 2,500,000 | | 1,831,613 |

Countrywide Home Loan Trust Series 2006-BC2N

Class N, 6.5% 2/25/47 (b) | | 397,584 | | 393,699 |

Crest Clarendon Street Ltd./Crest Clarendon Corp. Series 2002-1A Class D, 9% 12/28/35 (b) | | 500,000 | | 538,670 |

Fairfield Street Solar Corp. Series 2004-1A Class E1, 8.765% 11/28/39 (b)(c) | | 850,000 | | 865,513 |

Home Equity Asset Trust Series 2006-3N Class B, 6.5% 8/27/36 (b) | | 750,000 | | 739,115 |

Long Beach Asset Holdings Corp. Series 2006-4

Class N1, 5.877% 6/25/46 (b) | | 1,539,355 | | 1,537,431 |

Merit Securities Corp. Series 13 Class M1, 8.63% 12/28/33 | | 1,500,000 | | 1,365,000 |

Resi Finance LP Series 2006-B Class B6, 7.03% 6/15/38 (c) | | 998,053 | | 998,051 |

Residential Asset Securities Corp. Series 2003-KS10 Class MI3, 6.41% 12/25/33 | | 1,000,000 | | 982,852 |

Sharps SP I LLC Net Interest Margin Trust Series 2004-HE3N Class NA, 5.19% 11/25/34 (b) | | 21,331 | | 21,302 |

Structured Asset Securities Corp. Series 2006-BC1

Class B1, 7.83% 3/25/36 (b)(c) | | 100,000 | | 87,060 |

Taberna Preferred Funding III Ltd. Series 2005-3A

Class D, 8.13% 2/5/36 (b)(c) | | 250,000 | | 233,125 |

TOTAL ASSET-BACKED SECURITIES (Cost $10,538,657) | 10,556,509 |

Collateralized Mortgage Obligations - 0.2% |

| Principal Amount | | Value

(Note 1) |

Private Sponsor - 0.2% |

Banc of America Large Loan, Inc. floater Series 2003-BBA2 Class L, 9.28% 11/15/15 (b)(c) | | $ 2,000,000 | | $ 1,978,905 |

Countrywide Alternative Loan Trust Series 2006-OC5N Class N, 7.25% 7/25/37 (b) | | 913,572 | | 912,370 |

Countrywide Home Loans, Inc. Series 2005-R3 Class B3, 5.5% 9/25/35 (b)(c) | | 147,611 | | 114,612 |

Countrywide Home Loans, Inc. Series 2003-J15: | | | | |

Class B3, 4.71% 1/25/19 (b)(c) | | 106,605 | | 96,892 |

Class B4, 4.71% 1/25/19 (b)(c) | | 213,210 | | 168,281 |

Residential Finance LP/Residential Finance Development Corp. floater Series 2005-D Class B6, 7.58% 12/15/37 (b)(c) | | 492,784 | | 499,802 |

Resix Finance Ltd. floater: | | | | |

Series 2005-C Class B7, 8.43% 9/10/37 (b)(c) | | 147,936 | | 147,936 |

Series 2005-D Class B7, 9.58% 12/15/37 (b)(c) | | 295,670 | | 298,728 |

Series 2006-A Class B7, 8.83% 3/15/38 (b)(c) | | 745,095 | | 745,092 |

Series 2006-B Class B7, 9.18% 7/15/38 (b)(c) | | 998,053 | | 998,047 |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $5,948,870) | 5,960,665 |

Commercial Mortgage Securities - 1.0% |

|

Asset Securitization Corp. Series 1997-MD7 Class A4, 7.8496% 1/13/30 (c) | | 499,608 | | 499,608 |

Banc of America Large Loan, Inc. floater: | | | | |

Series 2003-BBA2 Class K, 7.93% 11/15/15 (b)(c) | | 675,000 | | 669,758 |

Series 2005-ESHA Class K, 7.13% 7/14/08 (b)(c) | | 300,000 | | 300,150 |

Series 2005-MIB1 Class K, 7.33% 3/15/22 (b)(c) | | 800,000 | | 791,743 |

Credit Suisse/Morgan Stanley Commercial Mortgage Trust Series 2006-HC1A Class K, 6.807% 5/15/23 (b)(c) | | 3,757,000 | | 3,757,000 |

Crest Ltd. Series 2001-1A Class C, 9% 2/25/34 (b) | | 500,000 | | 525,560 |

CS First Boston Mortgage Securities Corp. Series 2004-FL1A Class G, 8.2286% 5/15/14 (b)(c) | | 652,274 | | 652,981 |

Global Signal Trust II Series 2004-2A: | | | | |

Class D, 5.093% 12/15/14 (b) | | 1,000,000 | | 976,420 |

Class F, 6.376% 12/15/14 (b) | | 800,000 | | 788,122 |

Global Signal Trust III Series 2006-1 Class F, 7.036% 2/15/36 (b) | | 930,000 | | 948,920 |

Commercial Mortgage Securities - continued |

| Principal Amount | | Value

(Note 1) |

GMAC Commercial Mortgage Securities, Inc.: | | | | |

Series 1997-C2 Class E, 7.624% 4/15/29 (c) | | $ 900,000 | | $ 973,266 |

Series 1999-C1 Class F, 6.02% 5/15/33 (b) | | 2,500,000 | | 2,557,812 |

Series 2003-J10 Class B2, 6.75% 4/15/29 (c) | | 1,000,000 | | 1,010,508 |

Guggenheim Structure Real Estate Funding Ltd. floater Series 2006-3 Class E, 6.98% 9/25/46 (b)(c) | | 750,000 | | 750,000 |

LB-UBS Commercial Mortgage Trust sequential pay Series 2005-C7 Class A1, 4.99% 11/15/30 | | 2,588,223 | | 2,580,808 |

Mezz Capital Commercial Mortgage Trust

Series 2005-C3: | | | | |

Class D, 7.7% 5/20/44 (b) | | 600,000 | | 585,817 |

Class F, 10.813% 5/20/44 (b) | | 400,000 | | 396,127 |

TERRA LNR I Series 2006-E, 7% 6/15/17 (b)(c) | | 770,000 | | 769,992 |

Wachovia Bank Commercial Mortgage Trust Series 2005-C20 Class A3SF, 5.46% 7/15/42 (c) | | 5,200,000 | | 5,191,074 |

Wachovia Ltd./Wachovia Llc Series 2006-1 Class 1Ml, LIBOR + 5.5% 9/25/26 (b)(c) | | 3,000,000 | | 3,007,560 |

Wrightwood Capital Real Estate CDO Ltd. floater Series 2005-1A Class F, 7.3425% 11/21/40 (b)(c) | | 1,500,000 | | 1,518,615 |

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $29,146,939) | 29,251,841 |

Common Stocks - 3.8% |

| | Shares | | |

CONSUMER DISCRETIONARY - 0.3% |

Hotels, Restaurants & Leisure - 0.2% |

Red Lion Hotels Corp. (a) | | 120,600 | | 1,297,656 |

Starwood Hotels & Resorts Worldwide, Inc. | | 60,700 | | 3,471,433 |

| | | 4,769,089 |

Household Durables - 0.1% |

KB Home | | 20,000 | | 876,000 |

Lennar Corp. Class A | | 20,700 | | 936,675 |

Ryland Group, Inc. | | 23,000 | | 993,830 |

| | | 2,806,505 |

TOTAL CONSUMER DISCRETIONARY | | | 7,575,594 |

Common Stocks - continued |

| | Shares | | Value

(Note 1) |

FINANCIALS - 3.4% |

Real Estate Investment Trusts - 3.4% |

Acadia Realty Trust (SBI) | | 21,100 | | $ 538,050 |

Alexandria Real Estate Equities, Inc. | | 26,300 | | 2,466,940 |

American Financial Realty Trust (SBI) | | 113,400 | | 1,265,544 |

American Home Mortgage Investment Corp. | | 6,000 | | 209,220 |

Annaly Capital Management, Inc. | | 335,500 | | 4,408,470 |

Anworth Mortgage Asset Corp. | | 234,300 | | 1,956,405 |

Apartment Investment & Management Co. Class A | | 7,700 | | 418,957 |

Archstone-Smith Trust | | 14,200 | | 773,048 |

AvalonBay Communities, Inc. | | 19,500 | | 2,347,800 |

Boston Properties, Inc. | | 12,800 | | 1,322,752 |

Capital Lease Funding, Inc. | | 89,600 | | 993,664 |

CBRE Realty Finance, Inc. | | 175,000 | | 2,668,750 |

Cousins Properties, Inc. | | 33,900 | | 1,159,719 |

Developers Diversified Realty Corp. | | 48,700 | | 2,715,512 |

DiamondRock Hospitality Co. | | 24,200 | | 401,962 |

Duke Realty Corp. | | 25,000 | | 933,750 |

Education Realty Trust, Inc. | | 30,550 | | 450,918 |

Equity Lifestyle Properties, Inc. | | 78,700 | | 3,597,377 |

Equity Office Properties Trust | | 79,280 | | 3,152,173 |

Equity Residential (SBI) | | 73,800 | | 3,732,804 |

Federal Realty Investment Trust (SBI) | | 26,800 | | 1,991,240 |

Fieldstone Investment Corp. | | 161,600 | | 1,410,768 |

General Growth Properties, Inc. | | 131,900 | | 6,285,035 |

Glenborough Realty Trust, Inc. | | 15,800 | | 406,534 |

GMH Communities Trust | | 84,200 | | 1,062,604 |

Healthcare Realty Trust, Inc. | | 16,300 | | 626,083 |

Hersha Hospitality Trust | | 36,900 | | 354,240 |

HomeBanc Mortgage Corp., Georgia | | 284,200 | | 1,747,830 |

Host Hotels & Resorts, Inc. | | 150,947 | | 3,461,215 |

Inland Real Estate Corp. | | 173,000 | | 3,030,960 |

Innkeepers USA Trust (SBI) | | 39,200 | | 638,568 |

Kimco Realty Corp. | | 73,400 | | 3,146,658 |

KKR Financial Corp. | | 10,200 | | 250,308 |

Lexington Corporate Properties Trust | | 17,100 | | 362,178 |

MFA Mortgage Investments, Inc. | | 298,700 | | 2,225,315 |

MortgageIT Holdings, Inc. | | 116,000 | | 1,633,280 |

Nationwide Health Properties, Inc. | | 74,300 | | 1,986,782 |

New York Mortgage Trust, Inc. | | 191,700 | | 739,962 |

Newcastle Investment Corp. | | 127,200 | | 3,486,552 |

Opteum, Inc. Class A | | 88,700 | | 714,035 |

Common Stocks - continued |

| | Shares | | Value

(Note 1) |

FINANCIALS - continued |

Real Estate Investment Trusts - continued |

Plum Creek Timber Co., Inc. | | 4,700 | | $ 159,988 |

ProLogis Trust | | 44,900 | | 2,561,994 |

Redwood Trust, Inc. | | 11,800 | | 594,366 |

Regency Centers Corp. | | 26,400 | | 1,815,264 |

Resource Capital Corp. | | 32,000 | | 494,400 |

Saxon Capital, Inc. | | 229,900 | | 3,227,796 |

Simon Property Group, Inc. | | 20,800 | | 1,884,896 |

Spirit Finance Corp. | | 388,600 | | 4,511,646 |

Strategic Hotel & Resorts, Inc. | | 47,100 | | 936,348 |

Sunstone Hotel Investors, Inc. | | 6,700 | | 199,124 |

Thornburg Mortgage, Inc. (SBI) | | 28,000 | | 713,160 |

Trizec Properties, Inc. | | 23,800 | | 688,058 |

Trustreet Properties, Inc. | | 53,700 | | 671,787 |

U-Store-It Trust | | 10,800 | | 231,768 |

United Dominion Realty Trust, Inc. (SBI) | | 47,000 | | 1,419,400 |

Ventas, Inc. | | 87,400 | | 3,368,396 |

Vornado Realty Trust | | 14,100 | | 1,536,900 |

Washington (REIT) (SBI) | | 26,300 | | 1,046,740 |

| | | 97,135,993 |

Real Estate Management & Development - 0.0% |

The St. Joe Co. | | 18,900 | | 1,037,043 |

TOTAL FINANCIALS | | | 98,173,036 |

HEALTH CARE - 0.0% |

Health Care Providers & Services - 0.0% |

Capital Senior Living Corp. (a) | | 45,000 | | 416,250 |

Emeritus Corp. (a) | | 39,300 | | 846,915 |

| | | 1,263,165 |

MATERIALS - 0.1% |

Paper & Forest Products - 0.1% |

Weyerhaeuser Co. | | 27,300 | | 1,679,769 |

TOTAL COMMON STOCKS (Cost $99,650,918) | | 108,691,564 |

Preferred Stocks - 3.8% |

| | Shares | | Value

(Note 1) |

Convertible Preferred Stocks - 0.5% |

FINANCIALS - 0.5% |

Real Estate Investment Trusts - 0.5% |

Annaly Capital Management, Inc. Series B, 6.00% | | 80,000 | | $ 2,185,760 |

Lexington Corporate Properties Trust Series C 6.50% | | 10,700 | | 501,830 |

The Mills Corp. 6.75% (b) | | 8,254 | | 6,923,043 |

Trustreet Properties, Inc. Series C, 7.50% | | 91,300 | | 1,893,562 |

Windrose Medical Properties Trust 7.50% | | 92,200 | | 2,581,600 |

| | | 14,085,795 |

Nonconvertible Preferred Stocks - 3.3% |

FINANCIALS - 3.3% |

Diversified Financial Services - 0.1% |

DRA CRT Acquisition Corp. Series A, 8.50% | | 1,700 | | 40,375 |

Red Lion Hotels Capital Trust 9.50% | | 138,465 | | 3,607,013 |

| | | 3,647,388 |

Real Estate Investment Trusts - 3.2% |

Accredited Mortgage Loan Trust Series A, 9.75% | | 100,700 | | 2,527,570 |

Alexandria Real Estate Equities, Inc.: | | | |

Series B, 9.10% | | 3,600 | | 91,224 |

Series C, 8.375% | | 10,000 | | 262,000 |

American Home Mortgage Investment Corp.: | | | |

Series A, 9.375% | | 79,300 | | 2,110,173 |

Series B, 9.25% | | 230,944 | | 5,960,665 |

Annaly Capital Management, Inc. Series A, 7.875% | | 141,300 | | 3,505,653 |

Anthracite Capital, Inc. Series C, 9.375% | | 400 | | 10,680 |

Anworth Mortgage Asset Corp. Series A, 8.625% | | 189,600 | | 4,692,600 |

Apartment Investment & Management Co. Series T, 8.00% | | 80,000 | | 2,030,400 |

Ashford Hospitality Trust, Inc. Series A, 8.55% | | 10,000 | | 255,500 |

Capital Lease Funding, Inc. Series A, 8.125% | | 20,000 | | 501,000 |

CBL & Associates Properties, Inc. Series B, 8.75% | | 64,200 | | 3,300,522 |

CenterPoint Properties Trust Series D, 5.377% | | 5,280 | | 4,224,000 |

Colonial Properties Trust (depositary shares) Series D, 8.125% | | 5,000 | | 129,950 |

Cousins Properties, Inc. Series A, 7.75% | | 49,600 | | 1,269,760 |

Crescent Real Estate Equities Co. Series B, 9.50% | | 50,000 | | 1,283,000 |

Developers Diversified Realty Corp. (depositary shares) Series F, 8.60% | | 10,000 | | 254,300 |

Digital Realty Trust, Inc.: | | | |

Series A, 8.50% | | 90,000 | | 2,335,500 |

Series B, 7.875% | | 36,100 | | 915,496 |

Eagle Hospitality Properties Trust, Inc. Series A, 8.25% | | 71,300 | | 1,829,558 |

Preferred Stocks - continued |

| | Shares | | Value

(Note 1) |

Nonconvertible Preferred Stocks - continued |

FINANCIALS - continued |

Real Estate Investment Trusts |

FelCor Lodging Trust, Inc. (depositary shares) Series C, 8.00% | | 40,000 | | $ 980,000 |

Glimcher Realty Trust Series F, 8.75% | | 30,000 | | 760,800 |

Hersha Hospitality Trust Series A, 8.00% | | 40,000 | | 1,038,400 |

Home Properties of New York, Inc. Series F, 9.00% | | 124,800 | | 3,183,648 |

HomeBanc Mortgage Corp., Georgia Series A, 10.00% | | 311,415 | | 7,866,343 |

Impac Mortgage Holdings, Inc. Series C, 9.125% | | 17,700 | | 412,587 |

Innkeepers USA Trust Series C, 8.00% | | 53,000 | | 1,341,960 |

LaSalle Hotel Properties Series A, 10.25% | | 124,500 | | 3,189,690 |

Lexington Corporate Properties Trust Series B, 8.05% | | 60,000 | | 1,534,200 |

MFA Mortgage Investments, Inc. Series A, 8.50% | | 162,900 | | 4,012,227 |

Mid-America Apartment Communities, Inc. Series H, 8.30% | | 45,100 | | 1,150,501 |

Nationwide Health Properties, Inc. 7.677% | | 19,200 | | 1,940,160 |

New Century Financial Corp. Series B 9.75% | | 25,000 | | 625,000 |

New Plan Excel Realty Trust (depositary shares) Series D, 7.80% | | 20,500 | | 1,025,000 |

Newcastle Investment Corp. Series B, 9.75% | | 79,000 | | 2,063,480 |

NorthStar Realty Finance Corp. Series A 8.75% | | 20,000 | | 513,000 |

Omega Healthcare Investors, Inc. Series D, 8.375% | | 80,000 | | 2,080,800 |

Parkway Properties, Inc. Series D, 8.00% | | 80,000 | | 2,032,800 |

Prime Group Realty Trust Series B, 9.00% | | 15,500 | | 280,550 |

PS Business Parks, Inc. (depositary shares) Series F, 8.75% | | 3,400 | | 86,088 |

Public Storage, Inc. Series I, 7.25% | | 20,000 | | 495,000 |

RAIT Investment Trust: | | | |

Series A, 7.75% | | 60,000 | | 1,473,000 |

Series B, 8.375% | | 17,000 | | 434,350 |

Realty Income Corp. 8.25% | | 100 | | 2,604 |

Saul Centers, Inc. 8.00% | | 40,000 | | 1,018,400 |

Simon Property Group, Inc. Series G, 7.89% | | 11,500 | | 593,400 |

Strategic Hotel & Resorts, Inc.: | | | |

Series A, 8.50% | | 120,000 | | 3,015,000 |

Series C, 8.25% | | 60,000 | | 1,539,000 |

Sunstone Hotel Investors, Inc. Series A, 8.00% | | 15,000 | | 381,000 |

Taubman Centers, Inc. Series G, 8.00% | | 20,000 | | 530,200 |

The Mills Corp.: | | | |

Series B, 9.00% | | 64,400 | | 1,378,160 |

Series C, 9.00% | | 156,500 | | 3,302,150 |

Series E, 8.75% | | 138,885 | | 2,880,475 |

Series G, 7.875% | | 39,933 | | 775,100 |

| | | 91,424,624 |

Preferred Stocks - continued |

| | Shares | | Value

(Note 1) |

Nonconvertible Preferred Stocks - continued |

FINANCIALS - continued |

Real Estate Management & Development - 0.0% |

Affordable Residential Communties, Inc. Series A, 8.25% | | 52,800 | | $ 1,251,360 |

TOTAL FINANCIALS | | | 96,323,372 |

TOTAL PREFERRED STOCKS (Cost $109,846,393) | | 110,409,167 |

Floating Rate Loans - 0.8% |

| | Principal

Amount | | |

CONSUMER DISCRETIONARY - 0.2% |

Hotels, Restaurants & Leisure - 0.0% |

Landry's Seafood Restaurants, Inc. term loan 7.1201% 12/28/10 (c) | | $ 997,462 | | 996,215 |

Specialty Retail - 0.2% |

The Pep Boys - Manny, Moe & Jack term loan 8.32% 1/27/11 (c) | | 39,800 | | 39,999 |

Toys 'R' US, Inc. term loan 8.33% 12/9/08 (c) | | 5,000,000 | | 4,993,750 |

| | | 5,033,749 |

TOTAL CONSUMER DISCRETIONARY | | | 6,029,964 |

CONSUMER STAPLES - 0.0% |

Food & Staples Retailing - 0.0% |

Cumberland Farms, Inc. term loan 7.37% 9/25/13 (c) | | 2,000,000 | | 2,007,500 |

FINANCIALS - 0.4% |

Real Estate Investment Trusts - 0.2% |

Capital Automotive (REIT) Tranche B, term loan 7.08% 12/16/10 (c) | | 488,393 | | 489,614 |

General Growth Properties, Inc. Tranche A1, term loan 6.58% 2/24/10 (c) | | 3,000,000 | | 2,966,250 |

Newkirk Master LP Tranche B, term loan 7.08% 8/11/08 (c) | | 1,221,055 | | 1,219,529 |

Trizec Properties, Inc. term loan 6.775% 5/2/07 (c) | | 1,140,000 | | 1,138,575 |

| | | 5,813,968 |

Floating Rate Loans - continued |

| | Principal Amount | | Value

(Note 1) |

FINANCIALS - continued |

Real Estate Management & Development - 0.1% |

MDS Realty Holdings LLC: | | | |

Tranche M1, term loan 7.6563% 1/8/08 (c) | | $ 1,872,076 | | $ 1,872,076 |

Tranche M3, term loan 8.9063% 1/8/08 (c) | | 1,497,661 | | 1,497,661 |

North Las Vegas/Olympia Group Tranche 1, term loan 8.1169% 5/9/11 (c) | | 497,500 | | 487,550 |

| | | 3,857,287 |

Thrifts & Mortgage Finance - 0.1% |

Charter Municipal Mortgage Acceptance Co. term loan 7.9% 8/15/12 (c) | | 1,500,000 | | 1,503,750 |

TOTAL FINANCIALS | | | 11,175,005 |

HEALTH CARE - 0.2% |

Health Care Providers & Services - 0.2% |

HealthSouth Corp. term loan 8.58% 3/10/13 (c) | | 3,990,000 | | 4,009,950 |

Skilled Healthcare Group, Inc. Tranche 1, term loan 8.08% 6/15/12 (c) | | 997,475 | | 1,004,956 |

| | | 5,014,906 |

TELECOMMUNICATION SERVICES - 0.0% |

Wireless Telecommunication Services - 0.0% |

Crown Castle Operating Co. Tranche B, term loan 7.65% 6/1/14 (c) | | 510,000 | | 510,000 |

TOTAL FLOATING RATE LOANS (Cost $24,758,659) | | 24,737,375 |

Commodity-Linked Notes - 7.3% |

|

AIG-FP Private Funding Ltd.: | | | | |

Master Note, one-month U.S. dollar LIBOR plus .10% due 6/29/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 7,670,000 | | 5,869,668 |

Master Note, one-month U.S. dollar LIBOR plus .10% due 7/12/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 5,000,000 | | 3,521,488 |

Master Note, one-month U.S. dollar LIBOR plus .10% due 7/6/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 9,500,000 | | 7,381,505 |

Commodity-Linked Notes - continued |

| | Principal Amount | | Value

(Note 1) |

AIG-FP Private Funding Ltd.: - continued | | | | |

Master Note, one-month U.S. dollar LIBOR plus .10% due 8/20/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | $ 15,100,000 | | $ 14,642,092 |

Master Note, one-month U.S. dollar LIBOR plus .10% due 8/24/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 6,000,000 | | 6,137,428 |

Master Note, one-month U.S. dollar LIBOR plus .10% due 8/29/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 2,600,000 | | 2,697,291 |

Master Note, one-month U.S. dollar LIBOR plus .15% due 3/15/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 9,970,000 | | 8,687,327 |

Master Note, one-month U.S. dollar LIBOR plus .15% due 3/8/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 3,330,000 | | 2,993,347 |

Master Note, one-month U.S. dollar LIBOR plus .15% due 4/20/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 6,670,000 | | 4,695,243 |

Master Note, one-month U.S. dollar LIBOR plus .15% due 4/9/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 3,300,000 | | 2,282,453 |

Master Note, one-month U.S. dollar LIBOR plus .15% due 6/6/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 1,670,000 | | 1,232,797 |

Master Note, one-month U.S. dollar LIBOR plus .15% due 3/2/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 5,000,000 | | 4,721,259 |

Master Note, one-month U.S. dollar LIBOR plus .15% due 3/8/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 2,500,000 | | 2,272,002 |

JPMorgan Chase Bank NA: | | | | |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 4/27/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 9,670,000 | | 7,845,989 |

Commodity-Linked Notes - continued |

| | Principal Amount | | Value

(Note 1) |

JPMorgan Chase Bank NA: - continued | | | | |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 4/9/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | $ 6,630,000 | | $ 4,507,896 |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 5/4/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 5,070,000 | | 4,201,611 |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 6/29/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 1,500,000 | | 1,139,610 |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 6/6/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 1,670,000 | | 1,277,517 |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 7/12/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 5,000,000 | | 3,521,687 |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 7/20/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 4,000,000 | | 3,144,954 |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 8/24/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 3,550,000 | | 3,707,282 |

Medium Term Note, one-month U.S. dollar LIBOR minus .15% due 8/29/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 7,210,000 | | 7,415,465 |

Medium Term Note, one-month U.S. dollar LIBOR minus .17% due 10/06/2006 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 1,780,000 | | 1,568,657 |

Medium Term Note, one-month U.S. dollar LIBOR minus .17% due 10/16/2006 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 4,970,000 | | 4,175,429 |

Medium Term Note, one-month U.S. dollar LIBOR minus .17% due 12/14/2006 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 4,160,000 | | 3,735,211 |

Commodity-Linked Notes - continued |

| | Principal Amount | | Value

(Note 1) |

JPMorgan Chase Bank NA: - continued | | | | |

Medium Term Note, one-month U.S. dollar LIBOR minus .17% due 2/12/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | $ 4,000,000 | | $ 4,070,736 |

Medium Term Note, one-month U.S. dollar LIBOR minus .17% due 3/15/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 2,500,000 | | 2,183,504 |

Medium Term Note, one-month U.S. dollar LIBOR minus .17% due 3/2/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 3,340,000 | | 3,272,148 |

Medium Term Note, one-month U.S. dollar LIBOR minus .18% due 10/06/2006 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 3,060,000 | | 2,635,931 |

Morgan Stanley: | | | | |

Note, one-month U.S. dollar LIBOR minus .03% due 8/6/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 8,340,000 | | 6,997,640 |

Note, one-month U.S. dollar LIBOR minus .07% due 6/27/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 8,340,000 | | 5,859,783 |

Note, one-month U.S. dollar LIBOR minus .10% due 3/23/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 8,340,000 | | 6,178,330 |

Note, one-month U.S. dollar LIBOR minus .10% due 6/6/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 12,340,000 | | 9,787,378 |

Note, one-month U.S. dollar LIBOR minus .15% due 2/27/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 22,330,000 | | 20,955,892 |

Note, one-month U.S. dollar LIBOR minus .15% due 3/23/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 5,000,000 | | 4,487,387 |

Commodity-Linked Notes - continued |

| | Principal Amount | | Value

(Note 1) |

Societe Generale Commodities Products, LLC: | | | | |

Note, one-month U.S. dollar LIBOR minus .10% due 7/17/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | $ 6,340,000 | | $ 4,557,961 |

Note, one-month U.S. dollar LIBOR minus .10% due 7/20/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 13,300,000 | | 10,629,582 |

Note, one-month U.S. dollar LIBOR minus .10% due 7/27/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 5,170,000 | | 4,136,794 |

Note, one-month U.S. dollar LIBOR minus .10% due 8/10/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 9,150,000 | | 7,975,186 |

Note, one-month U.S. dollar LIBOR minus .10% due 8/31/2007 (indexed to the Dow Jones-AIG Commodity Total Return Index, multiplied by 3) (b)(c)(e) | | 3,000,000 | | 3,014,017 |

TOTAL COMMODITY-LINKED NOTES (Cost $248,070,000) | 210,117,477 |

Fixed-Income Funds - 42.2% |

| Shares | | |

Fidelity Floating Rate Central Investment Portfolio (d) | 7,132,846 | | 715,567,111 |

Fidelity Ultra-Short Central Fund (d) | 5,084,144 | | 505,821,487 |

TOTAL FIXED-INCOME FUNDS (Cost $1,222,731,910) | 1,221,388,598 |

Preferred Securities - 0.2% |

| Principal

Amount | | |

FINANCIALS - 0.2% |

Diversified Financial Services - 0.2% |

Cairn High Grade ABS CDO II Ltd. Series 2006-2A Class SUB, 1/13/47 (b) | $ 1,200,000 | | 1,080,000 |

Crest Clarendon Street 2002-1 Ltd. Series 2002-1A Class PS, 12/28/35 (b) | 500,000 | | 521,213 |

Preferred Securities - continued |

| Principal Amount | | Value

(Note 1) |

FINANCIALS - continued |

Diversified Financial Services - continued |

Harp High Grade CDO I Ltd. Series 2006-1, 7/8/46 (b) | $ 1,650,000 | | $ 1,600,500 |

Ipswich Street CDO Series 2006-1, 6/27/46 (b) | 2,250,000 | | 2,182,500 |

TOTAL PREFERRED SECURITIES (Cost $5,445,370) | 5,384,213 |

Cash Equivalents - 1.8% |

| Maturity Amount | | |

Investments in repurchase agreements (Collateralized by U.S. Treasury Obligations), in a joint trading account at 5.08%, dated 9/29/06 due 10/2/06

(Cost $51,181,000) | $ 51,202,668 | | 51,181,000 |

TOTAL INVESTMENT PORTFOLIO - 99.3% (Cost $2,900,634,389) | | 2,871,583,476 |

NET OTHER ASSETS - 0.7% | | 21,317,909 |

NET ASSETS - 100% | $ 2,892,901,385 |

Legend |

(a) Non-income producing |

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $275,428,372 or 9.5% of net assets. |

(c) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(d) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited list of holdings for each Fidelity Central Fund, as of the Investing Fund's report date, is available upon request or at fidelity.com and/or advisor.fidelity.com, as applicable. The reports are located just after the Investing Fund's financial statements and quarterly reports but are not part of the financial statements or quarterly reports. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Investing Fund's Report of Independent Registered Public Accounting Firm, are available on the EDGAR Database on the SEC's web site, www.sec.gov, or upon request. |

(e) Security is linked to the Dow Jones-AIG Commodity Total Return Index. Securities do not guarantee any return of principal at maturity but instead, will pay at maturity or upon exchange, an amount based on the closing value of the Dow Jones-AIG Commodity Index Total Return. Although these instruments are primarily debt obligations, they indirectly provide exposure to changes in the value of the underlying commodities. Holders of the security have the right to exchange these notes at any time. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Floating Rate Central Investment Portfolio | $ 23,003,598 |

Fidelity Ultra-Short Central Fund | 11,744,528 |

Total | $ 34,748,126 |

|

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows: |

Fund | Value, beginning of period | Purchases | Sales Proceeds | Value, end of period | % ownership, end of period |

Fidelity Floating Rate Central Investment Portfolio | $ 7,598,671 | $ 709,374,857 | $ - | $ 715,567,111 | 46.3% |

Fidelity Ultra-Short Central Fund | 6,644,141 | 499,114,422 | - | 505,821,487 | 5.9% |

Total | $ 14,242,812 | $ 1,208,489,279 | $ - | $ 1,221,388,598 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

| September 30, 2006 |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $51,181,000) -

See accompanying schedule: Unaffiliated issuers (cost $1,677,902,479) | $ 1,650,194,878 | |

Fidelity Central Funds (cost $1,222,731,910) | 1,221,388,598 | |

Total Investments (cost $2,900,634,389) | | $ 2,871,583,476 |

Receivable for investments sold | | 5,473,539 |

Receivable for fund shares sold | | 20,135,812 |

Dividends receivable | | 1,719,704 |

Interest receivable | | 19,821,398 |

Receivable from investment adviser for expense reductions | | 235 |

Other receivables | | 1,137 |

Total assets | | 2,918,735,301 |

| | |

Liabilities | | |

Payable to custodian bank | $ 839,981 | |

Payable for investments purchased | 21,149,229 | |

Payable for fund shares redeemed | 1,751,121 | |

Accrued management fee | 1,315,228 | |

Distribution fees payable | 23,721 | |

Other affiliated payables | 381,005 | |

Other payables and accrued expenses | 373,631 | |

Total liabilities | | 25,833,916 |

| | |

Net Assets | | $ 2,892,901,385 |

Net Assets consist of: | | |

Paid in capital | | $ 2,890,235,544 |

Undistributed net investment income | | 35,583,876 |

Accumulated undistributed net realized gain (loss) on investments | | (3,867,122) |

Net unrealized appreciation (depreciation) on investments | | (29,050,913) |

Net Assets | | $ 2,892,901,385 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities - continued

| September 30, 2006 |

| | |

Calculation of Maximum Offering Price

Class A:

Net Asset Value and redemption price per share

($13,335,218 ÷ 1,322,619 shares) | | $ 10.08 |

| | |

Maximum offering price per share (100/95.25 of $10.08) | | $ 10.58 |

Class T:

Net Asset Value and redemption price per share ($22,825,074 ÷ 2,264,602 shares) | | $ 10.08 |

| | |

Maximum offering price per share (100/96.50 of $10.08) | | $ 10.45 |

Class B:

Net Asset Value and offering price per share ($6,001,546 ÷ 596,777 shares)A | | $ 10.06 |

| | |

Class C:

Net Asset Value and offering price per share ($16,528,091 ÷ 1,645,914 shares)A | | $ 10.04 |

| | |

Strategic Real Return:

Net Asset Value, offering price and redemption price per share ($2,694,765,026 ÷ 266,860,845 shares) | | $ 10.10 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($139,446,430 ÷ 13,823,004 shares) | | $ 10.09 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

| Year ended September 30, 2006 |

| | |

Investment Income | | |

Dividends | | $ 7,049,737 |

Interest | | 41,245,356 |

Income from Fidelity Central Funds | | 34,748,126 |

Total income | | 83,043,219 |

| | |

Expenses | | |

Management fee | $ 7,570,420 | |

Transfer agent fees | 1,753,452 | |

Distribution fees | 170,374 | |

Accounting fees and expenses | 569,065 | |

Custodian fees and expenses | 25,788 | |

Independent trustees' compensation | 4,144 | |

Registration fees | 548,206 | |

Audit | 123,515 | |

Legal | 13,299 | |

Miscellaneous | 2,751 | |

Total expenses before reductions | 10,781,014 | |

Expense reductions | (87,924) | 10,693,090 |

Net investment income | | 72,350,129 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | (5,738,064) |

Change in net unrealized appreciation (depreciation) on investment securities | | (29,436,055) |

Net gain (loss) | | (35,174,119) |

Net increase (decrease) in net assets resulting from operations | | $ 37,176,010 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended

September 30, 2006 | For the period

September 7, 2005 (commencement of operations) to

September 30, 2005 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 72,350,129 | $ 81,416 |

Net realized gain (loss) | (5,738,064) | 2,066 |

Change in net unrealized appreciation (depreciation) | (29,436,055) | 385,142 |

Net increase (decrease) in net assets resulting

from operations | 37,176,010 | 468,624 |

Distributions to shareholders from net investment income | (34,978,986) | - |

Share transactions - net increase (decrease) | 2,852,107,184 | 38,055,768 |

Redemption fees | 72,674 | 111 |

Total increase (decrease) in net assets | 2,854,376,882 | 38,524,503 |

| | |

Net Assets | | |

Beginning of period | 38,524,503 | - |

End of period (including undistributed net investment income of $35,583,876 and undistributed net investment income of $78,944, respectively) | $ 2,892,901,385 | $ 38,524,503 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended September 30, | 2006 | 2005 H |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 10.15 | $ 10.00 |

Income from Investment Operations | | |

Net investment income E | .524 | .031 |

Net realized and unrealized gain (loss) | (.329) | .119 |

Total from investment operations | .195 | .150 |

Distributions from net investment income | (.266) | - |

Redemption fees added to paid in capital E | .001 | - |

Net asset value, end of period | $ 10.08 | $ 10.15 |

Total Return B, C, D | 1.96% | 1.50% |

Ratios to Average Net Assets F, I | | |

Expenses before reductions | 1.02% | 4.71% A |

Expenses net of fee waivers, if any | 1.00% | 1.00% A |

Expenses net of all reductions | .99% | 1.00% A |

Net investment income | 5.24% | 4.28% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $ 13,335 | $ 3,405 |

Portfolio turnover rate G | 11% | 78% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period September 7, 2005 (commencement of operations) to September 30, 2005.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Years ended September 30, | 2006 | 2005 H |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 10.15 | $ 10.00 |

Income from Investment Operations | | |

Net investment income E | .517 | .030 |

Net realized and unrealized gain (loss) | (.325) | .120 |

Total from investment operations | .192 | .150 |

Distributions from net investment income | (.263) | - |

Redemption fees added to paid in capital E | .001 | - |

Net asset value, end of period | $ 10.08 | $ 10.15 |

Total Return B, C, D | 1.93% | 1.50% |

Ratios to Average Net Assets F, I | | |

Expenses before reductions | 1.05% | 4.81% A |

Expenses net of fee waivers, if any | 1.05% | 1.10% A |

Expenses net of all reductions | 1.05% | 1.10% A |

Net investment income | 5.19% | 4.18% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $ 22,825 | $ 3,284 |

Portfolio turnover rate G | 11% | 78% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period September 7, 2005 (commencement of operations) to September 30, 2005.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended September 30, | 2006 | 2005 H |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 10.14 | $ 10.00 |

Income from Investment Operations | | |

Net investment income E | .450 | .025 |

Net realized and unrealized gain (loss) | (.318) | .115 |

Total from investment operations | .132 | .140 |

Distributions from net investment income | (.213) | - |

Redemption fees added to paid in capital E | .001 | - |

Net asset value, end of period | $ 10.06 | $ 10.14 |

Total Return B, C, D | 1.33% | 1.40% |

Ratios to Average Net Assets F, I | | |

Expenses before reductions | 1.74% | 5.47% A |

Expenses net of fee waivers, if any | 1.74% | 1.75% A |

Expenses net of all reductions | 1.73% | 1.75% A |

Net investment income | 4.49% | 3.53% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $ 6,002 | $ 3,253 |

Portfolio turnover rate G | 11% | 78% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period September 7, 2005 (commencement of operations) to September 30, 2005.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Years ended September 30, | 2006 | 2005 H |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 10.14 | $ 10.00 |

Income from Investment Operations | | |

Net investment income E | .437 | .024 |

Net realized and unrealized gain (loss) | (.323) | .116 |

Total from investment operations | .114 | .140 |

Distributions from net investment income | (.215) | - |

Redemption fees added to paid in capital E | .001 | - |

Net asset value, end of period | $ 10.04 | $ 10.14 |

Total Return B, C, D | 1.15% | 1.40% |

Ratios to Average Net Assets F, I | | |

Expenses before reductions | 1.86% | 5.56% A |

Expenses net of fee waivers, if any | 1.85% | 1.85% A |

Expenses net of all reductions | 1.84% | 1.85% A |

Net investment income | 4.39% | 3.43% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $ 16,528 | $ 3,467 |

Portfolio turnover rate G | 11% | 78% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period September 7, 2005 (commencement of operations) to September 30, 2005.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Strategic Real Return

Years ended September 30, | 2006 | 2005 G |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 10.15 | $ 10.00 |

Income from Investment Operations | | |

Net investment income D | .544 | .028 |

Net realized and unrealized gain (loss) | (.317) | .122 |

Total from investment operations | .227 | .150 |

Distributions from net investment income | (.278) | - |

Redemption fees added to paid in capital D | .001 | - I |

Net asset value, end of period | $ 10.10 | $ 10.15 |

Total Return B, C | 2.28% | 1.50% |

Ratios to Average Net Assets E, H | | |

Expenses before reductions | .80% | 4.41% A |

Expenses net of fee waivers, if any | .80% | .85% A |

Expenses net of all reductions | .79% | .85% A |